UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-7740 |

|

Western Asset 2008 Worldwide Dollar Government Term Trust Inc. |

(Exact name of registrant as specified in charter) |

|

55 Water Street, New York, NY | | 10041 |

(Address of principal executive offices) | | (Zip code) |

|

Robert I. Frenkel, Esq. Legg Mason & Co., LLC 300 First Stamford Place, 4th Floor Stamford, CT 06902 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (800) 451-2010 | |

|

Date of fiscal year end: | July 31 | |

|

Date of reporting period: | January 31, 2008 | |

| | | | | | | |

ITEM 1. REPORT TO STOCKHOLDERS.

The Semi-Annual Report to Stockholders is filed herewith.

| |

| |

SEMI-ANNUAL REPORT / JANUARY 31, 2008 | |

| |

| |

Western Asset 2008 Worldwide Dollar Government Term Trust Inc. (SBG) | |

| |

Managed by WESTERN ASSET | |

| |

| |

INVESTMENT PRODUCTS: NOT FDIC INSURED · NO BANK GUARANTEE · MAY LOSE VALUE | |

| | |

Fund objective

The investment objective of the Fund is to manage a portfolio of fixed income securities so as to return $10 per share to investors on or about November 30, 2008 while providing high monthly income. No assurance can be given that the Fund’s investment objective will be achieved.

What’s inside

Letter from the chairman | I | |

| | |

Fund at a glance | 1 | |

| | |

Schedule of investments | 2 | |

| | |

Statement of assets and liabilities | 6 | |

| | |

Statement of operations | 7 | |

| | |

Statements of changes in net assets | 8 | |

| | |

Financial highlights | 9 | |

| | |

Notes to financial statements | 10 | |

| | |

Board approval of management and subadvisory agreements | 19 | |

| | |

Additional shareholder information | 24 | |

| | |

Dividend reinvestment plan | 25 | |

Legg Mason Partners Fund Advisor, LLC (“LMPFA”) is the Fund’s investment manager and Western Asset Management Company (“Western Asset”) is the Fund’s sub adviser, LMPFA and Western Asset are wholly-owned subsidiaries of Legg Mason, Inc.

Letter from the Chairman

Dear Shareholder,

While the U.S. economy continued to expand during the six-month reporting period ended January31, 2008, it weakened significantly as the period progressed. After U.S. gross domestic product (“GDP”)i growth was a tepid 0.6% in the first quarter of 2007, the economy then rebounded during the next six months. Second quarter 2007 GDP growth was a solid 3.8% and third quarter GDP growth accelerated to 4.9%, its strongest showing in four years. However, continued weakness in the housing market and an ongoing credit crunch took their toll on the economy during the last three months of 2007. During this period, the preliminary estimate for GDP growth was 0.6%. Recently, there have been additional signs of an economic slowdown, leading some to believe that the U.S. may be headed for a recession. The U.S. Commerce Department reported that consumer spending rose an anemic 0.3% in December 2007, the weakest growth rate in 15 months. Elsewhere, the U.S. Department of Labor estimated that non-farm payroll employment fell 22,000 in January 2008, the first monthly decline in more than four years.

Ongoing issues related to the housing and subprime mortgage markets and an abrupt tightening in the credit markets prompted the Federal Reserve Board (“Fed”)ii to take several actions during the reporting period. The Fed initially responded by lowering the discount rate—the rate the Fed uses for loans it makes directly to banks—from 6.25% to 5.75% in mid-August 2007. Then, at its meeting on September 18, the Fed reduced the discount rate to 5.25% and the federal funds rateiii from 5.25% to 4.75%. This marked the first reduction in the federal funds rate since June 2003. The Fed again lowered rates in October and December 2007, bringing the federal funds rate to 4.25% at the end of 2007. In January 2008, the Fed continued to aggressively ease monetary policy in an attempt to ward off a recession. In a surprise move, the Fed cut the federal funds rate on January 22, 2008 by 0.75% to 3.50%. The Fed again lowered the federal funds rate during its meeting on January 30, 2008, bringing it to 3.00%, its lowest level since May 2005. In its statement accompanying its latest rate cut, the Fed stated: “Today’s policy action, combined with those taken earlier, should help to promote moderate growth over time and to mitigate the risks to economic activity. However, downside risks to growth remain. The Committee will

Western Asset 2008 Worldwide Dollar Government Term Trust Inc. | | I |

Letter from the chairman continued

continue to assess the effects of financial and other developments on economic prospects and will act in a timely manner as needed to address those risks.”

During the six-month reporting period, both short- and long-term Treasury yields experienced periods of volatility. This was due, in part, to mixed economic and inflation data, the fallout from the subprime mortgage market and shifting expectations regarding the Fed’s monetary policy. Within the bond market, investors were initially focused on the subprime segment of the mortgage-backed market. These concerns broadened, however, to include a wide range of financial institutions and markets. As a result, other fixed-income instruments also experienced increased price volatility. This turmoil triggered several “flights to quality,” causing Treasury yields to move sharply lower (and their prices higher), while riskier segments of the market saw their yields move higher (and their prices lower).

Overall, during the six months ended January31, 2008, two-year Treasury yields fell from 4.56% to 2.17%. Over the same time frame, 10-year Treasury yields fell from 4.78% to 3.67%. The U.S. yield curveiv steepened during the reporting period. Short-term yields fell sharply in concert with the Fed’s rate cuts while longer-term yields fell less dramatically due to inflationary concerns. Looking at the six-month period as a whole, the overall bond market, as measured by the Lehman Brothers U.S. Aggregate Indexv, returned 6.82%.

Increased investor risk aversion in November 2007 and again at the end of the reporting period caused the high-yield bond market to post only a modest gain for the six months ended January 31, 2008. During that period, the Citigroup High Yield Market Indexvi returned 1.26%. While high-yield bond prices rallied several times during the period, several flights to quality dragged down the sector, despite continued low default rates.

Despite increased investor risk aversion, emerging markets debt generated strong results, as the JPMorgan Emerging Markets Bond Index Global (“EMBI Global”)vii returned 7.15% over the six months ended January 31, 2008. Overall solid demand, an expanding global economy, increased domestic spending and the Fed’s numerous rate cuts supported the emerging market debt asset class.

II | | Western Asset 2008 Worldwide Dollar Government Term Trust Inc. |

Performance review

For the six months ended January 31, 2008, Western Asset 2008 Worldwide Dollar Government Term Trust Inc. returned 3.49% based on its net asset value (“NAV”)viii and 2.84% based on its New York Stock Exchange (“NYSE”) market price per share. In comparison, the Fund’s unmanaged benchmark, the EMBI Global, returned 7.15% for the same period. The Lipper Global Income Closed-End Funds Category Averageix increased 3.56% over the same time frame. Please note that Lipper performance returns are based on each fund’s NAV per share.

During this six-month period, the Fund made distributions to shareholders totaling $0.38 per share, which may have included a return of capital. The performance table shows the Fund’s six-month total return based on its NAV and market price as of January 31, 2008. Past performance is no guarantee of future results.

PERFORMANCE SNAPSHOT as of January 31, 2008 (unaudited)

PRICE PER SHARE | | | | 6-MONTH

TOTAL RETURN | |

$10.52 (NAV) | | | | 3.49% | |

$10.24 (Market Price) | | | | 2.84% | |

All figures represent past performance and are not a guarantee of future results.

Total returns are based on changes in NAV or market price, respectively. Total returns assume the reinvestment of all distributions, including returns of capital, if any, in additional shares.

Information about your fund

Important information with regard to recent regulatory developments that may affect the Fund is contained in the Notes to Financial Statements included in this report.

Looking for additional information?

The Fund is traded under the symbol “SBG” and its closing market price is available in most newspapers under the NYSE listings. The daily NAV is available on-line under the symbol “XSBGX” on most financial websites. Barron’s and The Wall Street Journal’s Monday edition both carry closed-end fund tables that provide additional information. In addition, the Fund issues a quarterly press release that can be found on most major financial websites, as well as www.leggmason.com/individualinvestors.

In a continuing effort to provide information concerning the Fund, shareholders may call 1-888-777-0102 (toll free), Monday through Friday from 8:00 a.m. to 6:00 p.m. Eastern Time, for the Fund’s current NAV, market price and other information.

Western Asset 2008 Worldwide Dollar Government Term Trust Inc. | | III |

Letter from the chairman continued

As always, thank you for your confidence in our stewardship of your assets. We look forward to helping you meet your financial goals.

Sincerely,

R. Jay Gerken, CFA

Chairman, President and Chief Executive Officer

March 7, 2008

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

RISKS: An investment in the Fund is subject to risks, including the possible loss of the entire principal amount that you invest. Your shares, at any point, may be worth less than what you invested, even after taking into account the reinvestment of Fund dividends and distributions. The Fund may invest in foreign securities that are subject to certain risks of overseas investing, including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. These risks are magnified in emerging or developing markets. The Fund also may invest in derivatives, such as options and futures, which can be illiquid and harder to value, especially in declining markets. A small investment in certain derivatives potentially may have a large impact on the Fund’s performance.

All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

i Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time.

ii The Federal Reserve Board (“Fed”) is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments.

iii The federal funds rate is the rate charged by one depository institution on an overnight sale of immediately available funds (balances at the Federal Reserve) to another depository institution; the rate may vary from depository institution to depository institution and from day to day.

iv The yield curve is the graphical depiction of the relationship between the yield on bonds of the same credit quality but different maturities.

v The Lehman Brothers U.S. Aggregate Index is a broad-based bond index comprised of government, corporate, mortgage- and asset-backed issues, rated investment grade or higher, and having at least one year to maturity.

vi The Citigroup High Yield Market Index is a broad-based unmanaged index of high-yield securities.

vii The JPMorgan Emerging Markets Bond Index Global (“EMBI Global”) tracks total returns for U.S. dollar denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities: Brady bonds, loans, Eurobonds, and local market instruments. Countries covered are Algeria, Argentina, Brazil, Bulgaria, Chile, China, Colombia, Cote d’Ivoire, Croatia, Ecuador, Greece, Hungary, Lebanon, Malaysia, Mexico, Morocco, Nigeria, Panama, Peru, the Philippines, Poland, Russia, South Africa, South Korea, Thailand, Turkey and Venezuela.

viii NAV is calculated by subtracting total liabilities and outstanding preferred stock (if any) from the closing value of all securities held by the Fund (plus all other assets) and dividing the result (total net assets) by the total number of the common shares outstanding. The NAV fluctuates with changes in the market prices of securities in which the Fund has invested. However, the price at which an investor may buy or sell shares of the Fund is at the Fund’s market price as determined by supply of and demand for the Fund’s shares.

ix Lipper, Inc. is a major independent mutual-fund tracking organization. Returns are based on the six-month period ended January 31, 2008, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 15 funds in the Fund’s Lipper category.

IV | | Western Asset 2008 Worldwide Dollar Government Term Trust Inc. |

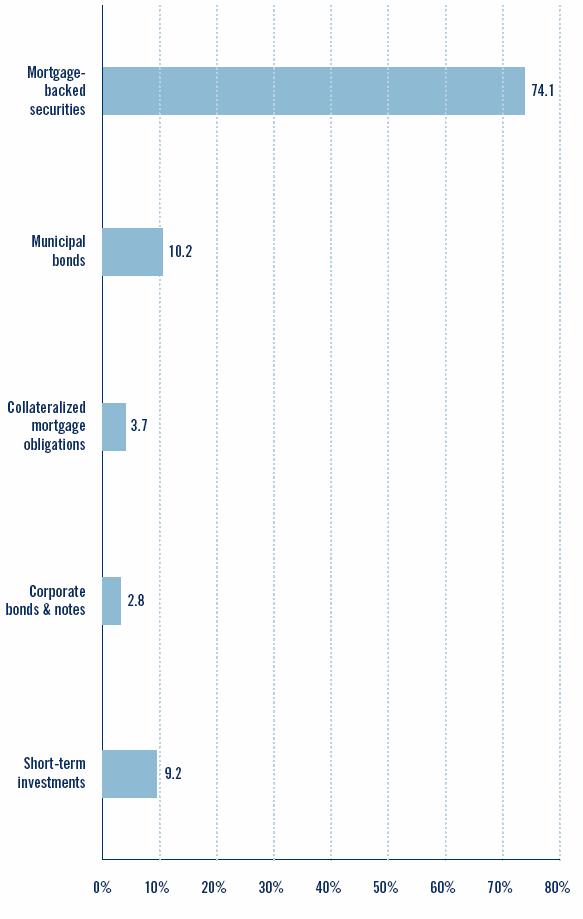

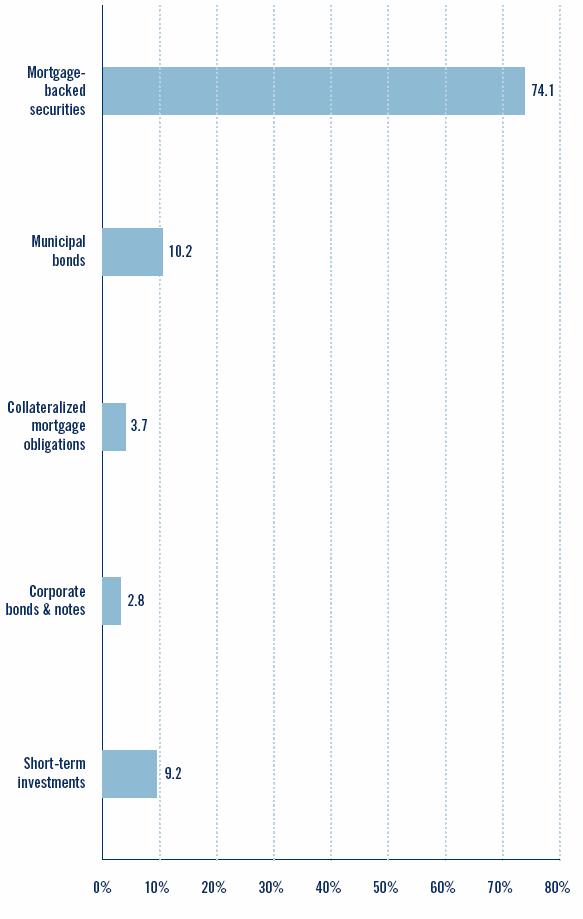

Fund at a glance (unaudited)

INVESTMENT BREAKDOWN (%) as a percent of total investments — January 31, 2008

Western Asset 2008 Worldwide Dollar Government Term Trust Inc. 2008 Semi-Annual Report | | 1 |

Schedule of investments (unaudited)

January 31, 2008

WESTERN ASSET 2008 WORLDWIDE DOLLAR GOVERNMENT TERM TRUST INC. |

|

FACE AMOUNT | | SECURITY | | VALUE | |

MORTGAGE-BACKED SECURITIES — 73.5% | | | |

| | FHLMC — 50.4% | | | |

| | Federal Home Loan Mortgage Corp. (FHLMC): | | | |

$ | 32,673,549 | | 5.582% due 5/1/36a,b | | $ | 33,306,501 | |

8,452,837 | | 6.113% due 7/1/36a,b | | 8,742,631 | |

45,262,807 | | 6.178% due 12/1/36a,b | | 46,697,377 | |

22,258,882 | | 5.814% due 1/1/37a,b | | 22,908,159 | |

23,418,654 | | 5.763% due 5/1/37a,b | | 24,060,109 | |

45,778,371 | | 5.902% due 5/1/37a,b | | 47,110,676 | |

53,968 | | Gold, 7.000% due 10/1/17 | | 57,564 | |

| | Total FHLMC | | 182,883,017 | |

| | FNMA — 23.1% | | | |

| | Federal National Mortgage Association (FNMA): | | | |

1,624,840 | | 4.792% due 2/1/35a | | 1,686,028 | |

2,414,139 | | 5.051% due 3/1/35a,b | | 2,491,328 | |

22,205,178 | | 5.153% due 1/1/36a,b | | 22,603,965 | |

16,900,270 | | 5.897% due 12/1/36a,b | | 17,312,130 | |

18,982,046 | | 5.966% due 12/1/36a,b | | 19,536,702 | |

19,923,481 | | 5.503% due 2/1/37a,b | | 20,160,571 | |

| | Total FNMA | | 83,790,724 | |

| | TOTAL MORTGAGE-BACKED SECURITIES | | | |

| | (Cost — $262,460,604) | | 266,673,741 | |

COLLATERALIZED MORTGAGE OBLIGATIONS — 3.7% | | | |

| | Federal Home Loan Mortgage Corp. (FHLMC): | | | |

| | PAC IO: | | | |

1,517,235 | | 4.500% due 8/15/12c | | 8,597 | |

174,675 | | 5.000% due 9/15/12c | | 8 | |

3,097,324 | | 5.000% due 3/15/14c | | 44,634 | |

5,497,906 | | 4.500% due 5/15/15c | | 300,429 | |

3,117,694 | | 5.500% due 9/15/22c | | 32,643 | |

21,388 | | 5.500% due 9/15/22 | | 11 | |

8,502,271 | | 5.000% due 5/15/23c | | 1,282,268 | |

7,855,461 | | 5.000% due 7/15/26c | | 371,003 | |

| | PAC-1 IO: | | | |

2,452,786 | | 5.000% due 3/15/22c | | 349,845 | |

8,778,908 | | 5.500% due 9/15/28c | | 808,699 | |

10,327,304 | | 5.500% due 2/15/30c | | 943,748 | |

| | Federal National Mortgage Association (FNMA): | | | |

| | IO: | | | |

6,177,342 | | 4.500% due 1/25/14c | | 150,030 | |

6,813,270 | | 5.000% due 5/25/16c | | 142,827 | |

| | | | | | | |

See Notes to Financial Statements.

2 | | Western Asset 2008 Worldwide Dollar Government Term Trust Inc. 2008 Semi-Annual Report |

WESTERN ASSET 2008 WORLDWIDE DOLLAR GOVERNMENT TERM TRUST INC. |

|

FACE AMOUNT | | SECURITY | | VALUE | |

| | STRIP, IO: | | | |

$ | 15,312,954 | | 6.000% due 3/1/33c | | $ | 3,078,440 | |

13,283,673 | | 5.000% due 7/1/33c | | 2,952,374 | |

14,032,350 | | 5.500% due 8/1/34c | | 2,918,233 | |

286,954 | | Government National Mortgage Association (GNMA), PAC IO,

5.500% due 2/16/28c | | 1,820 | |

| | TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS

(Cost — $12,480,815) | | 13,385,609 | |

CORPORATE BONDS & NOTES — 2.7% | | | |

| | Capital Markets — 1.4% | | | |

4,950,000 | | Credit Suisse First Boston Brazil (Bahamas) Ltd.,

5.850% due 11/24/08b | | 4,985,578 | |

| | Consumer Finance — 1.3% | | | |

5,000,000 | | SLM Corp., 3.944% due 4/18/08a,b,d | | 4,964,410 | |

| | TOTAL CORPORATE BONDS & NOTES

(Cost — $9,944,123) | | 9,949,988 | |

MUNICIPAL BONDS — 10.1% | | | |

| | Pennsylvania — 1.4% | | | |

| | Westmoreland County, PA, GO, Refunding, FGIC: | | | |

2,665,000 | | Zero coupon bond to yield 3.845% due 6/1/08 | | 2,643,600 | |

2,515,000 | | Zero coupon bond to yield 3.904% due 12/1/08 | | 2,464,348 | |

| | Total Pennsylvania | | 5,107,948 | |

| | Texas — 8.7% | | | |

11,200,000 | | Austin, TX, Utility Systems Revenue, Refunding, Prior Lien,

MBIA, zero coupon bond to yield 3.901% due 11/15/08b | | 10,997,168 | |

| | Edinburg, TX, Consolidated ISD, GO, Refunding School Building, PSFG: | | | |

1,845,000 | | Zero coupon bond to yield 3.823% due 2/15/08 | | 1,843,432 | |

2,705,000 | | Zero coupon bond to yield 3.938% due 2/15/09 | | 2,642,433 | |

5,470,000 | | Harris County, TX, GO, FGIC, zero coupon bond to yield 3.873% due 8/15/08b | | 5,399,820 | |

10,535,000 | | Texas State Public Finance Authority, Capital Appreciation Refunding, MBIA, zero coupon bond to yield 3.810% due 2/1/08b | | 10,535,000 | |

| | Total Texas | | 31,417,853 | |

| | TOTAL MUNICIPAL BONDS (Cost — $36,646,531) | | 36,525,801 | |

| | TOTAL INVESTMENTS BEFORE SHORT-TERM INVESTMENTS

(Cost — $321,532,073) | | 326,535,139 | |

SHORT-TERM INVESTMENTS — 9.1% | | | |

| | U.S. Government Agency — 0.6% | | | |

2,200,000 | | Federal National Mortgage Association (FNMA),

Discount Notes, 5.203% due 3/17/08e,f

(Cost — $2,186,223) | | 2,186,223 | |

| | | | | | | |

See Notes to Financial Statements.

Western Asset 2008 Worldwide Dollar Government Term Trust Inc. 2008 Semi-Annual Report | | 3 |

Schedule of investments (unaudited) continued

January 31, 2008

WESTERN ASSET 2008 WORLDWIDE DOLLAR GOVERNMENT TERM TRUST INC. |

|

FACE AMOUNT | | SECURITY | | VALUE | |

| | Repurchase Agreement — 8.5% | | | |

$ | 30,970,000 | | Morgan Stanley tri-party repurchase agreement dated 1/31/08, 2.800% due 2/1/08; Proceeds at maturity — $30,972,409; (Fully collateralized by various U.S. government agency obligations, 4.125% to 5.450% due 4/15/09 to 6/20/16; Market value — $32,146,372) (Cost — $30,970,000)b | | $ | 30,970,000 | |

| | TOTAL SHORT-TERM INVESTMENTS (Cost — $33,156,223) | | 33,156,223 | |

| | TOTAL INVESTMENTS — 99.1% (Cost — $354,688,296#) | | 359,691,362 | |

| | Other Assets in Excess of Liabilities — 0.9% | | 3,267,924 | |

| | TOTAL NET ASSETS — 100.0% | | $ | 362,959,286 | |

| | | | | | | |

a | Variable rate security. Interest rate disclosed is that which is in effect at January 31, 2008. |

b | All or a portion of this security is segregated for open futures contracts, written options and swap contracts. |

c | Illiquid security. |

d | Security is exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions that are exempt from registration, normally to qualified institutional buyers. This security has been deemed liquid pursuant to guidelines approved by the Board of Directors, unless otherwise noted. |

e | All or a portion of this security is held at the broker as collateral for open futures contracts. |

f | Rate shown represents yield-to-maturity. |

# | Aggregate cost for federal income tax purposes is substantially the same. |

| Abbreviations used in this schedule: |

| FGIC | – | Financial Guaranty Insurance Company – Insured Bonds |

| GO | – | General Obligation |

| IO | – | Interest Only |

| ISD | – | Independent School District |

| MBIA | – | Municipal Bond Investors Assurance Corporation – Insured Bonds |

| PAC | – | Planned Amortization Class |

| PSFG | – | Permanent School Fund Guaranty |

| STRIP | – | Separate Trading of Registered Interest and Principal |

See Notes to Financial Statements.

4 | | Western Asset 2008 Worldwide Dollar Government Term Trust Inc. 2008 Semi-Annual Report |

Schedule of Options Written | | | | | | | |

| | | | | | | |

Notional

Par | Reference Entity | | Expiration

Date | | Strike

Rate | Value | |

$500,000 | | Credit default swaption with Barclays Capital Inc. to sell protection on Dow Jones CDX.NA.IG.HVOL.9 Index, Put | | 2/20/08 | | 1.80 | % | $ | (28 | ) |

200,000 | | Credit default swaption with Barclays Capital Inc. to sell protection on Dow Jones CDX.NA.IG.HVOL.9 Index, Put | | 2/20/08 | | 1.80 | | (11 | ) |

700,000 | | Credit default swaption with Barclays Capital Inc. to sell protection on Dow Jones CDX.NA.IG.HVOL.9 Index, Put | | 2/20/08 | | 1.95 | | (192 | ) |

800,000 | | Credit default swaption with Barclays Capital Inc. to sell protection on Dow Jones CDX.NA.IG.HVOL.9 Index, Put | | 2/20/08 | | 2.30 | | (2,225 | ) |

400,000 | | Credit default swaption with Barclays Capital Inc. to sell protection on Dow Jones CDX.NA.IG.HVOL.9 Index, Put | | 3/20/08 | | 2.20 | | (1,638 | ) |

800,000 | | Credit default swaption with Barclays Capital Inc. to sell protection on Dow Jones CDX.NA.IG.HVOL.9 Index, Put | | 3/20/08 | | 2.20 | | (1,297 | ) |

700,000 | | Credit default swaption with Barclays Capital Inc. to sell protection on Dow Jones CDX.NA.IG.HVOL.9 Index, Put | | 3/20/08 | | 2.20 | | (1,135 | ) |

700,000 | | Credit default swaption with Barclays Capital Inc. to sell protection on Dow Jones CDX.NA.IG.HVOL.9 Index, Put | | 4/21/08 | | 2.10 | | (3,500 | ) |

| | TOTAL OPTIONS WRITTEN | | | | | | | |

| | (Premiums received — $22,428) | | | | | | $ | (10,026 | ) |

| | | | | | | | | | | |

See Notes to Financial Statements.

Western Asset 2008 Worldwide Dollar Government Term Trust Inc. 2008 Semi-Annual Report | | 5 |

Statement of assets and liabilities (unaudited)

January 31, 2008

ASSETS: | | VALUE | |

Investments, at value (Cost — $354,688,296) | | $359,691,362 | |

Cash | | 698 | |

Interest receivable | | 2,670,918 | |

Principal paydown receivable | | 2,065,175 | |

Receivable from broker — variation margin on open futures contracts | | 689,890 | |

Interest receivable for open swap contracts | | 22,000 | |

Receivable for securities sold | | 3,500 | |

Prepaid expenses | | 8,335 | |

Total Assets | | 365,151,878 | |

LIABILITIES: | | | |

Swap Contracts, at value (premiums paid $663,215) | | 1,838,535 | |

Investment management fee payable | | 233,801 | |

Options written, at value (premium received $22,428) | | 10,026 | |

Directors’ fees payable | | 3,941 | |

Accrued expenses | | 106,289 | |

Total Liabilities | | 2,192,592 | |

TOTAL NET ASSETS | | $362,959,286 | |

NET ASSETS: | | | |

Par value ($0.001 par value; 34,510,639 shares issued and outstanding; 200,000,000 shares authorized) | | $ 34,511 | |

Paid-in capital in excess of par value | | 318,104,655 | |

Undistributed net investment income | | 22,099,243 | |

Accumulated net realized gain on investments, futures contracts,

options written and swap contracts | | 16,050,075 | |

Net unrealized appreciation on investments, futures contracts,

options written and swap contracts | | 6,670,802 | |

TOTAL NET ASSETS | | $362,959,286 | |

Shares Outstanding | | 34,510,639 | |

Net Asset Value | | $10.52 | |

See Notes to Financial Statements.

6 | | Western Asset 2008 Worldwide Dollar Government Term Trust Inc. 2008 Semi-Annual Report |

Statement of operations (unaudited)

For the Six Months Ended January 31, 2008

INVESTMENT INCOME: | | VALUE | |

Interest | | $ | 10,582,255 | |

Dividends | | 985,950 | |

Total Investment Income | | 11,568,205 | |

EXPENSES: | | | |

Investment management fee (Note 2) | | 1,355,387 | |

Shareholder reports | | 47,603 | |

Directors’ fees | | 35,075 | |

Audit and tax | | 32,728 | |

Transfer agent fees | | 14,002 | |

Stock exchange listing fees | | 12,476 | |

Custody fees | | 6,274 | |

Legal fees | | 3,499 | |

Insurance | | 2,943 | |

Miscellaneous expenses | | 5,069 | |

Total Expenses | | 1,515,056 | |

NET INVESTMENT INCOME | | $ | 10,053,149 | |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS, FUTURES CONTRACTS,

OPTIONS WRITTEN AND SWAP CONTRACTS (NOTES 1 AND 3): | | | |

Net Realized Gain (Loss) From: | | | |

Investment transactions | | $ | 24,837,206 | |

Futures contracts | | (9,953,437 | ) |

Options written | | 4,129 | |

Swap contracts | | 56,500 | |

Net Realized Gain | | 14,944,398 | |

Change in Net Unrealized Appreciation/Depreciation From: | | | |

Investments | | (15,406,062 | ) |

Futures contracts | | 3,968,026 | |

Options written | | 12,402 | |

Swap contracts | | (1,175,320 | ) |

Change in Net Unrealized Appreciation/Depreciation | | (12,600,954 | ) |

Net Gain on Investments, Futures Contracts, Options Written and Swap Contracts | | 2,343,444 | |

INCREASE IN NET ASSETS FROM OPERATIONS | | $ | 12,396,593 | |

See Notes to Financial Statements.

Western Asset 2008 Worldwide Dollar Government Term Trust Inc. 2008 Semi-Annual Report | | 7 |

Statements of changes in net assets

FOR THE SIX MONTHS ENDED JANUARY 31, 2008 (unaudited)

AND THE YEAR ENDED JULY 31, 2007 | | 2008 | | 2007 | |

OPERATIONS: | | | | | |

Net investment income | | $ | 10,053,149 | | $ | 22,169,570 | |

Net realized gain | | 14,944,398 | | 8,996,856 | |

Change in net unrealized appreciation/depreciation | | (12,600,954 | ) | (9,700,933 | ) |

Increase in Net Assets from Operations | | 12,396,593 | | 21,465,493 | |

DISTRIBUTIONS TO SHAREHOLDERS FROM (NOTE 1): | | | | | |

Net investment income | | (4,175,788 | ) | (20,996,273 | ) |

Net realized gains | | (8,869,234 | ) | (33,882,545 | ) |

Decrease in Net Assets from Distributions to Shareholders | | (13,045,022 | ) | (54,878,818 | ) |

DECREASE IN NET ASSETS | | (648,429 | ) | (33,413,325 | ) |

NET ASSETS: | | | | | |

Beginning of period | | 363,607,715 | | 397,021,040 | |

End of period* | | $ | 362,959,286 | | $ | 363,607,715 | |

* Includes undistributed net investment income of: | | $ | 22,099,243 | | $ | 16,221,882 | |

See Notes to Financial Statements.

8 | | Western Asset 2008 Worldwide Dollar Government Term Trust Inc. 2008 Semi-Annual Report |

Financial highlights

FOR A SHARE OF CAPITAL STOCK OUTSTANDING THROUGHOUT EACH YEAR ENDED JULY31, UNLESS OTHERWISE NOTED:

| | 20081 | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

NET ASSET VALUE,

BEGINNING OF PERIOD | | $ | 10.54 | | $ | 11.50 | | $ | 11.47 | | $ | 10.58 | | $ | 10.19 | | $ | 9.06 | |

INCOME (LOSS) FROM OPERATIONS: | | | | | | | | | | | | | |

Net investment income | | 0.29 | | 0.64 | | 0.78 | | 0.76 | | 0.73 | | 0.72 | |

Net realized and unrealized gain (loss) | | 0.07 | | (0.01 | ) | 0.02 | | 1.01 | | 0.54 | | 1.29 | |

Total income from operations | | 0.36 | | 0.63 | | 0.80 | | 1.77 | | 1.27 | | 2.01 | |

LESS DISTRIBUTIONS FROM: | | | | | | | | | | | | | |

Net investment income | | (0.12 | ) | (0.61 | ) | (0.67 | ) | (0.66 | ) | (0.73 | ) | (0.88 | ) |

Net realized gains | | (0.26 | ) | (0.98 | ) | (0.10 | ) | (0.22 | ) | (0.15 | ) | — | |

Total distributions | | (0.38 | ) | (1.59 | ) | (0.77 | ) | (0.88 | ) | (0.88 | ) | (0.88 | ) |

NET ASSET VALUE,

END OF PERIOD | | $ | 10.52 | | $ | 10.54 | | $ | 11.50 | | $ | 11.47 | | $ | 10.58 | | $ | 10.19 | |

MARKET PRICE,

END OF PERIOD | | $ | 10.24 | | $ | 10.33 | | $ | 10.81 | | $ | 11.22 | | $ | 11.01 | | $ | 10.41 | |

Total return, based on

Net Asset Value2,3 | | 3.49 | % | 5.76 | % | 7.16 | % | 17.28 | % | 12.75 | % | 22.74 | % |

Total return, based on

Market Price3 | | 2.84 | % | 10.61 | % | 3.40 | % | 10.15 | % | 14.50 | % | 11.10 | % |

NET ASSETS,

END OF PERIOD (MILLIONS) | | $ | 363 | | $ | 364 | | $ | 397 | | $ | 396 | | $ | 365 | | $ | 352 | |

RATIOS TO AVERAGE NET ASSETS: | | | | | | | | | | | | | |

Gross expenses | | 0.83 | %4 | 0.83 | % | 0.85 | % | 0.86 | % | 0.87 | % | 0.89 | % |

Net expenses | | 0.83 | 4 | 0.83 | | 0.84 | 5 | 0.86 | | 0.87 | | 0.89 | |

Net investment income | | 5.54 | 4 | 5.81 | | 6.60 | | 6.83 | | 6.84 | | 7.17 | |

PORTFOLIO TURNOVER RATE | | 33 | %6 | 126 | %6 | 553 | %6 | 102 | %6 | 62 | %6 | 24 | % |

Total mortgage dollar rolls outstanding, end of period (millions) | | $ | — | | $ | 160 | | $ | 381 | | $ | 320 | | $ | 290 | | $ | 357 | |

1 For the six months ended January31, 2008 (unaudited).

2 Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized.

3 The total return calculation assumes that distributions are reinvested in accordance with the Fund’s dividend reinvestment plan. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized.

4 Annualized.

5 Reflects fee waivers and/or expense reimbursements.

6 Excluding mortgage dollar roll transactions. If mortgage dollar roll transactions had been included, the portfolio turnover rate would have been 231%, 983%, 1,167%, 580%, and 613% for the period ended January 31, 2008 and for the years ended July 31, 2007, 2006, 2005 and 2004, respectively.

See Notes to Financial Statements.

Western Asset 2008 Worldwide Dollar Government Term Trust Inc. 2008 Semi-Annual Report | | 9 |

Notes to financial statements (unaudited)

1. Organization and significant accounting policies

Western Asset 2008 Worldwide Dollar Government Term Trust Inc. (the “Fund”) was incorporated in Maryland on May 24, 1993 and is registered as a non-diversified, closed-end management investment company under the Investment Company Act of 1940, as amended, (the “1940 Act”). The investment objective of the Fund is to manage a portfolio of fixed income securities so as to return $10 per share to investors on or about November 30, 2008 while providing high monthly income. No assurance can be given that the Fund’s investment objective will be achieved.

The Fund seeks to achieve its investment objective by investing substantially all (at least 90%) of its assets, under normal conditions, in securities issued or guaranteed by the U.S. government, its agencies or instrumentalities, securities issued or guaranteed by foreign governments (sovereign bonds) and collateralized in full as to principal due at their maturity by U.S. government securities and zero-coupon obligations of municipal issuers. The market prices of the securities in which the Fund invests are expected to fluctuate with changes in interest rates and the perceived credit quality of such assets. The Fund’s investments in sovereign bonds may be affected by political, social, economic or diplomatic changes in such countries and the Fund’s investment in such securities increases the risk that the Fund will return less than $10 per share in the year 2008. In addition, the Fund’s investment in mortgage-backed securities is subject to the risk that rapid principal repayment, including prepayment, may have an adverse effect on the yield to maturity of such securities.

The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S. generally accepted accounting principles (“GAAP”). Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ.

(a) Investment valuation. Debt securities are valued at the mean between the bid and asked prices provided by an independent pricing service that are based on transactions in debt obligations, quotations from bond dealers, market transactions in comparable securities and various other relationships between securities. Equity securities for which market quotations are available are valued at the last sale price or official closing price on the primary market or exchange on which they trade. Publicly traded foreign government debt securities are typically traded internationally in the over-the-counter market, and are valued at the mean between the bid and asked prices as of the close of business of that market. When prices are not readily available, or are determined not to reflect fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the Fund calculates its net asset value, the Fund

10 | | Western Asset 2008 Worldwide Dollar Government Term Trust Inc. 2008 Semi-Annual Report |

may value these investments at fair value as determined in accordance with the procedures approved by the Fund’s Board of Directors. Short-term obligations with maturities of 60 days or less are valued at amortized cost, which approximates fair value.

(b) Repurchase agreements. When entering into repurchase agreements, it is the Fund’s policy that its custodian or a third party custodian take possession of the underlying collateral securities, the market value of which, at all times, at least equals the principal amount of the repurchase transaction, including accrued interest. To the extent that any repurchase transaction exceeds one business day, the value of the collateral is marked-to-market to ensure the adequacy of the collateral. If the seller defaults, and the market value of the collateral declines or if bankruptcy proceedings are commenced with respect to the seller of the security, realization of the collateral by the Fund may be delayed or limited.

(c) Financial futures contracts. The Fund may enter into financial futures contracts typically to hedge a portion of the portfolio. Upon entering into a financial futures contract, the Fund is required to deposit cash or securities as initial margin, equal to a certain percentage of the contract amount (initial margin deposit). Additional securities are also segregated up to the current market value of the financial futures contracts. Subsequent payments, known as “variation margin,” are made or received by the Fund each day, depending on the daily fluctuations in the value of the underlying financial instruments. For foreign denominated futures, variation margins are not settled daily. The Fund recognizes an unrealized gain or loss equal to the fluctuation in the value. When the financial futures contracts are closed, a realized gain or loss is recognized equal to the difference between the proceeds from (or cost of) the closing transactions and the Fund’s basis in the contracts.

The risks associated with entering into financial futures contracts include the possibility that a change in the value of the contract may not correlate with the changes in the value of the underlying financial instruments. In addition, investing in financial futures contracts involves the risk that the Fund could lose more than the initial margin deposit and subsequent payments required for a futures transaction. Risks may also arise upon entering into these contracts from the potential inability of the counterparties to meet the terms of their contracts.

(d) Securities traded on a to-be-announced basis. The Fund may trade securities on a to-be-announced (“TBA”) basis. In a TBA transaction, the Fund commits to purchasing or selling securities which have not yet been issued by the issuer and for which specific information is not known, such as the face amount and maturity date and the underlying pool of investments in U.S. government agency mortgage pass-through securities. Securities purchased on a TBA basis are not settled until they are delivered to the Fund, normally 15 to 45 days after purchase. Beginning on the date the Fund enters into a TBA transaction, cash, U.S. government securities or other liquid

Western Asset 2008 Worldwide Dollar Government Term Trust Inc. 2008 Semi-Annual Report | | 11 |

Notes to financial statements (unaudited) continued

high-grade debt obligations are segregated in an amount equal in value to the purchase price of the TBA security. These securities are subject to market fluctuations and their current value is determined in the same manner as for other securities.

(e) Stripped securities. The Fund invests in “Stripped Securities,” a term used collectively for stripped fixed income securities. Stripped securities can be principal only securities (“PO”), which are debt obligations that have been stripped of unmatured interest coupons or, interest only securities (“IO”), which are unmatured interest coupons that have been stripped from debt obligations. As is the case with all securities, the market value of Stripped Securities will fluctuate in response to changes in economic conditions, interest rates and the market’s perception of the securities. However, fluctuations in response to interest rates may be greater in Stripped Securities than for debt obligations of comparable maturities that pay interest currently. The amount of fluctuation increases with a longer period of maturity.

The yield to maturity on IO’s is sensitive to the rate of principal repayments (including prepayments) on the related underlying debt obligation and principal payments may have a material effect on yield to maturity. If the underlying debt obligation experiences greater than anticipated prepayments of principal, the Fund may not fully recoup its initial investment in IO’s.

(f) Written options. When the Fund writes an option, an amount equal to the premium received by the Fund is recorded as a liability, the value of which is marked-to-market daily to reflect the current market value of the option written. If the option expires, the Fund realizes a gain from investments equal to the amount of the premium received. When a written call option is exercised, the difference between the premium received plus the option exercise price and the Fund’s basis in the underlying security (in the case of a covered written call option), or the cost to purchase the underlying security (in the case of an uncovered written call option), including brokerage commission, is treated as a realized gain or loss. When a written put option is exercised, the amount of the premium received is added to the cost of the security purchased by the Fund from the exercise of the written put option to form the Fund’s basis in the underlying security purchased. The writer or buyer of an option traded on an exchange can liquidate the position before the exercise of the option by entering into a closing transaction. The cost of a closing transaction is deducted from the original premium received resulting in a realized gain or loss to the Fund.

The risk in writing a covered call option is that the Fund may forego the opportunity of profit if the market price of the underlying security increases and the option is exercised. The risk in writing a put option is that the Fund may incur a loss if the market price of the underlying security decreases and the option is exercised. The risk in writing a call option is that the Fund is exposed to the risk of loss if the market price of the underlying security increases. In addition, there is the risk that the Fund may not be able to enter into a closing transaction because of an illiquid secondary market.

12 | | Western Asset 2008 Worldwide Dollar Government Term Trust Inc. 2008 Semi-Annual Report |

(g) Mortgage dollar rolls. The Fund may enter into dollar rolls in which the Fund sells mortgage-backed securities for delivery in the current month, realizing a gain or loss, and simultaneously contracts to repurchase substantially similar (same type, coupon and maturity) securities to settle on a specified future date. During the roll period, the Fund forgoes interest paid on the securities. The Fund is compensated by the interest earned on the cash proceeds of the initial sale and by the lower repurchase price at the specified future date. The Fund maintains a segregated account, the dollar value of which is at least equal to its obligations with respect to dollar rolls.

The Fund executes its mortgage dollar rolls entirely in the to-be-announced (“TBA”) market, where the Fund makes a forward commitment to purchase a security and, instead of accepting delivery, the position is offset by a sale of the security with a simultaneous agreement to repurchase at a future date.

The risk of entering into a mortgage dollar roll is that the market value of the securities the Fund is obligated to repurchase under the agreement may decline below the repurchase price. In the event the buyer of securities under a mortgage dollar roll files for bankruptcy or becomes insolvent, the Fund’s use of proceeds of the dollar roll may be restricted pending a determination by the other party, or its trustee or receiver, whether to enforce the Fund’s obligation to repurchase the securities.

(h) Credit default swaps. The Fund may enter into credit default swap (“CDS”) contracts for investment purposes, to manage its credit risk or to add leverage. CDS agreements involve one party making a stream of payments to another party in exchange for the right to receive a specified return in the event of a default by a third party, typically corporate issuers or sovereign issuers of an emerging country, on a specified obligation. The Fund may use a CDS to provide a measure of protection against defaults of the issuers (i.e., to reduce risk where a Fund has exposure to the sovereign issuer) or to take an active long or short position with respect to the likelihood of a particular issuer’s default. As a seller of protection, the Fund generally receives an upfront payment or a fixed rate of income throughout the term of the swap provided that there is no credit event. If the Fund is a seller of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will pay to the buyer of the protection an amount up to the notional value of the swap and, in certain instances, take delivery of the security. As the seller, the Fund would effectively add leverage to its portfolio because, in addition to its total net assets, the Fund would be subject to investment exposure on the notional amount of the swap. As a buyer of protection, the Fund generally receives an amount up to the notional value of the swap if a credit event occurs.

Payments received or made at the beginning of the measurement period are reflected as such on the Statement of Assets and Liabilities. These upfront payments are recorded as realized gain or loss on the Statement of Operations upon termination or maturity of the swap. A liquidation payment received or

Western Asset 2008 Worldwide Dollar Government Term Trust Inc. 2008 Semi-Annual Report | | 13 |

Notes to financial statements (unaudited) continued

made at the termination of the swap is recorded as realized gain or loss on the Statement of Operations. Net periodic payments received or paid by the Fund are recorded as realized gain or loss on the Statement of Operations.

Entering into a CDS agreement involves, to varying degrees, elements of credit, market and documentation risk in excess of the related amounts recognized on the Statement of Assets and Liabilities. Such risks involve the possibility that there will be no liquid market for these agreements, that the counterparty to the agreement may default on its obligation to perform or disagree as to the meaning of the contractual terms in the agreement, and that there will be unfavorable changes in net interest rates.

(i) Swaptions. The Fund may write swaption contracts to manage exposure to fluctuations in interest rates and to enhance portfolio yield. Swaption contracts written by the Fund represent an option that gives the purchaser the right, but not the obligation, to enter into a previously agreed upon swap contract at a future date. If a written call swaption is exercised, the writer enters a swap and is obligated to pay the fixed rate and receive a floating rate in exchange. If a written put swaption is exercised, the writer enters a swap and is obligated to pay the floating rate and receive a fixed rate in exchange. Swaptions are marked to market daily based upon quotations from market makers.

When the Fund writes a swaption, an amount equal to the premium received by the Fund is recorded as a liability, the value of which is marked to market daily to reflect the current market value of the swaption written. Changes in the value of the swaption are reported as unrealized gains or losses in the Statement of Operations. If the swaption expires, the Fund realizes a gain equal to the amount of the premium received. When a written swaption is exercised, the difference between the premium received and the amount paid on effecting a closing transaction is treated as a realized gain or loss.

Entering into a swaption contract involves, to varying degrees, the elements of credit, market and interest rate risk associated with both option contracts and swap contracts. To reduce credit risk from potential counterparty default, the Fund enters into swaption contracts with counterparties whose creditworthiness has been evaluated by the investment manager. The Fund bears the market risk arising from any change in index values or interest rates.

(j) Credit and market risk. The Fund invests in high yield and emerging market instruments that are subject to certain credit and market risks. The yields of high yield and emerging market debt obligations reflect, among other things, perceived credit and market risks. The Fund’s investment in securities rated below investment grade typically involves risks not associated with higher rated securities including, among others, greater risk related to timely and ultimate payment of interest and principal, greater market price volatility and less liquid secondary market trading. The consequences of political, social, economic or diplomatic changes may have disruptive effects on the market prices of investments held by the Fund. The Fund’s investment in non-dollar

14 | | Western Asset 2008 Worldwide Dollar Government Term Trust Inc. 2008 Semi-Annual Report |

denominated securities may also result in foreign currency losses caused by devaluations and exchange rate fluctuations.

Investments in structured securities collateralized by residential real estate mortgages are subject to certain credit and liquidity risks. When market conditions result in an increase in default rates of the underlying mortgages and the foreclosure values of underlying real estate properties are materially below the outstanding amount of these underlying mortgages, collection of accrued interest and principal on these investments may be doubtful. Such market conditions may significantly impair the value of these investments resulting in a lack of correlation between their credit ratings and values.

(k) Other risks. Consistent with its objective to seek high current income, the Fund may invest in instruments whose values and interest rates are linked to foreign currencies, interest rates, indices or some other financial indicator. The value at maturity or interest rates for these instruments will increase or decrease according to the change in the indicator to which they are indexed. These securities are generally more volatile in nature, and the risk of loss of principal is greater.

(l) Security transactions and investment income. Security transactions are accounted for on a trade date basis. Interest income, adjusted for amortization of premium and accretion of discount, is recorded on the accrual basis. Dividend income is recorded on the ex-dividend date. The cost of investments sold is determined by use of the specific identification method. To the extent any issuer defaults on an expected interest payment, the Fund’s policy is to generally halt any additional interest income accruals and consider the realizability of interest accrued up to the date of default.

(m) Distributions to shareholders. Distributions from net investment income for the Fund, if any, are declared and paid on a monthly basis. Distributions of net realized gains, if any, are declared at least annually. Distributions are recorded on the ex-dividend date and are determined in accordance with income tax regulations, which may differ from GAAP.

(n) Federal and other taxes. It is the Fund’s policy to comply with the federal income and excise tax requirements of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. Accordingly, the Fund intends to distribute substantially all of its taxable income and net realized gains, if any, to shareholders each year. Therefore, no federal income tax provision is required in the Fund’s financial statements.

Management has analyzed the Fund’s tax positions taken on federal income tax returns for all open tax years and has concluded that as of January 31, 2008, no provision for income tax would be required in the fund’s financial statements. The Fund’s federal and state income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue.

Western Asset 2008 Worldwide Dollar Government Term Trust Inc. 2008 Semi-Annual Report | | 15 |

Notes to financial statements (unaudited) continued

(o) Reclassification. GAAP requires that certain components of net assets be adjusted to reflect permanent differences between financial and tax reporting. These reclassifications have no effect on net assets or net asset values per share.

2. Investment management agreement and other transactions with affiliates

Legg Mason Partners Fund Advisor, LLC (“LMPFA”) is the Fund’s investment manager and Western Asset Management Company (“Western Asset”) is the Fund’s subadviser. LMPFA and Western Asset are wholly-owned subsidiaries of Legg Mason, Inc. (“Legg Mason”).

LMPFA provides administrative and certain oversight services to the the Fund. The Fund pays LMPFA an investment management fee payable monthly and calculated at an aggregate annual rate of 0.75% of the Fund’s average weekly net assets up to $250 million and 0.725% of the Fund’s average weekly net assets in excess of $250 million.

LMPFA has delegated to Western Asset the day-to-day portfolio management of the Fund. For its services, LMPFA pays Western Asset 70% of the net management fee it receives from the Fund.

Certain officers and one Director of the Fund are employees of Legg Mason or its affiliates and do not receive compensation from the Fund.

3. Investments

During the six months ended January 31, 2008, the aggregate cost of purchases and proceeds from sales of investments (excluding short-term investments) and U.S. Government & Agency Obligations were as follows:

| | | | U.S. GOVERNMENT & | |

| | INVESTMENTS | | AGENCY OBLIGATIONS | |

Purchases | | — | | $1,047,872,458 | |

Sales | | $79,129,626 | | 1,158,390,461 | |

| | | | | | |

At January 31, 2008, the aggregate gross unrealized appreciation and depreciation of investments for federal income tax purposes were substantially as follows:

Gross unrealized appreciation | | $7,151,942 | |

Gross unrealized depreciation | | (2,148,876 | ) |

Net unrealized appreciation | | $5,003,066 | |

16 | | Western Asset 2008 Worldwide Dollar Government Term Trust Inc. 2008 Semi-Annual Report |

At January 31, 2008, the Fund had the following open futures contracts:

| | NUMBER OF | | EXPIRATION | | BASIS | | MARKET | | UNREALIZED |

| | CONTRACTS | | DATE | | VALUE | | VALUE | | GAIN |

Contracts to Buy: | | | | | | | | | | |

Eurodollar | | 650 | | | 12/08 | | | $158,278,250 | | $158,331,875 | | $ 53,625 | |

U.S. Treasury 2-Year Note | | 203 | | | 3/08 | | | 42,596,124 | | 43,283,406 | | 687,282 | |

U.S. Treasury 5-Year Note | | 1,163 | | | 3/08 | | | 129,329,253 | | 131,419,000 | | 2,089,747 | |

Net Unrealized Gain on Open Futures Contracts | | | | | | $2,830,654 | |

During the six months ended January 31, 2008, written option transactions for the Fund were as follows:

| | NOTIONAL | | |

| | PAR | | PREMIUMS |

Options written, outstanding July 31, 2007 | | — | | | — | |

Options written | | $5,700,000 | | | $26,557 | |

Options closed | | — | | | — | |

Options expired | | (900,000 | ) | | (4,129 | ) |

Options written, outstanding January 31, 2008 | | $4,800,000 | | | $22,428 | |

At January 31, 2008, the Fund held the following credit default swap contracts:

Swap Counterparty: | | Barclays Capital Inc. |

Effective Date: | | 10/11/2007 |

Reference Entity: | | CDX North America Crossover Index |

Notional Amount: | | $24,000,000 |

Payments received by the Fund: | | Fixed Rate, 0.75% |

Payments made by the Fund: | | Payment only if credit event occurs |

Termination Date: | | 6/20/2012 |

Unrealized Depreciation | | $(1,175,320) |

4. Distributions subsequent to January 31, 2008

On November 19, 2007, the Board of Directors (“Board”) of the Fund declared a dividend distribution in the amount of $0.063 per common share payable on February 29, 2008 to shareholders of record on February 22, 2008.

On February 15, 2008, the Board declared distributions of $0.063 per common share, payable on March 28, 2008, April 25, 2008, and May 30, 2008, to shareholders of record on March 20, 2008, April 18, 2008, and May 23, 2008, respectively.

Western Asset 2008 Worldwide Dollar Government Term Trust Inc. 2008 Semi-Annual Report | | 17 |

Notes to financial statements (unaudited) continued

5. Other matters

As previously disclosed, on September 16, 2005, the staff of the Securities and Exchange Commission (“SEC”) informed Smith Barney Fund Management LLC (“SBFM”) and Salomon Brothers Asset Management Inc. (“SBAM”) that the staff was considering recommending administrative proceedings against SBFM and SBAM for alleged violations of Section 19(a) and 34(b) of the Investment Company Act (and related Rule 19a-1). On September 27, 2007, SBFM and SBAM, without admitting or denying any findings therein, consented to the entry of an order by the SEC relating to the disclosure by certain other closed-end funds of the sources of distributions paid by the funds between 2001 and 2004. Each of SBFM and SBAM agreed to pay a fine of $450,000, for which it was indemnified by Citigroup, Inc., its former parent. It is not expected that this matter will adversely impact the Fund or its current investment manager.

6. Recent accounting pronouncement

On September 20, 2006, the Financial Accounting Standards Board released Statement of Financial Accounting Standards No. 157, Fair Value Measurements (“FAS 157”). FAS 157 establishes an authoritative definition of fair value, sets out a framework for measuring fair value, and requires additional disclosures about fair value measurements. The application of FAS 157 is required for fiscal years beginning after November 15, 2007 and interim periods within those fiscal years. At this time, management is evaluating the implications of FAS 157.

18 | | Western Asset 2008 Worldwide Dollar Government Term Trust Inc. 2008 Semi-Annual Report |

Board approval of management and subadvisory agreements (unaudited)

Background

The Investment Company Act of 1940 (the “1940 Act”) requires that the Board of Directors (the “Board”) of Western Asset 2008 Worldwide Dollar Government Term Trust (the “Fund”), including a majority of its members that are not considered to be “interested persons” under the 1940 Act (the “Independent Directors”) voting separately, approve the continuation of the investment management contract (the “Management Agreement”) with the Fund’s manager, Legg Mason Partners Fund Advisor, LLC (the “Manager”) and the sub-advisory agreement (the “Sub-Advisory Agreement”) with the Manager’s affiliate, Western Asset Management Company (the “Subadviser”), on an annual basis. At a meeting (the “Contract Renewal Meeting”) held in-person on November 13 and 14, 2007, the Board, including the Independent Directors, considered and approved the continuation of each of the Management and Sub-Advisory Agreements for an additional one-year term, recognizing that the Fund is scheduled to wind down in November 2008. To assist in its consideration of the renewals of the Management and Sub-Advisory Agreements, the Board received and considered a variety of information about the Manager and Subadviser, as well as the management and sub-advisory arrangements for the Fund and other funds overseen by the Board (the “Contract Renewal Information”), certain portions of which are discussed below. A presentation made by the Manager and Subadviser to the Board at the Contract Renewal Meeting in connection with its evaluations of the Management and Sub-Advisory Agreements encompassed the Fund and all the funds for which the Board has responsibility. In addition to the Contract Renewal Information, including information presented by management at the Contract Renewal Meeting, the Board received performance and other information throughout the year related to the respective services rendered by the Manager and the Subadviser to the Fund. The Board’s evaluation took into account the information received throughout the year and also reflected the knowledge and familiarity gained as Board members of the Fund and other funds in the same complex with respect to the services provided to the Fund by each of the Manager and Subadviser.

The discussion below covers both advisory and administrative functions being rendered by the Manager, each such function being encompassed by the Management Agreement, and the investment advisory function being rendered by the Subadviser.

Board approval of management agreement and sub-advisory agreement

In its deliberations regarding renewal of the Management Agreement and Sub-Advisory Agreement, the Fund’s Board, including the Independent Directors, considered the factors below.

Western Asset 2008 Worldwide Dollar Government Term Trust Inc. | | 19 |

Board approval of management and subadvisory agreements (unaudited) continued

Nature, extent and quality of the services under the management agreement and sub-advisory agreement

The Board received and considered Contract Renewal Information regarding the nature, extent and quality of services provided to the Fund by the Manager and the Subadviser under the Management Agreement and the Sub-Advisory Agreement, respectively, during the past year. The Board also reviewed Contract Renewal Information regarding the Fund’s compliance policies and procedures established pursuant to Rule 38a-1 under the 1940 Act.

The Board reviewed the qualifications, backgrounds and responsibilities of the Fund’s senior personnel and the portfolio management team primarily responsible for the day-to-day portfolio management of the Fund. The Board also considered, based on its knowledge of the Manager and its affiliates, the Contract Renewal Information and the Board’s discussions with the Manager at the Contract Renewal Meeting, the financial resources available to the parent organization of the Manager and Subadviser, Legg Mason, Inc. (“Legg Mason”).

The Board considered the responsibilities of the Manager and the Subadviser under the Management Agreement and the Sub-Advisory Agreement, respectively, including the Manager’s coordination and oversight of services provided to the Fund by the Subadviser and others. The Board also considered the brokerage policies and practices of the Manager and Subadviser, the standards applied in seeking best execution, the policies and practices of the Manager and Subadviser regarding soft dollars, the use of a broker affiliated with the Manager or the Subadviser, and the existence of quality controls applicable to brokerage allocation procedures. In addition, the Manager also reported generally to the Board on, among other things, its business plans, recent organizational changes, including Legg Mason’s plans to address the pending retirement of its Chief Executive Officer, and the compensation plan for the Fund’s portfolio managers.

The Board concluded that, overall, the nature, extent and quality of services provided (and expected to be provided) to the Fund under the Management Agreement and the Sub-Advisory Agreement have been satisfactory under the circumstances.

Fund performance

The Board received and considered performance information and analyses (the “Lipper Performance Information”) for the Fund, as well as for a group of funds (the “Performance Universe”) selected by Lipper, Inc. (“Lipper”), an independent provider of investment company data. The Board was provided with a description of the methodology Lipper used to determine the similarity of the Fund with the funds included in the Performance Universe. The Performance Universe consisted of the Fund and all closed-end nonleveraged global income funds, as classified by Lipper, regardless of asset size or primary distribution channel. The Board noted that it had received and discussed with the Manager and Subadviser

20 | | Western Asset 2008 Worldwide Dollar Government Term Trust Inc. |

information throughout the year at periodic intervals comparing the Fund’s performance against its benchmark(s) and, at the Board’s request, its peer funds as selected by Lipper.

The Lipper Performance Information comparing the Fund’s performance to that of the Performance Universe based on net asset value per share showed, among other things, that the Fund’s performance for the 1-year period ended June 30, 2007 was ranked in the fifth quintile among the funds in the Performance Universe for that period but that the Fund’s performance for the 3-, 5- and 10-year periods ended June 30, 2007 was ranked in the second, third and first quartiles, respectively, among the funds in the Performance Universe. Among other things, the Manager noted that the Fund’s performance for the 1-year period ended June 30, 2007 reflected investment strategy changes intended to reduce portfolio risk in anticipation of the Fund’s scheduled liquidation and termination on or about November 30, 2008. The Board also noted the small number of funds in the Performance Universe, which ranged from six to nine funds during the 1-, 3-, 5- and 10-year periods. The Board also considered the Fund’s performance in relation to its benchmark(s) and in absolute terms.

Based on its review, which included consideration of all of the factors noted above, the Board concluded that, under the circumstances, the Fund’s performance supported continuation of the Management and Sub-advisory Agreements for an additional period not to exceed one year.

Management fees and expense ratios

The Board reviewed and considered the management fee (the “Management Fee”) payable by the Fund to the Manager in light of the nature, extent and quality of the management and sub-advisory services provided by the Manager and the Subadviser. The Board noted that the compensation paid to the Subadviser is paid by the Manager, not the Fund, and, accordingly, that the retention of the Subadviser does not increase the fees or expenses otherwise incurred by the Fund’s shareholders.

Additionally, the Board received and considered information and analyses prepared by Lipper (the “Lipper Expense Information”) comparing the Management Fee and the Fund’s overall expenses with those of funds in an expense universe (the “Expense Universe”) selected and provided by Lipper for the 1-year period ended June 30, 2007. The Expense Universe consisted of the Fund and other closed-end nonleveraged global income funds, as classified by Lipper, excluding certain funds regarded by Lipper as inappropriate for comparative purposes. The Expense Universe consisted of six funds, with assets ranging from $92.1 million to $1.15 billion.

The Lipper Expense Information comparing the Management Fee as well as the Fund’s actual total expenses to the Fund’s Expense Universe showed that the Management Fee, whether on a contractual basis or an actual basis (i.e., giving

Western Asset 2008 Worldwide Dollar Government Term Trust Inc. | | 21 |

Board approval of management and subadvisory agreements (unaudited) continued

in effect to a voluntary fee waiver implemented by the Manager), was ranked second among the six funds in the Performance Universe and that its actual total expenses also ranked second among the six funds.

The Board also reviewed Contract Renewal Information regarding fees charged by the Manager to other U.S. clients investing primarily in an asset class similar to that of the Fund, including, where applicable, separate accounts. The Board was advised that the fees paid by such other clients generally are lower, and may be significantly lower, than the Management Fee. The Contract Renewal Information discussed the significant differences in scope of services provided to the Fund and to these other clients, noting that the Fund is provided with administrative services, office facilities, Fund officers (including the Fund’s chief executive, chief financial and chief compliance officers), and that the Manager coordinates and oversees the provision of services to the Fund by other fund service providers. The Board considered the fee comparisons in light of the differences required to manage these different types of accounts. The Contract Renewal Information included an analysis of complex-wide management fees provided by the Manager, which, among other things, set out a proposed framework of fees based on asset classes.

Taking all of the above into consideration, the Board determined that the Management Fee and the sub-advisory fee were reasonable in light of the nature, extent and quality of the services provided to the Fund under the Management Agreement and the Sub-Advisory Agreement.

Manager profitability

The Board, as part of the Contract Renewal Information, received an analysis of the profitability to the Manager and its affiliates in providing services to the Fund. The Board also received profitability information with respect to the Legg Mason fund complex as a whole. In addition, the Board received Contract Renewal Information with respect to the Manager’s revenue and cost allocation methodologies used in preparing such profitability data, together with a report from an outside consultant that had reviewed the Manager’s methodologies. The profitability to the Subadviser was not considered to be a material factor in the Board’s considerations since the Subadviser’s fee is paid by the Manager, not the Fund. The profitability analysis presented to the Board as part of the Contract Renewal Information indicated that profitability to the Manager in providing services to the Fund had increased by 2 percent over the period covered by the analysis. However, the Board noted that the Manager had implemented a new revenue and cost allocation methodology in 2007 which was used in preparing the profitability analysis presented at the Contract Renewal Meeting and that the methodology was subject to further review and refinement. Under the Fund’s circumstances, the Board did not consider profitability to be such as to support a determination against continuation of the Management and Sub-advisory Agreements.

22 | | Western Asset 2008 Worldwide Dollar Government Term Trust Inc. |

Economies of scale

The Board received and discussed Contract Renewal Information concerning whether the Manager realizes economies of scale if the Fund’s assets grow. The Board noted that because the Fund is a closed-end Fund with no current plans to seek additional assets prior to its scheduled liquidation and termination on or about November 30, 2008 beyond maintaining its dividend reinvestment plan, any significant growth in its assets generally will occur through appreciation in the value of the Fund’s investment portfolio, rather than sales of additional shares in the Fund. The Board noted that the Management Fee was ranked second among the six funds in the Expense Universe. The Board determined that the management fee structure was appropriate under present circumstances.

Other benefits to the manager and the subadviser

The Board considered other benefits received by the Manager, the Subadviser and its affiliates as a result of their relationship with the Fund, including the opportunity to obtain research services from brokers who effect Fund portfolio transactions.

* * * * * *

In light of all of the foregoing, the Board determined that, under the circumstances, continuation of the Management and Sub-Advisory Agreements would be consistent with the interests of the Fund and its shareholders and unanimously voted to continue each Agreement for a period of one additional year.

No single factor reviewed by the Board was identified by the Board as the principal factor in determining whether to approve continuation of the Management and Sub-Advisory Agreements, and each Board member attributed different weights to the various factors. The Independent Directors were advised by separate independent legal counsel throughout the process. Prior to the Contract Renewal Meeting, the Board received a memorandum discussing its responsibilities in connection with the proposed continuation of the Management and Sub-Advisory Agreements from Fund counsel and the Independent Directors separately received a memorandum discussing such responsibilities from their independent counsel. Prior to voting, the Independent Directors also discussed the proposed continuation of the Management Agreement and the Sub-Advisory Agreement in private sessions with their independent legal counsel at which no representatives of the Manager were present.

Western Asset 2008 Worldwide Dollar Government Term Trust Inc. | | 23 |

Additional shareholder information (unaudited)

Result of annual meeting of shareholders

The Annual Meeting of Shareholders of the Fund was held on November 16, 2007, for the purpose of considering and voting upon the election of Directors. The following table provides information concerning the matter voted upon at the Meeting:

Election of directors

NOMINEES | | Votes For | | Votes Withheld | |

Dr. Riordan Roett | | 26,194,105 | | 313,401 | |

Jeswald W. Salacuse | | 26,199,155 | | 308,351 | |

At January31, 2008, in addition to Dr. Riordan Roett and Jeswald W. Salacuse, the other Directors of the Fund were as follows:

Carol L. Colman

Daniel P. Cronin

Paolo M. Cucchi

Leslie H. Gelb

R. Jay Gerken

William R. Hutchinson

24 | | Western Asset 2008 Worldwide Dollar Government Term Trust Inc. |

Dividend reinvestment plan (unaudited)

Pursuant to certain rules of the SEC, the following additional disclosure is provided.

Pursuant to the Fund’s Dividend Reinvestment Plan (the “Plan”), stockholders may elect to have all distributions, including returns of capital, if any, automatically reinvested by American Stock Transfer & Trust Company (the “Plan Agent”) in Fund shares pursuant to the Plan. Each registered stockholder will receive from the Fund, as soon as practicable, an authorization card to be signed and returned if the stockholder elects to participate in the Plan. Stockholders who do not participate in the Plan will receive all distributions in cash paid by check in dollars mailed directly to the stockholder by the custodian, as dividend disbursing agent. In the case of stockholders, such as banks, brokers or nominees, that hold shares for others who are the beneficial owners, the Plan Agent will administer the Plan on the basis of the number of shares certified from time to time by the stockholders as representing the total amount registered in such stockholders’ names and held for the account of beneficial owners who are participants in the Plan. Investors that own shares registered in the name of a bank, broker-dealer or other nominee should consult with such nominee as to the participation in the Plan through such nominee, and may be required to have their shares registered in their own names in order to participate in the Plan.

The Plan Agent serves as agent for the stockholders in administering the Plan. After the Fund declares a distribution, the Plan Agent will, as agent for the participants, receive the cash payment and use it to buy Fund shares in the open market, on the New York Stock Exchange or elsewhere, for the participants’ accounts. The Fund will not issue any new shares in connection with the Plan.

The Plan Agent maintains all stockholder accounts in the Plan and furnishes written confirmations of all transactions in an account, including information needed by stockholders for personal and tax records. Shares in the account of each Plan participant will be held by the Plan Agent in the name of the participant, and each stockholder’s proxy will include those shares purchased pursuant to the Plan.

There is no charge to participants for reinvesting distributions. The Plan Agent’s fees for the reinvestment of distributions will be paid by the Fund. However, each participant will pay a pro rata share of brokerage commissions incurred with respect to the Plan Agent’s open market purchases in connection with the reinvestment of distributions. Brokerage charges for purchasing small amounts of stock for individual accounts through the Plan are expected to be less than the usual brokerage charges for such transactions because the Plan Agent will be purchasing stock for all participants in blocks and prorating the lower commission thus attainable.

The reinvestment of distributions under the Plan will not relieve participants of any federal income tax that may be payable on such distributions.

Western Asset 2008 Worldwide Dollar Government Term Trust Inc. | | 25 |

Experience under the Plan may indicate that changes are desirable. Accordingly, the Fund and the Plan Agent reserve the right to terminate the Plan as applied to any distribution paid subsequent to written notice of the termination sent to members of the Plan at least 30 days before the record date for such distribution. The Plan also may be amended by the Fund or the Plan Agent, but (except when necessary or appropriate to comply with applicable law, rules or policies of a regulatory authority) only by at least 30 days’ written notice to participants in the Plan. All correspondence concerning the Plan should be directed to the Plan Agent at 59 Maiden Lane, New York New York 10038.

26 | | Western Asset 2008 Worldwide Dollar Government Term Trust Inc. |

(This page intentionally left blank.)

(This page intentionally left blank.)

(This page intentionally left blank.)

(This page intentionally left blank.)

(This page intentionally left blank.)

Western Asset

2008 Worldwide Dollar

Government Term Trust Inc.

Directors | Subadviser |

Carol L. Colman | Western Asset Management |

Daniel P. Cronin | Company |

Paolo M. Cucchi | |

Leslie H. Gelb | Custodian |

R. Jay Gerken, CFA | State Street Bank & |

Chairman | Trust Company |

William R. Hutchinson | 225 Franklin Street |

Dr. Riordan Roett | Boston, Massachusetts 02110 |

Jeswald W. Salacuse | |

| |

Officers | Transfer agent |

R. Jay Gerken, CFA | American Stock Transfer & |

President and Chief Executive | Trust Company |

Officer | 59 Maiden Lane |

Kaprel Ozsolak | New York, New York 10038 |

Chief Financial Officer and | |

Treasurer | Independent registered public |

Ted P. Becker | accounting firm |

Chief Compliance Officer | KPMG LLP |

Robert I. Frenkel | 345 Park Avenue |

Secretary and Chief Legal Officer | New York, New York 10154 |

Thomas Mandia | |

Assistant Secretary | Legal counsel |

Steve Frank | Simpson Thacher & Bartlett LLP |

Controller | 425 Lexington Avenue |

Albert Laskaj | New York, New York 10017-3909 |

Controller | |

| New York Stock Exchange Symbol |

Western Asset | SBG |

2008 Worldwide Dollar | |

Government Term Trust Inc. | |

55 Water Street | |

32 Floor | |

New York, New York 10041 | |

| |

Investment manager | |

Legg Mason Partners Fund | |

Advisor, LLC | |

Western Asset 2008 Worldwide Dollar Government Term Trust Inc.

WESTERN ASSET 2008 WORLDWIDE DOLLAR GOVERMENT TERM TRUST INC.

American Stock Transfer

& Trust Company

59 Maiden Lane

New York, New York 10038