Profile

Our Business

Russel Metals is one of the largest metals distribution and processing companies in North America based on revenues, profits and tons sold. The Company conducts its distribution business primarily in three metals segments: service centers; energy sector pipe, tube, valves and fittings; and import/export. Russel Metals is one of the few metals distribution companies in the world to operate a significant international trading operation in conjunction with service centers.

Service CentersPurchases metal in large volumes from producers principally in North America, adds value by providing a wide range of value added services, and then distributes the product to a broad base of approximately 15,000 end users through a network of 42 Canadian and 4 U.S. locations.

Energy SectorThe business units distribute pipe, tube, valves and fittings, chiefly to the energy sector in Western Canada and the Western United States from 5 Canadian and 2 U.S. locations.

Import/ExportImports foreign steel products into Canada and the United States for customers that include both steel mills and metals distribution companies and also exports North American steel products to international end users.

Our Values

Management looks to maintain superior returns throughout the current and future economic cycles. Both short and long-term success in any business depends on the development and retention of strong relationships. At Russel Metals, these relationships include our customers, suppliers, employees, community, and, of course, our shareholders.

Our CustomersCritical to our relationship with our customers is providing competitively priced, quality product with on-time delivery. Our geographically diverse network of locations throughout Canada and various areas in the United States enables us to store our product close to our customer locations and respond to their needs on a timely basis. We at Russel Metals strive to meet our customers’ quality expectations by promoting high quality standards throughout the organization. The vast majority of our locations are ISO 9000 certified and our Regional Quality Leaders strive to enhance Best Practices in their region.

Our SuppliersWithout the support of our suppliers, the Company would not be successful. We endeavor to pay fair market value for those goods we buy for either resale or for further processing. We look upon our suppliers as partners, and we reward those suppliers who we feel support us with the majority of our purchases.

Our EmployeesRussel Metals has approximately 1,900 employees with offices and operations throughout North America. The Company continues to elevate awareness of Health & Safety throughout the organization from the shop floor to the Board of Directors. In 2002, as a result of proactive initiatives in this area, the number of accidents decreased by 33% and the accident severity as measured by the number of days lost improved 63% over the previous year.

The Company encourages the implementation of results oriented bonus plans at all levels of the organization. This helps to ensure that the interests of the employees and the shareholders are aligned. In addition, our Value Sharing Plan provides financial incentives to every employee to participate in the ownership of our Company.

Our CommunityOur management does not administer social responsibility, including charitable donations, at the corporate level. Rather branch management, in our diverse locations throughout North America, are encouraged to sponsor community-based local initiatives both in donations of cash and in employee time.

Our EnvironmentThe business practices involved in the metals distribution business of the Company present minimal environmental exposure. The Company has implemented rigorous environmental standards and an ongoing audit process. The Environmental Manager proactively reports to both management and our Board of Directors on any changes in legislation and the effect, if any, on our continuing operations.

The ongoing environmental cleanup costs expended by the Company relate to non-metals operations previously sold or discontinued, not the metals operations. The Company has actively honoured its legacy environmental costs for non-metals operations and over the last 10 years has spent in excess of $18 million on environmental cleanups.

Our ShareholdersThe above, coupled with our emphasis on bottom line performance and effective asset management throughout the organization enables us to be a sector leader in dividend yield and share appreciation.

| Management Priorities | Accomplishments |

Be a sector leader in return on capital throughout the steel cycle | - 2002 was a recovery year for the steel sector. Generated a top decile return on ending capital of 15.3%.

- 2001 was a weak year for the steel sector. Generated a top decile 11.4% return on ending capital.

|

| Grow the Company’s foundation through prudent acquisitions | - Acquired Williams Steel in Milwaukee, Wisconsin – a steel service center.

- Acquired Arrow Steel in Houston, Texas – a cut to length coil processor.

|

| Optimize the Company’s application of capital | - Restructured British Columbia and Wisconsin service center operations, closing two unprofitable locations.

- The A. J. Forsyth acquisition in British Columbia generated an operating profit of $4.9 million and a return on the incremental investment of 24.5%. A similar turnaround is expected for the Wisconsin operations.

|

| Provide leadership for employees through progressive health and safety practices | - Continued proactive management of health and safety issues resulted in a 33% reduction in lost time accidents in 2002.

- The accident severity measured by the number of days lost improved by 63% over the previous year.

|

| Provide shareholders with superior common share yields | - Dividends of $0.17 were paid, which was a yield of 3.3% based on year-end price. Dividends have increased by 40% to $0.28 per year during the past year, which will yield 5.1%.

- Common share market value has appreciated 76% since January 2001.

|

Report to ShareholdersPerformance

| Edward M. Siegel, Jr.

President and Chief Executive Officer As the Chief Executive Officer, I am always cognizant of the comparison of our performance against that of other companies. |

These comparisons include both companies in the steel sector and others against which we compete with for attention in the capital markets. This is essentially all the companies traded on the Toronto Stock Exchange (TSX). By the investment industry definition, Russel Metals is not a blue chip company due to our small market capitalization. We do, however, fit the New York Stock Exchange definition of a blue chip company, which is “a company known nationally for the quality of its products or services and its reliability to operate profitably in good and bad economic times.” We fit that definition perfectly with our diverse portfolio of companies providing nationwide distribution services throughout Canada and select regions in the United States, coupled with our strong financial performance over the last six years.

Share price is not only a function of past success; it is also a function of future potential. Management’s primary goal is to maximize bottom line earnings not only in the short term but also throughout the cycle.

Russel Metals has delivered an excellent performance in 2002 compared with virtually every significant performance metric, such as share appreciation, dividend yield, return on common equity, and return on market capitalization. The strong operational performance of the Company has not gone unnoticed in the capital markets as illustrated by the 76% appreciation in our common share price over the last two years.

The past year was an excellent one as we achieved record earnings. This is especially gratifying since it occurred in a year characterized by static demand with strong pressure on our cost of goods. Furthermore, 2002 was an economic environment fraught with business failures and governmental intervention. We operate in a cyclical industry and our business model is predicated on principles intended to minimize significant earnings volatility. As I have often stressed, we will make an acquisition only if it makes good business sense, not simply because it will generate top-line growth. Our 2002 adjusted earnings per share of $0.75 and 2001 adjusted earnings per share of $0.37, in an extremely difficult environment, demonstrate that our philosophy of fiscal restraint in the era of consolidation in the steel service center industry was justified. Our record pre-tax earnings in 2002 were attributable to the higher gross margins, particularly in the import/export operations, overall focus on cost containment and tight working capital management of the balance sheet.

We could not have achieved these excellent results without the extraordinary effort of our entire employee group, and to them I want to extend my heart-felt appreciation. I would also like to welcome the employees of both Arrow Steel Processors and Williams Steel to the organization. On behalf of the Board, I would like to acknowledge the contribution of Mr. Martin Freedman who retired as a Director of our Company due to his appointment to the Manitoba Court of Appeal after 16 years of valuable service. Replacing Mr. Freedman on our Board is Mr. James Dinning, Executive Vice President – TransAlta Corporation. Mr. Dinning brings to our Board a wealth of business expertise primarily in the energy sector and we look forward to a long association.

We feel that our performance measures up very well against other companies. In order to demonstrate this, we have chosen a few quality companies, which we have called the Performance Group, whom we consider to be strong companies in their own right to compare to our performance.

Dofasco – In the steel sector, Dofasco Inc. is considered to be the preeminent steel mill. It is listed on the TSX.

Royal Bank – We have chosen the Royal Bank of Canada because it is the largest component of the TSX and is considered to be the premier financial institution in Canada.

Magna – We chose Magna International Inc. since it is a TSX listed industrial company that is also preeminent in its field.

Reliance – The publicly traded company that is the most like us, from an operations point of view, is Reliance Steel & Aluminum Co. Reliance is a successful NYSE listed steel distribution company with operations primarily in the United States.

Performance – Stock AppreciationTheoretically, consistently strong earnings should lead to corresponding share appreciation. In the late 1990s this was not the case, as capital flowed to companies with ’a story’ and away from companies, like ours, with conservative profiles and a strong earnings base. As the ’bubble’ burst, investors looked to companies with real assets whose performance justified an inflow of capital. As demonstrated by our share price appreciation, investors have realized the value of Russel Metals. In 2001 our stock appreciated 24%, and in 2002 it rose from $3.60 to $5.10, an appreciation of 42%.

Our share appreciation over the last two years has also been a result of our strong earnings history. We have been profitable in each of the last six years throughout turbulent times in the steel industry. In a cyclical industry, we have managed to remain profitable through the troughs in the cycle, even the severe trough experienced in 2001. Share price is not only a function of past success; it is also a function of future potential. Management’s primary goal is to maximize bottom line earnings not only in the short term but also throughout the cycle.

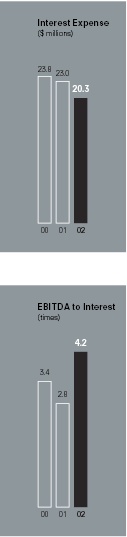

Performance – Dividend YieldRussel Metals’ dividend yield ranks first in our Performance Group. Dividends are a direct reflection of earnings. Our ability to pay dividends is constrained by restrictions on our U.S. Note Indenture. Russel Metals considers it prudent to distribute a high level of earnings to its shareholders as it adds discipline to the management of shareholder funds. Cash flow from operations of $55.7 million, free cash flow of $13.8 million and net earnings of $29.2 million were significant contributors in our ability to increase our dividend. The Company manages its operations based on return on net assets and thus reduces its working capital when revenues decline, resulting in strong cash flow at all points in the cycle. The management of this counter cyclical cash flow is critical to the generation of superior earnings over the entire cycle and is an area in which Russel Metals excels.

The Company has increased the dividend by 40% during the past year. Russel Metals increased its quarterly dividend by $0.01 to $0.06 per common share during 2002, and on February 17, 2003, based on strong earnings, the Company was able to further increase the dividend to $0.07. This dividend yields approximately a 5.1% return to our shareholders in addition to stock appreciation.

Performance – Return on Market CapitalizationIn a cyclical industry, management believes that the key to success is to maintain a flexible enough balance sheet that can be contracted during the troughs and expanded during the peaks. By not encumbering our balance sheet with unnecessary debt due to unsustainable goodwill, we maintain the financial flexibility to maintain profitability throughout the cycle. Even after accounting for the stock appreciation that has occurred over the last two years, our return on year-end market capitalization of 15.8% is the strongest of our Performance Group.

This strong return on market capitalization has been achieved in part through balance sheet management and debt reduction, which lowered interest expense. Book value per share has increased 64% over the last five years to $5.84. During that same period the Company has reduced debt levels by $84 million, repurchased $51.9 million in equity and paid common share dividends of $19.9 million.

Performance – Return on Common EquityOur return on common equity improved to 13.8% for 2002. We rank number 2 in the Performance Group on this measure. Our ability to reduce net assets when operating earnings decline has resulted in lower interest expense and correspondingly higher net earnings. The return on common equity has averaged 14.0% during the last five years.

The Company actively manages its inventory and accounts receivable, which represent 76.4% of its total assets. As a market leader, we strive to maintain service center inventory turns at significantly higher levels than the industry norm. Our service center inventory turns for the last quarter of 2002 were 4.2 times, compared to the industry at 3.2 times. In 2001 and 2002, the Company made sizable acquisitions in the service center sector and still was able to report inventory turns approximately one turn better than the industry.

We look at an acquisition opportunity seriously when we deem it to be in the best strategic interest of the Company and if it will be accretive immediately. Our 2001 acquisition of A. J. Forsyth and the subsequent restructuring of our British Columbia operations has generated incremental operating profit of $4.9 million in 2002. We have replicated this strategy to strengthen our Wisconsin operation by purchasing the operating assets of Williams Steel in October 2002. The restructuring of Williams Steel with the Bahcall operations started in November 2002. It will be accretive to earnings in 2003.

The key to success is to maintain a flexible enough balance sheet that can be contracted during the troughs and expanded during the peaks.

Management strongly believes that it is more prudent to be profitable throughout a cycle, without the spikes in earnings caused by less emphasis on asset management, and have average earnings over the full range of the cycle in the top decile of the industry.

In the future, the length of the steel-based economic cycle will continue to shorten and a management structure that allows the fastest reaction to the changes will be most successful.

We carefully manage the Company portfolio to continue to optimize our return on capital. If an operation is not producing consistently, we will make changes, as we did with the rationalizations after the purchase of Forsyth and Williams. In addition, we will not hesitate to divest ourselves of under-performing operations, such as we did with Total Distributors in 2001.

Performance – Corporate GovernanceThere has been significant emphasis over the last year on strong corporate governance. Regulators have been struggling with balancing a rule-based system with the significant costs associated with more regulations. To date, regulators have strengthened rules for the independence of the audit function, both through auditor independence and the maintenance of a strong audit committee. Companies have also been criticized for not separating the office of Chairman from the CEO and for their aggressive accounting policies. We, at Russel Metals, already have within our corporate governance structure many of the new requirements being suggested now and have always discharged our corporate responsibilities with a keen awareness of the spirit of strong governance standards. The members of our Audit Committee, whose diverse backgrounds include a strong financial knowledge base, are all independent. Our CEO and Chairman functions have been separated since the new management took office in 1997. Our accounting policies are conservative, reflecting the conventional nature of our industry as a whole. While the Company continues to use the intrinsic value method for stock options, we have focused on this issue since it gained prominence almost a year ago. We intend to expense these options as soon as the new Canadian accounting rules have been finalized to ensure that we meet all of the new requirements.

Our performance emphasis coupled with a strong corporate governance ethos and our remarkable employee group should lay the framework for Russel to position itself to continue to outperform competitors over the course of the cycle both operationally and in the capital markets. We look forward to the challenge.

/s/Edward M. Siegel, Jr.

President and Chief Executive Officer

Operating Performance

| Service Centers | Energy | Import/Export |

| Purchases metal in large volumes from producers principally in North America, adds value by providing a wide range of reliable services, and then distributes the product to a broad base of 15,000 end users in a wide variety of industries through a network of 42 Canadian and 4 U.S. locations. | The business units distribute pipe, tube, valves and fittings, chiefly to the energy sector in Western Canada and the Western United States from 5 Canadian and 2 U.S. locations. | Imports foreign steel products into Canada and the United States for customers that include both steel mills and metals distribution companies and exports North American steel products to international end users. |

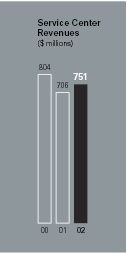

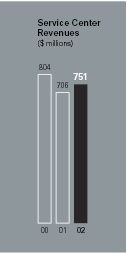

Strong Performance in 2002Service Center Performance

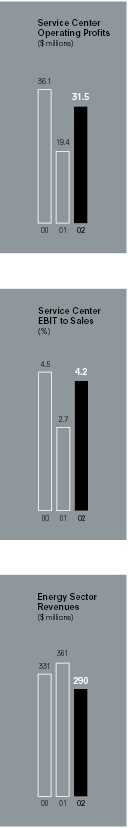

- 6% sales increase to $750.9 million

- 63% increase in operating profits to $31.5 million

- Cash flow from operations of $53.9 million generated

- Industry leading inventory turns

- Restructured British Columbia operations. Generated $4.9 million incremental operating profit

- Strengthened Wisconsin operations with Williams Steel acquisition

Russel Metals’ service center segment was a strong performer in 2002, delivering increased operating profits and increased return on net assets over the previous year.

Service Centers

Through a strong network of service centers, Russel Metals provides processing and distribution services to a broad base of approximately 15,000 end users in a wide variety of industries, including machinery and equipment manufacturing, construction, shipbuilding and natural resources, such as mining and petroleum. The service center network includes 42 Canadian and 4 U.S. locations.

Russel Metals’ network of service centers carries a full line of metal products in a wide range of sizes, shapes and specifications, including carbon hot rolled and cold finished steel, pipe and tubular products, stainless steel and aluminum. Russel Metals purchases these products primarily from steel producers in North America and packages them for end users who typically require steel products in quantities that are smaller than the economic minimum order available from steel producers.

Russel Metals service center operations provide specialized processing services to satisfy specifications established by end users. By providing these services, as well as by offering inventory management and just-in-time delivery, Russel Metals enables end users to reduce their overall production costs and decrease capital required for raw materials and metals processing equipment.

Canadian OperationsRussel Metals operates one of the two largest steel service center operations in Canada based on revenue and tons sold. Russel Metals’ Canadian service centers sell plate, flat rolled carbon and general line steel products, as well as some stainless steel, aluminum and other non-ferrous specialty metal products.

Within Canada, the steel service centers operate under the names Russel Metals, Métaux Russel, Drummond McCall, A. J. Forsyth and Vantage Laser. Heavy gauge flat rolled operations are conducted by B&T Steel and McCabe Steel, both located in Hamilton, Ontario.

U.S. OperationsRussel Metals’ U.S. service centers sell primarily general line carbon steel products. General line steel products consist of plate, structurals, bars, sheet, pipe, tubing and hollow structural steel tubing.

In 2002, to strengthen Russel Metals’ Wisconsin operations, the Company purchased the operating assets of a leading service center located in Milwaukee, Wisconsin formerly known as Williams Steel. This operation had annual sales of approximately $49 million. The Bahcall and Williams operations initiated a restructuring process in the fourth quarter of 2002.

Russel Metals’ U.S. service center operations are conducted under the name Russel Metals Williams Bahcall and Baldwin International. Russel Metals Williams Bahcall focuses primarily on the distribution of general line carbon products through three facilities in Wisconsin. Baldwin International distributes specialty alloy products through its facility in Ohio.

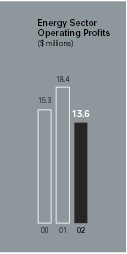

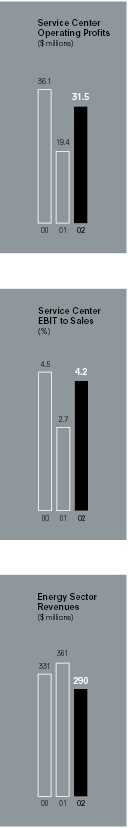

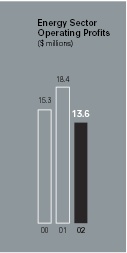

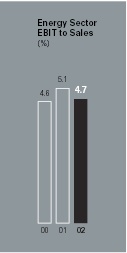

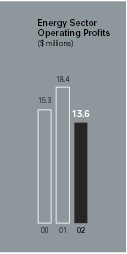

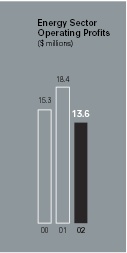

| Energy Performance | - 20% sales decrease to $289.6 million

- 26% decline in operating profits to $13.6 million

- Cash flow from operations of $6.2 million generated

- 4.7% segment operating profit to revenues maintained on lower revenues

|

The flexibility of our oil and gas operations produced a healthy operating profit despite revenue declines in 2002 due to lower rig activity.

Energy

Each business unit within the Company’s energy sector distribution operations occupies strong geographic niches and carries a more specialized and limited product line than the service centers. This segment distributes pipe, tube, valves and fittings primarily to the energy sector, from 5 Canadian and 2 U.S. locations.

Products are sourced from either the pipe processing arms of North American steel mills or from independent manufacturers of pipe and its accessories.

Each business in this segment sells a distinct line of products. These businesses include:

Fedmet TubularsA distributor of oil country tubular goods (which includes casing and tubing) and line pipe and related products, with its sales office in Calgary, Alberta.

Comco Pipe and Supply CompanyA distributor of pipe, valve and fitting products, specializing in the supply and distribution of pipe and fluid handling products to various industries. Distribution facilities are located in Calgary and Edmonton, Alberta; Stonewall, Manitoba; and Guelph and Sarnia, Ontario.

Pioneer PipeA distributor and processor of steel pipe products to the construction, oil and gas and ski industries in the Western United States. Pioneer Pipe has facilities in Aurora, Colorado and Lindon, Utah. These operations include Spartan Steel, headquartered in Evergreen, Colorado.

Triumph Tubular & SupplyAn established distributor of oil country tubular goods. Triumph’s sales office is located in Calgary, Alberta.

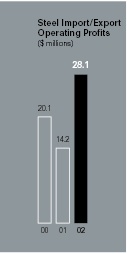

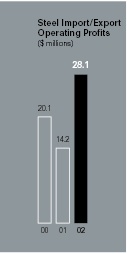

| Import/Export Performance | - 8% sales increase to $348.1 million

- Record operating profits of $28.1 million, an increase of 98%

- Cash flow used in operations of $9.7 million to support higher working capital

- Acquired Arrow Steel Processors, a coil processor of customer owned material, in Houston, Texas

|

This operation delivered a strong performance in 2002, benefiting from higher steel pricing following resolution of the U.S. trade rulings.

Import/Export

Russel Metals’ import/export operations, through Wirth Steel located in Canada and the Sunbelt Group located in the U.S., imports foreign steel products into Canada and the United States and exports steel from Canada and the United States. These operations also provide the Company’s other business segments with valuable insight regarding international pricing trends and their potential impact in North America.

Revenues from these operations may vary substantially from year to year, depending largely on general economic conditions and trade actions both in North America and in the export markets served. In 2002, the Company purchased the operations of Arrow Steel Processors, a coil processor of customer owned material, which is located at the port in Houston, Texas.

This segment specializes in the import into North America of carbon steel, plate, beams, channel, flat rolled products, rail and pipe products. Sales commitments for a significant portion of these products are generally obtained prior to their purchase or while the product is in transit. Products for which sales commitments have not been obtained are held in public warehouses for sale to North American service centers and other customers.

Management’s Discussion and Analysis

For the Year Ended December 31, 2002

The following management’s discussion and analysis of financial condition and results of operations of Russel Metals Inc. and its subsidiaries (Russel Metals or the Company) provides information to assist the reader and should be read in conjunction with the audited Consolidated Financial Statements for the year ended December 31, 2002, including the notes thereto. Statements contained in this document that relate to Russel Metals’ beliefs or expectations as to certain future events are not statements of historical fact and are forward-looking statements. Russel Metals cautions readers that there are important factors, risks and uncertainties, including but not limited to economic, competitive and governmental factors affecting Russel Metals’ operations, markets, products, services and prices that could cause the Company’s actual results, performance or achievements to be materially different from those forecasted or anticipated by Russel Metals in such forward-looking statements. All dollar references in this report are in Canadian dollars unless otherwise stated.

Russel Metals is one of the largest metal distribution companies in North America based on revenues and tons sold. The Company conducts business primarily in three metals distribution business segments: service centers; energy sector related pipe, tube, valves and fittings; and steel import/export.

| Brian R. Hedges

Executive Vice President and Chief Financial Officer 2002 was a year of contradictions in the steel sector, and was as unique as 2001, but for different reasons. Several factors contributed to the record $0.75 net earnings from operations before other costs of Russel Metals. |

Summary

2001 was one of the toughest years the steel industry experienced with record steel mill and service center bankruptcy levels, declining prices and soft demand. Russel Metals was an exception in the industry, demonstrating the ability to remain profitable while at the same time making investments to advance its corporate objectives through prudent acquisitions, divestitures, and excellent working capital management.

2002 was a year of contradictions in the steel sector, and was as unique as 2001, but for different reasons. Several factors contributed to the record $0.75 net earnings from operations before other costs of Russel Metals. The North American dumping actions, coupled with the financial weakness of North American steel mills, led to an unprecedented 40% price increase in flatroll products, including plate. The supply side driven price increases were at odds with the demand side fundamentals, which remained static in 2002. The rapid price increases resulted in inventory holding gains and higher gross margin dollars per ton. In the case of Russel Metals, these higher per ton margins, despite the relatively flat demand, enabled the service center segment to generate stronger earnings than the previous year. In addition, the import/export operations experienced higher volumes and increasingly strong margins under the umbrella of the aforementioned higher steel prices.

Political uncertainty and merger and acquisition activity influenced energy sector exploration and development and caused weak drilling activity in 2002, despite very strong oil and gas prices. This decline in activity led to lower revenues, gross margins and operating profits in our energy sector distribution businesses.

Strong balance sheet management continued in 2002, which resulted in lower borrowings and lower interest expense. Inventories did climb in the import/export operations during the later months of the year due to strong activity in our import/export operations. These elevated inventory levels will be reduced during the first quarter of 2003.

The following analysis provides a more detailed discussion of our results of operations.

Results of Operations

The following table provides a summary of revenues, gross margins (revenue minus cost of sales) as a percentage of revenues and operating profits (revenue minus cost of sales and operating expenses excluding corporate expenses and interest expense) for Russel Metals’ operating segments. The table shows the segments as they are reported to management and they are consistent with the segmented reporting in Note 13 to the 2002 Consolidated Financial Statements.

Service Center Distribution

a) Description of operationsThe Company provides processing and distribution services to a broad base of approximately 15,000 end users through a network of 42 Canadian and four U.S. locations. The Company’s network of service centers carries a full line of products in a wide range of sizes, shapes and specifications, including carbon hot rolled and cold finished steel, pipe and tubular products, stainless steel and aluminum. Russel Metals purchases these products primarily from steel producers in North America and packages them in accordance with end user specifications. The Company services all major geographic regions of Canada and selected regions in the United States. Within Canada, the service centers operate under the names Russel Metals, Métaux Russel, Drummond McCall, A. J. Forsyth and Vantage Laser. Heavy gauge flat rolled operations are conducted by B&T Steel and McCabe Steel, both located in Hamilton, Ontario. Russel Metals’ U.S. service center operations are conducted under the names Russel Metals Williams Bahcall and Baldwin International. The Williams Bahcall operations focus primarily on the distribution of general line carbon products through three facilities in Wisconsin. Baldwin International distributes specialty alloy products through its facility in Ohio.

In September 2002, the Company purchased the operating assets of a service center located in Milwaukee, Wisconsin formerly known as Williams Steel. This operation will add strength to the Russel Metals Bahcall operations. Williams Steel had sales of approximately $49 million for the year prior to the acquisition date. The acquisition is anticipated to be accretive to earnings in 2003. The Bahcall and Williams operations have substantially completed the process of restructuring which commenced during November 2002.

In October 2001, the Company purchased the shares of A. J. Forsyth and Company Limited, a service center operation with six locations in British Columbia and one in the Yukon. The A. J. Forsyth operations strengthen Russel Metals’ operations within the British Columbia region. A. J. Forsyth had sales of approximately $66 million for the year prior to the acquisition date.

b) Factors affecting results

b) Factors affecting results

External –

- steel pricing fluctuates significantly throughout the cycle. Steel prices are influenced by overall demand and by product availability.

- demand is significantly affected by economic cycles with revenues and operating profit fluctuating with the level of general business activity in the markets served.

- product availability is affected by supply side management practiced by steel producers in North America and international supply and demand which impacts steel imports.

- trade sanctions initiated either by steel mills or the public sector in North America, and less directly worldwide.

- Canadian steel service centers, which represent a large portion of the service center distribution segment operations, are particularly affected by general economic conditions and the manufacturing sector in Ontario and Quebec, and by pulp and paper, agriculture and resource sector activities in Western Canada, where demand for steel by the construction and capital goods sectors fluctuates considerably during the economic cycle.

Internal –

- the Company has a strong strategic network of branches across Canada, encompassing all provinces, thus declines in demand in one region may be countered by higher demands in other regions.

- many employees, including management, receive bonuses based on bottom line results; thus a portion of their compensation is variable and employees are motivated to maximize profitability.

- a large portion of the service center costs are fixed and are not reduced as volume declines, which can negatively impact results when demand weakens.

- the Company monitors its inventory levels and endeavors to achieve above average inventory turns in order to position itself to react to pricing and supply changes in the market and to minimize holding losses. The above average turns mean the Company is able to reduce the impact of price changes and stabilize its earnings stream, which results in stronger earnings in a downturn and compared to our competitors slightly lower earnings increases when prices increase.

- knowledge of international pricing trends obtained by the steel import/export operations provides insight for pricing and buying decisions.

c) Service center segment results – 2002 compared to 2001

Revenues for 2002 increased 6.3% due to higher selling prices and acquisitions compared to 2001. Revenue increases were most significant in British Columbia region due to the acquisition of A. J. Forsyth in October 2001. Volume declines occurred in Alberta due to lower oil and gas activity and at our U.S. operation, Williams Bahcall, due to general lower customer demand in the Wisconsin region and customer facility closures. Increased revenues, from the acquisition of Williams Steel effective September 9, 2002, are offset by the sale of the Eagan, Minnesota location in October 2001.

The average selling price per ton was approximately 5% higher in 2002 compared to 2001. The average selling price started to increase during the second quarter of 2002, reflecting price increases implemented by the North American steel mills. The average selling price plateaued in the last half of 2002.

Gross margins improved from 24.9% for 2001 to 26.8% for 2002, mainly a result of rising selling prices during 2002 and inventory holding gains. Gross margins decreased in the fourth quarter of 2002 and the Company expects them to decrease further in 2003.

Service center operating profits for 2002 increased by 62.9% compared to 2001. This increase is a result of selling price increases and corresponding higher gross margins, and the acquisition of A. J. Forsyth. Operating expenses for 2002 were $13.6 million, or 8.7% higher than 2001. Approximately $10.2 million of the increase in operating costs relates to the British Columbia region due to the acquisition of A. J. Forsyth.

Operating profits as a percentage of revenues for 2002 were 4.2%, a significant improvement over 2001 at 2.7% in one of the weakest years on record for the industry.

d) Service center segment results – 2001 compared to 2000Revenues for 2001 decreased 12.2% due to lower volume and selling prices. Volume declines were most significant in British Columbia due to weaker demand in the pulp and paper industry and Ontario due to weaknesses in the manufacturing sector. Alberta was the only region with increased volume due to the strength of the oil and gas industry. Excess inventory positions at both the mills and our competitors affected market pricing in the first half of 2001. Selling prices declined in all regions excluding Alberta with the most significant declines in British Columbia, Ontario and the U.S. operations of Bahcall. Selling prices for Alberta showed a slight improvement.

Gross margins improved from 24.3% in 2000 to 24.9% in 2001. By maintaining lower inventory levels than our competitors, Russel Metals was able to capitalize on low-priced purchases resulting in gross margin improvements compared to 2000.

The recession affecting the U.S. Midwest resulted in significant losses at Bahcall during 2001. In an effort to reduce costs and minimize losses, the Company disposed of the inventory and fixed assets of the Eagan, Minnesota operation for book value in October 2001.

Service center operating profits for the year ended 2001 decreased by 46.3% compared to 2000. This decline was a result of the significant volume and selling price declines. Operating expenses for 2001, adjusted for expenses of A. J. Forsyth in 2001, were $6.6 million, or 4.1% lower than 2000.

Operating profits as a percentage of revenues for 2001 were 2.7% compared to 4.5% for 2000 due to operating expenses not declining as significantly as revenues, a result of the significant portion of operating expenses being fixed.

Energy Sector Distribution

a) Description of operationsThese operations distribute pipe, tube, valves and fittings, primarily to the energy sector in Western Canada and the Western United States, from five Canadian and two U.S. locations. Russel Metals purchases these products either from the pipe processing arms of North American steel mills or from independent manufacturers of pipe and its accessories. The energy sector operates under the names Comco Pipe and Supply Company, Fedmet Tubulars, Triumph Tubular & Supply, Pioneer Pipe and Spartan Steel.

In August 2001, the Company purchased Spartan Steel, a pipe distributor in the midwest and southern United States. The Spartan operations complement the Pioneer Pipe business. Spartan had sales of approximately US $15 million for the year prior to the acquisition date.

In June 2001, the Company sold the operations of Total Distributors Supply Corporation, its U.S. operation serving the petrochemical and heat exchanger industries. The decision to sell the Total Distributors’ assets was based on the significant losses that had occurred in this operation due to the very competitive heat exchanger tubing market it served.

b) Factors affecting results

External –

- affected by economic cycles.

- significantly affected by oil and gas pricing, which impacts oil rig count and subsequent drilling activities particularly in Western Canada.

- Canadian operations affected by U.S. dollar since some products are sourced outside Canada and are priced in U.S. dollars.

- pricing is influenced by overall demand and by product availability.

- trade sanctions initiated either by steel mills or the public sector in North America.

Internal –

- low fixed costs due to a large portion of inventory stored at locations rented on a usage basis.

- employees’ compensation is highly variable as it is based on profits, allowing the Company to be profitable throughout the cycle.

c) Energy sector distribution results – 2002 compared to 2001 Energy sector revenues decreased 19.7% for 2002 compared to 2001. Lower rig activity for 2002 compared to 2001 has resulted in volume declines for the oil country tubular operations in Western Canada and the United States. Although oil pricing is comparable to 2001 levels, the consolidation of some large players and the restructuring to income trusts have impacted investment in capital and contributed to lower drilling levels in 2002.Comco Pipe, which distributes pipe, valves and fittings to other fluid handling industries as well as the energy sector, had increased revenues of 28.9% in 2002 compared to 2001. Comco Pipe’s revenue is more project oriented and as such is not as dependent on drilling levels.

Energy sector operating profits declined $4.8 million, or 26.0%, in 2002 compared to 2001. The decline is related to the drop in volume in the oil country tubular goods operations, partially offset by increased operating profits at Comco Pipe due to higher volumes from large projects.

d) Energy sector distribution results – 2001 compared to 2000

Energy sector revenues increased 8.8% for 2001 compared to 2000. The increase in revenue for the businesses excluding Total Distributors, which was divested in June 2001, is 13.7%. Approximately 60% of the revenue increase relates to the acquisition of Triumph Tubular effective September 1, 2000 and Spartan Steel effective August 15, 2001. The strong oil and gas prices experienced through the first three quarters of 2001 resulted in higher volumes in 2001 compared to 2000 for the other businesses. The oil country tubular operations in Western Canada and Western United States both had significant declines in volume during the fourth quarter of 2001 due to general economic uncertainty, a late winter freeze and weaker oil and gas pricing.

Energy sector operating profits improved by 20.2% in 2001 compared to 2000. Total Distributors, our U.S. operation serving the petrochemical and the heat exchanger industries, was sold in June 2001, which had a negative impact on revenue; however, it positively impacted operating profits. The operating profits increased 1.3% for the businesses, excluding Total Distributors’ losses from each year. The operating profits for the first nine months of 2001 were stronger than those for the same period in 2000; however, the fourth quarter was significantly lower than the fourth quarter of 2000 as drilling activity declined.

Steel Import/Export

a) Description of operationsRussel Metals’ steel import/export business primarily imports foreign steel products into Canada and the United States. It also exports steel from Canada and the United States. The international presence provides the Company’s other business segments with valuable insight regarding international pricing trends and their potential impact on steel markets in North America.

The main steel products sourced by the import/export operations are structural beam, heavy-wall plate, heavy-wall coils, pipe and tubing. The operations in this sector are Wirth Steel and Sunbelt Group.

Effective March 1, 2002, the Company purchased the operations of Arrow Steel Processors, a coil processor of customer owned material, located at the port in Houston, Texas. Arrow had sales of approximately US $2 million for the year prior to the acquisition date. Arrow Steel provides processing to Sunbelt as well as other customers.

b) Factors affecting results

External –

- trade sanctions initiated either by steel mills or the public sectors in North America.

- mill capacity by product line in North America.

- Canadian operations affected by movement in the U.S. dollar since purchases are mainly in U.S. dollars.

- steel pricing is influenced by overall demand and by product availability both domestically and worldwide.

- demand is affected by economic cycles.

- supply side management practiced by steel producers in North America and international supply and demand, which impacts steel imports and significantly affects product availability.

Internal –

- operating costs are variable with volume, since inventory is stored in public warehouses and employees are significantly compensated based on earnings.

- inventory is sourced throughout the world, including North America, providing flexibility for sourcing supply.

c) Steel import/export results – 2002 compared to 2001Steel import/export revenues increased 8.3% in 2002 compared to 2001. A decline in revenue was experienced during the first quarter of 2002 compared to the first quarter of 2001, when uncertainty existed related to the resolution of the U.S. and Canadian trade rulings. The U.S. made its ruling in March 2002, while the Canadian Safeguard initiative is still under review. This resulted in increased steel pricing. Revenues during the remainder of 2002 were significantly higher than 2001 due to a slight improvement in customer demand and higher selling prices.

Steel price increases initiated by North American steel mills contributed to higher selling prices resulting in a stronger gross margin of 14.3% for 2002 compared to 9.4% for 2001. The gross margin as a percentage of revenue of 14.3% for 2002 is higher than normal and is expected to decline in 2003.

Steel import/export operating profits increased 98.2% to $28.1 million for 2002 compared to 2001. The increase is mainly related to higher gross margin. This higher gross margin resulted in operating profits as a percentage of revenues of 8.1% for 2002 compared to 4.4% for 2001.

d) Steel import/export results – 2001 compared to 2000Steel import/export revenues decreased 16.6% for 2001 compared to 2000. The oversupply of carbon products in North America and the weakness in demand at the service center level impacted 2001 revenues. Volumes and selling prices for 2001 were lower than 2000.

Steel import/export operating profits decreased by 29.6% in 2001 compared to 2000. The lower volume was the most significant contributor to this; however, a bad debt write-off of $1.3 million related to a large U.S. service center which filed for Chapter 11 also impacted expenses for 2001.

Other – 2002 compared to 2001 and 2000

Other revenue and income represents the results of Thunder Bay Terminals, our coal handling terminal in Thunder Bay. Revenue for 2002 was 2.5% higher than 2001 due to increased volumes of coal handled. The revenues in 2001 had increased 40.9% compared to 2000. Operating profits for 2002 at $5.7 million are slightly less than 2001; however, 2002 and 2001 represent a significant increase over 2000, which is attributable to higher volumes handled. Approximately 37% of the 2002 revenues were a result of a short-term contract with one large customer. Revenues for 2003 may vary based on renewing this contract.

Consolidated Results – 2002 compared to 2001

Earnings from operations were $70.4 million, an increase of 39.1% compared to 2001 at $50.6 million. This increase in operating profits for 2002 relates to higher volumes and margins in service center and import/export operations offset by lower volumes in the energy operations. Consolidated revenues for 2002 approximate revenues for 2001.

During the second quarter of 2001, the Company reported a number of items that are not representative of the Company’s ongoing business and thus were disclosed separately. The loss on sale of business related to the sale of the inventory and fixed assets of Total Distributors and the acquisition costs related to the cost of due diligence and legal expense of an unsuccessful acquisition attempt. These items are referred to as unusual items.

The following table discloses earnings from ongoing operations net of income taxes, other costs net of income taxes and unusual items net of income taxes. Earnings per common share are also disclosed to assist the reader in determining results from ongoing operations.

|  |

The acquisition of Williams Steel was completed in September 2002. Similar to the acquisition of A. J. Forsyth in 2001, the Williams Steel operation was a strategic acquisition and the rationalization of the Williams Steel and Bahcall operations is expected to strengthen the Wisconsin operations. Williams Steel had one large operation in Milwaukee, which serviced most of Wisconsin and other nearby states. The restructuring with Bahcall will result in the closure of the Bahcall location near Milwaukee in the first quarter of 2003. The closing of this location as well as employee terminations related to eliminating duplicate functions has been estimated to cost $3.1 million, pre-tax. The first steps in the plan commenced in November 2002. The cost of restructuring the Williams Bahcall operations was anticipated at the time of acquisition.

The 2001 reserve, which provided for the restructuring of A. J. Forsyth with the Russel Metals operation in British Columbia, was reduced in the fourth quarter of 2002 by $392,000, pre-tax. The restructuring related to all operations other than those on Vancouver Island have been completed, and facility closure costs were less than originally anticipated.

During 2002, the Company recorded a foreign exchange gain of $0.3 million related to U.S. denominated debt that was not designated as a hedge of the Company’s net investment in foreign subsidiaries. The movement in the Canadian dollar against the U.S. dollar caused the gain for 2002 versus the loss for 2001.

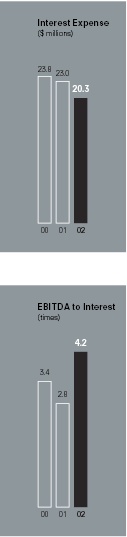

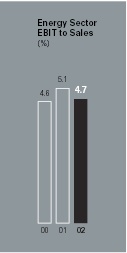

Consolidated interest expense decreased $2.7 million to $20.3 million for 2002 compared to 2001. This decrease is due to lower borrowing levels to fund working capital and lower U.S. denominated debt in 2002 due to the purchases of US $9.4 million of the U.S. Note in September and October 2001. The majority of the interest expense relates to the fixed term 10% Senior Notes and, therefore, no benefit was experienced from lower prime borrowing rates available through the bank credit facility.

Income taxes for 2002 were $18.4 million compared to $7.1 million for 2001. This dollar increase relates to higher operating earnings before tax for 2002 compared to 2001 and the unusual items recorded in 2001.

Basic earnings per share for 2002 was $0.71 compared to $0.17 for 2001. Earnings per share before other costs and unusual items was $0.75 for 2002 compared to $0.37 in 2001.

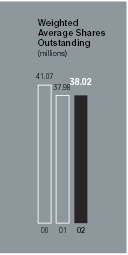

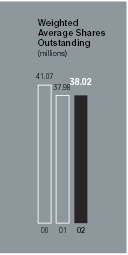

The weighted average number of common shares outstanding for 2002 was 38,024,034 compared to 37,981,501 for 2001. The increase relates to stock options exercised. The number of common shares outstanding at December 31, 2002 is 38,057,001.

Consolidated Results – 2001 compared to 2000

Earnings from operations were $50.6 million, a decline of 23.5% from $66.1 million in 2000. The lower volumes and selling prices in the service center and import/export operations were partially offset by increased volumes in the energy sector. In addition, Thunder Bay Terminals had a very strong year. Consolidated revenues for the entire Company decreased by 8.4%, to $1,402.5 million, in 2001 compared to 2000.

The acquisition of A. J. Forsyth in October 2001 was completed to strengthen the Russel Metals’ operations in British Columbia. The cost of restructuring the Russel Metals’ operations, including employee termination costs, relocation of equipment and closure of plants, was estimated at $2.4 million, based on the plan prepared by management. The first steps in the plan commenced in December 2001. The cost of restructuring the A. J. Forsyth operations was anticipated at the time of acquisition.

During 2001, the Company recorded a foreign exchange loss of $1.4 million related to U.S. denominated debt that was not designated as a hedge of the Company’s net investment in foreign subsidiaries.

Debt repurchase costs relate to the repurchase of US $9.4 million of 10% Senior Notes in 2001. This cost includes $0.3 million for the write-off of deferred issue costs recorded at the time of the issue of the Senior Notes.

In June 2001, the Company sold the inventory and fixed assets of Total Distributors, its Tulsa-based energy sector operation, for cash of $9.6 million. This transaction resulted in a pre-tax operating loss on the sale of the business of $6.0 million. The decision to sell these assets below book value was based on the significant losses that had occurred in this operation due to the very competitive heat exchanger tubing market it served.

In May 2001, the Company announced that it had been unsuccessful in finalizing an agreement for the acquisition of a U.S. service center operation. The due diligence process and legal expenses resulted in a write-off of costs of $1.7 million.

Consolidated interest expense decreased $0.8 million to $23.0 million for 2001 compared to 2000. This decrease is due to lower debt outstanding offset by higher exchange rates on U.S. denominated long-term debt for 2001 compared to 2000. The majority of the interest expense relates to the fixed term 10% Senior Notes and, therefore, no benefit was experienced from lower prime borrowing rates available through the bank credit facility.

Income taxes for 2001 were $7.1 million compared to $18.4 million for 2000. This decrease relates primarily to lower earnings. In the second quarter of 2001, the Company recorded income taxes recovered of $0.4 million relating to an Ontario tax rate adjustment enacted in 2001, applicable to timing differences on the balance sheet.

Basic earnings per share for 2001 was $0.17 compared to $0.53 for 2000. Earnings per share before other costs and unusual items was $0.37 for 2001 compared to $0.53 in 2000.

The weighted average number of common shares outstanding for 2001 was 37,981,501 compared to 41,068,870 for 2000. The reduction relates to common shares purchased under a substantial issuer bid on March 31, 2000 and under normal course issuer bids during 2000.

Interest Expense

The following table shows the components of interest expense.

The long-term debt interest expense relates to the 10% Senior Notes and the 8% Debentures. The Company currently has no floating rate long-term debt. The decrease in the long-term debt interest relates to lower interest costs due to the repurchase of 10% Senior Notes in 2001 offset by higher foreign exchange on the U.S. denominated debt interest of approximately $0.2 million. In September and October 2001, the Company used cash on hand to repurchase US $9.4 million of Senior Notes.

The Company had cash on hand and no short-term borrowings for most of 2002, resulting in net interest income of $0.2 million. The Company experienced a lower cash on hand position during the fourth quarter of 2002 due to increased working capital caused by price increases in steel inventory, higher revenues and the acquisition of Williams Steel.

Coverage Ratio

Russel Metals’ interest coverage ratio for 2002 improved to the best ratio experienced in the last ten years and is significantly higher than 2001 and 2000 due to the higher earnings from operations and lower interest expense. The Company’s ability to meet interest payments for the next two years remains strong. The coverage ratios set forth below are calculated using earnings from operations before interest, income taxes, depreciation and amortization (EBITDA) excluding restructuring costs and foreign exchange gain (loss) and, for 2001, debt repurchase costs and unusual items.

Coverage Ratio

Accounting Policies and Estimates

a) GoodwillThe Company adopted the Canadian Institute of Chartered Accountants’ new accounting standard for goodwill and other intangible assets effective January 1, 2002. Goodwill on acquisitions is not amortized but is subject to an impairment test. Under the new standard, all goodwill is subject to an initial impairment test as of January 1, 2002 and generally annually thereafter.

The Company’s initial impairment test as of January 1, 2002 indicated that the value of the goodwill was less than its carrying value in each reporting unit containing goodwill. The impairment loss of $15.1 million has been charged to opening retained earnings as at January 1, 2002.

Under the previous standard, the Company was required to write down goodwill when there was a permanent impairment in value based on a recoverability test using undiscounted cash flows. The new standard requires a “point in time” evaluation of goodwill at the reporting unit level. The initial evaluation of goodwill required at January 1, 2002, was at a point when the sector of the economy that the Company services and the steel industry were depressed. The Company’s evaluation of goodwill at the various reporting units required assumptions on the impact of the safeguard actions on imported steel in the U.S. and Canada, the effect of the softwood lumber tariffs on the British Columbia market, how oil and gas pricing would impact drilling, and the general economy. These factors significantly influence operations on a discounted cash flow basis, even though the Company believes these operations will contribute positively to its results subsequent to January 1, 2002.

The acquisition of Williams Steel in September 2002 resulted in goodwill of $2.7 million.

b) OtherThe preparation of the Company’s financial statements requires management to make estimates and judgements that affect the reported amounts. On an ongoing basis, the Company evaluates its estimates, including those related to bad debts, inventories, fixed asset lives, income taxes, restructuring costs, pensions and other post-retirement benefits, environmental, contingencies and litigation. The Company bases its estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgements about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

The Company’s most significant assets consist of accounts receivable and inventory. The Company maintains allowances for doubtful accounts for estimated losses resulting from the inability of its customers to make required payments. If the financial condition of the Company’s customers were to deteriorate, resulting in an impairment of their ability to make payments, additional allowances may be required. The Company reviews its inventory for obsolescence and to ensure that the cost of inventory is not in excess of the estimated market value. Inventory reserves or write downs are recorded if required.

The Company continues to use the intrinsic value-based method for stock-based compensation. If the Company had adopted the fair value-based accounting method effective January 1, 2002 and expensed stock options issued in 2002, the amount expensed would have been $136,000 or less than $0.01 per share. The Company has considered changing its policy to the fair value-based accounting method; however, since the change would not be material, the Company is waiting for the proposed new Canadian pronouncements to be finalized.

Capital Expenditures

Capital expenditures during 2002 were $12.8 million compared to $8.2 million in 2001. Russel Metals’ capital expenditures are mainly related to maintenance capital, the purchase of additional processing equipment across a broad base of the operations and upgrades to its existing facilities and computer systems.

In 2002, capital expenditures of $5.3 million were incurred in the British Columbia region to consolidate the Russel Metals operations with the A. J. Forsyth operations primarily to expand the Vancouver location to consolidate both operations.

Depreciation expense was $14.0 million for 2002 and $13.0 million for 2001. Depreciation expense has increased in 2002 mainly related to assets acquired from the A. J. Forsyth acquisition in October 2001. It will increase slightly in 2003 due to the Williams Steel acquisition.

Liquidity

Russel Metals stresses working capital management to ensure working capital is minimized and leverage reduced in an economic downturn. The Company reduced working capital employed significantly over the five quarters to March 31, 2002 as economic conditions deteriorated in the steel sector. Revenue increased in the last half of 2002 and working capital employed by Russel Metals has also increased. The amount of cash used for additional working capital in 2002 was $29.1 million.

Inventory and accounts receivable represent 76.4% of total assets, at December 31, 2002, compared to 72.7% at December 31, 2001. The increase relates to the expansion of inventory and accounts receivable levels to support the increased revenues. Property, plant and equipment utilized in the operations of the Company are very stable and are not expected to vary significantly. During 2002 capital spending was less than depreciation expense. Acquisitions in 2002 added $6.3 million to fixed assets.

The balances disclosed in the consolidated cash flow statements are adjusted to remove the non-cash component related to foreign exchange rate changes impacting inventory, accounts receivable and accounts payable of the U.S. operations. Assets purchased as part of the Williams Steel and Arrow Steel Processors acquisitions are also shown separately based on balances at the date of the transactions.

The Company’s net cash position, cash less bank indebtedness, at December 31, 2002 is $3.9 million. This balance is approximately $13.2 million lower than December 31, 2001.

For 2002, cash generated from operations was $55.7 million and cash utilized for changes in working capital was $29.1 million. Revenue increases have resulted in increased inventories utilizing cash of $55.8 million for 2002. However, accounts payable increases, related to increased volumes, generated cash of $23.9 million.

Inventory levels for 2002 increased $64.0 million from December 31, 2001. Inventory turns declined to 3.5 in the fourth quarter, as inventory levels increased more than cost of sales.

Inventory Turns

The inventory turns are calculated using the cost of sales for the quarter annualized and the ending inventory position.

The service center inventory turns are lower in the last half of 2002 compared to the first half due to higher inventory levels. The turns for the last half of 2002 are consistent with the last half of 2001. This can be compared with the industry turns estimated to be 3.2 for the three months ended November 30, 2002 as derived from the monthly Business Conditions Report published for the United States by the Metals Service Center Institute. It is management’s goal to maintain service center inventory turns at significantly higher levels than the industry norm.

Steel import/export inventory levels are significantly higher at December 31, 2002 compared to December 31, 2001 and the first three quarters of 2002. The inventory position at December 31, 2001 and during the first half of 2002 was intentionally lower than normal due to concerns about the impending dumping actions, steel pricing and profitability.

The level of inventory held by the import/export sector at December 31, 2002 has significantly reduced inventory turns for the quarter ended December 31, 2002 for the steel import/export sector and the total company. At December 31, 2002, approximately one third of the inventory was either pre-sold and not yet delivered to the customer or was in transit from the mill. The Company anticipates that the steel import/export sector will reduce its inventory during the first quarter of 2003.

The other major component of working capital is accounts payable and accrued liabilities, which increased to support higher inventory purchases in the last half of 2002, generating cash of $23.9 million. For 2001, accounts payable decreased utilizing cash of $46.3 million.

The Company acquired the operations including the fixed assets of Arrow Steel Processors, a coil processor of customer owned material, for $4.4 million in March 2002 and the operating assets of Williams Steel, a service center operation, for $17.0 million in September 2002.

During 2002, the Company utilized cash of $12.8 million on capital expenditures and $8.7 million on common and preferred share dividends.

For several years, the Company’s cash flow has been positively impacted by its ability to utilize income tax losses. In 2003, the Company will be required to make payments related to 2002 as well as instalments for 2003. The Company estimates income tax payments of $3.8 million will be required in the first quarter of 2003. Payments for the remainder of the year are estimated to be $5.8 million; however, this amount may vary based on earnings.

The Company will be relocating its flat rolled operation in Hamilton, Ontario during the fourth quarter of 2003. The Company anticipates spending $29 million for land, building, machinery and equipment for the new location. These commitments will result in periodic payments throughout 2003.

For 2001, overall cash generated was $46.7 million, determined by adding the decrease in bank indebtedness to the increase in cash. Cash generated from operations before working capital changes was $38.2 million. The improvement in net working capital generated by lower revenues resulted in cash generated from working capital of $54.9 million in 2001.

The sale of businesses in 2001 generated $10.4 million in cash.

The acquisition of A. J. Forsyth in October 2001 and Spartan Steel in August 2001, including assumed bank debt, consumed $42.4 million in cash.

In addition, during 2001 the Company utilized cash of $14.8 million to repurchase Senior Notes in September and October 2001, $8.2 million for capital expenditures and $9.8 million for common and preferred share dividends.

Debt and Credit Facilities

Debt and Credit Facilities

The Company manages its cash position based on bank borrowings net of cash. The bank credit facilities table provides the split between loans and cash on deposit.

Bank Credit Facilities

The Company has two long-term debt instruments outstanding. The $30 million 8% Subordinated Debentures mature in 2006. The 10% Senior Notes mature in 2009. The balance outstanding at December 31, 2002 is US $115.6 million, unchanged from December 31, 2001. The Canadian dollar equivalent of the Senior Notes fluctuates with the exchange rate.

Russel Metals has a bank credit facility with a syndicate of Canadian and U.S. banks. The $253.8 million facility may be extended for an additional one year period on each anniversary, with the consent of the banks. Russel Metals has extended the facility to June 19, 2005. Russel Metals is entitled to borrow under this facility, on a revolving basis, up to an amount equal to the sum of specified percentages of eligible accounts receivable and inventories, to a maximum of $253.8 million. At December 31, 2002, Russel Metals was entitled to borrow $231.3 million, including letters of credit. At December 31, 2002, Russel Metals had borrowings of $5.8 million and $8.0 million in letters of credit under this facility. At December 31, 2001, Russel Metals had no borrowings and had $10.5 million in letters of credit under this facility.

In addition, certain U.S. subsidiaries of Russel Metals have their own one year bank credit facility. The maximum borrowing under this facility is US $35.0 million. At December 31, 2002, these subsidiaries had borrowings of US $11.8 million and letters of credit of US $5.6 million compared to borrowings of US $0.5 million and letters of credit of US $1.8 million at December 31, 2001.

Based on Russel Metals’ current financial position, operating results and absence of scheduled debt maturities, Russel Metals believes that it will generate a sufficient amount of cash flow to pay all of its preferred share dividends, interest obligations and operating costs as they become due during the next two years.

Contractual Obligations

The Company is contractually obligated to payments under its long-term debt agreements and lease obligations that come due during the following periods.

The Company does not have any off-balance sheet arrangements other than the letters of credit referred to in the bank credit facilities table.

Dividends and Share Capital

The ability to pay dividends on common shares is impacted by restrictions associated with the 10% Senior Notes due June 2009. Dividends on common shares and the repurchase of common and preferred shares are considered to be restricted payments under the Note Indenture. Due to these restrictions, the quarterly dividend on common shares was not declared for payment during the first quarter of 2002. The quarterly dividend on common shares of $0.05 per common share was resumed in the second quarter. A decision was made to increase the $0.05 per share quarterly dividend on common shares to $0.06 per share, in the third quarter of 2002. Dividends totaling $6.5 million were paid in 2002 to common shareholders compared to $7.6 million 2001. The Senior Notes do not restrict preferred share dividends. At December 31, 2002, the Company had $10.1 million available for restricted payments.

The ability to make restricted payments is adjusted quarterly by 50% of the quarterly net income or loss. Net income is adjusted for certain exclusions that include: extraordinary items, gains or losses on asset dispositions and unrealized foreign exchange gains and losses.

As at December 31, 2002, the Company had 38,057,001 common shares and 1,200,000 class II preferred shares outstanding. During 2002, 75,500 common shares were issued upon the exercise of stock options at an average exercise price of $3.35. At February 17, 2003, the Company has 38,059,301 common shares and 1,200,000 class II preferred shares outstanding.

Vision and Strategy

The metals distribution business is a segment of a mature, cyclical industry – steel. The use of distributors by both manufacturers and end users of steel continues to grow. This is evidenced by the growth in the percentage of total steel shipments from steel producers to distributors. As the distribution segment continues to grow its share of steel industry shipments, steel distributors such as Russel Metals can grow their business over the course of a cycle.

Russel Metals strives to deal with the cyclical nature of the business by operating with the lowest possible net assets throughout the course of a cycle. In addition, its aim is to be more profitable through the various successive peaks and troughs as the steel cycles progress. In order to achieve this, management emphasizes profitability rather than revenue growth. This intensive asset management reduces borrowings and therefore interest expense in declining periods in the economic cycle and creates much more stable returns on net assets over the course of the cycle. Our conservative management approach creates relatively stronger trough earnings but could cause peak earnings to be somewhat muted. In periods of rapid price increases, as was experienced in 2002, strong inventory management led to lower inventory holding gains due to lower inventory levels.

Management strongly believes that it is more prudent to be profitable throughout a cycle, without the spikes in earnings caused by less emphasis on asset management, and have average earnings over the full range of the cycle in the top decile of the industry.

Growth from selective acquisitions is also a core management philosophy. The Company focuses on investment opportunities in businesses that have dominant market niches or provide mass to existing Russel Metals operations. The acquisition of A. J. Forsyth and Williams Steel, and the subsequent rationalization of the new businesses with existing Russel Metals businesses, has enabled the Company to establish a stronger market presence in both British Columbia and Wisconsin. The Company believes it requires stronger market positions in the Quebec and Ontario service center marketplace and is looking to make meaningful acquisitions in those markets.

In the energy and import/export segments, all of the companies in the Russel Metals group have significant operations in the market niche that they service. Consistent with our acquisition philosophy, any new acquisitions in these areas could likely be either major stand alone operations or complements to existing operations.

In the future, the length of the steel-based economic cycle will continue to shorten and a management structure that allows the fastest reaction to the changes will be the most successful. The Company will continue to invest in business systems to enable faster reaction times to changing business conditions. In addition, management believes the high level of service and flexibility provided by service centers will enable this distribution channel to capture an increasing percentage of total steel revenues to end users, allowing for increased growth within the sector.

Outlook

We expect the current demand experienced in the service center and import/export operations in the previous three quarters of 2002 to continue, although we anticipate pricing will weaken. We expect the decline in gross margins that was experienced in the fourth quarter of 2002 to continue in 2003.

At the current oil and gas price levels we would anticipate a seasonal pickup in demand in the energy sector in 2003; however, we believe it will be very modest based on indications at this time.

Management's Report to the Shareholders

The accompanying consolidated financial statements, management’s discussion and analysis and all information in the Annual Report have been prepared by management and approved by the Board of Directors of the Company. The consolidated financial statements were prepared in accordance with Canadian generally accepted accounting principles and, where appropriate, reflect management’s best estimates and judgements. Management is responsible for the accuracy, integrity and objectivity of the consolidated financial statements and management’s discussion and analysis within reasonable limits of materiality and for the consistency of financial data included in the text of the Annual Report with that contained in the consolidated financial system.

To assist management in the discharge of these responsibilities, the Company maintains a system of internal controls designed to provide reasonable assurance that its assets are safeguarded; that only valid and authorized transactions are executed; and that accurate, timely and comprehensive financial information is prepared.

The Company’s Audit Committee is appointed annually by the Board of Directors and is comprised of Directors, all of whom are neither employees nor officers of the Company. The Audit Committee meets with management as well as with external auditors to satisfy itself that management is properly discharging its financial reporting responsibilities and to review the consolidated financial statements, the independent auditors’ report and the management’s discussion and analysis. The Audit Committee reports its findings to the Board of Directors for consideration in approving the consolidated financial statements and management’s discussion and analysis for presentation to the shareholders. The external auditors have direct access to the Audit Committee of the Board of Directors.

The consolidated financial statements have been independently audited by Deloitte & Touche LLP. Their report outlines the nature of their audits and expresses their opinion on the consolidated financial statements of the Company.

/s/ E. M. Siegel, Jr.

President and

Chief Executive Officer | /s/ Brian R. Hedges

Executive Vice President and

Chief Financial Officer |

Auditors’ Report

To the Shareholders of Russel Metals Inc.

We have audited the consolidated balance sheets of Russel Metals Inc. as at December 31, 2002 and 2001 and the consolidated statements of earnings and retained earnings and cash flows for each of the years in the three year period ended December 31, 2002. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with Canadian generally accepted auditing standards. Those standards require that we plan and perform an audit to obtain reasonable assurance whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation.

In our opinion, these consolidated financial statements present fairly, in all material respects, the financial position of the Company as at December 31, 2002 and 2001 and the results of its operations and its cash flows for each of the years in the three year period ended December 31, 2002 in accordance with Canadian generally accepted accounting principles.

/s/ Deloitte Touche LLP

Chartered Accountants

Toronto, Ontario

January 31, 2003

Comments by Auditors on Canada – U.S. Reporting Differences

In the United States of America, reporting standards for auditors require the addition of an explanatory paragraph (following the opinion paragraph) when there is a change in accounting principles that have a material effect on the comparability of the Company’s financial statements, such as the changes described in Note 2 (a) to the financial statements. Our report to the Shareholders, dated January 31, 2003, is expressed in accordance with Canadian reporting standards, which does not require a reference to such a change in accounting principles in the auditors’ report when the change is properly accounted for and adequately disclosed in the financial statements.

/s/ Deloitte Touche LLP