UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the Fiscal Year Ended December 31, 2011

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the Transition Period From ______________ to________________

Commission file number 000-21864

Vu1 Corporation

(Exact name of registrant as specified in its charter)

| California | 84-0672714 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| One New Hampshire Ave, Suite 125 | |

| Portsmouth, New Hampshire | 03801 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code:(855) 881-2825

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, no par value

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes¨ Nox

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes¨ Nox

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨(Not required)

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filero | | Accelerated filero |

| Non-accelerated filero | | Smaller reporting companyx |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes¨ Nox

The aggregate market value of the issuer’s voting stock held by non-affiliates on June 30, 2011, the last business day of the registrant’s most recently completed second fiscal quarter, was $27,613,995, based on the average of the bid and ask prices of such stock on that date of $8.80 per share, as reported by the OTC Bulletin Board.

On April 9, 2012, there were 5,881,317 shares of registrant’s common stock issued and outstanding.

Vu1 Corporation

2011 ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

| | | | | Page No. |

| PART I | | | | |

| Item 1. | | Business | | 1 |

| Item 1A. | | Risk Factors | | 10 |

| Item 1B. | | Unresolved Staff Comments | | 17 |

| Item 2. | | Properties | | 17 |

| Item 3. | | Legal Proceedings | | 18 |

| Item 4. | | Mine Safety Disclosures | | 18 |

| | | | | |

| PART II | | | | |

| Item 5. | | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | | 19 |

| Item 6. | | Selected Financial Data | | 21 |

| Item 7. | | Management’s Discussion and Analysis of Financial Condition and Results of Operations | | 21 |

| Item 7A. | | Quantitative and Qualitative Disclosures About Market Risk | | 27 |

| Item 8. | | Financial Statements and Supplementary Data | | 27 |

| Item 9. | | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | | 27 |

| Item 9A. | | Controls and Procedures | | 27 |

| Item 9B. | | Other Information | | 28 |

| | | | | |

| PART III | | | | |

| Item 10. | | Directors, Executive Officers and Corporate Governance | | 29 |

| Item 11. | | Executive Compensation | | 35 |

| Item 12. | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | 42 |

| Item 13. | | Certain Relationships and Related Transactions, and Director Independence | | 44 |

| Item 14. | | Principal Accountant Fees and Services | | 45 |

| | | | | |

| PART IV | | | | |

| Item 15. | | Exhibits and Financial Statement Schedules | | 46 |

| | | | | |

| Signatures | | | | 49 |

EXPLANATORY NOTE

Unless otherwise indicated or the context otherwise requires, all references in this Annual Report on Form 10-K to “we,” “us,” “our” and the “Company” are to Vu1 Corporation, Sendio, s.r.o., our Czech subsidiary, and our inactive subsidiary Telisar Corporation.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

We are including the following cautionary statement in this Annual Report on Form 10-K to make applicable and take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 for any forward-looking statements. All statements other than statements of historical fact, including statements concerning plans, objectives, goals, strategies, future events or performance and underlying assumptions, future results of operations or financial position, made in this Annual Report on Form 10-K are forward looking. In particular, the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “may,” “will,” “target,” variations of such words, and similar expressions identify forward-looking statements, but are not the exclusive means of identifying such statements and their absence does not mean that the statement is not forward-looking.

The forward-looking statements contained herein involve risks and uncertainties which could cause actual results or outcomes to differ materially from those expressed in the forward-looking statements. Our expectations, beliefs and projections are expressed in good faith and are believed by management to have a reasonable basis, including without limitation, management’s examination of historical operating trends, data contained in our records and other data available from third parties; however, management’s expectations, beliefs and projections may not be achieved or accomplished. In addition to other factors and matters discussed elsewhere herein, the following are important factors that, in our view, could cause actual results to differ materially from those discussed in the forward-looking statements:

| · | our lack of working capital and lack of revenues; |

| · | the availability of capital to us, in the amount and time needed, to fund our development programs and operations, and the terms and dilutive effect of any such financings; |

| · | our ability to be successful in our product development and testing efforts; |

| · | our ability to obtain commercial development for our products; |

| · | our ability to obtain manufacturing capability for our products in a cost-effective manner and at the times and in the volumes required, while maintaining quality assurance; |

| · | market demand for and acceptance of our products and planned products, and other factors affecting market conditions; |

| · | technological advances and competitive pressure by our competitors; |

| · | governmental regulations imposed on us in the United States and European Union; and |

| · | the loss of any of our key employees or consultants. |

For a discussion of these and other factors that may affect our business, results and prospects, see “Item 1. Business” and “Item 1A. Risk Factors.” Readers are urged to carefully review and consider the various disclosures made by us in this Report and in our other reports filed with the Securities and Exchange Commission, and those described from time to time in our press releases and other communications, which attempt to advise interested parties of the risks and factors that may affect our business, prospects and results of operations. Except as required by U.S. federal securities laws, we do not undertake any obligation to update or revise any forward-looking statements to reflect any future events or circumstances.

PART I

ITEM 1. BUSINESS

We design, develop and sell mercury-free lighting products using our proprietary Electron Stimulated Luminescence™, or ESL, technology. Our ESL lights use a form of cathode-ray tube technology in which accelerated electrons stimulate phosphor to create light, making the surface of our lights glow in a highly energy-efficient manner and with a warm white natural light. In December 2010, we released our first product, the R30 reflector light for recessed fixtures (a direct replacement for the 65-watt incandescent flood light), which we believe will capture a growing share of the general illumination market in 2012 and over the next several years. We believe our current and planned ESL lighting products offer advantages over competing technologies including increased energy efficiency, longer product lifetime, environmentally safer and toxin-free disposal, superior light quality and lower cost of usage. We also believe that our ESL lights have the potential to replace traditional incandescent light bulbs, compact fluorescent light bulbs (CFLs) and solid-state light emitting diodes (LEDs) in the future because of these competitive advantages. Our technology, intellectual property position and strategic manufacturing relationship should enable us to share in the revenues from the worldwide general lighting products market as our current and planned ESL lights enter mainstream consumer, commercial and industrial markets.

Our primary growth strategy is to accelerate the introduction of our lighting products into the commercial and residential general illumination market with the goal of obtaining widespread marketplace adoption over the next two years. In support of this objective, we are pursuing a multi-channel sales, marketing and distribution strategy, which includes efforts to establish business relationships with “big box” retailers, electrical and lighting distributors and municipal utilities.

We accomplished the first step in this strategy in October 2011 when we received a purchase order from Lowe’s Companies, Inc., the world’s second largest home improvement retailer. Under the terms of a master standard buying agreement, Lowe’s agreed to begin distributing our R30 light on its website in December 2011 and at its approximately 1,725 retail stores in the United States as they are commercially released. We granted Lowe’s limited exclusivity to sell our lighting products in the “big box” home improvement retailing market and “most favored customer” pricing and delivery terms. The agreement with Lowe’s extends until March 12, 2013, and may be terminated upon 60 days written notice prior to any annual renewal, or at any time without cause by providing advance written notice to us.

In addition to our R30 reflector light, which received certification from Underwriters Laboratories Inc. (UL®) in October 2010, we are currently developing our version of the standard Edisonian A19 screw-in light (and its European equivalent, the A60), the most common general purpose electric light in the world, for anticipated release during the second quarter of 2012. In June 2011, we submitted our A19 light to UL for certification and, in August 2011, received that certification. We are also developing an R40 flood light for the United States commercial market and a smaller R63 light for the European market to be used in currently-installed recessed lighting fixtures. According to Strategies Unlimited, an independent research firm, the worldwide lighting market accounts for approximately $90 billion in annual sales.

We believe a significant contributing factor to our prospects are government regulations mandating the use of energy-efficient lighting, including the elimination of the production of traditional incandescent light bulbs in Europe by 2012 and in the United States by 2014, and regulations restricting the use of hazardous substances such as the mercury contained in CFLs. We believe these developments disrupt the well-entrenched lighting industry of past decades and, given the energy conservation and eco-friendly characteristics of our ESL lighting products, create significant opportunities for us to introduce our products into the market in place of incandescent bulbs, as well as CFLs and LEDs. Unlike LEDs, our lights also work with existing lighting fixtures without modification.

In October 2011, we established a key strategic business relationship with Huayi Lighting Company Ltd., (“Huayi Lighting”) an experienced lighting products manufacturer. Under a new manufacturing agreement, Huayi Lighting has agreed, under our direction, to produce substantially all of our ESL lighting products for resale to our customers over the next five years. Through this relationship, Huayi Lighting is responsible for fabricating the required electronic components of our lights, sourcing the glass components from its multiple approved suppliers and using its established automated processes to assemble and package finished products. We have transitioned our manufacturing operations to Huayi Lighting from our former facility in the Czech Republic, which in the past has primarily provided us with product testing, engineering development and pilot production of our initial products. Through these development efforts in the Czech Republic, we have filed nine U.S. and related foreign patent applications, of which three patents have been granted and one application is expected to be granted shortly, covering important features of our current and planned lighting technology and products, and have accumulated over the past seven years a substantial amount of technical know-how relating to our ESL technology.

As of December 31, 2011, we employed a team of 28 research scientists, engineers and laboratory technicians concentrating on technology development and innovation.

On February 13, 2012, Sendio filed a petition of insolvency with the Regional Court in Olomouc, Czech Republic. In March, 2012 the court determined that Sendio was insolvent, and control of the legal entity passed to a court appointed trustee. The trustee will oversee the orderly sale of the Sendio assets and use proceeds to satisfy the liabilities of Sendio. Our lease obligation and the obligation to purchase the Sendio facility as discussed in Note 6 of the Notes to Consolidated Financial Statements were terminated.

Our executive officers and directors have significant experience in developing and executing a “go-to-market” business model in a competitive, high growth industry. In addition, our management team has assembled highly-skilled technical personnel in Europe and the United States to conduct ongoing research and product development of new lighting products and next-generation technologies.

Corporate Information

We were incorporated under the laws of the State of California in August 1996 under the name of Telegen Corporation. In late 2004, we began research and product development on our lighting technology and, in May 2008, changed our name to Vu1 Corporation to better reflect this business focus. Our principal executive offices are located at One New Hampshire Ave, Suite 125 Portsmouth, New Hampshire 03801, and our telephone number is (855) 881-2825. Our Internet website address is http://www.vu1.com. The information on our website is not incorporated by reference into this Report.

All share and per share information in this Form 10-K reflects, and where appropriate, is retrospectively adjusted for a 1-for-20 reverse stock split of our outstanding shares of common stock, effective November 23, 2011.

Our Company

We design, develop and sell mercury-free lighting products using our proprietary Electron Stimulated Luminescence™, or ESL, technology. Our ESL lights use a form of cathode-ray tube technology in which accelerated electrons stimulate phosphor to create light, making the surface of our lights glow in a highly energy-efficient manner and with a warm white natural light. In December 2010, we released our first product, the R30 reflector light for recessed fixtures (a direct replacement for the 65-watt incandescent flood light). In the fourth quarter of 2010, we began developing the standard Edisonian A19 screw-in light, the most common general purpose electric light in the world, which was submitted to Underwriters Laboratories Inc. (UL®) in June 2011 and received certification in August 2011. We believe these products will capture a growing share of the general illumination market in 2011 and over the next several years. We believe that this is because our current and planned ESL lighting products offer advantages over competing technologies including increased energy efficiency, longer product lifetime, environmentally safer and toxin-free disposal, superior light quality and lower cost of usage. We also believe that our ESL lights have the potential to replace traditional incandescent light bulbs, compact fluorescent light bulbs (CFLs) and solid-state light emitting diodes (LEDs) in the future because of these competitive advantages. Our technology, intellectual property position and strategic manufacturing relationship should enable us to share in the revenues from the worldwide general lighting products market as our current and planned ESL lights enter mainstream consumer, commercial and industrial markets.

Overview of the Lighting Market

Traditional incandescent light bulbs are inefficient because they convert only about 5% of the energy they consume into visible light, with the rest emerging as heat. CFLs use excited gases, or plasmas, to achieve a higher energy conversion efficiency of about 20%. However, the color rendering index, or CRI, of most fluorescent bulbs – in other words, how good their color is compared to an ideal light source – is inferior to that of an incandescent bulb. CFLs also pose environmental concerns because they have historically contained mercury. By avoiding the heat and plasma-producing processes of incandescent bulbs and CFLs, LEDs can have substantially higher energy conversion efficiencies. Current LEDs are very small in size (about one square millimeter) and are extremely bright. Having been developed in the 1980s, they are already employed in various specialty lighting products, such as traffic lights, billboards, replacements for neon lighting and as border or accent lighting. However, the high operating temperatures and intense brightness of LEDs may make them less desirable for general illumination and diffuse lighting applications.

The key design features of our ESL lighting products, on the other hand, are that they are energy efficient, fully dimmable, illuminate immediately when switched on and have a color quality or CRI that is warm and similar to incandescent light. In addition, our lights do not contain mercury, a feature which will ease disposal. If our efforts are successful, we believe that our lighting products could begin to be used for applications currently addressed by incandescent bulbs, CFLs and LEDs.

We believe a significant contributing factor to our prospects are government regulations mandating the use of energy-efficient lighting, including the elimination of the production of traditional incandescent light bulbs in Europe by 2012 and in the United States by 2014, and regulations restricting the use of hazardous substances such as the mercury contained in CFLs. We believe these developments disrupt the well-entrenched lighting industry of past decades and, given the energy conservation and eco-friendly characteristics of our ESL lighting products, create significant opportunities for us to introduce our products into the market in place of incandescent bulbs, as well as CFLs and LEDs. Unlike LEDs, our lights also work with existing lighting fixtures without modification.

Our Competitive Advantages

We believe our position in the lighting market is the direct result of our technological innovation. We have built an intellectual property portfolio around our ESL technology and are working with our strategic product manufacturer to prepare for large scale commercial production and to launch our lighting products into the marketplace. Our key competitive advantages include:

Lighting Qualities.We believe our current and planned ESL lighting products offer potential advantages over competing lighting technologies including increased energy efficiency, longer product lifetime, environmentally safer and toxin-free disposal, superior light quality and lower usage cost as a percentage of the lights’ extended lifetime.

Proprietary Technology. Through our internal development efforts in the Czech Republic, we have filed nine U.S. and related foreign patent applications, of which three patents have been granted and one application is expected to be granted shortly, covering important features of our current and planned lighting technology and products, and have accumulated over the past six years a substantial amount of technical know-how relating to our ESL technology.

Strategic Manufacturing Relationship.We have established a key strategic relationship with Huayi Lighting Company Ltd., an experienced lighting products manufacturer. Under a new manufacturing agreement, Huayi Lighting has agreed, under our direction, to produce substantially all of our ESL lighting products for resale to our customers over the next five years. We believe that this manufacturing agreement will provide us with a consistent and high caliber source of supply to meet the current and future needs of our customers.

Experienced Management. Our executive officers and directors have significant experience in developing and executing a “go-to-market” business model in a competitive, high growth industry. In addition, our management team has assembled highly-skilled technical personnel in Europe and the United States to conduct ongoing research and product development of new lighting products and next-generation technologies.

Our Growth Strategy

Our primary growth strategy is to accelerate the introduction of our lighting products into the commercial and residential general illumination market with the goal of obtaining widespread marketplace adoption over the next two years. In support of this objective, we are pursuing a multi-channel sales, marketing and distribution strategy, which includes efforts to establish business relationships with “big box” retailers, electrical and lighting distributors and municipal utilities. We accomplished the first step in this strategy in October 2011 when we received a purchase order from Lowe’s Companies, Inc., the world’s second largest home improvement retailer. Under the terms of a master standard buying agreement, Lowe’s agreed to begin distributing our R30 light on its website in December 2011 and at its approximately 1,725 retail stores in the United States. Lowe’s also agreed to distribute our other lighting products as they are commercially released.

In addition to our R30 reflector light, which received UL certification in October 2010, we are currently developing our version of the standard Edisonian A19 screw-in light (and its European equivalent, the A60), the most common general purpose electric light in the world, for anticipated release during the second quarter of 2012. In June 2011, our A19 light was submitted to UL for safety certification and, in August 2011, received that certification. We are also developing an R40 flood light for the United States commercial market and a smaller R63 light for the European market to be used in currently-installed recessed lighting fixtures. According to Strategies Unlimited, an independent research firm, the worldwide lighting market accounts for approximately $90 billion in annual sales.

Our Lighting Technology

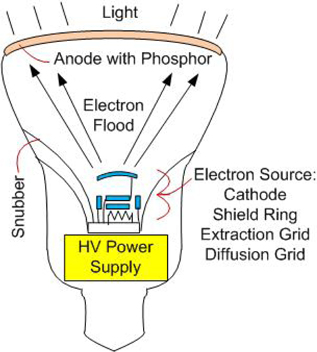

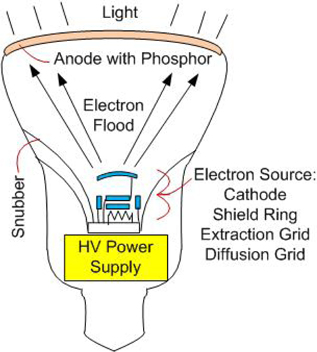

Our light uses a form of cathode-ray tube. It has an electron source and a power supply that supplies power to the electron source, as well as high voltage to accelerate the electrons toward the anode, where the electrons stimulate light emission from phosphors.

Electron Source. Our light generates a broad flood of high-energy electrons for evenly exciting the anode. The lights use a hot (thermionic) cathode having a flat disc emissive surface surrounded by a cold shield ring. A positively-biased extraction grid close to the cathode surface provides a high field to extract electrons from the cathode. A diffusion grid above the extraction grid provides a low-field zone allowing the electrons to be distributed evenly across the anode.

Power Supply.The power supply transforms power received through a connector from a fixture into three voltages. One voltage powers a heating filament that heats the cathode to a desired temperature to enhance electron emission. A second voltage biases both the extraction and diffusion grids, providing the high field that pulls electrons from the cathode and a low field that spreads the electrons. The third voltage is the several thousand volts provided through a snubber and a conductive coating inside the glass light structure to the anode; this voltage accelerates the electrons so the electrons can stimulate phosphors into emitting light. The power supply is able to respond to dimmers by reducing the anode voltage, thereby reducing phosphor stimulation and light output.

Anode. The anode is a thin conductive layer of aluminum, with a phosphor layer. Accelerated electrons stimulate light emission from the phosphors. Our white lights have a mixture of three phosphors, two of which (blue and green) are zinc-based, and a third (red) is a europium-doped phosphor. Virtually any color can be produced by choosing an appropriate mix of one or more known phosphors.

Our Lighting Products

The key design features of our current and planned lighting products are that they are energy efficient, fully dimmable, illuminate immediately when switched on and have a color quality that is warm and similar to incandescent light. Our lighting products do not contain mercury, a feature which will ease disposal.

We are continuing to refine the design of our planned products to maximize their efficiency, and we expect there will be adjustments to our current designs. If these efforts are successful, we believe that our lighting products could begin to be used for applications currently addressed by incandescent bulbs, CFLs and LEDs.

A list and description of each of our current and planned lighting products is set forth below, together with their estimated commercial introduction date:

| Model Shape/Size | | General Description | | Estimated Introduction Date |

| | | | | |

| R30 | | U.S. reflector light for recessed lighting fixtures. This is the most popular size reflector. | | First quarter of 2012 |

| | | | | |

| A19 | | U.S. standard Edisonian screw-in light. This is the most common general purpose electric light in the world. | | Third quarter of 2012 |

| | | | | |

| R40 | | U.S. reflector flood light for recessed lighting fixtures. This is the second largest selling reflector. | | Fourth quarter of 2012 |

| | | | | |

| R95 | | European version of R30 reflector (220 volt). | | First quarter of 2013 |

| | | | | |

| A60 | | European standard version of A19 Edisonian screw-in light (220 volt). | | First quarter of 2013 |

| | | | | |

| R125 | | European version of R40 reflector flood light (220 volt). | | First quarter of 2013 |

| | | | | |

| R20/R63 | | U.S. and European reflector. | | First quarter of 2013 |

| | | | | |

| PAR38 | | U.S. and European spot reflector primarily for outdoor use. | | First quarter of 2014 |

In the future, we expect the retail price of our R30 reflector light and our other lighting products to be established by “big box” retailers and electrical and lighting distributors. The R30 light, previously available on our website during the second quarter of this year, represented all of our revenue in that period. Substantially all of such revenue was derived from U.S.-based customers.

Product Development

During late 2009, we transitioned our U.S. development efforts to the Czech Republic and focused on the application of ESL technology on the requirements of our initial product, an R30 size light. The R30 size light is used primarily in lighting fixtures that are recessed in the ceiling of commercial and residential buildings and are commonly referred to as “recessed can fixtures.” We continued our development work on the technology to refine the prototype with the miniaturization of the electronics and improvements to the efficiency of the product and the design and implementation of the processes required for manufacturing the light. During the second quarter of 2010, we submitted the R30 light for safety certification to UL and, in October 2010, we received certification. We are continuing to refine the size of the light, further miniaturize the electronics and improve the manufacturing processes to enable us to produce the product at commercially viable levels.

During the fourth quarter of 2010, we began developing our version of the standard Edisonian A19 screw-in light (and its European equivalent, the A60), the most common general purpose electric light in the world. This size light is used in ordinary household lamps and non-recessed ceiling fixtures. In December 2010, we successfully developed a working prototype of this light. We are continuing to refine the prototype with the miniaturization of the electronics and improvements to the efficiency of the product. In June 2011, we submitted our A19 light to UL for safety certification and, in August 2011, received that certification. We are also developing an R40 flood light for the United States commercial market and a smaller R63 light for the European market to be used in currently-installed recessed lighting fixtures.

Our emphasis on the development of our planned products, the additional manufacturing processes required by our product manufacturer, the distribution, marketing and branding of products and the development of sales channels relating to our lighting products will command management’s primary attention during the next 12 months. It will also comprise the primary use of our financial resources. In 2012, our success will depend on our ability to reach commercial manufacturing levels for our R30 and A19 lights, generate market awareness and acceptance of our current and planned lighting products, protect our technology through patents and trade secrets, and develop our planned products to meet industry standards. If we are unable for technological, financial, competitive or other reasons to successfully take these steps, our business and operations will be adversely affected.

Target Markets and Customers

We are initially targeting the U.S. R30 and R40 reflector lighting market. According to recent reports, the U.S. residential market is comprised of 800 million recessed can lights with more than 140 million bulbs sold per year (“CFL Market Profile,” U.S. Department of Energy, March 2009, and “A Review of the Reflector Compact Fluorescent Lamps Technology Procurement Program: Conclusions and Results,” Pacific Northwest National Laboratory, May 2008). We intend to target the A19 standard Edisonian screw-in lighting market when our technology and manufacturing capabilities are fully established for large scale commercial production.

Significant lighting market drivers are product size, shape, cost, brightness, color rendering, mercury content, dimming capability and energy efficiency. As indicated above, we are directing our product development efforts with awareness of these features. Distribution in this market segment is primarily through electrical and lighting distributors (typically on a regional level) or directly from manufacturers to “big box” retailers.

In October 2011, we received a purchase order from Lowe’s Companies, Inc., the world’s second largest home improvement retailer. Under the terms of a master standard buying agreement, Lowe’s agreed to begin distributing our R30 light on its website in December 2011 and at its approximately 1,725 retail stores in the United States. The retail unit price of our R30 light will be $14.98. Lowe’s also agreed to distribute our other lighting products as they are commercially released. We granted Lowe’s limited exclusivity to sell our lighting products in the “big box” home improvement retailing market, and “most favored customer” pricing and delivery terms under which we cannot offer a lower price or more favorable delivery terms to other customers without offering the same pricing and delivery terms to Lowe’s. The agreement with Lowe’s extends until March 12, 2013, and may be terminated upon 60 days written notice prior to any annual renewal, or at any time without cause by providing advance written notice to us. There is no requirement that Lowe’s issue any purchase order under the agreement.

Strategic Relationship with Product Manufacturer

In October 2011, we entered into a manufacturing agreement with Huayi Lighting Company Ltd., an experienced lighting products manufacturer. Under this exclusive five-year agreement, Huayi Lighting has agreed to produce substantially all of our R30 lights and future lighting products for resale to our customers. Through this agreement, Huayi Lighting is responsible for fabricating the required electronic components of our lights, sourcing the glass components from its multiple approved suppliers and using its established automated processes to assemble and package finished products. We are required to provide estimated quarterly volume requirements to Huayi Lighting during the term of the agreement. We are responsible to pay the upfront costs of specialized production tooling required by Huayi Lighting, and for the cost of additional machinery needed for its assembly lines, to produce our ESL lighting products, all of which amounts will be reimbursed to us at the end of the agreement. Payments to Huayi Lighting under the agreement are based on a negotiated margin above its verified cost to source raw materials and manufacture the product, and payments are made by us in U.S. dollars when the products are delivered to the loading dock in Guangzhou, China for shipment to the west coast of the United States. Our products will be transported to us in bulk via ocean by fully-insured logistics companies. For all lighting products manufactured by Huayi Lighting, the products are warranted to have been made to our required technical specifications and to fully meet applicable quality standards. In connection with the agreement, we granted Huayi Lighting limited license rights to use our technologies and intellectual property for the manufacture of our lights. The manufacturing agreement may be terminated at any time by the parties’ mutual agreement or by us in the event of a material breach under the agreement or failure to deliver products on a timely basis. Additionally, we have the right to independently seek a lower cost supplier to Huayi Lighting during the five-year agreement term under certain circumstances.

We believe that this manufacturing agreement will provide us with a consistent and high caliber source of supply to meet the current and future needs of our customers.

We expect to pay a duty on all lighting products that we import from China. This duty is expected to represent a 3.9% mark-up to factory invoice.

Sales, Marketing and Distribution

During 2011, we continued our marketing initiatives to determine our initial marketing strategy and begin branding and corporate positioning. Our marketing efforts have included market research to determine market size, competition, product features, consumer attitudes, pricing, certifications, government agencies, grants, target sales channels and retailers, branding and creation of initial marketing collateral. We have also had strategic and pre-contractual meetings with certain retailers and potential channel and distribution partners to determine levels of interest in our lighting products and ESL technology. We believe that the results of these meetings were positive, but no significant customer agreements have been entered into to date.

During 2011, we also initiated our efforts to sell our lights directly to consumers through an online order facility at our company’s corporate website. We began shipping orders through this facility during the second quarter of 2011. We currently intend to outsource our online order facility to an e-commerce fulfillment service provider to enable consumers to more efficiently buy our lights and review our product catalog. In early 2011, we also selected a vendor to assist us with the specific packaging and display design requirements of “big box” retailers. In late 2011, Lowes received shipments of our R30 bulbs for sale on their website.

We intend to adopt inventory-carrying practices, together with the terms under which we sell our lighting products (including payment and delivery terms), that are customary in the lighting products markets.

Twenty states have enacted Conservation Improvement Programs (CIP). Through a CIP, electric and natural gas utilities are required to invest a portion of their state revenues in projects designed to reduce their customers' consumption of electricity and natural gas, and to generally improve resource efficiency. One form of CIP investment is conducting “give-aways” of energy efficient lighting products. Alternatively, some states provide cash rebates to lighting manufacturers, stores or directly to the consumer. We have met with a number of utilities and utility groups to determine interest in the promotion of ESL energy efficient lighting products. We believe that the results of these meetings were positive, but no agreements in this regard have been entered into to date.

In September 2010, we entered into an agreement with Integrated Sales Solutions II, LLC (ISS) to enhance our capabilities in designing and establishing sales strategy and distribution channels with retailers, electrical utilities, electrical distributors and government agencies. In April 2011, we entered into an agreement with Hamlin Consulting, LLC to advise and assist us in defining logistics, warehousing, finished good requirements, distribution, packaging, merchandising and support for our ESL lighting products. We work closely with ISS and Hamlin Consulting to develop programs aimed at further developing these channels and potential distribution partnerships. ISS and Hamlin Consulting are controlled by Bill K. Hamlin, the President, Chief Operating Officer and a director of our company.

Our technology has been featured on the Discovery Channel website, Popular Science magazine and website, CNET website and on The New York Times website.

Intellectual Property, Patents and Proprietary Rights

We have filed nine U.S. and related foreign patent applications, of which three patents have been granted and one application is expected to be granted shortly. These patents cover important features of our current and planned lighting technology and products. We expect to apply for additional patent protection on our ESL technology and our manufacturing processes both domestically and internationally in the future. We believe that our technology has unique aspects that are patentable; however, there can be no assurance that any patent application will be granted or, if granted, that it will be defensible.

We protect our intellectual property rights through a combination of patent, trademark, trade secret laws and other methods of restricting disclosure, and requiring our independent consultants, strategic vendors and suppliers to sign non-disclosure agreements, as well as assignment of inventions agreements, when appropriate.

Raw Materials and Supplies

Development and production of our lighting products will require certain raw materials, including glass, electronics, coatings, certain chemicals and chemical compounds, plastic and packaging. Pursuant to our manufacturing agreement with Huayi Lighting Company Ltd., Huayi Lighting assumed sole responsibility for sourcing these raw materials. Huayi Lighting has advised us that it has multiple dedicated supply agreements with glass and other suppliers, and maintains relationships with alternative suppliers for raw materials and specialized component needs. We do not anticipate raw material shortages in the foreseeable future.

Research and Product Development

We spent approximately $3.7 million during fiscal 2011 and approximately $2.1 million during fiscal 2010, in our product development efforts.

We have retained certain key members of the former Sendio development team subsequent to the insolvency of Sendio, and we intend in the future to establish a research and development center in New England to develop new products for the lighting industry by taking advantage of the latest technology advancements. We expect to collaborate closely with Huayi Lighting Company Ltd. and other subcontractors which use standard production processes to ensure that new lighting products can be produced quickly, and at the lowest cost and highest quality.

Government Regulation and Industry Certification

In October 2010, we obtained safety certification from UL for our R30 reflector light. This certification enables us to sell our ESL lighting products in the United States and Canada. In June 2011, we submitted our A19 light to UL for safety certification and, in August 2011, received that certification.

Any commercial lighting products that we develop in the future will require certifications from an independent third party testing laboratory prior to their sale. There is presently no Energy Star® certification standard for our products. However, we are in discussions with Energy Star® in relation to its new self-certification system which we intend to pursue. In addition, we may be subject to other certifying agencies and other regulatory approvals. The approvals and certifications required will be determined based upon the markets that we enter. We are designing our lighting products to meet the standards for certification from independent third party laboratories, and we intend to submit an application to the appropriate testing laboratory once we have completed the necessary development and manufacturing processes required to obtain certification. We cannot predict whether we will obtain any future required certification from an independent third party testing laboratory or any other regulatory agency.

Our activities currently are subject to no particular regulation by governmental agencies other than that routinely imposed on corporate businesses, and no such regulation is now anticipated.

Competition

Our market segment is highly competitive and traditionally dominated by several large competitors such as General Electric Company, Philips Electronics NV and Osram Sylvania. These entities possess far more substantial financial, human and other resources than we do. There are also hundreds of small manufacturers of low-end products – many inexpensive and often poor performing compact fluorescent lamps. Many companies are now developing products utilizing solid-state LED technology. As energy efficient technologies are adopted, it is likely that the industry will continue to be dominated by large competitors who will often outsource manufacturing to smaller companies. Research will continue on incandescent type technologies such as halogen infrared reflecting. Abandoned technologies such as induction lighting may temporarily re-emerge. Based on meetings over the last four years with electric utilities, U.S. Department of Energy consultants, electrical distributors and major retailers, we have not identified any competitors with a similar technology to ESL.

Environmental Compliance

We are not aware of any material effects that compliance with federal, state, local or foreign environmental protection laws or regulations will have on our business. We have not expended material amounts to comply with any environmental protection laws or regulations and do not anticipate having to do so in the foreseeable future. We have obtained the necessary permits required for our existing product development operations in our facility in the Czech Republic.

Employees

As of December 31, 2011, we had 72 full-time employees in the Czech Republic through our Sendio subsidiary, plus three full-time employees in the United States. In February, 2012 we filed a petition of insolvency for Sendio, which terminated all employees at the facility. Vu1 entered into consulting agreements with five key members of the development and manufacturing team to work closely with Huayi Lighting in the manufacturing of our R30 bulbs and to continue development of our future planned products. We have routinely used consultants in our U.S. operations and strategic vendors on a work-for-hire contract basis. None of our employees are subject to a collective bargaining agreement and we consider relations with employees to be good.

ITEM 1A. RISK FACTORS

Risks Related to Our Business and Industry

We have historically been a research and product development company. We have a limited operating history with minimal revenue to date, so it may be difficult to evaluate our business and prospects. We also received a going concern modification in our 2011 audit.

We have been primarily engaged during the last seven years in the research and development of our lighting products, and have incurred significant operating losses. We have only recently commenced commercial manufacturing. In the second quarter of 2011, we recognized revenue of approximately $8,000 from initial sales of our R30 reflector light. We had no revenues in 2010. We currently depend on third-party financing to fund our operations. We have a very limited operating history upon which an investor can evaluate our business and prospects, and we may never generate significant revenue or achieve net income. Peterson Sullivan, LLP, our independent registered public accounting firm, in its opinion on our financial statements for the year ended December 31, 2011, raised substantial doubt about our ability to continue as a going concern due to our net losses and negative cash flows from operations and other factors.

We have incurred historical losses and, as a result, may not be able to generate profits, support our operations or establish a return on invested capital, which can have a detrimental effect on the long-term capital appreciation of our common stock.

We incurred a net loss in 2011 of $9.1 million and had an accumulated deficit of $79.6 million as of December 31, 2011. We cannot predict when or whether we will ever realize a profit or otherwise establish a return on invested capital. Our business strategies may not be successful and we may never generate significant revenues or profitability, in any future fiscal period or at all.

We have a number of technology issues to resolve before we will be able to successfully manufacture a full line ofcommercially viable lighting products.

Although we have completed initial engineering and obtained UL certification of our initial R30 reflector light, further development work and third-party testing will be necessary before the technology can be deployed and production of a full line of lighting products can be commenced. Specifically, we are continuing to work on our standard Edisonian A19 screw-in light, including obtaining acceptable life and output specifications. If we are unable to solve current and future technology issues, we may not be able to offer a full line of commercially viable products. In addition, if we encounter difficulty in solving technology issues, our research and development costs could increase substantially and our development and production schedules could be significantly delayed.

We have experienced delays in executing our business plan, and further delays will reduce the likelihood that we will be able to manufacture lighting products or generate sufficient revenue to stay in business.

We have previously experienced delays in executing our business plan. These delays are attributable to a number of factors, including:

| · | unanticipated difficulties and increased expenses in developing our ESL technology, |

| · | unanticipated difficulties in establishing large scale commercial manufacturing processes, and |

| · | our inability to obtain funding in a timely manner. |

In the future, we may experience delays caused by these and other factors. Our business must be viewed in light of the problems, expenses, complications and delays frequently encountered in connection with the development of new technologies, products, markets and operations. If we are unable to anticipate or manage challenges confronting our business in a timely manner, we may be unable to continue our operations.

We must successfully develop, introduce, market and sell lighting products and manage our operating expenses.

To be a viable business, we must successfully develop, introduce, market and sell products and manage our operating expenses. Many of our lighting products are still in development and are subject to the risks inherent in the development of technology products, including unforeseen delays, expenses, patent challenges and complications frequently encountered in the development and commercialization of technology products, the dependence on and attempts to apply new and rapidly changing technology, and the competitive environment of the industry. Many of these events are beyond our control, such as unanticipated development requirements, delays and difficulties with obtaining third-party certification, delays in submitting documentation for and being granted patents and establishing manufacturing relationships. Our success also depends on our ability to maintain high levels of employee utilization, manage our production costs, sales and marketing costs and general and administrative expenses, and otherwise execute on our business plan. We may not be able to effectively and efficiently manage our development and growth. Any inability to do so could increase our expenses and negatively impact our results of operations.

Our business could be adversely affected if Lowe’s share of the consumer marketplace declined or if Lowe’s were to discontinue or limit its relationship with us.

We currently expect that sales of our lighting products through Lowe’s will initially be our primary retail channel to the general consumer marketplace. We will depend, therefore, on the success of the Lowe’s chain of home improvement stores, and the U.S. retail industry generally. Our business could be adversely affected if Lowe’s share in the home improvement retailing market declined, if a significant number of its stores shut down or if its customer base eroded. We cannot predict the impact, if any, such developments will have on the sales, marketing and distribution of our lighting products. Additionally, our master standard buying agreement with Lowe’s extends until March 12, 2013, and may be terminated upon 60 days written notice prior to any annual renewal, or at any time without cause by providing advance written notice to us. There is no requirement that Lowe’s issue any purchase order under the agreement. A decision by Lowe’s to discontinue or limit its relationship with us could result in a significant loss of potential revenue for us.

We rely solely on Huayi Lighting Company to manufacture the ESL lighting products we sell to customers and to source the required raw materials.

Our business prospects depend significantly on our ability to obtain ESL lighting products for sale to our customers. Our new manufacturing agreement with Huayi Lighting Company Ltd. provides us with a single source for our ESL lights. Through this agreement, Huayi Lighting is responsible for fabricating the required electronic components of our lights, sourcing the glass components from its suppliers and using its established automated processes to assemble and package finished products. Huayi Lighting is located in the People’s Republic of China, where shipments of product to us could be delayed, rerouted, lost or damaged. Our inability to obtain finished products from Huayi Lighting in accordance with our required technical specifications and on a timely basis due to shipping delays, manufacturing problems or its failure to obtain required raw materials would have a material adverse effect on our revenue from product sales, as well as on our ability to support our customers’ purchase requirements, which could result in loss of customers and damage to our reputation. We may also be subject to the risk of fluctuations in raw material prices, since our arrangement with Huayi Lighting provides that increases and decreases in the prices of such raw materials obtained from local China-based vendors are passed through to us in the form of adjusted final finished good prices charged by Huayi Lighting.

We may face additional barriers and tariffs as a result of importing our lighting products from China, which could increase our prices and make our products less desirable.

We expect to pay a duty on all lighting products that we import from China. This duty is expected to represent a 3.9% mark-up to factory invoice. We will also bear related importing costs such as customs inspection fees and ocean freight charges. In the future, China and the United States may create additional barriers to business between our China-based product manufacturer and us, including new tariffs, costs, restrictions, controls or embargos that could negatively impact our business and operating results. New or increased tariffs would likely result in higher prices (and potentially lower sales volumes) and lower operating margins on our products.

We rely heavily on a few consultants and employees, the loss of whom could have a material adverse effect on our business, operating results and financial condition.

Our future success will depend in significant part upon the continued services of our executive officers and directors and certain key consultants, and our ability to attract, assimilate and retain highly qualified technical, managerial and sales and marketing personnel when needed. Competition for quality personnel is intense, and there can be no assurance that we can retain our existing key personnel or that we will be able to attract, assimilate and retain such employees in the future when needed. The loss of key personnel or the inability to hire, assimilate or retain qualified personnel in the future could have a material adverse effect on our business.

We rely on outside vendors to manage certain key business processes, and any failure by them to perform will negatively affect our business.

We have outsourced certain of our key business processes. In September 2010, we retained Integrated Sales Solutions II, LLC (a company controlled by Bill K. Hamlin, our President and Chief Operating Officer) to help develop our sales, marketing and distribution strategies and channels. If any of our service providers fail to perform at a satisfactory level, our business development will be negatively affected and delayed, and our reputation may be harmed.

Our future operating results are difficult to predict; thus, the future of our business is uncertain.

Due to our limited operating history and the significant development and manufacturing objectives that we must achieve to be successful, our quarterly and annual operating results are difficult to predict and are expected to vary significantly from period to period. In addition, the amount and duration of losses will be extended if we are unable to develop and manufacture our products in a timely manner. Factors that could inhibit our product development, manufacturing and future operating results include:

| · | failure to solve existing or future technology-related issues in a timely manner, |

| · | failure to obtain sufficient financing when needed, |

| · | failure to secure key manufacturing or other strategic business relationships, and |

| · | competitive factors, including the introduction of new products, product enhancements and the introduction of new or improved technologies by our competitors, the entry of new competitors into the lighting markets and pricing pressures. |

We face currency risks associated with fluctuating foreign currency valuations.

With operations in the Czech Republic through our Sendio s.r.o. subsidiary (our only foreign subsidiary), Sendio’s accounts, which primarily consist of lease payments, compensation and other research and development, and administrative expenses, are denominated in the Czech koruna (CZK) and the Euro. An increase in the value of the CZK and Euro in relation to the U.S. dollar would have an adverse effect on our operating expenses. In addition, we may engage in business in other countries, particularly in the European Union, and our operating results will be subject to fluctuations in the value of those currencies against the U.S. dollar. In addition, the financial statements for our Czech subsidiary are denominated in the CZK; accordingly, on a consolidated financial statement reporting basis, these numbers are translated into U.S. dollars and are affected by currency conversion rates. To date, we have not entered into foreign currency contracts or other currency-related derivatives to mitigate the potential impact of foreign currency fluctuations.

Because we are smaller and have fewer financial resources than most of our competitors, we may not be able to successfully compete in the very competitive lighting industry.

The lighting industry is very competitive and we expect this competition to continue to increase. The general illumination market segment within the lighting industry is dominated by a number of well-funded multi-national companies such as General Electric Company, Phillips Electronics NV and Osram Sylvania, that have established products and are developing new products that compete with our current and planned lighting products. We may not be able to compete effectively against these or other competitors, most of whom have substantially greater financial resources and operating experience than we do. Many of our current and future competitors may have advantages over us, including:

| · | well established products that dominate the market, |

| · | longer operating histories, |

| · | established customer bases, |

| · | substantially greater financial resources, |

| · | well established and significantly greater technical, research and development, manufacturing, sales and marketing resources, capabilities and experience, and |

| · | greater name recognition. |

Our current and potential competitors have established, and may continue to establish in the future, cooperative relationships among themselves or with third parties that would increase their market dominance and negatively impact our ability to compete with them. In addition, competitors may be able to adapt more quickly than we can to new or emerging technologies and changes in customer needs, or to devote more resources to promoting and selling their products. If we fail to adapt to market demands and to compete successfully with existing and new competitors, our results of operations could be materially adversely affected. The market for lighting technology is changing rapidly and there can be no assurance that we will be able to compete, especially in light of our limited resources. There can be no assurance that any of our current or planned lighting products can compete successfully on a cost, quality or market acceptance basis with competitors’ products and technologies.

We depend on our intellectual property. If we are unable to protect our intellectual property, we may be unable to compete and our business may fail.

Our success and ability to develop our technology and create products and become competitive depend to a significant degree on our ability to protect our proprietary technology, particularly any patentable material. We rely on a combination of patent, trademark, trade secret and other intellectual property laws, nondisclosure agreements and other protective measures to preserve our rights to our technology. In addition, any intellectual property protection we seek may not preclude competitors from developing products similar to ours. In addition, the laws of certain foreign countries do not protect intellectual property rights to the same extent as do the laws of the United States.

We do not currently have sufficient available resources to defend a lawsuit challenging our intellectual property rights or to prosecute others who may be infringing our rights. Accordingly, even if we have strong intellectual property rights and patent rights, we may not be able to afford to engage in the necessary litigation to enforce our rights.

We compete in industries where competitors pursue patent prosecution worldwide and patent litigation is customary. At any given time, there may be one or more patent applications filed or patents that are the subject of litigation, which, if granted or upheld, could impair our ability to conduct our business without first obtaining licenses or granting cross-licenses, which may not be available on commercially reasonable terms, if at all. We have several patent applications pending in the United States and internationally and we expect to file additional patent applications; however, none of these patents may ever be issued. We do not perform worldwide patent searches as a matter of custom and, at any given time, there could be patent applications pending or patents issued that may have an adverse impact on our business, financial condition and results of operations.

Other parties may assert intellectual property infringement claims against us, and our products may infringe on the intellectual property rights of third parties. Intellectual property litigation is expensive and time consuming and could divert management’s attention from our business and could result in the loss of significant rights. If there is a successful claim of infringement, we may be required to develop non-infringing technology or enter into royalty or license agreements which may not be available on acceptable terms, if at all. In addition, we could be required to cease selling any of our products that infringe on the intellectual property rights of others. Successful claims of intellectual property infringement against us may have a material adverse effect on our business, financial condition and results of operations. Even successful defense and prosecution of patent suits is costly and time consuming.

We rely in part on unpatented proprietary technology, and others may independently develop the same or similar technology or otherwise obtain access to our unpatented technology. To protect our trade secrets and other proprietary information, we require employees, consultants, advisors and strategic partners to enter into confidentiality agreements. These agreements may not provide meaningful protection for our trade secrets, know-how or other proprietary information in the event of any unauthorized use, misappropriation or disclosure of those trade secrets, know-how or other proprietary information. In particular, we may not be able to protect our proprietary information as we conduct discussions with potential strategic partners. If we are unable to protect the proprietary nature of our technologies, it may have an adverse impact on our business, financial condition and results of operations.

Failure to obtain and maintain industry certification for our lighting products could cause an erosion of our current competitive strengths.

We are designing our lighting products to be UL or ETL (an Intertek listed mark for product compliance to North American safety standards) compliant and intend to seek Energy Star certification, as well as appropriate certifications in the European Union and in other countries. UL or ETL compliance certification is a key standard in the lighting industry, and if we fail to obtain or maintain this standard we may not have any market interest for our products. We may not obtain this certification or we may be required to make changes to our lights, which would delay our commercialization efforts and would negatively harm our business and our results of operations.

Rapid technological changes and evolving industry standards could result in our lighting products becoming obsolete and no longer in demand.

The lighting industry is characterized by rapid technological change and evolving industry standards and is highly competitive with respect to timely product innovation. The introduction of lighting products embodying new technology and the emergence of new industry standards can render existing products and technologies obsolete and unmarketable. Our success will depend in part on our ability to successfully develop commercial applications for our technology, anticipate and respond to technology developments and changes in industry standards, and obtain market acceptance on any products we introduce. We may not be successful in the development of our ESL technology, and we may encounter technical or other serious difficulties in our development or commercialization efforts that would materially and adversely affect our results of operations.

Despite government regulations aimed at eliminating the production of traditional incandescent light bulbs, consumer and political opposition could cause delays in the implementation of those regulations, possibly delaying the pace and impact of our future market penetration.

There has been consumer, political and media resistance from time to time to government regulations mandating the use of energy-efficient lighting, including the elimination of the production of traditional incandescent light bulbs, owing to the low cost of incandescent light bulbs, their easy and broad availability and concerns about other alternatives such as mercury contamination with CFLs. In the event implementation of these government regulations is delayed, we may experience a delay in the pace with which our products may be able to penetrate the general lighting products market.

If we fail to maintain proper and effective internal controls in the future, our ability to produce accurate and timely financial statements could be impaired, which could harm our operating results, investors’ views of us and, as a result, the value of our common stock.

Ensuring that we have effective internal control over financial reporting and disclosure controls and procedures in place is a costly and time-consuming effort that needs to be frequently evaluated. As a public company, we conduct an annual management assessment of the effectiveness of our internal controls over financial reporting in compliance with Section 404 of the Sarbanes-Oxley Act of 2002. As a smaller reporting company, we are not currently required to receive a report from our independent registered public accounting firm addressing the effectiveness of our internal controls over financial reporting. As we grow, it may be necessary in the future to update our internal controls over financial reporting on the basis of periodic reviews. If we are not able to comply with the requirements of Section 404, or if we (or our independent registered public accounting firm) identify deficiencies in our internal controls over financial reporting that could rise to the level of a material weakness, we may not be able to complete our evaluation, testing and any required remediation in a timely fashion. During the evaluation and testing process, if we identify one or more material weaknesses in our internal controls over financial reporting, we will be unable to assert that our internal controls over financial reporting are effective. If we are unable to assert that they are effective (or if our independent registered public accounting firm is unable in the future to express an opinion on the effectiveness of our internal controls over financial reporting), we could be subject to investigations or sanctions by the SEC or other regulatory authorities, and we could lose investor confidence in the accuracy and completeness of our financial reports, which could cause an adverse effect on the market price of our common stock, our business, reputation, financial position and results of operation. In addition, we could be required to expend significant management time and financial resources to correct any material weaknesses that may be identified or to respond to any regulatory investigations or proceedings.

Risks Related to our Securities

Our historic stock price has been volatile and the future market price for our common stock is likely to continue to be volatile. This may make it difficult for you to sell our common stock for a positive return on your investment.

The public market for our common stock has historically been volatile. Any future market price for our shares is likely to continue to be volatile. This price volatility may make it more difficult for you to sell shares when you want at prices you find attractive. The stock market in general has experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of specific companies. Broad market factors and the investing public’s negative perception of our business may reduce our stock price, regardless of our operating performance. Further, the market for our common stock is limited and we cannot assure you that a larger market will ever be developed or maintained. We cannot predict the effect that this offering or a Nasdaq Capital Market listing will have on the volume or trading price of our common stock. We cannot provide assurance that the market price of our common stock will not fall below the public offering price or that, following the offering, a stockholder will be able to sell shares acquired in this offering at a price equal to or greater than the offering price. Market fluctuations and volatility, as well as general economic, market and political conditions, could reduce our market price. As a result, these factors may make it more difficult or impossible for you to sell our common stock for a positive return on your investment.

Our management and SAM Special Opportunities Fund, L.P. own a substantial amount of our stock and are capable of influencing our affairs.

As of December 31, 2011, our executive officers and directors (and their respective affiliates) beneficially owned approximately 26.7% of our outstanding common stock, with SAM Advisors, LLC, an investment advisor controlled by William B. Smith, our Chairman, beneficially owning approximately 17.8% of our outstanding common stock. As a result, these shareholders substantially influence our management and affairs and, if acting together, control most matters requiring the approval by our shareholders including the election of directors, any merger, consolidation or sale of all or substantially all of our assets and any other significant corporate transactions. The concentration of ownership may delay or prevent a change of control at a premium price.

Our articles of incorporation contain authorized, unissued preferred stock which, if issued, may inhibit a takeover at a premium price that may be beneficial to you.

Our articles of incorporation allow us to issue up to 10,000,000 shares of preferred stock without further stockholder approval and upon such terms and conditions, and having such rights, preferences, privileges and restrictions as the board of directors may determine. The rights of the holders of common stock will be subject to, and may be adversely affected by, the rights of holders of any preferred stock that may be issued in the future. In addition, the issuance of preferred stock could have the effect of making it more difficult for a third party to acquire control of, or of discouraging bids for control of our company. This could limit the price that certain investors might be willing to pay in the future for shares of common stock. We have no current plans to issue any shares of preferred stock.

Shares of stock issuable pursuant to our stock options, warrants, convertible debentures and underwriters’ warrants may adversely affect the market price of our common stock.

As of December 31, 2011, we have outstanding under our 2007 Stock Incentive Plan stock options to purchase 591,181 shares of common stock, outstanding warrants to purchase 921,963 shares of common stock and outstanding convertible debentures to acquire 374,346 shares of common stock. The exercise or conversion of these securities and sales of common stock issuable pursuant to them, would reduce a stockholder’s percentage voting and ownership interest.

The stock options, warrants and convertible debentures are likely to be exercised when our common stock is trading at a price that is higher than the exercise or conversion price of these securities, and we would be able to obtain a higher price for our common stock than we will receive under such securities. The exercise or conversion, or potential exercise or conversion, of these stock options, warrants and convertible debentures could adversely affect the market price of our common stock and adversely affect the terms on which we could obtain additional financing, if needed.

The large number of shares eligible for future sale may adversely affect the market price of our common stock.

The sale, or availability for sale, of a substantial number of shares of common stock in the public market could materially and adversely affect the market price of our common stock and could impair our ability to raise additional capital through the sale of our equity securities. At December 31, 2011 there are 5,568,253 shares of common stock issued and outstanding. Of these shares, approximately 5,527,628 are freely transferable. Our executive officers and directors beneficially own 1,571,860 shares, which would be eligible for resale, subject to the volume and manner of sale limitations of Rule 144 under the Securities Act. An additional 40,625 shares are “restricted shares,” as that term is defined in Rule 144, and are eligible for sale under the provisions of Rule 144.

Our common stock is currently considered a “penny stock” and may be difficult to sell unless we obtain and maintain our Nasdaq listing.

Our common stock is subject to certain rules and regulations relating to “penny stock.” A “penny stock” is generally defined as any equity security that has a price less than $5.00 per share and that is not quoted on a national securities exchange such as Nasdaq. Being a penny stock generally means that any broker who wants to trade in our shares (other than with established clients and certain institutional investors) must comply with certain “sales practice requirements,” including delivery to the prospective purchaser of the penny stock a risk disclosure document describing the penny stock market and the risks associated with it. These penny stock rules make it more difficult for broker-dealers to recommend our common stock and, as a result, our stockholders may have difficulty in selling their shares in the secondary trading market. This lack of liquidity may also make it more difficult for us to raise capital in the future through the sale of our equity securities.

We do not intend to pay cash dividends on our common stock, so any return on investment must come from appreciation.

We have never declared or paid any cash dividends on our common stock and do not intend to pay cash dividends in the foreseeable future. We intend to invest all future earnings, if any, to fund our growth. Therefore, any investment return in our common stock must come from increases in the trading price of our common stock.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not Applicable.

ITEM 2. PROPERTIES

We do not own any real property.

Facilities

As of December 31, 2011 our corporate headquarters consisted of approximately 200 square feet, were located in New York, New York for total rent per month of $1,320.

On July 11, 2011 we entered into a month to month lease agreement for office space in New Hampshire. Monthly rental payments are $1,445 under the lease.

Our pilot production facility and research and development laboratories were located in Olomouc in the Czech Republic. We occupied the entire 75,000 square-foot facility. During 2011, we paid approximately $40,350 per month (or approximately 719,560 Czech koruna) in rent under a lease that extended through June 2013. In 2008, we entered into a purchase agreement with the landlord to acquire the building and property at which this facility is located for approximately $8,735,000 (or approximately 155,776,900 Czech koruna) payable by June 30, 2013. In February, 2012 we filed a petition of insolvency for Sendio. Our lease for the premises was terminated effective March 15, 2012 and our obligation to acquire the building was terminated on February 8, 2012. See Note 6 to our Notes to the Consolidated Financial Statements for a further discussion of the lease and purchase agreements.

ITEM 3. LEGAL PROCEEDINGS

On February 13, 2012, Sendio filed a petition of insolvency with the Regional Court in Olomouc, Czech Republic. In March, 2012 the court determined that Sendio was insolvent, and control of the legal entity passed to a court appointed trustee. The trustee will oversee the orderly sale of the Sendio assets and use proceeds to satisfy the liabilities of Sendio.