UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of | | September 2005 |

Commission File Number | | 0-24096 |

QUEENSTAKE RESOURCES LTD.

999 18th Street, Suite 2940, Denver, CO 80202

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40 F.

Form 20-F ý Form 40 F o

Indicate by check mark whether by furnishing the information contained in this Form the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o No ý

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

DOCUMENTS FILED: | | Press Release NR2005-26 September 27, 2005 |

DESCRIPTION: | | Queenstake Expands Resources and Increases Ore Grade at Starvation Canyon |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| QUEENSTAKE RESOURCES LTD. | |

| (Registrant) | |

| | | |

Date | September 27, 2005 | | By | “Dorian L. Nicol”“ (signed) | |

| | (Signature) | |

| | | |

| | | Dorian L. Nicol, President & CEO | | |

| | | | | | | |

|

| NEWS RELEASE | | |

| | | | |

News Release 2005-26 | | September 27, 2005 |

SEC file number 0-24096 | | |

Queenstake Expands Resources and

Increases Ore Grade at Starvation Canyon

Denver, Colorado – September 27, 2005 – Queenstake Resources Ltd.’s (TSX:QRL, AMEX:QEE) internal estimate of indicated resources(1) at Starvation Canyon increased to 181,600 ounces of gold (617,800 tons at a grade of 0.294 ounce of gold per ton), based on 2005 drilling results. This represents an increase of 16% in contained ounces as well as an increase in grade of 9% compared to the year-end 2004 estimate. In addition, Queenstake’s internal estimate of inferred resources at Starvation Canyon increased to 78,900 tons at a grade of 0.295 ounce per ton (opt), containing 23,300 ounces of gold.

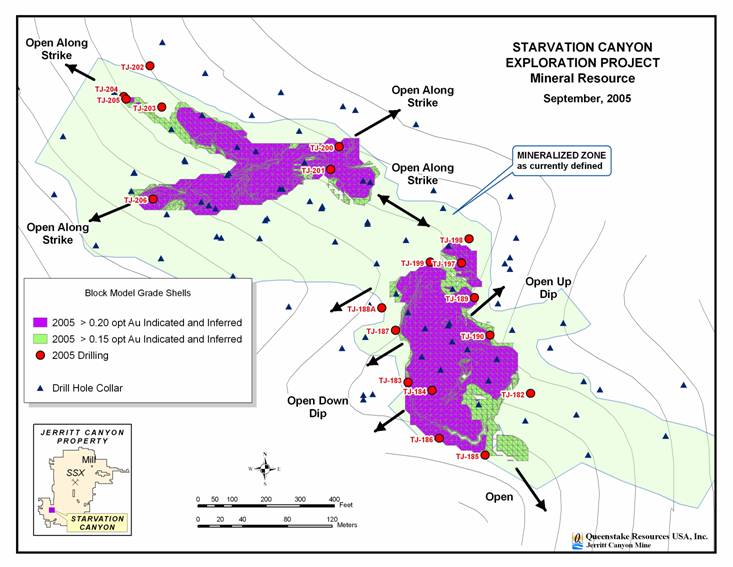

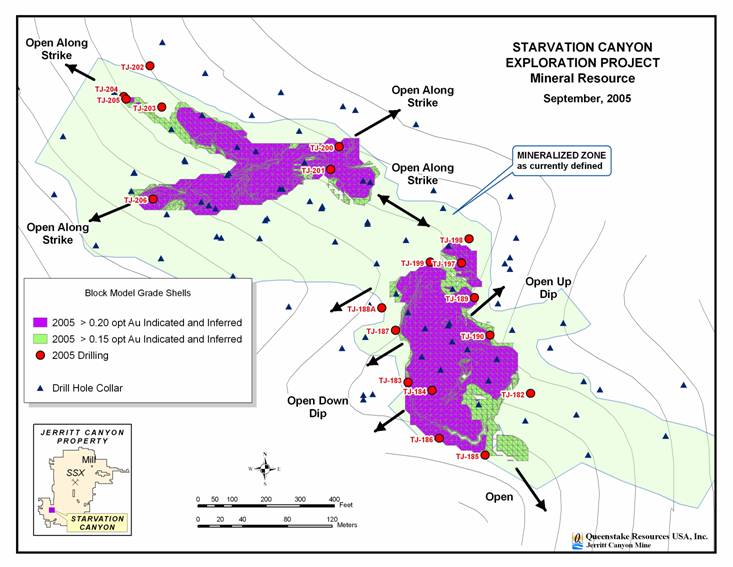

Based on these encouraging results, Queenstake’s increasing confidence in the ongoing turnaround at the Jerritt Canyon operations and the current strong gold price environment, management has authorized the resumption of exploration drilling at Starvation Canyon this year. (See Appendix Map 1. All Appendix maps are available under the Investor Information/News Releases section at www.queenstake.com.) An infill and step-out drilling program budgeted at $300,000 to $500,000 will be conducted through the fall, with the objective of further upgrading and expanding the Starvation Canyon resource.

The Company also announced that its near-mine drilling program(2) continues to identify high-grade gold mineralization. Positive results were obtained at the SSX, Steer, Smith and Murray mines outside the current resource boundary, and represent extensions of mineralization. Further underground drilling this fall will continue testing these and other near-mine targets, including the Mahala deposit. Mahala, which initiated gold production in August 2005, represents some of the highest ore grades in reserves(1) at Jerritt Canyon.

The data for the near-mine program reported in this news release are from underground drilling conducted from June to August 2005. (See Appendix Map 2). The drill results are outside the current resource boundary and represent additions to mineralization, which could add to resources or reserves. The results will be incorporated in new mine models that will be used in the estimation of reserves and resources at year-end 2005.

Dorian L. (Dusty) Nicol, President and Chief Executive Officer of Queenstake, said, “Our 100-square mile Jerritt Canyon district in northeastern Nevada continues to demonstrate high-grade upside and underscores the potential to continue increasing the reserves and resources. The 19-hole drill program at Starvation Canyon identified more high-grade mineralization and successfully increased the indicated resources by 16% and the grade by 9%. Around our mines, some of the best prospects for mineralization growth are at Zone 5B at SSX, Block 3 at Steer, Mahala at Smith and Zone 7 at Murray.”

District Exploration – Starvation Canyon

In July and August 2005, 19 reverse-circulation drill holes totaling 11,325 feet were completed from surface at the Starvation Canyon project, located 12 miles southwest of the Jerritt Canyon

1

mill on private land owned by Queenstake. Drilling at Starvation Canyon will resume shortly and is anticipated to continue in 2006.

The 2,000-foot long mineralized zone at Starvation Canyon lies above the water table in an area of steep topography and could be readily accessed by portal from the hillside. Mineralization remains open along both directions (northeast and southwest; northwest and southeast) of each of the two principal controlling structures. Starvation Canyon appears to be part of a mineralized trend with a strike length of approximately 4.5 miles. This trend appears comparable geographically and geochemically to the mineralized trends in the northern and central parts of the Jerritt Canyon district that have combined to produce over seven million ounces of gold since 1981.

From the recent drill data, Queenstake has estimated that the indicated resources at Starvation Canyon now total 617,800 tons at a grade of 0.294 opt containing 181,600 ounces of gold. This is compared with indicated resources at year-end 2004 of 576,900 tons at 0.271 opt, containing 156,225 ounces. The estimated grade increase from 0.271 opt in 2004 to 0.294 opt is very encouraging. In addition, Queenstake has estimated Starvation Canyon’s inferred resources now total 78,900 tons at 0.295 opt containing 23,300 ounces, compared with inferred resources at year-end 2004 of 51,600 tons at 0.227 opt, containing 11,729 ounces of gold.

Of the 19 holes drilled, 13 intercepted 10 feet or more of gold mineralization above 0.15 opt; these holes are tabulated in Table 1. (See Appendix Map 1.) Of the remaining six holes, three failed to return samples at the depth interval where mineralization was targeted due to fractures or voids in the rock. These holes will be redrilled with core holes to test the target interval. The following table shows intercepts of 10 feet or more at an ore grade of 0.20 opt of higher.

Table 1: Starvation Canyon Results Highlights(4), (5)

Hole # | | Dip | | From

(feet) | | To

(feet) | | Length

(feet) | | Grade

Opt | | Drill Type | |

TJ-183 | | -90 | | 550 | | 595 | | 45 | | 0.294 | | RC | |

TJ-184 | | -90 | | 585 | | 625 | | 40 | | 0.326 | | RC | |

TJ-185 | | -90 | | 625 | | 635 | | 10 | | 0.180 | | RC | |

TJ-186 | | -90 | | 620 | | 635 | | 15 | | 0.228 | | RC | |

TJ-188A | | -80 | | 430 | | 445 | | 15 | | 0.276 | | RC | |

and | | -80 | | 515 | | 530 | | 15 | | 0.220 | | RC | |

TJ-189 | | -90 | | 560 | | 580 | | 20 | | 0.410 | | RC | |

TJ-190 | | -90 | | 555 | | 570 | | 15 | | 0.218 | | RC | |

TJ-197 | | -90 | | 365 | | 425 | | 60 | | 0.327 | | RC | |

and | | -90 | | 435 | | 450 | | 15 | | 0.203 | | RC | |

TJ-199 | | -90 | | 455 | | 480 | | 25 | | 0.355 | | RC | |

TJ-200 | | -90 | | 415 | | 485 | | 70 | | 0.307 | | RC | |

TJ-201 | | -90 | | 410 | | 450 | | 40 | | 0.396 | | RC | |

TJ-205 | | -90 | | 305 | | 320 | | 15 | | 0.220 | | RC | |

TJ-206 | | -90 | | 225 | | 250 | | 25 | | 0.334 | | RC | |

2

Near-Mine Exploration – SSX Mine

At the SSX Mine, 16 underground core drill holes were completed totaling 7,293 feet in the prospective Zone 5B in June 2005. The following table shows intercepts of 10 feet or more at an ore grade of 0.20 opt or higher.

Table 2: SSX – Zone 5B Results Highlights (4), (5)

Hole # | | From

(feet) | | To

(feet) | | Length

(feet) | | Grade Opt | | Drill

Type(3) | |

SX-944 | | | 365 | | 385 | | 20 | | 0.251 | | Core | |

SX-945 | | | 275 | | 310 | | 35 | | 0.310 | | Core | |

SX-946 | | | 245 | | 260 | | 15 | | 0.469 | | Core | |

and | | | 270 | | 305 | | 35 | | 0.289 | | Core | |

SX-948 | | | 206 | | 230 | | 24 | | 0.235 | | Core | |

and | | | 290 | | 310 | | 20 | | 0.211 | | Core | |

and | | | 310 | | 352 | | 42 | | 0.212 | | Core | |

SX-952 | | | 225 | | 236.5 | | 11.5 | | 0.618 | | Core | |

SX-953 | | | 238.5 | | 253 | | 14.5 | | 0.267 | | Core | |

Near-Mine Exploration – Steer Mine

At the Steer Mine, the 1,800-foot drift to connect with the SSX Mine is nearing completion. When completed, the connection will provide secondary access for the Steer Mine and also lead to greater operational efficiency in a combined SSX-Steer complex. SSX-Steer production is expected to ramp up from 1,140 ore tons per day in the third quarter to steady state rate of 1,950 ore tons per day in the first quarter of 2006. Drilling of 14 underground core holes totaling 5,300 feet was conducted from June to August 2005. The following table shows intercepts of 10 feet or more at an ore grade of 0.20 opt or higher.

Table 3: Steer – Block 3 Results Highlights (4), (5)

Hole # | | | From

(feet) | | To

(feet) | | Length

(feet) | | Grade Opt | | Drill

Type(3) | |

SR-43 | | | 160 | | 170 | | 10 | | 0.361 | | Core | |

SR-44 | | | 210 | | 230 | | 20 | | 0.214 | | Core | |

with | | | 220 | | 230 | | 10 | | 0.258 | | Core | |

with | | | 345 | | 375 | | 30 | | 0.702 | | Core | |

and | | | 480 | | 520 | | 40 | | 0.219 | | Core | |

with | | | 480 | | 490 | | 10 | | 0.307 | | Core | |

with | | | 505 | | 520 | | 15 | | 0.288 | | Core | |

and | | | 565 | | 585 | | 20 | | 0.650 | | Core | |

SR-45 | | | 345 | | 380 | | 35 | | 0.478 | | Core | |

and | | | 555 | | 585 | | 30 | | 0.780 | | Core | |

SR-59 | | | 5 | | 15 | | 10 | | 0.208 | | Core | |

SR-60 | | | 55 | | 170 | | 115 | | 0.301 | | Core | |

Near-Mine Exploration – Smith Mine

At the Smith Mine, 17 underground core drill holes were completed totaling 5,500 feet in the B-Pit area. These holes, targeting additions to reserves and resources, were drilled west of the main

3

drift from July to August 2005. A 30 to 50-hole drill program will be conducted at the Mahala deposit this fall targeting resource and reserve additions. The following table shows intercepts of 10 feet or more at an ore grade of 0.20 opt or higher.

Table 4: Smith – B-Pit Results Highlights (4), (5)

Hole # | | | From

(feet) | | To

(feet) | | Length

(feet) | | Grade Opt | | Drill

Type(3) | |

LX-595 | | | 455 | | 530 | | 75 | | 0.344 | | Core | |

LX-596 | | | 50 | | 65 | | 15 | | 0.236 | | Core | |

LX-599 | | | 90 | | 110 | | 20 | | 0.240 | | Core | |

LX-602 | | | 205 | | 215 | | 10 | | 0.217 | | Core | |

LX-603 | | | 120 | | 140 | | 20 | | 0.214 | | Core | |

LX-605 | | | 145 | | 195 | | 50 | | 0.286 | | Core | |

LX-610 | | | 360 | | 375 | | 15 | | 0.468 | | Core | |

LX-611 | | | 370 | | 390 | | 20 | | 0.254 | | Core | |

At the West Dash area, approximately 700 feet west of the main Smith drift, surface drilling from 10 reverse circulation holes totaling 7,860 feet was completed. Encouraging results were received from four of these holes, including intercepts of 40 feet at 0.30 opt and 65 feet of 0.29 opt. The drill results are outside the current resource boundary and represent additions to mineralization, which could add to resources or reserves. (See Appendix Map 3.)

Near-Mine Exploration: Murray Mine

At the Murray mine, currently planned for closure in April 2006, 16 underground reverse circulation drill holes were completed totaling 3,655 feet at the Zone 7 target in June 2005. Ongoing drilling targets expansion of the edges of the remaining deposit. The following table shows intercepts of 10 feet or more at an ore grade of 0.20 opt or higher.

Table 5: Murray – Zone 7 Results Highlight (4), (5)

Hole # | | | From

(feet) | | To

(feet) | | Length

(feet) | | Grade

Opt | | Drill

Type(3) | |

C70029 | | | 140 | | 160 | | 20 | | 0.338 | | RC | |

C70030 | | | 50 | | 110 | | 60 | | 0.359 | | RC | |

C70031 | | | 80 | | 95 | | 15 | | 0.293 | | RC | |

Queenstake Resources Ltd. is a gold mining and exploration company based in Denver, Colorado. Its principal asset is the wholly owned Jerritt Canyon district in Nevada. Jerritt Canyon has produced over seven million ounces of gold since 1981. Current production at the property is from underground mines. The Jerritt Canyon district comprises over 100 square miles of geologically prospective ground and represents one of the largest contiguous exploration properties in Nevada.

Notes:

(1) “Resources” or “resource” used in this news release are as defined in National Instrument 43-101 of the Canadian Securities Administrators and are not terms recognized or defined by the U.S. Securities and Exchange Commission (SEC). For further information, please refer to the risk factors and definitions of reserves and resources in the

4

Company’s filings on SEDAR and with the SEC on the Company’s website, www.queenstake.com. The Qualified Person for the technical information contained in this news release is Mr. Dorian L. (Dusty) Nicol, President and Chief Executive Officer of Queenstake.

The Starvation Canyon gold resource block model is constrained within an interpreted 3-dimensional geologic wireframe boundary and uses an Inverse-Distance to the third power interpolation algorithm. This methodology is the same as was used for the EOY 2004 resource calculation. However, the new drilling data has allowed for adjustments to the wireframe boundaries and refinement of the search ellipse orientation, resulting in greater continuity of high-grade mineralization.

(2) A complete data set, from which the drill results highlighted in this news release were derived, is available as an Appendix to this news release under the Investor Information/News section on the Company’s website, www.queenstake.com. Intercepts are reported as drilled and are not necessarily “true width.”

(3) Surface and underground drilling use either core or reverse circulation methods for near-mine and surface exploration programs at Jerritt Canyon. Underground reverse circulation drilling has demonstrated accuracy in ore control definition drilling and for resource conversion at Jerritt Canyon’s mines. However, reverse circulation drilling can result in a lower degree of confidence and less geologic information than core drilling.

(4) Samples from surface and underground drilling are analyzed using standard fire assay techniques at the Jerritt Canyon laboratory. Intercepts are reported as drilled and are not necessarily “true width.”

(5) A description of the geology, sampling procedures and the Company’s laboratory Quality Assurance/Quality Control procedures are described in the Company’s National Instrument 43-101 Technical Report filed on Sedar on February 23, 2005. This report is available under Investor Information/Financial Information/Sedar Filings at www.queenstake.com.

# # #

For further information call:

Wendy Yang, 303-297-1557 ext. 105

800-276-6070

Email – info@queenstake.com Web – www.queenstake.com

Cautionary Statement – This news release contains “Forward-Looking Statements” within the meaning of Section 21E of the United States Securities Exchange Act of 1934, as amended and the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, included in this release, and Queenstake’s future plans are forward-looking statements that involve various risks and uncertainties. Such forward-looking statements include, without limitation, (i) estimates and projections of reserves and resources, (ii) estimates and opinions regarding geologic and mineralization interpretation and (ii) estimates of exploration investment and scope of exploration programs. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements, in particular the estimates do not include input cost increases that could occur in future. Forward-looking statements are based on the estimates and opinions of management on the date the statements are made, and Queenstake does not undertake any obligation to update forward-looking statements should conditions or management’s estimates or opinions change. Forward-looking statements are subject to risks, uncertainties and other factors, including gold and other commodity price volatility, political and operational risks, which are described in in the Company’s 2004 Annual Report on Form 40-F on file with the Securities and Exchange Commission as well as the Company’s other SEC filings.

The Toronto Stock Exchange has neither reviewed nor accepts responsibility

for the adequacy or accuracy of this release.

5

APPENDIX

Map 1: Starvation Canyon Project

6

Map 2: Near Mine Resource Conversion Drilling

7

Map 3: West Dash Surface Drilling Results Highlights

8