KEY TECHNOLOGY, INC. The NASDAQ Global Market (KTEC) INVESTOR FORUM PRESENTATION Q2-FY2014 Presented on April 24, 2014 Live in New York 1

Key Technology, Inc. A GLOBAL SOLUTIONS PROVIDER in the design and manufacture of process improvement systems for the food processing industry and other non-food markets. 2

Safe Harbor Statement THE FOLLOWING PRESENTATION contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These statements, which address future financial and operating results, are based on management’s current expectations or beliefs and are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. For a detailed discussion of these factors and other cautionary statements, please refer to the company’s filings with the Securities and Exchange Commission, particularly Item 1A, “Risk Factors,” of the company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2013. 3

Presenting Today: Members of the Key Technology Executive Team Louis C. Vintro Senior Vice President of New Products and Business Development Stephen M. Pellegrino Senior Vice President of Global Sales Frank L. A. Zwerts Chief Strategy Officer President of EMEIA John J. Ehren President and Chief Executive Officer Jeffrey T. Siegal Vice President and Chief Financial Officer 4

Q2-2014 FINANCIAL UPDATE Jeff Siegal Vice President and CFO 5

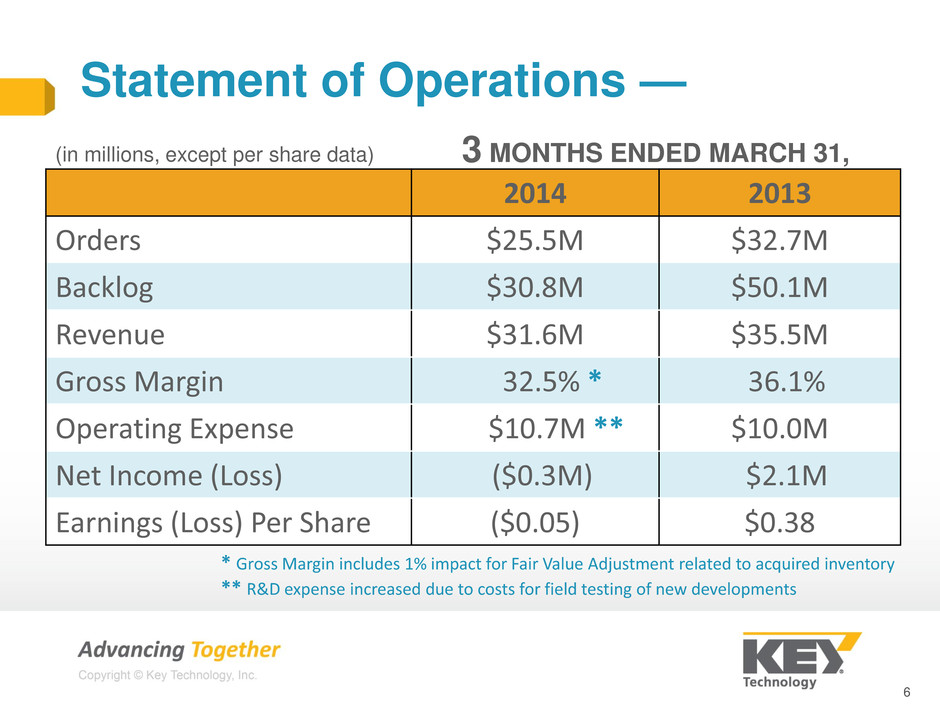

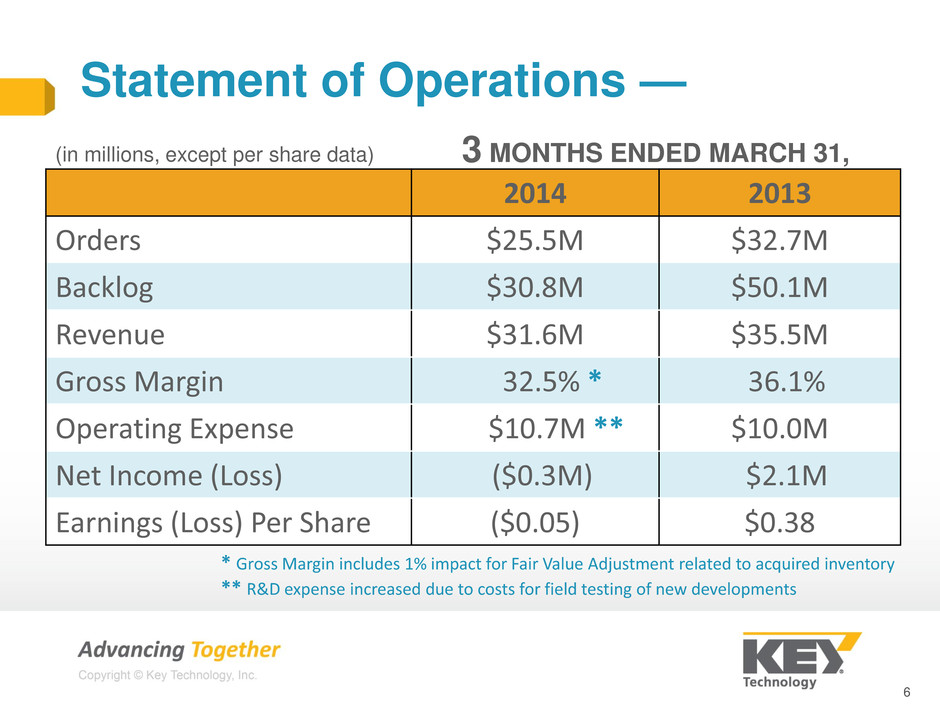

Statement of Operations — 3 MONTHS ENDED MARCH 31, 2014 2013 Orders $25.5M $32.7M Backlog $30.8M $50.1M Revenue $31.6M $35.5M Gross Margin 32.5% * 36.1% Operating Expense $10.7M ** $10.0M Net Income (Loss) ($0.3M) $2.1M Earnings (Loss) Per Share ($0.05) $0.38 (in millions, except per share data) * Gross Margin includes 1% impact for Fair Value Adjustment related to acquired inventory ** R&D expense increased due to costs for field testing of new developments 6

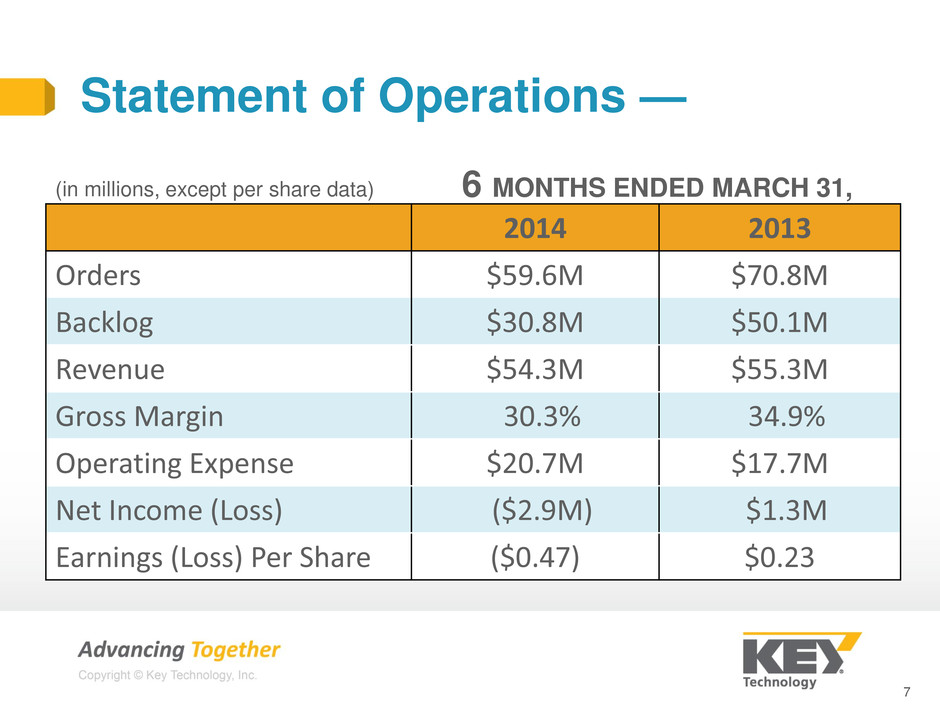

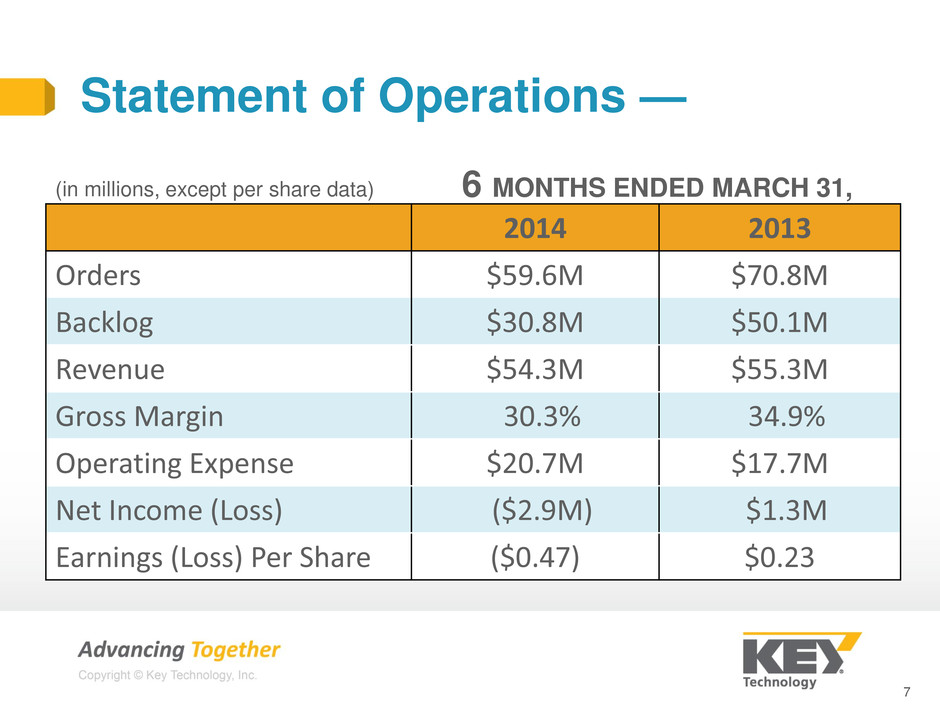

Statement of Operations — 6 MONTHS ENDED MARCH 31, 2014 2013 Orders $59.6M $70.8M Backlog $30.8M $50.1M Revenue $54.3M $55.3M Gross Margin 30.3% 34.9% Operating Expense $20.7M $17.7M Net Income (Loss) ($2.9M) $1.3M Earnings (Loss) Per Share ($0.47) $0.23 (in millions, except per share data) 7

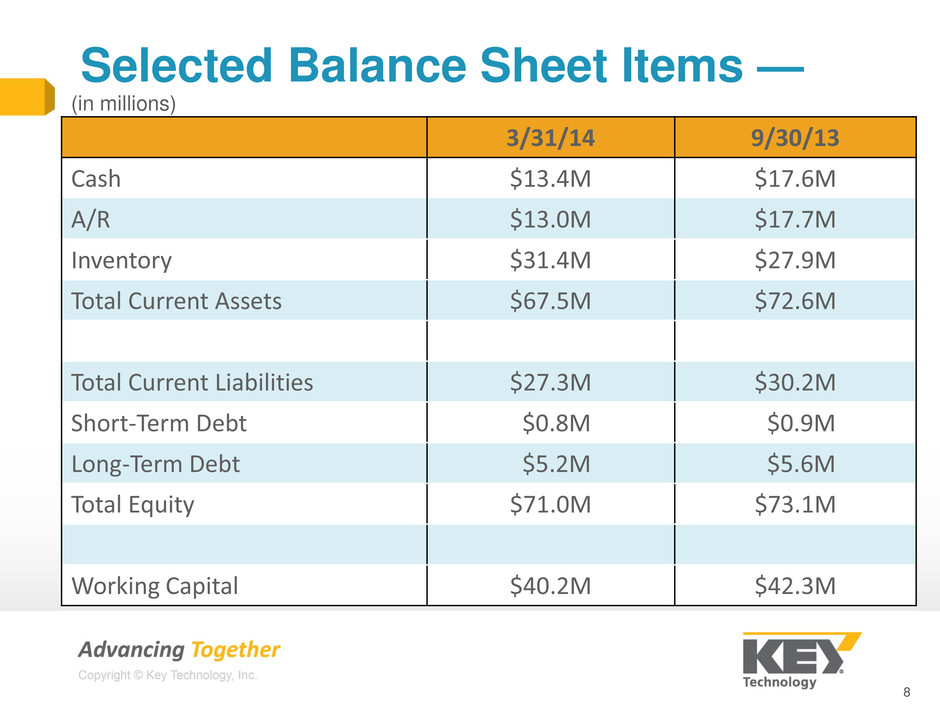

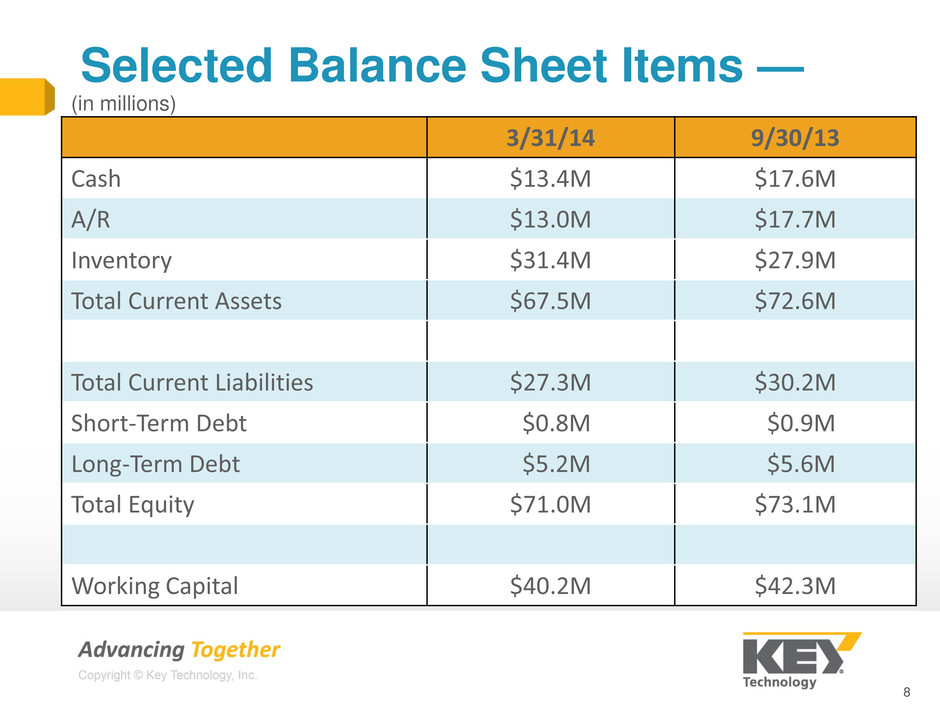

Selected Balance Sheet Items — 3/31/14 9/30/13 Cash $13.4M $17.6M A/R $13.0M $17.7M Inventory $31.4M $27.9M Total Current Assets $67.5M $72.6M Total Current Liabilities $27.3M $30.2M Short-Term Debt $0.8M $0.9M Long-Term Debt $5.2M $5.6M Total Equity $71.0M $73.1M Working Capital $40.2M $42.3M (in millions) 8

Business Outlook — Q3 Revenues are expected to be consistent with Q2 levels Q3 Gross Margins are expected to decrease slightly, as compared to Q2 levels Q3 Operating Expenses are expected to decrease moderately, as compared to Q2 Fiscal Year 2014 Revenues are anticipated to be lower than the prior year revenues, and FY2014 is not expected to be profitable 9

KEY’S TRANSFORMATION AND STRATEGIC OVERVIEW Jack Ehren President and CEO 10

Where We Have Been — FY2012 Mid-FY2012, we formed a new experienced, energized, and united executive team Together, we committed to “Transforming Key for Tomorrow” Focus: – Winning Culture – Sustainable Long-Term Strategy “Key’s Transformation” “Key’s Unique Strategic Position” 11

Long-Term Strategy — KEY’S TRANSFORMATION 12 Process automation SYSTEMS (optical and material handling) Full process improvement – Smart SOLUTIONS (holistic bundling of hardware, software, intelligent information, and processing knowledge) Many sales-opportunistic, one-off projects Scalable niche MARKET-DRIVEN solutions – new and enhanced existing insertion points (core and adjacencies) All in-house, one-off R&D projects Market-driven development platforms, leveraging innovative technologies and capabilities, and third-party partnerships North America-centric leader True global leader FROM TO OUR AIM: Reposition Key: as the global industry leader in our core markets as speedy and agile innovator for growth and sustainable profitabilty to provide consistent shareholder return

Trusted partner – Complete customer satisfaction partner – to optimize their operations – Long-standing reputation in the industry Innovation architecture – Unique and differentiated industry-leading solutions – Leveraging M&A and technology partners for differentiated value-add innovation Smart and intelligent systems – partner for yield improvement – Optimization of customer processing lines, yields and profitability – Advanced proprietary sort engine, software and algorithms Leading provider of global food processing solutions – Capable of offering full processing improvement solutions (holistic mix of hardware, software, intelligent information, and processing knowledge), instead of single stand-alone products and systems – Deep process knowledge and application expertise – Focused on identified core markets – Market intelligence – disciplined ROI selection of insertion points – Ever-increasing global footprint close to core markets and strategic customers 13 Long-Term Strategy — KEY’S UNIQUE STRATEGIC POSITION

Where We Have Been — FY2013 We initiated the execution of our new Strategic Plan We demonstrated real progress on our 2013 Strategic Imperatives Renewed and strengthened customer relationships by listening and demonstrating a commitment to provide real differentiated, value-add solutions – We won several very significant strategic opportunities: Two major potato processors – each contributed approximately $15M of orders A successful proprietary development solution with a major snack food processor – significantly contributed to over $9M of orders Orders from a major vegetable processor – exceeded $5M Orders from a major agricultural seed customer – approximately $5M 14

Where We Have Been — FY2013 We strengthened our overall innovation and capabilities by advancing our internal expertise, and developing through new third-party relationships – Successful completion of the Visys acquisition in February – Technical partnership agreement with EVK in July – Technical partnership agreement with Insort in July We made real progress in our commitment to develop true industry-leading and differentiated solutions for our markets – Visys acquisition brought new, complementary products, technologies, and advanced developments – Our EVK and Insort partnerships are enabling us to leverage hyperspectral technologies into our solutions, and offer unique “Chemical Imaging Technology” for potato applications – In September, with speed and agility, we launched Taurys – the first Key-Visys new product to the market – Unique features and capabilities of Taurys will be leveraged and further enhanced in future solutions currently being developed 15

Where We Have Been — FY2013 We expanded into new market adjacencies: – Nuts and dried fruit became new core market FY2013 experienced an increase in capital spending in our core markets, especially in the potato segment, and Key took advantage and executed on these opportunities 16

Customer Testimonial — 17 Quotes from major customer executive in our core markets, supporting our new culture and strategic direction: “Great move by Key to link up these new additional technical solutions! I am excited about the potential to drive that technology further and faster through partnership with Key. I am personally pleased with the direction and tone of the relationship that is being nurtured between Key and our company. Thanks for Key’s leadership and commitment.” “I really appreciate Key’s leadership – the change in tone is remarkable and much appreciated.”

Where We Are Today — FY2014 We are experiencing global slow-downs and delays in capital expenditures in our core markets compared to the prior year We continue working closely with new and existing strategic customers to bring new value-add solutions to their operations Our activity with global strategic customers is strong in the planning and development stages for future project opportunities We are aggressively investing for the future in our innovative developments and smart system solutions 2012 2013 2014 Today New Executive Team Visys Acquisition EVK and Insort Partnerships Taurys Launch Robust Order Growth Order Slow-Down New Technology and Smart Solutions Development Continued Execution of Strategic Plan New Strategic Plan 18 Successful Execution of 2013 Imperatives New Branding

Where We Are Today — Today members of the executive team will share portions of our future strategic plan and future direction with you and, share why we are excited about the future of Key. 19 While FY2014 financial results have fallen below our expectations, we are confident in and entirely committed to our long-term strategic plan. FY2014

THE POWER OF KEY-VISYS EUROPEAN MARKET MARKET DRIVERS Frank Zwerts Chief Strategy Officer President of EMEIA 20

Value of Visys Acquisition Visys acquisition was very important to the overall long-term strategy of Key for several reasons: Visys brought proprietary chute-fed solutions that highly complemented Key’s product portfolio – Chute-fed products provide Key with mid- and end-of-line insertion points in nuts and dried fruit, frozen fruits and vegetables – Visys sorters created better value for legacy Key sorters and pull-through catalyst for conveyors Visys brought new technologies and developments that also highly complemented Key’s development efforts: – BioPrint, leveraging hyperspectral technologies – Multi-spectral laser sorting capabilities 21

Visys acquisition was very important to the overall long-term strategy of Key for several reasons: Visys brought new talent and skill sets that complement Key’s existing expertise, experience, and deep applications knowledge – Several employees from Visys now hold very important leadership responsibilities in our combined companies Visys brought an “Optical Center of Excellence” and an overall enhanced European Base, including the manufacturing of optical sorters: – Customer processing operations for our markets differ in Europe compared to North America. We are now better equipped to fully understand and analyze the needs of our European customers and provide differentiated, value-add solutions – This increased presence and expertise demonstrates Key’s overall commitment to the European market, and increases our global critical mass – Key is no longer being viewed as North America-centric 22 Value of Visys Acquisition

European Core Market Opportunities — Though more fragmented, our overall core markets are larger in Europe than in North America Key’s current overall market share in Europe is in the low double-digits – significantly lower than in North America Increasing our market penetration in Europe by executing on our strategic plan, and focusing on strategic accounts in each region We believe our new products and technology solutions and developments will be successful in demonstrating real differentiated value to these important strategic customers 23

Market Drivers — PROVIDING TAILWIND TO KEY’S TRANSFORMATION 24 Growing industry globalization Continued consolidation to food processing majors Global food processing solutions provider Ever-increasing global footprint close to core markets and strategic customers Faster world and market dynamics Market-driven innovation architecture Unique and differentiated industry-leading solutions M&A and technology partners for differentiated value-add innovation Factories become “smart” Scarcity of resources and yield focus Interconnectivity Plug and Play (simplicity) Smart system partner for yield improvement Optimization of food processing line yields and profitability Advanced proprietary sort engine, software, and algorithms Increased customer expectations Desire for trusted, complete solutions from major suppliers Differing requirements in fragmented markets Knowledgeable solutions partner Provide complete customer satisfaction experience Apply deep process knowledge and expertise Partner with customers to understand issues and develop value-add solutions MARKET DRIVERS KEY STRATEGIC RESPONSE

TECHNOLOGY OVERVIEW Louis Vintro Senior Vice President of New Products and Business Development 25

Innovation at Key — NEW APPROACHES SINCE 2012 26 Renewed focus on customer value and yield improvement – Customer visits and Voice-of-the-Customer (including Europe and ROW) More market-driven R&D planning – Market-driven priorities for 3-year technology roadmap – Investment in “tomorrow’s business” Strengthening of Key’s core competencies – Reassessment and strengthening of core (e.g. optical and systems engineering) – 3rd party technology partnerships Transforming Key’s innovation culture via Key-Visys combination – Globalizing and integrating R&D team and leadership roles – Speed and agility, and entrepreneurial culture – Synergistic technology roadmap merging Accountability for R&D results – Plan of Record (POR) commitment and performance metrics

RELEASED SEPTEMBER 2013 – Key demonstrated speed and agility as well as growing market success in introducing this new “chute-fed” sorter Only the beginning of innovation from Key… Taurys – 1st JOINT KEY-VISYS PRODUCT 27 – Taurys represents step change improvement in defect removal efficiency & lower product damage

28 Key-Visys — INNOVATION FOR THE FUTURE Taurys – delivers technology improvements on multiple aspects of “chute-fed” sorting in: ① Product Presentation & Ejection ② Product Detection ③ Automated Decisioning Going forward – we will be implementing and expanding this technology into Key future systems – Will be field testing during 2014 season ① Product Presentation & Ejection Taurys Chycaneslide™ Mono-layered presentation ② Product Detection e.g. Berry with feather – removed 100% successfully! Visys laser scanner technology ③ Automated Decisioning Sensor 1 Sensor 2 Sensor M Key Going Forward Mo re Inte lligent D ecisi o n w it h F u sed Da ta fro m M u lti p le Sen so rs

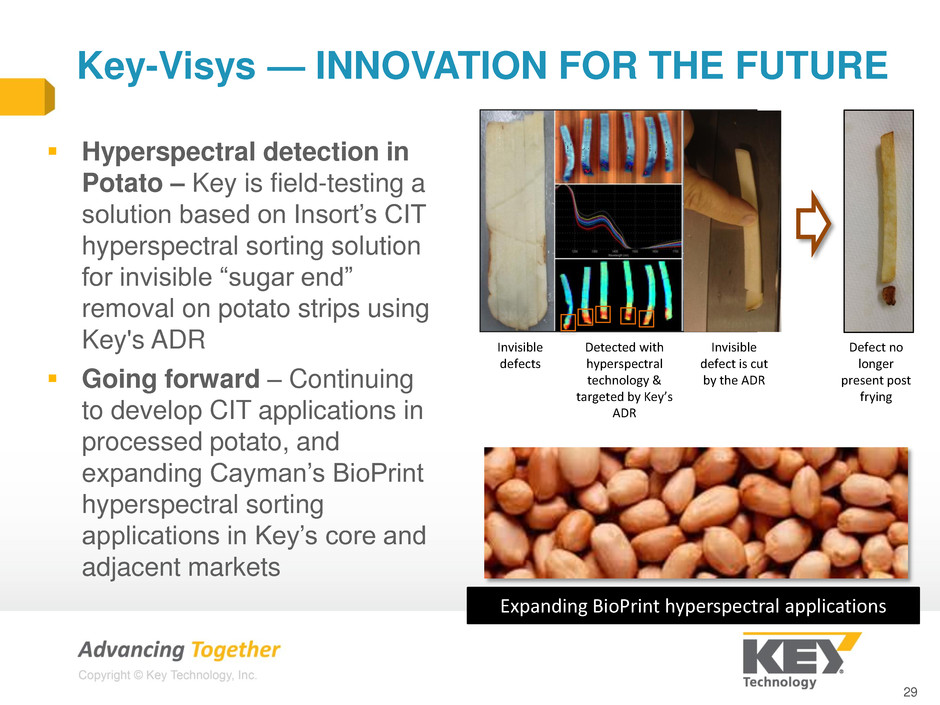

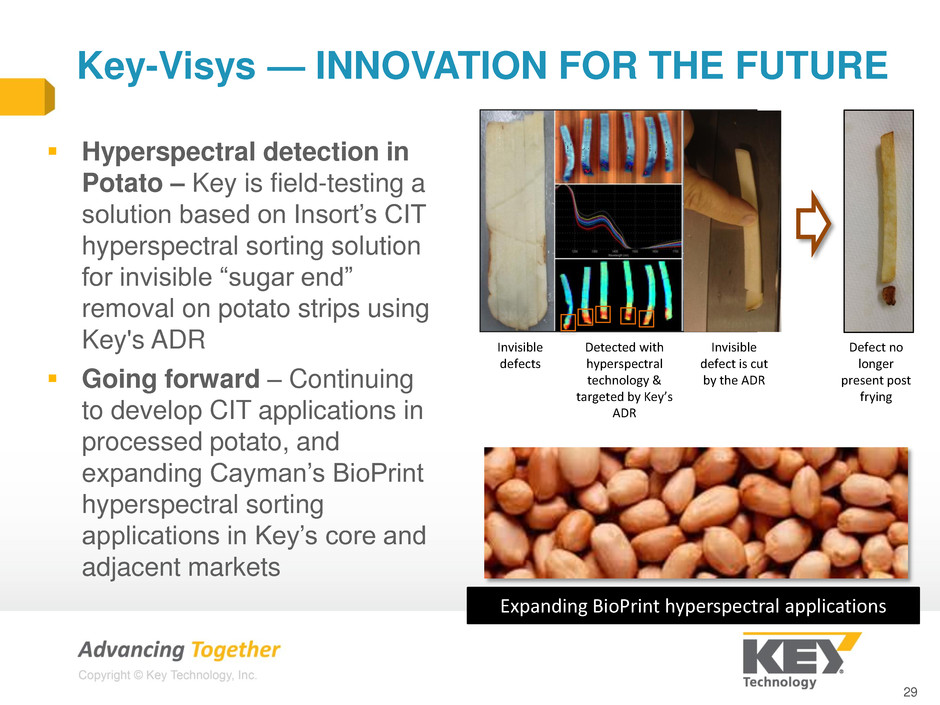

29 Key-Visys — INNOVATION FOR THE FUTURE Hyperspectral detection in Potato – Key is field-testing a solution based on Insort’s CIT hyperspectral sorting solution for invisible “sugar end” removal on potato strips using Key's ADR Going forward – Continuing to develop CIT applications in processed potato, and expanding Cayman’s BioPrint hyperspectral sorting applications in Key’s core and adjacent markets Expanding BioPrint hyperspectral applications Invisible defects Detected with hyperspectral technology & targeted by Key’s ADR Invisible defect is cut by the ADR Defect no longer present post frying

Key – VIBRATORY EQUIPMENT 30 Multi-focus development: MOTOR DRIVE TECHNOLOGY MECHANICAL COUPLING/ARM SPRING CONVEYING SURFACE Address top- priority customer needs Generate new customer value Strengthening Key’s vibratory technology roadmap to increase Key’s market leadership and share

Key – SMART SYSTEM PARTNER Key continues to build upon our “Smart System Partner” capabilities to help increase our customer’s food processing yields Interconnectivity Information Analytics Intelligent Operation Consistent and Sustainable Performance 31 • Our systems can operate most intelligently Self adjustment to plant and product changes Most intelligent advanced algorithm and sensor fusion Greatest level of advanced diagnostics • Key represents the “safest pair of hands” in the industry • Our systems and services perform the most reliably and consistently from plant- to -plant and day-to- day Key’s systems provide easy access and integrate most effectively with our customers’ plant automation and control systems Our systems and services provide the most complete information and “complex data” about our customers’ product to run the plant and its production assets with greatest yield

GLOBAL SALES OVERVIEW Steve Pellegrino Senior Vice President of Global Sales 32

Global Sales Overview — Activity through the first six months of FY2014 has been softer than FY2013 in recurring potatoes and processed fruit and vegetable applications – Projects in North America and Europe have been delayed as customers have been redirecting investments to other projects Customers making significant purchases in our core markets in North America have chosen to partner with Key in FY2014 33

Global Sales Overview — We expect that the successes achieved in FY2013 will result in future investments with strategic core customers – but bookings will not occur until late FY2014 and into FY2015 We have positioned our Innovation and Solutions Centers in Walla Walla, Sacramento and Hasselt to be fully integrated with all of our sorting and conveying solutions so we can quickly respond to applications testing needs for our customers We are confident that our new developments and solutions, going into field testing starting this spring, will provide truly differentiated and added value for our customers’ operations – in both existing and new applications and insertion points 34

Chute-Fed Solutions Impact — In FY2014, chute-fed solutions are gaining traction and having a real positive impact in North America Our chute-fed solutions – Cayman hyperspectral BioPrint sorter and our new Taurys laser sorter – have made solid contributions in North America – This has mitigated some of the down-turn in processed potato and processed fruit and vegetable conveying solutions Chute-fed bookings are forecasted to remain strong in North America for the remainder of the fiscal year – Taurys penetration has occurred primarily in raisin, nut and frozen berry applications, and is driven by the increased performance of Taurys in removing very small particles of foreign material, while minimizing good product loss – Success has been aided by our new Sacramento Innovation and Solutions Center, positioned close to this critical dried fruit and nut market segment – Successful ongoing in-plant tests at customer locations with Taurys and Cayman have contributed to additional penetration of our chute-fed solutions in North America – We are aggressively focused on replicating these successes in other geographic areas, especially in EMEIA 35

Positioning EMEIA for Growth — We are focused on increasing our core segment penetration in EMEIA We have further aligned our sales resources in the EMEIA region to better address strategic markets, geographies and customers We are establishing our Hasselt, Belgium location as our Sorting Center of Excellence for the EMEIA region – We are fully committed to the EMEIA region with sales, applications, manufacturing and after-sale customer service and support capabilities Complementary optical and material handling solutions provide a real competitive advantage in EMEIA We are equipped to effectively address the unique operations, processes and products in EMEIA, which are different from North America EMEIA, although more fragmented, has a larger market size in our core markets than North America. We are confident that with our new focused sales strategy in EMEIA, and our new developments and solutions, we will be successful in capturing a larger share of this market 36

Positioning Intercon for Growth — In addition to strengthening EMEIA, we are also positioning our Intercon region for growth We are focused on fully leveraging country representatives to penetrate geographic regions that can realize value from our new solution developments We will also evaluate regional demonstration centers located at some of our representative facilities to ensure our capabilities can be fully demonstrated to these potential customers 37

Global Customers and Markets — Driving global consistency better positions us to support our largest customers Our strategic customers in our core segments want further improvements in their cost positions through labor reductions and yield improvements They are also being tasked to eliminate foreign material completely from their finished products These requirements are driving customers to evaluate and implement the following: – Increased use of multiple sorters in series – Sorters that combine multiple types of sensors in the same unit – New sorter insertion points in their production lines, that are now closer to final packaging, to further insure that foreign material is eliminated We are increasing and strengthening cross-training of our sales, applications and service teams across all regions to ensure and leverage global consistency in our leading solutions 38

Global Customers and Markets — Our customers are changing their processes and products to meet changing consumer needs and we are increasing our Voice-of-the- Customer roles to be a leader in responding to these needs Processed potato customers are working with our sales and application teams to improve the capabilities of potato strip length management – First, through improved mechanical conveying and grading needs – Concurrently, they are exploring replacing that function with electronic length management as part of the optical sorting platform – we believe we are ideally positioned to help satisfy and implement these needs, since we understand and supply both solutions and can help determine the optimal solution – In addition, customers are also demanding increased data management of the critical information gained regarding length, foreign material incidents, etc. Tree nut customers continue to increase investments to meet global demand and quality requirements, and that is driving new improvements in cracking and processing nuts – This increases the demands on the sorting solutions to remove smaller and smaller fragments, while minimizing yield loss – The Taurys is just our first response to this need, and its quick acceptance is validation that we are listening to the customer and positioning Key for growth 39

Customer Testimonials — “I’ve had experience with Key at a number of other facilities. They are head-and-shoulders above when it comes to service, which is why we chose them for this project. As we got deeper into it and Key continued to modify things for us, we ended up with an integrated system that is steps ahead of what the others offered.” 40 “We want to identify and remove everything that doesn’t belong, including co-mingled product from another run, off-color product, misshapen product and, of course, any foreign material. We use shape sorting for every product we run to double our protection.”

BUSINESS MODEL – DRIVING SHAREHOLDER VALUE Jack Ehren President and CEO 41

Reasonably Attainable Business Model — BUILDING ON A STRONG FOUNDATION Leveraging the investments made in 2013-2014 to propel profitable growth in the future Annualized sustainable business model that we believe can be reasonably achieved within the next 2-3 years through organic growth: To further accelerate and drive profitable growth, partnerships and M&A continue to be a part of our overall corporate strategy 42 Revenue: $160M-$170M Gross Margin: 36%+ Operating Income Margin: 8%+ EBITDA: $18M-$19M+ DRIVING SHAREHOLDER VALUE

How We Get There — 1. New innovative and differentiated technology, capabilities, and solutions Industry-leading optical sorting and material handling solutions Smart and intelligent systems 2. Grow core market share in Europe and North America (with new industry-leading solutions) Existing application insertion points (especially Europe, where market share is lower) Additional application insertion points with new innovation (examples: berries, diced/sliced fruits, frozen vegetables, etc.) New and existing insertion points with strategic customers (many customers have multiple business units and applications) 43

How We Get There — 3. Identify and penetrate global high potential adjacencies New applications with new insertion points that must have high correlation to our core competencies 4. Other geographic growth opportunities Leveraging global strategic customers and new solutions 44 Other potential adjacent markets Immediate Adjacencies Dried Fruit and Nuts Core markets: Processed Vegetables and Fruit, and Potatoes Based upon Key’s internal addressable market estimates

How We Get There — 5. Improve operating margins New innovative solutions designed for manufacturability, serviceability, modularity and cost, and real customer value Global manufacturing and operational efficiencies Scale to benefit SG&A and R&D infrastructure with higher revenue levels 6. Continue development of strategic partnerships and new capabilities 45

46 DRIVING SHAREHOLDER VALUE Trusted Partner Innovation Architecture Smart and Intelligent Systems Leading Provider of Global Food Processing Solutions Market-Driven Focus High-Potential Adjacencies Innovative Industry-Leading Solutions Strategic Partnerships Core Growth in North America and EMEIA

Advancing Together— Shareholders, Customers, Employees and Strategic Partners 47