Exhibit (a)(5)(xvii)

IN THE COURT OF CHANCERY OF THE STATE OF DELAWARE

GLENN P. WAGNER, Individually and on Behalf of all Others Similarly Situated, | | C.A. No. ____-___ |

Plaintiff, |

v. |

INTERMUNE, INC., JEAN-JACQUES BIENAIME, LOUIS DRAPEAU, LARS EKMAN, JAMES I. HEALY, DAVID S. KABAKOFF, ANGUS C. RUSSELL, FRANK VERWIEL, DANIEL G. WELCH, ROCHE HOLDINGS, INC., and KLEE ACQUISITION CORPORATION, |

| Defendants. |

VERIFIED CLASS ACTION COMPLAINT

Plaintiff Glenn P. Wagner (“Plaintiff”), by and through his attorneys, alleges upon personal knowledge as to himself and his own acts, and upon information and belief as to all other matters, based upon the investigation conducted by and through his attorneys, which included, inter alia, a review of documents filed by Defendants with the United States Securities and Exchange Commission (the “SEC”), news reports, press releases, conference call transcripts and other publicly available documents, as follows:

SUMMARY OF THE ACTION

1. Plaintiff brings this action on behalf of himself and as a class action on behalf of the stockholders of InterMune Inc. (“InterMune” or the “Company”) against InterMune’s board of directors (the “Director Defendants” or the “Board”) for breaches of fiduciary duty arising from their attempt to sell the Company to Roche Holdings, Inc. (“Roche Holdings”), an indirect subsidiary of Roche Holding AG (“Roche AG, and collectively with Roche Holdings, “Roche”).

2. As first announced on August 24, 2014, Roche intends to acquire InterMune (the “Proposed Transaction”) as detailed in the Agreement and Plan of Merger dated August 22, 2014 (the “Merger Agreement”). Pursuant to the terms set forth in the Merger Agreement, InterMune stockholders will receive $74 in cash for each share of InterMune common stock they own (the “Merger Consideration”). The total value of the Proposed Transaction was announced as approximately $9 billion, according to the Company’s transaction valuation as filed with the SEC.

3. The Merger Agreement represented the extension of a long-standing, continuing relationship between Roche and InterMune. Over the previous ten years, the two companies entered into a number of major research and/or asset agreements. On July 17, 2014, the Company received a coveted breakthrough therapy designation from the Food and Drug Administration (“FDA”). Pouncing upon the opportunity to snatch up the Company before its value skyrocketed once the therapy was approved, the very next day, Roche’s chief executive officer (“CEO”) called Daniel G. Welch (“Welch”), CEO of InterMune, to initiate takeover discussions. Approximately one month later, without initiating a formal sales process, InterMune agreed to the terms of the Proposed Transactions. Other companies, on their own and without being contacted by either the Company or its financial advisors, even expressed their interest in a potential strategic transaction and were never allowed access to non-public information. By emphasizing speed over price in the negotiations, the Board greatly harmed shareholders.

4. Even though it was entered into without a sales process or market check, the Merger Agreement includes burdensome deal protection provisions that benefit Roche but discourage third parties from submitting superior offers, to the detriment of

InterMune’s stockholders. These protections include a strict no-solicitation provision prohibiting InterMune or any of its representatives from soliciting any competing offer and permitting a third-party to review nonpublic information or engage in discussion with the Company if, and only if: (i) that third-party submits an unsolicited, written proposal and (ii) InterMune’s Board believes it would result in a superior proposal to the Proposed Transaction after consulting with legal and financial advisors.

5. The terms of the InterMune Merger Agreement also prohibit the Board from communicating with InterMune’s shareholders for three business days if the Board changes its recommendation regarding the Proposed Transaction and, should the terms of the offer change in any material way, the Board is prevented from communicating with its shareholders for an additional two business day period for each and every change made to the terms of any counter-offers. The Company is further prohibited from waiving any standstill agreements that may prevent bidders previously involved in the process from placing even an unsolicited bid.

6. Given the haste with which the Company leapt into Roche’s arms, without conducting a market check and without providing non-public information to any other bidder, these deal protections combine to mean that the Board has no basis for assuming that the price to be paid by Roche is the best price available to shareholders. It did not canvass available bidders in the few short weeks it negotiated with Roche, and cannot now contact or even speak with those parties who have expressed interest unless those companies once again, after being rebuffed the first time, approach the Company and without any non-public information offer a higher bid.

7. Showing that the Company’s logic for entering into the Proposed Transaction is different than what it has publicly espoused, InterMune, in its Schedule 14D-9, filed with the SEC on August 29, 2014 (the “Proxy”), claims that “any transaction undertaken at this point would require the acquiror to provide a high degree of closing certainty, including assuming the risk with respect to, among other things, FDA approval and labeling.” However, InterMune agreed to a termination provision whereby if it chooses to continue to operate as a standalone entity or accepts an unsolicited superior offer, it must pay a sizeable termination fee. Conversely, should Roche choose to abandon the Proposed Transaction, it may do so without paying the same fee, or even compensating the Company for its transaction-related expenses. These deal protection terms are collectively designed to prohibit and chill the ardor of any third party considering a fair, reasonable and superior offer for InterMune.

8. Compounding the harm to investors, they are being asked to tender their shares based on incomplete and materially misleading information. In just one example of the misleading information contained in the Proxy, the information and inputs which formed the basis for the analysis on which the Company’s financial advisors Centerview Partners LLC (“Centerview”) and Goldman Sachs crafted their fairness opinions, is materially lacking. At least one key analysis appears to have used artificial inputs to depress the valuation range generated in the advisors’ fairness opinion.

9. The low transaction premium, relative to recent pharmaceutical strategic transactions for companies with drug pipelines as well developed as InterMune’s, does not adequately maximize shareholder value.

10. For these reasons, and as set forth more fully herein, Plaintiff seeks to enjoin Defendants from proceeding with the Proposed Transaction. In the event that the Proposed Transaction is consummated, Plaintiff seeks to recover damages from the Director Defendants for their breaches of fiduciary duties and from Roche and its affiliates for aiding and abetting said breaches.

PARTIES

11. Plaintiff Glenn P. Wagner is, and at all relevant times has been, a significant holder of InterMune common stock. More specifically, based on the Merger Consideration, Mr. Wagner currently holds millions of dollars’ worth of InterMune common stock.

12. Defendant InterMune is a Delaware corporation that maintains its corporate headquarters in Brisbane, California. InterMune is a pharmaceutical company with a number of fully developed treatments such as pirfenidone, and has a number of promising compounds in its development pipeline. Pirfenidone is approved for idiopathic pulmonary fibrosis (“IPF”) in the European Union (“EU”) and Canada and is under regulatory review in the United States. InterMune trades on the NASDAQ stock exchange under the ticker symbol “ITMN”.

13. Defendant Jean-Jacques Bienaime (“Bienaime”) has been a member of the Board since March 2012. He is a member of the Company’s Compensation and Corporate Governance, Nominating and Compliance Committees. He is currently the chief executive officer (“CEO”) and a member of the board of directors of BioMarin Pharmaceutical Inc. (“BioMarin”). Bienaime is the former chairman of the board of directors, CEO and president of Genencor and of Sangstat Medical Corporation

subsequently acquired by Genzyme Corporation. He also previously worked in various managerial roles at both a predecessor of Sanofi-Aventis and Genentech, Inc.

14. Defendant Louis Drapeau (“Drapeau”) has been a member of the Board since September 2007. Drapeau is a member of the Company’s Audit and Compensation Committees. He is currently the chief financial officer (“CFO”) and a senior vice president of InSite Vision Incorporated. Drapeau is a former senior vice president and CFO of Nektar Therapeutics and BioMarin, the latter of which he served as acting CEO. He worked for over 30 years at Arthur Anderson, the vast majority of which was spent as a partner. He is currently a member of the board of directors of Bio-Rad Laboratories and AmpliPhi Biosciences Corporation and is a former director of Inflazyme Pharmaceuticals.

15. Defendant Lars Ekman (“Ekman”) has served on the Board since September 2006, and has been lead independent director of the Board since May 2008. He is an executive partner at Sofinnova Ventures (“Sofinnova”), the co-founder and CEO of Cebix Incorporated, executive chairman of Sophiris Bio Inc. (formerly Protox Therapeutics) and is chairman of Prothena Biosiences. Ekman is the former executive vice president of Elan Corporation, plc and Schwartz Pharma AG. He also served in a variety of senior roles at a predecessor to Pfizer, Inc. Ekman currently serves as a director on the boards of Amarin Corporation (“Amarin”), Cebix Inc. and Ocera Therapeutics.

16. Defendant James I. Healy (“Healy”) has been a member of the Board since April 1999, and previously served as interim chairman of the Board. Healy is a member of the Company’s Corporate Governance, Nominating and Compliance and

Science Committees. He is currently a general partner and managing director of Sofinnova. He was a former partner at Sanderling Ventures, and was formerly employed by Brigham and Women’s Hospital, the Howard Hughes Medical Institute and Stanford University, and researched under a grant from the Novartis Foundation. Healy currently serves as a member of the boards of directors of Anthera Pharmaceuticals, Inc., Amarin, and several private companies.

17. Defendant David S. Kabakoff (“Kabakoff”) has been a member of the Board since November 2005. Kabakoff is a member of the Company’s Audit, Corporate Governance, Nominating and Compliance and Science Committees. He is currently the executive partner of Sofinnova, and serves on the boards of directors of Trius Therapeutics and several private companies. Kabakoff formerly served as the founder, chairman and CEO of Salmedix, Inc. and served in several executive positions at Dura Pharmaceuticals prior to its subsequent acquisition by Elan Pharmaceuticals.

18. Defendant Angus C. Russell (“Russell”) has been a member of the Board since October 2011 and was the independent lead director from March 2009 through May 2012. He is a member of the Company’s Corporate Governance, Nominating and Compliance Committee. Russell is a member of the board of directors of Shire plc, where he served for years as the CFO and then CEO, and currently serves as a member of the advisory board of Celtic Pharma Management L.P. He was previously an executive at ICI, Zeneca and AstraZeneca plc (“AstraZeneca”). Russell also qualified as a chartered accountant at a predecessor entity of Pricewaterhouse Coopers LLP.

19. Defendant Frank Verwiel (“Verweil”) has been a member of the Board since March 2012. Verwiel is a member of the Company’s Audit and Compensation

Committee. He is a former president and CEO of Aptalis Pharma, which was recently acquired by TPG Capital. Verwiel held a variety of senior management positions at Merck & Co. Inc. (“Merck”) and Servier Laboratories.

20. Defendant Welch has been a member of the Board, CEO, and president of the Company since September 2003, and has been the Board’s chairman since May 2008. He previously served as chairman and CEO of Triangle Pharmaceuticals, Inc., as president of Elan Corporation plc’s pharmaceutical division, and in various senior management roles at Sanofi predecessor entities. Welch currently serves on the boards of directors of Seattle Genetics and Hyperion Therapeutics, along with at least one privately held company.

21. Each of the Director Defendants was a member of the Board at all pertinent times and participated in the decisions and conduct alleged herein. By reason of their positions, each Director Defendant had, and continues to have, an obligation to determine whether the Proposed Transaction is in the best interest of the Company’s shareholders and maximizes shareholder value.

22. Defendant Roche Holdings is a Delaware corporation with its principal executive offices at 1 DNA, MS #24, South San Francisco, CA 94080. It is an indirect wholly-owned subsidiary of Roche Holding Ltd, the ultimate parent of which is Roche AG.

23. Defendant Klee Acquisition Corporation (“Merger Sub”) is a Delaware corporation with principal executive offices at 1209 Orange Street, Wilmington, Delaware 19801 and a wholly owned subsidiary of Roche through which the purchase of InterMune will be facilitated. It was incorporated on just two days before the Merger

Agreement was signed, and has transacted no business other than that related to the Proposed Transaction.

24. Roche and Merger Sub (the “Acquisition Defendants”) aided and abetted the Director Defendants’ breach of fiduciary duties to the InterMune shareholders.

SUBSTANTIVE ALLEGATIONS

25. InterMune is a biotechnology company focused on the research, development and commercialization of innovative therapies in pulmonology and orphan fibrotic diseases. Its pulmonology focus is on therapies for the treatment of IPF, a progressive and fatal lung disease.

26. Pirfenidone, the Company’s primary asset, barely a month before the Proposed Transaction was announced, received a breakthrough therapy designation from the FDA. This sought after designation was likely indicative of InterMune achieving its stated goal of extending approval of pirfenidone, also known as Esbriet, from the Canada and the EU, where it has shown itself to be a valuable addition to the fight against IPF, to the United States, currently an untapped market.1 Between 2013 and 2014, Pirfenidone sales more than doubled, on a same quarter comparison.

27. Roche is the fifth largest pharma company in the world. It has pharmaceutical and diagnostic operations in dozens of locations worldwide. In the United States, Roche conducts many operations through Genentech, a biotechnology company which it wholly owns.

1 The names pirfenidone and Esbriet are used interchangeably in describing the Company’s IPF treatment.

28. Pharmaceutical companies have traditionally been among the most sought after targets for mergers and acquisitions activity, particularly when they have generated potentially game changing, fully developed treatments such as pirfenidone. To compensate investors in growing pharmaceutical corporations for the loss of the extraordinary growth opportunity they hold, when successful companies in this industry are acquired, the strategic transactions feature extremely high transaction premiums. For example, when Bristol-Myers Squibb Company and AstraZeneca combined to purchase Amylin Pharmaceuticals Inc. in a 2012 transaction, it tendered a premium of more than 101% to the unaffected share price. Notably, however, this transaction was not included in the precedent transaction analysis conducted by Centerview or Goldman Sachs in their precedent transaction analyses, despite the fact that it was nearly identical in size to the Proposed Transaction.

| | II. | Background of the Negotiation of the Proposed Transaction |

29. InterMune and Roche have a long history of collaboration that dates back nearly a decade. In 2006, the Company entered into a collaboration agreement (the “2006 Collaboration Agreement”) with Hoffmann-LaRoche Inc. and F. Hoffman-LaRoche Ltd (collectively, the “Roche Subsidiaries”) allowing the two affiliates of Roche to develop and commercialize products from InterMune’s HCV protease inhibitor program, including danoprevir, which has subsequently entered Phase 2b clinical trials. Pursuant to the 2006 Collaboration Agreement, InterMune received an upfront payment of $60 million and a milestone payment of $10 million. In total, based on additional clinical and commercialization milestones, the Collaboration Agreement was worth approximately $115 million.

30. In October 2010, the Roche Subsidiaries and InterMune entered into an agreement for the purchase of the worldwide development and commercialization rights to danoprevir (the “Asset Purchase Agreement”) which terminated the Collaboration Agreement. The Roche Counterparties acquired intellectual property, as well as certain regulatory filings, assumed contracts, books and records, and product data related to danoprevir, and assumed InterMune’s liabilities and obligations relating to the assumed contracts, including potential future milestone and royalty obligations payable to Novartis Corporation and Array BioPharma, Inc. in connection with the further development of danoprevir by the Roche Counterparties. In addition, InterMune granted the Roche Counterparties an exclusive, irrevocable, non-terminable, fully paid-up license of InterMune’s intellectual property rights for use by the Roche Counterparties in the development and commercialization of danoprevir.

31. In December of 2010, InterMune and Roche again entered into an agreement, with regards to the development of next-generation protease inhibitors for the treatment of HCV.

32. As such, the two parties had a long history of familiarity and a negotiation structure in place when on July 17, 2014, the Company received its breakthrough therapy designation for pirfenidone from the FDA. The very next day, Dr. Severin Schwan (“Schwan”), CEO of Roche, called InterMune to initiate takeover talks.

33. Over the next few weeks, several pharmaceutical companies contacted either the Company’s financial advisors or InterMune CEO Welch personally to express their unsolicited interest in an acquisition of the Company, if it began a formal sales process. However, Welch, the sole contact point for all negotiations, remained laser-

focused on a deal with long-time collaborator Roche and only Roche, and never initiated a formal sales process. InterMune also never solicited bids, nor did it have its financial advisors create a data room or make presentations to any potential bidders. Thus, Welch deliberately depressed the expectations of rival pharmaceutical companies in order to deliver the Company to Roche.

34. Unsurprisingly, once CEO Welch had successfully fought off the overtures of Roche’s competitors, on August 18, 2014, simultaneously with negotiating the terms of the Proposed Transaction and on the eve of an important Board meeting, Welch and Schawn discussed Welch’s new role at the combined entity.

35. At the August 19, 2014 Board meeting, the Director Defendants made the decision to ignore the findings of a consultant hired prior to the initiation of the merger discussions with regard to the future of pirfenidone, likely in order to justify the Merger Consideration as adequate. The Board conceded, at the same meeting, that the timetable for negotiations was extremely truncated, and that a post-closing market check would be the minimal step it could take to ensure shareholder value. However, the Board did not require Welch, who was solely responsible for the negotiations, to negotiate a ‘go-shop’ period whereby the Company could shop itself post-closing and he did not. Compounding this harm, the onerous deal protections agreed to prohibited it from pursuing the very market check it knew was required to deliver fair value to shareholders, in light of the Company’s positive growth announcements and impending FDA approval.

| | III. | InterMune Is A Company With A Remarkable Drug Compound And Is Poised For Future Growth |

36. InterMune’s stock skyrocketed to nearly 400% of its price in just the six months prior to the announcement of the Proposed Transaction. By any objective

measure, the Company’s value is expected to materially appreciate in the coming years. Indeed, the Company has been delivering its investors positive drug development news and ever increasing sales of its primary product, pirfenidone, clearly demonstrated the Company’ robust growth potential.

37. For example, on October 30, 2013, InterMune announced, in a press release and in a filing with the SEC, its third quarter 2013 results. In the announcement, Welch, CEO of the Company, stated “Esbriet revenue growth in the third quarter came from both new country launches and growth in countries where the product has been available …. We are particularly pleased to report strong growth in Germany during the third quarter, where we see continued market penetration and improved persistence after two full years of marketing Esbriet in that country. Regarding the U.S. market, we remain on track to report top-line results from the confirmatory Phase 3 ASCEND study of Esbriet in the second quarter of 2014.”2 Projected revenues from Esbriet were increased, and actual revenues from the drug increased by 163 percent, representing the eighth consecutive quarter of revenue growth. The release also stated, in relevant part:

InterMune Reports Third Quarter 2013 Financial Results And Business Highlights

-- Reports 8th Consecutive Quarter of Esbriet Revenue Growth

--

InterMune, Inc. (NASDAQ: ITMN) today announced results from operations for the third quarter and nine months ended September 30, 2013, and recent business highlights.

InterMune reported Esbriet® (pirfenidone) revenue in the third quarter of 2013 of $19.7 million, compared with $7.5 million of Esbriet revenue in the third quarter of 2012, an increase of 163 percent. Sequentially, Esbriet revenue in the third quarter of 2013 increased 37 percent from $14.4

2 Unless otherwise noted, all emphasis has been added by counsel.

million in the second quarter of 2013. Esbriet is InterMune’s product marketed in Europe and Canada for the treatment of adult patients with mild to moderate idiopathic pulmonary fibrosis (IPF).

Dan Welch, Chairman, Chief Executive Officer and President of InterMune, said, “Notably, Esbriet revenue growth in the third quarter came from both new country launches and growth in countries where the product has been available. During the quarter we launched Esbriet in Italy and the UK, two of the five largest countries in Europe, as well as in Finland and Ireland. Esbriet revenue grew in the third quarter in countries where Esbriet had previously been launched, with Germany, France, the mid-sized European countries and Canada all reporting sequential double-digit growth. We are particularly pleased to report strong growth in Germany during the third quarter, where we see continued market penetration and improved persistence after two full years of marketing Esbriet in that country.”

“Regarding the U.S. market, we remain on track to report top-line results from the confirmatory Phase 3 ASCEND study of Esbriet in the second quarter of 2014,” Mr. Welch added.

Recent Business and Clinical Development Highlights

| | · | In July 2013, InterMune launched Esbriet in Italy. Up to nine months are needed in Italy for completion of regional procedures before full reimbursement for Esbriet is available in all regions of the country. |

| | · | In mid-August 2013, InterMune launched Esbriet in the UK. |

| | · | The company noted that revenue in the first few months following launch in newly launched countries such as Italy and the UK may be affected by certain one-time events that are not expected to recur in subsequent quarters. |

| | · | Esbriet has now been launched in 13 of InterMune’s 15 original targeted European countries in Europe, plus Canada. |

| | · | The company continues discussions with regulatory authorities in Spain and the Netherlands, two of InterMune’s original 15 top-priority European countries, regarding the pricing and reimbursement of Esbriet. The company now expects that additional clarity on the status of Esbriet reimbursement in these two countries will be available during the first half of 2014. |

| | · | The process of gaining reimbursement from private insurance carriers in Canada has been largely completed with 90 percent of private plans now reimbursing Esbriet. Approximately one third of IPF patients in Canada are covered under private insurance. Reimbursement of a new medicine from the public plans (provincial and territorial) typically requires approximately 18-24 |

| | | months. InterMune currently expects that meaningful reimbursement from the public plans will begin to be secured in the second half of 2014 and the process to be concluded in mid-2015. |

| | · | Study conduct in the ASCEND Phase 3 study remains excellent with a level of patient retention in the study that exceeds 90 percent. More than 90 percent of eligible patients who have completed the ASCEND study have decided to enter the RECAP open-label extension study in which all patients receive pirfenidone. ASCEND is InterMune’s confirmatory Phase 3 study of Esbriet in 555 IPF patients to support marketing approval in the United States. InterMune currently expects to report top-line results from ASCEND in the second quarter of 2014 and intends to present the results at the May 2014 International Conference of the American Thoracic Society (ATS) in San Diego. |

38. On January 9, 2014, InterMune announced, in a press release and in a filing with the SEC, its fourth quarter 2013 financial results. The Company increased its Esbriet growth for the ninth consecutive quarter, and declared that it had made “strong progress on [its] R&D pipeline”. CEO Welch stated that “2013 was a year of strong execution and growing momentum in every part of our business … Our European operations are performing well and we expect cash flows from our European sales to fully support our European operations sometime in the latter half of 2014.” Thus, the Company anticipated that its European operations would be self-sustaining for the first time in InterMune’s history just as it agreed to be acquired by Roche. In addition, the Company announced that the last patient was expected to complete treatment in Phase 3 of the American ASCEND trial, crucial to receiving FDA approval. Finally, Welch stated that “[a]s we closed out 2013, we announced our progress and planned investments in our growing R&D pipeline that build on our commercial momentum with Esbriet, leverage our expertise in IPF and fibrosis and move us toward realizing our strategic vision of becoming a leader in specialty fibrotic diseases.” The release stated, in relevant part:

InterMune Reports Preliminary Fourth Quarter 2013 Esbriet® (pirfenidone) Revenue and Recent Business Highlights

Q4’13 revenue of $25.6 million represents ninth consecutive quarter of Esbriet growth

Last patient to complete treatment this month in Phase 3 ASCEND trial

Strong progress on antifibrotic R&D pipeline

InterMune, Inc. (NASDAQ: ITMN) today announced unaudited revenue for the fourth quarter and year ended December 31, 2013. The company also provided updated 2013 expense guidance, highlighted recent progress in its commercial and other business activities and provided forward-looking guidance for 2014 revenue and expenses.

Dan Welch, Chairman, Chief Executive Officer and President of InterMune said, “2013 was a year of strong execution and growing momentum in every part of our business. Revenue from our Esbriet product, marketed in certain European countries and Canada for the treatment of patients with idiopathic pulmonary fibrosis, or IPF, grew by 168 percent in 2013 to approximately $70.2 million, and we expect Esbriet revenue growth to continue in 2014 by 65-90 percent to $115-$135 million. We are proud to have reported four consecutive quarters of revenue growth during 2013 and nine consecutive quarters of growth since Esbriet was first launched. Our European operations are performing well and we expect cash flows from our European sales to fully support our European operations sometime in the latter half of 2014.

“Today, we announced that we expect to communicate top-line results from the ASCEND study early in the second quarter of 2014, and to present the study results at the American Thoracic Society (ATS) conference in May 2014,” Mr. Welch added. “As we closed out 2013, we announced our progress and planned investments in our growing R&D pipeline that build on our commercial momentum with Esbriet, leverage our expertise in IPF and fibrosis and move us toward realizing our strategic vision of becoming a leader in specialty fibrotic diseases.”

2013 Highlights

InterMune noted the following achievements in 2013:

| | · | Unaudited Esbriet revenue in the fourth quarter of 2013 totaled approximately $25.6 million, compared with $8.2 million in the fourth quarter of 2012, an increase of 212 percent. Unaudited Esbriet revenue totaled approximately $70.2 million for the full-year 2013, compared with $26.2 million in 2012, an increase of 168 percent. |

| | · | Esbriet is now reimbursed, attractively priced and launched in countries that comprise approximately 85 percent of the population in the company’s 15 priority countries in Europe. |

| | · | In January 2013, InterMune launched Esbriet in Canada, the world’s ninth largest pharmaceutical market. Esbriet is now reimbursed by approximately 90 percent of the private insurers in Canada, which cover approximately one third of all IPF patients in that country. InterMune currently expects that meaningful reimbursement from the public plans will begin to be secured in the second half of 2014 and the process to be concluded in mid-2015. |

| | · | The last patients will complete treatment later this month in ASCEND, the company’s pivotal Phase 3 trial of pirfenidone to support marketing approval in the United States. A safety follow-up period on the last patients must be completed and typical industry procedures conducted to ensure data integrity for all 555 patients at 127 sites prior to reporting top-line results. Top-line results are expected to be reported early in the second quarter of 2014. |

| | · | Study conduct in ASCEND remains excellent with a level of patient retention in the study that exceeds 90 percent. More than 95 percent of eligible patients (those patients who remain on blinded pirfenidone or placebo therapy) who have completed the ASCEND study have decided to enter the open-label RECAP extension study. RECAP is a study in which all patients receive pirfenidone. RECAP also includes patients rolled over from the company’s prior CAPACITY program which completed in late 2008 and enrolled 779 patients in two Phase 3 studies. RECAP provides valuable long-term safety data that further expands the already large safety database for pirfenidone in patients with IPF. |

| | · | In November of 2013, InterMune announced its new strategic growth plan that will guide the company’s investments and business focus to achieve its vision of becoming a leader in specialty fibrotic diseases. The strategic growth plan calls for targeted investments that will enable the company to: |

| | · | Successfully commercialize Esbriet for IPF in its focus countries; |

| | · | Expand the knowledge and use of Esbriet by introducing new formulations, conducting additional clinical studies, exploring possible new indications and implementing patient registries; and |

| | · | Grow beyond Esbriet and beyond IPF, by developing compounds from internal R&D efforts and external business development that treat specific fibrotic indications with significant unmet medical need. |

| | · | Also in November of 2013, InterMune announced significant progress in advancing the company’s strategic growth plan including: |

| | · | Initiation in the third quarter of the PANORAMA clinical trial to evaluate the safety and tolerability of Nacetylcysteine (NAC) when added to Esbriet in IPF patients; |

| | · | Initiation in October of the LOTUSS clinical trial to evaluate the safety and tolerability of Esbriet in patients with systemic sclerosis-related interstitial lung disease (SSc-ILD). SSc-ILD is an orphan disease with a prevalence approximately as large as that of IPF and with no approved therapies. In November, pirfenidone was granted orphan drug status for the treatment of SSc-ILD in the United States; |

| | · | Development of an improved Esbriet formulation intended to enhance patient convenience and potentially lead to greater compliance and persistence; |

| | · | Advancement to IND preparation stage of a second-generation pirfenidone compound (pirfenidone analog) which has demonstrated, in animals, greater potency, improved pharmacokinetics and improved dosing schedule and for which an IND filing is currently planned in approximately one year; |

| | · | Advancement of an LPA-1 receptor program. LPA-1 is a bioactive lipid receptor that is implicated in fibrosis in numerous organ systems; |

| | · | Progress in the company’s research efforts aimed at the discovery and evaluation of new compounds representing various antifibrotic mechanisms that have been shown to address important aspects of fibrotic pathophysiology; |

| | · | More than a dozen scientific abstracts covering the company’s growing antifibrotic research and development pipeline have been submitted for presentation at the American Thoracic Society (ATS) meeting in May 2014. |

Esbriet Fourth Quarter and Full-Year 2013 Unaudited Net Sales

Unaudited Esbriet revenue for the fourth quarter of 2013 totaled approximately $25.6 million, compared with $8.2 million in the fourth quarter of 2012, an increase of 212 percent. Unaudited Esbriet revenue totaled approximately $70.2 million for the full-year 2013, compared with $26.2 million in 2012, an increase of 168 percent. Higher revenues in both the three and 12-month periods of 2013 were driven by both increased penetration in countries in which Esbriet was launched in late 2011 or 2012 as well as additional launches of Esbriet in European countries and Canada during 2013.

39. On May 1, 2014, the Company announced, in a press release and in a filing with the SEC, its first quarter financial results and clinical development highlights. This announcement continued the optimistic outlook for growth for the Company’s sales, likelihood of FDA approval, and the strength of its pipeline of drugs in development. CEO Welch announced that “[o]ur commercial momentum continues, with sequential quarterly revenue growth of 18 percent in the first quarter of 2014”, despite the fact that InterMune did not launch its star treatment pirfenidone in any new countries over the quarter. This represented a tenth consecutive quarter of growth. Welch also noted that during the quarter the Company had reached an “important event” with regard to pirfenidone’s pending approval in the United States, the announcement of the top-line Phase 3 study results. The May 1, 2014, release stated, in relevant part:

InterMune Reports First Quarter 2014 Financial Results, Clinical Development and Business Highlights

InterMune, Inc. (NASDAQ: ITMN) today announced results from operations for the first quarter ended March 31, 2014. The company also highlighted recent clinical development and business highlights, and raised its forward-looking revenue guidance for 2014.

InterMune reported Esbriet® (pirfenidone) revenue in the first quarter of 2014 of $30.3 million, compared with $10.5 million in the same quarter a year earlier, an increase of 188 percent. Sequentially, Esbriet revenue in the first quarter of 2014 increased 18 percent from $25.7 million in the fourth quarter of 2013. Esbriet is InterMune’s product marketed in Europe and Canada for the treatment in adults of mild-to-moderate idiopathic pulmonary fibrosis (IPF).

Dan Welch, Chairman, Chief Executive Officer and President of InterMune said, “Our commercial momentum continues, with sequential quarterly revenue growth of 18 percent in the first quarter of 2014 – one of the few quarters in which Esbriet was not launched in a new country since the initial launch in September 2011. Based on our solid first quarter results, we today raised our 2014 revenue guidance to a range of $130-$140 million. This represents potential growth of approximately 85 to 100 percent from Esbriet revenue of $70.3 million in 2013. With the April 1 approval of pricing and reimbursement in the Netherlands, Esbriet is now

reimbursed and launched in 14 of our original 15 top-priority markets in Europe.”

Mr. Welch continued, “An important event during the quarter was the announcement in February of the top-line results from the Phase 3 ‘ASCEND’ trial of pirfenidone in IPF. Presentation of the ASCEND results will be made during the international meeting of the American Thoracic Society (ATS) in San Diego. In addition to ASCEND, we are pleased that 18 abstracts covering pirfenidone and our expanding anti-fibrotic R&D pipeline will be presented at ATS. In particular, we look forward to sharing for the first time with the pulmonology community at ATS the performance characteristics of our pirfenidone analogs. Based on the clinically validated pirfenidone chemical scaffold, these novel agents are now in preclinical development and a development candidate is currently expected to enter the clinic in the first half of next year.”

Recent Clinical Development and Business Highlights

On February 25, InterMune reported top-line results from the ASCEND Phase 3 trial of pirfenidone in IPF. In ASCEND, pirfenidone significantly decreased the decline in percent predicted forced vital capacity (FVC) between Baseline and Week 52 (rank ANCOVA p<0.000001). Significant treatment effects were demonstrated on both of the two key secondary endpoints of six-minute walk test distance change (p=0.0360) and progression-free survival (p=0.0001). A pre-specified analysis of the pooled population (N=1,247) across ASCEND and the two Phase 3 CAPACITY studies taking CAPACITY mortality data through Week 52 showed that the risk of all-cause mortality was reduced by 48% in the pirfenidone group compared to the placebo group (HR=0.52, log rank p=0.0107).

Additionally, in ASCEND the well-characterized safety and tolerability profile of pirfenidone was confirmed. The most common adverse events (AEs) with higher incidence in the pirfenidone group were primarily gastrointestinal (GI) (e.g., nausea and dyspepsia) and skin-related (e.g., rash). The GI and rash AEs were generally mild to moderate in severity, manageable, reversible and only infrequently led to treatment discontinuations.

InterMune is preparing to resubmit the pirfenidone New Drug Application (NDA) to the U.S. Food and Drug Administration (FDA) early in the third quarter of 2014. The NDA will include the ASCEND Clinical Study Report as well as pooled analyses of efficacy and mortality from the three InterMune Phase 3 trials. The NDA resubmission will also include a comprehensive safety update that involves patient exposure of pirfenidone in approximately 15,000 patients including clinical studies and the extensive post-marketing experience on pirfenidone collected since 2008.

As a Class 2 resubmission, FDA’s review is expected to be completed within six months. If FDA approval occurs within that timeframe,

InterMune currently anticipates that it would be prepared to launch pirfenidone in the United States early in the second quarter of 2015.

A total of 27 abstracts concerning pirfenidone sponsored by either InterMune or others will be presented at the ATS meeting. A total of 18 abstracts sponsored by InterMune will be presented at ATS covering pirfenidone and the company’s expanding anti-fibrotic pipeline. Additional information on the presentation of InterMunesponsored abstracts will be provided prior to the ATS meeting.

Effective April 1, 2014, the Ministry of Health, Welfare and Sport of the Netherlands approved Esbriet for inclusion on the Dutch list of reimbursed drugs, making Esbriet the first registered and reimbursed medicine for the treatment of IPF in the Netherlands. Esbriet will be reimbursed for patients with mild to moderate IPF with forced vital capacity (FVC) of more than 50% of predicted. The Ministry set a price corresponding to €31,157 (~$43,000) per patient per year.

The company announced that enrollment was completed on schedule for its Phase 2, four-month LOTUSS trial to evaluate the safety and tolerability of pirfenidone in 63 patients with systemic sclerosis-related interstitial lung disease (SSc-ILD). SSc-ILD is an orphan disease with a prevalence approximately as large as that of IPF and with no approved therapies. In November 2013, pirfenidone was granted orphan drug status for the treatment of SSc-ILD in the United States. The data from LOTUSS are expected in the fourth quarter of this year.

The company announced that it will describe at the ATS conference the performance characteristics of ITMN-30162 and ITMN-14440, its two lead second-generation pirfenidone analogs. These compounds display potent anti-fibrotic activity at very low doses in animal models, have pharmacokinetic profiles that predict once or twice-daily dosing in humans and as deduced from nonclinical studies a reduced potential for GI and photosensitivity effects. Based on the clinically validated pirfenidone scaffold, these novel agents are now in preclinical development and a development candidate is currently expected to enter the clinic in the first half of 2015.

InterMune provided an update on its growing patent estate relating to pirfenidone in the U.S. and the European Union (EU). The company now has 16 issued patents and two allowed patent applications in the U.S. concerning the formulation and the safe and efficacious use of pirfenidone, and five issued patents and one allowed patent application in the EU. These patents and pending applications have 20-year patent terms with expiration dates that range from 2026 to 2033.

The company continues on track to be prepared to launch pirfenidone in the United States should an FDA approval of the pirfenidone NDA be granted. Senior U.S. commercial management is now hired and the team is executing against the comprehensive strategic and tactical plans including

the building of all the commercial, medical affairs and infrastructure requirements for a successful launch.

40. On July 17, 2014, the Company announced what its shareholders had been hoping for: pirfenidone had received a breakthrough therapy designation from the FDA. This meant that the FDA would expedite its review of the drug and that the Company’s most valuable asset would be available to patients in the United States sooner than anticipated. CEO Welch stated that “[t]he Breakthrough Therapy Designation underscores the significant need to help patients with this irreversible and ultimately fatal disease, particularly as no FDA-approved therapies are currently available. We are pleased that the FDA recognized the importance of pirfenidone as a potential new therapy for IPF, a disease with great unmet medical need.”

41. On August 6, 2014, less than three weeks prior to announcing that it had entered into the Proposed Transaction InterMune announced, in a press release and filing made simultaneously with the SEC, its second quarter 2014 financial results and business highlights. CEO Welch announced that the Company had experienced “an exceptionally strong quarter, with excellent progress made in all areas of our business.” The release recounted the FDA’s Breakthrough Therapy Designation status for pirfenidone, resulting in accelerated preparations for the United States launch of pirfenidone, advanced to the fourth quarter of 2014. The release continued, in relevant part:

InterMune Reports Second Quarter 2014 Financial Results and Business Highlights

Transformational H1 2014 includes presentation of Phase 3 ASCEND data, NDA resubmission and target PDUFA date of Nov. 23 for pirfenidone in U.S.

Reports Esbriet® revenue of $35.7 million in Q2 2014

InterMune, Inc. (NASDAQ: ITMN) today announced results from operations for the second quarter ended June 30, 2014. The company also

highlighted recent clinical development and business highlights, and updated its forward-looking financial guidance for 2014.

InterMune reported Esbriet® (pirfenidone) revenue in the second quarter of 2014 of $35.7 million, compared with $14.4 million in the second quarter of 2013, an increase of 148 percent. Sequentially, Esbriet revenue in the second quarter of 2014 increased 18 percent from $30.3 million in the first quarter of 2014. Esbriet is InterMune’s product for the treatment of idiopathic pulmonary fibrosis (IPF) in adults in Europe and Canada, and pirfenidone is currently under U.S. Food and Drug Administration (FDA) review for the treatment of adults with IPF in the United States.

Dan Welch, Chairman, Chief Executive Officer and President of InterMune, said, “We are pleased to report an exceptionally strong quarter with excellent progress demonstrated in all areas of our business. We had a substantial presence at the International Conference of the American Thoracic Society, where the ASCEND Phase 3 results were presented and simultaneously published in the New England Journal of Medicine. We announced in early July that the pirfenidone NDA resubmission had been accepted by the FDA and assigned a target PDUFA date of November 23, 2014. On July 17 the FDA assigned Breakthrough Therapy Designation status for pirfenidone. We recently accelerated our preparations for the potential U.S. launch of pirfenidone to be prepared to launch in Q4 2014, versus our previous plan of Q1 2015. We achieved continued Esbriet revenue growth in Europe and Canada and made strong progress with our pirfenidone life cycle management programs and our anti-fibrotic research programs.”

Recent Business and Clinical Development Highlights

| | · | On July 17, 2014, InterMune reported that pirfenidone had been granted Breakthrough Therapy Designation by the FDA. This designation is reserved for drugs that are intended to treat a serious or life threatening disease or condition and for which preliminary clinical evidence indicates that the drug may demonstrate substantial improvement over existing therapies on one or more clinically significant endpoints. According to the FDA Fact Sheet: “If a drug is designated as breakthrough therapy, FDA will expedite the development and review of such drug.” |

| | · | InterMune today reported that the FDA has informed the company that at this time, the agency does not plan to convene an advisory committee for pirfenidone. |

| | · | On July 10, 2014, InterMune submitted to the European Medicines Agency (EMA) a variation to the Esbriet marketing authorization. The purpose of the variation is to update the Summary of Product Characteristics (SmPC) to include the ASCEND clinical data. InterMune anticipates receiving a decision on the proposed variation from the EMA in early 2015. |

| | · | At the International Conference of the American Thoracic Society (ATS) in May 2014, data from the Phase 3 ASCEND trial of pirfenidone in IPF were presented. The ATS presentation included data and additional supportive analyses demonstrating the treatment effect of pirfenidone on Forced Vital Capacity (FVC) change and other important clinical endpoints, including mortality. Additionally, the data demonstrated a favorable safety and tolerability profile of pirfenidone in ASCEND that was generally consistent with observations from the previous Phase 3 CAPACITY studies, open-label extension studies and post-marketing experience. Simultaneous with its presentation at ATS, the results of ASCEND were published in the New England Journal of Medicine. |

| | · | Enrollment was completed on schedule for InterMune’s Phase 2, four-month LOTUSS trial to evaluate the safety and tolerability of pirfenidone in 63 patients with systemic sclerosis-related interstitial lung disease (SSc-ILD). SSc-ILD is an orphan disease with prevalence comparable to that of IPF and with no approved therapies. In November 2013, pirfenidone was granted orphan drug status for the treatment of SSc-ILD in the United States. The trial will conclude in the fourth quarter of 2014 and InterMune currently expects to report results at a medical meeting in 2015. |

| | · | Effective April 1, 2014, the Ministry of Health, Welfare and Sport of the Netherlands approved Esbriet for inclusion on the Dutch list of reimbursed drugs, making Esbriet the first registered and reimbursed medicine for the treatment of IPF in the Netherlands. Esbriet is reimbursed for patients with mild to moderate IPF with FVC of more than 50% of predicted. The Ministry set a public price corresponding to €31,157 (~$43,000) per patient per year. |

| | · | Regarding Spain, the only country of the company’s original 15 top-priority European countries for which Esbriet reimbursement and product launch have not occurred, InterMune expects to provide an update on the Esbriet pricing and reimbursement discussions in Spain later in the second half of this year. |

| | · | InterMune today reported that 123 patients have been enrolled in the PANORAMA trial, a randomized, double-blind, placebo controlled trial to evaluate the safety and tolerability of Nacetylcysteine (NAC) added to Esbriet therapy in patients with mild to moderate IPF. InterMune announced that as a result of the outcome of the NIH PANTHER study, which demonstrated that NAC provided no benefit to IPF patients, no additional patients will be enrolled in PANORAMA. Patients already enrolled will be followed according to the study protocol to provide a safety analysis of NAC administered on top of pirfenidone. Results will |

| | | be reported by the end of 2015. The PANORAMA trial was initially designed to enroll up to 250 patients at approximately 70 centers in Europe for a treatment period of six months. |

| | · | Based on regulatory progress noted above, InterMune has accelerated its efforts to build its commercial infrastructure to be prepared to launch pirfenidone in the United States in the fourth quarter of 2014 (previously targeted for the first quarter of 2015), assuming FDA approval during the fourth quarter of 2014. |

| | · | InterMune currently anticipates that the U.S. commercial organization will consist of approximately 175 employees. InterMune expects that the build-out of the U.S. commercial organization will be substantially completed by the end of the third quarter of 2014. |

| | · | Additionally, InterMune currently expects its U.S. Medical Affairs staff to consist of approximately 35 personnel including field-based medical science directors and staff and professionals managing medical education, medical information, scientific communications and publications, clinical trials and patient registries. |

| | · | In June and July 2014, InterMune completed the exchange of approximately $43.1 million and $52.9 million, respectively, of its 2.50% convertible notes due 2017 for shares of its common stock and $16.9 million of its 5.00% convertible notes due 2015 for shares of its common stock. |

| | IV. | The Proposed Transaction Is Announced |

42. Against this backdrop of InterMune’s strong growth in for pirfenidone

everywhere it had been approved, the Company’s encouraging research and

development pipeline and the expected accelerated FDA approval of pirfenidone

for use in the United States, InterMune entered into an agreement to sell the

Company to Roche on August 22, 2014.

43. Upon consummation of the Proposed Transaction, Roche will acquire InterMune, assuming the merger passes Hart-Scott-Rodino Act and other regulatory approval. The Proposed Transaction was announced via a joint press release by Roche and the Company on August 26, 2014. It stated, in relevant part:

Roche and InterMune Reach Definitive Merger Agreement

Roche to acquire InterMune for $74.00 per share

InterMune’s lead product pirfenidone for idiopathic pulmonary fibrosis to expand Roche’s respiratory product portfolio --

Roche (SIX: RO, ROG; OTCQX: RHHBY) and InterMune, Inc. (NASDAQ: ITMN) today announced they have entered into a definitive merger agreement for Roche to fully acquire InterMune at a price of $74.00 per share in an all-cash transaction. This corresponds to a total transaction value of $8.3 billion on a fully diluted basis. This offer represents a premium of 38% to InterMune’s closing price on August 22, 2014 and a premium of 63% to InterMune’s unaffected closing price on August 12, 2014. The merger agreement has been approved by the boards of InterMune and Roche.

Under the terms of the merger agreement, Roche will commence a tender offer no later than August 29, 2014, to acquire all outstanding shares of InterMune common stock, and InterMune will file a recommendation statement containing the unanimous recommendation of the InterMune board that InterMune’s shareholders tender their shares to Roche. The transaction is expected to be neutral to core earnings per share in 2015 and accretive from 2016 onwards.

The acquisition of InterMune, a Brisbane, California based biotechnology company focused on the research, development and commercialization of innovative therapies in pulmonology and fibrotic diseases, will allow Roche to broaden and strengthen its respiratory portfolio globally. InterMune’s lead medicine pirfenidone is approved for idiopathic pulmonary fibrosis (IPF) in the EU and Canada and under regulatory review in the United States. IPF is a progressive, irreversible and ultimately fatal disease characterized by progressive loss of lung function due to fibrosis, or scarring, in the lungs. Roche markets Pulmozyme and Xolair in the US and has other novel therapeutic medicines targeting respiratory diseases in clinical development.

Commenting on the transaction, Severin Schwan, CEO of Roche, said, “We are very pleased that we reached this agreement with InterMune. Our offer provides significant value to InterMune’s shareholders and this acquisition will complement Roche’s strengths in pulmonary therapy. We look forward to welcoming InterMune employees into the Roche Group and to making a difference for patients with idiopathic pulmonary fibrosis, a devastating disease.”

Roche plans a smooth transition of InterMune employees and operations into the Roche organization, ensuring readiness for an expected launch of pirfenidone in the US in 2014. Commenting on the transaction, InterMune’s Chairman, CEO and President, Dan Welch, said, “This merger recognizes the significant value created by our team’s

commitment, hard work and execution for more than a decade to develop and commercialize treatment options for IPF patients and their families. Roche shares our passion and commitment to the IPF community and to ensuring that pirfenidone is available as quickly as possible to patients in the United States, pending FDA approval. Roche’s global resources and scale will not only facilitate and accelerate our ability to deliver pirfenidone to more patients around the world, but also to realize our joint vision to bring additional innovative therapies to patients with respiratory diseases.”

Pirfenidone has been marketed by InterMune in the EU and Canada as Esbriet® since regulatory approval in 2011 and 2012 respectively. After previous regulatory review in the USA in 2010, the Food and Drug Administration (FDA) recommended an additional Phase 3 clinical trial to support the efficacy of pirfenidone. The results of this study, the ASCEND trial, were part of the new drug application (NDA) resubmission that InterMune made in May 2014. On July 17, 2014 pirfenidone received breakthrough therapy designation from the FDA. This designation is reserved for drugs that are intended to treat a serious or life-threatening disease or condition and preliminary clinical evidence indicates that the drug may demonstrate substantial improvement over existing therapies on one or more clinically significant endpoints. The target action date, also known as the PDUFA date, for the pirfenidone NDA is November 23, 2014.

In addition to pirfenidone, InterMune has research programs exploring new targets and pathways that may ultimately lead to improved treatment options for people with IPF, and other fibrotic diseases.

Terms of the agreement

Under the terms of the merger agreement, Roche will promptly commence a tender offer to acquire all of the outstanding shares of InterMune’s common stock at a price of $74.00 per share in cash. The closing of the tender offer will be subject to the tender of a number of shares that represents a majority of the total number of outstanding shares on a fully diluted basis. In addition, the transaction is subject to the expiration or termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 and other customary conditions.

Following completion of the tender offer, Roche will acquire all remaining shares at the same price of $74.00 per share through a second step merger. The closing of the transaction is expected to take place in 2014.

Citi is acting as financial advisor to Roche and Davis Polk & Wardwell LLP is acting as legal counsel to Roche. Centerview Partners and Goldman Sachs are acting as financial advisors to InterMune and Cravath, Swaine & Moore LLP is acting as legal counsel to InterMune.

| | V. | The Director Defendants Breached Their Fiduciary Duties By Failing To Maximize Shareholder Value |

44. The Director Defendants had a duty to act as auctioneers charged with ensuring that shareholders received the best possible price and terms in any sale of the Company. They failed to meet this obligation.

45. By hastily cutting a deal without allowing the Company’s shareholders to reap the return on the impending FDA approval of pirfenidone, the Director Defendants breached their fiduciary duty to maximize shareholder value. The Board could have either permitted the Company to continue its undeniable path of growth as an independent concern or revisited the opportunity for a strategic transaction with any one of its potential suitors once the FDA finally approved the drug, allowing it to negotiate with the increased leverage of a potential billion dollar per year market indication firmly in hand. Instead, the price accepted is merely equal to, and reflects no premium on, the median analyst price target for the Company’s stock and does not compensate investors for the loss of the potential growth in the Company.

46. Indeed, although analysts have estimated that annual sales of pirfenidone for IPF could reach $2 billion dollars annually, these returns on pirfenidone could be a drop in the bucket of future returns when compared to the potential success of drugs already in InterMune’s pipeline and which could begin clinical trials within the next year. These new products are expected to treat damage to the liver and kidneys similar to that caused by IPF in lungs, a far larger market. Reuters noted that “[s]uccess there could be a game changer”, because the same type of internal scarring caused to the lungs by IPF is caused to the liver and kidneys by the much more common factors of obesity, diabetes and alcohol and drug abuse.

47. Katherine Xu, an analyst with William Blair & Co., declared that “[l]iver fibrosis is a huge, multibillion-dollar market that’s far bigger that the lung fibrosis market. It involves millions of patients in the United States, versus 100,000.”

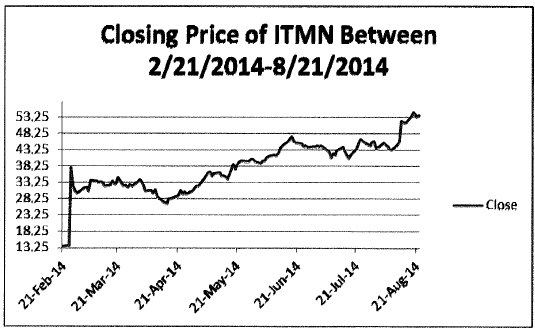

48. InterMune’s recent stock chart shows the incredible investor optimism in the Company. Its share price in just the six months prior to the Proposed Transaction’s announcement showed that it had experienced growth of nearly 400% of its price in February 2014, as is shown by the following chart.

49. Given InterMune’s explosive growth, the minimal premium of just 38% would likely have been quickly subsumed by the positive developments of the Company. In part, the reason that the Company agreed to such an insufficient price was because of the flawed analysis conducted by its financial advisors Goldman Sachs and Centerview.

| | VI. | The Financial Analyses Conducted By Goldman Sachs and Centerview Were Defective |

50. Because the Board did not conduct a market check prior to entering into the Proposed Transaction, did not negotiate a go-shop period once the Merger Agreement was signed, and agreed to the preclusive deal protections detailed infra, it was extremely reliant upon the analyses conducted by its financial advisors Centerview and Goldman

Sachs. Unfortunately, those analyses were flawed to the point of being little more than a rubber stamp on a deal with the Company’s longtime partner that the Board had already decided to agree to.

51. The fairness opinions of Centerview and Goldman Sachs create too wide of a valuation range to offer any real guidance to shareholders. The ranges of $27.30-$90.50 and $19.54-$124.53 for Centerview and Goldman Sachs, respectively, are facially useless, and demonstrate that the purported ‘analysis’ was little more than a cover to allow almost any price to be approved by the Board, and to provide a basis for the Board to claim that any price offered by Roche was, according to their financial advisors, fair.

52. In addition, the inputs to the discounted cash flow analyses (“DCF”) conducted by Goldman Sachs and Centerview appear to have been conducted using incorrect, and improper, factors. One of the key inputs to a DCF is the weighted average cost of capital (“WACC”). An elevated WACC leads to a diminished valuation for the Company. Both of the financial advisors calculated a WACC of above 10%, which is far above the range which should be expected for InterMune, given the actual cost of its debt, the applicable market premiums, and the risk free rate. It appears that Goldman Sachs and Centerview each used a beta, a multiple that tracks the performance of the Company versus the performance of the market as a whole, of higher than one. This is a flawed input, given that the beta for a company like InterMune, which has unleashed a revolutionary therapy upon the market which people’s lives will depend on, will have an elasticity beta of less than one. Simple logic dictates that regardless of the performance of a stock market as a whole, if a drug is keeping people alive, they will continue to purchase it above all else. By artificially inflating the WACC, Goldman Sachs and

Centerview artificially deflated the true value of InterMune. A more appropriate range of values, using proper WACC inputs and then generating that into a DCF, would be between $74.59 and $104.62 per share.

53. Neither of the financial advisors undertook a market check, meaning that in crafting their opinions they had no idea what the market demand was for an acquisition of the Company.

54. Centerview admitted that it did not evaluate either the solvency or fair value of InterMune, yet still purported to issue a fairness opinion. In addition to this defect, all of Centerview’s analyses have the same critical problem, which is share count. Centerview never defines how it calculates share count, leading to unreliable equity values. Centerview claims that it uses the equity purchase price, “taking into account outstanding in-the-money options, warrants, and other convertible securities” when calculating enterprise value (“EV”). Unfortunately, ‘taking into account’ means nothing, and there is no generally accepted industry practice of methodology to which it relates. Appropriate generally accepted accounting practices (“GAAP”) formulas for determining fully diluted share count include the Treasury Stock Method and the If-Converted Method: it appears that Centerview used neither. The bulk of Centerview’s analysis relies upon EVs. Unfortunately for stockholders, it is not clear that Centerview calculated EV accurately, and thus its complete analysis and fairness opinion are suspect.

55. In addition, Centerview’s selected comparable public company analysis was misleading because it evaluated EV/2016-revenue multiples. This is deceptive and of questionable value because the estimated 2016 revenues that it used are unreliable and extracted from unspecified Wall Street research. Any multiples greater than 25x were

discarded although no lower end multiples were dropped from the analysis. Therefore, the results of Centerview’s selected comparable public company analysis were artificially lowered.

56. Goldman Sachs also made mistakes detrimental to the efficacy of its analysis. For example, Goldman Sachs’ selected companies analysis included European companies, which skews the results, and valuation range of InterMune, downward. Goldman Sachs also discarded any price 2017 earnings multiples greater than 50x from its comparison, despite the fact that the Proposed Transaction had a 53x multiple. Therefore, Goldman Sachs arbitrarily tilted the range lower than that of the actual comparative company that it purported to mirror.

57. Goldman Sachs’ premia paid analysis is also biased and of little value. First, deal premiums simply depict the difference between the price investors (with incomplete information and without contemplation of a control premium or synergies) and what connected acquirers (with access to non-public information and reflective of synergies and a control premium) would pay. Even this analysis was fatally crippled by the financial advisor’s indefensible decision to utilize an ‘unaffected’ share price of July 15, 2014. This price is absurd because InterMune received its breakthrough therapy designation on July 17, 2014, just two days later and therefore the price used as a comparison by Goldman Sachs did not reflect this positive news. Even the Company’s own timeline does not indicate any related interest by Roche until July 18, 2014, and there is no justification for using July 15, 2014, as an unaffected price, other than to make the premium look more impressive than it truly is and thereby not reflect the positive FDA news.

58. The Company in December 2013 commissioned a consultant to analyze factors related to the United States launch of pirfenidone. However, neither of the financial advisors considered this study, likely because it would have reflected a value well above the Merger Consideration.

| | VII. | The Director Defendants Stand To Profit Handsomely From The Proposed Transaction |

59. InterMune’s executive officers and directors will collect windfall profits from the Proposed Transaction and, as such, are differently situated than the Company’s shareholders – giving these individuals an economic interest in the Proposed Transaction far beyond the anticipated Merger Consideration.

60. Specifically, InterMune’s insiders and directors are entitled to, among other things, exorbitant severance packages and accelerated vesting of their stock options as a result of the Proposed Transaction and the resultant change of control.

61. In fact, as noted in Section 6.04 of the Merger Agreement, the portion of each option that is not vested as the closing date, and that is held by insiders as of the date of the Proposed Transaction, will be automatically subject to accelerated vesting and become exercisable and cashed-out in the same manner as other, vested options. This acceleration occurs regardless of the originally contemplated time frame for the options’ vesting and without concern for whether any incentive or performance requirements for the option had been achieved. Section 6.04 states, in relevant part:

immediately prior to the Effective Time, each Company Stock Option, whether vested or unvested, outstanding immediately prior to the Effective Time, shall become fully exercisable and may be exercised immediately prior to the Effective Time. To the extent not exercised prior to the Effective Time, then at the Effective Time, each Company Stock Option shall be canceled, with the holder of such Company Stock Option becoming entitled to receive an amount in cash equal to (A) the excess, if any, of (1) the Merger Consideration minus (2) the exercise price per share of Company Common Stock subject to such Company Stock

Option, multiplied by (B) the number of shares of Company Common Stock subject to such Company Stock Option immediately prior to the Effective Time;

(ii) at the Effective Time, each Company Restricted Stock Unit outstanding immediately prior to the Effective Time shall be canceled, with the holder of such Company Restricted Stock Unit becoming entitled to receive an amount in cash equal to (A) the Merger Consideration multiplied by (B) the number of shares of Company Common Stock subject to such Company Restricted Stock Unit immediately prior to the Effective Time (with any applicable performance conditions deemed to be achieved at maximum performance);

(iii) at the Effective Time, each award of Company Restricted Shares outstanding immediately prior to the Effective Time shall be canceled, with the holder thereof becoming entitled to receive an amount in cash equal to (A) the Merger Consideration multiplied by (B) the number of Company Restricted Shares subject to such award immediately prior to the Effective Time (with any applicable performance conditions deemed to be achieved at maximum performance); and

(iv) (A) effective immediately after the Acceptance Time, (1) the then-current purchase period under the Company ESPP shall end and each participant’s accumulated payroll deduction shall be used to purchase shares of Company Common Stock in accordance with the terms of the Company ESPP, (2) shares of Company Common Stock purchased thereunder shall be converted at the Effective Time into the right to receive an amount in cash equal to the Merger Consideration pursuant to Section 2.07(c) and (3) no further purchase period shall commence under the Company ESPP following that date and (B) at the Effective Time, the Company shall cause the Company ESPP to terminate, and no further purchase rights shall be granted or exercised under the Company ESPP thereafter.

62. The following chart shows the amount of money each director and executive officer stands to collect because of the terms of Section 6.04 of the Merger Agreement.

| | Cash Amount Payable in Respect of Unvested InterMune Stock Options | | | | Cash Amount Payable in Respect of Unvested InterMune Stock Options | |

| Daniel G. Welch | | $ | 15,146,642 | | Jean-Jacques Bienaimé | | $ | 327,705 | |

| John C. Hodgman | | | 3,973,611 | | Lois Drapeau | | | 224,945 | |

| Giacomo Di Nepi | | | 3,604,114 | | Lars G. Ekman, M.D., Ph.D. | | | 224,945 | |

| Sean P. Nolan | | | 9,322,854 | | James I. Healy, M.D., Ph.D. | | | 224,945 | |

| Andrew Powell, Esq. | | | 6,121,700 | | David S. Kabakoff, Ph.D. | | | 224,945 | |

| Paul D. Arate | | | 3,921,462 | | Angus C. Russell | | | 261,320 | |

| Jonathan A. Leff, M.D. | | | 8,604,737 | | Frank Verwiel, MD. | | | 327,705 | |

Each of those options will be cashed in for the substantial gain noted above, and many of them were granted when InterMune common stock traded at approximately $10 or lower.

63. In addition, each of the Director Defendants and the executive officers have substantial blocks of outstanding vested options, for which the Proposed Transaction will serve as a liquidity event, at a significant premium and with none of the dilutive effect that would normally accompany the sale of such a considerable block of stock. The holdings of the officers and Director Defendants, as of August 26, 2014, are listed in the following chart.

| | | | | Cash Amount Payable in Respect of Shares | | | Number of InterMune Stock Options | | | Cash Amount Payable in Respect of InterMune Stock Options(1) | | | Number of InterMune Restricted Stock Units | | | Cash Amount Payable in Respect of InterMune Restricted Stock Units | | | Number of InterMune Restricted Shares | | | Cash Amount Payable in Respect of InterMune Restricted Shares | |

| Executive Officers | | | | | | | | | | | | | | | | | | | | | | | | |

| Daniel G. Welch | | | 71,202 | | | $ | 5,268,948 | | | | 478,975 | | | $ | 25,414,303 | | | | 145,750 | | | $ | 10,785,500 | | | | 23,000 | | | $ | 1,702,000 | |

| John C. Hodgman | | | 13,593 | | | | 1,005,882 | | | | 102,918 | | | | 5,464,410 | | | | 37,975 | | | | 2,810,150 | | | | 5,250 | | | | 388,500 | |

| Giacomo Di Nepi | | | 11,476 | | | | 849,224 | | | | 126,875 | | | | 6,190,969 | | | | 41,975 | | | | 3,106,150 | | | | – | | | | – | |

| Sean. P. Nolan | | | 9,271 | | | | 686,054 | | | | 183,500 | | | | 11,163,460 | | | | 25,800 | | | | 1,909,200 | | | | 56,400 | | | | 4,173,600 | |

| Andrew Powell, Esq. | | | 250 | | | | 18,500 | | | | 142,500 | | | | 7,965,450 | | | | 66,275 | | | | 4,904,350 | | | | – | | | | – | |

| Paul D. Arata | | | 9,649 | | | | 714,026 | | | | 90,000 | | | | 5,408,700 | | | | 26,400 | | | | 1,953,600 | | | | 12,500 | | | | 925,000 | |

| Jonathan A. Leff, M.D. | | | 9,437 | | | | 698,338 | | | | 248,000 | | | | 14,755,550 | | | | 49,400 | | | | 3,655,600 | | | | 38,600 | | | | 2,856,400 | |

| Directors | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Jean-Jacques Bienaimé | | | 9,725 | | | | 719,650 | | | | 30,500 | | | | 1,653,940 | | | | 4,000 | | | | 296,000 | | | | 1,200 | | | | 88,800 | |

| Louis Drapeau | | | 7,500 | | | | 555,000 | | | | 107,000 | | | | 5,755,150 | | | | 4,000 | | | | 296,000 | | | | – | | | | – | |

| Lars G. Ekman, M.D., Ph.D. | | | 5,500 | | | | 407,000 | | | | 140,003 | | | | 7,731,301 | | | | 4,000 | | | | 296,000 | | | | – | | | | – | |

| James I. Healy, M.D., Ph.D. | | | 13,549 | | | | 1,002,626 | | | | 128,335 | | | | 7,191,848 | | | | 4,000 | | | | 296,000 | | | | – | | | | – | |

| David S. Kabakoff, Ph.D. | | | 21,600 | | | | 1,598,400 | | | | 88,000 | | | | 4,692,540 | | | | 4,000 | | | | 296,000 | | | | – | | | | – | |

| Angus C. Russell | | | 17,158 | | | | 1,269,692 | | | | 32,500 | | | | 1,64,630 | | | | 4,000 | | | | 296,000 | | | | 1,200 | | | | 88,800 | |

| Frank Verwiel, M.D. | | | 9,725 | | | | 719,650 | | | | 30,500 | | | | 1,653,940 | | | | 4,000 | | | | 296,000 | | | | 1,200 | | | | 88,800 | |

64. CEO Welch has tens of thousands of stock options which will be accelerated through the Proposed Transaction, resulting in a payment of tens of millions of dollars to him. In addition, because of his severance agreements, he will realize nearly millions of dollars in additional payments in the event that he does not continue on as CEO, as noted by the following chart:

| | | | | | | | | | | | | | | | | | |

| Named Executive Officers | | | | | | | | | | | | | | | | | | |

| Daniel G. Welch | | $ | 2,535,843 | | | $ | 27,634,142 | | | $ | 57,633 | | | $ | 6,421,096 | | | $ | 40,000 | | | $ | 36,688,714 | |

| John C. Hodgman | | | 976,028 | | | | 7,208,469 | | | | 81,096 | | | | – | | | | 40,000 | | | | 8,305,593 | |

| Giacomo Di Nepi | | | 1,041,155 | | | | 6,710,264 | | | | 67,220 | | | | – | | | | – | | | | 7,818,639 | |

| Sean P. Nolan | | | 1,023,241 | | | | 15,405,654 | | | | 77,688 | | | | – | | | | 40,000 | | | | 16,546,583 | |

| Andrew Powell, Esq. | | | 917,585 | | | | 11,037,388 | | | | 81,096 | | | | – | | | | 40,000 | | | | 12,076,069 | |

65. Moreover executives, including Welch, will be guaranteed bonuses under the Merger Agreement at no less than 125% of target established under the 2014 bonus plan. However, it is customary that, after a corporate takeover, bonuses are paid at either 100% of targeted levels or at actual performance levels, without using a floor. Here, the Board has extorted payments for Company insiders far above what their actual performance dictated.

66. Compounding the harm to investors, the Director Defendants have agreed to onerous deal protections that will dissuade other competing bidders from coming forward and submitting bids offering a higher price.

67. The Merger Agreement contain numerous terms and conditions that prevent the Board from fulfilling its fiduciary duties to its shareholders and discourage competing bidders from coming forward to compensate stockholders in an amount truly reflective of the Company’s worth.

68. First, Section 5.03 of the Merger Agreement, entitled “No Solicitation broadly provides that neither InterMune, nor any of its representatives, can solicit, provide information to, or engage in discussions with any potential bidder. The limitations are so draconian and restrictive that the Company may not solicit or encourage a bid, participate in any discussions with any third party, other than to state that the Company cannot be involved in any negotiations, provide any non-public information to an interested third party or endorse or recommend any unsolicited proposal barring extremely limited circumstances. Moreover, the Board is obligated to enforce any standstill agreements executed with other bidders. This means that those entities most likely to submit a trumping offer, because they have participated in

confidential due diligence of the Company, will continue to be barred from bidding on the Company, even if they wish to re-enter the process and offer more value to stockholders. Section 5.03(a) states in its entirety: