UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 20-F

| (Mark One) | | |

| | | | |

| | REGISTRATION STATEMENT PURSUANT TO SECTION 12 (b) OR (g) OF THE |

| | SECURITIES EXCHANGE ACT OF 1934 | | |

| | OR | | |

X | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES |

| | EXCHANGE ACT OF 1934 | | |

| | For the fiscal year ended December 31, 2002 | | |

| | OR | | |

| | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE |

| | SECURITIES EXCHANGE ACT OF 1934 | | |

| | For the transition period from | | to | |

| | | | | |

| Commission file number | 0-24096 |

| | |

Queenstake Resources Ltd. |

| (Exact name of registrant as specified in its charter) |

| | |

| Yukon, Canada |

| (Jurisdiction of incorporation or organization) |

| | |

| 712C 12th Street, New Westminster, BC, Canada V3M 4J6 |

| (Address of principal executive offices) |

| |

| Securities registered or to be registered pursuant to Section 12(b) of the Act. |

| | |

| Title of each class | | Name of each exchange on which registered |

| None | | Not Applicable |

| |

| Securities registered or to be registered pursuant to Section 12(g) of the Act: |

| | |

| Common Shares Without Par Value |

| (Title of Class) |

| |

| Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: |

| | |

| None |

| (Title of Class) |

| | |

| Indicate the number of outstanding shares of each of the Company's classes of capital or common stock as of the close of the period covered by the annual report. |

| | | | | | |

| 67,984,045 |

| | | | | | |

| Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. |

| | | | | | |

Yes | X | No | | |

| | | | | | |

| Indicate by check mark which financial statement item the registrant has elected to follow. |

| | | | | | |

Item 17 | X | Item 18 | | |

| | | | | | |

| (APPLICABLE ONLY TO COMPANIES INVOLVED IN BANKRUPTCY PROCEEDING DURING |

| THE PAST FIVE YEARS) | | | | | |

| | | | | | |

| Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. |

| | | | | | |

Yes | | | No | | Not Applicable | X | |

Special Note Regarding Forward-Looking Statements

Except for the statements of historical fact contained herein, the information under the headings "Item 4-Information on the Company", "Item 5 - Operating and Financial Review and Prospects", Item 11 - Quantitative and Qualitative Disclosure about Market Risk" and elsewhere in this Form 20-F Annual Report constitutes "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company, or other future events, to be materially different from any future results, performances or achievements or other events expressly or impliedly predicted by such forward-looking statements. Statements in this Annual Report regarding, anticipated commencement dates of mining or metal production operations, projected quantities of future metal production and anticipated production rates, operating efficiencies, costs and expenditures are forward-looking statements. Actual results could differ materially depending upon the availability of materials, equipment, required permits or approvals and financing, the occurrence of unusual weather or operating conditions, the accuracy of reserve estimates, lower than expected ore grades or the failure of equipment or processes to operate in accordance with specifications. Such risks, uncertainties and other factors include, but are not limited to, the Company's history of limited revenue, losses and negative cash flow; the Company's need for additional financing; precious and base metal price volatility; mining industry operational hazards and environment concerns; the absence of operating history of the Company's precious and base metal properties; currency fluctuations; uninsured risks; dependence on management; uncertainty of estimates of mineral deposits; risks related to mining exploration programs; government regulation and requirements for permits and licenses; title matters; risks of international operations; conflicts of interest; competition and stock market volatility. See Item 3. Key Information B. Risk Factors.

The information set forth in this Annual Report on Form 20-F is as at December 31, 2002 unless an earlier or later date is indicated.

SECURITIES AND EXCHANGE COMMISSION

FORM 20-F

QUEENSTAKE RESOURCES LTD.

TABLE OF CONTENTS

GLOSSARY

The following terms have the following meanings in this Form 20-F Annual Report:

| | |

| "Company" or | Queenstake Resources Ltd., including, unless the context or otherwise requires, the Company's subsidiaries. |

| "Queenstake": |

| | |

| "deposit": | a mineralized body which has been physically delineated by sufficient drilling, trenching, and/or underground work, and found to contain a sufficient average grade of metal or metals to warrant further exploration and/or development expenditures; such a deposit does not qualify as a commercially mineable ore body or as containing ore reserves, until final legal, technical, and economic factors have been resolved. |

| |

| |

| |

| |

| "development": | the preparation of a known commercially mineable deposit for mining. |

| | |

| "diamond drill": | A type of rotary drill in which the cutting is done by abrasion rather than percussion. The cutting bit is set with diamonds and is attached to the end of the long hollow rods through which water is pumped to the cutting face. The drill cuts a core of rock which is recovered in long cylindrical sections, an inch or more in diameter. |

| |

| |

| |

| "exploration": | The prospecting, diamond drilling and other work involved in searching for ore bodies. |

| |

| "Feasibility Study": | A detailed report showing the feasibility of placing a prospective ore body or deposit of the minerals within a mineral property into production, which report typically includes, inter alia the specific portion or portions of the property that should be included, in a development block, conclusions and recommendations regarding any adjustments that should be made to the boundaries of a development block, a description of the work to be performed in order to develop the mineral resources within the development block and to construct a mine or mines and related facilities on the development block, the estimated capital and operation costs thereof, a proposed schedule for the timing of development and mine construction, and an assessment of the impact of the operation and the information obtained and evaluations made in respect thereof. |

| |

| |

| |

| |

| |

| |

| "gpt": | grams per tonne |

| | |

| "heap leaching": | A process of extracting gold by placing broken material on sloping, impermeable pads and applying dilute cyanide solution that dissolves a portion of the contained gold, which is then recovered in a carbon column or Merrill-Crowe circuit. |

| |

| |

| |

| "hectare": | Measurement of an area of land equivalent to 10,000 square meters or 2.47 acres. |

| | |

| "leach pad": | A large impermeable foundation or pad used as a base for material during heap leaching. The pad prevents the leach solution from escaping out of the circuit. |

| |

| | |

| "mill": | A plant where ore is ground, usually to fine powder, and the metals are extracted by physical and/or chemical processes. |

| |

| | |

| "mineral reserves": | The economically mineable part of a measured or indicated mineral resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant facts that demonstrate, at the time of reporting, that economic extraction can be justified. A mineral reserve includes diluting materials and allowances for losses that may occur when the material is mined. Mineral reserves are subdivided in order of increasing confidence into probable mineral reserves and proven mineral reserves. |

| |

| |

| |

| |

| |

| "mineral resources": | A concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the earth's crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge. Mineral resources which are not mineral reserves do not have demonstrated economic viability. |

| |

| |

| |

| |

| "mineralization": | Mineral-bearing rock; the minerals may have been either a part of the original rock unit or injected at a later time. |

| |

| | |

| "mm": | millimeter, one thousandth of a meter |

| | |

| "net smelter return royalty/ NSR royalty": | A phrase used to describe a royalty payment made by a producer of metals based on the value of the gross metal production from the property, less deduction of certain limited costs including smelting, refining, transportation and insurance costs. |

| |

| |

| "ore": | A metal or mineral bearing rock or a combination of these of sufficient value as toquality and quantity to enable it to be mined at a profit. |

| |

| | |

| "ounces": | Troy ounces. |

| | |

| "ppm": | parts per million. One ppm has the same value as one gram per tonne. |

| | |

| "ppb": | parts per billion. One ppb has the same value as one thousandth of a gram per tonne. |

| |

| "probable mineral reserves": | A probable mineral reserve is the economically mineable part of an indicated, and in some circumstances, a measured mineral resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economical and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. |

| |

| |

| "production": | The exploitation of a mineral deposit or reserve. |

| | |

| "proven mineral reserves": | A proven mineral reserve is the economically mineable pat of a measured mineral resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economical and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. |

| |

| |

| "Santa Cruz": | The Company amalgamated with Santa Cruz Gold Inc. on July 19, 1999. |

| | |

| "Share": | A common share without par value of the Company. Historical references to number of shares have been adjusted to reflect the share exchange ratio of 0.4993 used in the July 19, 1999 amalgamation with Santa Cruz Gold Inc. |

| |

| |

| | |

| "stripping ratio": | the ratio of the tonnage of waste material that must be removed to allow the mining of one tonne of ore in an open pit. |

| |

| | |

| "the Study": | Certain disclosure in Item 4D - Property, Plant and Equipment - the "Magistral Gold Project" is based on the Kappes Cassiday and Associates of Reno and Pincock Allen & Holt of Denver feasibility study report dated May 2000 |

| |

| |

| | |

| "tailings": | Waste material from a mineral processing mill after the metals and minerals of a commercial nature have been extracted. |

| |

| | |

| "Ton" | A short ton (2,000 pounds). |

| | |

| "Tonne" | A metric ton (2,204 pounds). |

| | |

| "TSX": | The Toronto Stock Exchange now known as the TSX. |

| | |

| "YBCA": | the Business Corporations Act (Yukon), R.S.Y. 1996, c.15, as amended. |

PART I

ITEM 1 IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

This Form 20F is being filed as an Annual Report under the Exchange Act and, as such, there is not a requirement to provide any information under this item.

ITEM 2 OFFER STATISTICS AND EXPECTED TIMETABLE

This Form 20F is being filed as an Annual Report under the Exchange Act and, as such, there is not a requirement to provide any information under this item.

ITEM 3 KEY INFORMATION

A. Selected Financial Data

The information in the following table summarizes selected financial data for the Company (stated in Canadian dollars) prepared in accordance with U.S. generally accepted accounting principles ("U.S. GAAP"). The information in the table was extracted from Note 17 of the more detailed financial statements included herein and should be read in conjunction with these financial statements and with the information appearing under the heading "Item 5 - Operating and Financial Review and Prospects."

Results for the period ended December 31, 2002 are not necessarily indicative of results for future periods.

| | Fiscal Year ended December 31, (1) |

| | | 2002 | | 2001 | | 2000 | | 1999 | | 1998 |

| | (In Canadian Dollar thousands, except for per share amounts) |

| | | | | | | | | | | |

| Revenue | $ | 916 | $ | 50 | $ | 73 | $ | 314 | $ | 507 |

| Net loss under U.S. GAAP | | (1,575) | | (5,587) | | (2,788) | | (8,889) | | (4,488) |

| Net loss per share under U.S. | | | | | | | | | | |

| GAAP | | (0.03) | | (0.12) | | (0.09) | | (0.36) | | (0.23) |

| | | | | | | | | | | |

| Total assets under U.S. GAAP | | 7,402 | | 6,141 | | 2,564 | | 3,726 | | 8,948 |

| Net assets under U.S. GAAP | | 6,682 | | 4,463 | | 379 | | 1,457 | | 7,779 |

| Share capital | $ | 55,414 | $ | 51,728 | $ | 49,829 | $ | 48,492 | $ | 46,158 |

| Shares issued and outstanding | 67,984,045 | 48,002,294 | 38,988,294 | 30,032,864 | 19,499,907 |

(1) No dividends were declared in any of the periods presented.

In this Form 20-F Annual Report, unless otherwise specified, all monetary amounts are expressed in Canadian dollars. The following table sets out the exchange rates, based on the noon buying rates published by The Bank of Canada, for the conversion of Canadian dollars into United States dollars in effect at the end of the following periods, and the average exchange rates (based on the average of the exchange rates on the last day of each month in such periods) and the range of high and low exchange rates for such periods.

The information set forth in this Form 20-F Annual Report, is as at December 31, 2002 unless an earlier or later date is indicated.

(a) On June 30, 2003, the noon rate of exchange, as reported by the Bank of Canada for the conversion of one United States dollars into one Canadian dollar was $1.3553 (U.S. $1.00 = Cdn. $0.7378)

(b) The following table sets out the high and low exchange rates for each month during the previous six months:

| | | |

| | High | Low |

| June 2003 | 1.3925 | 1.3323 |

| May 2003 | 1.4263 | 1.3438 |

| April 2003 | 1.4785 | 1.4334 |

| March 2003 | 1.4944 | 1.4628 |

| February 2003 | 1.5297 | 1.4840 |

| January 2003 | 1.5672 | 1.5184 |

(c) The following table sets out the average exchange rates for each of the last five years, calculated by using the average of the Noon Rate of Exchange on the last day of each month during the period:

| | Year Ended December 31 |

| | 2002 | 2001 | 2000 | 1999 | 1998 |

| Average for the year | 1.5704 | 1.5488 | 1.4852 | 1.4858 | 1.4831 |

B. Capitalization and Indebtedness

This Form 20F is being filed as an Annual Report under the Exchange Act and, as such, there is not a requirement to provide any information under this item.

C. Reasons for the Offer and Use of Proceeds

This Form 20F is being filed as an Annual Report under the Exchange Act and, as such, there is not a requirement to provide any information under this item.

D. Risk Factors

An investment in the Shares of the Company must be considered highly speculative due to the nature of the Company's business and in particular the following risk factors apply. The order in which they appear does not necessarily reflect management's opinion of their order or priority.

Fluctuations in the Market Price of Precious Metals.

The future profitability of the Company's operations is directly related to the market price of gold and silver as well as factors including the cost of operations and variations in the grade of ore mined.

The price of gold has fluctuated in recent years. The price of gold has experienced volatile and significant price movements over short periods of time and is affected by numerous factors beyond the control of the Company, such as demand for precious metals, forward selling by producers, central bank sales and purchases of gold and production and cost levels in major gold-producing regions. Moreover, gold prices are also affected by macroeconomic factors such as expectations for inflation, interest rates, currency exchange rates and global or regional political and economic situations. The current demand for and supply of gold affects gold prices, but not necessarily in the same manner as current demand and supply affect the prices of other commodities. The potential supply of gold consists of new mine production plus existing stocks of bullion and fabricated gold held by governments, financial institutions, industrial organizations and individuals. Since mine production in any single year constitutes a very small portion of the total potential supply of gold, normal variations in current production do not necessarily have a significant effect on the supply of gold or on its price.

Depending on the price of gold, the Company may determine that it is impractical to commence or continue commercial production.

No Production Revenues; History of Losses

The Company has not recorded any significant revenues from its mining operations since 1991. The Company acquired the Jerritt Canyon mine effective June 30, 2003 and income from the mine prior to that date is not included in the Company's results of operations. The Company has accumulated net losses from its operations of approximately $49 million under Canadian GAAP to December 31, 2002. There can be no assurance that significant additional losses will not occur in the near future or that the Company will be profitable in the future.

The Company anticipates that its operating expenses and capital expenditures will increase significantly in subsequent years with the acquisition of the Jerritt Canyon mine and as it adds the consultants, personnel and equipment associated with advancing exploration, development and commercial production of its properties. There can be no assurance that the underlying assumed levels of expenses will prove to be accurate.

The Company had completed its Jerritt Canyon acquisition financing by July 8, 2003 and the Company intends to rely on accumulated cash reserves, if any; cash generated from operations to fund its operations during the next twelve months.

Mining Industry Risks

Resource exploration, development and operations is a highly speculative business, characterized by a number of significant risks including, among other things, unprofitable efforts resulting not only from the failure to discover mineral deposits but from finding mineral deposits which, though present, are insufficient in quantity and quality to return a profit from production. Few properties that are explored are ultimately developed into producing mines. At present the Company's newly acquired Jerritt Canyon mine in Nevada, and its Magistral property in Mexico have known ore bodies and the other mineral properties in which the Company has an interest are without a known body of commercial ore. There is no assurance that mineral exploration activities will result in any additional discoveries of commercial bodies of ore.

Unusual or unexpected formations, formation pressures, fires, power outages, labour disruptions, flooding, explosions, cave-ins, land slides and the inability to obtain suitable or adequate machinery, equipment or labour are other risks involved in the operation of mines and the conduct of exploration programs. The Company has relied and may continue to rely upon consultants and others for construction, exploration, development and operating expertise. The economics of developing gold and other mineral properties is affected by many factors including the cost of operations, variations of the grade of ore mined, fluctuant mineral markets, costs of processing equipment and such other factors as government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals and environmental protection. Depending on the price of gold or other minerals produced, the Company may determine that it is impractical to commence or continue commercial production.

No Assurance of Title

The Company has investigated title to all of its mineral claims and has obtained title opinions with respect to its most significant properties, and to the best of its knowledge, title to all properties is in good standing. This should not be construed as a guarantee of title and there is no guarantee that title to such properties will not be challenged or impugned. Any of the Company's properties may be subject to prior unregistered agreements or transfers or native land claims and title may be affected by undetected defects.

Foreign Countries and Regulatory Requirements

Queenstake's Magistral property is in Mexico. Mineral exploration and mining activities in Mexico may be affected in varying degrees by political stability and government regulations relating to the mining industry. Any changes in regulations or shifts in political conditions are beyond the control of Queenstake and may adversely affect its business. Mexico is an economically developing country, which may make it more difficult for Queenstake to obtain any required exploration, development and production financing for projects located there.

Existing and possible future environmental legislation, regulations and actions could cause additional expense, capital expenditures, restrictions and delays in the activities of the Company, the extent of which cannot be predicted. The cost of compliance with changes in governmental regulations has the potential to reduce the profitability of operations.

Continued exploration activities, development and production activities on its properties, require permits from various foreign, federal, state and local governmental authorities and such activities will be governed by laws and regulations governing prospecting, development, mining, production, exports, taxes, labour standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. Companies engaged in the development and operation of mines and related facilities generally experience increased costs, and delays in production and other schedules as a result of the need to comply with applicable laws, regulations and permits.

The Company believes it is currently in substantial compliance with all material laws and regulations, which currently apply to its activities. Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations. Amendments to current laws, regulations and permits governing operations and activities of mining companies, could have a material adverse impact on the Company and cause increases in exploration expenditures and, in the future, on production costs or reduction in levels of production at producing properties or require abandonment or delays in development of new mining properties.

Environmental Risks and Hazards

All phases of the Company's operations are subject to environmental regulation in the various jurisdictions in which the Company operates. Environmental legislation is evolving in a manner which may require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. There is no assurance that existing or future environmental regulation will not materially adversely affect the Company's business, financial condition and results of operations. Environmental hazards may exist on the properties on which the Company holds interests which are unknown to the Company at present and which have been caused by previous or existing owners or operators of the properties and which are beyond the limits of the insurance coverage purchased by the Company.

Government approvals and permits are currently, or may in the future be, required in connection with the Company's operations. To the extent such approvals are required and not obtained, the Company may be curtailed or prohibited from proceeding with planned exploration or development of properties.

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in mining operations, including the Company, may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations which are beyond the limits of the insurance coverage purchased by the Company.

Amendments to current laws, regulations and permits governing operations and activities of mining companies, or more stringent implementation thereof, could have a material adverse impact on the Company and cause increases in exploration expenses, capital expenditures or production costs or a reduction in levels of production at producing properties or require abandonment or delays in development of new mining properties.

Environmental Regulations

The Company's operations may be subject to environmental regulations promulgated by government agencies from time to time. Environmental legislation provides for restrictions and prohibitions on spills, releases or emissions of various substances produced in association with certain mining industry operations, such as seepage from tailings disposal areas, which would result in environmental pollution. A violation of such legislation may result in imposition of fines and penalties. In addition, certain types of operations require the submission and approval of environmental impact assessments. Environmental legislation is evolving in a manner where stricter standards and enforcement are being applied and fines and penalties for non-compliance are more stringent. Environmental assessments of proposed projects carry a heightened degree of responsibility for companies and directors, officers and employees. The cost of compliance with changes in governmental regulations has a potential to reduce the profitability of operations. The Company intends to fully comply with all environmental regulations in all of the countries in which it is active.

Uncertainty as to Calculations of Material Reserves, Mineral Deposits and Ore Grades

There is a significant degree of uncertainty attributable to the calculation of ore reserves, mineral deposits and corresponding material grades. Until the material is actually mined and processed, ore reserves, mineral deposits and ore grade must be considered as estimates only. Consequently, there can be no assurance that any material reserve, mineral deposit or material grade information contained in this Annual Report will prove accurate. In addition, the quantity of material reserves and mineral deposits may vary depending on mineral prices and other factors. Any material change in reserves, ore grades or stripping ratios may affect the economic viability of the Company's projects. Furthermore, reserve and mineral deposit information should not be interpreted as any assurance of mine life or of the potential profitability of existing or future projects.

Financing Risks

Queenstake expects to receive operating income from the Jerritt Canyon mine and operator fees from production at Magistral during the next twelve months; however, if production is delayed or is not profitable, then there may be delays in receiving this anticipated income.

Future development and exploration of the Company's properties may require additional financing. There can be no assurance that Queenstake will be able to obtain adequate financing in the future or that the terms of such financing will be favourable. Failure to obtain such additional combination of equity and debt financing could result in delay or indefinite postponement of further exploration and development of its projects with the possible loss of such properties.

Uninsured Risks

The Company carries insurance to protect against certain risks, in such amounts as it considers adequate. In the course of exploration, development and production of mineral properties, certain risks, and in particular, unexpected or unusual geological operating conditions including rock bursts, cave-ins, fire, flooding and earthquakes may occur. It is not always possible to fully insure against such risks and the Company may decide not to take out insurance against such risks as a result of high premium costs or for other reasons. The payment of any such liabilities would reduce the funds available for exploration and mining activities. Payment of liabilities for which the Company does not carry insurance may have a material adverse effect on the financial position of the Company and a decline in the value of the Shares of the Company.

Competition

The Company competes with other mining companies for the acquisition of mineral claims, leases and other mineral interests as well as for the recruitment and retention of qualified employees. Many of these companies have greater financial and technical resources than the Company.

Dependence on Management

The Company is dependent upon a number of key management personnel. The loss of the services of one or more of such personnel could have a material adverse effect on the Company. The Company's ability to manage its operations, exploration and development activities, and hence its success, will depend in large part on the efforts of these individuals. The Company faces intense competition for qualified personnel and there can be no assurance that the Company will be able to attract and retain such personnel. Investors must be willing to rely to a significant extent on their discretion and judgment.

Currency Fluctuation

The Company's operations are primarily conducted in U.S. dollars while its financial results are expressed in Canadian dollars. The Company does not currently engage in foreign currency hedging and its operations are subject to foreign currency fluctuations, and such fluctuations may materially affect the Company's financial position and results of operations.

The Company maintains the majority of its cash treasury in U.S. dollars. With respect to currencies to fund its operations in Mexico, the Company transfers funds to its subsidiaries on an "as needed" basis to avoid significant exposure to local currency fluctuations. There can be no assurance that steps taken by management to address foreign currency fluctuations will eliminate all adverse effects and accordingly, the Company may suffer losses due to adverse foreign currency fluctuations.

Conflicts of Interest

Certain of the directors and officers of Company are also directors and/or officers of other natural resource companies. Such associations may give rise to conflicts of interest from time to time. The directors of Queenstake are required by law to act honestly and in good faith with a view to the best interests of Queenstake and to disclose any interest, which they may have in any project or opportunity of Queenstake. If a conflict of interest arises at a meeting of the board of directors, any director in a conflict must disclose his interest and abstain from voting on such matter. In determining whether or not Queenstake will participate in any project or opportunity, the directors will primarily consider the degree of risk to which Queenstake may be exposed and its financial position at the time.

Potential Volatility of Market Price of Common Shares

Both the Canadian and U.S. stock markets have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These broad market fluctuations may adversely affect the market price of the Company's Shares. In addition, the market price of the Company's Shares may be highly volatile. Factors such as the price of gold and precious metals, announcements by competitors, changes in stock market analyst recommendations regarding the Company, and general market conditions affecting other exploration and mining companies may have a significant effect on the market price of the Company's Shares. Moreover, it is likely that during future quarterly periods, the Company's results and exploration activities may fluctuate significantly or may fail to meet the expectations of stock market analysts and investors and, in such event the market price of the Company's Shares could be materially adversely affected. In the past, securities class action litigation has often been initiated following periods of volatility in the market price of a company's securities. Such litigation, if brought against the Company, could result in substantial costs and a diversion of management's attention and resources, which could have a material adverse effect on the Company's business, financial condition and results of operations.

Shares Reserved for Future Issuance: Dilution

The Company had unlimited authorized but unissued and unreserved Shares. The Company has reserved, as of June 30, 2003, 125,435,984 Shares for issuance on the exercise of subscription receipts, incentive stock options and warrants. Such amount of Shares represents a potential equity dilution of 152%, based upon the 82,298,243 Shares outstanding at June 30, 2003. Furthermore, the Company may enter into commitments in the future, which would require the issuance of additional Shares and may grant additional stock options and issue additional warrants. By July 8, 2003 the Company had completed the balance of the funding required to finance its June 30, 2003 acquisition of the Jerritt Canyon mine. The Company has reserved, as of July 8, 2003, 131,935,984 Shares for issuance on the exercise of incentive stock options and warrants. Such amount of Shares represents a potential equity dilution of 54%, based upon the 244,398,243 Shares outstanding at July 8, 2003. Issuance of additional Shares would be subject to certain regulatory approvals and compliance with applicable securities legislation

Payment Obligations

Under certain contractual agreements to which the Company is or may in the future become a party, the Company is or may become subject to payment and other obligations. If such obligations are not complied with when due, in addition to any other remedies, which may be available to other parties, this could result in dilution or forfeiture of interests held by the Company. The Company may not have, or be able to obtain, financing for all such obligations as they arise.

ITEM 4 INFORMATION ON THE COMPANY

A. History and development of the Company

Queenstake Resources Ltd. (the "Company") was incorporated under the laws of British Columbia on May 3, 1977 under the name "Queenstake Resources Ltd." by registration of its Memorandum and Articles with the British Columbia Registrar of Companies. To facilitate a business combination of the Company and Santa Cruz Gold Inc. ("Santa Cruz") on June 24, 1999, the Company's shareholders passed a special resolution authorizing the continuance of the Company from British Columbia to the Yukon, and the Company continued under the YBCA effective June 24, 1999.

Effective July 19, 1999, the Company merged with Santa Cruz through an amalgamation by way of statutory plan of arrangement under the YBCA and continued as one company with the name "Queenstake Resources Ltd.".

The registered office of the Company is located at Suite 200, 204 Lambert Street, Whitehorse, Yukon Y1A 3T2.

The corporate office of the Company is located at 712C - 12th Street, New Westminster, British Columbia, V3M 4J6.

The executive offices of the Company are located at 999 Eighteenth Street, Suite 2940, Denver, Colorado U.S.A. 80202.

General

The Company's business is the acquisition, exploration, and if determined to be economically viable, the development and exploitation of mineral properties.

On June 30, 2003 the Company acquired the Jerritt Canyon gold mine (the "JC Mine") located in the Independence Mountain Range of Nevada, USA. Prior to June 30, 2003 the Company owned a 42.5% interest and is operator of the newly commissioned, small-scale Magistral gold mine in Mexico. The acquisition of the JC Mine has taken Queenstake from an emerging to a mid-tier gold producer with projected annual production in excess of 300,000 ounces per year on a pro-forma basis. Fundamental asset value attributable to Queenstake's shareholders is expected to be significantly enhanced through the addition of mature, stable cash flows, supported by the significant resource base at Jerritt Canyon and extensive exploration potential.

Jerritt Canyon mine, Nevada

On June 30, 2003, the Company completed the purchase of the JC Mine pursuant to a May 30, 2003 asset purchase and sale agreement (the "Purchase and Sale Agreement") with certain subsidiaries of AngloGold Limited ("AngloGold") and Meridian Gold Inc. ("Meridian") (collectively the "Sellers") pursuant to which Queenstake agreed to acquire their respective 70% and 30% interests in the assets comprising the operating JC Mine.

Pursuant to the terms of the Purchase and Sale Agreement, Queenstake paid the Sellers US$1,500,000, and issued 32 million Shares of Queenstake. In addition Queenstake has agreed to pay the Sellers US$6 million payable in quarterly installments of US$1 million commencing on the earlier of repayment of Queenstake's senior debt financing or June 30, 2005. A net smelter return royalty on the JC Mine will also be payable to the Sellers commencing on the earlier of repayment of Queenstake's senior debt financing or June 30, 2005, based on a sliding scale ranging from 2% to 4% at gold prices above US$320 per ounce. The royalty is capped at US$4 million at which point the royalty will convert to a 1% net profits interest royalty payable only to AngloGold.

Queenstake assumed all reclamation and environmental liabilities of the Sellers. The required replacement of existing surety bonds was achieved by a closure and reclamation insurance policy underwritten by AIG Environmental Inc. The premium cost to Queenstake of such insurance policy, which will fund the pre-existing closure and reclamation costs, is US$31.75 million. The policy includes a US$1.5 million performance bond in favour of the Sellers.

By July 8, 2003 Queenstake had raised the financing totaling C$26 million equity and US$20 million debt.

On July 2, 2003 Subscription Receipts issued and sold by the Company on June 26, 2003 for gross proceeds of $21 million were exercised for no additional consideration, the Company issued 105,000,000 Shares and 52,500,000 Share purchase warrants ("Warrant"), and the proceeds were released from escrow. Each Warrant will entitle the holder to purchase one Share at an exercise price of $0.25 until June 25, 2005.

On July 4, 2003 the Company issued 25,000,000 units at $0.20 each on a private placement basis for gross proceeds of $5 million. The issue was made pursuant to an over-allotment option granted on June 19, 2003 to the Company's Agents, Westwind Partners Inc. and Loewen, Ondaatje, McCutcheon Limited, in connection with the Company's previously completed Subscription Receipt financing. Each unit comprised one Share and one half a Warrant. Each whole Warrant will entitle the holder to purchase one Share at an exercise price of $0.25 until June 25, 2005.

On July 8, 2003 the Company drew down a senior debt financing of US$20 million, bearing interest at U.S. Prime plus 7%, a current effective rate of 11% (the "JC Debt"). The JC Debt is fully secured by all of the JC Mine assets as well as a guarantee of the Company secured by its assets. The JC Debt is to be repaid, with minimum quarterly payments of US$2.5 million, by June 27, 2005. The lender was paid a 3% set up fee and was issued 37,000,000 Warrants with a five year term and a nominal exercise price of $0.01 per share and 2,000,000 Warrants at an exercise price of $0.25 expiring on July 7, 2005. The lender also guaranteed the Company's purchase of a series of gold put options by which the Company has effectively established a minimum price of US$330 per ounce for approximately 400,000 ounces of gold production from the JC Mine over the next 24 months. This method of price protection does not in any way limit the upside gold price potential. The Company will pay the cost of the put options out of cash flow as the puts become exercisable.

Westwind Partners Inc. ("Westwind") acted as financial advisor to Queenstake in connection with the acquisition and JC Debt and acted as lead agent in connection with the equity offerings. In consideration of the services of Westwind, Queenstake issued and paid to Westwind:

| (i) | 1,000,000 share purchase warrants exercisable to purchase 1,000,000 Shares of Queenstake at a price of $0.20 per share until June 11, 2004 as an engagement fee; |

| |

| (ii) | a fee equal to 4% based on the value of the gross proceeds raised under the Debt Financing; and |

| (iii) | a cash commission equal to 6% of the total gross proceeds raised under the Equity Offerings together with broker's warrants entitling Westwind to purchase up to 6% of the number of units sold under the equity offerings for a period of twelve months. |

| |

| |

Magistral Mine, Mexico

On September 14, 2001 the Company's subsidiary Pangea, owner of 100% of the share capital of Minera Pangea, which in turn owned 100% of the Magistral gold project, entered into a joint venture agreement (the "Magistral Joint Venture" or "MJV") with Midwest, a private Delaware corporation owned by Landon Clay. At June 30, 2003 Mr. Clay was a significant (25%) shareholder of the Company. Pangea contributed its beneficial ownership of 100% of the shares of Minera Pangea to an unincorporated joint venture known as the Magistral Joint Venture (or MJV) for the development of the Magistral gold mine in exchange for a 50% interest in the MJV. Midwest agreed to contribute a total of US$6,625,000 ("Preferred Capital") to fund the development of the Magistral gold mine in exchange for a 50% interest in the MJV and a 15% interest in the shares of Pangea. Midwest subsequently funded construction expenditures at the Magistral mine, through the MJV, with US$625,000 on September 1, 2001, US$3,000,000 on January 11, 2002, and US$3,000,000 on May 7, 2002.

In 2002, the Company and Midwest each loaned the Magistral Joint Venture US$1,150,000 at 18% annual interest (the "Operating Loans"), for a total of US$2,300,000, in order to fund completion of construction at the Magistral mine and provide initial required working capital.

Pursuant to the terms of the MJV, after full repayment pari passu of the Operating Loans and accrued interest thereon advanced by the Company and Midwest to the MJV for capital construction overruns and working capital for the Magistral mine, Midwest will receive preferential payback from 100% of the cash flow of the MJV until Midwest recovers its Preferred Capital of US$6,625,000 plus a return of 12% per year (combined, the "Payback Amount"). The Magistral Joint Venture agreement provides a mechanism for penalties and possible dilution of Queenstake's investment in the MJV if the Payback Amount is not paid within 5.5 years from the date of the production decision, being sixty-six months from funding the first tranche of development capital, or July 10, 2008 (the "Payback Date").

Midwest's joint venture and equity interests in respect of the Magistral mine are subject to put/call option arrangements. For a period running from one year prior to the Payback Date to 60 days after the Payback Date, Midwest has the right to cause the Company to purchase (the "Put Option") its interests at fair market value ("FMV"). The parties will determine FMV with provision for independent valuation and Queenstake shall have the right to pay the FMV in either cash or Shares. The Shares will be priced at that time based on the 20-day weighted-average trading price for the Company's Shares and subject to regulatory approval. If payback is achieved early, the Put Option period will be accelerated to expire 60 days from the date payback is achieved. If Midwest's Put Option is not exercised, Queenstake has the right, or call option, to purchase Midwest's joint venture and equity interests at FMV. Queenstake shall have the right to pay the FMV in either cash or Shares. The Shares will be priced at that time based on the 20-day weighted-average trading price per Share, but with a discount of 10% applied, and subject to regulatory approval. The JC Debt restricts the Company from paying the FMV in cash as long as the JC Debt has not been paid.

The MJV has effectively assumed through its ownership of Minera Pangea, all of the following agreements:

- On December 31, 2001, on behalf of the MJV, Queenstake notified Campbell Resources Inc. ("Campbell") of its intention to exercise its option acquired on August 31, 2001 to have Minera Pangea purchase the shares of Oro de Sotula S.A. de C.V. ("Oro"), a Mexican subsidiary of Campbell and past operator of the shut-down Santa Gertrudis gold mine in Sonora, Mexico. The assets of Oro included most of the equipment necessary for the development of the Magistral mine. In accordance with the MJV agreement these assets and a related contingent liability were contributed to the MJV by Queenstake. The purchase of Oro by Minera Pangea closed on January 31, 2002. Aggregate option payments paid to Campbell amounted to US$125,000 to December 31, 2001. The purchase price of Oro was satisfied by the issuance of two notes totalling US$2 million that are to be paid by the MJV as follows:

The first US$1 million note (the "Gold Note") is contingently payable in tranches at certain milestone gold prices (US$150,000 at US$310, US$250,000 at US$330 and US$600,000 at US$350 per ounce) that must be reached and sustained for 120 days before December 31, 2005. On September 9, 2002, the first US$150,000 tranche of the Gold Note was triggered and the Company elected to satisfy the MJV obligation by the issuance of 978,500 Shares to Campbell on behalf on the MJV. On January 30, 2003, the second tranche of the US$250,000 Gold Note was triggered and the Company elected to satisfy the MJV obligations by the issuance of 1,194,531 Shares to Campbell on behalf of the MJV. Should the final US$600,000 tranche of the Gold Note be triggered by the gold price reaching and sustaining for 120 days US$350 per ounce prior to December 31, 2005, it may only be paid in cash by the MJV.

The second US$1,000,000 note, will become payable by the MJV on the earlier of completion of reclamation work at Santa Gertrudis and settlement of all assumed liabilities or January 31, 2005. The MJV has agreed to cover all the costs of acquiring Oro, including funding of the assumed liabilities of Oro and the reclamation costs of Santa Gertrudis. If the aggregate expenditures relating to these liabilities exceed US$2 million, all or a portion of the second US$1 million note will be reduced according to a formula.

On March 22, 2002 Oro sold all the mineral claims comprising the Santa Gertrudis property owned by it to a Mexican subsidiary of International Coromandel Resources Ltd. ("Coromandel") for consideration of US$30,000 worth of shares of Coromandel, the assumption of any and all reclamation liabilities, and the retention of a 2% NSR royalty. Oro and Campbell Resources Inc. shared the consideration on the basis of two-thirds to Oro and one-third to Campbell so that Oro received 241,539 shares of Coromandel at a deemed value of US$20,000 and owns a 1 1/3% NSR from any future production from the Santa Gertrudis properties sold to Coromandel.- The Magistral gold project is covered by five contiguous mining concessions totalling approximately 9,181 hectares owned 100% by Minera Pangea. In addition, Minera Pangea is leasing and has an option to purchase three nearby exploration mining concessions covering 445 hectares from a Mexican national. The lease and option to purchase agreement dated October 10, 1996, and amended March 30, 2000, gives Minera Pangea the right to explore the property until March 30, 2005 by paying a total of US$165,000 (which has been paid) including the final US$20,000 paid by the MJV on January 15, 2002. Minera Pangea may elect to purchase the mineral rights by making a final payment on or before March 30, 2005 of US$812,500 or may relinquish the three concessions at any time upon 30 days' notice to the owner.

- Minera Pangea also bought the right to use, process and exploit the tailings located at the Magistral gold project, from the surface landowners in the area on January 31, 2002 for US$20,000 and a further US$100,000 payable three months after the MJV begins processing of the tailings.

On January 15, 2002, by making the final instalment of the purchase price of US$185,000, Minera Pangea purchased and eliminated a net smelter return royalty of 1.5% held by a third party on two of the concessions comprising the Magistral gold project.

IAMGOLD Corporation, through its wholly-owned subsidiary Repadre International Corporation, holds a net smelter return royalty on gold recovered from the Magistral gold project. The royalty is calculated at a rate of 1% of net smelter returns on the initial 30,000 ounces of gold production, then at a rate of 3.5% of net smelter returns on the next 350,000 ounces of gold production and thereafter at a rate of 1% of net smelter returns on gold recovered from the Magistral gold project, in perpetuity.In January 2002, the Magistral Joint Venture made a production decision to proceed with construction of the Magistral mine and construction proceeded through to commencement of gold production at Magistral in October 2002. Construction began in February 2002 with road construction to the site and the dismantling and preparation for shipment of the equipment from the Santa Gertrudis mine site in Sonora. By the end of March, the transfer of equipment was essentially complete, together with site roads and work began on the earthworks for the leach pads, crusher workshops and a mine haul road. By the end of April the first liner was placed on the leach pad, the dams that form the solution ponds were nearing completion and reconstruction of the gold recovery plant and workshops was well in hand. In August the leach pads were completed, mining started at the outcrop of the San Rafael ore body, the primary and secondary crushers were commissioned and the resulting crushed ore began to be stacked on the pads. The ponds and excess solution dams were completed in mid September and the first cyanide solution was added to the stacked ore. The first carbon strip was completed in early October and on October 10, 2002, the first gold doré bar from Magistral was poured, weighing in at 255 ounces.

During 2002, construction was credited with the production of 4,482 ounces of gold recovered from 247,000 tonnes of ore stacked on the leach pads between August and December of that year. Production was deemed to have commenced on January 1, 2003. During the first quarter of 2003, 228,585 tonnes were stacked at a grade of 1.56 gpt and 6,608 ounces of gold were poured. During the second quarter of 2003, 189,829 tonnes were stacked at a grade of 1.73 gpt and 6,371 ounces of gold poured.

The whole of 2002 was considered to be the construction period for accounting purposes and the resulting US$1.5 million of production revenues were treated as a credit to construction costs, for net development costs of $US$10 million. This was more than the somewhat tight original budget estimate with increases resulting largely from difficult ground conditions in the preparation of the leach pad area resulting in substantially greater equipment requirements than had been budgeted. The difference in cost between the US$6.625 million provided by Midwest and the final cost was provided by the Operating Loans made equally between Midwest and the Company through the MJV. The loans bear interest at a rate of 18% per annum and have first priority in distribution of cash flows from the operation.

On June 12, 2003 the management committee of the MJV approved an amended US$1.6 million program for the 2003 MJV work program and budget. The Company and Midwest have each agreed to fund their respective 50% share of this US $1.6 million program on the same basis as the 2002 Operating Loans. To date the Company has funded US$300,000 and in July it will fund the remaining US$500,000. In addition to approving the work program and budget the parties to the MJV agreed to hire a Denver based controller for the MJV and after paying the cost of the controller and shared office facilities, Queenstake and Midwest will share the balance of the monthly US$50,000 operator fee beginning in June 2003.

Production during the first quarter was considered an encouraging build up toward full scale production but the second quarter was disappointing. Reasons for the shortfall in production included low tonnage placed on the leach pads due to poor equipment availabilities, lower than anticipated grade and continuing problems in the crushing and gold recovery areas. A new generator was purchased for the crushing area but was not fully commissioned at the end of the second quarter. A face shovel was transferred from Santa Gertrudis and is being re-erected at Magistral. When operational, this will help alleviate the constraint on loading capacity experienced to date.

The problems encountered during the second quarter are perceived to be extended start up problems, somewhat exacerbated by the minimum initial capital used in the project. Production is expected to expand again in the third and fourth quarters as capacity constraints are removed.

Significant Acquisitions and Significant Disposition

For the year ended December 31, 2002, and to the date of this Annual Report, in addition to the June 30, 2003 acquisition of the JC Mine, and the development and construction at Magistral described above, of less significance to the Company were:

The February 26, 2001 acquisition of various interests in six exploration permits and two diamond prospecting permits in Burkina Faso, West Africa through the acquisition of 100% of Incanore Gold Mines Ltd. ("Incanore Gold") a private Canadian company, in consideration for 7,600,000 Shares of the Company. Incanore Gold's most significant asset was its 18.5% joint venture interest in the Taparko project in Burkina Faso. During the year 2001, the Company either disposed of or returned to the Burkina Faso Government all of its interests in the properties acquired in the Incanore Gold acquisition except for its interest in the Taparko property. The joint venture majority partner, High River Gold Mines Ltd. ("High River"), had an option to purchase the Company's interest in the Taparko project for $1.4 million until February 26, 2004. On July 15, 2002, the Company accepted a discounted price of $1.2 million and sold all interest in the Taparko project to High River.

The sale during 2000 of certain exploration properties in Peru to James Mancuso, a director of the Company, in exchange for a 1% net smelter return royalty.

The sale on June 30, 2001 of all of the issued and outstanding share capital of its subsidiary,

Intercontinental Resources Inc. ("IRI"), a private Cayman Islands Corporation, to Monterrico Metals PLC ("Monterrico"). Prior to that date Mr. Mancuso had contributed his Peru property interests acquired from the Company to Monterrico. For the sale of IRI to Monterrico, the Company received 300,000 shares of Monterrico, valued at $30,000 at the time and $3,750 in cash received in 2001 and $8,750 received in 2002. The Company also retains a 1% net smelter return royalty on Monterrico's, Carisla, Yarpun, Chupaca, Ancash 38, El Alcatraz 8 and 9 and IRI 63 properties in Peru. Monterrico is not required to maintain or retain any of these exploration properties. The shares of Monterrico trade on the London Stock Exchange under the symbol MNA.L and the Company's shares in Monterrico had an approximate market value of $340,000 on December 31, 2002. The Company has agreed to sell these shares for approximate proceeds of US$300,000 in a private sale expected to close in August 2003.B. Business overview

The Company's business is the acquisition, exploration, and if determined to be economically viable, the development and exploitation of mineral properties.

On June 30, 2003 the Company acquired the Jerritt Canyon gold mine (the "JC Mine") located in the

Independence Mountain Range of Nevada, USA. Prior to June 30, 2003 the Company owned a 42.5% interest and is operator of the newly commissioned, small-scale Magistral gold mine in Mexico. The acquisition of the JC Mine has taken Queenstake from an emerging to a mid-tier gold producer with projected annual production in excess of 300,000 ounces per year on a pro-forma basis. Fundamental asset value attributable to Queenstake's shareholders is expected to be significantly enhanced through the addition of mature, stable cash flows, supported by the significant resource base at Jerritt Canyon and extensive exploration potential.

The following information has been compiled by the Company from various sources the Company believes to be reliable.

Operations - United States

Property Interests in the United States

U.S. federal and state governments and private parties own mineral interests in the United States. In order for the Company to explore or develop a prospective mineral property that is owned by a private party or by a state, it must enter into a property or mineral rights acquisition agreement. The Company may also acquire rights to explore for and produce minerals on U.S. federally owned lands. This acquisition is accomplished through the location of unpatented mining claims upon unappropriated U.S. federal land pursuant to procedures established principally by the General Mining Law of 1872, as amended (the "General Mining Law") and the Federal Land Policy and Management Act of 1976 (or the acquisition of previously located mining claims from a private party as described above). These laws and regulations generally provide that a citizen of the United States (including a U.S. Corporation) may acquire a possessory right to develop and mine valuable mineral deposits discovered upon unappropriated U.S. Federal lands, provided that such lands have not been withdrawn from mineral location (which would include, for example, lands included in national parks and military reservations and lands designated as part of the National Wilderness Preservation System). This right can be freely transferred and is protected against appropriation by the government without just compensation. Also, the claim locator acquires the right to obtain a patent (or deed) conveying fee title to his claim from the U.S. federal government upon compliance with certain additional procedures.

Substantially all of the Jerritt Canyon proven and probable ore reserves are located on unpatented mining claims owned or leased by the Company. The Jerritt Canyon mill is located on land owned by the Company.

Foreign Operations - Mexico

The Company's operations in Mexico are governed primarily by the following regulations:

Mexico Foreign Investment Regulations

Foreign investment regulation in Mexico is governed by the Law of Foreign Investment which provides investment rights to investors from all countries on the same basis as granted to investors from the United States and Canada under the North American Free Trade Agreement. Foreign investment of up to 100% in Mexican mining companies is freely permitted with the requirement that such companies must register with the National Registry of Foreign Investment, which is maintained by the Ministry of Commerce and Industrial Development.

Mexico Mining Regulations

Exploration and exploitation of minerals in Mexico may be carried out through Mexican companies incorporated under Mexican law by means of obtaining exploration and exploitation concessions. Exploration concessions are granted by the Mexican government for a period of six years from the date of their recording in the Public Registry of Mining and are not renewable. Holders of exploration concessions may, prior to the expiration of such exploration concessions, apply for one or more exploitation concessions covering all or part of the area covered by an exploration concession. Failure to do so prior to expiration of the term of the exploration concession will result in termination of the concession. An exploitation concession has a term of 50 years, generally renewable for a further 50 years upon application within five years of the expiration of such concession. Both exploration and exploitation concessions are subject to annual work requirements and payment of annual surface taxes which are assessed and levied on a biannual basis. Such concessions may be transferred or assigned by their holders, but such transfers or assignments must be registered in order to be valid against third parties.

The holder of a concession must pay biannual duties in January and July of each year which for 2002 were in the following amounts per hectare:

| | Exploration Concessions | Exploitation Concessions |

| | | (pesos) | | | (pesos) | |

| | Year 1 | Year 2-4 | Year 5-6 | Year 1-2 | Year 3-4 | Year 5-50 |

| January | 1.8464 | 5.5000 | 11.3600 | 22.8900 | 45.9600 | 80.6100 |

| July | 1.8883 | 5.6200 | 11.6100 | 23.4000 | 47.0000 | 82.4300 |

The exchange rate at December 31, 2002 was approximately 10.42 pesos for each US$1.00.

Concessionaires for both exploration and exploitation must perform work each year that must begin within ninety days of the concession being granted. Concessionaires must file each May proof of the work performed. Noncompliance of these requirements is cause for cancellation of the corresponding concessions.

Foreign citizens or foreign corporations may also obtain mineral exploration and exploitation concessions. Foreign citizens are required to register their investment in the National Registry of Foreign Investment. In the case of foreign corporations, in addition to registration in the National Registry of Foreign Investment, additional authorization from the Ministry of Commerce and Industrial Development is required in order to obtain subsequent registration in the corresponding local Public Registry of Commerce.

Mexican mining law does not require payment of finder's fees or royalties to the government, except for a discovery premium in connection with national mineral reserves, concessions and claims or allotments contracted directly from the Council of Mineral Resources. None of the claims held by any subsidiaries of the Company are under such a discovery premium regime.

There are no limitations on the total amount of surface covered by exploration or exploitation concessions or on the amount of land held by an individual or company. Excessive accumulation of land is regulated indirectly through the duties levied on the property and the production requirements as outlined above.

Mexico - Taxation

The Mexican general corporate tax rate is 35%. The tax procedures allow for the carry-forward of losses for a period of up to 10 years, indexed for inflation. The project is not expected to attract corporate tax for the first several years of production due to loss carry-forwards.

Mexico Environmental Law

The Environmental Law in Mexico called the General Law of Ecological Balance and Protection to the

Environment ("General Law"), provides for general environmental policies, with specific requirements set forth in regulations called "Ecological Technical Standards". Responsibility for enforcement of the General Law, the regulations and the Ecological Technical Standards is with the Ministry of Environment, Natural Resources and Fishing, which regulate all environmental matters with the assistance of the National Institute of Ecology and the Procuraduria Federal de Proteccion al Ambiente.

The primary laws and regulations governing environmental protection for mining in Mexico are found in the General Law, the Ecological Technical Standards and also in the air, water and hazardous waste regulations, among others. In order to comply with the environmental regulations, a concessionaire must obtain a series of permits during the exploration stage. Generally, these permits are issued on a timely basis after the completion of an application by a concession holder. The subsidiaries of the Company are currently in full compliance with the General Law and its regulations in relation to their mineral property interests.

C. Organizational structure

Unless the context otherwise requires, all references herein to the Company include the Company and its subsidiaries. The following chart illustrates the inter-corporate relationships of the Company and its active subsidiaries and their jurisdictions of incorporation. For definitions of certain terms used throughout this document, see the Glossary at the beginning of this Annual Report.

The Company owns its interest in the JC Mine through its 100% ownership of Queenstake Resources U.S.A., Inc.

The Company owns its interest in the Magistral property through its 85% ownership of Pangea Resources Inc. owner of a 50% interest in the Magistral Joint Venture. The Magistral Joint Venture beneficially owns 100% of Minera Pangea S.A. de C.V. ("Minera Pangea"). Minera Pangea owns 100% of the shares of Oro de Sotula S.A. de C.V. Midwest Mining Inc. owns 15% of Pangea Resources Inc. and a 50% interest in the Magistral Joint Venture.

The Company's 100% owned subsidiary, Castle Exploration Inc., Denver, Colorado, provides office space for the Company's business activities and its Denver-based employees. It is expected that all the Company's USA based employees will ultimately become employees of Queenstake Resources U.S.A., Inc.

D. Property, plant and equipment

The Company's primary asset is its newly acquired 100% interest in the Jerritt Canyon mine, Elko, Nevada. The Company's secondary asset is its 50% joint venture interest in the Magistral property in Sinaloa, Mexico. The Company retains a 1% net smelter return interest on certain mineral exploration properties in Peru.

June 30 2003 acquisition - Jerritt Canyon mine, Nevada

On June 30, 2003, the Company completed the purchase of the Jerritt Canyon mine (or the JC Mine) pursuant to a May 30, 2003 asset purchase and sale agreement with certain subsidiaries of AngloGold Limited and Meridian Gold Inc. pursuant to which Queenstake agreed to acquire their respective 70% and 30% interests in the assets comprising the operating JC Mine (see "History and Development of the Company").

The following summary, covering much of the information from this page to page 34, relating to the JC mine has been extracted from the technical report dated June 9, 2003, prepared by Pincock Allen and Holt ("PAH") entitled "Jerritt Canyon Mine Technical Report". Company updates to the information extracted from this report are noted where appropriate.

"Project Description

The Jerritt Canyon project is an operating gold property with four underground mines currently in production feeding ore to a process plant. It is located in Elko County, Nevada approximately 50 miles north of Elko, Nevada. The property operated as the Jerritt Canyon Joint Venture (JCJV), which comprised of AngloGold (70%) and Meridian Gold, Inc. ("Meridian") (30%). Queenstake announced on May 30, 2003, that it has entered into a Purchase and Sale Agreement with said owners to acquire the mine. The transaction closed effective June 30, 2003 with the transfer of the operating permits.

Gold mineralization was originally discovered in 1972 by Meridian. Mining at Jerritt Canyon commenced in 1981 and has continued uninterrupted until the present. Open pit mining occurred from 1981 through 1999. Underground mining started in 1993 and is currently continuing. The JC Mine property covers approximately 100 square miles.

The property has been subjected to numerous drill campaigns since the 1970s. Thousands of drill holes exist on the property. In 2002, more than 300,000 feet were drilled. Several resource areas both adjacent to the existing mines and elsewhere in the district show potential for resource expansion and reserve development.

Tenure

The JC Mine operations are conducted on a combination of public and private lands, with the mines and mining related surface facilities being primarily located on public lands and the process plant administrative facilities and tailings impoundment located on private lands obtained in part through a land swap with the Bureau of Land Management.

At the present time, Jerritt Canyon includes 2,177 owned and leased claims, 12,433 acres of fee land, 934 acres of patented claims, and 9,911 acres of leased fee land with mineral rights as shown in the following table.

Total Land Available to the Company for Exploration

And Exploitation in the Jerritt Canyon Area

| Land Status | No. Claims | Acres |

| Owned Claims | 1,845 | 36,900 |

| Leased Claims | 332 | 6,640 |

| Total Claims | 2,177 | 43,540 |

| Fee Land Owned | | 12,433 |

| Patented Claims Owned | | 934 |

| Fee Land Leased | | 9,911 |

| | | 23,278 |

| Total acreage of Project | | 66,818 |

Location and Access

The Jerritt Canyon Mine operation is located in Elko County, Nevada within the Independence Mountain Range, approximately 50 miles north of the City of Elko, Nevada. Access to the property is by means of State Road 225 to the main entrance road to the mine. The roads are in excellent condition and are paved all the way to the mine gate where the administrative offices are located. The active mining areas are located at elevations that range from approximately 6,400 feet at the administration offices, process plant, and tailings impoundment site to 8,000 feet at the mine sites. Sagebrush vegetation dominates the lower elevations in the southern part of the range. The northern part of the range is mostly dominated by scrublands. Small forest stands of sub alpine fir grow in canyons and north slopes.

Climate and Local Resources and Infrastructure

The climate is characterized by winters with temperatures between 0 and 40 degrees Fahrenheit and summer temperatures between 35 and 85 degrees Fahrenheit. Average annual precipitation at the tailings impoundment area is estimated at 14 inches per year with an estimated annual average evaporation of 43 inches. A significant amount of the total precipitation falls as snow and increases with elevation to the mining areas. Only rarely are conditions severe enough to halt mine operations. Mill operations are located at lower elevations and are not exposed to the severe weather.

The nearest city, Elko, has a population of 34,000 and is serviced by regular scheduled air service from Reno, Nevada and Salt Lake City, Utah. All services required by the operation are readily available.

Regional Geology

The Jerritt Canyon district deposits are hosted by a Paleozoic sedimentary sequence that underlay the

Independence Mountain range and consists of four distinct assemblages: (1) the western facies (upper plate of the Roberts Mountains thrust fault), (2) the eastern facies (lower plate of the Roberts Mountains thrust fault), (3) the Schoonover sequence, and (4) the Antler overlap sequence.

The western facies consists of chert, argillite, siltstone, shale, quartzite, and limestone-greenstone complex and is considered to be a deep-water sequence. The eastern sequence is a Cambrian to Silurian continental shelf carbonate sequence that includes the Hanson Creek Formation, and the Roberts Mountains Formation, which are the main hosts to the gold mineralization in the district.

Deposit Geology

Within the Jerritt Canyon area, gold can locally occur within all sedimentary formations, but is preferentially hosted by the Roberts Mountain and Hanson Creek Formations of the eastern facies. The Roberts Mountain Formation consists of calcareous to dolomitic siltstones and silty limestones. The Hanson Creek Formation is divided into five members and consists of medium-grained limestone, dolomitic limestone, carbonaceous micrites, and chert beds.

Mineralization

Gold mineralization at Jerritt Canyon is preferentially found within the base of the Roberts Mountain Formation and the Upper Hanson Creek Formation. Gold mineralization is structurally controlled by high angle northwest and northeast trending structures that acted as conduits for mineralizing fluids. Much of the higher grade and more continuous gold mineralization occurs where two sets of high angle structures intersect and cut the favourable stratigraphic intervals that contain high proportions of clay-sized materials. The deposits are considered to be Carlin-type, sediment-hosted, replacement fine-grained gold deposits in carbonaceous sediments. Gold occurs as very fine-grained micron size particles deposited in carbonates and fine-grained, calcareous, clastic sedimentary rocks. The average size of gold particles is in the order of two microns.

Exploration and Production History

Prospectors explored for antimony in the area in the 1910s. Reportedly, 30 to 40 tons of stibnite as antimony ore were mined and shipped from the Burns Basin mine in the Independence Mountain range between 1918 and 1945. In the early 1970s there was a short burst in antimony exploration when its price reached historic highs of $40 a pound. Around 1971, FMC Inc. began exploring for antimony in the range. In 1972, Meridian discovered a disseminated gold deposit in the Jerritt Canyon area. In 1976, a joint venture was formed with Freeport-McMoRan Inc., to explore and develop the area, and mining at Jerritt Canyon commenced in 1981. In 1990, Freeport sold its interest in Jerritt Canyon to a predecessor of Anglogold.

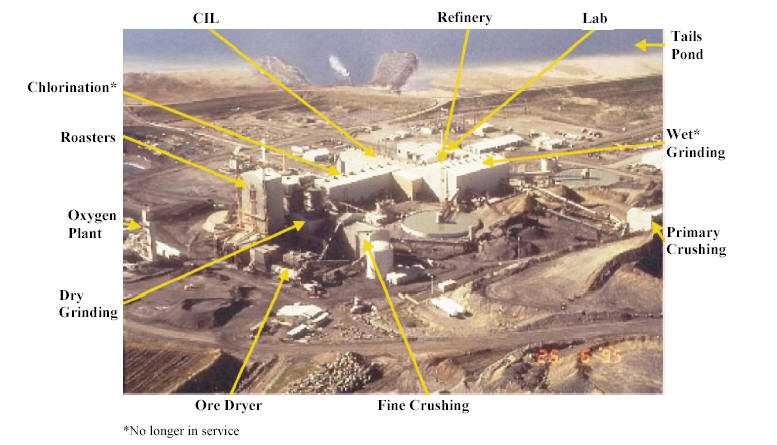

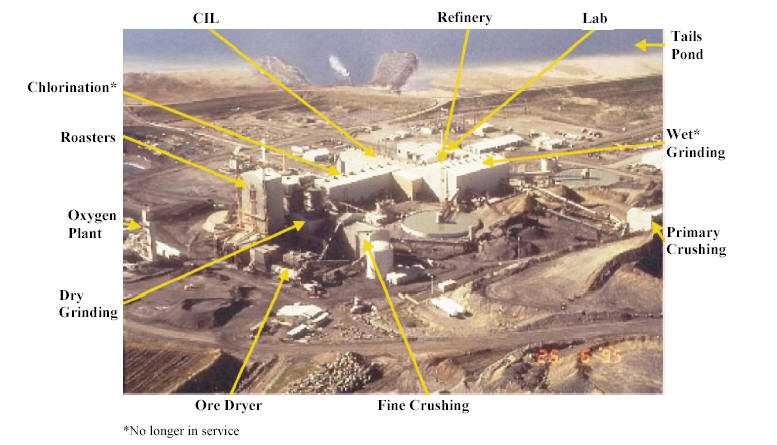

While open pit mining was done at the site from startup in 1981 until 1999, the Jerritt Canyon Mine currently consists of four underground mining operations feeding ore to a process plant consisting of a roaster followed by carbon-in-leach processing. The mines are mechanized operations using backfilling for ground control and to increase ore recovery. From the time of start-up, the less refractory ores mined at the operation were processed through a "wet" mill. This wet mill continued to operate until 1997 and is still located on site. With ores becoming more carbonaceous and refractory as well as with the introduction of higher-grade ore from underground operations, a dry mill with an ore roasting circuit was added in 1989 and is currently in operation. Since its inception, the Jerritt Canyon mine has produced in excess of five million ounces of gold. Annual production has historically averaged between 300,000 and 350,000 ounces of gold, at historical cash costs ranging from US$245 to US$260 per ounce. Anglo Gold reports production from Jerritt Canyon at 1,467,469 tons in 2002 with 338,660 ounces of gold attributed to the operation.

Resource Estimation