Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934 (Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| x | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12 | |||

American National Insurance Company | ||||

| (Name of Registrant as Specified In Its Charter) | ||||

| ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| ||||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| ||||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| ||||

| (5) | Total fee paid: | |||

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| ||||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| ||||

| (3) | Filing Party:

| |||

| ||||

| (4) | Date Filed:

| |||

| ||||

Table of Contents

AMERICAN NATIONAL INSURANCE COMPANY

One Moody Plaza

Galveston, Texas 77550

NOTICE OF ANNUAL STOCKHOLDERS’ MEETING

To Be Held April 27, 2012

In Galveston, Texas

Notice is hereby given that the Annual Meeting of Stockholders ofAMERICAN NATIONAL INSURANCE COMPANY, a Texas insurance company (the “Company”), will be held in the Mary Moody Northen Auditorium of the American National Insurance Company Building, Second Floor, One Moody Plaza, Galveston, Texas, at 10:00 a.m. local time on April 27, 2012 for the following purposes:

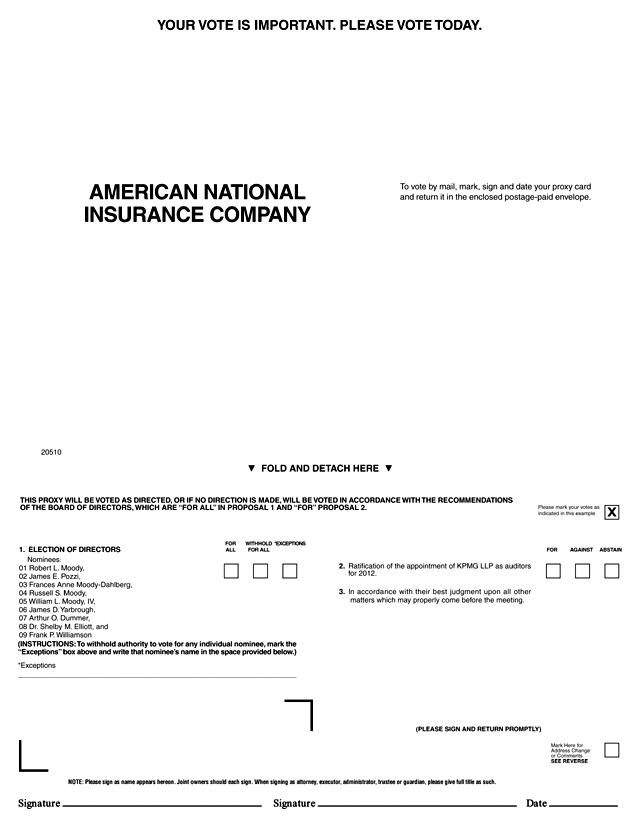

| 1. | The election of a Board of nine (9) directors of the Company; |

| 2. | Ratification of the appointment of KPMG LLP as auditors for 2012; and |

| 3. | The transaction of such other business as may properly come before the meeting or any adjournment thereof. |

Only holders of common stock of the Company of record at the close of business on March 1, 2012 are entitled to notice of, and to vote at, the meeting or any adjournment thereof.

IT IS IMPORTANT THAT YOUR STOCK BE REPRESENTED AT THE MEETING. WHETHER OR NOT YOU PLAN TO ATTEND, PLEASE FILL IN, SIGN, DATE AND RETURN THE ACCOMPANYING PROXY CARD AS PROMPTLY AS POSSIBLE. A RETURN ENVELOPE, WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES, IS ENCLOSED FOR YOUR CONVENIENCE.

By Order of the Board of Directors

J. Mark Flippin, Secretary

March 21, 2012

Important Notice Regarding the Availability of Proxy Materials

for the Stockholders’ Meeting to Be Held on April 27, 2012:

Our proxy materials relating to our 2012 Annual Meeting (notice, proxy statement, proxy and 2011 Annual Report) are available at the following website: https://materials.proxyvote.com/028591.This information as well as similar information relating to all of our future Annual Meetings will also be available by calling 1-888-252-0177 or by email at investorrelations@anico.com. We have elected to deliver a full set of proxy materials to all of our stockholders entitled to notice of and to vote at the annual meeting, and distribution will begin on or about March 21, 2012.

For the date, time and location of the 2012 Annual Meeting and an identification of the matters to be voted upon at the 2012 Annual Meeting, please see the “Notice of Annual Stockholders’ Meeting” above. For the Board’s recommendation regarding those matters, please refer to the accompanying proxy statement. For information on how to obtain directions to be able to attend the meeting and vote in person, please contact Investor Relations at 1-888-252-0177 or by email at investorrelations@anico.com.

1

Table of Contents

| Page | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 6 | ||||

| 7 | ||||

| 7 | ||||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| 14 | ||||

| 15 | ||||

| 24 | ||||

| 37 | ||||

| 38 | ||||

| 38 | ||||

| 39 | ||||

| 39 | ||||

| 40 | ||||

| 40 | ||||

| 41 | ||||

| 41 | ||||

| 41 | ||||

| 41 | ||||

2

Table of Contents

AMERICAN NATIONAL INSURANCE COMPANY

One Moody Plaza

Galveston, Texas 77550

P R O X Y S T A T E M E N T

For the Annual Meeting of Stockholders

To Be Held April 27, 2012

in the Mary Moody Northen Auditorium

on the Second Floor of the

American National Insurance Company Building

One Moody Plaza

Galveston, Texas 77550

The Board of Directors of AMERICAN NATIONAL INSURANCE COMPANY, a Texas insurance company (sometimes referred to in this proxy statement as the “Company,” “American National,” or as “we,” “us” and “our”), is soliciting your proxy for use at the Annual Meeting of Stockholders of the Company to be held at 10:00 a.m. local time, on April 27, 2012 (the “Annual Meeting”), and at any adjournment thereof. At such meeting, the stockholders will consider and vote upon the items set forth in the attached Notice of Annual Stockholders’ Meeting. These proxy materials will be available over the Internet.

All shares represented by duly executed proxies received by the Company will be voted in accordance with the instructions shown thereon. If no contrary instructions are given, such proxies will be votedFOR the election as directors of the Company of each of the director nominees named under Proposal 1 andFORthe approval of KPMG LLP as auditors for 2012. The Board of Directors does not know of any other matters to be acted upon at the Annual Meeting. As to any other matter of business that may properly be brought before the Annual Meeting, the enclosed proxy also confers discretionary authority upon the persons named therein to vote the shares represented by such proxy in accordance with their best judgment.

Any stockholder giving a proxy may revoke it by notice in writing addressed to the Secretary of the Company at One Moody Plaza, Galveston, Texas 77550, or by a proxy bearing a later date and properly signed, which may be delivered personally or by mail to the Secretary of the Company prior to the taking of a vote at the Annual Meeting. The execution of a proxy will not affect a stockholder’s right to attend the Annual Meeting and to give the Secretary of the Company notice of such stockholder’s intention to vote in person, in which event the proxy will not be used.

All costs of preparing, assembling and distributing the proxy materials and the cost of solicitation will be paid by the Company. The Company may pay persons holding shares in their names or the names of their nominees for the benefit of others, such as brokerage firms, banks, depositories, and other fiduciaries, for costs incurred in forwarding soliciting materials to their beneficial owners. The Company has retained Broadridge Financial Solutions, Inc., Edgewood, New York, to distribute proxies. The aggregate cost of these services is not expected to exceed $32,000. The Company may also retain other firms or individuals to assist with the solicitation of proxies. Directors, officers and employees of the Company may also solicit some stockholders in person, or by telephone, email or facsimile, following solicitation by this proxy statement, but they will not be separately compensated for such solicitation services.

As of the close of business on March 1, 2012, which has been fixed as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting, there were 26,836,591 shares of common stock, $1.00 par value per share, of the Company (the “Common Stock”) issued and outstanding and entitled to vote at the meeting. There were no other classes of shares issued and outstanding. An alphabetical list of all registered stockholders entitled to notice of and to vote at the Annual Meeting will be available for examination by any stockholder for any purpose germane to the meeting. Such list may be examined during business hours at the office of the Company’s Secretary, Eighth Floor, American National Insurance Company Building, One Moody Plaza, Galveston, Texas, during the ten (10) day period immediately prior to the Annual Meeting, and it will also be available at the meeting.

Each share of Common Stock entitles the holder to one vote in the determination of all matters to be brought before the meeting. Abstentions and broker non-votes will be counted for the purpose of determining the presence or absence of a quorum, and abstentions will be counted for the purpose of determining the number of votes cast on a given proposal. However, broker non-votes will not be considered present at the Annual Meeting for such proposals and thus will have the practical effect of reducing the number of affirmative votes required to achieve a majority vote by reducing the total number of shares from which a majority is calculated. Any shares for which a broker or nominee does not have discretionary voting authority under applicable NASDAQ Stock Market, LLC (“NASDAQ”) rules will be considered as shares not entitled to vote and will not be considered in the tabulation of the votes. Votes cast at the Annual Meeting will be counted by the independent inspector(s) of election appointed by the Company.

3

Table of Contents

The required vote for each of the proposals expected to be acted upon at the Annual Meeting is as follows:

Proposal 1 – Election of Directors.The affirmative vote of a majority of shares present at the Annual Meeting, in person or by proxy, and entitled to vote is required to elect each nominee for director. Abstentions with respect to any director nominee have the effect of a vote against such nominee.

Please note that NASDAQ rules do not give brokers discretionary authority to vote on the election of directors. This means that your broker, bank, or other nominee cannot vote your shares unless you provide it with voting instructions. Therefore, if you hold shares of our Common Stock in street name and do not provide voting instructions to your broker, bank, or other nominee, your shares will not be voted on the election of directors.

Proposal 2 – Ratification of the appointment of KPMG LLP as auditors for 2012.The appointment of KPMG LLP as the Company’s auditors for 2012 will be ratified by the affirmative vote of a majority of shares present at the Annual Meeting, in person or by proxy, and entitled to vote. Abstentions will have the same effect as voting against the proposal.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

As of the close of business on March 1, 2012, we had 26,836,591 shares of our Common Stock issued and outstanding. There were no other classes of shares issued and outstanding. The following table sets forth information as of March 1, 2012 concerning each person or group owning more than five percent of the outstanding shares of our Common Stock.

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class | ||||||

5% Beneficial Owners: | ||||||||

THE MOODY FOUNDATION(1) 2302 Postoffice Street, Suite 704 Galveston, Texas 77550 | 6,157,822 | 22.95 | % | |||||

LIBBIE SHEARN MOODY TRUST(2) c/o Moody National Bank Trust Division 2302 Postoffice Street Galveston, Texas 77550 | 9,949,585 | 37.07 | % | |||||

MOODY NATIONAL BANK TRUST DIVISION, TRUSTEE(4) 2302 Postoffice Street Galveston, Texas 77550 | 12,167,507 | (3) | 45.34 | % | ||||

| (1) | The Moody Foundation is a charitable trust classified as a private foundation established in 1942 by W. L. Moody, Jr., and his wife, Libbie Shearn Moody, for charitable and educational purposes. The Trustees of The Moody Foundation are Robert L. Moody, Sr., our Chairman of the Board and Chief Executive Officer, Frances Anne Moody-Dahlberg, one of our directors, and Ross Rankin Moody. Frances Anne Moody-Dahlberg and Ross Rankin Moody are children of Robert L. Moody, Sr. |

| (2) | The Libbie Shearn Moody Trust is a split-interest trust with both charitable and non-charitable beneficiaries. Such trust was established in 1943 and funded by a residuary bequest under the Will of Libbie Shearn Moody. Moody National Bank is the Trustee of the Libbie Shearn Moody Trust and, as such, has voting power with respect to the 9,949,585 shares of our Common Stock owned by such Trust. |

| (3) | The Moody National Bank Trust Division is Trustee of the Libbie Shearn Moody Trust, and this number includes the 9,949,585 shares of our Common Stock owned by the Libbie Shearn Moody Trust. Management has been advised that, in addition to acting as Trustee of and voting the Common Stock owned by the Libbie Shearn Moody Trust, the Moody National Bank Trust Division also acts as (i) trustee for and votes the 1,155,000 shares of our Common Stock owned by the W.L. Moody, Jr. Trust for Grandchildren (“Trust 19”) (see “Security Ownership of Directors and Executive Officers” for additional information regarding Trust 19); (ii) agent for and votes 896,678 shares of our Common Stock held pursuant to an Agency and Investment Services Agreement for the benefit of The Moody Endowment, a non-profit corporation; and (iii) trustee or agent for and votes the 166,244 shares of our Common Stock owned by other trusts. Accordingly, the Moody National Bank Trust Division, as trustee, agent or custodian, votes an aggregate of 12,167,507 shares, which constitutes 45.34% of our outstanding shares. |

| (4) | Management has been advised that Moody Bank Holding Company, Inc. (“MBHC”), which is wholly-owned by Moody Bancshares, Inc. (“Bancshares”), owns approximately 97.8% of the common stock of Moody National Bank. Management has further been advised that the Three R Trusts, trusts created by Robert L. Moody, Sr. for the benefit of his children (two of whom, Russell S. Moody and Frances Anne Moody-Dahlberg, are among our directors, and one of whom, Robert L. Moody, Jr., is an advisory director), own 100% of Bancshares’ Class B Stock (which elects a majority of Bancshares’ directors) and 51.3% of Bancshares’ Class A Stock. Accordingly, the Three R Trusts, through ownership of Bancshares, control Moody National Bank. |

4

Table of Contents

| The Trustee of the Three R Trusts is Irwin M. Herz, Jr., one of our advisory directors, and a partner in Greer, Herz & Adams, L.L.P., One Moody Plaza, 18th Floor, Galveston, Texas, General Counsel to us and counsel to Moody National Bank, Bancshares and MBHC. Robert L. Moody, Sr. is Chairman of the Board, Chief Executive Officer and a director of Moody National Bank, Bancshares and MBHC. |

The beneficial ownership information shown for the Moody National Bank Trust Division is based on information contained in an amended Schedule 13G filed jointly on February 10, 2012 by the Moody National Bank Trust Division, Bancshares, MBHC, Three R Trusts, and Irwin M. Herz, Jr. (the “Amended 13G”). According to the Amended 13G, the Libbie Shearn Moody Trust has shared voting power with respect to 9,949,585 shares of our Common Stock; the Moody National Bank Trust Division, Bancshares and MBHC have shared voting power with respect to 12,167,507 shares of our Common Stock and shared investment power with respect to 17,869 shares of our Common Stock; the Three R Trusts and Irwin M. Herz, Jr. have shared voting power with respect to 12,177,057 shares of our Common Stock and shared investment power with respect to 27,419 shares of our Common Stock; and Irwin M. Herz, Jr. has sole voting and investment power with respect to 16,815 shares of our Common Stock. Subsequent to the filing of the Amended 13G, Mr. Herz acquired sole voting and investment power with respect to an additional 187 shares of our Common Stock as a result of the March 1, 2012 conversion of restricted stock units issued to him as an advisory director of the Company in 2011. According to the Amended 13G, Bancshares, MBHC, Three R Trusts and Irwin M. Herz, Jr. disclaim beneficial ownership with respect to the shares of our Common Stock beneficially owned by the Moody National Bank Trust Division. In addition, Irwin M. Herz, Jr. disclaims beneficial ownership with respect to the 9,550 shares of our Common Stock beneficially owned by the Three R Trusts. The principal address of the Libbie Shearn Moody Trust, the Moody National Bank Trust Division, Bancshares and MBHC is as shown in the table above. The principal address of the Three R Trusts is 2302 Postoffice, Suite 702, Galveston, Texas 77550, and the principal address of Irwin M. Herz, Jr. is One Moody Plaza, 18th Floor, Galveston, Texas 77550.

SECURITY OWNERSHIP OF DIRECTORS AND EXECUTIVE OFFICERS

The information contained in the following table is given with respect to the ownership of our Common Stock as of the close of business on March 1, 2012 by each of our directors, each of the executive officers named in the Summary Compensation Table, and for our directors and executive officers as a group:

Name of Beneficial Owner | Amount and Nature of | Percent of Class | ||||

Arthur O. Dummer |

| 5,177 1,751 | (1) Direct (2) Indirect | * * | ||

Dr. Shelby M. Elliott | 4,917 | (1) Direct | * | |||

Frances Anne Moody-Dahlberg(3) | 8,187 | (4) Direct | * | |||

| 6,157,822 | (5) Indirect | 22.95% | ||||

Robert L. Moody, Sr.(3)(6) | 496,759 | (7) Direct | 1.85% | |||

| 557,025 | (8)(9) Indirect | 2.08% | ||||

| 6,157,822 | (5) Indirect | 22.95% | ||||

Russell S. Moody(3) | 8,187 | (4) Direct | * | |||

William L. Moody IV(3)(6) | 98,490 | (4) Direct | * | |||

James E. Pozzi | 662 | Direct | * | |||

Frank P. Williamson | 6,967 | (1) Direct | * | |||

James D. Yarbrough | 8,250 | (4) Direct | * | |||

G. Richard Ferdinandtsen | 66,000 | (10) Direct | * | |||

John J. Dunn, Jr. | 0 | * | ||||

Ronald J. Welch |

| 2,761 700 | Direct (2) Indirect | * | ||

5

Table of Contents

Name of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class | ||||||

All Directors(11) and Executive Officers as a Group | 759,047 | Direct | 2.83 | % | ||||

| 6,721,811 | Indirect | 25.05 | % | |||||

|

|

|

| |||||

| 7,480,858 | 27.88 | % | ||||||

| * | Less than 1%. |

| (1) | Includes 4,667 shares of our Restricted Stock. |

| (2) | Shares owned by a family trust. |

| (3) | Robert L. Moody, Sr. and William L. Moody IV are life income beneficiaries of Trust 19. Frances Anne Moody-Dahlberg and Russell S. Moody, two of our directors, and Robert L. Moody, Jr., one of our advisory directors, are children of Robert L. Moody, Sr. and, as such, have a contingent residuary interest in his beneficial interest in Trust 19. The numbers in the table above do not include shares held in Trust 19. (See Footnote 3 under “Security Ownership of Certain Beneficial Owners” above for additional information about Trust 19). |

| (4) | Includes 6,000 shares of our Restricted Stock. |

| (5) | These shares are owned by The Moody Foundation, of which Frances Anne Moody-Dahlberg and Robert L. Moody, Sr. are Trustees. (See “Security Ownership of Certain Beneficial Owners” above). |

| (6) | Robert L. Moody, Sr. and William L. Moody IV are life income beneficiaries of the Libbie Shearn Moody Trust. Robert L. Moody, Sr. has advised management that he has assigned all of his life income interest in such trust to National Western Life Insurance Company, a Colorado insurance company controlled by him. The numbers in the table above do not include shares held in the Libbie Shearn Moody Trust. (See Footnote 2 under “Security Ownership of Certain Beneficial Owners” above for additional information about such trust). |

| (7) | Includes 150,000 shares of our Restricted Stock. |

| (8) | Robert L. Moody, Sr. is the sole owner of the 1% general partner in the M-N Family Limited Partnership (the “M-N Partnership”), which owns 507,025 shares of our Common Stock. As the sole owner of the general partner of the M-N Partnership, Robert L. Moody, Sr. has the indirect power to manage the assets of the M-N Partnership, including voting the M-N Partnership’s 507,025 shares of our Common Stock. |

| (9) | Robert L. Moody, Sr. is a 1% general partner in the RLMFLP Limited Partnership (the “RLMFLP Partnership”), which owns 50,000 shares of our Common Stock. As the sole general partner of the RLMFLP Partnership, Robert L. Moody, Sr. has the power to manage the assets of the RLMFLP Partnership, including voting the RLMFLP Partnership’s 50,000 shares of our Common Stock. |

| (10) | Includes 50,000 shares of our Restricted Stock. |

| (11) | Includes our Advisory Directors, whose security ownership is described in the next section below. |

SECURITY OWNERSHIP OF ADVISORY DIRECTORS

The information contained in the following table is given with respect to the ownership of our Common Stock as of the close of business on March 1, 2012 by each of our advisory directors:

Name of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class | ||||

Irwin M. Herz, Jr.(1) | 17,002 | (2) Direct | * | |||

R. Eugene Lucas | 8,934 | (2) Direct | * | |||

| 13 | (3) Indirect | * | ||||

E. Douglas McLeod | 14,250 | (2) | * | |||

Robert L. Moody, Jr. |

| 1,583 4,000 | (4) Direct (5) Indirect | * * | ||

| * | Less than 1%. |

| (1) | According to an amended Schedule 13G filed jointly on February 10, 2012 by the Moody National Bank Trust Division, Bancshares, MBHC, Three R Trusts, and Irwin M. Herz, Jr., Mr. Herz may have beneficial ownership of the shares of our Common Stock beneficially owned by the Moody National Bank Trust Division and the shares of our Common Stock beneficially owned by the Three R Trusts; however, Mr. Herz disclaims beneficial ownership of such shares. Accordingly, such shares are not included in this table. (See Footnote 4 under “Security Ownership of Certain Beneficial Owners” above for additional information regarding such amended Schedule 13G). |

| (2) | Includes 6,000 shares of our Restricted Stock. |

| (3) | Shares owned by spouse. |

| (4) | Includes 1,333 shares of our Restricted Stock. |

| (5) | Shares of our Restricted Stock. |

6

Table of Contents

Unless otherwise noted, the information shown in the previous three tables was obtained from ownership disclosures furnished to us by each of the persons or entities listed or from other communications with such persons or entities.

ELECTION OF DIRECTORS

Nine (9) directors of the Company are to be elected at the Annual Meeting to serve until our Annual Meeting of Stockholders to be held in April 2013. All nominees now serve as directors of the Company, with the exception of James E. Pozzi, who was nominated to replace outgoing director G. Richard Ferdinandtsen. In connection with his intended retirement as our President and Chief Operating Officer, effective May 1, 2012, Mr. Ferdinandtsen withheld his name from nomination as a director; however, he will begin serving as an advisory director of the Company immediately following the Annual Meeting. All nominees have consented to be nominated as directors and to be named in this proxy statement. Accordingly, it is not contemplated that any nominee named herein will be unwilling or unable to serve as a director. However, if either of such events should occur, the enclosed proxy permits the persons named in the proxy to vote the shares represented by the proxy in favor of such person or persons as our Board of Directors may nominate upon the recommendation of the Nominating Committee.

The Board has determined that Arthur O. Dummer, Dr. Shelby M. Elliott, W. L. Moody IV, Frank P. Williamson and James D. Yarbrough, currently directors, continue to be “independent” as defined in the NASDAQ listing standards.

Board Recommendation:The Board of Directors recommends a vote “FOR” each of the director nominees named under this Proposal 1.

INFORMATION CONCERNING NOMINEES FOR DIRECTORS

The following information is given with respect to the nominees for election at the Annual Meeting:

| Name | Age | Principal Occupation and Background | Year First Elected to Board | |||

Arthur O. Dummer | 78 | President, The Donner Company (privately owned actuarial consulting company), Salt Lake City, Utah since 1985; Director of Casualty Underwriters Insurance Company, Salt Lake City, Utah (privately owned insurance company); President and Director of Western United Holding Company, Spokane, Washington (privately owned insurance holding company); Director of American Underwriters Insurance Company (privately owned insurance company); Past Chairman of the Board of Directors of the National Organization of Life and Health Guaranty Associations, Herndon, Virginia; Past Director of American Community Mutual Insurance Company, Livonia, Michigan (mutual insurance company); Past Director of Beneficial Life Insurance Company, Salt Lake City, Utah; Aurora National Life Assurance Company, Los Angeles, California; Continental Western Life Insurance Company, Des Moines, Iowa; Utah Home Fire Insurance Company, Salt Lake City, Utah; and PHA Life Insurance Company, Portland, Oregon (all privately owned insurance companies); Past Director of National Western Life Insurance Company.(1)

Mr. Dummer is a Fellow of the Society of Actuaries and a Member of the American Academy of Actuaries. He has fifty-two years of experience in the insurance industry, including service as the former Chief Examiner and Actuary of the Utah Insurance Department. His extensive background in the insurance industry and his knowledge of actuarial and accounting issues are valuable to our Board’s discussion of these issues. | 2004 |

7

Table of Contents

| Name | Age | Principal Occupation and Background | Year First Elected to Board | |||

Dr. Shelby M. Elliott | 85 | President-Emeritus of Texas Chiropractic College since 2004; President of Texas Chiropractic College from 1990 through 2003; Director of Moody National Bank from March 2000 to March 2004; Past Director of First Texas Bank, Vidor, Texas (privately owned bank); Past Director of Yettie Kersting Memorial Hospital, Liberty, Texas; and Past Chairman of the American Chiropractic Association.

Dr. Elliott brings solid administrative and executive skills to our Board from his service as President of Texas Chiropractic College. His experience in the health care field, both as a practitioner and an educator, enables him to provide a unique perspective to our Board. Dr. Elliott is a member of the American Chiropractic Association, the Texas Chiropractic Association and the Florida Chiropractic Association. | 2004 | |||

Frances Anne Moody-Dahlberg | 42 | Executive Director of The Moody Foundation (charitable and educational foundation) since 1998, and a Trustee of The Moody Foundation since 2004; Director of National Western Life Insurance Company since 1990(1); Director of Gal-Tex Hotel Corporation (hotel management corporation) from March 2000 to December 2003(2); Director of The Moody Endowment (charitable organization) from 1991 to February 2004.

Ms. Moody-Dahlberg has twenty-five years of experience as a member of our Board. Her service as Executive Director of The Moody Foundation, one of the largest charitable foundations in the State of Texas, provides her with valuable insight regarding the concerns of our significant non-profit stockholders. | 1987 | |||

Robert L. Moody, Sr. | 76 | Chief Executive Officer since July 1991 and Chairman of the Board since 1982; Chairman of the Board, Chief Executive Officer and Director of Moody National Bank; Chairman of the Board, Chief Executive Officer and Director of National Western Life Insurance Company(1); Trustee of The Moody Foundation (charitable and educational foundation).

Mr. Moody has a lifetime of experience in the financial services industry, serving as a director or executive officer of a variety of insurance and banking interests. He has served on our Board for over fifty years and has served as our Chairman for thirty years. His wealth of experience as our Chairman and Chief Executive Officer provides our Board with an insightful, long-term perspective of our Company’s challenges, opportunities and operations. | 1960 | |||

Russell S. Moody | 50 | Investments, League City, Texas, since 2003. Director of National Western Life Insurance Company since 1988(1); Director of The Moody Endowment since July 2009 and Director of Transitional Learning Center at Galveston since July 2009 (charitable organizations); Director of Gal-Tex Hotel Corporation (hotel management company) from March 2000 to December 2003(2).

Mr. Moody has served as a member of our Board for twenty-six years. Along with his sister, Frances Anne Moody-Dahlberg, Mr. Moody helps to represent the concerns of our significant non-profit stockholders. Mr. Moody serves as a director of The Moody Endowment, a charitable organization that owns nearly 900,000 shares of our Common Stock. | 1986 | |||

8

Table of Contents

| Name | Age | Principal Occupation and Background | Year First Elected to Board | |||

William L. Moody IV | 87 | Investments and Ranching, Oil and Gas, Galveston, Texas, since 1959; Trustee, Board of Trustees of Rosenberg Library (charitable organization); Trustee, University of Texas Medical Branch Development Board (charitable organization); President and Director of Moody Ranches, Inc. (investments and ranching); Director of American National Life Insurance Company of Texas (subsidiary life insurance company).

Mr. Moody’s sixty-one years of service as a member of our Board and his background as an investor, rancher and oilman bring a valuable perspective to the Board’s discussion of how the past challenges that have faced the Company may impact present and future opportunities. | 1951 | |||

James E. Pozzi(3) | 61 | Senior Executive Vice President, Chief Administrative Officer of the Company since 2008. Previously Senior Executive Vice President, Corporate Planning, Systems and Life Administration of the Company from 2004-2008.

Mr. Pozzi has been an officer of the Company for thirty-six years. His service as Chief Administrative Officer has provided him with intimate knowledge of our operations. | New nominee | |||

Frank P. Williamson | 79 | Retired Pharmacist, since 2009; Director of The Moody Endowment and Transitional Learning Center at Galveston (charitable organizations); Director and Member of the Executive Committee and Governance Committee of American National Life Insurance Company of New York (subsidiary life insurance company); Director of SM&R Investments, Inc. and American National Investment Accounts, Inc. from 1997 to March 2004 (mutual funds formerly advised by a Company subsidiary).

Mr. Williamson’s thirty-four years of experience as a small business owner brings a comprehensive view of business operations to our Board. His years of service as a pharmacist bring a unique perspective and contribute to the diversity of experience represented on our Board. | 2004 | |||

James D. Yarbrough | 56 | Owner and Consultant, James D. Yarbrough & Co., since October 2011, and October 1989 through December 1994 (privately owned contract management and financial consulting firm); Director of Economic Development, City of Galveston, Texas, February 2011 through September 2011; County Judge, County of Galveston, Texas, 1995 through 2010; Director and Member of the Governance and Executive Committees of American National Life Insurance Company of New York (subsidiary life insurance company); Member, Galveston County Economic Development Alliance; Advisory Director, Texas First Bank - Galveston, Galveston, Texas (privately owned bank); Ex-Officio Director, Texas City-LaMarque Chamber of Commerce; Member, Development and Advisory Council, University of Houston - Clear Lake, Houston, Texas.

Judge Yarbrough has management experience in both the private and public sectors, including sixteen years as the chief executive of the County of Galveston. In the private sector, he has served as a bank president, owner of a business consulting firm, and director of numerous interests. This varied experience makes him a valuable contributor to the Board’s deliberations. | 2001 | |||

| (1) | Robert L. Moody, Sr. is Chairman of the Board, Chief Executive Officer and controlling stockholder of National Western Life Insurance Company, a publicly traded life insurance company. |

| (2) | The Moody Foundation owns 34.0% and the Libbie Shearn Moody Trust owns 50.2% of Gal-Tex Hotel Corporation. |

| (3) | Mr. Pozzi is being nominated to replace outgoing director G. Richard Ferdinandtsen, who is currently our President and Chief Operating Officer. Effective May 1, 2012, Mr. Ferdinandtsen intends to resign as President and Chief Operating Officer of the Company. The Board currently expects to elect Mr. Pozzi as President of the Company following Mr. Ferdinandtsen’s resignation. Additionally, immediately following the Annual Meeting, Mr. Ferdinandtsen will begin serving as an advisory director of the Company. The Board also currently expects to elect Mr. Ferdinandtsen as Vice Chairman of the Board following his resignation. |

9

Table of Contents

INFORMATION CONCERNING ADVISORY DIRECTORS

The Board of Directors has appointed the following persons as our advisory directors. Our advisory directors serve at the pleasure of the Board. Although advisory directors do not vote on matters considered by the Board, we benefit from their experience and advice. Advisory directors receive the same compensation and benefits as our directors who are not also our officers.

The following information is given with respect to our advisory directors:

| Name | Age | Principal Occupation and Background | Year First Appointed Advisory Director | Years Served as a Director | ||||

Irwin M. Herz, Jr. | 71 | Since 1980, Partner of Greer, Herz & Adams, L.L.P., General Counsel to the Company; Trustee of the Three R Trusts (trusts for the benefit of the children of Robert L. Moody, Sr.).

Mr. Herz’s service as a director of numerous insurance companies, including over thirty years on our Board, has provided him with extensive knowledge of the insurance industry. In addition, his background as a corporate and commercial lawyer provides an invaluable source of knowledge and problem-solving skills to the Board. | 2004 | 1981 to 1983; 1984 to 2004 | ||||

R. Eugene Lucas | 86 | Since 1971, President and Director of Gal-Tex Hotel Corporation (hospitality and hotel management company) (1); President of Gal-Tenn Hotel Corporation, LHH Hospitality, LLC, Colorado Landmark Hotels, LLC, Kentucky Landmark Hotels, LLC, and Virginia Landmark Hotels, LLC (hospitality and hotel management companies); Director of Colonel Museum, Inc. (charitable corporation); President and Director of 1859-Beverage Company (hospitality company).

Mr. Lucas has served on our Board for over thirty years, including twenty-three years as a member of our Audit Committee. In addition, Mr. Lucas provides our Board with the perspective of an experienced and knowledgeable executive officer outside of the insurance industry. He has been associated with Gal-Tex Hotel Corporation since 1941, including over forty years as its President. | 2004 | 1981 to 2004 | ||||

E. Douglas McLeod | 70 | Since 1982, Director of Development of The Moody Foundation (charitable and educational foundation); Chairman and Director of Moody Gardens, Inc. (charitable corporation); Attorney; Director of National Western Life Insurance Company since 1979(2); Director of ANREM Corporation (subsidiary real estate management corporation); Vice President and Director of Colonel Museum, Inc. (charitable organization); Director, San Jacinto Museum of History (charitable organization); Past Director and past Chairman of Center for Transportation and Commerce (charitable organization); Past Director and Executive Board Member, South Texas College of Law (law school); Past Member of State House of Representatives of the State of Texas (terms ended January 1983).

Mr. McLeod has experience as a lawyer and public servant, including as a state legislator, as well as experience in real estate development and non-profit administration. He brings a varied set of problem-solving skills and valuable insight to the Board. | 2004 | 1984 to 2004 | ||||

Robert L. Moody, Jr. | 52 | Since 1986, President and Director of Moody Insurance Group, Inc. (privately owned insurance agency); Director of Moody National Bank; Director of ANREM Corporation (subsidiary real estate management corporation); Director of HomeTown Bank, National Association (national bank); Director of The Moody Endowment (charitable organization).

Mr. Moody is the owner of Moody Insurance Group, Inc., a marketing consultant to the Company and one of the many significant producers marketing our products. Through this insurance agency experience, Mr. Moody brings the valuable perspective of an agent to our Board’s deliberations. In addition, Mr. Moody’s experience as an entrepreneur provides him with a broad perspective of business operations. | 2009 | 1982 to 1987 | ||||

| (1) | The Moody Foundation owns 34.0% and the Libbie Shearn Moody Trust owns 50.2% of Gal-Tex Hotel Corporation. |

| (2) | Robert L. Moody, Sr. is Chairman of the Board, Chief Executive Officer and controlling stockholder of National Western Life Insurance Company, a publicly traded life insurance company. |

10

Table of Contents

Family Relationships

Robert L. Moody, Sr., our Chairman of the Board and Chief Executive Officer, is the cousin of William L. Moody IV, one of our directors, and the brother-in-law of E. Douglas McLeod, one of our advisory directors. Russell S. Moody and Frances Anne Moody-Dahlberg, two of our directors, are children of Robert L. Moody, Sr. Robert L. Moody, Jr., a son of Robert L. Moody, Sr. and brother of Russell S. Moody and Frances Ann Moody-Dahlberg, is one of our advisory directors.

DIRECTOR ATTENDANCE AT MEETINGS

During the fiscal year ended December 31, 2011, the Board of Directors of the Company held a total of five (5) meetings. All of the nominees for director who served as directors during the past year and all of the advisory directors attended at least 75% of the aggregate of (1) the total number of such meetings and (2) the total number of meetings held by all committees of the Board on which such nominees served during such year. It is the Company’s policy that all directors should make an effort to attend the Company’s annual meeting of stockholders. All directors attended the 2011 Annual Meeting.

BOARD OF DIRECTORS AND COMMITTEES

Board Leadership Structure

The Board believes that our Chief Executive Officer is best situated to serve as Chairman because he is the director most experienced with our business and most capable of effectively identifying present and future strategic priorities and leading the discussion and execution of strategy. Independent directors and management have different perspectives and roles in strategy development. The Company does not have a lead independent director. Our independent directors bring experience, oversight and expertise from outside the Company and the industry, while the Chief Executive Officer brings Company-specific experience and expertise. The Board believes that the combined role of Chairman and Chief Executive Officer promotes strategy development and execution and facilitates information flow between management and the Board, which are essential to effective governance.

The Board’s Role in Risk Oversight

The Company is exposed to a number of risks and undertakes enterprise risk management reviews to identify and evaluate these risks and to develop plans to manage them effectively. Two committees lend support to the Board in reviewing the Company’s consideration of material risks and overseeing the Company’s management of material risks. First, the Management Risk Committee coordinates the risk management efforts that occur within our business segments to (i) ensure alignment between our risk-taking activities and strategic objectives and (ii) ensure consistent application of enterprise risk management processes across all business units. The Management Risk Committee provides periodic reports to the Board of Directors concerning the Company’s risk management, which may cover risk identification, risk limits and related significant breaches, returns on risk-adjusted capital, and information related to the development of the Company’s enterprise risk management program. The Management Risk Committee is comprised of several members of our senior management team and is chaired by the Senior Executive Vice President, Corporate Risk Officer & Chief Actuary. Second, the Audit Committee of the Board of Directors makes inquiries to senior management about the Company’s risk assessment and risk management policies, including risks related to our financial position and internal controls. These policies address our major financial risk exposures and the steps management has taken to monitor and mitigate these risks.

Additionally, our Board Compensation Committee considers risks that may result from our compensation policies, including working directly with senior management to determine whether such programs improperly encourage management to take risks relating to our business and/or whether risks arising from our compensation programs are likely to have a material adverse effect on the Company.

11

Table of Contents

Independent Directors and Executive Sessions

The Board has determined, after considering all of the relevant facts and circumstances, that Arthur O. Dummer, Dr. Shelby M. Elliott, W. L. Moody IV, Frank P. Williamson and James D. Yarbrough are “independent” from management in accordance with the NASDAQ listing standards. To be considered independent, the Board must determine that a director does not have any direct or indirect material relationships with us. In making this determination, the Board considered the fact that W. L. Moody IV is related to other members of the Board and determined that the familial relationship did not impair his independence.

Our independent directors meet in executive session at least twice per year, generally in connection with the April and October Board meetings.

Board Committees

The Company’s Board has an Audit Committee, a Compensation Committee, a Nominating Committee and an Executive Committee. The Compensation Committee of the Board of Directors is referred to herein as the Board Compensation Committee to distinguish it from the Management Compensation Committee.

The following sets forth Committee memberships as of the date hereof:

| Director | Audit Committee | Compensation Committee | Nominating Committee | Executive Committee | ||||

James D. Yarbrough | X | XX | ||||||

Arthur O. Dummer(1) | XX | |||||||

Dr. Shelby M. Elliott | X | XX | ||||||

Frank P. Williamson | X | X | X | |||||

William L. Moody IV | X | |||||||

Robert L. Moody, Sr. | XX | |||||||

G. Richard Ferdinandtsen | X |

X = Member

XX = Committee Chair

| (1) | The Board has determined that Mr. Dummer is the financial expert on the Audit Committee, as defined by NASDAQ’s rules and by the Securities Exchange Act of 1934. |

Audit Committee

Arthur O. Dummer, Chairman, Frank P. Williamson and James D. Yarbrough are the present members of the Audit Committee. The Audit Committee held thirteen (13) meetings during the Company’s last fiscal year. The Audit Committee is responsible for, among other matters, recommending the appointment of independent auditors for the Company, reviewing the activities and independence of such independent auditors, including the plan and scope of the audit and audit fees, monitoring the adequacy of the Company’s reporting and internal controls, reviewing related party transactions, recommending the inclusion of the Company’s audited financial statements in the Company’s Annual Report, and meeting periodically with management and the Company’s independent auditors. Pursuant to the NASDAQ Marketplace Rules and applicable independence requirements under the Securities Exchange Act of 1934, the Board has determined that all of the members of the Audit Committee are independent.

The Board of Directors has adopted a written Charter of the Audit Committee, and the Audit Committee reviews the Charter annually. The Audit Committee Charter is posted on the Company’s website and can be viewed by going to www.anico.com/InvestorRelations/CorporateGovernance/index.htm and clicking “Audit Committee Charter.” You may also obtain a printed copy of the Charter at no charge by writing the office of the Secretary at One Moody Plaza, Galveston, Texas 77550.

Board Compensation Committee

The Board Compensation Committee was established in 1975 to make recommendations as to the compensation of the Company’s executive officers. The present members of such committee are James D. Yarbrough, Chairman, Dr. Shelby M. Elliott and Frank P. Williamson. Pursuant to the NASDAQ Marketplace Rules, all of the members of the Compensation Committee are independent. The Board Compensation Committee held five (5) meetings during the Company’s last fiscal year.

The Board of Directors has adopted a written Charter of the Board Compensation Committee, and the Board Compensation Committee reviews the Charter annually. The Board Compensation Committee Charter is posted on the Company’s website and can be viewed by going to www.anico.com/InvestorRelations/CorporateGovernance/index.htm and clicking “Compensation Committee Charter.” You may also obtain a printed copy of the Charter at no charge by writing the office of the Secretary at One Moody Plaza, Galveston, Texas 77550. A description of the Company’s process and procedures for the consideration and determination of executive compensation is provided below in the Compensation Discussion and Analysis.

12

Table of Contents

Nominating Committee

The Nominating Committee was established in 2004 to recommend to the Board director nominees to be submitted for election at each Annual Meeting of Stockholders. While there are no specific minimum qualifications that a potential nominee must possess, director nominees are evaluated based upon, among other things, their integrity, diversity of experience, business or other relevant experience, leadership, the ability to exercise sound judgment, satisfaction of applicable independence standards, civility, and ability to devote sufficient time to Board matters. The Board of Directors and the Nominating Committee believe that, based on their knowledge of the needs and qualifications of the Board at any given time, the Board, with the help of the Nominating Committee, is best equipped to select nominees that will result in a well-qualified and well-rounded Board of Directors. The Nominating Committee may (but is not required to) consider candidates suggested by management or other members of the Board. In addition, the Nominating Committee may (but is not required to) consider stockholder recommendations for candidates to the Board. In order to recommend a candidate to the Board, stockholders should submit the recommendation to the Chairperson of the Nominating Committee in the manner described in the section of this proxy statement titled “Communications with the Board of Directors.”

In making its nominations, the Board and the Nominating Committee identify nominees by first evaluating the current members of the Board willing to continue their service. Current members with qualifications and skills that are consistent with the criteria for Board service are re-nominated. As to potential new candidates, it is expected that the Board and the Nominating Committee would discuss among themselves and members of management their respective recommendations and any recommendations submitted by stockholders and evaluate the qualifications, experience and background of the potential candidates. The Nominating Committee does not have a formal policy with respect to diversity; however, the Board and the Nominating Committee believe that it is valuable that Board members represent diverse experience and viewpoints.

Dr. Shelby M. Elliott, Chairman, and Frank P. Williamson are the present members of the Nominating Committee. Pursuant to the NASDAQ Marketplace Rules, both members of the Nominating Committee are independent. The Nominating Committee held one (1) meeting during the prior fiscal year. The Board of Directors has adopted a written Charter of the Nominating Committee, and the Nominating Committee reviews the Charter annually. The Nominating Committee Charter is posted on the Company’s website and can be viewed by going to www.anico.com/InvestorRelations/CorporateGovernance/index.htm and clicking “Nominating Committee Charter.” You may also obtain a printed copy of the Charter at no charge by writing the office of the Secretary at One Moody Plaza, Galveston, Texas 77550. After receiving the Nominating Committee’s recommendations, the full Board nominates the slate of directors to be presented to the Company’s stockholders at the Annual Meeting.

Executive Committee

The Executive Committee was established in 1977 to act on behalf of the full Board of Directors, within certain limitations, between regular Board meetings. The present members of such committee are Robert L. Moody, Sr., Chairman; G. Richard Ferdinandtsen; and W. L. Moody IV. The Executive Committee held one (1) meeting during the Company’s last fiscal year.

Consideration of Risks from Compensation Policies and Practices

In early 2012, at the request of the Board Compensation Committee, Frederic W. Cook & Co., Inc. (“Cook & Co.”), the committee’s independent compensation consultant, performed an assessment of our compensation policies and practices to determine whether those programs encourage excessive risk taking that is reasonably likely to have a material adverse effect on the Company as a whole. Based on the findings of this assessment, the committee concluded that our compensation programs do not present any such material adverse risk. In reaching such conclusion, the Board Compensation Committee considered the size of our Company and the following features of our compensation programs and policies that discourage excessive or unnecessary risk taking:

| • | appropriate pay philosophy, peer group for comparison purposes, and market positioning to support core business objectives; |

| • | conservative overall pay positioning; |

| • | payment of 40% of any annual incentive awards earned in restricted stock units (30% for the Chairman and CEO) with three-year vesting; |

| • | effective balance in: (i) short- and long-term performance focus; (ii) corporate, business unit, and individual performance focus and measurement; and (iii) financial and non-financial performance measurements used that are well balanced between growth, profitability, return on capital, and other relevant measures in the industry; |

| • | a cap on non-equity incentive compensation payable to our executive officers; |

| • | the adoption of stock ownership guidelines for executive officers; and |

| • | independent Board Compensation Committee oversight. |

13

Table of Contents

INFORMATION CONCERNING EXECUTIVE OFFICERS

The following is a list of our executive officers, other than Messrs. Moody and Pozzi, who are also director nominees, their current ages, and their positions and offices for the past five years. For executive officers who have been with us for less than five years, information is also provided with respect to the nature of their responsibilities undertaken with their prior employers during such time.

| Name of Officer | Age | Position (Year Elected to Position) | ||||

G. Richard Ferdinandtsen* | 75 | President (2000) and Chief Operating Officer (1997) | ||||

Ronald J. Welch | 66 | Senior Executive Vice President, Corporate Risk Officer & Chief Actuary (2008); Senior Executive Vice President, Chief Actuary and Chief Corporate Risk Management Officer (2004-2008) | ||||

David A. Behrens | 49 | Executive Vice President, Independent Marketing (1999) | ||||

John J. Dunn, Jr. | 53 | Executive Vice President, Corporate Chief Financial Officer (July 2010) & Treasurer (March 2011); Vice President International Accounting of Ally Financial, Inc. (formerly GMAC, Inc.) (2009 – May 2010)(charged with responsibility for auto finance and insurance accounting outside of the U.S. and Canada for this financial services provider); Vice President and Chief Financial Officer (2007-2009) of GMAC Insurance (charged with overall responsibility for the finance and accounting areas) | ||||

Gregory V. Ostergren | 56 | Executive Vice President, Director of Multiple Line (2000) | ||||

Hoyt J. Strickland | 55 | Executive Vice President, Career Sales and Service Division (February 2012); Senior Vice President, Career Sales and Service Division (April 2009); National Field Director, Career Sales and Service Division (2001 – April 2009) | ||||

Dwain A. Akins | 60 | Senior Vice President, Corporate Affairs, Chief Compliance Officer (2006) | ||||

Albert L. Amato, Jr. | 63 | Senior Vice President, Life Insurance Administration (1994) | ||||

Scott F. Brast | 48 | Senior Vice President, Real Estate / Mortgage Loan Investments (2005) | ||||

Frank V. Broll, Jr. | 62 | Senior Vice President & Actuary (2005) | ||||

William F. Carlton | 53 | Senior Vice President & Corporate Controller (2010); Vice President and Controller (2007-2010) | ||||

Gordon D. Dixon | 66 | Senior Vice President, Stock/Bond Investments (2011); Senior Vice President, Securities Investments (2004-2011) | ||||

Bernard S. Gerwel | 53 | Senior Vice President, Chief Information/Innovation Officer Multiple Line (2010); Senior Vice President, Chief MLEA Administrative Officer (2006-2010) | ||||

Rex D. Hemme | 63 | Senior Vice President & Actuary (2005) | ||||

Johnny D. Johnson | 59 | Senior Vice President, Corporate Chief Information Officer (2008); Senior Vice President, Chief Information Officer (2007) | ||||

Bruce M. LePard | 55 | Senior Vice President, Human Resources (2006) | ||||

James W. Pangburn | 55 | Senior Vice President, Credit Insurance (2004) | ||||

Ronald C. Price | 60 | Senior Vice President, Chief Marketing Officer – Career Life Agencies (2004) | ||||

Steven H. Schouweiler | 65 | Senior Vice President, Health Insurance Operations (1998) | ||||

Shannon L. Smith | 52 | Senior Vice President, Chief Multiple Line Marketing Officer (July 2008); Program Marketing Manager of Meadowbrook Insurance Group (April 2008 – July 2008)(charged with identifying and developing business opportunities and creating and managing programs to enhance growth of this specialty property and casualty insurance holding company); Vice President – Marketing and Distribution of Lincoln General Insurance Company (July 2003 – October 2007)(charged with developing marketing and distribution strategies for this provider of property and casualty insurance to the transportation industry) | ||||

| * | Effective May 1, 2012, Mr. Ferdinandtsen intends to resign as President and Chief Operating Officer of the Company. The Board currently expects to elect Mr. Pozzi as President of the Company following Mr. Ferdinandtsen’s resignation. Additionally, immediately following the Annual Meeting, Mr. Ferdinandtsen will begin serving as an advisory director of the Company. The Board also currently expects to elect Mr. Ferdinandtsen as Vice Chairman of the Board following his resignation. |

There are no arrangements or understandings pursuant to which any officer was elected. All officers are elected annually by the Board of Directors and serve until their successors are elected and qualified, unless otherwise specified by the Board.

14

Table of Contents

Compensation Discussion and Analysis

Executive Summary

This Compensation Discussion and Analysis explains the philosophy underlying our compensation strategy and the fundamental elements of compensation paid to our executive officers included in the Summary Compensation Table, to whom we refer collectively as our “Named Executive Officers.” The Named Executive Officers for 2011 were:

| • | Robert L. Moody, Sr., Chairman of the Board of Directors and CEO (“CEO”) |

| • | G. Richard Ferdinandtsen, President and Chief Operating Officer (“President”) |

| • | James E. Pozzi, Senior Executive Vice President and Chief Administrative Officer |

| • | Ronald J. Welch, Senior Executive Vice President, Corporate Risk Management Officer and Chief Actuary |

| • | John J. Dunn, Jr., Executive Vice President, Corporate Chief Financial Officer and Treasurer |

The overall goal of our executive compensation program is to retain and reward leaders who create long-term value for our stockholders. With this goal in mind, our compensation program is designed to:

| • | Attract and retain experienced, highly qualified individuals who are in a position to make significant contributions to our success; |

| • | Drive exceptional performance and motivate our executive officers to achieve desired financial results; |

| • | Encourage our executives to develop a significant ownership stake in our company; and |

| • | Align the interests of our executive officers with the long-term interests of our stockholders. |

Our Board Compensation Committee (the “Committee”) has oversight responsibility for our compensation program. The key components of the program include base salary, cash incentive awards and long-term equity-based incentive awards. The annual and long-term incentive opportunities for our executives are based 100% on performance relative to a range of measures that are aligned with long-term stockholder value creation and outcomes that each executive has the ability to impact.

Highlights of our 2011 Executive Compensation Program:

At last year’s Annual Meeting, our stockholders approved in a non-binding advisory vote our executive compensation for 2010 as disclosed in our 2011 Proxy Statement (the “say-on-pay” vote). The Committee viewed the affirmative vote by a substantial majority of our stockholders (over 96% of the votes cast) as a strong indication of support for our compensation policies and practices. At such meeting, our stockholders also approved by a substantial majority, in a separate non-binding advisory vote, a three-year frequency for holding future say-on-pay votes. As such, we intend to hold the next say-on-pay vote at our Annual Meeting in 2014. The Committee viewed these results as strong support for the compensation programs already in place for 2010 and, therefore, made only minor changes for 2011.

| • | Base Salaries in 2011. In response to competitive market base salary information provided to the Committee by its independent compensation consultant, the salaries of our Senior Executive Vice President and Chief Administrative Officer and our Executive Vice President and Chief Financial Officer were increased, as shown in the Summary Compensation Table below. Base salaries for the other Named Executive Officers were unchanged, as they were considered competitive. |

| • | Bonus Opportunities Under the 2011 Executive Incentive Compensation Plan (“EICP”). No changes were made to the target bonus opportunities for our Named Executive Officers in 2011. We also continued to use the same performance measures for our Named Executive Officers, although the goals associated with those measures were adjusted to reflect changes in performance expectations. We made a change in 2011 to modify the cap on the annual bonus that can be earned by executive officers. In prior years, the aggregate bonus that could be earned by an executive officer was capped at the aggregate bonus that would be earned if all performance measures were satisfied at Level 2 (this is the target level; the incentive bonus structure is explained in more detail below). As modified, an executive officer (other than the CEO) can earn an incentive award in excess of the incentive award he would receive if all performance measures were satisfied at Level 2, up to a cap at Level 3 performance; however, the amount earned in excess of the aggregate target (Level 2), if any, is awarded solely in restricted stock units (“RSUs”). |

| • | Long-Term Incentives. Long-term incentives are delivered in the form of RSUs, and the grant value of RSUs delivered is based on performance under the EICP, as described below. In 2011, the vesting period for RSUs awarded under the EICP was lengthened from two to three years. |

15

Table of Contents

Other Significant Recent Compensation Changes and Best Governance Practices

In recent years, we have instituted a number of compensation changes intended to increase the alignment between stockholder interests and those of our executives, or otherwise to adopt additional best practices in corporate governance.

| • | In 2009, the salary of the CEO was substantially restructured, with his base salary being reduced from $5 million to $2 million, together with increasing his performance-based incentive opportunity, thereby shifting a significant amount from fixed to variable “at risk” pay. |

| • | In 2009, the EICP, which previously paid annual incentive awards solely in cash, was modified so that 40% of the awards (30% in the case of the CEO) is paid in the form of RSUs vesting two years after the date of award; the vesting period was lengthened to three years in 2011. |

| • | Stock ownership guidelines for executive officers and directors were adopted in February 2011, as described below under “Stock Ownership Guidelines.” |

| • | In early 2012, we adopted a clawback policy, described below, that applies when inaccurate financial statements have affected incentive award payments to executive officers. |

| • | We do not grant or maintain any severance or employment agreements, nor do we provide any tax reimbursements or gross-ups for any of the Named Executive Officers. |

| • | Our securities trading guidelines preclude the Named Executive Officers from transactions involving puts or calls, and short sales, of our stock. |

| • | The Committee’s independent compensation consultant performs no services for us other than those that support the needs of the Committee. |

| • | The Committee is comprised entirely of independent directors and, beginning in 2012, will conduct regular executive sessions with its independent consultant without management present. |

Elements of Compensation

The following table lists the primary elements of our executive compensation program and the primary purpose of each element. Additional explanation of each element will be provided below under “Elements of Compensation Provided to the Named Executive Officers.”

| Element | Purpose | |

Base Salary | Provides a fixed level of competitive compensation. | |

Annual Incentive Compensation | Focuses executive attention on key financial and operational performance measures under the EICP. | |

Long-Term Incentive Compensation, consisting in 2011 of RSUs awarded under the EICP as a fixed percentage of any annual incentive compensation earned | Aligns executives’ interests with those of our stockholders and helps retain executive talent. | |

Retirement Benefits, consisting of qualified and non-qualified Company pension plans and the Company’s 401(k) plan | Assists executives in providing for their and their families’ long-term financial security and future well being. | |

Health and Welfare Benefits (consisting of basic and supplemental health insurance, disability protection, and life insurance) | Assists executives in providing for their and their families’ current well being and protection. | |

16

Table of Contents

Approach for Determining Form and Amount of Compensation

The Committee oversees the compensation policies and programs for our senior officers, including the Named Executive Officers, and our equity-based incentive compensation plans. The Committee is supported in its role by our Management Compensation Committee. The Management Compensation Committee is comprised of three of our most senior officers: G. Richard Ferdinandtsen, President and Chief Operating Officer; James E. Pozzi, Senior Executive Vice President and Chief Administrative Officer; and Ronald J. Welch, Senior Executive Vice President, Corporate Risk Officer and Chief Actuary.

The compensation process for our Named Executive Officers and other executive officers begins with an annual evaluation by the Management Compensation Committee, which considers Company performance against the stated performance measures and goals for the year, each executive officer’s individual performance over the prior year, any changes in responsibilities, internal equity and consistency, and the future potential of each executive officer. The process also considers competitive market data available from a peer group of comparable insurance companies, and nationally published compensation surveys obtained from a range of industry and general market sources. The Management Compensation Committee formulates recommendations based on this process for all executive officers other than the CEO and the President. Recommendations with respect to Mr. Pozzi and Mr. Welch are made solely by the President. After review and approval of the recommendations by the CEO, they are presented to the Committee for its consideration. The Committee evaluates these recommendations and develops its own recommendations for the CEO and the President, with the advice of its independent outside consultant.

To evaluate the compensation of our executive officers relative to market comparables and to better inform the Committee in making fiscal 2011 compensation decisions, the Committee engaged Frederic W. Cook & Co., Inc. (“Cook & Co.”), a national compensation consulting firm, to conduct a review of our executive officer compensation practices relative to our peer group and nationally published market surveys of executive compensation practices. Cook & Co. is independent of us and has no relationship with us other than assisting the Committee with its executive compensation practices. After considering the Management Compensation Committee’s recommendations and Cook & Co.’s report, the Committee submitted its compensation recommendations to our Board of Directors for their consideration. The Board of Directors unanimously approved those recommendations.

During 2011, Cook & Co. performed the following services for the Committee:

| • | Evaluated the competitive positioning of our executive officers’ base salaries, annual incentives and long-term incentive compensation relative to our primary peers and the broader insurance industry; |

| • | Briefed the Committee on executive compensation trends among our peers and the broader industry, developments related to our executive compensation program, and legislative changes; |

| • | Provided ongoing advice to the Committee as needed for periodic requests related to the determination of the amount and form of executive compensation; and |

| • | Provided an assessment of our compensation policies and practices to determine whether they encourage excessive risk taking that is reasonably likely to have a material adverse effect on the Company as a whole. |

The Committee has established procedures that it considers adequate to ensure that the compensation consultant’s advice to the Committee remains objective and is not influenced by our management. These procedures include the following: a direct reporting relationship of the consultant to the Committee chairman; a provision in the Committee’s engagement letter with Cook & Co. specifying the information, data, and recommendations that can and cannot be shared with management; and an annual update to the Committee on Cook & Co.’s financial relationship with us, including a summary of the work performed for us during the preceding twelve months. Additionally, Cook & Co. has no service lines other than executive compensation consulting, so the potential for any conflict of interest as a result of providing other services to us is eliminated. With the consent of the Committee chair, the independent compensation consultant may, from time to time, contact our executive officers for information necessary to complete its assignments and may make reports and presentations to and on behalf of the Committee that the executive officers also receive.

All of the decisions with respect to determining the amount or form of executive compensation under our executive compensation program are ultimately made by our Board of Directors upon the recommendation of the Committee and may reflect factors and considerations other than the information and advice provided by the compensation consultant.

How We Determine Each Element of Compensation

In determining the amounts of each element of compensation and the aggregate compensation for our Named Executive Officers, we review market practices as described under “Market Comparisons” below. We do not use any specific formulae or attempt to satisfy any specific ratio for compensation among our executive officers. We also do not generally target any particular allocation for base salary, annual incentive, or long-term equity awards as a percentage of total compensation. Target compensation levels are decided subjectively based on a review of relevant market practices, the responsibilities and future potential of each executive, internal equity considerations, and each executive’s ability to impact financial and operational results. Historically, our compensation program has more heavily emphasized fixed compensation, while many of our peers place a greater emphasis on incentive compensation. In 2009, however, we modified our compensation program to significantly increase the proportion of performance-based compensation paid to our Named Executive Officers.

17

Table of Contents

Market Comparisons

During early 2011, Cook & Co. evaluated the total direct compensation (consisting of base salary, annual incentives, and long-term incentives) of our Named Executive Officers relative to market practices. The compensation of each of our Named Executive Officers was compared to that of individuals in comparable positions among a peer group of companies listed below, and to nationally published compensation survey data.

The peer group consists of companies that compete with us for talent, face similar challenges in the financial services sector, and have senior executives with comparable responsibilities. As of the date of Cook & Co.’s report, peer group revenues for the prior four quarters ranged from approximately $1.0 billion to $5.0 billion (median revenues of approximately $3.4 billion), and assets ranged from approximately $7.3 billion to $52.0 billion (median assets of approximately $16.0 billion). Our total revenues were approximately $3.0 billion in 2011, and our assets were approximately $22.3 billion at the end of 2011, placing us toward the middle of the revenue and asset range of the peer group. The peer group is comprised of the following companies:

W.R. Berkley Corporation | Cincinnati Financial Corporation | |

The Hanover Insurance Group, Inc. | HCC Insurance Holdings, Inc. | |

Horace Mann Educators Corporation | Old Republic International Corporation | |

Phoenix Companies, Inc. | Protective Life Corporation | |

StanCorp Financial Group, Inc. | Torchmark Corporation | |

Transatlantic Holdings, Inc. | Kemper Corporation | |

White Mountains Insurance Group, Ltd. | ||

The published survey data covers a broader set of companies, including many if not all of the peer companies within the insurance industry. The specific surveys used for fiscal 2011 were:

| • | Mercer2010 Benchmark Database(containing tabular data of insurance companies with assets greater than $5 billion); |

| • | Mercer 2010Financial Services Survey Suite – Insurance Compensation Survey; |

| • | Towers Watson2010/2011 Top Management Calculator (containing insurance industry data regressed to each executive’s individual scope as measured in assets); and |

| • | LOMA’s2010 Executive Compensation Survey Report(containing tabular insurance industry data from companies with assets between $5 billion and $30 billion). |

Cook & Co.’s evaluation for 2011found that the total direct compensation of our CEO was in the top quartile of the peer group and survey data, while total direct compensation for the other Named Executive Officers generally approximated the median of the peer group and survey data, with the President somewhat above the range and the Chief Financial Officer somewhat below the range. The Committee determined that the positioning of the Named Executive Officers was appropriate given their respective levels of experience and performance, with the exception of Messrs. Pozzi and Dunn, who were determined to have base salaries below the market. As such, the Committee increased base salaries for Messrs. Pozzi and Dunn but did not increase target total direct compensation for any of the other Named Executive Officers.

Elements of Compensation Provided to the Named Executive Officers

Base Salary

Base salary is an important component of total compensation for our Named Executive Officers, and it is vital to our goal of recruiting and retaining executive officers with proven abilities. Base salaries are determined for each Named Executive Officer based on abilities, qualifications, accomplishments, and prior work experience. Adjustments are considered annually based on current market data, the consistency of the executive officer’s individual performance over the prior year, changes in responsibilities, future potential and internal equity.

A significant change was made to the base salary of our CEO in 2009. As part of an effort to shift the pay mix away from fixed compensation into incentive-based compensation, the base salary of the CEO was reduced from $5 million to $2 million. Correspondingly, his annual performance-based incentive opportunity was increased. This shift better aligned the pay mix of the CEO with the market, and this compensation mix remained unchanged in 2011. The base salaries of Messrs. Pozzi and Dunn were increased by approximately 9.4% and 11.1%, respectively, because their salaries were found to be below market in our benchmarking study. Salaries of our other Named Executive Officers remained unchanged.

18

Table of Contents

| Name/Title | 2010 Base Salary | 2011 Base Salary | Percentage Increase | |||||||||

Robert L. Moody, Sr., Chairman of the Board and CEO | $ | 2,000,000 | $ | 2,000,000 | 0.0 | % | ||||||

G. Richard Ferdinandtsen, President and Chief Operating Officer | $ | 1,000,000 | $ | 1,000,000 | 0.0 | % | ||||||

James E. Pozzi, Senior Executive Vice President and Chief Administrative Officer | $ | 425,759 | $ | 465,759 | 9.4 | % | ||||||

Ronald J. Welch, Senior Executive Vice President, Corporate Risk Management Officer and Chief Actuary | $ | 408,887 | $ | 408,887 | 0.0 | % | ||||||

John J. Dunn, Jr., Executive Vice President, Corporate Chief Financial Officer and Treasurer | $ | 300,000 | * | $ | 333,333 | 11.1 | % | |||||

| * | Mr. Dunn began his service with us on August 16, 2010. The base salary shown represents the annualized amount of the $112,500 he actually received as base salary during 2010. |

Annual Incentive Compensation

Our Named Executive Officers participate in the EICP. Eligibility to participate in the EICP is determined by the Committee and approved by the Board of Directors. Payouts are based on actual performance relative to predetermined performance objectives across a range of performance measures that an executive has the ability to impact. All incentive compensation is subject to review and approval by the Committee and the Board of Directors, both at the time of the setting of the performance objectives and at the time of payment of the annual incentive award. In order to receive an incentive compensation payout, an executive must be employed by us at the time of payout; provided, however, that in the event of death, disability or normal retirement after the age of 65 prior to such payout, the payout will be prorated for the portion of the calendar year up to the date of death, disability or retirement.