SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement | ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

¨ | | Definitive Additional Materials |

¨ | | Soliciting Material Under Rule 14a-12 |

SRA INTERNATIONAL, INC.

(Name of Registrant as Specified In Its Certificate)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

¨ | | Fee paid previously with preliminary materials. |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

SRA INTERNATIONAL, INC.

4350 FAIR LAKES COURT

FAIRFAX, VA 22033

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON NOVEMBER 19, 2002

The Annual Meeting of Stockholders of SRA International, Inc. (the “Company”) will be held at the Hilton McLean Tysons Corner, 7920 Jones Branch Drive, McLean, Virginia 22102 on Tuesday, November 19, at 9:30 A.M., local time, to consider and act upon the following matters:

| | 1. | | To elect two Class I directors for the ensuing three years. |

| | 2. | | To approve the continuance of the 2002 Stock Incentive Plan. |

| | 3. | | To ratify the selection by the Board of Directors of Deloitte & Touche LLP as the Company’s independent auditors for the current fiscal year. |

| | 4. | | To transact such other business as may properly come before the meeting or any adjournment thereof. |

Stockholders of record at the close of business on October 4, 2002 will be entitled to notice of and to vote at the meeting or any adjournment thereof. The stock transfer books of the Company will remain open following the record date.

By Order of the Board of Directors,

Stephen C. Hughes, Secretary

Fairfax, Virginia

October 15, 2002

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED PROXY AND MAIL IT PROMPTLY IN THE ENCLOSED ENVELOPE IN ORDER TO ENSURE REPRESENTATION OF YOUR SHARES. NO POSTAGE NEED BE AFFIXED IF THE PROXY IS MAILED IN THE UNITED STATES.

SRA INTERNATIONAL, INC.

4350 FAIR LAKES COURT

FAIRFAX, VA 22033

PROXY STATEMENT FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON TUESDAY, NOVEMBER 19, 2002

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of SRA International, Inc. (the “Company”) for use at the Company’s Annual Meeting of Stockholders to be held on Tuesday, November 19, 2002 (the “Annual Meeting”) and at any adjournment of that meeting. All executed proxies will be voted in accordance with the stockholder’s instructions, and if no choice is specified, executed proxies will be voted in favor of the matters set forth in the accompanying Notice of Meeting. Any proxy may be revoked by a stockholder at any time before its exercise by delivery of written revocation or a subsequently dated proxy to the Secretary of the Company or by voting in person at the Annual Meeting.

On October 4, 2002, the record date for the determination of stockholders entitled to vote at the Annual Meeting (the “Record Date”), there were outstanding and entitled to vote an aggregate of 11,672,066 shares of class A common stock, $0.004 par value per share (“Class A Common Stock”), of the Company and 9,082,711 shares of class B common stock, $0.004 par value per share (“Class B Common Stock,” and together with the Class A Common Stock, the “Common Stock”), of the Company (constituting all of the voting stock of the Company). Holders of Class A Common Stock are entitled to one vote per share and holders of Class B Common Stock are entitled to ten votes per share.

The Company’s Annual Report, including the Company’s Annual Report on Form 10-K, for the year ended June 30, 2002 is being mailed to stockholders, together with these proxy materials, on or about October 15, 2002.

VOTES REQUIRED

The holders of shares of Common Stock representing a majority of the votes entitled to be cast at the Annual Meeting will constitute a quorum for the transaction of business at the Annual Meeting. Shares of Common Stock represented in person or by proxy (including shares which abstain or do not vote with respect to one or more of the matters presented for stockholder approval) will be counted for purposes of determining whether a quorum is present at the Annual Meeting.

The affirmative vote of a plurality of the votes cast by stockholders entitled to vote on the matter is required for the election of directors. The affirmative vote of a majority of the shares of Common Stock voting on the matter is required to approve the continuance of the 2002 Stock Incentive Plan and to ratify the selection by the Board of Directors of Deloitte & Touche LLP as the Company’s independent auditors for the current year.

Shares which abstain from voting as to a particular matter, and shares held in “street name” by brokers or nominees who indicate on their proxies that they do not have discretionary authority to vote such shares as to a particular matter, will not be counted as votes in favor of such matter, and will also not be counted as shares voting on such matter. Accordingly, abstentions and “broker non-votes” will have no effect on the voting on matters (such as the election of directors, the continuation of the stock plan and the ratification of the selection of the auditors) that require the affirmative vote of a plurality or a majority of the votes cast or the shares voting on the matter.

STOCKHOLDERS AGREEMENT

In April 2002, the Company entered into a stockholders agreement with some of its stockholders, including the Company’s executive officers and the entities affiliated with General Atlantic Partners, LLC (the “GAP Entities”). The stockholders agreement provides the GAP Entities the right to designate one member of the Company’s Board of Directors and obligates the Company to use its best efforts to cause that designee to be

1

nominated and elected to the Board of Directors and its committees. Pursuant to the stockholders agreement, stockholders, including the Company’s executive officers, who together beneficially own approximately 90% of the combined voting power of the Company’s outstanding common stock, have agreed to vote their shares in favor of the designee of the GAP Entities. Steven A. Denning is the designee of the GAP Entities and is a nominee to be a class I director.

HOUSEHOLDING OF PROXY MATERIALS

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This means that only one copy of this proxy statement or the Company’s annual report may have been sent to multiple stockholders in your household. The Company will promptly deliver a separate copy of either document to you if you call or write the Company at the following address or phone number: SRA International, Inc., 4350 Fair Lakes Court, Fairfax, Virginia 22033, phone: (703) 803-1500, Attention: Mr. Stuart Davis, Director, Investor Relations. If you want to receive separate copies of the Company’s annual report and proxy statement in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your bank, broker or other nominee record holder, or you may contact the Company at the above address and phone number.

2

BENEFICIAL OWNERSHIP OF COMMON STOCK

The following table sets forth certain information regarding the beneficial ownership of the Company’s Common Stock as of October 4, 2002 by (i) each person or entity who is known by the Company to be the beneficial owner of more than 5% of the outstanding shares of Class A Common Stock or Class B Common Stock, (ii) by each director or nominee for director, (iii) by each of the executive officers named in the Summary Compensation Table set forth under the caption “Executive Compensation” below and (iv) by all directors and executive officers as a group. Unless otherwise indicated, each person or entity named in the table has sole voting power and investment power (or shares such power with his or her spouse) with respect to all shares of capital stock listed as owned by such person or entity.

Unless otherwise indicated, the address of each person owning more than 5% of the outstanding shares of Common Stock is c/o SRA International, Inc., 4350 Fair Lakes Court, Fairfax, VA 22033.

| | | Number of Shares Beneficially Owned (1)

| | Percentage Owned %

| | | Percentage of Total Voting Power

| |

Name of Beneficial Owner

| | Class A Common Stock

| | Class B Common Stock

| | Class A Common Stock

| | | Class B Common Stock

| | |

| Ernst Volgenau (2) | | 710,145 | | 6,908,270 | | 5.9 | % | | 76.1 | % | | 67.9 | % |

| Renato A. DiPentima (3) | | 202,076 | | — | | 1.7 | | | — | | | * | |

| Stephen C. Hughes (4) | | 144,162 | | — | | 1.2 | | | — | | | * | |

| Barry S. Landew (5) | | 392,741 | | — | | 3.3 | | | — | | | * | |

| Edward E. Legasey (6) | | 901,117 | | — | | 7.5 | | | — | | | * | |

| William K. Brehm (7) | | 488,523 | | 2,174,441 | | 4.1 | | | 23.9 | | | 21.6 | |

| E. David Crockett | | 47,058 | | — | | * | | | — | | | * | |

| Steven A. Denning (8) | | 2,117,645 | | — | | 18.1 | | | — | | | 2.1 | |

| Michael R. Klein (9) | | 11,028 | | — | | * | | | — | | | * | |

| Delbert C. Staley | | 29,411 | | — | | * | | | — | | | * | |

All executive officers and directors as a group

(10 persons) (10) | | 5,043,906 | | 9,082,711 | | 38.1 | | | 100.0 | | | 92.1 | |

Entities affiliated with General Atlantic

Partners, LLC (8) | | 2,117,645 | | — | | 18.1 | | | | | | 2.1 | |

| (1) | | The number of shares beneficially owned by each stockholder is determined under rules promulgated by the Securities and Exchange Commission, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares as to which the individual or entity has sole or shared voting power or investment power and any shares as to which the individual or entity has the right to acquire beneficial ownership within 60 days after October 4, 2002 through the exercise of any stock option, warrant or other right. The inclusion herein of such shares, however, does not constitute an admission that the named stockholder is a direct or indirect beneficial owner of such shares. |

| (2) | | Includes 306,484 shares of Class A Common Stock issuable upon exercise of options and 402,940 shares of Class A Common Stock held by a grantor retained annuity trust, of which Dr. Volgenau’s wife is the trustee. |

| (3) | | Includes 162,633 shares of Class A Common Stock issuable upon exercise of options. |

| (4) | | Includes 143,141 shares of Class A Common Stock issuable upon exercise of options and 400 shares of Class A Common Stock held by minor children of Mr. Hughes. |

| (5) | | Includes 361,593 shares of Class A Common Stock issuable upon exercise of options. |

| (6) | | Includes 216,191 shares of Class A Common Stock issuable upon exercise of options and 58,823 shares of Class A Common Stock issuable upon exercise of options held by a grantor retained annuity trust, of which Mr. Legasey’s wife is the trustee. |

3

| (7) | | Includes 290,845 shares of Class A Common Stock issuable upon exercise of options and 197,057 shares of Class A Common Stock held by a grantor retained annuity trust, of which Mr. Brehm’s wife is the trustee. |

| (8) | | Consists of the following shares held by the following entities: 1,740,441 shares held by General Atlantic Partners 75, L.P. (“GAP 75”), 236,329 shares held by GAP Coinvestment Partners II, L.P. (“GAPCO II”), 137,408 shares held by GapStar, LLC (“GapStar”), and 3,467 shares held by GAPCO GmbH & Co. KG (“GAPCO KG”). General Atlantic Partners, LLC (“GAP LLC”) is the general partner of GAP 75 and the managing member of GapStar. The managing members of GAP LLC (other than Klaus Esser) are also the general partners of GAPCO II. Steven A. Denning is a managing member of GAP LLC and a general partner of GAPCO II. The general partner of GAPCO KG is GAPCO Management GmbH, (“Management GmbH”). Mr. Denning is a Managing Director and a shareholder of Management GmbH. Mr. Denning disclaims beneficial ownership of the shares held by the General Atlantic entities. The address of Mr. Denning, GAP 75, GAPCO II, GapStar and GAP LLC is c/o General Atlantic Service Corporation, 3 Pickwick Plaza, Greenwich, CT 06830. The address of GAPCO KG and Management GmbH is c/o General Atlantic Partners GmbH, Koenigsallee 62, 40212 Duesseldorf, Germany. |

| (9) | | Consists of 11,028 shares of Class A Common Stock issuable upon exercise of options. |

| (10) | | Includes 1,550,738 shares of Class A Common Stock issuable upon exercise of options and the shares held in grantor retained annuity trusts described in notes (2) and (7) above. |

PROPOSAL 1—ELECTION OF DIRECTORS

The Company’s Amended and Restated Certificate of Incorporation provides that the Board of Directors is classified into three classes (designated as Class I directors, Class II directors and Class III directors), with members of each class holding office for staggered three-year terms. There are currently two Class I directors, whose terms expire at the Annual Meeting, two Class II directors, whose terms expire at the 2003 Annual Meeting of Stockholders, and two Class III directors, whose terms expire at the 2004 Annual Meeting of Stockholders (in all cases subject to the election and qualification of their successors and to their earlier death, resignation or removal).

The persons named in the enclosed proxy will vote to elect as Class I directors the two nominees named below, both of whom are presently Class I directors of the Company, unless authority to vote for the election of any or all of the nominees is withheld by marking the proxy to that effect. All of the nominees have indicated their willingness to serve, if elected, but if any should be unable or unwilling to serve, proxies may be voted for a substitute nominee designated by the Board of Directors. Each Class I director will be elected to hold office until the 2005 Annual Meeting of Stockholders (subject to the election and qualification of his successor and to his earlier death, resignation or removal).

NOMINATION OF CLASS I DIRECTORS

Set forth below, for each nominee for Class I director, are his name, his age as of October 1, 2002, his positions with the Company, his principal occupation and business experience during the past five years, and the year of the commencement of his term as a director of the Company:

E. DAVID CROCKETT is 66 years old and has served on the Company’s board of directors since October 1996. Since 1990, he has served as the founding general partner of Aspen Ventures, a venture capital firm. From 1985 to 1987, Dr. Crockett was president and chief executive officer of Pyramid Technology Corporation, a UNIX server company. He also serves on the board of directors of Herman Miller, Inc., a furniture manufacturing company.

STEVEN A. DENNING is 54 years old and has served on the Company’s board of directors since April 2002. Mr. Denning is the Executive Managing Member of General Atlantic Partners, LLC, a private equity investment firm focused exclusively on information technology, process outsourcing and communications on a

4

global basis. He has been with General Atlantic or its predecessor since 1980. Mr. Denning is a director of Exult, Inc., a human resources outsourcing company, Eclipsys Corporation, a healthcare information technology company, Manugistics Group, Inc., a supply chain management software company, EXE Technologies, Inc., a supply chain execution software company, and two private information technology companies in which investment entities affiliated with General Atlantic are investors. Mr. Denning was initially named to the Board of Directors pursuant to a stockholders agreement, which is described below under “Certain Relationships and Transactions – Sale of Class A Common Stock to General Atlantic Partners.”

Board Recommendation

The Board of Directors recommends a vote FOR the election of the nominees named above.

INCUMBENT DIRECTORS

Set forth below, for each incumbent director, are his name, his age as of October 1, 2002, his positions with the Company, his principal occupation and business experience during the past five years and the year of the commencement of his term as a director of the Company:

Incumbent Class II Directors

WILLIAM K. BREHM is 73 years old and has served on the Company’s board of directors since 1978 and has been the Company’s chairman since 1980. From 1977 to 1980, he served as executive vice president and director of Computer Network Corporation, a computer systems company based in Washington, D.C. Mr. Brehm served as Assistant Secretary of Defense from 1973 to 1977. He was vice president for corporate development of Dart Industries, a consumer products company, from 1971 to 1973. He also served as Assistant Secretary of the Army from 1968 to 1970, following four years of service on the staff of the Secretary of Defense.

DELBERT C. STALEY is 78 years old has served on the Company’s board of directors since October 1996. Mr. Staley served as the chairman and chief executive officer of NYNEX Corporation, a telecommunications company, from 1983 until his retirement in 1989.

Incumbent Class III Directors

ERNST VOLGENAU, the Company’s founder, is 69 years old and has served as the Company’s president, chief executive officer, and a director since the Company’s inception in 1978. From 1976 to 1978, he served as the director of inspection and enforcement for the U.S. Nuclear Regulatory Commission. Dr. Volgenau retired from active duty with the U.S. Air Force as Colonel in 1976. His military service included positions in the Office of the Secretary of Defense and as director of data automation for the Air Force Logistics Command.

MICHAEL KLEIN is 60 years old and has served on the Company’s board of directors since December 1998. He has been a partner of Wilmer, Cutler & Pickering, a law firm based in Washington, D.C., since 1974. Mr. Klein co-founded and currently serves as chairman of the board of directors of CoStar Group, Inc., a provider of electronic commercial real estate information, and currently serves as vice chairman of Perini Corporation, a civil engineering and building construction company.

BOARD AND COMMITTEE MEETINGS

Since March 2002, the Board of Directors has had an Executive Compensation Committee composed of Messrs. Crockett, Denning, Klein and Staley. The Executive Compensation Committee reviews executive salaries, administers the Company’s bonus, incentive compensation and stock plans and approves the salaries and other benefits of the executive officers. In addition, the Executive Compensation Committee consults with management regarding the Company’s employee benefit plans and compensation policies and practices. The Executive Compensation Committee met two times during fiscal 2002. Prior to March 2002, the functions of the Executive Compensation Committee were performed by the Compensation Committee, which was composed of Messrs. Brehm, Crockett, and Volgenau. The Compensation Committee met one time during fiscal 2002.

5

The Board of Directors also has an Audit Committee, currently composed of Messrs. Crockett, Denning, Klein and Staley, which reviews the professional services provided by the Company’s independent accountants, the independence of the accountants from the Company’s management, annual financial statements and the Company’s system of internal accounting controls. The Audit Committee also reviews such other matters with respect to the Company’s accounting, auditing and financial reporting practices and procedures as it may find appropriate or may be brought to its attention. The Audit Committee met three times during fiscal 2002.

The Board of Directors met four times during fiscal 2002. Each director attended at least 80% of the aggregate of the number of Board meetings and the number of meetings held by all committees on which the director then served.

DIRECTOR COMPENSATION

Pursuant to the Company’s compensation plan for outside directors, the Company pays each non-employee director $18,000 per year, $1,000 for each board meeting attended, and $1,500 for each committee meeting held on a date different from a board meeting. The Company may, in its discretion, grant stock options and other equity awards to non-employee directors from time to time pursuant to stock incentive plans.

On December 21, 2001, the Company granted Michael R. Klein an option to purchase 14,705 shares of Class A Common Stock at an exercise price of $10.15 per share, pursuant to its 1994 Stock Option Plan. This option vests 25% per year over four years, beginning on the date of grant.

6

EXECUTIVE COMPENSATION

Summary Compensation

The following table sets forth the total compensation paid or accrued for the last two fiscal years for the Company’s Chief Executive Officer and its four other executive officers (together, the “Named Executive Officers”):

Summary Compensation Table

Name and Principal Position

| | Fiscal Year

| | Annual Compensation

| | Long-Term Compensation

| | All Other Compensation

| |

| | | Salary

| | Bonus

| | Securities Underlying Options(1)

| |

| Ernst Volgenau | | 2002 | | $ | 311,000 | | $ | 337,595 | | — | | $ | 458,890 | (2) |

| President and Chief Executive Officer | | 2001 | | | 311,000 | | $ | 195,797 | | 10,405 | | | 458,725 | (2) |

|

| Edward E. Legasey | | 2002 | | | 280,000 | | | 305,444 | | — | | | 19,690 | (3) |

Executive Vice President and Chief

Operating Officer | | 2001 | | | 280,000 | | | 174,942 | | 10,405 | | | 19,525 | (3) |

|

| Renato A. DiPentima | | 2002 | | | 250,000 | | | 280,946 | | 29,411 | | | 2,090 | (4) |

| Senior Vice President and President | | 2001 | | | 245,000 | | | 240,688 | | 21,688 | | | 1,925 | (4) |

| SRA Consulting & Systems Integration | | | | | | | | | | | | | | |

|

| Barry S. Landew | | 2002 | | | 225,000 | | | 152,799 | | — | | | 2,090 | (4) |

Senior Vice President for Corporate

Development | | 2001 | | | 180,000 | | | 166,530 | | 16,605 | | | 1,925 | (4) |

|

| Stephen C. Hughes | | 2002 | | | 210,000 | | | 185,376 | | — | | | 2,090 | (4) |

Senior Vice President and Chief

Financial Officer | | 2001 | | | 185,000 | | | 142,731 | | 18,211 | | | 1,925 | (4) |

| (1) | | Represents options to acquire shares of Class A Common Stock. |

| (2) | | Includes premiums of $456,800 on term life insurance on the life of the executive paid by the Company. The Company is the sole beneficiary of these policies, and is obligated to use the proceeds of the policies to repurchase shares of Dr. Volgenau’s Common Stock upon his death. In September 2002, pursuant to a letter agreement amending the Second Amended and Restated Stock Purchase Agreement between the Company and Dr. Volgenau, the Company reduced the amount of insurance on Dr. Volgenau’s life to $10,000,000. The corresponding annual premium is now $53,200. Also includes 401(k) matching contributions of $2,090 in fiscal year 2002 and $1,925 in fiscal year 2001 paid on behalf of the executive. |

| (3) | | Includes a premium of $17,600 of term life insurance on the life of the executive paid by the Company. This policy was cancelled on May 21, 2002. Also includes 401(k) matching contributions of $2,090 in fiscal year 2002 and $1,925 in fiscal year 2001 paid on behalf of the executive. |

| (4) | | Represents 401(k) matching contributions of $2,090 in fiscal year 2002 and $1,925 in fiscal year 2001 paid on behalf of the executive. |

7

Stock Options

The table below contains information relating to stock options granted to the Named Executive Officers during fiscal 2002.

Option Grants in the Last Fiscal Year

Name

| | Individual Grants

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(2)

|

| | Number of Securities Underlying Options Granted(1)

| | Percent of Total Options Granted to Employees in Fiscal Year 2001

| | | Exercise Price Per Share

| | Expiration Date

| | 0%

| | 5%

| | 10%

|

| Ernst Volgenau | | — | | — | | | | — | | — | | | — | | | — | | | — |

| Edward E. Legasey | | — | | — | | | | — | | — | | | — | | | — | | | — |

| Renato A. DiPentima | | 29,411 | | 27.4 | % | | $ | 10.15 | | 12/21/2016 | | $ | 230,906 | | $ | 802,088 | | $ | 1,912,935 |

| Barry S. Landew | | — | | — | | | | — | | — | | | — | | | — | | | — |

| Stephen C. Hughes | | — | | — | | | | — | | — | | | — | | | — | | | — |

| (1) | | Represents shares of Class A Common Stock. |

| (2) | | The potential realizable value is calculated based on the term of the option at the time of grant. Assumed rates of stock price appreciation of 0%, 5% and 10% are prescribed by rules of the Securities and Exchange Commission and do not represent the Company’s prediction of the Company’s stock price performance. The potential realizable values at 0%, 5% and 10% appreciation are calculated by assuming that the price of $18.00 per share in the Company’s initial public offering, which the Company has assumed for accounting purposes was the fair market value on the date of grant, appreciates at the indicated rate for the entire 15-year term of the option and that the option is exercised at the exercise price and sold on the last day of its term at the appreciated price. |

Option Exercises and Year-End Option Values

The following table sets forth certain information concerning option exercises by the Named Executive Officers in fiscal 2002 and the number and value of unexercised options held by each of the Named Executive Officers on June 30, 2002.

Aggregate Option Exercises in Fiscal Year 2002 and Fiscal Year-End Option Values

Name

| | Number of Shares Acquired on Exercise(1)

| | Value Realized(2)

| | Number of Securities Underlying Unexercised Options at Fiscal Year End

| | Value of Unexercised

In-the-Money Options at

Fiscal Year End(3)

|

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

| Ernst Volgenau | | 167,647 | | $ | 1,494,258 | | 306,484 | | 33,953 | | $ | 7,301,236 | | $ | 619,273 |

| Edward E. Legasey | | 602,941 | | | 5,041,770 | | 275,014 | | 33,953 | | | 6,417,272 | | | 619,273 |

| Renato A. DiPentima | | 97,647 | | | 1,097,616 | | 162,633 | | 92,461 | | | 3,268,157 | | | 1,654,033 |

| Barry S. Landew | | — | | | — | | 361,593 | | 36,162 | | | 9,083,352 | | | 668,725 |

| Stephen C. Hughes | | 33,088 | | | 605,363 | | 143,141 | | 49,367 | | | 3,138,508 | | | 908,969 |

| (1) | | Represents shares of Class A Common Stock. |

| (2) | | Represents the difference between the exercise prices and the fair market value per share of the Class A Common Stock at the date of exercise, as determined by the Board of Directors. All exercises were prior to the Company’s initial public offering of its Class A Common Stock. |

| (3) | | Represents the difference between the exercise price and $26.98, which was the last sale price of the Class A Common Stock as reported on the New York Stock Exchange on June 28, 2002, the last trading day of fiscal 2002. |

8

EQUITY COMPENSATION PLAN INFORMATION

The following table provides information about the securities authorized for issuance under the Company’s equity compensation plans as of June 30, 2002:

Plan category

| | Number of securities to be issued upon exercise of outstanding options, warrants and rights

| | Weighted-average exercise price of outstanding options, warrants and rights

| | Number of securities remaining available for future issuance under equity compensation plans (excluding securities to be issued upon exercise of outstanding options, warrants and rights)(1)

| |

| Equity compensation plans approved by security holders | | 4,876,692 | | $ | 5.76 | | 3,529,411 | (2) |

| Equity compensation plans not approved by security holders | | N/A | | | N/A | | N/A | |

| Total | | 4,876,692 | | $ | 5.76 | | 3,529,411 | (2) |

| (1) | | In addition to being available for future issuance upon exercise of options that may be granted after June 30, 2002, 3,529,411 shares under the 2002 Stock Incentive Plan may instead be issued in the form of restricted stock or other equity-based awards. |

| (2) | | Consists of shares issuable under the Company’s 2002 Stock Incentive Plan. Under the terms of the 2002 Stock Incentive Plan, the number of shares available for issuance is automatically increased every July 1 beginning with fiscal year 2004 and ending with fiscal year 2012 by an amount equal to the lesser of (i) 1,176,470 shares of Class A Common Stock, (ii) 3% of the outstanding shares of Class A Common Stock and Class B Common Stock on such date or (iii) an amount determined by the Company’s Board of Directors. |

CERTAIN RELATIONSHIPS AND TRANSACTIONS

Repurchase of shares from senior executives and charities

Previously, the Company was party to an agreement with Dr. Volgenau, Mr. Brehm, Mr. Legasey, and two former executives who no longer own any shares of Common Stock, that obligated the Company to purchase up to $200,000 in any calendar year of the Common Stock of each of Dr. Volgenau and Mr. Brehm and up to $75,000 in any calendar year of the Common Stock of Mr. Legasey. The purchase price per share for these purchases was the fair market value of the Common Stock, as determined from time to time by the Board of Directors. These annual purchase requirements were able to be increased upon the agreement of Dr. Volgenau and Mr. Brehm. This agreement was terminated upon the closing of the Company’s initial public offering in May 2002.

Previously, the Company maintained an informal internal repurchase program in which its stockholders, including its executive officers, were periodically offered the opportunity to sell shares of Common Stock to the Company. The purchase price per share in this program was the fair market value of the common stock as determined from time to time by the Board of Directors. The Company discontinued this repurchase program after the closing of its initial public offering in May 2002. The table below sets forth the dates, number of shares and price per share of each repurchase from the Company’s executive officers, directors and 5% stockholders since July 1, 2001. All repurchases were of Class A Common Stock.

Name

| | Date of repurchase

| | Number of shares

| | Price per share

|

| Ernst Volgenau | | November 2001 | | 123,529 | | $ | 10.15 |

| Edward E. Legasey | | November 2001 August 2001 | | 7,058 205,822 | | | 10.15 8.50 |

| Barry S. Landew | | November 2001 | | 20,588 | | | 10.15 |

In addition, Dr. Volgenau and Mr. Brehm have donated shares of Common Stock held by them to various charities over the last fiscal year and SRA has purchased those shares from the charities as set forth in the following table.

9

Name

| | Date of repurchase

| | Number of shares

| | Price per share

|

| Ernst Volgenau | | November 2001 | | 12,317 | | $ | 10.15 |

| William K. Brehm | | October/November 2001 | | 61,584 | | | 10.15 |

Mr. Brehm has also transferred shares of Common Stock held by him to a charitable remainder unitrust and the Company has purchased those shares from the trust as set forth in the following table. This trust distributes a fixed 10% of the trust assets each year to Mr. Brehm and his wife during their lives and provides that the remainder of the trust assets will be distributed to charity upon their deaths.

Name

| | Date of repurchase

| | Number of shares

| | Price per share

|

| William K. Brehm | | October 2001 | | 147,798 | | $ | 10.15 |

Life insurance policies and stock purchase agreements with executive officers and chairman

Pursuant to a stock purchase agreement with Dr. Volgenau, the Company is obligated to use the proceeds of term life insurance that it maintains on his life to repurchase his shares of Common Stock upon his death. Under the stock purchase agreement, the purchase price per share for this purchase is the fair market value of the stock, as most recently determined by the Board of Directors. Prior to the Company’s initial public offering in May 2002, the agreement did not obligate the Company to maintain any specified level of insurance. From June 2000 until September 26, 2002, the Company maintained policies having an aggregate value of $80,000,000 on the life of Dr. Volgenau, with aggregate annual premiums of $456,800. The Company has been the sole beneficiary of these policies since their inception. On May 19, 2002, the Company amended the purchase agreement with Dr. Volgenau to provide that the Company would be obligated following the Company’s initial public offering to maintain these life insurance policies through 2010. The purchase agreement was further amended on September 26, 2002, to reduce the amount of coverage from $80,000,000 to $10,000,000, with premiums for the $10,000,000 policy being $53,200 per year. These premiums are fixed until 2010. The Company also agreed that, should these policies cease to be available before 2010, the Company will purchase and maintain life insurance policies providing the maximum coverage for the remainder of that period that can be purchased with the same overall annual premiums.

The Company terminated a similar stock purchase agreement with Mr. Brehm on May 21, 2002. The Company also terminated a similar informal arrangement with Mr. Legasey at that time. The Company cancelled the life insurance policies on Mr. Brehm’s and Mr. Legasey’s lives on May 21, 2002. From June 2000 until May 21, 2002, the Company maintained a policy having a value of $20,000,000 on the life of Mr. Brehm, with an annual premium of $211,660. From June 2000 until May 21, 2002, the Company maintained a policy having a value of $10,000,000 on the life of Mr. Legasey, with a premium of $17,600 per year. The Company was the sole beneficiary of these policies since their inception.

Sale of Class A Common Stock to General Atlantic Partners

In April 2002, the Company and several of its stockholders, including its executive officers, entered into a stock purchase agreement with four investment entities affiliated with General Atlantic Partners, LLC, or GAP, a private investment group, whereby the GAP entities purchased an aggregate of 2,117,645 shares of Class A Common Stock at a per share price of $18.70. Pursuant to the stock purchase agreement, the Company sold 535,348 shares of Class A Common Stock and its executive officers sold the following numbers of shares pursuant to the Stock Purchase Agreement:

Name

| | Number of shares

|

| Ernst Volgenau | | 482,352 |

| Renato A. DiPentima | | 58,823 |

| Stephen C. Hughes | | 33,088 |

| Barry S. Landew | | 73,529 |

| Edward E. Legasey | | 411,764 |

10

In addition, William K. Brehm donated 58,823 shares of Class A Common Stock to a charity and 52,941 shares of Class A Common Stock to a charitable remainder unitrust that, in turn, sold the shares to the GAP entities. This charitable remainder unitrust distributes a fixed 7.5% of the trust assets each year to Mr. Brehm and his wife during their lives and provides that the remainder of the trust assets be distributed to charity upon their deaths. Dr. Volgenau donated 105,882 shares of Class A Common Stock to a charity that, in turn, sold the shares to the GAP entities. The remaining shares purchased by the GAP entities were sold by other employees of the Company.

In connection with the stock purchase agreement, the Company also entered into a registration rights agreement with the GAP entities, granting them specified rights with respect to the registration of their shares of Class A Common Stock under the Securities Act.

The Company also entered into a stockholders agreement with some of its stockholders, including its executive officers and the GAP entities. The stockholders agreement prohibits the GAP entities from selling, disposing of, or hedging any of their shares of Class A Common Stock until October 23, 2003, without the Company’s prior written consent, subject to limited exceptions. The stockholders agreement also provides the GAP entities the right to designate one member of the Board of Directors and obligates the Company to use its best efforts to cause that designee to be nominated and elected to the Board of Directors and its committees. Pursuant to the stockholders agreement, stockholders, including the Company’s executive officers, also agreed to vote their shares of the Common Stock in favor of any designee of the GAP entities nominated to the Board of Directors. Under the stockholders agreement, the Company appointed Steven A. Denning, as the designee of the GAP entities, to be a class I director and a member of the audit and executive compensation committees. In addition, the stockholders agreement provides the GAP entities with specified preemptive rights with respect to specified future private placements of the capital stock, or securities convertible into the Company’s capital stock, enabling the GAP entities to maintain their proportionate percentage ownership of the capital stock. All the rights and obligations under the stockholders agreement terminate once the GAP entities cease to own at least 423,529 shares of Class A Common Stock.

Policy on Future Transactions

For all future transactions, the Board of Directors has adopted a policy that all transactions between the Company and its officers, directors, principal stockholders and their affiliates must (i) be approved by a majority of the disinterested members of the Board of Directors and (ii) be on terms no less favorable to the Company than could be obtained from unaffiliated third parties.

11

EXECUTIVE COMPENSATION COMMITTEE REPORT

ON EXECUTIVE COMPENSATION

Since March 2002, the Executive Compensation Committee has set the compensation packages for each of the Company’s executive officers (Messrs. Volgenau, Legasey, DiPentima, Landew, and Hughes). In addition, the Committee reviews and approves salaries for the remainder of the Company’s officers, target cash and equity incentive compensation pools for all employee groups, performance goals for the Company and its major operating units, cash and equity incentive compensation payouts according to performance plans, and general compensation policies. The Committee comprises four members, all of whom are outside directors. Prior to March 2002, the functions of the Executive Compensation Committee were performed by the Compensation Committee. Two of the three members of the Compensation Committee during fiscal 2002, Dr. Volgenau and Mr. Brehm, were during that period officers or employees of the Company. None of the members of the Executive Compensation Committee has any interlocking or other relationship with the Company or its executive officers that would call into question his independence.

Executive Compensation Philosophy

The Company’s executive compensation program is based on several principles that ensure its integrity:

| | • | | Meritocracy: The Company pays above average incentives for outstanding performance and low or no incentives for poor performance. |

| | • | | Fairness: The Company measures people against what they are asked to do; if their assignment changes, so is how they are measured. |

| | • | | Clarity: Goals and computational methods are clear and are communicated in written performance plans. |

| | • | | Unity of Effort: While each individual has goals that are tied to his or her performance, everyone is graded to some extent on the Company’s overall performance. The executive officers’ performance assessment is tied primarily to the Company’s overall performance. |

Components of Compensation

The three major components of the Company’s executive officer compensation are (i) base salary, (ii) annual incentive awards in the form of cash bonuses and (iii) long-term, equity-based incentive awards.

We set base salaries for executives using market compensation data based on companies that we believe are comparable to the Company. We use as a base salary benchmark the salary data representing the 50th percentile. We set total target cash compensation (base salary plus target bonus) at the 75th percentile. The difference between an executive’s total cash target and base salary represents his or her cash bonus target.

The actual cash bonus earned by each executive officer is determined at the end of each fiscal year based on the degree to which the specified goals we have established at the beginning of the year for the executive have been met or exceeded. For each of the executive officers, these goals include Company-wide financial performance measures. In some cases, we also establish individual goals for the executive, typically involving the performance of a business unit or function managed by him or her.

We also use stock based compensation to the executive officers as a way of aligning management’s interests with those of the stockholders. Like bonuses, stock option awards are determined for each executive officer at the end of each fiscal year based on the goals established at the beginning of the year. Stock option grants reflect a constant value approach. That is, we focus on the face value of the grant, not the number of options, in determining the option grant to the executive. This has the effect of reducing the average size of awards over time if the share price increases. The Company grants non-qualified stock options, which provide the company a tax deduction in the year of exercise. Options vest in equal increments over a four-year period.

12

Chief Executive Officer Compensation

Ernst Volgenau has served as the Company’s President and Chief Executive Officer since its inception. Dr. Volgenau’s base salary, cash bonus target, and total cash target for fiscal 2002 were unchanged from fiscal 2001. The total cash bonus earned by and paid to Dr. Volgenau in fiscal 2002 was higher than fiscal 2001 as a result of improved company performance. The cash bonus awarded Dr. Volgenau for fiscal 2002 was based entirely on actual Company performance measured against targets for revenue, gross margin, and net income established at the beginning of the year. The Committee believes that Dr. Volgenau’s compensation is consistent with the size and mix of total compensation provided to chief executive officers of comparable companies.

Compliance with Section 162(m)

Section 162(m) of the Internal Revenue Code of 1986, as amended, generally disallows a tax deduction to public companies for certain compensation in excess of $1 million paid to the company’s Chief Executive Officer and the four other most highly compensated executive officers. Certain compensation, including qualified performance-based compensation, will not be subject to the deduction limit if certain requirements are met. The Executive Compensation Committee reviews the potential effect of Section 162(m) periodically and generally seeks to structure the long-term incentive compensation granted to its executive officers through option issuances in a manner that is intended to avoid disallowance of deductions under Section 162(m). Nevertheless, there can be no assurance that compensation attributable to awards granted under the 2002 Stock Incentive Plan will be treated as qualified performance-based compensation under Section 162(m). In addition, the Executive Compensation Committee reserves the right to use its judgment to authorize compensation payments that may be subject to the limit when the Executive Compensation Committee believes such payments are appropriate and in the best interests of the Company and its stockholders, after taking into consideration changing business conditions and the performance of its employees.

Executive Compensation Committee

E. David Crockett (Chairman)

Delbert C. Staley

Steven A. Denning

Michael R. Klein

13

AUDIT COMMITTEE REPORT

The Audit Committee of the Company’s Board of Directors is composed of four members and acts under a written charter. A copy of this charter is attached to this proxy statement as Appendix A. The members of the Audit Committee are independent, financially literate members of the board of directors, as defined by its charter and the rules of The New York Stock Exchange. Mr. Denning has accounting or related financial management experience. The Audit Committee held three meetings during the fiscal year ended June 30, 2002.

The Audit Committee reviewed the Company’s audited financial statements for the fiscal year ended June 30, 2002 and discussed these financial statements with the Company’s management. Management is responsible for the Company’s internal controls and the financial reporting process. The Company’s independent accountants are responsible for performing an independent audit of the Company’s financial statements in accordance with generally accepted accounting principles and to issue a report on those financial statements. The Audit Committee is responsible for monitoring and overseeing these processes. As appropriate, the Audit Committee reviews and evaluates, and discusses with the Company’s management, internal accounting, financial and auditing personnel and the independent auditors, the following:

| | • | | the independent auditors’ report on each audit of the Company’s financial statements; |

| | • | | the Company’s financial disclosure documents, including all financial statements and reports filed with the Securities and Exchange Commission or sent to shareholders; |

| | • | | changes in the Company’s accounting practices, principles, controls or methodologies; |

| | • | | significant developments or changes in accounting rules applicable to the Company; and |

| | • | | the adequacy of the Company’s internal controls and accounting, financial and auditing personnel and Audit Committee Charter. |

Management represented to the Audit Committee that the Company’s financial statements had been prepared in accordance with generally accepted accounting principles.

The Audit Committee also reviewed and discussed the audited financial statements and the matters required by Statement on Auditing Standards 61 (Communication with Audit Committees) with Deloitte & Touche LLP, the Company’s independent auditors. SAS 61 requires the Company’s independent auditors to discuss with the Company’s Audit Committee, among other things, the following:

| | • | | methods to account for significant, unusual transactions; |

| | • | | the effect of significant accounting policies in controversial or emerging areas for which there is a lack of authoritative guidance or consensus; |

| | • | | the process used by management in formulating particularly sensitive accounting estimates and the basis for the auditors’ conclusions regarding the reasonableness of those estimates; and |

| | • | | disagreements with management over the application of accounting principles, the basis for management’s accounting estimates and the disclosures in the financial statements. |

14

The Company’s independent auditors also provided the Audit Committee with the written disclosures and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees). In addition, the Audit Committee discussed with the independent auditors their independence from the Company. The Audit Committee also considered whether the independent auditors’ provision of other, non-audit related services to the Company is compatible with maintaining such auditors’ independence.

Based on its discussions with management and the independent auditors, and its review of the representations and information provided by management and the independent auditors, the Audit Committee recommended to the Company’s Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2002.

Audit Committee

Delbert C. Staley (Chairman)

E. David Crockett

Steven A. Denning

Michael R. Klein

15

EXECUTIVE COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The Company established its Executive Compensation Committee in March 2002. No members of the Executive Compensation Committee are officers or employees of the Company. Prior to March 2002, the functions of the Executive Compensation Committee were performed by the Compensation Committee. Two of the three members of the Company’s Compensation Committee during fiscal 2002, Dr. Volgenau and Mr. Brehm, were during that period officers or employees of the Company. No interlocking relationships exist between the Board of Directors, Executive Compensation Committee or Compensation Committee and the Board of Directors or compensation committee of any other company, nor has any interlocking relationship existed in the past.

LEGAL PROCEEDINGS

Neither the Company nor any members of the Board of Directors are parties to any material legal proceedings.

16

COMPARATIVE STOCK PERFORMANCE

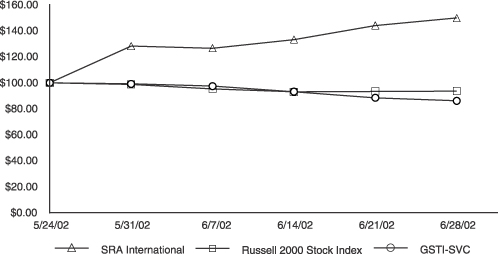

The following graph compares the cumulative total stockholder return on the Class A Common Stock of the Company from May 24, 2002 (the first trading date following the Company’s initial public offering) to June 30, 2002 with the cumulative total return of (i) the Russell 2000 stock index and (ii) the services sector index of the Goldman Sachs Technology Index (the GSTI services index). This graph assumes the investment of $100.00 on May 24, 2002 in the Company’s Class A Common Stock, the Russell 2000 stock index, and the GSTI services index, and assumes any dividends are reinvested. The historical information set forth below is not necessarily indicative of future performance.

COMPARISON OF TWO-MONTH CUMULATIVE TOTAL RETURN

AMONG SRA INTERNATIONAL, INC.,

RUSSELL 2000 INDEX AND GSTI SERVICES INDEX

| | | Base May 24, 2002

| | June 30, 2002

|

| SRA International, Inc. | | $ | 100.00 | | $ | 149.89 |

| Russell 2000 Index | | | 100.00 | | | 93.72 |

| GSTI Services Index | | | 100.00 | | | 86.16 |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

The Company is not aware of any failure during fiscal 2002 by its officers, directors or holders of 10% of the Company’s Class A Common Stock to comply in a timely manner with the filing requirements of Section 16(a) of the Securities Exchange Act of 1934.

17

PROPOSAL 2—APPROVAL OF THE CONTINUANCE OF THE 2002 STOCK INCENTIVE PLAN

Section 162(m) of the Internal Revenue Code, as amended (the “Code”), generally disallows a tax deduction to public corporations for compensation in excess of $1 million paid to the corporation’s chief executive officer and four other most highly compensated officers. Qualifying performance-based compensation is not subject to the deduction limitation if certain requirements are met. In particular, income recognized upon the exercise of a stock option is not subject to the deduction limitation if, among other things, the option was issued under a plan approved by the stockholders, which plan provides a limit on the number of shares that may be issued under the plan to any individual.

In order for options and restricted stock granted under the 2002 Plan to comply with Section 162(m) after the Annual Meeting, the stockholders must approve the continuance of the 2002 Plan. If the stockholders do not approve the continuance of the 2002 Plan, the Company will not grant any future options or make any further restricted stock awards under the 2002 Plan.

Summary of the 2002 Plan

The following is a summary of the material provisions of the 2002 Plan. A copy of the 2002 Plan is attached to this proxy statement as Appendix B.

Description of Awards

The 2002 Plan provides for the grant (each, an “Award”) of incentive stock options within the meaning of Section 422 of the Code (“incentive stock options”), options not intended to qualify as incentive stock options (“nonstatutory stock options”), restricted stock Awards and other stock-based Awards. Generally, Awards under the 2002 Plan are not assignable or transferable except by will or the laws of descent and distribution.

Incentive Stock Options and Nonstatutory Stock Options. Optionees receive the right to purchase a specified number of shares of Class A Common Stock at a specified option price and subject to such other terms and conditions as are specified in connection with the option grant. Subject to the limitations described below, options may be granted at an exercise price, which may be less than, equal to, or greater than the fair market value of the Class A Common Stock on the date of grant. Under present law, however, incentive stock options may not be granted at an exercise price less than the fair market value of the Class A Common Stock on the date of grant (or less than 110% of the fair market value in the case of incentive stock options granted to optionees holding more than 10% of the total combined voting power of all classes of stock of the Company or subsidiary corporations). Incentive stock options may not be granted for a term in excess of ten years (or more than five years in the case of incentive stock options granted to optionees holding more than 10% of the total combined voting power of all classes of stock of the Company or subsidiary corporations). Payment for Class A Common Stock upon exercise of incentive stock options and nonstatutory stock options may be made (i) in cash or by check, payable to the order of the Company; (ii) except as the Board of Directors may otherwise provide in a particular option agreement, by delivery of an irrevocable and unconditional undertaking by a creditworthy broker to deliver promptly to the Company sufficient funds to pay the exercise price, or delivery by the participant to the Company of a copy of irrevocable and unconditional instructions to a creditworthy broker to deliver promptly to the Company cash or a check sufficient to pay the exercise price; (iii) by delivery of shares of Class A Common Stock valued at their fair market value as determined by the Board of Directors in good faith and owned by the participant for at least six months; (iv) to the extent permitted by the Board of Directors, by delivery of a promissory note or by payment of such other lawful consideration as the Board may determine; or (v) through any combination of the foregoing methods of payment.

Restricted Stock Awards. Restricted stock Awards entitle recipients to acquire shares of Class A Common Stock, subject to the right of the Company to repurchase all or part of such shares from the recipient in the event that the conditions specified in the applicable Awards are not satisfied prior to the end of the applicable restriction period established for such Award.

18

Other Stock-Based Awards. Under the 2002 Plan, the Board of Directors has the right to grant other Awards based upon the Class A Common Stock having such terms and conditions as the Board may determine, including the grant of shares based upon certain conditions, the grant of securities convertible into Class A Common Stock and the grant of stock appreciation rights.

Shares Available for Issuance Under the Plan

The Company authorized 3,529,411 shares of its Class A Common Stock for issuance under the 2002 Plan. Under the terms of the 2002 Plan, the number of shares available for issuance is automatically increased every July 1 beginning with fiscal year 2004 and ending with fiscal year 2012 by an amount equal to the lesser of (i) 1,176,470 shares of Class A Common Stock, (ii) 3% of the outstanding shares of Class A Common Stock and Class B Common Stock on such date or (iii) an amount determined by the Company’s Board of Directors.

Eligibility to Receive Awards

Officers, employees, directors of, and consultants and advisors to the Company are eligible to be granted Awards under the 2002 Plan. Under present law, however, incentive stock options may be granted only to employees. The maximum number of shares with respect to which Awards may be granted to any participant under the 2002 Plan may not exceed 294,117 shares per calendar year.

As of June 30, 2002, the Company had 2,078 full-time employees, including officers, and four non-employee directors. All full-time employees and non-employee directors were eligible to participate in the 2002 Plan. The number of individuals receiving Awards varies from year to year depending on various factors, such as the number of promotions and the Company’s hiring needs during the year, and thus the Company cannot now determine future Award recipients.

On October 4, 2002 the last reported sale price of the Class A Common Stock on New York Stock Exchange was $27.22 per share.

Administration

The 2002 Plan is administered by the Board of Directors. Subject to the provisions of the 2002 Plan, the Board of Directors has the authority to select the persons to whom Awards are granted and determine the terms of each Award, including (i) the number of shares of Class A Common Stock covered by options and the dates upon which such options become exercisable, (ii) the exercise price of options, (iii) the duration of options and (iv) the number of shares of Class A Common Stock subject to any restricted stock or other stock-based Awards and the terms and conditions of such Awards, including conditions for repurchase, issue price and repurchase price. The Board of Directors may delegate any or all of its powers under the Plan to one or more committees or subcommittees of the Board of Directors.

The Board of Directors may amend, modify or terminate any outstanding Award, including without limitation, substituting therefor another Award of the same or a different type, changing the date of exercise or realization, and converting an incentive stock option into a nonstatutory stock option, subject to the participant’s consent if such amendment, modification or termination would materially or adversely affect the participant. The Board of Directors may also accelerate the date on which an option, restricted stock Award or a stock-based Award becomes exercisable, becomes free of some or all restrictions or conditions or becomes realizable, as the case may be.

Upon the occurrence of any stock split, reverse stock split, stock dividend, recapitalization, combination of shares, reclassification of shares, spin-off or other similar change in capitalization or event, or any distribution to holders of Class A Common Stock other than a normal cash dividend, the Board of Directors will make adjustments to the number and class of securities available under the 2002 Plan, the maximum number of shares with respect to which Awards may be granted to any participant per calendar year under the 2002 Plan, the number and class of security and exercise price subject to each outstanding option, the repurchase price subject to each outstanding restricted stock Award, and the terms of each other outstanding stock-based Award to the extent that the Board of Directors determines in good faith that such adjustments are necessary and appropriate and that such change in capitalization not a “Reorganization Event” as defined in the 2002 Plan.

19

In the event of a proposed liquidation or dissolution of the Company, the Board of Directors shall upon written notice to the participants provide that all then unexercised options will (i) become exercisable in full as of a specified time at least 10 business days prior to the effective date of such liquidation or dissolution and (ii) terminate effective upon such liquidation or dissolution, except to the extent exercised before such effective date. The Board of Directors may specify the effect of a liquidation or dissolution on any restricted stock Award or other Award granted under the 2002 Plan at the time of the grant of such Award.

In the event of a Reorganization Event (as defined in the 2002 Plan) or a the execution by the Company of an agreement with respect to a Reorganization Event, the Board of Directors is required to provide for outstanding options to be assumed or substituted for by the acquiring or succeeding corporation. However, if the acquiring or succeeding corporation does not agree to assume, or substitute for, such options, then the Board will provide that all options will become exercisable in full as of a specified time prior to the Reorganization Event and will terminate immediately prior to the consummation of such Reorganization Event, except to the extent exercised by the participants before the consummation of such Reorganization Event. In addition, upon the occurrence of a Reorganization Event, the repurchase and other rights of the Company under each outstanding restricted stock Award shall inure to the benefit of the Company’s successor and shall apply to the cash, securities or other property which the Class A Common Stock was converted into or exchanged for pursuant to such Reorganization Event in the same manner and to the same extent as they applied to the Class A Common Stock subject to such restricted stock Award. The Board will specify the effect of a Reorganization Event on any other stock-based Award granted under the 2002 Plan at the time of the grant of such Award.

If any Award expires or is terminated, surrendered, canceled or forfeited, the unused shares of Class A Common Stock covered by such Award will again be available for grant under the 2002 Plan, subject, however, in the case of incentive stock options to any limitations under the Code.

No Award may be granted under the 2002 Plan after March 2012, but the vesting and effectiveness of Awards granted before those dates may extend beyond those dates. The Board of Directors may amend, suspend or terminate the 2002 Plan or any portion thereof at any time.

Federal Income Tax Consequences

The following generally summarizes the United States federal income tax consequences that generally will arise with respect to awards granted under the 2002 Plan. This summary is based on the tax laws in effect as of the date of this proxy statement. Changes to these laws could alter the tax consequences described below.

Incentive Stock Options. A participant will not have income upon the grant of an incentive stock option. Also, except as described below, a participant will not have income upon exercise of an incentive stock option if the participant has been employed by the Company or its corporate parent or majority-owned corporate subsidiary at all times beginning with the option grant date and ending three months before the date the participant exercises the option. If the participant has not been so employed during that time, then the participant will be taxed as described below under “Nonstatutory Stock Options.” The exercise of an incentive stock option may subject the participant to the alternative minimum tax.

A participant will have income upon the sale of the Class A Common Stock acquired under an incentive stock option at a profit (if sales proceeds exceed the exercise price). The type of income will depend on when the participant sells the Class A Common Stock. If a participant sells the Class A Common Stock more than two years after the option was granted and more than one year after the option was exercised, then all of the profit will be long-term capital gain. If a participant sells the Class A Common Stock prior to satisfying these waiting periods, then the participant will have engaged in a disqualifying disposition and a portion of the profit will be ordinary income and a portion may be capital gain. This capital gain will be long-term if the participant has held the Class A Common Stock for more than one year and otherwise will be short-term. If a participant sells the Class A Common Stock at a loss (sales proceeds are less than the exercise price), then the loss will be a capital loss. This capital loss will be long-term if the participant held the Class A Common Stock for more than one year and otherwise will be short-term.

20

Nonstatutory Stock Options. A participant will not have income upon the grant of a nonstatutory stock option. A participant will have compensation income upon the exercise of a nonstatutory stock option equal to the value of the Class A Common Stock on the day the participant exercised the option less the exercise price. Upon sale of the Class A Common Stock, the participant will have capital gain or loss equal to the difference between the sales proceeds and the value of the Class A Common Stock on the day the option was exercised. This capital gain or loss will be long-term if the participant has held the Class A Common Stock for more than one year and otherwise will be short-term.

Restricted Stock. A participant will not have income upon the grant of restricted stock unless an election under Section 83(b) of the Code is made within 30 days of the date of grant. If a timely 83(b) election is made, then a participant will have compensation income equal to the value of the Class A Common Stock less the purchase price. When the Class A Common Stock is sold, the participant will have capital gain or loss equal to the difference between the sales proceeds and the value of the Class A Common Stock on the date of grant. If the participant does not make an 83(b) election, then when the Class A Common Stock vests the participant will have compensation income equal to the value of the Class A Common Stock on the vesting date less the purchase price. When the Class A Common Stock is sold, the participant will have capital gain or loss equal to the sales proceeds less the value of the Class A Common Stock on the vesting date. Any capital gain or loss will be long-term if the participant held the Class A Common Stock for more than one year and otherwise will be short-term.

Other Stock-Based Awards. The tax consequences associated with any other stock-based award granted under the 2002 Plan will vary depending on the specific terms of the award. Among the relevant factors are whether or not the award has a readily ascertainable fair market value, whether or not the award is subject to forfeiture provisions or restrictions on transfer, the nature of the property to be received by the participant under the award, and the participant’s holding period and tax basis for the award or underlying stock.

Tax Consequences to the Company. There will be no tax consequences to the Company except that the Company will be entitled to a deduction when a participant has compensation income. Any such deduction will be subject to the limitations of Section 162(m) of the Code.

Board Recommendation

The Board of Directors believes that the approval of the continuance of the 2002 Plan is in the best interests of the Company and its stockholders and therefore recommends that the stockholders vote FOR this proposal.

21

PROPOSAL 3—RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS

The Board of Directors, which includes all of the members of the Audit Committee, has selected the firm of Deloitte & Touche LLP as the Company’s independent auditors for the current fiscal year. Deloitte & Touche LLP has served as the Company’s independent auditors since March 2002. Although stockholder approval of the Board of Directors’ selection of Deloitte & Touche LLP is not required by law, the Board of Directors believes that it is advisable to give stockholders an opportunity to ratify this selection. If this proposal is not approved at the Annual Meeting, the Board of Directors may reconsider its selection of Deloitte & Touche LLP.

Representatives of Deloitte & Touche LLP are expected to be present at the Annual Meeting and will have the opportunity to make a statement if they desire to do so and will also be available to respond to appropriate questions from stockholders.

Change of Independent Public Accountants

In March 2002, the Company dismissed its independent public accountants, Arthur Andersen LLP, and retained Deloitte & Touche LLP to act as its independent auditors. Arthur Andersen LLP had been the Company’s independent public accountants since 1984. In connection with Arthur Andersen LLP’s audit of the consolidated financial statements for the fiscal years 1999, 2000, and 2001, and in connection with the subsequent period up to their dismissal, there were no disagreements with Arthur Andersen LLP on any matters of accounting principles or practices, financial statement disclosure or auditing scope or procedures, nor any reportable events. Arthur Andersen LLP’s report on the Company’s consolidated financial statements for the fiscal years ended June 30, 1999, 2000, and 2001 contained no adverse opinion or disclaimer of opinion and was not modified or qualified as to uncertainty, audit scope or accounting principles. The decision to change auditors was unanimously approved by the Board of Directors, including all of the members of the audit committee. Prior to the dismissal of Arthur Andersen LLP, the Company had not consulted with Deloitte & Touche LLP on any accounting matters. The Company has provided Arthur Andersen LLP and Deloitte & Touche LLP with a copy of the disclosure contained in this section of the proxy statement. The Company’s consolidated financial statements for the fiscal years ended June 30, 1999, 2000, 2001 and 2002, have been audited by Deloitte & Touche LLP.

Audit Fees

Deloitte & Touche LLP billed the Company an aggregate of $140,726 for professional services rendered in connection with the audit of the Company’s financial statements for the most recent fiscal year.

Financial Information Systems Design and Implementation Fees

Deloitte & Touche LLP did not provide services in connection with financial information systems design, implementation, the operation of the Company’s information system or the management of its local area network.

All Other Fees

Deloitte & Touche LLP billed the Company an aggregate of $533,730 in fees for other services rendered to the Company and its affiliates for the fiscal year ended June 30, 2002 related to registration statements connected with the Company’s initial public offering in May 2002.

Leased Employees

The Company has been informed by Deloitte & Touche LLP that no work was performed by persons other than full-time, permanent employees of Deloitte & Touche on the Deloitte & Touche LLP engagement to audit the Company’s financial statements for the most recent fiscal year.

The audit committee of the Board of Directors believes that the provision of services by Deloitte & Touche LLP is compatible with maintaining such auditor’s independence.

Board Recommendation

The Board of Directors recommends a vote FOR the ratification of the appointment of Deloitte & Touche LLP as the Company’s independent auditors.

22

OTHER MATTERS

The Board of Directors does not know of any other matters which may come before the Annual Meeting. However, if any other matters are properly presented to the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote, or otherwise act, in accordance with their judgment on such matters.

All costs of solicitation of proxies will be borne by the Company. In addition to solicitations by mail, the Company’s directors, officers and employees, without additional remuneration, may solicit proxies by telephone, telegraph and personal interviews, and the Company reserves the right to retain outside agencies for the purpose of soliciting proxies. Brokers, custodians and fiduciaries will be requested to forward proxy soliciting material to the owners of stock held in their names, and, as required by law, the Company will reimburse them for their out-of-pocket expenses in this regard.

Pursuant to Securities Exchange Act Rule 14a-8(e), proposals of stockholders intended to be presented at the 2003 annual meeting of stockholders must be received by the Company at its principal office at 4350 Fair Lakes Court, Fairfax, Virginia 22033, not later than June 17, 2003 for inclusion in the proxy statement for that meeting. Under the Company’s By-laws, proposals of stockholders intended to be presented at the 2003 Annual Meeting of Stockholders that do not comply with Rule 14a-8(e) must be received by the Secretary of the Company at its principal office in Fairfax, Virginia not earlier than the 90th day prior to such annual meeting and not later than the later of (a) the 60th day prior to the annual meeting and (b) the 10th day following the day notice of the date of the annual meeting was mailed or public disclosure was made, whichever first occurs. A copy of the Company’s Amended and Restated By-laws may be obtained from the Secretary of the Company.

By Order of the Board of Directors,

Stephen C. Hughes, Secretary

October 15, 2002

THE BOARD OF DIRECTORS HOPES THAT STOCKHOLDERS WILL ATTEND THE MEETING. WHETHER OR NOT YOU PLAN TO ATTEND, YOU ARE URGED TO COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY IN THE ACCOMPANYING ENVELOPE. STOCKHOLDERS WHO ATTEND THE MEETING MAY VOTE THEIR STOCK PERSONALLY EVEN IF THEY HAVE SENT IN THEIR PROXIES.

23

APPENDIX A

AUDIT COMMITTEE CHARTER

SRA INTERNATIONAL, INC.

I. Membership

| | A. | | Number. Within three months of the Company’s initial public offering, the Audit Committee shall consist of at least two independent, financially literate members of the board of directors meeting the requirements set forth in Sections I.B. and I.C. below. Within twelve months of the Company’s initial public offering, the Audit Committee shall consist of at least three such members. |

| | B. | | Independence. A director is independent if he or she has no relationship to the Company that may interfere with the exercise of his or her independence from management and the company, and if service by the director is not excluded by the following restrictions. A director may not serve on the Audit Committee: |

| | 1. | | until three years following the termination of his or her employment by the Company or any affiliate of the Company. If the employment relationship was with a former parent or predecessor of the Company, the director may not serve on the Audit Committee until three years after the termination of the relationship between the Company and the former parent or predecessor; |

| | 2. | | until three years after the termination of any employment of a member of his or her immediate family as an executive officer of the Company; |

| | 3. | | if he or she is employed as an executive of an entity other than the Company having a compensation committee which includes any of the Company’s executives; and |

| | 4. | | if he or she has or had a direct business relationship with the Company (e.g. a consultant), or if he or she is or was a partner, controlling shareholder, or executive officer of an organization that has a business relationship with the Company, unless the Company’s board of directors determines in its business judgment that the relationship does not interfere with the director’s exercise of independent judgment. Such a determination need not be made by Company’s board in order to permit service on the Audit Committee after five years following the termination of (as applicable): (i) the relationship between the related organization and the Company; (ii) the director’s status as partner, controlling shareholder or executive officer of a related organization; or (iii) the business relationship between the director and the Company. A “Business relationship” may include commercial, industrial, banking, consulting, legal, accounting and other relationships. |

Under exceptional and limited circumstances, one director who is not a Company employee, or who is an immediate family member of a former executive officer of the Company or its affiliates but who is not considered independent under these standards due to a three-year restriction period, may serve on the Audit Committee if the board of directors determines in its business judgment that the director’s membership on the Audit Committee is required by the best interests of the Company and its shareholders, and the Company discloses in the next annual proxy statement after such determination the nature of the relationship and the reasons for the determination.