UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-7762 |

|

First Eagle Funds |

(Exact name of registrant as specified in charter) |

|

1345 Avenue of the Americas

New York, NY | | 10105-4300 |

(Address of principal executive offices) | | (Zip code) |

|

Robert Bruno First Eagle Funds 1345 Avenue of the Americas New York, NY 10105-4300 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-212-632-2700 | |

|

Date of fiscal year end: | October 31 | |

|

Date of reporting period: | April 30, 2009 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Semi-Annual Report

APRIL 30, 2009

Global Fund

Overseas Fund

U.S. Value Fund

Gold Fund

Fund of America

ADVISED BY ARNHOLD AND S. BLEICHROEDER ADVISERS, LLC

Forward-Looking Statement Disclosure

One of our most important responsibilities as mutual fund managers is to communicate with shareholders in an open and direct manner. Some of our comments in our letters to shareholders are based on current management expectations and are considered "forward-looking statements." Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as "may", "will", "believe", "attempt", "seem", "think", "ought", "try" and other similar terms. We cannot promise future returns. Our opinions are a reflection of our best judgment at the time this report is compiled, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

Table of Contents

| Letter from the President | | | 4 | | |

|

| Letter from the Global Value Team Portfolio Managers | | | 6 | | |

|

Management's Discussion of Fund Performance: First Eagle Global, Overseas,

U.S. Value and Gold Funds | | | 8 | | |

|

| Performance Chart | | | 12 | | |

|

| First Eagle Global Fund: | |

|

| Fund Overview | | | 16 | | |

|

| Schedule of Investments | | | 18 | | |

|

| First Eagle Overseas Fund: | |

|

| Fund Overview | | | 36 | | |

|

| Schedule of Investments | | | 38 | | |

|

| First Eagle U.S. Value Fund: | |

|

| Fund Overview | | | 52 | | |

|

| Schedule of Investments | | | 54 | | |

|

| First Eagle Gold Fund: | |

|

| Fund Overview | | | 62 | | |

|

| Schedule of Investments | | | 64 | | |

|

| First Eagle Fund of America: | |

|

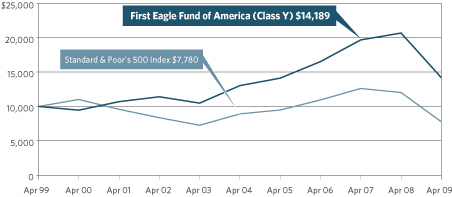

| Management's Discussion of Fund Performance | | | 69 | | |

|

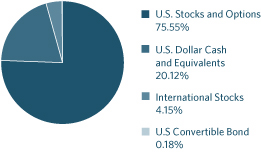

| Fund Overview | | | 70 | | |

|

| Schedule of Investments | | | 72 | | |

|

| Statements of Assets and Liabilities | | | 78 | | |

|

| Statements of Operations | | | 82 | | |

|

| Statements of Changes in Net Assets | | | 84 | | |

|

| Financial Highlights | | | 88 | | |

|

| Notes to Financial Statements | | | 98 | | |

|

| General Information | | | 117 | | |

|

| Fund Expenses | | | 118 | | |

|

| Additional Information | | | 121 | | |

|

| Consideration of Investment Advisory Agreements | | | 129 | | |

|

Letter from the President

Dear Fellow Shareholders,

Since my last letter six months ago markets around the world have continued along a volatile path. Through February most global markets seemed to be in a consistent state of decline. Then on March 9th domestic markets began to rise off the bottom and many thought this could be the first sign of recovery. At First Eagle Funds we believe that the future is still very uncertain and we continue to worry first and foremost about what could go wrong. In our opinion, we have yet to see the complete ramifications of the extraordinary actions taken by global governments in an effort to restore both liquidity and consumer confidence. This does not mean that we are doom-sayers though.

As I look across the industry, many investors experienced a loss during the last 18 months, some more significant than others. We believe that the majority of our losses are temporary in nature and that over the long-term we think that we will recover most, if not all, of the loss of capital experienced by our clients in our funds. Our primary goal remains focused on preserving capital over time for our shareholders.

We continue to manage assets with an unwavering adherence to intelligent value investing. Our portfolio management and analyst teams search the globe for high quality businesses with strong balance sheets trading at a discount to our estimate of intrinsic value. Currently, we are able to find new opportunities and add to existing positions in a variety of sectors, countries and across the entire capital structure due to the depressed valuations which further add to the potential for future value creation in our portfolios.

I am pleased to say that the Global Value Team is stronger than it has ever been. Jean-Marie Eveillard officially transitioned to a senior advisory role on March 26th. He remains a Senior Vice President of Arnhold and S. Bleichroeder Advisers, LLC as well as a Trustee of the First Eagle Funds. Since early September he has worked closely with the portfolio management team and we expect that the dialogue will continue. In February we named Rachel Benepe and Abhay Deshpande as portfolio managers of First Eagle Gold Fund. We also

John P. Arnhold

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2009

4

recently announced that Senior Analyst Elizabeth Tobin has re-joined the team. Elizabeth and Jean-Marie worked together on the Funds for over 15 years. She brings tremendous expertise to the team and her temperament is that of a true value investor. The Global Value Team led by Matthew McLennan is deep and the spirit of value investing has never been more palpable.

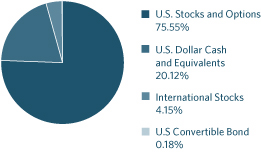

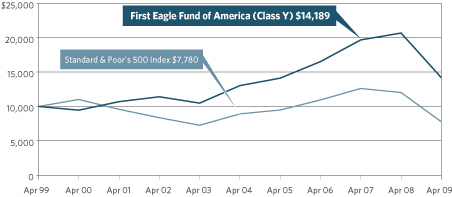

First Eagle Fund of America, sub-advised by Harold Levy and David Cohen of Iridian Asset Management, has now produced consistently strong performance on both a relative and absolute basis for over 22 years. The Fund invests in what are believed to be undervalued companies poised to benefit from a corporate event. We believe this fund is an undiscovered mutual fund treasure. There are few peers with First Eagle Fund of America's long-term performance record, risk profile and the same management team since inception available for investment today.

Please be assured that your investments in our funds will continue to be managed in the same diligent manner as they have been for over 30 years. Our portfolio managers and other senior executives have substantial investments alongside of yours and we are grateful for the confidence that you continue to place in our firm.

Sincerely,

John P. Arnhold

President

May 2009

"Our primary goal remains focused on preserving capital over time for our shareholders."

Past performance is no guarantee of future results. The portfolio is actively managed. The portfolio and opinions expressed herein are subject to change. Current and future portfolio holdings are subject to risk.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2009

5

Letter from the Global Value Team Portfolio Managers

There is often wisdom in sailing a steady course despite stormy waters. When markets are unusually volatile many feel a tendency to zig and zag trying to be ahead of each development in sentiment. For those who try to speculate on market sentiment, the past six months would have been a challenge: in February the chorus was "isn't it obvious that we're in a deflationary spiral and shouldn't one own all bonds"; in April the chorus was "isn't it obvious that the authorities are reflating and shouldn't one own all levered equities". The truth is that it is never obvious—nobody has a perfect crystal ball. When all the past six month's market gyrations are fully accounted for, the Funds sailed a steady course with low turnover and the majority returning a handful of percentage points. Sometimes it is better to simply watch the grass grow than to frenetically mow the lawn every week!

We exist in a world where the range of potential future outcomes is broad. Governments in many countries are taking on debt at a rapid rate as they grow their economic influence; on the one hand, banks are scrambling to recapitalize in developed markets and, on the other hand, banks are rapidly expanding balance sheets in some emerging markets and to add to the mix the central banks of the world are expanding the definition of what constitutes lender of last resort with a suite of unconventional market interventions. With deleveraging and rising unemployment having a life of their own, current deflationary forces are strong yet the second order effects of all this government medicine may be to produce more future inflation. Thus there is paradoxically more risk of both deflation and inflation depending on one's time horizon and even today we see some signs of both co-existing with inflation in food and energy prices over the pas t few months even as real estate prices in many areas continue to deflate. Our sense of the possibilities is foggier than usual.

When one's time horizon is short, cash provides stability against a backdrop of uncertainty but as one's horizon lengthens to years from months this stability is exposed as illusory due to inflation, currency debasement and taxes. As long term investors, our approach to dealing with the current uncertainty is to be primarily owners of enterprises, favoring those with entrenched market position, latency in potential cash flows, prudent management, strong balance sheets and most importantly modest prices. We believe such businesses can better endure the current storm and can better sustain real purchasing power in the long term. We are not 100% fully invested—we typically like to have some deferred purchasing power because we fundamentally acknowledge the world as uncertain and hope that when we least expect it opportunity will come knocking in some

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2009

6

Pictured: (from left to right) Abhay Deshpande, Matthew McLennan and Jean-Marie Eveillard

corner of the globe. Importantly, a good part of our deferred purchasing power remains in gold and gold equities. With interest rates low, government credit weakening and a global race to devalue currencies in order to protect domestic profits a possibility, we believe that the opportunity cost of holding gold as money is reasonable despite gold's strength in recent years.

Our analysts are busy as ever attempting to unearth opportunities in a world of lower prices but are also willing to realistically move on where either fundamentals have eroded or new risks are emerging. Their focus and open-minded calm in the storm has been impressive.

Matthew McLennan

Global Value Team Lead

Portfolio Manager – Global, Overseas and U.S. Value Funds

Abhay Deshpande

Portfolio Manager – Global, Overseas, U.S. Value and Gold Funds

Jean-Marie Eveillard

Senior Adviser

May 2009

Past performance is no guarantee of future results. The portfolio is actively managed. The portfolio and opinions expressed herein are subject to change. Current and future portfolio holdings are subject to risk.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2009

7

Management's Discussion of Fund Performance

Global markets were mixed for the six months ended April 30, 2009 as investors tried to identify which markets would benefit from a world-wide economic recovery. The market's rally which began in early March gathered pace through April even as negative news about the U.S. auto industry emerged. The MSCI World Index fell 5% and the MSCI EAFE Index fell 3% during the period. In Japan, the Nikkei 225 Index rose 3%. In Europe, the French CAC 40 Index fell 9% and the German DAX Index fell 4%. In the U.S., the S&P 500 Index declined 9%. The U.S. dollar fell 4% against the euro and was unchanged against the Japanese yen as fear about the global financial system weakened the dollar. Crude oil fell 25% to $51 by the end of April while gold rose 23% to $888 per ounce as concerns about inflation increased.

First Eagle Global Fund

The net asset value ("NAV") of the Fund's Class A shares rose 2.01% for the six month period while the MSCI World Index declined 5.44%. The Fund's cash position decreased slightly from 6.2% at the end of October to 4.8% on April 30, 2009.

The five largest contributors to the performance of First Eagle Global Fund over the period were Gold bullion, Gold Fields Limited, ADR (gold mining, South Africa), Fresnillo PLC (gold & silver mining, Mexico), Newmont Mining Corporation (gold mining, U.S.) and Wharf Holdings Limited (real estate investment company, Hong Kong) collectively accounting for 4.11% of this period's performance.

The five largest detractors were San Juan Basin Royalty Trust (energy trust, U.S.), Berkshire Hathaway, Inc., Class 'A' (holding company, U.S.), Astellas Pharma, Inc. (pharmaceuticals, Japan), Toho Company Limited (motion picture distributor, Japan) and Pargesa Holding SA (holding company, Switzerland). Their combined negative performance over the six month period subtracted 2.24% from the Fund's performance.

In most instances, prices declined in the absence of changes in our estimates of business value. In some cases, the Fund seized the opportunity to add to the positions at prices we deemed attractive.

As of April 30, 2009, we were approximately 30% hedged on the Japanese yen as we believe Asian currencies should ultimately be revalued against the U.S. dollar. We also remained approximately 60% hedged on the euro.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2009

8

First Eagle Global, Overseas, U.S. Value and Gold Funds

First Eagle Overseas Fund

The NAV of the Fund's Class A shares rose 1.96% for the six month period while the MSCI EAFE Index declined 2.64%. The Fund's cash position remained relatively unchanged during the six-month period at 7.7% on April 30, 2009.

The five largest contributors to the performance of First Eagle Overseas Fund over the period were Gold bullion, Gold Fields Limited, ADR (gold mining, South Africa), Wharf Holdings Limited (real estate investment company, Hong Kong), Newmont Mining Corporation (gold mining, U.S.) and Kuehne & Nagel International AG (freight transportation, Switzerland) collectively accounting for 3.80% of this period's performance.

The five largest detractors were Pargesa Holding SA (holding company, Switzerland), Astellas Pharma, Inc. (pharmaceuticals, Japan), T. Hasegawa Company Limited (flavors & fragrances, Japan), Toho Company Limited (motion picture distributor, Japan) and Laurent-Perrier (champagne, France). Their combined negative performance over the six month period subtracted 1.49% from the Fund's performance.

In most instances, prices declined in the absence of changes in our estimates of business value. In some cases, the Fund seized the opportunity to add to the positions at prices we deemed attractive.

As of April 30, 2009, we were approximately 30% hedged on the Japanese yen as we believe Asian currencies should ultimately be revalued against the U.S. dollar. We also remained approximately 60% hedged on the euro.

First Eagle U.S. Value Fund

The NAV of the Fund's Class A shares increased 1.23% for the six month period while the S&P 500 Index declined 8.53% and the Russell 2000 Index decreased 8.40%. The Fund's cash position decreased from 20.9% at the beginning of the period to 16.0% on April 30, 2009.

The five largest contributors to the performance of First Eagle U.S. Value Fund over the period were Gold bullion, Newmont Mining Corporation (gold mining), Barnes & Noble, Inc. (retail), Sirius XM Radio, Inc. (radio) and Rayonier, Inc., REIT (paper & forest products) collectively accounting for 3.69% of this period's performance.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2009

9

Management's Discussion of Fund Performance (continued)

The five largest detractors were Berkshire Hathaway, Inc., Class 'A' (holding company), San Juan Basin Royalty Trust (energy trust), Blount International, Inc. (diversified manufacturing company), Beazer Homes USA, Inc. Corporate Bond (homebuilder) and ConocoPhillips (energy). Their combined negative performance over the six month period subtracted 3.32% from the Fund's performance.

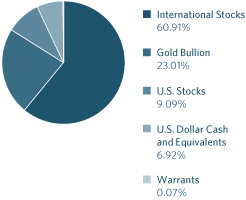

First Eagle Gold Fund

The NAV of the Fund's Class A shares rose 40.87% for the six month period while the FTSE Gold Mines Index increased 51.47%. The Fund's cash position increased from 4.5% at the beginning of the period to 7.5% on April 30, 2009.

The five largest contributors to the performance of First Eagle Gold Fund over the period were Gold bullion, IAMGOLD Corporation (Canada), Randgold Resources Limited, ADR (Africa), Gold Fields Limited, ADR (South Africa) and Kinross Gold Corporation (Canada) collectively accounting for 22.47% of this period's performance.

The five largest detractors were NovaGold Resources (Canada), Dundee Precious Metals, Inc. (Canada), Anglo American PLC (U.K.), Gammon Gold (Canada) and Etruscan Resources, Inc. (Canada). Their combined negative performance over the six month period subtracted 1.51% from the Fund's performance.

We look at gold as insurance against "extreme outcomes." In the U.S., the current financial crisis is the worst since the Great Depression. The status of the U.S. dollar as the world's reserve currency is suspect, and the other major currencies (the euro, the yen) are not particularly appealing. There is a scarcity side to gold: as we pointed out a year ago, the value of all above ground gold is about 1% of the value of global real estate plus financial assets. From a long-term standpoint, we believe gold as insurance still makes sense.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2009

10

First Eagle Global, Overseas, U.S. Value and Gold Funds

As always, we appreciate your confidence and thank you for your support.

Matthew McLennan

Global Value Team Lead

Portfolio Manager

Global, Overseas

and U.S. Value Funds

| |  | |

|

| Abhay Deshpande | | Rachel Benepe | |

|

| Portfolio Manager | | Portfolio Manager | |

|

Global, Overseas,

Gold and U.S. Value Funds | | Gold Fund | |

|

Jean-Marie Eveillard

Senior Adviser

May 2009

Past performance is no guarantee of future results. The portfolio is actively managed. The portfolio and opinions expressed herein are subject to change. Current and future portfolio holdings are subject to risk.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2009

11

Performance Chart1

| | | ONE-YEAR | | THREE-YEARS | | FIVE-YEARS | | TEN-YEARS | | SINCE

INCEPTION | | INCEPTION

DATE | |

| First Eagle Global Fund | |

| Class A (SGENX) | |

| without sales charge | | | -22.77 | % | | | -2.30 | % | | | 6.63 | % | | | 11.24 | % | | | 14.02 | % | | 01/01/792 | |

| with sales charge | | | -26.63 | | | | -3.96 | | | | 5.55 | | | | 10.81 | | | | 13.88 | | | 01/01/792 | |

| Class C (FESGX) | | | -24.12 | | | | -3.05 | | | | 5.84 | | | | — | | | | 10.32 | | | 06/05/00 | |

| Class I (SGIIX) | | | -22.57 | | | | -2.07 | | | | 6.90 | | | | 11.50 | | | | 10.87 | | | 07/31/98 | |

| MSCI World Index3 | | | -39.33 | | | | -11.54 | | | | -1.02 | | | | -1.57 | | | | 8.94 | | | 01/01/79 | |

| First Eagle Overseas Fund | |

| Class A (SGOVX) | |

| without sales charge | | | -25.21 | % | | | -4.24 | % | | | 6.64 | % | | | 11.64 | % | | | 11.32 | % | | 08/31/93 | |

| with sales charge | | | -28.95 | | | | -5.87 | | | | 5.55 | | | | 11.21 | | | | 11.05 | | | 08/31/93 | |

| Class C (FESOX) | | | -26.56 | | | | -4.98 | | | | 5.83 | | | | — | | | | 10.17 | | | 06/05/00 | |

| Class I (SGOIX) | | | -25.04 | | | | -4.01 | | | | 6.91 | | | | 11.88 | | | | 11.44 | | | 07/31/98 | |

| MSCI EAFE Index4 | | | -42.76 | | | | -12.34 | | | | 0.66 | | | | -0.04 | | | | 3.08 | | | 08/31/93 | |

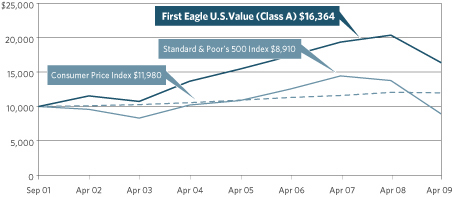

| First Eagle U.S. Value Fund | |

| Class A (FEVAX) | |

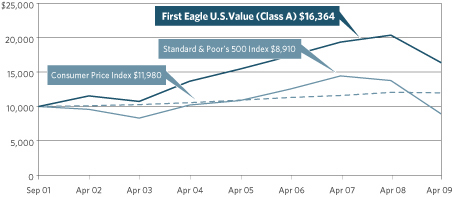

| without sales charge | | | -19.69 | % | | | -1.94 | % | | | 3.67 | % | | | — | | | | 7.35 | % | | 09/04/01 | |

| with sales charge | | | -23.70 | | | | -3.60 | | | | 2.61 | | | | — | | | | 6.63 | | | 09/04/01 | |

| Class C (FEVCX) | | | -21.09 | | | | -2.69 | | | | 2.88 | | | | — | | | | 6.54 | | | 09/04/01 | |

| Class I (FEVIX) | | | -19.51 | | | | -1.72 | | | | 3.91 | | | | — | | | | 7.60 | | | 09/04/01 | |

Standard & Poor's

500 Index5 | | | -35.31 | | | | -10.76 | | | | -2.70 | | | | — | | | | -1.50 | | | 09/04/01 | |

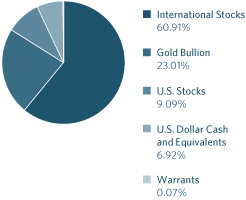

| First Eagle Gold Fund | |

| Class A (SGGDX) | |

| without sales charge | | | -12.95 | % | | | 0.75 | % | | | 14.16 | % | | | 17.70 | % | | | 8.61 | % | | 08/31/93 | |

| with sales charge | | | -17.30 | | | | -0.96 | | | | 13.00 | | | | 17.26 | | | | 8.35 | | | 08/31/93 | |

| Class C (FEGOX) | | | -14.42 | | | | 0.02 | | | | 13.32 | | | | — | | | | 13.90 | | | 05/15/03 | |

| Class I (FEGIX) | | | -12.69 | | | | 1.03 | | | | 14.45 | | | | — | | | | 15.03 | | | 05/15/03 | |

| FTSE Gold Mines Index6 | | | -17.90 | | | | -5.17 | | | | 10.34 | | | | 8.29 | | | | 1.17 | | | 08/31/93 | |

| MSCI World Index3 | | | -39.33 | | | | -11.54 | | | | -1.02 | | | | -1.57 | | | | 4.18 | | | 08/31/93 | |

Please see the following pages for important notes to this table.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2009

12

Average Annual Returns as of April 30, 2009 (unaudited)

| | | ONE-YEAR | | THREE-YEARS | | FIVE-YEARS | | TEN-YEARS | | SINCE

INCEPTION | | INCEPTION

DATE | |

| First Eagle Fund of America | |

| Class A (FEFAX) | |

| without sales charge | | | -31.35 | % | | | -4.93 | % | | | 1.71 | % | | | 3.47 | % | | | 4.74 | % | | 11/20/98 | |

| with sales charge | | | -34.79 | | | | -6.54 | | | | 0.67 | | | | 2.94 | | | | 4.23 | | | 11/20/98 | |

| Class C (FEAMX) | | | -32.55 | | | | -5.66 | | | | 0.97 | | | | 2.80 | | | | 4.23 | | | 03/02/98 | |

| Class Y (FEAFX)7 | | | -31.38 | | | | -4.95 | | | | 1.71 | | | | 3.56 | | | | 10.88 | | | 04/10/87 | |

Standard &Poor's

500 Index5 | | | -35.31 | | | | -10.76 | | | | -2.70 | | | | -2.48 | | | | 7.53 | | | 04/10/87 | |

1The performance data quoted herein represents past performance and does not guarantee future results. Market volatility can dramatically impact the Funds' short term performance. Current performance may be lower or higher than figures shown. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Past performance data through the most recent month end is available at www.firsteaglefunds.com or by calling (800) 334-2143. The average annual returns shown on the prior page are historical and reflect changes in share price, reinvested dividends and are net of expenses. The average annual returns for Class A Shares "with sales charge" of First Eagle Global Fund, First Eagle Overseas Fund and First Eagle Gold Fund give effect to the deduction of the maximum sales charge of 3.75% for periods prior to March 1, 2000 and of 5.00% the reafter. The average annual returns for Class A Shares "with sales charge" of First Eagle U.S. Value Fund and First Eagle Fund of America give effect to the deduction of the maximum sales charge of 5.00%.

The average annual returns for Class C Shares reflect the CDSC (Contingent Deferred Sales Charge) of 1.00% which pertains to the first year or less of investment only.

Class I Shares of First Eagle Global Fund, First Eagle Overseas Fund, First Eagle U.S. Value Fund, and First Eagle Gold Fund require $1mm minimum investment and are offered without charge.

Class Y Shares of First Eagle Fund of America are offered without charge.

2Commencement of management by Jean-Marie Eveillard. Mr. Eveillard transitioned to senior adviser on March 26, 2009, a position he also held from January 2005 to March 2007, and continues to be a member of First Eagle Fund's Board of Trustees and a Senior Vice President of Arnhold and S. Bleichroeder Advisers, LLC. The Fund commenced operations on April 28, 1970.

3The MSCI World Index is a widely followed, unmanaged group of stocks from 23 international markets and is not available for purchase. The index provides total returns in U.S. dollars with net dividends reinvested.

4The MSCI EAFE Index is a total return index, reported in U.S. dollars, based on share prices and reinvested net dividends of approximately 1,100 companies from 21 countries and is not available for purchase.

Please see the following page for important notes to this table.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2009

13

Performance Chart (continued)

5The Standard & Poor's 500 Index is a widely recognized unmanaged index including a representative sample of 500 leading companies in leading sectors of the U.S. economy and is not available for purchase. Although the Standard & Poor's 500 Index focuses on the large-cap segment of the market, with approximately 75% coverage of U.S. equities, it is also considered a proxy for the total market.

6The FTSE Gold Mines Index is an unmanaged index composed of approximately 19 mining companies and is only available without dividends reinvested and is not available for purchase.

7As of September 1, 2005 First Eagle Fund of America Class Y is closed to new accounts.

Expense Ratios As Stated In The Most Recent Prospectus

Total Annual Gross Operating Expense Ratios

| | | CLASS A | | CLASS I | | CLASS C | | CLASS Y | |

| First Eagle Global Fund | | | 1.14 | % | | | 0.89 | % | | | 1.89 | % | | | — | % | |

| First Eagle Overseas Fund | | | 1.15 | | | | 0.90 | | | | 1.90 | | | | — | | |

| First Eagle U.S. Value Fund | | | 1.21 | | | | 0.96 | | | | 1.96 | | | | — | | |

| First Eagle Gold Fund | | | 1.21 | | | | 0.96 | | | | 1.96 | | | | — | | |

| First Eagle Fund of America | | | 1.42 | | | | — | | | | 2.17 | | | | 1.42 | | |

These expense ratios are presented as of October 31, 2008 and may differ from corresponding ratios shown elsewhere in this report because of differing time periods (and/or, if applicable, because these expense ratios do not include expense credits or waivers).

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2009

14

This page was intentionally left blank.

Fund Overview | Data as of April 30, 2009 (unaudited)

INVESTMENT OBJECTIVE

First Eagle Global Fund seeks long-term growth of capital by investing in a wide range of asset classes from markets in the United States and around the world. This truly global fund is managed with a highly disciplined, bottom-up, value oriented style that may help to minimize risk.

Average Annual Returns

| | | ONE-YEAR | | FIVE-YEARS | | TEN-YEARS | |

First Eagle Global

Fund (A Shares) | |

| without sales charge | | | -22.77 | % | | | 6.63 | % | | | 11.24 | % | |

| with sales charge | | | -26.63 | | | | 5.55 | | | | 10.81 | | |

| MSCI World Index | | | -39.33 | | | | -1.02 | | | | -1.57 | | |

| Consumer Price Index | | | -0.74 | | | | 2.55 | | | | 2.52 | | |

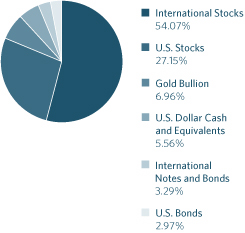

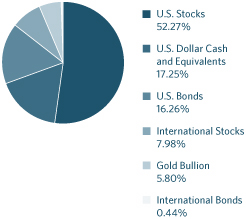

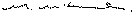

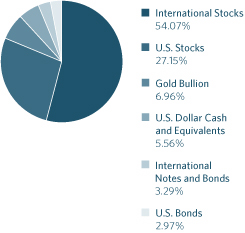

Asset Allocation

Countries

| United States | | | 37.08 | % | |

| Japan | | | 23.26 | | |

| France | | | 12.82 | | |

| Switzerland | | | 5.07 | | |

| Singapore | | | 1.87 | | |

| Germany | | | 1.86 | | |

| South Africa | | | 1.85 | | |

| Italy | | | 1.67 | | |

| Hong Kong | | | 1.64 | | |

| Mexico | | | 1.51 | | |

| South Korea | | | 1.12 | | |

| United Kingdom | | | 0.96 | | |

| Malaysia | | | 0.81 | | |

| Netherlands | | | 0.81 | | |

| Taiwan | | | 0.71 | | |

| Brazil | | | 0.51 | | |

| Thailand | | | 0.46 | | |

| Panama | | | 0.16 | | |

| Canada | | | 0.09 | | |

| Chile | | | 0.08 | | |

| Norway | | | 0.06 | | |

| Belgium | | | 0.03 | | |

| Jersey | | | 0.01 | | |

The Fund's portfolio composition (represented as a percentage of net assets) is subject to change at any time.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2009

16

Global Fund

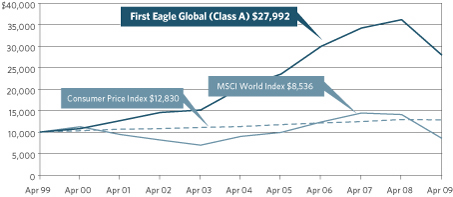

Growth of a $10,000 Initial Investment

Performance data quoted herein represents past performance and should not be considered indicative of future results. Performance data quoted herein does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. The average annual returns shown above are historical and reflect changes in share price, reinvested dividends and are net of expenses.

The average annual returns for Class A Shares give effect to the deduction of the maximum sales charge of 3.75% for periods prior to March 1, 2000 and of 5.00% thereafter.

The MSCI World Index is a widely followed, unmanaged group of stocks from 23 international markets and is not available for purchase. The index provides total returns in U.S. dollars with net dividends reinvested. The Consumer Price Index (CPI) represents the change in price of all goods and services purchased for consumption by urban households.

Top 10 Holdings

| Gold Bullion (precious metal) | | | 6.96 | % | |

| Berkshire Hathaway, Inc., Class 'A' (U.S. holding company) | | | 2.71 | | |

| Fanuc Limited (Japanese industrial manufacturing company) | | | 2.48 | | |

| SMC Corporation (Japanese automated control devices manufacturer) | | | 2.47 | | |

| Secom Company Limited (Japanese security services provider) | | | 2.25 | | |

| Sanofi-Aventis SA (French health care company) | | | 1.91 | | |

| Sodexo (French food management services provider) | | | 1.84 | | |

| Keyence Corporation (Japanese sensors manufacturer) | | | 1.79 | | |

| Aioi Insurance Company Limited (Japanese insurance company) | | | 1.78 | | |

| Cintas Corporation (U.S. uniform designer and manufacturer) | | | 1.73 | | |

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2009

17

First Eagle Global Fund

| NUMBER OF SHARES | | DESCRIPTION | | COST (NOTE 1) | | VALUE (NOTE 1) | |

| Common Stocks—80.21% | | | |

| U.S. Common Stocks—27.06% | | | |

| Consumer Discretionary 6.57% | | | |

| | 10,768,581 | | | Cintas Corporation (a) | | $ | 380,345,326 | | | $ | 276,321,788 | | |

| | 5,304,276 | | | Barnes & Noble, Inc. (a) | | | 142,425,487 | | | | 138,547,689 | | |

| | 2,572,580 | | | Costco Wholesale Corporation | | | 98,858,810 | | | | 125,027,388 | | |

| | 8,316,595 | | | Comcast Corporation , Class 'A' | | | 147,903,820 | | | | 122,087,615 | | |

| | 4,463,150 | | | Home Depot, Inc. | | | 110,672,383 | | | | 117,470,108 | | |

| | 3,013,150 | | | Omnicom Group, Inc. | | | 77,356,445 | | | | 94,823,830 | | |

| | 1,966,900 | | | Tiffany & Company | | | 49,748,172 | | | | 56,922,086 | | |

| | 1,111,175 | | | Wal-Mart Stores, Inc. | | | 51,029,419 | | | | 56,003,220 | | |

| | 1,381,358 | | | Unifirst Corporation | | | 30,865,195 | | | | 51,510,840 | | |

| | 241,530 | | | Weyco Group, Inc. | | | 712,328 | | | | 6,629,999 | | |

| | 2,485 | | | JG Boswell Company (b) | | | 573,840 | | | | 1,354,325 | | |

| | 185,000 | | | St. John Knits

International, Inc. (b)(c) | | | 3,180,703 | | | | 749,250 | | |

| | | | | | | | 1,093,671,928 | | | | 1,047,448,138 | | |

| Energy 2.86% | | | |

| | 2,407,091 | | | Apache Corporation | | | 164,692,743 | | | | 175,380,650 | | |

| | 2,536,293 | | | ConocoPhillips | | | 116,539,901 | | | | 103,988,013 | | |

| | 2,327,880 | | | Helmerich & Payne, Inc. | | | 57,215,205 | | | | 71,745,262 | | |

| | 3,975,644 | | | San Juan Basin Royalty Trust (a) | | | 141,567,358 | | | | 56,493,901 | | |

| | 1,008,530 | | | Murphy Oil Corporation | | | 39,438,919 | | | | 48,116,966 | | |

| | | | | | | | 519,454,126 | | | | 455,724,792 | | |

| Financials 4.18% | | | |

| | 4,599 | | | Berkshire Hathaway, Inc. ,

Class 'A' (c) | | | 392,199,945 | | | | 432,306,000 | | |

| | 9,253,133 | | | American Express Company | | | 397,945,907 | | | | 233,364,014 | | |

| | 34,924 | | | Mills Music Trust (a)(b) | | | 1,055,337 | | | | 699,179 | | |

| | 192,250 | | | LandCo Real Estate LLC (b)(c)(d)(e) | | | 669,030 | | | | 669,030 | | |

| | 21,124 | | | Security Capital European

Realty (b)(c)(d) | | | — | | | | — | | |

| | | | | | | | 791,870,219 | | | | 667,038,223 | | |

| Health Care 1.02% | | | |

| | 2,499,370 | | | WellPoint, Inc. (c) | | | 118,103,478 | | | | 106,873,061 | | |

| | 1,059,980 | | | Johnson & Johnson | | | 59,610,842 | | | | 55,500,553 | | |

| | | | | | | | 177,714,320 | | | | 162,373,614 | | |

See Notes to Financial Statements.

18

Schedule of Investments | Six-Month Period Ended April 30, 2009 (unaudited)

| NUMBER OF SHARES | | DESCRIPTION | | COST (NOTE 1) | | VALUE (NOTE 1) | |

| U.S. Common Stocks—27.06%—(continued) | |

| Industrials 2.78% | |

| | 4,564,980 | | | 3M Company | | $ | 364,617,757 | | | $ | 262,942,848 | | |

| | 1,474,890 | | | Alliant Techsystems, Inc. (c) | | | 158,314,106 | | | | 117,474,989 | | |

| | 9,778,961 | | | Blount International, Inc. (a)(c) | | | 127,911,050 | | | | 62,585,350 | | |

| | 4,169 | | | Conbraco Industries, Inc. (a)(b)(c) | | | 1,258,498 | | | | 604,505 | | |

| | | | | | 652,101,411 | | | | 443,607,692 | | |

| Information Technology 2.95% | |

| | 11,770,017 | | | Microsoft Corporation | | | 289,344,087 | | | | 238,460,544 | | |

| | 5,821,360 | | | Linear Technology Corporation | | | 163,252,124 | | | | 126,789,221 | | |

| | 6,694,310 | | | Intel Corporation | | | 91,240,768 | | | | 105,636,212 | | |

| | | | | | 543,836,979 | | | | 470,885,977 | | |

| Materials 5.38% | |

| | 6,493,622 | | | Rayonier, Inc. , REIT (a) | | | 149,477,283 | | | | 250,783,681 | | |

| | 5,603,662 | | | Newmont Mining Corporation | | | 228,913,155 | | | | 225,491,359 | | |

| | 3,676,750 | | | Newmont Mining Corporation, CDI | | | 3,394,059 | | | | 14,985,255 | | |

| | 3,987,548 | | | Plum Creek Timber

Company, Inc. , REIT | | | 147,118,846 | | | | 137,650,157 | | |

| | 2,784,350 | | | Weyerhaeuser Company | | | 124,714,724 | | | | 98,176,181 | | |

| | 1,655,620 | | | Vulcan Materials Company | | | 110,867,265 | | | | 78,724,731 | | |

| | 1,258,500 | | | Deltic Timber Corporation (a) | | | 62,903,243 | | | | 53,033,190 | | |

| | | | | | 827,388,575 | | | | 858,844,554 | | |

| Telecommunication Services 0.65% | |

| | 5,391,150 | | | Cisco Systems, Inc. (c) | | | 86,351,072 | | | | 104,157,018 | | |

| Utilities 0.67% | |

| | 4,440,260 | | | IDACorporation, Inc. (a) | | | 148,334,642 | | | | 106,433,032 | | |

| Total U.S. Common Stocks | | | | | 4,840,723,272 | | | | 4,316,513,040 | | |

| International Common Stocks—53.15% | |

| Belgium 0.03% | |

| | 1,863,159 | | | Deceuninck NV (a) | | | 44,135,320 | | | | 5,552,027 | | |

| Brazil 0.51% | |

| | 3,031,450 | | | Petroleo Brasileiro SA , ADR | | | 50,673,221 | | | | 81,788,521 | | |

| Canada 0.07% | |

| | 2,628,490 | | | Harry Winston Diamond

Corporation | | | 66,744,399 | | | | 11,031,401 | | |

| Chile 0.08% | |

| | 7,600,803 | | | Quinenco SA (b) | | | 5,676,192 | | | | 13,458,530 | | |

See Notes to Financial Statements.

19

Global Fund

| NUMBER OF SHARES | | DESCRIPTION | | COST (NOTE 1) | | VALUE (NOTE 1) | |

| International Common Stocks—53.15%—(continued) | | | |

| France 12.52% | | | |

| | 5,259,547 | | | Sanofi-Aventis SA | | $ | 415,745,822 | | | $ | 304,890,576 | | |

| | 6,059,452 | | | Sodexo | | | 204,703,427 | | | | 292,837,254 | | |

| | 2,943,836 | | | Neopost SA (a) | | | 284,754,430 | | | | 250,596,390 | | |

| | 5,398,259 | | | Cie Generale d'Optique Essilor

International SA | | | 243,531,070 | | | | 234,073,099 | | |

| | 4,530,023 | | | Carrefour SA | | | 282,483,345 | | | | 185,326,459 | | |

| | 5,361,738 | | | Remy Cointreau SA (a) | | | 250,320,035 | | | | 178,095,208 | | |

| | 2,307,233 | | | Société BIC SA | | | 125,700,859 | | | | 124,290,556 | | |

| | 1,429,334 | | | Air Liquide SA | | | 160,589,540 | | | | 117,092,115 | | |

| | 2,095,213 | | | Total SA | | | 116,415,367 | | | | 106,403,530 | | |

| | 2,299,271 | | | Wendel | | | 133,700,715 | | | | 85,401,347 | | |

| | 541,213 | | | Guyenne et Gascogne SA (a) | | | 72,303,381 | | | | 47,307,638 | | |

| | 63,019 | | | Sucrière de Pithiviers-Le-Vieil (a) | | | 35,947,627 | | | | 39,644,617 | | |

| | 165,085 | | | Robertet SA | | | 21,842,347 | | | | 14,867,421 | | |

| | 42,252 | | | Robertet SA CI (b) | | | 800,508 | | | | 2,797,927 | | |

| | 104,457 | | | Gaumont SA | | | 6,087,824 | | | | 5,536,480 | | |

| | 385,000 | | | Sabeton SA (a) | | | 4,841,233 | | | | 5,358,985 | | |

| | 69,500 | | | NSC Groupe (a)(b) | | | 12,298,421 | | | | 2,485,236 | | |

| | | | | | | | 2,372,065,951 | | | | 1,997,004,838 | | |

| Germany 1.56% | | | |

| | 2,556,816 | | | Fraport AG | | | 108,879,985 | | | | 103,449,835 | | |

| | 1,172,304 | | | Pfeiffer Vacuum | | | 105,767,273 | | | | 78,219,948

Technology AG (a) | | |

| | 2,464,510 | | | Tognum AG | | | 26,236,180 | | | | 30,224,608 | | |

| | 1,337,532 | | | Bertelsmann AG , Series 'A' (f) | | | 33,414,943 | | | | 24,268,552 | | |

| | 386,842 | | | Hornbach Baumarkt AG | | | 21,504,161 | | | | 12,808,337 | | |

| | | | | | | | 295,802,542 | | | | 248,971,280 | | |

| Hong Kong 1.64% | | | |

| | 55,141,450 | | | Wharf Holdings Limited | | | 147,882,908 | | | | 183,210,732 | | |

| | 12,693,580 | | | Guoco Group Limited | | | 115,086,260 | | | | 78,126,433 | | |

| | 20,738,780 | | | City e-Solutions Limited (a)(b)(c) | | | 936,898 | | | | 963,344 | | |

| | | | | | | | 263,906,066 | | | | 262,300,509 | | |

See Notes to Financial Statements.

20

Schedule of Investments | Six-Month Period Ended April 30, 2009 (unaudited)

| NUMBER OF SHARES | | DESCRIPTION | | COST (NOTE 1) | | VALUE (NOTE 1) | |

| International Common Stocks—53.15%—(continued) | | | |

| Italy 1.67% | | | |

| | 18,139,395 | | | Italcementi S.p.A. RSP | | $ | 249,186,230 | | | $ | 116,035,009 | | |

| | 4,682,069 | | | Italcementi S.p.A. | | | 86,201,872 | | | | 57,079,573 | | |

| | 1,734,972 | | | Italmobiliare S.p.A. RSP | | | 121,356,934 | | | | 42,509,237 | | |

| | 1,021,137 | | | Italmobiliare S.p.A. | | | 107,360,738 | | | | 39,070,653 | | |

| | 3,067,773 | | | Gewiss S.p.A. | | | 18,442,735 | | | | 11,376,283 | | |

| | | | | | | | 582,548,509 | | | | 266,070,755 | | |

| Japan 23.13% | | | |

| | 5,524,780 | | | Fanuc Limited | | | 472,265,654 | | | | 395,866,977 | | |

| | 4,053,720 | | | SMC Corporation (a) | | | 474,941,650 | | | | 394,402,676 | | |

| | 9,712,830 | | | Secom Company Limited | | | 441,193,277 | | | | 358,312,569 | | |

| | 1,617,690 | | | Keyence Corporation | | | 323,870,015 | | | | 284,780,331 | | |

| | 64,994,300 | | | Aioi Insurance Company

Limited (a) | | | 312,994,683 | | | | 284,560,024 | | |

| | 8,089,020 | | | Astellas Pharma, Inc. | | | 332,426,725 | | | | 263,157,537 | | |

| | 5,211,900 | | | Ono Pharmaceutical

Company Limited | | | 237,044,527 | | | | 220,793,980 | | |

| | 7,086,170 | | | Shimano, Inc. (a) | | | 164,314,591 | | | | 207,550,738 | | |

| | 14,646,430 | | | MISUMI Group, Inc. (a) | | | 256,798,648 | | | | 196,681,056 | | |

| | 14,072,800 | | | THK Company Limited (a) | | | 262,374,634 | | | | 193,542,005 | | |

| | 1,579,510 | | | Hirose Electric Company Limited | | | 175,236,917 | | | | 163,761,906 | | |

| | 4,567,060 | | | Canon, Inc. | | | 218,295,606 | | | | 136,544,309 | | |

| | 10,972,000 | | | Kirin Holdings Company Limited | | | 145,500,358 | | | | 120,428,458 | | |

| | 7,791,760 | | | Toho Company Limited | | | 133,461,584 | | | | 102,974,106 | | |

| | 14,391,850 | | | Sompo Japan Insurance, Inc. | | | 152,635,615 | | | | 85,764,749 | | |

| | 3,501,380 | | | Chofu Seisakusho Company

Limited (a) | | | 63,721,317 | | | | 64,229,227 | | |

| | 5,147,000 | | | T. Hasegawa Company Limited (a) | | | 79,849,658 | | | | 53,259,218 | | |

| | 2,719,100 | | | Meitec Corporation (a) | | | 79,203,905 | | | | 36,706,610 | | |

| | 3,461,892 | | | Nissin Healthcare Food Service

Company Limited | | | 47,886,384 | | | | 32,699,740 | | |

| | 1,505,600 | | | Shimachu Company Limited | | | 36,098,733 | | | | 26,214,866 | | |

| | 1,725,100 | | | Ariake Japan Company Limited (a) | | | 29,754,119 | | | | 23,620,250 | | |

| | 2,002,100 | | | Seikagaku Corporation | | | 21,143,745 | | | | 19,073,416 | | |

| | 2,567,150 | | | Nipponkoa Insurance

Company Limited | | | 8,856,912 | | | | 13,893,363 | | |

| | 175,240 | | | Mabuchi Motor Company Limited | | | 10,233,214 | | | | 7,903,294 | | |

| | 271,100 | | | Aderans Holdings

Company Limited | | | 6,159,738 | | | | 2,599,175 | | |

| | | | | | | | 4,486,262,209 | | | | 3,689,320,580 | | |

See Notes to Financial Statements.

21

Global Fund

| NUMBER OF SHARES | | DESCRIPTION | | COST (NOTE 1) | | VALUE (NOTE 1) | |

| International Common Stocks—53.15%—(continued) | | | |

| Malaysia 0.81% | | | |

| | 98,012,905 | | | Genting Berhad | | $ | 207,219,051 | | | $ | 128,848,426 | | |

| Mexico 1.51% | | | |

| | 16,559,243 | | | Fresnillo PLC | | | 131,822,209 | | | | 131,089,444 | | |

| | 9,745,693 | | | Industrias Peñoles S.A.B. de C.V. | | | 17,199,241 | | | | 105,339,863 | | |

| | 1,746,840 | | | Grupo Televisa S.A.B. CPO | | | 5,488,500 | | | | 5,378,668 | | |

| | | | | | | | 154,509,950 | | | | 241,807,975 | | |

| Netherlands 0.33% | | | |

| | 2,199,913 | | | Heineken Holding NV | | | 64,244,115 | | | | 52,356,752 | | |

| Panama 0.16% | | | |

| | 2,036,652 | | | Banco Latinoamericano de

Exportaciones SA (a) | | | 33,554,517 | | | | 25,050,820 | | |

| Singapore 0.43% | | | |

| | 4,246,220 | | | United Overseas Bank Limited | | | 49,821,426 | | | | 32,999,851 | | |

| | 12,704,120 | | | Fraser and Neave Limited | | | 12,799,700 | | | | 22,493,526 | | |

| | 13,467,250 | | | ComfortDelgro Corporation

Limited | | | 3,279,184 | | | | 12,923,464 | | |

| | 20,890 | | | UOL Group Limited | | | 28,240 | | | | 31,340 | | |

| | | | | | | | 65,928,550 | | | | 68,448,181 | | |

| South Africa 1.85% | | | |

| | 21,587,580 | | | Gold Fields Limited , ADR | | | 255,003,062 | | | | 224,510,832 | | |

| | 749,210 | | | Gold Fields Limited | | | 2,173,737 | | | | 7,825,353 | | |

| | 5,676,147 | | | Harmony Gold Mining Company

Limited , ADR (c) | | | 55,528,431 | | | | 52,901,690 | | |

| | 1,000,000 | | | Harmony Gold Mining Company

Limited (c) | | | 4,591,642 | | | | 9,340,623 | | |

| | | | | | | | 317,296,872 | | | | 294,578,498 | | |

| South Korea 0.39% | | | |

| | 51,900 | | | Lotte Confectionery | | | 21,157,499 | | | | 41,665,628

Company Limited | | |

| | 39,989 | | | Namyang Dairy Products

Company Limited (a) | | | 7,325,466 | | | | 15,958,198 | | |

| | 740,720 | | | Daeduck GDS Company Limited | | | 4,554,227 | | | | 4,018,247 | | |

| | | | | | | | 33,037,192 | | | | 61,642,073 | | |

| Switzerland 5.07% | | | |

| | 3,783,070 | | | Pargesa Holding SA | | | 237,781,696 | | | | 241,581,916 | | |

| | 3,086,146 | | | Kuehne & Nagel International AG | | | 139,997,099 | | | | 234,409,669 | | |

| | 5,417,450 | | | Nestlé SA | | | 135,598,090 | | | | 177,415,789 | | |

See Notes to Financial Statements.

22

Schedule of Investments | Six-Month Period Ended April 30, 2009 (unaudited)

| NUMBER OF SHARES | | DESCRIPTION | | COST (NOTE 1) | | VALUE (NOTE 1) | |

| International Common Stocks—53.15%—(continued) | |

| Switzerland 5.07%—(continued) | |

| | 4,280 | | | Lindt & Spruengli AG | | $ | 128,261,246 | | | $ | 82,257,188 | | |

| | 40,274 | | | Lindt & Spruengli AG PC | | | 67,067,587 | | | | 64,958,064 | | |

| | 39,740 | | | Edipresse SA | | | 10,811,874 | | | | 7,663,745 | | |

| | | | | | 719,517,592 | | | | 808,286,371 | | |

| Thailand 0.46% | |

| | 26,375,300 | | | Bangkok Bank PCL NVDR | | | 84,757,791 | | | | 63,545,933 | | |

| | 448,850 | | | Bangkok Bank PCL | | | 1,459,292 | | | | 1,090,955 | | |

| | 577,000 | | | OHTL PCL (b) | | | 3,451,517 | | | | 8,210,147 | | |

| | | | | | 89,668,600 | | | | 72,847,035 | | |

| United Kingdom 0.93% | |

| | 3,238,610 | | | Willis Group Holdings Limited | | | 96,652,950 | | | | 89,094,161 | | |

| | 2,714,983 | | | Anglo American PLC | | | 62,810,160 | | | | 59,617,598 | | |

| | | | | | 159,463,110 | | | | 148,711,759 | | |

| Total International Common Stocks | | | | | 10,012,253,958 | | | | 8,478,076,331 | | |

| Total Common Stocks | | | | | 14,852,977,230 | | | | 12,794,589,371 | | |

| Preferred Stocks—1.01% | |

| U.S. Preferred Stocks—0.09% | |

| Financials 0.01% | |

| | 137,410 | | | Price Legacy Corporation,

Series '1' REIT (b) | | | 1,339,514 | | | | 965,305 | | |

| Utilities 0.08% | |

| | 335,000 | | | Calenergy Capital Trust III (b) | | | 14,782,812 | | | | 13,400,000 | | |

| Total U.S. Preferred Stocks | | | | | 16,122,326 | | | | 14,365,305 | | |

| International Preferred Stocks—0.92% | |

| Germany 0.30% | |

| | 877,242 | | | Hornbach Holding AG | | | 63,837,360 | | | | 47,727,531 | | |

| South Korea 0.62% | |

| | 384,890 | | | Samsung Electronics

Company Limited | | | 58,999,278 | | | | 99,597,412 | | |

| Total International Preferred Stocks | | | | | 122,836,638 | | | | 147,324,943 | | |

| Total Preferred Stocks | | | | | 138,958,964 | | | | 161,690,248 | | |

| OUNCES | | | | | | | |

| Commodity—6.96% | |

| | 1,249,002 | | | Gold bullion (c) | | | 693,749,790 | | | | 1,109,925,515 | | |

See Notes to Financial Statements.

23

Global Fund

| PRINCIPAL AMOUNT | | DESCRIPTION | | COST (NOTE 1) | | VALUE (NOTE 1) | |

| Notes and Bonds—6.26% | | | |

| U.S. Bonds—2.97% | | | |

| Corporate Bonds 0.94% | | | |

| | $4,910,000

| | | American Standard, Inc.

8.25% due 6/1/2009 | | | $4,914,922

| | | | $4,921,205

| | |

| | 2,810,655 | | | Avis Budget Car Rental LLC

7.625% due 5/15/2014 | | | 2,763,541 | | | | 815,090 | | |

| | 5,467,000 | | | Bausch & Lomb, Inc.

7.125% due 8/1/2028 (b) | | | 4,706,604 | | | | 1,640,100 | | |

| | 28,930,000 | | | Blount, Inc.

8.875% due 8/1/2012 | | | 28,946,625 | | | | 28,206,750 | | |

| | 6,900,000 | | | Briggs & Stratton Corporation

8.875% due 3/15/2011 | | | 7,021,716 | | | | 6,951,750 | | |

| | 13,500,000 | | | GATX Financial Corporation

8.875% due 6/1/2009 | | | 13,484,646 | | | | 13,523,085 | | |

| | 11,000,000 | | | Level 3 Financing, Inc.

9.25% due 11/1/2014 | | | 10,682,131 | | | | 8,868,750 | | |

| | 5,000,000 | | | Pulte Homes, Inc.

5.20% due 2/15/2015 | | | 4,228,008 | | | | 4,225,000 | | |

| | 12,522,000 | | | Sirius XM Radio, Inc.

9.625% due 8/1/2013 | | | 12,303,258 | | | | 7,575,810 | | |

| | 8,073,000 | | | Texas Industries, Inc.

7.25% due 7/15/2013 (g) | | | 5,914,516 | | | | 6,599,677 | | |

| | 2,794,000 | | | Texas Industries, Inc.

7.25% due 7/15/2013 | | | 2,049,689 | | | | 2,284,095 | | |

| | 3,500,000 | | | Toys R US, Inc.

7.625% due 8/1/2011 | | | 3,464,831 | | | | 2,380,000 | | |

| | 57,142,000 | | | Tronox Worldwide LLC

9.50% due 12/1/2012 (h) | | | 43,266,004 | | | | 9,999,850 | | |

| | 28,622,000 | | | Valassis Communications, Inc.

8.25% due 3/1/2015 | | | 26,414,757 | | | | 15,956,765 | | |

| | 12,554,000 | | | Yankee Acquisition Corporation,

Series 'B' 8.50% due 2/15/2015 | | | 12,462,771 | | | | 8,913,340 | | |

| | 22,554,000 | | | Yankee Acquisition Corporation,

Series 'B' 9.75% due 2/15/2017 | | | 21,795,006 | | | | 14,660,100 | | |

| | 220,588 | | | The Yankee Candle Company, Inc.

2.44% due 2/6/2014 | | | 142,909 | | | | 180,882 | | |

| | 14,933,556 | | | The Yankee Candle Company, Inc.

3.22% due 2/6/2014 | | | 9,670,106 | | | | 12,245,516 | | |

| | | | | | | | 214,232,040 | | | | 149,947,765 | | |

| Government Obligations 1.86% | | | |

| | 77,202,627 | | | United States Treasury

Inflation Indexed Bond

1.875% due 7/15/2013 (i) | | | 80,059,452 | | | | 78,770,766 | | |

See Notes to Financial Statements.

24

Schedule of Investments | Six-Month Period Ended April 30, 2009 (unaudited)

| PRINCIPAL AMOUNT | | DESCRIPTION | | COST (NOTE 1) | | VALUE (NOTE 1) | |

| U.S. Bonds—2.97%—(continued) | |

| Government Obligations 1.86%—(continued) | |

$132,920,572

| | United States Treasury

Inflation Indexed Bond

2.375% due 4/15/2011 (i) | | | $135,810,700

| | | | $135,869,814

| | |

| | 79,399,495 | | | United States Treasury

Inflation Indexed Bond

4.25% due 1/15/2010 (i) | | | 80,333,099 | | | | 81,235,608 | | |

| | | | | | 296,203,251 | | | | 295,876,188 | | |

| Convertible Bond 0.17% | |

| | 34,617,000 | | | Boston Properties LP, REIT

3.625% due 2/15/2014 (g) | | | 24,206,363 | | | | 27,607,057 | | |

| Total U.S. Bonds | | | | | 534,641,654 | | | | 473,431,010 | | |

| International Notes and Bonds—3.29% | |

| International Corporate Notes and Bonds—0.90% | |

| Canada 0.02% | |

33,260,000

USD | | CanWest LP

9.25% due 8/1/2015 (b)(g) | | | 28,951,677

| | | | 3,242,850

| | |

| France 0.30% | |

12,000,000

EUR | | FINEL 9.50%

due 6/30/2017 (b)(c)(d)(e)(h) | | | 14,474,400

| | | | —

| | |

15,000,000

EUR | | FINEL 9.50%

due 10/15/2017 (b)(c)(d)(e)(h) | | | 18,067,500

| | | | —

| | |

7,938,000

USD | | Lafarge SA 6.50%

due 7/15/2016 | | | 5,511,489

| | | | 5,899,426

| | |

2,000,000

USD | | Legrand SA 8.50%

due 2/15/2025 | | | 1,958,289

| | | | 1,594,152

| | |

12,050,000

EUR | | Wendel 4.375%

due 8/9/2017 | | | 10,133,631

| | | | 10,054,181

| | |

330,000

EUR | | Wendel 4.875%

due 11/4/2014 | | | 250,364

| | | | 295,010

| | |

10,000,000

EUR | | Wendel 4.875%

due 9/21/2015 (j) | | | 9,529,962

| | | | 8,807,259

| | |

3,500,000

EUR | | Wendel 4.875%

due 5/26/2016 | | | 2,266,682

| | | | 2,966,656

| | |

15,471,000

EUR | | Wendel 5.00%

due 2/16/2011 | | | 15,607,235

| | | | 18,748,158

| | |

| | | | | | 77,799,552 | | | | 48,364,842 | | |

| Ireland — 0.00% | |

13,650,000

EUR

| | Waterford Wedgwood PLC

9.875% due 12/1/2010

(b)(d)(g)(h) | | | 16,339,337

| | | | —

| | |

See Notes to Financial Statements.

25

Global Fund

| PRINCIPAL AMOUNT | | DESCRIPTION | | COST (NOTE 1) | | VALUE (NOTE 1) | |

| International Corporate Notes and Bonds—0.90%—(continued) | |

| Jersey 0.01% | |

2,500,000

EUR

| | Independent News &

Media Finance Limited

5.75% due 5/17/2009 | | | $2,918,970

| | | | $1,821,050

| | |

| Netherlands 0.48% | |

39,700,000

EUR | | UPC Holding BV 7.75%

due 1/15/2014 (j) | | | 46,296,203

| | | | 47,583,699

| | |

22,660,000

EUR | | UPC Holding BV 8.625%

due 1/15/2014 (j) | | | 26,654,625

| | | | 27,910,137

| | |

| | | | | | 72,950,828 | | | | 75,493,836 | | |

| Norway 0.06% | |

5,500,000

USD | | Den Norske Bank ASA FRN

1.938% due 8/28/2009 (b) | | | 3,888,750

| | | | 2,876,555

| | |

3,170,000

USD | | Den Norske Creditbank FRN

1.563% due 5/29/2009 (b) | | | 2,059,625

| | | | 1,505,592

| | |

3,500,000

USD | | Den Norske Creditbank FRN

2.025% due 8/31/2009 (b) | | | 2,610,000

| | | | 1,806,038

| | |

10,000,000

USD | | Nordea Bank Norge ASA FRN

2.783% due 5/18/2009 (b) | | | 6,826,750

| | | | 3,238,880

| | |

| | | | | | 15,385,125 | | | | 9,427,065 | | |

| United Kingdom 0.03% | |

3,000,000

GBP | | Marks & Spencer PLC

6.375% due 11/7/2011 | | | 5,265,700

| | | | 4,490,653

| | |

| Total International Corporate Notes and Bonds | | | | | 219,611,189 | | | | 142,840,296 | | |

| International Government Bonds—2.39% | |

| Japan 0.13% | |

2,196,478,800

JPY | | Japanese Government CPI Linked

Bond 1.40% due 6/10/2018 (i) | | | 20,176,060

| | | | 19,502,025

| | |

| Singapore 1.44% | |

52,947,000

SGD | | Singapore Government Bond

2.375% due 10/1/2009 | | | 32,470,112

| | | | 36,096,132

| | |

60,827,000

SGD | | Singapore Government Bond

3.625% due 7/1/2011 | | | 44,904,705

| | | | 43,896,890

| | |

211,030,000

SGD | | Singapore Government Bond

4.625% due 7/1/2010 | | | 147,279,231

| | | | 149,754,789

| | |

| | | | | | 224,654,048 | | | | 229,747,811 | | |

| South Korea 0.11% | |

22,823,640,000

KRW

| | Inflation Linked Korea

Treasury Bond 2.75%

due 3/10/2017 (i) | | | 21,744,808

| | | | 17,581,052

| | |

See Notes to Financial Statements.

26

Schedule of Investments | Six-Month Period Ended April 30, 2009 (unaudited)

| PRINCIPAL AMOUNT | | DESCRIPTION | | COST (NOTE 1) | | VALUE (NOTE 1) | |

| International Government Bonds—2.39%—(continued) | | | |

| Taiwan 0.71% | | | |

| | 1,767,500,000

TWD | | | Taiwan Government Bond

2.00% due 7/20/2012 | | | $53,849,283

| | | | $55,365,100

| | |

| | 1,826,000,000

TWD | | | Taiwan Government Bond

2.375% due 1/16/2013 | | | 59,116,581

| | | | 58,105,099

| | |

| | | | | | | | 112,965,864 | | | | 113,470,199 | | |

| Total International Government Bonds | | | | | 379,540,780 | | | | 380,301,087 | | |

| Total International Notes and Bonds | | | | | 599,151,969 | | | | 523,141,383 | | |

| Total Bonds | | | | | 1,133,793,623 | | | | 996,572,393 | | |

| U.S. Commercial Paper—4.80% | | | |

| $ | 7,000,000 | | | Altria Group, Inc. | | | 6,994,692 | | | | 6,994,692 | | |

| | | | | 1.05% due 5/27/2009 | | | | | | | | | |

| | 8,493,000 | | | Altria Group, Inc.

1.05% due 5/28/2009 | | | 8,486,312 | | | | 8,486,312 | | |

| | 6,399,000 | | | Altria Group, Inc.

1.05% due 5/29/2009 | | | 6,393,774 | | | | 6,393,774 | | |

| | 3,761,000 | | | Altria Group, Inc.

1.05% due 6/15/2009 | | | 3,756,064 | | | | 3,756,064 | | |

| | 12,500,000 | | | Altria Group, Inc.

1.60% due 5/19/2009 | | | 12,490,000 | | | | 12,490,000 | | |

| | 10,000,000 | | | Altria Group, Inc.

1.60% due 5/29/2009 | | | 9,987,556 | | | | 9,987,556 | | |

| | 10,000,000 | | | Altria Group, Inc.

1.65% due 5/11/2009 | | | 9,995,417 | | | | 9,995,417 | | |

| | 12,689,000 | | | Avery Dennison Corporation

0.75% due 5/1/2009 | | | 12,689,000 | | | | 12,689,000 | | |

| | 4,371,000 | | | Avery Dennison Corporation

0.85% due 5/18/2009 | | | 4,369,246 | | | | 4,369,246 | | |

| | 7,009,000 | | | Avery Dennison Corporation

0.85% due 5/27/2009 | | | 7,004,697 | | | | 7,004,697 | | |

| | 9,131,000 | | | Bemis Company, Inc.

0.30% due 5/5/2009 | | | 9,130,696 | | | | 9,130,696 | | |

| | 20,000,000 | | | BMW 0.50% due 5/1/2009 | | | 20,000,000 | | | | 20,000,000 | | |

| | 5,945,000 | | | The Clorox Company

0.60% due 5/22/2009 | | | 5,942,919 | | | | 5,942,919 | | |

| | 11,686,000 | | | The Coca-Cola Company

0.20% due 5/19/2009 | | | 11,684,831 | | | | 11,684,831 | | |

| | 64,015,000 | | | The Coca-Cola Company

0.20% due 5/20/2009 | | | 64,008,243 | | | | 64,008,243 | | |

| | 40,711,000 | | | ConocoPhillips

0.20% due 5/5/2009 | | | 40,710,095 | | | | 40,710,095 | | |

| | 40,000,000 | | | ConocoPhillips

0.27% due 5/1/2009 | | | 40,000,000 | | | | 40,000,000 | | |

See Notes to Financial Statements.

27

Global Fund

| PRINCIPAL AMOUNT | | DESCRIPTION | | COST (NOTE 1) | | VALUE (NOTE 1) | |

| U.S. Commercial Paper—4.80%—(continued) | | | |

| $ | 18,000,000 | | | Consolidated Edison, Inc. | | $ | 18,000,000 | | | $ | 18,000,000 | | |

| | | | | 0.30% due 5/1/2009 | | | | | | | | | |

| | 11,455,000 | | | Diageo Capital PLC

0.85% due 6/2/2009 | | | 11,446,345 | | | | 11,446,345 | | |

| | 10,000,000 | | | Emerson Electric Company

0.20% due 5/26/2009 | | | 9,998,611 | | | | 9,998,611 | | |

| | 19,107,000 | | | H.J. Heinz Company Limited

0.40% due 6/4/2009 | | | 19,099,782 | | | | 19,099,782 | | |

| | 15,652,000 | | | H.J. Heinz Company Limited

0.55% due 6/18/2009 | | | 15,640,522 | | | | 15,640,522 | | |

| | 29,513,000 | | | H.J. Heinz Company Limited

0.60% due 5/19/2009 | | | 29,504,146 | | | | 29,504,146 | | |

| | 8,874,000 | | | Harley Davidson, Inc.

0.50% due 5/1/2009 | | | 8,874,000 | | | | 8,874,000 | | |

| | 23,355,000 | | | Harley Davidson, Inc.

0.55% due 5/13/2009 | | | 23,350,718 | | | | 23,350,718 | | |

| | 9,402,000 | | | Harley Davidson, Inc.

0.55% due 5/18/2009 | | | 9,399,558 | | | | 9,399,558 | | |

| | 6,992,000 | | | Harley Davidson, Inc.

0.55% due 5/19/2009 | | | 6,990,077 | | | | 6,990,077 | | |

| | 4,174,000 | | | Harley Davidson, Inc.

1.75% due 5/7/2009 | | | 4,172,783 | | | | 4,172,783 | | |

| | 12,422,000 | | | ITT Corporation

1.20% due 5/4/2009 | | | 12,420,758 | | | | 12,420,758 | | |

| | 13,725,000 | | | ITT Corporation

1.50% due 5/18/2009 | | | 13,715,278 | | | | 13,715,278 | | |

| | 15,000,000 | | | ITT Corporation

1.75% due 5/1/2009 | | | 15,000,000 | | | | 15,000,000 | | |

| | 15,658,000 | | | Kraft Foods, Inc.

0.55% due 5/26/2009 | | | 15,652,020 | | | | 15,652,020 | | |

| | 25,000,000 | | | Microsoft Corporation

0.17% due 6/22/2009 | | | 24,993,861 | | | | 24,993,861 | | |

| | 11,442,000 | | | Moody's Corporation

0.50% due 5/1/2009 | | | 11,442,000 | | | | 11,442,000 | | |

| | 40,000,000 | | | Moody's Corporation

0.55% due 5/4/2009 | | | 39,998,167 | | | | 39,998,167 | | |

| | 22,021,000 | | | Moody's Corporation

0.55% due 5/8/2009 | | | 22,018,645 | | | | 22,018,645 | | |

| | 15,000,000 | | | Moody's Corporation

0.55% due 5/11/2009 | | | 14,997,708 | | | | 14,997,708 | | |

| | 35,775,000 | | | Nestle Capital Corporation

0.03% due 5/4/2009 | | | 35,774,911 | | | | 35,774,911 | | |

| | 31,939,000 | | | The Procter & Gamble Company

0.13% due 5/11/2009 | | | 31,937,847 | | | | 31,937,847 | | |

| | 10,341,000 | | | Transocean, Inc.

0.60% due 5/1/2009 | | | 10,341,000 | | | | 10,341,000 | | |

See Notes to Financial Statements.

28

Schedule of Investments | Six-Month Period Ended April 30, 2009 (unaudited)

| PRINCIPAL AMOUNT | | DESCRIPTION | | COST (NOTE 1) | | VALUE (NOTE 1) | |

| U.S. Commercial Paper—4.80%—(continued) | |

| $ | 7,119,000 | | | Transocean, Inc. | | $ | 7,118,614 | | | $ | 7,118,614 | | |

| | | 0.65% due 5/4/2009 | | | | | | | | | |

| | 40,000,000 | | | Transocean, Inc.

0.70% due 5/11/2009 | | | 39,992,222 | | | | 39,992,222 | | |

| | 22,332,000 | | | Verizon Communications Inc.

0.90% due 5/5/2009 | | | 22,329,767 | | | | 22,329,767 | | |

| | 2,366,000 | | | Verizon Communications Inc.

1.05% due 5/7/2009 | | | 2,365,586 | | | | 2,365,586 | | |

| | 16,172,000 | | | Vulcan Materials Company

0.45% due 5/1/2009 | | | 16,172,000 | | | | 16,172,000 | | |

| Total U.S. Commercial Paper | | | | | 766,390,468 | | | | 766,390,468 | | |

| Total Investments—99.24% | | | | $ | 17,585,870,075 | | | | 15,829,167,995 | | |

| Other Assets in Excess of Liabilities—0.76% | | | | | | | | | 121,097,853 | | |

| Net Assets—100.00% | | | | | | | | $ | 15,950,265,848 | | |

(a) An affiliate of the Fund as defined by the Investment Company Act of 1940. An affiliate is defined as a company in which the Fund directly or indirectly owns, controls, or holds power to vote 5% or more of the outstanding voting securities.

(b) Security is deemed illiquid. At April 30, 2009, the value of these securities amounted to $60,666,793 or 0.38% of net assets.

(c) Non-income producing security/commodity.

(d) Securities valued in accordance with fair value procedures under the supervision of the Board of Trustees, representing $669,030 or 0.00% of net assets.

(e) Represents interest in a restricted security which has not been registered with the Securities and Exchange Commission under the Securities Act of 1933. At April 30, 2009, the value of these securities amounted to $669,030 or 0.00% of net assets.

(f) Participation certificate security—A type of investment with a combination of share and bond-like features. This security does not come with voting rights.

(g) All or a portion of the security is exempt from registration under the Securities Act of 1933. Rule 144A securities may only be sold to qualified institutional buyers, pursuant to Rule 144A under the Securities Act of 1933.

(h) Defaulted security.

(i) Inflation protected security.

(j) Represents a security registered under Regulation S. Bonds sold under Regulation S may not be offered, sold or delivered within the U.S., or for the account or benefit of, U.S. persons, except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act of 1933.

At April 30, 2009 cost is substantially identical for both book and federal income tax purposes; and net unrealized depreciation consisted of:

| Gross unrealized appreciation | | $ | 1,301,353,223 | | |

| Gross unrealized depreciation | | | (3,058,055,303 | ) | |

| Net unrealized depreciation | | $ | (1,756,702,080 | ) | |

See Notes to Financial Statements.

29

Global Fund

ADR — American Depository Receipt

CDI — Chess Depository Interest

CPI — Consumer Price Index

CPO — Ordinary Participation Certificate

FRN — Floating Rate Note

NVDR — Non-Voting Depository Receipt

PC — Participation Certificate

PCL — Public Company Limited

PLC — Public Limited Company

REIT — Real Estate Investment Trust

RSP — Represents Non-Voting Shares

Currencies

EUR — Euro

GBP — British Pound

JPY — Japanese Yen

KRW — South Korean Won

SGD — Singapore Dollar

TWD — Taiwan Dollar

USD — United States Dollar

Restricted Securities

| SECURITY | | ACQUISITION

DATE | | COST | | CARRYING VALUE PER

SHARE/PRINCIPAL | |

| LandCo Real Estate LLC | | 9/6/2006 | | $ | 669,030 | | | $ | 3.48 | | |

| FINEL 9.50% due 6/30/2017 | | 6/22/2005 | | | 14,474,400 | | | | — | | |

| FINEL 9.50% due 10/15/2017 | | 10/11/2005 | | | 18,067,500 | | | | — | | |

Foreign Currency Exchange Contracts — Purchases

SETTLEMENT

DATES

THROUGH | | FOREIGN CURRENCY

TO BE RECEIVED | | U.S. $

TO BE

DELIVERED | | U.S. $ VALUE

AT APRIL 30,

2009 | | UNREALIZED

APPRECIATION

AT APRIL 30,

2009 | | UNREALIZED

DEPRECIATION

AT APRIL 30,

2009 | |

| 7/15/2009 | | | 241,223,000 | | | Euro | | $ | 312,190,807 | | | $ | 319,752,183 | | | $ | 7,561,376 | | | $ | — | | |

| 7/15/2009 | | | 40,788,000 | | | Pound Sterling | | | 58,150,228 | | | | 60,478,733 | | | | 2,328,505 | | | | — | | |

| 7/15/2009 | | | 35,882,000 | | | Pound Sterling | | | 52,832,657 | | | | 53,204,323 | | | | 371,666 | | | | — | | |

| | | | | | | | | $ | 423,173,692 | | | $ | 433,435,239 | | | $ | 10,261,547 | | | $ | | — | |

See Notes to Financial Statements.

30

Schedule of Investments | Six-Month Period Ended April 30, 2009 (unaudited)

Foreign Currency Exchange Contracts — Sales

SETTLEMENT

DATES

THROUGH | | FOREIGN CURRENCY

TO BE DELIVERED | | U.S. $

TO BE

RECEIVED | | U.S. $ VALUE

AT APRIL 30,

2009 | | UNREALIZED

APPRECIATION

AT APRIL 30,

2009 | | UNREALIZED

DEPRECIATION

AT APRIL 30,

2009 | |

| 7/15/2009 | | | 1,364,649,000 | | | Euro | | $ | 1,816,625,118 | | | $ | 1,808,907,097 | | | $ | 7,718,021 | | | $ | — | | |

| 7/15/2009 | | | 63,949,000 | | | Pound Sterling | | | 94,606,150 | | | | 94,820,891 | | | | — | | | | (214,741 | ) | |

| 7/15/2009 | | | 12,721,000 | | | Pound Sterling | | | 18,617,820 | | | | 18,862,165 | | | | — | | | | (244,345 | ) | |

| 7/15/2009 | | | 62,435,000 | | | Swiss Franc | | | 56,169,549 | | | | 54,850,734 | | | | 1,318,815 | | | | — | | |

| 8/12/2009 | | | 46,316,893,000 | | | Japanese Yen | | | 508,402,556 | | | | 469,728,857 | | | | 38,673,699 | | | | — | | |

| 9/16/2009 | | | 62,809,343,000 | | | Japanese Yen | | | 660,464,486 | | | | 636,957,729 | | | | 23,506,757 | | | | — | | |

| | | | | | | | | $ | 3,154,885,679 | | | $ | 3,084,127,473 | | | $ | 71,217,292 | | | $ | (459,086 | ) | |

Affiliated Securities

| AFFILIATE | | SHARES

OCTOBER 31,

2008 | | GROSS

ADDITIONS | | GROSS

REDUCTIONS | | SHARES

APRIL 30,

2009 | | MARKET

VALUE

APRIL 30,

2009 | | REALIZED

LOSS | | DIVIDEND

INCOME | |

Aioi

Insurance

Company

Limited | | | 64,994,300 | | | | — | | | | — | | | | 64,994,300 | | | $ | 284,560,024 | | | $ | — | | | $ | 6,193,422 | | |

Ariake

Japan

Company

Limited | | | 1,725,100 | | | | — | | | | — | | | | 1,725,100 | | | | 23,620,250 | | | | — | | | | 328,776 | | |

Banco

Latinoamericano

de

Exportaciones

SA | | | 2,036,652 | | | | — | | | | — | | | | 2,036,652 | | | | 25,050,820 | | | | — | | | | 753,561 | | |

Barnes &

Noble, Inc. | | | 6,483,956 | | | | — | | | | 1,179,680 | | | | 5,304,276 | | | | 138,547,689 | | | | (3,056,880 | ) | | | 3,241,978 | | |

Blount

International,

Inc. | | | 9,778,961 | | | | — | | | | — | | | | 9,778,961 | | | | 62,585,350 | | | | — | | | | — | | |

Chofu

Seisakusho

Company

Limited | | | 3,501,380 | | | | — | | | | — | | | | 3,501,380 | | | | 64,229,227 | | | | — | | | | 503,262 | | |

Cintas

Corporation | | | 10,059,141 | | | | 709,440 | | | | — | | | | 10,768,581 | | | | 276,321,788 | | | | — | | | | 5,061,233 | | |

City

e-Solutions

Limited | | | 20,738,780 | | | | — | | | | — | | | | 20,738,780 | | | | 963,344 | | | | — | | | | — | | |

Conbraco

Industries, Inc. | | | 4,169 | | | | — | | | | — | | | | 4,169 | | | | 604,505 | | | | — | | | | — | | |

Deceuninck

NV | | | 2,210,071 | | | | — | | | | 346,912 | | | | 1,863,159 | | | | 5,552,027 | | | | (9,941,080 | ) | | | — | | |

Deltic

Timber

Corporation | | | 1,258,500 | | | | — | | | | — | | | | 1,258,500 | | | | 53,033,190 | | | | — | | | | 188,775 | | |

Guyenne et

Gascogne SA | | | 541,213 | | | | — | | | | — | | | | 541,213 | | | | 47,307,638 | | | | — | | | | — | | |

See Notes to Financial Statements.

31

Global Fund

Affiliated Securities—(continued)

| AFFILIATE | | SHARES

OCTOBER 31,

2008 | | GROSS

ADDITIONS | | GROSS

REDUCTIONS | | SHARES

APRIL 30,

2009 | | MARKET

VALUE

APRIL 30,

2009 | | REALIZED

LOSS | | DIVIDEND

INCOME | |

IDA

Corporation,

Inc. | | | 4,440,260 | | | | — | | | | — | | | | 4,440,260 | | | $ | 106,433,032 | | | $ | — | | | $ | 2,664,156 | | |

Meitec

Corporation | | | 3,663,695 | | | | 110,400 | | | | 1,054,995 | | | | 2,719,100 | | | | 36,706,610 | | | | (14,964,639 | ) | | | 712,547 | | |

Mills Music

Trust | | | 34,924 | | | | — | | | | — | | | | 34,924 | | | | 699,179 | | | | — | | | | 52,963 | | |

MISUMI

Group, Inc. | | | 14,646,430 | | | | — | | | | — | | | | 14,646,430 | | | | 196,681,056 | | | | — | | | | 418,705 | | |

Namyang

Dairy

Products

Company

Limited | | | 39,989 | | | | — | | | | — | | | | 39,989 | | | | 15,958,198 | | | | — | | | | 24,409 | | |

| Neopost SA | | | 3,039,356 | | | | — | | | | 95,520 | | | | 2,943,836 | | | | 250,596,390 | | | | (3,101,018 | ) | | | 5,734,179 | | |

| NSC Groupe | | | 70,650 | | | | — | | | | 1,150 | | | | 69,500 | | | | 2,485,236 | | | | (121,438 | ) | | | — | | |

Pfeiffer

Vacuum

Technology

AG | | | 1,172,304 | | | | — | | | | — | | | | 1,172,304 | | | | 78,219,948 | | | | — | | | | — | | |

Rayonier, Inc.,

REIT | | | 5,905,362 | | | | 588,260 | | | | — | | | | 6,493,622 | | | | 250,783,681 | | | | — | | | | 6,199,492 | | |

Remy

Cointreau SA | | | 5,361,738 | | | | — | | | | — | | | | 5,361,738 | | | | 178,095,208 | | | | — | | | | — | | |

| Sabeton SA | | | 385,000 | | | | — | | | | — | | | | 385,000 | | | | 5,358,985 | | | | — | | | | — | | |

San Juan

Basin Royalty

Trust | | | 4,218,754 | | | | — | | | | 243,110 | | | | 3,975,644 | | | | 56,493,901 | | | | (2,444,034 | ) | | | 2,250,218 | | |

| Shimano, Inc. | | | 7,086,170 | | | | — | | | | — | | | | 7,086,170 | | | | 207,550,738 | | | | — | | | | 2,218,902 | | |

SMC

Corporation | | | 4,053,720 | | | | — | | | | — | | | | 4,053,720 | | | | 394,402,676 | | | | — | | | | 2,317,716 | | |

Sucrière de

Pithiviers-

Le-Vieil | | | 63,019 | | | | — | | | | — | | | | 63,019 | | | | 39,644,617 | | | | — | | | | 2,122,104 | | |

T. Hasegawa

Company

Limited | | | 5,147,000 | | | | — | | | | — | | | | 5,147,000 | | | | 53,259,218 | | | | — | | | | 490,467 | | |

THK

Company

Limited | | | 14,581,600 | | | | — | | | | 508,800 | | | | 14,072,800 | | | | 193,542,005 | | | | (4,193,879 | ) | | | 1,111,605 | | |

| Total | | $ | 3,049,286,530 | | | $ | (37,822,968 | ) | | $ | 42,588,470 | | |

See Notes to Financial Statements.

32

Schedule of Investments | Six-Month Period Ended April 30, 2009 (unaudited)

| INDUSTRY DIVERSIFICATION FOR PORTFOLIO HOLDINGS | | PERCENT OF

NET ASSETS | |

| U.S. Common Stocks | |

| Consumer Discretionary | | | 6.57 | % | |

| Energy | | | 2.86 | | |

| Financials | | | 4.18 | | |

| Health Care | | | 1.02 | | |

| Industrials | | | 2.78 | | |

| Information Technology | | | 2.95 | | |

| Materials | | | 5.38 | | |

| Telecommunication Services | | | 0.65 | | |

| Utilities | | | 0.67 | | |

| Total U.S. Common Stocks | | | 27.06 | | |

| International Common Stocks | |

| Consumer Discretionary | | | 5.62 | | |

| Consumer Staples | | | 6.50 | | |

| Energy | | | 1.18 | | |

| Financials | | | 6.89 | | |

| Health Care | | | 6.53 | | |

| Industrials | | | 14.42 | | |

| Information Technology | | | 5.31 | | |

| Materials | | | 6.55 | | |

| Telecommunication Services | | | 0.15 | | |

| Total International Common Stocks | | | 53.15 | | |

| U.S. Preferred Stocks | |

| Financials | | | 0.01 | | |

| Utilities | | | 0.08 | | |

| Total U.S. Preferred Stocks | | | 0.09 | | |

| International Preferred Stocks | |

| Consumer Discretionary | | | 0.30 | | |

| Information Technology | | | 0.62 | | |

| Total International Preferred Stocks | | | 0.92 | | |

| Commodity | | | 6.96 | | |

See Notes to Financial Statements.

33

Global Fund

| INDUSTRY DIVERSIFICATION FOR PORTFOLIO HOLDINGS—(CONTINUED) | | PERCENT OF

NET ASSETS | |

| U.S. Bonds | |

| Consumer Discretionary | | | 0.50 | % | |

| Energy | | | 0.36 | | |

| Government Issues | | | 1.85 | | |

| Industrials | | | 0.04 | | |

| Materials | | | 0.12 | | |

| Telecommunication Services | | | 0.10 | | |

| Total U.S. Bonds | | | 2.97 | | |

| International Notes and Bonds | |

| Consumer Discretionary | | | 0.03 | | |

| Financials | | | 0.32 | | |

| Government Issues | | | 2.38 | | |

| Industrials | | | 0.02 | | |

| Information Technology | | | 0.47 | | |

| Materials | | | 0.04 | | |

| Telecommunication Services | | | 0.03 | | |

| Total International Notes and Bonds | | | 3.29 | | |

| U.S. Commercial Paper | | | 4.80 | | |

| Total Investments | | | 99.24 | % | |

See Notes to Financial Statements.

34

This page was intentionally left blank.

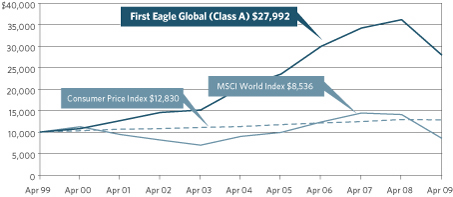

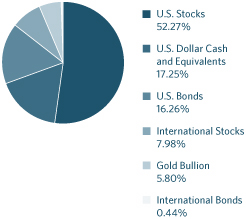

Fund Overview | Data as of April 30, 2009 (unaudited)

INVESTMENT OBJECTIVE

First Eagle Overseas Fund seeks long-term growth of capital by investing primarily in equities issued by non-U.S. corporations. Management's research-driven process seeks to minimize risk by focusing on undervalued securities.

Average Annual Returns

| | | ONE-YEAR | | FIVE-YEARS | | TEN-YEARS | |

First Eagle Overseas

Fund (A Shares) | |

| without sales charge | | | -25.21 | % | | | 6.64 | % | | | 11.64 | % | |

| with sales charge | | | -28.95 | | | | 5.55 | | | | 11.21 | | |

| MSCI EAFE Index | | | -42.76 | | | | 0.66 | | | | -0.04 | | |

| Consumer Price Index | | | -0.74 | | | | 2.55 | | | | 2.52 | | |

Asset Allocation

Countries

| Japan | | | 32.36 | % | |

| France | | | 13.70 | | |

| United States | | | 10.29 | | |

| Switzerland | | | 5.68 | | |

| Germany | | | 4.09 | | |

| Singapore | | | 3.73 | | |

| South Korea | | | 3.27 | | |

| Hong Kong | | | 2.37 | | |

| Taiwan | | | 1.91 | | |

| Italy | | | 1.88 | | |

| South Africa | | | 1.85 | | |

| Thailand | | | 1.76 | | |

| Netherlands | | | 1.72 | | |

| Canada | | | 1.32 | | |

| Brazil | | | 1.11 | | |

| United Kingdom | | | 1.05 | | |

| Malaysia | | | 0.82 | | |

| Chile | | | 0.76 | | |

| Mexico | | | 0.72 | | |

| Panama | | | 0.32 | | |

| Australia | | | 0.24 | | |

| Belgium | | | 0.10 | | |

| Jersey | | | 0.07 | | |

| New Zealand | | | 0.05 | | |

The Fund's portfolio composition (represented as a percentage of net assets) is subject to change at any time.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2009

36

Overseas Fund

Growth of a $10,000 Initial Investment

Performance data quoted herein represents past performance and should not be considered indicative of future results. Performance data quoted herein does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. The average annual returns shown above are historical and reflect changes in share price, reinvested dividends and are net of expenses.

The average annual returns for Class A Shares give effect to the deduction of the maximum sales charge of 3.75% for periods prior to March 1, 2000 and of 5.00% thereafter.

The MSCI EAFE Index is a total return index, reported in U.S. Dollars, based on share prices and reinvested net dividends of approximately 1,100 companies from 21 countries and is not available for purchase. The Consumer Price Index (CPI) represents the change in price of all goods and services purchased for consumption by urban households.

Top 10 Holdings

| Gold Bullion (precious metal) | | | 9.13 | % | |

| Shimano, Inc. (Japanese bicycle parts manufacturer) | | | 2.67 | | |

| Pargesa Holding SA (Swiss diversified financials company) | | | 2.40 | | |

| SMC Corporation (Japanese automated control devices manufacturer) | | | 2.13 | | |