SECURITIES AND EXCHANGE COMMISSION

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07704

Schwab Capital Trust – Schwab Fundamental Global

(Exact name of registrant as specified in charter)

211 Main Street, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Schwab Capital Trust – Schwab Fundamental Global Real Estate Index Fund

211 Main Street, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 636-7000

Date of fiscal year end: February 28

Date of reporting period: August 31, 2024

Item 1: Report(s) to Shareholders.

Schwab Fundamental Global Real Estate Index Fund

This

semiannual shareholder report

contains important information about the fund for the period of March 1, 2024, to August 31,

2024.

You can find additional information about the fund at

www.schwabassetmanagement.com/prospectus

. You can also request

this information by calling

or by sending an email request to

orders@mysummaryprospectus.com

.

If you purchase

or hold fund shares through a financial intermediary, the fund’s prospectus, Statement of Additional Information (SAI), reports to

shareholders and other information about the fund are available from your financial intermediary.

FUND COSTS FOR THE LAST six months ENDED August 31, 2024

(BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

| | |

Schwab Fundamental Global Real Estate Index Fund | | |

The performance data quoted

represents

past

performance. Past performance does not guarantee future results. Investment

returns

and

principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted.

To obtain performance information current to the most

recent month end, please visit

www.schwabassetmanagement.com/prospectus

Average Annual Total Returns

| | | | |

Fund: Schwab Fundamental Global Real Estate Index Fund (10/22/2014) 2 | | | | |

| | | | |

RAFI Fundamental High Liquidity Global Real Estate Index (Net) 3,5 | | | | |

Russell RAFI™ Global Select Real Estate Index (Net) 3 | | | | |

Fundamental Global Real Estate Spliced Index 3,6 | | | | |

FTSE EPRA Nareit Global Index (Net) 3 | | | | |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs,

which

would lower

performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see www.schwabassetmanagement.com/glossary.

Small-company stocks are subject to greater volatility than many other asset classes.

International investing may involve risk of capital loss from unfavorable fluctuations in currency values, from differences in generally accepted accounting principles, or from

economic or political instability in other nations. Investing in emerging markets may

accentuate

these risks.

The fund is subject to risks associated with the direct ownership of real estate securities and an investment in the fund will be closely linked to the performance of the real

estate markets.

Index ownership – The RAFI Fundamental High Liquidity Global Real Estate Index (the Index) is a service mark of RAFI Indices, LLC or its affiliates (collectively, RAFI) and has

been licensed for use by Charles Schwab Investment Management, Inc. The intellectual and other property rights to the Index are owned by or licensed to RAFI. The Schwab

Fundamental Global Real Estate Index Fund is not sponsored, endorsed, sold or promoted by RAFI, its agents or service providers (collectively, the RAFI Parties). The RAFI

Parties: (i) make no representation or warranty as to the results to be obtained from the use of the Index or otherwise; and (ii) shall not be liable (whether in negligence or

otherwise) to any person for any error in the Index. For full disclaimer, please see the fund’s statement of additional information.

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption of fund shares.

The fund’s performance relative to the index may be affected by fair-value pricing and timing differences in foreign exchange calculations.

The net version of the index reflects reinvested dividends net of withholding taxes but reflects no deductions for expenses or other taxes.

In anticipation of new regulatory requirements, the fund’s regulatory index has changed from the Russell RAFI™ Global Select Real Estate Index (Net) to the MSCI ACWI

Index (Net). The MSCI ACWI Index (Net) provides a broad measure of market performance. The fund does not seek to track the regulatory index.

Effective June 21, 2024, the fund changed its comparative index from the Russell RAFI™ Global Select Real Estate Index (Net) to the RAFI Fundamental High Liquidity

Global Real Estate Index (Net) in connection with a change to the fund’s investment objective and investment strategy to invest its assets in accordance with the index. The

inception date of the RAFI Fundamental High Liquidity Global Real Estate Index (Net) is January 31, 2024. The fund began tracking the index on June 21, 2024.

The Fundamental Global Real Estate Spliced Index is an internally calculated index comprised of the Russell RAFI™ Global Select Real Estate Index (Net) from October 22,

2014, until the close of business on June 21, 2024, and the RAFI Fundamental High Liquidity Global Real Estate Index (Net) from June 22, 2024, forward.

Schwab Fundamental Global Real Estate Index Fund | Semiannual Report

| |

| |

| |

Weighted Average Market Cap (millions) | |

Price/Earnings Ratio (P/E) | |

| |

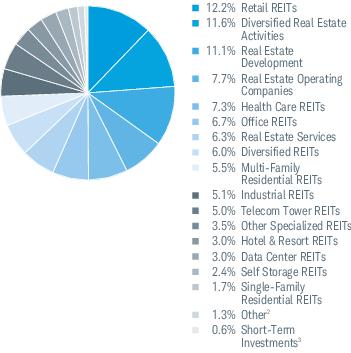

Industry Weightings % of Investments

Top Holdings % of Net Assets

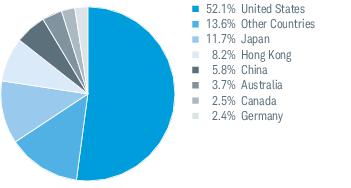

Country Weightings % of Investments

Po

rtfoli

o holdings may have changed since the report date.

An index is a statistical composite

of a s

pecified financial market or sector. Unlike the fund, an index does not actually hold a portfolio of securities and its return is not

inclusive of trading and management costs incurred by the fund.

The Sector/Industry classifications in this report use the Global Industry Classification Standard (GICS) which was developed by and is the exclusive property of MSCI Inc.

(MSCI) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc.

Represents an aggregate of industry

wei

ghtings, none of which represent more than 1.0% of investments.

Includes the fund’s position(s) in money market mutual funds registered under the Investment Company Act of 1940, as amended.

This list is not a recommendation of any security by the investment adviser.

Schwab Fundamental Global Real Estate Index Fund | Semiannual Report

AVAILABILITY OF ADDITIONAL INFORMATION

You can find the fund’s prospectus, Statement of Additional Information (SAI), reports to shareholders, financial information,

holdings, certain tax information, proxy voting information, and other information about the fund online at

www.schwabassetmanagement.com/prospectus

.

Proxy Voting Policies, Procedures and Results

A description of the proxy voting policies and procedures used to determine how to vote proxies on behalf of the funds is available

without charge, upon request, by visiting the Schwab Funds’ website at

www.schwabassetmanagement.com/prospectus

, the

SEC’s website at

, or by contacting Schwab Funds at 1-877-824-5615.

Information regarding how a fund voted proxies relating to portfolio securities during the most recent twelve-month period ended

June 30 is available, without charge, by visiting the fund’s website at

www.schwabassetmanagement.com/prospectus

or the

SEC’s website at

, by calling

, or by sending an email request to

orders@mysummaryprospectus.com

.

Schwab Fundamental Global Real Estate Index Fund | Semiannual Report

Item 2: Code of Ethics.

Not applicable to this semi-annual report.

Item 3: Audit Committee Financial Expert.

Not applicable to this semi-annual report.

Item 4: Principal Accountant Fees and Services.

Not applicable to this semi-annual report.

Item 5: Audit Committee of Listed Registrants.

Not applicable to this semi-annual report.

Item 6: Schedule of Investments.

The schedules of investments are included as part of the report to shareholders filed under Item 7 of this Form.

Item 7: Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Semiannual Holdings and Financial Statements | August 31, 2024

Schwab Fundamental Global Real Estate Index Fund

Fund investment adviser: Charles Schwab Investment Management, Inc., dba Schwab Asset Management®

Distributor: Charles Schwab & Co., Inc. (Schwab)

The Sector/Industry classifications in this report use the Global Industry Classification Standard (GICS) which was developed by and is the exclusive property of MSCI Inc. (MSCI) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Schwab.

Schwab Fundamental Global Real Estate Index Fund | Semiannual Holdings and Financial Statements

1

Schwab Fundamental Global Real Estate Index Fund

Financial Statements

| | | | | | |

|

Net asset value at beginning of period | | | | | | |

Income (loss) from investment operations: | | | | | | |

Net investment income (loss)1 | | | | | | |

Net realized and unrealized gains (losses) | | | | | | |

Total from investment operations | | | | | | |

| | | | | | |

Distributions from net investment income | | | | | | |

Distributions from net realized gains | | | | | | |

| | | | | | |

Net asset value at end of period | | | | | | |

| | | | | | |

|

Ratios to average net assets: | | | | | | |

| | | | | | |

Net investment income (loss) | | | | | | |

| | | | | | |

Net assets, end of period (x 1,000) | | | | | | |

| |

| Calculated based on the average shares outstanding during the period. |

| |

| |

| Ratio includes less than 0.005% of non-routine proxy expenses. |

2

Schwab Fundamental Global Real Estate Index Fund | Semiannual Holdings and Financial Statements

Schwab Fundamental Global Real Estate Index Fund

Portfolio Holdings as of August 31, 2024 (Unaudited)

| | |

COMMON STOCKS 99.2% OF NET ASSETS |

|

|

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

|

| | |

| | |

| | |

| | |

|

|

Cyrela Brazil Realty SA Empreendimentos e Participacoes | | |

Multiplan Empreendimentos Imobiliarios SA | | |

| | |

|

|

Allied Properties Real Estate Investment Trust | | |

| | |

Artis Real Estate Investment Trust | | |

Boardwalk Real Estate Investment Trust | | |

Canadian Apartment Properties REIT | | |

Chartwell Retirement Residences | | |

Choice Properties Real Estate Investment Trust | | |

Colliers International Group, Inc. | | |

Crombie Real Estate Investment Trust | | |

CT Real Estate Investment Trust | | |

Dream Industrial Real Estate Investment Trust | | |

First Capital Real Estate Investment Trust | | |

| | |

Granite Real Estate Investment Trust | | |

H&R Real Estate Investment Trust | | |

Killam Apartment Real Estate Investment Trust | | |

NorthWest Healthcare Properties Real Estate Investment Trust | | |

RioCan Real Estate Investment Trust | | |

SmartCentres Real Estate Investment Trust | | |

| | |

|

| | |

|

Agile Group Holdings Ltd. *(a) | | |

A-Living Smart City Services Co. Ltd. | | |

C&D International Investment Group Ltd. | | |

China Merchants Shekou Industrial Zone Holdings Co. Ltd., A Shares | | |

China Resources Land Ltd. | | |

China Resources Mixc Lifestyle Services Ltd. | | |

China SCE Group Holdings Ltd. *(a) | | |

China Vanke Co. Ltd., A Shares * | | |

China Vanke Co. Ltd., H Shares * | | |

CIFI Holdings Group Co. Ltd. * | | |

Country Garden Holdings Co. Ltd. *(a)(b) | | |

Country Garden Services Holdings Co. Ltd. | | |

| | |

| | |

Gemdale Properties & Investment Corp. Ltd. | | |

Greenland Holdings Corp. Ltd., A Shares * | | |

Greentown China Holdings Ltd. | | |

Greentown Service Group Co. Ltd. | | |

Guangzhou R&F Properties Co. Ltd., H Shares * | | |

Hopson Development Holdings Ltd. * | | |

Jiayuan International Group Ltd. *(b) | | |

| | |

KWG Group Holdings Ltd. * | | |

| | |

Longfor Group Holdings Ltd. | | |

Midea Real Estate Holding Ltd. * | | |

| | |

Poly Developments & Holdings Group Co. Ltd., A Shares | | |

Powerlong Real Estate Holdings Ltd. *(a) | | |

| | |

Seazen Holdings Co. Ltd., A Shares * | | |

Shanghai Lujiazui Finance & Trade Zone Development Co. Ltd., A Shares | | |

Shenzhen Overseas Chinese Town Co. Ltd., A Shares * | | |

Shinsun Holdings Group Co. Ltd. *(b) | | |

| | |

Sunac China Holdings Ltd. * | | |

| | |

|

|

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Unibail-Rodamco-Westfield * | | |

| | |

|

|

| | |

| | |

| | |

| | |

Schwab Fundamental Global Real Estate Index Fund | Semiannual Holdings and Financial Statements

3

Schwab Fundamental Global Real Estate Index Fund

Portfolio Holdings as of August 31, 2024 (Unaudited) (continued)

| | |

| | |

| | |

|

|

| | |

|

|

China Jinmao Holdings Group Ltd. | | |

China Overseas Grand Oceans Group Ltd. | | |

China Overseas Land & Investment Ltd. | | |

| | |

Fortune Real Estate Investment Trust | | |

| | |

Hang Lung Properties Ltd. | | |

Henderson Land Development Co. Ltd. | | |

Hongkong Land Holdings Ltd. | | |

Hysan Development Co. Ltd. | | |

| | |

| | |

New World Development Co. Ltd. | | |

Poly Property Group Co. Ltd. | | |

Shanghai Industrial Holdings Ltd. | | |

| | |

| | |

Sino-Ocean Group Holding Ltd. *(a) | | |

Sun Hung Kai Properties Ltd. | | |

Swire Pacific Ltd., A Shares | | |

Swire Pacific Ltd., B Shares | | |

| | |

| | |

Wharf Real Estate Investment Co. Ltd. | | |

| | |

Yuexiu Real Estate Investment Trust | | |

| | |

|

|

Alony Hetz Properties & Investments Ltd. | | |

| | |

| | |

| | |

| | |

| | |

Mivne Real Estate KD Ltd. | | |

| | |

|

|

| | |

Advance Residence Investment Corp. | | |

| | |

AEON REIT Investment Corp. | | |

Comforia Residential REIT, Inc. | | |

Daito Trust Construction Co. Ltd. | | |

Daiwa House REIT Investment Corp. | | |

Daiwa Office Investment Corp. | | |

Daiwa Securities Living Investments Corp. | | |

Frontier Real Estate Investment Corp. | | |

| | |

| | |

Heiwa Real Estate Co. Ltd. | | |

| | |

| | |

Industrial & Infrastructure Fund Investment Corp. | | |

Invincible Investment Corp. | | |

| | |

| | |

Japan Hotel REIT Investment Corp. | | |

Japan Logistics Fund, Inc. | | |

Japan Metropolitan Fund Invest | | |

Japan Prime Realty Investment Corp. | | |

Japan Real Estate Investment Corp. | | |

Japan Wool Textile Co. Ltd. | | |

KDX Realty Investment Corp. | | |

| | |

| | |

Mitsubishi Estate Co. Ltd. | | |

| | |

Mori Hills REIT Investment Corp. | | |

Nippon Accommodations Fund, Inc. | | |

Nippon Building Fund, Inc. | | |

Nippon Kanzai Holdings Co. Ltd. | | |

Nippon Prologis REIT, Inc. | | |

NIPPON REIT Investment Corp. | | |

Nomura Real Estate Holdings, Inc. | | |

Nomura Real Estate Master Fund, Inc. | | |

NTT UD REIT Investment Corp. | | |

Open House Group Co. Ltd. | | |

| | |

| | |

| | |

| | |

| | |

| | |

Sumitomo Realty & Development Co. Ltd. | | |

Sun Frontier Fudousan Co. Ltd. | | |

| | |

| | |

Tokyu Fudosan Holdings Corp. | | |

United Urban Investment Corp. | | |

| | |

|

|

| | |

Grand City Properties SA * | | |

| | |

|

|

Corp. Inmobiliaria Vesta SAB de CV | | |

| | |

Fibra Uno Administracion SA de CV | | |

Prologis Property Mexico SA de CV | | |

TF Administradora Industrial S de Real de CV | | |

| | |

|

|

Eurocommercial Properties NV | | |

| | |

| | |

| | |

|

|

Alliance Global Group, Inc. | | |

| | |

| | |

| | |

| | |

4

Schwab Fundamental Global Real Estate Index Fund | Semiannual Holdings and Financial Statements

Schwab Fundamental Global Real Estate Index Fund

Portfolio Holdings as of August 31, 2024 (Unaudited) (continued)

| | |

| | |

| | |

|

|

| | |

| | |

| | |

CapitaLand Integrated Commercial Trust | | |

CapitaLand Investment Ltd. | | |

| | |

| | |

Frasers Logistics & Commercial Trust | | |

| | |

Manulife U.S. Real Estate Investment Trust * | | |

Mapletree Industrial Trust | | |

Mapletree Logistics Trust | | |

Mapletree Pan Asia Commercial Trust | | |

Suntec Real Estate Investment Trust | | |

| | |

| | |

|

|

Fortress Real Estate Investments Ltd., Class B | | |

Growthpoint Properties Ltd. | | |

| | |

| | |

| | |

Vukile Property Fund Ltd. | | |

| | |

|

|

Inmobiliaria Colonial Socimi SA | | |

Merlin Properties Socimi SA | | |

| | |

|

|

| | |

Corem Property Group AB, B Shares | | |

| | |

Fastighets AB Balder, B Shares * | | |

| | |

| | |

| | |

Samhallsbyggnadsbolaget i Norden AB | | |

Samhallsbyggnadsbolaget i Norden AB, D Shares | | |

| | |

| | |

|

|

| | |

| | |

| | |

| | |

| | |

|

|

Chong Hong Construction Co. Ltd. | | |

Farglory Land Development Co. Ltd. | | |

Highwealth Construction Corp. | | |

Huaku Development Co. Ltd. | | |

| | |

Kindom Development Co. Ltd. | | |

Ruentex Development Co. Ltd. | | |

| | |

|

|

3BB Internet Infrastructure Fund * | | |

| | |

| | |

Digital Telecommunications Infrastructure Fund, Class F | | |

| | |

| | |

| | |

| | |

| | |

|

United Arab Emirates 1.3% |

| | |

| | |

| | |

| | |

|

|

| | |

| | |

| | |

Cushman & Wakefield PLC * | | |

| | |

| | |

| | |

Land Securities Group PLC | | |

LondonMetric Property PLC | | |

Primary Health Properties PLC | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

|

| | |

| | |

Alexander & Baldwin, Inc. | | |

Alexandria Real Estate Equities, Inc. | | |

American Assets Trust, Inc. | | |

American Homes 4 Rent, Class A | | |

| | |

Americold Realty Trust, Inc. | | |

Anywhere Real Estate, Inc. * | | |

Apple Hospitality REIT, Inc. | | |

AvalonBay Communities, Inc. | | |

| | |

Brixmor Property Group, Inc. | | |

Broadstone Net Lease, Inc. | | |

| | |

| | |

| | |

CBL & Associates Properties, Inc. | | |

CBRE Group, Inc., Class A * | | |

| | |

| | |

Schwab Fundamental Global Real Estate Index Fund | Semiannual Holdings and Financial Statements

5

Schwab Fundamental Global Real Estate Index Fund

Portfolio Holdings as of August 31, 2024 (Unaudited) (continued)

| | |

Claros Mortgage Trust, Inc. | | |

| | |

| | |

| | |

| | |

| | |

| | |

DiamondRock Hospitality Co. | | |

Digital Realty Trust, Inc. | | |

DigitalBridge Group, Inc. | | |

Diversified Healthcare Trust (c) | | |

| | |

Easterly Government Properties, Inc. | | |

EastGroup Properties, Inc. | | |

| | |

Empire State Realty Trust, Inc., Class A | | |

| | |

| | |

Equity LifeStyle Properties, Inc. | | |

| | |

Essential Properties Realty Trust, Inc. | | |

Essex Property Trust, Inc. | | |

| | |

Extra Space Storage, Inc. | | |

Federal Realty Investment Trust | | |

First Industrial Realty Trust, Inc. | | |

Four Corners Property Trust, Inc. | | |

Gaming & Leisure Properties, Inc. | | |

| | |

| | |

| | |

HA Sustainable Infrastructure Capital, Inc. | | |

Healthcare Realty Trust, Inc. | | |

Healthpeak Properties, Inc. | | |

Highwoods Properties, Inc. | | |

Host Hotels & Resorts, Inc. | | |

Howard Hughes Holdings, Inc. * | | |

Hudson Pacific Properties, Inc. | | |

Independence Realty Trust, Inc. | | |

Industrial Logistics Properties Trust | | |

Innovative Industrial Properties, Inc. | | |

InvenTrust Properties Corp. | | |

| | |

| | |

| | |

Jones Lang LaSalle, Inc. * | | |

Kennedy-Wilson Holdings, Inc. | | |

| | |

| | |

| | |

Lamar Advertising Co., Class A | | |

| | |

| | |

| | |

| | |

| | |

Medical Properties Trust, Inc. | | |

Mid-America Apartment Communities, Inc. | | |

National Health Investors, Inc. | | |

National Storage Affiliates Trust | | |

Newmark Group, Inc., Class A | | |

| | |

Office Properties Income Trust | | |

Omega Healthcare Investors, Inc. | | |

Opendoor Technologies, Inc. * | | |

| | |

| | |

Park Hotels & Resorts, Inc. | | |

| | |

| | |

| | |

Phillips Edison & Co., Inc. | | |

Piedmont Office Realty Trust, Inc., Class A | | |

| | |

| | |

| | |

| | |

Retail Opportunity Investments Corp. | | |

Rexford Industrial Realty, Inc. | | |

| | |

Ryman Hospitality Properties, Inc. | | |

Sabra Health Care REIT, Inc. | | |

| | |

Seaport Entertainment Group, Inc. * | | |

| | |

Simon Property Group, Inc. | | |

| | |

| | |

| | |

| | |

Sunstone Hotel Investors, Inc. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Xenia Hotels & Resorts, Inc. | | |

Zillow Group, Inc., Class A * | | |

Zillow Group, Inc., Class C * | | |

| | |

Total Common Stocks

(Cost $68,856,906) | |

|

INVESTMENT COMPANIES 0.1% OF NET ASSETS |

|

|

iShares Core U.S. REIT ETF | | |

Total Investment Companies

(Cost $92,093) | |

| | |

SHORT-TERM INVESTMENTS 0.6% OF NET ASSETS |

|

|

State Street Institutional U.S. Government Money Market Fund, Premier Class 5.24% (d)(e) | | |

Total Short-Term Investments

(Cost $513,021) | |

Total Investments in Securities

(Cost $69,462,020) | |

6

Schwab Fundamental Global Real Estate Index Fund | Semiannual Holdings and Financial Statements

Schwab Fundamental Global Real Estate Index Fund

Portfolio Holdings as of August 31, 2024 (Unaudited) (continued)

| | | CURRENT VALUE/

UNREALIZED

APPRECIATION

($) |

|

| | | |

Dow Jones U.S. Real Estate Index, expires 09/20/24 | | | |

MSCI Emerging Markets Index, expires 09/20/24 | | | |

| | | |

| Non-income producing security. |

| All or a portion of this security is on loan. Securities on loan were valued at $288,689. |

| Fair valued using significant unobservable inputs (see financial note 2(a), Securities for which no quoted value is available, for additional information). |

| Issuer is an affiliated company, as the investment adviser owns at least 5% of the voting securities of such company. |

| The rate shown is the annualized 7-day yield. |

| Security purchased with cash collateral received for securities on loan. |

| American Depositary Receipt |

| |

| |

| Non-Voting Depositary Receipt |

| Real Estate Investment Trust |

| |

|

| |

Diversified Real Estate Activities | |

| |

Real Estate Operating Companies | |

| |

| |

| |

| |

Multi-Family Residential REITs | |

| |

| |

| |

| |

| |

| |

Single-Family Residential REITs | |

| |

| |

| |

| |

| Includes holdings within industries that are less than 1.0% of net assets. |

Below is a summary of the fund’s transactions with affiliated issuers and affiliated companies which are or were affiliates during the period ended August 31, 2024. An affiliated company is a company in which the investment adviser has or had an ownership of at least 5% of the voting securities of a security issue during the report period. A dash in the Value at February 29, 2024, and/or Value at August 31, 2024, columns means either the issuer was not held or not held as an affiliate at the beginning of period and is no longer held at period end or the issuer is held at period end but is no longer an affiliate.

| | | | | NET CHANGE IN UNREALIZED APPRECIATION (DEPRECIATION) | | BALANCE OF SHARES HELD AT 8/31/24 | |

COMMON STOCKS 0.3% OF NET ASSETS |

|

|

Ashford Hospitality Trust, Inc. | | | | | | | | |

Diversified Healthcare Trust | | | | | | | | |

| | | | | | | | |

Schwab Fundamental Global Real Estate Index Fund | Semiannual Holdings and Financial Statements

7

Schwab Fundamental Global Real Estate Index Fund

Portfolio Holdings as of August 31, 2024 (Unaudited) (continued)

The following is a summary of the inputs used to value the fund’s investments as of August 31, 2024 (see financial note 2(a) for additional information):

| QUOTED PRICES IN

ACTIVE MARKETS FOR

IDENTICAL ASSETS

(LEVEL 1) | OTHER SIGNIFICANT

OBSERVABLE INPUTS

(LEVEL 2) | SIGNIFICANT

UNOBSERVABLE INPUTS

(LEVEL 3) | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Level 3 amount shown includes securities determined to have no value at August 31, 2024. |

| As categorized in the Portfolio Holdings. |

| Futures contracts are reported at cumulative unrealized appreciation or depreciation. |

8

Schwab Fundamental Global Real Estate Index Fund | Semiannual Holdings and Financial Statements

Schwab Fundamental Global Real Estate Index Fund

Statement of Assets and Liabilities

As of August 31, 2024; unaudited

|

Investments in securities, at value - affiliated issuers (cost $90,416) | | |

Investments in securities, at value - unaffiliated issuers (cost $69,371,604) including securities on loan of $288,689 | | |

| | |

Foreign currency, at value (cost $142,483) | | |

Deposit with broker for futures contracts | | |

| | |

| | |

| | |

| | |

| | |

Income from securities on loan | | |

Variation margin on future contracts | | |

| | |

| | |

|

|

Collateral held for securities on loan | | |

| | |

| | |

| | |

| | |

| | |

| | |

|

|

Capital received from investors | | |

| | |

| | |

Schwab Fundamental Global Real Estate Index Fund | Semiannual Holdings and Financial Statements

9

Schwab Fundamental Global Real Estate Index Fund

Statement of Operations

For the period March 1, 2024 through August 31, 2024; unaudited |

|

Dividends received from securities - unaffiliated issuers (net of foreign withholding tax of $86,235) | | |

Dividends received from securities - affiliated issuers | | |

| | |

| | |

| | |

|

|

| | |

| | |

| | |

|

REALIZED AND UNREALIZED GAINS (LOSSES) |

Net realized gains on sales of securities - affiliated issuers | | |

Net realized losses on sales of securities - unaffiliated issuers | | |

Net realized gains on futures contracts | | |

Net realized losses on foreign currency transactions | | |

| | |

Net change in unrealized appreciation (depreciation) on securities - affiliated issuers | | |

Net change in unrealized appreciation (depreciation) on securities - unaffiliated issuers | | |

Net change in unrealized appreciation (depreciation) on futures contracts | | |

Net change in unrealized appreciation (depreciation) on foreign currency translations | | |

Net change in unrealized appreciation (depreciation) | | |

Net realized and unrealized gains | | |

Increase in net assets resulting from operations | | |

10

Schwab Fundamental Global Real Estate Index Fund | Semiannual Holdings and Financial Statements

Schwab Fundamental Global Real Estate Index Fund

Statement of Changes in Net Assets

For the current and prior report periods

Figures for the current period are unaudited

|

| | |

| | | |

| | | |

Net change in unrealized appreciation (depreciation) | | | |

Increase (decrease) in net assets resulting from operations | | | |

|

DISTRIBUTIONS TO SHAREHOLDERS |

| | | |

TRANSACTIONS IN FUND SHARES |

| | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Net transactions in fund shares | | | | | |

|

SHARES OUTSTANDING AND NET ASSETS |

| | |

| | | | | |

| | | | | |

Total increase (decrease) | | | | | |

| | | | | |

Schwab Fundamental Global Real Estate Index Fund | Semiannual Holdings and Financial Statements

11

Schwab Fundamental Global Real Estate Index Fund

Financial Notes, unaudited

1. Business Structure of the Fund:

Schwab Fundamental Global Real Estate Index Fund is a series of Schwab Capital Trust (the trust), a no-load, open-end management investment company. The trust is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended (the 1940 Act). The list below shows all the funds in the trust as of the end of the period, including the fund discussed in this report, which is highlighted:

|

Schwab Fundamental Global Real Estate Index Fund | |

Schwab Fundamental U.S. Large Company Index Fund | |

Schwab Fundamental U.S. Small Company Index Fund | |

Schwab Fundamental International Equity Index Fund | |

Schwab Fundamental International Small Equity Index Fund | |

Schwab Fundamental Emerging Markets Equity Index Fund | |

Schwab S&P 500 Index Fund | |

Schwab Small-Cap Index Fund® | |

Schwab Total Stock Market Index Fund® | |

Schwab U.S. Large-Cap Growth Index Fund | |

Schwab U.S. Large-Cap Value Index Fund | |

Schwab U.S. Mid-Cap Index Fund | Schwab Monthly Income Fund — Target Payout |

Schwab International Index Fund® | Schwab Monthly Income Fund — Flexible Payout |

Schwab MarketTrack All Equity Portfolio™ | Schwab Monthly Income Fund — Income Payout |

Schwab MarketTrack Growth Portfolio™ | Schwab Target 2010 Index Fund |

Schwab MarketTrack Balanced Portfolio™ | Schwab Target 2015 Index Fund |

Schwab MarketTrack Conservative Portfolio™ | Schwab Target 2020 Index Fund |

Schwab International Opportunities Fund™ | Schwab Target 2025 Index Fund |

| Schwab Target 2030 Index Fund |

| Schwab Target 2035 Index Fund |

Schwab Dividend Equity Fund | Schwab Target 2040 Index Fund |

Schwab Large-Cap Growth Fund | Schwab Target 2045 Index Fund |

Schwab Small-Cap Equity Fund | Schwab Target 2050 Index Fund |

| Schwab Target 2055 Index Fund |

Schwab International Core Equity Fund | Schwab Target 2060 Index Fund |

| Schwab Target 2065 Index Fund |

Schwab Fundamental Global Real Estate Index Fund offers one share class. Shares are bought and sold at closing net asset value per share (NAV), which is the price for all outstanding shares of the fund. Each share has a par value of 1/1,000 of a cent, and the fund’s Board of Trustees (the Board) may authorize the issuance of as many shares as necessary.

The fund maintains its own account for purposes of holding assets and accounting, and is considered a separate entity for tax purposes. Within its account, the fund may also keep certain assets in segregated accounts, as required by securities law. The "Fund Complex" includes The Charles Schwab Family of Funds, Schwab Capital Trust, Schwab Investments, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust.

The Schwab Fundamental Global Real Estate Index Fund’s goal is to track as closely as possible, before fees and expenses, the total return of an index that measures the performance of global real estate equities based on their fundamental size and weight.

2. Significant Accounting Policies:The following is a summary of the significant accounting policies the fund uses in its preparation of financial statements. The fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standard Codification Topic 946 Financial Services — Investment Companies. The accounting policies are in conformity with accounting principles generally accepted in the United States of America (GAAP).

The fund may invest in mutual funds and exchange-traded funds (ETFs), which are referred to as "underlying funds". For more information about the underlying funds’ operations and policies, please refer to those funds’ semiannual and annual reports and holdings and financial statements, which are filed in Form N-CSR with the U.S. Securities and Exchange Commission (SEC) and are available on the SEC’s website at www.sec.gov.

12

Schwab Fundamental Global Real Estate Index Fund | Semiannual Holdings and Financial Statements

Schwab Fundamental Global Real Estate Index Fund

Financial Notes, unaudited (continued)

2. Significant Accounting Policies (continued):

(a) Security Valuation:

Pursuant to Rule 2a-5 under the 1940 Act, the Board has designated authority to a Valuation Designee, the fund’s investment adviser, to make fair valuation determinations under adopted procedures, subject to Board oversight. The investment adviser has formed a Pricing Committee to administer the pricing and valuation of portfolio securities and other assets and liabilities as well as to ensure that prices used for internal purposes or provided by third parties reasonably reflect fair value. The Valuation Designee may utilize independent pricing services, quotations from securities and financial instrument dealers and other market sources to determine fair value.

Securities held in the fund’s portfolio are valued every business day. The following valuation policies and procedures are used by the Valuation Designee to value various types of securities:

● Securities traded on an exchange or over-the-counter: Traded securities are valued at the closing value for the day, or, on days when no closing value has been reported, at the mean of the most recent bid and ask quotes. Securities that are primarily traded on foreign exchanges are valued at the official closing price or the last sales price on the exchange where the securities are principally traded with these values then translated into U.S. dollars at the current exchange rate, unless these securities are fair valued as discussed below.

● Foreign equity security fair valuation: The Valuation Designee has adopted procedures to fair value foreign equity securities that are traded in markets that close prior to the valuation of the fund’s holdings. By fair valuing securities whose prices may have been affected by events occurring after the close of trading, the Valuation Designee seeks to establish prices that investors might expect to realize upon the current sales of these securities. This methodology is designed to deter “arbitrage” market timers, who seek to exploit delays between the change in the value of the fund’s portfolio holdings and the NAV of the fund’s shares and seeks to help ensure that the prices at which the fund’s shares are purchased and redeemed are fair and do not result in dilution of shareholder interest or other harm to shareholders. When fair value pricing is used at the open or close of a reporting period, it may cause a temporary divergence between the return of the fund and that of its comparative index or benchmark.

● Futures contracts: Futures contracts are valued at their settlement prices as of the close of their exchanges.

● Mutual funds: Mutual funds are valued at their respective NAVs.

● Securities for which no quoted value is available: The Valuation Designee has adopted procedures to fair value the fund’s securities when market prices are not “readily available” or are unreliable. For example, a security may be fair valued when it’s de-listed or its trading is halted or suspended; when a security’s primary pricing source is unable or unwilling to provide a price; or when a security’s primary trading market is closed during regular market hours. Fair value determinations are made in good faith in accordance with adopted valuation procedures. The Valuation Designee considers a number of factors, including unobservable market inputs, when arriving at fair value. The Valuation Designee may employ methods such as the review of related or comparable assets or liabilities, related market activities, recent transactions, market multiples, book values, transactional back-testing, disposition analysis and other relevant information. Due to the subjective and variable nature of fair value pricing, there can be no assurance that the fund could obtain the fair value assigned to the security upon the sale of such security.

In accordance with the authoritative guidance on fair value measurements and disclosures under GAAP, the fund discloses the fair value of its investments in a hierarchy that prioritizes the significant inputs to valuation methods used to measure the fair value. The hierarchy gives the highest priority to valuations based upon unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to valuations based upon unobservable inputs that are significant to the valuation (Level 3 measurements). If inputs used to measure the financial instruments fall within different levels of the hierarchy, the categorization is based on the lowest level input that is significant to the valuation. If it is determined that either the volume and/or level of activity for an asset or liability has significantly decreased (from normal conditions for that asset or liability) or price quotations or observable inputs are not associated with orderly transactions, increased analysis and the Valuation Designee’s judgment will be required to estimate fair value.

The three levels of the fair value hierarchy are as follows:

● Level 1 — quoted prices in active markets for identical investments — Investments whose values are based on quoted market prices in active markets. These generally include active listed equities, mutual funds, ETFs and futures contracts. Mutual funds and ETFs are classified as Level 1 prices, without consideration to the classification level of the underlying securities held which could be Level 1, Level 2 or Level 3 in the fair value hierarchy.

Schwab Fundamental Global Real Estate Index Fund | Semiannual Holdings and Financial Statements

13

Schwab Fundamental Global Real Estate Index Fund

Financial Notes, unaudited (continued)

2. Significant Accounting Policies (continued):

● Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) — Investments that trade in markets that are not considered to be active, but whose values are based on quoted market prices, dealer quotations or valuations provided by alternative pricing sources supported by observable inputs are classified as Level 2 prices. These generally include forward foreign currency exchange contracts, U.S. government and sovereign obligations, most government agency securities, investment-grade corporate bonds, certain mortgage products, less liquid listed equities, and state, municipal and provincial obligations. In addition, international securities whose markets close hours before the valuation of the fund’s holdings may require fair valuations due to significant movement in the U.S. markets occurring after the daily close of the foreign markets. The Valuation Designee has approved a vendor that calculates fair valuations of international equity securities based on a number of factors that appear to correlate to the movements in the U.S. markets.

● Level 3 — significant unobservable inputs (including the Valuation Designee’s assumptions in determining the fair value of investments) — Investments whose values are classified as Level 3 prices have significant unobservable inputs, as they may trade infrequently or not at all. When observable prices are not readily available for these securities, one or more valuation methods are used for which sufficient and reliable data is available. The inputs used in estimating the value of Level 3 prices may include the original transaction price, quoted prices for similar securities or assets in active markets, completed or pending third-party transactions in the underlying investment or comparable issuers, and changes in financial ratios or cash flows. Level 3 prices may also be adjusted to reflect illiquidity and/or non-transferability, with the amount of such discount estimated in the absence of market information. Assumptions used due to the lack of observable inputs may significantly impact the resulting fair value and therefore a fund’s results of operations.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The levels associated with valuing the fund’s investments as of August 31, 2024, are disclosed in the fund’s Portfolio Holdings.

(b) Accounting Policies for certain Portfolio Investments (if held):

Futures Contracts: Futures contracts are instruments that represent an agreement between two parties that obligates one party to buy, and the other party to sell, specific instruments at an agreed upon price on a stipulated future date. The fund must give the broker a deposit of cash and/or securities (initial margin) whenever it enters into a futures contract. The amount of the deposit may vary from one contract to another. Subsequent payments (variation margin) are made or received by the fund depending on the daily fluctuations in the value of the futures contract and are accounted for as unrealized appreciation or depreciation until the contract is closed, at which time the gains or losses are realized. Futures contracts are traded publicly on exchanges, and their value may change daily.

Securities Lending: Under the trust’s Securities Lending Program, the fund (lender) may make short-term loans of its securities to another party (borrower) to generate additional revenue for the fund. The borrower pledges collateral in the form of cash, securities issued or fully guaranteed by the U.S. government or foreign governments, or letters of credit issued by a bank. Collateral at the individual loan level is required to be maintained on a daily marked-to-market basis in an amount at least equal to the current value of the securities loaned. The lending agent provides the fund with indemnification against borrower default (the borrower fails to return the security on loan) reducing the risk of loss as a result of default. The cash collateral of securities loaned is currently invested in money market portfolios operating pursuant to Rule 2a-7 under the 1940 Act. The fund bears the risk of loss with respect to the investment of cash collateral. The terms of the securities lending agreement allow the fund or the lending agent to terminate any loan at any given time and the securities must be returned within the earlier of the standard trade settlement period or the specified time period under the relevant securities lending agreement. Securities lending income, as disclosed in the fund’s Statement of Operations, if applicable, represents the income earned from the investment of the cash collateral plus any fees paid by borrowers, less the fees paid to the lending agent and broker rebates which are subject to adjustments pursuant to the securities lending agreement. On loans not collateralized by cash, a fee is received from the borrower, and is allocated between the fund and the lending agent. The aggregate fair value of securities loaned will not at any time exceed one-third of the total assets of the fund, including collateral received from the loan. Securities lending fees paid to the unaffiliated lending agents start at 9% of gross lending revenue, with subsequent breakpoints to a low of 5%. In this context, the gross lending revenue equals the income received from the investment of cash collateral and fees paid by borrowers less any rebates paid to the borrowers. Any expenses charged by the cash collateral fund are in addition to these fees. All remaining revenue is retained by the fund, as applicable. No portion of lending revenue is paid to or retained by the investment adviser or any of its affiliates.

14

Schwab Fundamental Global Real Estate Index Fund | Semiannual Holdings and Financial Statements

Schwab Fundamental Global Real Estate Index Fund

Financial Notes, unaudited (continued)

2. Significant Accounting Policies (continued):

As of August 31, 2024, the fund had securities on loan, all of which were classified as common stocks. The value of the securities on loan and the related collateral as of August 31, 2024, are disclosed in the fund’s Portfolio Holdings and Statement of Assets and Liabilities.

Cash Investments: The fund may invest a portion of its assets in cash. Cash includes cash bank balances in an interest-bearing demand deposit account with maturity on demand by the fund.

Passive Foreign Investment Companies: The fund may own shares in certain foreign corporations that meet the Internal Revenue Code definition of a Passive Foreign Investment Company (PFIC). The fund may elect for tax purposes to mark-to-market annually the shares of each PFIC lot held and would be required to distribute as ordinary income to shareholders any such marked-to-market gains (as well as any gains realized on sale).

Central Securities Depositories Regulation: The Central Securities Depositories Regulation (CSDR) introduced measures for the authorization and supervision of European Union Central Security Depositories and created a common set of prudential, organizational, and conduct of business standards at a European level. CSDR is designed to support securities settlement and operational aspects of securities settlement, including the provision of shorter settlement periods; mandatory buy-ins; and cash penalties, to prevent and address settlement fails. CSDR measures are aimed to prevent settlement fails by ensuring that all transaction details are provided to facilitate settlement, as well as further incentivizing timely settlement by imposing cash penalty fines and buy-ins. The fund may be subject to pay cash penalties and may also receive cash penalties with certain counterparties in instances where there are settlement fails. These cash penalties are included in net realized gains (losses) on sales of securities in the fund’s Statement of Operations, if any.

(c) Security Transactions:

Security transactions are recorded as of the date the order to buy or sell the security is executed. Realized gains and losses from security transactions are based on the identified costs of the securities involved.

Assets and liabilities denominated in foreign currencies are reported in U.S. dollars. For assets and liabilities held on a given date, the dollar value is based on market exchange rates in effect on that date. Transactions involving foreign currencies, including purchases, sales, income receipts and expense payments, are calculated using exchange rates in effect on the transaction date. Realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the differences between the recorded amounts of dividends, interest, and foreign withholding taxes and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange appreciation or depreciation arises from changes in foreign exchange rates on foreign denominated assets and liabilities other than investments in securities held at the end of the reporting period. These realized and unrealized foreign exchange gains or losses are reported in foreign currency transactions or translations in the fund’s Statement of Operations, if any. The fund does not isolate the portion of the fluctuations on investments resulting from changes in foreign currency exchange rates from the fluctuations in market prices of investments held. Such fluctuations are included with the net realized and unrealized gain or loss from investments, if any.

Gains realized by the fund on the sale of securities in certain foreign countries may be subject to non-U.S. taxes. In those instances, the fund records a liability based on unrealized appreciation to provide for potential non-U.S. taxes payable upon the sale of these securities.

When the fund closes out a futures contract position, it calculates the difference between the value of the position at the beginning and at the end of the contract, and records a realized gain or loss accordingly.

The fund invests in real estate investment trusts (REITs) which report information on the source of their distributions annually. The fund’s policy is to record all REIT distributions initially as dividend income on the ex-dividend date and then re-designate them as return of capital and/or capital gain distributions at the end of the reporting period based on information provided annually by each REIT, and management estimates such re-designations when actual information has not yet been reported.

Interest income is recorded as it accrues. Dividends and distributions from portfolio securities and underlying funds are recorded on the date they are effective (the ex-dividend date), although the fund records certain foreign security dividends on the date the ex-dividend date is confirmed. Any distributions from underlying funds are recorded in accordance with the character of the distributions as designated by the underlying funds.

Schwab Fundamental Global Real Estate Index Fund | Semiannual Holdings and Financial Statements

15

Schwab Fundamental Global Real Estate Index Fund

Financial Notes, unaudited (continued)

2. Significant Accounting Policies (continued):

Income received from foreign sources may result in withholding tax. Withholding taxes are accrued at the same time as the related income if the tax rate is fixed and known, unless a tax withheld is reclaimable from the local tax authorities in which case it is recorded as receivable. If the tax rate is not known or estimable, such expense or reclaim receivable is recorded when the net proceeds are received.

Pursuant to an Amended and Restated Investment Advisory and Administration Agreement (Advisory Agreement) between the investment adviser and the fund, the investment adviser pays the operating expenses of the fund, excluding acquired fund fees and expenses, taxes, any brokerage expenses, and extraordinary or non-routine expenses. Taxes, any brokerage expenses and extraordinary or non-routine expenses that are specific to the fund are charged directly to the fund. The Advisory Agreement excludes paying acquired fund fees and expenses, which are indirect expenses incurred by the fund through its investments in underlying funds.

(f) Distributions to Shareholders:

The fund makes distributions from net investment income, if any, quarterly and from net realized capital gains, if any, once a year. To receive a distribution, you must be a registered shareholder on the record date. Distributions are paid to shareholders on the payable date.

(g) Accounting Estimates:

The accounting policies described in this report conform to GAAP. Notwithstanding this, shareholders should understand that in order to follow these principles, fund management has to make estimates and assumptions that affect the information reported in the financial statements. It’s possible that once the results are known, they may turn out to be different from these estimates and these differences may be material.

(h) Federal Income Taxes:

The fund intends to meet federal income and excise tax requirements for regulated investment companies under subchapter M of the Internal Revenue Code, as amended. Accordingly, the fund distributes substantially all of its net investment income and net realized capital gains, if any, to its shareholders each year. As long as the fund meets the tax requirements, it is not required to pay federal income tax.

The fund may be subject to foreign taxes (a portion of which may be reclaimable) on income, corporate events, foreign currency exchanges and capital gains on investments. All foreign taxes are recorded in accordance with the applicable foreign tax regulations and rates that exist in foreign markets in which the fund invests. These foreign taxes, if any, are paid by the fund and are disclosed in the fund’s Statement of Operations, if any. Foreign taxes accrued as of August 31, 2024, if any, are reflected in the fund’s Statement of Assets and Liabilities.

Under the fund’s organizational documents, the officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the fund. In addition, in the normal course of business the fund enters into contracts with its vendors and others that provide general indemnifications. The fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the fund. However, based on experience, the fund expects the risk of loss attributable to these arrangements to be remote.

Investing in the fund may involve certain risks, as discussed in the fund’s prospectus, including, but not limited to, those described below. Any of these risks could cause an investor to lose money.

Market Risk. Financial markets rise and fall in response to a variety of factors, sometimes rapidly and unpredictably. Markets may be impacted by economic, political, regulatory and other conditions, including economic sanctions and other government actions. In addition, the occurrence of global events, such as war, terrorism, environmental disasters, natural disasters and epidemics, may also negatively affect the financial markets. As with any investment whose performance is tied to these markets, the value of an investment in the fund will fluctuate, which means that an investor could lose money over short or long periods.

16

Schwab Fundamental Global Real Estate Index Fund | Semiannual Holdings and Financial Statements

Schwab Fundamental Global Real Estate Index Fund

Financial Notes, unaudited (continued)

3. Risk Factors (continued):

Equity Risk. The prices of equity securities rise and fall daily. These price movements may result from factors affecting individual companies, industries or the securities market as a whole. In addition, equity markets tend to move in cycles, which may cause stock prices to fall over short or extended periods of time.

Investment Style Risk. The fund is an index fund. Therefore, the fund follows the securities included in the index during upturns as well as downturns. Because of its indexing strategy, the fund does not take steps to reduce market exposure or to lessen the effects of a declining market. In addition, because of the fund’s expenses, the fund’s performance may be below that of the index. Errors relating to the index may occur from time to time and may not be identified by the index provider for a period of time. In addition, market disruptions could cause delays in the index’s rebalancing schedule. Such errors and/or market disruptions may result in losses for the fund.

New Index Risk. The fund’s comparative index was recently constituted and has not previously been utilized for a registered fund, which may create additional risks for investing in the fund.

Market Capitalization Risk. Securities issued by companies of different market capitalizations tend to go in and out of favor based on market and economic conditions. During a period when securities of a particular market capitalization fall behind other types of investments, the fund’s performance could be impacted.

Large-Cap Company Risk. Large-cap companies are generally more mature and the securities issued by these companies may not be able to reach the same levels of growth as the securities issued by small- or mid-cap companies.

Mid-Cap Company Risk. Mid-cap companies may be more vulnerable to adverse business or economic events than larger, more established companies and the value of securities issued by these companies may move sharply.

Small-Cap Company Risk. Securities issued by small-cap companies may be riskier than those issued by larger companies, and their prices may move sharply, especially during market upturns and downturns.

Real Estate Investment Risk. Due to the composition of the index, the fund will concentrate its investments in real estate companies and companies related to the real estate industry. As such, the fund is subject to risks associated with the direct ownership of real estate securities and an investment in the fund will be closely linked to the performance of the real estate markets. These risks include, among others: declines in the value of (or income generated by) real estate; risks related to general and local economic conditions; possible lack of availability of mortgage funds or other limits to accessing the credit or capital markets; defaults by borrowers or tenants, particularly during an economic downturn; and changes in interest rates.

REITs Risk. In addition to the risks associated with investing in securities of real estate companies and real estate related companies, REITs are subject to certain additional risks. Equity REITs may be affected by changes in the value of the underlying properties owned by the trusts. Further, REITs are dependent upon specialized management skills and cash flows, and may have their investments in relatively few properties, or in a small geographic area or a single property type. Failure of a company to qualify as a REIT under federal tax law may have adverse consequences to the fund. In addition, REITs have their own expenses, and the fund will bear a proportionate share of those expenses. The value of a REIT may be affected by changes in interest rates.

Foreign Investment Risk. The fund’s investments in securities of foreign issuers involve certain risks that may be greater than those associated with investments in securities of U.S. issuers. These include risks of adverse changes in foreign economic, political, regulatory and other conditions; changes in currency exchange rates or exchange control regulations (including limitations on currency movements and exchanges); the imposition of economic sanctions or other government restrictions; differing accounting, auditing, financial reporting and legal standards and practices; differing securities market structures; and higher transaction costs. These risks may negatively impact the value or liquidity of the fund’s investments and could impair the fund’s ability to meet its investment objective or invest in accordance with its investment strategy. There is a risk that investments in securities denominated in, and/or receiving revenues in, foreign currencies will decline in value relative to the U.S. dollar. Foreign securities also include American Depositary receipts (ADRs), Global Depositary receipts (GDRs) and European Depositary receipts (EDRs), which may be less liquid than the underlying shares in their primary trading market, and GDRs, in particular, many of which are issued by companies in emerging markets, may be more volatile. Foreign securities may also include investments in variable interest entities (VIEs) structures, which are created by China-based operating companies in jurisdictions outside of China to obtain indirect financing due to Chinese regulations that prohibit non-Chinese ownership of those companies. To the extent the fund’s investments in a single country or a limited number of countries represent a large percentage of the fund’s assets, the fund’s performance may be adversely affected by the economic, political, regulatory and social conditions in those countries, and the fund’s price may be more volatile than the price of a fund that is geographically diversified.

Schwab Fundamental Global Real Estate Index Fund | Semiannual Holdings and Financial Statements

17

Schwab Fundamental Global Real Estate Index Fund

Financial Notes, unaudited (continued)

3. Risk Factors (continued):

Emerging Markets Risk. Emerging market countries may be more likely to experience political turmoil or rapid changes in market or economic conditions than more developed countries. Emerging market countries often have less uniformity in accounting, auditing, financial reporting and recordkeeping requirements and greater risk associated with the custody of securities. In addition, the financial stability of issuers (including governments) in emerging market countries may be more precarious than in developed countries. As a result, there may be an increased risk of illiquidity and price volatility associated with the fund’s investments in emerging market countries, which may be magnified by currency fluctuations relative to the U.S. dollar, and, at times, it may be difficult to value such investments.

Sampling Index Tracking Risk. The fund may not fully replicate the index and may hold securities not included in the index. As a result, the fund is subject to the risk that the investment adviser’s investment management strategy, the implementation of which is subject to a number of constraints, may not produce the intended results. Because the fund utilizes a sampling approach it may not track the return of the index as well as it would if the fund purchased all of the securities in the index.

Tracking Error Risk. As an index fund, the fund seeks to track the performance of the index, although it may not be successful in doing so. The divergence between the performance of the fund and the index, positive or negative, is called “tracking error.” Tracking error can be caused by many factors and it may be significant.

Concentration Risk. To the extent that the fund’s or the index’s portfolio is concentrated in the securities of issuers in a particular market, industry, group of industries, sector, country, or asset class (including the real estate industry, as described above), the fund may be adversely affected by the performance of those securities, may be subject to increased price volatility and may be more vulnerable to adverse economic, market, political or regulatory occurrences affecting that market, industry, group of industries, sector, country, or asset class.

Derivatives Risk. The fund may use derivatives to enhance returns or hedge against market declines. Examples of derivatives are options, futures, options on futures and swaps. An option is the right, but not the obligation, to buy or sell an instrument at a specific price on or before a specific date. A future is an agreement to buy or sell a financial instrument at a specific price on a specific day. A swap is an agreement whereby two parties agree to exchange payment streams calculated in relation to a rate, index, instrument or certain securities and a predetermined amount. The fund’s use of derivatives that are subject to regulation by the Commodity Futures Trading Commission (CFTC) could cause the fund to become a commodity pool, which would require the fund to comply with certain CFTC rules.

The fund’s use of derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. Certain of these risks, such as liquidity risk, leverage risk, market risk and operational risk, are discussed elsewhere in this section. The fund’s use of derivatives is also subject to counterparty risk, lack of availability risk, valuation risk, correlation risk and tax risk. Counterparty risk is the risk that the counterparty to a derivatives transaction may not fulfill its contractual obligations either because the financial condition of the counterparty declines, or because the counterparty is otherwise unable or unwilling to perform under the contract. Lack of availability risk is the risk that suitable derivative transactions may not be available in all circumstances for risk management or other purposes. Valuation risk is the risk that a particular derivative may be valued incorrectly. Correlation risk is the risk that changes in the value of the derivative may not correlate perfectly with the underlying asset, rate or index. Tax risk is the risk that the use of derivatives may cause the fund to realize higher amounts of short-term capital gains. The fund’s use of derivatives could reduce the fund’s performance, increase the fund’s volatility, and could cause the fund to lose more than the initial amount invested. The fund’s use of derivatives also could create a risk of counterparty default under certain transactions, risks that the fund would need to liquidate portfolio positions when it may not be advantageous to do so in order to meet margin and payment obligations, and legal risks relating to insufficient documentation, insufficient capacity or authority of a counterparty, or legality or enforceability of a contract.

Exchange-Traded Fund (ETF) Risk. The fund may purchase shares of ETFs to gain exposure to a particular portion of the market while awaiting an opportunity to purchase securities directly. When the fund invests in an ETF, in addition to directly bearing the expenses associated with its own operation, it will bear a proportionate share of the ETF’s expenses. Therefore, it may be more costly to own an ETF than to own the underlying securities directly. In addition, while the risks of owning shares of an ETF generally reflect the risks of owning the underlying securities the ETF holds, lack of liquidity in the market for an ETF’s shares can result in its value being more volatile than the underlying portfolio of securities.

Liquidity Risk. The fund may be unable to sell certain securities, such as illiquid securities, readily at a favorable time or price, or the fund may have to sell them at a loss.

18

Schwab Fundamental Global Real Estate Index Fund | Semiannual Holdings and Financial Statements

Schwab Fundamental Global Real Estate Index Fund

Financial Notes, unaudited (continued)

3. Risk Factors (continued):

Leverage Risk. Certain fund transactions, such as derivatives transactions, may give rise to a form of leverage and may expose the fund to greater risk. Leverage tends to magnify the effect of any decrease or increase in the value of the fund’s portfolio securities which means even a small amount of leverage can have a disproportionately large impact on the fund. The use of leverage may cause the fund to liquidate portfolio positions when it would not be advantageous to do so in order to satisfy its obligations.

Securities Lending Risk. Securities lending involves the risk of loss of rights in, or delay in recovery of, the loaned securities if the borrower fails to return the security loaned or becomes insolvent.

Please refer to the fund’s prospectus for a more complete description of the principal risks of investing in the fund.

4. Affiliates and Affiliated Transactions:Charles Schwab Investment Management, Inc., dba Schwab Asset Management, a wholly owned subsidiary of The Charles Schwab Corporation, serves as the fund’s investment adviser and administrator pursuant to an Investment Advisory Agreement between the investment adviser and the trust.

For its advisory and administrative services to the fund, the investment adviser is entitled to receive an annual fee, payable monthly, equal to 0.39% of the fund’s average daily net assets.

The fund may engage in direct transactions with certain other funds in the Fund Complex in accordance with procedures adopted by the Board pursuant to Rule 17a-7 under the 1940 Act. When one fund is seeking to sell a security that another fund is seeking to buy, an interfund transaction can allow both funds to benefit by reducing transaction costs while allowing each fund to execute the transaction at the current market price. This practice is limited to funds that share the same investment adviser, trustees and/or officers. The net realized gains or losses on sales of interfund transactions are recorded in Net realized gains (losses) on sales of securities — unaffiliated issuers in the Statement of Operations. For the period ended August 31, 2024, the fund’s purchases and sales of securities with other funds in the Fund Complex was $1,051,437 and $1,941,626, respectively and includes realized gain of $322,251.

Interfund Borrowing and Lending

Pursuant to an exemptive order issued by the SEC, the fund may enter into interfund borrowing and lending transactions with other funds in the Fund Complex. All loans are for temporary or emergency purposes and the interest rate to be charged will be the average of the overnight repurchase agreement rate and the short-term bank loan rate. All loans are subject to numerous conditions designed to ensure fair and equitable treatment of all participating funds. The interfund lending facility is subject to the oversight and periodic review by the Board. The fund had no interfund borrowing or lending activity during the period.

The Board may include people who are officers and/or directors of the investment adviser or its affiliates. Federal securities law limits the percentage of such “interested persons” who may serve on a trust’s board, and the trust was in compliance with these limitations throughout the report period. The fund did not pay any interested persons or non-interested persons (independent trustees). The independent trustees are paid by the investment adviser.

During the period, the fund was a participant with other funds in the Fund Complex in a joint, syndicated, committed $1 billion line of credit (the Syndicated Credit Facility), maturing on September 26, 2024. Under the terms of the Syndicated Credit Facility, in addition to the investment adviser paying the interest charged on any borrowings by the fund, the investment adviser paid a commitment fee of 0.15% per annum on the fund’s proportionate share of the unused portion of the Syndicated Credit Facility.

During the period, the fund was a participant with other funds in the Fund Complex in a joint, unsecured, uncommitted $400 million line of credit (the Uncommitted Credit Facility), with State Street Bank and Trust Company, maturing on September 26, 2024. Under the terms of the Uncommitted Credit Facility, the investment adviser pays interest on the amount the fund borrows. There were no borrowings by the fund from either line of credit during the period.

Schwab Fundamental Global Real Estate Index Fund | Semiannual Holdings and Financial Statements

19

Schwab Fundamental Global Real Estate Index Fund

Financial Notes, unaudited (continued)

6. Borrowing from Banks (continued):

The fund also has access to custodian overdraft facilities. The fund may have utilized the overdraft facility and incurred an interest expense, which is paid by the investment adviser. The interest expense is determined based on a negotiated rate above the current Federal Funds Rate.

The fund entered into futures contracts during the report period to equitize available cash. Refer to financial note 2(b) for the fund’s accounting policies with respect to futures contracts and financial note 3 for disclosures concerning the risks of investing in futures contracts.

As of August 31, 2024, the Statement of Assets and Liabilities included the following financial derivative instrument fair values held at period end:

| |

| Includes cumulative unrealized appreciation of futures contracts as reported in the fund’s Portfolio Holdings. Only current day’s variation margin on futures contracts is reported in the Statement of Assets and Liabilities. |

The effects of the derivative contracts in the Statement of Operations for the period ended August 31, 2024, were:

| | |

Net Realized Gains (Losses) | | |

| | |

Net Change in Unrealized Appreciation (Depreciation) | | |

| | |

| |

| Statement of Operations location: Net realized gains (losses) on futures contracts. |

| Statement of Operations location: Net change in unrealized appreciation (depreciation) on futures contracts. |

During the period ended August 31, 2024, the month-end average notional amounts of futures contracts held by the fund and the month-end average number of contracts held were as follows:

8. Purchases and Sales of Investment Securities:For the period ended August 31, 2024, purchases and sales of securities (excluding short-term obligations) were as follows:

20

Schwab Fundamental Global Real Estate Index Fund | Semiannual Holdings and Financial Statements

Schwab Fundamental Global Real Estate Index Fund

Financial Notes, unaudited (continued)

9. Federal Income Taxes:

As of August 31, 2024, the tax basis cost of the fund’s investments and gross unrealized appreciation and depreciation were as follows:

| | GROSS UNREALIZED

APPRECIATION | GROSS UNREALIZED

DEPRECIATION | NET UNREALIZED

APPRECIATION

(DEPRECIATION) |

| | | | |

| | | | |

| | | | |

The primary differences between book basis and tax basis unrealized appreciation or unrealized depreciation of investments are the tax deferral of losses on wash sales. The tax cost of the fund’s investments, disclosed above, have been adjusted from its book amounts to reflect these unrealized appreciation or depreciation differences, as applicable.

Capital loss carryforwards have no expiration and may be used to offset future realized capital gains for federal income tax purposes. As of February 29, 2024, the fund had capital loss carryforwards of $19,853,047.

The tax basis components of distributions and components of distributable earnings on a tax basis are finalized at fiscal year-end; accordingly, tax basis balances have not been determined as of August 31, 2024. The tax basis components of distributions paid during the fiscal year ended February 29, 2024, were as follows:

| PRIOR FISCAL YEAR END DISTRIBUTIONS |

| |

| |

Distributions paid to shareholders are based on net investment income and net realized gains determined on a tax basis, which may differ from net investment income and net realized gains for financial reporting purposes. These differences reflect the differing character of certain income items and net realized gains and losses for financial statement and tax purposes, and may result in reclassification among certain capital accounts in the financial statements. The fund may also designate a portion of the amount paid to redeeming shareholders as a distribution for tax purposes.

As of February 29, 2024, management has reviewed the tax positions for open periods (for federal purposes, three years from the date of filing and for state purposes, four years from the date of filing) as applicable to the fund, and has determined that no provision for income tax is required in the fund’s financial statements. The fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the fund’s Statement of Operations. During the fiscal year ended February 29, 2024, the fund did not incur any interest or penalties.

Management has determined there are no other subsequent events or transactions through the date the financial statements were issued that would have materially impacted the financial statements as presented.

Schwab Fundamental Global Real Estate Index Fund | Semiannual Holdings and Financial Statements

21