UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant [X]

Filed by a party other than the Registrant [ ]

Check the appropriate box:

| | |

| [ ] | | Preliminary Proxy Statement |

| [ ] | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | | Definitive Proxy Statement |

| [ ] | | Definitive Additional Materials |

[ ] | | Soliciting Material under § 240.14a-12 |

STONE ENERGY CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

[X] | | No fee required. |

[ ] | | Fee computed on table shown below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

[ ] | | Fee paid previously with preliminary materials. |

| |

[ ] | | Check box if any part of the fee is offset as provided by Exchange Act Rule 240.0-11 and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

2014

Notice of Annual Meeting

and Proxy Statement

IMPORTANT VOTING INFORMATION

If you owned shares of our common stock at the close of business on March 26, 2014, you are entitled to one vote per share upon each matter presented at our 2014 annual meeting of stockholders to be held on May 22, 2014. Stockholders whose shares are held in an account at a brokerage firm, bank or other nominee (i.e., in “street name”) will need to obtain a proxy from the broker, bank or other nominee that holds their shares authorizing them to vote at the annual meeting.

Your broker is not permitted to vote on your behalf on the election of directors and other matters to be considered at the annual meeting, except on ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal 2014, unless you provide specific instructions by completing and returning the voting instruction form or following the instructions provided to you to vote your shares via telephone or the Internet. For your vote to be counted, you will need to communicate your voting decisions to your broker, bank or other nominee before the date of the annual meeting.

Your vote is important. Our board strongly encourages you to exercise your right to vote. Voting early helps ensure that we receive a quorum of shares necessary to hold the annual meeting.

If you have any questions about the proxy voting process, please contact the broker, bank or other nominee where you hold your shares. The Securities and Exchange Commission also has a website (www.sec.gov/spotlight/proxymatters.shtml) with more information about your rights as a stockholder. You also may contact our Investor Relations Department by phone at (337) 237-0410 or by e-mail at information@stoneenergy.com.

ATTENDING THE ANNUAL MEETING IN PERSON

Only stockholders of record or their legal proxy holders as of March 26, 2014 or our invited guests may attend the annual meeting in person.If you plan to attend the annual meeting in person, youmust present a valid form of government-issued photo identification. If you wish to attend the annual meeting and your shares are held in street name with a broker, bank or other nominee, you will need to bring your notice or a copy of your brokerage statement or other documentation reflecting your stock ownership as of the record date for the meeting.

|

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY 22, 2014 |

The Notice of the 2014 Annual Meeting of Stockholders, the Proxy Statement for the 2014 Annual Meeting of Stockholders and the 2013 Annual Report to Stockholders (which includes the Annual Report on Form 10-K for the fiscal year ended December 31, 2013) of Stone Energy Corporation are available athttp://www.edocumentview.com/SGY. |

| | |

| | Stone Energy Corporation 625 E. Kaliste Saloom Road Lafayette, Louisiana 70508 |

| | |

| | Dear Fellow Stone Energy Corporation Stockholder: You are cordially invited to attend the 2014 annual meeting of stockholders of Stone Energy Corporation, which will be held on May 22, 2014 at 10:00 a.m., local time, at our New Orleans office, which is located at 1100 Poydras Street, Suite 1050, New Orleans, Louisiana 70163. At the annual meeting, stockholders will be asked to elect our board of directors, ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal 2014 and hold an advisory vote to approve named executive officer compensation. The proxy statement included with this letter provides you with information about the annual meeting and the business to be conducted. This year’s proxy statement demonstrates our ongoing commitment to simplify and more effectively communicate the matters to be considered at our upcoming annual meeting and the other information included in our proxy statement. This year, you will see several enhancements in how we present information to you about our director nominees, corporate governance practices and executive compensation policies and practices. We have attempted to improve the readability of our proxy statement by using easier to read columns and text throughout. We also have attempted to present information in a clearer fashion by using more bulleted lists, tables and graphics, and by grouping and ordering information so that it is easier to find within the proxy statement. In addition, we now include a proxy statement summary which appears immediately before the Notice of the 2014 Annual Meeting of Stockholders. This summary serves to highlight important information included elsewhere in the proxy statement. The Board and I believe that these changes reflect our ongoing commitment to make the information you are looking for easier to locate and review. You will see that we also have continued to enhance the discussion and analysis of our executive compensation program on pages 28 to 50. Also, pages 12 through 18 and pages 68 and 69 of the proxy statement include detailed information about our director nominees and why we believe they are qualified to serve you. We trust these enhancements to our proxy statement disclosures will aid your review of this important information. We are committed to maintaining a constructive and open dialogue with all of our stockholders, and we view these improvements to our annual proxy information as an important part of this commitment to you. Thank you for your continued support of Stone Energy Corporation. Very truly yours,

David H. Welch Chairman, President and Chief Executive Officer YOUR VOTE IS IMPORTANT. We urge you to read the proxy statement carefully. Whether or not you plan to attend the annual meeting, we ask that you vote as soon as possible. |

Table of Contents

i

ii

This summary highlights information contained in the proxy statement. This summary does not contain all of the information you should consider, and you should read the entire proxy statement carefully before voting.

2014 Annual Meeting of Stockholders

| | |

Date: | | May 22, 2014 |

| |

Time: | | 10:00 a.m., local time |

| |

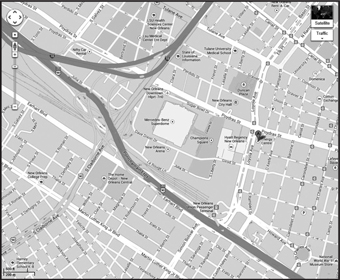

Place: | | 1100 Poydras Street, Suite 1050, New Orleans, Louisiana 70163 |

| |

Record Date: | | March 26, 2014 |

| |

Agenda: | | 1. Election of 10 directors each to serve a term of one year |

| |

| | 2. Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal 2014 |

| |

| | 3. Advisory vote to approve named executive officer compensation |

| |

| | 4. Transaction of any other business that may properly come before the annual meeting or any adjournment or postponement thereof |

| |

Voting: | | Stockholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the proposals to be voted on. |

Voting Matters and the Board’s Recommendation

The following table summarizes the items that will be brought for a vote of our stockholders at the annual meeting, along with the recommendation of our board of directors (“Board”) as to how stockholders should vote on each item.

| | | | |

Description | | Board’s Recommendation |

Proposal 1 | | Election of 10 director candidates nominated by the Board, each to serve a one-year term and until his or her successor has been elected and qualified | | FOR |

Proposal 2 | | Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal 2014 | | FOR |

Proposal 3 | | Advisory vote to approve named executive officer compensation | | FOR |

In addition to these matters, stockholders may be asked to vote on such other business as may properly be brought before the annual meeting or any adjournment or postponement thereof.

1

Director Nominees

The Board is comprised of nine independent directors and our Chairman, who is also our President and CEO. The following table provides summary information about each director nominee, including whether the Board considers the nominee to be independent under the New York Stock Exchange’s independence standards. Each director is elected annually by a majority of votes cast.

| | | | | | | | | | | | |

Name | | Age | | | Director Since | | | Independent | | Positions/Committee

Memberships |

George R. Christmas | | | 74 | | | | 2003 | | | Yes | | C, NG |

B. J. Duplantis | | | 74 | | | | 1993 | | | Yes | | C, R, NG |

Peter D. Kinnear | | | 67 | | | | 2008 | | | Yes | | A, C, NG |

David T. Lawrence | | | 58 | | | | 2013 | | | Yes | | A, R, NG |

Robert S. Murley | | | 64 | | | | 2011 | | | Yes | | A, C, NG |

Richard A. Pattarozzi | | | 70 | | | | 2000 | | | Yes | | LID, R, NG |

Donald E. Powell | | | 72 | | | | 2008 | | | Yes | | A, NG |

Kay G. Priestly | | | 58 | | | | 2006 | | | Yes | | A, R, NG |

Phyllis M. Taylor | | | 72 | | | | 2012 | | | Yes | | C, R, NG |

David H. Welch | | | 65 | | | | 2004 | | | No | | Chairman of the Board |

| | NG | Nominating and Governance Committee |

| | LID | Lead Independent Director |

Corporate Governance Highlights

Below are a number of our corporate governance highlights, including policies implemented and other governance achievements.

| | |

Ø Appropriately Sized Board (10 Members) Ø 9 out of 10 Directors are Independent Ø Diverse Board Members (as to Gender, Experience and Skills) Ø 2 out of 10 Directors are Female; Awarded Corporate Governance Distinction of Gender Diverse Board for Fiscal 2013 Ø All Directors Are Elected Annually Ø Adopted Majority Vote for Uncontested Election of Directors Ø Board Operates with a Lead Independent Director Ø Compensation Committee Engaged Independent Compensation Consultant During 2013 and 2014 Ø Independent Directors Routinely Meet Without Management Present | | Ø All Board Committees Comprised Solely of Independent Directors Ø Committee Authority to Retain Independent Advisors Ø Audit Committee Members May Not Serve on More Than Three Public Company Audit Committees Ø Four Audit Committee Financial Experts Ø Non-Employee Directors Receive a Portion of Compensation in Equity Ø Robust Stock Ownership and Retention Requirements for Executive Officers and Directors Ø Directors Receive Orientation/Education Programs Ø Robust Corporate Compliance Program Ø Disclosure Committee for Financial Reporting |

2

| | |

Ø Robust Director Nomination Process to Identify Talented and Diverse Board Members Ø Board and Committees Conduct Annual Self-Evaluations | | Ø “Say on Pay” Advisory Vote Conducted Annually Ø Adopted Policy of No-Hedging of Company Stock Ø No Poison Pill |

2013 Executive Compensation Highlights

The cornerstone of our 2013 compensation program for our executives and all employees, regardless of level, is “pay-for-performance.” The program is designed to align the interests of our employees, including our Named Executive Officers, or “NEOs,” with those of our stockholders and to support both our short-term and long-term business objectives and the corporate values that we believe steer success. This approach allows us to pay our employees for delivering value to our stockholders while reducing overall compensation levels if we do not achieve our goals. Our compensation program discourages excessive risk by rewarding both short-term and long-term performance, maintains flexibility to respond to the dynamic and cyclical nature of our industry and allows us to be competitive in attracting, retaining and motivating our employees, including our leaders and other top-tier talent, in the highly competitive oil and gas industry.

Compensation decisions by our Compensation Committee and the Board in recognition of performance during 2013 and in response to its analysis of market data included the following:

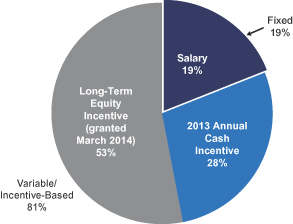

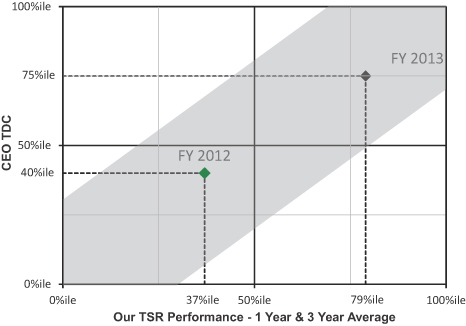

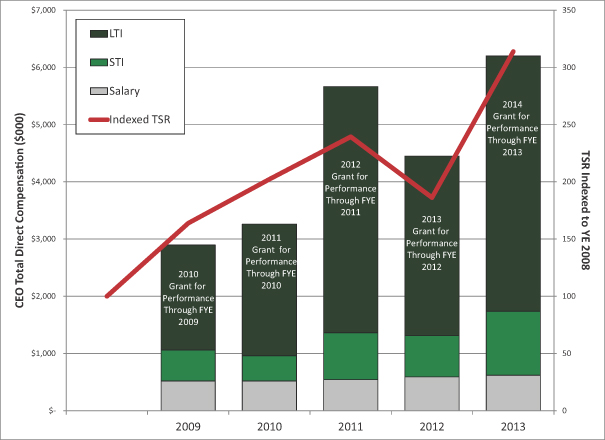

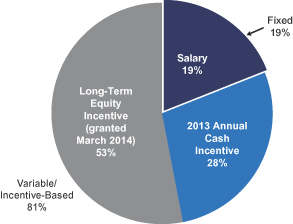

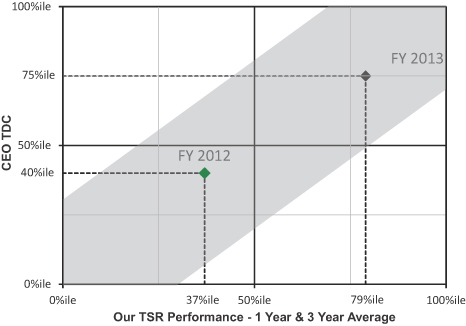

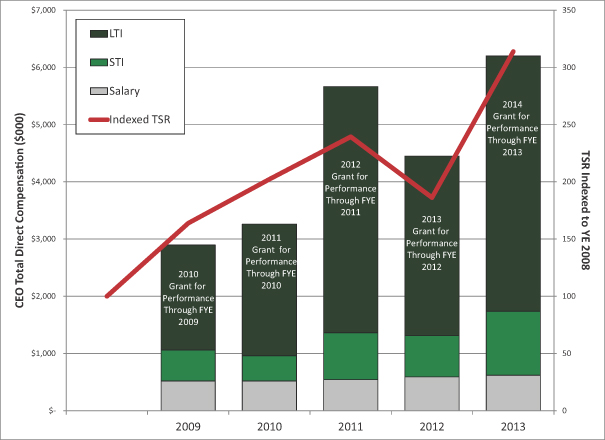

| | • | | 2013 Total Direct Compensation, or “TDC,” for our CEO and our other NEOs as a group approximated the 75th percentile of our peer group, consistent with our standing (at the 79th percentile) versus our peer group in terms of relative total stockholder return, or “TSR,” performance (being the average of our one-year and three-year performance, weighted equally). |

| | • | | NEO annual cash incentive compensation earned for 2013 performance was paid out in 2014 at above the targeted amount for achievement of the stated business objectives and in recognition of our company’s overall performance in 2013. |

| | • | | NEO annual long-term equity incentive awards were made in the form of restricted share grants vesting over three years. |

Because our stock performance relative to our peers is not determined until after year end, the base salary element of TDC for our NEOs is the only TDC element known prior to the end of our fiscal year. The annual cash incentive and the long-term equity incentive elements of TDC are determined and awarded in the first quarter of the following year (in this instance, in fiscal 2014). The table below provides a summary of the TDC earned by our NEOs for 2013 performance despite the actual date that the particular element of compensation may have been granted or paid. This presentation is in contrast to the Summary Compensation Table and the Grants of Plan Based Awards Table that reflect annual incentive/discretionary bonus and long-term incentive awards made during calendar year 2013 in recognition of 2012 performance, but do not reflect the awards made in calendar year 2014 in recognition of 2013 performance. Accordingly, in addition to the table below, we have added a column to the Summary Compensation Table labeled “TDC,” setting forth the total TDC earned by our NEOs for 2013 performance inclusive of the annual incentive/discretionary bonus and long-term incentive awards made in 2014 in recognition of 2013 performance.

3

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Executive | | 2013

Salary | | | 2013

Annual

Incentive | | | 2013

Discretionary

Bonus | | | 2013 Restricted Stock Grant

(Granted March 2014) | | | Resulting Total

Direct

Compensation

(TDC) | |

| | | | | Shares | | | Grant

Price | | | Grant Value | | |

D. Welch, CEO | | $ | 625,000 | | | $ | 894,000 | | | $ | 223,500 | | | | 123,331 | | | $ | 35.94 | | | $ | 4,432,516 | | | $ | 6,175,016 | |

K. Beer, CFO | | | 375,000 | | | | 448,000 | | | | 112,000 | | | | 46,188 | | | | 35.94 | | | | 1,659,997 | | | | 2,594,997 | |

J. Pierret | | | 275,000 | | | | 328,000 | | | | 82,000 | | | | 14,190 | | | | 35.94 | | | | 509,989 | | | | 1,194,989 | |

K. Seilhan | | | 245,000 | | | | 288,158 | | | | 76,842 | | | | 15,442 | | | | 35.94 | | | | 554,985 | | | | 1,164,985 | |

R. Toothman | | | 275,000 | | | | 327,273 | | | | 92,727 | | | | 17,807 | | | | 35.94 | | | | 639,984 | | | | 1,334,984 | |

Stockholder Outreach and Engagement Efforts

Our Board and its Compensation Committee take stockholder support of our executive compensation program very seriously. In 2011 and 2012, the first two years of our say-on-pay vote, our stockholders approved the resolution on our executive compensation with roughly 96% of the votes cast. While our 2013 stockholder vote continued to reflect a significant level of support at 67% of the votes cast in favor, we aspire to achieve the full support of our stockholders for our compensation program, which we believe pays for performance, enables talent attraction, retains top talent and closely aligns the interests of our executives with those of our stockholders.

In an effort to solicit and respond to feedback about our executive compensation program and to broaden the dialogue with our stockholders, we reached out to investors representing approximately 70% of our outstanding shares of common stock and had discussions with slightly more than 20% of the same. Through this engagement process, we determined that our stockholders desired a better understanding of the direct link between performance and the specific pay decisions made for our NEOs. Similarly, from these discussions we learned that our stockholders perceived a misalignment between the compensation awarded to our NEOs for 2012 performance and the performance of our stock in 2012 relative to our peers. We believe this perceived misalignment was due in part to a disconnect between our approach to pay and performance alignment and the manner in which we are required to disclose compensation:

| | • | | Equity awards granted during calendar year 2012 and reported in our 2013 proxy filing were granted at a level intended to reflect our relative TSR performance through the end of 2011 (at the 75th percentile of our peer group). |

| | • | | In response to our lower relative TSR performance through the end of 2012, TDC for 2012 was targeted at the 40th percentile of the market. The Compensation Committee consequently approved equity grants in March 2013 that were below those granted in 2012. However, due to Securities and Exchange Commission executive compensation reporting rules, the Summary Compensation Table in our 2013 proxy statement reflected the larger equity awards for more favorable 2011 performance. |

In this year’s 2014 proxy statement, we have endeavored to be clearer regarding our approach to pay and performance alignment, both as to our philosophy and our practices. In addition, as a result of discussions with our stockholders, we also made adjustments in several of our governance and compensation practices, including the following:

| | • | | Majority Voting in Uncontested Director Elections: The Board amended our Bylaws to adopt majority voting in uncontested director elections (retaining plurality voting in contested elections), with an associated amendment to our Corporate Governance Guidelines to provide that if a director candidate does not receive a majority of the votes |

4

| | cast, the director will tender his or her resignation, to be accepted by the Board in the exercise of its business judgment. |

| | • | | Stock Retention Requirements: The Board amended our Stock Ownership Guidelines for our executive officers and directors to provide that, until an executive officer or director attains the stock retention guideline associated with his or her position, the officer or director is required to retain, and not sell or otherwise dispose of, not less than 75% of the net shares acquired through equity awards from the company. |

| | • | | Prohibition on Hedging:The Board adopted a policy prohibiting any executive officer of the company, including the NEOs, from hedging company stock. |

Furthermore, certain related party transactions relating to the 2012 disclosure year were resolved in fiscal 2013 with John L. Laborde’s retirement from the Board in June 2013, and the son of our Lead Independent Director, Richard A. Pattarozzi, no longer being employed by one of our financial advisory firms.

We believe that stockholders will favorably view the changes we have made as a result of our ongoing outreach efforts. The changes are intended to improve our corporate governance and to maintain the strong, direct link between the compensation of our NEOs and our performance.

5

| | |

| | Stone Energy Corporation 625 E. Kaliste Saloom Road Lafayette, Louisiana 70508 |

Notice of the 2014 Annual Meeting of Stockholders

Meeting Date: May 22, 2014

Meeting Time: 10:00 a.m., local time

Location: 1100 Poydras Street, Suite 1050, New Orleans, Louisiana 70163

Record Date: March 26, 2014

Purposes of the 2014 annual meeting of stockholders:

| | (1) | To elect 10 director candidates nominated by the board of directors, each to serve a one-year term and until his or her successor has been elected and qualified; |

| | (2) | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014; |

| | (3) | To hold an advisory vote to approve named executive officer compensation; and |

| | (4) | To transact such other business as may properly come before the annual meeting or any adjournment or postponement thereof. |

Information relevant to these matters is set forth in the accompanying proxy statement.

The close of business on March 26, 2014 was fixed as the record date for the determination of stockholders entitled to receive notice of and to vote at the annual meeting or any adjournment or postponement thereof. Only our stockholders or their legal proxy holders as of the record date or our invited guests may attend the annual meeting in person.

Beginning on or about April 10, 2014, we mailed a Notice of Internet Availability of Proxy Materials to our stockholders containing instructions on how to access the proxy statement and vote online and made our proxy materials available to our stockholders over the Internet.

By Order of the Board of Directors,

Lisa S. Jaubert

Senior Vice President, General Counsel and Secretary

6

2014 PROXY STATEMENT

This proxy statement is furnished to you in connection with the solicitation by and on behalf of the board of directors (the “Board”) of Stone Energy Corporation (“we,” “our,” “company” or “Stone”) for use at the 2014 annual meeting of stockholders to be held on May 22, 2014 at 10:00 a.m., local time, at our New Orleans office located at 1100 Poydras Street, Suite 1050, New Orleans, Louisiana 70163, or at any adjournment or postponement thereof (the “Annual Meeting”).

Purposes of the Annual Meeting; Board Recommendations

The agenda for the Annual Meeting includes the following items:

| | | | |

Agenda Item | | Board Recommends Vote |

Proposal 1 | | Election of 10 director candidates nominated by the Board, each to serve a one-year term and until his or her successor has been elected and qualified | | FOR |

Proposal 2 | | Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal 2014 | | FOR |

Proposal 3 | | Advisory vote to approve named executive officer compensation | | FOR |

Notice of Internet Availability of Proxy Materials

On or about April 10, 2014, we mailed a Notice of Internet Availability of Proxy Materials to our stockholders of record and beneficial owners who owned shares of our common stock at the close of business on March 26, 2014. The Notice of Internet Availability of Proxy Materials contained instructions on how to access the proxy materials and vote online. We have made these proxy materials available to you over the Internet or, upon your request, have delivered paper versions of these materials to you by mail, in connection with the solicitation of proxies by our Board for the Annual Meeting.

Choosing to receive your future proxy materials by e-mail will save us the cost of printing and mailing documents to you. If you choose to receive future proxy materials by e-mail, you will receive an e-mail next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by e-mail will remain in effect until you terminate it.

Record Date

At the close of business on March 26, 2014, the “Record Date” for the determination of stockholders entitled to receive notice of and to vote at the Annual Meeting, there were 50,414,082 shares of common stock outstanding, each share of which is entitled to one vote. Common stock is the only class of our outstanding securities entitled to receive notice of and to vote at the Annual Meeting.

7

Appointment of Proxy Holders

Our Board asks you to appoint David H. Welch, Richard A. Pattarozzi and B.J. Duplantis as your proxy holders (“Proxy Holders”) to vote your shares at the Annual Meeting. You make this appointment by using one of the voting methods described below.

Quorum and Discretionary Authority

The presence at the Annual Meeting of a majority of shares of our common stock issued and outstanding and entitled to vote, present in person or by proxy, is necessary to constitute a quorum in order to transact business at the Annual Meeting. Your shares are counted as present at the Annual Meeting if you attend the Annual Meeting and vote in person or if you properly return a proxy by Internet, telephone or mail. Abstentions and broker non-votes will be counted for purposes of establishing a quorum at the Annual Meeting.

If less than a quorum is represented at the Annual Meeting, the Chairman of the meeting or a majority of the issued and outstanding shares so represented may adjourn the Annual Meeting from time to time, and the Proxy Holders will vote the proxies they have been authorized at the Annual Meeting in favor of such an adjournment. In the event a quorum is present at the Annual Meeting but sufficient votes to approve any of the items proposed by our Board have not been received, the Chairman of the meeting or the Proxy Holders may propose one or more adjournments of the Annual Meeting to permit further solicitation of proxies. A stockholder vote may be taken on one or more of the proposals in this proxy statement prior to such adjournment if sufficient proxies have been received and it is otherwise appropriate.

Our Board does not know of any other matters that are to be presented for action at the Annual Meeting. However, if other matters properly come before the Annual Meeting, the proxies solicited by the Board will provide the Proxy Holders with the authority to vote on those matters and nominees in accordance with such persons’ discretion. Where a stockholder has appropriately specified how a proxy is to be voted, it will be voted by the Proxy Holders in accordance with the specification.

How to Vote Shares Registered in Your Name

If you own shares that are registered in your own name, you are a “registered stockholder” and you may attend the Annual Meeting and vote in person. You also may vote by proxy without attending the Annual Meeting in any of the following ways:

| | • | | By Internet. You may submit a proxy electronically on the Internet by following the instructions provided in the Notice of Internet Availability of Proxy Materials. Please have the Notice of Internet Availability of Proxy Materials in hand when you log onto the website. Internet voting facilities will be available 24 hours a day, 7 days a week, and will close at 11:59 p.m., Eastern Time, on May 21, 2014. |

| | • | | By Telephone. If you request paper copies of the proxy materials by mail, you may submit a proxy by telephone using the toll-free number listed on the proxy card. Please have your proxy card in hand when you call. Telephone voting facilities will close and no longer be available on the date and time specified on the proxy card. |

| | • | | In Person. You may vote in person at the Annual Meeting by completing a ballot, which will be available at the Annual Meeting. Please note that attending the Annual Meeting without completing a ballot will not count as a vote. |

| | • | | By Mail. If you request paper copies of the proxy materials by mail, you may indicate your vote by completing, signing and dating your proxy card and returning it in the reply envelope provided. |

8

For stockholders who have their shares voted by duly submitting a proxy by Internet, telephone or mail, the Proxy Holders will vote all shares represented by such valid proxies in accordance with the Board’s recommendations as set forth above, unless a stockholder appropriately specifies otherwise.

If you received more than one Notice of Internet Availability of Proxy Materials, your shares are likely registered in different names or with different addresses or are in more than one account. You must separately vote the shares shown on each Notice of Internet Availability of Proxy Materials that you receive in order for all of your shares to be voted at the Annual Meeting.

How to Vote Shares Held in “Street Name”

If you hold shares through a brokerage firm, trustee, bank, other financial intermediary or nominee (known as shares held in “street name”), you will receive from that broker, trustee, bank, financial intermediary or other nominee (the “intermediary”) a voting instruction form that will explain how to direct the voting of your shares through the intermediary, which may include the ability to provide voting instructions via the Internet or by telephone.

If your shares are held in street name through a brokerage firm that is a member of the New York Stock Exchange (“NYSE”) and you want to vote on any of the proposals to be submitted to a vote at the Annual Meeting (except as to Proposal 2), you MUST indicate how you wish your shares to be voted. The broker will vote shares held by you in street name in accordance with your voting instructions, as indicated on your signed voting instruction form or by the instructions you provide via the Internet or by telephone. Absent such instructions, the proxy submitted by the broker with respect to your shares will indicate that the broker is not able to cast a vote with respect to the matter, which is commonly referred to as a “broker non-vote.”Accordingly, if your shares are held in street name, it is important that you provide voting instructions to the broker or other intermediary so that your vote will be counted. Under NYSE rules, Proposal 2 would be considered a “routine matter,” and thus a broker would be permitted in its discretion to cast a vote on that proposal as to your shares in the event that you do not provide the broker with voting instructions.

If you hold shares in street name and wish to vote your shares in person at the Annual Meeting, you must first obtain a valid proxy from the intermediary. To attend the Annual Meeting in person (regardless of whether you intend to vote your shares in person at the Annual Meeting), you should follow the instructions under “Attending the Annual Meeting in Person” below.

If you received more than one voting instruction form, your shares are likely registered in different names or with different addresses or are in more than one account. You must separately follow the foregoing voting procedures for each voting instruction form that you receive in order for all of your shares to be voted at the Annual Meeting.

Revoking or Changing a Proxy

If you are a registered stockholder, you may revoke your proxy at any time before your shares are voted at the Annual Meeting by:

| | • | | voting again through the Internet or by telephone prior to 11:59 p.m., Eastern Time on May 21, 2014; |

| | • | | requesting, completing and mailing in a new paper proxy card, as outlined in the Notice of Internet Availability of Proxy Materials; |

| | • | | voting in person at the Annual Meeting by completing a ballot; however, attending the Annual Meeting without completing a ballot will not revoke any previously submitted proxy; or |

| | • | | submitting a written notice of revocation to the Secretary of Stone Energy Corporation at 625 E. Kaliste Saloom Road, Lafayette, Louisiana 70508 no later than May 21, 2014. |

9

If you are a street-name stockholder and you vote by proxy, you may change your vote by submitting new voting instructions to your broker, bank or other nominee in accordance with that entity’s procedures.

Required Vote and Method of Counting

Proposal 1. Election of Directors

To be elected, each nominee for election as a director must receive the affirmative vote of a majority of the votes of the shares of common stock cast on such nominee at the Annual Meeting. This means that a director nominee will be elected if the number of votes cast for that nominee’s election exceeds the number of votes cast against that nominee’s election. Broker non-votes and abstentions will not be counted as votes cast, and, accordingly, will not affect the outcome of the vote on this proposal.

Proposal 2. Ratification of the Appointment of the Independent Registered Public Accounting Firm

Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal 2014 requires the affirmative vote of a majority of the votes of the shares of common stock cast on this proposal at the Annual Meeting. Abstentions will not be counted as votes cast, and, accordingly, will not affect the outcome of the vote on this proposal.

Proposal 3. Advisory Vote to Approve Named Executive Officer Compensation

Approval of this proposal requires the affirmative vote of a majority of the votes of the shares of common stock cast on this proposal at the Annual Meeting. Abstentions and broker non-votes will not be counted as votes cast, and, accordingly, will not affect the outcome of the vote on this proposal. While this vote is required by law, it will neither be binding on our company or the Board nor will it create or imply any change in the fiduciary duties of, or impose any additional fiduciary duty on, our company or the Board. However, the views of our stockholders are important to us, and our Compensation Committee will take into account the outcome of the vote when considering future executive compensation decisions. We urge you to read the section entitled “Compensation Discussion and Analysis,” which discusses in detail how our executive compensation program implements our compensation philosophy.

Method and Cost of Soliciting and Tabulating Votes

The Board is providing these proxy materials to you in connection with the solicitation by the Board of proxies to be voted at the Annual Meeting. In addition to solicitation by mail, our officers, directors and employees may solicit proxies personally or by telephone, facsimile or electronic means. These officers, directors and employees will not receive any extra compensation for these services. In addition, we will make arrangements with brokerage houses, custodians, nominees and other fiduciaries to send proxy materials to the beneficial owners of our stock, and we will reimburse them for postage and clerical expenses. We will bear the costs of the solicitation, including the cost of the preparation, assembly, printing and, where applicable, mailing of the Notice of Internet Availability of Proxy Materials, the Notice of the 2014 Annual Meeting of Stockholders, this proxy statement, the proxy card and any additional information furnished by us to our stockholders.

Attending the Annual Meeting in Person

Only stockholders of record or their legal proxy holders as of the Record Date or our invited guests may attend the Annual Meeting in person.If you plan to attend the Annual Meeting in person, youmust present a valid form of government-issued photo identification. If you wish to attend the

10

Annual Meeting and your shares are held in street name with a broker, bank or other nominee, you will need to bring your notice or a copy of your brokerage statement or other documentation reflecting your stock ownership as of the Record Date.

No cameras, recording equipment, electronic devices, large bags, briefcases or packages will be permitted at the Annual Meeting. No banners, signs, firearms or weapons will be allowed in the meeting room. We reserve the right to inspect all items entering the meeting room.

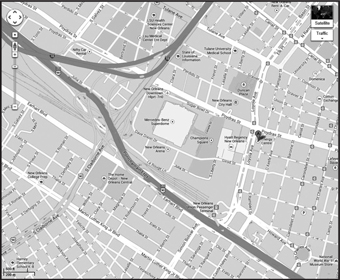

The Annual Meeting will be held at our New Orleans office, located at 1100 Poydras Street, Suite 1050, New Orleans, Louisiana 70163. For directions to the Annual Meeting, please see your Notice of Internet Availability of Proxy Materials.

11

General Overview

We are committed to good corporate governance. The Board has adopted several governance documents to guide the operation and direction of the Board and its committees, which include Corporate Governance Guidelines, a Code of Business Conduct and Ethics (which applies to all directors and employees, including the Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer) and charters for the Audit, Compensation, Nominating and Governance and Reserves Committees. Each of these documents is available on our website (www.stoneenergy.com), and stockholders may obtain a printed copy, free of charge, by sending a written request to Stone Energy Corporation, Attention: Secretary, 625 E. Kaliste Saloom Road, Lafayette, Louisiana 70508, facsimile number (337) 521-9880. We will also promptly post on our website any amendments to these documents and any waivers from the Code of Business Conduct and Ethics for our directors and principal executive, financial and accounting officers.

Our Board of Directors

During 2013, the Board held eight meetings. Each director attended at least 75% of the aggregate of all meetings of the Board and the standing committees on which he or she served during 2013. Directors are encouraged, but not required, to attend our annual meetings of stockholders, and all of our then current directors attended the 2013 annual meeting of stockholders.

To facilitate candid discussion by non-management directors, our non-management directors meet in executive sessions that are not attended by management in conjunction with each regular Board meeting. Mr. Pattarozzi presides over meetings of non-management directors and contributes to the agenda for each such meeting (the “Lead Director”). The Lead Director is chosen by the independent directors, and Mr. Pattarozzi was chosen as Lead Director in May 2012 in connection with the appointment of Mr. Welch as Chairman of the Board. For additional information about the role of our Lead Director and executive sessions of our non-management directors, please see “Board Leadership Structure” below.

Set forth below is biographical information regarding each of our directors. There are no family relationships between any of our directors and executive officers. In addition, there are no arrangements or understandings between any of our executive officers or directors and any other person pursuant to which any person was selected as a director or an executive officer, respectively.

| | |

| | George R. Christmas Age 74 Director since 2003 Chairman of the Compensation Committee Member of the Nominating and Governance Committee Retired Lt. General George R. Christmas retired in 2011 as President and Chief Executive Officer of the Marine Corps Heritage Foundation, which directly supports the historical programs of the Marine Corps, preserves the history, traditions and culture of the Marine Corps, and educates Americans in its virtues. Retired Lt. Gen. Christmas graduated from the University of Pennsylvania with a bachelor of arts degree and then from Shippensburg University with a master of public administration degree. He served in the U.S. Marine Corps from 1962 to 1996, originally commissioned as a second lieutenant and rising to Brigadier General in 1988, Major General in 1991, and Lieutenant General in 1993 as Commanding General, I Marine |

12

| | |

| | Expeditionary Force, Camp Pendleton, California. Lt. General Christmas’s personal decorations and medals include the Navy Cross, Defense Distinguished Service Medal, Navy Distinguished Service Medal, Defense Superior Service Medal, Purple Heart, Meritorious Service Medal and three gold stars in lieu of consecutive awards, the Army Commendation Medal, and the Vietnamese Cross of Gallantry with palm. He previously served as a consultant or advisor to various entities, including Wexford Group International, Northrup Gruman Space & Mission Systems Corporation, Marine Corps Heritage Foundation, RAND Corporation and HARRIS Corporation. Retired Lt. General Christmas presently serves as an advisor to the Marine Corps Heritage Foundation; as Member, Advisory Board, to the Florence & Robert A. Rosen Family Wellness Center for Law Enforcement and Military; as Chairman, Board of Directors, for Center House Association; as Marine Corps Senior Advisor for the Department of Defense Commemoration of the 50th Anniversary of the Vietnam War; as Witness to the War Advisory Board; as Member of the Stafford County Virginia Armed Services Memorial Commission; and as Trustee of the Stafford Hospital Foundation. |

| | B. J. Duplantis Age 74 Director since 1993 Chairman of the Nominating and Governance Committee Member of the Compensation and Reserves Committees Mr. Duplantis is a senior partner with the law firm of Gordon, Arata, McCollam, Duplantis & Eagan, having joined the firm in 1982, with a practice focused on the oil and gas industry. Prior to joining the law firm, Mr. Duplantis served in the legal department of The Superior Oil Company from 1979 to 1982 and previously was employed by Shell Oil Company, where he served in various engineering and management capacities over 10 years in Louisiana, Texas, California and New York, and also as a member of its legal department from 1971 to 1978. Mr. Duplantis graduated from Louisiana State University with a bachelor of science degree in petroleum chemical engineering and from Loyola University with a Juris Doctor degree. |

| | In addition to his several professional affiliations, Mr. Duplantis has served on the Louisiana State Office of Conservation Intrastate Pipelines Ad Hoc Committee, the Louisiana State Office of Conservation Committee on Revision of Rules of Procedure, and the Advisory Committee for the Louisiana State Commissioner’s Office of Conservation, and is a former board member of Holy Cross College, New Orleans, Louisiana. |

13

| | |

| | Peter D. Kinnear Age 67 Director since 2008 Member of the Audit, Compensation and Nominating and Governance Committees Mr. Kinnear held numerous management, operations and marketing roles with FMC Technologies, Inc. and FMC Corporation, both leading providers of technology services to the energy industry, starting in 1971 and retiring from FMC Technologies, Inc. in 2011. Mr. Kinnear served as Chief Executive Officer from March 2007 through February 2011 of FMC Technologies, Inc., and previously as President from March 2006 through April 2010, and Chief Operating Officer from March 2006 through March 2007. Mr. Kinnear received a bachelor’s degree in chemical engineering from Vanderbilt University and an MBA from University of Chicago. |

| | In addition to serving as trustee or director of various non-public entities, including The Petroleum Equipment Suppliers Association, the Business Council, and Spindletop International, Mr. Kinnear previously served on the board of directors of Tronox Incorporated from November 2005 to December 2010, and as FMC Technologies, Inc.’s Chairman of the Board from October 2008 through October 2011. Mr. Kinnear presently serves on the board of directors of Superior Energy Services, Inc. (member of the audit and corporate governance committees). |

| | David T. Lawrence Age 58 Director since October 2013 Member of the Audit, Reserves and Nominating and Governance Committees Mr. Lawrence has extensive global experience across the upstream business. He served as Executive Vice President Exploration and Commercial for Shell Upstream Americas and Functional Head of Global Exploration for Shell worldwide from June 2009 until retiring from this position in April 2013. His responsibilities included exploration, acquisitions, divestments, new business development, LNG, Gas to Liquids and wind energy in the Americas. Prior roles included Executive Vice President Global Exploration and Executive Vice President Investor Relations for Royal Dutch Shell based in The Hague and London, respectively, and Vice President Exploration and Development for Shell Exploration and Production Company in the United States. Mr. Lawrence began his career with Shell in Houston in 1984 in the Global Geology research section working on the Gulf of Mexico and early exploration concepts of the Deepwater. In his subsequent 29 years with Shell, he conducted business in more than 40 countries around the globe. |

| | Mr. Lawrence has held numerous leadership roles in industry and civic organizations. He currently serves as a Trustee Associate of the American Association of Petroleum Geologists Foundation, and he has served on the National Ocean Industry Association as Membership Chair and as a past |

14

| | |

| | commissioner on the Aspen Institute commission on Arctic Climate Change. He was a member of the American Petroleum Institute Upstream Committee, where he helped lead efforts to establish the Center for Offshore Safety and was the chairman of the European Association of Geologists and Engineers (EAGE) Annual Meeting in Amsterdam in 2008. Mr. Lawrence is the author of numerous technical articles, is a recipient of the Meritorious Service Award from the American Petroleum Institute, and received the Wallace Pratt Memorial Award for best paper in the American Association of Petroleum Geologists bulletin. Mr. Lawrence received his Ph.D. in Geology and Geophysics from Yale University in 1984 and his B.A. in Geology from Lawrence University in 1977. |

| | Robert S. Murley Age 64 Director since 2011 Member of the Audit, Compensation and Nominating and Governance Committees Mr. Murley is a Senior Advisor to Credit Suisse, LLC, having been employed by Credit Suisse and its predecessors from 1975 to April 2012. In 2005, he was appointed Chairman of Investment Banking in the Americas, serving in that position until April 2012. Prior to that time, Mr. Murley headed the Global Industrial and Services Group within the Investment Banking Division, as well as the Chicago investment banking office. He was named a Managing Director in 1984 and appointed a Vice Chairman in 1998. Mr. Murley received a bachelor of arts degree from Princeton University, a MBA from the UCLA Anderson School of Management and a master of science degree in International Economics from the London School of Economics. |

| | Mr. Murley has been a director of Apollo Education Group since June 2011 (Chairman of the audit, finance and special litigation committees, and member of the nominating and governance committee). He also serves as a Trustee of Princeton University, is Chairman of the Board of the Educational Testing Service in Princeton, New Jersey, is Vice Chairman of the Board of the Ann & Robert Lurie Children’s Hospital of Chicago, is a Trustee of the Museum of Science & Industry in Chicago, Illinois, and is a member of the Board of Overseers of the UCLA Anderson School of Management. |

| | Richard A. Pattarozzi Age 70 Director since 2000 Lead Independent Director Member of the Reserves and Nominating and Governance Committees Mr. Pattarozzi served as Vice President of Shell Oil Company from March 1999 until his retirement in January 2000, having worked for Shell Oil Company for over 33 years, from 1966 to 2000, in the United States, both onshore and in the Gulf of Mexico. He also served as President and Chief Executive Officer for both Shell Deepwater Development, Inc. and Shell Deepwater Production, Inc. from 1995 until 1999, and previously was appointed General Manager of Shell’s Deepwater Production Division in |

15

| | |

| | April 1991 and General Manager of Shell’s Deepwater Exploration and Production Division in October 1991. Mr. Pattarozzi graduated from the University of Illinois with a civil engineering degree. |

| | Mr. Pattarozzi presently serves on the board of directors of FMC Technologies, Inc. (member of the compensation and nominating and governance committees) and Tidewater Inc. (“Tidewater”) (as independent Chairman of the Board), both public companies, as well as on the board of directors of Environmental Drilling Solutions, a private company. Mr. Pattarozzi is a former director of Superior Energy Services, Inc. and Global Industries, Ltd., which merged with Technip in December 2011. Mr. Pattarozzi also serves on the board of trustees of the U.S. Army War College Foundation and is a past Trustee of the National World War II Museum, Inc. and past Chairman of the Offshore Energy Center and also of the United Way in New Orleans, Louisiana. |

| | Donald E. Powell Age 72 Director since 2008 Member of the Audit and Nominating and Governance Committees Mr. Powell served as the Federal Coordinator of Gulf Coast Rebuilding from November 2005 until March 2008, and he received the Presidential Citizens Medal in 2008 from President George W. Bush. Mr. Powell was the 18th Chairman of the Federal Deposit Insurance Corporation, where he served from August 2001 until November 2005. Mr. Powell previously served as President and Chief Executive Officer of the First National Bank of Amarillo, where he started his banking career in 1971. Mr. Powell graduated from West Texas State University with a bachelor of science degree in economics and is a graduate of The Southwestern Graduate School of Banking at Southern Methodist University. |

| | Mr. Powell currently serves as a director of QR Energy, LP (member of the audit and compensation committees and Chairman of the conflicts committee), and formerly served as a director of Bank of America Corporation and Merrill Lynch International (United Kingdom) (retiring in May 2013 from both). He also has served on the boards of several non-public, civic and charitable organizations, including as Chairman of the Board of Regents of the Texas A&M University System, Advisory Board Member of the George Bush School of Government and Public Service and Chairman of the Amarillo Chamber of Commerce, the City of Amarillo Housing Board and the High Plains Baptist Hospital and Harrington Regional Medical Center in Amarillo, Texas. |

16

| | |

| | Kay G. Priestly Age 58 Director since 2006 Chairman of the Audit Committee Member of the Reserves and Nominating and Governance Committees Ms. Priestly is the Chief Executive Officer and a director of Turquoise Hill Resources Ltd., an international mining company focused on copper, gold and coal in the Asia Pacific region. From 2008 until her appointment as CEO of Turquoise Hill in 2012, she was Chief Financial Officer of Rio Tinto Copper (a division of the Rio Tinto Group – Rio Tinto plc and Rio Tinto Limited). From 2006 to 2008, she was Vice President, Finance and Chief Financial Officer of Rio Tinto’s Kennecott Utah Copper operations. Ms. Priestly served as Vice President, Risk Management and General Auditor for Entergy Corporation, an integrated energy company engaged primarily in electric power production and retail distribution operations, from 2004 to 2006. Ms. Priestly previously spent over 24 years with global professional services firm Arthur Andersen, where she provided tax and consulting services to global companies in the energy and mining sectors. While at Andersen, she was a member of the global energy team, served as managing partner of the New Orleans office from 1997 to 2000, and was a member of Andersen’s global executive team from 2001 to 2002. |

| | Ms. Priestly currently serves as chairman of the board of directors of SouthGobi Resources Ltd., and formerly served as a director of Palabora Mining Company Limited. |

| | Phyllis M. Taylor Age 72 Director since 2012 Chairman of the Reserves Committee Member of the Compensation and Nominating and Governance Committees |

| | |

| | Ms. Taylor is the Chairman and Chief Executive Officer of Taylor Energy Company LLC and Chief Executive Officer of Endeavor Enterprises LLC. Ms. Taylor is a graduate of Tulane University School of Law in New Orleans, and she served as a law clerk for the Supreme Court of Louisiana and subsequently served as in-house counsel for private energy companies. Ms. Taylor also serves as Chairman and President of the Patrick F. Taylor Foundation and on the Iberia Bank Advisory Board. |

| | Ms. Taylor serves as a member of the New Orleans Business Council, the Education Commission of the States, the Congressional Medal of Honor Foundation, the Smithsonian National Board, the Catholic Leadership Institute National Advisory Board, Capital Campaign Chair of the Greater New Orleans Foundation, the Tulane University Board of Trustees, the Xavier University Board of Trustees and the New Orleans Ballet Association. |

17

| | |

| | David H. Welch Age 65 Director since 2004 Chairman of the Board |

| | |

| | Mr. Welch has served as the President and Chief Executive Officer of Stone since April 2004 and has served as Chairman of the Board since May 2012. Prior to joining our company in 2004, he worked for BP Amoco or its predecessors for 26 years, where his final role was Senior Vice President, BP America Inc. Mr. Welch has an engineering degree from Louisiana State University and a doctoral degree in engineering and economics from Tulane University. He has completed the Harvard Business School advanced management program and executive development programs at Stanford Business School and at Cambridge University. |

| | Mr. Welch serves as a director of Iberia Bank (member of the compensation committee and Chairman of the enterprise risk committee). Mr. Welch has served as Chairman of the Offshore Energy Center, Chairman of the Greater Lafayette Chamber of Commerce and 2011 Chairman of the United Way in Acadiana. He currently serves as an executive director of the National Ocean Industries Association, a trustee of The Nature Conservancy of Louisiana, a director of the Offshore Energy Center, a director of Louisiana Association of Business and Industry, a director of the Upper Lafayette Economic Development Foundation and on the Lafayette Central Park board. |

Director Independence Determinations

Our Corporate Governance Guidelines provide that a majority of our Board will consist of independent directors. Only directors who have been determined to be independent serve on our Audit Committee, Compensation Committee, Nominating and Governance Committee and Reserves Committee.

Rather than adopting categorical standards, the Board assesses director independence on a case-by-case basis, in each case consistent with applicable legal requirements and the independence standards adopted by the NYSE. None of the non-employee directors were disqualified from “independent” status under the objective NYSE listing standards. Based on information provided by the directors and after reviewing all relationships each director has with Stone, including charitable contributions we make to organizations where our directors serve as board members, the Board has affirmatively determined that none of its non-employee directors have a material relationship with Stone and therefore each is independent as defined by the current listing standards of the NYSE. In making its independence determinations, the Board took into account the relationships and recommendations of the Nominating and Governance Committee as described below, as well as the transactions discussed under “Certain Relationships and Related Transactions—Related Party Transactions.” In addition, during 2013, we engaged Tidewater in connection with our oil and gas exploration, development and production activities and paid Tidewater $107,454 for such engagement. Mr. Pattarozzi is a member of the board of directors of Tidewater (serving as Tidewater’s independent Chairman). The Nominating and Governance Committee made a determination that the Tidewater relationship did not preclude the independence of Mr. Pattarozzi. Mr. Welch, our Chairman, President and CEO, is not considered by the Board to be an independent director because of his employment with us.

18

Board Leadership Structure

The Board’s leadership structure does not separate the CEO and Chairman of the Board positions. The Board retains the authority to modify this structure to best address our unique circumstances as and when appropriate, and it is possible that the Board may decide to separate the CEO and Chairman of the Board positions in the future.

The Board believes that there is no single, generally accepted approach to providing Board leadership and that each of the possible leadership structures for a board must be considered in the context of the individuals involved and the specific circumstances facing a company as the right leadership structure may vary as circumstances change. The Board currently is of the view that it is in Stone’s best interest for its CEO to also serve as the Board’s Chairman and to have an independent Lead Director selected by the Board. The Board believes this arrangement permits a clear, unified strategic vision that ensures alignment between the Board and management, provides clear leadership, helps ensure accountability for performance, and is efficient and cost effective for the size of our company.

Mr. Welch serves as our President and CEO as well as Chairman of the Board. As the director most familiar with our business and industry, having primary responsibility for managing Stone’s day-to-day operations, and most capable of effectively identifying strategic priorities, he is best positioned to lead the Board through reviews of key business and strategic issues. The role of our Chairman is to run the Board and ensure Board effectiveness. This includes working with the Lead Director and others to set the Board’s agenda, provide clear, accurate and timely information to the Board, manage Board meetings to allow time for discussion of complex issues and promote active participation by all Board members.

Mr. Pattarozzi was selected by the Board, upon a recommendation from the Nominating and Governance Committee, to serve as the Lead Director for meetings of the non-management directors held in executive session. The role of the Lead Director includes:

| | • | | presiding at all meetings of the Board at which the Chairman is not present, including executive sessions of the non-management directors; |

| | • | | serving as liaison between the Chairman and the independent directors and among the independent directors; |

| | • | | assuring the full flow of information to the Board; |

| | • | | contributing to meeting agendas for the Board and for executive sessions; |

| | • | | authority to call meetings of the independent directors; |

| | • | | receiving and addressing stockholder communications directed to the Lead Director; and |

| | • | | if requested by major stockholders, ensuring that he is available for consultation and direct communication. |

The designation of a Lead Director is subject to annual review by the Nominating and Governance Committee and the Board.

Whenever the Nominating and Governance Committee (which is comprised of all of our independent directors) meets in executive session, there is a meeting solely of our independent directors. In these executive sessions, the independent directors deliberate on matters such as corporate governance, board structure, succession planning and the performance of the CEO, among others.

19

Committees of the Board

As of the date of this proxy statement, our Board has the following four separately designated standing committees. The membership and purposes of each of the committees are described below. Each of the committees operates under a written charter adopted by the Board. The Board appoints members to its various committees at its regularly scheduled meeting each May.

| | |

| Audit Committee |

PURPOSES: • Assist the Board in monitoring: • The integrity of the financial statements | | NUMBER OF MEETINGS IN FISCAL 2013: 8 |

of the company • The independent registered public accounting firm’s qualifications, independence and performance • The effectiveness and performance of the company’s internal audit function and independent public accountants • The compliance by the company with legal and regulatory requirements | | COMMITTEE MEMBERS: Peter D. Kinnear (F, I) David T. Lawrence (I) Robert S. Murley (F, I) Donald E. Powell (F, I) Kay G. Priestly (C, F, I) |

| | |

| Compensation Committee |

PURPOSES: • Review, evaluate and approve the agreements, plans, policies and programs of | | NUMBER OF MEETINGS IN FISCAL 2013: 7 |

the company to compensate the company’s officers and directors • Oversee the company’s plans, policies and programs to compensate the company’s employees • Review and discuss with the company’s management the Compensation Discussion and Analysis (“CD&A”) to be included in the company’s proxy statement for its annual meeting of stockholders, and determine whether to recommend to the Board that the CD&A be included in the proxy statement, in accordance with applicable rules and regulations • Produce the Compensation Committee Report as required by Item 407(e)(5) of RegulationS-K for inclusion in the company’s proxy statement, in accordance with applicable rules and regulations • Otherwise discharge the Board’s responsibilities relating to the compensation of the company’s officers and directors | | COMMITTEE MEMBERS: George R. Christmas (C, I) B. J. Duplantis (I) Peter D. Kinnear (I) Robert S. Murley (I) Phyllis M. Taylor (I) |

20

| | |

| Nominating and Governance Committee |

PURPOSES: • Assist the Board by identifying individuals qualified to become Board members, and | | NUMBER OF MEETINGS IN FISCAL 2013: 5 |

recommend to the Board the director nominees for the next annual meeting of stockholders or for appointment to fill vacancies on the Board • Recommend to the Board the Corporate Governance Guidelines applicable to the company • Lead the Board in the annual review of the performance of the Board and its committees, and of management • Recommend to the Board director nominees for each committee • Advise the Board and make recommendations regarding appropriate corporate governance practices and assist the Board in implementing those practices, all in accordance with the company’s Corporate Governance Guidelines | | COMMITTEE MEMBERS: George R. Christmas (I) B. J. Duplantis (C, I) Peter D. Kinnear (I) David T. Lawrence (I) Robert S. Murley (I) Richard A. Pattarozzi (I) Donald E. Powell (I) Kay G. Priestly (I) Phyllis M. Taylor (I) |

| | |

| Reserves Committee |

PURPOSES: • Assist the Board in monitoring: • The integrity of the reserve estimates and | | NUMBER OF MEETINGS IN FISCAL 2013: 5 |

related disclosures of same by the company • The qualifications, performance and independence of the independent reservoir engineers and training of the company’s internal reservoir engineers, geologists and geophysicists • Hydrocarbon reserve matters as deemed necessary or appropriate in the interest of the company and its stockholders | | COMMITTEE MEMBERS: B. J. Duplantis (I) David T. Lawrence (I) Richard A. Pattarozzi (I) Kay G. Priestly (I) Phyllis M. Taylor (C, I) |

| | F | Audit Committee Financial Expert as defined under Securities and Exchange Commission (“SEC”) rules |

| | I | Satisfies the NYSE’s definitions of independent director, as determined by the Board |

Compensation Committee Processes

The Compensation Committee is appointed by the Board to discharge the Board’s responsibilities relating to the compensation of our officers and other employees.

The Compensation Committee annually reviews and approves corporate goals and objectives relevant to executive officer compensation, evaluates the executive officers’ performance in light of those goals and objectives and recommends to the Board the compensation levels of the CEO and the

21

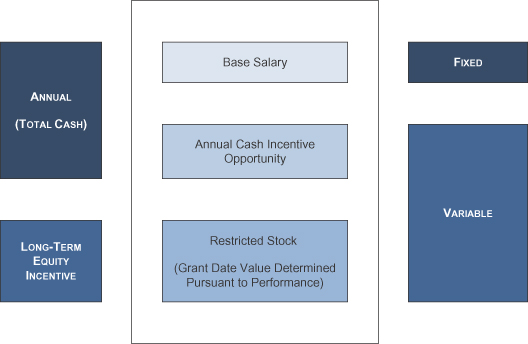

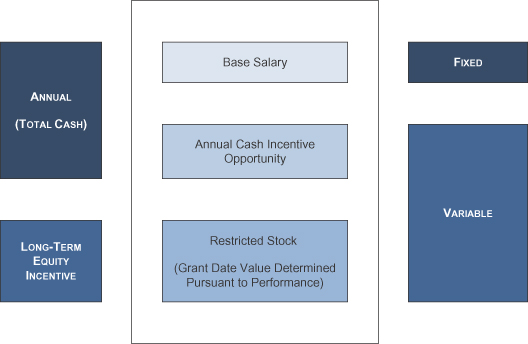

other NEOs based on this evaluation. The Compensation Committee annually reviews and approves, and recommends to the Board for approval and ratification, for the CEO, the executive officers and any other person whose total compensation is reasonably likely to equal or exceed the total compensation of any member of senior management: (1) the TDC level, including each element of TDC, being the annual base salary level, the annual cash incentive opportunity level and the long-term equity incentive opportunity level, (2) employment agreements, severance arrangements and change in control agreements/provisions, in each case as, when and if appropriate, and (3) any special or supplemental benefits, including any perquisites.

The Compensation Committee also has overall responsibility for approving and evaluating the annual employee incentive compensation plan amount as well as our director and officer compensation plans, policies and programs and has the authority to make grants pursuant to these plans. Members of the Compensation Committee are not eligible to participate in any of the plans that they administer under the 2009 Amended and Restated Stock Incentive Plan (the “Stock Incentive Plan”). However, the Board has the authority to grant discretionary awards of restricted stock to non-employee directors pursuant to the Stock Incentive Plan.

Please see “Compensation Discussion and Analysis” for additional information on the roles of the Compensation Committee, compensation consultant and our management team in determining the form and amount of executive compensation.

The Board’s Role in Risk Oversight

The Board is responsible for overseeing our company’s management of risk. The Board strives to effectively oversee our enterprise-wide risk management in a way that balances managing risks while enhancing the long-term value of our company for the benefit of our stockholders. The Board understands that its focus on effective risk oversight is critical to setting our company’s tone and culture towards effective risk management. To administer its oversight function, the Board seeks to understand our company’s risk philosophy by having regular discussions with management to establish a mutual understanding of our company’s overall appetite for risk. The Board maintains an active dialogue with management about existing risk management processes and how management identifies, assesses and manages our most significant risk exposures, including market risk, liquidity risk, reputational risk, commodity price risk, operational risk, hurricane risk, safety risk, cybersecurity risk, compliance risk and legal risk. The CEO is considered to be our chief risk officer, being ultimately responsible for day-to-day operations, and is primarily responsible for instituting risk management practices that are consistent with our overall business strategy and risk profile. The Board expects, and receives, frequent updates from the CEO and other members of our management team about our most significant risks so as to enable it to evaluate whether management is responding appropriately. For example, senior management attends Board meetings and is available to address any questions or concerns raised by our Board on risk management-related and any other matters. In addition, our Board receives presentations from senior management on strategic matters involving our operations.

The Board relies on each of its committees to help oversee the risk management responsibilities relating to the functions performed by such committees. For example, the Audit Committee considers risks related to financial reporting such as overseeing our internal controls and interacting with our independent public accounting firm at least quarterly. The Compensation Committee oversees our compensation practices in order that they do not encourage unnecessary and excessive risk taking by management. In addition, the Reserves Committee monitors the integrity of our reserve estimates and related disclosures, while the Nominating and Governance Committee oversees risks relating to our corporate compliance programs and assists the Board and management in promoting an organizational culture that encourages commitment to ethical conduct and a commitment to compliance with the law. Each of the Board’s committees reports regularly to the Board on risk-related matters within its responsibilities.

22

The Board believes that the combination of these practices provides integrated insight into our management of risks.

Consideration of Director Nominees

Stockholder Nominees

Our Nominating and Governance Committee will consider all properly submitted stockholder recommendations of candidates for election to the Board. Our Bylaws permit stockholders to nominate candidates for election to the Board provided that such nominees are recommended in writing pursuant to the procedures described below under “Communications, Stockholder Proposals and Other Company Information—Stockholder Proposals and Director Nominations.” In evaluating the recommendations of stockholders for director nominees, as with all other possible director nominees, our Nominating and Governance Committee will address the membership criteria set forth below under “Director Criteria, Qualifications, Experience and Diversity.” There have been no material changes in the procedures by which stockholders may recommend director nominees.

Identifying and Evaluating Nominees for Directors

Our Nominating and Governance Committee is responsible for leading the search for individuals qualified to serve as directors and for recommending to the Board nominees as directors to be presented for election at meetings of the stockholders or of the Board. Our Nominating and Governance Committee evaluates candidates for nomination to the Board, including those recommended by stockholders, and conducts appropriate inquiries into the backgrounds and qualifications of possible candidates. Our Nominating and Governance Committee may retain outside consultants to assist in identifying director candidates in its sole discretion, but it did not engage any outside consultants in connection with selecting the nominees for election at the Annual Meeting. Stockholders may recommend possible director nominees for consideration by our Nominating and Governance Committee as indicated above. None of our stockholders recommended director nominees for election at the Annual Meeting. The Nominating and Governance Committee does not intend to alter the manner in which it evaluates candidates based on whether the candidate is recommended by a stockholder or not.

We do not have a formal policy to consider diversity in identifying director nominees, but our Nominating and Governance Committee does take into account certain diversity considerations, which are described below. The Board considers itself to be well diversified due to its members’ differences in viewpoint on many issues, professional experience, education and general backgrounds, while also having the requisite business and oil and gas industry experience to perform its oversight role satisfactorily for our stockholders.

Director Criteria, Qualifications, Experience and Diversity

Our Corporate Governance Guidelines contain qualifications that apply to director nominees recommended by our Nominating and Governance Committee. All candidates must possess the requisite skills and characteristics the Board deems necessary. In addition to an assessment of a director’s qualification as independent, the Nominating and Governance Committee considers integrity, honesty, age, skills and experience in the context of the needs of the Board as to the long-term corporate needs for new and supplemental board expertise. The Nominating and Governance Committee believes that the Board should include appropriate expertise and reflect gender, cultural and geographical diversity, in light of the entire Board’s current composition. In addition, the Board looks for recognized achievement and reputation, an ability to contribute to specific aspects of our activities and the willingness to commit the time and effort required, including attendance at Board meetings and committee meetings of which he or she is a member.

23

Certain Relationships and Related Transactions

Policies and Procedures

The Nominating and Governance Committee Charter provides that the Nominating and Governance Committee periodically reviews all transactions that would require disclosure under Item 404(a) of Regulation S-K (each, a “Related Person Transaction”) and makes a recommendation to the Board regarding the initial authorization or ratification of any such transaction. In accordance with such policies and procedures, each officer and director must complete a directors and officers questionnaire each year that solicits information concerning transactions with related persons. Additionally, each quarter, the Nominating and Governance Committee asks each director whether any issues have arisen concerning independence, transactions with related persons or conflicts of interest. To the extent that a transaction or a possible transaction with a related person exists, the Nominating and Governance Committee determines whether the transaction should be approved or ratified and makes its recommendation to the Board. In determining whether or not to recommend the initial approval or ratification of a Related Person Transaction, the Nominating and Governance Committee considers all of the relevant facts and circumstances available to the committee, including (if applicable) but not limited to:

| | • | | whether there is an appropriate business justification for the transaction; |

| | • | | the benefits that accrue to Stone as a result of the transaction; |

| | • | | the terms available to unrelated third parties entering into similar transactions; |

| | • | | the impact of the transaction on a director’s independence (in the event the related person is a director, an immediate family member of a director or an entity in which a director is a partner, stockholder or executive officer); |

| | • | | the availability of other sources for comparable products or services; |

| | • | | whether it is a single transaction or a series of ongoing, related transactions; and |

| | • | | whether entering into the transaction would be consistent with our Code of Business Conduct and Ethics. |

In the event that the Board considers ratification of a Related Person Transaction and determines not to so ratify, management makes all reasonable efforts to cancel or annul such transaction.

Related Party Transactions

In November 2013, Stone completed its public offering of $475 million aggregate principal amount of 7.5% Senior Notes due 2022 (the “Senior Notes”). Participating in this transaction as underwriters and initial purchasers were Merrill Lynch, Pierce, Fenner & Smith Incorporated (38%), which is an affiliate of Bank of America, Barclays Capital Inc. (38%) and Wells Fargo Securities, LLC (4%). Participating as co-managers on this transaction were Tudor, Pickering, Holt & Co. Securities, Inc. (3%), IBERIA Capital Partners L.L.C. (2%), and seven other investment banking firms. Donald E. Powell was a member of the board of directors of Bank of America until his resignation in May 2013, David H. Welch is a member of the board of directors of IberiaBank Corporation, and a son of Richard A. Pattarozzi was employed as a financial analyst by Tudor, Pickering, Holt & Co. until May 2013. Because the interests of Messrs. Powell and Welch arose only from their positions as directors of Bank of America and IberiaBank, respectively, they are not deemed to have a material indirect interest in this transaction. Tudor, Pickering, Holt & Co. received $228,550 in November 2013 for its participation in

24

this transaction. The Board has determined that Mr. Pattarozzi is independent and, subsequent to May 2013, Mr. Pattarozzi was appointed to the Nominating and Governance Committee.

In 2013, we utilized the services of FMC Technologies, Inc., which is a leading global provider of technology solutions for the energy industry, particularly subsea, and we paid FMC Technologies, Inc. $2,008,974 for those services. Richard A. Pattarozzi is a member of the board of directors of FMC Technologies, Inc. Because the interests of Mr. Pattarozzi arise only from his position as a director of FMC Technologies, Inc., he is not deemed to have a material indirect interest in these transactions.

In 2013, we utilized the services of Superior Energy Services, Inc. (and affiliated companies), which is a leading provider of specialized oilfield services and equipment used throughout the economic life cycle of oil and gas wells, and we paid Superior Energy Services, Inc. $1,521,108 for those services and equipment. Peter A. Kinnear is a member of the board of directors of Superior Energy Services, Inc. Because the interests of Mr. Kinnear arise only from his position as a director of Superior Energy Services, Inc., he is not deemed to have a material indirect interest in these transactions.

25