CONFIDENTIAL

Project Varsity

Presentation to the Board of Directors

April 11, 2003

| Project Varsity |

The accompanying material was compiled on a confidential basis, solely for the benefit and use of the Board of Directors (the “Board”) of Ek Chor China Motorcycle Co. Ltd. (together with its affiliates, “EKC” or the “Company”). Neither Bear, Stearns & Co. Inc. (“Bear Stearns”) nor any of its officers, directors, employees, affiliates, advisors, agents or representatives warrants the accuracy or completeness of any of the materials set forth herein.

It should be noted in connection with our review of the matters discussed herein that:

| • | In the ordinary course of business, Bear Stearns and its affiliates may hold or actively trade in the securities of the controlling shareholder of the Company, C.P. Pokphand Co. Ltd. (“CPP”), or those of its affiliates, and may at any time hold a long or short position in such securities. |

| • | Any valuations, estimates or projections contained in the accompanying materials were provided to us by the Company, or prepared or derived from financial and other information supplied by the Company or derived from other public sources, and involve numerous and significant subjective determinations by the Company that may or may not be correct. We have relied upon and assumed, without independent verification, the accuracy and completeness of such information, including without limitation the projections and estimates for the Company provided to us by the Company’s management. We have further relied upon the assurances of the senior management of the Company that they are unaware of any facts that would make the information provided to us incomplete or misleading. Accordingly, no representation or warranty can be made or is made by Bear Stearns as to the accuracy or achievability of any such valuations, estimates or projections. |

| • | During the course of our engagement by the Company, we were not asked to solicit bids or offers for the Company from other parties, nor were we requested to, and we did not, participate in the negotiations or structuring of any transaction to be considered by the Company. Furthermore, we did not make any independent evaluation or appraisal of the assets or liabilities (contingent or otherwise) of the Company, and nor was Bear Stearns furnished with any such evaluation or appraisal. |

| • | We have necessarily based our review on financial, economic, monetary, market and other conditions, and the information made available to us, as of the date hereof. |

CONFIDENTIAL

| Project Varsity |

| • | Our review does not address (i) any specific mechanics, process, procedures, structure or any other aspect of any transaction, (ii) the Company’s underlying business decision to pursue any transaction, the relative merits of any transaction as compared to any alternative business strategies that might exist for the Company, or (iii) the effects of any transaction in which the Company might engage. |

| • | Our review addresses information which may be useful to the Board in considering a possible transaction; however, it is not intended to identify all of the information that should be taken into account or the analyses that should be undertaken by the Board in considering the fairness or advisability of any transaction. |

| • | Our review and the accompanying material does not (i) include a recommendation to the Board on the amount of weight it should assign to any particular methodology or any other factor described in the accompanying material or (ii) constitute a recommendation to the Board or any holder of the Company’s common stock as to how to vote or act in connection with any transaction under consideration, or may be considered, by the Company’s management or Board, as the case may be. |

| • | We have assumed that any transaction that the Company may choose to pursue will be consummated by means of an arrangement pursuant to which every shareholder of the Company other than CPP will receive the same cash consideration in exchange for their shares of the Company’s common stock, and will be completed in a timely manner without any limitations, restrictions, conditions, amendments or modifications, regulatory or otherwise, which collectively would have an adverse effect on the Company or the contemplated benefits of such transaction to the Company and its shareholders. Furthermore, our review does not consider the potential effects of the tax laws of any jurisdiction. |

| • | The accompanying material, including without limitation analyses of the Company’s operations, methodologies, estimates and projections, should be reviewed in its entirety as a whole. Furthermore, each of the methodologies presented herein are subject to unique advantages and disadvantages. None of the methodologies should be considered as being more meaningful than others without considering all alternative methodologies along with the advantages, disadvantages and assumptions impacting such methodologies. |

The accompanying material is not to be used for any other purpose, or reproduced, disseminated, quoted to or referred to at any time, in whole or in part, without the prior written consent of Bear Stearns. We assume no responsibility for updating or revising our review based on circumstances or events occurring after the date of this presentation.

CONFIDENTIAL

| Project Varsity |

Table of Contents

Section | ||

1 | Executive Summary | |

2 | Public Market Perspective | |

3 | Analysis | |

A | Ek Chor China Motorcycle Co. Ltd. | |

B | Shanghai Machinery | |

C | Luoyang Motorcycle | |

D | Deni Carburetor | |

E | ECI Metro | |

F | Corporate | |

Appendices | ||

A | Relevant Company and Precedent Transaction Analyses | |

B | Weighted Average Cost of Capital Analysis | |

CONFIDENTIAL |

Section 1

Executive Summary

| Project Varsity |

Introduction

We appreciate this opportunity to meet with the management and Board of Directors of Ek Chor China Motorcycle Co. Ltd. (together with its affiliates, “EKC” or the “Company”) to discuss the parameters of a going-private transaction.

During our meeting today, we plan to review the following:

| • | EKC’s public market performance over the past year |

| • | An overall perspective on EKC applying several methodologies. Giving due weight and consideration to the various methodologies and other information discussed during our meeting today will, we believe, enhance the likelihood that the Company will succeed in obtaining any requisite shareholder approval. |

| • | Each of EKC’s joint venture operations, including: |

| • | Business model, opportunities and risks |

| • | Financial projections |

| • | Implications |

CONFIDENTIAL | 1 |

| Project Varsity |

EKC’s Public Company Status

EKC has few reasons to remain a public company:

| • | No real current or near-term access to capital through public markets |

| • | Limited liquidity and float (trading volume) |

| • | Small market capitalization |

| • | No research coverage, published analyses or earnings estimates by third parties |

| • | Minority shareholders have no ability to affect Company policies (e.g., dividends) |

| • | No comparable public companies for comparison or benchmarking |

| • | Holding company structure with investments in Sino-foreign joint ventures |

| • | The ability of EKC to control significant aspects of the business and operations of its joint venture is subject to significant limitations |

CONFIDENTIAL | 2 |

| Project Varsity |

Benefits of a Going-Private Transaction

A going-private transaction would offer benefits to both C.P. Pokphand Co. Ltd. (“CPP”) and EKC’s minority shareholders.

Benefits to CPP | Benefits to Minority Shareholders | |

• Eliminates cost of public reporting (financial and operational) | • Liquidity event (cash consideration) | |

• Gives CPP direct access to EKC’s balance sheet | • Eliminates the following: | |

– China political, economic, legal and social uncertainties | ||

– Motorcycle and automotive industry risks | ||

– Risks associated with execution of joint ventures’ businessplans | ||

– Risk of no foreseeable future dividend distributions (currentdividend yield is zero) | ||

– Potential conflicts of interest between CPP and minorityshareholders | ||

– Risk caused by limitations on EKC’s ability to controlsignificant aspects of its joint ventures’ businessesand operations |

CONFIDENTIAL | 3 |

Section 2

Public Market Perspective

| Project Varsity |

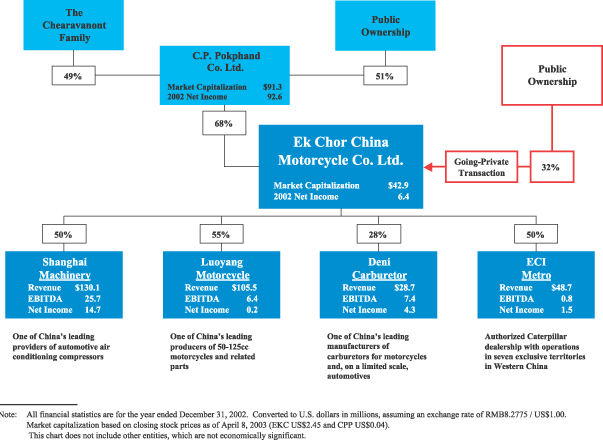

Overview of EKC Operations and Ownership

CONFIDENTIAL | 4 |

| Project Varsity |

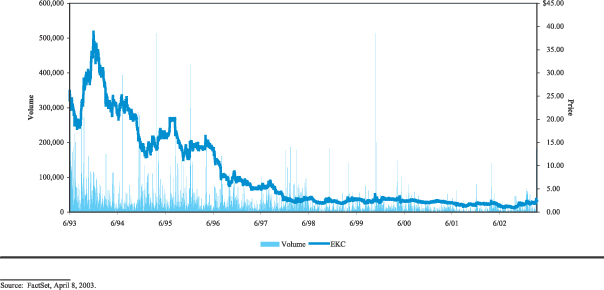

EKC’s Stock Price Performance Since IPO

Since its all-time high in December 1993, EKC’s share price has lost nearly 93% of its value; since 1998, the stock has traded in a very low band.

June 29, 1993 — April 8, 2003

CONFIDENTIAL | 5 |

| Project Varsity |

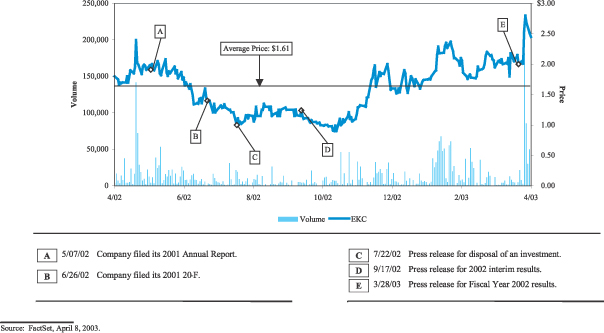

EKC Last 12 Month Stock Price Perormance

Although EKC is trading above its 12-month average stock price, the stock suffers from limited trading volume and significant volatility.

April 8, 2002 — April 8, 2003

CONFIDENTIAL | 6 |

| Project Varsity |

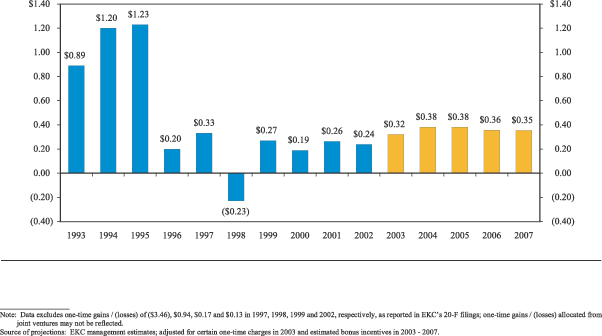

Earnings per Share History and Projections

EKC’s Earnings per Share | ($US per share) |

CONFIDENTIAL | 7 |

| Project Varsity |

One-Year Stock Price Performance of EKC Compared with Major Indices

EKC’s stock price is up 36.1% for the last twelve months and has outperformed most of the major indices.

April 8, 2002 — April 8, 2003

CONFIDENTIAL | 8 |

| Project Varsity |

Implications of Change in the Chinese Economy

Although China’s economy in general, and the automotive and motorcycle industries in particular, have been experiencing strong growth, increased competition resulting from the recent WTO entry is expected to cause significant price and margin erosion. We believe:

| • | The dominant automotive companies will continue to place significant pricing pressure on their suppliers |

| • | Changes in regulation will allow greater foreign investments as well as imports |

| • | Changes in safety and pollution regulations may require the Company to procure advanced component technology, much of which is protected by patents |

| • | Multi-national motorcycle design, development and manufacturing companies will likely increase their China market presence through direct investments or imports |

| • | International competition will hasten competitive change, including: |

| • | Price and margin erosion |

| • | Technology advancement |

CONFIDENTIAL | 9 |

Section 3

Analysis

| Project Varsity |

Analysis

EKC’s corporate governance, holding company structure and Sino-foreign joint venture investments pose unique challenges to the Company. Since it is impossible to determine the effect of these challenges on EKC and the minority shares, we have not modified our analysis or quantified the effect to EKC or the minority shares.

| • | Corporate governance |

| • | CPP controls approximately 68.2% of EKC’s issued and outstanding shares, thereby limiting the voting power and influence of minority shareholders |

| – | CPP has appointed all of EKC’s Directors |

| • | EKC is incorporated in Bermuda, which generally provides less protection (e.g. appraisal or dissenter’s rights) to minority shareholders than Delaware (U.S.) corporations |

| • | Holding company and joint venture structure |

| • | EKC does not control each of the joint ventures |

| – | EKC has management and board influence but no absolute authority(1) |

| – | Potential conflicts of interest with joint venture partners |

| • | Business plan execution risk |

| • | Cash flow and dividend distribution uncertainty |

| (1) | While EKC has the majority of the board seats and the authority to appoint the General Manager of Luoyang Motorcycle, it has in practice adopted a consensus board decision making process in the operation of Luoyang Motorcycle consistent with the decision making process of EKC’s other joint ventures. |

CONFIDENTIAL | 10 |

Section 3-A

Ek Chor China Motorcycle Co. Ltd.

| Project Varsity |

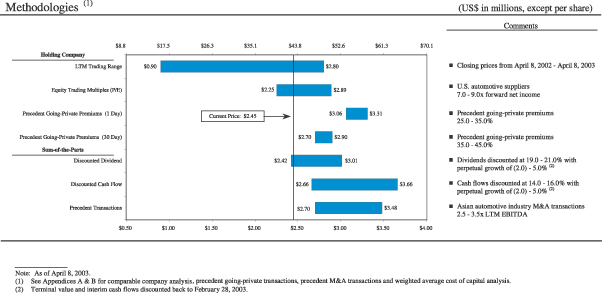

Summary of Analysis

Giving due weight and consideration to the various methodologies and other information discussed during our meeting today will, we believe, enhance the likelihood that the Company will succeed in obtaining any requisite shareholder approval.

CONFIDENTIAL | 11 |

| Project Varsity |

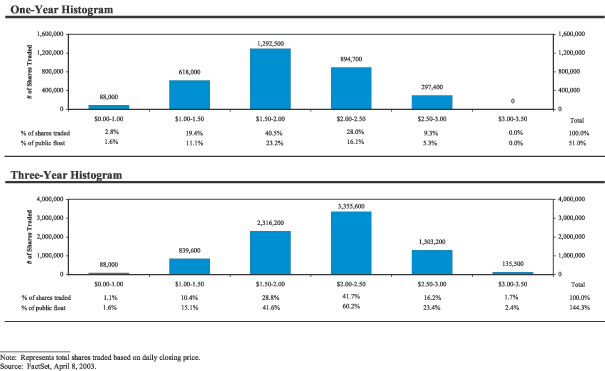

Stock Price Histogram — Distribution of Trading Prices

During the past three years, EKC’s stock price has not traded above $3.38. During the past year, the closing price has not exceeded $2.80.

CONFIDENTIAL | 12 |

| Project Varsity |

EKC Metrics

EKC Metrics | (US$ in millions, except per share) | |||||||||

Implied 2003 Price / Earnings | Implied Premium | Current Price / Share (1) | Implied Market Capitalization | Implied Price /Share | ||||||

LTM Trading Range | 2.8—8.7x | (63.3)—14.3% | $2.45 | $15.8—49.1 | $0.90—2.80 | |||||

U.S. Equity Comps | 7.0—9.0 | (8.3)—17.9 | 2.45 | 39.4—50.6 | 2.25—2.89 | |||||

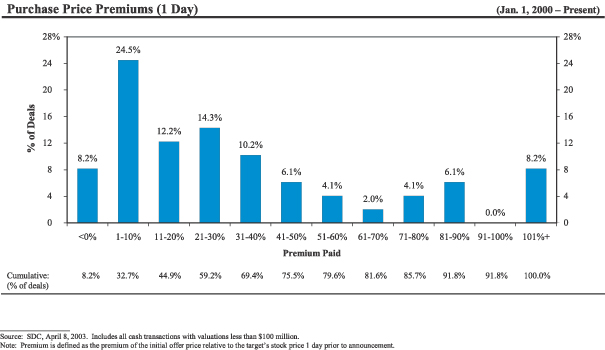

Average Premium (1 day prior)(2) | 9.5—10.3 | 25.0—35.0 | 2.45 | 53.7—58.0 | 3.06—3.31 | |||||

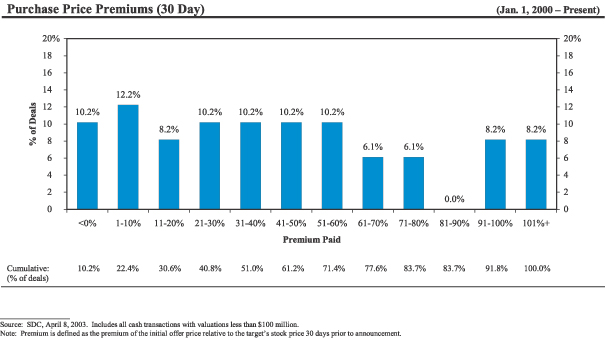

Average Premium (30 days prior)(2)(3) | 8.4—9.0 | 35.0—45.0 | 2.00 | 47.3—50.8 | 2.70—2.90 | |||||

| Note: | Highlighted fields indicate the driving statistic for each of the methodologies. |

| (1) | Current share price as of April 8, 2003, except as noted below. |

| (2) | See Appendix A for precedent going-private premium analysis. 25 — 35% premium 1 day prior and 35 — 45% premium 30 days prior represent ranges approximated by the median and mean premiums paid in precedent minority buy-in transactions. |

| (3) | Share price as of March 16, 2003; assumes deal will be announced on April 15, 2003. |

CONFIDENTIAL | 13 |

| Project Varsity |

Sum-of-the-Parts Metrics

Discounted Dividend | (US$ in millions, except per share) | |||||||||||||||||||||||||||||||||||

Discount Rate | Perpetual Growth Rate | Dividends | Implied Market Cap + Net Debt | Unrestricted Cash | Debt | Implied Market Capitalization | EKC Ownership | Implied Price / Share | ||||||||||||||||||||||||||||

2003(1) | 2004 | 2005 | 2006 | 2007 | ||||||||||||||||||||||||||||||||

Shanghai | 19.0—21.0% | (2.0)—0.0% | $ | 10.1 | $ | 9.9 | $ | 10.0 | $ | 10.1 | $ | 9.4 | NA |

| NA |

| NA | $ | 50.6—57.5 | 50.0 | % | $ | 1.44—1.64 | |||||||||||||

Luoyang | 19.0—21.0 | 2.0—4.0 |

| 0.0 |

| 0.0 |

| 0.0 |

| 0.0 |

| 0.0 | NA |

| NA |

| NA |

| 7.6—10.6 | 55.0 |

|

| 0.24—0.33 | |||||||||||||

Deni | 19.0—21.0 | (2.0)—0.0 |

| 2.6 |

| 2.2 |

| 1.9 |

| 1.6 |

| 1.5 | NA |

| NA |

| NA |

| 9.7—10.8 | 28.0 |

|

| 0.16—0.17 | |||||||||||||

ECI | 19.0—21.0 | 3.0—5.0 |

| 0.0 |

| 0.0 |

| 0.0 |

| 0.0 |

| 0.0 | NA |

| NA |

| NA |

| 2.9—4.0 | 50.0 |

|

| 0.08—0.11 | |||||||||||||

Corporate(3) | 19.0—21.0 | 1.0—3.0 |

| 0.0 |

| 0.0 |

| 0.0 |

| 0.0 |

| 0.0 | ($29.7)—(25.4) | $ | 38.5 | $ | 0.0 |

| 8.8—13.2 | 100.0 |

|

| 0.50—0.75 | |||||||||||||

EKC | $ | 12.7 | $ | 12.1 | $ | 11.9 | $ | 11.8 | $ | 10.9 | ($29.7)—(25.4) | $ | 38.5 | $ | 0.0 | $ | 79.6—96.1 | $ | 2.42—3.01 | |||||||||||||||||

Discounted Cash Flow | (US$ in millions, except per share) | ||||||||||||||||||||||||||||||||||||||||||

Discount Rate | Perpetual Growth Rate | Implied Terminal EBITDA Multiple | Free Cash Flow | Implied Market Cap + Net Debt | Unrestricted Cash | Debt | Implied Market Capitalization | EKC Ownership | Implied Price / Share | ||||||||||||||||||||||||||||||||||

2003(1) | 2004 | 2005 | 2006 | 2007 | |||||||||||||||||||||||||||||||||||||||

Shanghai Machinery | 14.0—16.0% | (2.0)—0.0% | 3.0—3.8x | $ | 13.8 |

| $ | 10.3 |

| $ | 7.6 |

| $ | 11.2 |

| $ | 11.0 |

| $71.1—$85.5 | $ | 4.3 | $ | 25.4 | $ | 50.0—$64.4 | 50.0 | % | $ | 1.43—$1.84 | ||||||||||||||

Luoyang Motorcycle | 14.0—16.0 | 2.0—4.0 | 3.3—4.7 |

| 0.0 |

|

| 0.0 |

|

| 0.0 |

|

| 0.0 |

|

| 0.0 |

| 13.6—21.0 |

| 1.9 |

| 6.3 |

| 9.2—16.6 | 55.0 |

|

| 0.29—0.52 | ||||||||||||||

Deni Carburetor | 14.0—16.0 | (2.0)—0.0 | 2.7—3.4 |

| 4.7 |

|

| 3.3 |

|

| 2.6 |

|

| 2.2 |

|

| 2.2 |

| 18.0—21.0 |

| 2.7 |

| 4.2 |

| 16.5—19.5 | 28.0 |

|

| 0.26—0.31 | ||||||||||||||

ECI Metro | 14.0—16.0 | 3.0—5.0 | 2.5—3.6 |

| (3.4 | ) |

| (0.3 | ) |

| 0.5 |

|

| 0.6 |

|

| 0.8 |

| 0.9—2.9 |

| 11.0 |

| 5.5 |

| 6.4—8.3 | 50.0 |

|

| 0.18—0.24 | ||||||||||||||

Corporate (3) | 19.0—21.0 | 1.0—3.0 | NM |

| (4.5 | ) |

| (4.3 | ) |

| (4.5 | ) |

| (4.6 | ) |

| (4.7 | ) | (29.7)—(25.4) |

| 38.5 |

| 0.0 |

| 8.8—13.2 | 100.0 |

|

| 0.50—0.75 | ||||||||||||||

EKC | $ | 10.6 |

| $ | 8.9 |

| $ | 6.2 |

| $ | 9.5 |

| $ | 9.3 |

| $73.9—105.0 | $ | 58.4 | $ | 41.4 | $ | 90.9—122.0 | $ | 2.66—3.66 | |||||||||||||||||||

Precedent Transactions | (US$ in millions, except per share) | ||||||||||||||||||||

LTM EBITDA Multiple | LTM EBITDA | Implied Market Cap + Net Debt | Unrestricted Cash | Debt | Implied Market Capitalization | EKC Ownership | Implied Price /Share | ||||||||||||||

Shanghai Machinery | 2.5—3.0x | $ | 25.7 | $64.3—77.1 | $4.3 | $ | 25.4 | $ | 43.2—56.0 | 50.0 | % | $ | 1.23—1.60 | ||||||||

Luoyang Motorcycle | 3.0—3.5 |

| 6.4 | 19.2—22.4 | 1.9 |

| 6.3 |

| 14.7—17.9 | 55.0 |

|

| 0.46—0.56 | ||||||||

Deni Carburetor | 2.5—3.0 |

| 7.4 | 18.6—22.3 | 2.7 |

| 4.2 |

| 17.1—20.8 | 28.0 |

|

| 0.27—0.33 | ||||||||

ECI Metro | 3.0—3.5 |

| 0.8 | 2.5—2.9 | 11.0 |

| 5.5 |

| 8.0—8.4 | 50.0 |

|

| 0.23—0.24 | ||||||||

Corporate(3) | NM |

| NM | (29.7)—(25.4) | 38.5 |

| 0.0 |

| 8.8—13.2 | 100.0 |

|

| 0.50—0.75 | ||||||||

EKC | $74.8—99.3 | $58.4 | $ | 41.4 | $ | 86.7—117.9 | $ | 2.70—3.48 | |||||||||||||

| Note: | Highlighted fields indicate the driving statistic for each of the methodologies. |

| Note: | See Appendix for precedent Asian automotive parts manufacturer transaction analysis, precedent minority buy-in premium analysis and weighted average cost of capital analysis. |

| Note: | Cash and debt balances as of February 28, 2003. |

| (1) | Represents ten months (83.3% of 2003 budget). |

| (2) | Assumes a dividend yield of 75% (approximately, the average dividend yield for Shanghai Machinery and Deni Carburetor) is implemented in 2008; no dividend in 2003 — 2007 in accordance with joint venture model and low earnings or negative retained earnings expectations. |

| (3) | Analysis based on discounted cash flow. Cash includes $2.6 million of non-cash generating assets (based on management’s assertion that the market value of the Company’s real estate holdings approximate 50% of the book value of $5.2 million). |

CONFIDENTIAL | 14 |

| Project Varsity |

Illustrative Sum-of-the-Parts Metrics

(US$ per share) | ||

CONFIDENTIAL | 15 |

Section 3-B

Shanghai Machinery

| Project Varsity |

Shanghai Machinery

Business and Market Overview

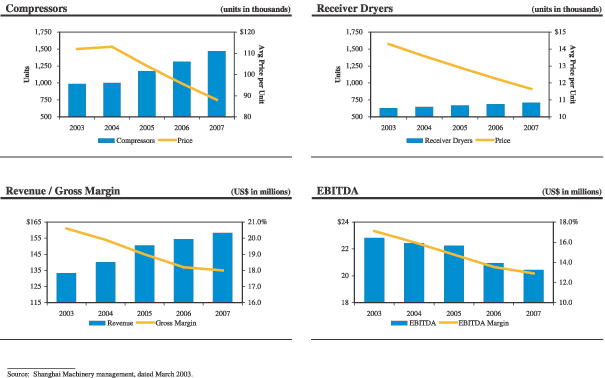

Shanghai Machinery is the leading automotive air conditioning compressor manufacturer in China, having manufactured approximately one million air conditioning compressors in 2002. Shanghai Machinery also manufactures receiver dryers, which are often sold in bundles with air conditioning compressors. Shanghai Machinery’s leading customers include Shanghai Volkswagen (a Sino-foreign joint venture in which Shanghai Automotive Industry Corporation owns a 25% equity interest), Shanghai General Motors and First Automotive Works. Shanghai Machinery derives approximately 85% of its revenue and gross profit from the sale of air conditioning compressors and the remaining 15% of its revenue and gross profit from the sale of receiver dryers.

Governance | ||||||

Ek Chor | Shanghai Automotive | Longhua County | ||||

Ownership Interest | 50% | 40% | 10% | |||

Board Representation (Seats) | 4 | 3 | 1 | |||

Management Appointment | Marketing Deputy General Manager (“DGM”) | GM | None | |||

Finance DGM | DGM | |||||

Term of Joint Venture Agreement

Original term of 25 years (expiring 2015), which may be extended with the mutual consent of the participants in the venture, subject to the approval of government authorities in the People’s Republic of China (the “PRC”).

Summary Income Statement(1) | (US$ in millions) | |||||||||||

Fiscal Year Ended December 31, | ||||||||||||

2001A | 2002A | 2003E | ||||||||||

Revenue | $ | 119.1 |

| $ | 130.1 |

| $ | 133.4 |

| |||

Revenue Growth |

| 3.3 | % |

| 9.3 | % |

| (8.1 | %) | |||

Cost of Goods Sold |

| 87.3 |

|

| 97.9 |

|

| 105.9 |

| |||

Gross Profit |

| 31.8 |

|

| 32.2 |

|

| 27.5 |

| |||

Gross Margin |

| 26.7 | % |

| 24.8 | % |

| 20.6 | % | |||

SG&A |

| 8.4 |

|

| 11.9 |

|

| 10.9 |

| |||

Joint Venture Income |

| 0.4 |

|

| 1.2 |

|

| 1.8 |

| |||

EBIT |

| 23.8 |

|

| 21.5 |

|

| 18.4 |

| |||

EBIT Margin |

| 20.0 | % |

| 16.5 | % |

| 13.8 | % | |||

Depreciation & Amortization |

| 4.6 |

|

| 4.2 |

|

| 4.4 |

| |||

EBITDA |

| 28.3 |

|

| 25.7 |

|

| 22.8 |

| |||

EBITDA Margin |

| 23.8 | % |

| 19.8 | % |

| 17.1 | % | |||

Summary Balance Sheet | |||

Feb 28, 2003 | |||

“Unrestricted” Cash(2) | $ | 4.3 | |

“Restricted” Cash(3) |

| 10.9 | |

Receivables |

| 33.4 | |

Inventory |

| 30.3 | |

Other Current Assets |

| 0.3 | |

PP&E |

| 28.5 | |

Other Non-Current Assets |

| 9.8 | |

Total Assets | $ | 117.5 | |

Accounts Payable | $ | 29.6 | |

Other Current Liabilities |

| 6.4 | |

Debt |

| 25.4 | |

Total Liabilities |

| 61.4 | |

Minority Interest |

| 0.0 | |

Equity(4) |

| 56.1 | |

Liabilities and Equity | $ | 117.5 | |

| (1) | Source: Shanghai Machinery management, March 2003. |

| (2) | “Unrestricted” cash equals total cash less “Restricted” cash. |

| (3) | “Restricted” cash is unavailable for distribution to shareholders due to PRC joint venture rules relating to reserve accounts. Shanghai Machinery estimates that as of February 2003, reserve accounts include approximately $4.0 million in the Reserve Fund and $7.0 million in the Enterprise Expansion Fund. Shanghai Machinery expects to allocate 6% of net income to the Reserve Fund and 6% of net income to the Enterprise Expansion Fund. For purposes of our analysis, “Restricted” cash is assumed to be unavailable for distribution to shareholders, except with respect to the Reserve Fund and Enterprise Expansion Fund upon dissolution of the joint venture. |

| (4) | Includes amounts allocated to Reserve and Enterprise Expansion Funds. |

CONFIDENTIAL | 16 |

| Project Varsity |

Shanghai Machinery Strengths and Weaknesses

| • | Strengths / Opportunities |

| • | A/C compressor market share (estimated at 80% for new sedans / mid-sized compressors) |

| • | Relationship with Shanghai Automotive Industry Corporation |

| – | Joint venture partner has ownership interests in both Shanghai Volkswagen and Shanghai Machinery |

| • | Export sales opportunities |

| – | India, Indonesia, Korea, South Africa, South America and other developing markets as well as the U.S. |

CONFIDENTIAL | 17 |

| Project Varsity |

Shanghai Machinery Strengths and Weaknesses (cont.)

| • | Weaknesses / Risks |

| • | Significant technology risks / new market environment |

| – | Uncertainty regarding automotive companies roll-out of next-generation engine design |

| – | Shanghai Volkswagen already transitioning toward advanced compressor systems |

| – | The Company will need to develop or procure new products |

| – | A/C compressor technology is well developed worldwide, and heavily protected with patents |

| – | Re-engineering / in-house development would be costly and difficult to avoid patent infringement |

| • | Competition is fierce |

| – | Forecasting significant price erosion |

| – | Complementary component manufacturers may expand into competing product lines |

| – | Product line limited to sedans; competitors in small and large truck segments may expand into this market segment |

| – | China’s entry into the WTO lifted many import restrictions and lowered tariffs |

| – | Expected to lead to increased competition (i.e., imported products and foreign-owned manufacturers) |

| – | Shanghai Machinery previously had the largest quota to import compressors |

| • | Customer concentration |

| – | Top 4 accounts represent approximately 60% of revenue |

CONFIDENTIAL | 18 |

| Project Varsity |

Shanghai Machinery Summary Financial Results

Income Statement and Selected Cash Flow Items | (US$ in millions, except per unit) | |||||||||||||||||||||||||||

Fiscal Year Ended December 31, | Projected Fiscal Year Ending December 31, | |||||||||||||||||||||||||||

2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | ||||||||||||||||||||||

Average Price — Compressors | $ | 112.0 |

| $ | 113.1 |

| $ | 104.0 |

| $ | 95.7 |

| $ | 88.1 |

| |||||||||||||

Units (thousands) — Compressors |

| 988 |

|

| 1,000 |

|

| 1,175 |

|

| 1,315 |

|

| 1,470 |

| |||||||||||||

Compressor Revenue | $ | 110.6 |

| $ | 113.1 |

| $ | 122.3 |

| $ | 125.9 |

| $ | 129.5 |

| |||||||||||||

Average Price — Receiver Dryers |

| 14.3 |

|

| 13.6 |

|

| 12.9 |

|

| 12.3 |

|

| 11.7 |

| |||||||||||||

Units (thousands) — Receiver Dryers |

| 630 |

|

| 650 |

|

| 670 |

|

| 690 |

|

| 710 |

| |||||||||||||

Receiver Dryer Revenue | $ | 9.0 |

| $ | 8.8 |

| $ | 8.7 |

| $ | 8.5 |

| $ | 8.3 |

| |||||||||||||

Other Revenue |

| 13.7 |

|

| 18.3 |

|

| 19.6 |

|

| 20.2 |

|

| 20.7 |

| |||||||||||||

Total Revenue | $ | 119.1 |

| $ | 130.1 |

| $ | 133.4 |

| $ | 140.2 |

| $ | 150.6 |

| $ | 154.5 |

| $ | 158.4 |

| |||||||

Revenue Growth |

| 3.3 | % |

| 9.3 | % |

| (8.1 | %) |

| 5.1 | % |

| 7.4 | % |

| 2.6 | % |

| 2.5 | % | |||||||

Cost of Goods Sold |

| 87.3 |

|

| 97.9 |

|

| 105.9 |

|

| 112.3 |

|

| 121.9 |

|

| 126.4 |

|

| 129.9 |

| |||||||

Gross Profit |

| 31.8 |

|

| 32.2 |

|

| 27.5 |

|

| 27.9 |

|

| 28.6 |

|

| 28.1 |

|

| 28.5 |

| |||||||

Gross Margin |

| 26.7 | % |

| 24.8 | % |

| 20.6 | % |

| 19.9 | % |

| 19.0 | % |

| 18.2 | % |

| 18.0 | % | |||||||

SG&A |

| 8.4 |

|

| 11.9 |

|

| 10.9 |

|

| 11.4 |

|

| 12.4 |

|

| 13.3 |

|

| 14.4 |

| |||||||

Joint Venture Income |

| 0.4 |

|

| 1.2 |

|

| 1.8 |

|

| 1.9 |

|

| 2.1 |

|

| 2.3 |

|

| 2.5 |

| |||||||

EBIT |

| 23.8 |

|

| 21.5 |

|

| 18.4 |

|

| 18.4 |

|

| 18.3 |

|

| 17.1 |

|

| 16.6 |

| |||||||

EBIT Margin |

| 20.0 | % |

| 16.5 | % |

| 13.8 | % |

| 13.1 | % |

| 12.2 | % |

| 11.0 | % |

| 10.4 | % | |||||||

Interest Expense |

| 1.6 |

|

| 1.4 |

|

| 1.3 |

|

| 1.2 |

|

| 1.1 |

|

| 1.1 |

|

| 1.0 |

| |||||||

Other |

| (0.2 | ) |

| 0.1 |

|

| 0.0 |

|

| 0.0 |

|

| 0.0 |

|

| 0.0 |

|

| 0.0 |

| |||||||

Pretax Income |

| 22.3 |

|

| 20.0 |

|

| 17.1 |

|

| 17.2 |

|

| 17.2 |

|

| 16.0 |

|

| 15.5 |

| |||||||

Pretax Margin |

| 18.7 | % |

| 15.4 | % |

| 12.8 | % |

| 12.3 | % |

| 11.4 | % |

| 10.3 | % |

| 9.8 | % | |||||||

Taxes |

| 6.0 |

|

| 5.4 |

|

| 4.0 |

|

| 4.0 |

|

| 4.0 |

|

| 3.6 |

|

| 3.5 |

| |||||||

Effective Tax Rate |

| 26.9 | % |

| 26.8 | % |

| 23.6 | % |

| 23.4 | % |

| 23.2 | % |

| 22.6 | % |

| 22.2 | % | |||||||

Net Income(1) |

| 16.3 |

|

| 14.7 |

|

| 13.0 |

|

| 13.2 |

|

| 13.2 |

|

| 12.4 |

|

| 12.1 |

| |||||||

Net Margin |

| 13.7 | % |

| 11.3 | % |

| 9.8 | % |

| 9.4 | % |

| 8.8 | % |

| 8.0 | % |

| 7.6 | % | |||||||

Depreciation & Amortization |

| 4.6 |

|

| 4.2 |

|

| 4.4 |

|

| 4.0 |

|

| 3.9 |

|

| 3.9 |

|

| 3.9 |

| |||||||

EBITDA |

| 28.3 |

|

| 25.7 |

|

| 22.8 |

|

| 22.4 |

|

| 22.3 |

|

| 20.9 |

|

| 20.4 |

| |||||||

EBITDA Margin |

| 23.8 | % |

| 19.8 | % |

| 17.1 | % |

| 16.0 | % |

| 14.8 | % |

| 13.6 | % |

| 12.9 | % | |||||||

Capital Expenditures |

| (3.7 | ) |

| (5.6 | ) |

| (4.9 | ) |

| (4.8 | ) |

| (7.2 | ) |

| (3.9 | ) |

| (3.9 | ) | |||||||

Changes in Working Capital |

| 0.6 |

|

| 3.1 |

|

| 4.1 |

|

| (1.8 | ) |

| (2.0 | ) |

| (0.8 | ) |

| (0.8 | ) | |||||||

Dividends Paid to Shareholders |

| 13.0 |

|

| 13.1 |

|

| 12.1 |

|

| 9.9 |

|

| 10.0 |

|

| 10.1 |

|

| 9.4 |

| |||||||

Source: Shanghai Machinery management, dated March 2003.

| (1) | Net income is reported before minority interest. |

CONFIDENTIAL | 19 |

| Project Varsity |

Shanghai Machinery Financial Highlights

CONFIDENTIAL | 20 |

| Project Varsity |

Shanghai Machinery — Summary of Analysis

Analysis | (US$ in millions, except per share) | ||||||||||||||

Analysis | Implied Enterprise Value | Cash | Debt | Implied Market Capitalization | Implied Contribution to EKC Price /Share | ||||||||||

Discounted Dividend |

| NA |

| NA |

| NA | $ | 53.7 | $ | 1.53 | |||||

Discounted Cash Flow | $ | 77.4 | $ | 4.3 | $ | 25.4 |

| 56.3 |

| 1.61 | |||||

Precedent Transactions |

| 70.7 |

| 4.3 |

| 25.4 |

| 49.6 |

| 1.41 | |||||

Price / Share Calculation | (US$ in millions, except per share) | |||||||||||

Discounted Dividend | Discounted Cash Flow | Precedent Transactions | ||||||||||

LTM EBITDA |

| NA |

|

| NA |

| $ | 25.7 |

| |||

LTM EBITDA Multiple |

| NA |

|

| NA |

|

| 2.75x |

| |||

PV of 2003 — 2007 Dividends / Cash Flows | $ | 33.6 |

| $ | 40.2 |

|

| NA |

| |||

PV of Terminal Value |

| 20.1 |

|

| 37.2 |

|

| NA |

| |||

Implied Enterprise Value |

| NA |

|

| 77.4 |

| $ | 70.7 |

| |||

Less: Total Debt |

| NA |

|

| (25.4 | ) |

| (25.4 | ) | |||

Plus: “Unrestricted” Cash |

| NA |

|

| 4.3 |

|

| 4.3 |

| |||

Implied Market Capitalization |

| 53.7 |

|

| 56.3 |

|

| 49.6 |

| |||

EKC Ownership Interest |

| 50.0 | % |

| 50.0 | % |

| 50.0 | % | |||

EKC Interest | $ | 26.9 |

| $ | 28.2 |

| $ | 24.8 |

| |||

EKC’s Fully Diluted Shares (millions) |

| 17.526 |

|

| 17.526 |

|

| 17.526 |

| |||

Implied Contribution to EKC’s Price / Share | $ | 1.53 |

| $ | 1.61 |

| $ | 1.41 |

| |||

Selected Assumptions: | ||||||||||||

Discount Rate |

| 20.0 | % |

| 15.0 | % |

| NA |

| |||

Perpetual Growth Rate |

| (1.0 | %) |

| (1.0 | %) |

| NA |

| |||

| Note: | Please see Appendices A & B for relevant company and precedent transaction analyses, as well as weighted average cost of capital analysis. |

CONFIDENTIAL | 21 |

| Project Varsity |

Shanghai Machinery Discounted Cash Flow Model

Projected Cash Flows(1) | ($ in millions, except per share) | ||||||||||||||||||||||

Ten Months 2003(2) | Projected Fiscal Year Ending December 31, | CAGR 2003-2007 | |||||||||||||||||||||

2004 | 2005 | 2006 | 2007 | ||||||||||||||||||||

Revenue | $ | 111.2 |

| $ | 140.2 |

| $ | 150.6 |

| $ | 154.5 |

| $ | 158.4 |

| 4.4 | % | ||||||

EBITDA (including other income) |

| 19.0 |

|

| 22.4 |

|

| 22.3 |

|

| 20.9 |

|

| 20.4 |

| (2.7 | %) | ||||||

Depreciation |

| (3.5 | ) |

| (3.9 | ) |

| (3.9 | ) |

| (3.9 | ) |

| (3.9 | ) | ||||||||

Amortization |

| (0.2 | ) |

| (0.2 | ) |

| (0.0 | ) |

| 0.0 |

|

| 0.0 |

| ||||||||

EBIT |

| 15.3 |

|

| 18.4 |

|

| 18.3 |

|

| 17.1 |

|

| 16.6 |

| (2.6 | %) | ||||||

Unlevered Cash Taxes |

| (3.6 | ) |

| (4.3 | ) |

| (4.3 | ) |

| (3.9 | ) |

| (3.7 | ) | ||||||||

NOPAT |

| 11.7 |

|

| 14.1 |

|

| 14.1 |

|

| 13.2 |

|

| 12.9 |

| (2.2 | %) | ||||||

Depreciation |

| 3.5 |

|

| 3.9 |

|

| 3.9 |

|

| 3.9 |

|

| 3.9 |

| ||||||||

Amortization |

| 0.2 |

|

| 0.2 |

|

| 0.0 |

|

| 0.0 |

|

| 0.0 |

| ||||||||

Capital Expenditures |

| (4.1 | ) |

| (4.8 | ) |

| (7.2 | ) |

| (3.9 | ) |

| (3.9 | ) | ||||||||

Working Capital Need |

| 3.4 |

|

| (1.8 | ) |

| (2.0 | ) |

| (0.8 | ) |

| (0.8 | ) | ||||||||

Allocation to Reserve Funds / Restricted Cash |

| (0.9 | ) |

| (1.2 | ) |

| (1.2 | ) |

| (1.1 | ) |

| (1.1 | ) | ||||||||

Unlevered Free Cash Flow |

| 13.8 |

|

| 10.3 |

|

| 7.6 |

|

| 11.2 |

|

| 11.0 |

| (5.5 | %) | ||||||

Present Value of Free Cash Flows |

| 13.2 |

|

| 8.5 |

|

| 5.5 |

|

| 7.1 |

|

| 6.0 |

| ||||||||

Present Value of Equity @ 2/28/03 | |||||

Perpetual Growth | |||||

PV of 2003 - 2007 Free Cash Flows | $ | 40.2 |

| ||

PV of Terminal Value |

| 37.2 |

| ||

Implied Enterprise Value |

| 77.4 |

| ||

Less: Total Debt |

| (25.4 | ) | ||

Plus: “Unrestricted” Cash |

| 4.3 |

| ||

Implied Market Capitalization |

| 56.3 |

| ||

EKC Ownership Interest |

| 50.0 | % | ||

EKC Interest | $ | 28.2 |

| ||

Fully Diluted Shares (millions) |

| 17.526 |

| ||

Implied Price / Share | $ | 1.61 |

| ||

Implied Price / Share | ||||||||||||||||||||

Perpetual Growth Rate of Unlevered Free Cash Flow | ||||||||||||||||||||

WACC |

| (2.0 | %) |

| (1.5 | %) |

| (1.0 | %) |

| (0.5 | %) |

| 0.0 | % | |||||

14.0% | $ | 1.66 |

| $ | 1.70 |

| $ | 1.74 |

| $ | 1.79 |

| $ | 1.84 |

| |||||

14.5 |

| 1.59 |

|

| 1.63 |

|

| 1.67 |

|

| 1.71 |

|

| 1.76 |

| |||||

15.0 |

| 1.53 |

|

| 1.57 |

|

| 1.61 |

|

| 1.65 |

|

| 1.69 |

| |||||

15.5 |

| 1.48 |

|

| 1.51 |

|

| 1.55 |

|

| 1.58 |

|

| 1.62 |

| |||||

16.0 |

| 1.43 |

|

| 1.46 |

|

| 1.49 |

|

| 1.52 |

|

| 1.56 |

| |||||

DCF Assumptions | |||

Weighted Average Cost of Capital(3) | 15.0 | % | |

Perpetual Growth Rate of Free Cash Flows(4) | (1.0 | %) | |

Implied Terminal EBITDA Multiple | 3.3 | x | |

Assumed Debt / Total Capitalization(5) | 33.0 | % | |

Assumed Cost of Debt(5) | 6.0 | % | |

| (1) | Source: Shanghai Machinery management, dated March 2003. |

| (2) | Represents ten months or 83.3% of budgeted 2003 results. |

| (3) | See Appendix B for weighted average cost of capital analysis. |

| (4) | Perpetual growth rate determined based on qualitative assessment of long-term Company and industry prospects along with management feedback. |

| (5) | Derived from the estimated average capital structure of each of the four joint ventures. |

CONFIDENTIAL | 22 |

Section 3-C

Luoyang Motorcycle

| Project Varsity |

Luoyang Motorcycle

Business and Market Overview

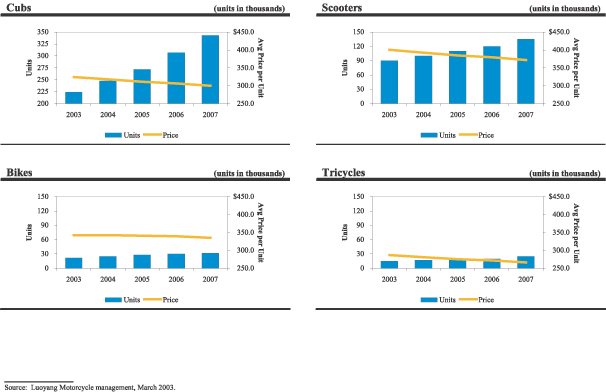

Luoyang Motorcycle (“Luoyang”) is one of the leading motorcycle manufacturers in China, having manufactured approximately 300,000 motorcycles in 2002 (representing approximately 2.5% market share). Luoyang specializes in the manufacture of 50-125cc motorcycles. Luoyang employs 1,500 people in its production facilities and 500 people in its corporate offices.

The market for 50-125cc motorcycles is highly competitive and includes both large and multi-national companies and small “mom and pop” manufacturers. During the early 1990s, Luoyang was consistently ranked in the top 5 (in terms of total Chinese domestic production). However, by 2001, Luoyang’s market position had slipped to the mid-teens due to a pause in innovative design. During 2002, Luoyang improved its motorcycle designs and increased its market position to #9 (in terms of total Chinese domestic motorcycle production).

Governance | ||||

Ek Chor | Luoyang Northern Motorcycle Works(2) | |||

Ownership Interests | 55% | 45% | ||

Board Representation (seats) | 4 | 3 | ||

Management Appointment | General Manager | Production DGM | ||

Finance DGM | Technology DGM | |||

Sales DGM | Personnel DGM | |||

Term of Joint Venture Agreement

Original term of 30 years (expiring 2022), which may be extended with the mutual consent of the participants in the venture, subject to the approval of PRC government authorities.

Summary Income Statement(1) | (US$ in millions) | |||||||||||

Fiscal Year Ended December 31, | ||||||||||||

2001A | 2002A | 2003E | ||||||||||

Revenue | $ | 79.2 |

| $ | 105.5 |

| $ | 122.9 |

| |||

Revenue Growth |

| (22.3 | %) |

| 33.1 | % |

| 18.6 | % | |||

Cost of Goods Sold |

| 74.5 |

|

| 95.9 |

|

| 107.3 |

| |||

Gross Profit |

| 4.8 |

|

| 9.6 |

|

| 15.6 |

| |||

Gross Margin |

| 6.0 | % |

| 9.1 | % |

| 12.7 | % | |||

SG&A |

| 7.8 |

|

| 9.0 |

|

| 14.9 |

| |||

Joint Venture Income |

| 0.0 |

|

| 0.1 |

|

| 2.9 |

| |||

EBIT |

| (2.0 | ) |

| 0.7 |

|

| 3.6 |

| |||

EBIT Margin |

| (2.5 | %) |

| 0.7 | % |

| 2.9 | % | |||

Depreciation & Amortization |

| 6.4 |

|

| 5.7 |

|

| 4.8 |

| |||

EBITDA |

| 4.4 |

|

| 6.4 |

|

| 8.4 |

| |||

EBITDA Margin |

| 5.6 | % |

| 6.1 | % |

| 6.8 | % | |||

Summary Balance Sheet | |||

Feb 28, 2003 | |||

“Unrestricted” Cash(3) | $ | 1.9 | |

“Restricted” Cash(4) |

| 6.1 | |

Receivables |

| 13.4 | |

Inventory |

| 13.0 | |

Other Current Assets |

| 0.5 | |

PP&E |

| 29.3 | |

Other Non-Current Assets |

| 2.2 | |

Total Assets | $ | 66.5 | |

Accounts Payable | $ | 19.2 | |

Other Current Liabilities |

| 6.1 | |

Debt |

| 6.3 | |

Total Liabilities |

| 31.6 | |

Minority Interest |

| 0.0 | |

Equity(5) |

| 34.9 | |

Liabilities and Equity | $ | 66.5 | |

| (1) | Source: Luoyang Motorcycle management, March 2003. |

| (2) | A PRC state-owned enterprise, named China South Industries Group Corp. |

| (3) | “Unrestricted” cash equals total cash less “Restricted” cash. |

| (4) | “Restricted” cash is unavailable for distribution to shareholders due to PRC joint venture rules relating to reserve accounts. Luoyang Motorcycle estimates that as of February 2003, reserve accounts include $1.8 million in the Reserve Fund and $4.3 million in the Enterprise Expansion Fund. Luoyang Motorcycle expects to allocate 3% of net income to the Reserve Fund and 7% of net income to the Enterprise Expansion Fund. For purposes of our analysis, “Restricted” cash is assumed to be unavailable for distribution to shareholders, except with respect to the Reserve Fund and Enterprise Expansion Fund upon dissolution of the joint venture. |

| (5) | Includes amounts allocated to Reserve and Enterprise Expansion Funds. Assumes the write-off of $12.3 million of bad debt; total equity is net of $17.3 million of accumulated losses; under the laws of the PRC, Sino-foreign joint ventures may not declare and pay dividends unless cumulative retained earnings are positive. |

CONFIDENTIAL | 23 |

| Project Varsity |

Luoyang Motorcycle Strengths and Opportunities

| • | Strengths / Opportunities |

| • | Brand name — well-established brand name generates consumer loyalty |

| • | Product quality / manufacturing capability |

| – | Honda engine technology translates into quality reputation |

| – | Reputation for reliability and safety |

| – | Invested heavily in engine production capabilities in early 1990s; excess capacity |

| • | Broad range of products — design mix and engine capacity |

| – | Motorcycles |

| – | Scooters |

| – | Cubs |

| • | Newer models feature innovative design |

| – | Design modifications to serve the needs of broad demographic groups (e.g., urban and rural customers) |

| • | Comprehensive distribution network |

| – | Non-exclusive sales network attracted by Luoyang’s broad range of products |

| • | Geographic expansion and export markets represent potential growth opportunity |

| – | Indonesia, Vietnam, Greece and other developing countries |

| – | May require significant capital expenditures |

CONFIDENTIAL | 24 |

| Project Varsity |

Luoyang Motorcycle Weaknesses and Risks

| • | Weaknesses / Risks |

| • | Limited in-house engine research and development expertise |

| – | Purchased Honda 100cc engine technology |

| – | New engine designs may be expensive to purchase; no in-house design / development capability |

| – | Other joint ventures in the PRC own their own technology and have foreign technological support and development |

| • | Competition from other Honda manufacturers |

| – | Honda has an ownership interest in certain joint venture against which Luoyang competes |

| – | Honda itself could be a competitor in the future |

| • | Price competition is fierce |

| – | China’s entry into the WTO lifted many import restrictions and lowered tariffs |

| – | Expected to lead to increased competition (i.e., imported products and foreign-owned manufacturers) |

| – | Sales are moving from large cities to smaller cities (brand conscious) and farm communities (brand less important) where price often drives consumer behavior |

| • | Intellectual property laws are poorly enforced and new designs are easily copied |

| – | “Mom & Pop” manufacturers often copy design and undercut price |

| • | Existing manufacturing facility not located in one of the top 3 motorcycle production facility sites in the PRC, although it is centrally located in China |

| – | Creates potential sourcing problems with suppliers and component manufacturers |

| • | Environmental concerns |

| – | Pollution concerns may lead to restrictions on carbureted engines in mid to large cities |

CONFIDENTIAL | 25 |

| Project Varsity |

Luoyang Motorcycle Summary Financial Results

Income Statement and Selected Cash Flow Items | (US$ in millions, except for per unit) | ||||||||||||||||||||||||||||

Fiscal Year Ended December 31, | Projected Fiscal Year Ending December 31, | ||||||||||||||||||||||||||||

2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | |||||||||||||||||||||||

Average Price – Cubs | $ | 324.0 |

| $ | 318.0 |

| $ | 311.0 |

| $ | 306.0 |

| $ | 300.0 |

| ||||||||||||||

Units – Cubs (thousands) |

| 224 |

|

| 248 |

|

| 272 |

|

| 307 |

|

| 343 |

| ||||||||||||||

Cubs Revenue | $ | 72.6 |

| $ | 78.9 |

| $ | 84.6 |

| $ | 94.1 |

| $ | 102.9 |

| ||||||||||||||

Average Price – Scooters | $ | 400.0 |

| $ | 393.0 |

| $ | 385.0 |

| $ | 380.0 |

| $ | 372.0 |

| ||||||||||||||

Units – Scooters (thousands) |

| 90 |

|

| 100 |

|

| 110 |

|

| 120 |

|

| 135 |

| ||||||||||||||

Scooters Revenue | $ | 36.0 |

| $ | 39.3 |

| $ | 42.3 |

| $ | 45.5 |

| $ | 50.2 |

| ||||||||||||||

Other Revenue(1) |

| 14.2 |

|

| 15.2 |

|

| 16.6 |

|

| 17.9 |

|

| 20.0 |

| ||||||||||||||

Total Revenue | $ | 79.2 |

| $ | 105.5 |

| $ | 122.9 |

| $ | 133.3 |

| $ | 143.6 |

| $ | 157.5 |

| $ | 173.1 |

| ||||||||

Revenue Growth |

| (22.3 | %) |

| 33.1 | % |

| 18.6 | % |

| 8.5 | % |

| 7.7 | % |

| 9.7 | % |

| 9.9 | % | ||||||||

Cost of Goods Sold |

| 74.5 |

|

| 95.9 |

|

| 107.3 |

|

| 116.3 |

|

| 125.5 |

|

| 136.5 |

|

| 151.2 |

| ||||||||

Gross Profit |

| 4.8 |

|

| 9.6 |

|

| 15.6 |

|

| 17.1 |

|

| 18.1 |

|

| 21.1 |

|

| 21.9 |

| ||||||||

Gross Margin |

| 6.0 | % |

| 9.1 | % |

| 12.7 | % |

| 12.8 | % |

| 12.6 | % |

| 13.4 | % |

| 12.6 | % | ||||||||

SG&A |

| 7.8 |

|

| 9.0 |

|

| 14.9 |

|

| 16.3 |

|

| 17.1 |

|

| 17.9 |

|

| 18.4 |

| ||||||||

Joint Venture Income(2) |

| 0.0 |

|

| 0.1 |

|

| 2.9 |

|

| 2.9 |

|

| 2.9 |

|

| 2.9 |

|

| 2.9 |

| ||||||||

EBIT |

| (2.0 | ) |

| 0.7 |

|

| 3.6 |

|

| 3.7 |

|

| 4.0 |

|

| 6.1 |

|

| 6.3 |

| ||||||||

EBIT Margin |

| (2.5 | %) |

| 0.7 | % |

| 2.9 | % |

| 2.8 | % |

| 2.8 | % |

| 3.8 | % |

| 3.7 | % | ||||||||

Interest Expense (Income) |

| 0.6 |

|

| (0.0 | ) |

| (0.2 | ) |

| (0.2 | ) |

| (0.2 | ) |

| (0.2 | ) |

| (0.2 | ) | ||||||||

Pretax Income |

| (2.7 | ) |

| 0.7 |

|

| 3.8 |

|

| 3.9 |

|

| 4.2 |

|

| 6.2 |

|

| 6.5 |

| ||||||||

Pretax Margin |

| (3.3 | %) |

| 0.7 | % |

| 3.1 | % |

| 2.9 | % |

| 2.9 | % |

| 4.0 | % |

| 3.8 | % | ||||||||

Taxes |

| 0.4 |

|

| 0.4 |

|

| 0.0 |

|

| 0.0 |

|

| 0.0 |

|

| 2.0 |

|

| 2.1 |

| ||||||||

Effective Tax Rate(3) |

| (16.2 | %) |

| 65.0 | % |

| 0.0 | % |

| 0.0 | % |

| 0.0 | % |

| 33.0 | % |

| 33.0 | % | ||||||||

Net Income |

| (3.1 | ) |

| 0.2 |

|

| 3.8 |

|

| 3.9 |

|

| 4.2 |

|

| 4.2 |

|

| 4.4 |

| ||||||||

Net Margin |

| (3.9 | %) |

| 0.2 | % |

| 3.1 | % |

| 2.9 | % |

| 2.9 | % |

| 2.7 | % |

| 2.5 | % | ||||||||

Depreciation & Amortization |

| 6.4 |

|

| 5.7 |

|

| 4.8 |

|

| 3.4 |

|

| 2.1 |

|

| 1.6 |

|

| 1.5 |

| ||||||||

EBITDA |

| 4.4 |

|

| 6.4 |

|

| 8.4 |

|

| 7.1 |

|

| 6.0 |

|

| 7.6 |

|

| 7.9 |

| ||||||||

EBITDA Margin |

| 5.6 | % |

| 6.1 | % |

| 6.8 | % |

| 5.3 | % |

| 4.2 | % |

| 4.8 | % |

| 4.5 | % | ||||||||

Capital Expenditures(4) |

| 1.0 |

|

| 0.9 |

|

| 0.5 |

|

| 1.2 |

|

| 1.2 |

|

| 1.2 |

|

| 1.2 |

| ||||||||

Changes in Working Capital |

| 3.9 |

|

| 1.2 |

|

| 1.9 |

|

| (1.2 | ) |

| (0.1 | ) |

| (2.1 | ) |

| (0.6 | ) | ||||||||

Dividends Paid to Shareholders |

| 0.0 |

|

| 0.0 |

|

| 0.0 |

|

| 0.0 |

|

| 0.0 |

|

| 0.0 |

|

| 0.0 |

| ||||||||

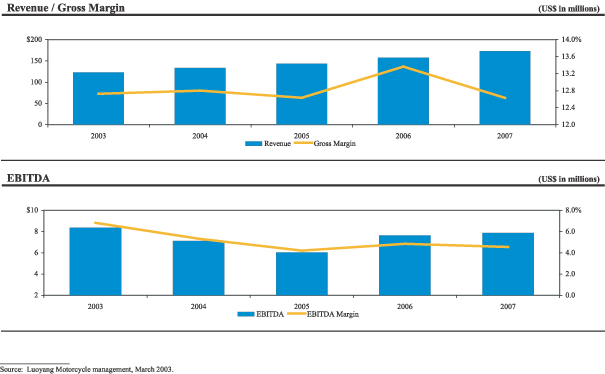

Source: Luoyang Motorcycle management, March 2003.

| (1) | Other revenue includes bikes, tricycles, engines and other components. |

| (2) | Represents royalty income from technology transfer and brand name license (5-year agreement expires in 2006, along with contractual sale of certain engines and components). |

| (3) | Effective tax rate is projected to be significantly lower than 33% statutory rate as a result of cumulative operating loss carry-forwards. |

| (4) | The Company projects low capital expenditures based on (i) existing excess capacity, (ii) low maintenance costs and (iii) strategic outsourcing of the manufacture of non-core components. |

CONFIDENTIAL | 26 |

| Project Varsity |

Luoyang Motorcycle Financial Highlights

CONFIDENTIAL | 27 |

| Project Varsity |

Luoyang Motorcycle Financial Highlights (cont.)

CONFIDENTIAL | 28 |

| Project Varsity |

Luoyang Motorcycle — Summary of Analysis

Analysis | (US$ in millions, except per share) | ||||||||||||||

Analysis | Implied Enterprise Value | Cash | Debt | Implied Market Capitalization | Implied Contribution to EKC Price / Share | ||||||||||

Discounted Dividend |

| NA |

| NA |

| NA | $ | 8.9 | $ | 0.28 | |||||

Discounted Cash Flow | $ | 16.7 | $ | 1.9 | $ | 6.3 |

| 12.3 |

| 0.38 | |||||

Precedent Transactions |

| 20.8 |

| 1.9 |

| 6.3 |

| 16.3 |

| 0.51 | |||||

Price / Share Calculation | (US$ in millions, except per share) | |||||||||||

Discounted Dividend | Discounted Cash Flow | Precedent Transactions | ||||||||||

LTM EBITDA |

| NA |

|

| NA |

| $ | 6.4 |

| |||

LTM EBITDA Multiple |

| NA |

|

| NA |

|

| 3.25x |

| |||

PV of 2003–2007 Dividends(1) / Cash Flows | $ | 0.0 |

| $ | 0.0 |

|

| NA |

| |||

PV of Terminal Value(2) |

| 8.9 |

|

| 16.7 |

|

| NA |

| |||

Implied Enterprise Value |

| NA |

|

| 16.7 |

| $ | 20.8 |

| |||

Less: Total Debt |

| NA |

|

| (6.3 | ) |

| (6.3 | ) | |||

Plus: “Unrestricted” Cash |

| NA |

|

| 1.9 |

|

| 1.9 |

| |||

Implied Market Capitalization |

| 8.9 |

|

| 12.3 |

|

| 16.3 |

| |||

EKC Ownership Interest |

| 55.0 | % |

| 55 | % |

| 55.0 | % | |||

EKC Interest | $ | 4.9 |

| $ | 6.7 |

| $ | 9.0 |

| |||

EKC’s Fully Diluted Shares (millions) |

| 17.526 |

|

| 17.526 |

|

| 17.526 |

| |||

Implied Contribution to EKC’s Price / Share | $ | 0.28 |

| $ | 0.38 |

| $ | 0.51 |

| |||

Selected Assumptions: | ||||||||||||

Discount Rate |

| 20.0 | % |

| 15.0 | % |

| NA |

| |||

Perpetual Growth Rate |

| 3.0 | % |

| 3.0 | % |

| NA |

| |||

Note: Please see Appendices A & B for relevant company and precedent transaction analyses, as well as weighted average cost

of capital analysis.

| (1) | Under the laws of the PRC, Sino-foreign joint ventures may not declare and pay dividends unless cumulative retained earnings are positive; Luoyang’s retained earnings are projected to be negative through 2007. |

| (2) | Assumed dividends in 2008 and beyond of 66% of net income, consistent with EKC management’s payout expectations. |

CONFIDENTIAL | 29 |

| Project Varsity |

Luoyang Motorcycle Discounted Cash Flow Model

Projected Cash Flows(1) | ($ in millions, except per share) | ||||||||||||||||||||||

Ten Months 2003(2) | Projected Fiscal Year Ending December 31, | CAGR 2003–2007 | |||||||||||||||||||||

2004 | 2005 | 2006 | 2007 | ||||||||||||||||||||

Revenue | $ | 102.4 |

| $ | 133.3 |

| $ | 143.6 |

| $ | 157.5 |

| $ | 173.1 |

| 8.9 | % | ||||||

EBITDA (including other income) |

| 7.0 |

|

| 7.1 |

|

| 6.0 |

|

| 7.6 |

|

| 7.9 |

| (1.5 | %) | ||||||

Depreciation |

| (3.9 | ) |

| (3.3 | ) |

| (1.9 | ) |

| (1.4 | ) |

| (1.4 | ) | ||||||||

Amortization |

| (0.1 | ) |

| (0.1 | ) |

| (0.2 | ) |

| (0.1 | ) |

| (0.1 | ) | ||||||||

EBIT |

| 3.0 |

|

| 3.7 |

|

| 4.0 |

|

| 6.1 |

|

| 6.3 |

| 15.4 | % | ||||||

Unlevered Cash Taxes |

| 0.0 |

|

| 0.0 |

|

| 0.0 |

|

| (2.0 | ) |

| (2.1 | ) | ||||||||

NOPAT |

| 3.0 |

|

| 3.7 |

|

| 4.0 |

|

| 4.1 |

|

| 4.3 |

| 4.4 | % | ||||||

Depreciation |

| 3.9 |

|

| 3.3 |

|

| 1.9 |

|

| 1.4 |

|

| 1.4 |

| ||||||||

Amortization |

| 0.1 |

|

| 0.1 |

|

| 0.2 |

|

| 0.1 |

|

| 0.1 |

| ||||||||

Capital Expenditures |

| (0.5 | ) |

| (1.2 | ) |

| (1.2 | ) |

| (1.2 | ) |

| (1.2 | ) | ||||||||

Working Capital Need |

| 1.9 |

|

| (1.2 | ) |

| (0.1 | ) |

| (2.1 | ) |

| (0.6 | ) | ||||||||

Allocation to Reserve Funds / Restricted Cash |

| (0.3 | ) |

| (0.4 | ) |

| (0.4 | ) |

| (0.4 | ) |

| (0.4 | ) | ||||||||

Unlevered Free Cash Flow |

| 8.2 |

|

| 4.3 |

|

| 4.3 |

|

| 1.9 |

|

| 3.6 |

| (22.3 | %) | ||||||

Retained Earnings(3) |

| (17.7 | ) |

| (14.3 | ) |

| (10.6 | ) |

| (6.8 | ) |

| (2.9 | ) | ||||||||

Present Value of Free Cash Flows(3) |

| 0.0 |

|

| 0.0 |

|

| 0.0 |

|

| 0.0 |

|

| 0.0 |

| ||||||||

Present Value of Equity @ 2/28/03 | ||||

Perpetual Growth | ||||

PV of 2003–2007 Free Cash Flows | $ | 0.0 |

| |

PV of Terminal Value |

| 16.7 |

| |

Implied Enterprise Value |

| 16.7 |

| |

Less: Total Debt |

| (6.3 | ) | |

Plus: “Unrestricted” Cash |

| 1.9 |

| |

Implied Market Capitalization |

| 12.3 |

| |

EKC Ownership Interest |

| 55 | % | |

EKC Interest | $ | 6.7 |

| |

Fully Diluted Shares (millions) |

| 17.526 |

| |

Implied Price / Share | $ | 0.38 |

| |

Implied Price / Share | ||||||||||||||||||||

Perpetual Growth Rate of Unlevered Free Cash Flow | ||||||||||||||||||||

WACC |

| 2.0 | % |

| 2.5 | % |

| 3.0 | % |

| 3.5 | % |

| 4.0 | % | |||||

14.0% | $ | 0.40 |

| $ | 0.43 |

| $ | 0.45 |

| $ | 0.49 |

| $ | 0.52 |

| |||||

14.5 |

| 0.37 |

|

| 0.39 |

|

| 0.42 |

|

| 0.45 |

|

| 0.48 |

| |||||

15.0 |

| 0.34 |

|

| 0.36 |

|

| 0.38 |

|

| 0.41 |

|

| 0.44 |

| |||||

25.5 |

| 0.31 |

|

| 0.33 |

|

| 0.35 |

|

| 0.38 |

|

| 0.40 |

| |||||

16.0 |

| 0.29 |

|

| 0.31 |

|

| 0.33 |

|

| 0.35 |

|

| 0.37 |

| |||||

DCF Assumptions | ||||

Weighted Average Cost of Capital(4) | 15.0 | % | ||

Perpetual Growth Rate of Free Cash Flows(5) | 3.0 | % | ||

Implied Terminal EBITDA Multiple | 3.9 | x | ||

Assumed Debt / Total Capitalization(6) | 33.0 | % | ||

Assumed Cost of Debt(6) | 6.0 | % | ||

| (1) | Source: Luoyang Motorcycle management, March 2003. |

| (2) | Represents ten months or 83.3% of budgeted 2003 results. |

| (3) | Under the laws of the PRC, Sino-foreign joint ventures may not declare and pay dividends unless cumulative retained earnings are positive. |

| (4) | See Appendix B for weighted average cost of capital analysis. |

| (5) | Perpetual growth rate determined based on qualitative assessment of long-term Company and industry prospects along with management feedback. |

| (6) | Derived from the estimated average capital structure of each of the four joint ventures. |

CONFIDENTIAL | 30 |

Section 3-D

Deni Carburetor

| Project Varsity | |

Project Varsity |

Deni Carburetor

Business and Market Description

Deni Carburetor (“Deni”) is a leading motorcycle and automotive carburetor manufacturer in China. Having manufactured approximately four million motorcycle carburetors in 2002, Deni estimates that it holds 26% motorcycle carburetor market share.

Deni faces competition from Walbro, Mikuni and Keihin; the top four motorcycle carburetor manufacturers are believed to control approximately 60% market share.

Governance | ||||||||||||

DongFeng Automobile | Ek Chor | China Zhan jiang | Keihin Seiki | |||||||||

Ownership Interests | 32 | % | 28 | % | 20 | % | 20 | % | ||||

Board Representation (Seats) | 3 |

| 3 |

| 2 |

| 2 |

| ||||

Management | Engineering |

| Finance DGM Accounting |

| Production |

| Quality Control |

| ||||

Appointment | DGM |

| DGM |

| DGM |

| DGM |

| ||||

Term of Joint Venture Agreement

Original term of 30 years (expiring 2023), which may be extended with the mutual consent of the participants in the venture, subject to the approval of PRC government authorities.

Summary Income Statement | (US$ in millions) | |||||||||||

Fiscal Year Ended December 31, | ||||||||||||

2001A | 2002A | 2003E | ||||||||||

Revenue | $ | 24.8 |

| $ | 28.7 |

| $ | 27.3 |

| |||

Revenue Growth |

| (10.7 | %) |

| 15.6 | % |

| (4.7 | %) | |||

Cost of Goods Sold |

| 17.0 |

|

| 18.9 |

|

| 18.9 |

| |||

Gross Profit |

| 7.8 |

|

| 9.8 |

|

| 8.4 |

| |||

Gross Margin |

| 31.5 | % |

| 34.2 | % |

| 30.7 | % | |||

SG&A |

| 3.7 |

|

| 4.4 |

|

| 3.7 |

| |||

EBIT |

| 4.1 |

|

| 5.4 |

|

| 4.7 |

| |||

EBIT Margin |

| 16.6 | % |

| 18.8 | % |

| 17.3 | % | |||

Depreciation & Amortization |

| 1.9 |

|

| 2.0 |

|

| 2.1 |

| |||

EBITDA |

| 6.0 |

|

| 7.4 |

|

| 6.8 |

| |||

EBITDA Margin |

| 24.3 |

|

| 25.9 | % |

| 24.8 | % | |||

Summary Balance Sheet | |||

Feb 28, 2003 | |||

“Unrestricted” Cash(2) | $ | 2.7 | |

“Restricted” Cash(3) |

| 2.9 | |

Receivables |

| 11.4 | |

Inventory |

| 6.7 | |

Other Current Assets |

| 0.5 | |

PP&E |

| 11.8 | |

Other Non-Current Assets |

| 1.4 | |

Total Assets | $ | 37.4 | |

Accounts Payable | $ | 4.8 | |

Other Current Liabilities |

| 0.9 | |

Debt |

| 4.2 | |

Total Liabilities |

| 9.9 | |

Minority Interest |

| 0.0 | |

Equity(4) |

| 27.6 | |

Liabilities and Equity | $ | 37.4 | |

| (1) | Source: Deni Carburetor management, March 2003. |

| (2) | “Unrestricted” cash equals total cash less “Restricted” cash. |

| (3) | “Restricted” cash is unavailable for distribution to shareholders due to PRC joint venture rules relating to reserve accounts. Deni Carburetor estimates that as of February 2003, reserve accounts include $2.4 million in the Reserve Fund and $0.5 million in the Enterprise Expansion Fund. Deni Carburetor expects to allocate 10% of net income to the Reserve Fund and 0% of net income to the Enterprise Expansion Fund. For purposes of our analysis, “Restricted” cash is assumed to be unavailable for distribution to shareholders, except with respect to the Reserve Fund and Enterprise Expansion Fund upon dissolution of the joint venture. |

| (4) | Includes amounts allocated to Reserve and Enterprise Expansion Funds. |

CONFIDENTIAL | 31 |

| Project Varsity |

Deni Carburetor Strengths and Weaknesses

| • | Strengths / Opportunities |

| • | Leading motorcycle carburetor market share (26%) |

| – | The motorcycle carburetor market is growing at approximately the same pace as the motorcycle market |

| – | Alternative technologies (e.g., fuel injection) are not expected to replace motorcycle carburetors in the near future, especially in the 50-150cc engine class |

| • | Sales and service |

| – | Building long-term customer relationships |

| • | Product quality / reputation |

| • | Export sales opportunities |

| – | Indonesia, South Africa, South America and other developing markets |

| • | Weaknesses / Risks |

| • | Fierce price competition |

| – | China’s entry into the WTO increases international competition |

| – | Competition from large multi-national competitors investing in China |

| • | Technology risk / introduction of fuel injection technology into China’s automotive market |

| – | Would require the purchase of fuel injection technology at unknown cost |

| – | Shanghai Volkswagen already transitioning toward fuel injection technology |

| • | Environmental concerns |

| – | Pollution concerns may lead to restrictions on carbureted engines in mid to large cities |

CONFIDENTIAL | 32 |

| Project Varsity |

Deni Carburetor Summary Financial Results

Income Statement and Selected Cash Flow Items | (US$ in millions) | ||||||||||||||||||||||||||||

Fiscal Year Ended December 31, | Fiscal Year Ending December 31, | ||||||||||||||||||||||||||||

2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | |||||||||||||||||||||||

Average Price – Motorcycle Carburetor | $ | 6.8 |

| $ | 6.1 |

| $ | 5.5 |

| $ | 4.9 |

| $ | 4.4 |

| ||||||||||||||

Units – Motorcycle Carburetor (thousands) |

| 3,500 |

|

| 3,675 |

|

| 3,859 |

|

| 4,052 |

|

| 4,254 |

| ||||||||||||||

Motorcycle Carburetor Revenue | $ | 23.7 |

| $ | 22.4 |

| $ | 21.1 |

| $ | 20.0 |

| $ | 18.9 |

| ||||||||||||||

Average Price – Auto Carburetor | $ | 114.8 |

| $ | 110.2 |

| $ | 110.2 |

| $ | 117.5 |

| $ | 112.8 |

| ||||||||||||||

Units – Auto Carburetor (thousands) |

| 12 |

|

| 10 |

|

| 8 |

|

| 6 |

|

| 5 |

| ||||||||||||||

Auto Carburetor Revenue | $ | 1.4 |

| $ | 1.1 |

| $ | 0.9 |

| $ | 0.7 |

| $ | 0.6 |

| ||||||||||||||

Other Revenue |

| 2.3 |

|

| 2.9 |

|

| 3.6 |

|

| 4.2 |

|

| 4.9 |

| ||||||||||||||

Total Revenue | $ | 24.8 |

| $ | 28.7 |

| $ | 27.3 |

| $ | 26.4 |

| $ | 25.6 |

| $ | 24.9 |

| $ | 24.4 |

| ||||||||

Revenue Growth |

| (10.7 | %) |

| 15.6 | % |

| (4.7 | %) |

| (3.5 | %) |

| (3.0 | %) |

| (2.6 | %) |

| (2.2 | %) | ||||||||

Cost of Goods Sold |

| 17.0 |

|

| 18.9 |

|

| 18.9 |

|

| 18.3 |

|

| 18.1 |

|

| 17.8 |

|

| 17.4 |

| ||||||||

Gross Profit |

| 7.8 |

|

| 9.8 |

|

| 8.4 |

|

| 8.1 |

|

| 7.5 |

|

| 7.1 |

|

| 6.9 |

| ||||||||

Gross Margin |

| 31.5 | % |

| 34.2 | % |

| 30.7 | % |

| 30.8 | % |

| 29.3 | % |

| 28.6 | % |

| 28.4 | % | ||||||||

SG&A |

| 3.7 |

|

| 4.4 |

|

| 3.7 |

|

| 3.7 |

|

| 3.8 |

|

| 3.9 |

|

| 3.9 |

| ||||||||

EBIT |

| 4.1 |

|

| 5.4 |

|

| 4.7 |

|

| 4.4 |

|

| 3.7 |

|

| 3.2 |

|

| 3.0 |

| ||||||||

EBIT Margin |

| 16.6 | % |

| 18.8 | % |

| 17.3 | % |

| 16.7 | % |

| 14.5 | % |

| 13.0 | % |

| 12.3 | % | ||||||||

Interest Expense |

| 0.4 |

|

| 0.4 |

|

| 0.2 |

|

| 0.1 |

|

| (0.0 | ) |

| (0.0 | ) |

| (0.1 | ) | ||||||||

Other |

| 0.0 |

|

| (0.0 | ) |

| 0.0 |

|

| 0.0 |

|

| 0.0 |

|

| 0.0 |

|

| 0.0 |

| ||||||||

Pretax Income |

| 3.8 |

|

| 5.0 |

|

| 4.5 |

|

| 4.3 |

|

| 3.7 |

|

| 3.3 |

|

| 3.0 |

| ||||||||

Pretax Margin |

| 15.3 | % |

| 17.6 | % |

| 16.4 | % |

| 16.3 | % |

| 14.5 | % |

| 13.1 | % |

| 12.5 | % | ||||||||

Taxes |

| 0.7 |

|

| 0.7 |

|

| 0.5 |

|

| 1.0 |

|

| 0.9 |

|

| 0.8 |

|

| 0.7 |

| ||||||||

Effective Tax Rate |

| 18.2 | % |

| 13.0 | % |

| 12.0 | % |

| 24.0 | % |

| 24.0 | % |

| 24.0 | % |

| 24.0 | % | ||||||||

Net Income |

| 3.1 |

|

| 4.4 |

|

| 3.9 |

|

| 3.3 |

|

| 2.8 |

|

| 2.5 |

|

| 2.3 |

| ||||||||

Net Margin |

| 12.5 | % |

| 15.3 | % |

| 14.4 | % |

| 12.4 | % |

| 11.0 | % |

| 10.0 | % |

| 9.5 | % | ||||||||

Depreciation & Amortization |

| 1.9 |

|

| 2.0 |

|

| 2.1 |

|

| 2.0 |

|

| 2.0 |

|

| 1.7 |

|

| 1.6 |

| ||||||||

EBITDA |

| 6.0 |

|

| 7.4 |

|

| 6.8 |

|

| 6.5 |

|

| 5.7 |

|

| 5.0 |

|

| 4.6 |

| ||||||||

EBITDA Margin |

| 24.3 | % |

| 25.9 | % |

| 24.8 | % |

| 24.5 | % |

| 22.2 | % |

| 19.8 | % |

| 19.0 | % | ||||||||

Capital Expenditures |

| 0.9 |

|

| 1.2 |

|

| 1.5 |

|

| 1.8 |

|

| 1.9 |

|

| 1.6 |

|

| 1.4 |

| ||||||||

Changes in Working Capital |

| 1.1 |

|

| 2.8 |

|

| 0.1 |

|

| 0.1 |

|

| 0.1 |

|

| 0.1 |

|

| 0.1 |

| ||||||||

Dividends Paid to Shareholders |

| 3.4 |

|

| 5.4 |

|

| 2.6 |

|

| 2.2 |

|

| 1.9 |

|

| 1.6 |

|

| 1.5 |

| ||||||||

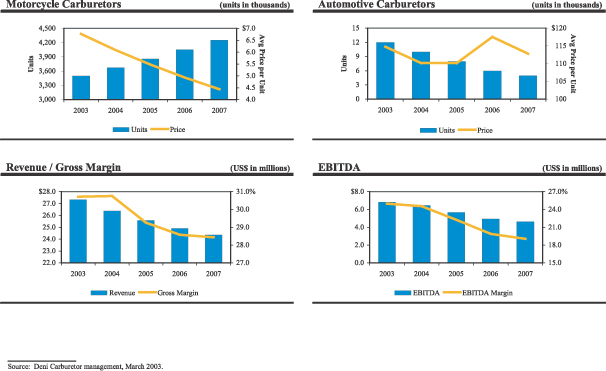

Source:Deni Carburetor management, March 2003. |

CONFIDENTIAL | 33 |

| Project Varsity |

Deni Carburetor Financial Highlights

CONFIDENTIAL | 34 |

| Project Varsity |

Deni Carburetor — Summary of Analysis

Analysis | (US$ in millions, except per share) | ||||||||||||||

Analysis | Implied Enterprise Value | Cash | Debt | Implied Market Capitalization | Implied Contribution to EKC Price / Share | ||||||||||

Discounted Dividend |

| NA |

| NA |

| NA | $ | 10.2 | $ | 0.16 | |||||

Discounted Cash Flow | $ | 19.4 | $ | 2.7 | $ | 4.2 |

| 17.8 |

| 0.29 | |||||

Precedent Transactions |

| 20.4 |

| 2.7 |

| 4.2 |

| 18.9 |

| 0.30 | |||||

Price / Share Calculation | (US$ in millions, except per share) | |||||||||||

Discounted Dividend | Discounted Cash Flow | Precedent Transactions | ||||||||||

LTM EBITDA |

| NA |

|

| NA |

| $ | 7.4 |

| |||

LTM EBITDA Multiple |

| NA |

|

| NA |

|

| 2.75 | x | |||

PV of 2003-2007 Dividends / Cash Flows | $ | 6.9 |

| $ | 11.8 |

|

| NA |

| |||

PV of Terminal Value |

| 3.3 |

|

| 7.6 |

|

| NA |

| |||

Implied Enterprise Value |

| NA |

|

| 19.4 |

| $ | 20.4 |

| |||

Less: Total Debt |

| NA |

|

| (4.2 | ) |

| (4.2 | ) | |||

Plus: “Unrestricted” Cash |

| NA |

|

| 2.7 |

|

| 2.7 |

| |||

Implied Market Capitalization |

| 10.2 |

|

| 17.8 |

|

| 18.9 |

| |||

EKC Ownership Interest |

| 28.0 | % |

| 28.0 | % |

| 28.0 | % | |||

EKC Interest | $ | 2.9 |

| $ | 5.0 |

| $ | 5.3 |

| |||

EKC’s Fully Diluted Shares (millions) |

| 17.526 |

|

| 17.526 |

|

| 17.526 |

| |||

Implied Contribution to EKC’s Price / Share | $ | 0.16 |

| $ | 0.29 |

| $ | 0.30 |

| |||

Selected Assumptions: | ||||||||||||

Discount Rate |

| 20.0 | % |

| 15.0 | % |

| NA |

| |||

Perpetual Growth Rate |

| (1.0 | %) |

| (1.0 | %) |

| NA |

| |||

| Note: | Please see Appendices A & B for relevant company and precedent transaction analyses, as well as weighted average cost of capital analysis. |

CONFIDENTIAL | 35 |

| Project Varsity |

Deni Carburetor Discounted Cash Flow Model

Projected Cash Flows(1) | ($ in millions, except per share) | ||||||||||||||||||||||

Ten Months 2003(2) | Projected Fiscal Year Ending December 31, | CAGR 2003–2007 | |||||||||||||||||||||

2004 | 2005 | 2006 | 2007 | ||||||||||||||||||||

Revenue | $ | 22.8 |

| $ | 26.4 |

| $ | 25.6 |

| $ | 24.9 |

| $ | 24.4 |

| (2.8 | %) | ||||||

EBITDA (including other income) |

| 5.7 |

|

| 6.5 |

|

| 5.7 |

|

| 5.0 |

|

| 4.6 |

| (9.1 | %) | ||||||

Depreciation |

| (1.7 | ) |

| (2.0 | ) |

| (1.9 | ) |

| (1.6 | ) |

| (1.6 | ) | ||||||||

Amortization |

| (0.0 | ) |

| (0.1 | ) |

| (0.1 | ) |

| (0.1 | ) |

| (0.1 | ) | ||||||||

EBIT |

| 3.9 |

|

| 4.4 |

|

| 3.7 |

|

| 3.2 |

|

| 3.0 |

| (10.8 | %) | ||||||

Unlevered Cash Taxes |

| (0.5 | ) |

| (1.1 | ) |

| (0.9 | ) |

| (0.8 | ) |

| (0.7 | ) | ||||||||

NOPAT |

| 3.5 |

|

| 3.4 |

|

| 2.8 |

|

| 2.5 |

|

| 2.3 |

| (14.0 | %) | ||||||

Depreciation |

| 1.7 |

|

| 2.0 |

|

| 1.9 |

|

| 1.6 |

|

| 1.6 |

| ||||||||

Amortization |

| 0.0 |

|

| 0.1 |

|

| 0.1 |

|

| 0.1 |

|

| 0.1 |

| ||||||||

Capital Expenditures |

| (1.3 | ) |

| (1.8 | ) |

| (1.9 | ) |

| (1.6 | ) |

| (1.4 | ) | ||||||||

Working Capital Need |

| 1.4 |

|

| 0.3 |

|

| 0.1 |

|

| 0.1 |

|

| 0.1 |

| ||||||||

Allocation to Reserve Funds / Restricted Cash |

| (0.6 | ) |

| (0.6 | ) |

| (0.5 | ) |

| (0.4 | ) |

| (0.4 | ) | ||||||||

Unlevered Free Cash Flow |

| 4.7 |

|

| 3.3 |

|

| 2.6 |

|

| 2.2 |

|

| 2.2 |

| (20.7 | %) | ||||||

Present Value of Free Cash Flows |

| 4.5 |

|

| 2.7 |

|

| 1.9 |

|

| 1.4 |

|

| 1.2 |

| ||||||||

Present Value of Equity @ 2/28/03 | |||||

Perpetual Growth | |||||

PV of 2003–2007 Free Cash Flows | $ | 11.8 |

| ||

PV of Terminal Value |

| 7.6 |

| ||

Implied Enterprise Value | $ | 19.4 |

| ||

Less: Total Debt |

| (4.2 | ) | ||

Plus: “Unrestricted” Cash |

| 2.7 |

| ||

Implied Market Capitalization | $ | 17.8 |

| ||

EKC Ownership Interest |

| 28.0 | % | ||

EKC Interest |

| 5.0 |

| ||

Net Fully Diluted Shares (millions) |

| 17.526 |

| ||

Implied Price / Share | $ | 0.29 |

| ||

Implied Price / Share | |||||||||||||||||||||

Perpetual Growth Rate of Unlevered Free Cash Flow | |||||||||||||||||||||

WACC |

| (2.0 | %) |

| (1.5 | %) |

| (1.0 | %) |

| (0.5 | %) |

| 0.0 | % | ||||||

14.0% | $ | 0.29 |

| $ | 0.30 |

| $ | 0.30 |

| $ | 0.31 |

| $ | 0.31 |

| ||||||

14.5 |

| 0.28 |

|

| 0.29 |

|

| 0.29 |

|

| 0.30 |

|

| 0.30 |

| ||||||

15.0 |

| 0.28 |

|

| 0.28 |

|

| 0.29 |

|

| 0.29 |

|

| 0.29 |

| ||||||

15.5 |

| 0.27 |

|

| 0.27 |

|

| 0.28 |

|

| 0.28 |

|

| 0.29 |

| ||||||

16.0 |

| 0.26 |

|

| 0.27 |

|

| 0.27 |

|

| 0.27 |

|

| 0.28 |

| ||||||

DCF Assumptions | ||||

Weighted Average Cost of Capital(3) | 15.0 | % | ||

Perpetual Growth Rate of Free Cash Flows(4) | (1.0 | %) | ||

Implied Terminal EBITDA Multiple | 3.0 | x | ||