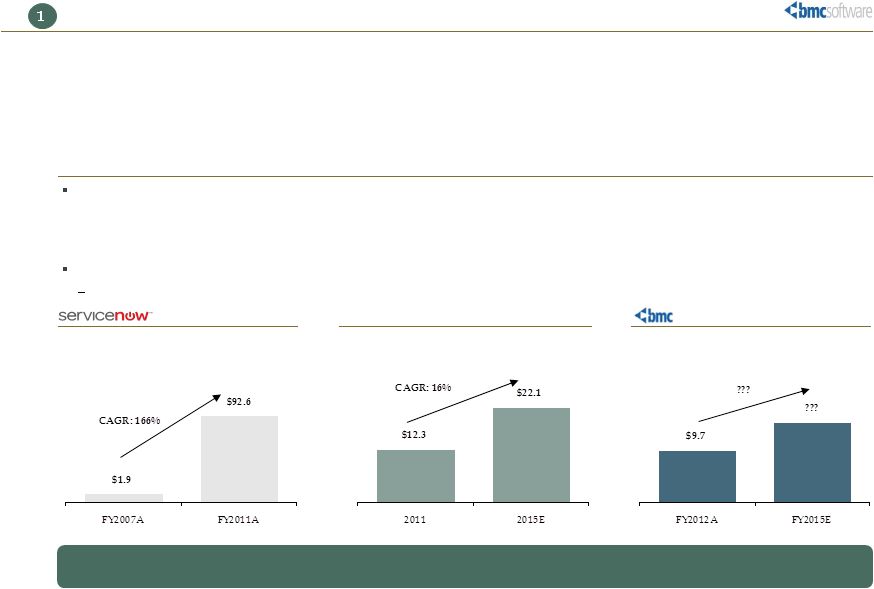

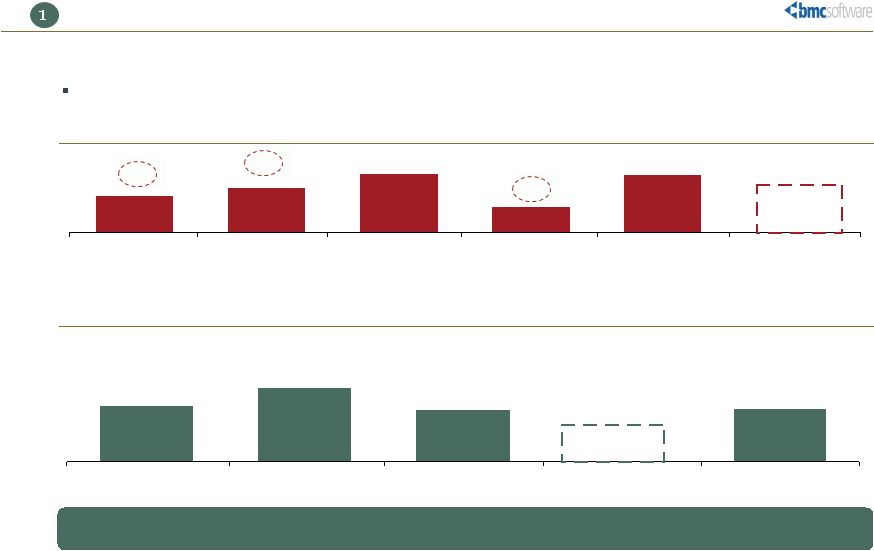

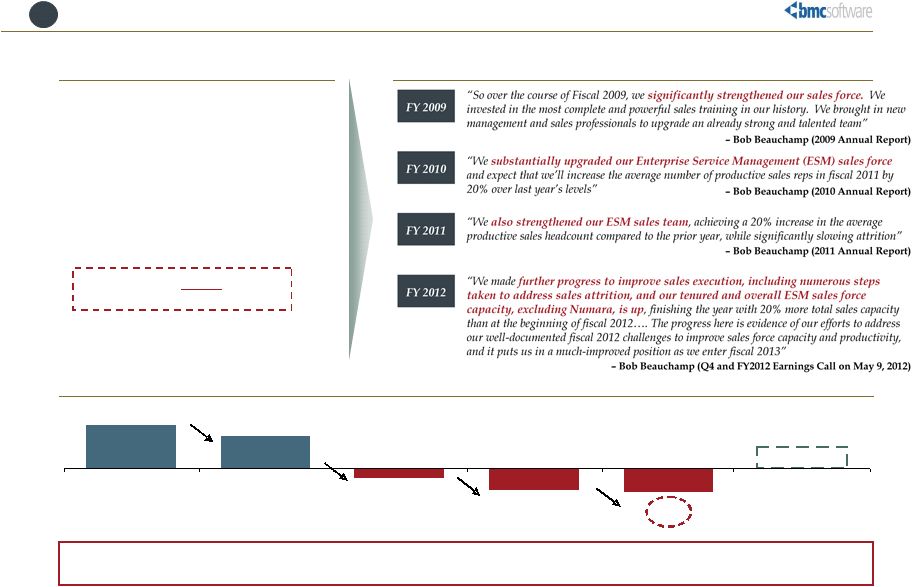

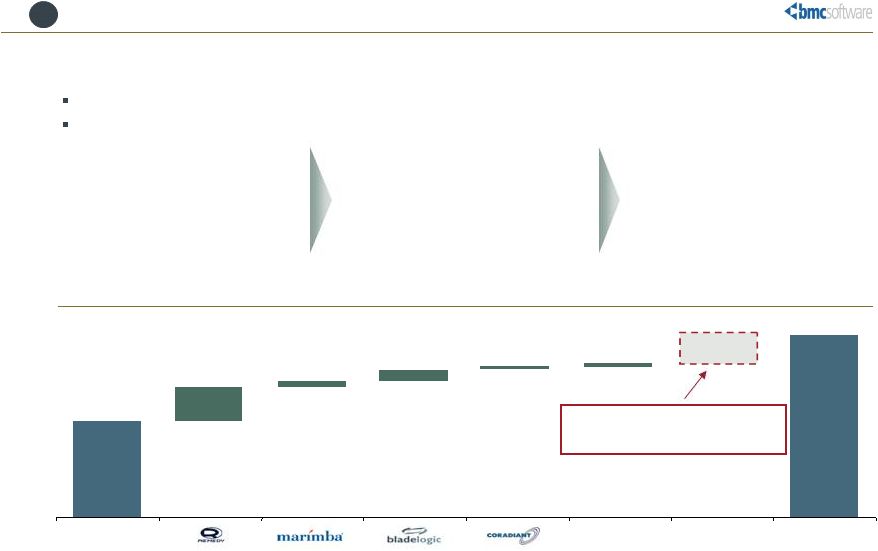

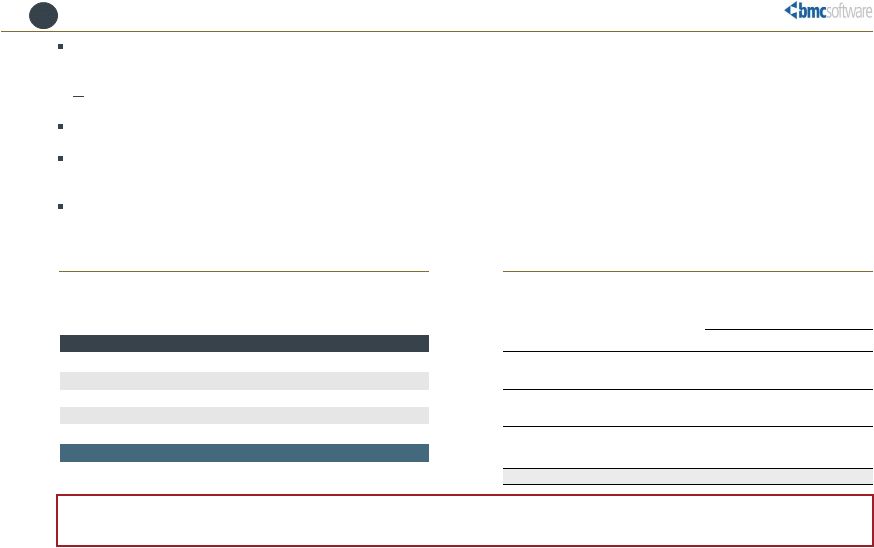

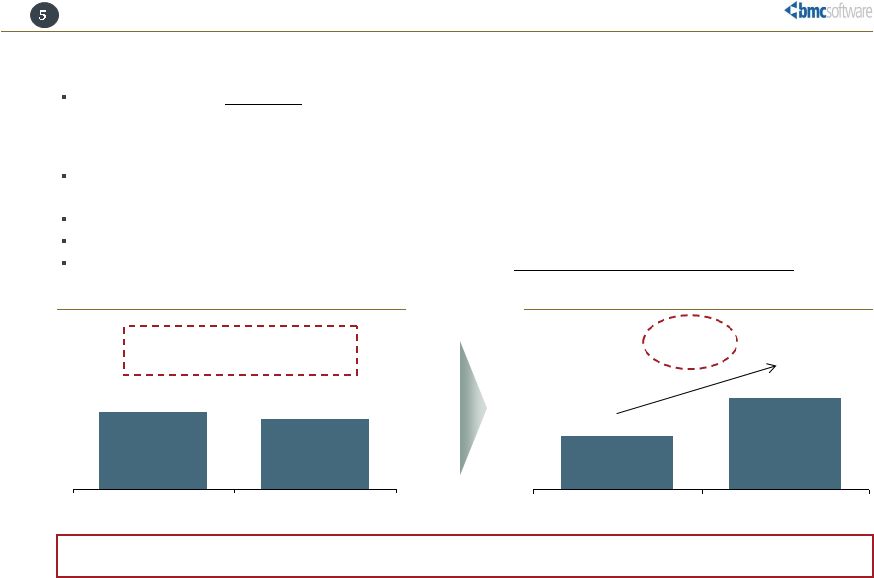

[ 20 ] [ 20 ] Management’s Same Story Doesn’t Really Fit…(cont’d) Source: Company Filings, News Reports 1. Management quote from Wall Street Journal article “Elliott Management Has Taken its Fight with BMC to Stockholders” dated 06/14/12 BMC has made similar claims since 2009, however, it appears that management is still struggling to resolve the very same sales force related issues: “BMC has made a significant investment in additional ESM direct sales capacity and adjusted the compensation structure, both of which we believe will drive growth as the sales force gains additional experience” “So over the course of Fiscal 2009, we significantly strengthened our sales force. We invested in the most complete and powerful sales training in our history. We brought in new management and sales professionals to upgrade an already strong and talented team” – Bob Beauchamp (2009 Annual Report) “Your Board and management team are dedicated to building value for all stockholders. We are excited about the opportunities that lie ahead and are confident in our future success” “In fiscal year 2013, we are targeting ESM license bookings growth in the low double digits” For FY2012 BMC’s management originally projected +20% ESM license bookings growth. In fact, FY2012 ended with a year-over- year decline in ESM license bookings of 11% This, to us, represents management’s profound failure to understand BMC’s underlying business trends and challenges, and gives us no confidence in management’s ability to predict future business prospects and performance in the ESM license business “We think that we’ve got a very strong and independent Board of Directors who have proven to be able to grow and to change as the industry grows. We refresh our Board pretty regularly, and we think that we can do that using the strategy that we’ve been using.” ¹ “BMC's Director nominees are proven leaders with a diverse range of relevant business, financial and corporate governance experience and expertise, and they have the critical industry knowledge and experience to continue executing the Board and management's strategy to enhance value for all BMC stockholders” MANAGEMENT’S CLAIMS IN STOCKHOLDER LETTER (6/12/12) The average tenure among the group of four Directors that we believe should not be elected is over 15 years on BMC’s Board, much higher than industry norm Additionally, these four incumbents have executive experience as a consultant, a government employee from the Federal Reserve, manager of a recruiting company and a satellite/telecom background, none of which is directly relevant for an enterprise software company like BMC ELLIOTT’S PERSPECTIVE 1 Elliott believes BMC can be a GREAT company – but the same plan and the same Board is the wrong answer |