Table of Contents

YPF SOCIEDAD ANONIMA

CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2022, 2021 AND 2020

Table of Contents

YPF SOCIEDAD ANONIMA CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, 2022, 2021 AND 2020 |  |

Note | Description | F - Page | ||

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 8 | ||||

1 | General information, structure and organization of the Group business | 9 | ||

2 | Basis of preparation of the consolidated financial statements | 10 | ||

3 | 38 | |||

4 | 38 | |||

5 | 42 | |||

6 | 46 | |||

7 | 50 | |||

8 | 52 | |||

9 | 57 | |||

10 | 58 | |||

11 | 60 | |||

12 | 60 | |||

13 | 60 | |||

14 | 61 | |||

15 | 61 | |||

16 | 61 | |||

17 | 67 | |||

18 | 68 | |||

19 | 69 | |||

20 | 69 | |||

21 | 70 | |||

22 | 73 | |||

23 | 73 | |||

24 | 73 | |||

25 | 77 | |||

26 | 77 | |||

27 | 79 | |||

28 | 79 | |||

29 | 79 | |||

30 | 81 | |||

31 | 81 | |||

32 | 81 | |||

33 | 87 | |||

34 | 92 | |||

35 | 96 | |||

36 | 113 | |||

37 | 117 | |||

38 | 120 |

Table of Contents

| F - 1 |  | ||

YPF SOCIEDAD ANONIMA CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, 2022, 2021 AND 2020 | ||||

Term | Definition | |

ADR | American Depositary Receipt | |

ADS | American Depositary Share | |

AESA | Subsidiary A-Evangelista S.A. | |

AFIP | Argentine Tax Authority (Administración Federal de Ingresos Públicos) | |

ANSES | National Administration of Social Security (Administración Nacional de la Seguridad Social) | |

ASC | Accounting Standards Codification | |

Associate | Company over which YPF has significant influence as provided for in IAS 28 | |

BCRA | Central Bank of the Argentine Republic (Banco Central de la República Argentina) | |

BNA | Argentine Nation Bank (Banco de la Nación Argentina) | |

BO | Official Gazette of the Argentine Republic (Boletín Oficial de la República Argentina) | |

BONAR | Argentine Treasury Bonds (Bonos de la Nación Argentina) | |

CAMMESA | Compañía Administradora del Mercado Mayorista Eléctrico S.A. | |

CDS | Associate Central Dock Sud S.A. | |

CFO | Chief Financial Officer | |

CGU | Cash-Generating Units | |

CNDC | Argentine Antitrust Authority (Comisión Nacional de Defensa de la Competencia) | |

CNV | Argentine Securities Commission (Comisión Nacional de Valores) | |

CPI | Consumer Price Index published by INDEC | |

CSJN | Argentine Supreme Court of Justice (Corte Suprema de Justicia de la Nación Argentina) | |

CT Barragán | Joint Venture CT Barragán S.A. | |

Dollar | United States dollar | |

Eleran | Subsidiary Eleran Inversiones 2011 S.A.U. | |

ENARGAS | Argentine Gas Regulator (Ente Nacional Regulador del Gas) | |

ENARSA | Energía Argentina S.A. (formerly Integración Energética Argentina S.A. “IEASA”) | |

FACPCE | Argentine Federation of Professional Councils in Economic Sciences (Federación Argentina de Consejos Profesionales de Ciencias Económicas) | |

FASB | Financial Accounting Standards Board | |

FOB | Free on board | |

Gas Austral | Associate Gas Austral S.A. | |

GPA | Associate Gasoducto del Pacífico (Argentina) S.A. | |

Group | YPF and its subsidiaries | |

IAS | International Accounting Standard | |

IASB | International Accounting Standards Board | |

IDS | Associate Inversora Dock Sud S.A. | |

IFRIC | International Financial Reporting Interpretations Committee | |

IFRS | International Financial Reporting Standard | |

IGJ | City of Buenos Aires’s Public Registry of Commerce (Inspección General de Justicia) | |

IIBB | Turnover tax (Impuesto a los ingresos brutos) | |

INDEC | National Institute of Statistics and Census (Instituto Nacional de Estadística y Censos) | |

IWPI | Internal Wholesale Price Index published by INDEC | |

JO | Joint operation | |

Joint venture | Company jointly owned by YPF as provided for in IFRS 11 | |

LGS | Argentine General Corporations Law (Ley General de Sociedades) No. 19,550 (T.O. 1984), as amended | |

LNG | Liquified natural gas | |

LPG | Liquefied petroleum gas | |

MBtu | Million British thermal units | |

MEGA | Joint Venture Company Mega S.A. | |

Metroenergía | Subsidiary Metroenergía S.A. | |

Metrogas | Subsidiary Metrogas S.A. | |

MINEM | Former Ministry of Energy and Mining (Ministerio de Energía y Minería) | |

NO | Negotiable Obligations | |

Oiltanking | Associate Oiltanking Ebytem S.A. | |

OLCLP | Joint Venture Oleoducto Loma Campana - Lago Pellegrini S.A. | |

Oldelval | Associate Oleoductos del Valle S.A. | |

OPESSA | Subsidiary Operadora de Estaciones de Servicios S.A. | |

OTA | Joint Venture OleoductoTrasandino (Argentina) S.A. | |

OTC | Joint Venture OleoductoTrasandino (Chile) S.A. | |

PEN | National Executive Power (Poder Ejecutivo Nacional) | |

Peso | Argentine peso | |

PIST | Transportation system entry point (Punto de ingreso al sistema de transporte) | |

Profertil | Joint Venture Profertil S.A. | |

Refinor | Joint Venture Refinería del Norte S.A. | |

ROD | Record of decision | |

RTI | Integral Tariff Review (Revisión Tarifaria Integral) | |

RTT | Transitional Tariff Regime (Régimen Tarifario de Transición) | |

SE | Secretariat of Energy (Secretaría de Energía) | |

SEC | U.S. Securities and Exchange Commission | |

SEE | Secretariat of Electric Energy (Secretaría de Energía Eléctrica) | |

SGE | Government Secretariat of Energy (Secretaría de Gobierno de Energía) | |

SRH | Hydrocarbon Resources Secretariat (Secretaría de Recursos Hidrocarburíferos) | |

SSHyC | Under-Secretariat of Hydrocarbons and Fuels (Subsecretaría de Hidrocarburos y Combustibles) | |

Subsidiary | Company controlled by YPF in accordance with the provisions of IFRS 10. | |

Sustentator | Joint Venture Sustentator S.A. | |

Termap | Associate Terminales Marítimas Patagónicas S.A. | |

TFN | National Fiscal Tribunal (Tribunal Fiscal de la Nación) | |

UNG | Unaccounted Natural Gas | |

US$ | United States dollars | |

US$/Bbl | Dollar per barrel | |

UVA | Unit of Value (Unidad de Valor Adquisitivo) | |

VAT | Value Added Tax | |

WI | Working interest | |

Y-GEN I | Joint venture Y-GEN Eléctrica S.A.U. | |

Y-GEN II | Joint venture Y-GEN Eléctrica II S.A.U. | |

YPF Brasil | Subsidiary YPF Brasil Comercio Derivado de Petróleo Ltda. | |

YPF Chile | Subsidiary YPF Chile S.A. | |

YPF EE | Joint venture YPF Energía Eléctrica S.A. | |

YPF Gas | Associate YPF Gas S.A. | |

YPF Holdings | Subsidiary YPF Holdings, Inc. | |

YPF International | Subsidiary YPF International S.A. | |

YPF or the Company | YPF S.A. | |

YPF Perú | Subsidiary YPF E&P Perú S.A.C. | |

YPF Ventures | Subsidiary YPF Ventures S.A.U. | |

YTEC | Subsidiary YPF Tecnología S.A. | |

WEM | Wholesale Electricity Market |

Table of Contents

| F - 2 |  | ||

YPF SOCIEDAD ANONIMA CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, 2022, 2021 AND 2020 | ||||

Legal address

Macacha Güemes 515 - City of Buenos Aires, Argentina.

Fiscal year

No.46 beginning on January 1, 2022.

Principal business of the Company

The Company’s purpose shall be to perform, on its own, through third parties or in association with third parties, the study, exploration, development and production of oil, natural gas and other minerals and the refining, marketing and distribution of oil and petroleum products and direct and indirect petroleum derivatives, including petrochemicals, chemicals, including those derived from hydrocarbons and non-fossil fuels, biofuels and their components, as well as the production of electric power from hydrocarbons, through which it may manufacture, use, purchase, sell, exchange, import or export them. It shall also be the Company’s purpose to render, directly, through a subsidiary, or in association with third parties, telecommunications services in all forms and modalities authorized by the legislation in force after applying for the relevant licenses, as required by the regulatory framework, as well as the production, industrialization, processing, commercialization, conditioning, transportation and stockpiling of grains and products derived from grains, as well as any other activity complementary to its industrial and commercial business or that may be necessary to attain its objective. In order to fulfill these objectives, the Company may set up, become associated with or have an interest in any public or private entity domiciled in Argentina or abroad, within the limits set forth in the Bylaws.

Filing with the Public Registry

Bylaws filed on February 5, 1991 under No. 404, Book 108, Volume A of Sociedades Anónimas, with the Public Registry of City of Buenos Aires, in charge of the IGJ; and Bylaws in substitution of previous Bylaws, filed on June 15, 1993, under No. 5,109, Book 113, Volume A of Sociedades Anónimas, with the above mentioned Registry.

Duration of the Company

Through June 15, 2093.

Last amendment to the Bylaws

April 30, 2021 registered with the IGJ on August 5, 2021 under No. 12,049, Book 103 of Corporations.

Capital structure

393,312,793 shares of common stock, $10 par value and 1 vote per share.

Subscribed, paid-in and authorized for stock exchange listing (in pesos)

3,933,127,930.

PABLO GERARDO GONZÁLEZ President |

Table of Contents

| F - 3 |  | ||

YPF SOCIEDAD ANONIMA CONSOLIDATED STATEMENTS OF FINANCIAL POSITION AS OF DECEMBER 31, 2022, 2021 AND 2020 (Amounts expressed in millions of United States dollars) | ||||

| Notes | 2022 | 2021 | 2020 | |||||||||||

ASSETS | ||||||||||||||

Non-current assets | ||||||||||||||

Intangible assets | 7 | 384 | 419 | 465 | ||||||||||

Property, plant and equipment | 8 | 17,510 | 16,003 | 16,413 | ||||||||||

Right-of-use assets | 9 | 541 | 519 | 524 | ||||||||||

Investments in associates and joint ventures | 10 | 1,905 | 1,529 | 1,274 | ||||||||||

Deferred income tax assets, net | 17 | 17 | 19 | 33 | ||||||||||

Other receivables | 12 | 205 | 190 | 175 | ||||||||||

Trade receivables | 13 | 6 | 43 | 101 | ||||||||||

Investment in financial assets | 14 | 201 | 25 | - | ||||||||||

|

|

|

|

|

|

|

|

| ||||||

Total non-current assets | 20,769 | 18,747 | 18,985 | |||||||||||

|

|

|

|

|

|

|

|

| ||||||

Current assets | ||||||||||||||

Assets held for disposal | - | 1 | 6 | |||||||||||

Inventories | 11 | 1,738 | 1,500 | 1,191 | ||||||||||

Contract assets | 24 | 1 | 13 | 10 | ||||||||||

Other receivables | 12 | 808 | 616 | 409 | ||||||||||

Trade receivables | 13 | 1,504 | 1,305 | 1,287 | ||||||||||

Investment in financial assets | 14 | 319 | 497 | 344 | ||||||||||

Cash and cash equivalents | 15 | 773 | 611 | 650 | ||||||||||

|

|

|

|

|

|

|

|

| ||||||

Total current assets | 5,143 | 4,543 | 3,897 | |||||||||||

|

|

|

|

|

|

|

|

| ||||||

TOTAL ASSETS | 25,912 | 23,290 | 22,882 | |||||||||||

|

|

|

|

|

|

|

|

| ||||||

SHAREHOLDERS’ EQUITY | ||||||||||||||

Shareholders’ contributions | 4,507 | 4,535 | 4,532 | |||||||||||

Retained earnings | 5,947 | 3,649 | 3,525 | |||||||||||

|

|

|

|

|

|

|

|

| ||||||

Shareholders’ equity attributable to shareholders of the parent company | 10,454 | 8,184 | 8,057 | |||||||||||

|

|

|

|

|

|

|

|

| ||||||

Non-controlling interest | 98 | 80 | 74 | |||||||||||

|

|

|

|

|

|

|

|

| ||||||

TOTAL SHAREHOLDERS’ EQUITY | 10,552 | 8,264 | 8,131 | |||||||||||

|

|

|

|

|

|

|

|

| ||||||

LIABILITIES | ||||||||||||||

Non-current liabilities | ||||||||||||||

Provisions | 16 | 2,571 | 2,519 | 2,219 | ||||||||||

Deferred income tax liabilities, net | 17 | 1,733 | 1,805 | 1,423 | ||||||||||

Income tax liability | 17 | 26 | 29 | 42 | ||||||||||

Taxes payable | 18 | 1 | 2 | 3 | ||||||||||

Salaries and social security | 19 | 1 | 32 | 46 | ||||||||||

Lease liabilities | 20 | 272 | 276 | 288 | ||||||||||

Loans | 21 | 5,948 | 6,534 | 6,277 | ||||||||||

Other liabilities | 22 | 19 | 9 | 35 | ||||||||||

Accounts payable | 23 | 6 | 9 | 8 | ||||||||||

| �� |

|

|

|

|

|

|

| ||||||

Total non-current liabilities | 10,577 | 11,215 | 10,341 | |||||||||||

|

|

|

|

|

|

|

|

| ||||||

Current liabilities | ||||||||||||||

Provisions | 16 | 199 | 188 | 73 | ||||||||||

Contract liabilities | 24 | 77 | 130 | 81 | ||||||||||

Income tax liability | 17 | 27 | 13 | 9 | ||||||||||

Taxes payable | 18 | 173 | 143 | 188 | ||||||||||

Salaries and social security | 19 | 297 | 229 | 178 | ||||||||||

Lease liabilities | 20 | 294 | 266 | 263 | ||||||||||

Loans | 21 | 1,140 | 845 | 1,793 | ||||||||||

Other liabilities | 22 | 12 | 34 | 108 | ||||||||||

Accounts payable | 23 | 2,564 | 1,963 | 1,717 | ||||||||||

|

|

|

|

|

|

|

|

| ||||||

Total current liabilities | 4,783 | 3,811 | 4,410 | |||||||||||

|

|

|

|

|

|

|

|

| ||||||

TOTAL LIABILITIES | 15,360 | 15,026 | 14,751 | |||||||||||

|

|

|

|

|

|

|

|

| ||||||

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | 25,912 | 23,290 | 22,882 | |||||||||||

|

|

|

|

|

|

|

|

| ||||||

Accompanying notes are an integral part of the consolidated financial statements.

PABLO GERARDO GONZÁLEZ President |

Table of Contents

| Notes | 2022 | 2021 | 2020 | |||||||||||||

Net income | ||||||||||||||||

Revenues | 24 | 18,757 | 13,682 | 9,690 | ||||||||||||

Costs | 25 | (13,684) | (10,629) | (8,663) | ||||||||||||

|

|

|

|

|

|

|

|

| ||||||||

Gross profit | 5,073 | 3,053 | 1,027 | |||||||||||||

|

|

|

|

|

|

|

|

| ||||||||

Selling expenses | 26 | (1,896) | (1,507) | (1,324) | ||||||||||||

Administrative expenses | 26 | (657) | (470) | (467) | ||||||||||||

Exploration expenses | 26 | (65) | (30) | (80) | ||||||||||||

(Impairment) / Recovery of property, plant and equipment and intangible assets, net | 7-8 | (123) | (115) | (53) | ||||||||||||

Other net operating results | 27 | 150 | (232) | 93 | ||||||||||||

|

|

|

|

|

|

|

|

| ||||||||

Operating profit / (loss) | 2,482 | 699 | (804) | |||||||||||||

|

|

|

|

|

|

|

|

| ||||||||

Income from equity interests in associates and joint ventures | 10 | 446 | 287 | 188 | ||||||||||||

Financial income | 28 | 2,188 | 904 | 1,492 | ||||||||||||

Financial costs | 28 | (2,315) | (1,408) | (1,966) | ||||||||||||

Other financial results | 28 | 255 | 233 | 253 | ||||||||||||

|

|

|

|

|

|

|

|

| ||||||||

Net financial results | 28 | 128 | (271) | (221) | ||||||||||||

|

|

|

|

|

|

|

|

| ||||||||

|

|

|

|

|

|

|

|

| ||||||||

Net profit / (loss) before income tax | 3,056 | 715 | (837) | |||||||||||||

|

|

|

|

|

|

|

|

| ||||||||

Income tax | 17 | (822) | (699) | (184) | ||||||||||||

|

|

|

|

|

|

|

|

| ||||||||

Net profit / (loss) for the year | 2,234 | 16 | (1,021) | |||||||||||||

|

|

|

|

|

|

|

|

| ||||||||

Other comprehensive income | ||||||||||||||||

Items that may be reclassified subsequently to profit or loss: | ||||||||||||||||

Translation effect from subsidiaries, associates and joint ventures | (194) | (62) | (111) | |||||||||||||

Result from net monetary position in subsidiaries, associates and joint ventures (1) | 276 | 177 | 96 | |||||||||||||

|

|

|

|

|

|

|

|

| ||||||||

Other comprehensive income for the year | 82 | 115 | (15) | |||||||||||||

|

|

|

|

|

|

|

|

| ||||||||

|

|

|

|

|

|

|

|

| ||||||||

Total comprehensive income for the year | 2,316 | 131 | (1,036) | |||||||||||||

|

|

|

|

|

|

|

|

| ||||||||

Net profit / (loss) for the year attributable to: | ||||||||||||||||

Shareholders of the parent company | 2,228 | 26 | (1,004) | |||||||||||||

Non-controlling interest | 6 | (10) | (17) | |||||||||||||

Other comprehensive income for the year attributable to: | ||||||||||||||||

Shareholders of the parent company | 70 | 98 | (13) | |||||||||||||

Non-controlling interest | 12 | 17 | (2) | |||||||||||||

Total comprehensive income for the year attributable to: | ||||||||||||||||

Shareholders of the parent company | 2,298 | 124 | (1,017) | |||||||||||||

Non-controlling interest | 18 | 7 | (19) | |||||||||||||

Earnings per share attributable to shareholders of the parent company: | ||||||||||||||||

Basic and diluted | 31 | 5.67 | 0.07 | (2.56) | ||||||||||||

| (1) | Result associated to subsidiaries, associates and joint ventures with the peso as functional currency. See Note 2.b.1). |

Accompanying notes are an integral part of the consolidated financial statements.

PABLO GERARDO GONZÁLEZ President |

Table of Contents

| F - 5 |  | ||

YPF SOCIEDAD ANONIMA CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY FOR THE YEARS ENDED DECEMBER 31, 2022, 2021 AND 2020 (Amounts expressed in millions of United States dollars) | ||||

| 2022 | ||||||||||||||||||||||||||||||||||||||||

| Shareholders’ contributions | ||||||||||||||||||||||||||||||||||||||||

| Capital | Treasury shares | Share-based benefit plans | Acquisition cost of treasury shares | Share trading premium | Issuance premiums | Total | ||||||||||||||||||||||||||||||||||

| Balance at the beginning of the fiscal year | 3,931 | 2 | 5 | (5) | (38) | 640 | 4,535 | |||||||||||||||||||||||||||||||||

| Accrual of share-based benefit plans (3) | - | - | 2 | - | - | - | 2 | |||||||||||||||||||||||||||||||||

| Repurchase of treasury shares | (19) | 19 | - | (28) | - | - | (28) | |||||||||||||||||||||||||||||||||

| Settlement of share-based benefit plans (2) | 3 | (3) | (5) | 3 | - | - | (2) | |||||||||||||||||||||||||||||||||

| As decided by the Shareholders’ Meeting on April 29, 2022: (4) | ||||||||||||||||||||||||||||||||||||||||

- Absorption of accumulated losses | - | - | - | - | - | - | - | |||||||||||||||||||||||||||||||||

| Other comprehensive income | - | - | - | - | - | - | - | |||||||||||||||||||||||||||||||||

| Net profit | - | - | - | - | - | - | - | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||

| Balance at the end of the fiscal year | 3,915 | 18 | 2 | (30) | (38) | 640 | 4,507 | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||

| Retained earnings | Equity attributable to | |||||||||||||||||||||||||||||||||||||||

| Legal reserve | Reserve for future dividends | Reserve for investments | Reserve for purchase of treasury shares | Other comprehensive income | Unappropriated retained earnings and losses | Shareholders of the parent company | Non- controlling interest | Total shareholders’ equity | ||||||||||||||||||||||||||||||||

| Balance at the beginning of the fiscal year | 787 | - | - | - | (564) | 3,426 | 8,184 | 80 | 8,264 | |||||||||||||||||||||||||||||||

| Accrual of share-based benefit plans (3) | - | - | - | - | - | - | 2 | - | 2 | |||||||||||||||||||||||||||||||

| Repurchase of treasury shares | - | - | - | - | - | - | (28) | - | (28) | |||||||||||||||||||||||||||||||

| Settlement of share-based benefit plans (2) | - | - | - | - | - | - | (2) | - | (2) | |||||||||||||||||||||||||||||||

| As decided by the Shareholders’ Meeting on April 29, 2022: (4) | ||||||||||||||||||||||||||||||||||||||||

- Absorption of accumulated losses | - | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||||||

| Other comprehensive income | - | - | - | - | 70 | - | 70 | 12 | 82 | |||||||||||||||||||||||||||||||

| Net profit | - | - | - | - | - | 2,228 | 2,228 | 6 | 2,234 | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||

| Balance at the end of the fiscal year | 787 | - | - | - | (494) | (1) | 5,654 | (5) | 10,454 | 98 | 10,552 | |||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||

| (1) | Includes (1,431) corresponding to the effect of the translation of the financial statements of investments in subsidiaries, associates and joint ventures with functional currencies other than the dollar and 937 corresponding to the recognition of the result for the net monetary position of subsidiaries, associates and joint ventures with the peso as functional currency, see Note 2.b.1). |

| (2) | Net of employees’ income tax withholdings related to the share-based benefit plans. |

| (3) | See Note 37. |

| (4) | The disposition of Shareholders’ Meeting is made based on the Company’s financial statements in pesos (the Argentine legal currency). |

| (5) | Includes 68 restricted to the distribution of unallocated retained earnings and losses (see Note 2.b.16)). |

PABLO GERARDO GONZÁLEZ President |

Table of Contents

| F - 6 |  | ||

YPF SOCIEDAD ANONIMA CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY FOR THE YEARS ENDED DECEMBER 31, 2022, 2021 AND 2020 (cont.) (Amounts expressed in millions of United States dollars) | ||||

| 2021 | ||||||||||||||||||||||||||||||||||||||

| Shareholders’ contributions | ||||||||||||||||||||||||||||||||||||||

| Capital | Treasury shares | Share-based benefit plans | Acquisition cost of treasury shares | Share trading premium | Issuance premiums | Total | ||||||||||||||||||||||||||||||||

| Balance at the beginning of the fiscal year | 3,926 | 7 | (4) | 7 | (44) | 640 | 4,532 | |||||||||||||||||||||||||||||||

| Accrual of share-based benefit plans (3) | - | - | 6 | - | - | - | 6 | |||||||||||||||||||||||||||||||

| Settlement of share-based benefit plans (2) | 5 | (5) | 3 | (12) |

| 6 |

| - | (3) | |||||||||||||||||||||||||||||

| As decided by the Shareholders’ Meeting on April 30, 2021: (4) | ||||||||||||||||||||||||||||||||||||||

- Reversal of reserves and absorption of accumulated losses | - | - | - | - | - | - | - | |||||||||||||||||||||||||||||||

| Other comprehensive income | - | - | - | - | - | - | - | |||||||||||||||||||||||||||||||

| Net profit / (loss) | - | - | - | - | - | - | - | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

| Balance at the end of the fiscal year | 3,931 | 2 | 5 | (5) | (38) | 640 | 4,535 | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

| Retained earnings | �� | Equity attributable to | ||||||||||||||||||||||||||||||||||||

| Legal reserve | Reserve for future dividends | Reserve for investments | Reserve for purchase of treasury shares | Other comprehensive income | Unappropriated retained earnings and losses | Shareholders of the parent company | Non- controlling interest | Total shareholders’ equity | ||||||||||||||||||||||||||||||

| Balance at the beginning of the fiscal year | 787 | 114 | 1,630 | 37 | (662) | 1,619 | 8,057 | 73 | 8,130 | |||||||||||||||||||||||||||||

| Accrual of share-based benefit plans (3) | - | - | - | - | - | - | 6 | - | 6 | |||||||||||||||||||||||||||||

| Settlement of share-based benefit plans (2) | - | - | - | - | - | - | (3) | - | (3) | |||||||||||||||||||||||||||||

| As decided by the Shareholders’ Meeting on April 30, 2021: (4) | ||||||||||||||||||||||||||||||||||||||

- Reversal of reserves and absorption of accumulated losses | - | (114) | (1,630) | (37) | - | 1,781 | - | - | - | |||||||||||||||||||||||||||||

| Other comprehensive income | - | - | - | - | 98 | - | 98 | 17 | 115 | |||||||||||||||||||||||||||||

| Net profit / (loss) | - | - | - | - | - | 26 | 26 | (10) | 16 | |||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

| Balance at the end of the fiscal year | 787 | - | - | - | (564) | (1) | 3,426 | 8,184 | 80 | 8,264 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

| (1) | Includes (1,237) corresponding to the effect of the translation of the financial statements of investments in subsidiaries, associates and joint ventures with functional currencies other than the dollar and 673 corresponding to the recognition of the result for the net monetary position of subsidiaries, associates and joint ventures with the peso as functional currency, see Note 2.b.1). |

| (2) | Net of employees’ income tax withholdings related to the share-based benefit plans. |

| (3) | See Note 37. |

| (4) | The disposition of Shareholders’ Meeting is made based on the Company’s financial statements in pesos (the Argentine legal currency). |

PABLO GERARDO GONZÁLEZ President |

Table of Contents

| F - 7 |  | ||

YPF SOCIEDAD ANONIMA CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY FOR THE YEARS ENDED DECEMBER 31, 2022, 2021 AND 2020 (cont.) (Amounts expressed in millions of United States dollars) | ||||

| 2020 | ||||||||||||||||||||||||||||||||||||||

| Shareholders’ contributions | ||||||||||||||||||||||||||||||||||||||

| Capital | Treasury shares | Share-based benefit plans | Acquisition cost of treasury shares | Share trading premium | Issuance premiums | Total | ||||||||||||||||||||||||||||||||

| Balance at the beginning of the fiscal year | 3,924 | 9 | 1 | 1 | (43) | 640 | 4,532 | |||||||||||||||||||||||||||||||

| Accrual of share-based benefit plans (3) | - | - | 7 | - | - | - | 7 | |||||||||||||||||||||||||||||||

| Repurchase of treasury shares | (3) | 3 | - | (6) | - | - | (6) | |||||||||||||||||||||||||||||||

| Settlement of share-based benefit plans (2) | 5 | (5) | (12) | 12 | (1) | - | (1) | |||||||||||||||||||||||||||||||

| As decided by the Shareholders’ Meeting on April 30, 2020: (4) | ||||||||||||||||||||||||||||||||||||||

- Reversal of reserves and absorption of accumulated losses | - | - | - | - | - | - | - | |||||||||||||||||||||||||||||||

- Constitution of reserves | - | - | - | - | - | - | - | |||||||||||||||||||||||||||||||

| Other comprehensive income | - | - | - | - | - | - | - | |||||||||||||||||||||||||||||||

| Net loss | - | - | - | - | - | - | - | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

| Balance at the end of the fiscal year | 3,926 | 7 | (4) | 7 | (44) | 640 | 4,532 | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

| Retained earnings | Equity attributable to | |||||||||||||||||||||||||||||||||||||

| Legal reserve | Reserve for future dividends | Reserve for investments | Reserve for purchase of treasury shares | Other comprehensive income | Unappropriated retained earnings and losses | Shareholders of the parent company | Non- controlling interest | Total shareholders’ equity | ||||||||||||||||||||||||||||||

| Balance at the beginning of the fiscal year | 787 | 100 | 2,045 | 36 | (649) | 2,223 | 9,074 | 93 | 9,167 | |||||||||||||||||||||||||||||

| Accrual of share-based benefit plans (3) | - | - | - | - | - | - | 7 | - | 7 | |||||||||||||||||||||||||||||

| Repurchase of treasury shares | - | - | - | - | - | - | (6) | - | (6) | |||||||||||||||||||||||||||||

| Settlement of share-based benefit plans (2) | - | - | - | - | - | - | (1) | - | (1) | |||||||||||||||||||||||||||||

| As decided by the Shareholders’ Meeting on April 30, 2020: (4) | ||||||||||||||||||||||||||||||||||||||

- Reversal of reserves and absorption of accumulated losses | ||||||||||||||||||||||||||||||||||||||

- Constitution of reserves | - | 14 | (415) | 1 | - | 400 | - | - | - | |||||||||||||||||||||||||||||

| Other comprehensive income | - | - | - | - | (13) | - | (13) | (2) | (15) | |||||||||||||||||||||||||||||

| Net loss | - | - | - | - | - | (1,004) | (1,004) | (17) | (1,021) | |||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

| Balance at the end of the fiscal year | 787 | 114 | 1,630 | 37 | (662) | (1) | 1,619 | 8,057 | 74 | 8,131 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

| (1) | Includes (1,175) corresponding to the effect of the translation of the financial statements of investments in subsidiaries, associates and joint ventures with functional currencies other than the dollar and 513 corresponding to the recognition of the result for the net monetary position of subsidiaries, associates and joint ventures with the peso as functional currency, see Note 2.b.1). |

| (2) | Net of employees’ income tax withholdings related to the share-based benefit plans. |

| (3) | See Note 37. |

| (4) | The disposition of Shareholders’ Meeting is made based on the Company’s financial statements in pesos (the Argentine legal currency). |

Accompanying notes are an integral part of the consolidated financial statements.

PABLO GERARDO GONZÁLEZ President |

Table of Contents

| F - 8 |  | ||

YPF SOCIEDAD ANONIMA CONSOLIDATED STATEMENTS OF CASH FLOW FOR THE YEARS ENDED DECEMBER 31, 2022, 2021 AND 2020 (Amounts expressed in millions of United States dollars) | ||||

| 2022 | 2021 | 2020 | ||||||||||

Cash flows from operating activities | ||||||||||||

Net loss | 2,234 | 16 | (1,021) | |||||||||

Adjustments to reconcile net loss to cash flows provided by operating activities: | ||||||||||||

Income from equity interests in associates and joint ventures | (446) | (287) | (188) | |||||||||

Depreciation of property, plant and equipment | 2,551 | 2,816 | 2,460 | |||||||||

Amortization of intangible assets | 43 | 51 | 48 | |||||||||

Depreciation of right-of-use assets | 214 | 201 | 254 | |||||||||

Retirement of property, plant and equipment and intangible assets and consumption of materials | 375 | 342 | 339 | |||||||||

Charge on income tax | 822 | 699 | 184 | |||||||||

Net increase in provisions | 139 | 510 | 396 | |||||||||

Impairment / (Recovery) of property, plant and equipment and intangible assets, net | 123 | 115 | 53 | |||||||||

Effect of changes in exchange rates, interest and other | (73) | 440 | 224 | |||||||||

Share-based benefit plans | 8 | 6 | 7 | |||||||||

Other insurance income | - | (15) | (52) | |||||||||

Result from debt exchange | - | (21) | 29 | |||||||||

Result from financial instruments exchange | - | - | (18) | |||||||||

Result from sale of WI of areas | - | (21) | (192) | |||||||||

Result from sale of assets | - | (57) | - | |||||||||

Changes in assets and liabilities: | ||||||||||||

Trade receivables | (397) | 117 | 414 | |||||||||

Other receivables | (94) | (241) | 89 | |||||||||

Inventories | (232) | (303) | 162 | |||||||||

Accounts payable | 600 | (91) | (490) | |||||||||

Taxes payables | 112 | (33) | 27 | |||||||||

Salaries and social security | 80 | 10 | 90 | |||||||||

Other liabilities | (14) | (92) | 109 | |||||||||

Decrease in provisions included in liabilities due to payment/use | (159) | (81) | (33) | |||||||||

Contract assets | 7 | (6) | (8) | |||||||||

Contract liabilities | (29) | 56 | (22) | |||||||||

Dividends received | 94 | 56 | 38 | |||||||||

Proceeds from collection of profit loss insurance | 1 | 19 | 51 | |||||||||

Income tax payments | (266) | (5) | (35) | |||||||||

|

|

|

|

|

|

|

|

| ||||

Net cash flows from operating activities (1) (2) | 5,693 | 4,201 | 2,915 | |||||||||

|

|

|

|

|

|

|

|

| ||||

Investing activities: (3) | ||||||||||||

Acquisition of property, plant and equipment and intangible assets | (4,006) | (2,448) | (1,650) | |||||||||

Contributions and acquisitions of interests in associates and joint ventures | (2) | - | - | |||||||||

Loans with related parties, net | (18) | - | - | |||||||||

Proceeds from sales of financial assets | 643 | 406 | 557 | |||||||||

Payments from purchase of financial assets | (740) | (594) | (641) | |||||||||

Interests received from financial assets | 99 | 41 | - | |||||||||

Proceeds from sales of WI of areas and assets | 8 | 48 | 217 | |||||||||

|

|

|

|

|

|

|

|

| ||||

Net cash flows used in investing activities | (4,016) | (2,547) | (1,517) | |||||||||

|

|

|

|

|

|

|

|

| ||||

Financing activities: (3) | ||||||||||||

Payments of loans | (780) | (1,653) | (2,283) | |||||||||

Payments of interests | (543) | (615) | (873) | |||||||||

Proceeds from loans | 402 | 963 | 1,803 | |||||||||

Account overdraft, net | 71 | 8 | 2 | |||||||||

Repurchase of treasury shares | (28) | - | (6) | |||||||||

Payments of leases | (341) | (302) | (331) | |||||||||

Payments of interests in relation to income tax | (8) | (1) | (10) | |||||||||

|

|

|

|

|

|

|

|

| ||||

Net cash flows used in financing activities | (1,227) | (1,600) | (1,698) | |||||||||

|

|

|

|

|

|

|

|

| ||||

|

|

|

|

|

|

|

|

| ||||

Effect of changes in exchange rates on cash and cash equivalents | (288) | (93) | (156) | |||||||||

|

|

|

|

|

|

|

|

| ||||

|

|

|

|

|

|

|

|

| ||||

Net Increase (Decrease) in cash and cash equivalents | 162 | (39) | (456) | |||||||||

|

|

|

|

|

|

|

|

| ||||

Cash and cash equivalents at the beginning of the fiscal year | 611 | 650 | 1,106 | |||||||||

Cash and cash equivalents at the end of the fiscal year | 773 | 611 | 650 | |||||||||

|

|

|

|

|

|

|

|

| ||||

Net Increase (Decrease) in cash and cash equivalents | 162 | (39) | (456) | |||||||||

|

|

|

|

|

|

|

|

| ||||

| (1) | Does not include exchange differences generated by cash and cash equivalents, which is exposed separately in this statement. |

| (2) | Includes 175, 119 and 161 for the fiscal year ended December 31, 2022, 2021 and 2020, respectively, for payment of short-term leases and payments of the variable charge of leases related to the underlying asset performance and/or use. |

| (3) | The main investing and financing transactions that have not affected cash and cash equivalents correspond to: |

| 2022 | 2021 | 2020 | ||||||||||

Unpaid acquisitions of property, plant and equipment | 488 | 357 | 205 | |||||||||

Hydrocarbon wells abandonment obligation costs | 268 | 32 | (166) | |||||||||

Additions of right-of-use assets | 306 | 284 | 149 | |||||||||

Capitalization of depreciation of right-of-use assets | 57 | 44 | 54 | |||||||||

Capitalization of financial accretion for lease liabilities | 14 | 11 | 14 | |||||||||

Capitalization in associates and joint ventures | 1 | - | - | |||||||||

Accompanying notes are an integral part of the consolidated financial statements.

PABLO GERARDO GONZÁLEZ President |

Table of Contents

| F - 9 |  | ||

YPF SOCIEDAD ANONIMA NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, 2022, 2021 AND 2020 | ||||

(Amounts expressed in millions of United States dollars, except shares and per shares amounts expressed in United States dollars, and as otherwise indicated)

| 1. | GENERAL INFORMATION, STRUCTURE AND ORGANIZATION OF THE GROUP BUSINESS |

General information

YPF S.A. (“YPF” or the “Company”) is a stock corporation (sociedad anónima) incorporated under the Argentine laws, with a registered office at Macacha Güemes 515, in the City of Buenos Aires.

YPF and its subsidiaries (the “Group”) form the leading energy group in Argentina, which operates a fully integrated oil and gas chain with leading market positions across the domestic Upstream, Downstream and Gas and Power segments.

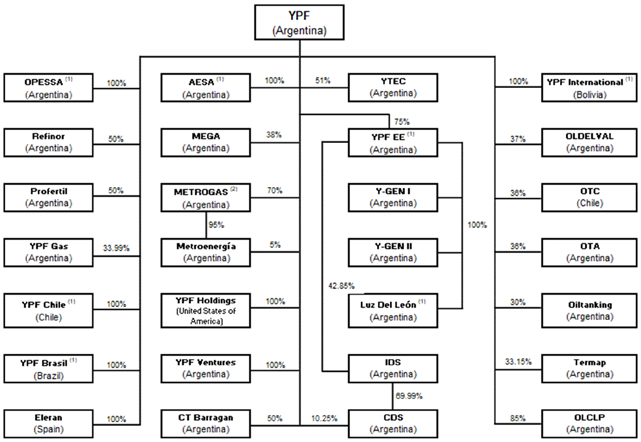

Structure and organization of the economic Group

The following chart shows the organizational structure, including the main companies of the Group, as of December 31, 2022:

| (1) | Held directly and indirectly. |

| (2) | See Note 35.c.3). |

Table of Contents

| F - 10 |  | |||

YPF SOCIEDAD ANONIMA NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, 2022, 2021 AND 2020 | ||||

| 1. | GENERAL INFORMATION, STRUCTURE AND ORGANIZATION OF THE GROUP BUSINESS (cont.) |

Organization of the business

As of December 31, 2022, the Group carries out its operations in accordance with the following structure:

| - | Upstream |

| - | Gas and Power |

| - | Downstream |

| - | Central administration and others, which covers the remaining activities not included in the previous segments |

Activities covered by each business segment are detailed in Note 5.

The operations, properties and clients of the Group are mainly located in Argentina. However, the Group also holds WI in exploratory areas in Bolivia and sells jet fuel, natural gas, lubricants and derivatives in Chile and lubricants and derivatives in Brazil.

| 2. | BASIS OF PREPARATION OF THE CONSOLIDATED FINANCIAL STATEMENTS |

2.a) Basis of preparation

Application of IFRS

The consolidated financial statements of the Group for the fiscal years ended December 31, 2022, 2021 and 2020 are presented in accordance with IFRS as issued by the IASB.

The amounts and other information corresponding to the fiscal years ended on December 31, 2021 and 2020 are an integral part of the consolidated financial statements mentioned above. See Note 2.d).

These consolidated financial statements were approved by the Board of Directors and authorized to be issued on March 9, 2023.

Fiscal year-end

The Company’s fiscal year begins on January 1 and ends on December 31, each year.

Current and Non-current classification

The presentation in the consolidated statement of financial position makes a distinction between current and non-current assets and liabilities, according to the activitie’s operating cycle. Current assets and liabilities include assets and liabilities which are realized or settled within the 12-month period from the end of the fiscal year. All other assets and liabilities are classified as non-current.

Income tax liabilities and deferred tax assets and liabilities are presented separately from each other and from other assets and liabilities, as current and non-current, as applicable.

Accounting criteria

The consolidated financial statements have been prepared under historical cost criteria, except for financial assets measured at fair value through profit or loss.

Non-monetary assets and liabilities of subsidiaries having the peso as functional currency, were adjusted for inflation. See Note 2.b.1).

Table of Contents

| F - 11 |  | |||

YPF SOCIEDAD ANONIMA NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, 2022, 2021 AND 2020 | ||||

| 2. | BASIS OF PREPARATION OF THE CONSOLIDATED FINANCIAL STATEMENTS (cont.) |

Use of estimates

The preparation of financial statements at a certain date requires the Company to make estimates and assessments affecting the amount of assets and liabilities recorded, contingent assets and liabilities disclosed at such date, as well as income and expenses recorded during the fiscal year. Future results might differ from the estimates and assessments made on the date of preparation of these consolidated financial statements.

The description of any significant estimates and accounting judgments made by the Company in applying the accounting policies, as well as the key estimates and areas with greater degree of complexity which require more critical judgments, are disclosed in Note 2.c).

Consolidation policies

For purposes of presenting the consolidated financial statements, the full consolidation method was used with respect to all subsidiaries, which are those companies which the Group controls. The Group controls an entity when it is exposed or is entitled to the variable results arising from its equity interest in the entity and has the ability to affect those results through its power over the entity. This capacity is, in general but not solely, obtained by the direct or indirect ownership of more than 50% of the voting shares of an entity.

Interest in JO and other agreements which give the Group a contractually-established percentage over the rights of the assets and obligations that emerge from the contract, have been consolidated line by line on the basis of the participation over the assets, liabilities, income and expenses related to each contract. Assets, liabilities, income and expenses of JO are presented in the consolidated statement of financial position and in the consolidated statement of comprehensive income, in accordance with their respective nature.

Note 10 details the fully consolidated controlled subsidiaries. Furthermore, the Note 29 details the main JO, proportionally consolidated.

In the consolidation process, balances, transactions, profits and losses between consolidated companies and JO have been eliminated.

The Company’s consolidated financial statements are based on the most recent available financial statements of the companies which YPF controls, taking into consideration, where applicable, significant subsequent events and transactions, management information availableand transactions between YPF and such subsidiaries, which could have produced changes to their shareholders’ equity. The date of the financial statements of such subsidiaries used in the consolidation process may differ from the date of YPF’s consolidated financial statements due to administrative reasons. The accounting principles and procedures used by subsidiaries have been homogenized, where appropriate, with those used by YPF in order to present the consolidated financial statements based on uniform accounting and presentation policies. The financial statements of subsidiaries whose functional currency is different from the YPF’s presentation currency are translated using the procedure set out in Note 2.b.1).

The Group holds 100% of capital of the consolidated companies, with the exception of the holdings in Metrogas and YTEC. The Group takes into account quantitative and qualitative aspects to determine which subsidiaries have significant non-controlling interests. In accordance with the previously mentioned, the Group concluded that there are no significant non-controlling interests to be disclosed, as required by IFRS 12 “Disclosure of Interests in Other Entities”.

Financial information of subsidiaries, associates and joint ventures in hyperinflationary economies

Under IAS 29 “Financial Reporting in Hyperinflationary Economies” the financial statements of an entity whose functional currency is the currency of a hyperinflationary economy shall be stated in terms of the measuring unit current at the end of the reporting period or fiscal year. The standard sets forth quantitative and qualitative factors to be contemplated in order to determine whether or not an economy is hyperinflationary.

Table of Contents

| F - 12 |  | |||

YPF SOCIEDAD ANONIMA NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, 2022, 2021 AND 2020 | ||||

| 2. | BASIS OF PREPARATION OF THE CONSOLIDATED FINANCIAL STATEMENTS (cont.) |

In recent years, inflation in Argentina has been high, with an accumulated inflation rate exceeding 100% over the last 3 years. In addition, certain qualitative and quantitative factors, such as the significant devaluation of the peso, led to the conclusion that the restatement by inflation of annual or interim financial statements corresponding to annual or interim periods ending after July 1, 2018, should be applied.

Companies could not present their restated financial statements because Decree No. 664/2003 of the PEN prohibited regulatory agencies (including the CNV) from receiving financial statements adjusted for inflation.

Law No. 27,468, published on December 4, 2018 in the BO repealed Decree No. 1,269/2002 of the PEN as amended (including the aforementioned Decree No. 664/2003). The provisions of the aforementioned Law became in full force and effect as of December 28, 2018, the date of the publication of the General Resolution No. 777/2018 of the CNV, which established that annual financial statements, interim and special periods closing from December 31, 2018 inclusive, must be submitted adjusted for inflation, as established by IAS 29. The FACPCE’s guidelines will be applied to those issues not specifically addressed in the aforementioned regulations.

Although the application of IAS 29 does not directly affect YPF because its functional currency is the dollar, as mentioned in Note 2.b.1), it does affect the investments that the Company has in its subsidiaries, associates and joint ventures whose functional currency is the peso, all of which have adjusted their financial statements.

In compliance with IAS 29 guidelines, the adjustment was based on the last date on which subsidiaries, associates and joint ventures whose functional currency is the peso restated their financial statements to reflect the effects of inflation. For this purpose, in general terms, the inflation from the date of acquisition or addition, or from the date of asset revaluation, as applicable, was computed in balances of non-monetary assets and liabilities. As a result of the adjustment for inflation in such financial statements, the value of non-monetary items increased, with the cap of their recoverable value, and with the consequent effect on deferred tax. Regarding income statement, in addition to the restatement of revenues, costs, expenses and other items, the net monetary position effect was included in a separate item in “Other financial results”.

2.b) Significant accounting policies

2.b.1) Functional and reporting currency and tax effect on other comprehensive income

Functional currency

YPF, based on parameters set out in IAS 21 “The Effects of Change in Foreign Exchange Rates”, has defined the dollar as its functional currency. Consequently, non-monetary cost-based measured assets and liabilities, as well as income or loss, are remeasured into functional currency by applying the exchange rate prevailing at the date of the transaction.

Transactions in currencies other than the functional currency of the Company are deemed to be foreign currency transactions and are remeasured into functional currency by applying the exchange rate prevailing at the date of the transaction (or, for practical reasons and when exchange rates do not fluctuate significantly, the average exchange rate for each month). At the end of each fiscal year or at the time of payment, the balances of monetary assets and liabilities in currencies other than the functional currency are measured at the exchange rate prevailing at such date and the exchange differences arising from such measurement are recognized in “Net financial results” in the consolidated statement of comprehensive income for the fiscal year in which they arise.

Assets, liabilities and results of subsidiaries, associates and joint ventures are expressed in their respective functional currencies. The effects of the conversion into dollar of the financial information of those companies whose functional currency is other than the dollar are recorded in “Other comprehensive income” in the consolidated statement of comprehensive income for the fiscal year in which they arise.

Table of Contents

| F - 13 |  | |||

YPF SOCIEDAD ANONIMA NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, 2022, 2021 AND 2020 | ||||

| 2. | BASIS OF PREPARATION OF THE CONSOLIDATED FINANCIAL STATEMENTS (cont.) |

Presentation currency

The information included in these consolidated financial statements is presented in dollars, which is the Company’s functional currency, that is, the currency of the primary economic environment in which the entity operates.

The consolidated financial statements used by YPF for statutory, legal and regulatory purposes in Argentina are those in Argentine pesos and filed with the CNV and approved by the Board of Directors and authorized to be issued on March 9, 2023.

Effective 2022, the Company changed its presentation currency from peso to dollar. The Company believes that the change in presentation currency provides users of the financial statements with a better reflection of the Company’s business activities and enhance the comparability of the Company’s financial information to its peers.

The change in presentation currency represents a voluntary change in accounting policy, which is accounted for retrospectively according to IAS 8 “Accounting Policies, Changes in Accounting Estimates and Errors”.

Due to this change these consolidated financial statements for all comparative periods reported have been presented in dollars.

Effect of the translation of investments in subsidiaries, associates and joint ventures with functional currency corresponding to a hyperinflationary economy

Under IAS 21, the financial statements of a subsidiary with the functional currency of a hyperinflationary economy have to be restated according to IAS 29 before they are included in the consolidated financial statements of its parent company with a functional currency of a non-hyperinflationary economy, except for their comparative figures.

Following the aforementioned guidelines, the results and financial position of subsidiaries with the peso as functional currency were translated into dollar by the following procedures: All amounts (i.e., assets, liabilities, stockholders’ equity items, expenditures and revenues) were translated at the exchange rate effective at the closing date of the financial statements, except for comparative amounts, which were presented as current amounts in the financial statements of the previous fiscal year (i.e., these amounts were not be adjusted to reflect subsequent variations in price levels or exchange rates). Thus, the effect of the restatement of comparative amounts was recognized in “Other comprehensive income” in the consolidated statement of comprehensive income.

These criteria were also implemented by the Group for its investments in associates and joint ventures.

When an economy ceases to be hyperinflationary and an entity ceases to restate its financial statements in accordance with IAS 29, it will use the amounts restated according to the price level of the date on which the entity ceased to make such restatement as historical costs, in order to translate them into the presentation currency.

Table of Contents

| F - 14 |  | |||

YPF SOCIEDAD ANONIMA NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, 2022, 2021 AND 2020 | ||||

| 2. | BASIS OF PREPARATION OF THE CONSOLIDATED FINANCIAL STATEMENTS (cont.) |

Tax effect on other comprehensive income

Results included in “Other comprehensive income” in the consolidated statement of comprehensive income have no effect on the income tax or in the deferred tax since at the time they were generated, the relevant transactions did not make any impact on net accounting result nor in taxable result.

2.b.2) Financial assets

Classification

In accordance with IFRS 9 “Financial Instruments”, the Group classifies its financial assets into 2 categories:

| (i) | Financial assets at amortized cost: |

Financial assets are measured at amortized cost if both of the following criteria are met: (1) the objective of the Group’s business model is to hold the assets to collect the contractual cash flow; and (2) the contractual terms only require specific dates for payments of principal and interest.

In addition, and for assets that meet the aforementioned conditions, IFRS 9 contemplates the option of designating, at the time of the initial recognition, an asset as measured at its fair value, if doing so would eliminate or significantly reduce the valuation or recognition inconsistency that could arise in the event that the valuation of the assets and liabilities or the recognition of profit or losses resulting therefrom be carried out on different bases. The Group has not designated a financial asset at fair value by using this option.

| (ii) | Financial assets at fair value through profit or loss: |

If either of the 2 criteria above are not met, the financial asset is classified as an asset measured at fair value through profit or loss.

Recognition and measurement

Purchases and sales of financial assets are recognized on the date on which the Group commits to purchase or sell the assets. Financial assets are derecognized when the rights to receive cash flows from the investments and the risks and rewards of ownership have expired or have been transferred.

Financial assets at amortized cost are initially recognized at fair value plus transaction costs. These assets accrue interest based on the effective interest rate method.

Financial assets at their fair value through profit or loss are initially recognized at fair value and transaction costs are recognized as an expense in the consolidated statement of comprehensive income. They are subsequently valued at fair value. Changes in fair values and results from sales of financial assets at fair value through profit or loss are recorded in “Net financial results” in the consolidated statement of comprehensive income.

In general, the Group uses the transaction price to ascertain the fair value of a financial instrument on initial recognition. In other cases, the Group records a profit or loss on initial recognition only if the fair value of the financial instrument can be supported by other comparable and observable market transactions for the same type of instrument or if it is based in a technical valuation that only inputs observable market information. Unrecognized profits or losses on initial recognition of a financial asset are recognized later on, only to the extent they arise from a change in the factors (including time) that market participants would consider upon setting the price.

Profit or loss on debt instruments measured at amortized cost and not included for hedging purposes are charged to income when the financial assets are derecognized or an impairment loss is recognized and during the amortization process using the effective interest rate method. The Group reclassifies all investments on debt instruments only when its business model for managing those assets changes.

Table of Contents

| F - 15 |  | |||

YPF SOCIEDAD ANONIMA NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, 2022, 2021 AND 2020 | ||||

| 2. | BASIS OF PREPARATION OF THE CONSOLIDATED FINANCIAL STATEMENTS (cont.) |

Impairment of financial assets

The Group assesses the impairment of its financial assets according to the expected credit losses model. The impairment methodology applied depends on whether there has been a significant increase in credit risk.

For trade receivables, the Group applies the simplified approach allowed by IFRS 9, which requires expected lifetime credit losses to be recognized from initial recognition of the receivables. See Note 2.b.18).

Offsetting financial instruments

Financial assets and liabilities are offset when there is a legally enforceable right to offset the recognized amounts and there is an intention to settle on a net basis or realize the asset and settle the liability simultaneously.

2.b.3) Inventories

Inventories are valued at the lower value between their cost and their net realizable value. Cost includes acquisition costs (less trade discount, rebates and other similar items), transformation and other costs, which have been incurred when bringing the inventory to its present location and condition. The net realizable value is the estimated selling price in the ordinary course of business less selling expenses.

In the case of refined products, costs are allocated in proportion to the selling price of the related products (isomargen method) due to the difficulty for distributing the production costs to each product. Raw materials, packaging and other inventory are valued at their acquisition cost.

The Group assesses the net realizable value of the inventories at the end of each fiscal year and recognizes in profit or loss in the consolidated statement of comprehensive income the appropriate valuation adjustment if the inventories exceed their net realizable value. When the circumstances that previously caused impairment no longer exist or when there is clear evidence of an increase in the inventories’ net realizable value because of changes in economic circumstances, the amount of a write-down is reversed.

2.b.4) Intangible assets

The Group initially recognizes intangible assets at their acquisition or development cost. This cost is amortized on a over the useful lives of these assets, if applicable. At the end of each year, such assets are measured at their acquisition or development cost, considering the criteria adopted by the Group in the transition to IFRS, less its respective accumulated amortization and, if applicable, impairment losses.

The main intangible assets of the Group are as follows:

Service concessions arrangements

Includes transportation and storage concessions. These assets are valued at their acquisition cost, considering the criteria adopted by the Group in the transition to IFRS, net of accumulated amortization. They are depreciated using the straight-line method during the course of the concession period.

The Hydrocarbons Law allows the PEN and the provinces to award concessions for the transportation of hydrocarbons for similar periods to the terms of the exploitation concessions granted (see Note 35.a.1)). Under of this regulatory framework, holders of production concessions are entitled to receive a transportation concession for the oil, natural gas and petroleum products that they produce. The holder of a transportation concession has the right to:

| - | Transport oil, natural gas and petroleum products. |

| - | Build and operate pipelines for oil, natural gas and their derivatives, storage facilities, pump stations, compressor plants, roads, railways and other facilities and equipment necessary for the efficient operation of a pipeline system. |

Table of Contents

| F - 16 |  | |||

YPF SOCIEDAD ANONIMA NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, 2022, 2021 AND 2020 | ||||

| 2. | BASIS OF PREPARATION OF THE CONSOLIDATED FINANCIAL STATEMENTS (cont.) |

In addition, a transportation concession holder is under an obligation to transport hydrocarbons to third parties, without discrimination, in exchange for a tariff. This obligation, however, is applicable to oil or natural gas producers only to the extent the concession holder has available additional capacity and is expressly subject to the transportation requirements of the concession holder. Transportation tariffs are subject to approval by the SE for oil and petroleum derivatives pipelines, and by ENARGAS for gas pipelines. Upon expiration of a transportation concession, pipelines and related facilities revert to the Argentine Government, without any payment to the concession holder.

In connection with the foregoing, the Privatization Law granted the Company 35-year transportation concessions for the transportation facilities operated by Yacimientos Petrolíferos Fiscales S.E. as of such date, with the possibility of being extended for 10 years. The main pipelines related to said transportation concessions are the following:

| - | La Plata / Dock Sud |

| - | Puerto Rosales / La Plata |

| - | Monte Cristo / San Lorenzo |

| - | Puesto Hernández / Luján de Cuyo |

| - | Luján de Cuyo / Villa Mercedes |

Thus, assets meeting certain requirements set forth by the IFRIC 12, which the Company’s judgment are met in the facilities mentioned in the preceding paragraphs, are recognized as intangible assets.

Exploration rights

The Group classifies exploration rights as intangible assets, which are valued at their cost, considering the deemed cost criteria adopted by the Group in the transition to IFRS, net of the related impairment, if applicable.

Investments related to unproved oil reserves or fields under evaluation are not depreciated. These investments are reviewed for impairment at least once a year, or whenever there are indicators that the assets may have become impaired. Any impairment loss or reversal is recognized in the consolidated statement of comprehensive income. Exploration costs (geological and geophysical expenditures, expenditures associated with the maintenance of unproved reserves and other expenditures relating to exploration activities), excluding exploratory well drilling costs, are charged to expense in the consolidated statement of comprehensive income as incurred.

Other intangible assets

This section mainly includes costs relating to computer software development expenditures, as well as assets that represent the rights to use technology and knowledge (“know how”) for the manufacture and commercial exploitation of equipment related to oil and/or natural gas extraction. These items are valued at their acquisition cost, considering the deemed cost criteria adopted by the Group in the transition to IFRS, net of the related depreciation and impairment, if applicable.

These assets are amortized on a straight-line basis over their useful lives, which range between 3 and 15 years. The Group reviews the aforementioned estimated useful life annually.

The Group has no intangible assets with indefinite useful lives as of December 31, 2022, 2021 and 2020.

2.b.5) Investments in associates and joint ventures

Investments in associates and joint ventures are valued using the equity method.

Table of Contents

| F - 17 |  | |||

YPF SOCIEDAD ANONIMA NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, 2022, 2021 AND 2020 | ||||

| 2. | BASIS OF PREPARATION OF THE CONSOLIDATED FINANCIAL STATEMENTS (cont.) |

According to this method, the investment is initially recognized at cost under “Investments in associates and joint ventures” in the consolidated statement of financial position, and the book value increases or decreases to recognize the investor’s interest in the income of the associate or joint venture after the acquisition date, which is reflected in the consolidated statement of comprehensive income under “Income from equity interests in associates and joint ventures”. The investment includes, if applicable, the goodwill identified in the acquisition.

Associates are those entities in respect of which the Group has significant influence, understood as the power to participate in the financial and operating policy decisions of the investee but not control or joint control over those policies. Significant influence is presumed in companies in which a company has an interest of 20% or more and less than 50%.

Joint arrangements are contractual agreements through which the Group and the other party or parties have joint control. Under the provisions of IFRS 11 “Joint Arrangements” and IAS 28 “Investments in Associates and Joint Ventures”, investments in which 2 or more parties have joint control (defined as a “joint arrangement”) should be classified as either a JO (when the parties that have joint control have rights to the assets and obligations for the liabilities relating to the joint arrangement) or a joint venture (when the parties that have joint control have rights to the net assets of the joint arrangement). Considering such classification, JO should be proportionally consolidated while joint ventures are accounted for under the equity method.

Associates and joint ventures have been valued based upon the latest available financial statements of these companies as of the end of each year, taking into consideration, if applicable, significant subsequent events and transactions, available management information and transactions between the Group and the related company that have produced changes on the latter’s shareholders’ equity. The dates of the financial statements of such related companies used in the consolidation process may differ from the date of the Company’s consolidated financial statements due to administrative reasons. The accounting principles and procedures used by associates and joint ventures have been homogenized, where appropriate, with those used by the Group in order to present the consolidated financial statements based on uniform accounting and presentation policies. The financial statements of associates and joint ventures whose functional currency is the currency of a hyperinflationary economy and/or different from the presentation currency are translated using the procedure set out in Note 2.b.1).

Investments in companies in which the Group has no significant influence or joint control, are valued at cost.

Investments in companies with negative shareholders’ equity are disclosed in the “Other liabilities”.

On each closing date or upon the existence of signs of impairment, it is determined whether there is any objective evidence of impairment in the value of the investment in associates and joint ventures. If this is the case, the Group calculates the amount of the impairment as the difference between the recoverable value of associates and joint ventures and their book value and recognizes the difference under “Income from equity interests in associates and joint ventures” in the consolidated statement of comprehensive income. The recorded value of investments in associates and joint ventures does not exceed their recoverable value.

Note 10 details the investments in associates and joint ventures.

2.b.6) Property, plant and equipment

Property, plant and equipment are valued at their acquisition cost, plus all the costs directly related to the location of such assets for their intended use, considering the deemed cost criteria adopted by the Group in the transition to IFRS.

Borrowing costs of assets that require a substantial period of time to be ready for their intended use are capitalized as part of the cost of these assets until they are ready for their intended use or sale.

Table of Contents

| F - 18 |  | |||

YPF SOCIEDAD ANONIMA NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, 2022, 2021 AND 2020 | ||||

| 2. | BASIS OF PREPARATION OF THE CONSOLIDATED FINANCIAL STATEMENTS (cont.) |

Major inspections, necessary to restore the service capacity of the related asset are capitalized and depreciated on a straight-line basis over the period until the next overhaul is scheduled.

The costs of renewals, betterments and enhancements that extend the useful life of properties and/or improve their service capacity are capitalized. As property, plant and equipment are retired, the related cost and accumulated depreciation are derecognized.

Repair, conservation and ordinary maintenance expenses are recognized in the consolidated statement of comprehensive income as incurred.

These assets are reviewed for impairment at least once a year, or whenever there are indicators that the assets may have become impaired, as detailed in Note 2.b.8).

Depreciation

Property, plant and equipment, other than those related to oil and natural gas production activities, are depreciated using the straight-line method, over the years of estimated useful life of the assets, as follows:

| Years of Estimated Useful Life | ||||

Buildings and other constructions | 50 | |||

Refinery equipment and petrochemical plants | 20 - 25 | |||

Infrastructure for natural gas distribution | 20 - 50 | |||

Transportation equipment | 5 - 25 | |||

Furniture, fixtures and installations | 10 | |||

Selling equipment | 10 | |||

Other property | 10 |

Land is classified separately from the buildings or facilities that may be located on it and is deemed to have an indefinite useful life. Therefore, it is not depreciated.

The Group reviews the estimated useful life of each class of assets annually.

Oil and natural gas production activities

The Group recognizes oil and natural gas exploration and production transactions using the successful-efforts method. The costs incurred in the acquisition of new WI in areas with proved and unproved reserves are capitalized as incurred in the “Mining properties, wells and related equipment” account. Costs related to exploration permits are classified as intangible assets.

Exploration costs, excluding the costs associated with exploratory wells, are charged to expense as incurred. Costs of drilling exploratory wells, including stratigraphic test wells, are capitalized pending determination as to whether the wells have found proved reserves that justify commercial development. If such reserves are not found, the mentioned costs are charged to expense. Occasionally, an exploratory well may be determined to have found oil and natural gas reserves, but classification of those reserves as proved cannot be made. In those cases, the drilling cost of the exploratory well will continue to be capitalized if the well has found a sufficient quantity of reserves to justify its completion as a producing well, and the Group is making sufficient progress assessing the reserves as well as the economic and operating viability of the project. If any of the mentioned conditions are not met, the drilling cost of the exploratory well is charged to the profit or loss of the fiscal year. In addition, the exploratory activity involves, in many cases, the drilling of multiple wells throughout several years in order to completely evaluate a project. As a consequence, some exploratory wells may be kept in evaluation for long periods, pending the completion of additional wells and exploratory activities needed to evaluate and quantify the reserves related to each project. The detail of the exploratory well costs in evaluation stage is described in Note 8.

Drilling costs applicable to productive wells and to developmental dry holes, as well as tangible equipment costs related to the development of oil and natural gas reserves, have been capitalized.

Table of Contents

| F - 19 |  | |||

YPF SOCIEDAD ANONIMA NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, 2022, 2021 AND 2020 | ||||

| 2. | BASIS OF PREPARATION OF THE CONSOLIDATED FINANCIAL STATEMENTS (cont.) |

The capitalized costs described above are depreciated as follows:

| - | The capitalized costs related to productive activities have been depreciated by field on a unit-of-production basis by applying the ratio of produced oil and natural gas to estimate proved developed oil and natural gas reserves estimated to recover. |

| - | The capitalized costs related to the acquisition of property and the extension of concessions with proved reserves have been depreciated by field on a unit-of-production basis by applying the ratio of produced oil and natural gas to the proved oil and natural gas reserves. |

Revisions in estimates of oil and natural gas proved reserves are considered prospectively in the calculation of depreciation. Revisions in estimates of reserves are performed at least once a year. Estimates of reserves are audited by external independent third parties on a 3-year rotation cycle.

Costs related to hydrocarbon well abandonment obligations

Costs related to hydrocarbon well abandonment obligations are capitalized at their discounted value along with the related assets and are depreciated using the unit-of-production method. As compensation, a liability is recognized for this concept at the estimated value of the discounted payable amounts. Revisions of the payable amounts are performed upon the current costs incurred in abandonment obligations considering internal and external available information. Due to the number of wells in operation and/or not abandoned, as well as the complexity with respect to different geographic areas where the wells are located, current costs incurred in plugging activities, weighted by the complexity level of the wells, are used for estimating the plugging activities costs of the wells pending abandonment. These costs are the best estimate of the liability hydrocarbon well abandonment obligations. Future changes in the costs mentioned above, the discount rate, the useful lifespan of the wells and their estimate of abandonment, as well as changes in regulations related to abandonment, which are not possible to be predicted as of the date of issuance of these consolidated financial statements, could affect the value of the hydrocarbon well abandonment obligations and, consequently, the related asset, affecting the results of future operations. Such changes are recognized pursuant to IFRIC 1, which indicates that changes in liabilities will be added to or deducted from the asset cost corresponding to the current period, taking into account that if the decrease in liabilities exceeds the carrying amount of assets, the excess will be recognized in the profit or loss of the fiscal year.

Environmental property, plant and equipment

The Group capitalizes the costs incurred in limiting, neutralizing or preventing environmental pollution only in those cases where at least one of the following conditions is met: (i) the expenditure improves the safety or efficiency of an operating plant (or other productive assets); (ii) the expenditure prevents or limits environmental pollution at operating facilities; or (iii) the expenditure is incurred to prepare assets for sale and does not raise the assets’ carrying value above their estimated recoverable value.

The environmental related property, plant and equipment and the corresponding accumulated depreciation are disclosed together with the other elements that are part of the corresponding property, plant and equipment which are classified according to their accounting nature.

2.b.7) Provisions and contingent assets and liabilities

The Group makes a distinction between:

Provisions