UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a – 101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

¨ Definitive Proxy Statement

x Definitive Additional Materials

¨ Soliciting Material Pursuant to Rule 14a-12

RURAL/METRO CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

Members of management of Rural/Metro Corporation will deliver a presentation to Institutional Shareholder Services on November 15, 2006. A copy of the materials that will be used in the presentation is set forth below. In addition, the following materials may be presented to stockholders or other investors in the future.

In Our Business, Every Second Counts |

Forward Looking Statements Nothing contained in this presentation is, or should be relied upon as, a promise or representation as to the future. Any projections contained herein or otherwise made available are based on management’s analysis of information available at the time this presentation was prepared and on assumptions and perspectives that may be unique to Rural/Metro management, which may or may not prove to be correct. There can be no representation, warranty or other assurance as to the accuracy or completeness of such projections or that any such projections will be realized. Recipients of this presentation should conduct their own investigation and analysis of the business, data and property described. 2 |

Lines of Business 911 and non-emergency, medically necessary ambulance transportation 88% of fiscal 2006 net revenue 9.4% net revenue growth in fiscal 2006 7.0% net revenue growth in first quarter of fiscal 2007, compared to same period of prior year Primarily subscription-based residential and commercial fire protection, as well as airport and industrial fire services 12% of fiscal 2006 net revenue 9.3% net revenue growth in fiscal 2006 13.4% year-over-year net revenue growth in first quarter of fiscal 2007, compared to same period of prior year Medical Transportation and Related Services Fire and Other Services 3 |

Key Success Factors Growing demand for ambulance services Aging Baby Boomers Outsourcing trend to specialty treatment centers Strong presence in high-growth markets Favorable Industry and Market Dynamics Diverse and Predictable Revenue & Cash Flow Well Positioned for Low-Risk Growth Disciplined Financial Policies Experienced Management with Strong Track Record 23 states, approx. 400 communities Strong contract retention record Stable Medicare reimbursement environment Opportunities for rate increases to help offset uncompensated care Focus on controlling costs and managing for cash flow Focus on deleveraging balance sheet Executing on margin expansion strategies Exited select markets with difficult payer mix and operating environments National presence and infrastructure with local, customer-focused approach Hub and spoke model creates operating leverage and efficiencies Exclusive 911 contracts enhance non-emergency medical transportation business and allow for greater utilization of assets Substantial management depth Top 9 managers average 20+ years of industry experience 24 division general managers average 20 years of industry experience Strong reputation as partner of choice 4 |

Medical Transportation Growth Strategy Win 911 Contract 5 Leverage Fixed Asset & Labor Base Build Out Non- Emergency Business Natural synergies exist between 911 and non-emergency business, which allow for greater utilization of assets and exceptional economies of scale Peak-time demand for 911 calls typically early morning, late night, drive time and weekends Peak-time demand for non-emergency business typically during business hours, as transports are pre-scheduled Work force and fleet utilization is optimized, creating margin expansion Analyze 911 contracting opportunities to determine favorable operating locations/regions (payer mix, potential to form public/private partnerships, competitors, politics) Pursue contract through public bidding process (6- to 12-month process, on average) Win contract through demonstrated record of service quality and excellence 911 contract provides foothold in community Once established, pursue non-emergency medical transport work through hospitals, nursing homes, and other healthcare facilities within the community Regional marketing teams reach out to all facilities in the community Become contracted provider for large local and regional healthcare systems |

Key Revenue Growth Drivers Aging U.S. Population Hospital Outsourcing of Ambulance Services Opportunities for Public-Private Partnerships Presence in High-Growth Markets Opportunities for Rate Increases 6 |

Income Statement – Fiscal Year Ended 6/30/06 8 |

Income Statement – First Quarter FY ‘07 9 |

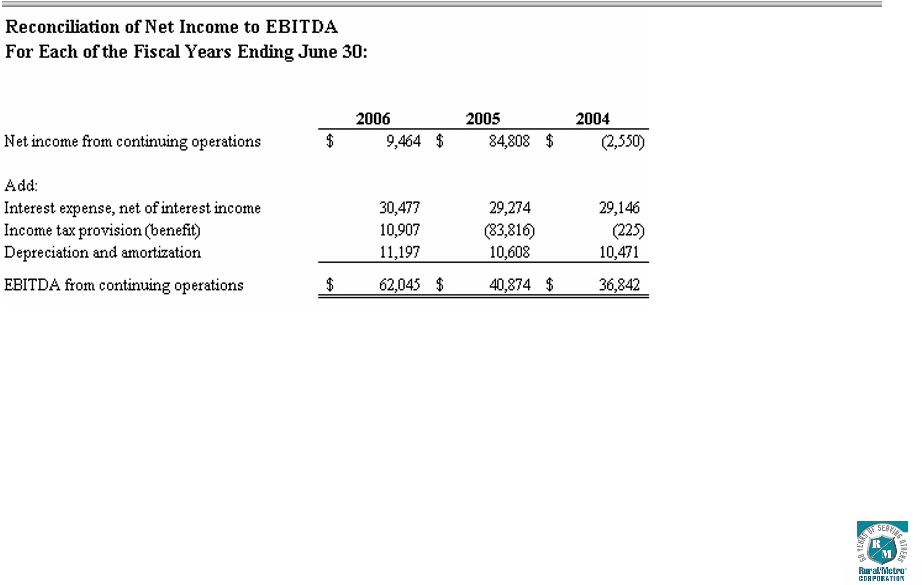

EBITDA (continuing operations) 6/30/04 6/30/05 6/30/06 10 $36.8 $40.9 $62.0 25 35 45 55 65 |

Strong Operating Performance Net Revenue ($ in millions; adjusted for discontinued operations for fiscal years ended June 30) 9.1% CAGR 11 $422.4 $462.5 $501.5 $548.5 200 250 300 350 400 450 500 550 600 2003 2004 2005 2006 |

Cash Flow Profile Maintenance CapEx primarily related to vehicles & equipment Approximately 2.5% of net revenue annually Conservative maintenance schedule to ensure fleet reliability Capital Expenditures Working Capital Other Potential Savings Minimal working capital requirements Effectively self-funding business Fire protection is prepaid Workforce management and overtime reduction Bad debt reduction Workplace health and safety initiatives Expense management Deleveraging Focus on deleveraging the enterprise Unscheduled principal payments totaling $35 million paid since March 2005 to reduce senior Term Loan B to $100.0 million $2.7 million interest savings annually at current rates .25 percent interest rate reduction on Senior Secured Credit Facilities; $0.4 million interest savings annually Shelf registration filed 2/8/06 to accelerate deleveraging through potential equity offering 12 |

Corporate Structure • Senior Discount (PIK) Notes @ 12.75% due 2016 ($93.5 M aggregate principal amount; $50.2M in gross proceeds. Accreted to $59.2 M at 6/30/06) • Term Loan B @ LIBOR + 2.25% due 2011 ($100.0 M)* • Revolving Credit Facility @ LIBOR + 3.00% due 2010 ($20.0 M/undrawn) • LC Facility @ 2.40% due 2011 ($45 M) • Sr. Sub. Notes @ 9.875% due 2015 ($125 M) Rural/Metro Corporation Rural/Metro Operating Subsidiaries Rural/Metro Operating Company LLC 13 Credit Facilities: *Moody’s: B1 S&P: B2 Senior Sub Notes: Moody’s: B3 S&P: CCC+ Senior Discount Notes: Moody’s: Caa1 S&P: CCC+ * Moody’s ratings upgraded on March 21, 2006 reflecting top-line growth, improved margins, and lower financial leverage measured by the ratio of free cash flow to total debt. |

Key Success Factors for Increased Stockholder Value 14 |

Experienced Management Team Jack E. Brucker, 9 President & Chief Executive Officer Kristi B. Ponczak 9 Senior Vice President and Chief Financial Officer President and Chief Executive Officer since February 2000 Senior Vice President and Chief Operating Officer from December 1997 until February 2000 Founder and President of Pacific Holdings, a strategic consulting firm, from July 1989 until December 1997 Presenters Years With Company Relevant Experience Senior Vice President & Chief Financial Officer since October 2006 Vice President & Treasurer since December 2004 Director of Financial Planning from 1998 to 2004 1994-1997,Corporate Controller, Sun Street Foods, following management buy-out from Main Street & Main, Inc. 15 |

Experienced Management Team 16 Senior Vice Presidents & Regional Presidents Industry Experience Barry Landon, Senior Vice President & President of Southwest Ambulance and Arizona/ Oregon fire divisions. Kurt Krumperman, Senior Vice President, Federal Affairs & Strategic Initiatives Todd Walker, President, Mid-Atlantic and Northeast Emergency Services Groups Bryan Gibson, President, Southern Emergency Services and Specialty Fire Groups Robert “Boo” Heffner, President, West Emergency Services Group 29 years 24 years 23 years 20 years 20 years |

Key Success Factors Proven record of enhancing stockholder value through strong financial and operating performance for past three fiscal years ended June 30: 6.6% compound annual growth in net revenue 41.2% compound annual growth in operating income 29.8% compound annual growth in EBITDA 115.3% compound annual growth in per-share market price 17 |

Key Success Factors Pursuit of initiatives to enhance long-term shareholder value is key to Rural/Metro’s strategic plan Target new markets that present opportunities for sustained, profitable growth Expand existing 911 markets and further leverage fixed base of labor and fleet assets Align growth with developing industry trends Continued investments in technology Focus on risk management and workplace safety Reduce debt and optimize capital structure 18 |

Targeting New Markets Targeting new markets that present opportunities for sustainable, profitable growth Evaluation of payer mix Demographic analysis Opportunities to partner with municipal or other government first-response agencies Return on capital investment Opportunities to build out non-emergency transport mix Highly selective process = 1 to 2 new 911 contracts targeted each year 19 R/M Became Exclusive 911 Ambulance Service in Salt Lake City, Utah, April 2006 |

Leveraging Existing Assets Expanding non-emergency transport mix in existing markets to further leverage fixed base of labor and fleet assets Benefit of community presence as 911 provider Proactive marketing efforts to local and regional hospitals, nursing homes and other healthcare facilities Identifying opportunities to expand market share in surrounding cities and counties Named Preferred Provider of Non-Emergency Ambulance Services to Valley Medical Center in Renton, Washington, October 2006 20 |

Investments in Technology Continued investments in technology to improve operating efficiency Electronic patient care record (ePCR) system Electronic document management system Internet-based labor scheduling system tied to computer-aided dispatch DriveCam system installed in nearly 100 percent of fleet 21 |

Optimizing Capital Structure Rural/Metro Board and management are committed to reducing debt and optimizing capital structure Series of unscheduled principal payments totaling $35 million paid senior secured Term Loan B since its inception in March 2005; annual interest savings of $2.7 million at current rates December 2005 – Term B lenders agree to reduce interest by 25 basis points Deleveraging opportunities Unscheduled principal payments Shelf Registration filed February 2006 provides opportunity to raise equity to pay off 100% of 12.75% Senior Discount Notes Timing based on accretive transaction per GAAP earnings per share 22 |

Proxy Contest Overview Accipiter Life Sciences Fund, LP (“Accipiter”) has filed a proxy statement nominating two people to be elected to the Board of Directors in place of the company’s two nominees for re-election. Accipiter claims to be long-term stockholders, even though their first purchase of Rural/Metro shares occurred only 15 months ago. Accipiter fails to recognize the company’s strong record of financial and operating performance over the past three years, including 115% compounded annual growth in per-share market price. We believe once you know the facts, you will agree that Accipiter’s nominees-will-not-represent-the-interests-of-ALL-stockholders-as-they irresponsibly call for reforms and actions that would put our business relationships at high risk. 24 |

Proxy Contest Overview Accipiter and its nominees, managing partner Gabe Hoffman and research analyst Nicole Viglucci, have no public company board experience and no experience in the medical transportation, fire protection, or safety services industries. The Accipiter Group is a small, 4-year-old hedge fund with no track record of increasing stockholder value for any public company. Accipiter criticizes our corporate governance, yet its nominees refused to provide additional background information on their qualifications when requested by the Nominating Committee, in accordance with the Committee’s charter. We believe Accipiter’s irresponsible “plan” for our Company and its self- serving agenda represents a significant risk to our stockholders. We are asking our stockholders to support Rural/Metro’s Board of Directors and management team. 25 |

Proxy Contest Overview Accipiter’s ultimate agenda is self-serving, short-sighted and unmistakable. Accipiter has failed to disclose to our stockholders their significant financial interest in a primary competitor of the Company. We believe this conflict would undermine their ability to effectively serve the balance of Rural/Metro’s stockholders, particularly in a takeover situation. Accipiter owns a significant stake in our primary competitor, Emergency Medical Services Corporation. 26 |

Rural/Metro’s Experienced Nominees More than 33 years of experience in public healthcare and hospital administration Partner in Andrade/Walker Consulting, LLC, a private firm specializing in services to executives and Boards of Directors. Former President and CEO of Providence Health System Former President and CEO of HealthPartners of Arizona, Inc. Former President and CEO of TMC Healthcare in Arizona Former Executive Vice President, Presbyterian Healthcare Services Vice Chairman of the Board of Rural/Metro Corporation since 2004; member of the Board since 1997 Henry G. Walker, Vice Chairman, 59 More than 32 years of experience at multinational public safety and security companies. Former CEO of NVD Group, one of Europe’s largest security companies Founder of Geldnet armored car services, which together with NVD Group became part of Group4 Securicor, and is now among the largest public safety and security companies in the world Chairman of the Board of Rural/Metro Corporation since 1998; member of the Board since 1992. Vice Chairman from 1994 to 1998 Cor J. Clement, Sr., Chairman of the Board, 58 27 |

Accipiter’s Unqualified Nominees Healthcare analyst, Accipiter Capital Management Employee of New York-based hedge fund, and there is no publicly available information that indicates she has any medical transportation, firefighting or public safety experience No publicly available information to indicate she has served on any Boards of Directors of public companies Nicole Viglucci, 31 Managing member, Accipiter Capital Management Runs New York-based hedge fund, and there is no publicly available information that indicates he has any medical transportation, firefighting or public safety experience No publicly available information to indicate he has served on any Boards of Directors of public companies Gabe Hoffman, 29 28 |

Rural/Metro’s Governance Rural/Metro is committed to continuously improving governance to serve the best interests of ALL stockholders. To enhance corporate governance, in December 2003 and September 2005, respectively, we added to our Board the following independent members: Robert E. Wilson, financial consultant and former partner with Arthur Andersen LLP. Mr. Wilson offers more than 30 years’ experience as a public accountant with a focus on the healthcare industry. He is Chairman of Rural/Metro’s Audit Committee. Conrad A. Conrad, Former Executive Vice President and Chief Financial Officer of the the $1.5 billion Dial Corporation. Mr. Conrad serves on Rural/Metro’s Audit Committee. 29 |

Rural/Metro’s Governance Each of the Board’s Audit Committee, Compensation Committee, Nominating Committee and Corporate Governance Committee is comprised solely of independent outside directors and operates under written charters. Our Audit Committee includes two financial experts. The current charters for each of these committees and the Company’s code of business conduct and ethics is publicly disclosed on the Company’s web site at www.ruralmetro.com 30 |

Accipiter’s Claims Accipiter criticizes the company in three areas: earnings-guidance, shelf-registration-statement,-governance-protections Earnings guidance Rural/Metro does not provide specific earnings guidance due to the potential for our markets to experience changes based on uncontrollable factors that cause shifts in demographic and competitor profiles, pricing and bad debt. Companies that miss earnings are penalized by the market more than companies that provide qualitative analysis on business direction. We communicate non-earnings guidance based on qualitative statements about market and industry conditions, trends, business drivers, and operating metrics We believe specific earnings guidance would be detrimental to stockholder value. 31 |

Accipiter’s Claims Shelf Registration Board and management are committed to deleveraging the enterprise and are successfully executing this initiative – Series of unscheduled principal payments made from free cash flow ($35 million since March 2005); approx. $2.7M in interest savings – Shelf registration filed in February 2006 with objective to raise capital through future equity issuance in order to accelerate deleveraging; company will consider a transaction when share price is not dilutive to stockholders – Shelf registration does not commit company to a transaction, but rather positions us to be proactive should the right market conditions occur. Debt-reduction-improves-stockholders’-equity-and-long-term investment value 32 |

Accipiter’s Claims We believe in protecting the interests of ALL stockholders. Exploration of strategic alternatives should be conducted in a thoughtful and cautious manner. The success of our business relationships is tied to a stable, predictable business environment. Accipiter’s self-serving agenda will put our business relationships at risk. Our business depends on the trust that cities, counties, healthcare providers, fire departments and patients place in our promise to meet their needs 24 hours a day. A breach of this trust would be detrimental to our business relationships 33 |

Summary of Issues Accipiter is targeting the Board and Management of a company with a strong track record: In the last three fiscal years, we have delivered compounded annual growth of 115.3% in per-share market price, 41.2% in operating income, 29.8% in EBITDA from continuing operations, and 6.6% in net revenue. We have consistently grown our base of profitable contracts and exited markets that were under-performing We have developed and implemented technologies to enhance efficiencies and profitability We have reduced debt by $35 million, saving approximately $2.7 million per year in interest expense at today’s rates. 34 |

Summary of Issues Accipiter’s nominees are unqualified 29-year-old hedge fund manager; 31-year-old research analyst No healthcare, fire protection, or safety services experience No experience as directors of publicly traded companies Accipiter is a 4-year-old activist hedge fund motivated by a conflicted, self-serving agenda. Accipiter has demonstrated no ability to enhance stockholder value for any publicly traded company 35 |

Summary of Issues Rural/Metro’s strategies to enhance stockholder value focus on: Targeting new markets that present excellent opportunities for sustainable and profitable growth Expanding existing 911-emergency medical transportation markets as we seek to further leverage our fixed base of labor and fleet assets to serve a growing demand for non-emergency medical transportation services Maximizing efficiencies through investments in technology Enhancing risk management and workplace safety in order to reduce insurance expenses Continuing to reduce debt and optimize our capital structure. By achieving these objectives, we will be better positioned financially and competitively to capitalize on future opportunities and build long-term value for ALL investors. 36 |

Summary of Issues The re-election of Messrs. Clement and Walker will benefit ALL Rural/Metro stockholders: Qualified, independent leaders Proven track record of success Strong healthcare, fire protection, and safety services experience 37 |

Additional Information On October 31, 2006, Rural/Metro began the process of mailing to its stockholders a definitive proxy statement together with a WHITE proxy card. Stockholders are strongly advised to read Rural/Metro’s definitive proxy statement, and any other relevant documents filed with the SEC when they become available, because they contain important information about the 2006 annual meeting of stockholders. Stockholders may obtain an additional copy of Rural/Metro’s definitive proxy statement and any other documents filed by Rural/Metro with the SEC free of charge on the website of the SEC at www.sec.gov. Copies of the definitive proxy statement are also available free of charge on our website at www.ruralmetro.com. Copies of the proxy materials may also be requested by contacting the company’s proxy solicitor, Georgeson Inc., toll-free at 1- 866-628-6069. Rural/Metro, its directors, executive officers and certain other members of management may be deemed to be participants in the solicitation of Rural/Metro’s security holders in connection with its 2006 Annual Meeting of Stockholders. Stockholders may obtain information regarding the names, affiliations and interests of such individuals in the definitive proxy statement. 38 |