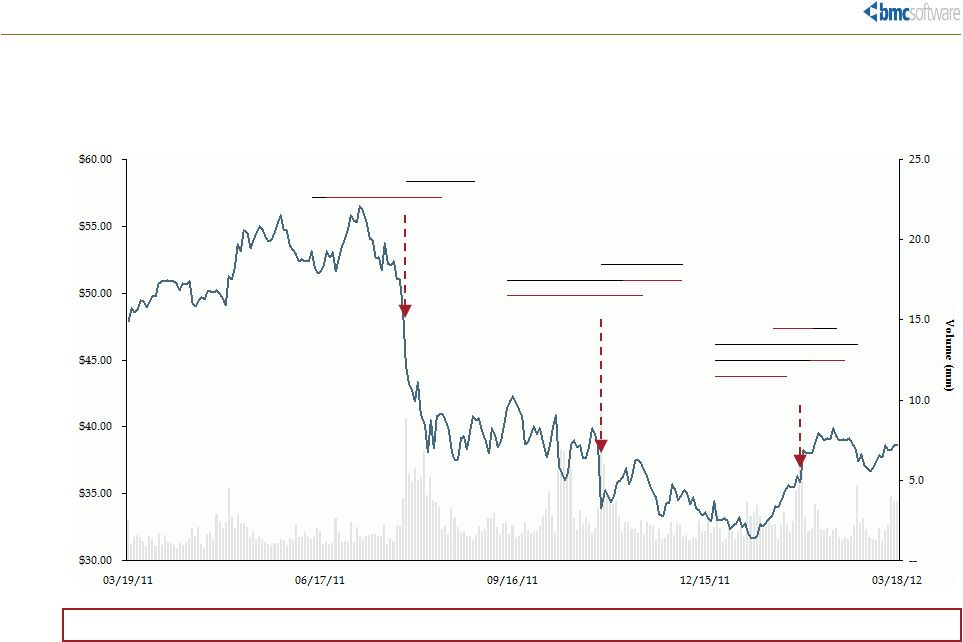

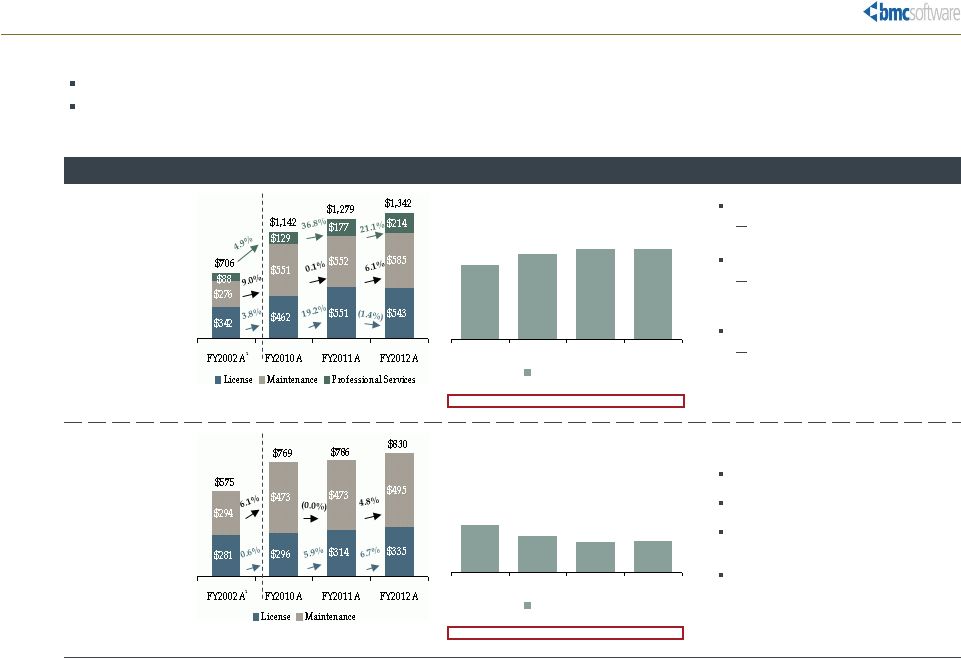

[ 34 ] Third Party Observations On BMC ON ESM: ON M&A: ON CAPITAL MANAGEMENT: BUSINESS OUTLOOK: “…but a closer look reveals a struggling business. The ESM business has deteriorated further to a surprisingly low license bookings rate, and the sales force issues do not appear to be positioned to turn this around soon....Unfortunately, it appears to us that the issues regarding the ESM business may take even longer to rectify” – J.P. Morgan (Feb 2, 2012 Following Q3’12 Results) “BMC has made a number of acquisitions in recent years, most significantly the $800 million buyout of BladeLogic in 2008, in order to diversify its offerings, but has had trouble integrating them into a coherent whole. It pitches its Remedy helpdesk, Patrol network management, and BladeLogic server automation tools as a suite, but the message hasn't always resonated with customers” – BMC Has Multiple Acquisition Suitors Information Week (May 25, 2012) “We believe investors should make several adjustments to the income statement in order to compare results… Higher rate of capitalized Software Development added to EPS…and…lower share count added to EPS” – J.P. Morgan (Feb 2, 2012 Following Q3’12 Results) “Today, BMC uses ~100% of its FCF for stock repurchases…however, during the previous three fiscal years, BMC used 55% of its FCF for buybacks” – Susquehanna Investment Group (Feb 14, 2012) “BMC has been using it [share repurchases] to materially reduce its share count, and in many cases at prices well above current levels....” – Susquehanna Investment Group (Feb 14, 2012) “Management’s guidance is predicated on an increase in sales force productivity of about 1-3% on top of an increase in productive tenured reps in the mid single digits (growth rate). This means the average fully productive sales person will sell more, which poses risk in our opinion, especially given the issues BMC appears to still be struggling with in regards to the sales” – J.P. Morgan (May 10, 2012 Following Q4’12 Results) We are not the only ones who share these perspectives on BMC: “BMC is coming off a challenging year. If it is unable to reverse the downward trend over the next year (in alignment with the stockholder rights plan), pressure may increase on the board to find a buyer at levels below their current expectations. The flip side of this likely means that even if the company doesn’t perform up to their expectations, the stock would likely have a floor as take-out speculation could intensify” - RBC Capital Markets (May 18, 2012) “BMC has historically made acquisitions to bolster growth within its lower margin ESM segment…Numara (a SaaS-based ITSM provider) was acquired in Jan 2012 for ~$300M and will be rolled into ESM to expand BMC’s cloud portfolio…Growth in bookings has been sluggish and is necessary to provide conviction on FY13 topline growth profile” – Jefferies (May 10, 2012) “In other words, BMC is now in play. It's a wake-up call that needs to be answered with more than the same old responses from management” – BMC Software becomes a takeover target as investor calls for a sale Houston Chronicle (May 24, 2012) “BMC could be an attractive asset for the likes of Hewlett Packard and Dell as they try to shift from manufacturing PCs and into integrated business service providers -- in the mold of a multi-decade turnaround at IBM. IT hardware and software giants Cisco and Oracle could find BMC's software services and cloud assets attractive as they brace for competition from the likes of salesforce.com (CRM) and peers such as SAP” – BMC Software Caught Between Cloud Boom And Tech Gloom The Street (May 23, 2012) |