Exhibit 99.1

NASDAQ: SFNC Investor Presentation

Forward - Looking Statements and Non - GAAP Financial Measures 2 Certain statements contained in this presentation may not be based on historical facts and are "forward - looking statements" within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . These forward - looking statements may be identified by reference to a future period(s) or by the use of forward - looking terminology, such as "anticipate," "estimate," "expect," "foresee," "may," "might," "will," "would," "could" or "intend," future or conditional verb tenses, and variations or negatives of such terms . These forward - looking statements include, without limitation, those relating to the Company's future growth, revenue, assets, asset quality, profitability and customer service, critical accounting policies, net interest margin, non - interest revenue, market conditions related to the Company's common stock repurchase program, allowance for loan losses, the effect of certain new accounting standards on the Company's financial statements, income tax deductions, credit quality, the level of credit losses from lending commitments, net interest revenue, interest rate sensitivity, loan loss experience, liquidity, capital resources, market risk, earnings, effect of pending litigation, acquisition strategy (including, without limitation, the expected benefits and timeline of the proposed merger of The Landrum Company with and into the Company), legal and regulatory limitations and compliance and competition . Readers are cautioned not to place undue reliance on the forward - looking statements contained in this presentation in that actual results could differ materially from those indicated in such forward - looking statements, due to a variety of factors . These factors include, but are not limited to, changes in the Company's operating or expansion strategy, availability of and costs associated with obtaining adequate and timely sources of liquidity, the ability to maintain credit quality, possible adverse rulings, judgments, settlements and other outcomes of pending litigation, the ability of the Company to collect amounts due under loan agreements, changes in consumer preferences, effectiveness of the Company's interest rate risk management strategies, laws and regulations affecting financial institutions in general or relating to taxes, the effect of pending or future legislation, the ability of the Company to repurchase its common stock on favorable terms, the ability of the Company to successfully implement its acquisition strategy (including, without limitation, the ability of the Company to receive all necessary approvals and meet other closing conditions with respect to the proposed merger of The Landrum Company with and into the Company), changes in interest rates and capital markets, inflation, customer acceptance of the Company's products and services, and other risk factors . Other relevant risk factors may be detailed from time to time in the Company's press releases and filings with the Securities and Exchange Commission . Any forward - looking statement speaks only as of the date of this Report, and we undertake no obligation to update these forward - looking statements to reflect events or circumstances that occur after the date of this Report . Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results . Non - GAAP Financial Measures This document contains financial information determined by methods other than in accordance with generally accepted accounting principles (GAAP) . The Company's management uses these non - GAAP financial measures in their analysis of the company's performance . These measures typically adjust GAAP performance measures to include the tax benefit associated with revenue items that are tax - exempt, as well as adjust income available to common shareholders for certain significant activities or nonrecurring transactions . Since the presentation of these GAAP performance measures and their impact differ between companies, management believes presentations of these non - GAAP financial measures provide useful supplemental information that is essential to a proper understanding of the operating results of the company's core businesses . These non - GAAP disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non - GAAP performance measures that may be presented by other companies .

Important Additional Information & Where to Find It 3 This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval with respect to the proposed merger of The Landrum Company ("Landrum") with and into Simmons First National Corporation ("Company"), with the Company as the surviving corporation ("Transaction") . No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933 , as amended, and no offer to sell or solicitation of an offer to buy shall be made in any jurisdiction in which such offer, solicitation or sale would be unlawful . In connection with the Transaction, the Company will file with the SEC a Registration Statement on Form S - 4 (the “Registration Statement”) that will include a proxy statement of Landrum and a prospectus of the Company (the “Proxy Statement/Prospectus”), and the Company may file with the SEC other relevant documents concerning the Transaction . The definitive Proxy Statement/Prospectus will be mailed to shareholders of Landrum . SHAREHOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE TRANSACTION CAREFULLY AND IN THEIR ENTIRETY WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC BY THE COMPANY, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION . Free copies of the Proxy Statement/Prospectus, as well as other filings containing information about the Company, may be obtained at the SEC’s Internet site (http : //www . sec . gov), when they are filed by the Company . You will also be able to obtain these documents, when they are filed, free of charge, from the Company at www . simmonsbank . com under the heading “Investor Relations . ” Copies of the Proxy Statement/Prospectus can also be obtained, when it becomes available, free of charge, by directing a request to Simmons First National Corporation, 501 Main Street, Pine Bluff, Arkansas 71601 , Attention : Stephen C . Massanelli, Chief Administrative Officer and Investor Relations Officer, Email : steve . massanelli@simmonsbank . com, Telephone : ( 870 ) 541 - 1000 or to The Landrum Company, 801 East Broadway, Columbia, Missouri 65201 , Attention : Kevin Gibbens , CEO, Telephone : ( 800 ) 618 - 5503 . Participants in the Solicitation The Company, Landrum and certain of its directors, executive officers and employees may be deemed to be participants in the solicitation of proxies from the shareholders of Landrum in connection with the proposed Transaction . Information about the Company’s directors and executive officers is available in its proxy statement for its 2019 annual meeting of stockholders, which was filed with the SEC on March 12 , 2019 . Information regarding all of the persons who may, under the rules of the SEC, be deemed participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement/Prospectus regarding the proposed Transaction and other relevant materials to be filed with the SEC when they become available . Free copies of these documents may be obtained as described in the preceding paragraph .

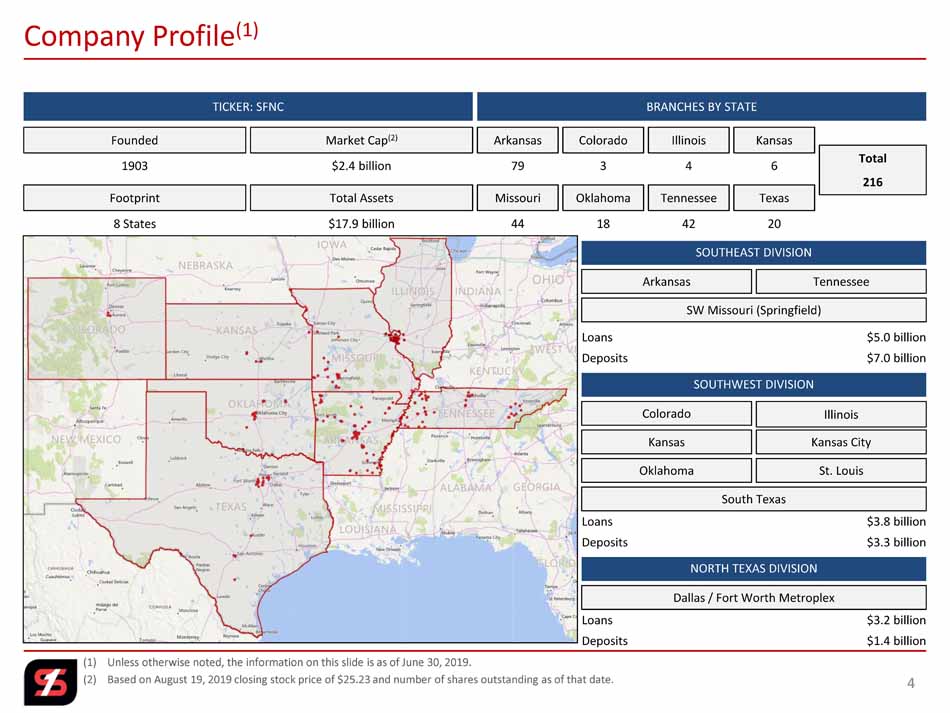

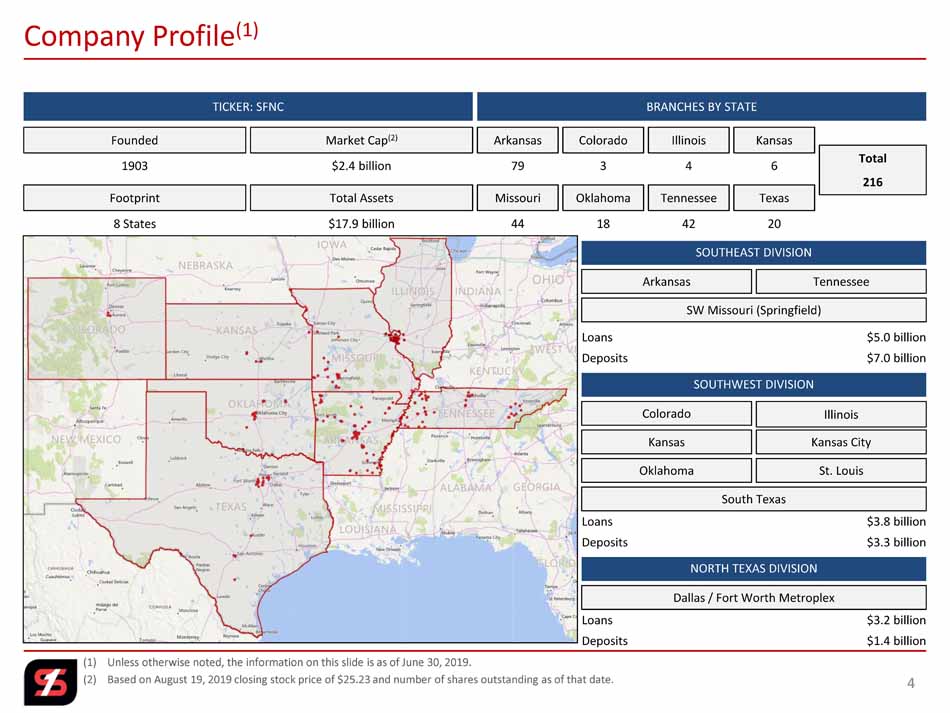

(1) Unless otherwise noted, the information on this slide is as of June 30, 2019. (2) Based on August 19, 2019 closing stock price of $25.23 and number of shares outstanding as of that date. Company Profile (1) 4 SOUTHEAST DIVISION SOUTHWEST DIVISION NORTH TEXAS DIVISION Arkansas SW Missouri (Springfield) Tennessee Dallas / Fort Worth Metroplex Loans $3.2 billion Deposits $1.4 billion Loans $5.0 billion Deposits $7.0 billion Loans $3.8 billion Deposits $3.3 billion BRANCHES BY STATE TICKER: SFNC Founded Footprint Total Assets Market Cap (2) 1903 $2.4 billion $17.9 billion 8 States Texas Oklahoma Tennessee Arkansas Colorado Missouri Kansas 79 20 3 6 44 18 42 Total 216 Illinois 4 South Texas St. Louis Kansas City Colorado Kansas Oklahoma Illinois

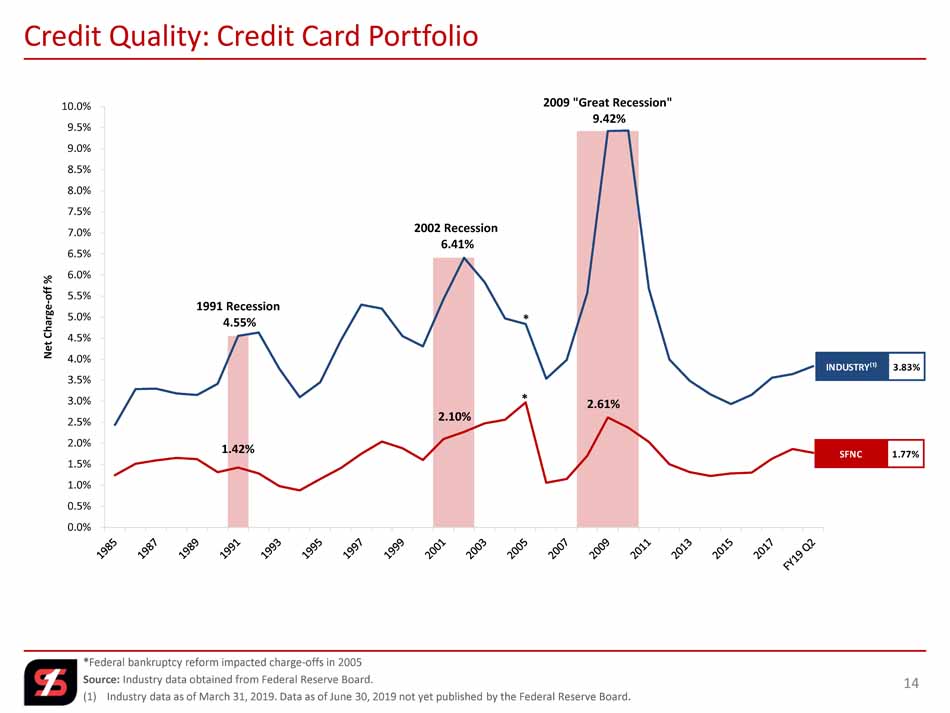

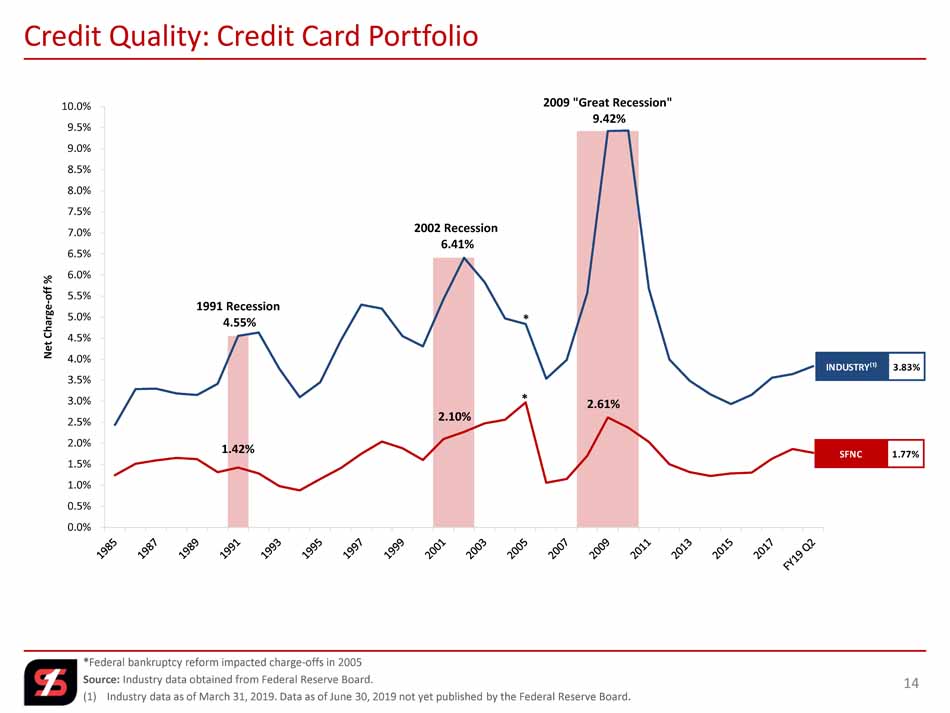

Q2 2019 Selected Business Units 5 ▪ $187.9 million nationwide credit card portfolio ▪ Loan yield (including fees): 14.6% ▪ History of excellent credit quality (1.77% net charge - off ratio) TRUST ▪ Total Assets: $5.3 billion – Managed Assets: $3.0 billion – Non - managed / Custodial Assets: $2.3 billion ▪ Profit Margin: 25.6% ▪ Growing investment management business ROYALTY TRUST ▪ Revenue: $1.0 million ▪ Profit Margin: 29.7% INVESTMENTS ▪ Beginning March 2019, retail investments services provided through networking arrangement with LPL Financial – LPL platform, among other things, provides customers with online self - service trade option – Retail Group: $1.2 billion AUM • $179.4 million in fee - based / advisory assets INSURANCE (EMPLOYEE BENEFITS & LIFE) ▪ Revenue: $1.3 million ▪ Profit Margin: 38.1% ▪ Mortgage Originations: $350 million ▪ 72% Purchase vs. 28% Refinance

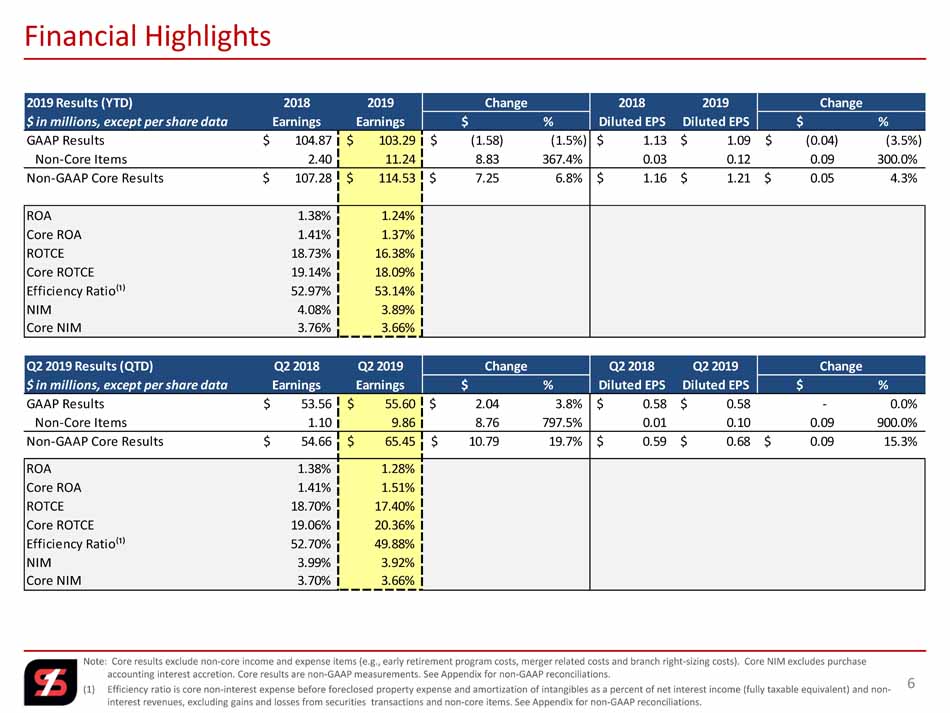

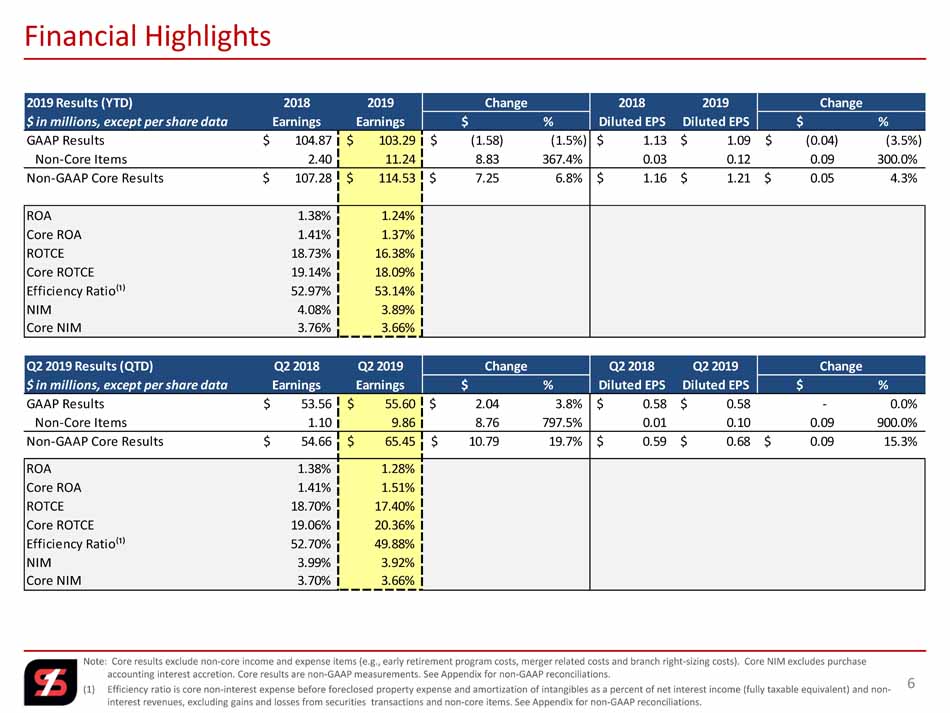

Note: Core results exclude non - core income and expense items (e.g., early retirement program costs, merger related costs and br anch right - sizing costs). Core NIM excludes purchase accounting interest accretion. Core results are non - GAAP measurements. See Appendix for non - GAAP reconciliations. (1) Efficiency ratio is core non - interest expense before foreclosed property expense and amortization of intangibles as a percent of net interest income (fully taxable equivalent) and non - interest revenues, excluding gains and losses from securities transactions and non - core items. See Appendix for non - GAAP reconc iliations. Financial Highlights 6 2019 Results (YTD) 2018 2019 Change 2018 2019 Change $ in millions, except per share data Earnings Earnings $ % Diluted EPS Diluted EPS $ % GAAP Results 104.87$ 103.29$ (1.58)$ (1.5%) 1.13$ 1.09$ (0.04)$ (3.5%) Non-Core Items 2.40 11.24 8.83 367.4% 0.03 0.12 0.09 300.0% Non-GAAP Core Results 107.28$ 114.53$ 7.25$ 6.8% 1.16$ 1.21$ 0.05$ 4.3% ROA 1.38% 1.24% Core ROA 1.41% 1.37% ROTCE 18.73% 16.38% Core ROTCE 19.14% 18.09% Efficiency Ratio⁽¹⁾ 52.97% 53.14% NIM 4.08% 3.89% Core NIM 3.76% 3.66% Q2 2019 Results (QTD) Q2 2018 Q2 2019 Change Q2 2018 Q2 2019 Change $ in millions, except per share data Earnings Earnings $ % Diluted EPS Diluted EPS $ % GAAP Results 53.56$ 55.60$ 2.04$ 3.8% 0.58$ 0.58$ - 0.0% Non-Core Items 1.10 9.86 8.76 797.5% 0.01 0.10 0.09 900.0% Non-GAAP Core Results 54.66$ 65.45$ 10.79$ 19.7% 0.59$ 0.68$ 0.09$ 15.3% ROA 1.38% 1.28% Core ROA 1.41% 1.51% ROTCE 18.70% 17.40% Core ROTCE 19.06% 20.36% Efficiency Ratio⁽¹⁾ 52.70% 49.88% NIM 3.99% 3.92% Core NIM 3.70% 3.66%

(1) Core results exclude non - core income and expense items (e.g., early retirement program costs, merger related costs and branch ri ght - sizing costs). Core results, tangible common equity to tangible assets and tangible book value are non - GAAP measurements. See Appendix for non - GAAP reconciliations. Q2 2019 Financial Highlights 7 NON - CORE ITEMS SELECTED HIGHLIGHTS (1) ▪ Merger - related, early retirement and branch right - sizing costs of $13.3 million pre - tax and $9.9 million after - tax ▪ Total loans were $13.1 billion, compared to $11.4 billion for the same period in 2018, an increase of $1.7 billion ▪ Deposits increased by $1.5 billion from Q1 2019 ▪ Total assets were $17.9 billion ▪ ROAA of 1.28% and Core ROAA of 1.51% ▪ ROACE of 9.48% and Core ROACE of 11.16% ▪ ROTCE of 17.40% and Core ROTCE of 20.36% ▪ NIM of 3.92% and Core NIM of 3.66% ▪ Diluted EPS of $0.58 and Core Diluted EPS of $0.68 ▪ Equity to asset ratio of 13.77% and tangible common equity to tangible asset ratio of 8.51% ▪ Book value per share was $25.57 and tangible book value per share was $14.90

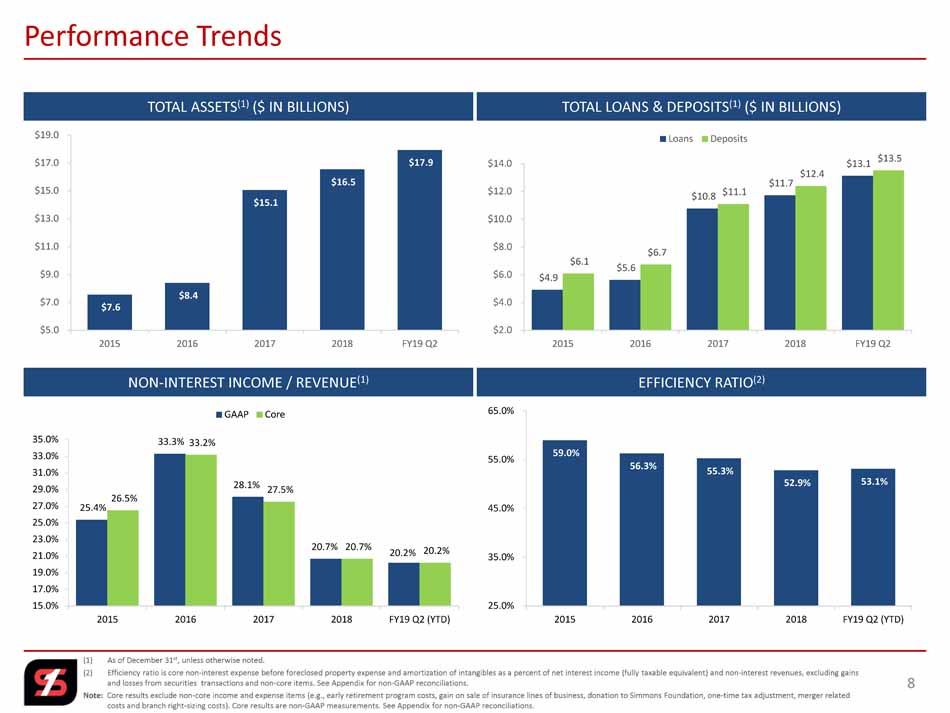

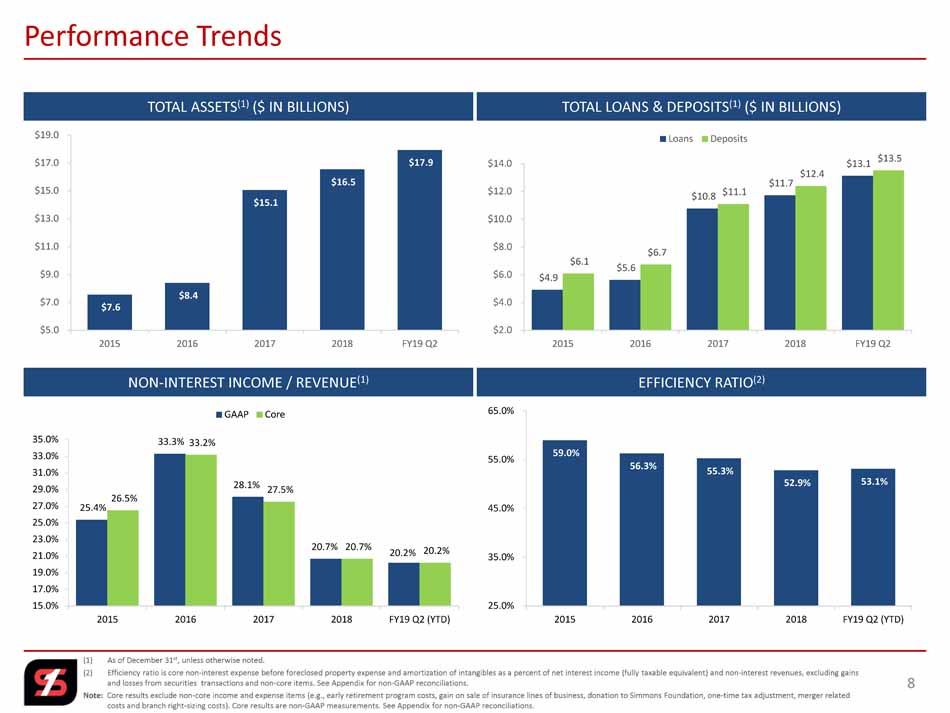

(1) As of December 31 st , unless otherwise noted. (2) Efficiency ratio is core non - interest expense before foreclosed property expense and amortization of intangibles as a percent of net interest income (fully taxable equivalent) and non - interest revenues, excluding gains and losses from securities transactions and non - core items. See Appendix for non - GAAP reconciliations. Note: Core results exclude non - core income and expense items (e.g., early retirement program costs, gain on sale of insurance lines of business, donation to Simmons Foundation, one - time tax adjustment, merger related costs and branch right - sizing costs). Core results are non - GAAP measurements. See Appendix for non - GAAP reconciliations. Performance Trends 8 TOTAL ASSETS (1) ($ IN BILLIONS) EFFICIENCY RATIO (2) NON - INTEREST INCOME / REVENUE (1) TOTAL LOANS & DEPOSITS (1) ($ IN BILLIONS) $7.6 $8.4 $15.1 $16.5 $17.9 $5.0 $7.0 $9.0 $11.0 $13.0 $15.0 $17.0 $19.0 2015 2016 2017 2018 FY19 Q2 25.4% 33.3% 28.1% 20.7% 20.2% 26.5% 33.2% 27.5% 20.7% 20.2% 15.0% 17.0% 19.0% 21.0% 23.0% 25.0% 27.0% 29.0% 31.0% 33.0% 35.0% 2015 2016 2017 2018 FY19 Q2 (YTD) GAAP Core 59.0% 56.3% 55.3% 52.9% 53.1% 25.0% 35.0% 45.0% 55.0% 65.0% 2015 2016 2017 2018 FY19 Q2 (YTD) $4.9 $5.6 $10.8 $11.7 $13.1 $6.1 $6.7 $11.1 $12.4 $13.5 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 2015 2016 2017 2018 FY19 Q2 Loans Deposits

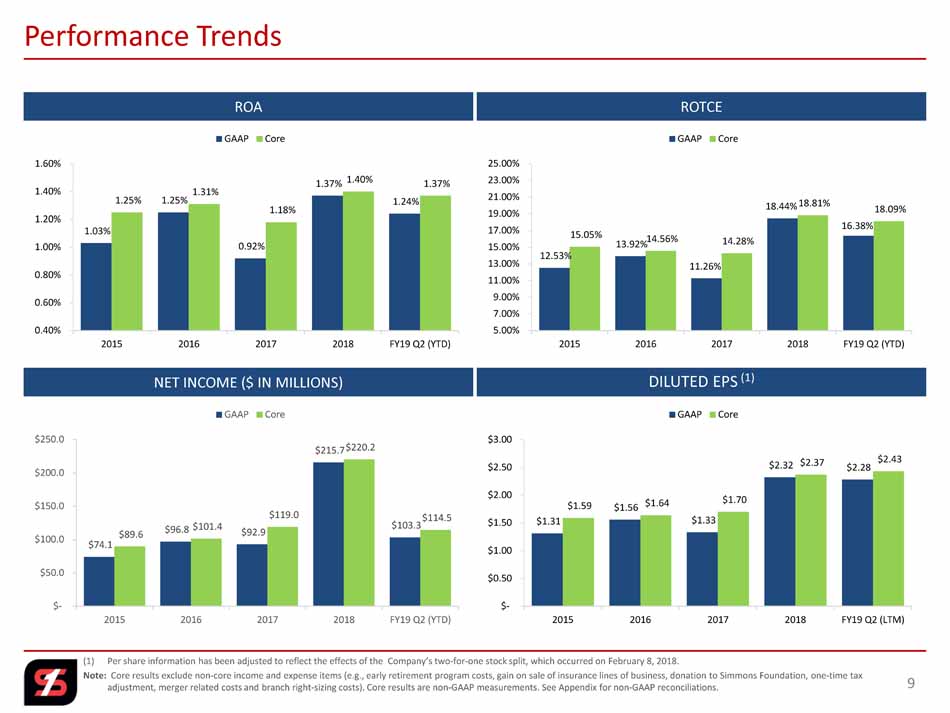

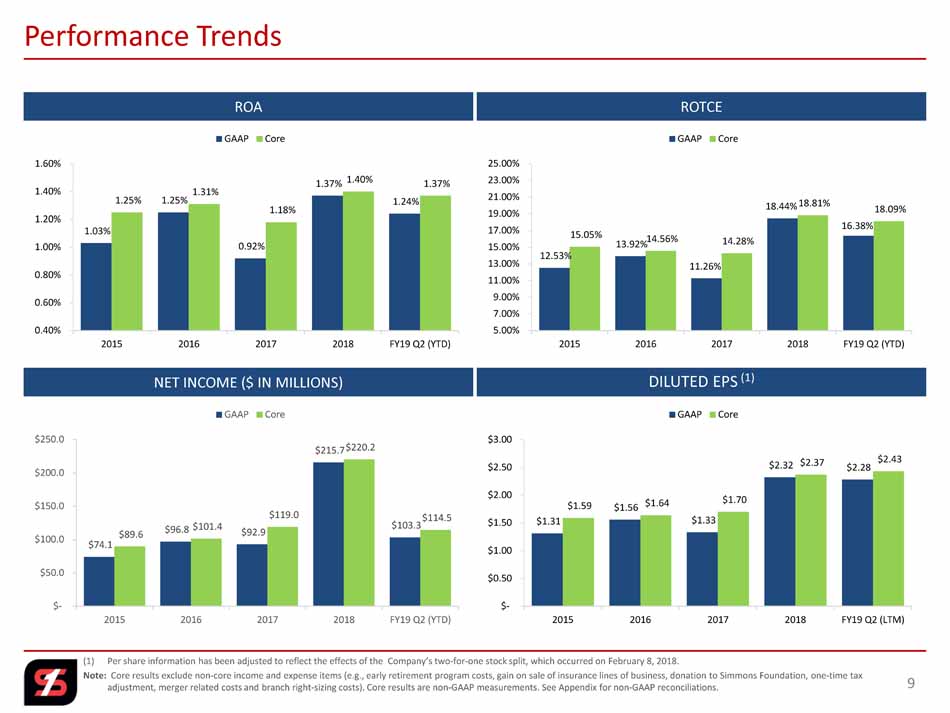

(1) Per share information has been adjusted to reflect the effects of the Company’s two - for - one stock split, which occurred on Febr uary 8, 2018. Note: Core results exclude non - core income and expense items (e.g., early retirement program costs, gain on sale of insurance lines of business, donation to Simmons Foundation, one - time tax adjustment, merger related costs and branch right - sizing costs). Core results are non - GAAP measurements. See Appendix for non - GA AP reconciliations. Performance Trends 9 ROA DILUTED EPS (1) NET INCOME ($ IN MILLIONS) ROTCE 1.03% 1.25% 0.92% 1.37% 1.24% 1.25% 1.31% 1.18% 1.40% 1.37% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 2015 2016 2017 2018 FY19 Q2 (YTD) GAAP Core 12.53% 13.92% 11.26% 18.44% 16.38% 15.05% 14.56% 14.28% 18.81% 18.09% 5.00% 7.00% 9.00% 11.00% 13.00% 15.00% 17.00% 19.00% 21.00% 23.00% 25.00% 2015 2016 2017 2018 FY19 Q2 (YTD) GAAP Core $74.1 $96.8 $92.9 $215.7 $103.3 $89.6 $101.4 $119.0 $220.2 $114.5 $- $50.0 $100.0 $150.0 $200.0 $250.0 2015 2016 2017 2018 FY19 Q2 (YTD) GAAP Core $1.31 $1.56 $1.33 $2.32 $2.28 $1.59 $1.64 $1.70 $2.37 $2.43 $- $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 2015 2016 2017 2018 FY19 Q2 (LTM) GAAP Core

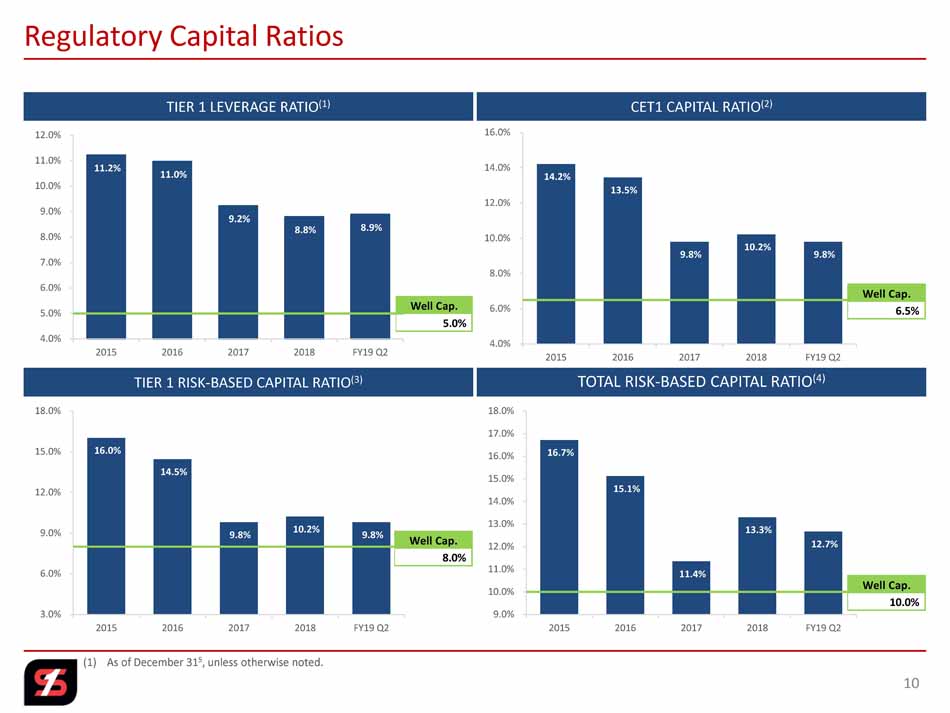

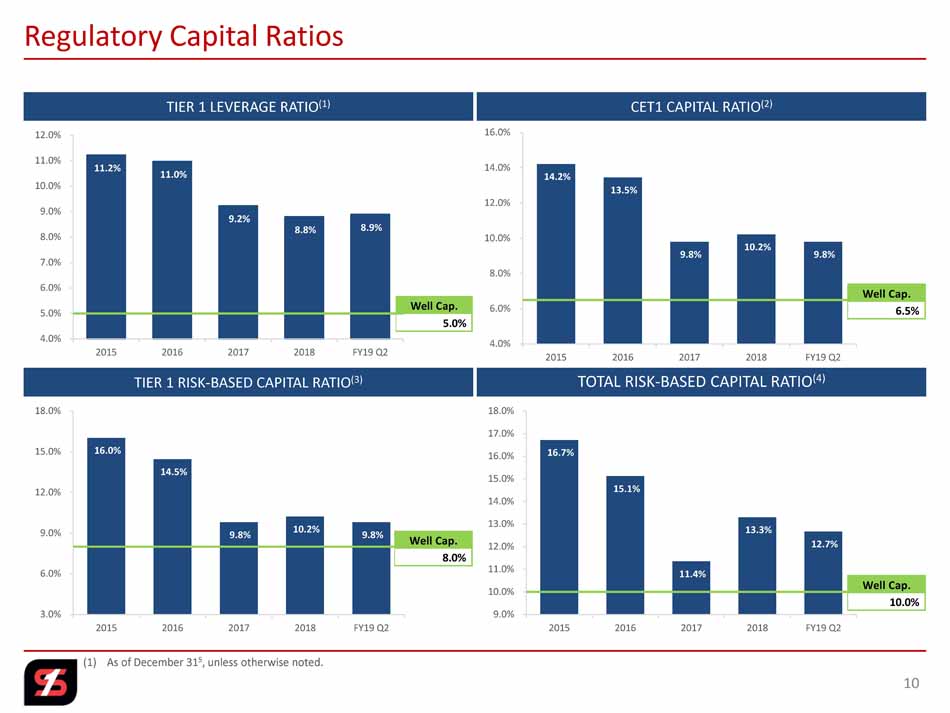

14.2% 13.5% 9.8% 10.2% 9.8% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 2015 2016 2017 2018 FY19 Q2 16.0% 14.5% 9.8% 10.2% 9.8% 3.0% 6.0% 9.0% 12.0% 15.0% 18.0% 2015 2016 2017 2018 FY19 Q2 16.7% 15.1% 11.4% 13.3% 12.7% 9.0% 10.0% 11.0% 12.0% 13.0% 14.0% 15.0% 16.0% 17.0% 18.0% 2015 2016 2017 2018 FY19 Q2 11.2% 11.0% 9.2% 8.8% 8.9% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% 11.0% 12.0% 2015 2016 2017 2018 FY19 Q2 (1) As of December 31 5 , unless otherwise noted. Regulatory Capital Ratios 10 TIER 1 LEVERAGE RATIO (1) TOTAL RISK - BASED CAPITAL RATIO (4) TIER 1 RISK - BASED CAPITAL RATIO (3) CET1 CAPITAL RATIO (2) Well Cap. 5.0% Well Cap. 6.5% Well Cap. 8.0% Well Cap. 10.0%

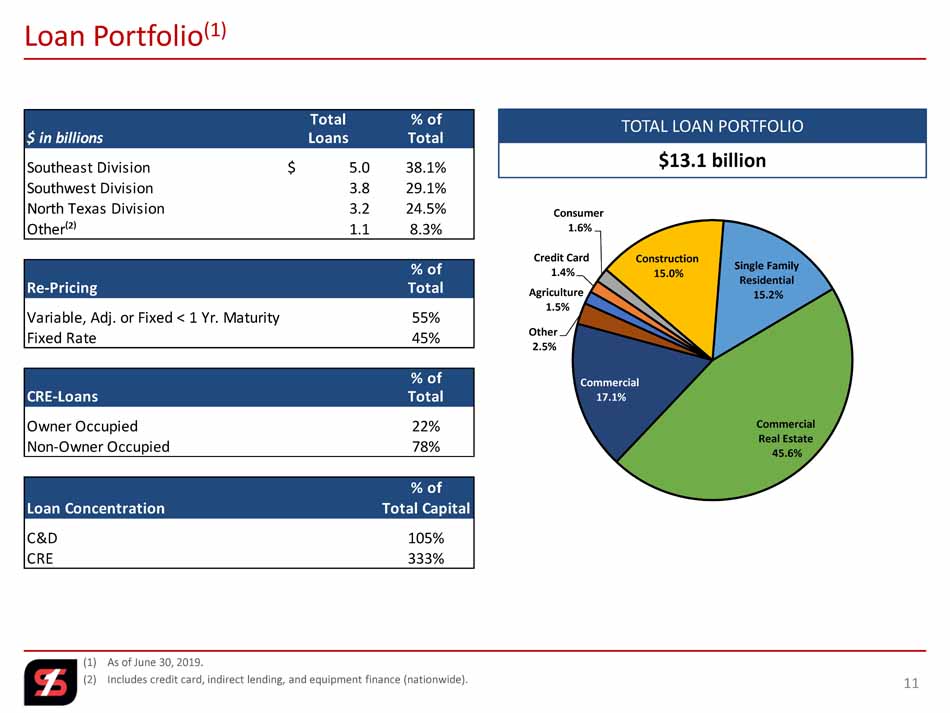

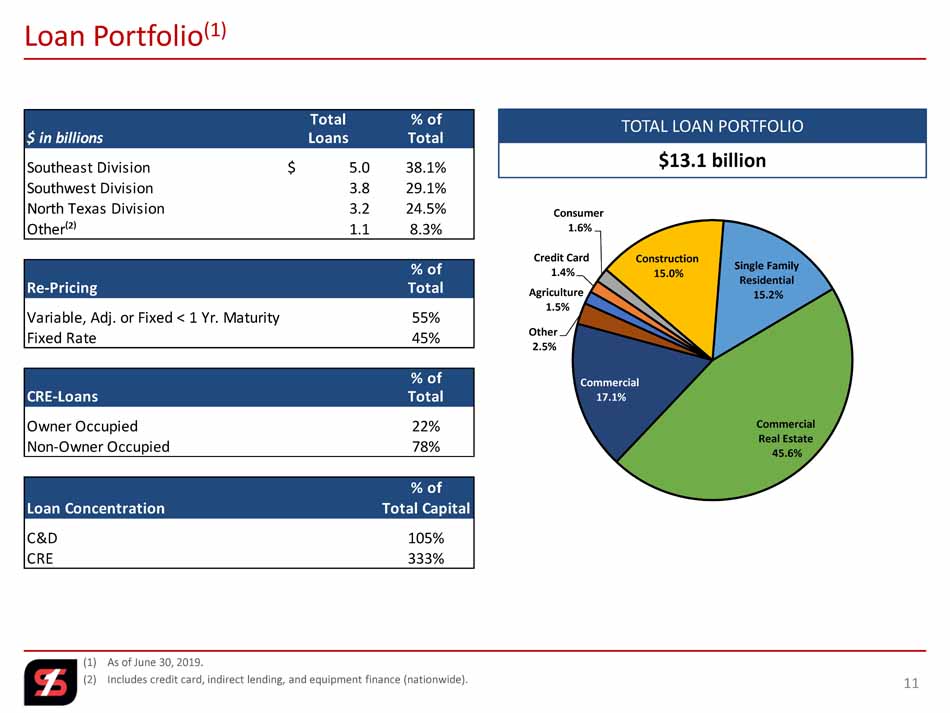

Agriculture 1.5% Credit Card 1.4% Consumer 1.6% Construction 15.0% Single Family Residential 15.2% Commercial Real Estate 45.6% Commercial 17.1% Other 2.5% (1) As of June 30, 2019. (2) Includes credit card, indirect lending, and equipment finance (nationwide). Loan Portfolio (1) 11 TOTAL LOAN PORTFOLIO $13.1 billion Total % of $ in billions Loans Total Southeast Division 5.0$ 38.1% Southwest Division 3.8 29.1% North Texas Division 3.2 24.5% Other⁽²⁾ 1.1 8.3% % of Re-Pricing Total Variable, Adj. or Fixed < 1 Yr. Maturity 55% Fixed Rate 45% % of CRE-Loans Total Owner Occupied 22% Non-Owner Occupied 78% % of Loan Concentration Total Capital C&D 105% CRE 333%

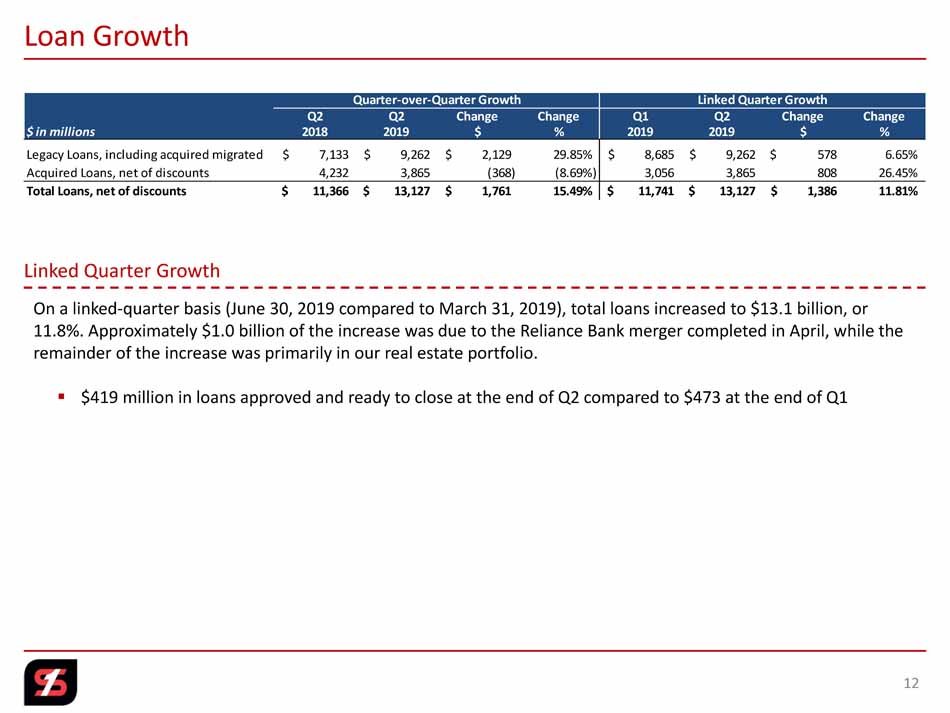

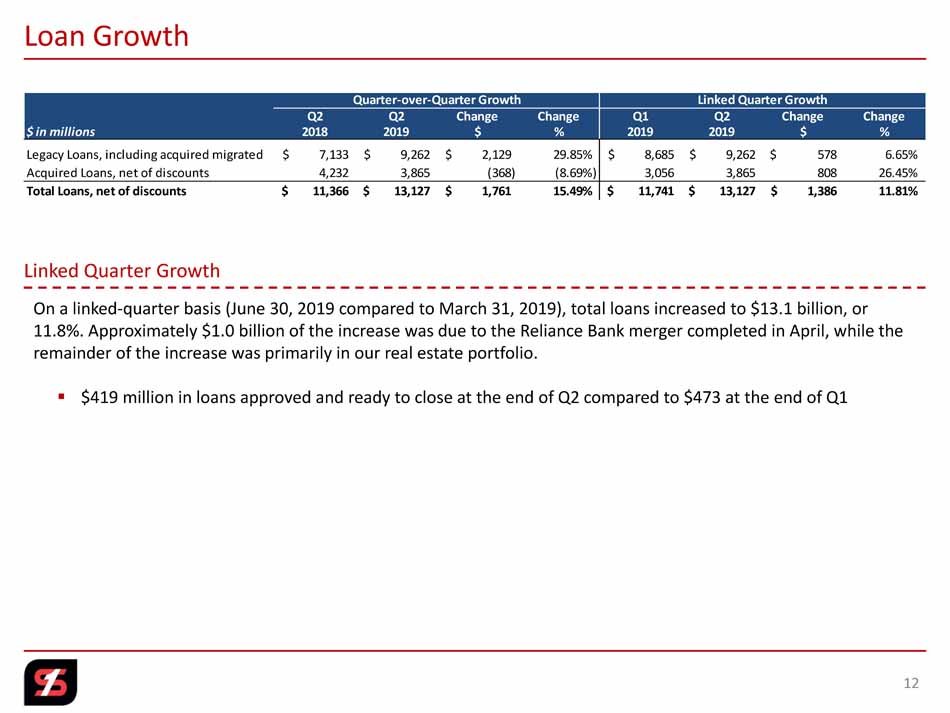

Loan Growth 12 Linked Quarter Growth On a linked - quarter basis (June 30, 2019 compared to March 31, 2019), total loans increased to $13.1 billion, or 11.8%. Approximately $1.0 billion of the increase was due to the Reliance Bank merger completed in April, while the remainder of the increase was primarily in our real estate portfolio. ▪ $419 million in loans approved and ready to close at the end of Q2 compared to $473 at the end of Q1 Quarter-over-Quarter Growth Linked Quarter GrowthQ2 Q2 Change Change Q1 Q2 Change Change $ in millions 2018 2019 $ % 2019 2019 $ % Legacy Loans, including acquired migrated 7,133$ 9,262$ 2,129$ 29.85% 8,685$ 9,262$ 578$ 6.65% Acquired Loans, net of discounts 4,232 3,865 (368) (8.69%) 3,056 3,865 808 26.45% Total Loans, net of discounts 11,366$ 13,127$ 1,761$ 15.49% 11,741$ 13,127$ 1,386$ 11.81%

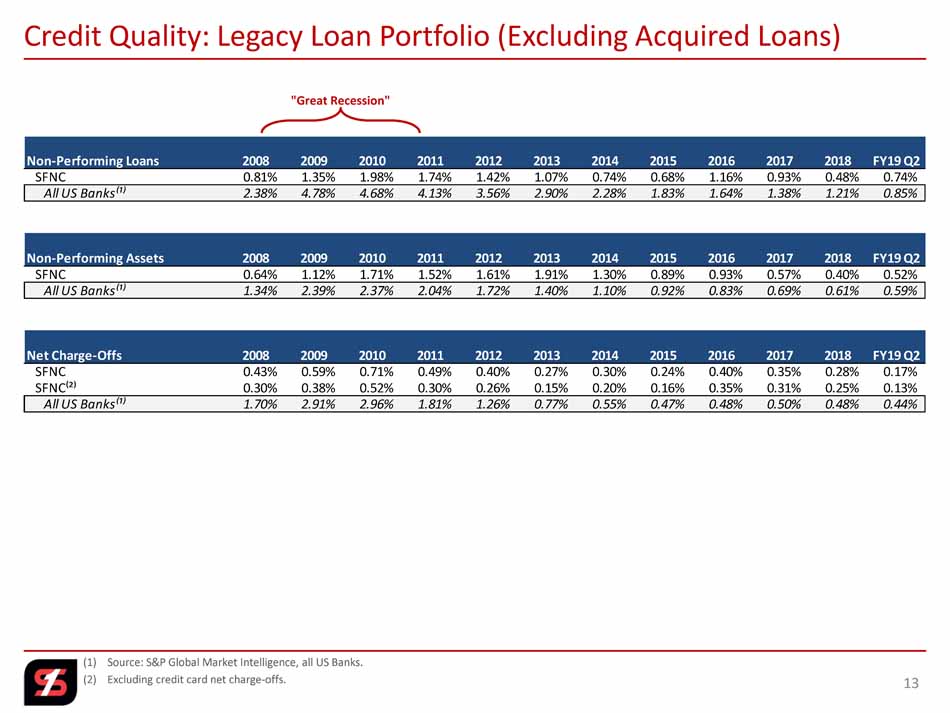

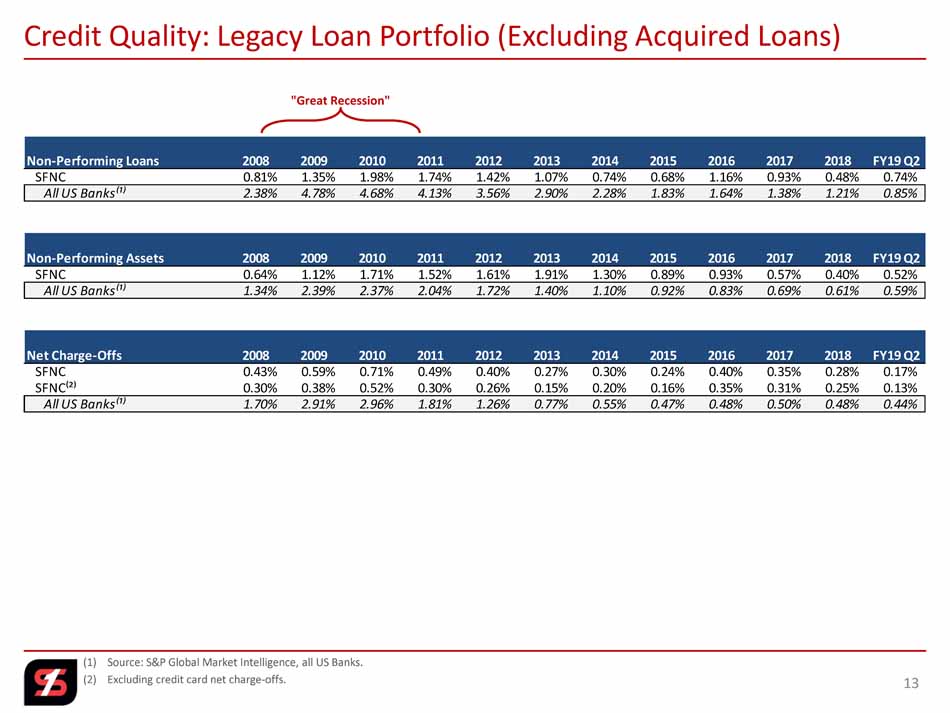

(1) Source: S&P Global Market Intelligence, all US Banks. (2) Excluding credit card net charge - offs. Credit Quality: Legacy Loan Portfolio (Excluding Acquired Loans) 13 "Great Recession" Non-Performing Loans 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 FY19 Q2 SFNC 0.81% 1.35% 1.98% 1.74% 1.42% 1.07% 0.74% 0.68% 1.16% 0.93% 0.48% 0.74% All US Banks⁽¹⁾ 2.38% 4.78% 4.68% 4.13% 3.56% 2.90% 2.28% 1.83% 1.64% 1.38% 1.21% 0.85% Non-Performing Assets 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 FY19 Q2 SFNC 0.64% 1.12% 1.71% 1.52% 1.61% 1.91% 1.30% 0.89% 0.93% 0.57% 0.40% 0.52% All US Banks⁽¹⁾ 1.34% 2.39% 2.37% 2.04% 1.72% 1.40% 1.10% 0.92% 0.83% 0.69% 0.61% 0.59% Net Charge-Offs 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 FY19 Q2 SFNC 0.43% 0.59% 0.71% 0.49% 0.40% 0.27% 0.30% 0.24% 0.40% 0.35% 0.28% 0.17% SFNC⁽²⁾ 0.30% 0.38% 0.52% 0.30% 0.26% 0.15% 0.20% 0.16% 0.35% 0.31% 0.25% 0.13% All US Banks⁽¹⁾ 1.70% 2.91% 2.96% 1.81% 1.26% 0.77% 0.55% 0.47% 0.48% 0.50% 0.48% 0.44%

1991 Recession 4.55% 2002 Recession 6.41% 2009 "Great Recession" 9.42% 1.42% 2.10% * 2.61% * 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 6.0% 6.5% 7.0% 7.5% 8.0% 8.5% 9.0% 9.5% 10.0% Net Charge - off % * Federal bankruptcy reform impacted charge - offs in 2005 Source: Industry data obtained from Federal Reserve Board. (1) Industry data as of March 31, 2019. Data as of June 30, 2019 not yet published by the Federal Reserve Board. Credit Quality: Credit Card Portfolio 14 SFNC 1.77% INDUSTRY⁽¹⁾ 3.83%

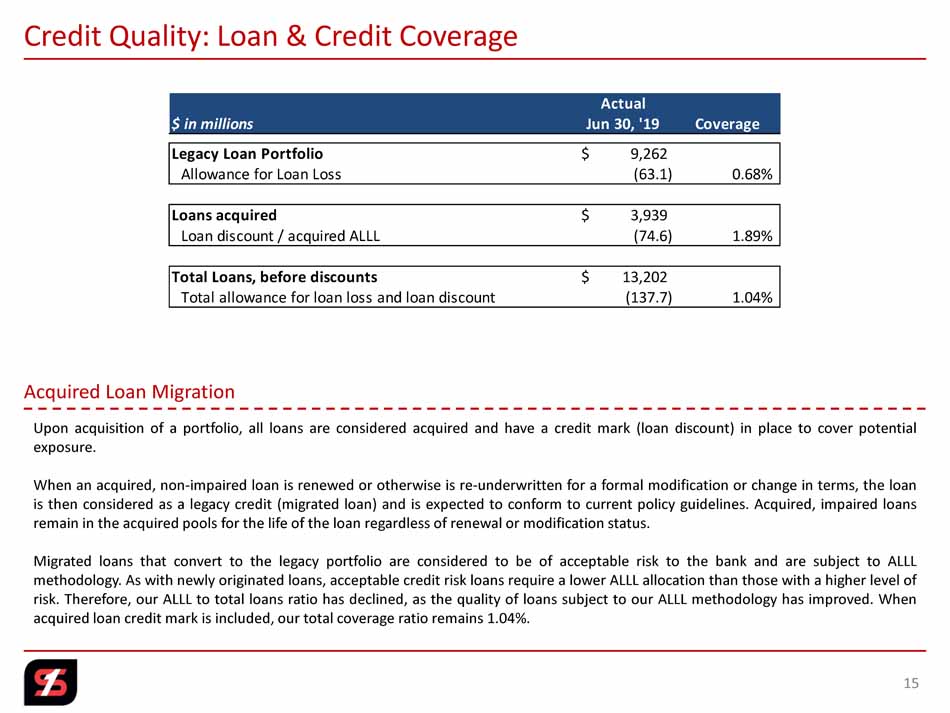

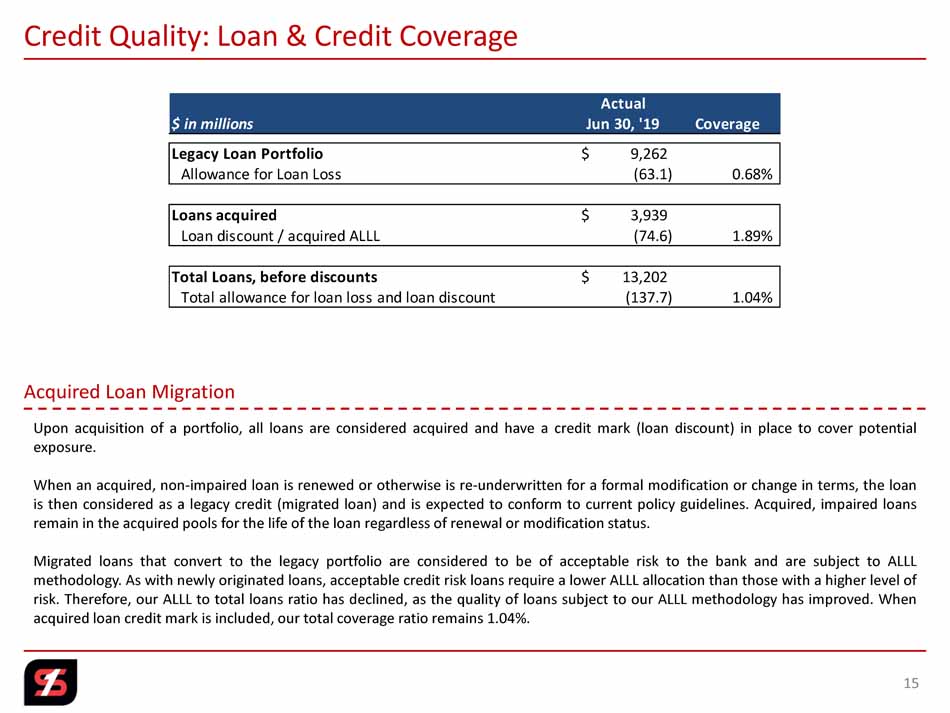

Credit Quality: Loan & Credit Coverage 15 Upon acquisition of a portfolio, all loans are considered acquired and have a credit mark (loan discount) in place to cover potential exposure . When an acquired, non - impaired loan is renewed or otherwise is re - underwritten for a formal modification or change in terms, the loan is then considered as a legacy credit (migrated loan) and is expected to conform to current policy guidelines . Acquired, impaired loans remain in the acquired pools for the life of the loan regardless of renewal or modification status . Migrated loans that convert to the legacy portfolio are considered to be of acceptable risk to the bank and are subject to ALLL methodology . As with newly originated loans, acceptable credit risk loans require a lower ALLL allocation than those with a higher level of risk . Therefore, our ALLL to total loans ratio has declined, as the quality of loans subject to our ALLL methodology has improved . When acquired loan credit mark is included, our total coverage ratio remains 1 . 04 % . Acquired Loan Migration Actual $ in millions Jun 30, '19 Coverage Legacy Loan Portfolio 9,262$ Allowance for Loan Loss (63.1) 0.68% Loans acquired 3,939$ Loan discount / acquired ALLL (74.6) 1.89% Total Loans, before discounts 13,202$ Total allowance for loan loss and loan discount (137.7) 1.04%

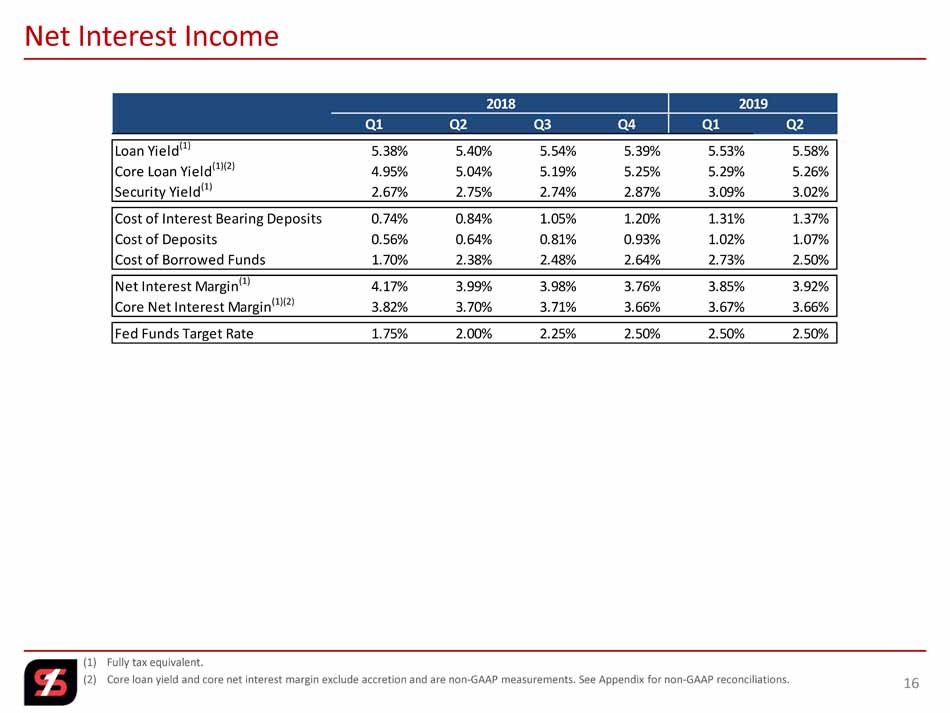

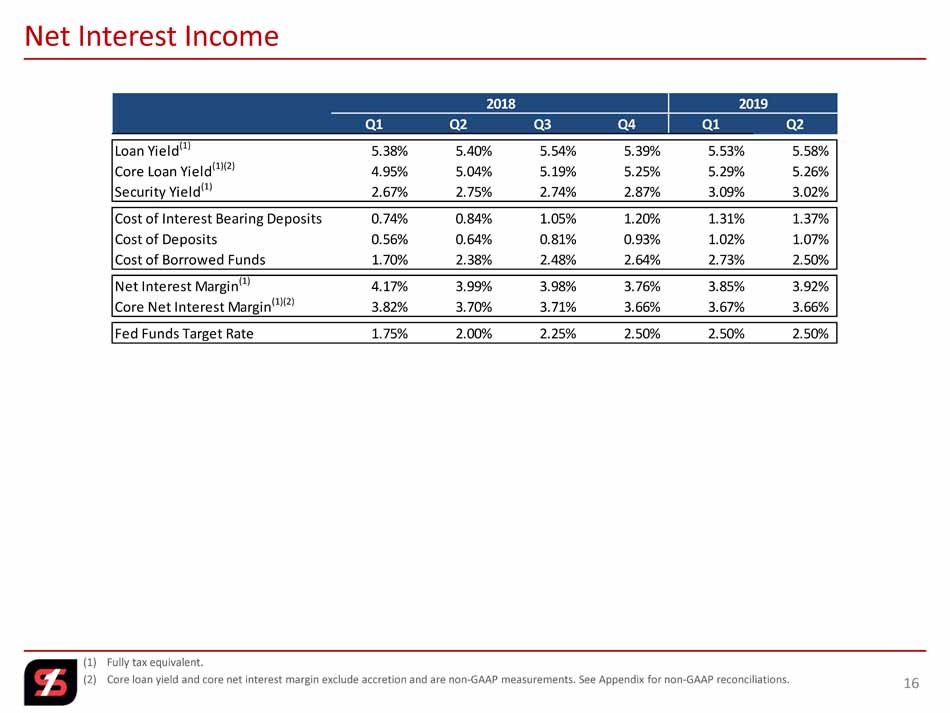

(1) Fully tax equivalent. (2) Core loan yield and core net interest margin exclude accretion and are non - GAAP measurements. See Appendix for non - GAAP reconcil iations. Net Interest Income 16 2018 2019 Q1 Q2 Q3 Q4 Q1 Q2 Loan Yield (1) 5.38% 5.40% 5.54% 5.39% 5.53% 5.58% Core Loan Yield (1)(2) 4.95% 5.04% 5.19% 5.25% 5.29% 5.26% Security Yield (1) 2.67% 2.75% 2.74% 2.87% 3.09% 3.02% Cost of Interest Bearing Deposits 0.74% 0.84% 1.05% 1.20% 1.31% 1.37% Cost of Deposits 0.56% 0.64% 0.81% 0.93% 1.02% 1.07% Cost of Borrowed Funds 1.70% 2.38% 2.48% 2.64% 2.73% 2.50% Net Interest Margin (1) 4.17% 3.99% 3.98% 3.76% 3.85% 3.92% Core Net Interest Margin (1)(2) 3.82% 3.70% 3.71% 3.66% 3.67% 3.66% Fed Funds Target Rate 1.75% 2.00% 2.25% 2.50% 2.50% 2.50%

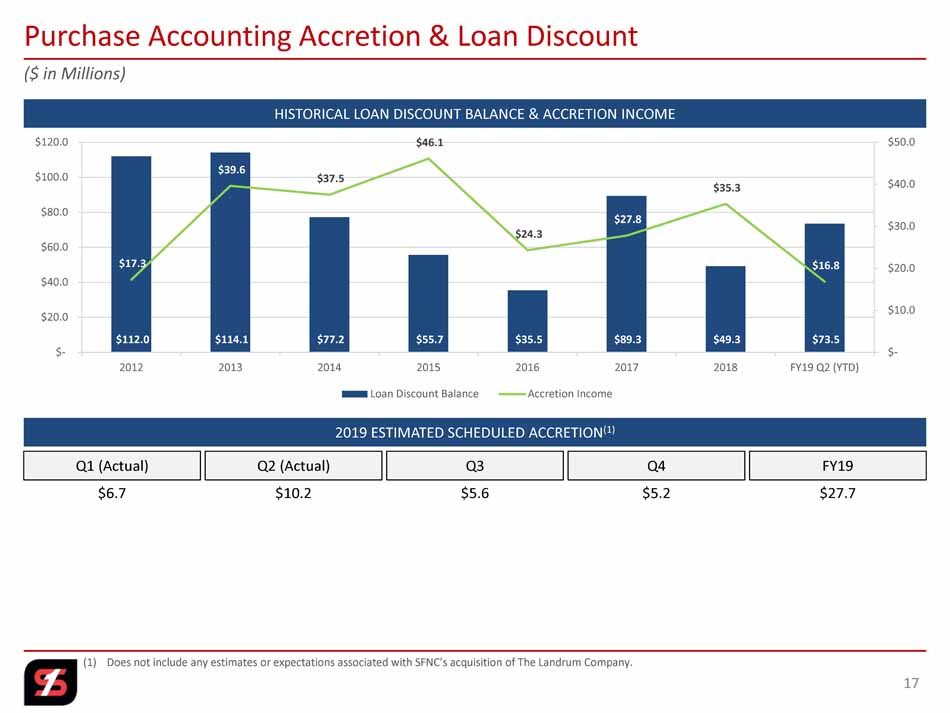

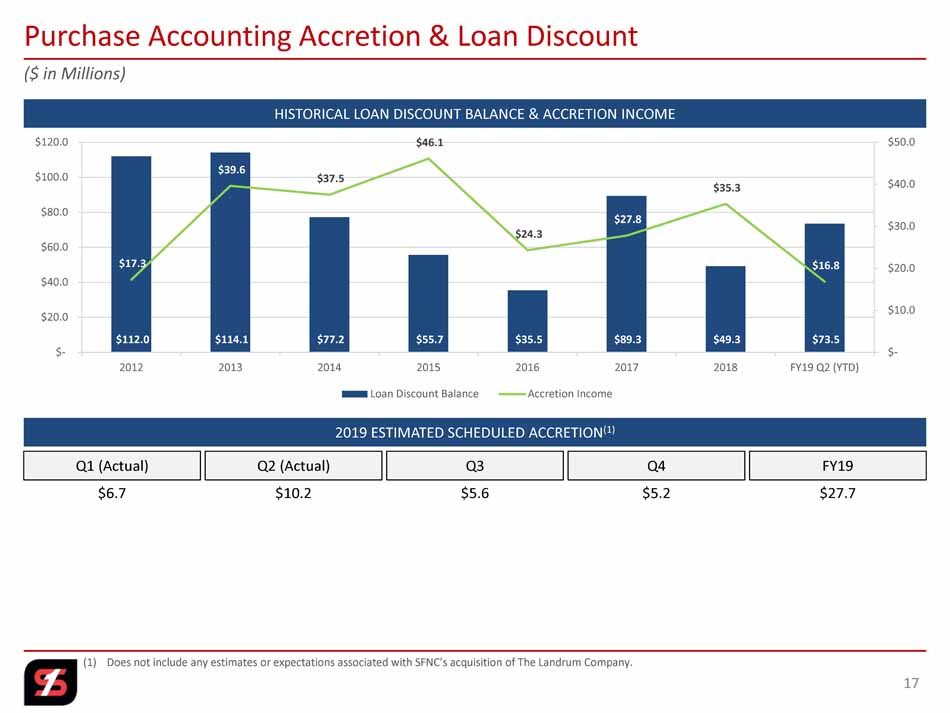

($ in Millions) Purchase Accounting Accretion & Loan Discount 17 HISTORICAL LOAN DISCOUNT BALANCE & ACCRETION INCOME 2019 ESTIMATED SCHEDULED ACCRETION (1) (1) Does not include any estimates or expectations associated with SFNC’s acquisition of The Landrum Company. $5.6 $6.7 $5.2 $10.2 Q1 (Actual) Q2 (Actual) Q4 Q3 FY19 $27.7 $112.0 $114.1 $77.2 $55.7 $35.5 $89.3 $49.3 $73.5 $17.3 $39.6 $37.5 $46.1 $24.3 $27.8 $35.3 $16.8 $- $10.0 $20.0 $30.0 $40.0 $50.0 $- $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 2012 2013 2014 2015 2016 2017 2018 FY19 Q2 (YTD) Loan Discount Balance Accretion Income

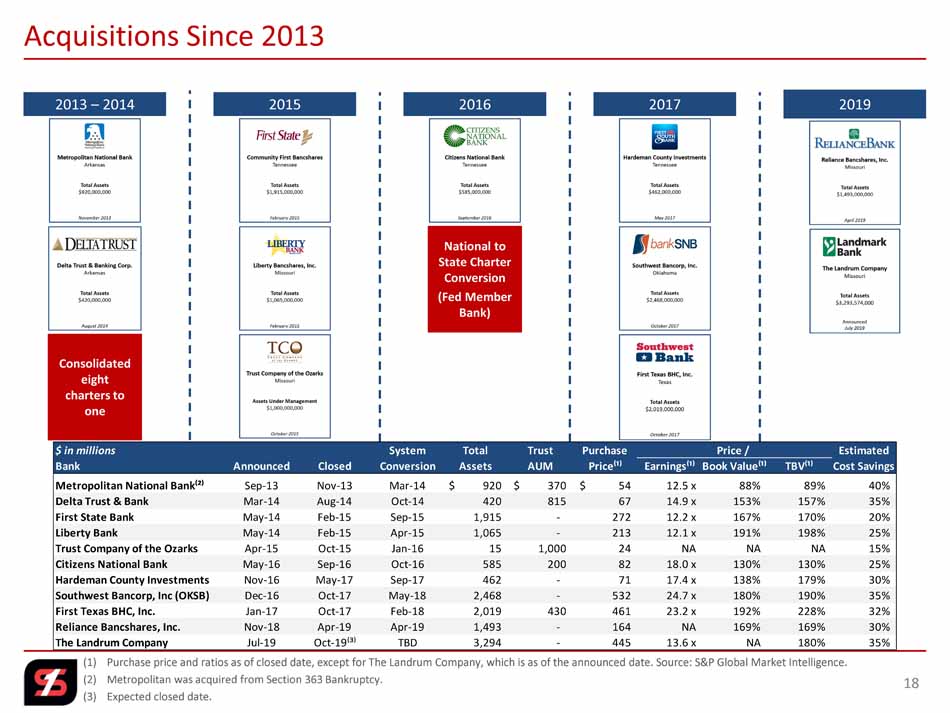

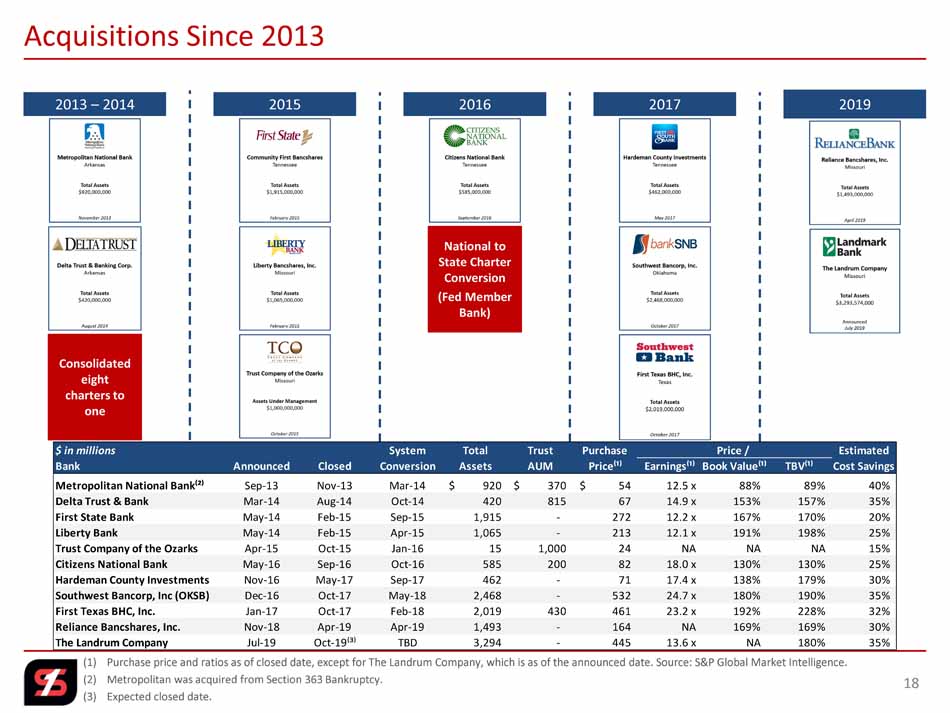

(1) Purchase price and ratios as of closed date, except for The Landrum Company, which is as of the announced date. Source: S&P G lob al Market Intelligence. (2) Metropolitan was acquired from Section 363 Bankruptcy. (3) Expected closed date. Acquisitions Since 2013 18 2013 – 2014 Consolidated eight charters to one National to State Charter Conversion (Fed Member Bank) 2015 2016 2017 2019 $ in millions System Total Trust Purchase Price / Estimated Bank Announced Closed Conversion Assets AUM Price⁽¹⁾ Earnings⁽¹⁾ Book Value⁽¹⁾ TBV⁽¹⁾ Cost Savings Metropolitan National Bank⁽²⁾ Sep-13 Nov-13 Mar-14 920$ 370$ 54$ 12.5 x 88% 89% 40% Delta Trust & Bank Mar-14 Aug-14 Oct-14 420 815 67 14.9 x 153% 157% 35% First State Bank May-14 Feb-15 Sep-15 1,915 - 272 12.2 x 167% 170% 20% Liberty Bank May-14 Feb-15 Apr-15 1,065 - 213 12.1 x 191% 198% 25% Trust Company of the Ozarks Apr-15 Oct-15 Jan-16 15 1,000 24 NA NA NA 15% Citizens National Bank May-16 Sep-16 Oct-16 585 200 82 18.0 x 130% 130% 25% Hardeman County Investments Nov-16 May-17 Sep-17 462 - 71 17.4 x 138% 179% 30% Southwest Bancorp, Inc (OKSB) Dec-16 Oct-17 May-18 2,468 - 532 24.7 x 180% 190% 35% First Texas BHC, Inc. Jan-17 Oct-17 Feb-18 2,019 430 461 23.2 x 192% 228% 32% Reliance Bancshares, Inc. Nov-18 Apr-19 Apr-19 1,493 - 164 NA 169% 169% 30% The Landrum Company Jul-19 Oct-19⁽³⁾ TBD 3,294 - 445 13.6 x NA 180% 35%

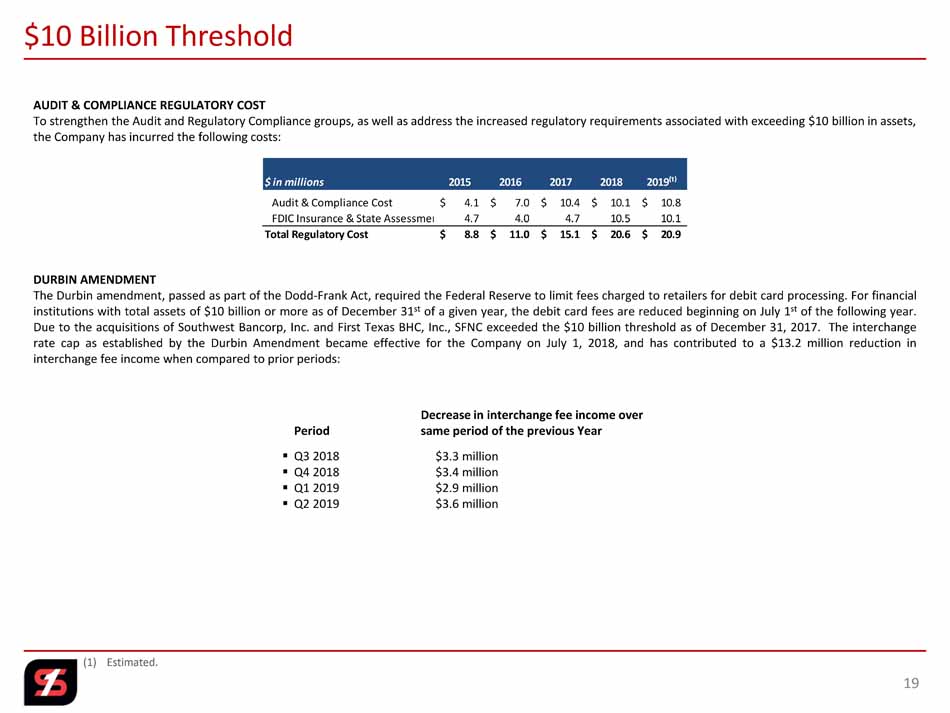

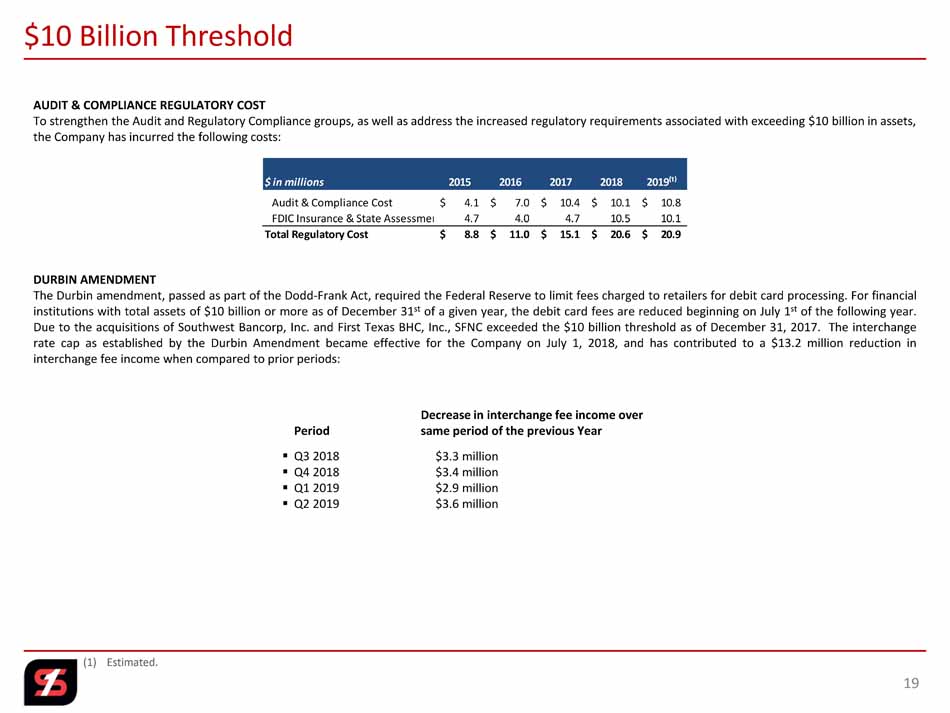

(1) Estimated. $10 Billion Threshold 19 AUDIT & COMPLIANCE REGULATORY COST To strengthen the Audit and Regulatory Compliance groups, as well as address the increased regulatory requirements associated wi th exceeding $10 billion in assets, the Company has incurred the following costs: DURBIN AMENDMENT The Durbin amendment, passed as part of the Dodd - Frank Act, required the Federal Reserve to limit fees charged to retailers for debit card processing . For financial institutions with total assets of $ 10 billion or more as of December 31 st of a given year, the debit card fees are reduced beginning on July 1 st of the following year . Due to the acquisitions of Southwest Bancorp, Inc . and First Texas BHC, Inc . , SFNC exceeded the $ 10 billion threshold as of December 31 , 2017 . The interchange rate cap as established by the Durbin Amendment became effective for the Company on July 1 , 2018 , and has contributed to a $ 13 . 2 million reduction in interchange fee income when compared to prior periods : Period Decrease in interchange fee income over same period of the previous Year ▪ Q3 2018 ▪ Q4 2018 ▪ Q1 2019 ▪ Q2 2019 $3.3 million $3.4 million $2.9 million $3.6 million $ in millions 2015 2016 2017 2018 2019⁽¹⁾ Audit & Compliance Cost 4.1$ 7.0$ 10.4$ 10.1$ 10.8$ FDIC Insurance & State Assessment 4.7 4.0 4.7 10.5 10.1 Total Regulatory Cost 8.8$ 11.0$ 15.1$ 20.6$ 20.9$

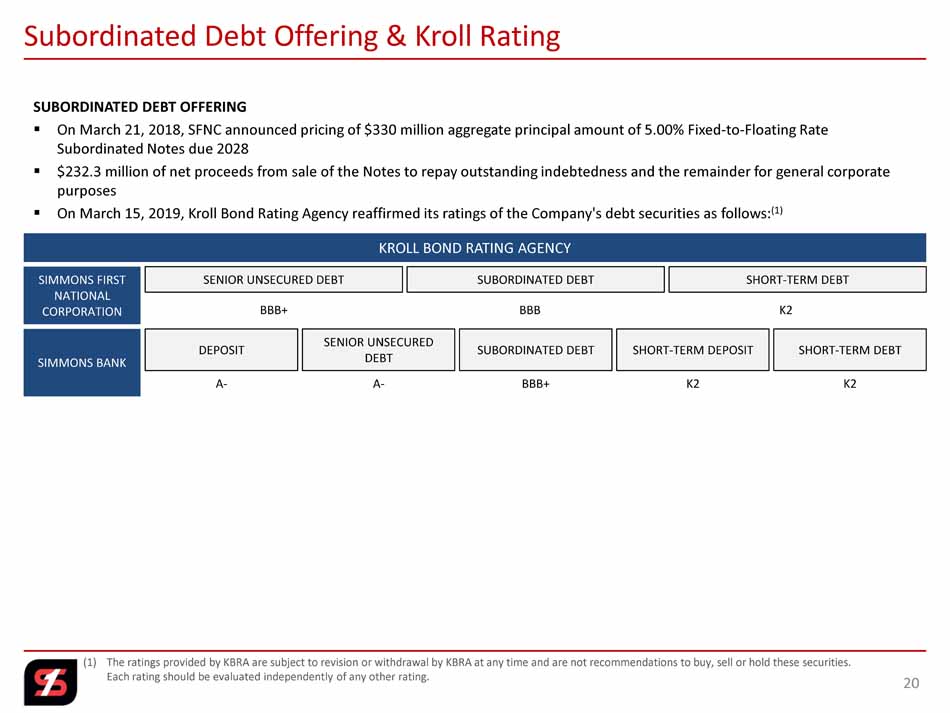

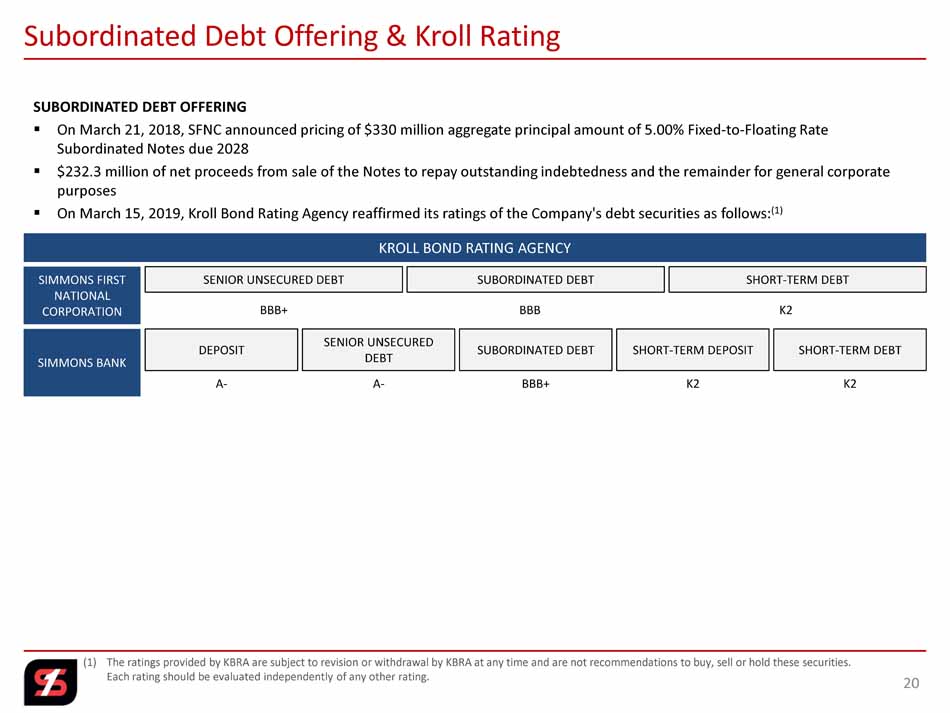

(1) The ratings provided by KBRA are subject to revision or withdrawal by KBRA at any time and are not recommendations to buy, se ll or hold these securities. Each rating should be evaluated independently of any other rating. Subordinated Debt Offering & Kroll Rating 20 SENIOR UNSECURED DEBT SHORT - TERM DEBT SUBORDINATED DEBT SENIOR UNSECURED DEBT SHORT - TERM DEBT SUBORDINATED DEBT SHORT - TERM DEPOSIT DEPOSIT BBB+ BBB K2 SIMMONS FIRST NATIONAL CORPORATION SIMMONS BANK A - A - BBB+ K2 K2 SUBORDINATED DEBT OFFERING ▪ On March 21, 2018, SFNC announced pricing of $330 million aggregate principal amount of 5.00% Fixed - to - Floating Rate Subordinated Notes due 2028 ▪ $232.3 million of net proceeds from sale of the Notes to repay outstanding indebtedness and the remainder for general corpora te purposes ▪ On March 15, 2019, Kroll Bond Rating Agency reaffirmed its ratings of the Company's debt securities as follows: (1) KROLL BOND RATING AGENCY

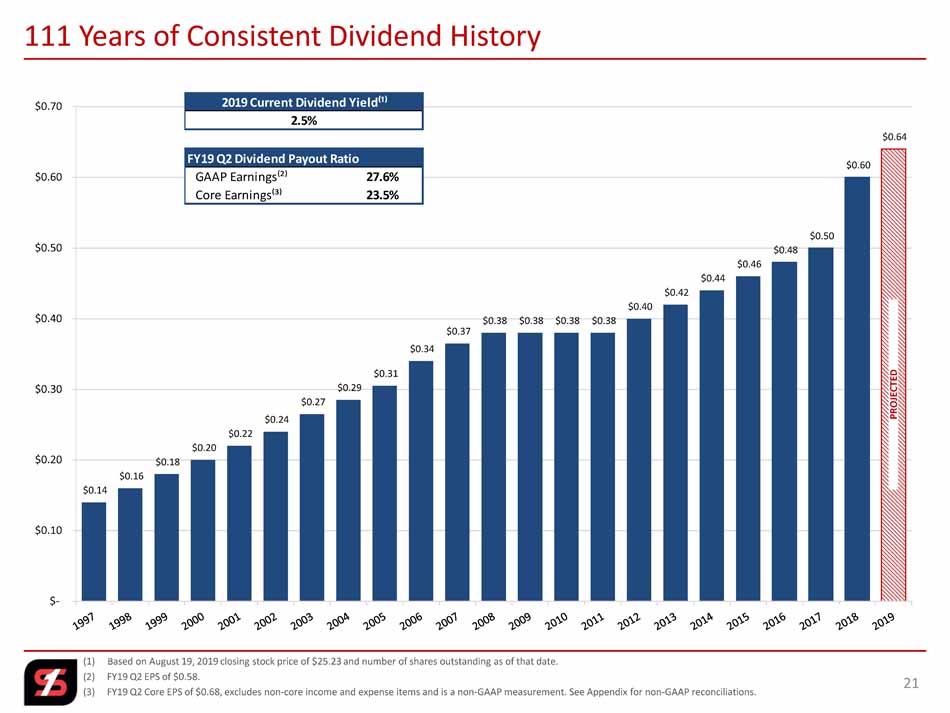

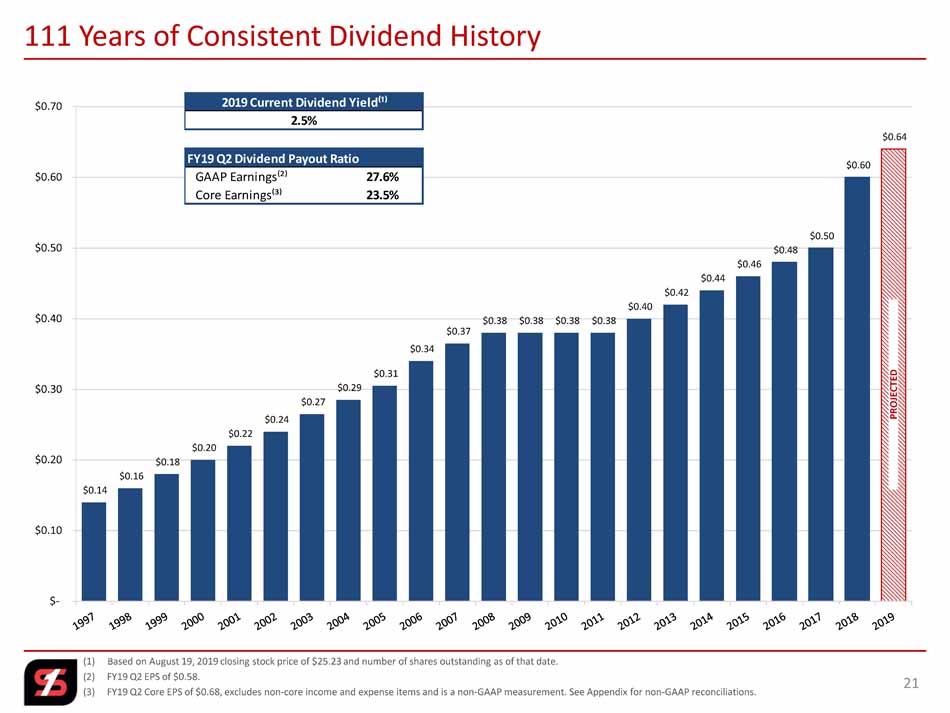

$0.14 $0.16 $0.18 $0.20 $0.22 $0.24 $0.27 $0.29 $0.31 $0.34 $0.37 $0.38 $0.38 $0.38 $0.38 $0.40 $0.42 $0.44 $0.46 $0.48 $0.50 $0.60 $0.64 $- $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 $0.70 (1) Based on August 19, 2019 closing stock price of $25.23 and number of shares outstanding as of that date. (2) FY19 Q2 EPS of $0.58. (3) FY19 Q2 Core EPS of $0.68, excludes non - core income and expense items and is a non - GAAP measurement. See Appendix for non - GAAP r econciliations. 111 Years of Consistent Dividend History 21 PROJECTED 2019 Current Dividend Yield⁽¹⁾ 2.5% FY19 Q2 Dividend Payout Ratio GAAP Earnings⁽²⁾ 27.6% Core Earnings⁽³⁾ 23.5%

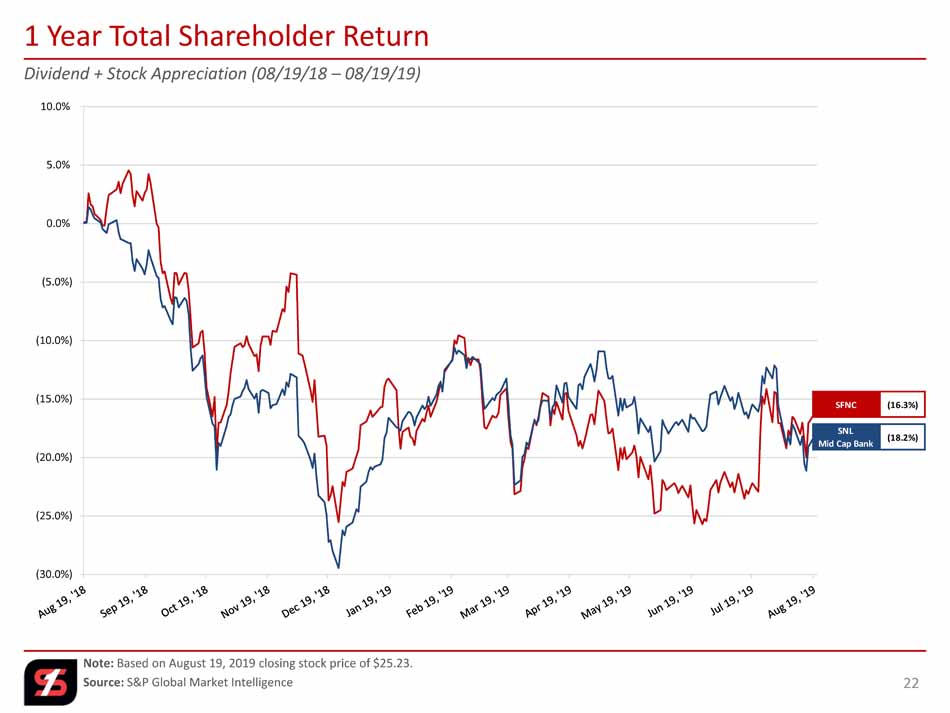

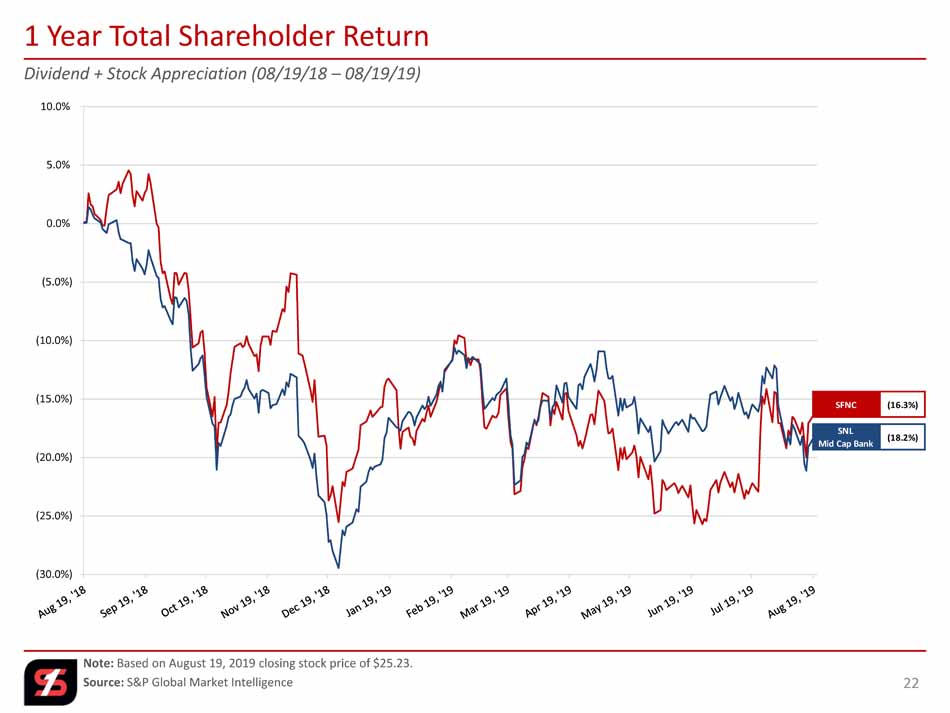

(30.0%) (25.0%) (20.0%) (15.0%) (10.0%) (5.0%) 0.0% 5.0% 10.0% Dividend + Stock Appreciation (08/19/18 – 08/19/19) Note: Based on August 19, 2019 closing stock price of $25.23. Source: S&P Global Market Intelligence 1 Year Total Shareholder Return 22 SFNC (16.3%) SNL Mid Cap Bank (18.2%)

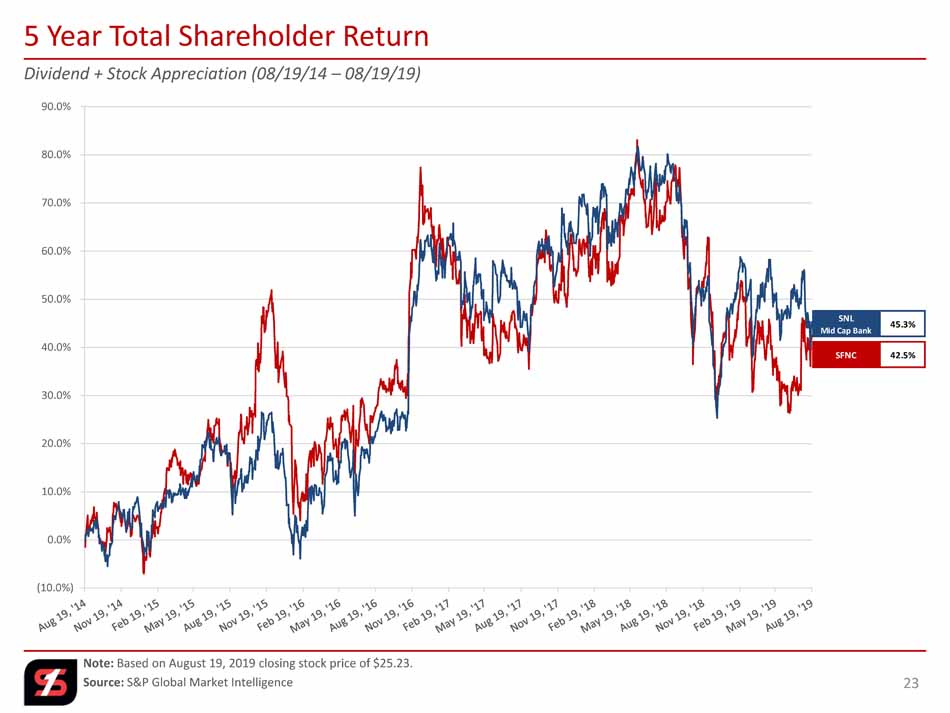

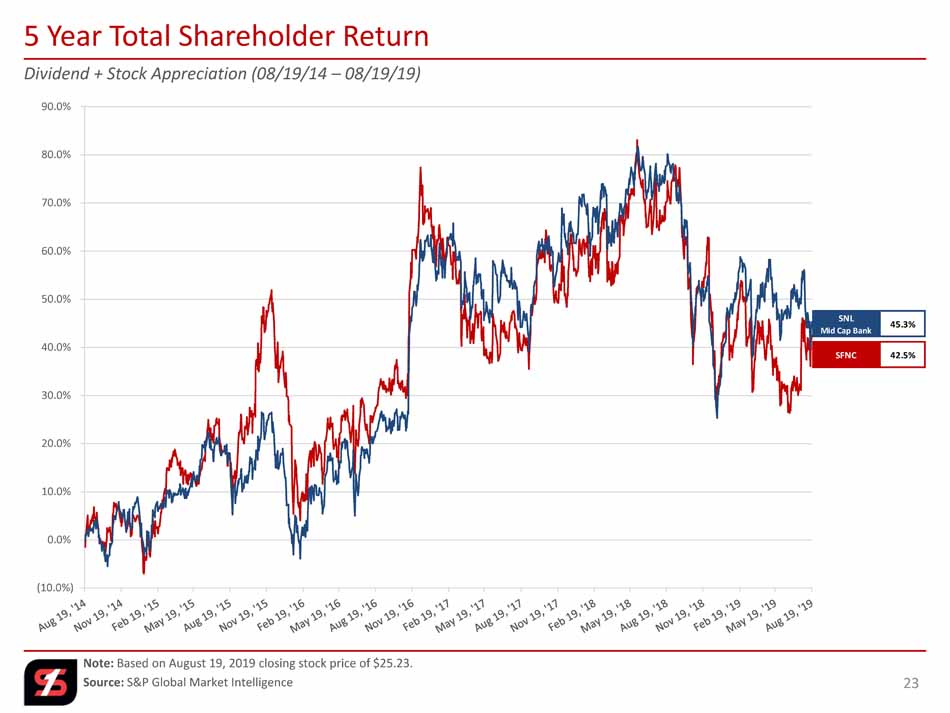

(10.0%) 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% 90.0% Dividend + Stock Appreciation (08/19/14 – 08/19/19) Note: Based on August 19, 2019 closing stock price of $25.23. Source: S&P Global Market Intelligence 5 Year Total Shareholder Return 23 SFNC 42.5% SNL Mid Cap Bank 45.3%

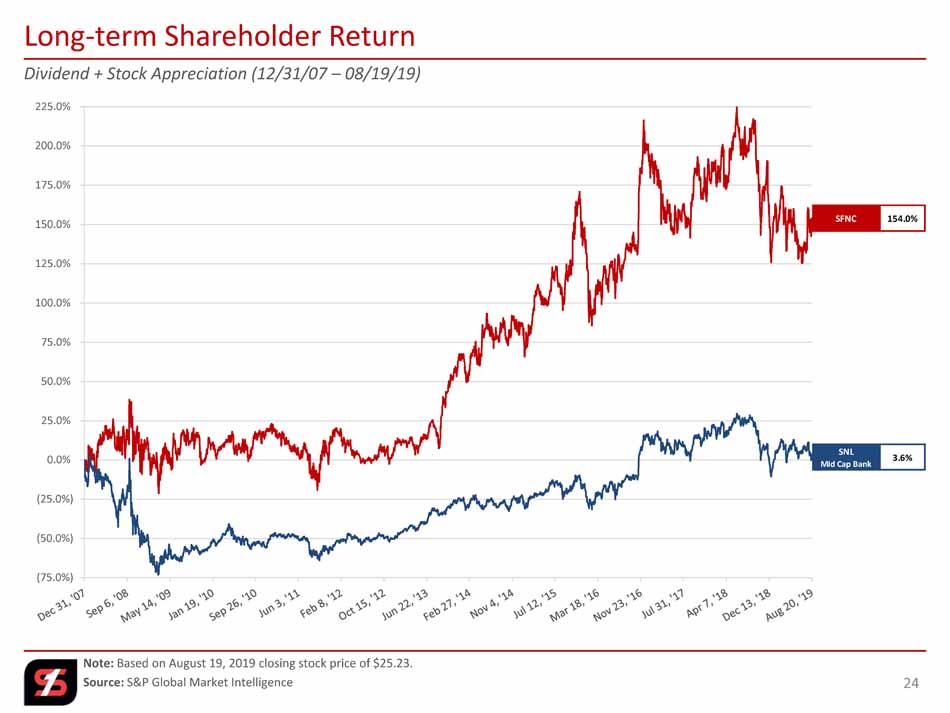

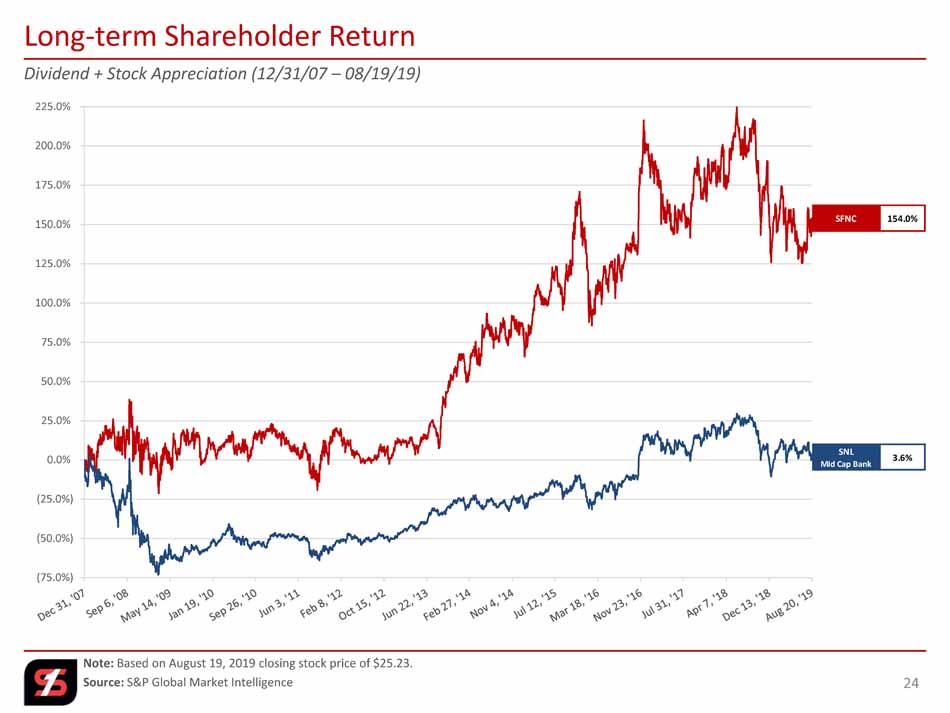

(75.0%) (50.0%) (25.0%) 0.0% 25.0% 50.0% 75.0% 100.0% 125.0% 150.0% 175.0% 200.0% 225.0% Dividend + Stock Appreciation (12/31/07 – 08/19/19) Note: Based on August 19, 2019 closing stock price of $25.23. Source: S&P Global Market Intelligence Long - term Shareholder Return 24 SFNC 154.0% SNL Mid Cap Bank 3.6%

(1) LTM Core EPS excludes non - core income and expense items and is a non - GAAP measurement. See Appendix for non - GAAP reconciliations . (2) Based upon the Company’s average seven analyst consensus EPS of $2.44 for 2019 and $2.59 for 2020, as of August 1, 2019. (3) Tangible Book Value is a non - GAAP measurement. See Appendix for non - GAAP reconciliations. Source: S&P Global Market Intelligence Investment Profile 25 Market Data as of August 19, 2019 SFNC Stock Price 25.23$ 52-Week High 32.45$ 52-Week Low 22.08$ Common Shares Outstanding (millions) 96.6 Market Capitalization (millions) 2,437.0$ % Institutional Ownership 68% Valuation & Per Share Data Price / LTM EPS 11.1 x Price / LTM Core EPS⁽¹⁾ 10.4 x Price / 2019 Consensus EPS⁽²⁾ 10.3 x Price / 2020 Consensus EPS⁽²⁾ 9.7 x Price / Book Value 1.0 x Price / Tangible Book Value⁽³⁾ 1.7 x

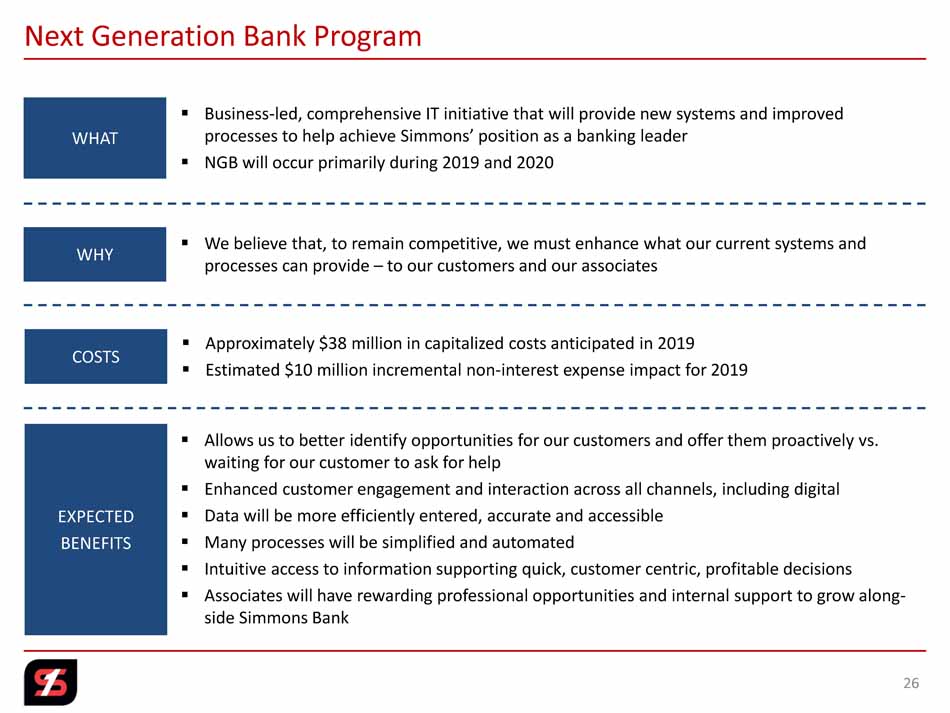

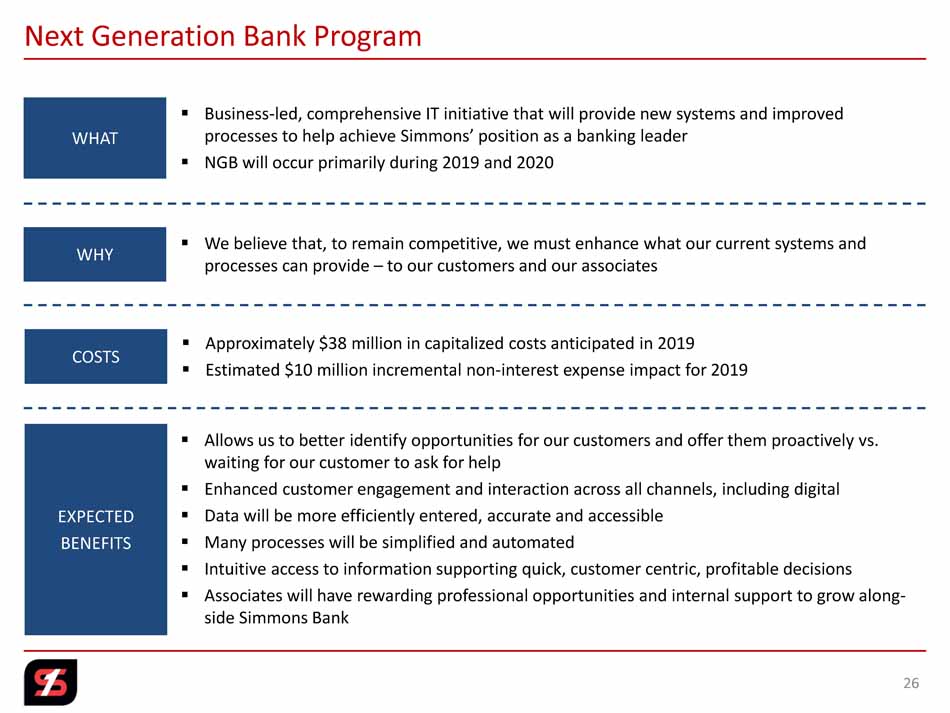

Next Generation Bank Program 26 WHY WHAT ▪ Allows us to better identify opportunities for our customers and offer them proactively vs. waiting for our customer to ask for help ▪ Enhanced customer engagement and interaction across all channels, including digital ▪ Data will be more efficiently entered, accurate and accessible ▪ Many processes will be simplified and automated ▪ Intuitive access to information supporting quick, customer centric, profitable decisions ▪ Associates will have rewarding professional opportunities and internal support to grow along - side Simmons Bank ▪ Business - led, comprehensive IT initiative that will provide new systems and improved processes to help achieve Simmons’ position as a banking leader ▪ NGB will occur primarily during 2019 and 2020 EXPECTED BENEFITS ▪ We believe that, to remain competitive, we must enhance what our current systems and processes can provide – to our customers and our associates COSTS ▪ Approximately $38 million in capitalized costs anticipated in 2019 ▪ Estimated $10 million incremental non - interest expense impact for 2019

2019 Strategy 27

Appendix 28

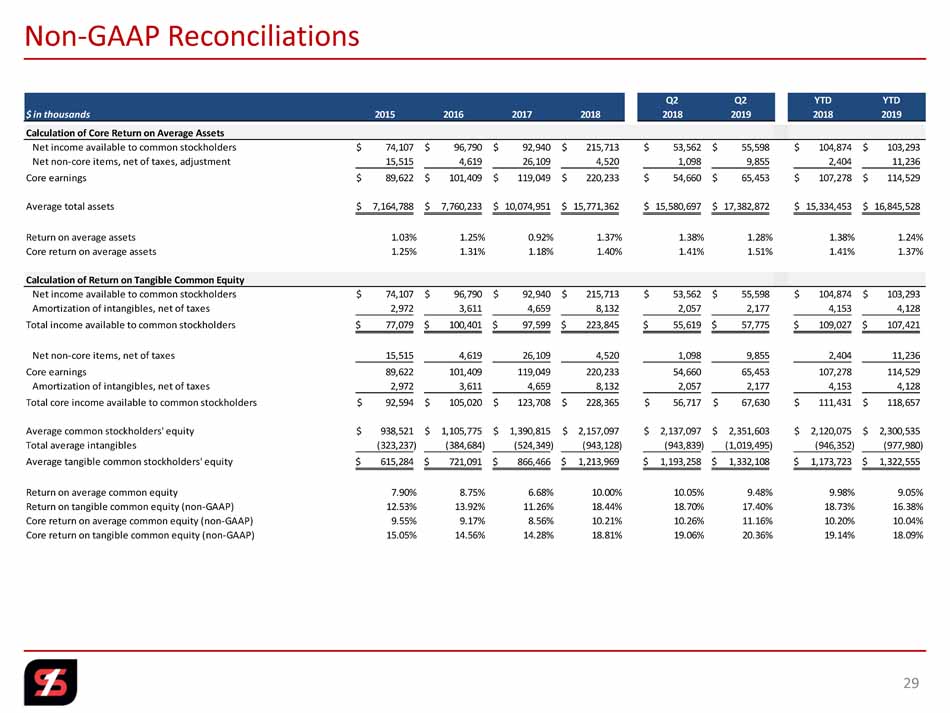

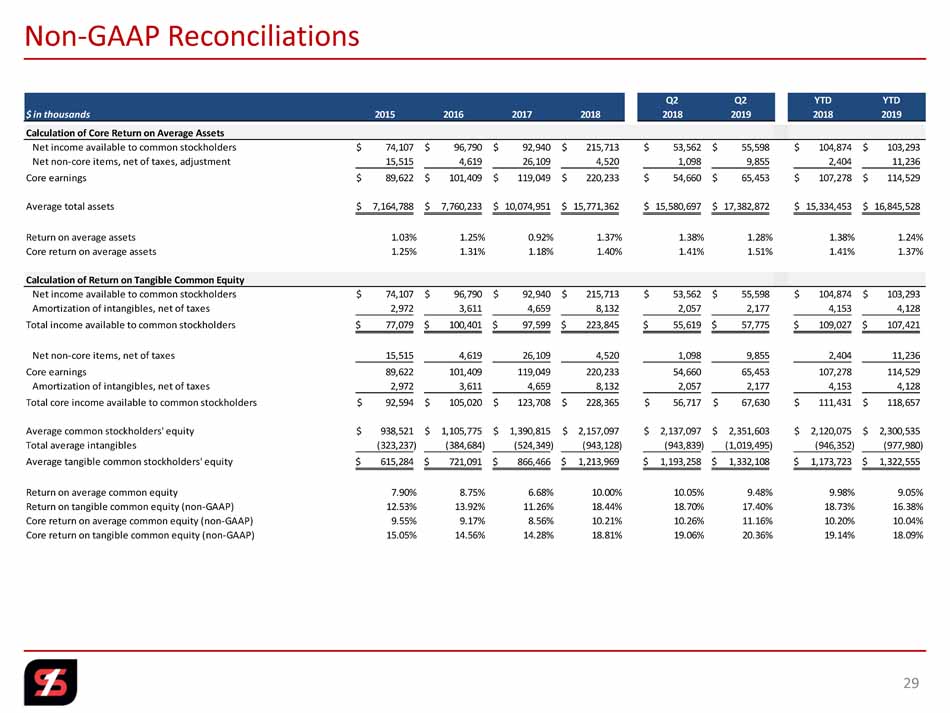

Non - GAAP Reconciliations 29 Q2 Q2 YTD YTD $ in thousands 2015 2016 2017 2018 2018 2019 2018 2019 Calculation of Core Return on Average Assets Net income available to common stockholders 74,107$ 96,790$ 92,940$ 215,713$ 53,562$ 55,598$ 104,874$ 103,293$ Net non-core items, net of taxes, adjustment 15,515 4,619 26,109 4,520 1,098 9,855 2,404 11,236 Core earnings 89,622$ 101,409$ 119,049$ 220,233$ 54,660$ 65,453$ 107,278$ 114,529$ Average total assets 7,164,788$ 7,760,233$ 10,074,951$ 15,771,362$ 15,580,697$ 17,382,872$ 15,334,453$ 16,845,528$ Return on average assets 1.03% 1.25% 0.92% 1.37% 1.38% 1.28% 1.38% 1.24% Core return on average assets 1.25% 1.31% 1.18% 1.40% 1.41% 1.51% 1.41% 1.37% Calculation of Return on Tangible Common Equity Net income available to common stockholders 74,107$ 96,790$ 92,940$ 215,713$ 53,562$ 55,598$ 104,874$ 103,293$ Amortization of intangibles, net of taxes 2,972 3,611 4,659 8,132 2,057 2,177 4,153 4,128 Total income available to common stockholders 77,079$ 100,401$ 97,599$ 223,845$ 55,619$ 57,775$ 109,027$ 107,421$ Net non-core items, net of taxes 15,515 4,619 26,109 4,520 1,098 9,855 2,404 11,236 Core earnings 89,622 101,409 119,049 220,233 54,660 65,453 107,278 114,529 Amortization of intangibles, net of taxes 2,972 3,611 4,659 8,132 2,057 2,177 4,153 4,128 Total core income available to common stockholders 92,594$ 105,020$ 123,708$ 228,365$ 56,717$ 67,630$ 111,431$ 118,657$ Average common stockholders' equity 938,521$ 1,105,775$ 1,390,815$ 2,157,097$ 2,137,097$ 2,351,603$ 2,120,075$ 2,300,535$ Total average intangibles (323,237) (384,684) (524,349) (943,128) (943,839) (1,019,495) (946,352) (977,980) Average tangible common stockholders' equity 615,284$ 721,091$ 866,466$ 1,213,969$ 1,193,258$ 1,332,108$ 1,173,723$ 1,322,555$ Return on average common equity 7.90% 8.75% 6.68% 10.00% 10.05% 9.48% 9.98% 9.05% Return on tangible common equity (non-GAAP) 12.53% 13.92% 11.26% 18.44% 18.70% 17.40% 18.73% 16.38% Core return on average common equity (non-GAAP) 9.55% 9.17% 8.56% 10.21% 10.26% 11.16% 10.20% 10.04% Core return on tangible common equity (non-GAAP) 15.05% 14.56% 14.28% 18.81% 19.06% 20.36% 19.14% 18.09%

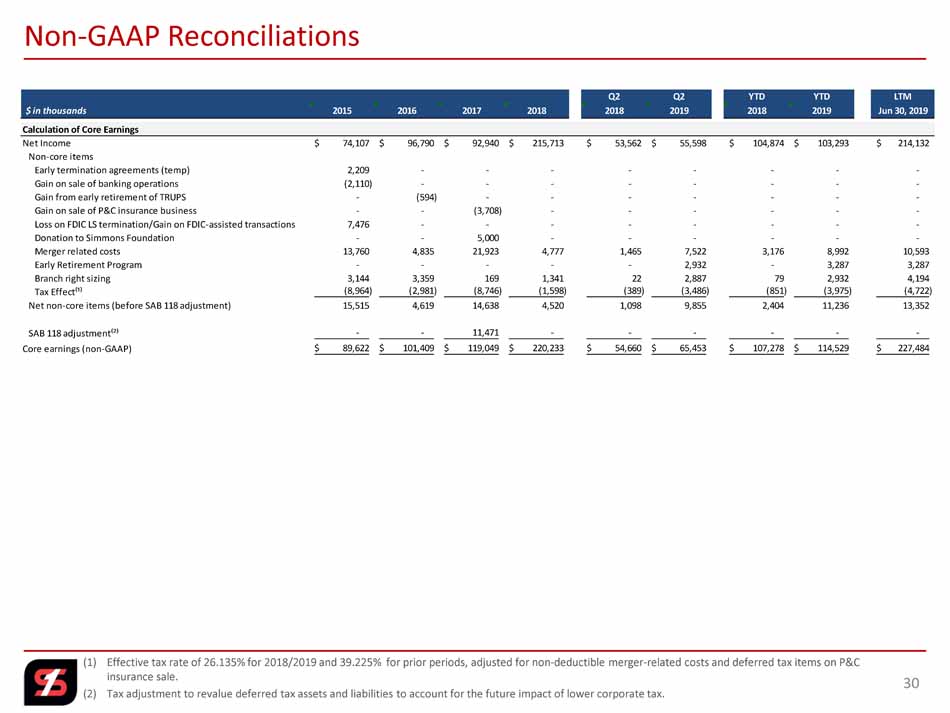

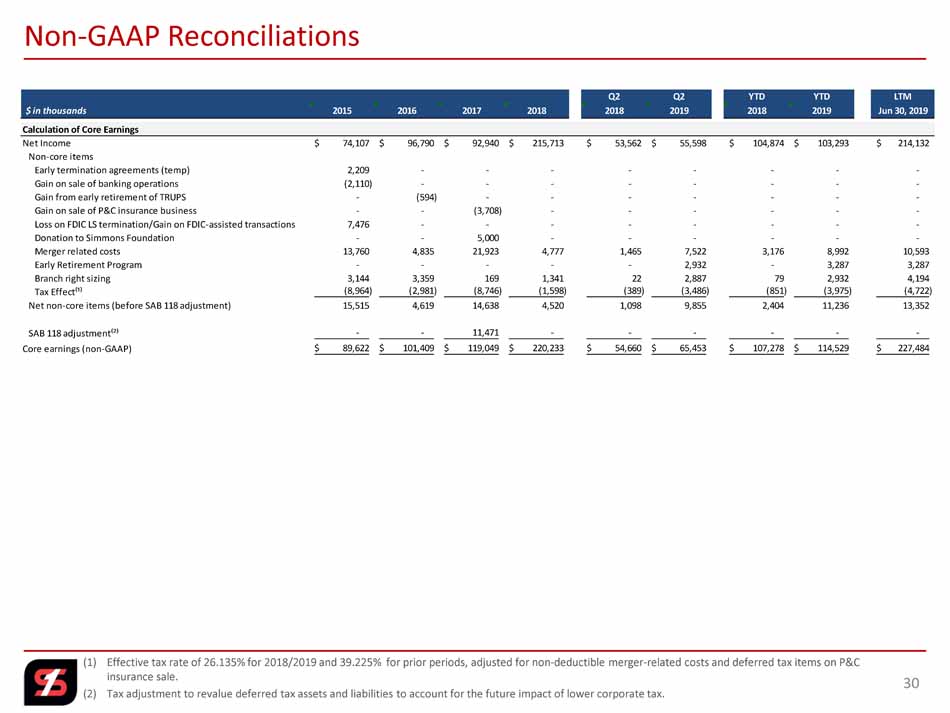

(1) Effective tax rate of 26.135% for 2018/2019 and 39.225% for prior periods, adjusted for non - deductible merger - related costs and deferred tax items on P&C insurance sale. (2) Tax adjustment to revalue deferred tax assets and liabilities to account for the future impact of lower corporate tax. Non - GAAP Reconciliations 30 Q2 Q2 YTD YTD LTM $ in thousands 2015 2016 2017 2018 2018 2019 2018 2019 Jun 30, 2019 Calculation of Core Earnings Net Income 74,107$ 96,790$ 92,940$ 215,713$ 53,562$ 55,598$ 104,874$ 103,293$ 214,132$ Non-core items Early termination agreements (temp) 2,209 - - - - - - - - Gain on sale of banking operations (2,110) - - - - - - - - Gain from early retirement of TRUPS - (594) - - - - - - - Gain on sale of P&C insurance business - - (3,708) - - - - - - Loss on FDIC LS termination/Gain on FDIC-assisted transactions 7,476 - - - - - - - - Donation to Simmons Foundation - - 5,000 - - - - - - Merger related costs 13,760 4,835 21,923 4,777 1,465 7,522 3,176 8,992 10,593 Early Retirement Program - - - - - 2,932 - 3,287 3,287 Branch right sizing 3,144 3,359 169 1,341 22 2,887 79 2,932 4,194 Tax Effect⁽¹⁾ (8,964) (2,981) (8,746) (1,598) (389) (3,486) (851) (3,975) (4,722) Net non-core items (before SAB 118 adjustment) 15,515 4,619 14,638 4,520 1,098 9,855 2,404 11,236 13,352 SAB 118 adjustment⁽²⁾ - - 11,471 - - - - - - Core earnings (non-GAAP) 89,622$ 101,409$ 119,049$ 220,233$ 54,660$ 65,453$ 107,278$ 114,529$ 227,484$

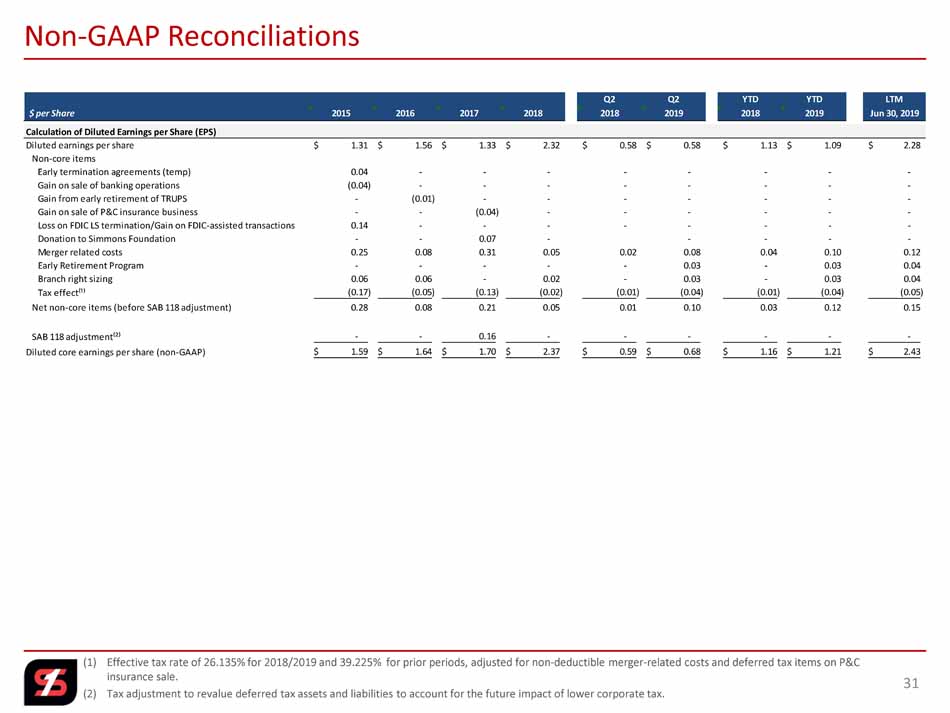

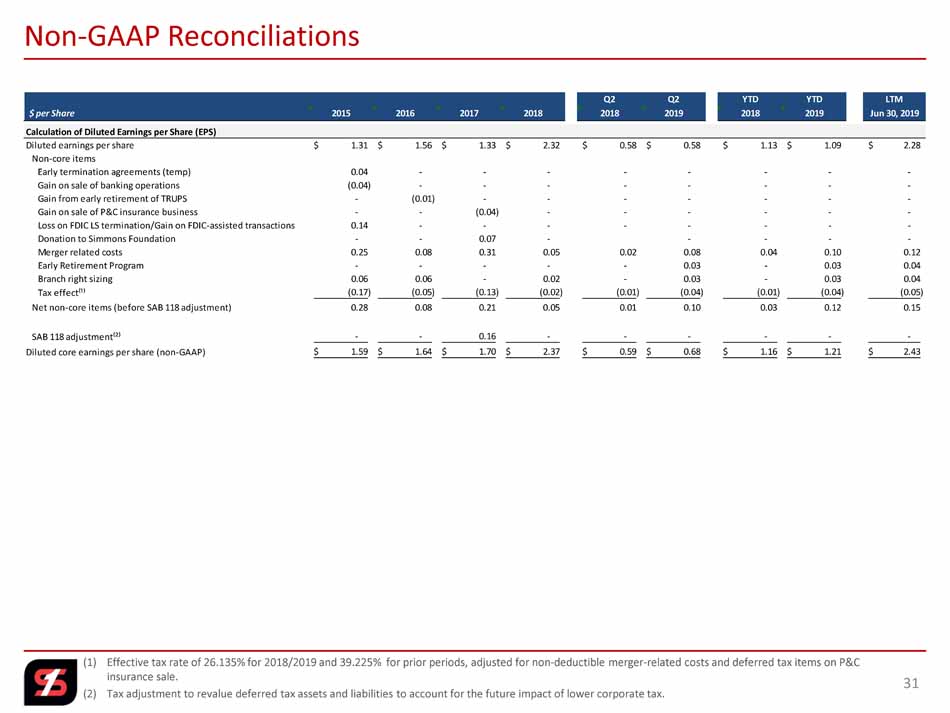

(1) Effective tax rate of 26.135% for 2018/2019 and 39.225% for prior periods, adjusted for non - deductible merger - related costs and deferred tax items on P&C insurance sale. (2) Tax adjustment to revalue deferred tax assets and liabilities to account for the future impact of lower corporate tax. Non - GAAP Reconciliations 31 Q2 Q2 YTD YTD LTM $ per Share 2015 2016 2017 2018 2018 2019 2018 2019 Jun 30, 2019 Calculation of Diluted Earnings per Share (EPS) Diluted earnings per share 1.31$ 1.56$ 1.33$ 2.32$ 0.58$ 0.58$ 1.13$ 1.09$ 2.28$ Non-core items Early termination agreements (temp) 0.04 - - - - - - - - Gain on sale of banking operations (0.04) - - - - - - - - Gain from early retirement of TRUPS - (0.01) - - - - - - - Gain on sale of P&C insurance business - - (0.04) - - - - - - Loss on FDIC LS termination/Gain on FDIC-assisted transactions 0.14 - - - - - - - - Donation to Simmons Foundation - - 0.07 - - - - - Merger related costs 0.25 0.08 0.31 0.05 0.02 0.08 0.04 0.10 0.12 Early Retirement Program - - - - - 0.03 - 0.03 0.04 Branch right sizing 0.06 0.06 - 0.02 - 0.03 - 0.03 0.04 Tax effect⁽¹⁾ (0.17) (0.05) (0.13) (0.02) (0.01) (0.04) (0.01) (0.04) (0.05) Net non-core items (before SAB 118 adjustment) 0.28 0.08 0.21 0.05 0.01 0.10 0.03 0.12 0.15 SAB 118 adjustment⁽²⁾ - - 0.16 - - - - - - Diluted core earnings per share (non-GAAP) 1.59$ 1.64$ 1.70$ 2.37$ 0.59$ 0.68$ 1.16$ 1.21$ 2.43$

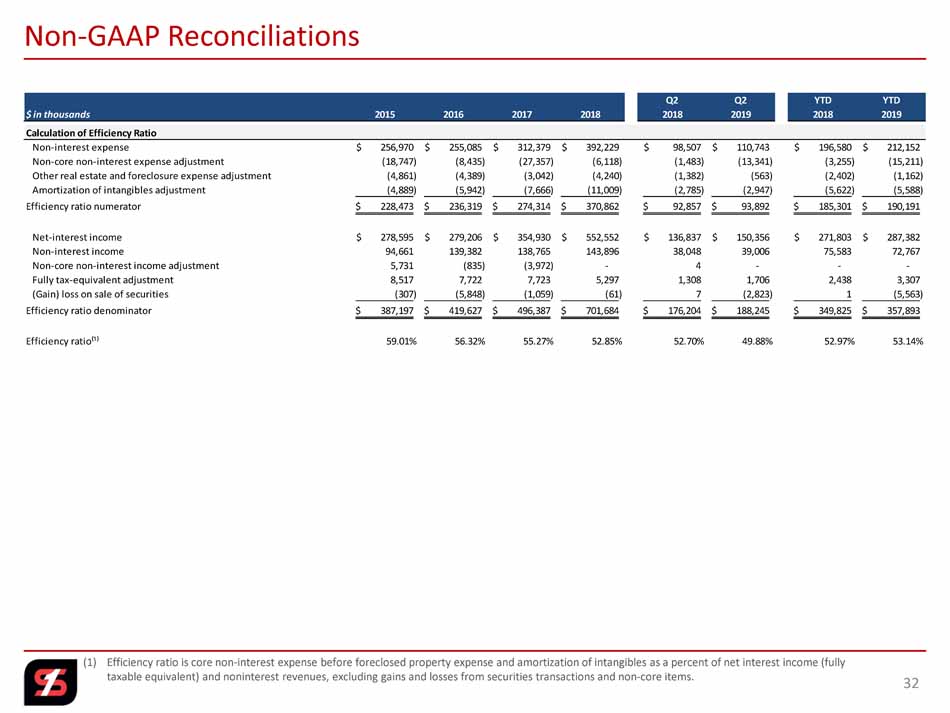

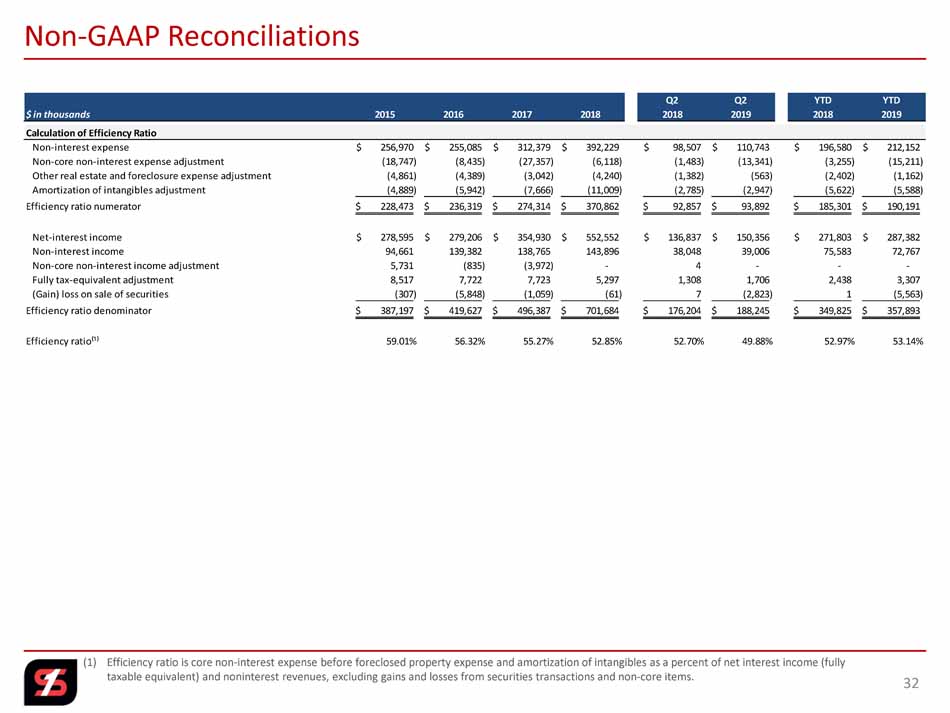

(1) Efficiency ratio is core non - interest expense before foreclosed property expense and amortization of intangibles as a percent of net interest income (fully taxable equivalent) and noninterest revenues, excluding gains and losses from securities transactions and non - core items. Non - GAAP Reconciliations 32 Q2 Q2 YTD YTD $ in thousands 2015 2016 2017 2018 2018 2019 2018 2019 Calculation of Efficiency Ratio Non-interest expense 256,970$ 255,085$ 312,379$ 392,229$ 98,507$ 110,743$ 196,580$ 212,152$ Non-core non-interest expense adjustment (18,747) (8,435) (27,357) (6,118) (1,483) (13,341) (3,255) (15,211) Other real estate and foreclosure expense adjustment (4,861) (4,389) (3,042) (4,240) (1,382) (563) (2,402) (1,162) Amortization of intangibles adjustment (4,889) (5,942) (7,666) (11,009) (2,785) (2,947) (5,622) (5,588) Efficiency ratio numerator 228,473$ 236,319$ 274,314$ 370,862$ 92,857$ 93,892$ 185,301$ 190,191$ Net-interest income 278,595$ 279,206$ 354,930$ 552,552$ 136,837$ 150,356$ 271,803$ 287,382$ Non-interest income 94,661 139,382 138,765 143,896 38,048 39,006 75,583 72,767 Non-core non-interest income adjustment 5,731 (835) (3,972) - 4 - - - Fully tax-equivalent adjustment 8,517 7,722 7,723 5,297 1,308 1,706 2,438 3,307 (Gain) loss on sale of securities (307) (5,848) (1,059) (61) 7 (2,823) 1 (5,563) Efficiency ratio denominator 387,197$ 419,627$ 496,387$ 701,684$ 176,204$ 188,245$ 349,825$ 357,893$ Efficiency ratio⁽¹⁾ 59.01% 56.32% 55.27% 52.85% 52.70% 49.88% 52.97% 53.14%

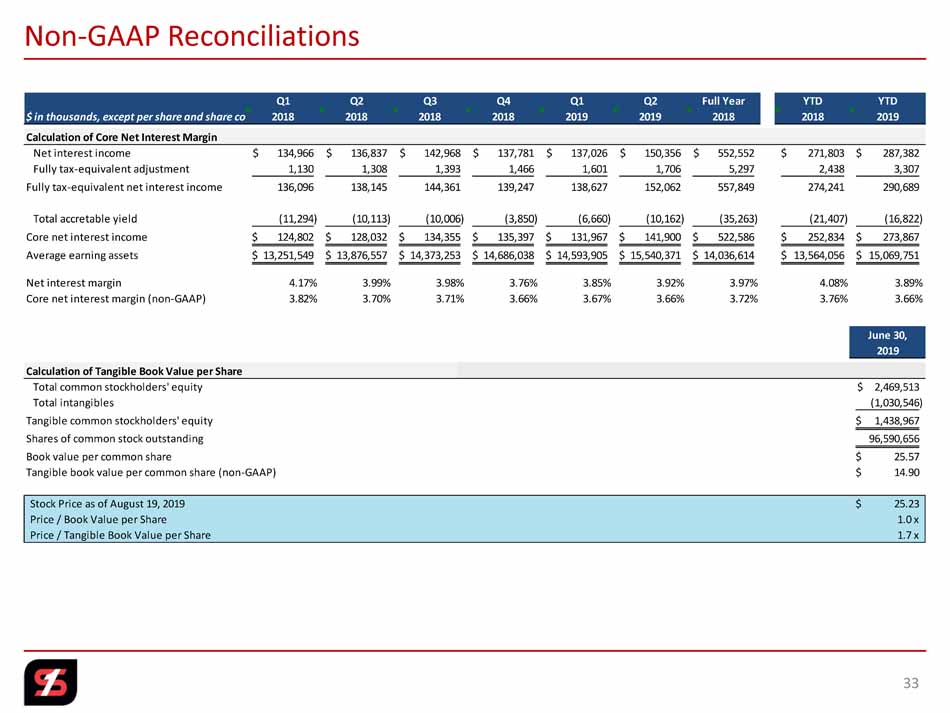

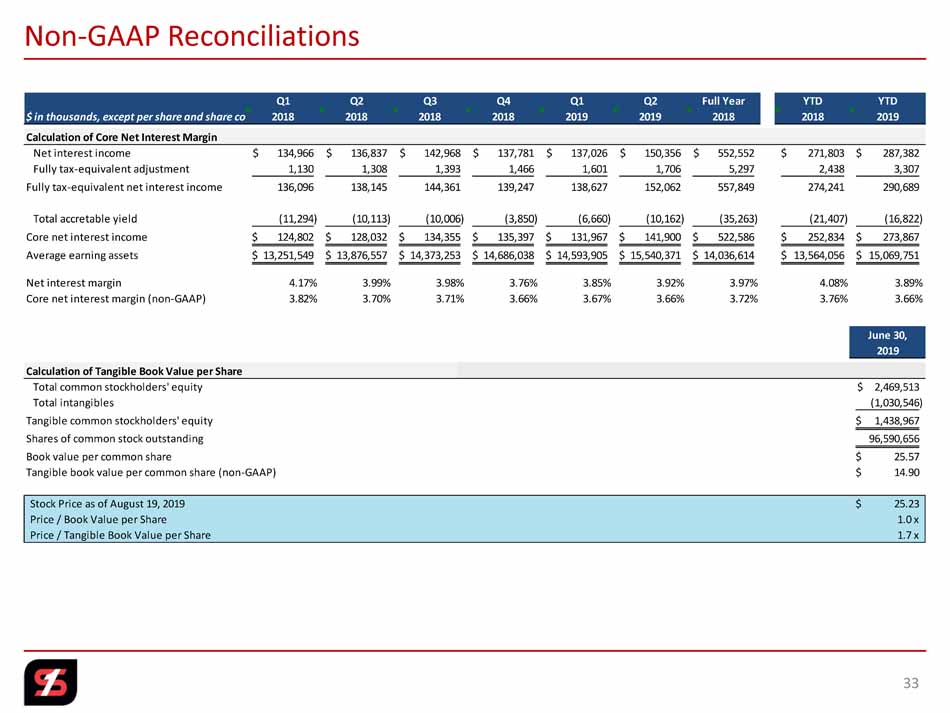

Non - GAAP Reconciliations 33 YTD YTD $ in thousands, except per share and share count 2015 2016 2017 2018 2018 2019 Calculation of Core Net Interest Margin Net interest income 278,595$ 279,206$ 354,930$ 552,552$ 271,803$ 287,382$ Fully tax-equivalent adjustment 8,517 7,722 7,723 5,297 2,438 3,307 Fully tax-equivalent net interest income 287,112 286,928 362,653 557,849 274,241 290,689 Total accretable yield (46,131) (24,257) (27,793) (35,263) (21,407) (16,822) Core net interest income 240,981$ 262,671$ 334,860$ 522,586$ 252,834$ 273,867$ Average earning assets 6,305,966$ 6,855,322$ 8,908,418$ 14,036,614$ 13,564,056$ 15,069,751$ Net interest margin 4.55% 4.19% 4.07% 3.97% 4.08% 3.89% Core net interest margin (non-GAAP) 3.82% 3.83% 3.76% 3.72% 3.76% 3.66% June 30, 2019 Calculation of Tangible Book Value per Share Total common stockholders' equity 2,469,513$ Total intangibles (1,030,546) Tangible common stockholders' equity 1,438,967$ Shares of common stock outstanding 96,590,656 Book value per common share 25.57$ Tangible book value per common share (non-GAAP) 14.90$ Stock Price as of August 19, 2019 25.23$ Price / Book Value per Share 1.0 x Price / Tangible Book Value per Share 1.7 x Q1 Q2 Q3 Q4 Q1 Q2 Full Year YTD YTD $ in thousands, except per share and share count 2018 2018 2018 2018 2019 2019 2018 2018 2019 Calculation of Core Net Interest Margin Net interest income 134,966$ 136,837$ 142,968$ 137,781$ 137,026$ 150,356$ 552,552$ 271,803$ 287,382$ Fully tax-equivalent adjustment 1,130 1,308 1,393 1,466 1,601 1,706 5,297 2,438 3,307 Fully tax-equivalent net interest income 136,096 138,145 144,361 139,247 138,627 152,062 557,849 274,241 290,689 Total accretable yield (11,294) (10,113) (10,006) (3,850) (6,660) (10,162) (35,263) (21,407) (16,822) Core net interest income 124,802$ 128,032$ 134,355$ 135,397$ 131,967$ 141,900$ 522,586$ 252,834$ 273,867$ Average earning assets 13,251,549$ 13,876,557$ 14,373,253$ 14,686,038$ 14,593,905$ 15,540,371$ 14,036,614$ 13,564,056$ 15,069,751$ Net interest margin 4.17% 3.99% 3.98% 3.76% 3.85% 3.92% 3.97% 4.08% 3.89% Core net interest margin (non-GAAP) 3.82% 3.70% 3.71% 3.66% 3.67% 3.66% 3.72% 3.76% 3.66%

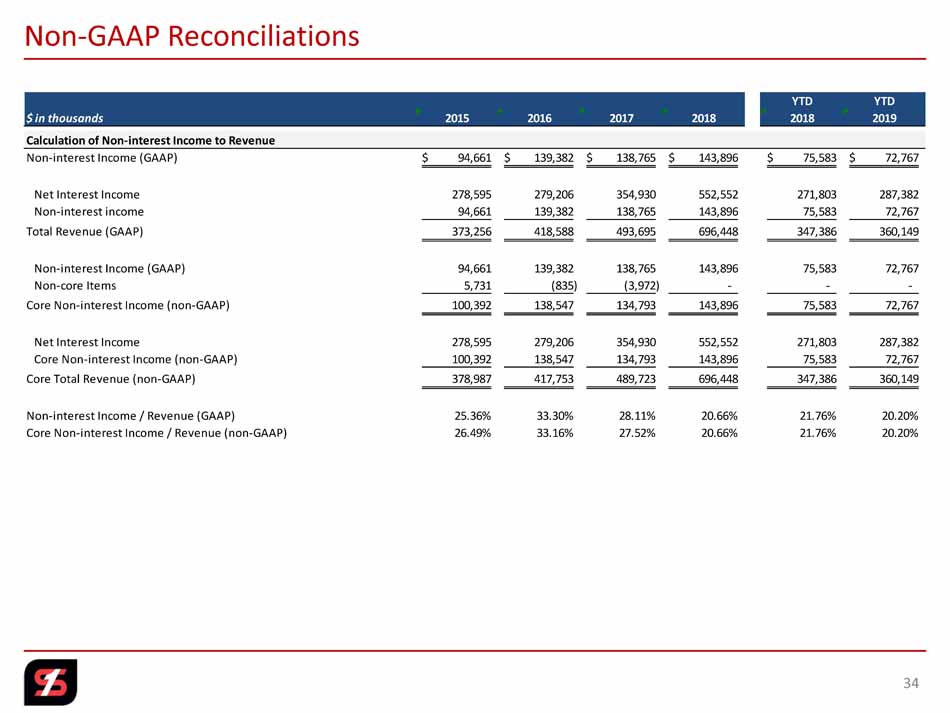

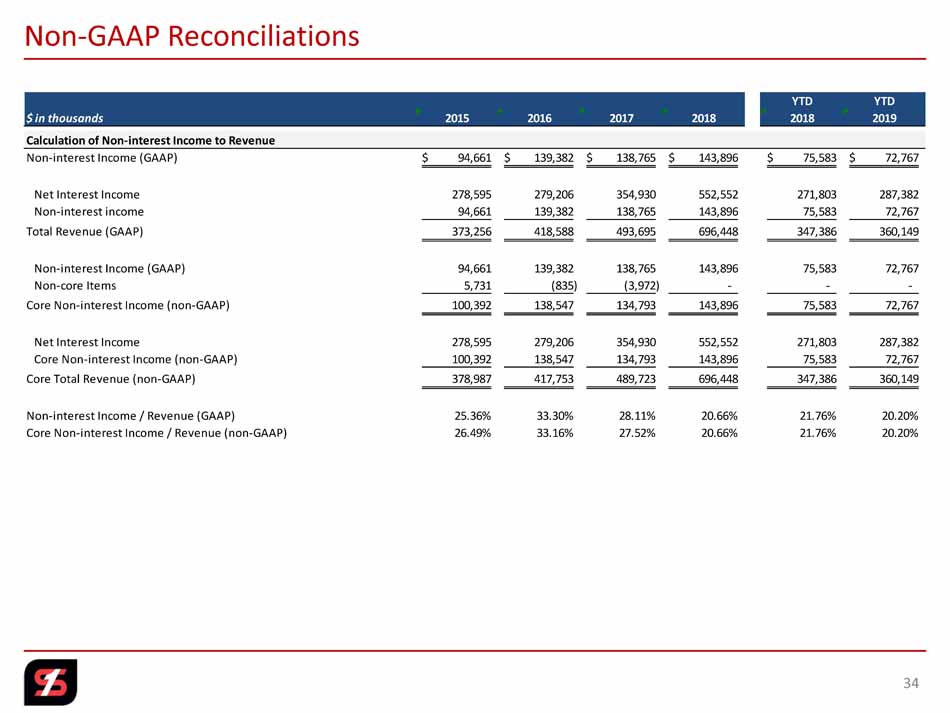

Non - GAAP Reconciliations 34 YTD YTD $ in thousands 2015 2016 2017 2018 2018 2019 Calculation of Non-interest Income to Revenue Non-interest Income (GAAP) 94,661$ 139,382$ 138,765$ 143,896$ 75,583$ 72,767$ Net Interest Income 278,595 279,206 354,930 552,552 271,803 287,382 Non-interest income 94,661 139,382 138,765 143,896 75,583 72,767 Total Revenue (GAAP) 373,256 418,588 493,695 696,448 347,386 360,149 Non-interest Income (GAAP) 94,661 139,382 138,765 143,896 75,583 72,767 Non-core Items 5,731 (835) (3,972) - - - Core Non-interest Income (non-GAAP) 100,392 138,547 134,793 143,896 75,583 72,767 Net Interest Income 278,595 279,206 354,930 552,552 271,803 287,382 Core Non-interest Income (non-GAAP) 100,392 138,547 134,793 143,896 75,583 72,767 Core Total Revenue (non-GAAP) 378,987 417,753 489,723 696,448 347,386 360,149 Non-interest Income / Revenue (GAAP) 25.36% 33.30% 28.11% 20.66% 21.76% 20.20% Core Non-interest Income / Revenue (non-GAAP) 26.49% 33.16% 27.52% 20.66% 21.76% 20.20%

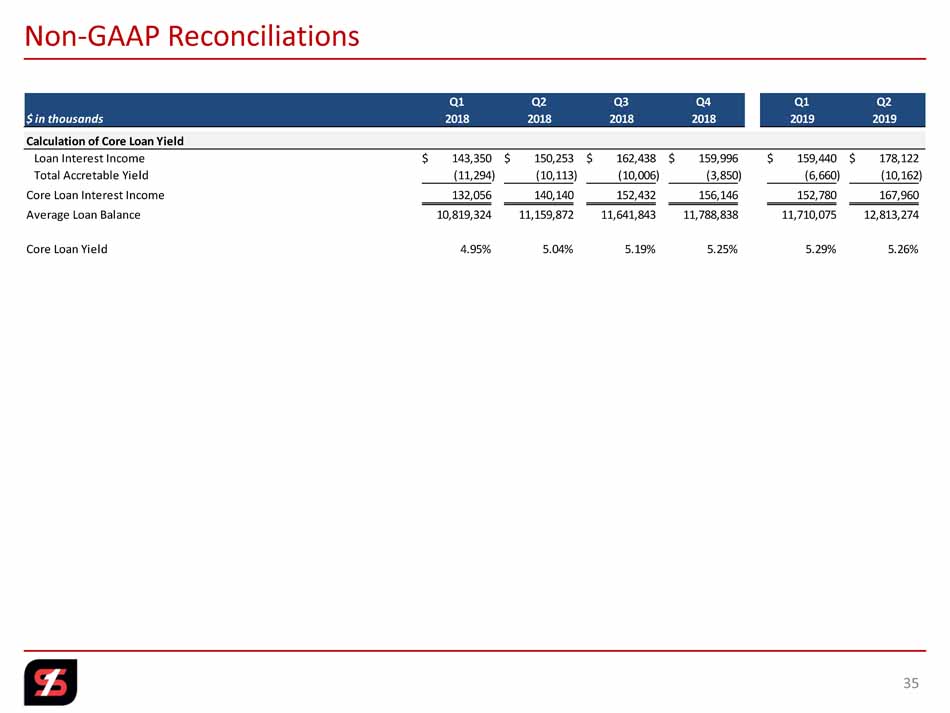

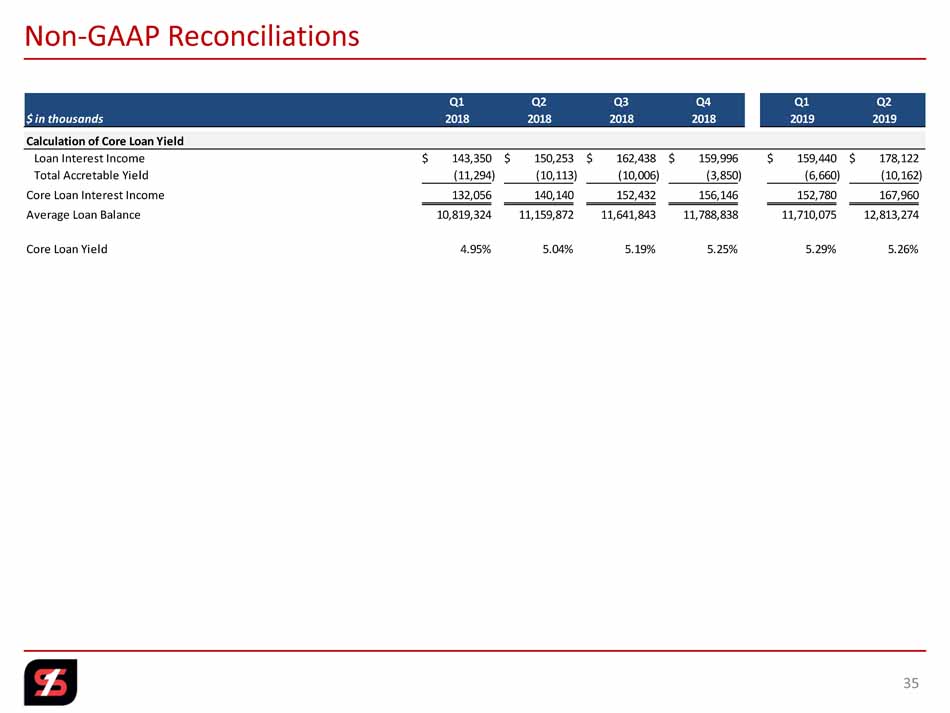

Non - GAAP Reconciliations 35 Q1 Q2 Q3 Q4 Q1 Q2 $ in thousands 2018 2018 2018 2018 2019 2019 Calculation of Core Loan Yield Loan Interest Income 143,350$ 150,253$ 162,438$ 159,996$ 159,440$ 178,122$ Total Accretable Yield (11,294) (10,113) (10,006) (3,850) (6,660) (10,162) Core Loan Interest Income 132,056 140,140 152,432 156,146 152,780 167,960 Average Loan Balance 10,819,324 11,159,872 11,641,843 11,788,838 11,710,075 12,813,274 Core Loan Yield 4.95% 5.04% 5.19% 5.25% 5.29% 5.26%

36