| | OMB APPROVAL |

| | OMB Number: 3235-0570 Expires: September 30, 2026

Estimated average burden hours per response ......... 7.78 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-7762

First Eagle Funds (Exact name of registrant as specified in charter)

1345 Avenue of the Americas

New York, NY 10105-4300

| (Address of principal executive offices) | | (Zip code) |

Sheelyn Michael

First Eagle Funds

1345 Avenue of the Americas

New York, NY 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-212-632-2700

Date of fiscal year end: October 31

Date of reporting period: October 31, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N- CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549- 1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

TABLE OF CONTENTS

First Eagle Global Fund

Class A - SGENX |

| | |

First Eagle Global Fund

Class C - FESGX |

| | |

First Eagle Global Fund

Class I - SGIIX |

| | |

First Eagle Global Fund

Class R6 - FEGRX |

| | |

First Eagle Overseas Fund

Class A - SGOVX |

| | |

First Eagle Overseas Fund

Class C - FESOX |

| | |

First Eagle Overseas Fund

Class I - SGOIX |

| | |

First Eagle Overseas Fund

Class R6 - FEORX |

| | |

First Eagle U.S. Value Fund

Class A - FEVAX |

| | |

First Eagle U.S. Value Fund

Class C - FEVCX |

| | |

First Eagle U.S. Value Fund

Class I - FEVIX |

| | |

First Eagle U.S. Value Fund

Class R6 - FEVRX |

| | |

First Eagle Gold Fund

Class A - SGGDX |

| | |

First Eagle Gold Fund

Class C - FEGOX |

| | |

First Eagle Gold Fund

Class I - FEGIX |

| | |

First Eagle Gold Fund

Class R6 - FEURX |

| | |

First Eagle Global Income Builder Fund

Class A - FEBAX |

| | |

First Eagle Global Income Builder Fund

Class C - FEBCX |

| | |

First Eagle Global Income Builder Fund

Class I - FEBIX |

| | |

First Eagle Global Income Builder Fund

Class R6 - FEBRX |

| | |

First Eagle Rising Dividend Fund

Class A - FEFAX |

| | |

First Eagle Rising Dividend Fund

Class C - FEAMX |

| | |

First Eagle Rising Dividend Fund

Class I - FEAIX |

| | |

First Eagle Rising Dividend Fund

Class R6 - FEFRX |

| | |

First Eagle Small Cap Opportunity Fund

Class A - FESAX |

| | |

First Eagle Small Cap Opportunity Fund

Class I - FESCX |

| | |

First Eagle Small Cap Opportunity Fund

Class R6 - FESRX |

| | |

First Eagle U.S. Smid Cap Opportunity Fund

Class A - FEMAX |

| | |

First Eagle U.S. Smid Cap Opportunity Fund

Class I - FESMX |

| | |

First Eagle U.S. Smid Cap Opportunity Fund

Class R6 - FEXRX |

| | |

First Eagle Global Real Assets Fund

Class A - FERAX |

| | |

First Eagle Global Real Assets Fund

Class I - FEREX |

| | |

First Eagle Global Real Assets Fund

Class R6 - FERRX |

| | |

First Eagle High Yield Municipal Fund

Class A - FEHAX |

| | |

First Eagle High Yield Municipal Fund

Class C - FEHCX |

| | |

First Eagle High Yield Municipal Fund

Class I - FEHIX |

| | |

First Eagle High Yield Municipal Fund

Class R6 - FEHRX |

| | |

First Eagle Short Duration High Yield Municipal Fund

Class A - FDUAX |

| | |

First Eagle Short Duration High Yield Municipal Fund

Class I - FDUIX |

| | |

First Eagle Short Duration High Yield Municipal Fund

Class R6 - FDURX |

| | |

0000906352fei:FRTSRGrowth10kMinusBenchmark18340BroadBasedIndexMember2016-05-310000906352fei:C000030900Member2022-11-300000906352fei:FRTSRTotalReturnMinus1yrMinusBenchmark28350AdditionalIndexMember2023-11-012024-10-310000906352fei:C000109583Member2016-04-300000906352fei:FRTSRGrowth10kMinusBenchmark18357BroadBasedIndexMember2018-04-300000906352fei:FRTSRGrowth10kMinusBenchmark18367BroadBasedIndexMember2020-04-300000906352fei:C000232391Member2023-08-310000906352fei:FRTSRGrowth10kMinusBenchmark18362BroadBasedIndexMember2017-04-30

October 31, 2024

Annual Shareholder Report

This Annual Shareholder Report contains important information about the Class A shares of the Fund for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at https://www.firsteagle.com/first-eagle-fund-shareholder-reports. You can also request this information by contacting us at 800.334.2143.

What Were the Fund's Costs for the Year?

Based on a Hypothetical $10,000 Investment

| Class Name | Cost of a $10,000 Investment | Cost Paid as a Percentage of a $10,000 Investment |

|---|

| Class A | $124 | 1.10% |

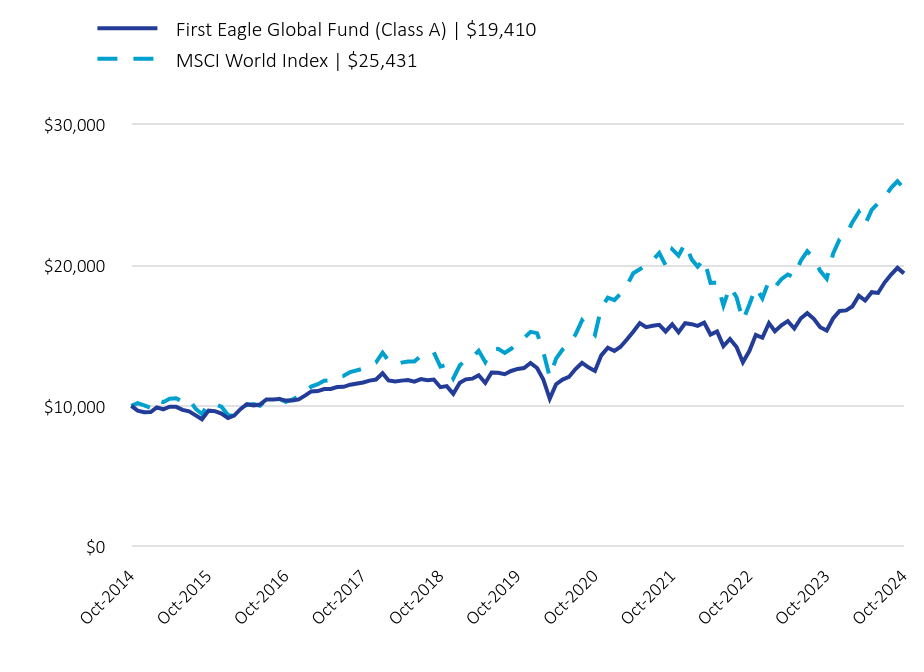

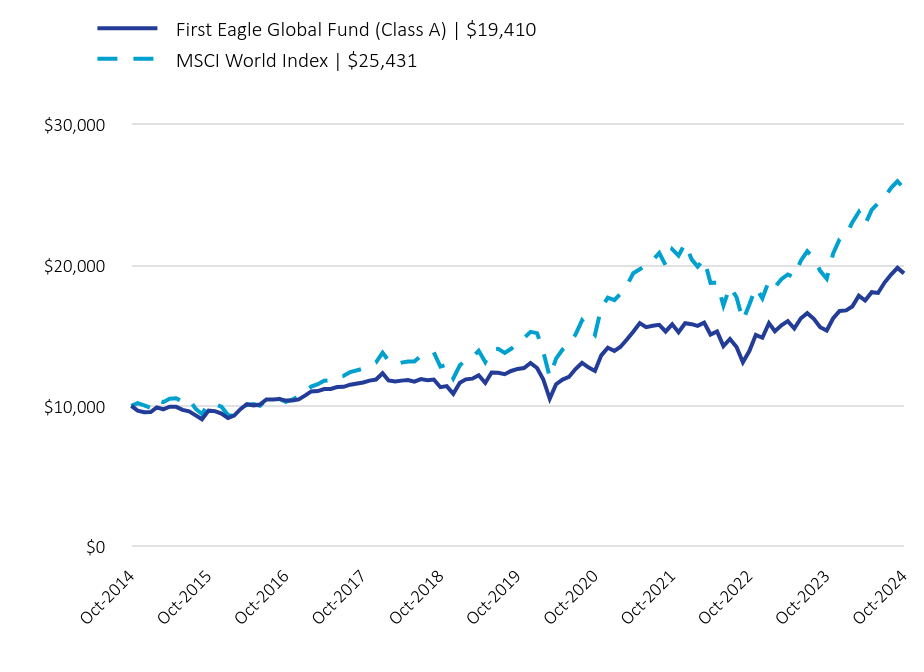

How Did the Fund Perform Last Year?

The NAV of First Eagle Global Fund Class A Shares1 increased 26.43% in the 12-month period ended October 31, 2024. The MSCI World Index increased 33.68% for the same period.

• Our equity holdings contributed to performance, while gold and gold-related equities also were a contributor.

• All geographic regions contributed to performance. North America and developed Europe were the leading contributors by region, while developed Asia excluding Japan and emerging markets were the worst performing regions.

• Materials, financials and information technology were the largest contributors among equity sectors. Energy was the only detractor, while utilities and real estate were the next worst performing sectors.

• Gold bullion was the leading contributor to performance. Schlumberger NV was the largest detractor.

1 Reflects performance for Class A shares without the effect of sales charges and assumes all distributions have been reinvested; if sales charges were included, values would be lower.

Total Return Based on a $10,000 Investment

| First Eagle Global Fund (Class A) | $19,410 | MSCI World Index | $25,431 |

|---|

| Oct-2014 | 10,000 | 10,000 |

| Nov-2014 | 9,662.450000 | 10,200.410000 |

| Dec-2014 | 9,548.430000 | 10,035.930000 |

| Jan-2015 | 9,570.390000 | 9,854.080000 |

| Feb-2015 | 9,896.750000 | 10,431.420000 |

| Mar-2015 | 9,764.130000 | 10,268.130000 |

| Apr-2015 | 9,949.650000 | 10,508.940000 |

| May-2015 | 9,936.710000 | 10,545.140000 |

| Jun-2015 | 9,718.110000 | 10,299.940000 |

| Jul-2015 | 9,612.180000 | 10,484.830000 |

| Aug-2015 | 9,327.660000 | 9,791 |

| Sep-2015 | 9,050.630000 | 9,429.860000 |

| Oct-2015 | 9,667.880000 | 10,177.120000 |

| Nov-2015 | 9,631.140000 | 10,126.490000 |

| Dec-2015 | 9,458.740000 | 9,948.490000 |

| Jan-2016 | 9,136.200000 | 9,353.330000 |

| Feb-2016 | 9,313.440000 | 9,283.720000 |

| Mar-2016 | 9,788.430000 | 9,913.700000 |

| Apr-2016 | 10,122.210000 | 10,070.570000 |

| May-2016 | 10,026.050000 | 10,127.130000 |

| Jun-2016 | 10,101.250000 | 10,013.650000 |

| Jul-2016 | 10,460.850000 | 10,436.720000 |

| Aug-2016 | 10,455.620000 | 10,445.390000 |

| Sep-2016 | 10,497.440000 | 10,500.870000 |

| Oct-2016 | 10,380.920000 | 10,297.650000 |

| Nov-2016 | 10,393.380000 | 10,445.720000 |

| Dec-2016 | 10,465.090000 | 10,695.670000 |

| Jan-2017 | 10,748.700000 | 10,953.810000 |

| Feb-2017 | 11,032.120000 | 11,377.630000 |

| Mar-2017 | 11,053.080000 | 11,546.090000 |

| Apr-2017 | 11,197.870000 | 11,790.340000 |

| May-2017 | 11,201.230000 | 11,835.710000 |

| Jun-2017 | 11,336.770000 | 12,118.960000 |

| Jul-2017 | 11,353.770000 | 12,136.030000 |

| Aug-2017 | 11,505.910000 | 12,408.410000 |

| Oct-2017 | 11,662.390000 | 12,642.910000 |

| Nov-2017 | 11,798.840000 | 12,916.860000 |

| Dec-2017 | 11,875.530000 | 13,091.540000 |

| Jan-2018 | 12,319.680000 | 13,782.770000 |

| Feb-2018 | 11,808.410000 | 13,211.790000 |

| Mar-2018 | 11,737.560000 | 12,923.820000 |

| Apr-2018 | 11,796.250000 | 13,072.330000 |

| May-2018 | 11,836.360000 | 13,154.240000 |

| Jun-2018 | 11,719.180000 | 13,147.970000 |

| Jul-2018 | 11,907.860000 | 13,558.630000 |

| Aug-2018 | 11,829.260000 | 13,726.380000 |

| Sep-2018 | 11,871.850000 | 13,802.820000 |

| Oct-2018 | 11,330.490000 | 12,789.300000 |

| Nov-2018 | 11,408.670000 | 12,934.590000 |

| Dec-2018 | 10,863.340000 | 11,951.070000 |

| Jan-2019 | 11,644.410000 | 12,880.930000 |

| Feb-2019 | 11,885.450000 | 13,268.260000 |

| Mar-2019 | 11,936.560000 | 13,442.530000 |

| Apr-2019 | 12,180.070000 | 13,919.190000 |

| May-2019 | 11,633.180000 | 13,116.040000 |

| Jun-2019 | 12,369.560000 | 13,980.320000 |

| Jul-2019 | 12,354.720000 | 14,049.570000 |

| Aug-2019 | 12,248.470000 | 13,762.200000 |

| Sep-2019 | 12,481.190000 | 14,055.070000 |

| Oct-2019 | 12,625.970000 | 14,412.730000 |

| Nov-2019 | 12,694.150000 | 14,814.130000 |

| Dec-2019 | 13,053.390000 | 15,257.940000 |

| Jan-2020 | 12,693.120000 | 15,165.070000 |

| Feb-2020 | 11,895.990000 | 13,883.240000 |

| Mar-2020 | 10,508.920000 | 12,045.890000 |

| Apr-2020 | 11,543 | 13,361.830000 |

| May-2020 | 11,874.280000 | 14,007.320000 |

| Jun-2020 | 12,057.150000 | 14,377.830000 |

| Jul-2020 | 12,620.210000 | 15,065.680000 |

| Aug-2020 | 13,053.090000 | 16,072.290000 |

| Sep-2020 | 12,737.200000 | 15,517.810000 |

| Oct-2020 | 12,485.010000 | 15,041.800000 |

| Nov-2020 | 13,591.180000 | 16,965.070000 |

| Dec-2020 | 14,137.540000 | 17,684.330000 |

| Jan-2021 | 13,897.200000 | 17,508.570000 |

| Feb-2021 | 14,183.490000 | 17,957.220000 |

| Mar-2021 | 14,709.690000 | 18,554.690000 |

| Apr-2021 | 15,264.250000 | 19,418.230000 |

| May-2021 | 15,876.350000 | 19,697.960000 |

| Jun-2021 | 15,585.810000 | 19,991.550000 |

| Jul-2021 | 15,685.560000 | 20,349.660000 |

| Aug-2021 | 15,759.280000 | 20,856.130000 |

| Sep-2021 | 15,286.500000 | 19,990.170000 |

| Oct-2021 | 15,794.010000 | 21,122.420000 |

| Nov-2021 | 15,228.590000 | 20,659.570000 |

| Dec-2021 | 15,869.710000 | 21,542.560000 |

| Jan-2022 | 15,803.060000 | 20,402.720000 |

| Feb-2022 | 15,684.540000 | 19,886.710000 |

| Mar-2022 | 15,913.530000 | 20,432.470000 |

| Apr-2022 | 15,066.930000 | 18,735.080000 |

| May-2022 | 15,285.400000 | 18,749.270000 |

| Jun-2022 | 14,242.940000 | 17,125.170000 |

| Jul-2022 | 14,749.990000 | 18,484.840000 |

| Aug-2022 | 14,179.160000 | 17,712.030000 |

| Sep-2022 | 13,097.290000 | 16,065.520000 |

| Oct-2022 | 13,913.250000 | 17,219.240000 |

| Nov-2022 | 15,047.180000 | 18,416.500000 |

| Dec-2022 | 14,841.040000 | 17,634.400000 |

| Jan-2023 | 15,875.460000 | 18,882.140000 |

| Feb-2023 | 15,303.940000 | 18,428.240000 |

| Mar-2023 | 15,723.270000 | 18,997.670000 |

| Apr-2023 | 16,017.290000 | 19,330.690000 |

| May-2023 | 15,495.130000 | 19,137.700000 |

| Jun-2023 | 16,206.360000 | 20,295.110000 |

| Jul-2023 | 16,585.580000 | 20,976.880000 |

| Aug-2023 | 16,185.870000 | 20,475.830000 |

| Sep-2023 | 15,590.230000 | 19,592.540000 |

| Oct-2023 | 15,354.820000 | 19,024.040000 |

| Nov-2023 | 16,205.480000 | 20,807.590000 |

| Dec-2023 | 16,740.260000 | 21,829.120000 |

| Jan-2024 | 16,782.110000 | 22,091.080000 |

| Feb-2024 | 17,055.660000 | 23,027.690000 |

| Mar-2024 | 17,824.870000 | 23,767.680000 |

| Apr-2024 | 17,482.630000 | 22,884.840000 |

| May-2024 | 18,071.790000 | 23,906.690000 |

| Jun-2024 | 18,019.380000 | 24,393.140000 |

| Jul-2024 | 18,756.380000 | 24,823.010000 |

| Aug-2024 | 19,324.700000 | 25,479.090000 |

| Sep-2024 | 19,800.080000 | 25,945.710000 |

| Oct-2024 | 19,410 | 25,431 |

The above chart represents historical performance of a hypothetical $10,000 investment over the past 10 years. The results of this chart do not predict the results of future time periods and does not guarantee the same results.

| Class/Index Name | 1 Year | 5 Years | 10 Years |

|---|

| Class A - without sales charge | 26.43% | 8.98% | 7.41% |

| Class A - with sales charge | 20.08% | 7.87% | 6.86% |

| MSCI World Index | 33.68% | 12.03% | 9.78% |

The Fund's past performance is not a good predictor of the Fund's future performance.The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Call us at 800.334.2143 or visit https://www.firsteagle.com if you have questions about current performance.

- Net Assets$56,336,120,291

- Number of Portfolio Holdings197

- Portfolio Turnover Rate9.51%

- Net Investment Advisory Fees (net of waivers and reimbursements)$393,022,590

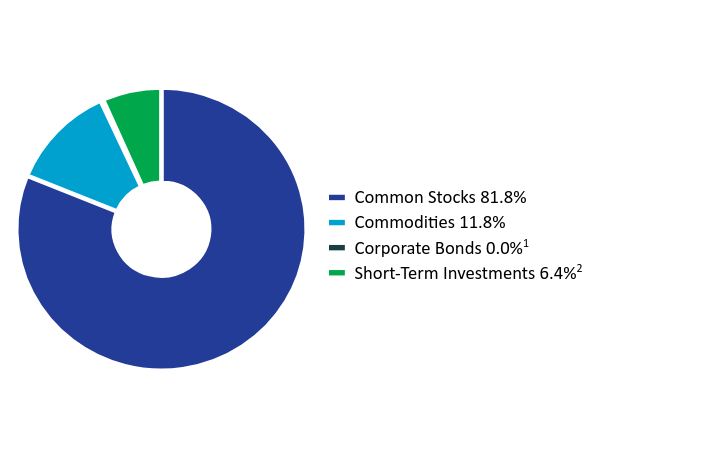

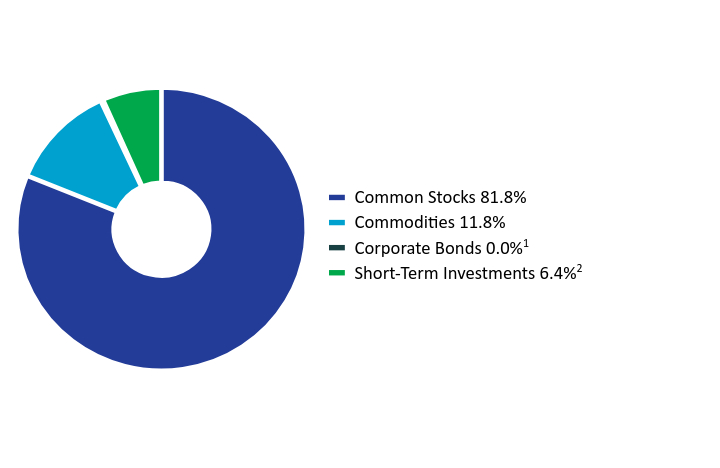

Asset Allocation by Asset Class

Based on total investments in the portfolio

| Value | Value |

|---|

| Common Stocks | 81.8% |

| Commodities | 11.8% |

| Corporate Bonds | 0.0%Footnote Reference1 |

| Short-Term Investments | 6.4%Footnote Reference2 |

Top 10 HoldingsFootnote Reference3

Based on total net assets of the portfolio

Gold bullion (Precious Metal)Footnote Reference4 | 11.8% |

| Oracle Corp. (Software, United States) | 2.9% |

| Meta Platforms, Inc., Class A (Interactive Media & Services, United States) | 2.6% |

| HCA Healthcare, Inc. (Health Care Providers & Services, United States) | 2.0% |

| Exxon Mobil Corp. (Oil, Gas & Consumable Fuels, United States) | 2.0% |

| Philip Morris International, Inc. (Tobacco, United States) | 1.9% |

| Comcast Corp., Class A (Media, United States) | 1.7% |

| Willis Towers Watson plc (Insurance, United States) | 1.5% |

| Bank of New York Mellon Corp. (The) (Capital Markets, United States) | 1.5% |

| CH Robinson Worldwide, Inc. (Air Freight & Logistics, United States) | 1.5% |

| Total | 29.4% |

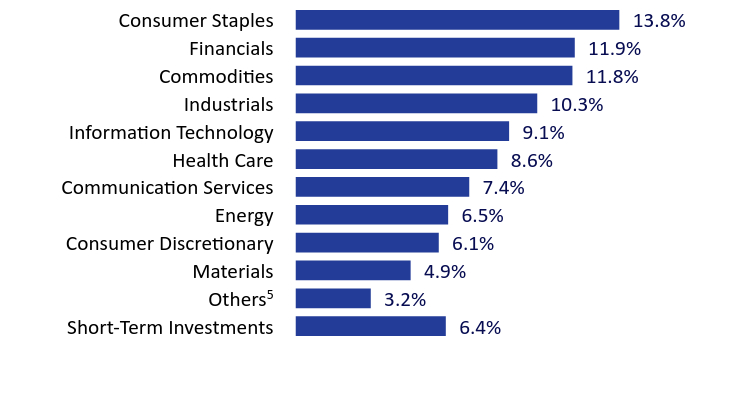

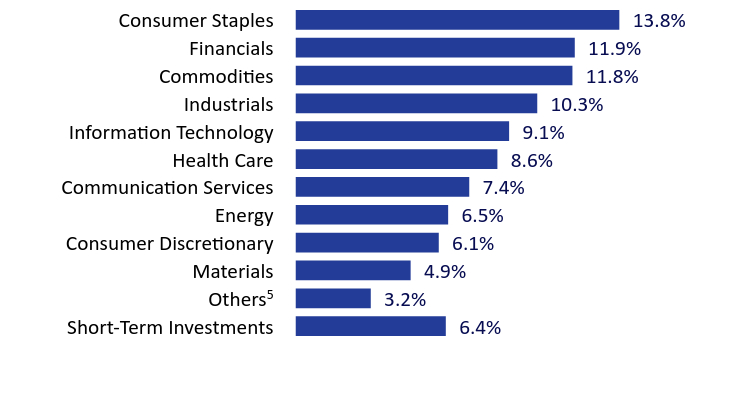

Asset Allocation by Sector

Based on total investments in the portfolio

| Value | Value |

|---|

| Short-Term Investments | 6.4% |

OthersFootnote Reference5 | 3.2% |

| Materials | 4.9% |

| Consumer Discretionary | 6.1% |

| Energy | 6.5% |

| Communication Services | 7.4% |

| Health Care | 8.6% |

| Information Technology | 9.1% |

| Industrials | 10.3% |

| Commodities | 11.8% |

| Financials | 11.9% |

| Consumer Staples | 13.8% |

Asset Allocation by CountryFootnote Reference6

Based on total investments in the portfolio

| United States | 55.9% |

| United Kingdom | 7.2% |

| Japan | 6.3% |

| Canada | 5.0% |

| France | 3.2% |

| Switzerland | 2.9% |

| South Korea | 2.5% |

| China | 2.2% |

| Mexico | 1.4% |

| Hong Kong | 1.2% |

OthersFootnote Reference7 | 5.8% |

| Short-Term Investments | 6.4% |

| Footnote | Description |

Footnote1 | Less than 0.05% |

Footnote2 | Includes short-term commercial paper (1.7% of total investments) that settles in 90 days or less; long-term commercial paper (4.6% of total investments) that settles in 91 days or more; and other short-term investments (0.1% of total investments), such as U.S. treasury bills or money market funds. |

Footnote3 | Holdings in cash, short-term commercial paper, long-term commercial paper and other short-term cash equivalents have been excluded. |

Footnote4 | The Fund invests in gold and precious metals through investment in a wholly owned subsidiary of the Fund organized under the laws of the Cayman Islands (the “Subsidiary”). Gold bullion and commodities include the Fund’s investment in the Subsidiary. |

Footnote5 | Includes additional sectors outside the top 10 listed above. |

Footnote6 | Country allocations reflect country of risk not currency of issue. Bonds of non-U.S. issuers may be U.S. dollar denominated. |

Footnote7 | Includes additional countries outside the top 10 listed above. |

October 31, 2024

Annual Shareholder Report

For more information, please scan the QR code to navigate to tailored shareholder reports and financial statements and other Information. If you wish to view additional information about the Fund, including but not limited to financial statements, holdings, or the Fund's prospectus, please visit http://www.firsteagle.com.

Important Notice Regarding Delivery of Shareholder Materials

Unless we are notified otherwise, we send one copy of these materials to shareholders with the same residential address (provided they have the same last name or are reasonably believed to be family members) for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800.334.2143 and we will send separate copies of these materials within 30 days after receiving your request.

October 31, 2024

Annual Shareholder Report

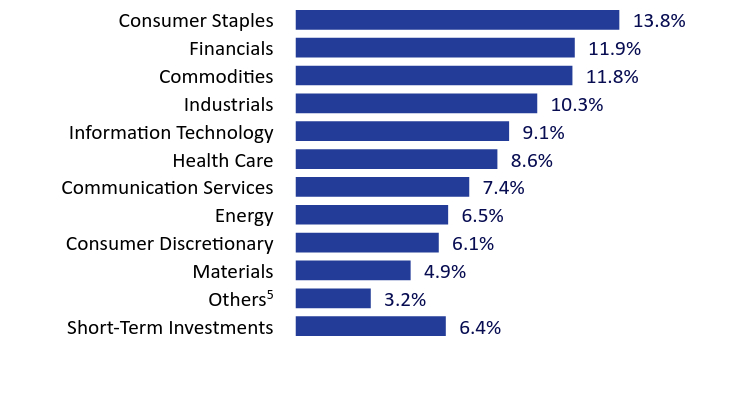

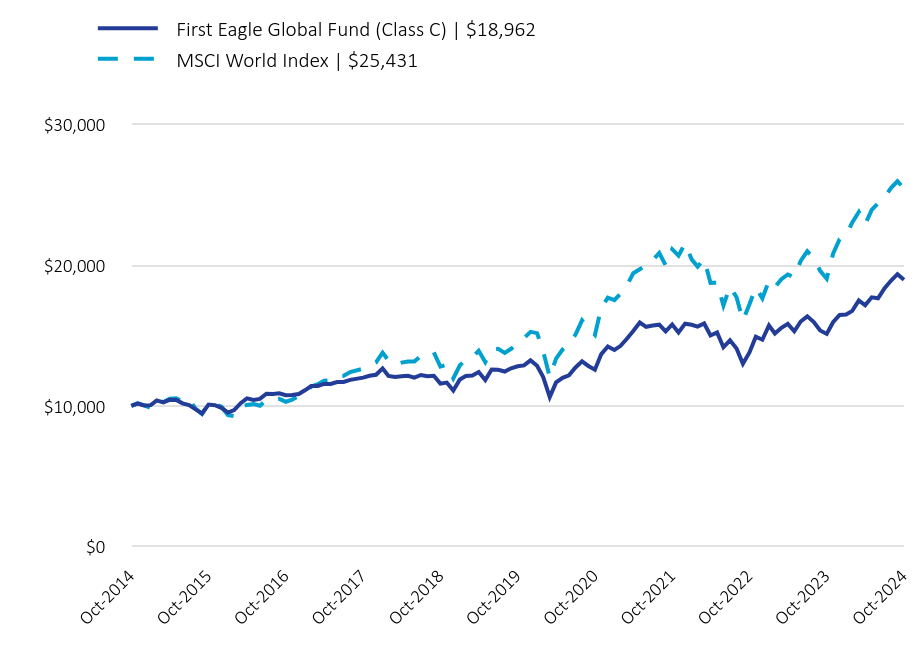

This Annual Shareholder Report contains important information about the Class C shares of the Fund for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at https://www.firsteagle.com/first-eagle-fund-shareholder-reports. You can also request this information by contacting us at 800.334.2143.

What Were the Fund's Costs for the Year?

Based on a Hypothetical $10,000 Investment

| Class Name | Cost of a $10,000 Investment | Cost Paid as a Percentage of a $10,000 Investment |

|---|

| Class C | $209 | 1.86% |

How Did the Fund Perform Last Year?

The NAV of First Eagle Global Fund Class C Shares1 increased 25.47% in the 12-month period ended October 31, 2024. The MSCI World Index increased 33.68% for the same period.

• Our equity holdings contributed to performance, while gold and gold-related equities also were a contributor.

• All geographic regions contributed to performance. North America and developed Europe were the leading contributors by region, while developed Asia excluding Japan and emerging markets were the worst performing regions.

• Materials, financials and information technology were the largest contributors among equity sectors. Energy was the only detractor, while utilities and real estate were the next worst performing sectors.

• Gold bullion was the leading contributor to performance. Schlumberger NV was the largest detractor.

1 Reflects performance for Class C shares without the effect of sales charges and assumes all distributions have been reinvested; if sales charges were included, values would be lower.

Total Return Based on a $10,000 Investment

| First Eagle Global Fund (Class C) | $18,962 | MSCI World Index | $25,431 |

|---|

| Oct-2014 | 10,000 | 10,000 |

| Nov-2014 | 10,164 | 10,200.410000 |

| Dec-2014 | 10,038.980000 | 10,035.930000 |

| Jan-2015 | 10,057.050000 | 9,854.080000 |

| Feb-2015 | 10,391.950000 | 10,431.420000 |

| Mar-2015 | 10,247.500000 | 10,268.130000 |

| Apr-2015 | 10,435.030000 | 10,508.940000 |

| May-2015 | 10,415.210000 | 10,545.140000 |

| Jun-2015 | 10,180.870000 | 10,299.940000 |

| Jul-2015 | 10,063.790000 | 10,484.830000 |

| Aug-2015 | 9,758.850000 | 9,791 |

| Sep-2015 | 9,465.110000 | 9,429.860000 |

| Oct-2015 | 10,102.110000 | 10,177.120000 |

| Nov-2015 | 10,056.650000 | 10,126.490000 |

| Dec-2015 | 9,869.600000 | 9,948.490000 |

| Jan-2016 | 9,528.110000 | 9,353.330000 |

| Feb-2016 | 9,706.290000 | 9,283.720000 |

| Mar-2016 | 10,196.450000 | 9,913.700000 |

| Apr-2016 | 10,537.020000 | 10,070.570000 |

| May-2016 | 10,431.650000 | 10,127.130000 |

| Jun-2016 | 10,502.580000 | 10,013.650000 |

| Jul-2016 | 10,870.170000 | 10,436.720000 |

| Aug-2016 | 10,856.040000 | 10,445.390000 |

| Sep-2016 | 10,894.040000 | 10,500.870000 |

| Oct-2016 | 10,765.490000 | 10,297.650000 |

| Nov-2016 | 10,771.950000 | 10,445.720000 |

| Dec-2016 | 10,841.960000 | 10,695.670000 |

| Jan-2017 | 11,127.110000 | 10,953.810000 |

| Feb-2017 | 11,408.110000 | 11,377.630000 |

| Mar-2017 | 11,422.940000 | 11,546.090000 |

| Apr-2017 | 11,563.440000 | 11,790.340000 |

| May-2017 | 11,561.130000 | 11,835.710000 |

| Jun-2017 | 11,694.080000 | 12,118.960000 |

| Jul-2017 | 11,704.610000 | 12,136.030000 |

| Aug-2017 | 11,853.250000 | 12,408.410000 |

| Oct-2017 | 12,008.530000 | 12,642.910000 |

| Nov-2017 | 12,140.630000 | 12,916.860000 |

| Dec-2017 | 12,213.470000 | 13,091.540000 |

| Jan-2018 | 12,662.930000 | 13,782.770000 |

| Feb-2018 | 12,132.350000 | 13,211.790000 |

| Mar-2018 | 12,051.060000 | 12,923.820000 |

| Apr-2018 | 12,104.090000 | 13,072.330000 |

| May-2018 | 12,136.770000 | 13,154.240000 |

| Jun-2018 | 12,010.550000 | 13,147.970000 |

| Jul-2018 | 12,196.710000 | 13,558.630000 |

| Aug-2018 | 12,108.890000 | 13,726.380000 |

| Sep-2018 | 12,145.220000 | 13,802.820000 |

| Oct-2018 | 11,584.110000 | 12,789.300000 |

| Nov-2018 | 11,657.090000 | 12,934.590000 |

| Dec-2018 | 11,092.890000 | 11,951.070000 |

| Jan-2019 | 11,883.810000 | 12,880.930000 |

| Feb-2019 | 12,121.490000 | 13,268.260000 |

| Mar-2019 | 12,165.120000 | 13,442.530000 |

| Apr-2019 | 12,407.210000 | 13,919.190000 |

| May-2019 | 11,842.680000 | 13,116.040000 |

| Jun-2019 | 12,584.030000 | 13,980.320000 |

| Jul-2019 | 12,561.380000 | 14,049.570000 |

| Aug-2019 | 12,443.300000 | 13,762.200000 |

| Sep-2019 | 12,673.510000 | 14,055.070000 |

| Oct-2019 | 12,811.650000 | 14,412.730000 |

| Nov-2019 | 12,874.420000 | 14,814.130000 |

| Dec-2019 | 13,231.050000 | 15,257.940000 |

| Jan-2020 | 12,856.610000 | 15,165.070000 |

| Feb-2020 | 12,042.780000 | 13,883.240000 |

| Mar-2020 | 10,632.570000 | 12,045.890000 |

| Apr-2020 | 11,669.250000 | 13,361.830000 |

| May-2020 | 11,995.990000 | 14,007.320000 |

| Jun-2020 | 12,173.530000 | 14,377.830000 |

| Jul-2020 | 12,734.730000 | 15,065.680000 |

| Aug-2020 | 13,162.620000 | 16,072.290000 |

| Sep-2020 | 12,836.180000 | 15,517.810000 |

| Oct-2020 | 12,573.040000 | 15,041.800000 |

| Nov-2020 | 13,678.210000 | 16,965.070000 |

| Dec-2020 | 14,218.500000 | 17,684.330000 |

| Jan-2021 | 13,968.260000 | 17,508.570000 |

| Feb-2021 | 14,247.620000 | 17,957.220000 |

| Mar-2021 | 14,767.660000 | 18,554.690000 |

| Apr-2021 | 15,314.060000 | 19,418.230000 |

| May-2021 | 15,917.440000 | 19,697.960000 |

| Jun-2021 | 15,616.600000 | 19,991.550000 |

| Jul-2021 | 15,705.610000 | 20,349.660000 |

| Aug-2021 | 15,768.430000 | 20,856.130000 |

| Sep-2021 | 15,287.500000 | 19,990.170000 |

| Oct-2021 | 15,782.810000 | 21,122.420000 |

| Nov-2021 | 15,209.900000 | 20,659.570000 |

| Dec-2021 | 15,838.060000 | 21,542.560000 |

| Jan-2022 | 15,762.040000 | 20,402.720000 |

| Feb-2022 | 15,634.370000 | 19,886.710000 |

| Mar-2022 | 15,853.250000 | 20,432.470000 |

| Apr-2022 | 15,001.930000 | 18,735.080000 |

| May-2022 | 15,210.460000 | 18,749.270000 |

| Jun-2022 | 14,162.460000 | 17,125.170000 |

| Jul-2022 | 14,655.310000 | 18,484.840000 |

| Aug-2022 | 14,080.820000 | 17,712.030000 |

| Sep-2022 | 12,998.010000 | 16,065.520000 |

| Oct-2022 | 13,798.680000 | 17,219.240000 |

| Nov-2022 | 14,915 | 18,416.500000 |

| Dec-2022 | 14,700.220000 | 17,634.400000 |

| Jan-2023 | 15,714.540000 | 18,882.140000 |

| Feb-2023 | 15,142.530000 | 18,428.240000 |

| Mar-2023 | 15,545.320000 | 18,997.670000 |

| Apr-2023 | 15,828.240000 | 19,330.690000 |

| May-2023 | 15,301.160000 | 19,137.700000 |

| Jun-2023 | 15,992.780000 | 20,295.110000 |

| Jul-2023 | 16,359.010000 | 20,976.880000 |

| Aug-2023 | 15,953.310000 | 20,475.830000 |

| Sep-2023 | 15,356.650000 | 19,592.540000 |

| Oct-2023 | 15,112.480000 | 19,024.040000 |

| Nov-2023 | 15,942.160000 | 20,807.590000 |

| Dec-2023 | 16,455.500000 | 21,829.120000 |

| Jan-2024 | 16,488.410000 | 22,091.080000 |

| Feb-2024 | 16,747.270000 | 23,027.690000 |

| Mar-2024 | 17,489.180000 | 23,767.680000 |

| Apr-2024 | 17,142.890000 | 22,884.840000 |

| May-2024 | 17,710.320000 | 23,906.690000 |

| Jun-2024 | 17,644.790000 | 24,393.140000 |

| Jul-2024 | 18,359.410000 | 24,823.010000 |

| Aug-2024 | 18,899.180000 | 25,479.090000 |

| Sep-2024 | 19,354.650000 | 25,945.710000 |

| Oct-2024 | 18,962 | 25,431 |

The above chart represents historical performance of a hypothetical $10,000 investment over the past 10 years. The results of this chart do not predict the results of future time periods and does not guarantee the same results.

| Class/Index Name | 1 Year | 5 Years | 10 Years |

|---|

| Class C - without sales charge | 25.47% | 8.16% | 6.60% |

| Class C - with sales charge | 24.47% | 8.16% | 6.60% |

| MSCI World Index | 33.68% | 12.03% | 9.78% |

The Fund's past performance is not a good predictor of the Fund's future performance.The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Call us at 800.334.2143 or visit https://www.firsteagle.com if you have questions about current performance.

- Net Assets$56,336,120,291

- Number of Portfolio Holdings197

- Portfolio Turnover Rate9.51%

- Net Investment Advisory Fees (net of waivers and reimbursements)$393,022,590

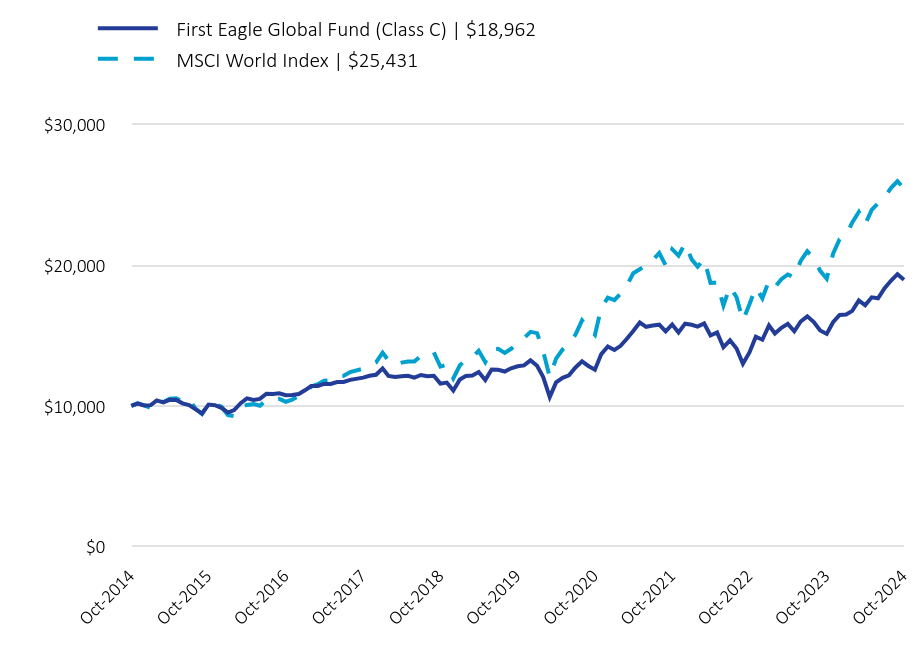

Asset Allocation by Asset Class

Based on total investments in the portfolio

| Value | Value |

|---|

| Common Stocks | 81.8% |

| Commodities | 11.8% |

| Corporate Bonds | 0.0%Footnote Reference1 |

| Short-Term Investments | 6.4%Footnote Reference2 |

Top 10 HoldingsFootnote Reference3

Based on total net assets of the portfolio

Gold bullion (Precious Metal)Footnote Reference4 | 11.8% |

| Oracle Corp. (Software, United States) | 2.9% |

| Meta Platforms, Inc., Class A (Interactive Media & Services, United States) | 2.6% |

| HCA Healthcare, Inc. (Health Care Providers & Services, United States) | 2.0% |

| Exxon Mobil Corp. (Oil, Gas & Consumable Fuels, United States) | 2.0% |

| Philip Morris International, Inc. (Tobacco, United States) | 1.9% |

| Comcast Corp., Class A (Media, United States) | 1.7% |

| Willis Towers Watson plc (Insurance, United States) | 1.5% |

| Bank of New York Mellon Corp. (The) (Capital Markets, United States) | 1.5% |

| CH Robinson Worldwide, Inc. (Air Freight & Logistics, United States) | 1.5% |

| Total | 29.4% |

Asset Allocation by Sector

Based on total investments in the portfolio

| Value | Value |

|---|

| Short-Term Investments | 6.4% |

OthersFootnote Reference5 | 3.2% |

| Materials | 4.9% |

| Consumer Discretionary | 6.1% |

| Energy | 6.5% |

| Communication Services | 7.4% |

| Health Care | 8.6% |

| Information Technology | 9.1% |

| Industrials | 10.3% |

| Commodities | 11.8% |

| Financials | 11.9% |

| Consumer Staples | 13.8% |

Asset Allocation by CountryFootnote Reference6

Based on total investments in the portfolio

| United States | 55.9% |

| United Kingdom | 7.2% |

| Japan | 6.3% |

| Canada | 5.0% |

| France | 3.2% |

| Switzerland | 2.9% |

| South Korea | 2.5% |

| China | 2.2% |

| Mexico | 1.4% |

| Hong Kong | 1.2% |

OthersFootnote Reference7 | 5.8% |

| Short-Term Investments | 6.4% |

| Footnote | Description |

Footnote1 | Less than 0.05% |

Footnote2 | Includes short-term commercial paper (1.7% of total investments) that settles in 90 days or less; long-term commercial paper (4.6% of total investments) that settles in 91 days or more; and other short-term investments (0.1% of total investments), such as U.S. treasury bills or money market funds. |

Footnote3 | Holdings in cash, short-term commercial paper, long-term commercial paper and other short-term cash equivalents have been excluded. |

Footnote4 | The Fund invests in gold and precious metals through investment in a wholly owned subsidiary of the Fund organized under the laws of the Cayman Islands (the “Subsidiary”). Gold bullion and commodities include the Fund’s investment in the Subsidiary. |

Footnote5 | Includes additional sectors outside the top 10 listed above. |

Footnote6 | Country allocations reflect country of risk not currency of issue. Bonds of non-U.S. issuers may be U.S. dollar denominated. |

Footnote7 | Includes additional countries outside the top 10 listed above. |

October 31, 2024

Annual Shareholder Report

For more information, please scan the QR code to navigate to tailored shareholder reports and financial statements and other Information. If you wish to view additional information about the Fund, including but not limited to financial statements, holdings, or the Fund's prospectus, please visit http://www.firsteagle.com.

Important Notice Regarding Delivery of Shareholder Materials

Unless we are notified otherwise, we send one copy of these materials to shareholders with the same residential address (provided they have the same last name or are reasonably believed to be family members) for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800.334.2143 and we will send separate copies of these materials within 30 days after receiving your request.

October 31, 2024

Annual Shareholder Report

This Annual Shareholder Report contains important information about the Class I shares of the Fund for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at https://www.firsteagle.com/first-eagle-fund-shareholder-reports. You can also request this information by contacting us at 800.334.2143.

What Were the Fund's Costs for the Year?

Based on a Hypothetical $10,000 Investment

| Class Name | Cost of a $10,000 Investment | Cost Paid as a Percentage of a $10,000 Investment |

|---|

| Class I | $98 | 0.86% |

How Did the Fund Perform Last Year?

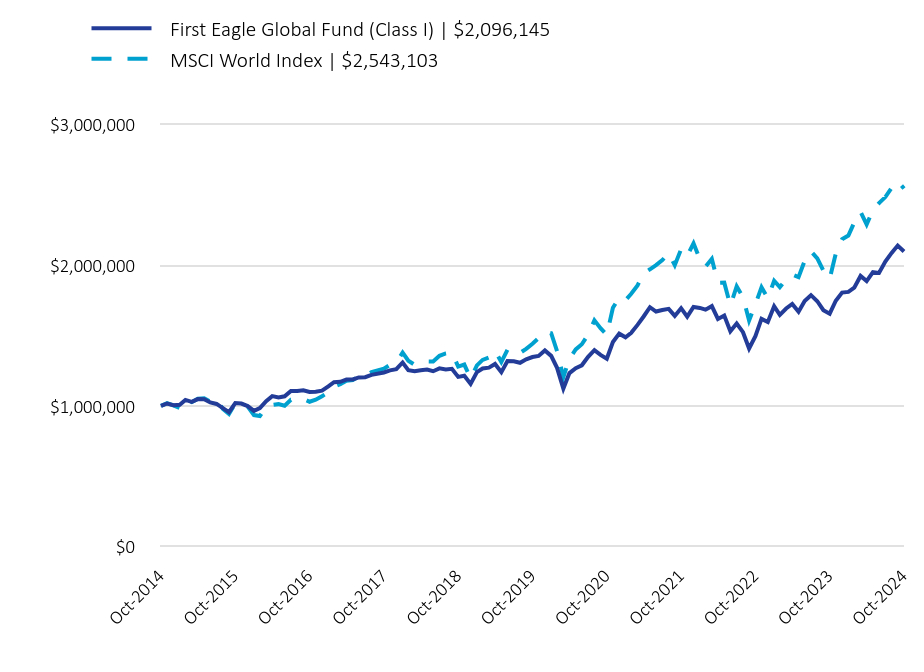

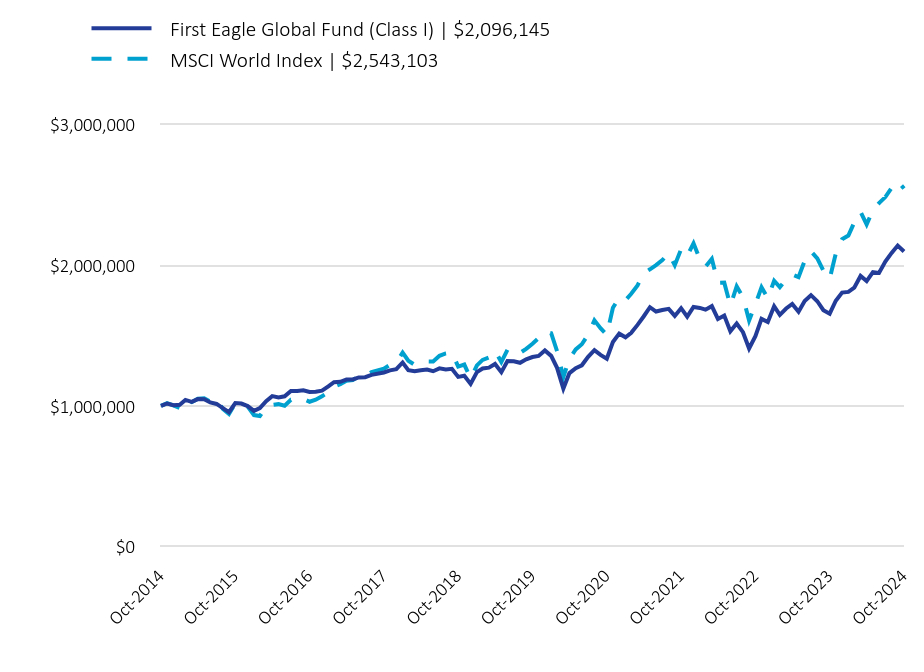

The NAV of First Eagle Global Fund Class I Shares increased 26.70% in the 12-month period ended October 31, 2024. The MSCI World Index increased 33.68% for the same period.

• Our equity holdings contributed to performance, while gold and gold-related equities also were a contributor.

• All geographic regions contributed to performance. North America and developed Europe were the leading contributors by region, while developed Asia excluding Japan and emerging markets were the worst performing regions.

• Materials, financials and information technology were the largest contributors among equity sectors. Energy was the only detractor, while utilities and real estate were the next worst performing sectors.

• Gold bullion was the leading contributor to performance. Schlumberger NV was the largest detractor.

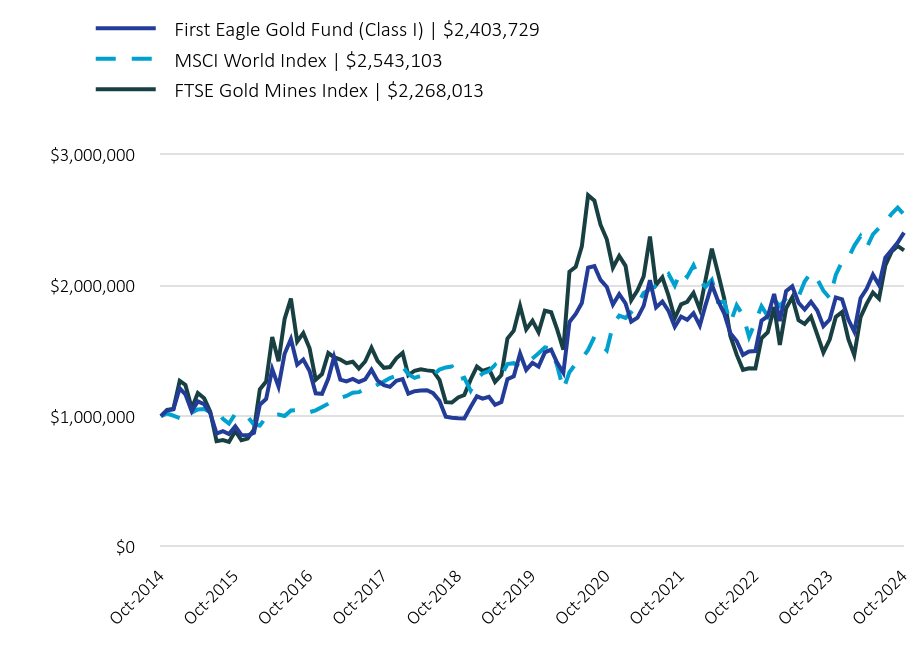

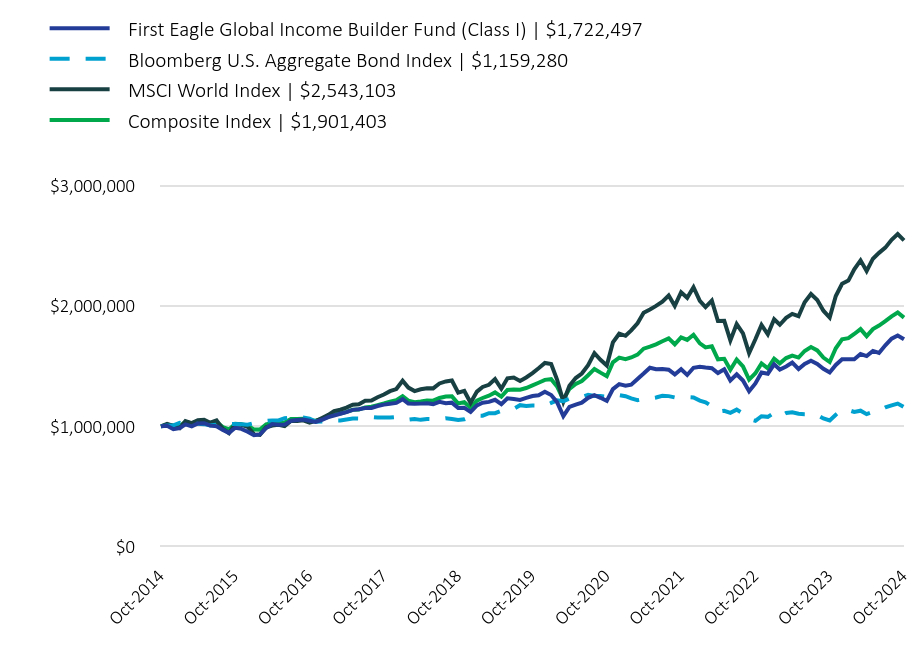

Total Return Based on a $1,000,000 Investment

| First Eagle Global Fund (Class I) | $2,096,145 | MSCI World Index | $2,543,103 |

|---|

| Oct-2014 | 1,000,000 | 1,000,000 |

| Nov-2014 | 1,017,200 | 1,020,040.930000 |

| Dec-2014 | 1,005,502.200000 | 1,003,592.650000 |

| Jan-2015 | 1,008,217.060000 | 985,407.900000 |

| Feb-2015 | 1,042,597.260000 | 1,043,141.600000 |

| Mar-2015 | 1,029,043.490000 | 1,026,812.730000 |

| Apr-2015 | 1,048,698.220000 | 1,050,894.140000 |

| May-2015 | 1,047,544.660000 | 1,054,514.170000 |

| Jun-2015 | 1,025,022.450000 | 1,029,994.290000 |

| Jul-2015 | 1,014,157.210000 | 1,048,482.690000 |

| Aug-2015 | 984,340.990000 | 979,099.770000 |

| Sep-2015 | 955,499.800000 | 942,986.340000 |

| Oct-2015 | 1,020,664.880000 | 1,017,712.460000 |

| Nov-2015 | 1,016,888.420000 | 1,012,648.690000 |

| Dec-2015 | 998,889.500000 | 994,848.970000 |

| Jan-2016 | 965,027.140000 | 935,332.940000 |

| Feb-2016 | 984,038.180000 | 928,371.650000 |

| Mar-2016 | 1,034,420.930000 | 991,370.080000 |

| Apr-2016 | 1,069,901.570000 | 1,007,056.990000 |

| May-2016 | 1,060,272.460000 | 1,012,713.250000 |

| Jun-2016 | 1,068,436.550000 | 1,001,365.380000 |

| Jul-2016 | 1,106,793.430000 | 1,043,671.510000 |

| Aug-2016 | 1,106,350.710000 | 1,044,538.900000 |

| Sep-2016 | 1,110,997.380000 | 1,050,087.410000 |

| Oct-2016 | 1,098,776.410000 | 1,029,765.180000 |

| Nov-2016 | 1,100,314.700000 | 1,044,572.200000 |

| Dec-2016 | 1,108,236.960000 | 1,069,567.120000 |

| Jan-2017 | 1,138,491.830000 | 1,095,381.290000 |

| Feb-2017 | 1,168,972.990000 | 1,137,762.520000 |

| Mar-2017 | 1,171,544.730000 | 1,154,609.230000 |

| Apr-2017 | 1,187,009.120000 | 1,179,034.400000 |

| May-2017 | 1,187,602.630000 | 1,183,570.740000 |

| Jun-2017 | 1,202,210.140000 | 1,211,896.470000 |

| Jul-2017 | 1,204,253.900000 | 1,213,603.030000 |

| Aug-2017 | 1,220,752.180000 | 1,240,841.420000 |

| Oct-2017 | 1,237,354.410000 | 1,264,291.420000 |

| Nov-2017 | 1,252,202.660000 | 1,291,685.500000 |

| Dec-2017 | 1,260,717.640000 | 1,309,153.590000 |

| Jan-2018 | 1,308,372.760000 | 1,378,277.170000 |

| Feb-2018 | 1,254,206.130000 | 1,321,178.620000 |

| Mar-2018 | 1,247,182.580000 | 1,292,381.630000 |

| Apr-2018 | 1,253,543.210000 | 1,307,232.610000 |

| May-2018 | 1,258,055.960000 | 1,315,424.290000 |

| Jun-2018 | 1,246,230.240000 | 1,314,796.820000 |

| Jul-2018 | 1,266,419.170000 | 1,355,862.580000 |

| Aug-2018 | 1,258,314.080000 | 1,372,638.460000 |

| Sep-2018 | 1,263,221.510000 | 1,380,281.500000 |

| Oct-2018 | 1,205,997.570000 | 1,278,930.350000 |

| Nov-2018 | 1,214,439.560000 | 1,293,458.880000 |

| Dec-2018 | 1,156,632.230000 | 1,195,106.870000 |

| Jan-2019 | 1,240,141.080000 | 1,288,093.100000 |

| Feb-2019 | 1,265,936.020000 | 1,326,825.840000 |

| Mar-2019 | 1,271,506.140000 | 1,344,252.990000 |

| Apr-2019 | 1,297,826.310000 | 1,391,919.280000 |

| May-2019 | 1,240,073.040000 | 1,311,604.340000 |

| Jun-2019 | 1,318,693.670000 | 1,398,032.370000 |

| Jul-2019 | 1,317,243.110000 | 1,404,957.310000 |

| Aug-2019 | 1,306,178.270000 | 1,376,219.560000 |

| Sep-2019 | 1,331,256.890000 | 1,405,506.850000 |

| Oct-2019 | 1,347,098.850000 | 1,441,273.460000 |

| Nov-2019 | 1,354,777.310000 | 1,481,413.160000 |

| Dec-2019 | 1,393,388.460000 | 1,525,793.690000 |

| Jan-2020 | 1,355,348.960000 | 1,516,506.700000 |

| Feb-2020 | 1,270,368.580000 | 1,388,323.600000 |

| Mar-2020 | 1,122,624.710000 | 1,204,589.060000 |

| Apr-2020 | 1,233,203.250000 | 1,336,183.490000 |

| May-2020 | 1,268,596.180000 | 1,400,732.060000 |

| Jun-2020 | 1,288,513.140000 | 1,437,782.890000 |

| Jul-2020 | 1,349,073.260000 | 1,506,568.380000 |

| Aug-2020 | 1,395,751.190000 | 1,607,228.790000 |

| Sep-2020 | 1,361,974.010000 | 1,551,780.800000 |

| Oct-2020 | 1,335,415.520000 | 1,504,179.890000 |

| Nov-2020 | 1,454,133.960000 | 1,696,506.620000 |

| Dec-2020 | 1,513,026.390000 | 1,768,432.920000 |

| Jan-2021 | 1,487,456.240000 | 1,750,857.040000 |

| Feb-2021 | 1,518,692.820000 | 1,795,721.650000 |

| Mar-2021 | 1,575,188.190000 | 1,855,469.100000 |

| Apr-2021 | 1,634,887.830000 | 1,941,822.840000 |

| May-2021 | 1,700,773.810000 | 1,969,795.650000 |

| Jun-2021 | 1,669,989.800000 | 1,999,155.130000 |

| Jul-2021 | 1,680,844.730000 | 2,034,965.660000 |

| Aug-2021 | 1,689,248.960000 | 2,085,612.620000 |

| Sep-2021 | 1,638,909.340000 | 1,999,016.870000 |

| Oct-2021 | 1,693,648.910000 | 2,112,242.200000 |

| Nov-2021 | 1,633,355.010000 | 2,065,956.720000 |

| Dec-2021 | 1,702,445.930000 | 2,154,256.090000 |

| Jan-2022 | 1,695,636.140000 | 2,040,272.450000 |

| Feb-2022 | 1,683,258 | 1,988,671.480000 |

| Mar-2022 | 1,708,170.220000 | 2,043,247.310000 |

| Apr-2022 | 1,617,637.200000 | 1,873,507.930000 |

| May-2022 | 1,641,578.230000 | 1,874,926.840000 |

| Jun-2022 | 1,529,950.910000 | 1,712,516.930000 |

| Jul-2022 | 1,584,570.150000 | 1,848,484.450000 |

| Aug-2022 | 1,523,405.750000 | 1,771,203.380000 |

| Sep-2022 | 1,407,626.910000 | 1,606,552.490000 |

| Oct-2022 | 1,495,603.590000 | 1,721,923.720000 |

| Nov-2022 | 1,617,943.960000 | 1,841,649.810000 |

| Dec-2022 | 1,595,939.930000 | 1,763,439.920000 |

| Jan-2023 | 1,707,655.720000 | 1,888,213.980000 |

| Feb-2023 | 1,646,521.650000 | 1,842,824.130000 |

| Mar-2023 | 1,691,636.340000 | 1,899,766.830000 |

| Apr-2023 | 1,723,946.590000 | 1,933,068.960000 |

| May-2023 | 1,668,090.720000 | 1,913,770.320000 |

| Jun-2023 | 1,744,822.900000 | 2,029,510.920000 |

| Jul-2023 | 1,786,175.200000 | 2,097,687.790000 |

| Aug-2023 | 1,743,485.610000 | 2,047,583 |

| Sep-2023 | 1,679,674.040000 | 1,959,253.580000 |

| Oct-2023 | 1,654,478.930000 | 1,902,404.200000 |

| Nov-2023 | 1,746,467.960000 | 2,080,758.540000 |

| Dec-2023 | 1,804,450.690000 | 2,182,911.810000 |

| Jan-2024 | 1,809,503.160000 | 2,209,107.800000 |

| Feb-2024 | 1,839,359.960000 | 2,302,768.820000 |

| Mar-2024 | 1,922,499.030000 | 2,376,767.870000 |

| Apr-2024 | 1,886,163.800000 | 2,288,483.530000 |

| May-2024 | 1,950,104.750000 | 2,390,668.870000 |

| Jun-2024 | 1,944,449.440000 | 2,439,313.960000 |

| Jul-2024 | 2,024,560.760000 | 2,482,300.590000 |

| Aug-2024 | 2,086,309.870000 | 2,547,909.010000 |

| Sep-2024 | 2,138,050.350000 | 2,594,571.250000 |

| Oct-2024 | 2,096,145 | 2,543,103 |

The above chart represents historical performance of a hypothetical $1,000,000 investment over the past 10 years. The results of this chart do not predict the results of future time periods and does not guarantee the same results.

| Class/Index Name | 1 Year | 5 Years | 10 Years |

|---|

| Class I | 26.70% | 9.25% | 7.69% |

| MSCI World Index | 33.68% | 12.03% | 9.78% |

The Fund's past performance is not a good predictor of the Fund's future performance.The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Call us at 800.334.2143 or visit https://www.firsteagle.com if you have questions about current performance.

- Net Assets$56,336,120,291

- Number of Portfolio Holdings197

- Portfolio Turnover Rate9.51%

- Net Investment Advisory Fees (net of waivers and reimbursements)$393,022,590

Asset Allocation by Asset Class

Based on total investments in the portfolio

| Value | Value |

|---|

| Common Stocks | 81.8% |

| Commodities | 11.8% |

| Corporate Bonds | 0.0%Footnote Reference1 |

| Short-Term Investments | 6.4%Footnote Reference2 |

Top 10 HoldingsFootnote Reference3

Based on total net assets of the portfolio

Gold bullion (Precious Metal)Footnote Reference4 | 11.8% |

| Oracle Corp. (Software, United States) | 2.9% |

| Meta Platforms, Inc., Class A (Interactive Media & Services, United States) | 2.6% |

| HCA Healthcare, Inc. (Health Care Providers & Services, United States) | 2.0% |

| Exxon Mobil Corp. (Oil, Gas & Consumable Fuels, United States) | 2.0% |

| Philip Morris International, Inc. (Tobacco, United States) | 1.9% |

| Comcast Corp., Class A (Media, United States) | 1.7% |

| Willis Towers Watson plc (Insurance, United States) | 1.5% |

| Bank of New York Mellon Corp. (The) (Capital Markets, United States) | 1.5% |

| CH Robinson Worldwide, Inc. (Air Freight & Logistics, United States) | 1.5% |

| Total | 29.4% |

Asset Allocation by Sector

Based on total investments in the portfolio

| Value | Value |

|---|

| Short-Term Investments | 6.4% |

OthersFootnote Reference5 | 3.2% |

| Materials | 4.9% |

| Consumer Discretionary | 6.1% |

| Energy | 6.5% |

| Communication Services | 7.4% |

| Health Care | 8.6% |

| Information Technology | 9.1% |

| Industrials | 10.3% |

| Commodities | 11.8% |

| Financials | 11.9% |

| Consumer Staples | 13.8% |

Asset Allocation by CountryFootnote Reference6

Based on total investments in the portfolio

| United States | 55.9% |

| United Kingdom | 7.2% |

| Japan | 6.3% |

| Canada | 5.0% |

| France | 3.2% |

| Switzerland | 2.9% |

| South Korea | 2.5% |

| China | 2.2% |

| Mexico | 1.4% |

| Hong Kong | 1.2% |

OthersFootnote Reference7 | 5.8% |

| Short-Term Investments | 6.4% |

| Footnote | Description |

Footnote1 | Less than 0.05% |

Footnote2 | Includes short-term commercial paper (1.7% of total investments) that settles in 90 days or less; long-term commercial paper (4.6% of total investments) that settles in 91 days or more; and other short-term investments (0.1% of total investments), such as U.S. treasury bills or money market funds. |

Footnote3 | Holdings in cash, short-term commercial paper, long-term commercial paper and other short-term cash equivalents have been excluded. |

Footnote4 | The Fund invests in gold and precious metals through investment in a wholly owned subsidiary of the Fund organized under the laws of the Cayman Islands (the “Subsidiary”). Gold bullion and commodities include the Fund’s investment in the Subsidiary. |

Footnote5 | Includes additional sectors outside the top 10 listed above. |

Footnote6 | Country allocations reflect country of risk not currency of issue. Bonds of non-U.S. issuers may be U.S. dollar denominated. |

Footnote7 | Includes additional countries outside the top 10 listed above. |

October 31, 2024

Annual Shareholder Report

For more information, please scan the QR code to navigate to tailored shareholder reports and financial statements and other Information. If you wish to view additional information about the Fund, including but not limited to financial statements, holdings, or the Fund's prospectus, please visit http://www.firsteagle.com.

Important Notice Regarding Delivery of Shareholder Materials

Unless we are notified otherwise, we send one copy of these materials to shareholders with the same residential address (provided they have the same last name or are reasonably believed to be family members) for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800.334.2143 and we will send separate copies of these materials within 30 days after receiving your request.

October 31, 2024

Annual Shareholder Report

This Annual Shareholder Report contains important information about the Class R6 shares of the Fund for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at https://www.firsteagle.com/first-eagle-fund-shareholder-reports. You can also request this information by contacting us at 800.334.2143.

What Were the Fund's Costs for the Year?

Based on a Hypothetical $10,000 Investment

| Class Name | Cost of a $10,000 Investment | Cost Paid as a Percentage of a $10,000 Investment |

|---|

| Class R6 | $89 | 0.78% |

How Did the Fund Perform Last Year?

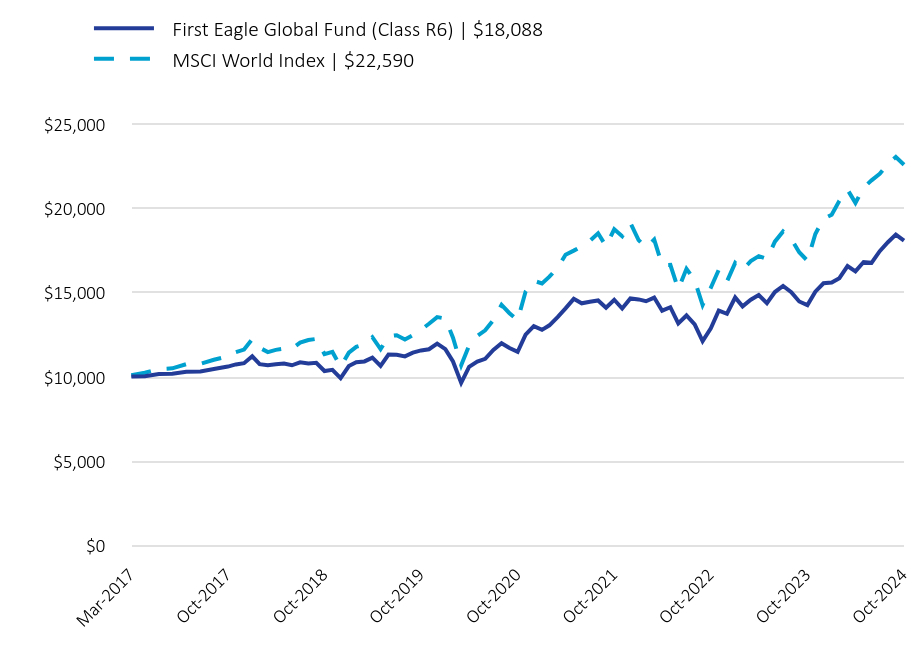

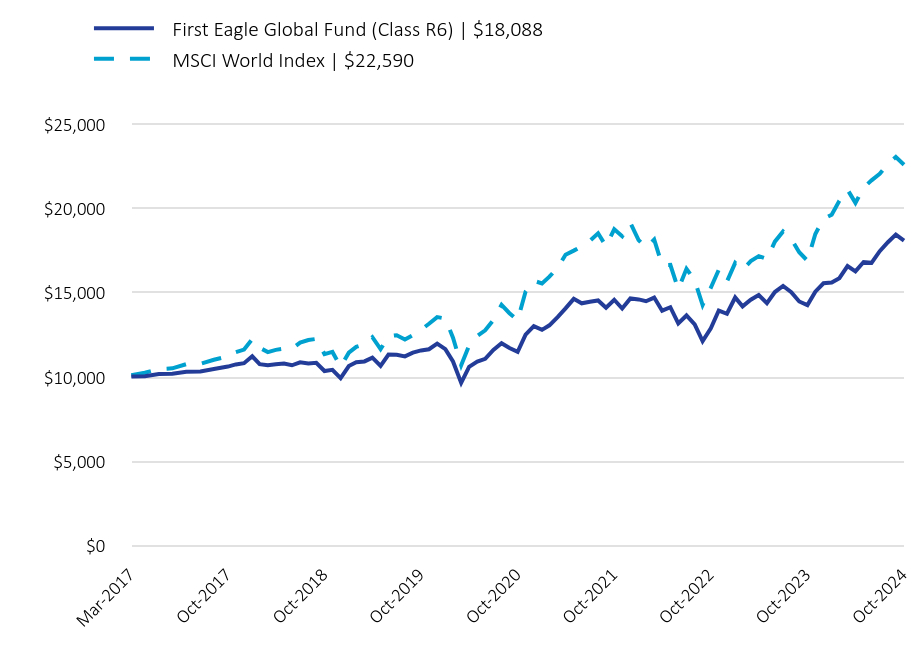

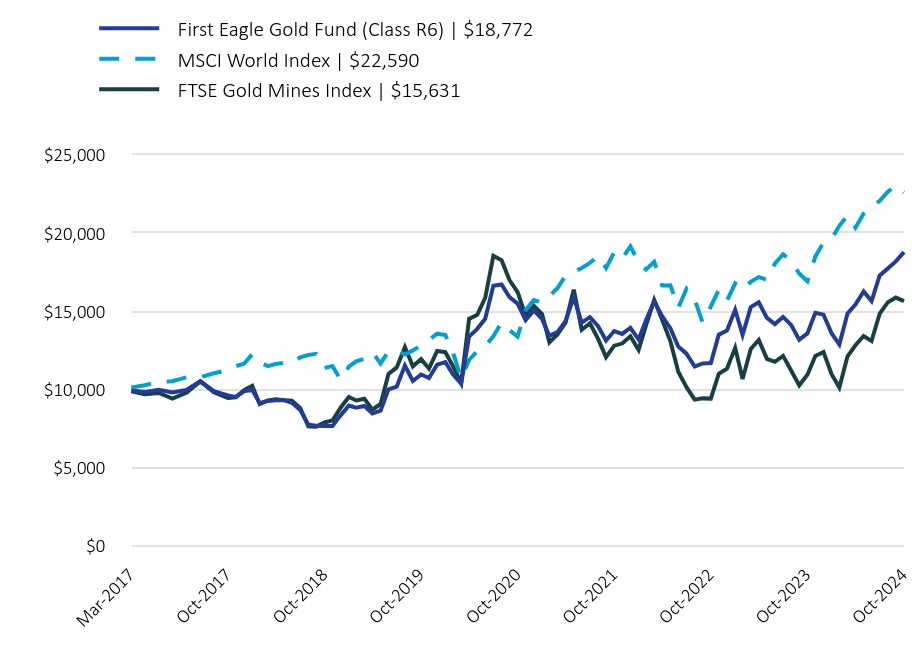

The NAV of First Eagle Global Fund Class R6 Shares increased 26.82% in the 12-month period ended October 31, 2024. The MSCI World Index increased 33.68% for the same period.

• Our equity holdings contributed to performance, while gold and gold-related equities also were a contributor.

• All geographic regions contributed to performance. North America and developed Europe were the leading contributors by region, while developed Asia excluding Japan and emerging markets were the worst performing regions.

• Materials, financials and information technology were the largest contributors among equity sectors. Energy was the only detractor, while utilities and real estate were the next worst performing sectors.

• Gold bullion was the leading contributor to performance. Schlumberger NV was the largest detractor.

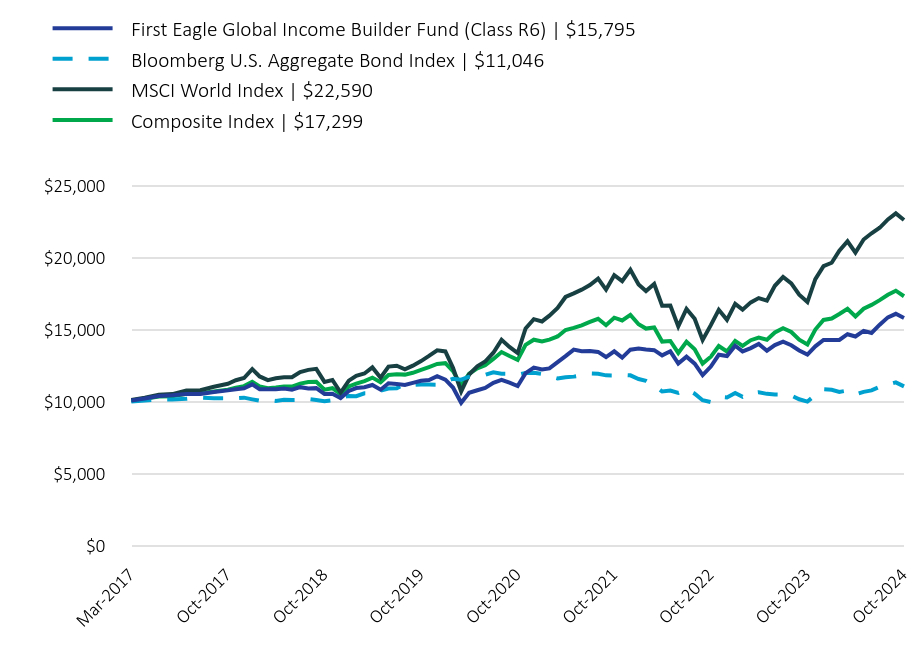

Total Return Based on a $10,000 Investment

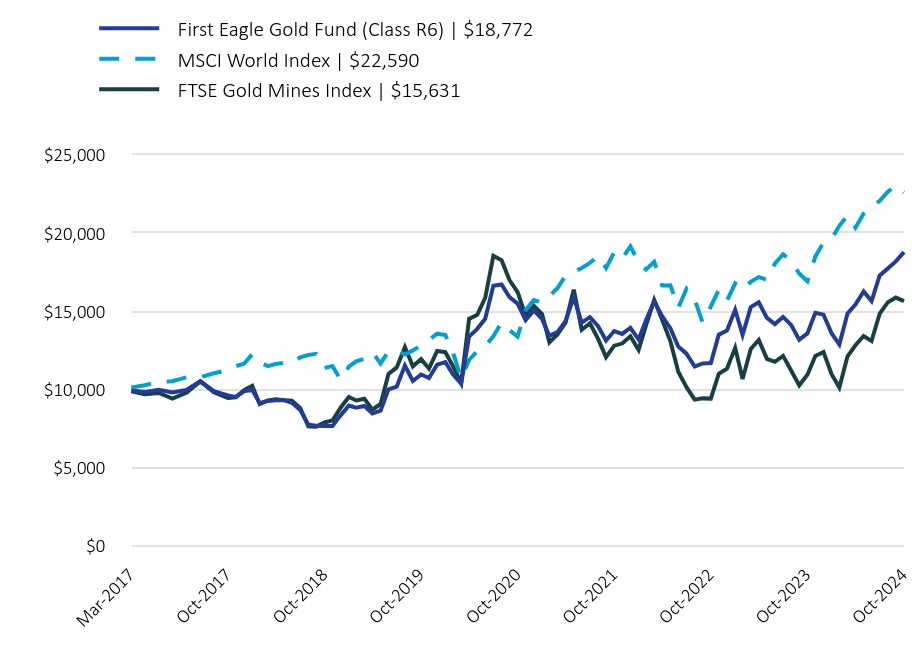

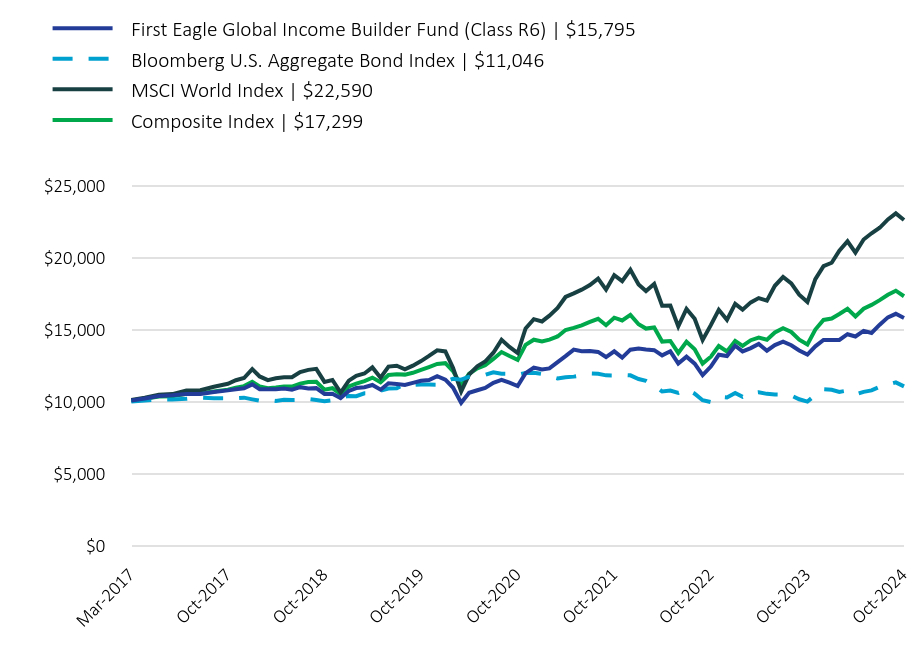

| First Eagle Global Fund (Class R6) | $18,088 | MSCI World Index | $22,590 |

|---|

| Mar-2017 | 10,027.910000 | 10,106.520000 |

| Apr-2017 | 10,048.840000 | 10,256.170000 |

| May-2017 | 10,183.490000 | 10,473.130000 |

| Jun-2017 | 10,190.620000 | 10,513.420000 |

| Jul-2017 | 10,313.930000 | 10,765.040000 |

| Aug-2017 | 10,333.530000 | 10,780.200000 |

| Sep-2017 | 10,474.060000 | 11,022.150000 |

| Oct-2017 | 10,618.600000 | 11,230.450000 |

| Nov-2017 | 10,748.150000 | 11,473.790000 |

| Dec-2017 | 10,820.160000 | 11,628.950000 |

| Jan-2018 | 11,229.170000 | 12,242.960000 |

| Feb-2018 | 10,765.400000 | 11,735.770000 |

| Mar-2018 | 10,705.120000 | 11,479.970000 |

| Apr-2018 | 10,759.710000 | 11,611.890000 |

| May-2018 | 10,799.520000 | 11,684.650000 |

| Jun-2018 | 10,695.850000 | 11,679.080000 |

| Jul-2018 | 10,871.260000 | 12,043.860000 |

| Aug-2018 | 10,803.860000 | 12,192.880000 |

| Sep-2018 | 10,845.990000 | 12,260.770000 |

| Oct-2018 | 10,355.750000 | 11,360.480000 |

| Nov-2018 | 10,430.310000 | 11,489.540000 |

| Dec-2018 | 9,934.880000 | 10,615.900000 |

| Jan-2019 | 10,652.170000 | 11,441.880000 |

| Feb-2019 | 10,875.870000 | 11,785.930000 |

| Mar-2019 | 10,924.810000 | 11,940.730000 |

| Apr-2019 | 11,150.950000 | 12,364.140000 |

| May-2019 | 10,654.740000 | 11,650.720000 |

| Jun-2019 | 11,331.310000 | 12,418.440000 |

| Jul-2019 | 11,322.250000 | 12,479.960000 |

| Aug-2019 | 11,224.870000 | 12,224.690000 |

| Sep-2019 | 11,442.640000 | 12,484.840000 |

| Oct-2019 | 11,578.800000 | 12,802.550000 |

| Nov-2019 | 11,647.120000 | 13,159.100000 |

| Dec-2019 | 11,980.230000 | 13,553.320000 |

| Jan-2020 | 11,653.170000 | 13,470.830000 |

| Feb-2020 | 10,922.510000 | 12,332.200000 |

| Mar-2020 | 9,653.320000 | 10,700.130000 |

| Apr-2020 | 10,606.100000 | 11,869.050000 |

| May-2020 | 10,910.500000 | 12,442.430000 |

| Jun-2020 | 11,081.790000 | 12,771.540000 |

| Jul-2020 | 11,604.850000 | 13,382.550000 |

| Aug-2020 | 12,006.380000 | 14,276.690000 |

| Sep-2020 | 11,718.230000 | 13,784.160000 |

| Oct-2020 | 11,489.720000 | 13,361.330000 |

| Nov-2020 | 12,510.010000 | 15,069.730000 |

| Dec-2020 | 13,017.910000 | 15,708.640000 |

| Jan-2021 | 12,797.910000 | 15,552.520000 |

| Feb-2021 | 13,066.670000 | 15,951.040000 |

| Mar-2021 | 13,555.360000 | 16,481.760000 |

| Apr-2021 | 14,069.110000 | 17,248.830000 |

| May-2021 | 14,636.090000 | 17,497.300000 |

| Jun-2021 | 14,371.180000 | 17,758.100000 |

| Jul-2021 | 14,468.900000 | 18,076.200000 |

| Aug-2021 | 14,541.250000 | 18,526.080000 |

| Sep-2021 | 14,107.920000 | 17,756.870000 |

| Oct-2021 | 14,581.950000 | 18,762.630000 |

| Nov-2021 | 14,064.290000 | 18,351.480000 |

| Dec-2021 | 14,659.210000 | 19,135.830000 |

| Jan-2022 | 14,602.030000 | 18,123.340000 |

| Feb-2022 | 14,495.440000 | 17,664.970000 |

| Mar-2022 | 14,712.870000 | 18,149.760000 |

| Apr-2022 | 13,933.090000 | 16,642 |

| May-2022 | 14,139.300000 | 16,654.600000 |

| Jun-2022 | 13,179.240000 | 15,211.950000 |

| Jul-2022 | 13,651.060000 | 16,419.720000 |

| Aug-2022 | 13,124.130000 | 15,733.250000 |

| Sep-2022 | 12,128.010000 | 14,270.690000 |

| Oct-2022 | 12,887.220000 | 15,295.510000 |

| Nov-2022 | 13,942.680000 | 16,359.010000 |

| Dec-2022 | 13,751.670000 | 15,664.290000 |

| Jan-2023 | 14,717.030000 | 16,772.630000 |

| Feb-2023 | 14,190.160000 | 16,369.440000 |

| Mar-2023 | 14,581.810000 | 16,875.250000 |

| Apr-2023 | 14,860.330000 | 17,171.070000 |

| May-2023 | 14,378.850000 | 16,999.640000 |

| Jun-2023 | 15,041.720000 | 18,027.740000 |

| Jul-2023 | 15,398.200000 | 18,633.340000 |

| Aug-2023 | 15,031.730000 | 18,188.270000 |

| Sep-2023 | 14,481.570000 | 17,403.660000 |

| Oct-2023 | 14,264.340000 | 16,898.680000 |

| Nov-2023 | 15,058.870000 | 18,482.970000 |

| Dec-2023 | 15,560.330000 | 19,390.370000 |

| Jan-2024 | 15,603.900000 | 19,623.070000 |

| Feb-2024 | 15,861.360000 | 20,455.040000 |

| Mar-2024 | 16,583.050000 | 21,112.360000 |

| Apr-2024 | 16,266.320000 | 20,328.150000 |

| May-2024 | 16,821 | 21,235.840000 |

| Jun-2024 | 16,773.900000 | 21,667.940000 |

| Jul-2024 | 17,464.980000 | 22,049.780000 |

| Aug-2024 | 17,997.660000 | 22,632.570000 |

| Sep-2024 | 18,445.810000 | 23,047.060000 |

| Oct-2024 | 18,088 | 22,590 |

The above chart represents historical performance of a hypothetical $10,000 investment since inception. The results of this chart do not predict the results of future time periods and does not guarantee the same results.

| Class/Index Name | 1 Year | 5 Years | Since Inception (3/1/17) |

|---|

| Class R6 | 26.82% | 9.33% | 8.03% |

| MSCI World Index | 33.68% | 12.03% | 11.03% |

The Fund's past performance is not a good predictor of the Fund's future performance.The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Call us at 800.334.2143 or visit https://www.firsteagle.com if you have questions about current performance.

- Net Assets$56,336,120,291

- Number of Portfolio Holdings197

- Portfolio Turnover Rate9.51%

- Net Investment Advisory Fees (net of waivers and reimbursements)$393,022,590

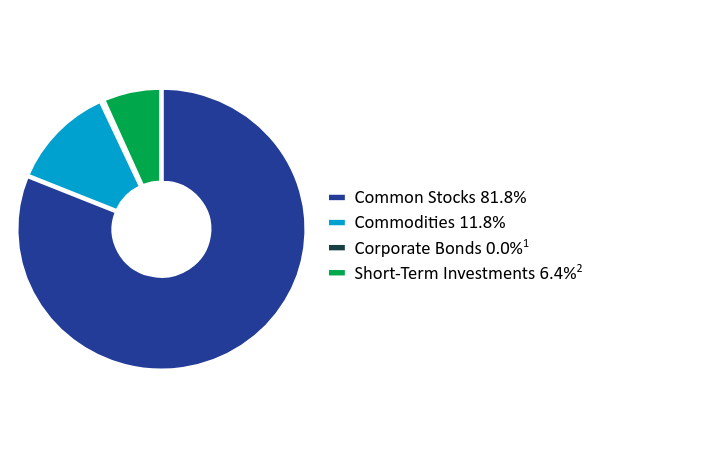

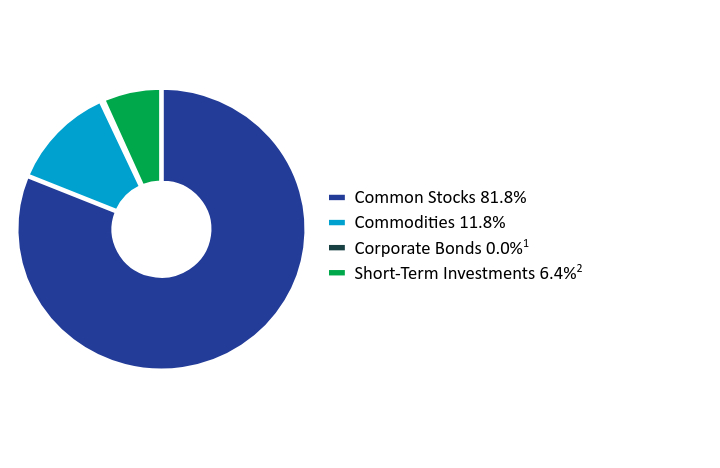

Asset Allocation by Asset Class

Based on total investments in the portfolio

| Value | Value |

|---|

| Common Stocks | 81.8% |

| Commodities | 11.8% |

| Corporate Bonds | 0.0%Footnote Reference1 |

| Short-Term Investments | 6.4%Footnote Reference2 |

Top 10 HoldingsFootnote Reference3

Based on total net assets of the portfolio

Gold bullion (Precious Metal)Footnote Reference4 | 11.8% |

| Oracle Corp. (Software, United States) | 2.9% |

| Meta Platforms, Inc., Class A (Interactive Media & Services, United States) | 2.6% |

| HCA Healthcare, Inc. (Health Care Providers & Services, United States) | 2.0% |

| Exxon Mobil Corp. (Oil, Gas & Consumable Fuels, United States) | 2.0% |

| Philip Morris International, Inc. (Tobacco, United States) | 1.9% |

| Comcast Corp., Class A (Media, United States) | 1.7% |

| Willis Towers Watson plc (Insurance, United States) | 1.5% |

| Bank of New York Mellon Corp. (The) (Capital Markets, United States) | 1.5% |

| CH Robinson Worldwide, Inc. (Air Freight & Logistics, United States) | 1.5% |

| Total | 29.4% |

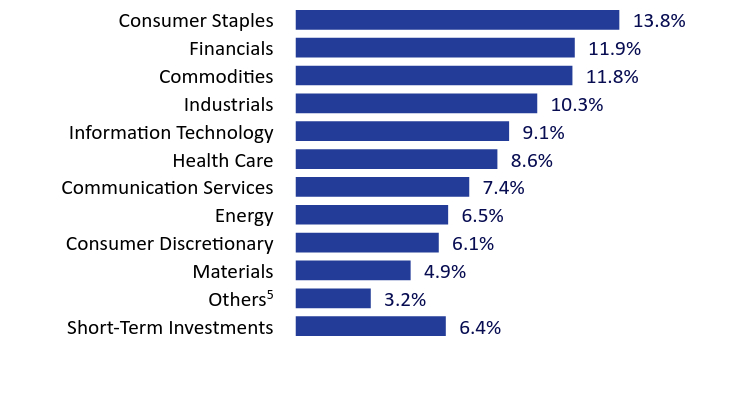

Asset Allocation by Sector

Based on total investments in the portfolio

| Value | Value |

|---|

| Short-Term Investments | 6.4% |

OthersFootnote Reference5 | 3.2% |

| Materials | 4.9% |

| Consumer Discretionary | 6.1% |

| Energy | 6.5% |

| Communication Services | 7.4% |

| Health Care | 8.6% |

| Information Technology | 9.1% |

| Industrials | 10.3% |

| Commodities | 11.8% |

| Financials | 11.9% |

| Consumer Staples | 13.8% |

Asset Allocation by CountryFootnote Reference6

Based on total investments in the portfolio

| United States | 55.9% |

| United Kingdom | 7.2% |

| Japan | 6.3% |

| Canada | 5.0% |

| France | 3.2% |

| Switzerland | 2.9% |

| South Korea | 2.5% |

| China | 2.2% |

| Mexico | 1.4% |

| Hong Kong | 1.2% |

OthersFootnote Reference7 | 5.8% |

| Short-Term Investments | 6.4% |

| Footnote | Description |

Footnote1 | Less than 0.05% |

Footnote2 | Includes short-term commercial paper (1.7% of total investments) that settles in 90 days or less; long-term commercial paper (4.6% of total investments) that settles in 91 days or more; and other short-term investments (0.1% of total investments), such as U.S. treasury bills or money market funds. |

Footnote3 | Holdings in cash, short-term commercial paper, long-term commercial paper and other short-term cash equivalents have been excluded. |

Footnote4 | The Fund invests in gold and precious metals through investment in a wholly owned subsidiary of the Fund organized under the laws of the Cayman Islands (the “Subsidiary”). Gold bullion and commodities include the Fund’s investment in the Subsidiary. |

Footnote5 | Includes additional sectors outside the top 10 listed above. |

Footnote6 | Country allocations reflect country of risk not currency of issue. Bonds of non-U.S. issuers may be U.S. dollar denominated. |

Footnote7 | Includes additional countries outside the top 10 listed above. |

October 31, 2024

Annual Shareholder Report

For more information, please scan the QR code to navigate to tailored shareholder reports and financial statements and other Information. If you wish to view additional information about the Fund, including but not limited to financial statements, holdings, or the Fund's prospectus, please visit http://www.firsteagle.com.

Important Notice Regarding Delivery of Shareholder Materials

Unless we are notified otherwise, we send one copy of these materials to shareholders with the same residential address (provided they have the same last name or are reasonably believed to be family members) for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800.334.2143 and we will send separate copies of these materials within 30 days after receiving your request.

October 31, 2024

Annual Shareholder Report

This Annual Shareholder Report contains important information about the Class A shares of the Fund for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at https://www.firsteagle.com/first-eagle-fund-shareholder-reports. You can also request this information by contacting us at 800.334.2143.

First Eagle Overseas Fund

What Were the Fund's Costs for the Year?

Based on a Hypothetical $10,000 Investment

| Class Name | Cost of a $10,000 Investment | Cost Paid as a Percentage of a $10,000 Investment |

|---|

| Class A | $127 | 1.15% |

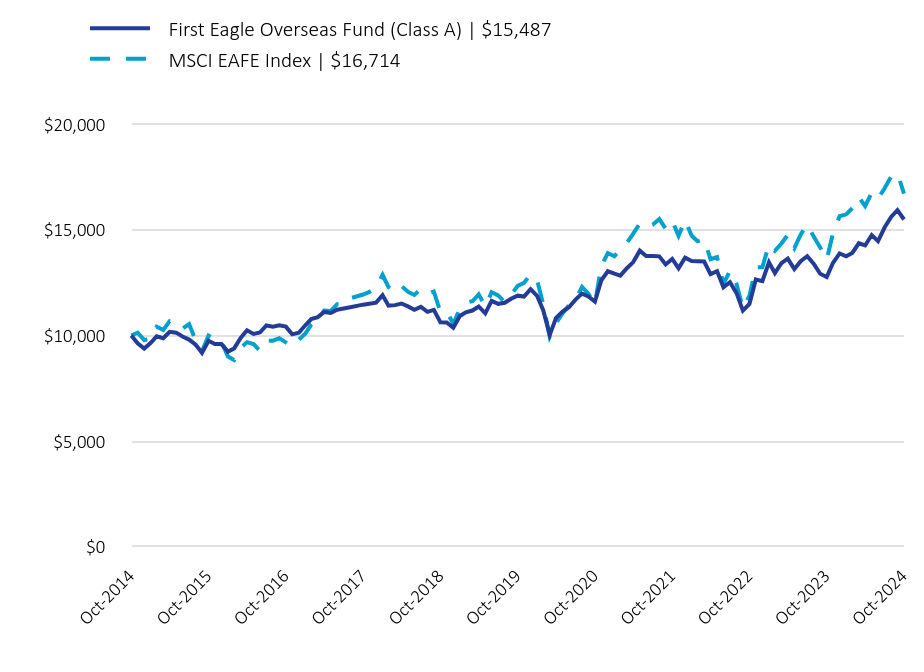

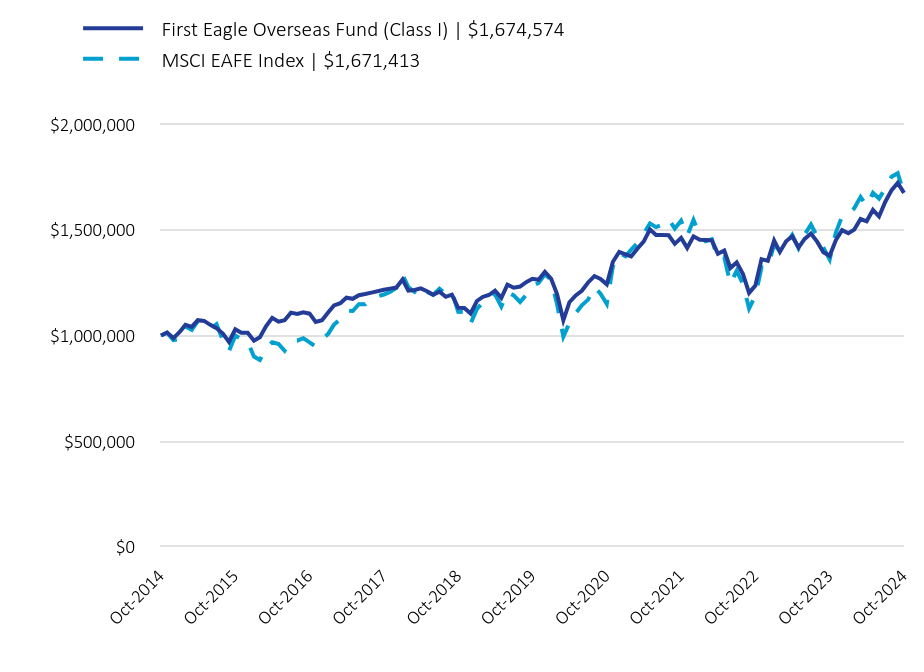

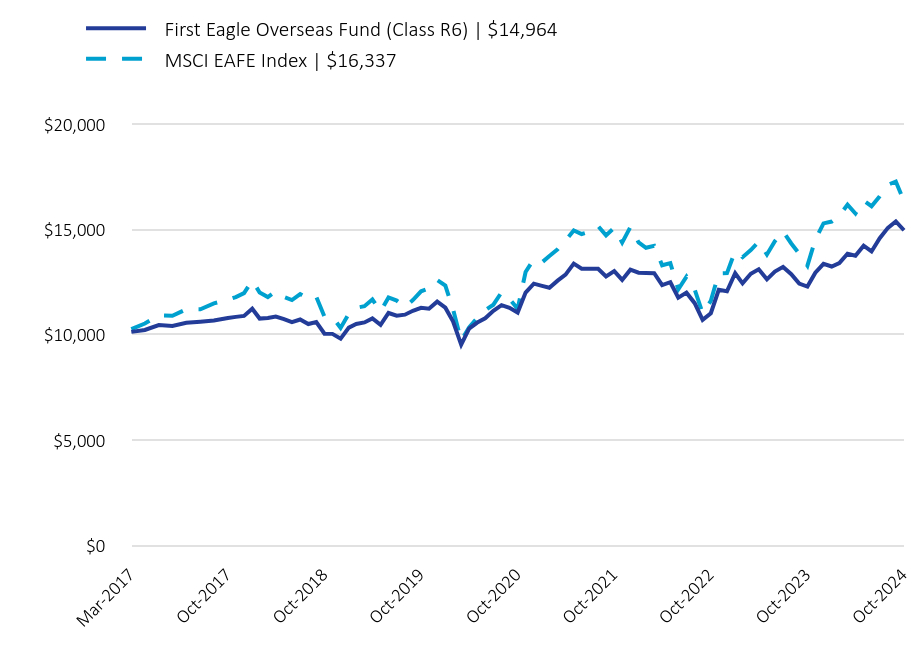

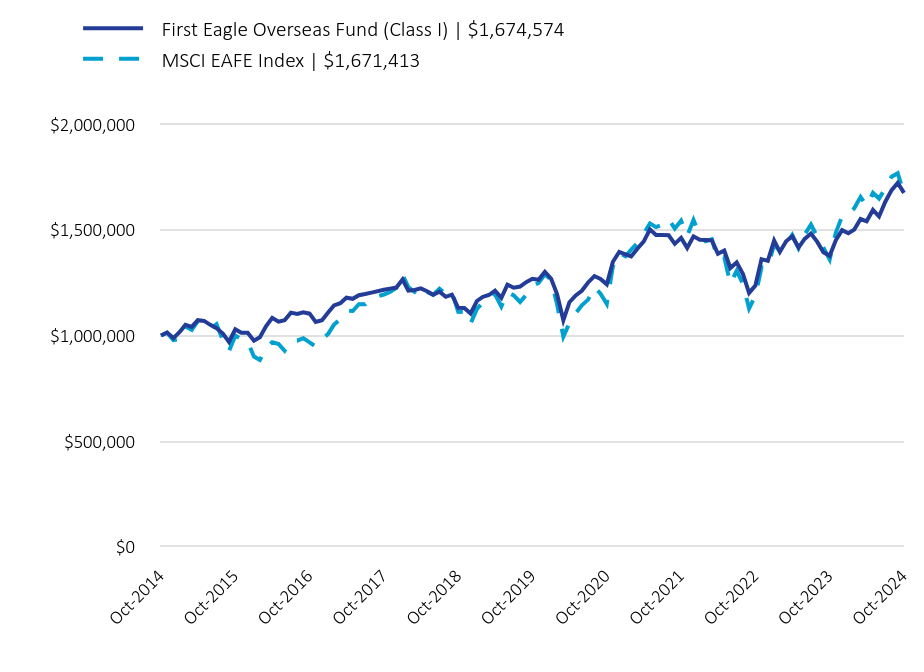

How Did the Fund Perform Last Year?

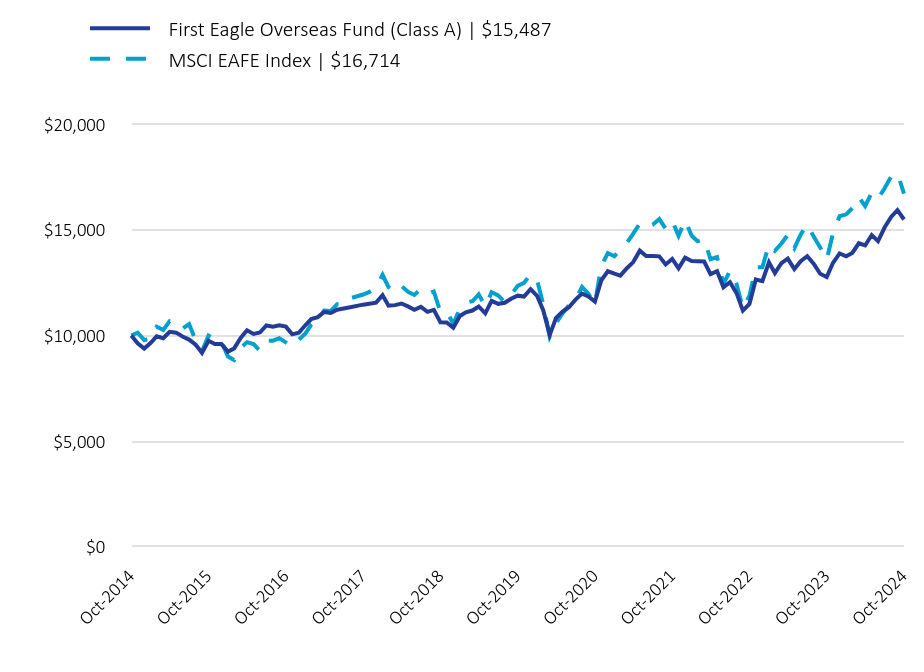

The NAV of First Eagle Overseas Fund Class A Shares1 increased 21.29% in the 12-month period ended October 31, 2024. The MSCI EAFE Index increased 22.97% for the same period.

• Our equity holdings contributed to performance, while gold and gold-related equities also were a contributor.

• All geographic regions contributed to performance. Developed Europe and Japan were the leading contributors, while developed Asia excluding Japan and emerging markets were the worst performing regions.

• Materials, financials and consumer staples were the largest contributors among equity sectors; communication services was the only detractor, while real estate and health care were the next worst performing sectors.

• Gold bullion was the leading contributor to performance. CK Asset Holdings Ltd. was the largest detractor.

1 Reflects performance for Class A shares without the effect of sales charges and assumes all distributions have been reinvested; if sales charges were included, values would be lower.

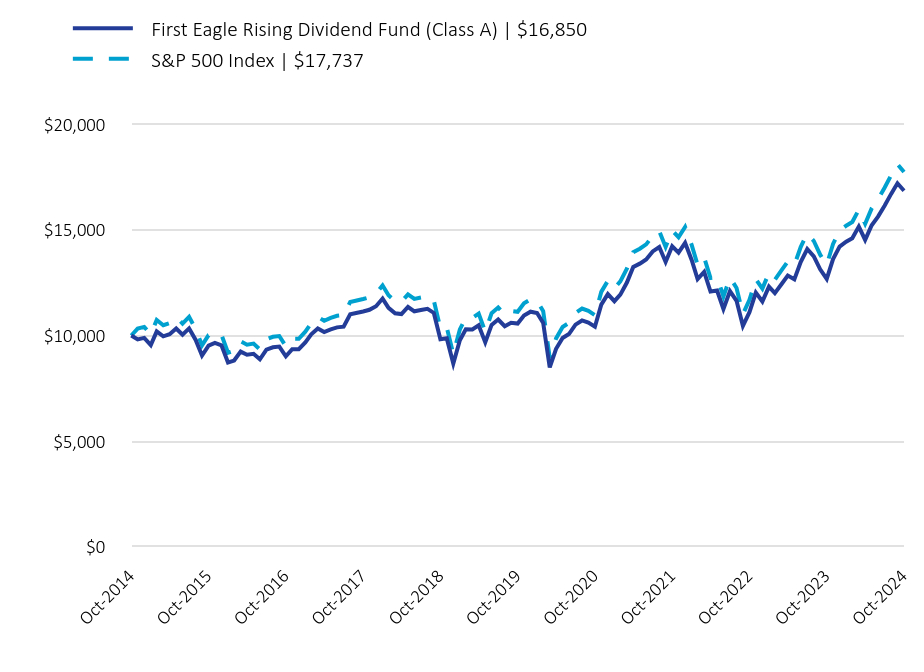

Total Return Based on a $10,000 Investment

| First Eagle Overseas Fund (Class A) | $15,487 | MSCI EAFE Index | $16,714 |

|---|

| Oct-2014 | 10,000 | 10,000 |

| Nov-2014 | 9,631.100000 | 10,136.020000 |

| Dec-2014 | 9,379.730000 | 9,784.890000 |

| Jan-2015 | 9,650.800000 | 9,832.730000 |

| Feb-2015 | 9,965.420000 | 10,420.530000 |

| Mar-2015 | 9,870.750000 | 10,262.230000 |

| Apr-2015 | 10,172.790000 | 10,681.230000 |

| May-2015 | 10,134.140000 | 10,626.560000 |

| Jun-2015 | 9,952.730000 | 10,325.470000 |

| Jul-2015 | 9,806.430000 | 10,539.860000 |

| Aug-2015 | 9,561.270000 | 9,764.520000 |

| Sep-2015 | 9,177.860000 | 9,268.720000 |

| Oct-2015 | 9,746.890000 | 9,993.250000 |

| Nov-2015 | 9,591.910000 | 9,837.780000 |

| Dec-2015 | 9,593.830000 | 9,705.230000 |

| Jan-2016 | 9,235.980000 | 9,003.410000 |

| Feb-2016 | 9,388.380000 | 8,838.460000 |

| Mar-2016 | 9,885.960000 | 9,413.550000 |

| Apr-2016 | 10,248.770000 | 9,686.080000 |

| May-2016 | 10,074.550000 | 9,598.090000 |

| Jun-2016 | 10,140.030000 | 9,275.910000 |

| Jul-2016 | 10,476.680000 | 9,746.020000 |

| Aug-2016 | 10,420.100000 | 9,752.940000 |

| Sep-2016 | 10,485.750000 | 9,872.750000 |

| Oct-2016 | 10,419.690000 | 9,670.800000 |

| Nov-2016 | 10,052.920000 | 9,478.200000 |

| Dec-2016 | 10,130.330000 | 9,802.300000 |

| Jan-2017 | 10,482.860000 | 10,086.640000 |

| Feb-2017 | 10,776.140000 | 10,512.520000 |

| Mar-2017 | 10,870.970000 | 10,780.010000 |

| Apr-2017 | 11,115.570000 | 11,175.680000 |

| May-2017 | 11,065.550000 | 11,155.910000 |

| Jun-2017 | 11,219.360000 | 11,477.710000 |

| Jul-2017 | 11,273.210000 | 11,473.390000 |

| Aug-2017 | 11,331.830000 | 11,758.850000 |

| Oct-2017 | 11,458.750000 | 11,937.410000 |

| Nov-2017 | 11,504.580000 | 12,062.620000 |

| Dec-2017 | 11,552.900000 | 12,256.240000 |

| Jan-2018 | 11,908.730000 | 12,871.010000 |

| Feb-2018 | 11,413.330000 | 12,290.060000 |

| Mar-2018 | 11,436.160000 | 12,068.550000 |

| Apr-2018 | 11,511.640000 | 12,344.110000 |

| May-2018 | 11,375.800000 | 12,066.640000 |

| Jun-2018 | 11,216.540000 | 11,919.210000 |

| Jul-2018 | 11,352.260000 | 12,212.610000 |

| Aug-2018 | 11,118.400000 | 11,976.750000 |

| Sep-2018 | 11,211.800000 | 12,080.700000 |

| Oct-2018 | 10,626.540000 | 11,119.170000 |

| Nov-2018 | 10,616.980000 | 11,105.160000 |

| Dec-2018 | 10,364.290000 | 10,566.070000 |

| Jan-2019 | 10,923.960000 | 11,260.480000 |

| Feb-2019 | 11,097.650000 | 11,547.520000 |

| Mar-2019 | 11,179.780000 | 11,620.340000 |

| Apr-2019 | 11,372.070000 | 11,947.050000 |

| May-2019 | 11,044.550000 | 11,373.280000 |

| Jun-2019 | 11,637.650000 | 12,048 |

| Jul-2019 | 11,497.990000 | 11,895.030000 |

| Aug-2019 | 11,546.290000 | 11,586.880000 |

| Sep-2019 | 11,739.110000 | 11,918.910000 |

| Oct-2019 | 11,883.500000 | 12,347.150000 |

| Nov-2019 | 11,840.720000 | 12,486.340000 |

| Dec-2019 | 12,190.020000 | 12,892.140000 |

| Jan-2020 | 11,879.180000 | 12,622.850000 |

| Feb-2020 | 11,197.310000 | 11,481.780000 |

| Mar-2020 | 10,031.670000 | 9,949.320000 |

| Apr-2020 | 10,831.190000 | 10,592.080000 |

| May-2020 | 11,126.890000 | 11,053.310000 |

| Jun-2020 | 11,336.070000 | 11,429.670000 |

| Jul-2020 | 11,697.690000 | 11,696.080000 |

| Aug-2020 | 11,983.120000 | 12,297.390000 |

| Sep-2020 | 11,845.310000 | 11,977.860000 |

| Oct-2020 | 11,606.030000 | 11,499.600000 |

| Nov-2020 | 12,604.150000 | 13,282.190000 |

| Dec-2020 | 13,039 | 13,899.760000 |

| Jan-2021 | 12,921.650000 | 13,751.670000 |

| Feb-2021 | 12,829.900000 | 14,060.110000 |

| Mar-2021 | 13,181.440000 | 14,383.400000 |

| Apr-2021 | 13,472.750000 | 14,816.190000 |

| May-2021 | 14,013.010000 | 15,299.360000 |

| Jun-2021 | 13,763.580000 | 15,127.180000 |

| Jul-2021 | 13,758.070000 | 15,241.080000 |

| Aug-2021 | 13,742.940000 | 15,509.920000 |

| Sep-2021 | 13,360.880000 | 15,059.810000 |

| Oct-2021 | 13,621.420000 | 15,430.210000 |

| Nov-2021 | 13,182.810000 | 14,712.030000 |

| Dec-2021 | 13,683.760000 | 15,465.340000 |

| Jan-2022 | 13,526.400000 | 14,718 |

| Feb-2022 | 13,515.570000 | 14,457.760000 |

| Mar-2022 | 13,499.360000 | 14,550.690000 |

| Apr-2022 | 12,904.030000 | 13,609.340000 |

| May-2022 | 13,044.690000 | 13,711.360000 |

| Jun-2022 | 12,277.660000 | 12,439.120000 |

| Jul-2022 | 12,520.760000 | 13,058.960000 |

| Aug-2022 | 12,001.150000 | 12,438.730000 |

| Sep-2022 | 11,174.270000 | 11,275.120000 |

| Oct-2022 | 11,492.730000 | 11,881.440000 |

| Nov-2022 | 12,650.050000 | 13,219.710000 |

| Dec-2022 | 12,574.150000 | 13,230.340000 |

| Jan-2023 | 13,458.120000 | 14,301.690000 |

| Feb-2023 | 12,954.780000 | 14,003.260000 |

| Mar-2023 | 13,425.040000 | 14,350.320000 |

| Apr-2023 | 13,637.160000 | 14,755.470000 |

| May-2023 | 13,139.400000 | 14,131.050000 |

| Jun-2023 | 13,513.870000 | 14,774.150000 |

| Jul-2023 | 13,749.010000 | 15,252.190000 |

| Aug-2023 | 13,384.670000 | 14,667.840000 |

| Sep-2023 | 12,920.220000 | 14,166.820000 |

| Oct-2023 | 12,769.050000 | 13,592.470000 |

| Nov-2023 | 13,440.700000 | 14,854.090000 |

| Dec-2023 | 13,882.900000 | 15,643.280000 |

| Jan-2024 | 13,745.460000 | 15,733.300000 |

| Feb-2024 | 13,906.280000 | 16,021.290000 |

| Mar-2024 | 14,363.800000 | 16,548.230000 |

| Apr-2024 | 14,260.380000 | 16,124.450000 |

| May-2024 | 14,752.360000 | 16,749.030000 |

| Jun-2024 | 14,460.270000 | 16,478.630000 |

| Jul-2024 | 15,108.090000 | 16,962.060000 |

| Aug-2024 | 15,612.700000 | 17,513.600000 |

| Sep-2024 | 15,928.070000 | 17,675.330000 |

| Oct-2024 | 15,487 | 16,714 |

The above chart represents historical performance of a hypothetical $10,000 investment over the past 10 years. The results of this chart do not predict the results of future time periods and does not guarantee the same results.

| Class/Index Name | 1 Year | 5 Years | 10 Years |

|---|

| Class A - without sales charge | 21.29% | 5.44% | 5.01% |

| Class A - with sales charge | 15.23% | 4.36% | 4.47% |

| MSCI EAFE Index | 22.97% | 6.24% | 5.27% |

The Fund's past performance is not a good predictor of the Fund's future performance.The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Call us at 800.334.2143 or visit https://www.firsteagle.com if you have questions about current performance.

- Net Assets$12,368,480,904

- Number of Portfolio Holdings133

- Portfolio Turnover Rate6.73%

- Net Investment Advisory Fees (net of waivers and reimbursements)$93,232,514

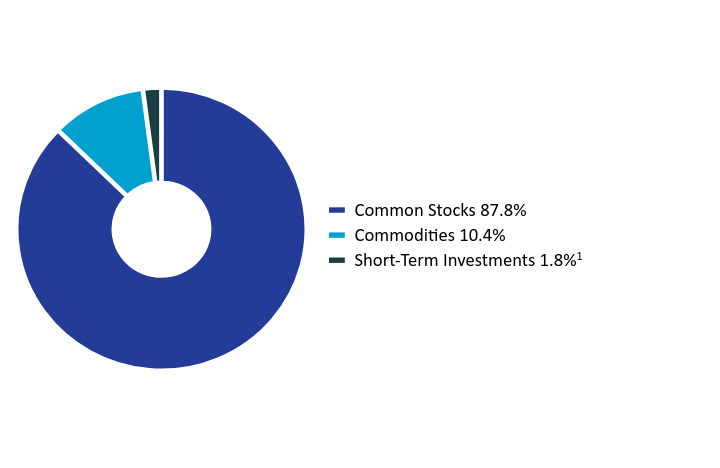

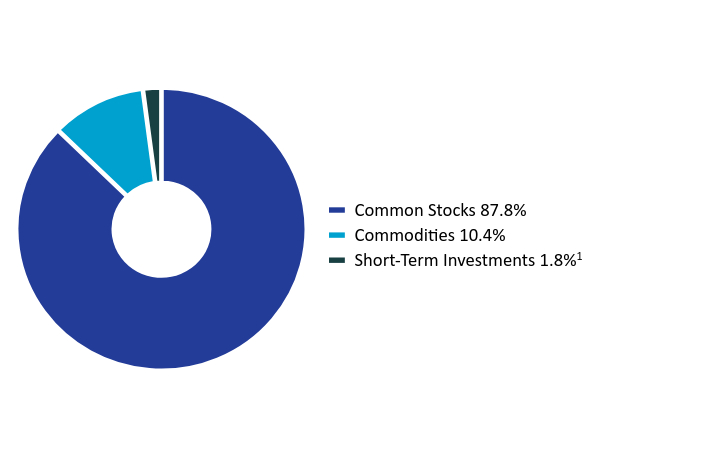

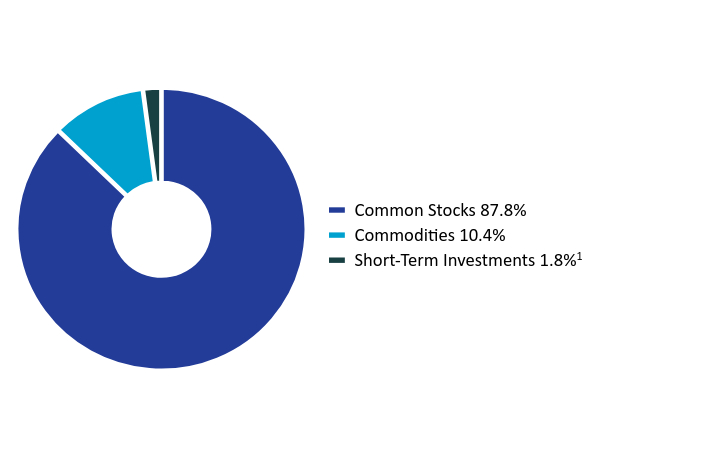

Asset Allocation by Asset Class

Based on total investments in the portfolio

| Value | Value |

|---|

| Common Stocks | 87.8% |

| Commodities | 10.4% |

| Short-Term Investments | 1.8%Footnote Reference1 |

Top 10 HoldingsFootnote Reference2

Based on total net assets of the portfolio

Gold bullion (Precious Metal)Footnote Reference3 | 10.3% |

| Imperial Oil Ltd. (Oil, Gas & Consumable Fuels, Canada) | 3.9% |

| British American Tobacco plc (Tobacco, United Kingdom) | 2.2% |

| Danone SA (Food Products, France) | 2.2% |

| Willis Towers Watson plc (Insurance, United States) | 2.2% |

| Shell plc (Oil, Gas & Consumable Fuels, United Kingdom) | 2.2% |

| Unilever plc (Personal Care Products, United Kingdom) | 2.2% |

| Prosus NV (Broadline Retail, China) | 2.1% |

| Fomento Economico Mexicano SAB de CV, ADR (Beverages, Mexico) | 2.0% |

| Cie Financiere Richemont SA (Registered) (Textiles, Apparel & Luxury Goods, Switzerland) | 1.9% |

| Total | 31.2% |

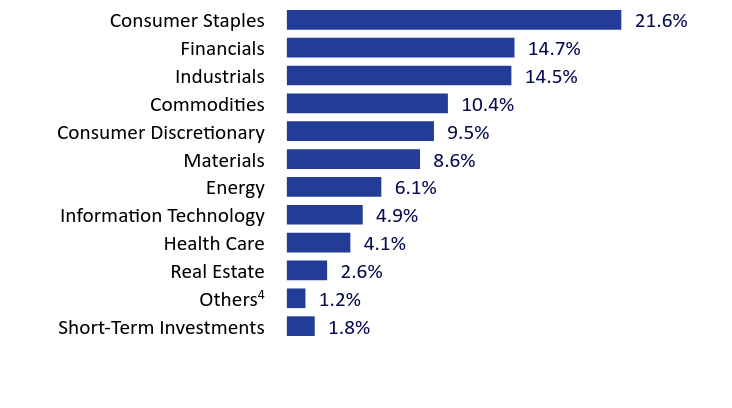

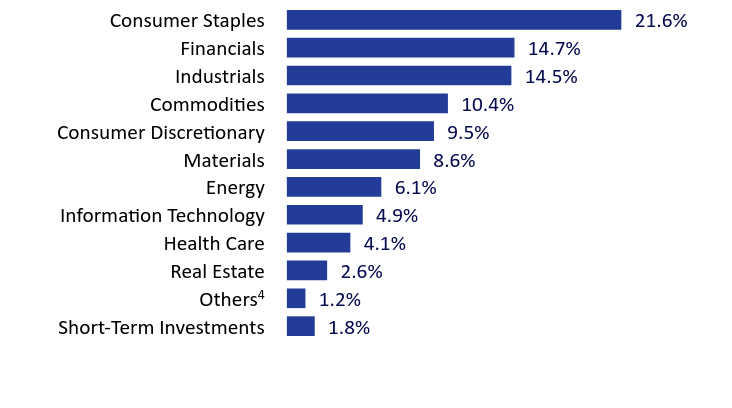

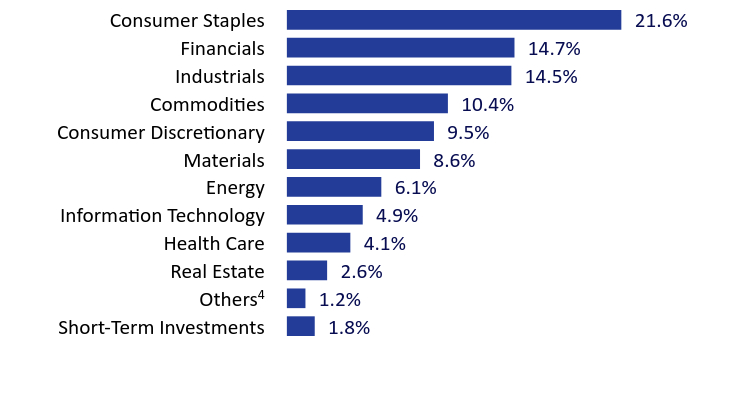

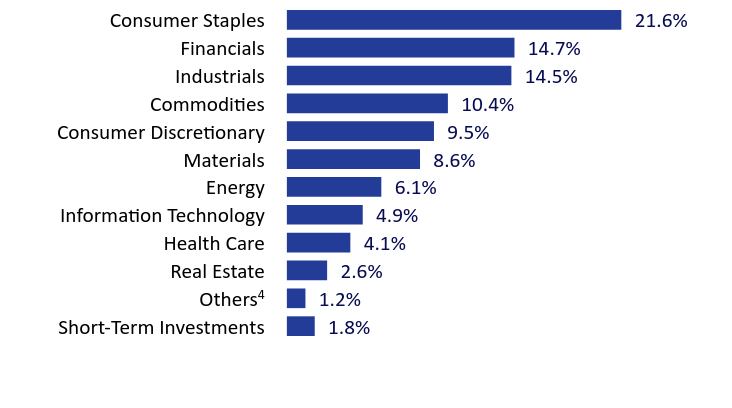

Asset Allocation by Sector

Based on total investments in the portfolio

| Value | Value |

|---|

| Short-Term Investments | 1.8% |

OthersFootnote Reference4 | 1.2% |

| Real Estate | 2.6% |

| Health Care | 4.1% |

| Information Technology | 4.9% |

| Energy | 6.1% |

| Materials | 8.6% |

| Consumer Discretionary | 9.5% |

| Commodities | 10.4% |

| Industrials | 14.5% |

| Financials | 14.7% |

| Consumer Staples | 21.6% |

Asset Allocation by CountryFootnote Reference5

Based on total investments in the portfolio

| Japan | 16.1% |

| United Kingdom | 14.5% |

| United States | 14.0% |

| Canada | 9.2% |

| France | 6.1% |

| South Korea | 5.2% |

| Switzerland | 4.9% |

| China | 3.4% |

| Sweden | 3.3% |

| Hong Kong | 3.3% |

OthersFootnote Reference6 | 18.2% |

| Short-Term Investments | 1.8% |

| Footnote | Description |

Footnote1 | Includes short-term commercial paper (1.4% of total investments) that settles in 90 days or less; long-term commercial paper (0.2% of total investments) that settles in 91 days or more; and other short-term investments (0.2% of total investments), such as U.S. treasury bills or money market funds. |

Footnote2 | Holdings in cash, short-term commercial paper, long-term commercial paper and other short-term cash equivalents have been excluded. |

Footnote3 | The Fund invests in gold and precious metals through investment in a wholly owned subsidiary of the Fund organized under the laws of the Cayman Islands (the “Subsidiary”). Gold bullion and commodities include the Fund’s investment in the Subsidiary. |

Footnote4 | Includes additional sectors outside the top 10 listed above. |

Footnote5 | Country allocations reflect country of risk not currency of issue. Bonds of non-U.S. issuers may be U.S. dollar denominated. |

Footnote6 | Includes additional countries outside the top 10 listed above. |

First Eagle Overseas Fund

October 31, 2024

Annual Shareholder Report

For more information, please scan the QR code to navigate to tailored shareholder reports and financial statements and other Information. If you wish to view additional information about the Fund, including but not limited to financial statements, holdings, or the Fund's prospectus, please visit http://www.firsteagle.com.

Important Notice Regarding Delivery of Shareholder Materials

Unless we are notified otherwise, we send one copy of these materials to shareholders with the same residential address (provided they have the same last name or are reasonably believed to be family members) for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800.334.2143 and we will send separate copies of these materials within 30 days after receiving your request.

October 31, 2024

Annual Shareholder Report

This Annual Shareholder Report contains important information about the Class C shares of the Fund for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at https://www.firsteagle.com/first-eagle-fund-shareholder-reports. You can also request this information by contacting us at 800.334.2143.

First Eagle Overseas Fund

What Were the Fund's Costs for the Year?

Based on a Hypothetical $10,000 Investment

| Class Name | Cost of a $10,000 Investment | Cost Paid as a Percentage of a $10,000 Investment |

|---|

| Class C | $207 | 1.88% |

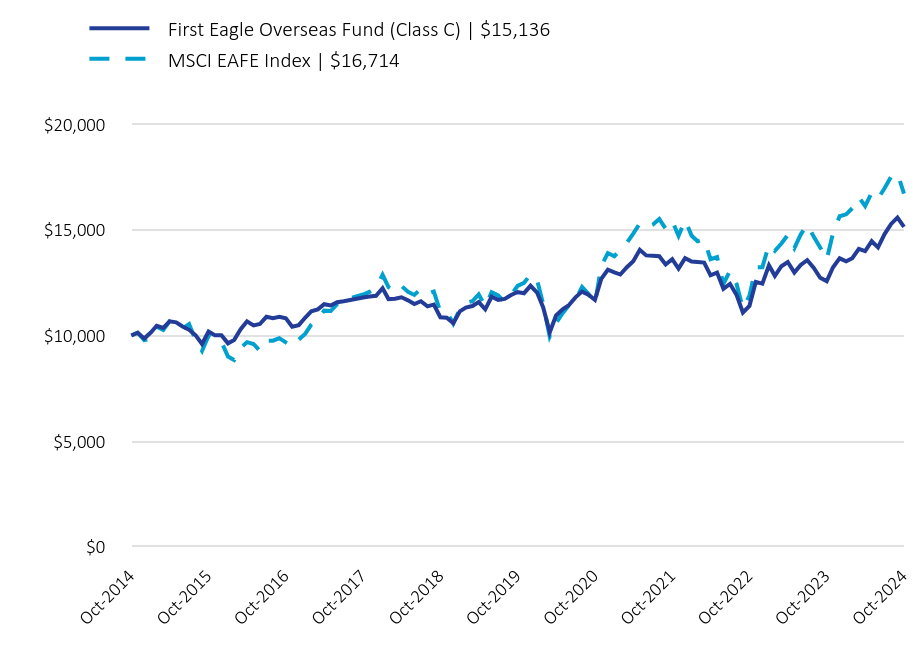

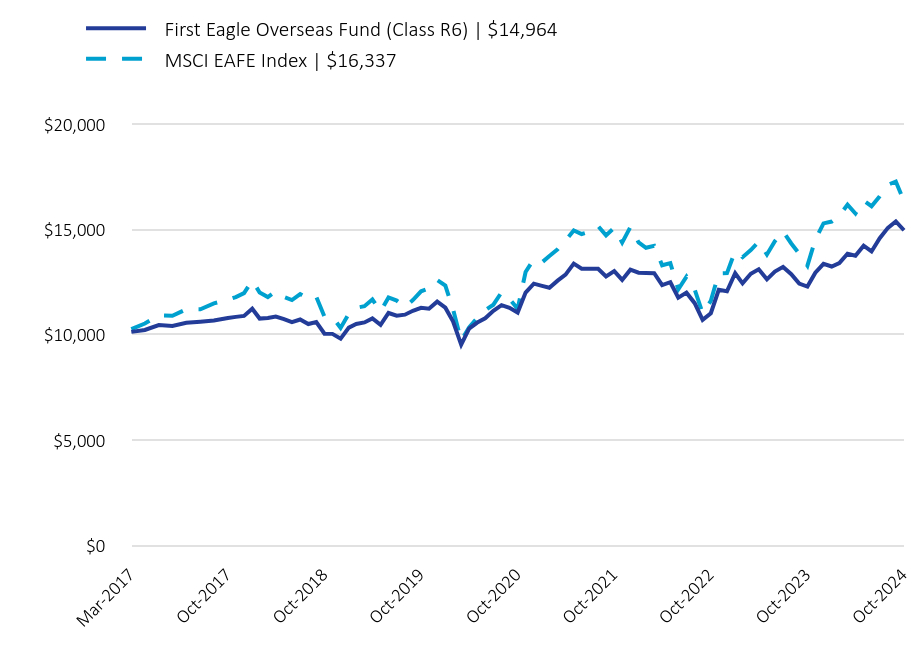

How Did the Fund Perform Last Year?

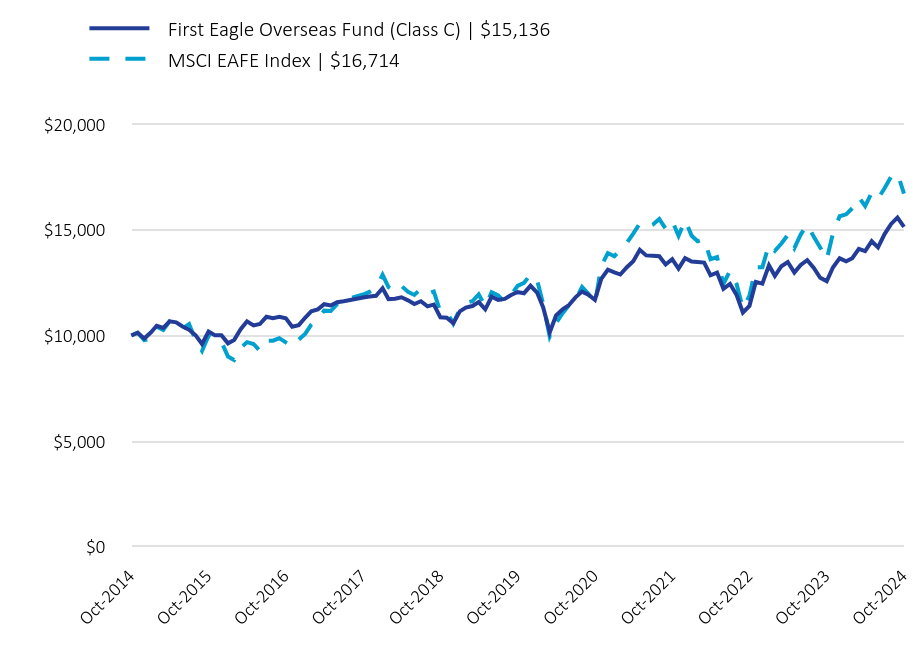

The NAV of First Eagle Overseas Fund Class C Shares1 increased 20.42% in the 12-month period ended October 31, 2024. The MSCI EAFE Index increased 22.97% for the same period.

• Our equity holdings contributed to performance, while gold and gold-related equities also were a contributor.

• All geographic regions contributed to performance. Developed Europe and Japan were the leading contributors, while developed Asia excluding Japan and emerging markets were the worst performing regions.

• Materials, financials and consumer staples were the largest contributors among equity sectors; communication services was the only detractor, while real estate and health care were the next worst performing sectors.

• Gold bullion was the leading contributor to performance. CK Asset Holdings Ltd. was the largest detractor.

1 Reflects performance for Class C shares without the effect of sales charges and assumes all distributions have been reinvested; if sales charges were included, values would be lower.

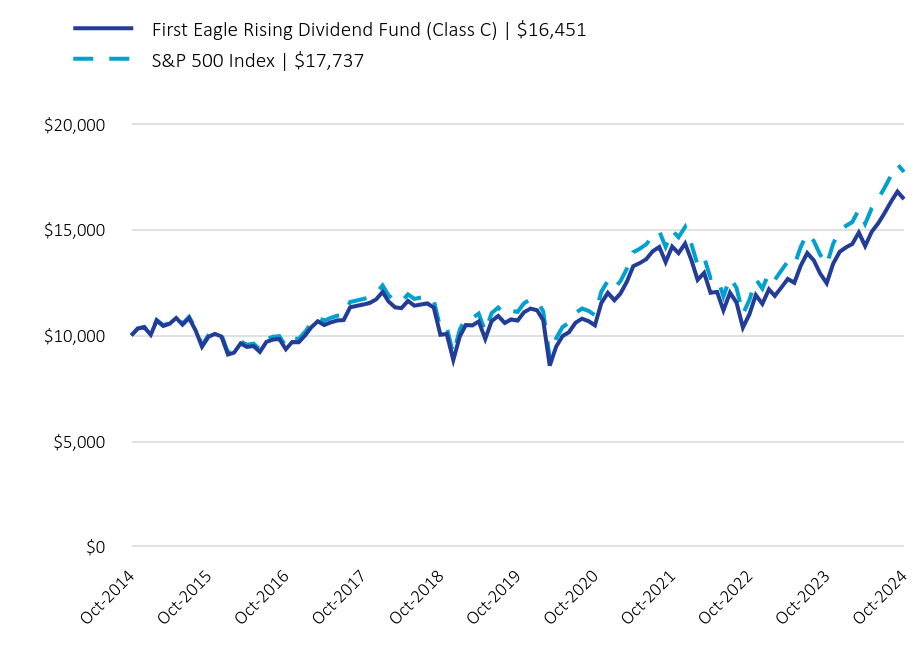

Total Return Based on a $10,000 Investment

| First Eagle Overseas Fund (Class C) | $15,136 | MSCI EAFE Index | $16,714 |

|---|

| Oct-2014 | 10,000 | 10,000 |

| Nov-2014 | 10,129 | 10,136.020000 |

| Dec-2014 | 9,855.520000 | 9,784.890000 |

| Jan-2015 | 10,140.340000 | 9,832.730000 |

| Feb-2015 | 10,461.790000 | 10,420.530000 |

| Mar-2015 | 10,359.260000 | 10,262.230000 |

| Apr-2015 | 10,672.110000 | 10,681.230000 |

| May-2015 | 10,620.890000 | 10,626.560000 |

| Jun-2015 | 10,425.460000 | 10,325.470000 |

| Jul-2015 | 10,267 | 10,539.860000 |

| Aug-2015 | 10,006.220000 | 9,764.520000 |

| Sep-2015 | 9,595.960000 | 9,268.720000 |

| Oct-2015 | 10,183.230000 | 9,993.250000 |

| Nov-2015 | 10,015.210000 | 9,837.780000 |

| Dec-2015 | 10,010.200000 | 9,705.230000 |

| Jan-2016 | 9,627.810000 | 9,003.410000 |

| Feb-2016 | 9,783.780000 | 8,838.460000 |

| Mar-2016 | 10,298.410000 | 9,413.550000 |

| Apr-2016 | 10,671.210000 | 9,686.080000 |

| May-2016 | 10,478.060000 | 9,598.090000 |

| Jun-2016 | 10,544.080000 | 9,275.910000 |

| Jul-2016 | 10,883.590000 | 9,746.020000 |

| Aug-2016 | 10,817.200000 | 9,752.940000 |

| Sep-2016 | 10,878.860000 | 9,872.750000 |

| Oct-2016 | 10,808.150000 | 9,670.800000 |

| Nov-2016 | 10,416.900000 | 9,478.200000 |

| Dec-2016 | 10,489.810000 | 9,802.300000 |

| Jan-2017 | 10,849.610000 | 10,086.640000 |

| Feb-2017 | 11,141.100000 | 10,512.520000 |

| Mar-2017 | 11,233.570000 | 10,780.010000 |

| Apr-2017 | 11,481.840000 | 11,175.680000 |

| May-2017 | 11,418.690000 | 11,155.910000 |

| Jun-2017 | 11,573.980000 | 11,477.710000 |

| Jul-2017 | 11,617.960000 | 11,473.390000 |

| Aug-2017 | 11,676.050000 | 11,758.850000 |

| Oct-2017 | 11,797.480000 | 11,937.410000 |

| Nov-2017 | 11,841.130000 | 12,062.620000 |

| Dec-2017 | 11,877.840000 | 12,256.240000 |

| Jan-2018 | 12,237.740000 | 12,871.010000 |

| Feb-2018 | 11,722.530000 | 12,290.060000 |

| Mar-2018 | 11,737.770000 | 12,068.550000 |

| Apr-2018 | 11,808.200000 | 12,344.110000 |

| May-2018 | 11,662.960000 | 12,066.640000 |

| Jun-2018 | 11,488.010000 | 11,919.210000 |

| Jul-2018 | 11,622.420000 | 12,212.610000 |

| Aug-2018 | 11,377.190000 | 11,976.750000 |

| Sep-2018 | 11,462.520000 | 12,080.700000 |

| Oct-2018 | 10,863.030000 | 11,119.170000 |

| Nov-2018 | 10,843.470000 | 11,105.160000 |

| Dec-2018 | 10,584.310000 | 10,566.070000 |

| Jan-2019 | 11,142.110000 | 11,260.480000 |

| Feb-2019 | 11,315.920000 | 11,547.520000 |

| Mar-2019 | 11,392.870000 | 11,620.340000 |

| Apr-2019 | 11,581.990000 | 11,947.050000 |

| May-2019 | 11,239.170000 | 11,373.280000 |

| Jun-2019 | 11,832.600000 | 12,048 |

| Jul-2019 | 11,684.690000 | 11,895.030000 |

| Aug-2019 | 11,730.260000 | 11,586.880000 |

| Sep-2019 | 11,914.420000 | 11,918.910000 |

| Oct-2019 | 12,057.400000 | 12,347.150000 |

| Nov-2019 | 12,000.730000 | 12,486.340000 |

| Dec-2019 | 12,349.950000 | 12,892.140000 |

| Jan-2020 | 12,028.850000 | 12,622.850000 |

| Feb-2020 | 11,327.570000 | 11,481.780000 |

| Mar-2020 | 10,149.500000 | 9,949.320000 |

| Apr-2020 | 10,947.250000 | 10,592.080000 |

| May-2020 | 11,236.260000 | 11,053.310000 |

| Jun-2020 | 11,439.630000 | 11,429.670000 |

| Jul-2020 | 11,803.420000 | 11,696.080000 |

| Aug-2020 | 12,076.070000 | 12,297.390000 |

| Sep-2020 | 11,931.160000 | 11,977.860000 |

| Oct-2020 | 11,685.380000 | 11,499.600000 |

| Nov-2020 | 12,680.970000 | 13,282.190000 |

| Dec-2020 | 13,109.590000 | 13,899.760000 |

| Jan-2021 | 12,986.360000 | 13,751.670000 |

| Feb-2021 | 12,885.070000 | 14,060.110000 |

| Mar-2021 | 13,227.810000 | 14,383.400000 |

| Apr-2021 | 13,517.500000 | 14,816.190000 |

| May-2021 | 14,052.790000 | 15,299.360000 |

| Jun-2021 | 13,790 | 15,127.180000 |

| Jul-2021 | 13,773.460000 | 15,241.080000 |

| Aug-2021 | 13,751.420000 | 15,509.920000 |

| Sep-2021 | 13,360.880000 | 15,059.810000 |

| Oct-2021 | 13,612.060000 | 15,430.210000 |

| Nov-2021 | 13,162.860000 | 14,712.030000 |

| Dec-2021 | 13,659.100000 | 15,465.340000 |

| Jan-2022 | 13,496.560000 | 14,718 |

| Feb-2022 | 13,473.620000 | 14,457.760000 |

| Mar-2022 | 13,450.710000 | 14,550.690000 |

| Apr-2022 | 12,848.120000 | 13,609.340000 |

| May-2022 | 12,977.890000 | 13,711.360000 |

| Jun-2022 | 12,207 | 12,439.120000 |

| Jul-2022 | 12,443.820000 | 13,058.960000 |

| Aug-2022 | 11,919.930000 | 12,438.730000 |

| Sep-2022 | 11,086.730000 | 11,275.120000 |

| Oct-2022 | 11,401.590000 | 11,881.440000 |

| Nov-2022 | 12,538.330000 | 13,219.710000 |

| Dec-2022 | 12,455.580000 | 13,230.340000 |

| Jan-2023 | 13,324.980000 | 14,301.690000 |

| Feb-2023 | 12,822.620000 | 14,003.260000 |

| Mar-2023 | 13,277.830000 | 14,350.320000 |

| Apr-2023 | 13,475.670000 | 14,755.470000 |

| May-2023 | 12,974.370000 | 14,131.050000 |

| Jun-2023 | 13,341.550000 | 14,774.150000 |

| Jul-2023 | 13,563.020000 | 15,252.190000 |

| Aug-2023 | 13,195.460000 | 14,667.840000 |

| Sep-2023 | 12,728.340000 | 14,166.820000 |

| Oct-2023 | 12,570.510000 | 13,592.470000 |

| Nov-2023 | 13,229.200000 | 14,854.090000 |

| Dec-2023 | 13,649.890000 | 15,643.280000 |

| Jan-2024 | 13,507.930000 | 15,733.300000 |

| Feb-2024 | 13,656.520000 | 16,021.290000 |

| Mar-2024 | 14,100.360000 | 16,548.230000 |

| Apr-2024 | 13,993.190000 | 16,124.450000 |

| May-2024 | 14,460.570000 | 16,749.030000 |

| Jun-2024 | 14,169.910000 | 16,478.630000 |

| Jul-2024 | 14,797.640000 | 16,962.060000 |

| Aug-2024 | 15,277.080000 | 17,513.600000 |

| Sep-2024 | 15,573.460000 | 17,675.330000 |

| Oct-2024 | 15,136 | 16,714 |

The above chart represents historical performance of a hypothetical $10,000 investment over the past 10 years. The results of this chart do not predict the results of future time periods and does not guarantee the same results.

| Class/Index Name | 1 Year | 5 Years | 10 Years |

|---|

| Class C - without sales charge | 20.42% | 4.66% | 4.23% |

| Class C - with sales charge | 19.42% | 4.66% | 4.23% |

| MSCI EAFE Index | 22.97% | 6.24% | 5.27% |

The Fund's past performance is not a good predictor of the Fund's future performance.The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Call us at 800.334.2143 or visit https://www.firsteagle.com if you have questions about current performance.

- Net Assets$12,368,480,904

- Number of Portfolio Holdings133

- Portfolio Turnover Rate6.73%

- Net Investment Advisory Fees (net of waivers and reimbursements)$93,232,514

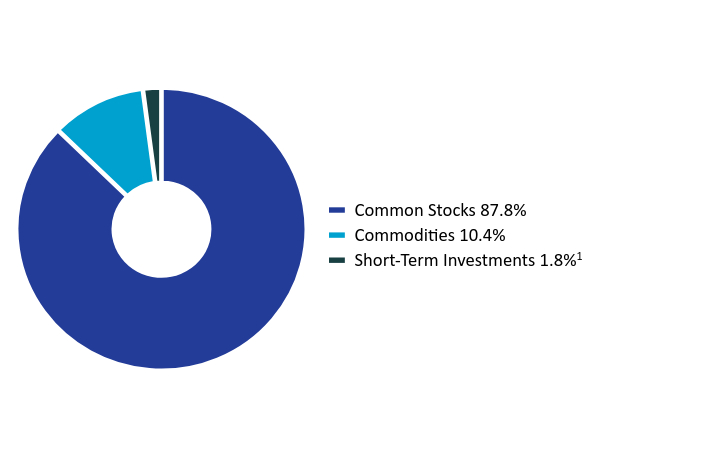

Asset Allocation by Asset Class

Based on total investments in the portfolio

| Value | Value |

|---|

| Common Stocks | 87.8% |

| Commodities | 10.4% |

| Short-Term Investments | 1.8%Footnote Reference1 |

Top 10 HoldingsFootnote Reference2

Based on total net assets of the portfolio

Gold bullion (Precious Metal)Footnote Reference3 | 10.3% |

| Imperial Oil Ltd. (Oil, Gas & Consumable Fuels, Canada) | 3.9% |

| British American Tobacco plc (Tobacco, United Kingdom) | 2.2% |

| Danone SA (Food Products, France) | 2.2% |

| Willis Towers Watson plc (Insurance, United States) | 2.2% |

| Shell plc (Oil, Gas & Consumable Fuels, United Kingdom) | 2.2% |

| Unilever plc (Personal Care Products, United Kingdom) | 2.2% |

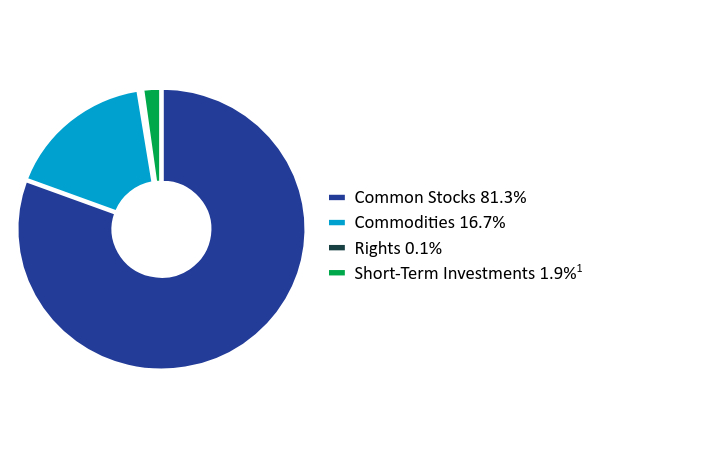

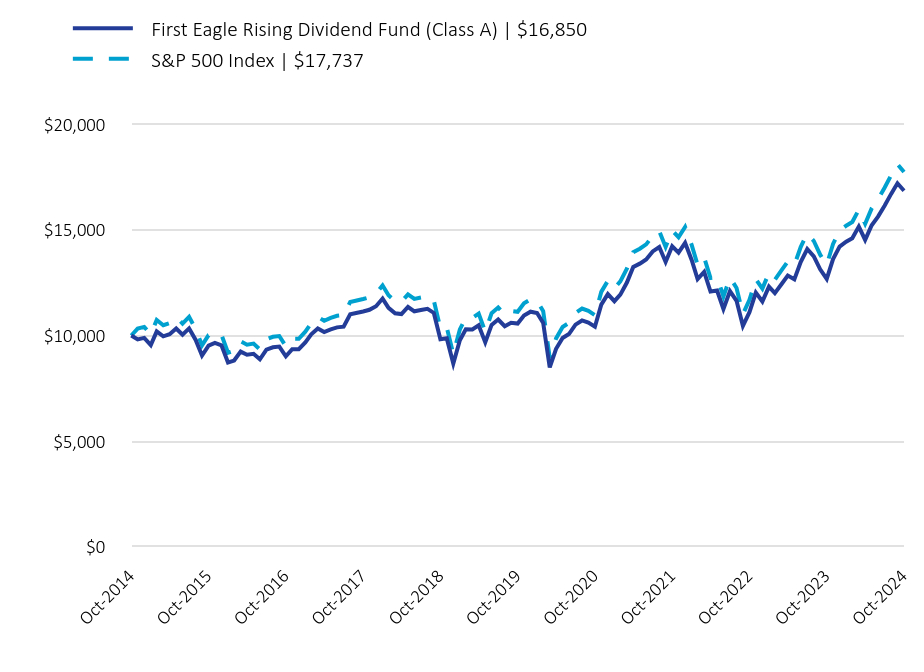

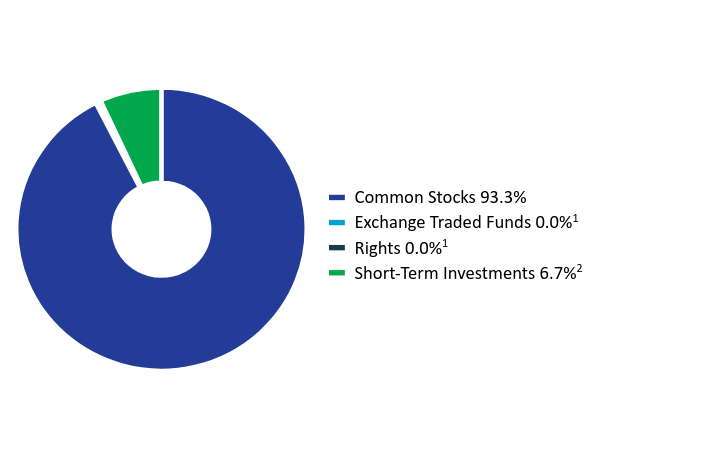

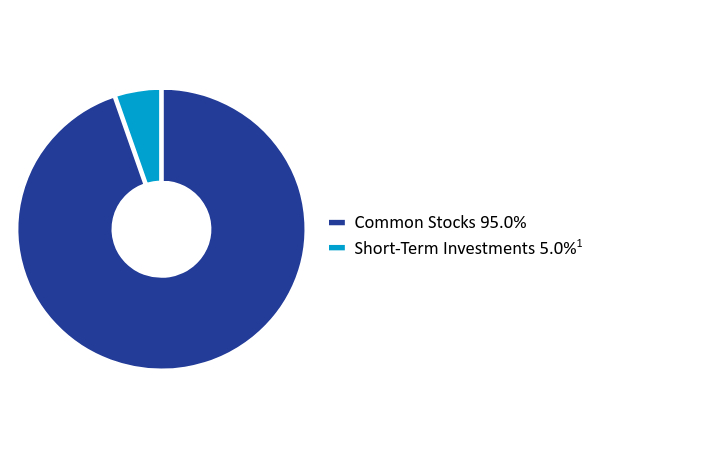

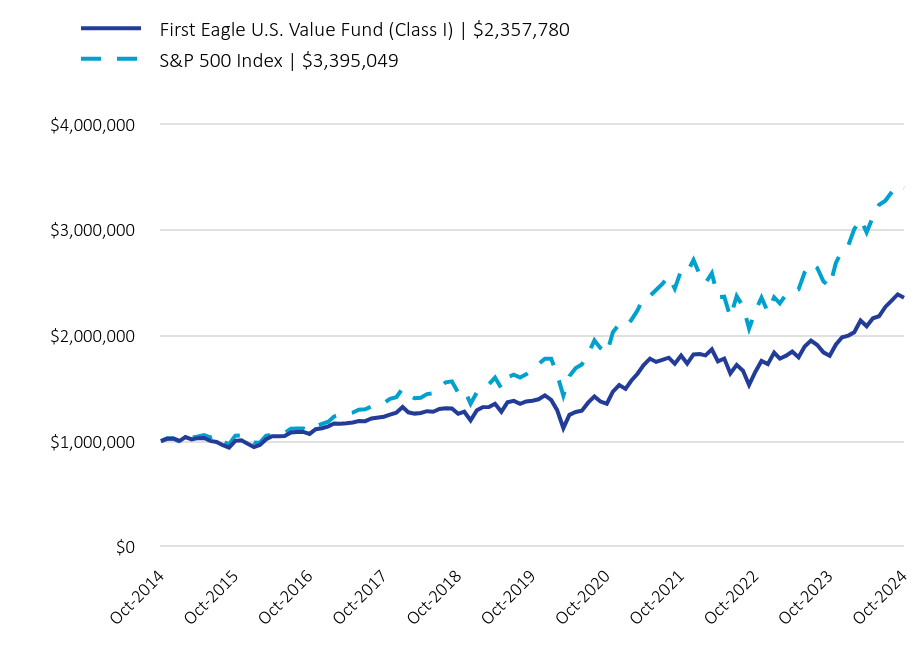

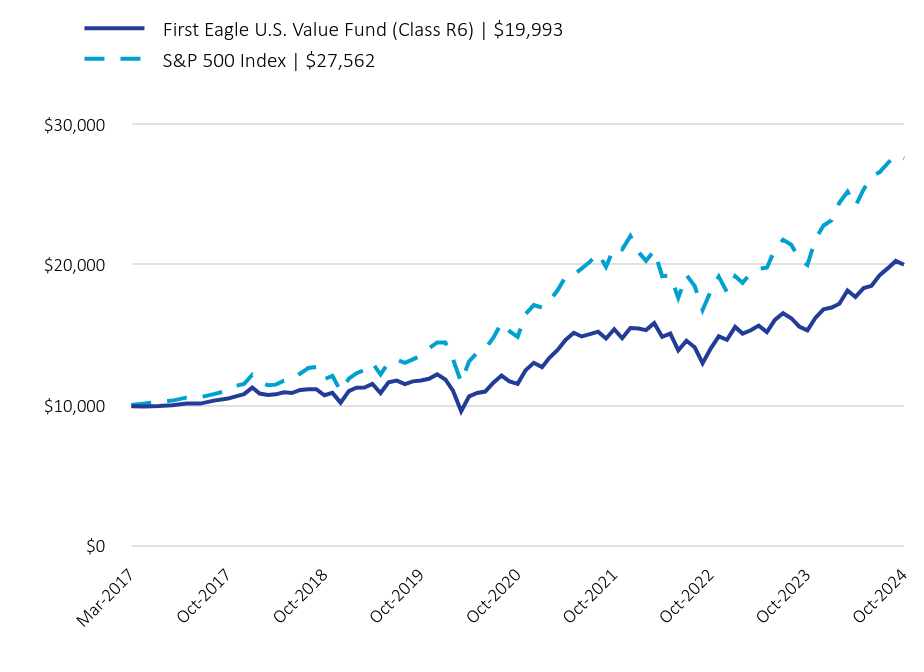

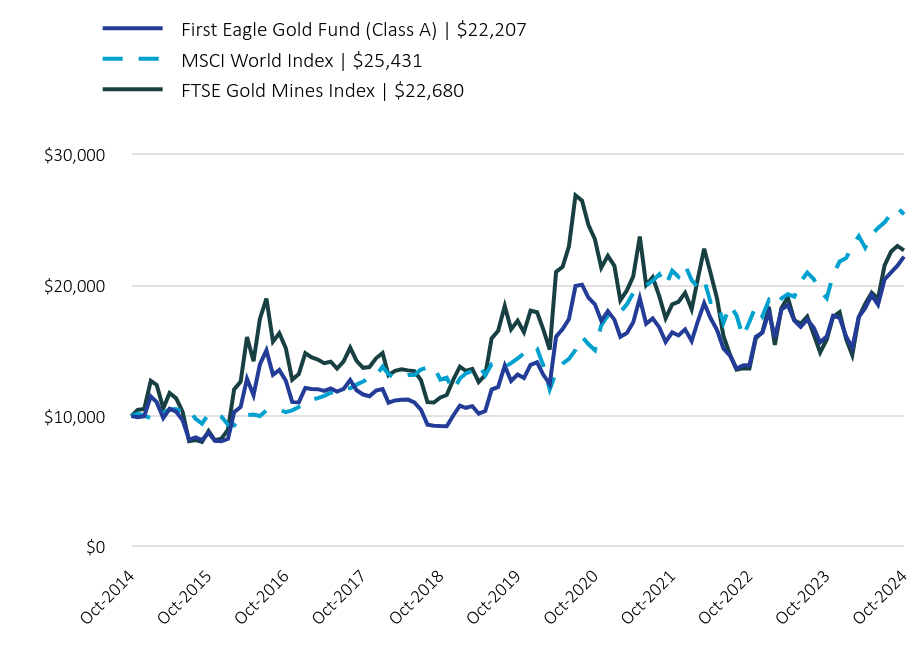

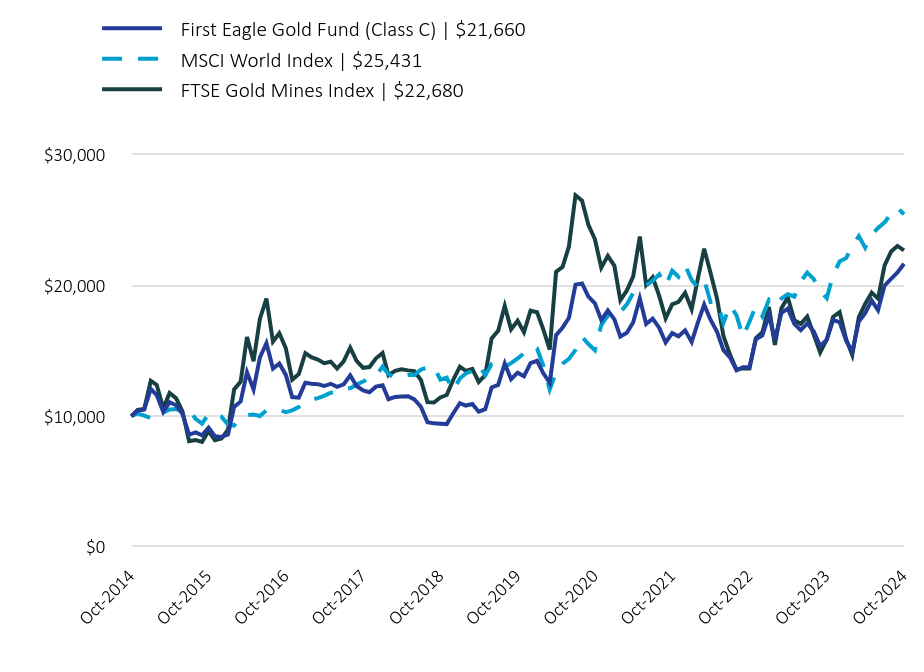

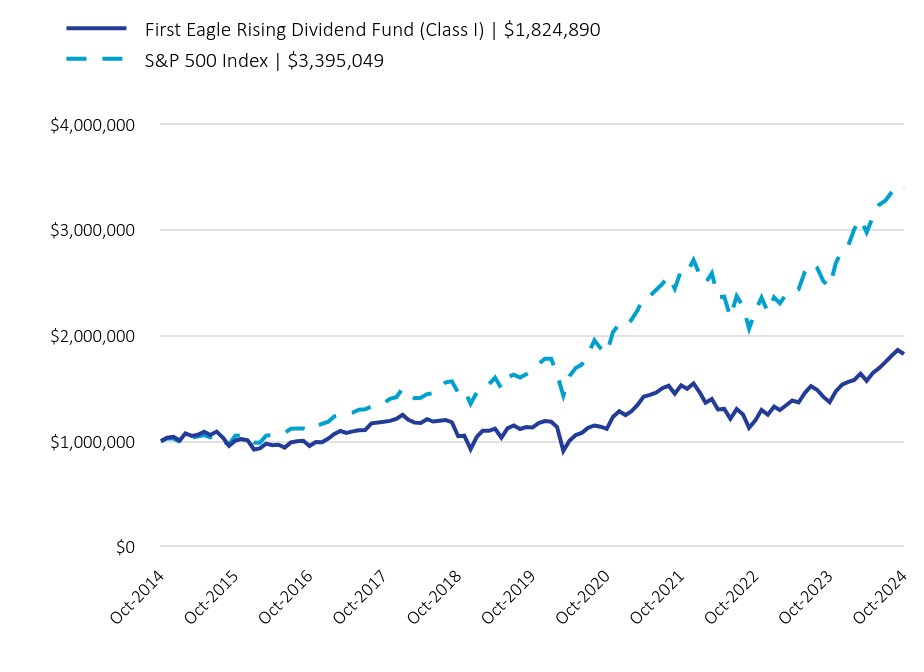

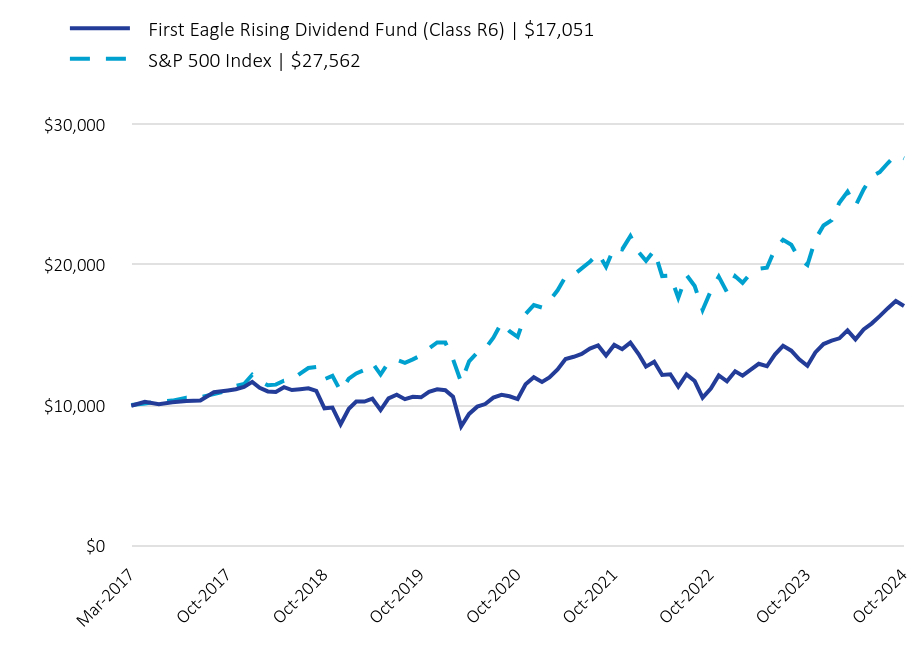

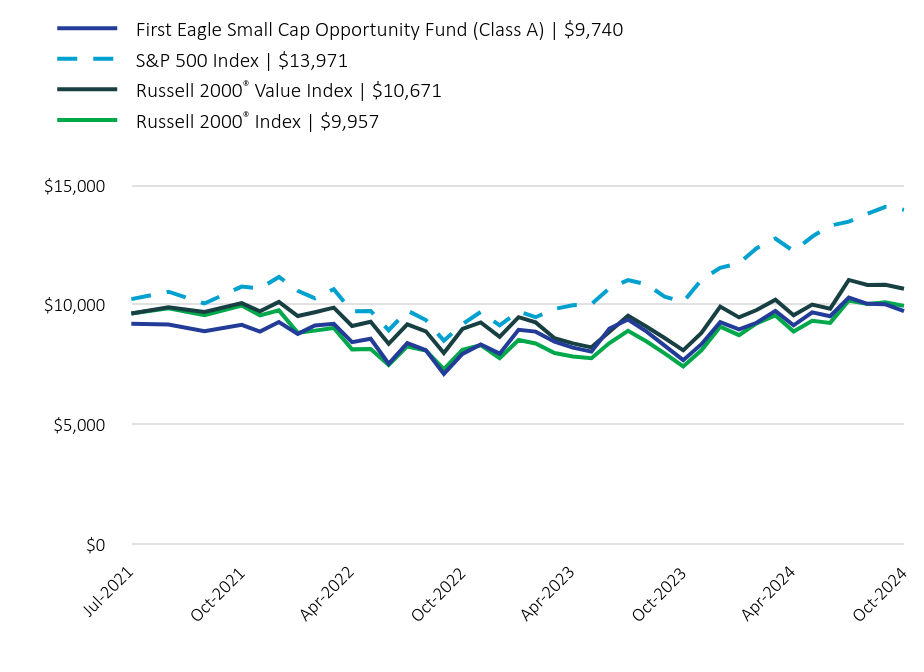

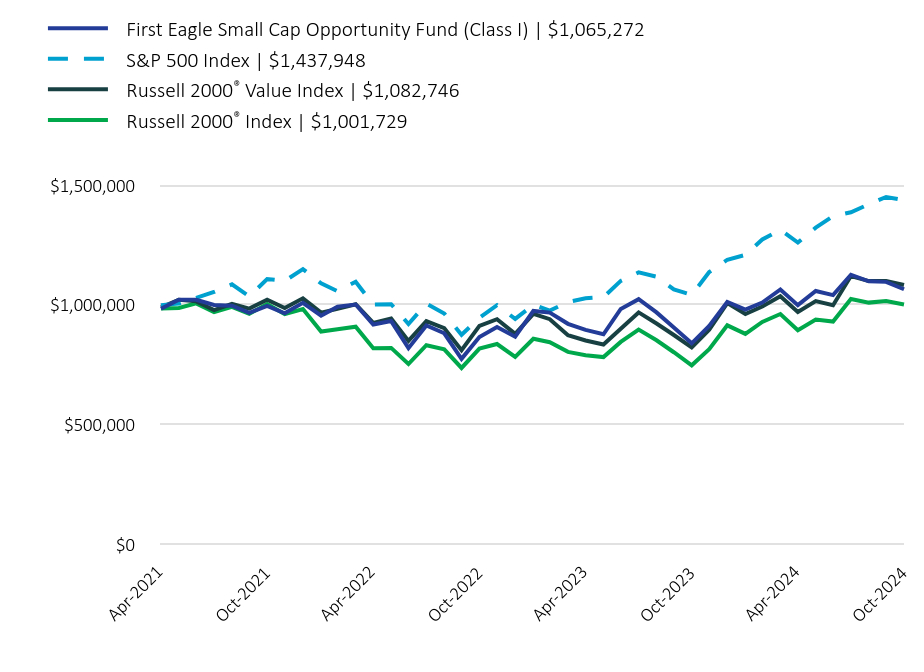

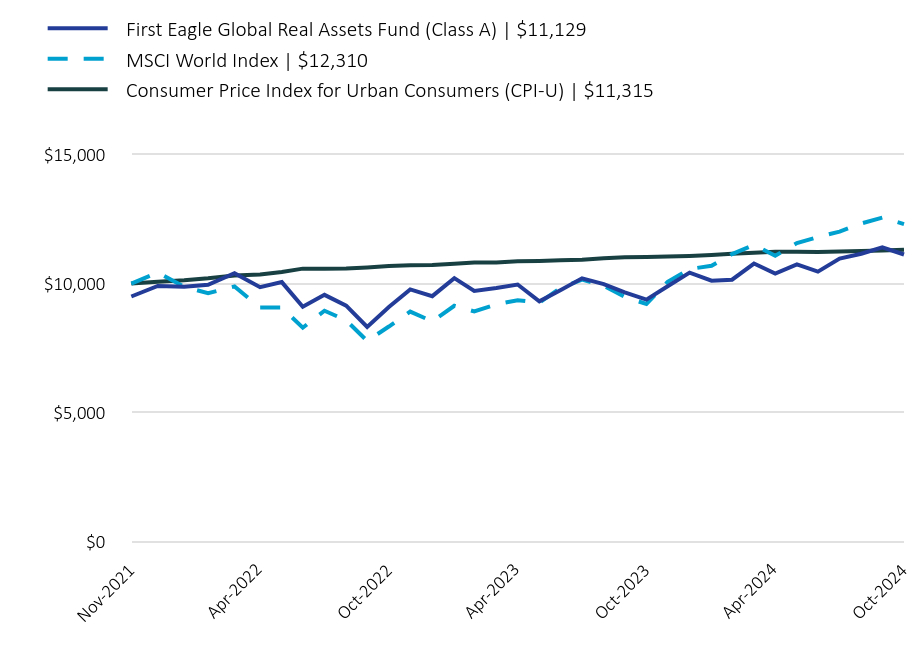

| Prosus NV (Broadline Retail, China) | 2.1% |