November 26, 2007

| | |

| Re: | | |

| | YPF Sociedad Anónima Form 20-F for the year ended December 31, 2006 File No. 001-12102 |

Mr. Ryan Milne

United States Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, D.C. 20549-7410

Dear Mr. Schwall:

Thank you for your letter dated November 8, 2007 setting forth comments of the staff of the Division of Corporation Finance (the “Staff”) of the United States Securities and Exchange Commission (the “SEC” or “Commission”) on the annual report on Form 20-F for the year ended December 31, 2006 (the “2006 Form 20-F”) of YPF Sociedad Anónima (“YPF”, also referred to in this letter as the “Company” and “we”).

To facilitate the Staff’s review, we have reproduced the captions and numbered comments from the Staff’s November 8, 2007 comment letter in bold text in our responses set forth in Annex I.

In providing these responses, and in response to the Staff’s prior request, we hereby acknowledge that:

| | • | | YPF is responsible for the adequacy and accuracy of the disclosure in its filings with the Commission; |

| | • | | Staff comments or changes to this disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| | • | | YPF may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

We would like to express our appreciation for your cooperation in these matters, and we are available to discuss any of our responses with you at your convenience. In that connection, please do not hesitate to contact the undersigned in Buenos Aires at 54-11-5071-2850 or fax: 54-11-4329-2113; Ricardo C. Ruiz and Manuel Arranz Alonso of Deloitte, our external auditors, at 54-11-4320-2700 (ext. 2221) and 34-915-14-50-00 (ext. 2072), or our counsel, Nicholas A. Kronfeld of Davis Polk & Wardwell, at 212-450-4950 or fax: 212-450-3950.

|

| Very truly yours, |

|

|

Walter Cristian Forwood Chief Financial Officer |

ANNEX A

Form 20-F for the Fiscal Year Ended December 31, 2006

Notes to Consolidated Financial Statements, page F-8

Note 15, Additional U.S. GAAP Disclosures, page F-46

c) Hydrocarbon well abandonment obligations, page F-46

| 1. | We have reviewed your response to comment 1 of our letter dated September 10, 2007. The basis for the revision to the asset retirement obligation amounts during fiscal years 2006, 2005 and 2004 remains unclear. We understand the general reason for the increase in previously recorded obligations relate to change in suppliers, new requirements of the Secretariat of Energy and increases in repair costs due to growth in demand as a result of rising WTI prices. Considering the magnitude of these revisions recorded during the past three fiscal years, please provide us with a breakdown by fiscal year of the revision amounts related to the specific changes in estimates identified in each future period. Your response should address in more detail what factors occurred during fiscal years 2006, 2005 and 2004 to justify these significant revisions to previously recorded amounts. In addition, please tell us why you believe these revisions of 58%, 107% and 72% of the beginning of year obligations under US GAAP as of December 31, 2006, 2005 and 2004, respectively should be considered a change in estimate versus the correction of an error. |

YPF S.A. conducts the bulk of its business in Argentina, in an area of approximately 16.9 million net acres onshore and offshore. Of this total, 6.2 million net acres are under production concessions and 10.7 million net acres are under exploration permits. Commercial production is concentrated in five basins, each of which has its own distinct geological conditions which are different from the rest: Neuquina, Cuyana and Golfo de San Jorge in central Argentina, Austral in southern Argentina (which includes onshore and offshore fields), and Noroeste in northern Argentina. YPF has over 19,000 wells drilled, distributed among the different areas in which it participates, which determines the existence of different criticality (complexity) characteristics at the time of being abandoned, such as:

| | • | | Broken casing, which implies doing tasks in addition to normal work; |

| | • | | Difficulties in order to access the wells, by reason of the wells being in areas where the access roads have been obstructed (for instance by vegetation), requiring incremental work; |

| | • | | Different well depths, which implies incurring extra costs (man-hours, equipment and materials); |

| | • | | Wells in depleted areas (i.e. settled with respect to their original condition), which require additional work in order to permit access and work by equipment. |

| | • | | Wells that go through geologic formations which contain water to be used for human consumption, like “El Patagoniano” in the south of Argentina, which implies additional work and costs (cement, rotating, additional auxiliary puncturing, Cement Bond Log (CBL) / Variable Density Log (VDL), among others) to ensure the preservation of such natural resource without any possible contamination in the future, and after the well is abandoned. A CBL is run to inspect the integrity of the cement sealing to the casing and to the formation. The VDL will predominantly measure the cement to formation bond. As a result, the CBL/VDL determines cement bond quality between cement and casing and also between cement and formation for zone isolation. |

Considering the above, the determination of “typical plugging costs” that applies to all the Company’s wells is a complex matter. Because of this, and as we mentioned in our response letter dated October 12, 2007, the Company’s accounting policy is to review estimates at the end of each fiscal year, upon considering the current costs incurred in that year in abandoning tasks on a field-by-field basis, in order to make the best estimate of the Asset Retirement Obligation (“ARO”). The current costs incurred, due to the complexities of the plugging activities, added to the price increases determined by suppliers of these services, are the Company’s best source of information at each financial statement issuance date, based upon knowing the new situations that have arisen, as we explained in the above paragraphs, at the time of doing the relevant work.

Based upon the above, and in accordance with FAS 143 (Financial Accounting Standard 143—Accounting for Asset Retirement Obligations), as described below, which does not require a specific estimating methodology for well abandonment in the Oil & Gas industry, we consider that the incremental abandoning costs referred to in the Staff’s comment are changes in estimates and not accounting errors.

FAS 143

| | |

| Paragraph | | Description |

| 3. | | “…An entity shall recognize the fair value of a liability for an asset retirement obligation in the period in which it is incurredif a reasonable estimate of fair value can be made…” |

| |

| 7. | | “…The fair value of a liability for an asset retirement obligation is the amount at which that liability could be settled in a current transaction between willing parties, that is, other than in a forced or liquidation transaction. Quoted market prices in active markets are the best evidence of fair value and shall be used as the basis for the measurement, if available. If quoted market prices are not available,the estimate of fair value shall be based on the best information available in the circumstances, including prices for similar liabilities and the results of present value (or other valuation) techniques…” |

| |

| A22. | | Whereassets with asset retirement obligationsare components of a larger group of assets (for example, a number of oil wells that make up an entire oil field operation),aggregation techniques may be necessary to derive a collective asset retirement obligation. This Statement does not preclude the use of estimatesand computational shortcuts that are consistent with the fair value measurement objective when computing an aggregate asset retirement obligation for assets that are components of a larger group of assets. |

Exhibit I to this Annex A sets forth the current costs incurred for well abandoning tasks in the years 2004, 2005 and 2006, on the basis of which the Company considers the average cost per economic unit in order to make projections for the wells that have not yet been abandoned. The information is presented separately for each of the different economic units where the Company operates, and according to the information used, in order to obtain the best reasonable estimate available, and in order to recognize it as a liability.

Additionally, we also confirm to the Staff that in future filings we will add a description substantially similar to the following, so that an investor can have a better understanding of the estimating methodology used by the Company, as described in the above paragraphs, in relation to hydrocarbon wells abandonment obligations:

“Costs related to hydrocarbon well abandonment obligations are capitalized along with the related assets, and are depreciated using the unit-of-production method. As compensation, a liability is recognized for this concept at the estimated value of the discounted amounts payable. The Company revises the cost of well abandoning obligations on an annual basis by using the information on current costs incurred in the fiscal year (or external information to adjust previous costs if such work has not been done). Due to the number of the wells in operation and/or not abandoned, and likewise the complexity with respect to different geographic areas where the wells are located, the above changes in estimates in plugging costs are extrapolated to the wells pending abandonment”.

Engineering Comments

Exploration and Development Properties and Production, page 35

| 2. | We have reviewed your response to prior comment 13. Because there is a material difference in value between oil reserves and gas reserves, we believe it is more meaningful to investors if you disclose the production and reserves for your principal properties in separate units of oil and gas. Please confirm that you will provide this expanded disclosure in your proposed table. |

We acknowledge the Staff’s comment and confirm that in future filings we will disclose the production and reserves for our principal properties in separate units of oil and gas.

Exhibit I to Annex A

We respectfully submit to the Staff that it is impracticable to break down revisions of well plugging costs into specific items because these revisions are based in substantial part on our actual experience of increased plugging costs, which reflects numerous factors, many of which cannot reasonably be disaggregated. For example, there are situations where the revisions include, for each year, new prices resulting from general cost increases in the industry, as well as increases relating to tasks that are not strictly equal (or comparable) to those done in previous years.

The table below sets forth information related to current costs incurred for well abandoning tasks in 2004, 2005 and 2006 on the basis of which the Company considers the average cost per economic unit in order to make projections for the wells that have not yet been abandoned:

Exhibit I to Annex A

| | | | | | | | | | | | | | | |

| | | | | Economic Unit (*) |

| | | | | UNAO | | | UNAS |

Year | | Information of well abandonment estimation | | Mendoza | | Rincón de los

Sauces -

Catriel | | Loma La

Lata | | El Porton | | | Chubut -

Cañadón Seco | | Las Heras |

2006 | | Total cost incurred related to well abandonment activities | | 1.68 | | 1.82 | | 0.24 | | 0.00 | (1) | | 21.98 | | 6 |

| | Number of wells abandoned | | 10 | | 15 | | 1 | | 0 | | | 125 | | 38 |

| | Average cost used to estimate the aggregate hydrocarbon well abandonment obligation | | 0.17 | | 0.12 | | 0.24 | | 0.28 | | | 0.18 | | 0.15 |

| | Number of wells subject to abandoned activities | | 1,890 | | 3,228 | | 923 | | 301 | | | 6,498 | | 6,133 |

| | Undiscounted hydrocarbon well abandonment obligation | | 317 | | 391 | | 226 | | 85 | | | 1,143 | | 935 |

| | Discounted hydrocarbon well abandonment obligation | | 196 | | 257 | | 135 | | 52 | | | 771 | | 633 |

| | | | | | | |

2005 | | Total cost incurred related to well abandonment activities | | 1.25 | | 3.32 | | 2.56 | | 0.23 | | | 2.58 | | 6.63 |

| | Number of wells abandoned | | 11 | | 32 | | 12 | | 1 | | | 25 | | 69 |

| | Average cost used to estimate the aggregate hydrocarbon well abandonment obligation | | 0.11 | | 0.10 | | 0.21 | | 0.23 | | | 0.10 | | 0.10 |

| | Number of wells subject to abandoned activities | | 1,829 | | 3,069 | | 871 | | 259 | | | 6,556 | | 6,055 |

| | Undiscounted hydrocarbon well abandonment obligation | | 206 | | 318 | | 173 | | 61 | | | 676 | | 570 |

| | Discounted hydrocarbon well abandonment obligation | | 115 | | 197 | | 100 | | 30 | | | 437 | | 349 |

| | | | | | | |

2004 | | Total cost incurred related to well abandonment activities | | 0.37 | | 2.62 | | 0.94 | | 0.68 | | | 1.31 | | 0.04 |

| | Number of wells abandoned | | 9 | | 34 | | 6 | | 6 | | | 40 | | 2 |

| | Average cost used to estimate the aggregate hydrocarbon well abandonment obligation | | 0.04 | | 0.08 | | 0.16 | | 0.11 | | | 0.03 | | 0.02 |

| | Number of wells subject to abandoned activities | | 1,789 | | 2,974 | | 860 | | 248 | | | 6,431 | | 5,855 |

| | Undiscounted hydrocarbon well abandonment obligation | | 74 | | 229 | | 135 | | 28 | | | 193 | | 113 |

| | Discounted hydrocarbon well abandonment obligation | | 44 | | 142 | | 71 | | 15 | | | 136 | | 65 |

| (1) | Considering that no abandonment activities were done in this year, we adjusted the cost of previous year to estimate the well abandonment obligation. |

| (*) | There are additional abandonment activities relating to third party-operated fields in the North Western and Joint Ventures in Argentina, which also are included in our aggregate hydrocarbon well abandonment obligation as of the end of each year and which represent to more than 15% of the total obligation. |

Additionally, set forth below is a description of the main sources of revisions for the years under analysis:

| • | | Revisions of estimations according to the increase in salaries and prices in the economy: |

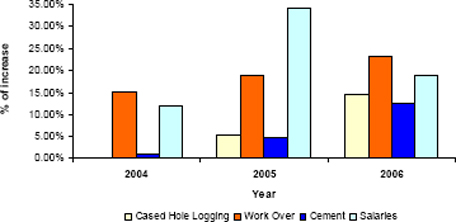

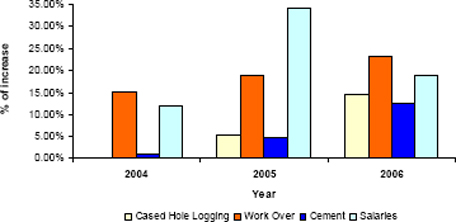

The following table shows the costs increases in each of the years indicated of workover and/or pulling equipment, cement activities, cased hole logging and salaries for the Mendoza, Loma La Lata and Rincon de los Sauces economic units, which represent a significant portion (without specifically considering the time required to use the equipment, depending on how critical the work is, that is, considering exclusively the rate per unit of service used) within the well plugging costs, and which determine, at least in part, the reason for the price increases associated to such activities.

Exhibit I to Annex A

| • | | Revisions of estimations according to changes in suppliers which provides well abandonment activities: |

In addition to the general increase in industry costs, and within the main cost revisions that occurred (especially in 2005 and 2006, relating to the corresponding prior year), and in relation to the well plugging activity at the South Business Unit “UNAS”, until 2005 there was a single well plugging contract with one supplier, which was replaced by multiple contracts with other companies as from such year (2005), and the costs of the latter, as it was showed by actual costs incurred in 2005 and 2006, were relatively higher than the costs until such date in particular because they used more complex equipment and technology to develop the abandonment activities as new requirements of the Company connected with such activities were implemented. The new companies that replaced the company engaged until 2005 do not do specific plugging work (i.e. they do not quote the Company for a “turnkey plugging service”), and each does individually different tasks necessary to abandon the wells.

Exhibit I to Annex A

| • | | Revisions of estimations according to new information related to more complex abandonment activities: |

Specifically on the subject of well plugging done at the UNAS, the activities that implied verifying the isolation of the only fresh water aquifer in southern Argentina implied increasing work and its associated costs. It should be taken into account that this region is approximately 100 years old in the oil business, which was mostly conducted by the National Government at the time when YPF was a state company, so there are no suitable records accurately determining the wells drilled through such geological formation (the Patagoniano). Since this verification is not a legal duty under current legislation as a requirement for plugging activities, and is only done by decision of the Company in order to mitigate or eliminate the possibility of any liability in the event of any claims by the Secretariat of Energy (which, however, has not passed upon the acceptability or not of the work done, at the date hereof) that could eventually arise in relation to such abandonment activities, the Company determined that in cases where wells are found to be drilled through this geological formation, work must be done to guarantee its isolation. The greatest increase in plugging costs, apart from those mentioned in the above paragraphs, corresponds to the extra work required to ensure isolation of the Patagoniano.

We describe below, by fiscal year, certain additional factors that have affected well abandonment costs, in addition to price increases in the economy and specifically in the oil and gas industry:

Year 2004: until this year, well abandonment activities did not identify the need for further work in addition to the normal plugging activities (i.e. the necessity of using complex equipment, additional cement, verification of the CBL/VDL logs of cementing activity, among others) as occurred in 2005 and 2006, because such activities did not present special problems (the wells did not go through El Patagoniano or similar formations or were covered by casing; they did not present broken casings; among other). According to the information available as of that year, the average cost used to estimate abandonment wells did not consider additional costs that appear in later years as new information also appeared, as explained below.

Year 2005: in this year abandonment activities demanded stricter requirements in terms of equipment and work, and, likewise, this year there was a larger number of wells with breakdowns (for instance the casing), which gave rise to a larger amount of auxiliary cementing. Of the total number of wells abandoned in the fiscal year, approximately 33% were subject to quality control logging with CBL/VDL. All this implied using more complex equipment (bottom motors, millers, pumping equipment, surface circuits, etc); longer standby time for cement setting; prior conditioning of wells, which implied an increase of about 44 hours per month of additional work to remove the installation equipment, rotating and/or adjusting wells. All of these extra activities were mostly related to El Patagoniano, for the reasons described in the preceding paragraphs.

Year 2006: this year abandonment activities evidenced that a large number of wells presented complex characteristics (of the total number of wells abandoned in the fiscal year, approximately 69% were subject to quality control logging with CBL/VDL), which determines stricter requirements with respect to the previous year, such as: longer setting times, wireline services, rotating, additional auxiliary puncturing, depleted areas needing a larger amount of

Exhibit I to Annex A

auxiliary equipment in order to achieve the same cement quality that is acceptable to do the work at hand. Likewise there were longer well conditioning times (rotating, removing materials, etc -about 119 hours vs. 44 in the previous year).

For these reasons, we believe that the extra costs associated to ensuring isolation of the aquifer are not an error, but rather represent revisions of estimates made pursuant to new information that becomes available each year, taking into account the specific plugging activities done each year (and its associated costs), and also considering both the best information available as of the date of each estimate, and also the estimating methodology used to calculate liabilities for well plugging done by the Company.