UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07704

Schwab Capital Trust – Target Index Funds

(Exact name of registrant as specified in charter)

211 Main Street, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Marie Chandoha

Schwab Capital Trust

211 Main Street, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 636-7000

Date of fiscal year end: March 31

Date of reporting period: March 31, 2017

Item 1: Report(s) to Shareholders.

Annual Report | March 31, 2017

Schwab Target Index Funds

Schwab Target 2010 Index Fund

Schwab Target 2015 Index Fund

Schwab Target 2020 Index Fund

Schwab Target 2025 Index Fund

Schwab Target 2030 Index Fund

Schwab Target 2035 Index Fund

Schwab Target 2040 Index Fund

Schwab Target 2045 Index Fund

Schwab Target 2050 Index Fund

Schwab Target 2055 Index Fund

Schwab Target 2060 Index Fund

This page is intentionally left blank.

Schwab Target Index Funds

Fund investment adviser: Charles Schwab Investment Management, Inc. (CSIM).

Distributor: Charles Schwab & Co., Inc. (Schwab).

Schwab Target Index Funds | Annual Report

Schwab Target Index Funds

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visit www.csimfunds.com.

| Total Returns From Inception (August 25, 2016) to March 31, 2017 |

| Schwab Target 2010 Index Fund | |

| Investor Shares (Ticker Symbol: SWXAX) | 2.26% |

| Institutional Shares (Ticker Symbol: SWYAX) | 2.26% |

| Target 2010 Passive Composite Index | 2.37% |

| Fund Category: Morningstar Target-Date 2000-2010 | 2.72% |

| Performance Details | pages 9-12 |

| |

| Schwab Target 2015 Index Fund | |

| Investor Shares (Ticker Symbol: SWXBX) | 2.48% |

| Institutional Shares (Ticker Symbol: SWYBX) | 2.49% |

| Target 2015 Passive Composite Index | 2.58% |

| Fund Category: Morningstar Target-Date 2015 | 3.22% |

| Performance Details | pages 13-16 |

| |

| Schwab Target 2020 Index Fund | |

| Investor Shares (Ticker Symbol: SWXCX) | 3.59% |

| Institutional Shares (Ticker Symbol: SWYLX) | 3.69% |

| Target 2020 Passive Composite Index | 3.68% |

| Fund Category: Morningstar Target-Date 2020 | 3.46% |

| Performance Details | pages 17-20 |

| |

| Schwab Target 2025 Index Fund | |

| Investor Shares (Ticker Symbol: SWXDX) | 4.81% |

| Institutional Shares (Ticker Symbol: SWYDX) | 4.82% |

| Target 2025 Passive Composite Index | 4.83% |

| Fund Category: Morningstar Target-Date 2025 | 4.56% |

| Performance Details | pages 21-24 |

| |

| Schwab Target 2030 Index Fund | |

| Investor Shares (Ticker Symbol: SWXEX) | 5.66% |

| Institutional Shares (Ticker Symbol: SWYEX) | 5.66% |

| Target 2030 Passive Composite Index | 5.70% |

| Fund Category: Morningstar Target-Date 2030 | 5.44% |

| Performance Details | pages 25-28 |

| |

| Schwab Target 2035 Index Fund | |

| Investor Shares (Ticker Symbol: SWXFX) | 6.33% |

| Institutional Shares (Ticker Symbol: SWYFX) | 6.44% |

| Target 2035 Passive Composite Index | 6.44% |

| Fund Category: Morningstar Target-Date 2035 | 6.46% |

| Performance Details | pages 29-32 |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indexes are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

The components that make up each of the composite indexes may vary over time. For index definitions, please see the Glossary.

Fund expenses may have been partially absorbed by CSIM and its affiliates. Without these reductions, a fund’s total return would have been lower. Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption of fund shares.

Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date.

Schwab Target Index Funds | Annual Report

Schwab Target Index Funds

Performance at a Glance (continued)

| Total Returns From Inception (August 25, 2016) to March 31, 2017 |

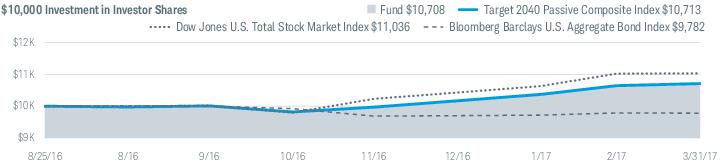

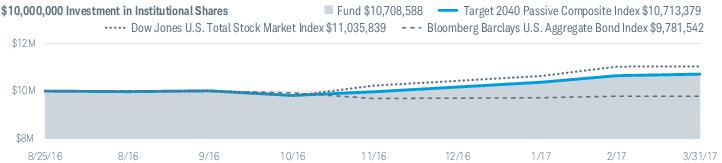

| Schwab Target 2040 Index Fund | |

| Investor Shares (Ticker Symbol: SWXGX) | 7.08% |

| Institutional Shares (Ticker Symbol: SWYGX) | 7.09% |

| Target 2040 Passive Composite Index | 7.13% |

| Fund Category: Morningstar Target-Date 2040 | 6.86% |

| Performance Details | pages 33-36 |

| |

| Schwab Target 2045 Index Fund | |

| Investor Shares (Ticker Symbol: SWXHX) | 7.50% |

| Institutional Shares (Ticker Symbol: SWYHX) | 7.51% |

| Target 2045 Passive Composite Index | 7.56% |

| Fund Category: Morningstar Target-Date 2045 | 7.36% |

| Performance Details | pages 37-40 |

| |

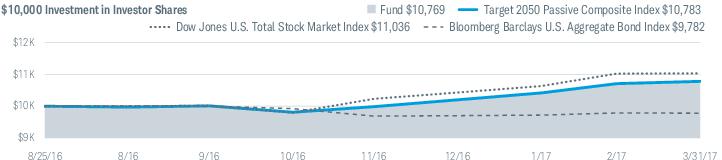

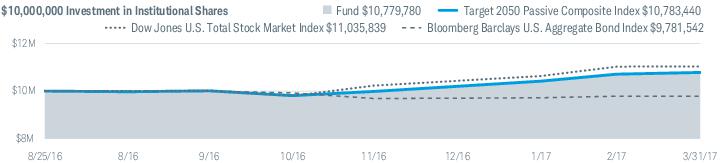

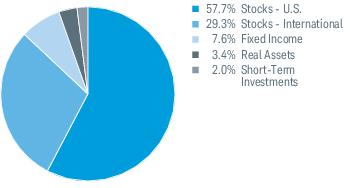

| Schwab Target 2050 Index Fund | |

| Investor Shares (Ticker Symbol: SWXIX) | 7.69% |

| Institutional Shares (Ticker Symbol: SWYMX) | 7.80% |

| Target 2050 Passive Composite Index | 7.83% |

| Fund Category: Morningstar Target-Date 2050 | 7.29% |

| Performance Details | pages 41-44 |

| |

| Schwab Target 2055 Index Fund | |

| Investor Shares (Ticker Symbol: SWXJX) | 8.02% |

| Institutional Shares (Ticker Symbol: SWYJX) | 8.03% |

| Target 2055 Passive Composite Index | 8.09% |

| Fund Category: Morningstar Target-Date 2055 | 7.58% |

| Performance Details | pages 45-48 |

| |

| Schwab Target 2060 Index Fund | |

| Investor Shares (Ticker Symbol: SWXKX) | 8.11% |

| Institutional Shares (Ticker Symbol: SWYNX) | 8.11% |

| Target 2060 Passive Composite Index | 8.16% |

| Fund Category: Morningstar Target-Date 2060+ | 7.78% |

| Performance Details | pages 49-52 |

| |

| Minimum Initial Investment1 | |

| Investor Shares | $ 100 |

| Institutional Shares | $10,000,000 |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indexes are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

The components that make up each of the composite indexes may vary over time. For index definitions, please see the Glossary.

Fund expenses may have been partially absorbed by CSIM and its affiliates. Without these reductions, a fund’s total return would have been lower. Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption of fund shares.

Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date.

| 1 | There is no minimum investment requirement for employer-sponsored retirement plans (including, but not limited to, profit sharing, 401(k), 403(b), 457(b) and defined benefit plans). Please see the funds' prospectus for further detail and eligibility requirements. |

Schwab Target Index Funds | Annual Report

Schwab Target Index Funds

Marie Chandoha

President and CEO of

Charles Schwab Investment

Management, Inc. and the

funds covered in this report.

Dear Shareholder,

As tax season wraps up, I’ve been reflecting on the importance of process in our financial lives. Filing taxes can be challenging for those who don’t have a sound approach for handling their returns, and investing is the same way: your goals can be easier to attain when you have a disciplined and deliberate plan that you follow. At Charles Schwab Investment Management, we believe the new Schwab Target Index Funds (the funds) can help with that process – and here’s how.

The funds can help investors stay anchored to their long-term plans and can remove impulses to buy or sell stocks or bonds during tumultuous market periods. Investors simply choose a fund based on their target retirement date, and we do the rest. The funds’ asset allocations are adjusted annually and follow a predetermined glide path, becoming more conservative as the target retirement date approaches. When developing the funds’ glide path, we use a series of factors to quantify investors’ risk tolerances, which helps us to identify appropriate market exposures at various ages. The funds all share a low-cost approach, made possible by the primary use of low-cost Schwab exchange-traded funds (ETFs) for the funds’ underlying investments. We believe the funds can help investors achieve their retirement goals by seeking to recognize and reduce risks along the way to retirement and beyond, and

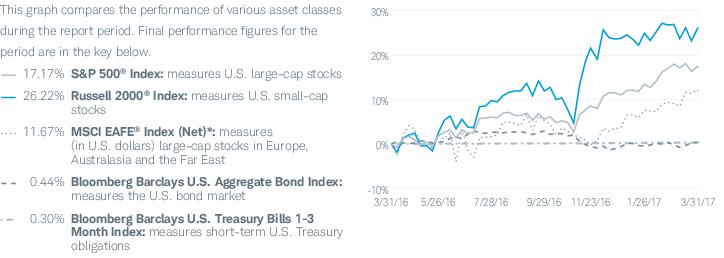

Asset Class Performance Comparison % returns during the 12 months ended 3/31/2017

Index figures assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Past performance is not an indication of future results.

For index definitions, please see the Glossary.

Data source: Index provider websites and CSIM.

Nothing in this report represents a recommendation of a security by the investment adviser.

Management views and portfolio holdings may have changed since the report date.

| * | The net version of the index reflects reinvested dividends net of withholding taxes, but reflects no deductions for expenses or other taxes. |

Schwab Target Index Funds | Annual Report

Schwab Target Index Funds

From the President (continued)

“ For the reporting period of the funds’ inception date of August 25, 2016 through March 31, 2017, the funds’ generated positive returns and tracked their respective indexes.”

we’re pleased that you have chosen the funds to include in your own investment portfolio in pursuit of your financial goals.

At Charles Schwab Investment Management, we also aim to deliver products with consistent performance, and the funds are just one example of our commitment to this goal. For the reporting period of the funds’ inception date of August 25, 2016 through March 31, 2017, the funds’ generated positive returns and tracked their respective indexes. The performance of the funds was marked by strong gains for equities and modest declines for U.S. bonds. Stocks rallied as investors focused on reflating economies around the globe, while bond prices fell in the face of rate hikes from the Federal Reserve and expectations for more in the coming months. In this environment, the longer-dated funds generated higher returns due to their larger allocation to equity ETFs.

Thank you for investing with Charles Schwab Investment Management, and for trusting us to help you achieve your financial goals. For more information about the funds, please continue reading this report. In addition, you can find further details about the funds by visiting our website at www.csimfunds.com. We are also happy to hear from you at 1-877-824-5615.

Sincerely,

Schwab Target Index Funds | Annual Report

Schwab Target Index Funds

The Investment Environment

Over the 12-month reporting period ended March 31, 2017, stock markets generated solid returns while U.S. bond yields rose and returns fell, ending the reporting period in slightly positive territory (bond yields and bond prices move in opposite directions). The Federal Reserve (Fed) raised short-term interest rates twice during the reporting period in December and again in March, while expectations for increased infrastructure spending, tax reform, and reduced regulation from the Trump administration helped fuel a post-election stock market rally. Internationally, concerns lessened around the state of China’s economy and the United Kingdom’s (U.K.) decision to leave the European Union (Brexit), and accommodative monetary policies contributed to improving overall global economic growth. Meanwhile, the U.S. dollar continued to strengthen against many major currencies over the reporting period, including the British pound and Mexican peso, generally reducing returns on investments from these countries in U.S. dollar terms. The S&P 500® Index, a bellwether for the overall U.S. stock market, returned 17.17%, and the MSCI EAFE Index (Net), a broad measure of developed international equity performance, returned 11.67% for the reporting period. In fixed income, the Bloomberg Barclays U.S. Aggregate Bond Index returned 0.44% over the same period.

U.S. short-term interest rates remained low over the reporting period, although the Fed took steps toward a more normalized interest rate environment. With unsteady global economic growth, low inflation, and room for improvement in the labor market, the Fed left the federal funds rate unchanged at each of its meetings through November. Then in December, with progress in several key economic measurements, the Fed raised short-term interest rates for only the second time in 10 years to a target range of 0.50% to 0.75%. As global growth continued to show signs of stability and labor market conditions strengthened, combined with an uptick in inflation, the Fed raised rates again in March by 0.25%. As both of these rate hikes were already priced into global equity markets, the response to these changes was muted. However, the Fed’s moves confirmed its confidence in the health and direction of the U.S. economy.

Outside the U.S., many central banks maintained or stepped up accommodative policy measures to spur economic growth and inflation. The European Central Bank (ECB) left its main interest rate at 0.00% and its deposit rate in negative territory. The ECB also extended its bond purchase program until at least December 2017 and announced it would loosen the restrictions on the types of bonds it can purchase. Meanwhile, facing a weakening growth outlook after Brexit, the Bank of England revived its government bond buying program and cut its main interest rate to an all-time low in August. In Asia, the Bank of Japan (BOJ) maintained its negative interest rate policy and expanded its asset-buying program. With these tools potentially reaching the limits of their effectiveness, the BOJ shifted focus in September and introduced yield curve management as a policy tool, targeting interest rates on government bonds to achieve its inflation goal. Stock markets in Europe and Japan rallied toward the end of the reporting period, suggesting that these monetary policies were beginning to achieve their intended results.

U.S. economic data was largely positive over the reporting period, especially toward the end of 2016 and in early 2017. Wage growth continued to trend upwards, and outside of a sharp drop in May, nonfarm payroll numbers came in near or above expectations. The unemployment rate fell to below 5% in May, and in November, dropped further to the lowest level since before the 2008 financial crisis. Consumer confidence, as measured by the Conference Board Consumer Confidence Index®, also grew over the reporting period, hitting a 16-year high in March amid post-election optimism for U.S. economic growth. Meanwhile, the consumer-price index, a broad measure of inflation, moved above 2% in early 2017 for the first time in over two years.

Most markets steadied over the reporting period, despite brief periods of volatility tied in part to political developments around the globe. The results of the Brexit referendum triggered a global stock selloff and sent the price of oil sharply downward, while the British pound depreciated significantly versus the U.S. dollar. Most markets stabilized in the days and weeks that followed, and concerns surrounding the future of the U.K. lessened in early 2017 as a feasible exit plan began to take shape. Meanwhile, U.S. election-related volatility picked up in the middle of the reporting period and through Election Day in early November, when U.S. equity futures dropped sharply soon after the election results were announced. Stock markets rebounded almost immediately the following day, however, and generally maintained an upward trajectory throughout the remainder of the reporting period. Expectations for new policies from the Trump administration supported a positive growth outlook, and contributed to the solid performance of both U.S. and international stock markets over the reporting period.

Schwab Target Index Funds | Annual Report

Schwab Target Index Funds

The Investment Environment (continued)

Global economic growth generally improved over the 12-month reporting period, due in part to accommodative central bank policies and rising oil and commodity prices. Economic activity in the eurozone slowed in the second quarter of 2016 and was flat in the third quarter, but surprisingly robust fourth quarter estimates indicated a turnaround for that region, driven by strong numbers from Germany, Spain, and France. At the same time, the U.K. economy specifically performed better than expected in the months following the Brexit vote with progress toward an exit plan, while the entire eurozone bloc had exited deflation by the end of January 2017. In Japan, economic growth accelerated and consumer prices fell at a slower pace, with inflation on track to hit the target of 2% in the next two years. Generally increasing oil and commodity prices supported a rebound in many oil-exporting emerging markets, including Russia and Brazil. The price of Brent crude oil (a global crude oil benchmark) rose from less than $40 per barrel in April 2016 to over $50 per barrel at the end of March 2017, providing a substantial tailwind for these countries. In China, despite slower economic growth in 2016 than in prior years, concerns lessened around this subdued pace as many economic indicators showed signs of strength toward the end of the reporting period.

Over the 12-month reporting period, U.S. bond yields generally rose but remained relatively low compared to long-term averages. Short-term yields climbed in response to both Fed interest rate increases in December and March. Meanwhile longer-term yields, which are generally influenced by economic growth and inflation expectations, rose after the U.S. presidential election in anticipation of changes in key economic policies. In this environment, the yield on the benchmark 10-year Treasury note began the reporting period at 1.79% and finished at 2.40%. Despite low bond yields in the U.S., negative interest rates and other central bank monetary policies resulted in even lower yields on many international government-backed securities, with some yielding below 0.00%.

Index figures assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized. Past performance is not an indication of future results.

For index definitions, please see the Glossary.

Nothing in this report represents a recommendation of a security by the investment adviser.

Management views may have changed since the report date.

Schwab Target Index Funds | Annual Report

Schwab Target Index Funds

| Zifan Tang, Ph.D., CFA, Managing Director and Senior Portfolio Manager, leads the portfolio management team and has overall responsibility for all aspects of the management of the funds. She has served as portfolio manager of the funds since their inception. Prior to joining CSIM in 2012, Ms. Tang was a product manager at Thomson Reuters and, from 1997 to 2009, worked as a portfolio manager at Barclays Global Investors, which was subsequently acquired by BlackRock. |

Schwab Target Index Funds | Annual Report

Schwab Target 2010 Index Fund

The Schwab Target 2010 Index Fund (the fund) seeks to provide capital appreciation and income consistent with its current asset allocation, and seeks to achieve its investment objective by investing primarily in affiliated Schwab exchange-traded funds (ETFs). The fund may also invest in affiliated Schwab and Laudus mutual funds and unaffiliated third party ETFs and mutual funds. The target asset allocation is adjusted annually based on the adviser’s asset allocation strategy; as of the annual adjustment at the end of January 2017, the fund’s asset allocation was approximately 37.1% equity securities, 55.9% fixed-income securities, and 7.1% cash and cash equivalents (including money market funds).1 (For portfolio allocations as of the end of this reporting period, please see the fund’s Portfolio Holdings included in this report.)

Market Highlights. Over the 12-month period, both international and U.S. equities generated solid returns, while U.S. bond yields rose and returns fell (bond yields and bond prices move in opposite directions). The Federal Reserve (Fed) raised short-term interest rates in both December and March amid steadily improving U.S. economic data and a slight uptick in inflation, and expectations for policy changes from the Trump administration contributed to a post-election stock market rally. Meanwhile, concerns lessened around global economic growth and potential fallout from the United Kingdom’s June vote to leave the European Union. Short-term bond yields rose after both Fed rate hikes, while longer-term yields rose after the U.S. presidential election as economic growth and inflation expectations grew.

Performance. For the period of fund inception (August 25, 2016) through March 31, 2017, the fund’s Investor Shares returned 2.26%. The fund’s internally calculated comparative index, the Target 2010 Passive Composite Index (the composite index), returned 2.37% for the same period.

Positioning and Strategies.2 The fund’s asset allocations were generally in line with those of the composite index over the reporting period.

The fund’s fixed-income allocation detracted from the fund’s total return over the reporting period. The fund’s intermediate-term bond holding, the Schwab U.S. Aggregate Bond ETF™, was the largest detractor from the fund’s total return. The Schwab U.S. Aggregate Bond ETF returned approximately -2.3%, while the Bloomberg Barclays U.S. Aggregate Bond Index, the composite index’s underlying intermediate-term bond component, returned -2.2% for the same period. The fund’s U.S. TIPS exposure, the Schwab US TIPS ETF™, also detracted from the total return of the fund, returning approximately -1% over the reporting period.

The fund’s real estate allocation was a small detractor from the fund’s total return and return relative to the composite index. The Schwab U.S. REIT ETF™ returned approximately -5.0% for the reporting period, slightly underperforming its comparative index, the Dow Jones U.S. Select REIT Index, which returned -4.8%.

The fund’s equity exposures provided the greatest contribution to total return, particularly from the fund’s U.S. large cap holding. The top contributor to the total return of the fund was the Schwab U.S. Large-Cap ETF™, which returned approximately 10.2% for the reporting period. The Schwab International Equity ETF™ also contributed notably. The Schwab International Equity ETF returned approximately 7.1%, slightly outperforming the composite index’s international equity component, the FTSE Developed ex US Index (Net), which returned 6.9% for the same period. The Schwab U.S. Small-Cap ETF™ also contributed to the fund’s total return, but detracted from the fund’s relative performance, as it slightly underperformed the composite index’s U.S. small cap component, the Dow Jones U.S. Small-Cap Total Stock Market Index.

Management views may have changed since the report date.

| 1 | Percentages may not equal 100% due to rounding. |

| 2 | ETF performance can be expressed on a market price or NAV basis. The returns cited in this section are Market Price Returns. The ETF’s per share NAV is the value of one share of the ETF. NAV is calculated by taking the ETF’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the ETF, and the Market Price Return is based on the market price per share of the ETF. The price used to calculate market return (Market Price) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which the shares of the ETF are listed for trading, as of the time that the ETF’s NAV is calculated. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the ETF at Market Price and NAV, respectively. |

Schwab Target Index Funds | Annual Report

Schwab Target 2010 Index Fund

Performance and Fund Facts as of 3/31/17

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visit www.csimfunds.com.

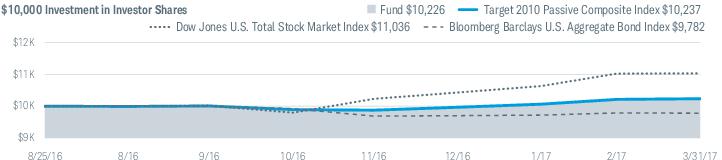

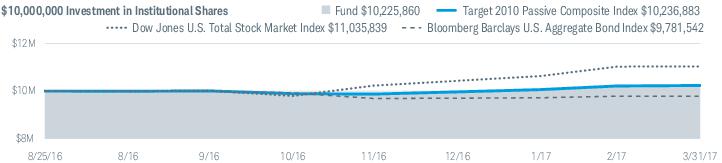

Performance of Hypothetical Investment (August 25, 2016 – March 31, 2017)1

| 1 | Fund expenses may have been partially absorbed by CSIM and its affiliates. Without these reductions, the fund's returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

Schwab Target Index Funds | Annual Report

Schwab Target 2010 Index Fund

Performance and Fund Facts as of 3/31/17 (continued)

| Class and Inception Date | Since Inception |

| Investor Shares (8/25/16) | 2.26% |

| Institutional Shares (8/25/16) | 2.26% |

| Target 2010 Passive Composite Index | 2.37% |

| Dow Jones U.S. Total Stock Market IndexSM | 10.36% |

| Bloomberg Barclays U.S. Aggregate Bond Index | -2.18% |

| Fund Category: Morningstar Target-Date 2000-20102 | 2.72% |

| Fund Expense Ratios3: Investor Shares: Net 0.13%; Gross 0.19% / Institutional Shares: Net 0.08%; Gross 0.14% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indexes are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

| 1 | Fund expenses may have been partially absorbed by CSIM and its affiliates. Without these reductions, the fund's returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| 2 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

| 3 | As stated in the prospectus. Includes expenses of the underlying funds in which the fund invests. The annualized weighted average expense ratio of the underlying funds was 0.06%. Net Expense: Expenses reduced by a contractual fee waiver in effect for so long as CSIM serves as the investment adviser to the fund. Gross Expense: Does not reflect the effect of contractual fee waivers. For actual ratios during the period, refer to the financial highlights section of the financial statements. |

Schwab Target Index Funds | Annual Report

Schwab Target 2010 Index Fund

Performance and Fund Facts as of 3/31/17 (continued)

| Number of Holdings | 10 |

| Portfolio Turnover Rate | 2% |

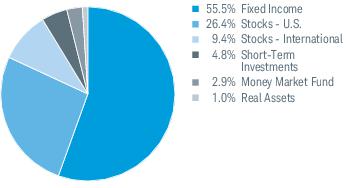

Asset Class Weightings % of Investments1

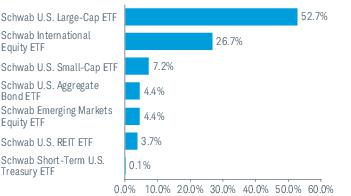

Top Holdings % of Net Assets2,3

Portfolio holdings may have changed since the report date.

| 1 | The fund intends to primarily invest in affiliated Schwab ETFs and may also invest in affiliated Schwab and Laudus mutual funds and unaffiliated third party ETFs and mutual funds (all such ETFs and mutual funds referred to as "underlying funds"). |

| 2 | This list is not a recommendation of any security by the investment adviser. |

| 3 | The holdings listed exclude any temporary liquidity investments. |

Schwab Target Index Funds | Annual Report

Schwab Target 2015 Index Fund

The Schwab Target 2015 Index Fund (the fund) seeks to provide capital appreciation and income consistent with its current asset allocation, and seeks to achieve its investment objective by investing primarily in affiliated Schwab exchange-traded funds (ETFs). The fund may also invest in affiliated Schwab and Laudus mutual funds and unaffiliated third party ETFs and mutual funds. The target asset allocation is adjusted annually based on the adviser’s asset allocation strategy; as of the annual adjustment at the end of January 2017, the fund’s asset allocation was approximately 39.3% equity securities, 54.0% fixed-income securities, and 6.7% cash and cash equivalents (including money market funds). (For portfolio allocations as of the end of this reporting period, please see the fund’s Portfolio Holdings included in this report.)

Market Highlights. Over the 12-month period, both international and U.S. equities generated solid returns, while U.S. bond yields rose and returns fell (bond yields and bond prices move in opposite directions). The Federal Reserve (Fed) raised short-term interest rates in both December and March amid steadily improving U.S. economic data and a slight uptick in inflation, and expectations for policy changes from the Trump administration contributed to a post-election stock market rally. Meanwhile, concerns lessened around global economic growth and potential fallout from the United Kingdom’s June vote to leave the European Union. Short-term bond yields rose after both Fed rate hikes, while longer-term yields rose after the U.S. presidential election as economic growth and inflation expectations grew.

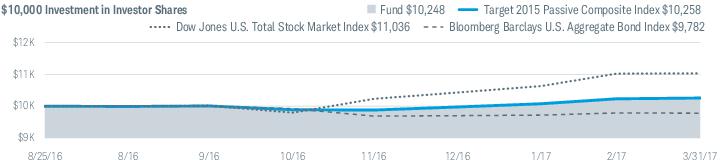

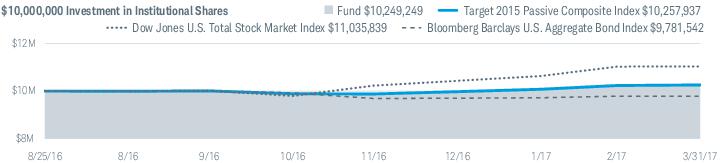

Performance. For the period of fund inception (August 25, 2016) through March 31, 2017, the fund’s Investor Shares returned 2.48%. The fund’s internally calculated comparative index, the Target 2015 Passive Composite Index (the composite index), returned 2.58% for the same period.

Positioning and Strategies.1 The fund’s asset allocations were broadly in line with those of the composite index over the reporting period.

The fund’s fixed-income allocation detracted from the fund’s total return over the reporting period. The fund’s intermediate-term bond holding, the Schwab U.S. Aggregate Bond ETF™, was the largest detractor from the fund’s total return. The Schwab U.S. Aggregate Bond ETF returned approximately -2.3%, while the Bloomberg Barclays U.S. Aggregate Bond Index, the composite index’s underlying intermediate-term bond component, returned -2.2% for the same period. The fund’s U.S. TIPS exposure, the Schwab US TIPS ETF™, also detracted from the total return of the fund, returning approximately -1% over the reporting period.

The fund’s real estate allocation was a small detractor from the fund’s total return and return relative to the composite index. The Schwab U.S. REIT ETF™ returned approximately -5.0% for the reporting period, slightly underperforming its comparative index, the Dow Jones U.S. Select REIT Index, which returned -4.8%.

The fund’s equity exposures provided the greatest contribution to total return, particularly from the fund’s U.S. large cap holding. The top contributor to the total return of the fund was the Schwab U.S. Large-Cap ETF™, which returned approximately 10.2% for the reporting period. The Schwab International Equity ETF™ also contributed notably. The Schwab International Equity ETF returned approximately 7.1%, slightly outperforming the composite index’s international equity component, the FTSE Developed ex US Index (Net), which returned 6.9% for the same period. The Schwab U.S. Small-Cap ETF™ also contributed to the fund’s total return, but detracted from the fund’s relative performance, as it slightly underperformed the composite index’s U.S. small cap component, the Dow Jones U.S. Small-Cap Total Stock Market Index.

Management views may have changed since the report date.

| 1 | ETF performance can be expressed on a market price or NAV basis. The returns cited in this section are Market Price Returns. The ETF’s per share NAV is the value of one share of the ETF. NAV is calculated by taking the ETF’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the ETF, and the Market Price Return is based on the market price per share of the ETF. The price used to calculate market return (Market Price) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which the shares of the ETF are listed for trading, as of the time that the ETF’s NAV is calculated. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the ETF at Market Price and NAV, respectively. |

Schwab Target Index Funds | Annual Report

Schwab Target 2015 Index Fund

Performance and Fund Facts as of 3/31/17

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visit www.csimfunds.com.

Performance of Hypothetical Investment (August 25, 2016 – March 31, 2017)1

| 1 | Fund expenses may have been partially absorbed by CSIM and its affiliates. Without these reductions, the fund's returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

Schwab Target Index Funds | Annual Report

Schwab Target 2015 Index Fund

Performance and Fund Facts as of 3/31/17 (continued)

| Class and Inception Date | Since Inception |

| Investor Shares (8/25/16) | 2.48% 2 |

| Institutional Shares (8/25/16) | 2.49% |

| Target 2015 Passive Composite Index | 2.58% |

| Dow Jones U.S. Total Stock Market IndexSM | 10.36% |

| Bloomberg Barclays U.S. Aggregate Bond Index | -2.18% |

| Fund Category: Morningstar Target-Date 20153 | 3.22% |

| Fund Expense Ratios4: Investor Shares: Net 0.13%; Gross 0.19% / Institutional Shares: Net 0.08%; Gross 0.14% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indexes are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

| 1 | Fund expenses may have been partially absorbed by CSIM and its affiliates. Without these reductions, the fund's returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| 2 | Total return for the report period presented in the table differs from the return in the Financial Highlights. The total return presented in the above table is calculated based on the net asset value (NAV) at which shareholder transactions were processed. The total return presented in the Financial Highlights section of the report is calculated in the same manner, but also takes into account certain adjustments that are necessary under generally accepted accounting principles required in the annual and semiannual reports. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

| 4 | As stated in the prospectus. Includes expenses of the underlying funds in which the fund invests. The annualized weighted average expense ratio of the underlying funds was 0.06%. Net Expense: Expenses reduced by a contractual fee waiver in effect for so long as CSIM serves as the investment adviser to the fund. Gross Expense: Does not reflect the effect of contractual fee waivers. For actual ratios during the period, refer to the financial highlights section of the financial statements. |

Schwab Target Index Funds | Annual Report

Schwab Target 2015 Index Fund

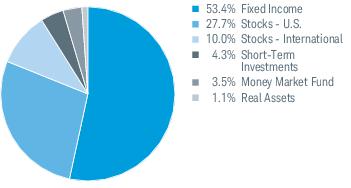

Performance and Fund Facts as of 3/31/17 (continued)

| Number of Holdings | 10 |

| Portfolio Turnover Rate | 15% |

Asset Class Weightings % of Investments1

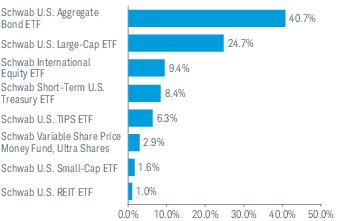

Top Holdings % of Net Assets2,3

Portfolio holdings may have changed since the report date.

| 1 | The fund intends to primarily invest in affiliated Schwab ETFs and may also invest in affiliated Schwab and Laudus mutual funds and unaffiliated third party ETFs and mutual funds (all such ETFs and mutual funds referred to as "underlying funds"). |

| 2 | This list is not a recommendation of any security by the investment adviser. |

| 3 | The holdings listed exclude any temporary liquidity investments. |

Schwab Target Index Funds | Annual Report

Schwab Target 2020 Index Fund

The Schwab Target 2020 Index Fund (the fund) seeks to provide capital appreciation and income consistent with its current asset allocation, and seeks to achieve its investment objective by investing primarily in affiliated Schwab exchange-traded funds (ETFs). The fund may also invest in affiliated Schwab and Laudus mutual funds and unaffiliated third party ETFs and mutual funds. The target asset allocation is adjusted annually based on the adviser’s asset allocation strategy; as of the annual adjustment at the end of January 2017, the fund’s asset allocation was approximately 49.2% equity securities, 45.4% fixed-income securities, and 5.4% cash and cash equivalents (including money market funds). (For portfolio allocations as of the end of this reporting period, please see the fund’s Portfolio Holdings included in this report.)

Market Highlights. Over the 12-month period, both international and U.S. equities generated solid returns, while U.S. bond yields rose and returns fell (bond yields and bond prices move in opposite directions). The Federal Reserve (Fed) raised short-term interest rates in both December and March amid steadily improving U.S. economic data and a slight uptick in inflation, and expectations for policy changes from the Trump administration contributed to a post-election stock market rally. Meanwhile, concerns lessened around global economic growth and potential fallout from the United Kingdom’s June vote to leave the European Union. Short-term bond yields rose after both Fed rate hikes, while longer-term yields rose after the U.S. presidential election as economic growth and inflation expectations grew.

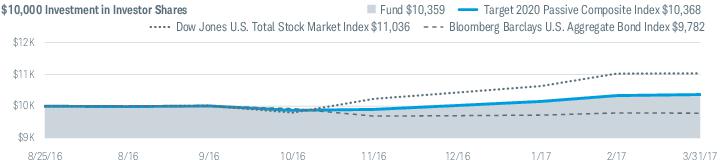

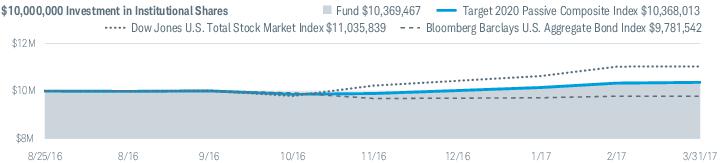

Performance. For the period of fund inception (August 25, 2016) through March 31, 2017, the fund’s Investor Shares returned 3.59%. The fund’s internally calculated comparative index, the Target 2020 Passive Composite Index (the composite index), returned 3.68% for the same period.

Positioning and Strategies.1 The fund’s asset allocations were generally in line with those of the composite index over the reporting period.

The fund’s fixed-income allocation detracted from the fund’s total return over the reporting period. The fund’s intermediate-term bond holding, the Schwab U.S. Aggregate Bond ETF™, was the largest detractor from the fund’s total return. The Schwab U.S. Aggregate Bond ETF returned approximately -2.3%, while the Bloomberg Barclays U.S. Aggregate Bond Index, the composite index’s underlying intermediate-term bond component, returned -2.2% for the same period. The fund’s U.S. TIPS exposure, the Schwab US TIPS ETF™, also detracted from the total return of the fund, returning approximately -1% over the reporting period.

The fund’s real estate allocation was another detractor from the fund’s total return and return relative to the composite index. The Schwab U.S. REIT ETF™ returned approximately -5.0% for the reporting period, slightly underperforming its comparative index, the Dow Jones U.S. Select REIT Index, which returned -4.8%.

The fund’s equity exposures provided the greatest contribution to total return, particularly from the fund’s U.S. large cap holding. The top contributor to the total return of the fund was the Schwab U.S. Large-Cap ETF™, which returned approximately 10.2% for the reporting period. The Schwab International Equity ETF™ also contributed notably. The Schwab International Equity ETF returned approximately 7.1%, slightly outperforming the composite index’s international equity component, the FTSE Developed ex US Index (Net), which returned 6.9% for the same period. The Schwab Emerging Markets Equity ETF™ also contributed to the fund’s total return and return relative to the index, as it slightly outperformed the composite index’s emerging markets component, the FTSE Emerging Index (Net). The fund’s U.S. small cap holding, the Schwab US Small-Cap ETF™, contributed to the fund’s total return, but detracted from return relative to the composite index.

Management views may have changed since the report date.

| 1 | ETF performance can be expressed on a market price or NAV basis. The returns cited in this section are Market Price Returns. The ETF’s per share NAV is the value of one share of the ETF. NAV is calculated by taking the ETF’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the ETF, and the Market Price Return is based on the market price per share of the ETF. The price used to calculate market return (Market Price) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which the shares of the ETF are listed for trading, as of the time that the ETF’s NAV is calculated. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the ETF at Market Price and NAV, respectively. |

Schwab Target Index Funds | Annual Report

Schwab Target 2020 Index Fund

Performance and Fund Facts as of 3/31/17

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visit www.csimfunds.com.

Performance of Hypothetical Investment (August 25, 2016 – March 31, 2017)1

| 1 | Fund expenses may have been partially absorbed by CSIM and its affiliates. Without these reductions, the fund's returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

Schwab Target Index Funds | Annual Report

Schwab Target 2020 Index Fund

Performance and Fund Facts as of 3/31/17 (continued)

| Class and Inception Date | Since Inception |

| Investor Shares (8/25/16) | 3.59% |

| Institutional Shares (8/25/16) | 3.69% |

| Target 2020 Passive Composite Index | 3.68% |

| Dow Jones U.S. Total Stock Market IndexSM | 10.36% |

| Bloomberg Barclays U.S. Aggregate Bond Index | -2.18% |

| Fund Category: Morningstar Target-Date 20202 | 3.46% |

| Fund Expense Ratios3: Investor Shares: Net 0.13%; Gross 0.19% / Institutional Shares: Net 0.08%; Gross 0.14% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indexes are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

| 1 | Fund expenses may have been partially absorbed by CSIM and its affiliates. Without these reductions, the fund's returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| 2 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

| 3 | As stated in the prospectus. Includes expenses of the underlying funds in which the fund invests. The annualized weighted average expense ratio of the underlying funds was 0.06%. Net Expense: Expenses reduced by a contractual fee waiver in effect for so long as CSIM serves as the investment adviser to the fund. Gross Expense: Does not reflect the effect of contractual fee waivers. For actual ratios during the period, refer to the financial highlights section of the financial statements. |

Schwab Target Index Funds | Annual Report

Schwab Target 2020 Index Fund

Performance and Fund Facts as of 3/31/17 (continued)

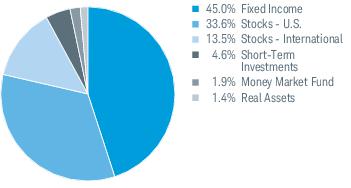

| Number of Holdings | 15 |

| Portfolio Turnover Rate | 17% |

Asset Class Weightings % of Investments1

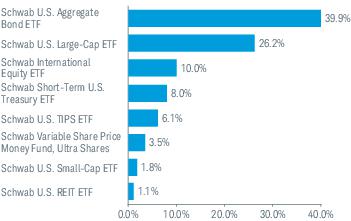

Top Holdings % of Net Assets2,3

Portfolio holdings may have changed since the report date.

| 1 | The fund intends to primarily invest in affiliated Schwab ETFs and may also invest in affiliated Schwab and Laudus mutual funds and unaffiliated third party ETFs and mutual funds (all such ETFs and mutual funds referred to as "underlying funds"). |

| 2 | This list is not a recommendation of any security by the investment adviser. |

| 3 | The holdings listed exclude any temporary liquidity investments. |

Schwab Target Index Funds | Annual Report

Schwab Target 2025 Index Fund

The Schwab Target 2025 Index Fund (the fund) seeks to provide capital appreciation and income consistent with its current asset allocation, and seeks to achieve its investment objective by investing primarily in affiliated Schwab exchange-traded funds (ETFs). The fund may also invest in affiliated Schwab and Laudus mutual funds and unaffiliated third party ETFs and mutual funds. The target asset allocation is adjusted annually based on the adviser’s asset allocation strategy; as of the annual adjustment at the end of January 2017, the fund’s asset allocation was approximately 61.2% equity securities, 34.9% fixed-income securities, and 3.9% cash and cash equivalents (including money market funds). (For portfolio allocations as of the end of this reporting period, please see the fund’s Portfolio Holdings included in this report.)

Market Highlights. Over the 12-month period, both international and U.S. equities generated solid returns, while U.S. bond yields rose and returns fell (bond yields and bond prices move in opposite directions). The Federal Reserve (Fed) raised short-term interest rates in both December and March amid steadily improving U.S. economic data and a slight uptick in inflation, and expectations for policy changes from the Trump administration contributed to a post-election stock market rally. Meanwhile, concerns lessened around global economic growth and potential fallout from the United Kingdom’s June vote to leave the European Union. Short-term bond yields rose after both Fed rate hikes, while longer-term yields rose after the U.S. presidential election as economic growth and inflation expectations grew.

Performance. For the period of fund inception (August 25, 2016) through March 31, 2017, the fund’s Investor Shares returned 4.81%. The fund’s internally calculated comparative index, the Target 2025 Passive Composite Index (the composite index), returned 4.83% for the same period.

Positioning and Strategies.1 The fund’s asset allocations were generally in line with those of the composite index over the reporting period.

The fund’s fixed-income allocation detracted from the fund’s total return over the reporting period. The fund’s intermediate-term bond holding, the Schwab U.S. Aggregate Bond ETF™, was the largest detractor from the fund’s total return. The Schwab U.S. Aggregate Bond ETF returned approximately -2.3%, while the Bloomberg Barclays U.S. Aggregate Bond Index, the composite index’s underlying intermediate-term bond component, returned -2.2% for the same period. The fund’s other fixed-income allocations, the Schwab Short-Term U.S. Treasury ETF™ and Schwab U.S. TIPS ETF™, slightly detracted from the fund’s relative return, as these holdings underperformed their respective comparative indexes.

The fund’s real estate allocation was another detractor from the fund’s total return and return relative to the composite index. The Schwab U.S. REIT ETF™ returned approximately -5.0% for the reporting period, slightly underperforming its comparative index, the Dow Jones U.S. Select REIT Index, which returned -4.8%.

The fund’s equity exposures provided the greatest contribution to total return, particularly from the fund’s U.S. large cap holding. The top contributor to the total return of the fund was the Schwab U.S. Large-Cap ETF™, which returned approximately 10.2% for the reporting period. The fund’s international equity component, the Schwab International Equity ETF™, also contributed notably. The Schwab International Equity ETF returned approximately 7.1%, slightly outperforming the composite index’s international equity component, the FTSE Developed ex US Index (Net), which returned 6.9% for the same period. The Schwab Emerging Markets Equity ETF™ also contributed to the fund’s total return and return relative to the index, as it slightly outperformed the composite index’s emerging markets component, the FTSE Emerging Index (Net). The fund’s U.S. small cap holding, the Schwab US Small-Cap ETF™, contributed to the fund’s total return, but detracted from return relative to the composite index.

Management views may have changed since the report date.

| 1 | ETF performance can be expressed on a market price or NAV basis. The returns cited in this section are Market Price Returns. The ETF’s per share NAV is the value of one share of the ETF. NAV is calculated by taking the ETF’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the ETF, and the Market Price Return is based on the market price per share of the ETF. The price used to calculate market return (Market Price) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which the shares of the ETF are listed for trading, as of the time that the ETF’s NAV is calculated. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the ETF at Market Price and NAV, respectively. |

Schwab Target Index Funds | Annual Report

Schwab Target 2025 Index Fund

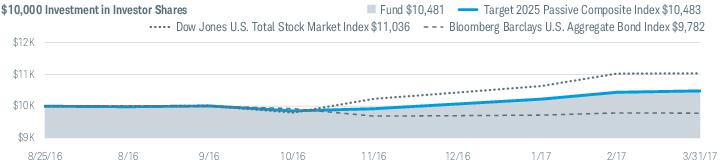

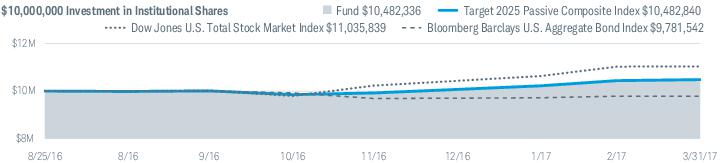

Performance and Fund Facts as of 3/31/17

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visit www.csimfunds.com.

Performance of Hypothetical Investment (August 25, 2016 – March 31, 2017)1

| 1 | Fund expenses may have been partially absorbed by CSIM and its affiliates. Without these reductions, the fund's returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

Schwab Target Index Funds | Annual Report

Schwab Target 2025 Index Fund

Performance and Fund Facts as of 3/31/17 (continued)

| Class and Inception Date | Since Inception |

| Investor Shares (8/25/16) | 4.81% |

| Institutional Shares (8/25/16) | 4.82% |

| Target 2025 Passive Composite Index | 4.83% |

| Dow Jones U.S. Total Stock Market IndexSM | 10.36% |

| Bloomberg Barclays U.S. Aggregate Bond Index | -2.18% |

| Fund Category: Morningstar Target-Date 20252 | 4.56% |

| Fund Expense Ratios3: Investor Shares: Net 0.13%; Gross 0.19% / Institutional Shares: Net 0.08%; Gross 0.14% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indexes are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

| 1 | Fund expenses may have been partially absorbed by CSIM and its affiliates. Without these reductions, the fund's returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| 2 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

| 3 | As stated in the prospectus. Includes expenses of the underlying funds in which the fund invests. The annualized weighted average expense ratio of the underlying funds was 0.06%. Net Expense: Expenses reduced by a contractual fee waiver in effect for so long as CSIM serves as the investment adviser to the fund. Gross Expense: Does not reflect the effect of contractual fee waivers. For actual ratios during the period, refer to the financial highlights section of the financial statements. |

Schwab Target Index Funds | Annual Report

Schwab Target 2025 Index Fund

Performance and Fund Facts as of 3/31/17 (continued)

| Number of Holdings | 14 |

| Portfolio Turnover Rate | 6% |

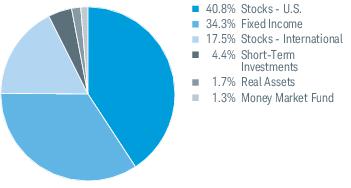

Asset Class Weightings % of Investments1

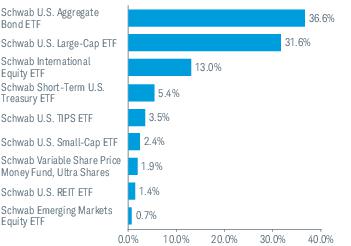

Top Holdings % of Net Assets2,3

Portfolio holdings may have changed since the report date.

| 1 | The fund intends to primarily invest in affiliated Schwab ETFs and may also invest in affiliated Schwab and Laudus mutual funds and unaffiliated third party ETFs and mutual funds (all such ETFs and mutual funds referred to as "underlying funds"). |

| 2 | This list is not a recommendation of any security by the investment adviser. |

| 3 | The holdings listed exclude any temporary liquidity investments. |

Schwab Target Index Funds | Annual Report

Schwab Target 2030 Index Fund

The Schwab Target 2030 Index Fund (the fund) seeks to provide capital appreciation and income consistent with its current asset allocation, and seeks to achieve its investment objective by investing primarily in affiliated Schwab exchange-traded funds (ETFs). The fund may also invest in affiliated Schwab and Laudus mutual funds and unaffiliated third party ETFs and mutual funds. The target asset allocation is adjusted annually based on the adviser’s asset allocation strategy; as of the annual adjustment at the end of January 2017, the fund’s asset allocation was approximately 70.1% equity securities, 26.9% fixed-income securities, and 3.0% cash and cash equivalents (including money market funds). (For portfolio allocations as of the end of this reporting period, please see the fund’s Portfolio Holdings included in this report.)

Market Highlights. Over the 12-month period, both international and U.S. equities generated solid returns, while U.S. bond yields rose and returns fell (bond yields and bond prices move in opposite directions). The Federal Reserve (Fed) raised short-term interest rates in both December and March amid steadily improving U.S. economic data and a slight uptick in inflation, and expectations for policy changes from the Trump administration contributed to a post-election stock market rally. Meanwhile, concerns lessened around global economic growth and potential fallout from the United Kingdom’s June vote to leave the European Union. Short-term bond yields rose after both Fed rate hikes, while longer-term yields rose after the U.S. presidential election as economic growth and inflation expectations grew.

Performance. For the period of fund inception (August 25, 2016) through March 31, 2017, the fund’s Investor Shares returned 5.66%. The fund’s internally calculated comparative index, the Target 2030 Passive Composite Index (the composite index), returned 5.70% for the same period.

Positioning and Strategies.1 The fund’s asset allocations were generally in line with those of the composite index over the reporting period.

The fund’s fixed-income allocation detracted from the fund’s total return over the reporting period, and return relative to the composite index. The fund’s intermediate-term bond holding, the Schwab U.S. Aggregate Bond ETF™, was the largest detractor from the fund’s total return. The Schwab U.S. Aggregate Bond ETF returned approximately -2.3%, while the Bloomberg Barclays U.S. Aggregate Bond Index, the composite index’s underlying intermediate-term bond component, returned -2.2% for the same period. The fund’s other fixed-income allocation, the Schwab Short-Term U.S. Treasury ETF™, detracted from the fund’s relative return, as the Schwab Short-Term U.S. Treasury ETF also underperformed its comparative index, the Bloomberg Barclays U.S. 1-3 Year Treasury Bond Index.

The fund’s real estate allocation was another detractor from the fund’s total return and return relative to the composite index. The Schwab U.S. REIT ETF™ returned approximately -5.0% for the reporting period, slightly underperforming its comparative index, the Dow Jones U.S. Select REIT Index, which returned -4.8%.

The fund’s equity exposures provided the greatest contribution to total return, particularly from the fund’s U.S. large cap holding. The top contributor to the total return of the fund was the Schwab U.S. Large-Cap ETF™, which returned approximately 10.2% for the reporting period. The fund’s international equity component, the Schwab International Equity ETF™, also contributed notably to both total return and return relative to the composite index. The Schwab International Equity ETF returned approximately 7.1%, slightly outperforming the composite index’s international equity component, the FTSE Developed ex US Index (Net), which returned 6.9% for the same period. The Schwab Emerging Markets Equity ETF™ also contributed to the fund’s total return and relative return, as it slightly outperformed the composite index’s emerging markets component, the FTSE Emerging Index (Net). The fund’s U.S. small cap holding, the Schwab US Small-Cap ETF™, contributed to the fund’s total return, but detracted from return relative to the composite index.

Management views may have changed since the report date.

| 1 | ETF performance can be expressed on a market price or NAV basis. The returns cited in this section are Market Price Returns. The ETF’s per share NAV is the value of one share of the ETF. NAV is calculated by taking the ETF’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the ETF, and the Market Price Return is based on the market price per share of the ETF. The price used to calculate market return (Market Price) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which the shares of the ETF are listed for trading, as of the time that the ETF’s NAV is calculated. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the ETF at Market Price and NAV, respectively. |

Schwab Target Index Funds | Annual Report

Schwab Target 2030 Index Fund

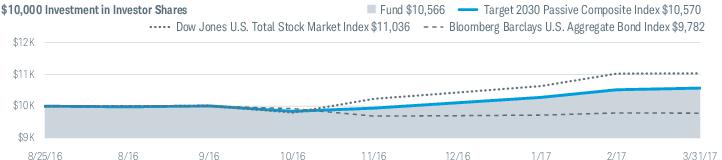

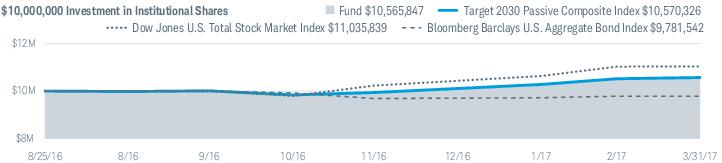

Performance and Fund Facts as of 3/31/17

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visit www.csimfunds.com.

Performance of Hypothetical Investment (August 25, 2016 – March 31, 2017)1

| 1 | Fund expenses may have been partially absorbed by CSIM and its affiliates. Without these reductions, the fund's returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

Schwab Target Index Funds | Annual Report

Schwab Target 2030 Index Fund

Performance and Fund Facts as of 3/31/17 (continued)

| Class and Inception Date | Since Inception |

| Investor Shares (8/25/16) | 5.66% |

| Institutional Shares (8/25/16) | 5.66% |

| Target 2030 Passive Composite Index | 5.70% |

| Dow Jones U.S. Total Stock Market IndexSM | 10.36% |

| Bloomberg Barclays U.S. Aggregate Bond Index | -2.18% |

| Fund Category: Morningstar Target-Date 20302 | 5.44% |

| Fund Expense Ratios3: Investor Shares: Net 0.13%; Gross 0.19% / Institutional Shares: Net 0.08%; Gross 0.14% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indexes are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

| 1 | Fund expenses may have been partially absorbed by CSIM and its affiliates. Without these reductions, the fund's returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| 2 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

| 3 | As stated in the prospectus. Includes expenses of the underlying funds in which the fund invests. The annualized weighted average expense ratio of the underlying funds was 0.06%. Net Expense: Expenses reduced by a contractual fee waiver in effect for so long as CSIM serves as the investment adviser to the fund. Gross Expense: Does not reflect the effect of contractual fee waivers. For actual ratios during the period, refer to the financial highlights section of the financial statements. |

Schwab Target Index Funds | Annual Report

Schwab Target 2030 Index Fund

Performance and Fund Facts as of 3/31/17 (continued)

| Number of Holdings | 12 |

| Portfolio Turnover Rate | 7% |

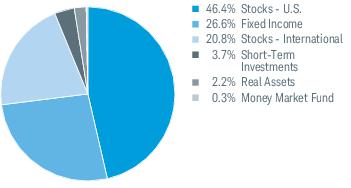

Asset Class Weightings % of Investments1

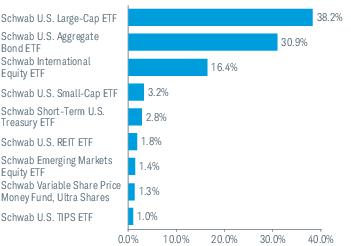

Top Holdings % of Net Assets2,3

Portfolio holdings may have changed since the report date.

| 1 | The fund intends to primarily invest in affiliated Schwab ETFs and may also invest in affiliated Schwab and Laudus mutual funds and unaffiliated third party ETFs and mutual funds (all such ETFs and mutual funds referred to as "underlying funds"). |

| 2 | This list is not a recommendation of any security by the investment adviser. |

| 3 | The holdings listed exclude any temporary liquidity investments. |

Schwab Target Index Funds | Annual Report

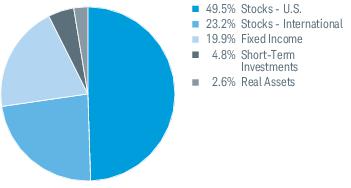

Schwab Target 2035 Index Fund

The Schwab Target 2035 Index Fund (the fund) seeks to provide capital appreciation and income consistent with its current asset allocation, and seeks to achieve its investment objective by investing primarily in affiliated Schwab exchange-traded funds (ETFs). The fund may also invest in affiliated Schwab and Laudus mutual funds and unaffiliated third party ETFs and mutual funds. The target asset allocation is adjusted annually based on the adviser’s asset allocation strategy; as of the annual adjustment at the end of January 2017, the fund’s asset allocation was approximately 77.4% equity securities, 20.3% fixed income securities, and 2.3% cash and cash equivalents (including money market funds). (For portfolio allocations as of the end of this reporting period, please see the fund’s Portfolio Holdings included in this report.)

Market Highlights. Over the 12-month period, both international and U.S. equities generated solid returns, while U.S. bond yields rose and returns fell (bond yields and bond prices move in opposite directions). The Federal Reserve (Fed) raised short-term interest rates in both December and March amid steadily improving U.S. economic data and a slight uptick in inflation, and expectations for policy changes from the Trump administration contributed to a post-election stock market rally. Meanwhile, concerns lessened around global economic growth and potential fallout from the United Kingdom’s June vote to leave the European Union. Short-term bond yields rose after both Fed rate hikes, while longer-term yields rose after the U.S. presidential election as economic growth and inflation expectations grew.

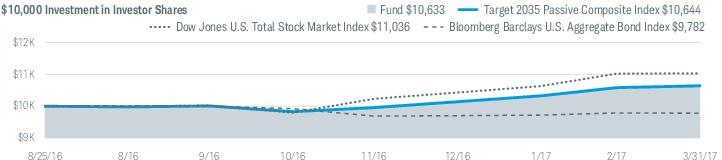

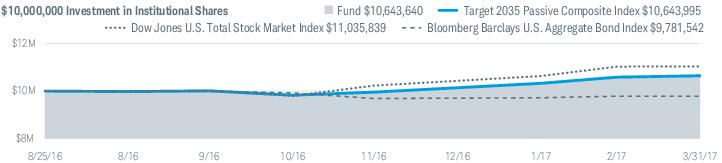

Performance. For the reporting period of fund inception (August 25, 2016) through March 31, 2017, the fund’s Investor Shares returned 6.33%. The fund’s internally calculated comparative index, the Target 2035 Passive Composite Index (the composite index), returned 6.44% for the same period.

Positioning and Strategies.1 The fund’s asset allocations were generally in line with those of the composite index over the reporting period.

The fund’s fixed-income allocation detracted from the fund’s total return over the reporting period, and return relative to the composite index. The fund’s intermediate-term bond holding, the Schwab U.S. Aggregate Bond ETF™, was the largest detractor from the fund’s total return. The Schwab U.S. Aggregate Bond ETF returned approximately -2.3%, while the Bloomberg Barclays U.S. Aggregate Bond Index, the composite index’s underlying intermediate-term bond component, returned -2.2% for the same period. The fund’s other fixed-income allocation, the Schwab Short-Term U.S. Treasury ETF™, detracted from the fund’s relative return, as the Schwab Short-Term U.S. Treasury ETF also underperformed its comparative index, the Bloomberg Barclays U.S. 1-3 Year Treasury Bond Index.

The fund’s real estate allocation was another detractor from the fund’s total return and return relative to the composite index. The Schwab U.S. REIT ETF™ returned approximately -5.0% for the reporting period, slightly underperforming its comparative index, the Dow Jones U.S. Select REIT Index, which returned -4.8%.

The fund’s equity exposures provided the greatest contribution to total return, particularly from the fund’s U.S. large cap holding. The top contributor to the total return of the fund was the Schwab U.S. Large-Cap ETF™, which returned approximately 10.2% for the reporting period. The fund’s international equity component, the Schwab International Equity ETF™, also contributed notably to both total return and return relative to the composite index. The Schwab International Equity ETF returned approximately 7.1%, slightly outperforming the composite index’s international equity component, the FTSE Developed ex US Index (Net), which returned 6.9% for the same period. The Schwab Emerging Markets Equity ETF™ also contributed to the fund’s total return and relative return, as it slightly outperformed the composite index’s emerging markets component, the FTSE Emerging Index (Net). The fund’s U.S. small cap holding, the Schwab US Small-Cap ETF™, contributed to the fund’s total return, but detracted from return relative to the composite index.

Management views may have changed since the report date.

| 1 | ETF performance can be expressed on a market price or NAV basis. The returns cited in this section are Market Price Returns. The ETF’s per share NAV is the value of one share of the ETF. NAV is calculated by taking the ETF’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the ETF, and the Market Price Return is based on the market price per share of the ETF. The price used to calculate market return (Market Price) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which the shares of the ETF are listed for trading, as of the time that the ETF’s NAV is calculated. NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the ETF at Market Price and NAV, respectively. |

Schwab Target Index Funds | Annual Report

Schwab Target 2035 Index Fund

Performance and Fund Facts as of 3/31/17

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visit www.csimfunds.com.

Performance of Hypothetical Investment (August 25, 2016 – March 31, 2017)1

| 1 | Fund expenses may have been partially absorbed by CSIM and its affiliates. Without these reductions, the fund's returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

Schwab Target Index Funds | Annual Report

Schwab Target 2035 Index Fund

Performance and Fund Facts as of 3/31/17 (continued)

| Class and Inception Date | Since Inception |

| Investor Shares (8/25/16) | 6.33% |

| Institutional Shares (8/25/16) | 6.44% |

| Target 2035 Passive Composite Index | 6.44% |

| Dow Jones U.S. Total Stock Market IndexSM | 10.36% |

| Bloomberg Barclays U.S. Aggregate Bond Index | -2.18% |

| Fund Category: Morningstar Target-Date 20352 | 6.46% |

| Fund Expense Ratios3: Investor Shares: Net 0.13%; Gross 0.18% / Institutional Shares: Net 0.08%; Gross 0.13% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indexes are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

| 1 | Fund expenses may have been partially absorbed by CSIM and its affiliates. Without these reductions, the fund's returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| 2 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

| 3 | As stated in the prospectus. Includes expenses of the underlying funds in which the fund invests. The annualized weighted average expense ratio of the underlying funds was 0.05%. Net Expense: Expenses reduced by a contractual fee waiver in effect for so long as CSIM serves as the investment adviser to the fund. Gross Expense: Does not reflect the effect of contractual fee waivers. For actual ratios during the period, refer to the financial highlights section of the financial statements. |

Schwab Target Index Funds | Annual Report

Schwab Target 2035 Index Fund

Performance and Fund Facts as of 3/31/17 (continued)

| Number of Holdings | 13 |

| Portfolio Turnover Rate | 13% |

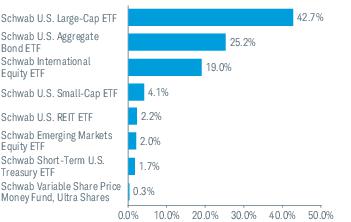

Asset Class Weightings % of Investments1

Top Holdings % of Net Assets2,3

Portfolio holdings may have changed since the report date.

| 1 | The fund intends to primarily invest in affiliated Schwab ETFs and may also invest in affiliated Schwab and Laudus mutual funds and unaffiliated third party ETFs and mutual funds (all such ETFs and mutual funds referred to as "underlying funds"). |

| 2 | This list is not a recommendation of any security by the investment adviser. |

| 3 | The holdings listed exclude any temporary liquidity investments. |

Schwab Target Index Funds | Annual Report

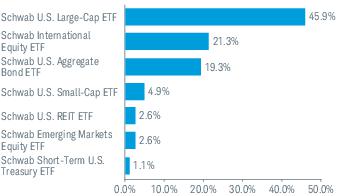

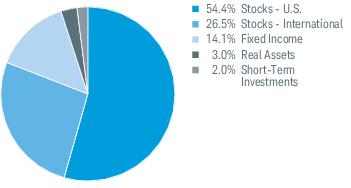

Schwab Target 2040 Index Fund

The Schwab Target 2040 Index Fund (the fund) seeks to provide capital appreciation and income consistent with its current asset allocation, and seeks to achieve its investment objective by investing primarily in affiliated Schwab exchange-traded funds (ETFs). The fund may also invest in affiliated Schwab and Laudus mutual funds and unaffiliated third party ETFs and mutual funds. The target asset allocation is adjusted annually based on the adviser’s asset allocation strategy; as of the annual adjustment at the end of January 2017, the fund’s asset allocation was approximately 84.3% equity securities, 14.1% fixed-income securities, and 1.6% cash and cash equivalents (including money market funds). (For portfolio allocations as of the end of this reporting period, please see the fund’s Portfolio Holdings included in this report.)

Market Highlights. Over the 12-month period, both international and U.S. equities generated solid returns, while U.S. bond yields rose and returns fell (bond yields and bond prices move in opposite directions). The Federal Reserve (Fed) raised short-term interest rates in both December and March amid steadily improving U.S. economic data and a slight uptick in inflation, and expectations for policy changes from the Trump administration contributed to a post-election stock market rally. Meanwhile, concerns lessened around global economic growth and potential fallout from the United Kingdom’s June vote to leave the European Union. Short-term bond yields rose after both Fed rate hikes, while longer-term yields rose after the U.S. presidential election as economic growth and inflation expectations grew.

Performance. For the reporting period of fund inception (August 25, 2016) through March 31, 2017, the fund’s Investor Shares returned 7.08%. The fund’s internally calculated comparative index, the Target 2040 Passive Composite Index (the composite index), returned 7.13% for the same period.

Positioning and Strategies.1 The fund’s asset allocations were generally in line with those of the composite index over the reporting period.

The fund’s fixed-income allocation detracted from the fund’s total return over the reporting period, and return relative to the composite index. The fund’s intermediate-term bond holding, the Schwab U.S. Aggregate Bond ETF™, was the largest detractor from the fund’s total return. The Schwab U.S. Aggregate Bond ETF returned approximately -2.3%, while the Bloomberg Barclays U.S. Aggregate Bond Index, the composite index’s underlying intermediate-term bond component, returned -2.2% for the same period. The fund’s other fixed-income allocation, the Schwab Short-Term U.S. Treasury ETF™, detracted from the fund’s relative return, as the Schwab Short-Term U.S. Treasury ETF also underperformed its comparative index, the Bloomberg Barclays U.S. 1-3 Year Treasury Bond Index.

The fund’s real estate allocation was another detractor from the fund’s total return and return relative to the composite index. The Schwab U.S. REIT ETF™ returned approximately -5.0% for the reporting period, slightly underperforming its comparative index, the Dow Jones U.S. Select REIT Index, which returned -4.8%.

The fund’s equity exposures provided the greatest contribution to total return, particularly from the fund’s U.S. large cap holding. The top contributor to the total return of the fund was the Schwab U.S. Large-Cap ETF™, which returned approximately 10.2% for the reporting period. The fund’s international equity component, the Schwab International Equity ETF™, also contributed notably to both total return and return relative to the composite index. The Schwab International Equity ETF returned approximately 7.1%, slightly outperforming the composite index’s international equity component, the FTSE Developed ex US Index (Net), which returned 6.9% for the same period. The Schwab Emerging Markets Equity ETF™ also contributed to the fund’s total return and relative return, as it slightly outperformed the composite index’s emerging markets component, the FTSE Emerging Index (Net). The fund’s U.S. small cap holding, the Schwab US Small-Cap ETF™, contributed to the fund’s total return, but detracted from return relative to the composite index.

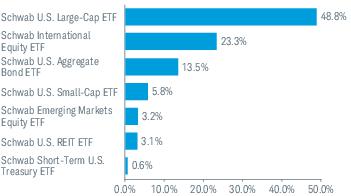

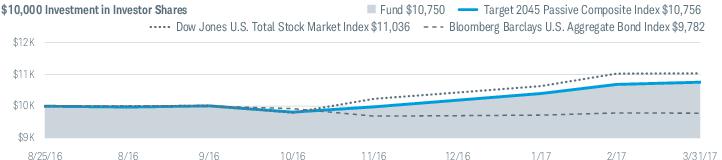

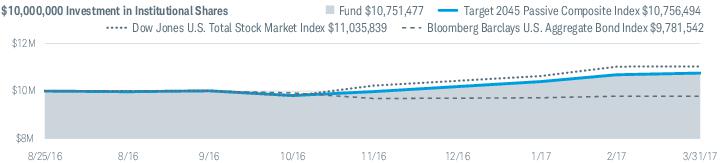

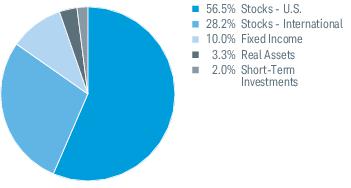

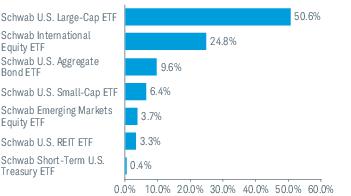

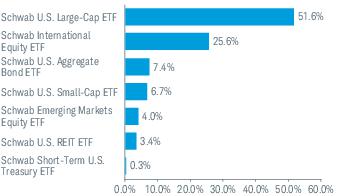

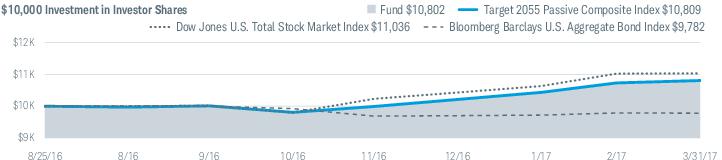

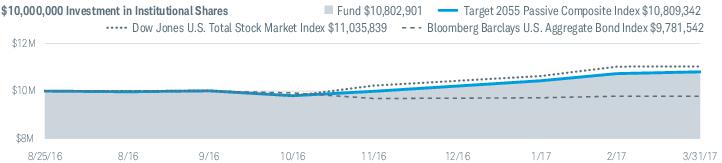

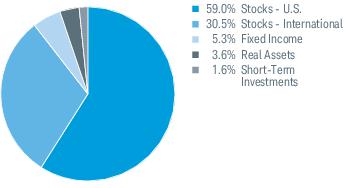

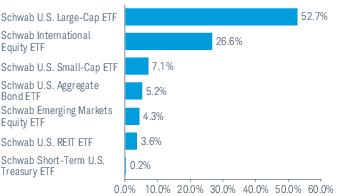

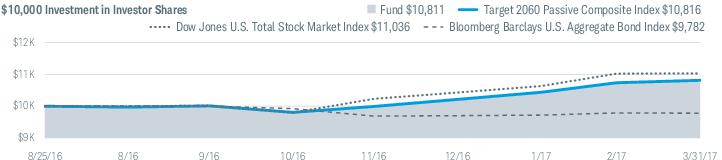

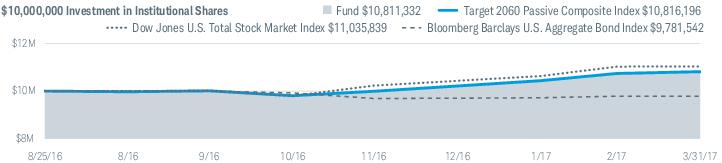

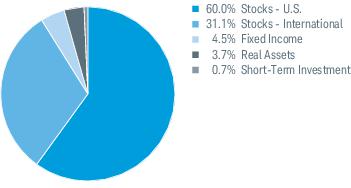

Management views may have changed since the report date.