Exhibit 99.1

NASDAQ: SFNC Investor Presentation

Forward - Looking Statements and Non - GAAP Financial Measures 2 Certain statements contained in this presentation may not be based on historical facts and are "forward - looking statements" within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . These forward - looking statements may be identified by reference to a future period(s) or by the use of forward - looking terminology, such as "anticipate," "estimate," "expect," "foresee," "may," "might," "will," "would," "could" or "intend," future or conditional verb tenses, and variations or negatives of such terms . These forward - looking statements include, without limitation, those relating to the Company's future growth, revenue, assets, asset quality, profitability and customer service, critical accounting policies, net interest margin, non - interest revenue, market conditions related to the Company's common stock repurchase program, allowance for loan losses, the effect of certain new accounting standards on the Company's financial statements, income tax deductions, credit quality, the level of credit losses from lending commitments, net interest revenue, interest rate sensitivity, loan loss experience, liquidity, capital resources, market risk, earnings, effect of pending litigation, acquisition strategy, legal and regulatory limitations and compliance and competition . Readers are cautioned not to place undue reliance on the forward - looking statements contained in this presentation in that actual results could differ materially from those indicated in such forward - looking statements, due to a variety of factors . These factors include, but are not limited to, changes in the Company's operating or expansion strategy, availability of and costs associated with obtaining adequate and timely sources of liquidity, the ability to maintain credit quality, possible adverse rulings, judgments, settlements and other outcomes of pending litigation, the ability of the Company to collect amounts due under loan agreements, changes in consumer preferences, effectiveness of the Company's interest rate risk management strategies, laws and regulations affecting financial institutions in general or relating to taxes, the effect of pending or future legislation, the ability of the Company to repurchase its common stock on favorable terms, the ability of the Company to successfully implement its acquisition strategy, changes in interest rates and capital markets, inflation, customer acceptance of the Company's products and services, and other risk factors . Other relevant risk factors may be detailed from time to time in the Company's press releases and filings with the Securities and Exchange Commission . Any forward - looking statement speaks only as of the date of this Report, and we undertake no obligation to update these forward - looking statements to reflect events or circumstances that occur after the date of this Report . Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results . Non - GAAP Financial Measures This document contains financial information determined by methods other than in accordance with generally accepted accounting principles (GAAP) . The Company's management uses these non - GAAP financial measures in their analysis of the company's performance . These measures typically adjust GAAP performance measures to include the tax benefit associated with revenue items that are tax - exempt, as well as adjust income available to common shareholders for certain significant activities or nonrecurring transactions . Since the presentation of these GAAP performance measures and their impact differ between companies, management believes presentations of these non - GAAP financial measures provide useful supplemental information that is essential to a proper understanding of the operating results of the company's core businesses . These non - GAAP disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non - GAAP performance measures that may be presented by other companies .

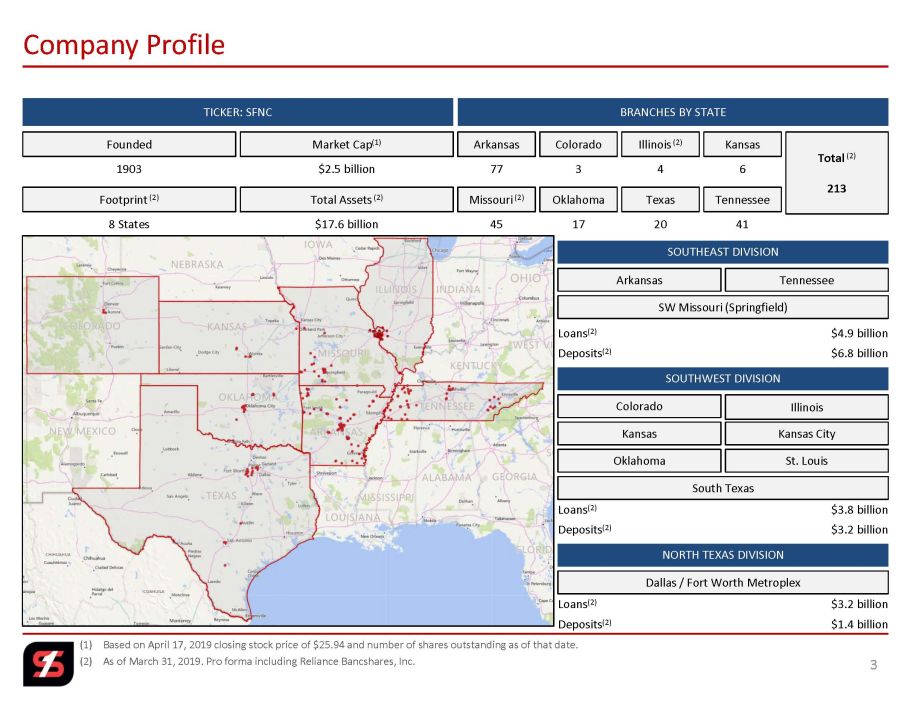

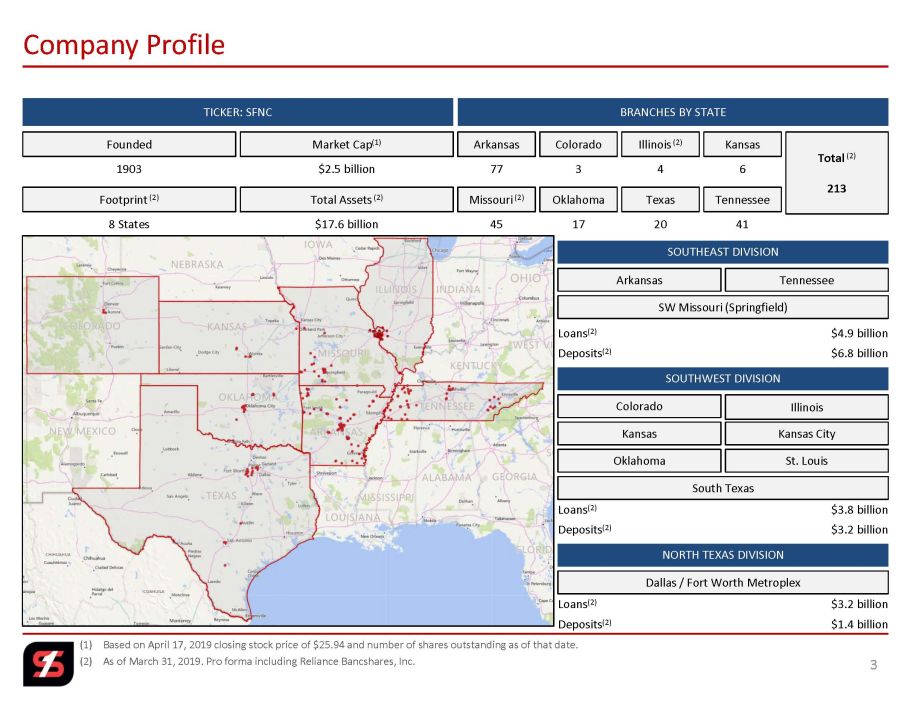

(1) Based on April 17, 2019 closing stock price of $25.94 and number of shares outstanding as of that date. (2) As of March 31, 2019. Pro forma including Reliance Bancshares, Inc. Company Profile 3 SOUTHEAST DIVISION SOUTHWEST DIVISION NORTH TEXAS DIVISION Arkansas SW Missouri (Springfield) Tennessee Dallas / Fort Worth Metroplex Loans (2) $3.2 billion Deposits (2) $1.4 billion Loans (2) $4.9 billion Deposits (2) $6.8 billion Loans (2) $3.8 billion Deposits (2) $3.2 billion BRANCHES BY STATE TICKER: SFNC Founded Footprint (2) Total Assets (2) Market Cap (1) 1903 $2.5 billion $17.6 billion 8 States Tennessee Oklahoma Texas Arkansas Colorado Missouri (2) Kansas 77 41 3 6 45 17 20 Total (2) 213 Illinois (2) 4 South Texas St. Louis Kansas City Colorado Kansas Oklahoma Illinois

Q1 2019 Non - Banking Business Units 4 ▪ $187.8 million nationwide credit card portfolio ▪ Loan yield (including fees): 14.5% ▪ History of excellent credit quality (1.95% net charge - off ratio) TRUST ▪ Total Assets: $5.3 billion – Managed Assets: $3.0 billion – Non - managed / Custodial Assets: $2.3 billion ▪ Profit Margin: 23.8% ▪ Growing investment management business ROYALTY TRUST ▪ Revenue: $514 thousand ▪ NIBT Margin: 24.6% INVESTMENTS ▪ Retail Group: $1.3 billion AUM – $189.8 million in fee - based / advisory assets ▪ Converted Retail Investments to LPL platform from First Clearing platform in March 2019 – Provides customers with online self - service trade option INSURANCE (EMPLOYEE BENEFITS & LIFE) ▪ Revenue: $525 thousand ▪ Profit Margin: 43.7% ▪ Mortgage Originations: $126 million ▪ 72% Purchase vs. 28% Refinance

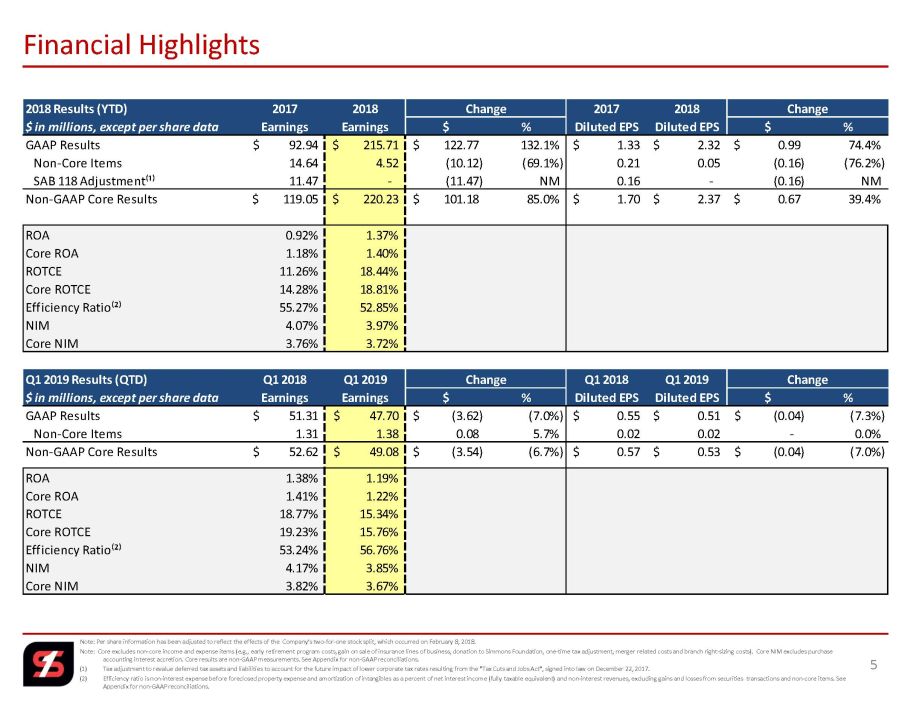

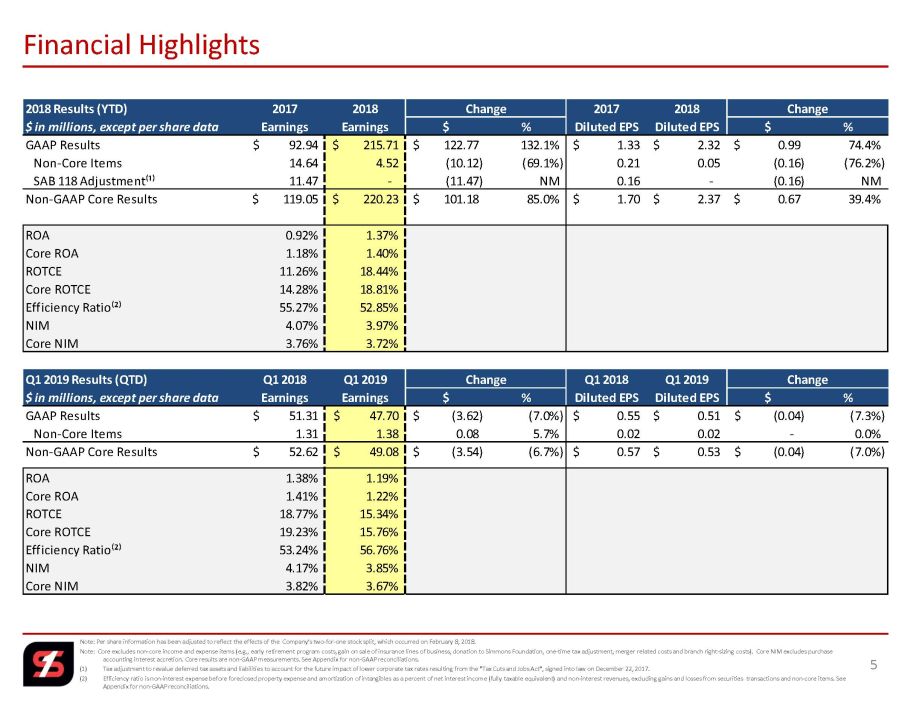

Note: Per share information has been adjusted to reflect the effects of the Company’s two - for - one stock split, which occurred o n February 8, 2018. Note: Core excludes non - core income and expense items (e.g., early retirement program costs, gain on sale of insurance lines of business, donation to Simmons Foundation, one - time tax adjustment, merger related costs and branch right - sizing costs). Core N IM excludes purchase accounting interest accretion. Core results are non - GAAP measurements. See Appendix for non - GAAP reconciliations. (1) Tax adjustment to revalue deferred tax assets and liabilities to account for the future impact of lower corporate tax rates r esu lting from the "Tax Cuts and Jobs Act", signed into law on December 22, 2017. (2) Efficiency ratio is non - interest expense before foreclosed property expense and amortization of intangibles as a percent of net interest income (fully taxable equivalent) and non - interest revenues, excluding gains and losses from securities transactions a nd non - core items. See Appendix for non - GAAP reconciliations. Financial Highlights 5 2018 Results (YTD) 2017 2018 Change 2017 2018 Change $ in millions, except per share data Earnings Earnings $ % Diluted EPS Diluted EPS $ % GAAP Results 92.94$ 215.71$ 122.77$ 132.1% 1.33$ 2.32$ 0.99$ 74.4% Non-Core Items 14.64 4.52 (10.12) (69.1%) 0.21 0.05 (0.16) (76.2%) SAB 118 Adjustment⁽¹⁾ 11.47 - (11.47) NM 0.16 - (0.16) NM Non-GAAP Core Results 119.05$ 220.23$ 101.18$ 85.0% 1.70$ 2.37$ 0.67$ 39.4% ROA 0.92% 1.37% Core ROA 1.18% 1.40% ROTCE 11.26% 18.44% Core ROTCE 14.28% 18.81% Efficiency Ratio⁽²⁾ 55.27% 52.85% NIM 4.07% 3.97% Core NIM 3.76% 3.72% Q1 2019 Results (QTD) Q1 2018 Q1 2019 Change Q1 2018 Q1 2019 Change $ in millions, except per share data Earnings Earnings $ % Diluted EPS Diluted EPS $ % GAAP Results 51.31$ 47.70$ (3.62)$ (7.0%) 0.55$ 0.51$ (0.04)$ (7.3%) Non-Core Items 1.31 1.38 0.08 5.7% 0.02 0.02 - 0.0% Non-GAAP Core Results 52.62$ 49.08$ (3.54)$ (6.7%) 0.57$ 0.53$ (0.04)$ (7.0%) ROA 1.38% 1.19% Core ROA 1.41% 1.22% ROTCE 18.77% 15.34% Core ROTCE 19.23% 15.76% Efficiency Ratio⁽²⁾ 53.24% 56.76% NIM 4.17% 3.85% Core NIM 3.82% 3.67%

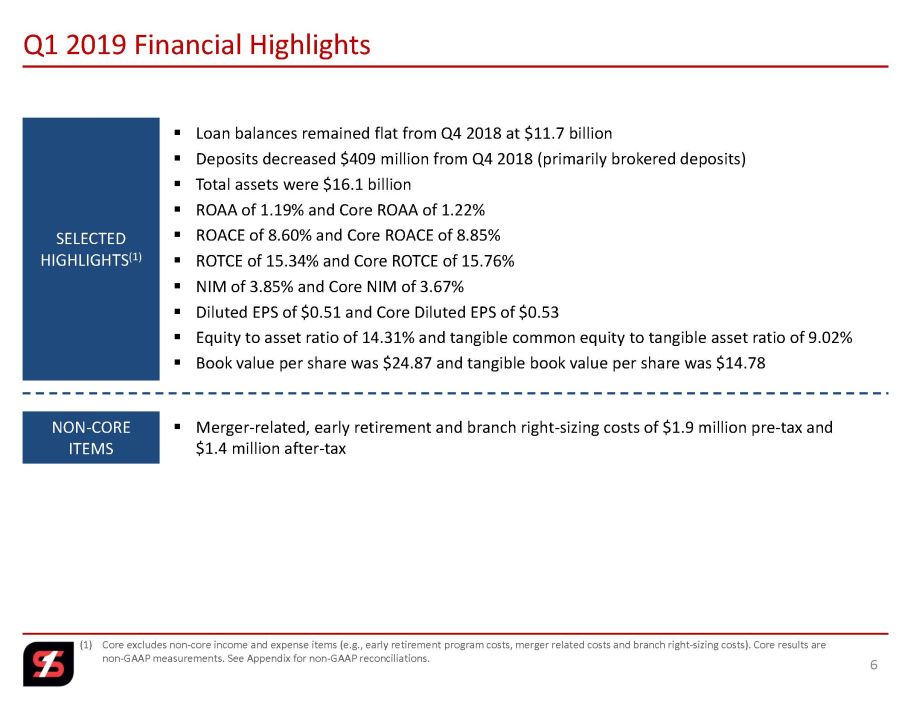

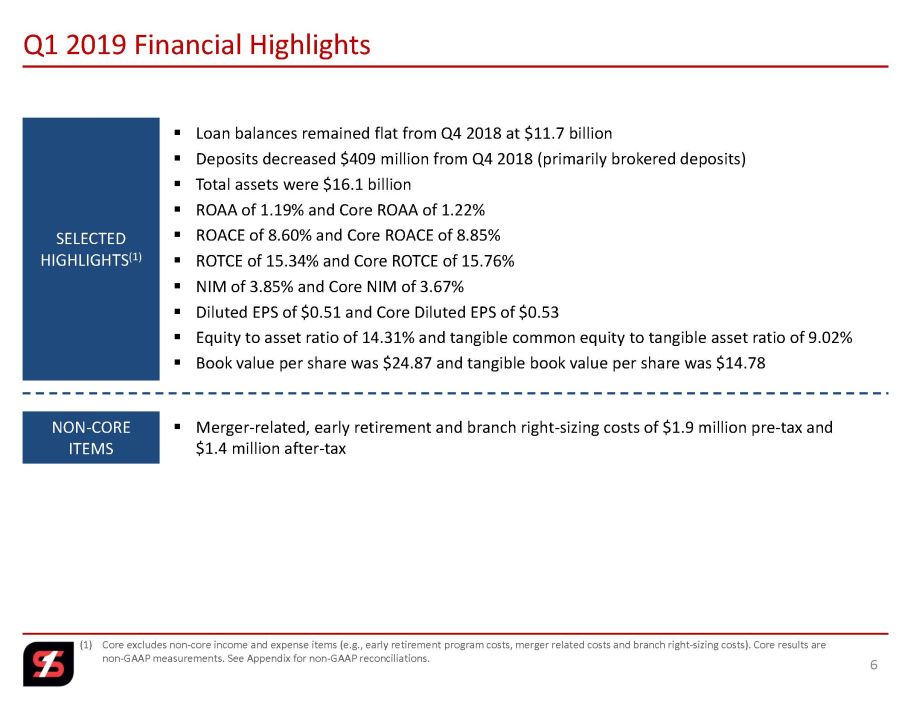

(1) Core excludes non - core income and expense items (e.g., early retirement program costs, merger related costs and branch right - siz ing costs). Core results are non - GAAP measurements. See Appendix for non - GAAP reconciliations. Q1 2019 Financial Highlights 6 NON - CORE ITEMS SELECTED HIGHLIGHTS (1) ▪ Merger - related, early retirement and branch right - sizing costs of $1.9 million pre - tax and $1.4 million after - tax ▪ Loan balances remained flat from Q4 2018 at $11.7 billion ▪ Deposits decreased $409 million from Q4 2018 (primarily brokered deposits) ▪ Total assets were $16.1 billion ▪ ROAA of 1.19% and Core ROAA of 1.22% ▪ ROACE of 8.60% and Core ROACE of 8.85% ▪ ROTCE of 15.34% and Core ROTCE of 15.76% ▪ NIM of 3.85% and Core NIM of 3.67% ▪ Diluted EPS of $0.51 and Core Diluted EPS of $0.53 ▪ Equity to asset ratio of 14.31% and tangible common equity to tangible asset ratio of 9.02% ▪ Book value per share was $24.87 and tangible book value per share was $14.78

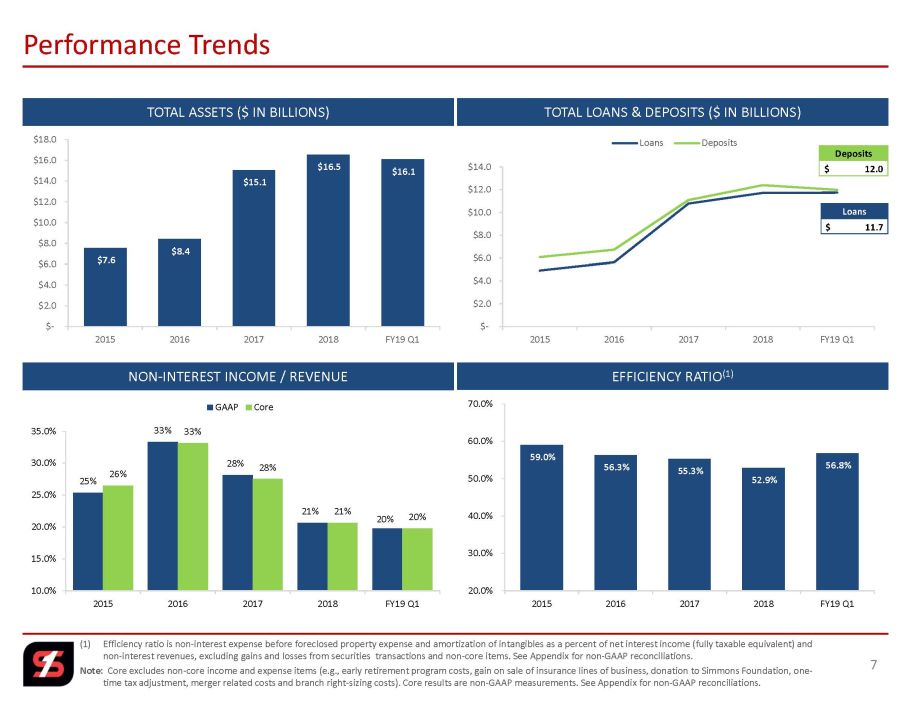

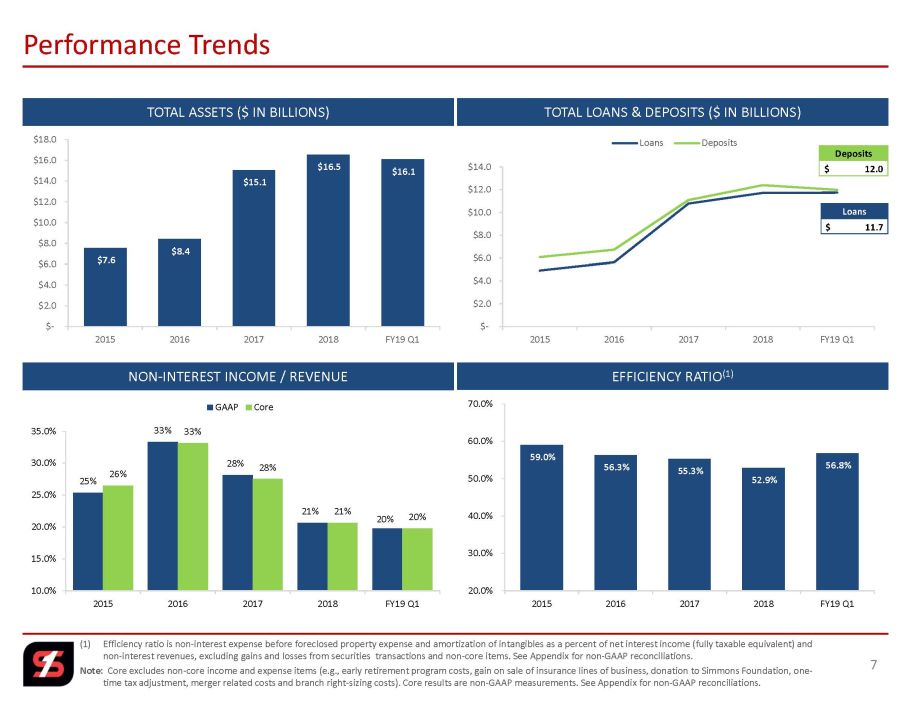

25% 33% 28% 21% 20% 26% 33% 28% 21% 20% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 2015 2016 2017 2018 FY19 Q1 GAAP Core $- $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 2015 2016 2017 2018 FY19 Q1 Loans Deposits $7.6 $8.4 $15.1 $16.5 $16.1 $- $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 $18.0 2015 2016 2017 2018 FY19 Q1 (1) Efficiency ratio is non - interest expense before foreclosed property expense and amortization of intangibles as a percent of net interest income (fully taxable equivalent) and non - interest revenues, excluding gains and losses from securities transactions and non - core items. See Appendix for non - GAAP re conciliations. Note: Core excludes non - core income and expense items (e.g., early retirement program costs, gain on sale of insurance lines of busi ness, donation to Simmons Foundation, one - time tax adjustment, merger related costs and branch right - sizing costs). Core results are non - GAAP measurements. See Appendix f or non - GAAP reconciliations. Performance Trends 7 TOTAL ASSETS ($ IN BILLIONS) EFFICIENCY RATIO (1) NON - INTEREST INCOME / REVENUE TOTAL LOANS & DEPOSITS ($ IN BILLIONS) Deposits 12.0$ Loans 11.7$ 59.0% 56.3% 55.3% 52.9% 56.8% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 2015 2016 2017 2018 FY19 Q1

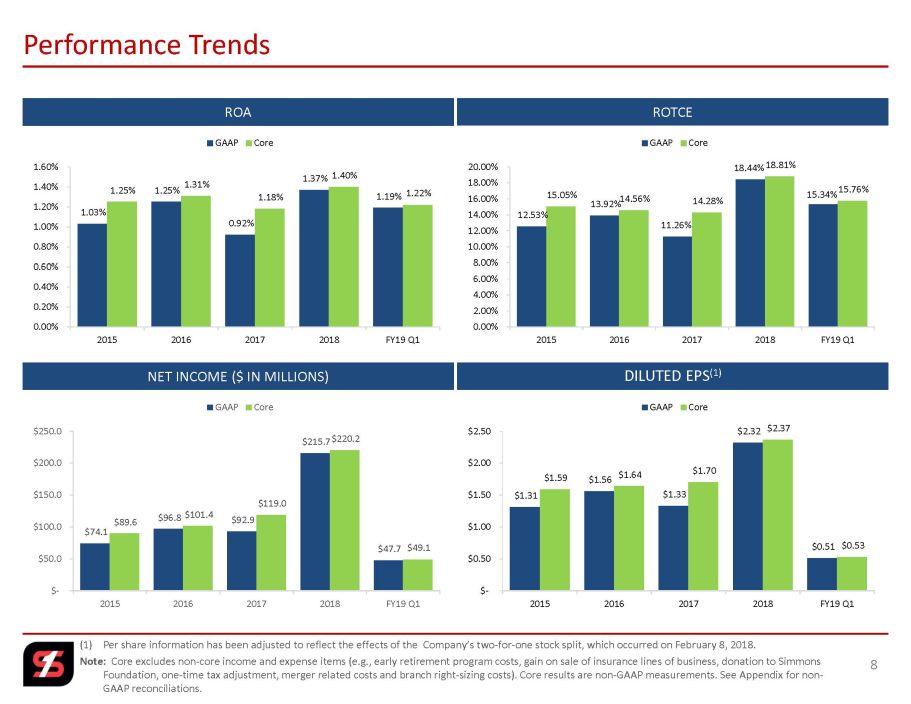

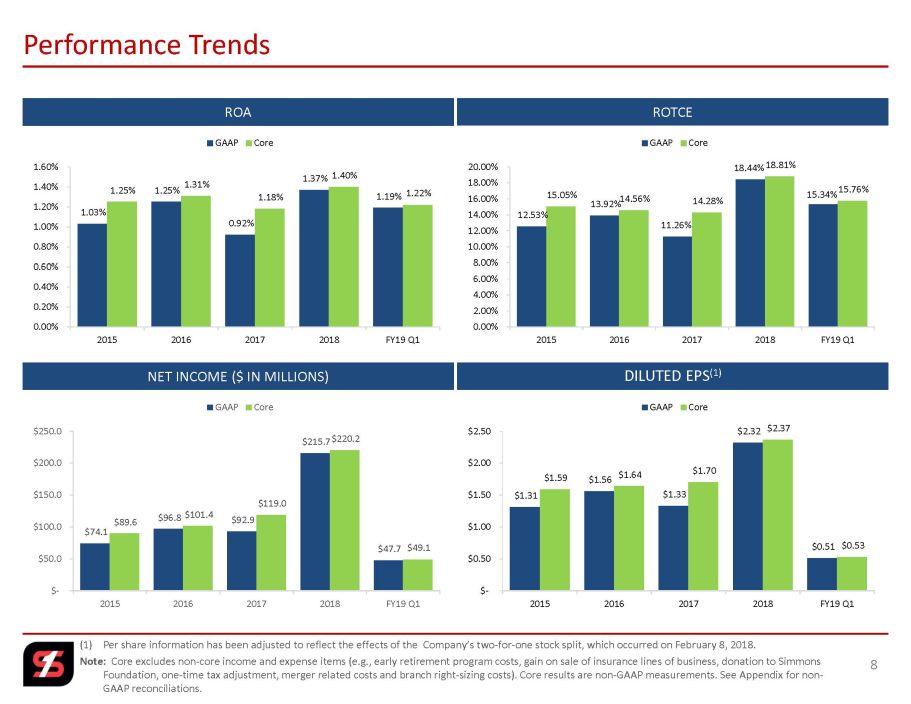

1.03% 1.25% 0.92% 1.37% 1.19% 1.25% 1.31% 1.18% 1.40% 1.22% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 2015 2016 2017 2018 FY19 Q1 GAAP Core (1) Per share information has been adjusted to reflect the effects of the Company’s two - for - one stock split, which occurred on Febr uary 8, 2018. Note: Core excludes non - core income and expense items (e.g., early retirement program costs, gain on sale of insurance lines of busi ness, donation to Simmons Foundation, one - time tax adjustment, merger related costs and branch right - sizing costs). Core results are non - GAAP measurements . See Appendix for non - GAAP reconciliations. Performance Trends 8 ROA DILUTED EPS (1) NET INCOME ($ IN MILLIONS) ROTCE 12.53% 13.92% 11.26% 18.44% 15.34% 15.05% 14.56% 14.28% 18.81% 15.76% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 18.00% 20.00% 2015 2016 2017 2018 FY19 Q1 GAAP Core $74.1 $96.8 $92.9 $215.7 $47.7 $89.6 $101.4 $119.0 $220.2 $49.1 $- $50.0 $100.0 $150.0 $200.0 $250.0 2015 2016 2017 2018 FY19 Q1 GAAP Core $1.31 $1.56 $1.33 $2.32 $0.51 $1.59 $1.64 $1.70 $2.37 $0.53 $- $0.50 $1.00 $1.50 $2.00 $2.50 2015 2016 2017 2018 FY19 Q1 GAAP Core

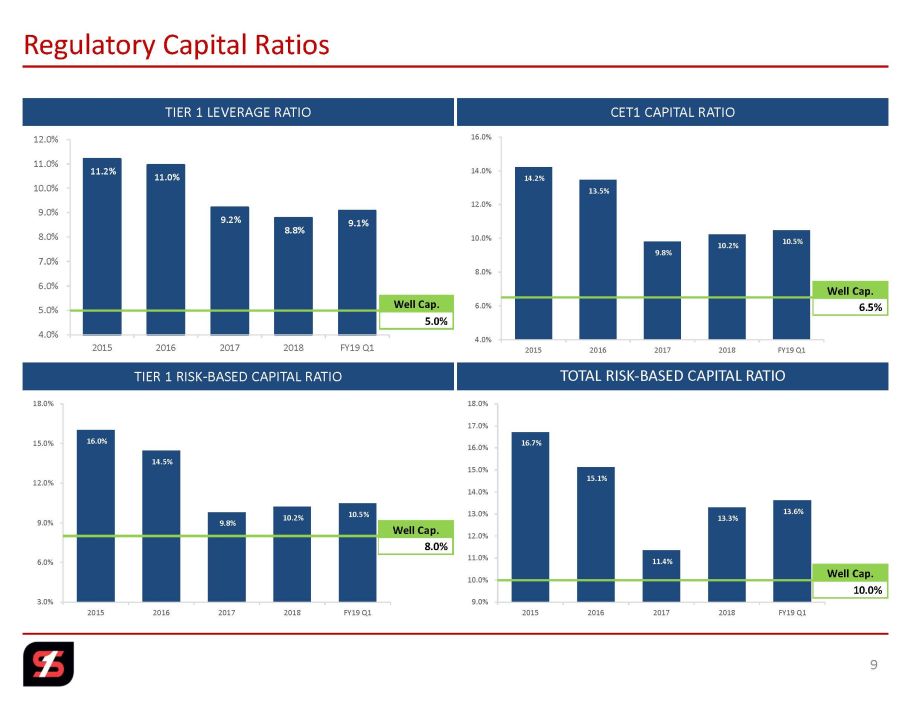

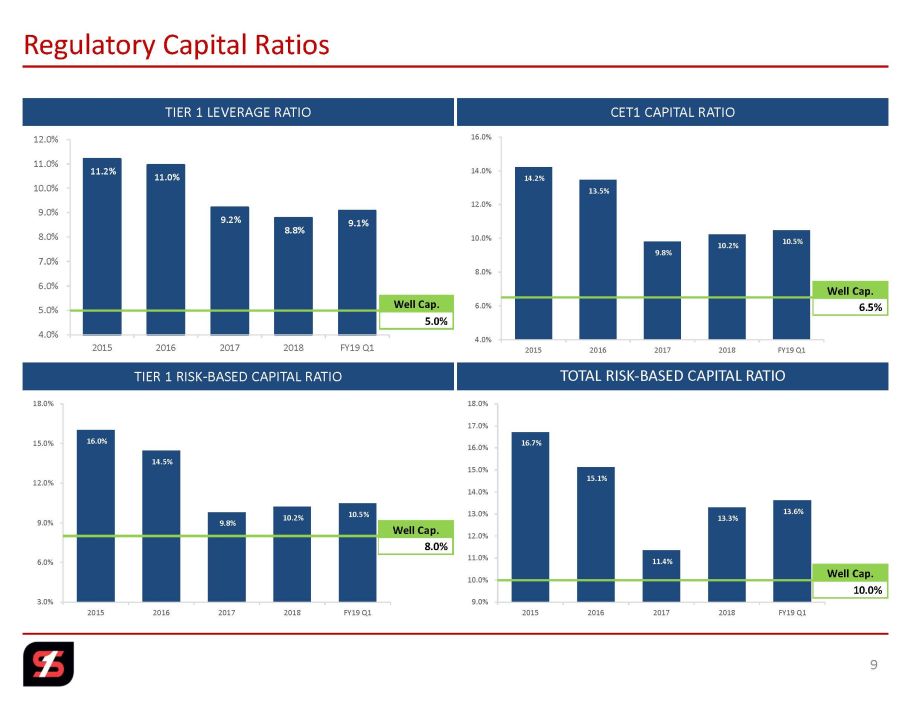

11.2% 11.0% 9.2% 8.8% 9.1% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% 11.0% 12.0% 2015 2016 2017 2018 FY19 Q1 16.7% 15.1% 11.4% 13.3% 13.6% 9.0% 10.0% 11.0% 12.0% 13.0% 14.0% 15.0% 16.0% 17.0% 18.0% 2015 2016 2017 2018 FY19 Q1 14.2% 13.5% 9.8% 10.2% 10.5% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 2015 2016 2017 2018 FY19 Q1 16.0% 14.5% 9.8% 10.2% 10.5% 3.0% 6.0% 9.0% 12.0% 15.0% 18.0% 2015 2016 2017 2018 FY19 Q1 Regulatory Capital Ratios 9 TIER 1 LEVERAGE RATIO TOTAL RISK - BASED CAPITAL RATIO TIER 1 RISK - BASED CAPITAL RATIO CET1 CAPITAL RATIO Well Cap. 5.0% Well Cap. 6.5% Well Cap. 8.0% Well Cap. 10.0%

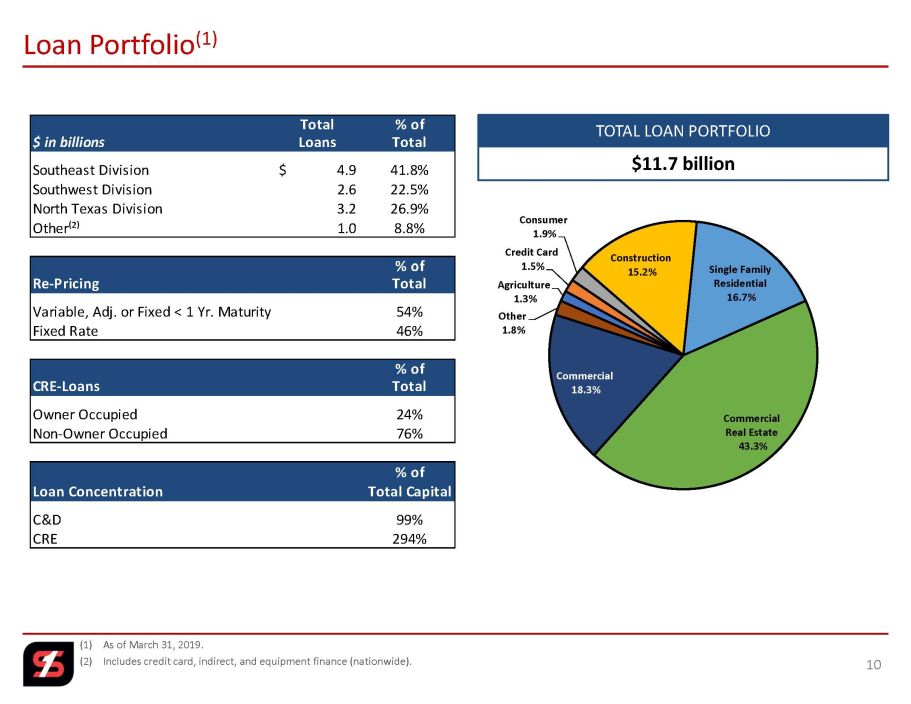

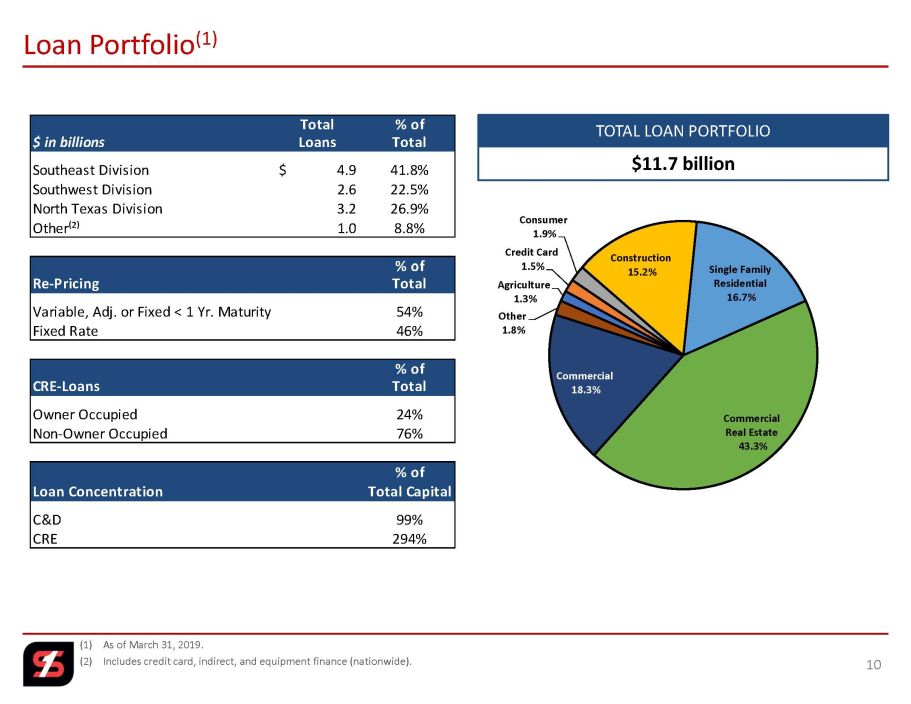

Total % of $ in billions Loans Total Southeast Division 4.9$ 41.8% Southwest Division 2.6 22.5% North Texas Division 3.2 26.9% Other⁽²⁾ 1.0 8.8% % of Re-Pricing Total Variable, Adj. or Fixed < 1 Yr. Maturity 54% Fixed Rate 46% % of CRE-Loans Total Owner Occupied 24% Non-Owner Occupied 76% % of Loan Concentration Total Capital C&D 99% CRE 294% (1) As of March 31, 2019. (2) Includes credit card, indirect, and equipment finance (nationwide). Loan Portfolio (1) 10 TOTAL LOAN PORTFOLIO $11.7 billion Agriculture 1.3% Credit Card 1.5% Consumer 1.9% Construction 15.2% Single Family Residential 16.7% Commercial Real Estate 43.3% Commercial 18.3% Other 1.8%

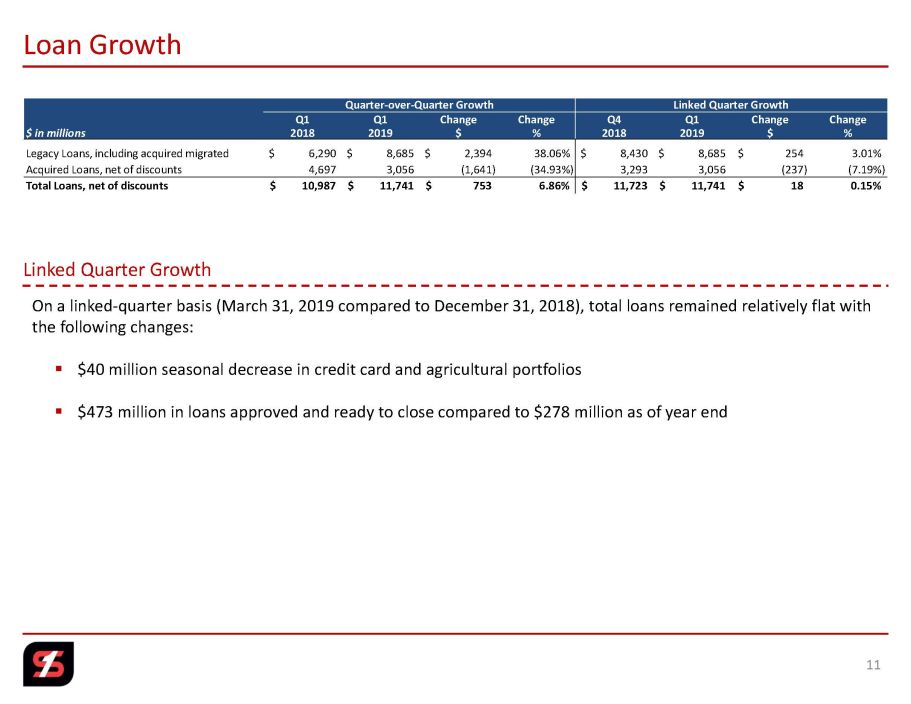

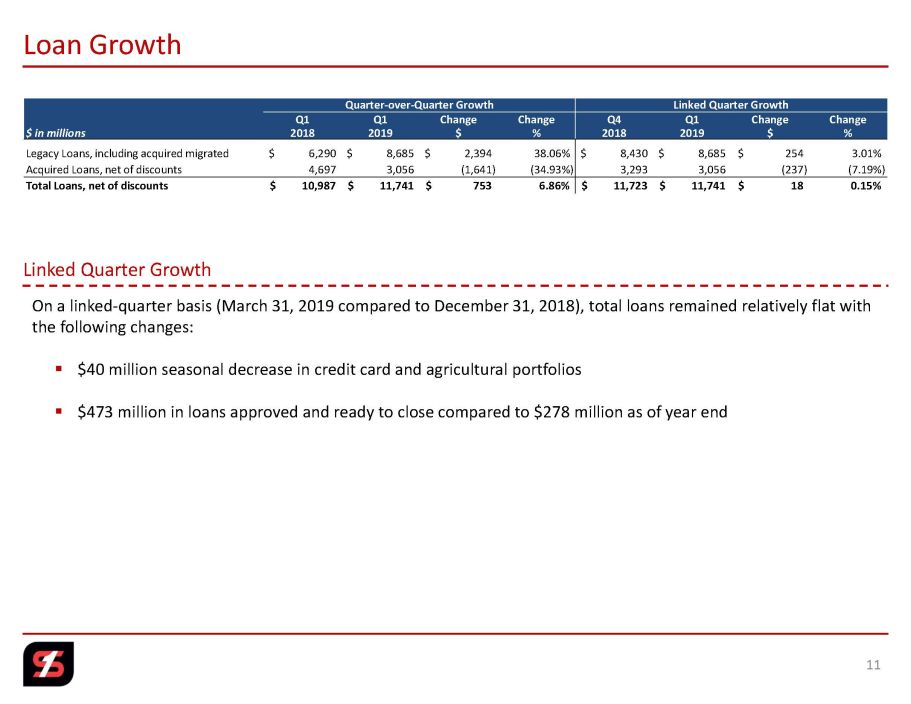

Loan Growth 11 Linked Quarter Growth On a linked - quarter basis (March 31, 2019 compared to December 31, 2018), total loans remained relatively flat with the following changes: ▪ $40 million seasonal decrease in credit card and agricultural portfolios ▪ $473 million in loans approved and ready to close compared to $278 million as of year end Quarter-over-Quarter Growth Linked Quarter Growth Q1 Q1 Change Change Q4 Q1 Change Change $ in millions 2018 2019 $ % 2018 2019 $ % Legacy Loans, including acquired migrated 6,290$ 8,685$ 2,394$ 38.06% 8,430$ 8,685$ 254$ 3.01% Acquired Loans, net of discounts 4,697 3,056 (1,641) (34.93%) 3,293 3,056 (237) (7.19%) Total Loans, net of discounts 10,987$ 11,741$ 753$ 6.86% 11,723$ 11,741$ 18$ 0.15%

Non-Performing Loans 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 FY19 Q1 SFNC 0.81% 1.35% 1.98% 1.74% 1.42% 1.07% 0.74% 0.68% 1.16% 0.93% 0.48% 0.78% All US Banks⁽¹⁾ 2.38% 4.78% 4.68% 4.13% 3.56% 2.90% 2.28% 1.83% 1.64% 1.38% 1.21% NA Non-Performing Assets 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 FY19 Q1 SFNC 0.64% 1.12% 1.71% 1.52% 1.61% 1.91% 1.30% 0.89% 0.93% 0.57% 0.40% 0.54% All US Banks⁽¹⁾ 1.34% 2.39% 2.37% 2.04% 1.72% 1.40% 1.10% 0.92% 0.83% 0.69% 0.61% NA Net Charge-Offs 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 FY19 Q1 SFNC 0.43% 0.59% 0.71% 0.49% 0.40% 0.27% 0.30% 0.24% 0.40% 0.35% 0.28% 0.20% SFNC⁽²⁾ 0.30% 0.38% 0.52% 0.30% 0.26% 0.15% 0.20% 0.16% 0.35% 0.31% 0.25% 0.16% All US Banks⁽¹⁾ 1.70% 2.91% 2.96% 1.81% 1.26% 0.77% 0.55% 0.47% 0.48% 0.50% 0.48% NA (1) Source: S&P Global Market Intelligence, all US Banks. LTM as of December 31, 2018. March 31, 2019 unavailable. (2) Excluding credit card net charge - offs. Credit Quality: Legacy Loan Portfolio (Excluding Acquired Loans) 12 "Great Recession"

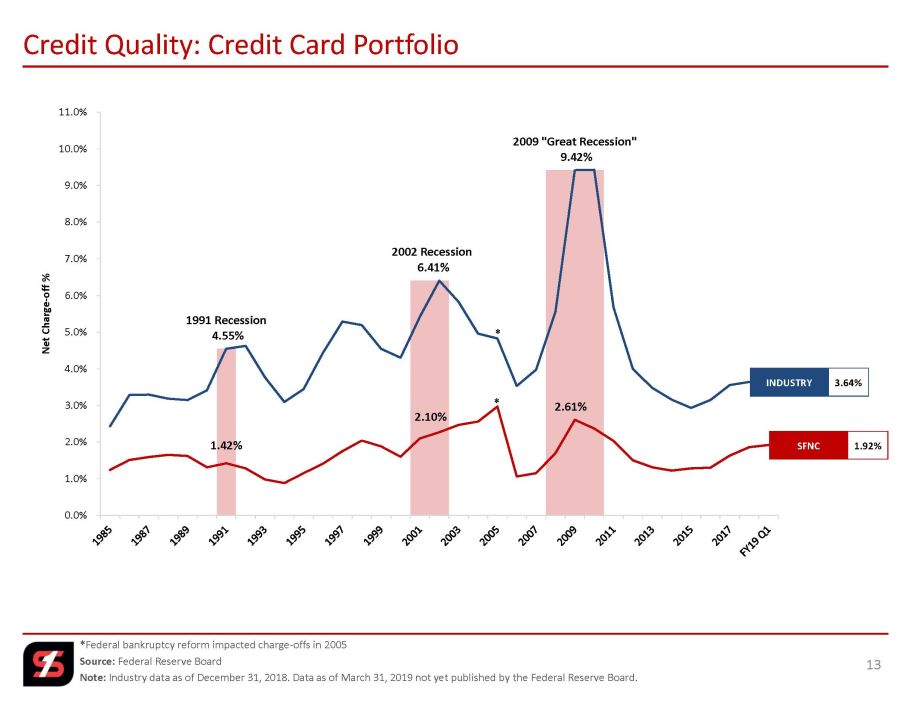

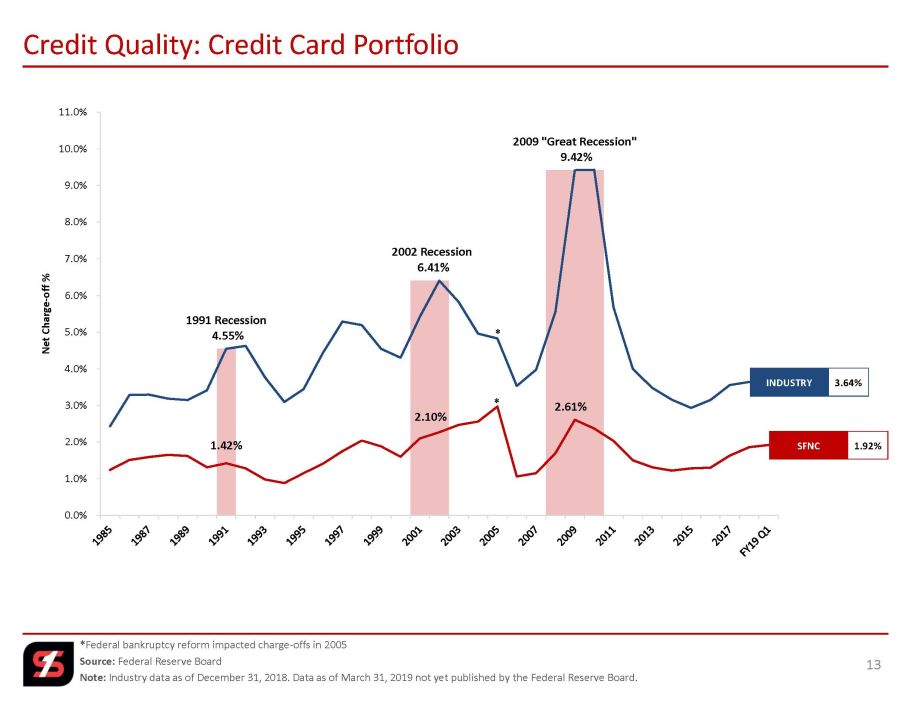

1991 Recession 4.55% 2002 Recession 6.41% 2009 "Great Recession" 9.42% 1.42% 2.10% * 2.61% * 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% 11.0% Net Charge - off % * Federal bankruptcy reform impacted charge - offs in 2005 Source: Federal Reserve Board Note: Industry data as of December 31, 2018. Data as of March 31, 2019 not yet published by the Federal Reserve Board. Credit Quality: Credit Card Portfolio 13 SFNC 1.92% INDUSTRY 3.64%

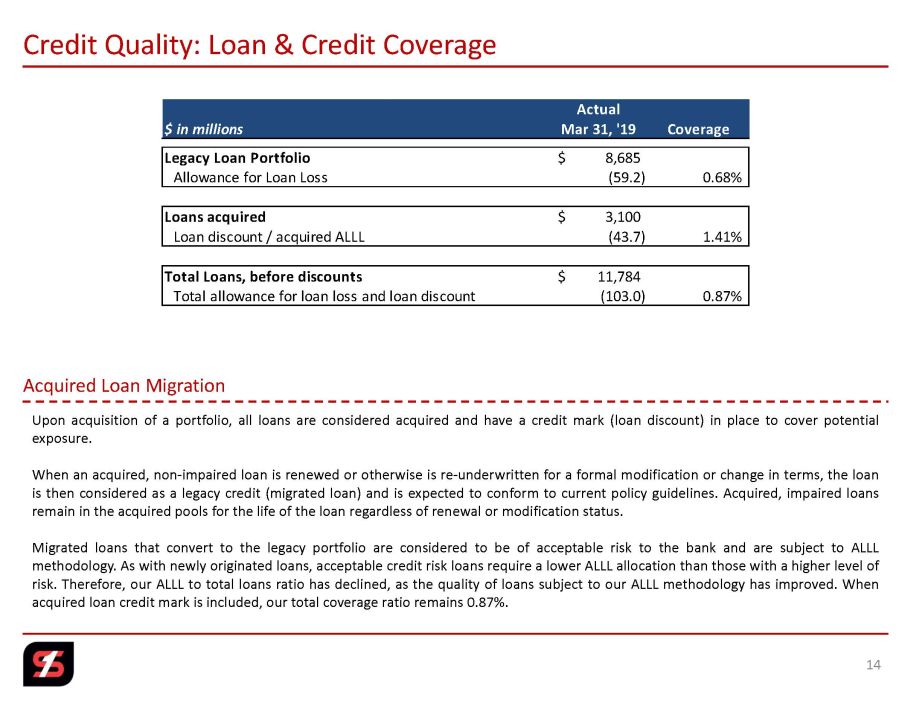

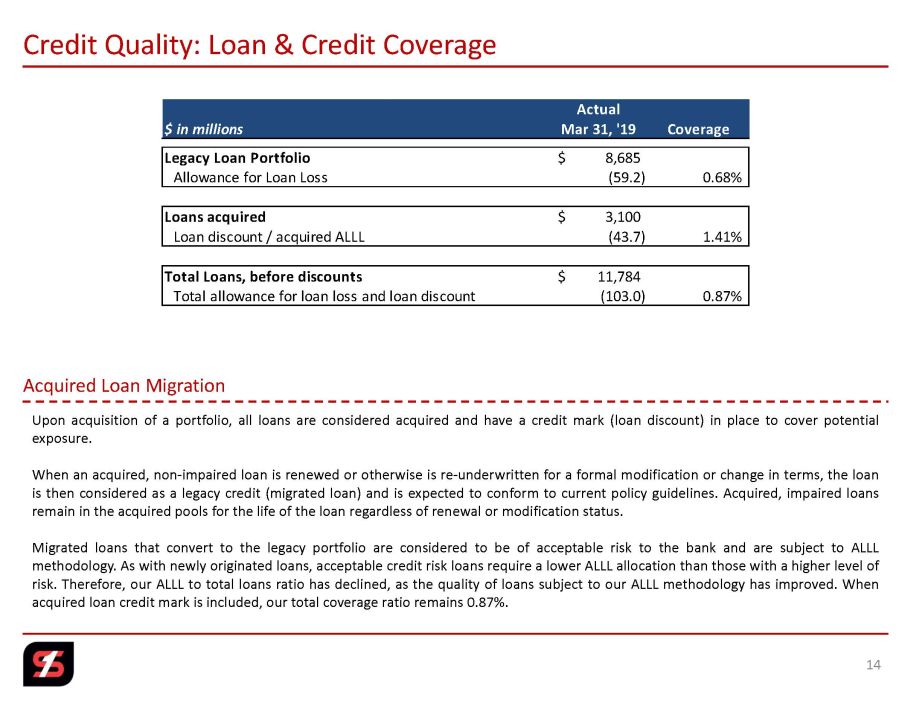

Credit Quality: Loan & Credit Coverage 14 Upon acquisition of a portfolio, all loans are considered acquired and have a credit mark (loan discount) in place to cover potential exposure . When an acquired, non - impaired loan is renewed or otherwise is re - underwritten for a formal modification or change in terms, the loan is then considered as a legacy credit (migrated loan) and is expected to conform to current policy guidelines . Acquired, impaired loans remain in the acquired pools for the life of the loan regardless of renewal or modification status . Migrated loans that convert to the legacy portfolio are considered to be of acceptable risk to the bank and are subject to ALLL methodology . As with newly originated loans, acceptable credit risk loans require a lower ALLL allocation than those with a higher level of risk . Therefore, our ALLL to total loans ratio has declined, as the quality of loans subject to our ALLL methodology has improved . When acquired loan credit mark is included, our total coverage ratio remains 0 . 87 % . Acquired Loan Migration Actual $ in millions Mar 31, '19 Coverage Legacy Loan Portfolio 8,685$ Allowance for Loan Loss (59.2) 0.68% Loans acquired 3,100$ Loan discount / acquired ALLL (43.7) 1.41% Total Loans, before discounts 11,784$ Total allowance for loan loss and loan discount (103.0) 0.87%

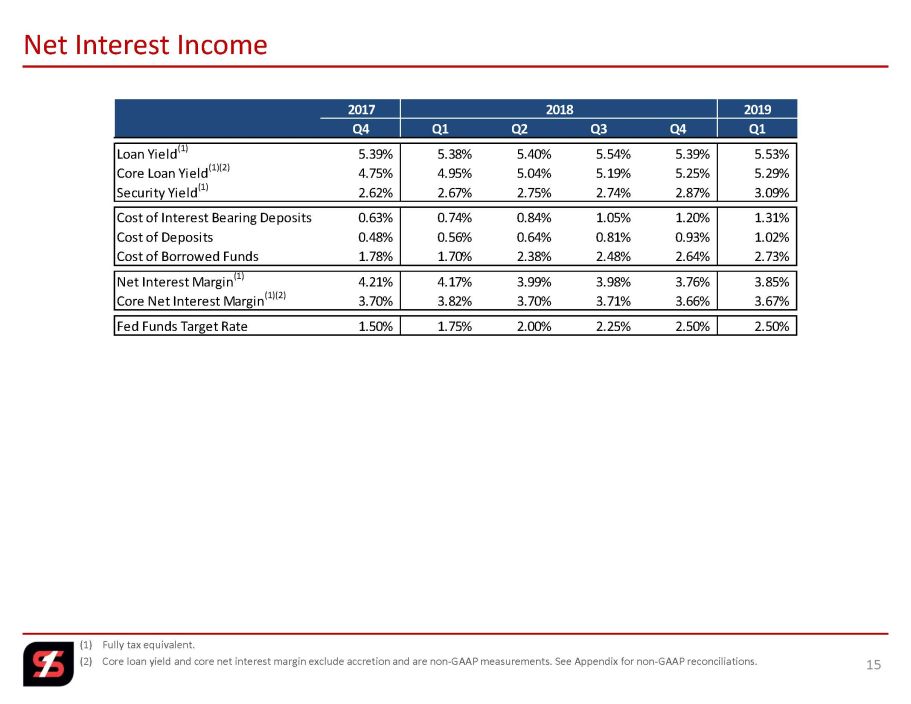

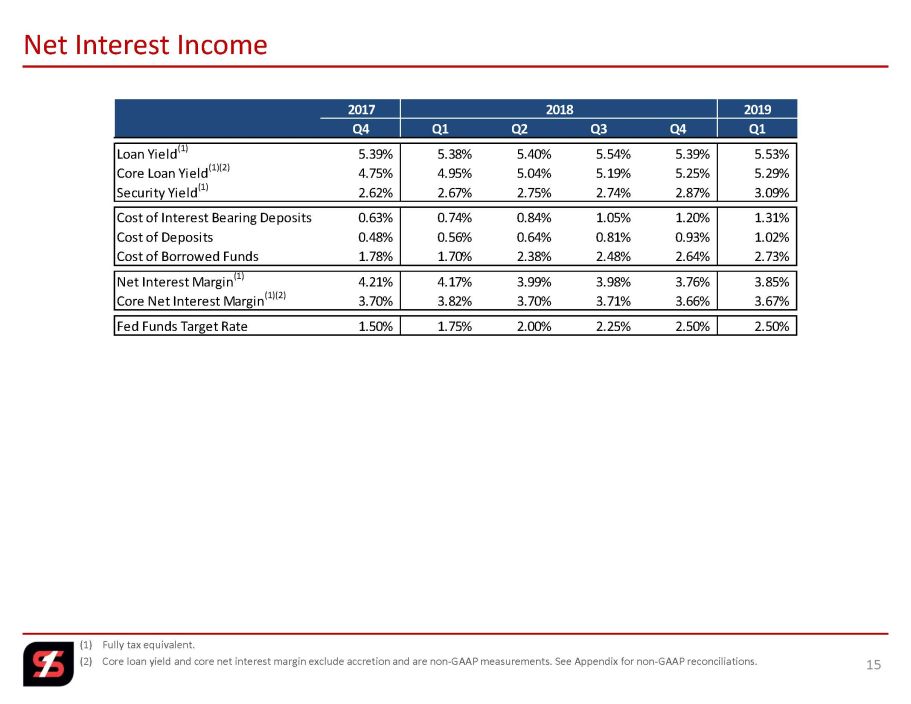

(1) Fully tax equivalent. (2) Core loan yield and core net interest margin exclude accretion and are non - GAAP measurements. See Appendix for non - GAAP reconcil iations. Net Interest Income 15 2017 2018 2019 Q4 Q1 Q2 Q3 Q4 Q1 Loan Yield (1) 5.39% 5.38% 5.40% 5.54% 5.39% 5.53% Core Loan Yield (1)(2) 4.75% 4.95% 5.04% 5.19% 5.25% 5.29% Security Yield (1) 2.62% 2.67% 2.75% 2.74% 2.87% 3.09% Cost of Interest Bearing Deposits 0.63% 0.74% 0.84% 1.05% 1.20% 1.31% Cost of Deposits 0.48% 0.56% 0.64% 0.81% 0.93% 1.02% Cost of Borrowed Funds 1.78% 1.70% 2.38% 2.48% 2.64% 2.73% Net Interest Margin (1) 4.21% 4.17% 3.99% 3.98% 3.76% 3.85% Core Net Interest Margin (1)(2) 3.70% 3.82% 3.70% 3.71% 3.66% 3.67% Fed Funds Target Rate 1.50% 1.75% 2.00% 2.25% 2.50% 2.50%

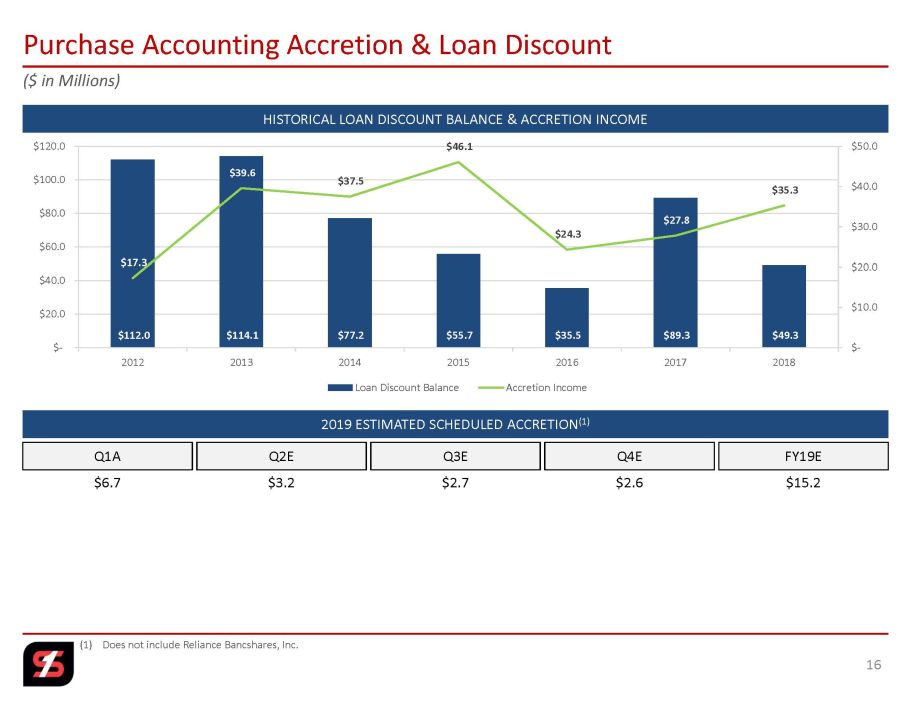

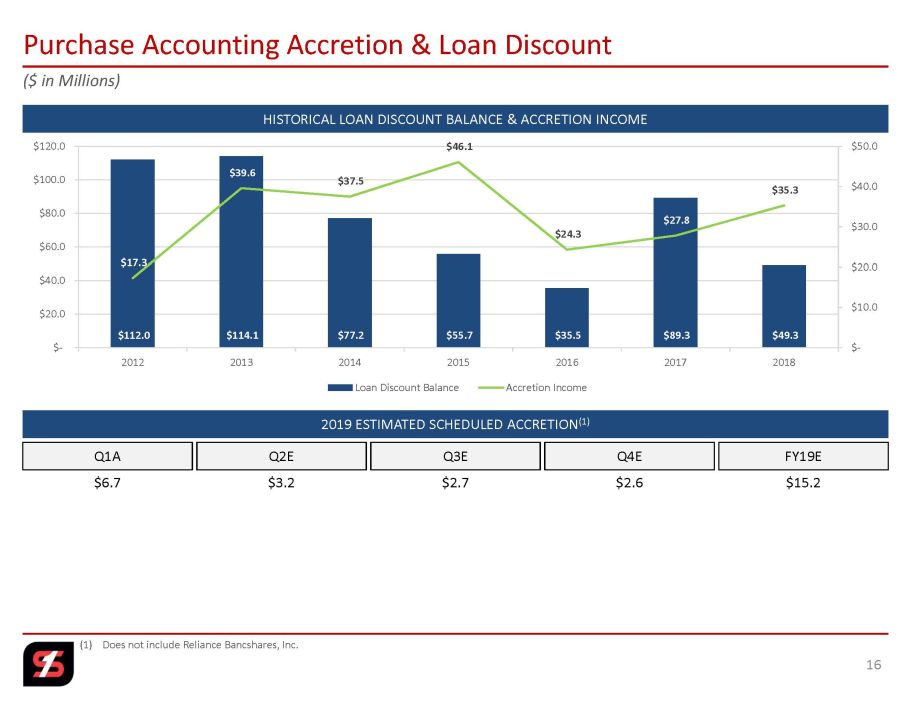

$112.0 $114.1 $77.2 $55.7 $35.5 $89.3 $49.3 $17.3 $39.6 $37.5 $46.1 $24.3 $27.8 $35.3 $- $10.0 $20.0 $30.0 $40.0 $50.0 $- $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 2012 2013 2014 2015 2016 2017 2018 Loan Discount Balance Accretion Income ($ in Millions) Purchase Accounting Accretion & Loan Discount 16 HISTORICAL LOAN DISCOUNT BALANCE & ACCRETION INCOME 2019 ESTIMATED SCHEDULED ACCRETION (1) (1) Does not include Reliance Bancshares, Inc. $2.7 $6.7 $2.6 $3.2 Q1A Q2E Q4E Q3E FY19E $15.2

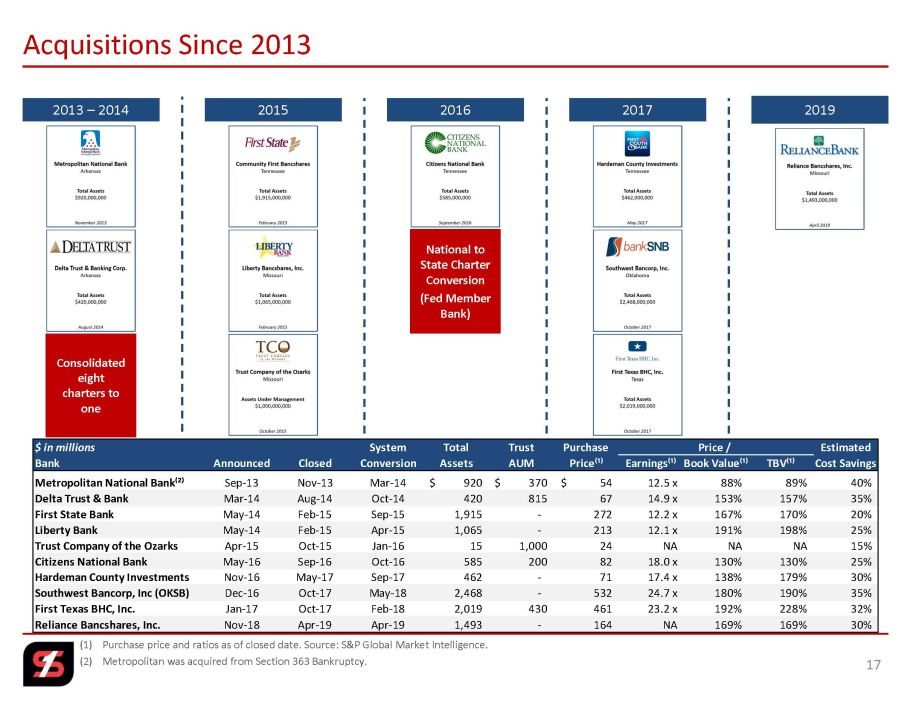

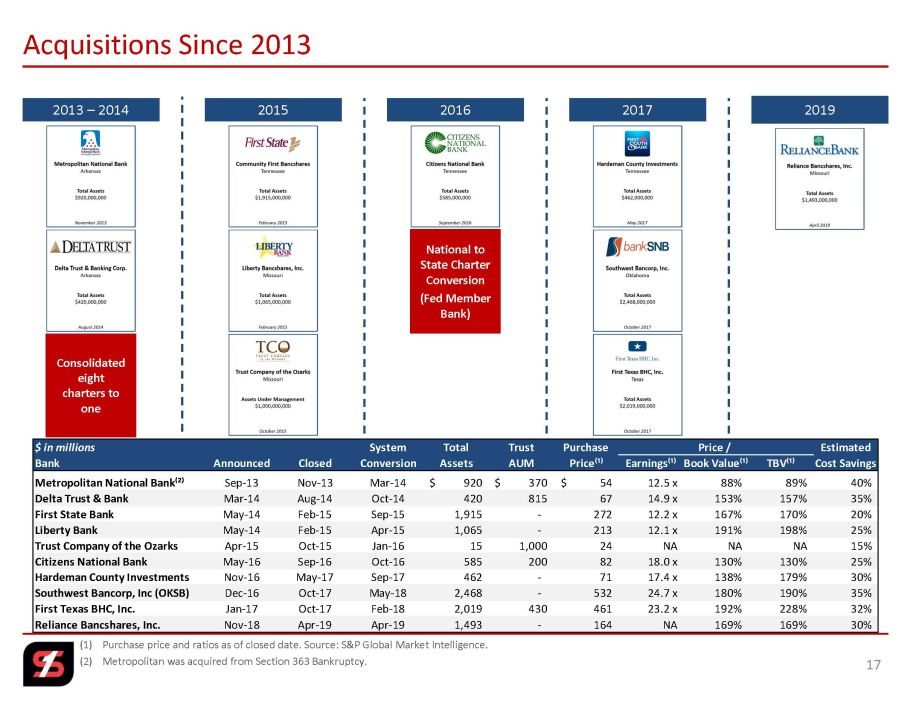

$ in millions System Total Trust Purchase Price / Estimated Bank Announced Closed Conversion Assets AUM Price⁽¹⁾ Earnings⁽¹⁾ Book Value⁽¹⁾ TBV⁽¹⁾ Cost Savings Metropolitan National Bank⁽²⁾ Sep-13 Nov-13 Mar-14 920$ 370$ 54$ 12.5 x 88% 89% 40% Delta Trust & Bank Mar-14 Aug-14 Oct-14 420 815 67 14.9 x 153% 157% 35% First State Bank May-14 Feb-15 Sep-15 1,915 - 272 12.2 x 167% 170% 20% Liberty Bank May-14 Feb-15 Apr-15 1,065 - 213 12.1 x 191% 198% 25% Trust Company of the Ozarks Apr-15 Oct-15 Jan-16 15 1,000 24 NA NA NA 15% Citizens National Bank May-16 Sep-16 Oct-16 585 200 82 18.0 x 130% 130% 25% Hardeman County Investments Nov-16 May-17 Sep-17 462 - 71 17.4 x 138% 179% 30% Southwest Bancorp, Inc (OKSB) Dec-16 Oct-17 May-18 2,468 - 532 24.7 x 180% 190% 35% First Texas BHC, Inc. Jan-17 Oct-17 Feb-18 2,019 430 461 23.2 x 192% 228% 32% Reliance Bancshares, Inc. Nov-18 Apr-19 Apr-19 1,493 - 164 NA 169% 169% 30% (1) Purchase price and ratios as of closed date. Source: S&P Global Market Intelligence. (2) Metropolitan was acquired from Section 363 Bankruptcy. Acquisitions Since 2013 17 2013 – 2014 Consolidated eight charters to one National to State Charter Conversion (Fed Member Bank) 2015 2016 2017 2019

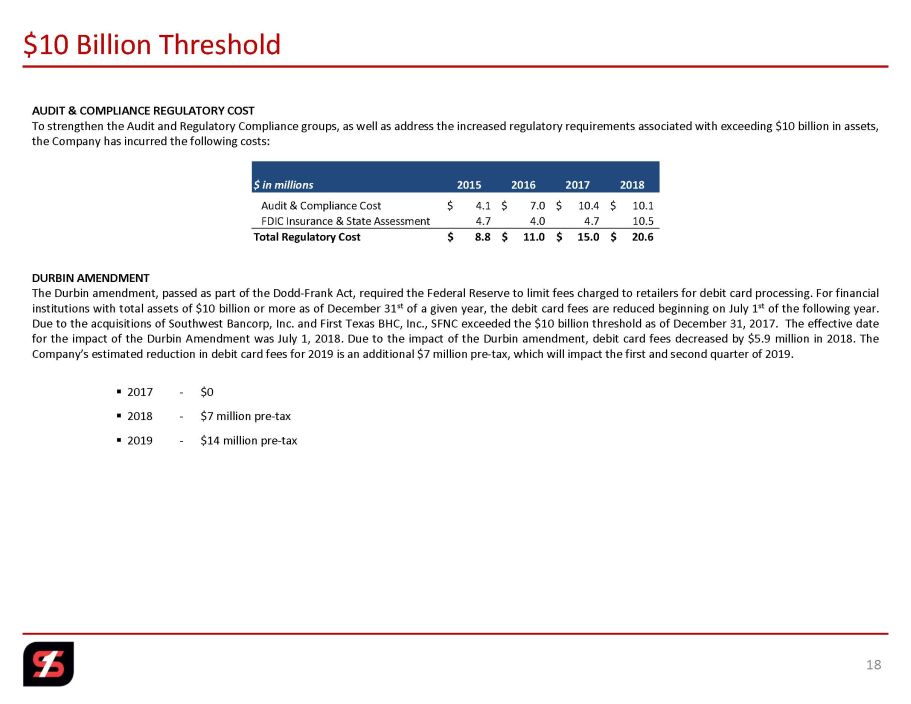

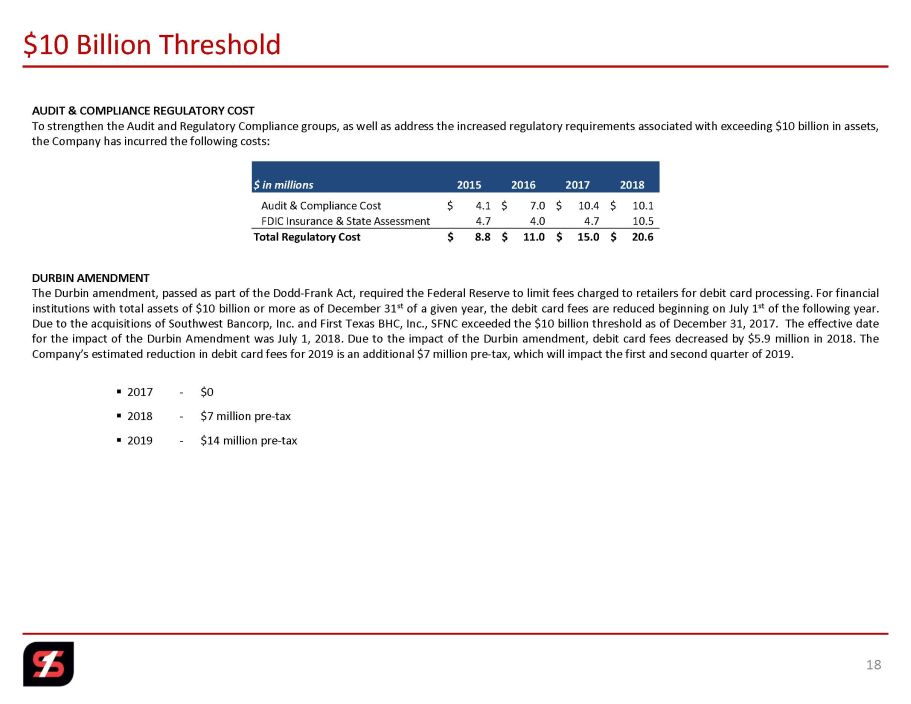

$10 Billion Threshold 18 AUDIT & COMPLIANCE REGULATORY COST To strengthen the Audit and Regulatory Compliance groups, as well as address the increased regulatory requirements associated wi th exceeding $10 billion in assets, the Company has incurred the following costs: DURBIN AMENDMENT The Durbin amendment, passed as part of the Dodd - Frank Act, required the Federal Reserve to limit fees charged to retailers for debit card processing . For financial institutions with total assets of $ 10 billion or more as of December 31 st of a given year, the debit card fees are reduced beginning on July 1 st of the following year . Due to the acquisitions of Southwest Bancorp, Inc . and First Texas BHC, Inc . , SFNC exceeded the $ 10 billion threshold as of December 31 , 2017 . The effective date for the impact of the Durbin Amendment was July 1 , 2018 . Due to the impact of the Durbin amendment, debit card fees decreased by $ 5 . 9 million in 2018 . The Company’s estimated reduction in debit card fees for 2019 is an additional $ 7 million pre - tax, which will impact the first and second quarter of 2019 . ▪ 2017 - $0 ▪ 2018 - $7 million pre - tax ▪ 2019 - $14 million pre - tax $ in millions 2015 2016 2017 2018 Audit & Compliance Cost 4.1$ 7.0$ 10.4$ 10.1$ FDIC Insurance & State Assessment 4.7 4.0 4.7 10.5 Total Regulatory Cost 8.8$ 11.0$ 15.0$ 20.6$

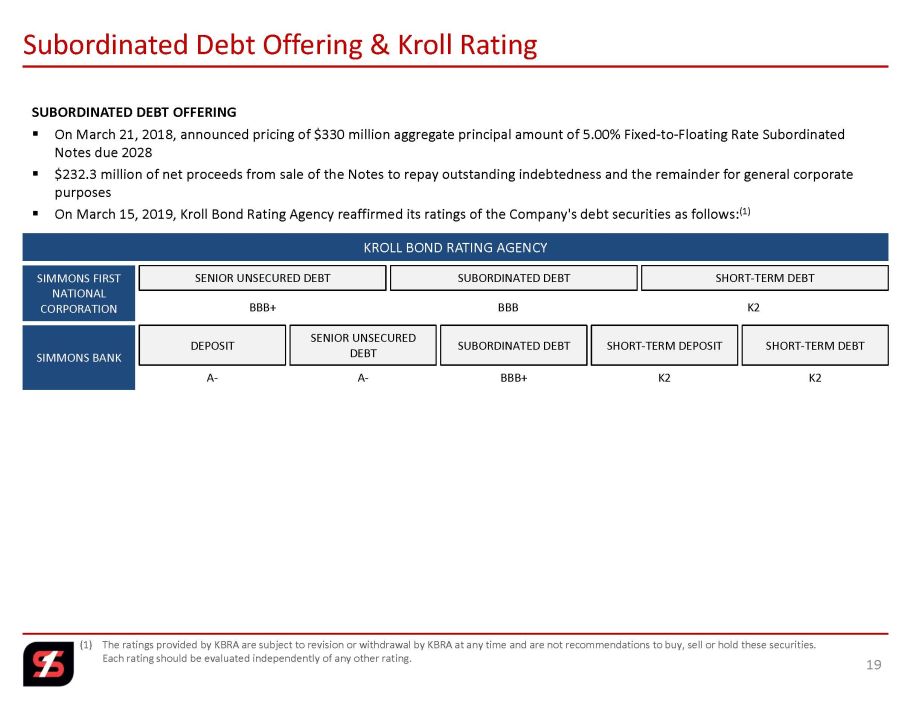

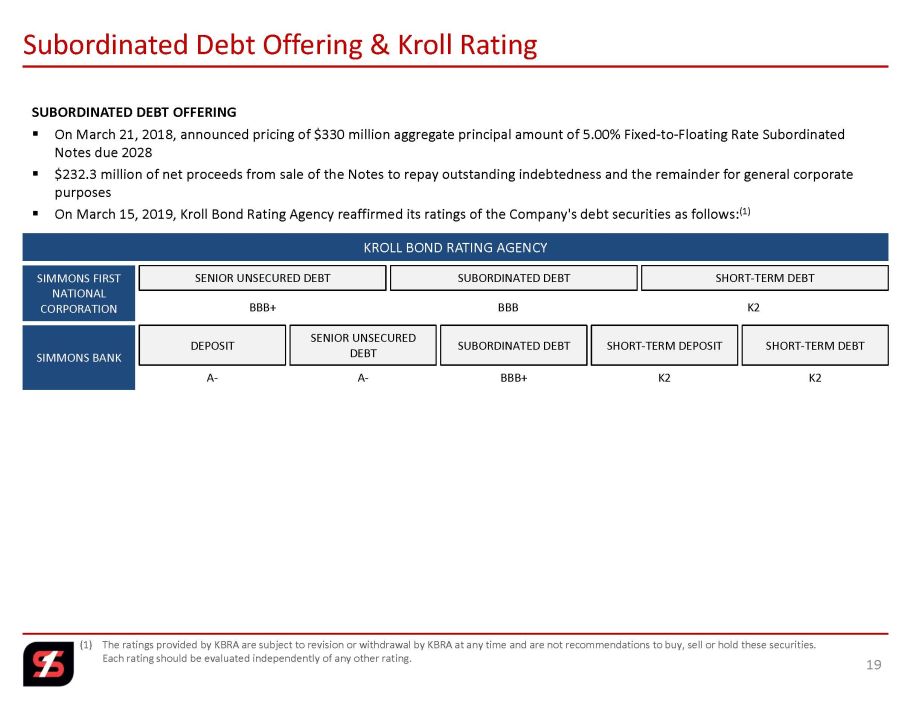

(1) The ratings provided by KBRA are subject to revision or withdrawal by KBRA at any time and are not recommendations to buy, se ll or hold these securities. Each rating should be evaluated independently of any other rating. Subordinated Debt Offering & Kroll Rating 19 SENIOR UNSECURED DEBT SHORT - TERM DEBT SUBORDINATED DEBT SENIOR UNSECURED DEBT SHORT - TERM DEBT SUBORDINATED DEBT SHORT - TERM DEPOSIT DEPOSIT BBB+ BBB K2 SIMMONS FIRST NATIONAL CORPORATION SIMMONS BANK A - A - BBB+ K2 K2 SUBORDINATED DEBT OFFERING ▪ On March 21, 2018, announced pricing of $330 million aggregate principal amount of 5.00% Fixed - to - Floating Rate Subordinated Notes due 2028 ▪ $232.3 million of net proceeds from sale of the Notes to repay outstanding indebtedness and the remainder for general corpora te purposes ▪ On March 15, 2019, Kroll Bond Rating Agency reaffirmed its ratings of the Company's debt securities as follows: (1) KROLL BOND RATING AGENCY

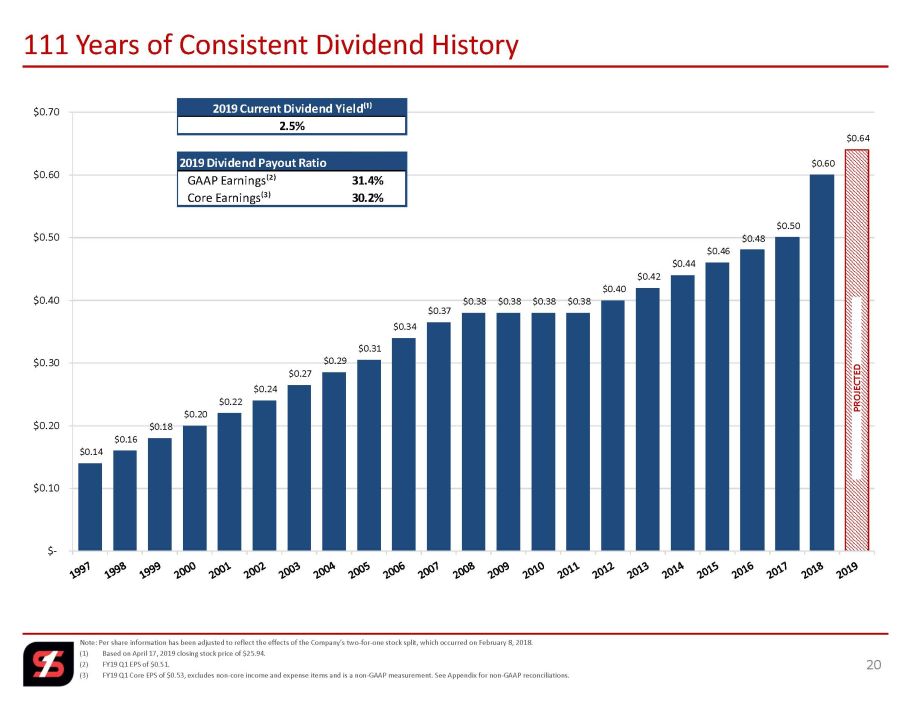

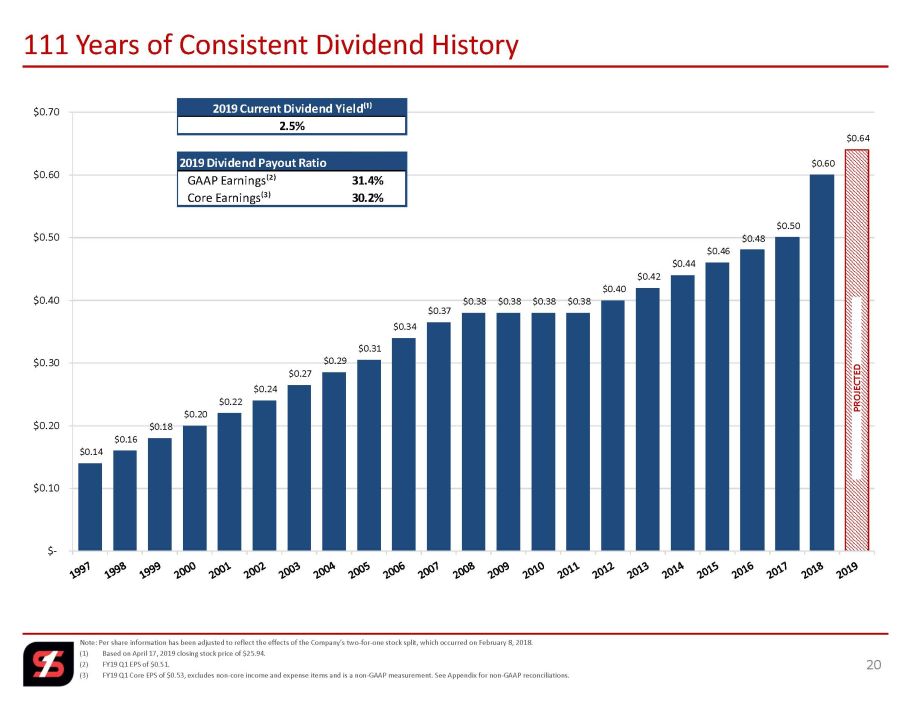

$0.14 $0.16 $0.18 $0.20 $0.22 $0.24 $0.27 $0.29 $0.31 $0.34 $0.37 $0.38 $0.38 $0.38 $0.38 $0.40 $0.42 $0.44 $0.46 $0.48 $0.50 $0.60 $0.64 $- $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 $0.70 Note: Per share information has been adjusted to reflect the effects of the Company’s two - for - one stock split, which occurred on February 8, 2018. (1) Based on April 17, 2019 closing stock price of $25.94. (2) FY19 Q1 EPS of $0.51. (3) FY19 Q1 Core EPS of $0.53, excludes non - core income and expense items and is a non - GAAP measurement. See Appendix for non - GAAP r econciliations. 111 Years of Consistent Dividend History 20 PROJECTED 2019 Current Dividend Yield⁽¹⁾ 2.5% 2019 Dividend Payout Ratio GAAP Earnings⁽²⁾ 31.4% Core Earnings⁽³⁾ 30.2%

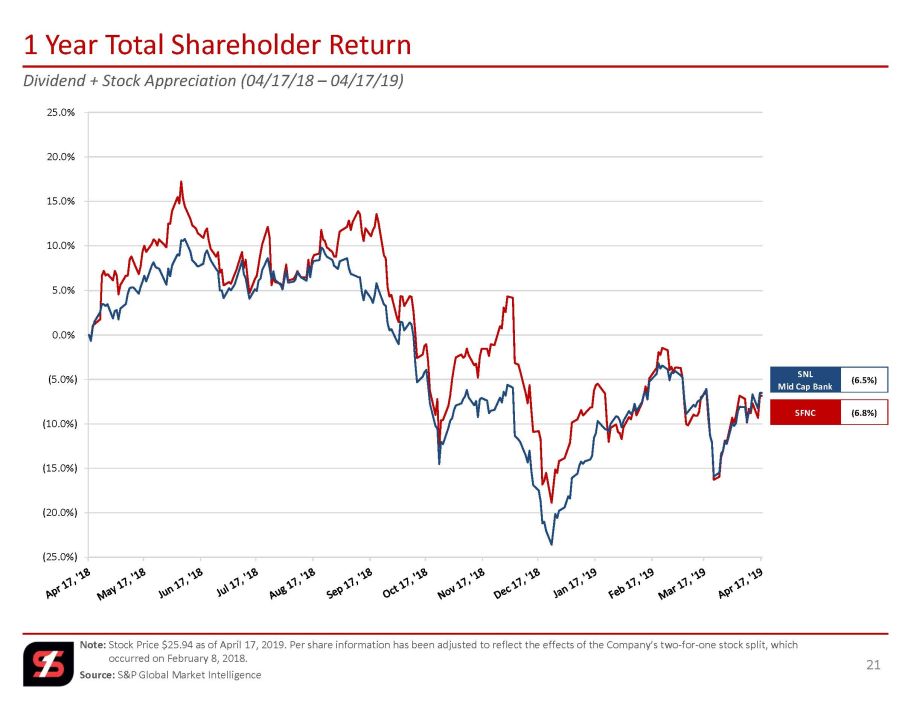

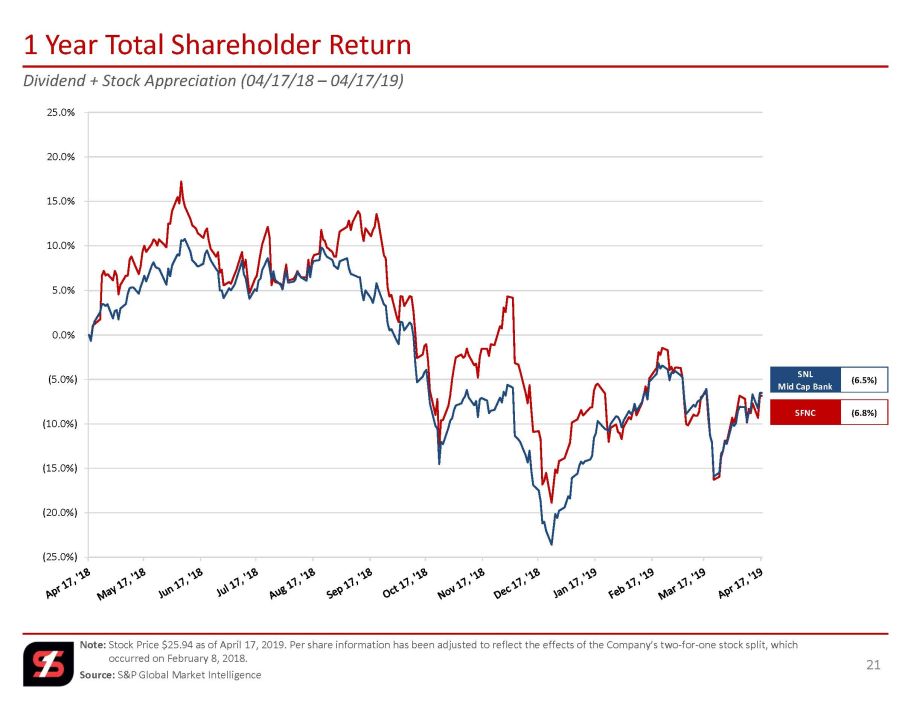

(25.0%) (20.0%) (15.0%) (10.0%) (5.0%) 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% Dividend + Stock Appreciation (04/17/18 – 04/17/19) Note: Stock Price $25.94 as of April 17, 2019. Per share information has been adjusted to reflect the effects of the Company’s two - for - one stock split, which occurred on February 8, 2018. Source: S&P Global Market Intelligence 1 Year Total Shareholder Return 21 SFNC (6.8%) SNL Mid Cap Bank (6.5%)

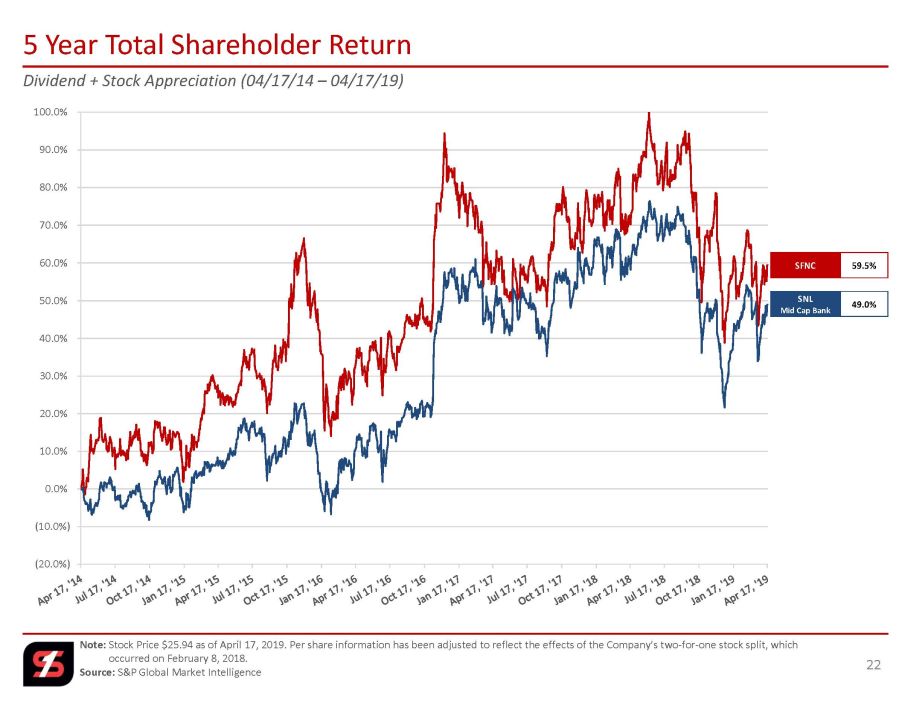

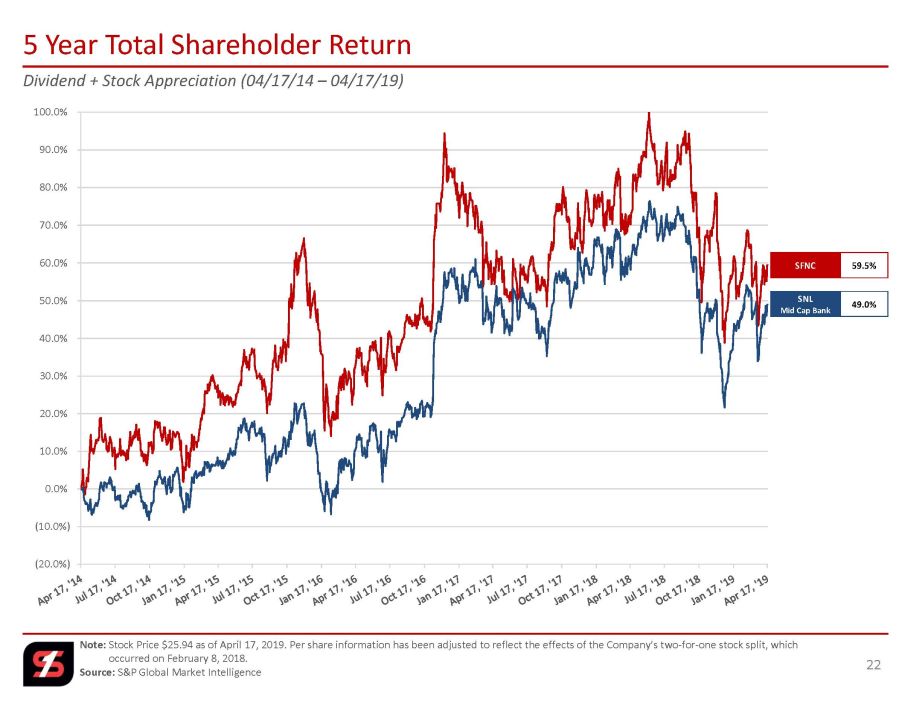

(20.0%) (10.0%) 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% 90.0% 100.0% Dividend + Stock Appreciation (04/17/14 – 04/17/19) Note: Stock Price $25.94 as of April 17, 2019. Per share information has been adjusted to reflect the effects of the Company’s two - for - one stock split, which occurred on February 8, 2018. Source: S&P Global Market Intelligence 5 Year Total Shareholder Return 22 SFNC 59.5% SNL Mid Cap Bank 49.0%

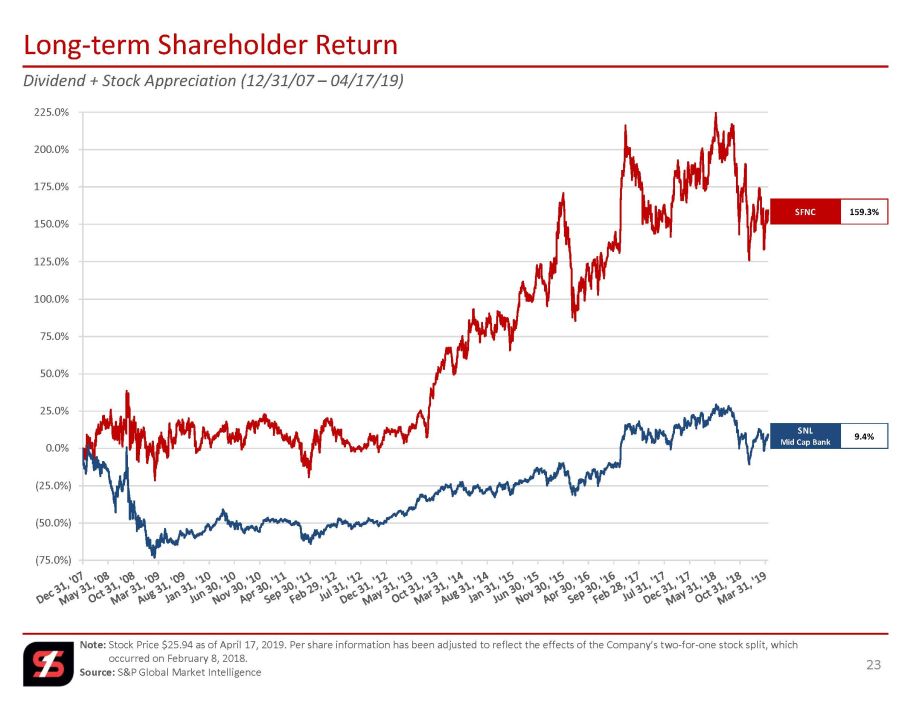

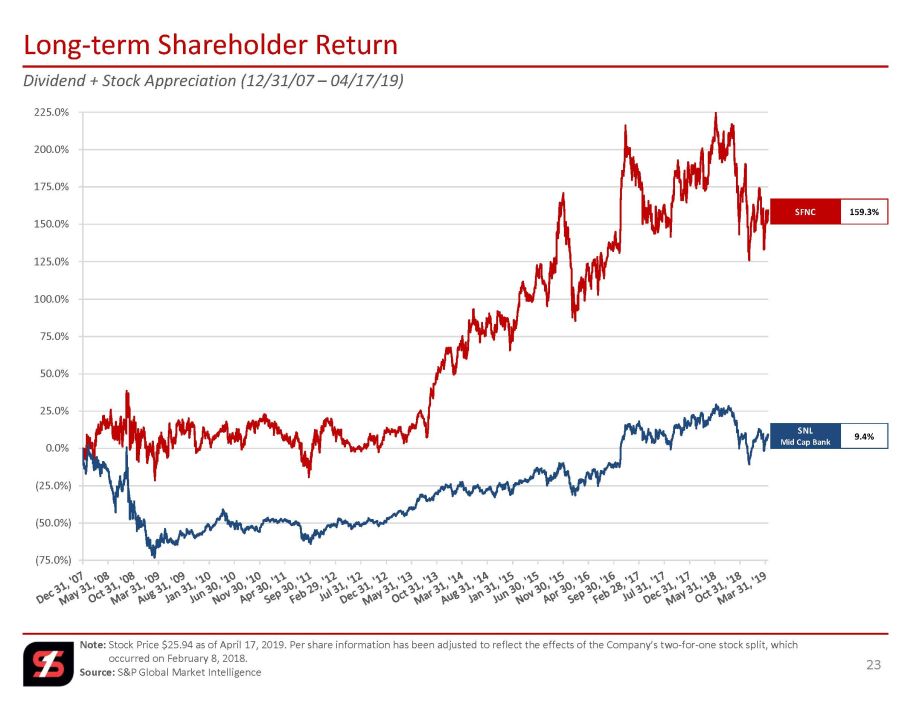

(75.0%) (50.0%) (25.0%) 0.0% 25.0% 50.0% 75.0% 100.0% 125.0% 150.0% 175.0% 200.0% 225.0% Dividend + Stock Appreciation (12/31/07 – 04/17/19) Note: Stock Price $25.94 as of April 17, 2019. Per share information has been adjusted to reflect the effects of the Company’s two - for - one stock split, which occurred on February 8, 2018. Source: S&P Global Market Intelligence Long - term Shareholder Return 23 SFNC 159.3% SNL Mid Cap Bank 9.4%

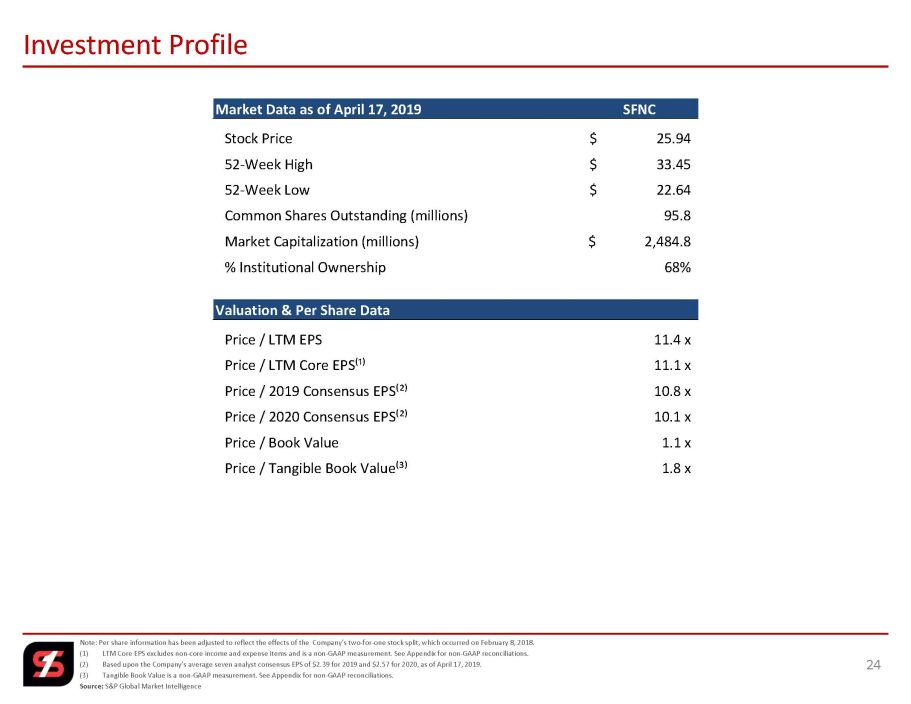

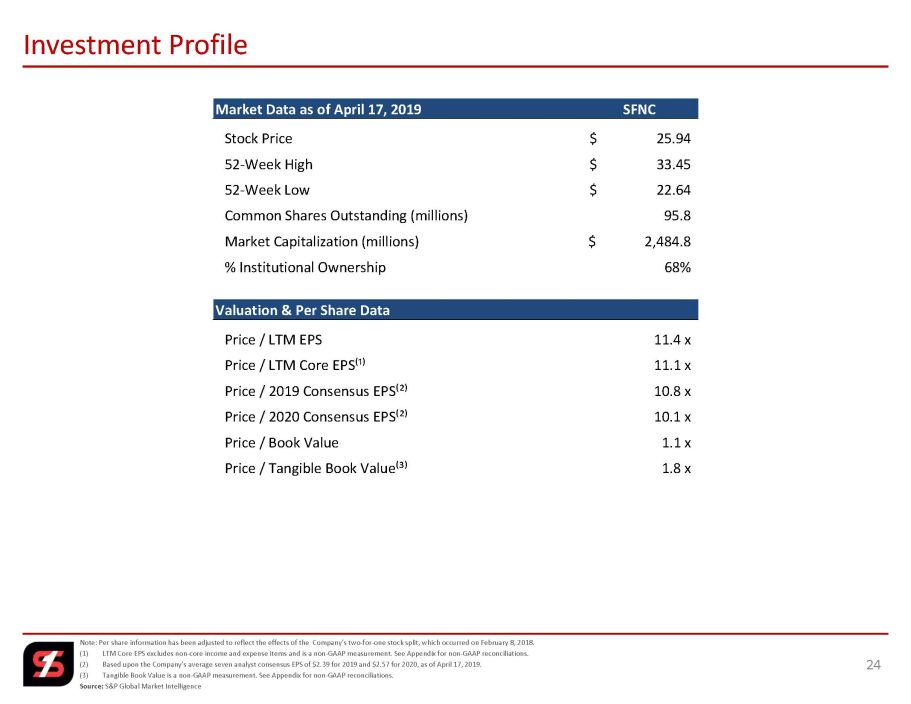

Note: Per share information has been adjusted to reflect the effects of the Company’s two - for - one stock split, which occurred o n February 8, 2018. (1) LTM Core EPS excludes non - core income and expense items and is a non - GAAP measurement. See Appendix for non - GAAP reconciliations . (2) Based upon the Company’s average seven analyst consensus EPS of $2.39 for 2019 and $2.57 for 2020, as of April 17, 2019. (3) Tangible Book Value is a non - GAAP measurement. See Appendix for non - GAAP reconciliations. Source: S&P Global Market Intelligence Investment Profile 24 Market Data as of April 17, 2019 SFNC Stock Price 25.94$ 52-Week High 33.45$ 52-Week Low 22.64$ Common Shares Outstanding (millions) 95.8 Market Capitalization (millions) 2,484.8$ % Institutional Ownership 68% Valuation & Per Share Data Price / LTM EPS 11.4 x Price / LTM Core EPS⁽¹⁾ 11.1 x Price / 2019 Consensus EPS⁽²⁾ 10.8 x Price / 2020 Consensus EPS⁽²⁾ 10.1 x Price / Book Value 1.1 x Price / Tangible Book Value⁽³⁾ 1.8 x

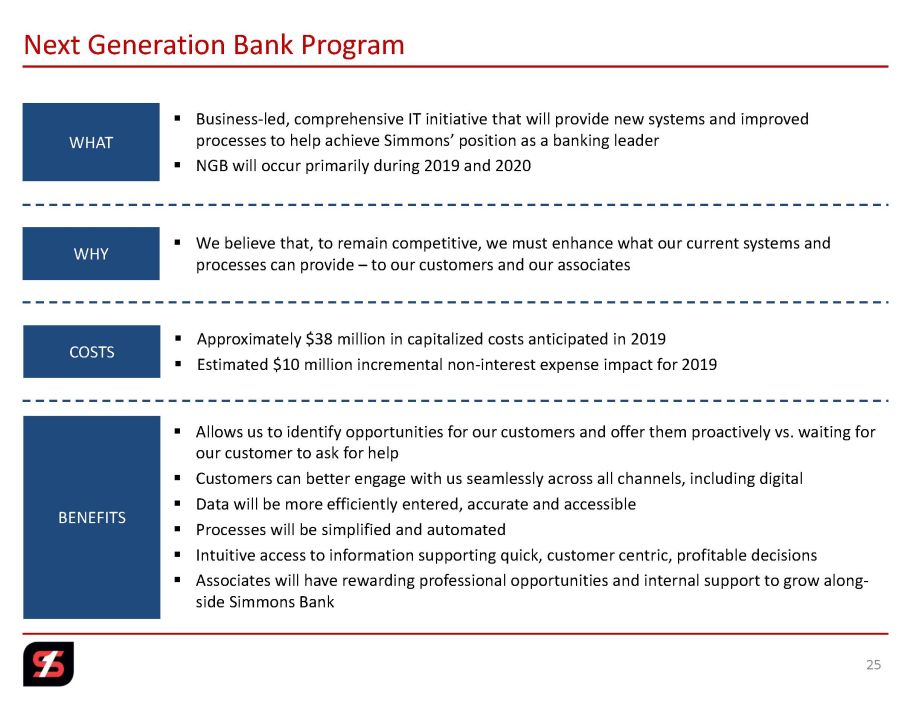

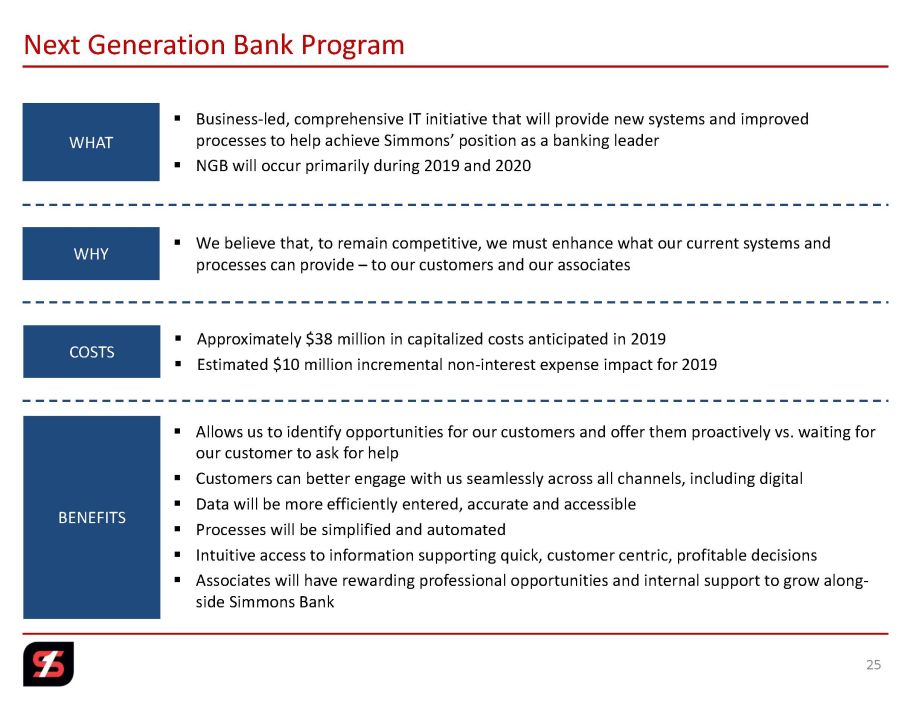

Next Generation Bank Program 25 WHY WHAT ▪ Allows us to identify opportunities for our customers and offer them proactively vs. waiting for our customer to ask for help ▪ Customers can better engage with us seamlessly across all channels, including digital ▪ Data will be more efficiently entered, accurate and accessible ▪ Processes will be simplified and automated ▪ Intuitive access to information supporting quick, customer centric, profitable decisions ▪ Associates will have rewarding professional opportunities and internal support to grow along - side Simmons Bank ▪ Business - led, comprehensive IT initiative that will provide new systems and improved processes to help achieve Simmons’ position as a banking leader ▪ NGB will occur primarily during 2019 and 2020 BENEFITS ▪ We believe that, to remain competitive, we must enhance what our current systems and processes can provide – to our customers and our associates COSTS ▪ Approximately $38 million in capitalized costs anticipated in 2019 ▪ Estimated $10 million incremental non - interest expense impact for 2019

2019 Strategy 26

Appendix 27

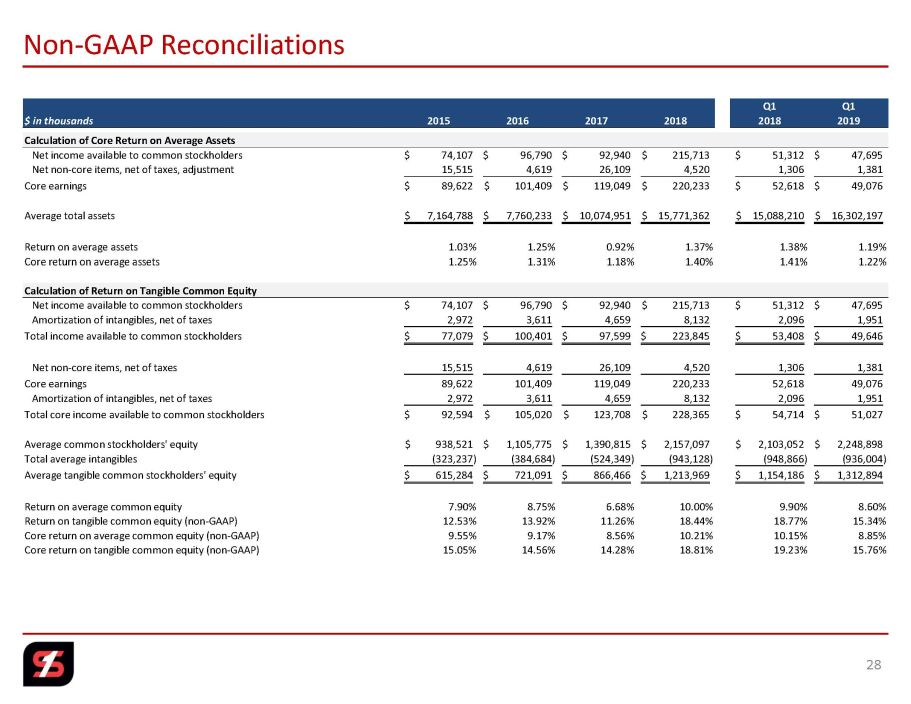

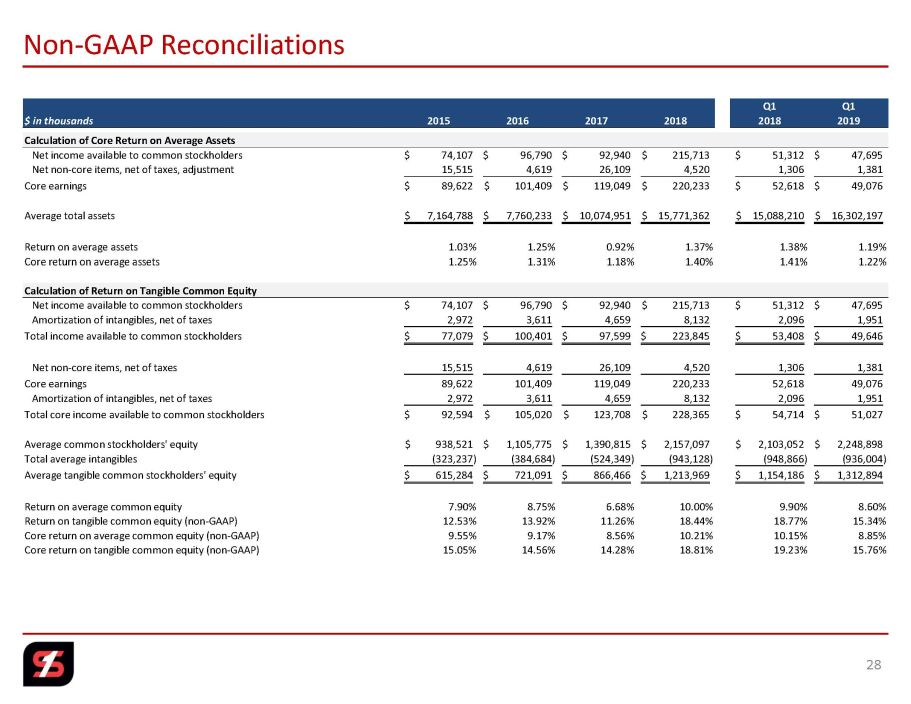

Non - GAAP Reconciliations 28 Q1 Q1 $ in thousands 2015 2016 2017 2018 2018 2019 Calculation of Core Return on Average Assets Net income available to common stockholders 74,107$ 96,790$ 92,940$ 215,713$ 51,312$ 47,695$ Net non-core items, net of taxes, adjustment 15,515 4,619 26,109 4,520 1,306 1,381 Core earnings 89,622$ 101,409$ 119,049$ 220,233$ 52,618$ 49,076$ Average total assets 7,164,788$ 7,760,233$ 10,074,951$ 15,771,362$ 15,088,210$ 16,302,197$ Return on average assets 1.03% 1.25% 0.92% 1.37% 1.38% 1.19% Core return on average assets 1.25% 1.31% 1.18% 1.40% 1.41% 1.22% Calculation of Return on Tangible Common Equity Net income available to common stockholders 74,107$ 96,790$ 92,940$ 215,713$ 51,312$ 47,695$ Amortization of intangibles, net of taxes 2,972 3,611 4,659 8,132 2,096 1,951 Total income available to common stockholders 77,079$ 100,401$ 97,599$ 223,845$ 53,408$ 49,646$ Net non-core items, net of taxes 15,515 4,619 26,109 4,520 1,306 1,381 Core earnings 89,622 101,409 119,049 220,233 52,618 49,076 Amortization of intangibles, net of taxes 2,972 3,611 4,659 8,132 2,096 1,951 Total core income available to common stockholders 92,594$ 105,020$ 123,708$ 228,365$ 54,714$ 51,027$ Average common stockholders' equity 938,521$ 1,105,775$ 1,390,815$ 2,157,097$ 2,103,052$ 2,248,898$ Total average intangibles (323,237) (384,684) (524,349) (943,128) (948,866) (936,004) Average tangible common stockholders' equity 615,284$ 721,091$ 866,466$ 1,213,969$ 1,154,186$ 1,312,894$ Return on average common equity 7.90% 8.75% 6.68% 10.00% 9.90% 8.60% Return on tangible common equity (non-GAAP) 12.53% 13.92% 11.26% 18.44% 18.77% 15.34% Core return on average common equity (non-GAAP) 9.55% 9.17% 8.56% 10.21% 10.15% 8.85% Core return on tangible common equity (non-GAAP) 15.05% 14.56% 14.28% 18.81% 19.23% 15.76%

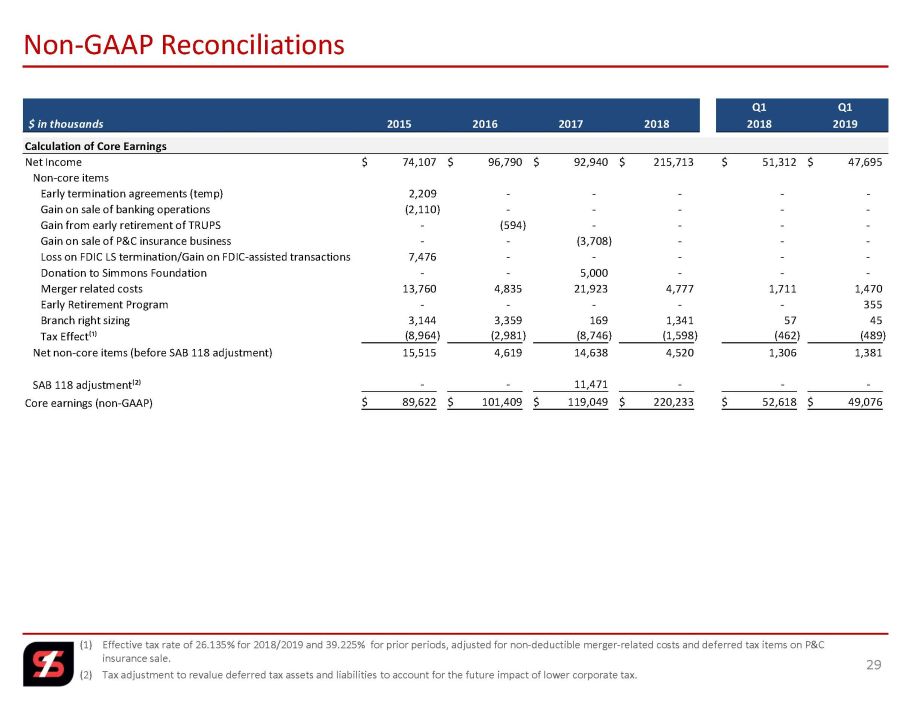

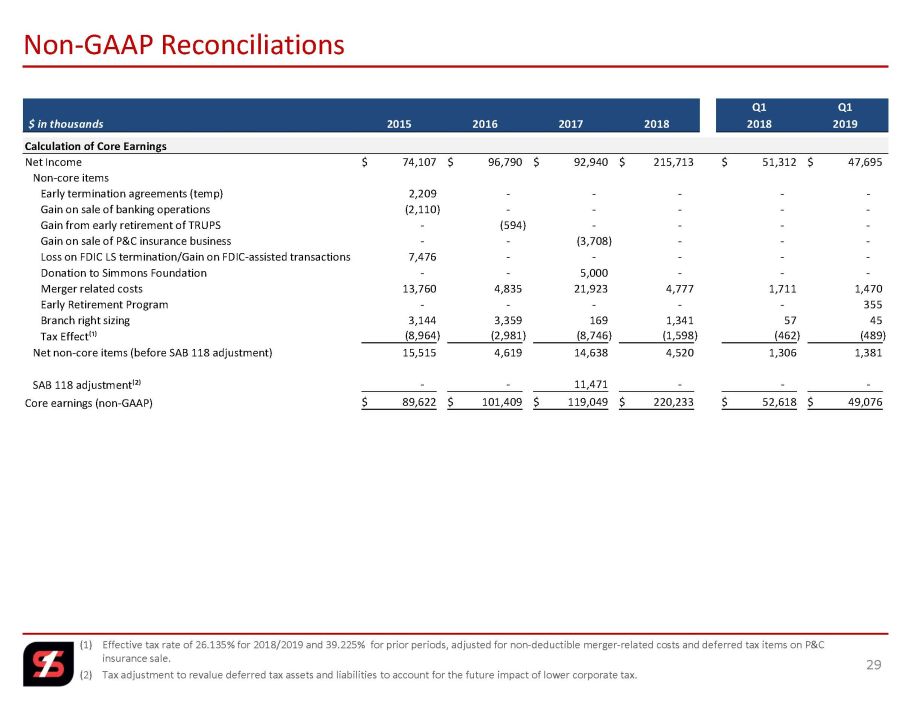

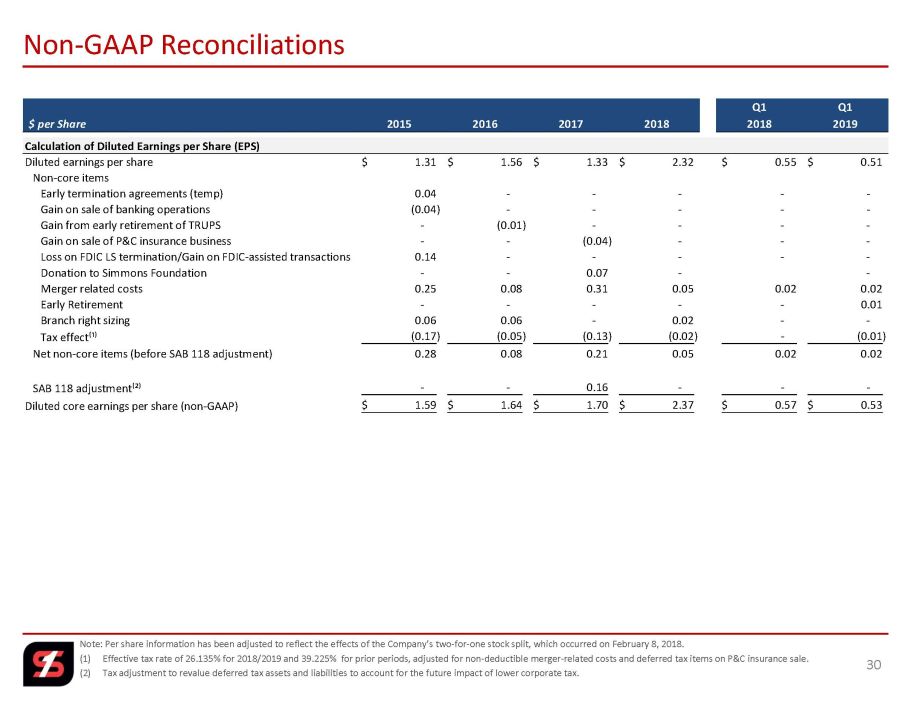

(1) Effective tax rate of 26.135% for 2018/2019 and 39.225% for prior periods, adjusted for non - deductible merger - related costs and deferred tax items on P&C insurance sale. (2) Tax adjustment to revalue deferred tax assets and liabilities to account for the future impact of lower corporate tax. Non - GAAP Reconciliations 29 Q1 Q1 $ in thousands 2015 2016 2017 2018 2018 2019 Calculation of Core Earnings Net Income 74,107$ 96,790$ 92,940$ 215,713$ 51,312$ 47,695$ Non-core items Early termination agreements (temp) 2,209 - - - - - Gain on sale of banking operations (2,110) - - - - - Gain from early retirement of TRUPS - (594) - - - - Gain on sale of P&C insurance business - - (3,708) - - - Loss on FDIC LS termination/Gain on FDIC-assisted transactions 7,476 - - - - - Donation to Simmons Foundation - - 5,000 - - - Merger related costs 13,760 4,835 21,923 4,777 1,711 1,470 Early Retirement Program - - - - - 355 Branch right sizing 3,144 3,359 169 1,341 57 45 Tax Effect⁽¹⁾ (8,964) (2,981) (8,746) (1,598) (462) (489) Net non-core items (before SAB 118 adjustment) 15,515 4,619 14,638 4,520 1,306 1,381 SAB 118 adjustment⁽²⁾ - - 11,471 - - - Core earnings (non-GAAP) 89,622$ 101,409$ 119,049$ 220,233$ 52,618$ 49,076$

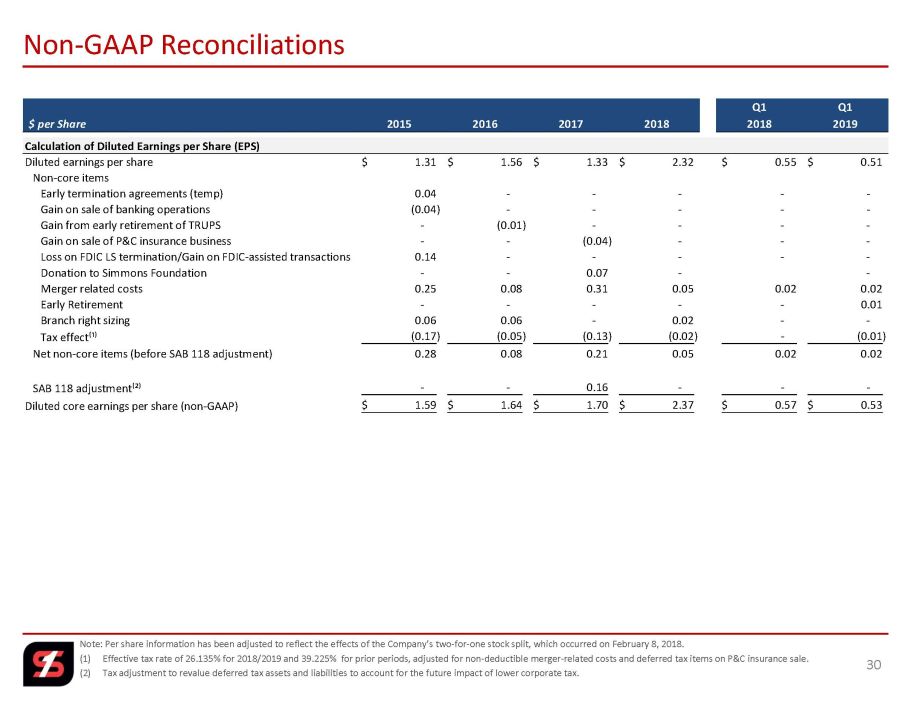

Note: Per share information has been adjusted to reflect the effects of the Company’s two - for - one stock split, which occurred on February 8, 2018. (1) Effective tax rate of 26.135% for 2018/2019 and 39.225% for prior periods, adjusted for non - deductible merger - related costs and deferred tax items on P&C insurance sale. (2) Tax adjustment to revalue deferred tax assets and liabilities to account for the future impact of lower corporate tax. Non - GAAP Reconciliations 30 Q1 Q1 $ per Share 2015 2016 2017 2018 2018 2019 Calculation of Diluted Earnings per Share (EPS) Diluted earnings per share 1.31$ 1.56$ 1.33$ 2.32$ 0.55$ 0.51$ Non-core items Early termination agreements (temp) 0.04 - - - - - Gain on sale of banking operations (0.04) - - - - - Gain from early retirement of TRUPS - (0.01) - - - - Gain on sale of P&C insurance business - - (0.04) - - - Loss on FDIC LS termination/Gain on FDIC-assisted transactions 0.14 - - - - - Donation to Simmons Foundation - - 0.07 - - Merger related costs 0.25 0.08 0.31 0.05 0.02 0.02 Early Retirement - - - - - 0.01 Branch right sizing 0.06 0.06 - 0.02 - - Tax effect⁽¹⁾ (0.17) (0.05) (0.13) (0.02) - (0.01) Net non-core items (before SAB 118 adjustment) 0.28 0.08 0.21 0.05 0.02 0.02 SAB 118 adjustment⁽²⁾ - - 0.16 - - - Diluted core earnings per share (non-GAAP) 1.59$ 1.64$ 1.70$ 2.37$ 0.57$ 0.53$

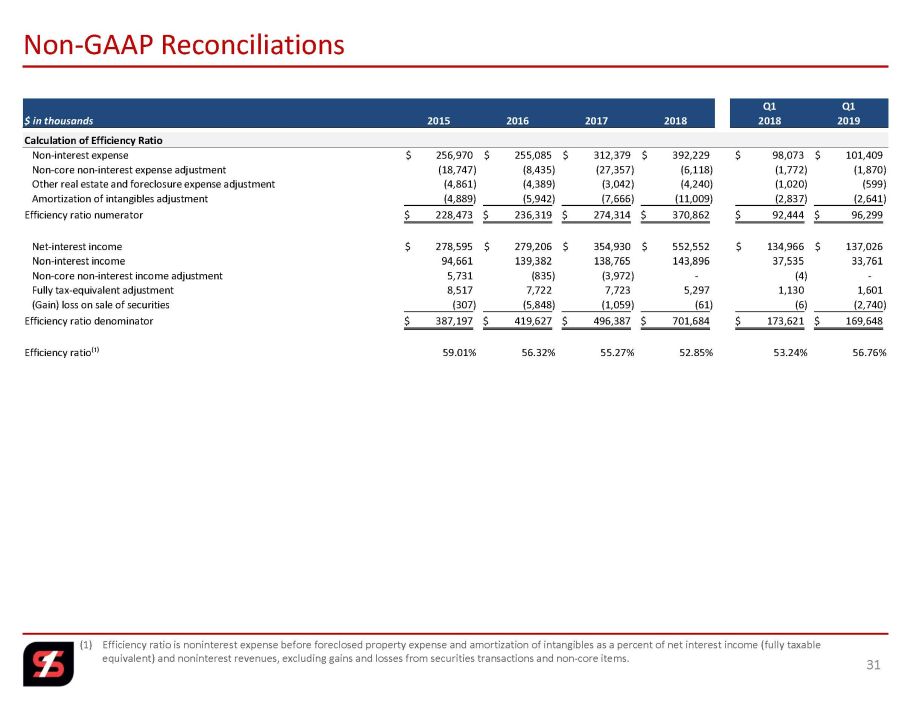

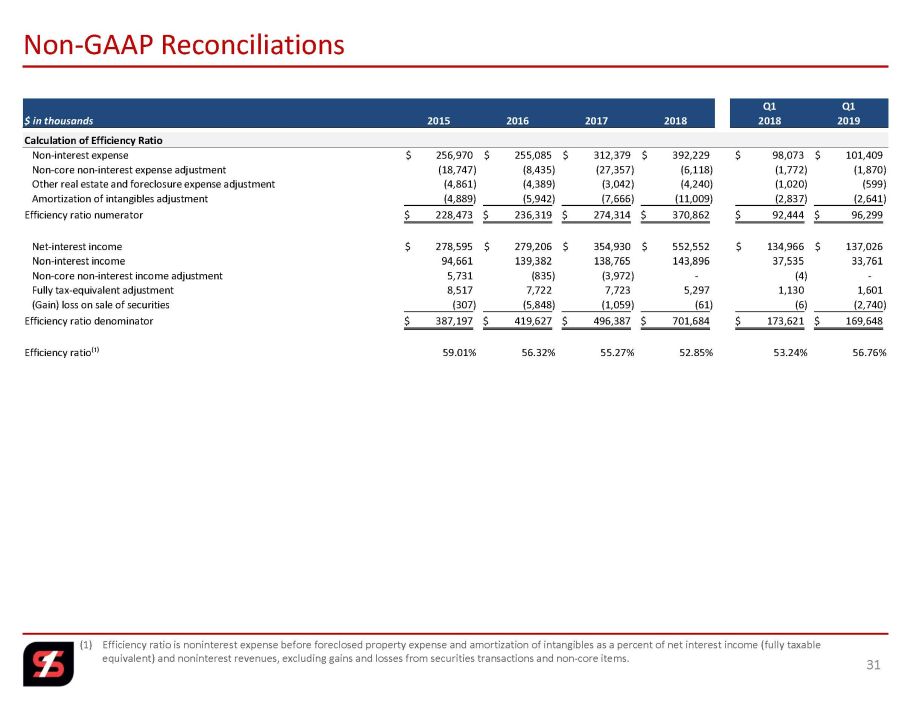

(1) Efficiency ratio is noninterest expense before foreclosed property expense and amortization of intangibles as a percent of ne t i nterest income (fully taxable equivalent) and noninterest revenues, excluding gains and losses from securities transactions and non - core items. Non - GAAP Reconciliations 31 Q1 Q1 $ in thousands 2015 2016 2017 2018 2018 2019 Calculation of Efficiency Ratio Non-interest expense 256,970$ 255,085$ 312,379$ 392,229$ 98,073$ 101,409$ Non-core non-interest expense adjustment (18,747) (8,435) (27,357) (6,118) (1,772) (1,870) Other real estate and foreclosure expense adjustment (4,861) (4,389) (3,042) (4,240) (1,020) (599) Amortization of intangibles adjustment (4,889) (5,942) (7,666) (11,009) (2,837) (2,641) Efficiency ratio numerator 228,473$ 236,319$ 274,314$ 370,862$ 92,444$ 96,299$ Net-interest income 278,595$ 279,206$ 354,930$ 552,552$ 134,966$ 137,026$ Non-interest income 94,661 139,382 138,765 143,896 37,535 33,761 Non-core non-interest income adjustment 5,731 (835) (3,972) - (4) - Fully tax-equivalent adjustment 8,517 7,722 7,723 5,297 1,130 1,601 (Gain) loss on sale of securities (307) (5,848) (1,059) (61) (6) (2,740) Efficiency ratio denominator 387,197$ 419,627$ 496,387$ 701,684$ 173,621$ 169,648$ Efficiency ratio⁽¹⁾ 59.01% 56.32% 55.27% 52.85% 53.24% 56.76%

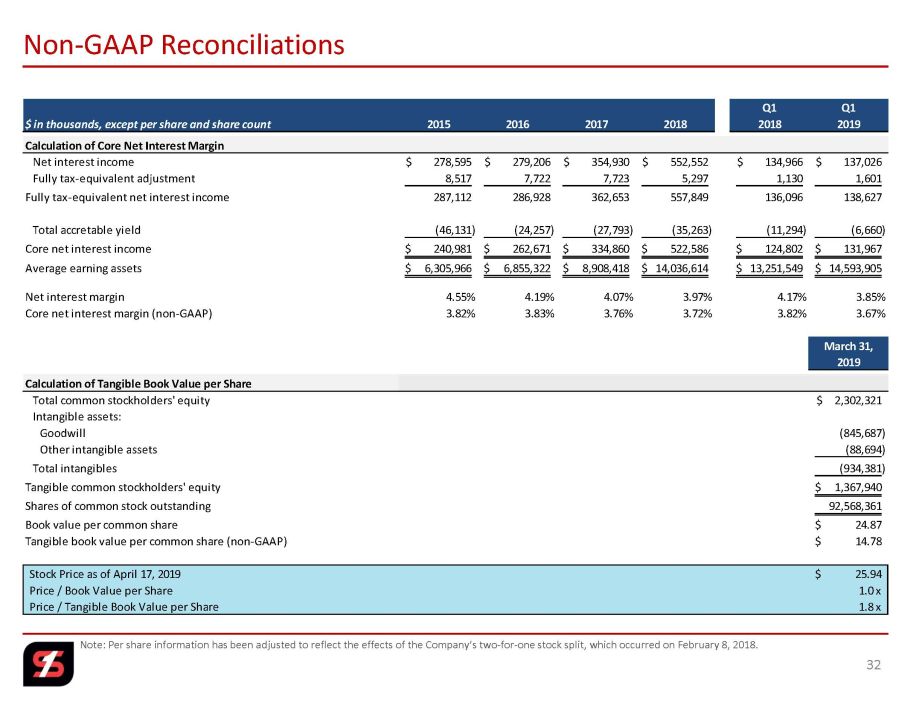

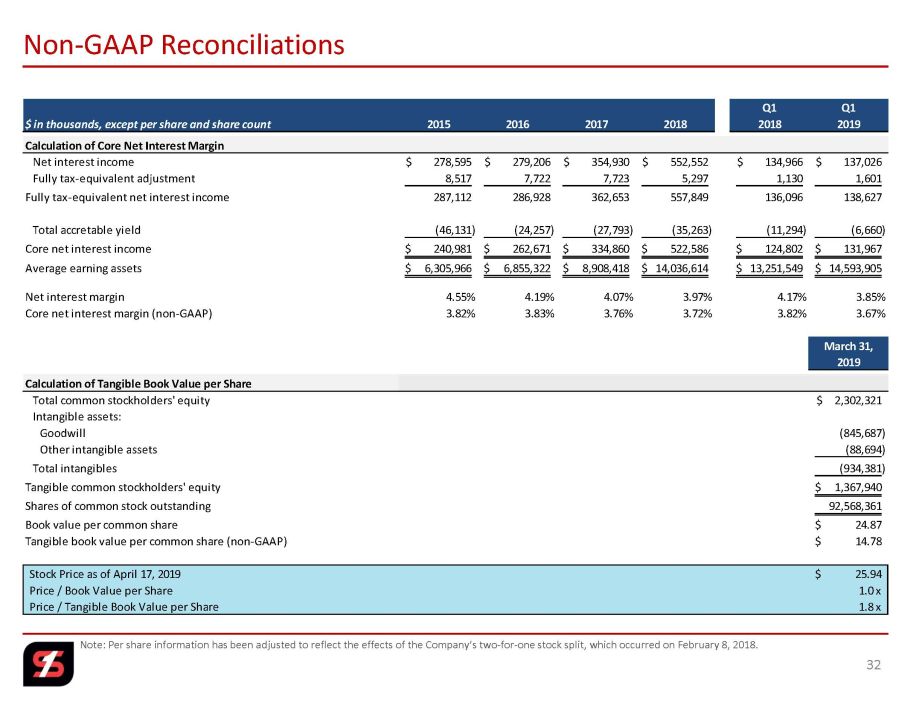

Note: Per share information has been adjusted to reflect the effects of the Company’s two - for - one stock split, which occurred on February 8, 2018. Non - GAAP Reconciliations 32 Q1 Q1 $ in thousands, except per share and share count 2015 2016 2017 2018 2018 2019 Calculation of Core Net Interest Margin Net interest income 278,595$ 279,206$ 354,930$ 552,552$ 134,966$ 137,026$ Fully tax-equivalent adjustment 8,517 7,722 7,723 5,297 1,130 1,601 Fully tax-equivalent net interest income 287,112 286,928 362,653 557,849 136,096 138,627 Total accretable yield (46,131) (24,257) (27,793) (35,263) (11,294) (6,660) Core net interest income 240,981$ 262,671$ 334,860$ 522,586$ 124,802$ 131,967$ Average earning assets 6,305,966$ 6,855,322$ 8,908,418$ 14,036,614$ 13,251,549$ 14,593,905$ Net interest margin 4.55% 4.19% 4.07% 3.97% 4.17% 3.85% Core net interest margin (non-GAAP) 3.82% 3.83% 3.76% 3.72% 3.82% 3.67% March 31, 2019 Calculation of Tangible Book Value per Share Total common stockholders' equity 2,302,321$ Intangible assets: Goodwill (845,687) Other intangible assets (88,694) Total intangibles (934,381) Tangible common stockholders' equity 1,367,940$ Shares of common stock outstanding 92,568,361 Book value per common share 24.87$ Tangible book value per common share (non-GAAP) 14.78$ Stock Price as of April 17, 2019 25.94$ Price / Book Value per Share 1.0 x Price / Tangible Book Value per Share 1.8 x

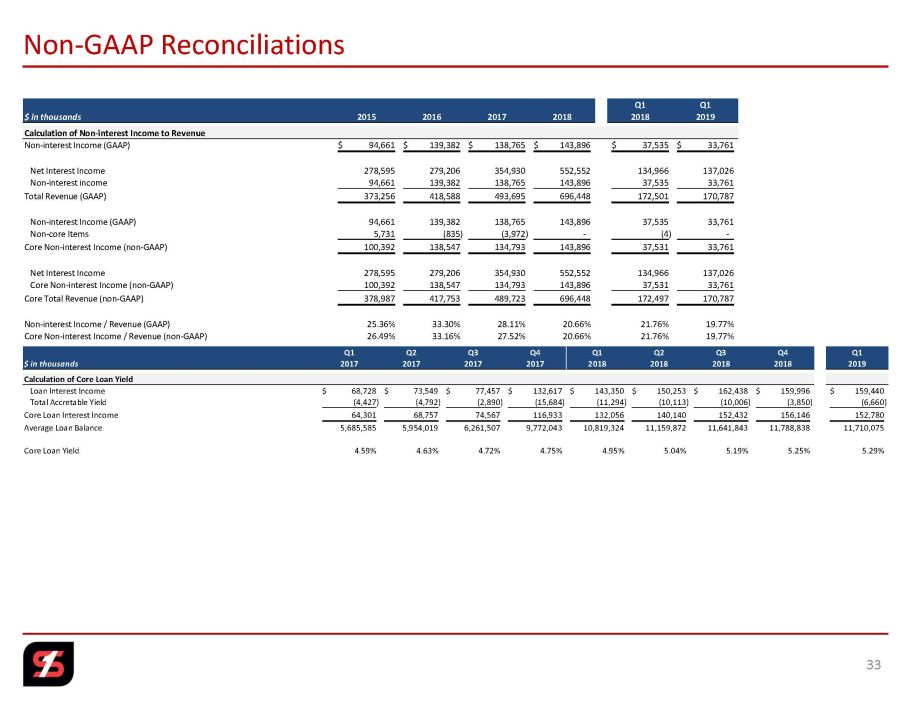

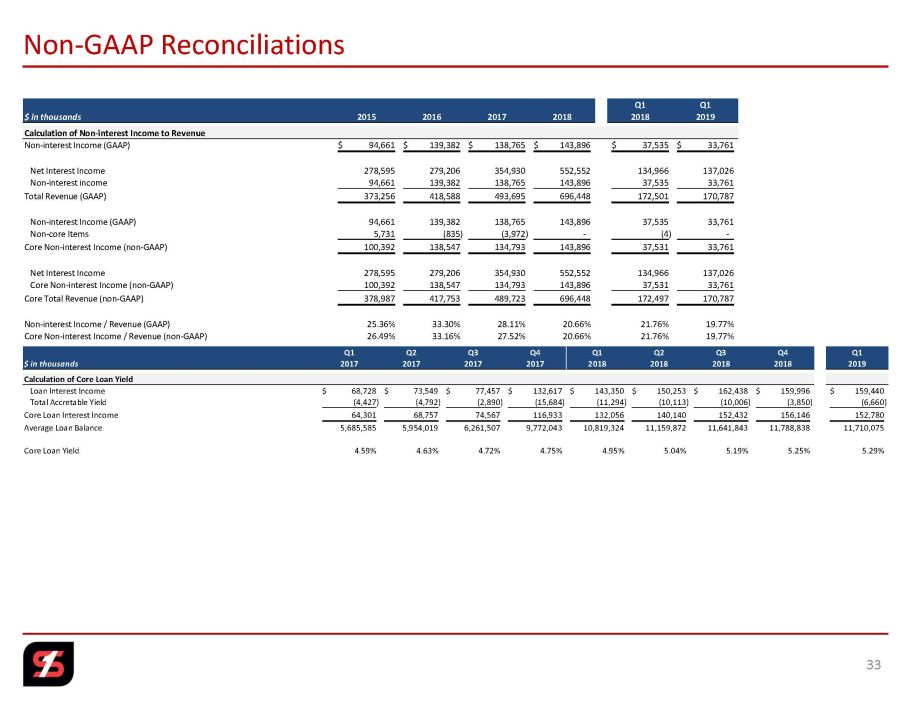

Non - GAAP Reconciliations 33 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 $ in thousands 2017 2017 2017 2017 2018 2018 2018 2018 2019 Calculation of Core Loan Yield Loan Interest Income 68,728$ 73,549$ 77,457$ 132,617$ 143,350$ 150,253$ 162,438$ 159,996$ 159,440$ Total Accretable Yield (4,427) (4,792) (2,890) (15,684) (11,294) (10,113) (10,006) (3,850) (6,660) Core Loan Interest Income 64,301 68,757 74,567 116,933 132,056 140,140 152,432 156,146 152,780 Average Loan Balance 5,685,585 5,954,019 6,261,507 9,772,043 10,819,324 11,159,872 11,641,843 11,788,838 11,710,075 Core Loan Yield 4.59% 4.63% 4.72% 4.75% 4.95% 5.04% 5.19% 5.25% 5.29% Q1 Q1 $ in thousands 2015 2016 2017 2018 2018 2019 Calculation of Non-interest Income to Revenue Non-interest Income (GAAP) 94,661$ 139,382$ 138,765$ 143,896$ 37,535$ 33,761$ Net Interest Income 278,595 279,206 354,930 552,552 134,966 137,026 Non-interest income 94,661 139,382 138,765 143,896 37,535 33,761 Total Revenue (GAAP) 373,256 418,588 493,695 696,448 172,501 170,787 Non-interest Income (GAAP) 94,661 139,382 138,765 143,896 37,535 33,761 Non-core Items 5,731 (835) (3,972) - (4) - Core Non-interest Income (non-GAAP) 100,392 138,547 134,793 143,896 37,531 33,761 Net Interest Income 278,595 279,206 354,930 552,552 134,966 137,026 Core Non-interest Income (non-GAAP) 100,392 138,547 134,793 143,896 37,531 33,761 Core Total Revenue (non-GAAP) 378,987 417,753 489,723 696,448 172,497 170,787 Non-interest Income / Revenue (GAAP) 25.36% 33.30% 28.11% 20.66% 21.76% 19.77% Core Non-interest Income / Revenue (non-GAAP) 26.49% 33.16% 27.52% 20.66% 21.76% 19.77%

34