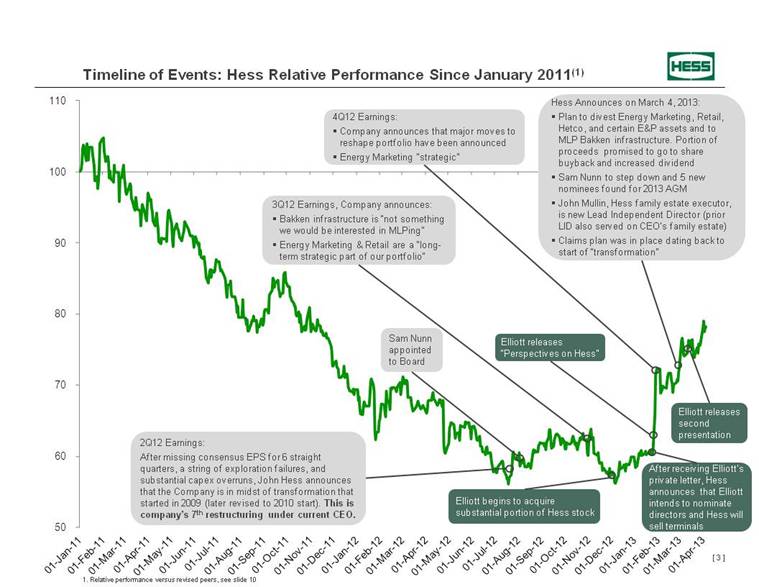

| Board and Management Received $540 Million in Compensation While Delivering Unrelenting Underperformance [ 46 ] Hess Over (Under) Performance(2,3) Despite highest oil weighting of any peer ... ...and material position in the Bakken, leading U.S. oil play In 3 of the last 5 years, John Hess has ranked in the Top 25 Highest Paid CEOs(4)... ...despite underperforming peers by (55%)(5) $540mm Paid to Board and Management Compensation to John Hess: $195mm(1) Compensation to Management excl. CEO: $313mm(1) Compensation to Board: $32mm(1) John Hess Tenure 17 Years 5-Year 4-Year 3-Year 2-Year 1-Year vs Proxy Peers (333)% (31)% (43)% (29)% (40)% (17)% vs Revised Proxy Peers (460)% (45)% (63)% (44)% (47)% (20)% vs Bakken Operators NA (263)% (984)% (184)% (70)% (16)% vs XLE NA (31)% (57)% (43)% (44)% (20)% vs XOP NA (39)% (81)% (52)% (39)% (15)% Source: Bloomberg, Company filings 1.Adjusted for inflation using Bloomberg Urban CPI; John Hess compensation calculated over his tenure as CEO, excluding inflation John Hess was paid a cumulative $165 million; NEO’s compensation calculated over John Hess’s tenure as CEO, excluding inflation NEOs were paid a cumulative $246 million; Director compensation over the tenure of each director, excluding inflation compensation totaled $26 million 2.As of 11/28/12, date before which Elliott began to purchase a substantial amount of Hess stock 3.Proxy peers: Used by Hess for mgmt compensation: Anadarko, Apache, BP, Chevron, ConocoPhillips, Devon, EOG, Exxon, Marathon, Murphy, Occidental, Shell, Statoil, Talisman and Total ; Revised proxy peers: excludes Devon & Talisman due to high North America gas weighting; excludes BP, Shell, Statoil, Total due to European super major status; includes Noble as additional relevant competitor; Bakken Operators: Includes Continental, Oasis and Kodiak 4.www.Forbes.com; According to Forbes, John Hess compensation ranked #23, #132, #94, #3 and #25 in 2012, 2011, 2010, 2009, 2008 respectively for all S&P 500 companies 5.Versus revised proxy peers; From January 1, 2008 through December 31, 2012 Source: Bloomberg, Company filings 1.Adjusted for inflation using Bloomberg Urban CPI; John Hess compensation calculated over his tenure as CEO, excluding inflation John Hess was paid a cumulative $165 million; NEO’s compensation calculated over John Hess’s tenure as CEO, excluding inflation NEOs were paid a cumulative $246 million; Director compensation over the tenure of each director, excluding inflation compensation totaled $26 million 2.As of 11/28/12, date before which Elliott began to purchase a substantial amount of Hess stock 3.Proxy peers: Used by Hess for mgmt compensation: Anadarko, Apache, BP, Chevron, ConocoPhillips, Devon, EOG, Exxon, Marathon, Murphy, Occidental, Shell, Statoil, Talisman and Total ; Revised proxy peers: excludes Devon & Talisman due to high North America gas weighting; excludes BP, Shell, Statoil, Total due to European super major status; includes Noble as additional relevant competitor; Bakken Operators: Includes Continental, Oasis and Kodiak 4.www.Forbes.com; According to Forbes, John Hess compensation ranked #23, #132, #94, #3 and #25 in 2012, 2011, 2010, 2009, 2008 respectively for all S&P 500 companies 5.Versus revised proxy peers; From January 1, 2008 through December 31, 2012 |