UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-7704

Schwab Capital Trust

(Exact name of registrant as specified in charter)

101 Montgomery Street, San Francisco, California 94104

(Address of principal executive offices) (Zip code)

Evelyn Dilsaver

Schwab Capital Trust

101 Montgomery Street, San Francisco, California 94104

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 627-7000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2006

TABLE OF CONTENTS

Item 1: Report(s) to Shareholders.

Schwab Equity Index Funds

Annual Report

October 31, 2006

Schwab S&P 500 Index Fund

Schwab Institutional Select®

S&P 500 Fund

Schwab 1000 Index® Fund

Schwab Small-Cap

Index Fund®

Schwab Total Stock Market

Index Fund®

Schwab International

Index Fund®

Six cost-efficient ways to tap into the power of

the stock market for long-term growth potential.

In this report

| |

| Performance at a Glance | | | | | 1 | |

| From the Chairman | | | | | 2 | |

| From the President | | | | | 3 | |

| Investment Environment | | | | | 4 | |

| Schwab S&P 500 Index Fund | | | | | 6 | |

| Schwab Institutional Select® S&P 500 Fund | | | | | 8 | |

| Schwab 1000 Index® Fund | | | | | 10 | |

| Schwab Small-Cap Index Fund® | | | | | 12 | |

| Schwab Total Stock Market Index Fund® | | | | | 14 | |

| Schwab International Index Fund® | | | | | 16 | |

| Fund Expenses | | | | | 18 | |

| Financial Statements | | | | | 20 | |

| Financial Notes | | | | | 63 | |

| Investment Advisory Agreement Approval | | | | | 72 | |

| Trustees and Officers | | | | | 74 | |

| Glossary | | | | | 78 | |

Select Shares® are available on many Schwab Funds®Schwab Funds offers Select Shares, a shares class that carries lower expenses than Investor Shares™ in exchange for higher investment minimums on many of its funds. Select Shares are available for initial purchases of $50,000 or more of a single fund in a single account and for shareholders who add to their existing Investor Share position, bringing the value to or above $50,000. We encourage shareholders of Investor Shares to review their portfolio to see if they are eligible to exchange into Select Shares. If you believe you are eligible, you should contact Schwab or your financial intermediary to request a tax-free interclass exchange into Select Shares. Instructions for performing a tax-free interclass exchange can also be referenced on the Schwab Funds website at www.schwab.com/schwabfunds under Schwab Funds Investor Information. Select Shares may not be available through financial intermediaries other than Charles Schwab & Co., Inc.

Fund investment adviser: Charles Schwab Investment Management, Inc. (CSIM).

Distributor and transfer agent: Charles Schwab & Co., Inc. (Schwab).

The industry/sector classification of the funds’ portfolio holdings uses the Global Industry Classification Standard (GICS) which was developed by and is the exclusive property of Morgan Stanley Capital International Inc. and Standard & Poor’s. GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc.

Performance at a Glance

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visit www.schwab.com/schwabfunds.

|

| Total Return for the Report Period

|

|---|

Schwab S&P 500 Index Fund | | | | |

| Investor Shares (Ticker Symbol: SWPIX) | | | 16.03 | % |

| Select Shares (Ticker Symbol: SWPPX) | | | 16.18 | % |

e.Shares (Ticker Symbol: SWPEX)1 | | | 16.20 | % |

| Benchmark: S&P 500® Index | | | 16.34 | % |

Performance Details | | | pages 6–7 | |

| | | | | |

Schwab Institutional Select® S&P 500 Fund (Ticker Symbol: ISLCX) | | | 16.39 | % |

| Benchmark: S&P 500® Index | | | 16.34 | % |

Performance Details | | | pages 8–9 | |

| | | | | |

Schwab 1000 Index® Fund | | | | |

| Investor Shares (Ticker Symbol: SNXFX) | | | 15.84 | % |

| Select Shares (Ticker Symbol: SNXSX) | | | 16.01 | % |

| Benchmark: Schwab1000 Index® | | | 16.26 | % |

Performance Details | | | pages 10–11 | |

| | | | | |

Schwab Small-Cap Index Fund® | | | | |

| Investor Shares (Ticker Symbol: SWSMX) | | | 17.62 | % |

| Select Shares (Ticker Symbol: SWSSX) | | | 17.78 | % |

| Benchmark: Schwab Small-Cap Index® | | | 17.94 | % |

Performance Details | | | pages 12–13 | |

| | | | | |

Schwab Total Stock Market Index Fund® | | | | |

| Investor Shares (Ticker Symbol: SWTIX) | | | 16.05 | % |

| Select Shares (Ticker Symbol: SWTSX) | | | 16.23 | % |

Benchmark: Dow Jones Wilshire 5000 Composite IndexSM | | | 16.61 | % |

Performance Details | | | pages 14–15 | |

| | | | | |

Schwab International Index Fund® | | | | |

| Investor Shares (Ticker Symbol: SWINX) | | | 26.15 | % |

| Select Shares (Ticker Symbol: SWISX) | | | 26.35 | % |

| Benchmark: Schwab International Index® | | | 26.76 | % |

Performance Details | | | pages 16–17 | |

| | | | | |

Minimum Initial Investment2 | | | | |

| Investor Shares ($1,000 for retirement, education and custodial accounts) | | | $ 2,500 | |

| Select Shares® | | | $50,000 | |

| e.Shares ($500 for retirement, education and custodial accounts) | | | $ 1,000 | |

| Institutional Select S&P 500 Fund | | | $75,000 | |

All fund and index figures on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged, and you cannot invest in them directly. Performance results less than one year are not annualized.

Expenses may be partially absorbed by CSIM and Schwab. Without these reductions, the funds’ total returns would have been lower. Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption of fund shares.

1One year return presented in the table differs from the return in the Financial Highlights. This is a result of the calculation of the Financial Highlights return adhering to GAAP presentation.

2Please see prospectus for further detail and eligibility requirements.

Schwab Equity Index Funds 1

| | | From the Chairman

|

| | Dear Shareholder, I founded Schwab over thirty years ago to be a home for serious investors. That mission continues to guide us today as we constantly strive to improve and innovate. By doing this, and providing some of the highest quality products and services — at a competitive price — we remain true to our heritage. I take particular pride in the Schwab Funds. Founded over 15 years ago, Schwab Funds now includes more than 50 funds with over $170 billion in assets. With a variety of investment strategies, Schwab Funds provides a range of innovative investment choices that can serve as a foundation for your asset allocation plan, including the Schwab Equity Index Funds, contained within this book. Schwab Funds are managed by Charles Schwab Investment Management, Inc., one of the largest mutual fund managers in the U.S. Our portfolio managers share a passion for market analysis and use some of the most sophisticated financial models in the country. I am proud of their depth of experience, which reflects an average of 14 years in the investment industry. Furthermore, I am impressed by the commitment that our managers bring to the stewardship of their funds, for you, their shareholders. In closing, I want to thank you for investing with us. We work every day to warrant the trust you have placed in us; that will never change. Sincerely, |

2 Schwab Equity Index Funds

| | | From the President |

Evelyn Dilsaver is President and

CEO of Charles Schwab Investment

Management, Inc. and of each of

the funds covered in this report.

She joined the firm in 1992 and

has held a variety of executive

positions at Schwab. | | Dear Shareholder, I am pleased to present the annual report for the Schwab Equity Index Funds for the period ended October 31, 2006. Thanks to the support of investors like you, Schwab Equity Index Funds assets were over $21 billion as of this report date. Schwab Equity Index Funds let you tap into the power of the stock market for long-term growth potential. Indexing can be a highly effective approach to stock investing. In fact, for the one-year report period, I’m pleased to note that all but one of our equity index funds beat their respective fund category averages. What’s more, since an indexing strategy generally results in lower turnover, this can mean fewer taxable capital gain distributions to shareholders. With this report, you will see that we have recently started an initiative to enhance the presentation of our shareholder reports to make it easier for you to find information about your fund. This book represents the first step in this process, with additional changes anticipated for future report cycles. You will notice, for example, that we have added a new lead page, Performance at a Glance, which includes the funds’ ticker symbols and report period returns for the funds and their benchmarks. For ease of reference, we have relocated the fund manager’s discussion to be in close proximity to the fund performance and portfolio statistics sections. At this time, I would like to highlight another valuable information resource for fund shareholders, namely, our website at www.schwabfunds.com. This website contains regular updates about the Schwab Funds. I encourage you to visit the website to stay informed about your fund. I’d like to emphasize that your trust is very important to us and I will do all I can to maintain that trust. Thank you for investing in Schwab Funds. Sincerely, Past performance is no guarantee of future results. |

Schwab Equity Index Funds 3

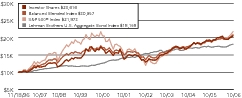

The Investment Environment

Jeffrey Mortimer, CFA, senior vice

president and chief investment

officer, equities, is responsible for the

overall management of the fund. | | As the U.S. economy transitioned to slower growth, equities markets rebounded, aided by higher corporate profitability, falling energy/commodity prices, and lower interest rates. The S&P 500 Index returned 16.34% and the Russell 2000 Index returned 19.98%, respectively, for the one-year report period ended October 31, 2006. Improving fundamentals and attractive valuations strengthened investor interest in emerging markets and the MSCI EAFE (Morgan Stanley Capital International, Inc. Europe, Australasia, and Far East) Index returned 27.52%. Performance in the bond markets has been mixed over the year, although the Lehman Brothers U.S. Aggregate Bond Index gained 5.19%. Several key issues continued to resonate with investors, including slowing economic growth, Federal Reserve (the Fed) policy, a sluggish real estate market, inflation concerns, and fluctuating energy prices. Economic growth has been anything but predictable over the past year. The last quarter of 2005 saw Gross Domestic Product (GDP) slow considerably as the economy adjusted to changes in inventories and higher energy prices. Although Hurricane Katrina remained a focal point in the news late in 2005, its economic impact was determined to be minimal as damage remained contained within the hurricane’s path. In the first quarter of 2006, GDP then rebounded, only to slow later in the year. Though falling existing home sales and lower motor vehicle production have done much to curtail growth in the eyes of the Fed, favorable labor market conditions, sustained increases in labor income, and lower energy prices continued to promote stable growth. The unemployment rate fell to a cyclical low of 4.4% in the third quarter of 2006 while consumer spending and business investment remained key contributors to GDP growth. |

| | | |

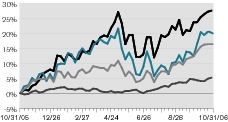

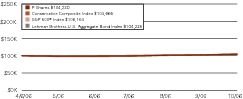

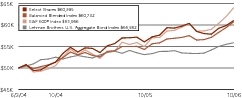

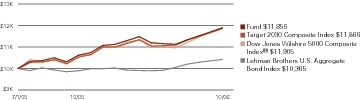

Asset Class Performance Comparison % returns during the report period |

| |

This graph compares the performance of various asset classes during the report period. Final performance figures for the period are in the key below.

| | |

| n 16.34% | S&P 500® Index: measures U.S. large-cap stocks |

| n 19.98% | Russell 2000® Index: measures U.S. small-cap stocks |

| n 27.52% | MSCI EAFE® Index: measures (in U.S. dollars) large-cap stocks in Europe, Australasia and the Far East |

| n 5.19% | Lehman Brothers U.S. Aggregate Bond Index: measures the U.S. bond market |

These figures assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and you cannot invest in them directly. Remember that past performance is not an indication of future results.

Data source: Charles Schwab & Co., Inc.

4 Schwab Equity Index Funds

The Investment Environment continued

In efforts to curb inflationary pressures, the Fed raised short-term interest rates six times during the period. August marked a key point in the year as Committee members decided to hold the Fed’s target rate at 5.25%, where it remained as of the end of the report period. In its statement, the Fed noted that the economy appeared to be growing at a more moderate rate as a result of prior rate increases, lagged effects of energy prices, and a cooling of the housing market. The Fed indicated they generally expected the economy to grow at a pace below its potential, which proved to be an accurate prediction. Consistent with the Fed’s report, GDP continued to decline, growing only 2.2% in the third quarter of 2006.

Energy prices have been a key issue in the markets over the past year. Following Hurricane Katrina, oil prices peaked around $71 per barrel, with domestic gasoline prices passing $3.00 a gallon. Prices subsequently fell, but rebounded nearly 21% early in 2006, partly due to concerns that Iran might cut back exports in response to a dispute over their nuclear program. Prices declined throughout the report period due to a lack of hurricanes in the Gulf of Mexico, as well as an increase in U.S. fuel inventories. More recently, abundant inventories, warmer weather, and skepticism regarding OPEC’s proposed production cuts contributed to a slip in oil prices. Crude oil has declined nearly 26% since July 2006’s record $78.40 per barrel, yet still remained around the $60–61 per barrel range at the end of the report period, as diminishing U.S. crude inventories and concern about global surplus lingered in investors’ minds.

The events of 2006 have also had a significant impact on the housing market. Housing starts fell considerably, down nearly 34% since the beginning of 2006. Existing home sales continued to decline as well, falling nearly 15% from their peak reached in 2005. Although sales have dropped, they remained strong by historical standards. Concerns remained as to whether the Fed’s actions, and the immediate effects on the housing market, would spill over into the rest of the economy. With regards to GDP, housing took off about one percent in the third quarter of 2006, although rebounds in income, consumer spending, and investments helped to offset the impact.

Despite a moderation in economic growth during the report period, economic fundamentals remained healthy as of the end of the period. The Fed’s task of balancing inflation pressures without significantly hindering economic growth will be thoroughly scrutinized in the coming months. The challenge is to bring this economy to a state of stable growth and achieve a soft landing.

Nothing in this report represents a recommendation of a security by the investment adviser.

Manager views and portfolio holdings may have changed since the report date.

Schwab Equity Index Funds 5

Schwab S&P 500 Index Fund

Larry Mano, (right) vice president and senior portfolio manager, is responsible for the co-management of the fund.

Tom Brown, (left) associate portfolio manager, is responsible for the dayto-day co-management of the fund. | | The Schwab S&P 500 Index Fund Investor Shares ended the one-year period with a positive return of 16.03%, tracking the benchmark, the S&P 500 Index, which was up 16.34%. Bear in mind that indices are unmanaged and unlike the fund, do not include operational and transaction costs. The S&P 500 Index includes the stocks of 500 leading U.S. publicly traded companies from a broad range of industries and is market-capitalization weighted. Therefore, its returns are most heavily influenced by the largest names in the index. Sectors with the best performance during the report period were Telecommunication Services, Materials, and Consumer Discretionary. On the downside, Information Technology (IT) and Health Care sectors trailed, with such IT industry heavyweights as Dell Inc., and Intel Corp. struggling. Top performing industry groups included Diversified Telecommunication Services, Metals and Mining, and Road and Rail. Conversely, Diversified Consumer Services, Internet Software and Services, and Wireless Telecommunication industry groups generated negative returns. Stocks that performed well during the period included Allegheny Technologies Inc., NVIDIA Corp. and Exxon Mobil Corp. |

| | | |

| As of 10/31/06: | | |

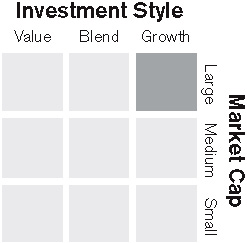

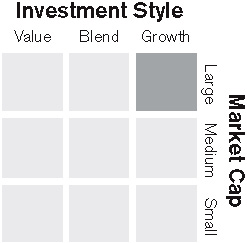

| Style Assessment1 | | |

| | |

Statistics |

| Number of Holdings | | 502 |

| Weighted Average Market Cap ($ x 1,000,000) | | 96,440 |

| Price/Earnings Ratio (P/E) | | 17.4 |

| Price/Book Ratio (P/B) | | 2.8 |

Sector Weightings % of Investments |

| Financials | | 22.1 | % |

| Information Technology | | 15.4 | % |

| Health Care | | 12.4 | % |

| Industrials | | 10.9 | % |

| Consumer Discretionary | | 10.3 | % |

| Consumer Staples | | 9.5 | % |

| Energy | | 9.4 | % |

| Telecommunication Services | | 3.5 | % |

| Utilities | | 3.4 | % |

| Materials | | 3.0 | % |

| Others | | 0.1 | % |

Total | | 100.0 | % |

Top Holdings % of Net Assets2 |

| Exxon Mobil Corp. | | 3.4 | % |

| General Electric Co. | | 2.9 | % |

| Citigroup, Inc. | | 2.0 | % |

| Microsoft Corp. | | 2.0 | % |

| Bank of America Corp. | | 2.0 | % |

| Procter & Gamble Co. | | 1.6 | % |

| Johnson & Johnson | | 1.6 | % |

| Pfizer, Inc. | | 1.6 | % |

| American International Group, Inc. | | 1.4 | % |

| Altria Group, Inc. | | 1.4 | % |

Total | | 19.9 | % |

Manager views and portfolio holdings may have changed since the report date.

Source of Sector Classification: S&P and MSCI.

Standard & Poor’s®, S&P®, S&P 500®, Standard & Poor’s 500® and 500® are trademarks of The McGraw-Hill Companies, Inc. and have been licensed for use by the fund. The fund is not sponsored, endorsed, sold or promoted by Standard & Poor’s, and Standard & Poor’s makes no representation regarding the advisability of investing in the fund.

1Source: Morningstar, Inc. This style assessment is the result of evaluating the fund based on a ten-factor model for value and growth characteristics. The fund’s market capitalization placement is determined by the geometric mean of its holdings’ market capitalizations. The assessment reflects the fund’s portfolio as of 10/31/06, which may have changed since then, and is not a precise indication of risk or performance — past, present, or future.

2This list is not a recommendation of any security by the investment adviser.

6 Schwab Equity Index Funds

Schwab S&P 500 Index Fund

Performance Summary as of 10/31/06The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visit www.schwab.com/schwabfunds.

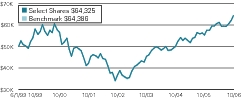

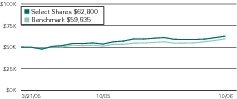

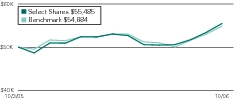

Performance of a Hypothetical

$10,000 Investment in Investor Shares1 | | Performance of a Hypothetical

$50,000 Investment in Select Shares1 | | Performance of a Hypothetical

$10,000 Investment in e.Shares1 |

| | | | |

Pre-Tax Average Annual Total Returns1,2 |

Fund Class and Inception Date | | 1 Year | | 5 Years | | 10 Years | | Since Inception |

| Investor Shares (5/1/96) | | | 16.03 | % | | | 6.94 | % | | | 8.26 | % | | n/a |

| Select Shares® (5/19/97) | | | 16.18 | % | | | 7.12 | % | | | n/a | | | 6.96% |

| e.Shares® (5/1/96) | | | 16.20 | % | | | 7.04 | % | | | 8.36 | % | | n/a |

| |

| Benchmark: S&P 500® Index | | | 16.34 | % | | | 7.25 | % | | | 8.63 | % | | (5/19/97) 7.13% |

| |

| Fund Category: Morningstar Large-Cap Blend | | | 14.74 | % | | | 6.82 | % | | | 7.76 | % | | (5/19/97) 6.63% |

| | | | | | | | | | | | | | | |

Average Annual Total Returns After Tax1,2 |

Fund Class and Inception Date | | 1 Year | | 5 Years | | 10 Years | | Since Inception |

Investor Shares (5/1/96) | | | | | | | | | | | | | | | | |

| Pre-Liquidation (still own shares) | | | 15.41 | % | | | 6.41 | % | | | 7.80 | % | | | n/a | |

| Post-Liquidation (shares were sold) | | | 10.39 | % | | | 5.65 | % | | | 7.01 | % | | | n/a | |

Select Shares® (5/19/97) | | | | | | | | | | | | | | | | |

| Pre-Liquidation (still own shares) | | | 15.89 | % | | | 6.60 | % | | | n/a | | | | 6.50 | % |

| Post-Liquidation (shares were sold) | | | 10.86 | % | | | 5.84 | % | | | n/a | | | | 5.83 | % |

e.Shares® (5/1/96) | | | | | | | | | | | | | | | | |

| Pre-Liquidation (still own shares) | | | 15.90 | % | | | 6.54 | % | | | 7.90 | % | | | n/a | |

| Post-Liquidation (shares were sold) | | | 10.86 | % | | | 5.79 | % | | | 7.11 | % | | | n/a | |

Fund Category: Morningstar Large-Cap Blend | | | | | | | | | | | | | | | | |

| Pre-Liquidation (still own shares) | | | 6.56 | % | | | 5.96 | % | | | 6.25 | % | | | n/a | |

| Post-Liquidation (shares were sold) | | | 5.04 | % | | | 5.31 | % | | | 5.97 | % | | | n/a | |

All figures on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged, and you cannot invest in them directly. Performance results less than one year are not annualized.

1Fund expenses may have been partially absorbed by CSIM and Schwab. Without these reductions, the fund’s returns would have been lower.

2The pre-tax total return and the graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. After-tax returns are calculated using the highest historical individual federal marginal income tax rates in effect as of 10/31/06 and do not reflect the impact of state and local taxes or the alternative minimum tax. Actual returns depend on an investor’s situation and may differ from those shown. After-tax returns may not be relevant to investors who hold their fund shares through tax-deferred arrangements. Pre-liquidation after-tax returns reflect the tax effects of purchases and sales of securities within the fund portfolios and assume investors continue to hold fund shares at the end of the measurement periods. Post-liquidation figures assume investors sold fund shares at the end of the measurement periods and reflect both the effects of taxable distributions and any taxable gains or losses realized upon the sale of shares. Source for category information: Morningstar, Inc. Some funds in this category may not use tax-efficient strategies, including this fund.

Schwab Equity Index Funds 7

Schwab Institutional Select® S&P 500 Fund

Larry Mano, (right) vice president and senior portfolio manager, is responsible for the co-management of the fund.

Tom Brown, (left) associate portfolio manager, is responsible for the dayto-day co-management of the fund. | | Schwab Institutional Select S&P 500 Fund ended the one-year period with a positive return of 16.39%, tracking the benchmark, the S&P 500 Index, which was up 16.34%. Bear in mind that indices are unmanaged and unlike the fund, do not include operational and transaction costs. The S&P 500 Index includes the stocks of 500 leading U.S. publicly traded companies from a broad range of industries and is market-capitalization weighted. Therefore, its returns are most heavily influenced by the largest names in the index. Sectors with the best performance during the report period were Telecommunication Services, Materials, and Consumer Discretionary. On the downside, Information Technology (IT) and Health Care sectors trailed, with such IT industry heavyweights as Dell Inc., and Intel Corp. struggling. Top performing industry groups included Diversified Telecommunication Services, Metals and Mining, and Road and Rail. Conversely, Diversified Consumer Services, Internet Software and Services, and Wireless Telecommunication industry groups generated negative returns. Stocks that performed well during the period included Allegheny Technologies Inc., NVIDIA Corp. and Exxon Mobil Corp. |

| | | |

| As of 10/31/06: | | |

| Style Assessment1 | | |

| | |

Statistics |

| Number of Holdings | | 506 |

| Weighted Average Market Cap ($ x 1,000,000) | | 96,160 |

| Price/Earnings Ratio (P/E) | | 17.4 |

| Price/Book Ratio (P/B) | | 2.8 |

Sector Weightings % of Investments |

| Financials | | 22.0 | % |

| Information Technology | | 15.3 | % |

| Health Care | | 12.3 | % |

| Industrials | | 10.8 | % |

| Consumer Discretionary | | 10.3 | % |

| Energy | | 9.4 | % |

| Consumer Staples | | 9.4 | % |

| Telecommunication Services | | 3.5 | % |

| Utilities | | 3.4 | % |

| Materials | | 2.9 | % |

| Others | | 0.7 | % |

Total | | 100.0 | % |

Top Holdings % of Net Assets2 |

| Exxon Mobil Corp. | | 3.4 | % |

| General Electric Co. | | 2.9 | % |

| Citigroup, Inc. | | 2.0 | % |

| Microsoft Corp. | | 2.0 | % |

| Bank of America Corp. | | 1.9 | % |

| Procter & Gamble Co. | | 1.6 | % |

| Johnson & Johnson | | 1.6 | % |

| Pfizer, Inc. | | 1.6 | % |

| American International Group, Inc. | | 1.4 | % |

| Altria Group, Inc. | | 1.4 | % |

Total | | 19.8 | % |

Manager views and portfolio holdings may have changed since the report date.

Source of Sector Classification: S&P and MSCI.

Standard & Poor’s®, S&P®, S&P 500®, Standard & Poor’s 500® and 500® are trademarks of The McGraw-Hill Companies, Inc. and have been licensed for use by the fund. The fund is not sponsored, endorsed, sold or promoted by Standard & Poor’s, and Standard & Poor’s makes no representation regarding the advisability of investing in the fund.

1Source: Morningstar, Inc. This style assessment is the result of evaluating the fund based on a ten-factor model for value and growth characteristics. The fund’s market capitalization placement is determined by the geometric mean of its holdings’ market capitalizations. The assessment reflects the fund’s portfolio as of 10/31/06, which may have changed since then, and is not a precise indication of risk or performance — past, present, or future.

2This list is not a recommendation of any security by the investment adviser.

8 Schwab Equity Index Funds

Schwab Institutional Select S&P 500 Fund

Performance Summary as of 10/31/06The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visit www.schwab.com/schwabfunds.

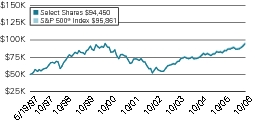

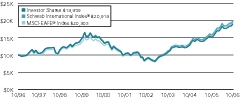

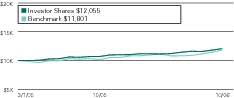

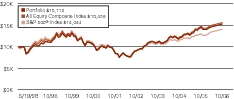

Performance of a Hypothetical

$75,000 Investment1 |

|

| |

Pre-Tax Average Annual Total Returns1,2 |

| | | 1 year | | 5 years | | Since Inception |

| Fund: Institutional Select® S&P 500 Fund (2/1/99) | | | 16.39 | % | | | 7.19 | % | | | 2.46 | % |

| |

| Benchmark: S&P 500® Index | | | 16.34 | % | | | 7.25 | % | | | 2.55 | % |

| |

| Fund Category: Morningstar Large-Cap Blend | | | 14.74 | % | | | 6.82 | % | | | 3.08 | % |

| | | | | | | | | | | | | |

Average Annual Total Returns After Tax1,2 |

| | | 1 year | | 5 years | | Since Inception |

Fund: Institutional Select S&P 500 Fund (2/1/99) | | | | | | | | | | | | |

| Pre-Liquidation (still own shares) | | | 16.14 | % | | | 6.67 | % | | | 2.03 | % |

| Post-Liquidation (shares were sold) | | | 10.90 | % | | | 5.89 | % | | | 1.84 | % |

| |

Fund Category: Morningstar Large-Cap Blend | | | | | | | | | | | | |

| Pre-Liquidation (still own shares) | | | 6.56 | % | | | 5.96 | % | | | n/a | |

| Post-Liquidation (shares were sold) | | | 5.04 | % | | | 5.31 | % | | | n/a | |

All figures on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged, and you cannot invest in them directly. Performance results less than one year are not annualized.

1Fund expenses may have been partially absorbed by CSIM and Schwab. Without these reductions, the fund’s returns would have been lower.

2The pre-tax total return and the graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. After-tax returns are calculated using the highest historical individual federal marginal income tax rates in effect as of 10/31/06 and do not reflect the impact of state and local taxes or the alternative minimum tax. Actual returns depend on an investor’s situation and may differ from those shown. After-tax returns may not be relevant to investors who hold their fund shares through tax-deferred arrangements. Pre-liquidation after-tax returns reflect the tax effects of purchases and sales of securities within the fund portfolios and assume investors continue to hold fund shares at the end of the measurement periods. Post-liquidation figures assume investors sold fund shares at the end of the measurement periods and reflect both the effects of taxable distributions and any taxable gains or losses realized upon the sale of shares. Source for category information: Morningstar, Inc. Some funds in this category may not use tax-efficient strategies, including this Fund.

Schwab Equity Index Funds 9

Schwab 1000 Index® Fund

Larry Mano, (right) vice president and senior portfolio manager, is responsible for the co-management of the fund.

Tom Brown, (left) associate portfolio manager, is responsible for the dayto-day co-management of the fund. | | The Schwab 1000 Index Fund Investor Shares returned 15.84% for the period, slightly underperforming its benchmark, the Schwab 1000 Index, which gained 16.26%. Bear in mind that indices are unmanaged and unlike the fund, do not include operational and transaction costs. The Schwab 1000 Index is comprised of the stocks of the largest 1000 publicly traded companies in the United States. The Index is market-capitalization weighted, and therefore, its returns are most heavily influenced by the largest names in the index. Sectors that performed well for the period included Telecommunication Services and Materials, while Health Care and Information Technology appreciated the least. From an industry group perspective, Diversified Telecommunication Services and Metals and Mining were among the top performers, while Diversified Consumer Services produced negative returns. Top performing stocks included such names as Exxon Mobil Corp. and Bank of America Corp. Exxon Mobil’s stock continued to climb throughout the year as net income continued to rise, propelled by increased production and discovery of new wells. On the downside, holdings in Yahoo!, Inc. and Dell, Inc. detracted from returns. |

| | | |

| As of 10/31/06: | | |

| Style Assessment1 | | |

| | |

Statistics |

| Number of Holdings | | 976 |

| Weighted Average Market Cap ($ x 1,000,000) | | 85,243 |

| Price/Earnings Ratio (P/E) | | 18.1 |

| Price/Book Ratio (P/B) | | 2.8 |

Sector Weightings % of Investments |

| Financials | | 23.0 | % |

| Information Technology | | 15.2 | % |

| Health Care | | 12.0 | % |

| Consumer Discretionary | | 11.5 | % |

| Consumer Staples | | 9.3 | % |

| Energy | | 8.8 | % |

| Utilities | | 3.3 | % |

| Telecommunication Services | | 3.2 | % |

| Materials | | 3.1 | % |

| Industrials | | 10.6 | % |

Total | | 100.0 | % |

Top Holdings % of Net Assets2 |

| Exxon Mobil Corp. | | 2.9 | % |

| General Electric Co. | | 2.4 | % |

| Microsoft Corp. | | 2.0 | % |

| Bank of America Corp. | | 1.7 | % |

| Citigroup, Inc. | | 1.7 | % |

| Procter & Gamble Co. | | 1.4 | % |

| Wal-Mart Stores, Inc. | | 1.3 | % |

| Johnson & Johnson | | 1.3 | % |

| Pfizer, Inc. | | 1.3 | % |

| American International Group, Inc. | | 1.2 | % |

Total | | 17.2 | % |

Manager views and portfolio holdings may have changed since the report date.

Source of Sector Classification: S&P and MSCI.

1Source: Morningstar, Inc. This style assessment is the result of evaluating the fund based on a ten-factor model for value and growth characteristics. The fund’s market capitalization placement is determined by the geometric mean of its holdings’ market capitalizations. The assessment reflects the fund’s portfolio as of 10/31/06, which may have changed since then, and is not a precise indication of risk or performance — past, present, or future.

2This list is not a recommendation of any security by the investment adviser.

10 Schwab Equity Index Funds

Schwab 1000 Index Fund

Performance Summary as of 10/31/06

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visit www.schwab.com/schwabfunds.

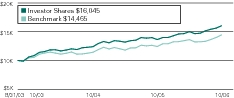

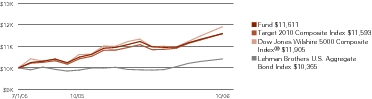

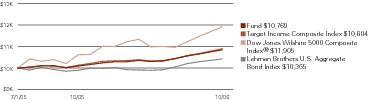

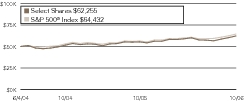

Performance of a Hypothetical

$10,000 Investment in Investor Shares1 | | Performance of a Hypothetical

$50,000 Investment in Select Shares1 |

| | |

Pre-Tax Average Annual Total Returns1,2 |

Fund Class and Inception Date | | 1 Year | | 5 Years | | 10 Years | | Since Inception |

| Investor Shares (4/2/91) | | | 15.84 | % | | | 7.70 | % | | | 8.64 | % | | n/a |

| Select Shares® (5/19/97) | | | 16.01 | % | | | 7.85 | % | | | n/a | | | 7.48% |

| |

| Benchmark: Schwab 1000® Index | | | 16.26 | % | | | 8.06 | % | | | 8.99 | % | | (5/19/97) 7.69% |

| |

| Fund Category: Morningstar Large-Cap Blend | | | 14.74 | % | | | 6.82 | % | | | 7.76 | % | | (5/19/97) 6.63% |

| | | | | | | | | | | | | | | |

Average Annual Total Returns After Tax1,2 |

Fund Class and Inception Date | | 1 Year | | 5 Years | | 10 Years | | Since Inception |

Investor Shares (4/2/91) | | | | | | | | | | | | | | | | |

| Pre-Liquidation (still own shares) | | | 15.63 | % | | | 7.30 | % | | | 8.25 | % | | n/a |

| Post-Liquidation (shares were sold) | | | 10.54 | % | | | 6.42 | % | | | 7.41 | % | | n/a |

| |

Select Shares® (5/19/97) | | | | | | | | | | | | | | | | |

| Pre-Liquidation (still own shares) | | | 15.77 | % | | | 7.40 | % | | | n/a | | | 7.08% |

| Post-Liquidation (shares were sold) | | | 10.68 | % | | | 6.52 | % | | | n/a | | | 6.33% |

| |

Fund Category: Morningstar Large-Cap Blend | | | | | | | | | | | | | | | | |

| Pre-Liquidation (still own shares) | | | 6.56 | % | | | 5.96 | % | | | 6.25 | % | | n/a |

| Post-Liquidation (shares were sold) | | | 5.04 | % | | | 5.31 | % | | | 5.97 | % | | n/a |

All figures on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged, and you cannot invest in them directly. Performance results less than one year are not annualized.

1Fund expenses may have been partially absorbed by CSIM and Schwab. Without these reductions, the fund’s returns would have been lower.

2The pre-tax total return and the graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. After-tax returns are calculated using the highest historical individual federal marginal income tax rates in effect as of 10/31/06 and do not reflect the impact of state and local taxes or the alternative minimum tax. Actual returns depend on an investor’s situation and may differ from those shown. After-tax returns may not be relevant to investors who hold their fund shares through tax-deferred arrangements. Pre-liquidation after-tax returns reflect the tax effects of purchases and sales of securities within the fund portfolios and assume investors continue to hold fund shares at the end of the measurement periods. Post-liquidation figures assume investors sold fund shares at the end of the measurement periods and reflect both the effects of taxable distributions and any taxable gains or losses realized upon the sale of shares. Source for category information: Morningstar, Inc. Some funds in this category may not use tax-efficient strategies.

Schwab Equity Index Funds 11

Schwab Small-Cap Index Fund®

Larry Mano, (right) vice president and senior portfolio manager, is responsible for the co-management of the fund.

Tom Brown, (left) associate portfolio manager, is responsible for the dayto-day co-management of the fund. | | The Schwab Small-Cap Index Fund Investor Shares returned 17.62% for the report period, trailing its benchmark, the Schwab Small-Cap Index, which posted 17.94%. The Schwab Small-Cap Index is comprised of the stocks of the second- largest 1,000 publicly traded companies in the United States. The Index is market-capitalization weighted, and therefore, its returns are most heavily influenced by the largest names in the index. Bear in mind that indices are unmanaged and unlike the fund, do not include operational and transaction costs. Sectors such as Materials and Industrials lead performance, while Consumer Staples lagged in returns. Within the fund, Industrial Conglomerates and Marine industry groups contributed positively, while Distributors and Household Products produced negative returns for the period. Stocks such as Continental Airlines, Inc. and Veritas DGC, Inc. were among the top performers. One of the fund’s largest holdings, Veritas received a cash and stock offer to be purchased, which helped boost the company’s stock price. Conversely, positions in Chet Networks, Inc. and Openwave Systems, Inc. detracted from performance. |

| | | |

| As of 10/31/06: | | |

| Style Assessment1 | | |

| | |

Statistics |

| Number of Holdings | | 983 |

| Weighted Average Market Cap ($ x 1,000,000) | | 1,509 |

| Price/Earnings Ratio (P/E) | | 25.8 |

| Price/Book Ratio (P/B) | | 2.4 |

Sector Weightings % of Investments |

| Financials | | 21.6 | % |

| Consumer Discretionary | | 17.0 | % |

| Information Technology | | 16.0 | % |

| Industrials | | 14.5 | % |

| Health Care | | 9.4 | % |

| Energy | | 8.0 | % |

| Materials | | 5.0 | % |

| Utilities | | 3.6 | % |

| Consumer Staples | | 3.4 | % |

| Telecommunication Services | | 1.2 | % |

| Others | | 0.3 | % |

Total | | 100.0 | % |

Top Holdings % of Net Assets2 |

| Continental Airlines, Inc., Class B | | 0.3 | % |

| OfficeMax, Inc. | | 0.3 | % |

| Albermarie Corp. | | 0.2 | % |

| Steel Dynamics, Inc. | | 0.2 | % |

| Boardwalk Pipeline Partners L.P. | | 0.2 | % |

| Carpenter Technology Corp. | | 0.2 | % |

| Veritas DGC, Inc. | | 0.2 | % |

| Polycom, Inc. | | 0.2 | % |

| Holly Corp. | | 0.2 | % |

| Brookdale Senior Living, Inc. | | 0.2 | % |

Total | | 2.2 | % |

Manager views and portfolio holdings may have changed since the report date.

Source of Sector Classification: S&P and MSCI.

Small-company stocks are subject to greater volatility than other asset classes.

1Source: Morningstar, Inc. This style assessment is the result of evaluating the fund based on a ten-factor model for value and growth characteristics. The fund’s market capitalization placement is determined by the geometric mean of its holdings’ market capitalizations. The assessment reflects the fund’s portfolio as of 10/31/06, which may have changed since then, and is not a precise indication of risk or performance — past, present, or future.

2This list is not a recommendation of any security by the investment adviser.

12 Schwab Equity Index Funds

Schwab Small-Cap Index Fund

Performance Summary as of 10/31/06

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visit www.schwab.com/schwabfunds.

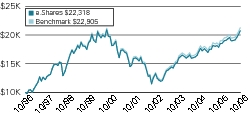

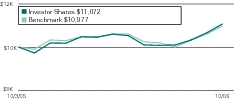

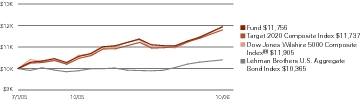

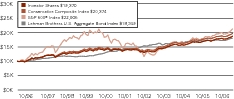

Performance of a Hypothetical

$10,000 Investment in Investor Shares1 | | Performance of a Hypothetical

$50,000 Investment in Select Shares1 |

| | |

| | |

Pre-Tax Average Annual Total Returns1,2 |

Fund Class and Inception Date | | 1 Year | | 5 Years | | 10 Years | | Since Inception |

| Investor Shares (12/3/93) | | | 17.62 | % | | | 11.79 | % | | | 9.60 | % | | n/a |

| Select Shares® (5/19/97) | | | 17.78 | % | | | 11.95 | % | | | n/a | | | 9.53% |

| |

| Benchmark: Schwab Small-Cap Index® | | | 17.94 | % | | | 11.98 | % | | | 10.37 | % | | (5/19/97) 10.06% |

| |

| Fund Category: Morningstar Small-Cap Blend | | | 16.35 | % | | | 13.54 | % | | | 11.03 | % | | (5/19/97) 10.57% |

| | | | | | | | | | | | | | | |

Average Annual Total Returns After Tax1,2 |

Fund Class and Inception Date | | 1 Year | | 5 Years | | 10 Years | | Since Inception |

Investor Shares (12/3/93) | | | | | | | | | | | | | | | | |

| Pre-Liquidation (still own shares) | | | 17.40 | % | | | 11.37 | % | | | 8.83 | % | | | n/a | |

| Post-Liquidation (shares were sold) | | | 11.69 | % | | | 10.07 | % | | | 8.07 | % | | | n/a | |

| |

Select Shares® (5/19/97) | | | | | | | | | | | | | | | | |

| Pre-Liquidation (still own shares) | | | 17.53 | % | | | 11.49 | % | | | n/a | | | | 8.69 | % |

| Post-Liquidation (shares were sold) | | | 11.83 | % | | | 10.19 | % | | | n/a | | | | 7.94 | % |

| |

Fund Category: Morningstar Large-Cap Blend | | | | | | | | | | | | | | | | |

| Pre-Liquidation (still own shares) | | | 4.38 | % | | | 12.39 | % | | | 8.66 | % | | | n/a | |

| Post-Liquidation (shares were sold) | | | 4.97 | % | | | 11.35 | % | | | 8.44 | % | | | n/a | |

All figures on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged, and you cannot invest in them directly. Performance results less than one year are not annualized.

1Fund expenses may have been partially absorbed by CSIM and Schwab. Without these reductions, the fund’s returns would have been lower.

2The pre-tax total return and the graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. After-tax returns are calculated using the highest historical individual federal marginal income tax rates in effect as of 10/31/06 and do not reflect the impact of state and local taxes or the alternative minimum tax. Actual returns depend on an investor’s situation and may differ from those shown. After-tax returns may not be relevant to investors who hold their fund shares through tax-deferred arrangements. Pre-liquidation after-tax returns reflect the tax effects of purchases and sales of securities within the fund portfolios and assume investors continue to hold fund shares at the end of the measurement periods. Post-liquidation figures assume investors sold fund shares at the end of the measurement periods and reflect both the effects of taxable distributions and any taxable gains or losses realized upon the sale of shares. Source for category information: Morningstar, Inc. Some funds in this category may not use tax-efficient strategies, including this fund.

Schwab Equity Index Funds 13

Schwab Total Stock Market Index Fund®

Larry Mano, vice president and senior portfolio manager, is responsible for the co-management of the fund. | | The Schwab Total Stock Market Index Fund Investor Shares returned 16.05% during the one-year period, tracking its benchmark, the Dow Jones Wilshire 5000 Composite Index, which was up 16.61%. The Dow Jones Wilshire 5000 Composite Index includes all publicly traded stocks of companies headquartered in the United States for which pricing information is readily available, currently more than 7,000 stocks. Bear in mind that indices are unmanaged and unlike the fund, do not include operational and transaction costs. Sectors that provided positive returns included Telecommunication Services and Materials, while on the downside, Health Care and Consumer Staples trailed. Within the Fund, industry groups that performed well were Diversified Telecommunication Services and Metals and Mining. Conversely, underperformers included Distributors and Diversified Consumer Services. From a stock perspective, Exxon Mobil Corp. and Bank of America Corp. weighed in as top contributors in the fund. Although many banks are experiencing narrower profit margins as a result of the inverted yield curve, Bank of America Corp. stock continued to rise throughout the year. Conversely, stocks like Yahoo!, Inc. and Dell, Inc. detracted from returns. |

| | | |

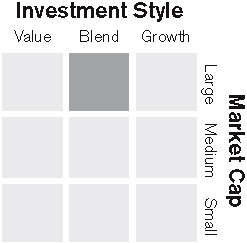

| As of 10/31/06: | | |

| Style Assessment1 | | |

| | |

Statistics |

| Number of Holdings | | 2,581 |

| Weighted Average Market Cap ($ x 1,000,000) | | 76,998 |

| Price/Earnings Ratio (P/E) | | 18.6 |

| Price/Book Ratio (P/B) | | 2.8 |

Sector Weightings % of Investments |

| Financials | | 22.8 | % |

| Information Technology | | 15.3 | % |

| Consumer Discretionary | | 12.3 | % |

| Health Care | | 11.8 | % |

| Industrials | | 11.0 | % |

| Consumer Staples | | 8.6 | % |

| Energy | | 8.6 | % |

| Utilities | | 3.4 | % |

| Materials Telecommunication | | 3.2 | % |

| Services | | 3.0 | % |

Total | | 100.0 | % |

Top Holdings % of Net Assets2 |

| Exxon Mobil Corp. | | 2.6 | % |

| General Electric Co. | | 2.1 | % |

| Microsoft Corp. | | 1.7 | % |

| Citigroup, Inc. | | 1.5 | % |

| Bank of America Corp. | | 1.5 | % |

| Procter & Gamble Co. | | 1.3 | % |

| Johnson & Johnson | | 1.2 | % |

| Pfizer, Inc. | | 1.2 | % |

| Wal-Mart Stores, Inc. | | 1.1 | % |

| American International Group, Inc. | | 1.1 | % |

Total | | 15.3 | % |

Manager views and portfolio holdings may have changed since the report date.

Source of Sector Classification: S&P and MSCI.

“Dow Jones”, “Wilshire”, “The DJW 5000SM”, “The Dow Jones Wilshire 5000SM” and “The Dow Jones Wilshire 5000 Composite IndexSM” are service marks of Dow Jones & Company, Inc. and Wilshire Associates Incorporated. The Schwab Total Stock Market Index Fund, based on The Dow Jones Wilshire 5000 Composite IndexSM, is not sponsored, endorsed, sold or promoted by Dow Jones or Wilshire; and, neither Dow Jones nor Wilshire makes any representation regarding the advisability of investing in such a product.

1Source: Morningstar, Inc. This style assessment is the result of evaluating the fund based on a ten-factor model for value and growth characteristics. The fund’s market capitalization placement is determined by the geometric mean of its holdings’ market capitalizations. The assessment reflects the fund’s portfolio as of 10/31/06, which may have changed since then, and is not a precise indication of risk or performance — past, present, or future.

2This list is not a recommendation of any security by the investment adviser.

14 Schwab Equity Index Funds

Schwab Total Stock Market Index Fund

Performance Summary as of 10/31/06

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visit www.schwab.com/schwabfunds.

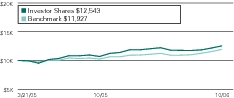

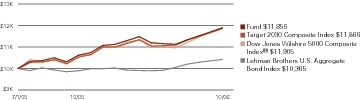

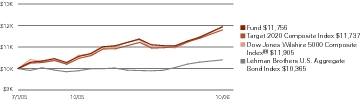

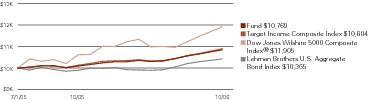

Performance of a Hypothetical

$10,000 Investment in Investor Shares1 | | Performance of a Hypothetical

$50,000 Investment in Select Shares1 |

| | |

| | | |

Pre-Tax Average Annual Total Returns1,2 |

Fund Class and Inception Date | | 1 Year | | 5 Years | | Since Inception |

| Investor Shares (6/1/99) | | | 16.05 | % | | | 8.64 | % | | | 3.29 | % |

| Select Shares® (6/1/99) | | | 16.23 | % | | | 8.80 | % | | | 3.45 | % |

| |

| Benchmark: Dow Jones Wilshire 5000 Composite® Index | | | 16.61 | % | | | 8.89 | % | | | 3.46 | % |

| |

| Fund Category: Morningstar Large-Cap Blend | | | 14.74 | % | | | 6.82 | % | | | 2.84 | % |

| | | | | | | | | | | | | |

Average Annual Total Returns After Tax1,2 |

Fund Class and Inception Date | | 1 Year | | 5 Years | | Since Inception |

Investor Shares (6/1/99) | | | | | | | | | | | | |

| Pre-Liquidation (still own shares) | | | 15.85 | % | | | 8.26 | % | | | 2.99 | % |

| Post-Liquidation (shares were sold) | | | 10.66 | % | | | 7.27 | % | | | 2.65 | % |

| |

Select Shares® (6/1/99) | | | | | | | | | | | | |

| Pre-Liquidation (still own shares) | | | 15.71 | % | | | 8.33 | % | | | 3.07 | % |

| Post-Liquidation (shares were sold) | | | 10.52 | % | | | 7.33 | % | | | 2.72 | % |

| |

Fund Category: Morningstar Large-Cap Blend | | | | | | | | | | | | |

| Pre-Liquidation (still own shares) | | | 6.56 | % | | | 5.96 | % | | | n/a | |

| Post-Liquidation (shares were sold) | | | 5.04 | % | | | 5.31 | % | | | n/a | |

All figures on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged, and you cannot invest in them directly. Performance results less than one year are not annualized.

1Fund expenses may have been partially absorbed by CSIM and Schwab. Without these reductions, the fund’s returns would have been lower.

2The pre-tax total return and the graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. After-tax returns are calculated using the highest historical individual federal marginal income tax rates in effect as of 10/31/06 and do not reflect the impact of state and local taxes or the alternative minimum tax. Actual returns depend on an investor’s situation and may differ from those shown. After-tax returns may not be relevant to investors who hold their fund shares through tax-deferred arrangements. Pre-liquidation after-tax returns reflect the tax effects of purchases and sales of securities within the fund portfolios and assume investors continue to hold fund shares at the end of the measurement periods. Post-liquidation figures assume investors sold fund shares at the end of the measurement periods and reflect both the effects of taxable distributions and any taxable gains or losses realized upon the sale of shares. Source for category information: Morningstar, Inc. Some funds in this category may not use tax-efficient strategies.

Schwab Equity Index Funds 15

Schwab International Index Fund®

Larry Mano, (right) vice president and senior portfolio manager, is responsible for the co-management of the fund.

Tom Brown, (left) associate portfolio manager, is responsible for the dayto-day co-management of the fund. | | The Schwab International Index Fund Investor Shares returned an 26.15% for the one-year period, closely tracking its benchmark, the Schwab International Index, which returned 26.76%. The Index is market-capitalization weighted and therefore, its returns are most heavily influenced by the largest names in the Index. Bear in mind that indices are unmanaged and unlike the fund, do not include operational and transaction costs. The Schwab International Index is comprised of stocks of 350 of the largest publicly traded companies stocks within 21 developed countries. Within the Fund, United Kingdom and Japan were the top contributors to total return, while Austria and Portugal were on the bottom end of the return scale. Sectors that performed well during the period included Financials and Materials. On the downside, Information Technology and Telecommunications Services appreciated the least. From an individual stock standpoint, HSBC Holdings plc and UBS AG were among the top contributors to returns. Conversely, stocks such as NTT DoCoMo, Inc. and Vodafone Group PLC, both wireless telecommunication services, detracted from overall returns. |

| | | |

| As of 10/31/06: | | |

| Style Assessment1 | | |

| | |

Country Weightings % of Investments |

| United Kingdom | | 24.4 | % | | Spain | | | 4.7 | % |

| Japan | | 18.9 | % | | Australia | | | 4.3 | % |

| France | | 10.3 | % | | Netherlands | | | 4.1 | % |

| Germany | | 7.6 | % | | Italy | | | 3.3 | % |

| Switzerland | | 7.6 | % | | Other | | | 8.1 | % |

| Canada | | 6.7 | % | | Total | | | 100.0 | % |

Statistics |

| Number of Holdings | | 347 |

| Weighted Average Market Cap ($ x 1,000,000) | | 69,079 |

| Price/Earnings Ratio (P/E) | | 15.8 |

| Price/Book Ratio (P/B) | | 2.4 |

Sector Weightings % of Investments |

| Financials | | 34.5 | % |

| Energy | | 10.3 | % |

| Consumer Discretionary | | 9.0 | % |

| Consumer Staples | | 7.6 | % |

| Materials | | 7.4 | % |

| Health Care | | 7.4 | % |

| Telecommunication Services | | 6.3 | % |

| Industrials | | 6.3 | % |

| Utilities | | 5.8 | % |

| Information Technology | | 4.8 | % |

| Other | | 0.6 | % |

Total | | 100.0 | % |

Top Holdings % of Net Assets2 |

| BP plc | | 2.2 | % |

| HSBC Holdings plc | | 2.1 | % |

| Total SA | | 1.6 | % |

| Novartis AG — Reg’d. | | 1.6 | % |

| Royal Dutch Shell plc, Class A | | 1.6 | % |

| Toyota Motor Corp. | | 1.6 | % |

| GlaxoSmithKline plc | | 1.5 | % |

| Nestle S.A. | | 1.4 | % |

| Vodafone Group plc | | 1.3 | % |

| UBS AG | | 1.3 | % |

Total | | 16.2 | % |

Manager views and portfolio holdings may have changed since the report date.

Source of Sector Classification: S&P and MSCI.

Foreign securities can involve risks such as political and economic instability and currency risk.

1Source: Morningstar, Inc. This style assessment is the result of evaluating the fund based on a ten-factor model for value and growth characteristics. The fund’s market capitalization placement is determined by the geometric mean of its holdings’ market capitalizations. The assessment reflects the fund’s portfolio as of 10/31/06, which may have changed since then, and is not a precise indication of risk or performance — past, present, or future.

2This list is not a recommendation of any security by the investment adviser.

16 Schwab Equity Index Funds

Schwab International Index Fund

Performance Summary as of 10/31/06

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visit www.schwab.com/schwabfunds.

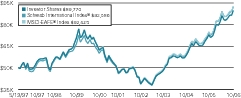

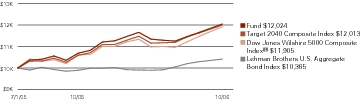

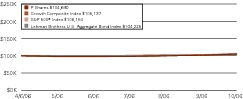

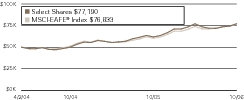

Performance of a Hypothetical

$10,000 Investment in Investor Shares1 | | Performance of a Hypothetical

$50,000 Investment in Select Shares1 |

| | |

| | | |

Pre-Tax Average Annual Total Returns1,2 |

Fund Class and Inception Date | | 1 Year | | 5 Years | | 10 Years | | Since Inception |

| Investor Shares (9/9/93) | | | 26.15 | % | | | 13.53 | % | | | 7.16 | % | | n/a |

| Select Shares® (5/19/97) | | | 26.35 | % | | | 13.70 | % | | | n/a | | | 6.39% |

| |

| Benchmark: Schwab International® Index | | | 26.76 | % | | | 14.21 | % | | | 7.66 | % | | (5/19/97) 6.74% |

| |

| Fund Category: Morningstar Foreign Large-Cap Blend | | | 26.31 | % | | | 12.90 | % | | | 7.29 | % | | (5/19/97) 6.05% |

| | | | | | | | | | | | | | | |

Average Annual Total Returns After Tax1,2 |

Fund Class and Inception Date | | 1 Year | | 5 Years | | 10 Years | | Since Inception |

Investor Shares (9/9/93) | | | | | | | | | | | | | | | | |

| Pre-Liquidation (still own shares) | | | 25.73 | % | | | 12.89 | % | | | 6.61 | % | | | n/a | |

| Post-Liquidation (shares were sold) | | | 17.31 | % | | | 11.43 | % | | | 5.93 | % | | | n/a | |

| |

Select Shares® (5/19/97) | | | | | | | | | | | | | | | | |

| Pre-Liquidation (still own shares) | | | 25.88 | % | | | 13.01 | % | | | n/a | | | | 5.83 | % |

| Post-Liquidation (shares were sold) | | | 17.47 | % | | | 11.55 | % | | | n/a | | | | 5.21 | % |

| |

Fund Category: Morningstar Foreign Large-Cap Blend | | | | | | | | | | | | | | | | |

| Pre-Liquidation (still own shares) | | | 15.10 | % | | | 11.98 | % | | | 5.48 | % | | | n/a | |

| Post-Liquidation (shares were sold) | | | 10.70 | % | | | 10.61 | % | | | 5.17 | % | | | n/a | |

All figures on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged, and you cannot invest in them directly. Performance results less than one year are not annualized.

1Fund expenses may have been partially absorbed by CSIM and Schwab. Without these reductions, the fund’s returns would have been lower.

2The pre-tax total return and the graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. After-tax returns are calculated using the highest historical individual federal marginal income tax rates in effect as of 10/31/06 and do not reflect the impact of state and local taxes or the alternative minimum tax. Actual returns depend on an investor’s situation and may differ from those shown. After-tax returns may not be relevant to investors who hold their fund shares through tax-deferred arrangements. Pre-liquidation after-tax returns reflect the tax effects of purchases and sales of securities within the fund portfolios and assume investors continue to hold fund shares at the end of the measurement periods. Post-liquidation figures assume investors sold fund shares at the end of the measurement periods and reflect both the effects of taxable distributions and any taxable gains or losses realized upon the sale of shares. Source for category information: Morningstar, Inc. Some funds in this category may not use tax-efficient strategies, including this fund.

Schwab Equity Index Funds 17

Fund Expenses (unaudited)

Examples for a $1,000 Investment |

As a fund shareholder, you incur two types of costs: transaction costs, such as redemption fees; and, ongoing costs, such as management fees, transfer agent and shareholder services fees, and other fund expenses.

The expense examples below are intended to help you understand your ongoing cost (in dollars) of investing in a fund and to compare this cost with the ongoing cost of investing in other mutual funds. These examples are based on an investment of $1,000 invested for six-months beginning May 1, 2006 and held through October 31, 2006.

Actual Return lines in the table below provide information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number given for your fund or share class under the heading entitled “Expenses Paid During Period.”

Hypothetical Return lines in the table below provide information about hypothetical account values and hypothetical expenses based on a fund’s or share class’ actual expense ratio and an assumed return of 5% per year before expenses. Because the return used is not an actual return, it may not be used to estimate the actual ending account value or expenses you paid for the period.

You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only, and do not reflect any transactional costs, such as redemption fees. If these transactional costs were included, your costs would have been higher.

|

| Expense Ratio1

(Annualized)

|

| Beginning

Account Value

at 5/1/06

|

|

Ending

Account Value

(Net of Expenses)

at 10/31/06

|

| Expenses Paid

During Period2

5/1/06–10/31/06

|

|---|

Schwab S&P 500 index Fund | | | | | | | | | | | | | | | | |

Investor Shares | | | | | | | | | | | | | | | | |

| Actual Return | | | 0.37 | % | | $ | 1,000 | | | $ | 1,059.70 | | | $ | 1.92 | |

| Hypothetical 5% Return | | | 0.37 | % | | $ | 1,000 | | | $ | 1,023.34 | | | $ | 1.89 | |

Select Shares® | | | | | | | | | | | | | | | | |

| Actual Return | | | 0.19 | % | | $ | 1,000 | | | $ | 1,060.50 | | | $ | 0.99 | |

| Hypothetical 5% Return | | | 0.19 | % | | $ | 1,000 | | | $ | 1,024.25 | | | $ | 0.97 | |

e.Shares® | | | | | | | | | | | | | | | | |

| Actual Return | | | 0.22 | % | | $ | 1,000 | | | $ | 1,060.20 | | | $ | 1.14 | |

| Hypothetical 5% Return | | | 0.22 | % | | $ | 1,000 | | | $ | 1,024.10 | | | $ | 1.12 | |

Schwab Institutional Select® | | | | | | | | | | | | | | | | |

S&P 500 Fund | | | | | | | | | | | | | | | | |

| Actual Return | | | 0.10 | % | | $ | 1,000 | | | $ | 1,061.80 | | | $ | 0.52 | |

| Hypothetical 5% Return | | | 0.10 | % | | $ | 1,000 | | | $ | 1,024.70 | | | $ | 0.51 | |

Schwab 1000 Index® Fund | | | | | | | | | | | | | | | | |

Investor Shares | | | | | | | | | | | | | | | | |

| Actual Return | | | 0.49 | % | | $ | 1,000 | | | $ | 1,055.10 | | | $ | 2.54 | |

| Hypothetical 5% Return | | | 0.49 | % | | $ | 1,000 | | | $ | 1,022.74 | | | $ | 2.50 | |

Select Shares | | | | | | | | | | | | | | | | |

| Actual Return | | | 0.34 | % | | $ | 1,000 | | | $ | 1,055.90 | | | $ | 1.76 | |

| Hypothetical 5% Return | | | 0.34 | % | | $ | 1,000 | | | $ | 1,023.49 | | | $ | 1.73 | |

Schwab Small-Cap Index Fund® | | | | | | | | | | | | | | | | |

Investor Shares | | | | | | | | | | | | | | | | |

| Actual Return | | | 0.58 | % | | $ | 1,000 | | | $ | 1,007.00 | | | $ | 2.93 | |

| Hypothetical 5% Return | | | 0.58 | % | | $ | 1,000 | | | $ | 1,022.30 | | | $ | 2.96 | |

Select Shares | | | | | | | | | | | | | | | | |

| Actual Return | | | 0.42 | % | | $ | 1,000 | | | $ | 1,007.80 | | | $ | 2.13 | |

| Hypothetical 5% Return | | | 0.42 | % | | $ | 1,000 | | | $ | 1,023.14 | | | $ | 2.14 | |

1 | | Based on the most recent six-month expense ratio; may differ from the expense ratio provided in Financial Highlights. |

2 | | Expenses for each fund or share class are equal to its annualized expense ratio, multiplied by the average account value over the period, multiplied by 184 days of the period, and divided by 365 days of the fiscal year. |

18 Schwab Equity Index Funds

Fund Expenses continued (unaudited)

|

| Expense Ratio1

(Annualized)

|

| Beginning

Account Value

at 5/1/06

|

|

Ending

Account Value

(Net of Expenses)

at 10/31/06

|

| Expenses Paid

During Period2

5/1/06–10/31/06

|

|---|

Schwab Total Stock Market Index Fund® | | | | | | | | | | | | | | | | |

Investor Shares | | | | | | | | | | | | | | | | |

| Actual Return | | | 0.54 | % | | $ | 1,000 | | | $ | 1,050.70 | | | $ | 2.79 | |

| Hypothetical 5% Return | | | 0.54 | % | | $ | 1,000 | | | $ | 1,022.48 | | | $ | 2.75 | |

Select Shares | | | | | | | | | | | | | | | | |

| Actual Return | | | 0.39 | % | | $ | 1,000 | | | $ | 1,051.50 | | | $ | 2.02 | |

| Hypothetical 5% Return | | | 0.39 | % | | $ | 1,000 | | | $ | 1,023.24 | | | $ | 1.99 | |

Schwab International Index Fund® | | | | | | | | | | | | | | | | |

Investor Shares | | | | | | | | | | | | | | | | |

| Actual Return | | | 0.69 | % | | $ | 1,000 | | | $ | 1,040.90 | | | $ | 3.55 | |

| Hypothetical 5% Return | | | 0.69 | % | | $ | 1,000 | | | $ | 1,021.73 | | | $ | 3.52 | |

Select Shares | | | | | | | | | | | | | | | | |

| Actual Return | | | 0.50 | % | | $ | 1,000 | | | $ | 1,041.90 | | | $ | 2.57 | |

| Hypothetical 5% Return | | | 0.50 | % | | $ | 1,000 | | | $ | 1,022.68 | | | $ | 2.55 | |

1 | | Based on the most recent six-month expense ratio; may differ from the expense ratio provided in Financial Highlights. |

2 | | Expenses for each fund or share class are equal to its annualized expense ratio, multiplied by the average account value over the period, multiplied by 184 days of the period, and divided by 365 days of the fiscal year. |

Schwab Equity Index Funds 19

Schwab S&P 500 Index Fund

Financial Statements

Financial Highlights

Investor Shares

| | | | 11/1/05—

10/31/06

| | 11/1/04—

10/31/05

| | 11/1/03—

10/31/04

| | 11/1/02—

10/31/03

| | 11/1/01—

10/31/02

|

|---|

Per-Share Data ($) | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value at beginning of period | | | | | 18.79 | | | | 17.61 | | | | 16.36 | | | | 13.79 | | | | 16.45 | |

Income or loss from investment operations:

| | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | | | 0.34 | | | | 0.34 | | | | 0.23 | | | | 0.20 | | | | 0.20 | |

| Net realized and unrealized gains or losses | | | | | 2.64 | | | | 1.14 | | | | 1.23 | | | | 2.57 | | | | (2.68 | ) |

| Total income or loss from investment operations | | | | | 2.98 | | | | 1.48 | | | | 1.46 | | | | 2.77 | | | | (2.48 | ) |

Less distributions:

| | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | | | (0.30 | ) | | | (0.30 | ) | | | (0.21 | ) | | | (0.20 | ) | | | (0.18 | ) |

| Net asset value at end of period | | | | | 21.47 | | | | 18.79 | | | | 17.61 | | | | 16.36 | | | | 13.79 | |

| Total return (%) | | | | | 16.03 | | | | 8.44 | | | | 9.03 | | | | 20.39 | | | | (15.32 | ) |

| |

Ratios/Supplemental Data (%) | | | | | | | | | | | | | | | | | | | | | | |

Ratios to average net assets:

| | | | | | | | | | | | | | | | | | | | | | |

| Net operating expenses | | | | | 0.36 | | | | 0.37 | | | | 0.37 | | | | 0.36 | | | | 0.35 | |

| Gross operating expenses | | | | | 0.36 | | | | 0.40 | | | | 0.45 | | | | 0.46 | | | | 0.46 | |

| Net investment income | | | | | 1.57 | | | | 1.74 | | | | 1.35 | | | | 1.45 | | | | 1.21 | |

| Portfolio turnover rate | | | | | 3 | | | | 4 | | | | 3 | | | | 3 | | | | 8 | |

| Net assets, end of period ($ x 1,000,000) | | | | | 3,685 | | | | 3,666 | | | | 3,849 | | | | 3,510 | | | | 2,760 | |

20 See financial notes.

Schwab S&P 500 Index Fund

Financial Highlights continued

Select Shares

| | | | 11/1/05—

10/31/06

| | 11/1/04—

10/31/05

| | 11/1/03—

10/31/04

| | 11/1/02—

10/31/03

| | 11/1/01—

10/31/02

|

|---|

Per-Share Data ($) | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value at beginning of period | | | | | 18.88 | | | | 17.68 | | | | 16.41 | | | | 13.83 | | | | 16.50 | |

Income or loss from investment operations:

| | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | | | 0.37 | | | | 0.36 | | | | 0.26 | | | | 0.24 | | | | 0.22 | |

| Net realized and unrealized gains or losses | | | | | 2.65 | | | | 1.16 | | | | 1.24 | | | | 2.57 | | | | (2.69 | ) |

| Total income or loss from investment operations | | | | | 3.02 | | | | 1.52 | | | | 1.50 | | | | 2.81 | | | | (2.47 | ) |

Less distributions:

| | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | | | (0.34 | ) | | | (0.32 | ) | | | (0.23 | ) | | | (0.23 | ) | | | (0.20 | ) |

| Net asset value at end of period | | | | | 21.56 | | | | 18.88 | | | | 17.68 | | | | 16.41 | | | | 13.83 | |

| Total return (%) | | | | | 16.18 | | | | 8.66 | | | | 9.25 | | | | 20.62 | | | | (15.20 | ) |

| |

Ratios/Supplemental Data (%) | | | | | | | | | | | | | | | | | | | | | | |

Ratios to average net assets:

| | | | | | | | | | | | | | | | | | | | | | |

| Net operating expenses | | | | | 0.19 | | | | 0.19 | | | | 0.19 | | | | 0.19 | | | | 0.19 | |

| Gross operating expenses | | | | | 0.21 | | | | 0.25 | | | | 0.30 | | | | 0.31 | | | | 0.31 | |

| Net investment income | | | | | 1.74 | | | | 1.92 | | | | 1.53 | | | | 1.63 | | | | 1.37 | |

| Portfolio turnover rate | | | | | 3 | | | | 4 | | | | 3 | | | | 3 | | | | 8 | |

| Net assets, end of period ($ x 1,000,000) | | | | | 4,038 | | | | 3,938 | | | | 4,119 | | | | 3,692 | | | | 3,029 | |

See financial notes. 21

Schwab S&P 500 Index Fund

Financial Highlights continued

e.Shares

| | | | 11/1/05—

10/31/06

| | 11/1/04—

10/31/05

| | 11/1/03—

10/31/04

| | 11/1/02—

10/31/03

| | 11/1/01—

10/31/02

|

|---|

Per-Share Data ($) | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value at beginning of period | | | | | 18.81 | | | | 17.62 | | | | 16.37 | | | | 13.79 | | | | 16.46 | |

Income or loss from investment operations:

| | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | | | 0.35 | | | | 0.39 | | | | 0.26 | | | | 0.23 | | | | 0.23 | |

| Net realized and unrealized gains or losses | | | | | 2.67 | | | | 1.11 | | | | 1.21 | | | | 2.56 | | | | (2.71 | ) |

| Total income or loss from investment operations | | | | | 3.02 | | | | 1.50 | | | | 1.47 | | | | 2.79 | | | | (2.48 | ) |

Less distributions:

| | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | | | (0.33 | ) | | | (0.31 | ) | | | (0.22 | ) | | | (0.21 | ) | | | (0.19 | ) |

| Net asset value at end of period | | | | | 21.50 | | | | 18.81 | | | | 17.62 | | | | 16.37 | | | | 13.79 | |

| Total return (%) | | | | | 16.25 | | | | 8.58 | | | | 9.10 | | | | 20.55 | | | | (15.32 | ) |

| |

Ratios/Supplemental Data (%) | | | | | | | | | | | | | | | | | | | | | | |

Ratios to average net assets:

| | | | | | | | | | | | | | | | | | | | | | |

| Net operating expenses | | | | | 0.21 | | | | 0.24 | | | | 0.28 | | | | 0.28 | | | | 0.28 | |

| Gross operating expenses | | | | | 0.21 | | | | 0.25 | | | | 0.30 | | | | 0.31 | | | | 0.31 | |

| Net investment income | | | | | 1.72 | | | | 1.88 | | | | 1.44 | | | | 1.54 | | | | 1.28 | |

| Portfolio turnover rate | | | | | 3 | | | | 4 | | | | 3 | | | | 3 | | | | 8 | |

| Net assets, end of period ($ x 1,000,000) | | | | | 241 | | | | 220 | | | | 249 | | | | 246 | | | | 220 | |

22 See financial notes.

Schwab S&P 500 Index Fund

Portfolio Holdings as of October 31, 2006

This section shows the fund’s 50 largest portfolio holdings in unaffiliated issuers and any holdings exceeding 1% of the fund’s total net assets as of the report date. The remaining securities held by the fund are grouped as “Other Securities” in each category. You can request a complete schedule of portfolio holdings as of the report date, free of charge, by calling Schwab Funds® at 1-800-435-4000. This complete schedule, filed on the fund’s Form N-CSR, is also available on the SEC’s website at http://www.sec.gov.

In addition, the fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available on the SEC’s website and may be viewed and copied at the SEC’s Public Reference Room in Washington, D.C. Call 1-800-SEC-0330 for information on the operation of the Public Reference Room. A copy of the fund’s most recently filed quarterly schedule of portfolio holdings, included on the fund’s Form N-CSR (with respect to the fund’s second and fourth fiscal quarters) or Form N-Q (with respect to the fund’s first and third fiscal quarters), is available by visiting Schwab’s website at www.schwab.com/schwabfunds.

Holdings by Category

|

| Cost

($ x 1,000)

|

| Value

($ x 1,000)

|

|---|

| 99.9% | | | | Common Stock | | | 5,588,418 | | | | 7,950,692 | |

| 0.1% | | | | Short-Term Investment | | | 8,212 | | | | 8,212 | |

| —% | | | | U.S. Treasury Obligation | | | 2,983 | | | | 2,983 | |

| 100.0% | | | | Total Investments | | | 5,599,613 | | | | 7,961,887 | |

| 1.6% | | | | Collateral Invested for Securities on Loan | | | 128,448 | | | | 128,448 | |

| (1.6)% | | | | Other Assets and Liabilities, Net | | | | | | | (125,539 | ) |

| 100.0% | | | | Net Assets | | | | | | | 7,964,796 | |

Security and Number of Shares

| | % of Net

Assets

| | Value

($ x 1,000)

|

|---|

Common Stock 99.9% of net assets |

Automobiles & Components 0.6% |

| Other Securities | | | | | 1,970,427 | | | | 0.6 | | | | 46,304 | |

Banks 5.7% |

| U.S. Bancorp | | | | | 1,139,832 | | | | 0.5 | | | | 38,572 | |

| Wachovia Corp. | | | | | 1,202,870 | | | | 0.8 | | | | 66,759 | |

| Wells Fargo & Co. | | | | | 2,151,676 | | | | 1.0 | | | | 78,084 | |

| Other Securities | | | | | 5,930,244 | | | | 3.4 | | | | 274,265 | |

| | | | | | | | | | 5.7 | | | | 457,680 | |

Capital Goods 8.5% |

| 3M Co. | | | | | 482,761 | | | | 0.5 | | | | 38,061 | |

General Electric Co. (b) | | | | | 6,641,667 | | | | 2.9 | | | | 233,189 | |

| The Boeing Co. | | | | | 512,990 | | | | 0.5 | | | | 40,967 | |

| Tyco International Ltd. | | | | | 1,304,215 | | | | 0.5 | | | | 38,383 | |

| United Technologies Corp. | | | | | 647,334 | | | | 0.5 | | | | 42,543 | |

| Other Securities | | | | | 4,837,222 | | | | 3.6 | | | | 285,365 | |

| | | | | | | | | | 8.5 | | | | 678,508 | |

Commercial Services & Supplies 0.6% |

| Other Securities | | | | | 1,175,319 | | | | 0.6 | | | | 44,497 | |

Consumer Durables & Apparel 1.2% |

| Other Securities | | | | | 2,253,790 | | | | 1.2 | | | | 93,606 | |

Consumer Services 1.8% |

| Other Securities | | | | | 3,661,042 | | | | 1.8 | | | | 143,622 | |

Diversified Financials 10.4% |

| American Express Co. | | | | | 795,834 | | | | 0.6 | | | | 46,007 | |

| Bank of America Corp. | | | | | 2,926,732 | | | | 2.0 | | | | 157,663 | |

| Citigroup, Inc. | | | | | 3,183,543 | | | | 2.0 | | | | 159,686 | |

| JPMorgan Chase & Co. | | | | | 2,236,116 | | | | 1.3 | | | | 106,081 | |

| Merrill Lynch & Co., Inc. | | | | | 570,290 | | | | 0.6 | | | | 49,855 | |

| Morgan Stanley | | | | | 685,848 | | | | 0.7 | | | | 52,419 | |

The Charles Schwab

Corp. (c) | | | | | 660,696 | | | | 0.2 | | | | 12,038 | |

The Goldman Sachs Group, Inc. (a) | | | | | 276,667 | | | | 0.7 | | | | 52,509 | |

| Other Securities | | | | | 3,291,125 | | | | 2.3 | | | | 191,456 | |

| | | | | | | | | | 10.4 | | | | 827,714 | |

Energy 9.4% |

| ChevronTexaco Corp. | | | | | 1,409,919 | | | | 1.2 | | | | 94,747 | |

| ConocoPhillips | | | | | 1,057,004 | | | | 0.8 | | | | 63,674 | |

Exxon Mobil Corp. (b) | | | | | 3,823,631 | | | | 3.4 | | | | 273,084 | |

| Schlumberger Ltd. | | | | | 755,559 | | | | 0.6 | | | | 47,661 | |

| Other Securities | | | | | 5,874,484 | | | | 3.4 | | | | 272,006 | |

| | | | | | | | | | 9.4 | | | | 751,172 | |

Food & Staples Retailing 2.3% |

| Wal-Mart Stores, Inc. | | | | | 1,582,493 | | | | 1.0 | | | | 77,985 | |

| Other Securities | | | | | 2,846,731 | | | | 1.3 | | | | 103,612 | |

| | | | | | | | | | 2.3 | | | | 181,597 | |