Janus Aspen Flexible Bond Portfolio

Additional Information (unaudited)

· For Perkins Small Cap Value Fund, the Trustees noted that the Fund’s performance was in the bottom Broadridge quartile for the 36 months ended May 31, 2015 and the second Broadridge quartile for the 12 months ended May 31, 2015. The Trustees noted the reasons for the Fund’s underperformance, noting that the Fund has a performance fee structure that results in lower management fees during periods of underperformance, the steps Janus Capital and Perkins had taken or were taking to improve performance, and that the performance trend was improving.

· For Perkins Value Plus Income Fund, the Trustees noted that the Fund’s performance was in the second Broadridge quartile for the 36 months ended May 31, 2015 and the second Broadridge quartile for the 12 months ended May 31, 2015.

Mathematical Funds

· For INTECH Emerging Markets Managed Volatility Fund, the Trustees noted that, due to limited performance for the Fund, performance history was not a material factor.

· For INTECH Global Income Managed Volatility Fund, the Trustees noted that the Fund’s performance was in the first Broadridge quartile for the 36 months ended May 31, 2015 and the third Broadridge quartile for the 12 months ended May 31, 2015.

· For INTECH International Managed Volatility Fund, the Trustees noted that the Fund’s performance was in the bottom Broadridge quartile for the 36 months ended May 31, 2015 and the bottom Broadridge quartile for the 12 months ended May 31, 2015. The Trustees noted the reasons for the Fund’s underperformance and the steps Janus Capital and INTECH had taken or were taking to improve performance.

· For INTECH U.S. Core Fund, the Trustees noted that the Fund’s performance was in the second Broadridge quartile for the 36 months ended May 31, 2015 and the second Broadridge quartile for the 12 months ended May 31, 2015.

· For INTECH U.S. Managed Volatility Fund, the Trustees noted that the Fund’s performance was in the second Broadridge quartile for the 36 months ended May 31, 2015 and the third Broadridge quartile for the 12 months ended May 31, 2015.

Growth and Core Funds

· For Janus Balanced Fund, the Trustees noted that the Fund’s performance was in the first Broadridge quartile for the 36 months ended May 31, 2015 and the first Broadridge quartile for the 12 months ended May 31, 2015.

· For Janus Contrarian Fund, the Trustees noted that the Fund’s performance was in the first Broadridge quartile for the 36 months ended May 31, 2015 and the bottom Broadridge quartile for the 12 months ended May 31, 2015.

· For Janus Enterprise Fund, the Trustees noted that the Fund’s performance was in the second Broadridge quartile for the 36 months ended May 31, 2015 and the first Broadridge quartile for the 12 months ended May 31, 2015.

· For Janus Forty Fund, the Trustees noted that the Fund’s performance was in the second Broadridge quartile for the 36 months ended May 31, 2015 and the first Broadridge quartile for the 12 months ended May 31, 2015.

· For Janus Fund, the Trustees noted that the Fund’s performance was in the second Broadridge quartile for the 36 months ended May 31, 2015 and the first Broadridge quartile for the 12 months ended May 31, 2015.

· For Janus Growth and Income Fund, the Trustees noted that the Fund’s performance was in the third Broadridge quartile for the 36 months ended May 31, 2015 and in the third Broadridge quartile for the 12 months ended May 31, 2015. The Trustees noted the reasons for the Fund’s underperformance and the steps Janus Capital had taken or was taking to improve performance.

· For Janus Research Fund, the Trustees noted that the Fund’s performance was in the first Broadridge quartile for the 36 months ended May 31, 2015 and the first Broadridge quartile for the 12 months ended May 31, 2015.

Janus Aspen Flexible Bond Portfolio

Additional Information (unaudited)

· For Janus Triton Fund, the Trustees noted that the Fund’s performance was in the second Broadridge quartile for the 36 months ended May 31, 2015 and the first Broadridge quartile for the 12 months ended May 31, 2015.

· For Janus Twenty Fund, the Trustees noted that the Fund’s performance was in the third Broadridge quartile for the 36 months ended May 31, 2015 and the bottom Broadridge quartile for the 12 months ended May 31, 2015. The Trustees noted the reasons for the Fund’s underperformance, noting that the Fund has a performance fee structure that results in lower management fees during periods of underperformance, and the steps Janus Capital had taken or was taking to improve performance.

· For Janus Venture Fund, the Trustees noted that the Fund’s performance was in the first Broadridge quartile for the 36 months ended May 31, 2015 and the first Broadridge quartile for the 12 months ended May 31, 2015.

Global and International Funds

· For Janus Asia Equity Fund, the Trustees noted that the Fund’s performance was in the third Broadridge quartile for the 36 months ended May 31, 2015 and the first Broadridge quartile for the 12 months ended May 31, 2015. The Trustees noted the reasons for the Fund’s underperformance, noting that the Fund has a performance fee structure that results in lower management fees during periods of underperformance, the steps Janus Capital had taken or was taking to improve performance, and that the performance trend was improving.

· For Janus Emerging Markets Fund, the Trustees noted that the Fund’s performance was in the second Broadridge quartile for the 36 months ended May 31, 2015 and the first Broadridge quartile for the 12 months ended May 31, 2015.

· For Janus Global Life Sciences Fund, the Trustees noted that the Fund’s performance was in the first Broadridge quartile for the 36 months ended May 31, 2015 and the first Broadridge quartile for the 12 months ended May 31, 2015.

· For Janus Global Real Estate Fund, the Trustees noted that the Fund’s performance was in the first Broadridge quartile for the 36 months ended May 31, 2015 and the first Broadridge quartile for the 12 months ended May 31, 2015.

· For Janus Global Research Fund, the Trustees noted that the Fund’s performance was in the second Broadridge quartile for the 36 months ended May 31, 2015 and the first Broadridge quartile for the 12 months ended May 31, 2015.

· For Janus Global Select Fund, the Trustees noted that the Fund’s performance was in the second Broadridge quartile for the 36 months ended May 31, 2015 and the first Broadridge quartile for the 12 months ended May 31, 2015.

· For Janus Global Technology Fund, the Trustees noted that the Fund’s performance was in the third Broadridge quartile for the 36 months ended May 31, 2015 and the third Broadridge quartile for the 12 months ended May 31, 2015. The Trustees noted the reasons for the Fund’s underperformance and the steps Janus Capital had taken or was taking to improve performance.

· For Janus International Equity Fund, the Trustees noted that the Fund’s performance was in the second Broadridge quartile for the 36 months ended May 31, 2015 and the second Broadridge quartile for the 12 months ended May 31, 2015.

· For Janus Overseas Fund, the Trustees noted that the Fund’s performance was in the bottom Broadridge quartile for the 36 months ended May 31, 2015 and the bottom Broadridge quartile for the 12 months ended May 31, 2015. The Trustees noted the reasons for the Fund’s underperformance, noting that the Fund has a performance fee structure that results in lower management fees during periods of underperformance, and the steps Janus Capital had taken or was taking to improve performance.

Janus Aspen Flexible Bond Portfolio

Additional Information (unaudited)

Janus Aspen Series

· For Janus Aspen Balanced Portfolio, the Trustees noted that the Fund’s performance was in the first Broadridge quartile for the 36 months ended May 31, 2015 and the first Broadridge quartile for the 12 months ended May 31, 2015.

· For Janus Aspen Enterprise Portfolio, the Trustees noted that the Fund’s performance was in the second Broadridge quartile for the 36 months ended May 31, 2015 and the first Broadridge quartile for the 12 months ended May 31, 2015.

· For Janus Aspen Flexible Bond Portfolio, the Trustees noted that the Fund’s performance was in the second Broadridge quartile for the 36 months ended May 31, 2015 and the second Broadridge quartile for the 12 months ended May 31, 2015.

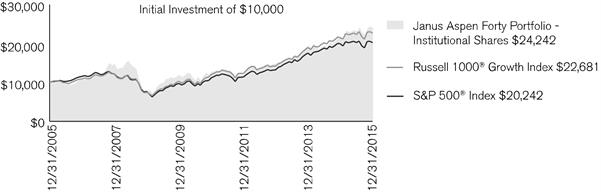

· For Janus Aspen Forty Portfolio, the Trustees noted that the Fund’s performance was in the second Broadridge quartile for the 36 months ended May 31, 2015 and the first Broadridge quartile for the 12 months ended May 31, 2015.

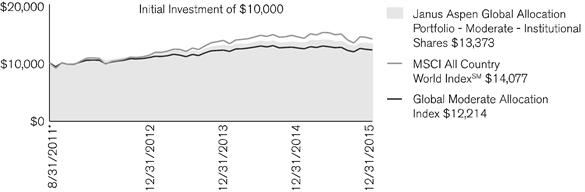

· For Janus Aspen Global Allocation Portfolio – Moderate, the Trustees noted that the Fund’s performance was in the first Broadridge quartile for the 36 months ended May 31, 2015 and the bottom Broadridge quartile for the 12 months ended May 31, 2015.

· For Janus Aspen Global Research Portfolio, the Trustees noted that the Fund’s performance was in the first Broadridge quartile for the 36 months ended May 31, 2015 and the second Broadridge quartile for the 12 months ended May 31, 2015.

· For Janus Aspen Global Technology Portfolio, the Trustees noted that the Fund’s performance was in the second Broadridge quartile for the 36 months ended May 31, 2015 and the third Broadridge quartile for the 12 months ended May 31, 2015.

· For Janus Aspen Global Unconstrained Bond Portfolio, the Trustees noted that, due to limited performance for the Fund, performance history was not a material factor.

· For Janus Aspen INTECH U.S. Low Volatility Portfolio, the Trustees noted that the Fund’s performance was in the first Broadridge quartile for the 12 months ended May 31, 2015.

· For Janus Aspen Janus Portfolio, the Trustees noted that the Fund’s performance was in the second Broadridge quartile for the 36 months ended May 31, 2015 and the first Broadridge quartile for the 12 months ended May 31, 2015.

· For Janus Aspen Overseas Portfolio, the Trustees noted that the Fund’s performance was in the bottom Broadridge quartile for the 36 months ended May 31, 2015 and the bottom Broadridge quartile for the 12 months ended May 31, 2015. The Trustees noted the reasons for the Fund’s underperformance, noting that the Fund has a performance fee structure that results in lower management fees during periods of underperformance, and the steps Janus Capital had taken or was taking to improve performance.

· For Janus Aspen Perkins Mid Cap Value Portfolio, the Trustees noted that the Fund’s performance was in the bottom Broadridge quartile for the 36 months ended May 31, 2015 and the bottom Broadridge quartile for the 12 months ended May 31, 2015. The Trustees noted the reasons for the Fund’s underperformance, noting that the Fund has a performance fee structure that results in lower management fees during periods of underperformance, and the steps Janus Capital and Perkins had taken or were taking to improve performance.

In consideration of each Fund’s performance, the Trustees concluded that, taking into account the factors relevant to performance, as well as other considerations, including steps taken to improve performance, the Fund’s performance warranted continuation of the Fund’s investment advisory and subadvisory agreement(s).

Costs of Services Provided

The Trustees examined information regarding the fees and expenses of each Fund in comparison to similar information for other comparable funds as provided by Broadridge, an independent data provider. They also reviewed an analysis of that information provided by their independent fee consultant and noted that the rate of management (investment advisory and any administration, but excluding out-of-pocket costs) fees for many of the Funds, after applicable waivers,

Janus Aspen Flexible Bond Portfolio

Additional Information (unaudited)

was below the mean management fee rate of the respective peer group of funds selected by an independent data provider. The Trustees also examined information regarding the subadvisory fees charged for subadvisory services, as applicable, noting that all such fees were paid by Janus Capital out of its management fees collected from such Fund.

The independent fee consultant provided its belief that the management fees charged by Janus Capital to each of the Funds under the current investment advisory and administration agreements are reasonable in relation to the services provided by Janus Capital. The independent fee consultant found: (1) the total expenses and management fees of the Funds to be reasonable relative to other mutual funds; (2) total expenses, on average, were 14% below the mean total expenses of their respective Broadridge Expense Group peers and 24% below the mean total expenses for their Broadridge Expense Universes; (3) management fees for the Funds, on average, were 15% below the mean management fees for their Expense Groups and 19% below the mean for their Expense Universes; and (4) Fund expenses at the functional level for each asset and share class category were reasonable. The Trustees also considered the total expenses for each share class of each Fund compared to the mean total expenses for its Broadridge Expense Group peers and to mean total expenses for its Broadridge Expense Universe.

The independent fee consultant concluded that, based on its strategic review of expenses at the complex, category and individual fund level, Fund expenses were found to be reasonable relative to both Expense Group and Expense Universe benchmarks. Further, for certain Funds, the independent fee consultant also performed a systematic “focus list” analysis of expenses in the context of the performance or service delivered to each set of investors in each share class in each selected Fund. Based on this analysis, the independent fee consultant found that the combination of service quality/performance and expenses on these individual Funds and share classes were reasonable in light of performance trends, performance histories, and existence of performance fees, breakpoints, and expense waivers on such Funds.

The Trustees considered the methodology used by Janus Capital and each subadviser in determining compensation payable to portfolio managers, the competitive environment for investment management talent, and the competitive market for mutual funds in different distribution channels.

The Trustees also reviewed management fees charged by Janus Capital and each subadviser to comparable separate account clients and to comparable non-affiliated funds subadvised by Janus Capital or by a subadviser (for which Janus Capital or the subadviser provides only or primarily portfolio management services). Although in most instances subadvisory and separate account fee rates for various investment strategies were lower than management fee rates for Funds having a similar strategy, the Trustees considered that Janus Capital noted that, under the terms of the management agreements with the Funds, Janus Capital performs significant additional services for the Funds that it does not provide to those other clients, including administration services, oversight of the Funds’ other service providers, trustee support, regulatory compliance and numerous other services, and that, in serving the Funds, Janus Capital assumes many legal risks and other costs that it does not assume in servicing its other clients. Moreover, they noted that the independent fee consultant found that: (1) the management fees Janus Capital charges to the Funds are reasonable in relation to the management fees Janus Capital charges to its institutional and subadvised accounts; (2) these institutional and subadvised accounts have different service and infrastructure needs; (3) the average spread between management fees charged to the Funds and those charged to Janus Capital’s institutional accounts is reasonable relative to the average spreads seen in the industry; and (4) by one estimation methodology, the fee margins implied by Janus Capital’s subadvised fees when compared to its mutual fund fees are reasonable relative to the estimated fee margins in the industry and relative to estimated fee margins of fund managers using Janus Capital as a subadviser.

The Trustees considered the fees for each Fund for its fiscal year ended in 2014, and noted the following with regard to each Fund’s total expenses, net of applicable fee waivers (the Fund’s “total expenses”):

Fixed-Income Funds and Money Market Funds

· For Janus Flexible Bond Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group mean for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

Janus Aspen Flexible Bond Portfolio

Additional Information (unaudited)

· For Janus Global Bond Fund, the Trustees noted that although the Fund’s total expenses exceeded the peer group mean for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Global Unconstrained Bond Fund, the Trustees noted that although the Fund’s total expenses exceeded the peer group mean for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus High-Yield Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group mean for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

· For Janus Multi-Sector Income Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group mean for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus has contractually agreed to limit the Fund’s expenses.

· For Janus Real Return Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group mean for all share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Short-Term Bond Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group mean for all share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Government Money Market Fund, the Trustees noted that the Fund’s total expenses exceeded the peer group mean for both share classes. The Trustees considered that management fees for this Fund are higher than the peer group mean due to the Fund’s management fee including other costs, such as custody and transfer agent services, while many funds in the peer group pay these expenses separately from their management fee. In addition, the Trustees considered that Janus Capital voluntarily waives one-half of its advisory fee and other expenses in order to maintain a positive yield.

· For Janus Money Market Fund, the Trustees noted that the Fund’s total expenses were below the peer group mean for both share classes. In addition, the Trustees considered that Janus Capital voluntarily waives one-half of its advisory fee and other expenses in order to maintain a positive yield.

Asset Allocation Funds

· For Janus Global Allocation Fund – Conservative, the Trustees noted that the Fund’s total expenses were below the peer group mean for all share classes.

· For Janus Global Allocation Fund – Growth, the Trustees noted that the Fund’s total expenses were below the peer group mean for all share classes.

· For Janus Global Allocation Fund – Moderate, the Trustees noted that, although the Fund’s total expenses exceeded the peer group mean for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

Alternative Fund

· For Janus Diversified Alternatives Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group mean for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

Value Funds

· For Perkins International Value Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group mean for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Perkins Global Value Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group mean for one share class, overall the Fund’s total expenses were reasonable.

Janus Aspen Flexible Bond Portfolio

Additional Information (unaudited)

· For Perkins Large Cap Value Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group mean for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Perkins Mid Cap Value Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group mean for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

· For Perkins Select Value Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group mean for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Perkins Small Cap Value Fund, the Trustees noted that the Fund’s total expenses were below the peer group mean for all share classes.

· For Perkins Value Plus Income Fund, the Trustees noted that although the Fund’s total expenses exceeded the peer group mean for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital had contractually agreed to limit the Fund’s expenses.

Mathematical Funds

· For INTECH Emerging Markets Managed Volatility Fund, the Trustees noted that although the Fund’s total expenses exceeded the peer group mean for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For INTECH Global Income Managed Volatility Fund, the Trustees noted that the Fund’s total expenses were below the peer group mean for all share classes.

· For INTECH International Managed Volatility Fund, the Trustees noted that although the Fund’s total expenses exceeded the peer group mean for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital had contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

· For INTECH U.S. Core Fund, the Trustees noted that although the Fund’s total expenses exceeded the peer group mean for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

· For INTECH U.S. Managed Volatility Fund, the Trustees noted that the Fund’s total expenses exceeded the peer group mean for one share class. The Trustees also noted that Janus Capital had contractually agreed to limit the Fund’s expenses.

Growth and Core Funds

· For Janus Balanced Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group mean for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

· For Janus Contrarian Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group mean for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

· For Janus Enterprise Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group mean for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

· For Janus Forty Fund, the Trustees noted that the Fund’s total expenses were below the peer group mean for all share classes.

Janus Aspen Flexible Bond Portfolio

Additional Information (unaudited)

· For Janus Fund, the Trustees noted that the Fund’s total expenses were below the peer group mean for all share classes.

· For Janus Growth and Income Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group mean for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

· For Janus Research Fund, the Trustees noted that the Fund’s total expenses were below the peer group mean for all share classes.

· For Janus Triton Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group mean for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

· For Janus Twenty Fund, the Trustees noted that the Fund’s total expenses were below the peer group mean for all share classes.

· For Janus Venture Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group mean for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

Global and International Funds

· For Janus Asia Equity Fund, the Trustees noted that the Fund’s total expenses were below the peer group mean for all share classes.

· For Janus Emerging Markets Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group mean for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Global Life Sciences Fund, the Trustees noted that the Fund’s total expenses were below the peer group mean for all share classes.

· For Janus Global Real Estate Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group mean for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Global Research Fund, the Trustees noted that the Fund’s total expenses were below the peer group mean for all share classes.

· For Janus Global Select Fund, the Trustees noted that the Fund’s total expenses were below the peer group mean for all share classes.

· For Janus Global Technology Fund, the Trustees noted that the Fund’s total expenses were below the peer group mean for all share classes.

· For Janus International Equity Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group mean for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

· For Janus Overseas Fund, the Trustees noted that the Fund’s total expenses were below the peer group mean for all share classes.

Janus Aspen Series

· For Janus Aspen Balanced Portfolio, the Trustees noted that the Fund’s total expenses were below the peer group mean for both share classes.

Janus Aspen Flexible Bond Portfolio

Additional Information (unaudited)

· For Janus Aspen Enterprise Portfolio, the Trustees noted that the Fund’s total expenses were below the peer group mean for both share classes.

· For Janus Aspen Flexible Bond Portfolio, the Trustees noted that, although the Fund’s total expenses exceeded the peer group mean for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital had contractually agreed to limit the Fund’s expenses.

· For Janus Aspen Forty Portfolio, the Trustees noted that the Fund’s total expenses were below the peer group mean for both share classes.

· For Janus Aspen Global Allocation Portfolio - Moderate, the Trustees noted that, although the Fund’s total expenses exceeded the peer group mean for both share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Aspen Global Research Portfolio, the Trustees noted that the Fund’s total expenses were below the peer group mean for both share classes.

· For Janus Aspen Global Technology Portfolio, the Trustees noted that the Fund’s total expenses were below the peer group mean for both share classes.

· For Janus Aspen Global Unconstrained Bond Portfolio, the Trustees noted that, although the Fund’s total expenses exceeded the peer group mean for both share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital had contractually agreed to limit the Fund’s expenses.

· For Janus Aspen INTECH U.S. Low Volatility Portfolio, the Trustees noted that the Fund’s total expenses were below the peer group mean for its sole share class.

· For Janus Aspen Janus Portfolio, the Trustees noted that the Fund’s total expenses were below the peer group mean for both share classes.

· For Janus Aspen Overseas Portfolio, the Trustees noted that the Fund’s total expenses were below the peer group mean for both share classes.

· For Janus Aspen Perkins Mid Cap Value Portfolio, the Trustees noted that the Fund’s total expenses were below the peer group mean for both share classes.

The Trustees reviewed information on the profitability to Janus Capital and its affiliates of their relationships with each Fund, as well as an explanation of the methodology utilized by Janus Capital when allocating various expenses of Janus Capital and its affiliates with respect to contractual relationships with the Funds and other clients. The Trustees also reviewed the financial statements and corporate structure of Janus Capital’s parent company. In their review, the Trustees considered whether Janus Capital and each subadviser receive adequate incentives and resources to manage the Funds effectively. The Trustees recognized that profitability comparisons among fund managers are difficult because very little comparative information is publicly available, and the profitability of any fund manager is affected by numerous factors, including the organizational structure of the particular fund manager, the types of funds and other accounts it manages, possible other lines of business, the methodology for allocating expenses, and the fund manager’s capital structure and cost of capital. However, taking into account those factors and the analysis provided by the Trustees’ independent fee consultant, and based on the information available, the Trustees concluded that Janus Capital’s profitability with respect to each Fund in relation to the services rendered was reasonable.

The independent fee consultant found that, while assessing the reasonableness of expenses in light of Janus Capital’s profits is dependent on comparisons with other publicly-traded mutual fund advisers, and that these comparisons are limited in accuracy by differences in complex size, business mix, institutional account orientation, and other factors, after accepting these limitations, the level of profit earned by Janus Capital from managing the Funds is reasonable.

The Trustees concluded that the management fees payable by each Fund to Janus Capital and its affiliates, as well as the fees paid by Janus Capital to the subadvisers of subadvised Funds, were reasonable in relation to the nature, extent, and quality of the services provided, taking into account the fees charged by other advisers for managing comparable mutual funds with similar strategies, the fees Janus Capital and the subadvisers charge to other clients, and, as applicable, the impact of fund performance on management fees payable by the Funds. The Trustees also concluded that each Fund’s total expenses were reasonable, taking into account the size of the Fund, the quality of services

Janus Aspen Flexible Bond Portfolio

Additional Information (unaudited)

provided by Janus Capital and any subadviser, the investment performance of the Fund, and any expense limitations agreed to or provided by Janus Capital.

Economies of Scale

The Trustees considered information about the potential for Janus Capital to realize economies of scale as the assets of the Funds increase. They noted that their independent fee consultant provided an analysis of economies of scale, which included discussion of analysis from prior years. They also noted that, although many Funds pay advisory fees at a base fixed rate as a percentage of net assets, without any breakpoints, their independent fee consultant concluded that 85% of these Funds have contractual management fees (gross of waivers) below their Broadridge expense group averages and, overall, 80% of the Funds are below their respective expense group averages for contractual management fees. They also noted that for those Funds whose expenses are being reduced by the contractual expense limitations of Janus Capital, Janus Capital is subsidizing the Funds because they have not reached adequate scale. Moreover, as the assets of some of the Funds have declined in the past few years, certain Funds have benefited from having advisory fee rates that have remained constant rather than increasing as assets declined. In addition, performance fee structures have been implemented for various Funds that have caused the effective rate of advisory fees payable by such a Fund to vary depending on the investment performance of the Fund relative to its benchmark index over the measurement period; and a few Funds have fee schedules with breakpoints and reduced fee rates above certain asset levels. The Trustees also noted that the Funds share directly in economies of scale through the lower charges of third-party service providers that are based in part on the combined scale of all of the Funds. Based on all of the information they reviewed, including research and analysis conducted by the Trustees’ independent fee consultant, the Trustees concluded that the current fee structure of each Fund was reasonable and that the current rates of fees do reflect a sharing between Janus Capital and the Fund of any economies of scale that may be present at the current asset level of the Fund.

The independent fee consultant concluded that, given the limitations of various analytical approaches to economies of scale considered in prior years, and their conflicting results, its analyses could not confirm or deny the existence of economies of scale in the Janus complex. Further, the independent fee consultant provided its belief that Fund investors are well-served by the fee levels and performance fee structures in place on the Funds in light of any economies of scale that may be present at Janus Capital.

Other Benefits to Janus Capital

The Trustees also considered benefits that accrue to Janus Capital and its affiliates and subadvisers to the Funds from their relationships with the Funds. They recognized that two affiliates of Janus Capital separately serve the Funds as transfer agent and distributor, respectively, and the transfer agent receives compensation directly from the non-money market funds for services provided. The Trustees also considered Janus Capital’s past and proposed use of commissions paid by the Funds on portfolio brokerage transactions to obtain proprietary and third-party research products and services benefiting the Fund and/or other clients of Janus Capital and/or Janus Capital, and/or a subadviser to a Fund. The Trustees concluded that Janus Capital’s and the subadvisers’ use of these types of client commission arrangements to obtain proprietary and third-party research products and services was consistent with regulatory requirements and guidelines and was likely to benefit each Fund. The Trustees also concluded that, other than the services provided by Janus Capital and its affiliates and subadvisers pursuant to the agreements and the fees to be paid by each Fund therefor, the Funds and Janus Capital and the subadvisers may potentially benefit from their relationship with each other in other ways. They concluded that Janus Capital and/or the subadvisers benefits from the receipt of research products and services acquired through commissions paid on portfolio transactions of the Funds and that the Funds benefit from Janus Capital’s and/or the subadvisers’ receipt of those products and services as well as research products and services acquired through commissions paid by other clients of Janus Capital and/or other clients of the subadvisers. They further concluded that the success of any Fund could attract other business to Janus Capital, the subadvisers or other Janus funds, and that the success of Janus Capital and the subadvisers could enhance Janus Capital’s and the subadvisers’ ability to serve the Funds.

Janus Aspen Flexible Bond Portfolio

Useful Information About Your Portfolio Report (unaudited)

Management Commentary

The Management Commentary in this report includes valuable insight as well as statistical information to help you understand how your Portfolio’s performance and characteristics stack up against those of comparable indices.

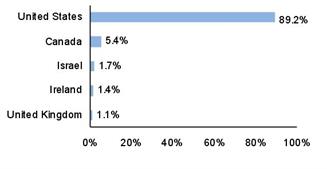

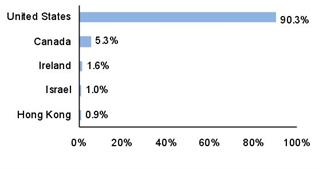

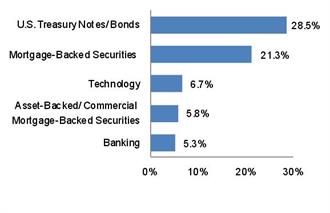

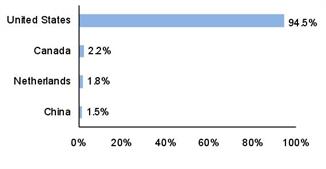

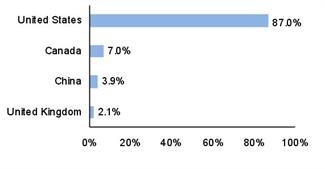

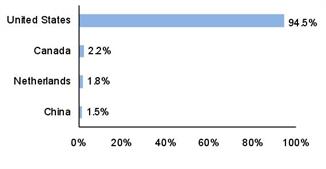

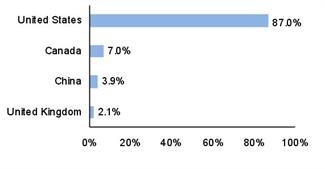

If the Portfolio invests in foreign securities, this report may include information about country exposure. Country exposure is based primarily on the country of risk. A company may be allocated to a country based on other factors such as location of the company’s principal office, the location of the principal trading market for the company’s securities, or the country where a majority of the company’s revenues are derived.

Please keep in mind that the opinions expressed in the Management Commentary are just that: opinions. They are a reflection based on best judgment at the time this report was compiled, which was December 31, 2015. As the investing environment changes, so could opinions. These views are unique and are not necessarily shared by fellow employees or by Janus in general.

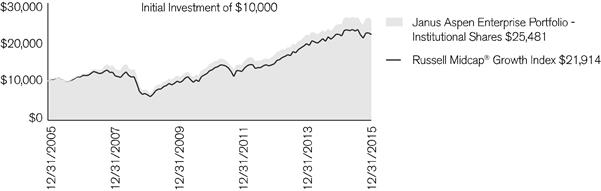

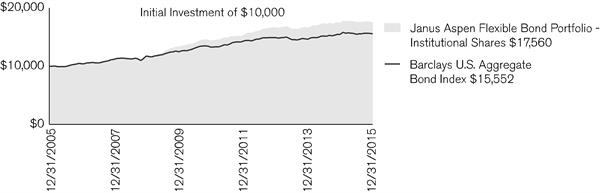

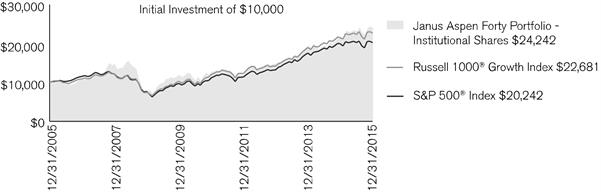

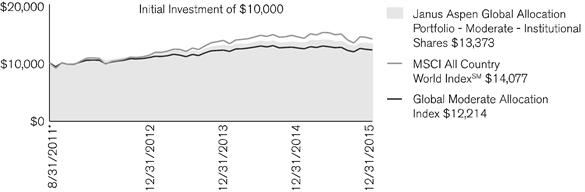

Performance Overviews

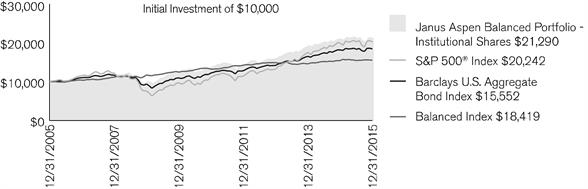

Performance overview graphs compare the performance of a hypothetical $10,000 investment in the Portfolio with one or more widely used market indices. When comparing the performance of the Portfolio with an index, keep in mind that market indices are not available for investment and do not reflect deduction of expenses.

Average annual total returns are quoted for a Portfolio with more than one year of performance history. Average annual total return is calculated by taking the growth or decline in value of an investment over a period of time, including reinvestment of dividends and distributions, then calculating the annual compounded percentage rate that would have produced the same result had the rate of growth been constant throughout the period. Average annual total return does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Cumulative total returns are quoted for a Portfolio with less than one year of performance history. Cumulative total return is the growth or decline in value of an investment over time, independent of the period of time involved. Cumulative total return does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Pursuant to federal securities rules, expense ratios shown in the performance chart reflect subsidized (if applicable) and unsubsidized ratios. The total annual fund operating expenses ratio is gross of any fee waivers, reflecting the Portfolio’s unsubsidized expense ratio. The net annual fund operating expenses ratio (if applicable) includes contractual waivers of Janus Capital and reflects the Portfolio’s subsidized expense ratio. Ratios may be higher or lower than those shown in the “Financial Highlights” in this report.

Schedule of Investments

Following the performance overview section is the Portfolio’s Schedule of Investments. This schedule reports the types of securities held in the Portfolio on the last day of the reporting period. Securities are usually listed by type (common stock, corporate bonds, U.S. Government obligations, etc.) and by industry classification (banking, communications, insurance, etc.). Holdings are subject to change without notice.

The value of each security is quoted as of the last day of the reporting period. The value of securities denominated in foreign currencies is converted into U.S. dollars.

If the Portfolio invests in foreign securities, it will also provide a summary of investments by country. This summary reports the Portfolio exposure to different countries by providing the percentage of securities invested in each country. The country of each security represents the country of risk. The Portfolio’s Schedule of Investments relies upon the industry group and country classifications published by Barclays and/or MSCI Inc.

Tables listing details of individual forward currency contracts, futures, written options, and swaps follow the Portfolio’s Schedule of Investments (if applicable).

Statement of Assets and Liabilities

This statement is often referred to as the “balance sheet.” It lists the assets and liabilities of the Portfolio on the last day of the reporting period.

Janus Aspen Flexible Bond Portfolio

Useful Information About Your Portfolio Report (unaudited)

The Portfolio’s assets are calculated by adding the value of the securities owned, the receivable for securities sold but not yet settled, the receivable for dividends declared but not yet received on securities owned, and the receivable for Portfolio shares sold to investors but not yet settled. The Portfolio’s liabilities include payables for securities purchased but not yet settled, Portfolio shares redeemed but not yet paid, and expenses owed but not yet paid. Additionally, there may be other assets and liabilities such as unrealized gain or loss on forward currency contracts.

The section entitled “Net Assets Consist of” breaks down the components of the Portfolio’s net assets. Because the Portfolio must distribute substantially all earnings, you will notice that a significant portion of net assets is shareholder capital.

The last section of this statement reports the net asset value (“NAV”) per share on the last day of the reporting period. The NAV is calculated by dividing the Portfolio’s net assets for each share class (assets minus liabilities) by the number of shares outstanding.

Statement of Operations

This statement details the Portfolio’s income, expenses, realized gains and losses on securities and currency transactions, and changes in unrealized appreciation or depreciation of Portfolio holdings.

The first section in this statement, entitled “Investment Income,” reports the dividends earned from securities and interest earned from interest-bearing securities in the Portfolio.

The next section reports the expenses incurred by the Portfolio, including the advisory fee paid to the investment adviser, transfer agent fees and expenses, and printing and postage for mailing statements, financial reports and prospectuses. Expense offsets and expense reimbursements, if any, are also shown.

The last section lists the amounts of realized gains or losses from investment and foreign currency transactions, and changes in unrealized appreciation or depreciation of investments and foreign currency-denominated assets and liabilities. The Portfolio will realize a gain (or loss) when it sells its position in a particular security. A change in unrealized gain (or loss) refers to the change in net appreciation or depreciation of the Portfolio during the reporting period. “Net Realized and Unrealized Gain/(Loss) on Investments” is affected both by changes in the market value of Portfolio holdings and by gains (or losses) realized during the reporting period.

Statements of Changes in Net Assets

These statements report the increase or decrease in the Portfolio’s net assets during the reporting period. Changes in the Portfolio’s net assets are attributable to investment operations, dividends and distributions to investors, and capital share transactions. This is important to investors because it shows exactly what caused the Portfolio’s net asset size to change during the period.

The first section summarizes the information from the Statement of Operations regarding changes in net assets due to the Portfolio’s investment operations. The Portfolio’s net assets may also change as a result of dividend and capital gains distributions to investors. If investors receive their dividends and/or distributions in cash, money is taken out of the Portfolio to pay the dividend and/or distribution. If investors reinvest their dividends and/or distributions, the Portfolio’s net assets will not be affected. If you compare the Portfolio’s “Net Decrease from Dividends and Distributions” to “Reinvested Dividends and Distributions,” you will notice that dividends and distributions have little effect on the Portfolio’s net assets. This is because the majority of the Portfolio’s investors reinvest their dividends and/or distributions.

The reinvestment of dividends and distributions is included under “Capital Share Transactions.” “Capital Shares” refers to the money investors contribute to the Portfolio through purchases or withdrawals via redemptions. The Portfolio’s net assets will increase and decrease in value as investors purchase and redeem shares from the Portfolio.

Financial Highlights

This schedule provides a per-share breakdown of the components that affect the Portfolio’s NAV for current and past reporting periods as well as total return, asset size, ratios, and portfolio turnover rate.

The first line in the table reflects the NAV per share at the beginning of the reporting period. The next line reports the net investment income/(loss) per share. Following is the per share total of net gains/(losses), realized and unrealized. Per share dividends and distributions to investors are then subtracted to arrive at the NAV per share at the end of the period. The next line reflects the total return for the period. The total return may include adjustments in accordance with

Janus Aspen Flexible Bond Portfolio

Useful Information About Your Portfolio Report (unaudited)

generally accepted accounting principles required at the period end for financial reporting purposes. The total return does not include any charges at the separate account level or contract level. As a result, the total return may differ from the total return reflected for individual shareholder transactions. Also included are ratios of expenses and net investment income to average net assets.

The Portfolio’s expenses may be reduced through expense offsets and expense reimbursements. The ratios shown reflect expenses before and after any such offsets and reimbursements.

The ratio of net investment income/(loss) summarizes the income earned less expenses, divided by the average net assets of the Portfolio during the reporting period. Do not confuse this ratio with the Portfolio’s yield. The net investment income ratio is not a true measure of the Portfolio’s yield because it does not take into account the dividends distributed to the Portfolio’s investors.

The next figure is the portfolio turnover rate, which measures the buying and selling activity in the Portfolio. Portfolio turnover is affected by market conditions, changes in the asset size of the Portfolio, fluctuating volume of shareholder purchase and redemption orders, the nature of the Portfolio’s investments, and the investment style and/or outlook of the portfolio manager(s) and/or investment personnel. A 100% rate implies that an amount equal to the value of the entire portfolio was replaced once during the fiscal year; a 50% rate means that an amount equal to the value of half the portfolio is traded in a year; and a 200% rate means that an amount equal to the value of the entire portfolio is traded every six months.

Janus Aspen Flexible Bond Portfolio

Designation Requirements (unaudited)

For federal income tax purposes, the Portfolio designated the following for the year ended December 31, 2015:

| | |

| | |

Capital Gain Distributions | $2,675,529 |

Dividends Received Deduction Percentage | 2% |

Janus Aspen Flexible Bond Portfolio

Trustees and Officers (unaudited)

The Portfolio’s Statement of Additional Information includes additional information about the Trustees and officers and is available, without charge, by calling 1-877-335-2687

The following are the Trustees and officers of the Trust, together with a brief description of their principal occupations during the last five years (principal occupations for certain Trustees may include periods over five years).

Each Trustee has served in that capacity since he or she was originally elected or appointed. The Trustees do not serve a specified term of office. Each Trustee will hold office until the termination of the Trust or his or her earlier death, resignation, retirement, incapacity, or removal. Under the Portfolio’s Governance Procedures and Guidelines, the policy is for Trustees to retire no later than the end of the calendar year in which the Trustee turns 75. The Trustees review the Portfolio’s Governance Procedures and Guidelines from time to time and may make changes they deem appropriate. The Portfolio’s Nominating and Governance Committee will consider nominees for the position of Trustee recommended by shareholders. Shareholders may submit the name of a candidate for consideration by the Committee by submitting their recommendations to the Trust’s Secretary. Each Trustee is currently a Trustee of one other registered investment company advised by Janus Capital: Janus Investment Fund. Collectively, these two registered investment companies consist of 58 series or funds.

The Trust’s officers are elected annually by the Trustees for a one-year term. Certain officers also serve as officers of Janus Investment Fund. Certain officers of the Portfolio may also be officers and/or directors of Janus Capital. Portfolio officers receive no compensation from the Portfolio, except for the Portfolio’s Chief Compliance Officer, as authorized by the Trustees.

| | | | | | |

TRUSTEES |

Name, Address, and Age | Positions Held with the Trust | Length of Time Served | Principal Occupations During the Past Five Years | Number of Portfolios/Funds in Fund Complex Overseen by Trustee | Other Directorships Held by Trustee During the Past Five Years |

Independent Trustees |

William F. McCalpin

151 Detroit Street

Denver, CO 80206

DOB: 1957 | Chairman

Trustee | 1/08-Present

6/02-Present | Managing Director, Holos Consulting LLC (provides consulting services to foundations and other nonprofit organizations). Formerly, Chief Executive Officer, Imprint Capital (impact investment firm) (2013-2015) and Executive Vice President and Chief Operating Officer of The Rockefeller Brothers Fund (a private family foundation) (1998-2006). | 58 | Chairman of the Board and Director of The Investment Fund for Foundations Investment Program (TIP) (consisting of 2 funds), and Director of the F.B. Heron Foundation (a private grantmaking foundation). |

Janus Aspen Flexible Bond Portfolio

Trustees and Officers (unaudited)

| | | | | | |

TRUSTEES |

Name, Address, and Age | Positions Held with the Trust | Length of Time Served | Principal Occupations During the Past Five Years | Number of Portfolios/Funds in Fund Complex Overseen by Trustee | Other Directorships Held by Trustee During the Past Five Years |

Alan A. Brown

151 Detroit Street

Denver, CO 80206

DOB: 1962 | Trustee | 1/13-Present | Executive Vice President, Institutional Markets, of Dividend Capital Group (private equity real estate investment management firm) (since 2012). Formerly, Executive Vice President and Co-Head, Global Private Client Group (2007-2010), Executive Vice President, Mutual Funds (2005-2007), and Chief Marketing Officer (2001-2005) of Nuveen Investments, Inc. (asset management). | 58 | Director of MotiveQuest LLC (strategic social market research company) (since 2003), and Director of WTTW (PBS affiliate) (since 2003). Formerly, Director of Nuveen Global Investors LLC (2007-2011); Director of Communities in Schools (2004-2010); and Director of Mutual Fund Education Alliance (until 2010). |

William D. Cvengros

151 Detroit Street

Denver, CO 80206

DOB: 1948 | Trustee | 1/11-Present | Managing Member and Chief Executive Officer of SJC Capital, LLC (a personal investment company and consulting firm) (since 2002). Formerly, Venture Partner for The Edgewater Funds (a middle market private equity firm) (2002-2004); Chief Executive Officer and President of PIMCO Advisors Holdings L.P. (a publicly traded investment management firm) (1994-2000); and Chief Investment Officer of Pacific Life Insurance Company (a mutual life insurance and annuity company) (1987-1994). | 58 | Advisory Board Member, Innovate Partners Emerging Growth and Equity Fund I (early stage venture capital fund) (since 2014) and Managing Trustee of National Retirement Partners Liquidating Trust (since 2013). Formerly, Chairman, National Retirement Partners, Inc. (formerly a network of advisors to 401(k) plans) (2005-2013); Director of Prospect Acquisition Corp. (a special purpose acquisition corporation) (2007-2009); Director of RemedyTemp, Inc. (temporary help services company) (1996-2006); and Trustee of PIMCO Funds Multi-Manager Series (1990-2000) and Pacific Life Variable Life & Annuity Trusts (1987-1994). |

Janus Aspen Flexible Bond Portfolio

Trustees and Officers (unaudited)

| | | | | | |

TRUSTEES |

Name, Address, and Age | Positions Held with the Trust | Length of Time Served | Principal Occupations During the Past Five Years | Number of Portfolios/Funds in Fund Complex Overseen by Trustee | Other Directorships Held by Trustee During the Past Five Years |

James T. Rothe

151 Detroit Street

Denver, CO 80206

DOB: 1943 | Trustee | 1/97-Present | Co-founder and Managing Director of Roaring Fork Capital SBIC, L.P. (SBA, SBIC fund focusing on private investment in public equity firms) and Professor Emeritus of Business of the University of Colorado, Colorado Springs, CO (since 2004). Formerly, Professor of Business of the University of Colorado (2002-2004); and Distinguished Visiting Professor of Business (2001-2002) of Thunderbird (American Graduate School of International Management), Glendale, AZ. | 58 | Formerly, Director of Red Robin Gourmet Burgers, Inc. (RRGB) (2004- 2014). |

William D. Stewart

151 Detroit Street

Denver, CO 80206

DOB: 1944 | Trustee | 9/93-Present | Retired. Formerly, Corporate Vice President and General Manager of MKS Instruments - HPS Products, Boulder, CO (a manufacturer of vacuum fittings and valves) and PMFC Division, Andover, MA (manufacturing pressure measurement and flow products) (1976-2012). | 58 | None |

Janus Aspen Flexible Bond Portfolio

Trustees and Officers (unaudited)

| | | | | | |

TRUSTEES |

Name, Address, and Age | Positions Held with the Trust | Length of Time Served | Principal Occupations During the Past Five Years | Number of Portfolios/Funds in Fund Complex Overseen by Trustee | Other Directorships Held by Trustee During the Past Five Years |

Linda S. Wolf

151 Detroit Street

Denver, CO 80206

DOB: 1947 | Trustee | 12/05-Present | Retired. Formerly, Chairman and Chief Executive Officer of Leo Burnett (Worldwide) (advertising agency) (2001-2005). | 58 | Director of Chicago Community Trust (Regional Community Foundation), Chicago Council on Global Affairs, InnerWorkings (U.S. provider of print procurement solutions to corporate clients), Lurie Children’s Hospital (Chicago, IL), Rehabilitation Institute of Chicago, Walmart, and Wrapports, LLC (digital communications company). Formerly, Director of Chicago Convention & Tourism Bureau (until 2014) and The Field Museum of Natural History (Chicago, IL) (until 2014). |

Trustee Consultant |

Raudline Etienne*

151 Detroit Street

Denver, CO 80206

DOB: 1965 | Consultant | 6/14-Present | Senior Advisor, Albright Stonebridge Group LLC (global strategy firm) (since 2016). Formerly, Senior Vice President (2011-2015), Albright Stonebridge Group LLC; and Deputy Comptroller and Chief Investment Officer, New York State Common Retirement Fund (public pension fund) (2008-2011). | N/A | Director of Brightwood Capital Advisors, LLC (since 2014). |

* Raudline Etienne was appointed consultant to the Trustees effective June 2, 2014. Shareholders of the Janus Funds are expected to be asked to elect Ms. Etienne as a Trustee at a future shareholder meeting.

Janus Aspen Flexible Bond Portfolio

Trustees and Officers (unaudited)

| | | | |

OFFICERS |

Name, Address, and Age | Positions Held with the Trust | Term of Office* and Length of Time Served | Principal Occupations During the Past Five Years |

Michael Keough

151 Detroit Street

Denver, CO 80206

DOB: 1978 | Executive Vice President and Co-Portfolio Manager

Janus Aspen Flexible Bond Portfolio | 12/15-Present | Portfolio Manager for other Janus accounts and Research Analyst for Janus Capital. |

Mayur Saigal

151 Detroit Street

Denver, CO 80206

DOB: 1975 | Executive Vice President and Co-Portfolio Manager

Janus Aspen Flexible Bond Portfolio | 12/15-Present | Portfolio Manager for other Janus accounts and Research Analyst for Janus Capital. |

Gibson Smith

151 Detroit Street

Denver, CO 80206

DOB: 1968 | Executive Vice President and Co-Portfolio Manager

Janus Aspen Flexible Bond Portfolio | 5/07-Present | Chief Investment Officer Fixed Income and Executive Vice President of Janus Capital; Director of Perkins Investment Management LLC; and Portfolio Manager for other Janus accounts. Formerly, Executive Vice President of Janus Distributors LLC and Janus Services LLC (2007-2013). |

Darrell Watters

151 Detroit Street

Denver, CO 80206

DOB: 1963 | Executive Vice President and Co-Portfolio Manager

Janus Aspen Flexible Bond Portfolio | 5/07-Present | Vice President of Janus Capital and Portfolio Manager for other Janus accounts. |

Stephanie Grauerholz 151 Detroit Street

Denver, CO 80206

DOB: 1970 | Chief Legal Counsel and Secretary

Vice President | 1/06-Present

3/06-Present | Senior Vice President and Chief Legal Counsel of Janus Capital and Senior Vice President of Janus Services LLC (since 2015). Formerly, Vice President and Assistant General Counsel of Janus Capital, Vice President and Assistant Secretary of Janus Distributors LLC, and Vice President of Janus Services LLC (2007-2015). |

* Officers are elected at least annually by the Trustees for a one-year term and may also be elected from time to time by the Trustees for an interim period.

Janus Aspen Flexible Bond Portfolio

Trustees and Officers (unaudited)

| | | | |

OFFICERS |

Name, Address, and Age | Positions Held with the Trust | Term of Office* and Length of Time Served | Principal Occupations During the Past Five Years |

Bruce L. Koepfgen

151 Detroit Street

Denver, CO 80206

DOB: 1952 | President and Chief Executive Officer | 7/14-Present | President of Janus Capital Group Inc. and Janus Capital Management LLC (since 2013); Executive Vice President and Director of Janus International Holding LLC (since 2011); Executive Vice President of Janus Distributors LLC (since 2011); Executive Vice President and Working Director of INTECH Investment Management LLC (since 2011); Executive Vice President and Director of Perkins Investment Management LLC (since 2011); and Executive Vice President and Director of Janus Management Holdings Corporation (since 2011). Formerly, Executive Vice President of Janus Services LLC (2011-2015), Janus Capital Group Inc. and Janus Capital Management LLC (2011-2013); and Chief Financial Officer of Janus Capital Group Inc., Janus Capital Management LLC, Janus Distributors LLC, Janus Management Holdings Corporation, and Janus Services LLC (2011-2013). |

David R. Kowalski

151 Detroit Street

Denver, CO 80206

DOB: 1957 | Vice President, Chief Compliance Officer, and Anti-Money Laundering Officer | 6/02-Present | Senior Vice President and Chief Compliance Officer of Janus Capital, Janus Distributors LLC, and Janus Services LLC; Vice President of INTECH Investment Management LLC and Perkins Investment Management LLC; and Director of The Janus Foundation. |

Jesper Nergaard

151 Detroit Street

Denver, CO 80206

DOB: 1962 | Chief Financial Officer

Vice President, Treasurer, and Principal Accounting Officer | 3/05-Present

2/05-Present | Vice President of Janus Capital and Janus Services LLC. |

* Officers are elected at least annually by the Trustees for a one-year term and may also be elected from time to time by the Trustees for an interim period.

Janus Aspen Flexible Bond Portfolio

Notes

NotesPage1

Janus Aspen Flexible Bond Portfolio

Notes

NotesPage2

Janus provides access to a wide range of investment disciplines.

Alternative

Janus alternative funds seek to deliver strong risk-adjusted returns over a full market cycle with lower correlation to equity markets than traditional investments.

Asset Allocation

Janus’ asset allocation funds utilize our fundamental, bottom-up research to balance risk over the long term. From fund options that meet investors’ risk tolerance and objectives to a method that incorporates non-traditional investment choices to seek non-correlated sources of risk and return, Janus’ asset allocation funds aim to allocate risk more effectively.

Fixed Income

Janus fixed income funds attempt to provide less risk relative to equities while seeking to deliver a competitive total return through high current income and appreciation. Janus money market funds seek capital preservation and liquidity with current income as a secondary objective.

Global & International

Janus global and international funds seek to leverage Janus’ research capabilities by taking advantage of inefficiencies in foreign markets, where accurate information and analytical insight are often at a premium.

Growth & Core

Janus growth funds focus on companies believed to be the leaders in their respective industries, with solid management teams, expanding market share, margins and efficiencies. Janus core funds seek investments in more stable and predictable companies. Our core funds look for a strategic combination of steady growth and, for certain funds, some degree of income.

Mathematical

Our mathematical funds seek to outperform their respective indices while maintaining a risk profile equal to or lower than the index itself. Managed by INTECH® (a Janus subsidiary), these funds use a mathematical process in an attempt to build a more “efficient” portfolio than the index.

Value

Our value funds, managed by Perkins® (a Janus subsidiary), seek to identify companies with favorable reward to risk characteristics by conducting rigorous downside analysis before determining upside potential.

For more information about our funds, contact your investment professional or go to janus.com/variable-insurance.

| | | | | | | | | | | | | |

| | | | | |

| | | | |

| | | | | |

Please consider the charges, risks, expenses and investment objectives carefully before investing. For a prospectus or, if available, a summary prospectus containing this and other information, please call Janus at 877.33JANUS (52687) or download the file from janus.com/variable-insurance. Read it carefully before you invest or send money. |

Janus, INTECH and Perkins are registered trademarks of Janus International Holding LLC. © Janus International Holding LLC. Funds distributed by Janus Distributors LLC |

Investment products offered are: | NOT FDIC-INSURED | MAY LOSE VALUE | NO BANK GUARANTEE | |

C-0216-108539 | | | | 109-02-81114 02-16 |

| | | | |

| | | |

| | | ANNUAL REPORT December 31, 2015 |

| | |

| | Janus Aspen Forty Portfolio |

| | |

| | Janus Aspen Series |

| | | |

| | | HIGHLIGHTS · Portfolio management perspective · Investment strategy behind your fund · Portfolio performance, characteristics

and holdings |

| | | |

| | |

|

Table of Contents

Janus Aspen Forty Portfolio

| | |

Management Commentary and Schedule of Investments | 1 |

Notes to Schedule of Investments and Other Information | 10 |

Statement of Assets and Liabilities | 11 |

Statement of Operations | 12 |

Statements of Changes in Net Assets | 13 |

Financial Highlights | 14 |

Notes to Financial Statements | 15 |

Report of Independent Registered Public Accounting Firm | 23 |

Additional Information | 24 |

Useful Information About Your Portfolio Report | 36 |

Designation Requirements | 39 |

Trustees and Officers | 40 |

Janus Aspen Forty Portfolio (unaudited)

| | | | | | |

PORTFOLIO SNAPSHOT We believe constructing a concentrated portfolio of quality growth companies will allow us to outperform our benchmark over time. We define quality as companies that enjoy sustainable “moats” around their businesses, potentially allowing companies to grow faster, with higher returns, than their competitors. We believe the market often underestimates these companies’ sustainable competitive advantage periods. | | | | |

Doug Rao portfolio manager |

| | | |

PERFORMANCE OVERVIEW

For the 12-month period ended December 31, 2015, Janus Aspen Forty Portfolio’s Institutional Shares and Service Shares returned 12.22% and 11.94%, respectively, versus a return of 5.67% for the Portfolio’s primary benchmark, the Russell 1000 Growth Index. The Portfolio’s secondary benchmark, the S&P 500 Index, returned 1.38% for the period.

INVESTMENT ENVIRONMENT

The multi-year equities rally encountered significant turbulence during 2015. Cooling growth, weak commodities prices, a surging U.S. dollar and a shift in monetary policy were some of the factors investors had to consider when valuing stock portfolios. Volatility began early in the year as the slide in crude prices started being considered a potential harbinger for sagging demand rather than solely a consequence of overproduction. Global volatility was in the minds of Federal Reserve (Fed) officials when they chose to delay raising interest rates at their September meeting. However, improving U.S. employment data later led to a consensus that rates would indeed rise by the end of the year, and investors digested their first hike in nearly a decade with relative ease. Although markets were again roiled late year by energy prices coming under renewed pressure, bringing back the prospect that global growth may fall short of projections, large caps ended the year up.

PERFORMANCE DISCUSSION

The Portfolio outperformed both its primary benchmark, the Russell 1000 Growth Index, and its secondary benchmark, the S&P 500 Index, during the period. As part of our investment strategy, we seek companies that have built clear, sustainable competitive moats around their businesses, which should help them grow market share within their respective industries over time. Important competitive advantages could include a strong brand, network effects from a product or service that would be hard for a competitor to replicate, a lower cost structure than competitors in the industry, a distribution advantage or patent protection over valuable intellectual property. We think emphasizing these sustainable competitive advantages can be a meaningful driver of outperformance over longer time horizons because the market often underestimates the duration of growth for these companies and the long-term potential return to shareholders. During the year, we saw a number of companies in our portfolio put up impressive results, further validating our view that they are well positioned to grow in excess of the market.

Amazon was the largest individual contributor to performance. The company benefited as its gross merchandise volume (GMV) sales accelerated. Continued improvements in operating leverage in its core retail business also aided results. We believe Amazon is a good example of the types of competitively advantaged companies we tend to seek in our portfolio. Amazon has already rewritten the rules for retail shopping and we believe it will continue to gain consumers’ wallet share as more shopping moves from physical stores to online and mobile purchases. Meanwhile, Amazon’s cloud business, Amazon Web Services, has come to market with scale and a disruptive pricing model for businesses seeking cloud-based services, and has continued to experience rapid growth.

Alphabet Inc., formerly known as Google, was also a strong contributor to performance. The company continued to benefit from the acceleration of its core business. Strong earnings also continued to indicate that the company is well positioned to consolidate advertising spending as advertising becomes increasingly connected and personalized, and as it transitions from offline channels such as print and television to more measurable online channels such as mobile and online video. The market continued to be encouraged by the new CFO’s focus on expense discipline. The stock also benefited from increased visibility of the monetization of YouTube after the completion of Google’s restructuring under

Janus Aspen Forty Portfolio (unaudited)

Alphabet. As the network effects around Alphabet’s advertising business and Android ecosystem grow, we believe it further deepens the company’s competitive moat and enables it to better understand users’ context and intent and connect those users with suppliers of products and services.

Pharmacyclics was another top contributor to performance during the period. The stock was up significantly in the first quarter after it was announced that AbbVie had won a bidding war to acquire the company. The high interest Pharmacyclics received from other companies bidding for it validated our view that its blood cancer treatments are truly innovative and offer significant growth potential. We sold the stock after the announcement.

While pleased with our performance during the year, we did hold companies that detracted from performance. Canadian Pacific Railway was a large detractor. Softer rail volumes due to a weaker commodity market had a broad impact on the railroad industry, and Canadian Pacific was not immune to the slowdown. However, we continue to have a high level of conviction in the long-term potential of the company. We believe Canadian Pacific’s railroad network across Canada and the U.S. is a valuable asset that would be nearly impossible for other transportation and logistics companies to replicate. The company also has a significant cost advantage over the trucking industry. Going forward, we believe Canadian Pacific can continue to grow revenues and railroad volumes as it improves execution around its railroad network. The company has made substantial investments to improve its service and reliability to customers, and as service improves, which should drive more shippers to use Canadian Pacific instead of trucking services.

Chipotle Mexican Grill also detracted after news about food-related illnesses created volatility and headwinds for the company during the period. However, we continue to like the stock; we believe Chipotle’s higher throughput rates, which have led to higher unit economics at each store, still separate it from most competitors in the fast-food or fast-casual industry. We believe that, in time, the company will be able to re-establish its reputation for food integrity.

Alibaba also detracted. The Chinese e-commerce company provides consumer-to-consumer, business-to-consumer and business-to-business sales services via Web and mobile platforms. The weakness of the Chinese economy weighed on the stock’s performance and we exited our position during the period.

OUTLOOK

We believe that volatility will stay elevated amid continuing questions about global economic growth. While household balance sheets are strong and improving employment and early signs of wage growth are supportive of U.S consumer spending, the modern consumer is also sober minded, as shown by their long-term focus on using savings from cheaper gas and utilities to build up their personal savings. We expect this mindset to continue for the foreseeable future.

While there are concerns about the global economy, we think it underscores the importance of finding those select companies with truly sustainable competitive advantages that can take market share and continue to grow earnings, even without the backdrop of a strong global economy. Such companies are more appreciated in a world where growth is harder to come by, as they can create their own path to creating value.

Thank you for your investment in Janus Aspen Forty Portfolio.

Janus Aspen Forty Portfolio (unaudited)

Portfolio At A Glance

December 31, 2015

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | 5 Top Performers - Holdings | | | | 5 Bottom Performers - Holdings | |

| | | | Contribution | | | Contribution |

| | Casey's General Stores, Inc. | | 2.47% | | Canadian Pacific Railway Limited | -1.16% |

| | Amazon.com, Inc. | | 2.03% | | Chipotle Mexican Grill, Inc. | -0.99% |

| | Alphabet Inc. - Class C | | 1.31% | | Alibaba Group Holding Ltd. Sponsored ADR | -0.70% |

| | Pharmacyclics, Inc. | | 1.21% | | Precision Castparts Corp. | -0.64% |

| | Starbucks Corp. | | 1.05% | | Biogen Inc. | -0.40% |

| | | | | | | |

| | 5 Top Performers - Sectors* | | | | | |

| | | | | | Portfolio Weighting | Russell 1000® Growth Index |

| | | | Portfolio Contribution | | (Average % of Equity) | Weighting |

| | Health Care | | 2.46% | | 17.64% | 15.88% |

| | Consumer Discretionary | | 2.43% | | 26.07% | 20.02% |

| | Information Technology | | 1.17% | | 26.69% | 28.15% |

| | Materials | | 1.03% | | 2.85% | 3.79% |

| | Financials | | 1.00% | | 12.68% | 5.33% |

| | | | | | | |

| | 5 Bottom Performers - Sectors* | | | | | |

| | | | | | Portfolio Weighting | Russell 1000® Growth Index |

| | | | Portfolio Contribution | | (Average % of Equity) | Weighting |

| | Consumer Discretionary | | -0.69% | | 0.25% | 10.74% |

| | Industrials | | -0.46% | | 9.46% | 11.37% |

| | Other** | | -0.30% | | 3.43% | 0.00% |

| | Utilities | | 0.02% | | 0.00% | 0.06% |

| | Telecommunication Services | | 0.18% | | 0.30% | 2.07% |

| | Security contribution to performance is measured by using an algorithm that multiplies the daily performance of each security with the previous day’s ending weight in the portfolio and is gross of advisory fees. Fixed income securities and certain equity securities, such as private placements and some share classes of equity securities, are excluded. |

* | Based on sector classification according to the Global Industry Classification Standard (“GICS”) codes, which are the exclusive property and a service mark of MSCI Inc. and Standard & Poor’s. |

** | Not a GICS classified sector. | | | | | |

Janus Aspen Forty Portfolio (unaudited)

Portfolio At A Glance

December 31, 2015

| | |

5 Largest Equity Holdings - (% of Net Assets) |

Alphabet, Inc. - Class C | |

Internet Software & Services | 6.1% |

Lowe's Cos., Inc. | |

Specialty Retail | 4.8% |

General Electric Co. | |

Industrial Conglomerates | 4.1% |

MasterCard, Inc. - Class A | |

Information Technology Services | 4.0% |

Adobe Systems, Inc. | |

Software | 3.7% |

| | 22.7% |

| | | | | | |

Asset Allocation - (% of Net Assets) |

Common Stocks | | 97.0% |

Investment Companies | | 3.1% |

Other | | (0.1)% |