EXHIBIT 10.51

[Execution Copy]

MORGANS LAS VEGAS, LLC

LIMITED LIABILITY COMPANY AGREEMENT

dated as of

January 3, 2006

between

MORGANS/LV INVESTMENT LLC

and

ECHELON RESORTS CORPORATION

TABLE OF CONTENTS

| PAGE | ||||

| Article 1 DEFINITIONS | 1 | |||

Section 1.01 | Definitions | 1 | ||

Section 1.02 | Certain Other Terms | 14 | ||

Section 1.03 | Accounting Terms | 15 | ||

Article 2 FORMATION AND PURPOSE OF THE COMPANY | 15 | |||

Section 2.01 | Formation of the Company | 15 | ||

Section 2.02 | Name of the Company | 15 | ||

Section 2.03 | Purpose of the Company | 15 | ||

Section 2.04 | Place of Business of the Company | 16 | ||

Section 2.05 | Registered Office and Registered Agent | 16 | ||

Section 2.06 | Duration of the Company | 16 | ||

Section 2.07 | Title to the Company Property | 16 | ||

Section 2.08 | Filing of Certificates | 16 | ||

Section 2.09 | Limitation on Liability | 16 | ||

Section 2.10 | No Responsibility for Liability of Other Member | 16 | ||

Article 3 REPRESENTATIONS AND WARRANTIES | 16 | |||

Section 3.01 | Representations and Warranties of Morgans | 16 | ||

Section 3.02 | Representations and Warranties of Boyd | 17 | ||

Article 4 PREDEVELOPMENT MATTERS | 19 | |||

Section 4.01 | Predevelopment | 19 | ||

Section 4.02 | Echelon Place Master Plan and Components | 20 | ||

Section 4.03 | Outside Start Date | 22 | ||

Article 5 CAPITAL CONTRIBUTIONS | 22 | |||

Section 5.01 | Initial Capital Contributions | 22 | ||

Section 5.02 | Additional Capital Contributions | 23 | ||

Section 5.03 | Procedures for Capital Contributions | 24 | ||

Section 5.04 | Failure to Fund Capital Contributions | 24 | ||

Section 5.05 | Dilution | 25 | ||

Section 5.06 | Payment of Cost Overruns | 25 | ||

Section 5.07 | Withdrawals of Capital | 26 | ||

Section 5.08 | Negative Capital Accounts | 26 | ||

Article 6 CAPITAL ACCOUNTS AND ALLOCATIONS | 27 | |||

Section 6.01 | Capital Accounts | 27 | ||

Section 6.02 | Allocations of Profits and Losses | 27 | ||

Article 7 DISTRIBUTIONS | 28 | |||

Section 7.01 | Net Operating Cash Flow | 28 | ||

Section 7.02 | Net Capital Proceeds | 28 | ||

i

| PAGE | ||||

Section 7.03 | Amounts Withheld | 28 | ||

Section 7.04 | Assignment of Distributions | 28 | ||

Section 7.05 | Dissolution | 29 | ||

Article 8 MANAGEMENT | 29 | |||

Section 8.01 | Morgans Duties | 29 | ||

Section 8.02 | Affiliate Agreement Control | 29 | ||

Section 8.03 | Morgans’ Additional Duties | 29 | ||

Section 8.04 | Bank Accounts | 30 | ||

Section 8.05 | Duties and Conflicts | 30 | ||

Section 8.06 | Financing | 31 | ||

Section 8.07 | Expenses of Members | 31 | ||

Section 8.08 | Removal of Morgans as a Managing Member | 32 | ||

Article 9 DEVELOPMENT DURING CONSTRUCTION PERIOD | 32 | |||

Section 9.01 | General | 32 | ||

Section 9.02 | Budget, Schedule and Plans | 32 | ||

Section 9.03 | Monitoring of Development | 32 | ||

Section 9.04 | Changes | 34 | ||

Section 9.05 | Participation of Boyd | 34 | ||

Section 9.06 | Loan Guaranties | 35 | ||

Section 9.07 | Activities Following Disputes | 35 | ||

Article 10 ACCOUNTING, BOOKS AND RECORDS AND TAX MATTERS | 36 | |||

Section 10.01 | Books and Records | 36 | ||

Section 10.02 | Reports | 36 | ||

Section 10.03 | Company Accountant | 37 | ||

Section 10.04 | Reserves | 37 | ||

Section 10.05 | Fiscal Year | 37 | ||

Section 10.06 | Partnership for Tax Purposes | 37 | ||

Section 10.07 | Tax Matters | 37 | ||

Section 10.08 | Audit Rights | 38 | ||

Article 11 LIMITATION OF LIABILITY AND INDEMNIFICATION | 38 | |||

Section 11.01 | Limitation of Liability | 38 | ||

Section 11.02 | Indemnification | 38 | ||

Section 11.03 | Certain Waivers | 39 | ||

Article 12 TRANSFERS | 40 | |||

Section 12.01 | General | 40 | ||

Section 12.02 | Permitted Transfers of Interests | 40 | ||

Section 12.03 | Transferees | 41 | ||

Section 12.04 | Admission of Additional Members | 41 | ||

Section 12.05 | Boyd Right to Purchase | 42 | ||

ii

| PAGE | ||||

Article 13 TERMINATION, DISSOLUTION AND LIQUIDATION | 44 | |||

Section 13.01 | Term | 44 | ||

Section 13.02 | Liquidating Events | 44 | ||

Section 13.03 | Winding Up | 45 | ||

Section 13.04 | Acts in Furtherance of Liquidation | 45 | ||

Article 14 MISCELLANEOUS | 45 | |||

Section 14.01 | Notices | 45 | ||

Section 14.02 | Amendments; No Waivers; Entire Agreement | 46 | ||

Section 14.03 | Expenses | 47 | ||

Section 14.04 | Consents and Approvals | 47 | ||

Section 14.05 | Successors and Assigns | 47 | ||

Section 14.06 | Governing Law | 47 | ||

Section 14.07 | Counterparts | 48 | ||

Section 14.08 | Severability | 48 | ||

Section 14.09 | Further Assurances | 48 | ||

Section 14.10 | Publicity | 48 | ||

Section 14.11 | Confidentiality | 48 | ||

Section 14.12 | Third Parties Not Benefited | 49 | ||

Section 14.13 | Time of the Essence | 49 | ||

Section 14.14 | Waiver of Jury Trial | 49 | ||

Section 14.15 | Jurisdiction; Choice of Forum | 49 | ||

iii

LIMITED LIABILITY COMPANY AGREEMENT

This LIMITED LIABILITY COMPANY AGREEMENT dated as of January 3, 2006 (this “Agreement”), between Morgans/LV Investment LLC, a Delaware limited liability company having an address at 475 Tenth Avenue, New York, New York 10018 (“Morgans”), and Echelon Resorts Corporation, a Nevada limited liability company having an address at 2950 Industrial Road, Las Vegas, Nevada 89109 (“Boyd”), each in its capacity as a Member (as hereinafter defined).

WITNESSETH:

WHEREAS, Morgans Las Vegas, LLC, a Delaware limited liability company (the “Company”), has been formed under the Delaware Limited Liability Company Act (the “Delaware Act”) by filing a Certificate of Formation with the Delaware Secretary of State on January 3, 2006 (the “Certificate”); and

WHEREAS, the Members desire to enter into this Agreement to govern the operations of the Company;

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

ARTICLE 1

DEFINITIONS

Section 1.01Definitions. As used herein, the following terms shall have the respective meanings set forth below:

“Affiliate” shall mean, when used with respect to any Person, any other Person controlling, controlled by or under common control with such Person. For purposes of this definition, (a) the term “control” shall mean, with respect to any Person, possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of such Person, whether through the ownership of voting securities, by contract or otherwise, and (b) a Person shall specifically be deemed to have “control” over a partnership or limited liability company (as the case may be) if such Person is a general partner of a partnership or a managing member of a limited liability company.

“Annual Plan” shall mean the annual budget and forecast of operations prepared by the Hotel Manager in accordance with Section 9.4 of the Morgans Hotel Management Agreement and approved by Boyd on behalf of the Company.

“Approved Cost Overruns” shall mean unbudgeted Development Costs that (a) are not Permitted Cost Overruns and (b) are approved by the Members.

“approve,” “approved” or “approval” shall mean, as to the subject matter thereof and as the context may require or permit, an express consent or approval contained in a written statement signed by the approving Person.

“Architects” shall mean architects and/or designers performing work on the Project.

“Bankruptcy Code” shall mean Title 11 of the United States Code entitled “Bankruptcy,” as now and hereafter in effect, or any successor statute.

“Boyd Controlled Affiliate” shall mean any Person, directly or indirectly, 100 percent owned and controlled by the Boyd Parent or any successor thereto.

“Boyd Parent” shall mean Boyd Gaming Corporation, a Nevada corporation.

“Budgeted Development Costs” shall mean aggregate amount of the Development Costs shown on the Development Budget including the amount of all contingencies and reserves set forth in the Development Budget but specifically excluding (i) any Financing Costs contained therein or (ii) the Company’s allocable share of the costs of the Echelon Place Master Plan Improvements.

“Business Day” shall mean any day other than a Saturday, a Sunday or a day on which banking institutions in the City of New York, New York are authorized by law, regulation or executive order to remain closed.

“Capital Call” shall mean a written notice from a Member to both Members requesting a Capital Contribution.

“Capital Contribution” shall mean, with respect to any Member, a contribution of capital made by such Member to the Company pursuant to Article 5.

“Cash Disbursements” shall mean, for any period, (a) all cash payments made by or on behalf of the Company (other than from reserve or escrow accounts, if any, maintained by the Company) during such period, excluding expenses incurred which are a deduction from proceeds or receipts in determining Net Capital Proceeds, plus (b) the amount, if any, added during such period to reserve or escrow accounts maintained by the Company.

“Cash Receipts” shall mean, for any period, (a) cash received by or on behalf of the Company from any source during such period, excluding proceeds or receipts which are used in determining Net Capital Proceeds,plus (b) the amount of any cash released to the Company during such period from reserve and escrow accounts (or no longer set aside by the Company in a reserve or escrow account), if any, maintained by the Company.

“Code” shall mean the Internal Revenue Code of 1986, as amended from time to time.

“Company Accountant” shall mean a nationally recognized accounting firm approved by the Members to act as accountants for the Company.

2

“Completion” shall mean the occurrence of the following:

(a) issuance by all applicable Governmental Authorities of a certificate of occupancy (which may be a temporary certificate of occupancy), certificate of completion or similar document authorizing the occupancy of the Hotels and the opening of the Hotels for business;

(b) final completion of all construction work for the Improvements, including punchlist items and other non-material items, (i) in accordance with the Plans and Specifications, (ii) in accordance with the Construction Loan Documents, and (iii) consistent and in compliance with all Legal Requirements;

(c) final payment for all work and materials involved in the construction of all portions of the Project as evidenced by a final affidavit and lien release from the general contractor and all other trade contractors, subcontractors, material suppliers and vendors furnishing services or materials to the Company in connection with the construction of the Project, or any similar document under Nevada law which has the effect of removing from the title to the Project all liens, inchoate or otherwise, which could have arisen on account of work done on, or materials delivered to, the Property in connection with the construction of the Project, including payment for all punchlist items, excepting affidavits and/or lien releases for non-material amounts that the Company has not been able to obtain notwithstanding Morgans’ good faith efforts to do so;

(d) receipt by Boyd of a title examination certificate from the Company’s title examiner that, as of the date of the latest to occur of (a), (b) or (c) above, no liens have been filed against the Project which have not been satisfied in full, discharged from the Project by bonding or insured over by the title insurance company; and

(e) the Opening Date of both Hotels has occurred.

“Completion Date” shall mean the date on which Completion shall have occurred.

“Construction Lender” shall mean the lender (or lending group or syndicate) providing the Construction Loan.

“Construction Loan” shall mean the construction loan, and (if applicable) permanent loan from the Construction Lender to the Company to finance property taxes, insurance, the design, construction, installation, furnishing and equipping of the Improvements and the payment of certain pre-opening expenses to be incurred by the Company during the Construction Period, on the terms for such loan set forth in the Construction Loan Documents.

“Construction Loan Agreement” shall mean the loan agreement between the Company and the Construction Lender relating to the Construction Loan.

“Construction Loan Documents” shall mean, collectively, the Construction Loan Agreement, the promissory notes evidencing the Company’s indebtedness in respect of the Construction Loan, the Mortgage securing such indebtedness, the Construction Loan Guaranty, and all other instruments and documents executed by the Company or any Member evidencing, securing, guaranteeing or otherwise relating to the Construction Loan.

3

“Construction Loan Guaranty” shall mean, collectively, any guaranty executed by Morgans or any Affiliate thereof, in favor of the Construction Lender, guaranteeing (i) lien-free completion (or, if applicable, substantial completion) of the Project in accordance with the Plans and Specifications and the Construction Schedule and (ii) customary carve outs for fraud and other “bad boy” acts, environmental matters arising after the Contribution Date and interest carry in connection with otherwise non-recourse financing.

“Construction Period” shall mean the period commencing on the Contribution Date and ending on the Completion Date.

“Construction Schedule” shall mean the preliminary design and construction timetable for the Project as approved, amended, modified or supplemented pursuant to the terms of this Agreement.

“Contributed Assets” shall mean the Land.

“Contribution Date” shall mean the date on or after the closing of the Construction Loan that all conditions for the initial funding under the Construction Loan are satisfied.

“Cost Overruns” shall mean an amount equal to the excess of (i) the total Development Costs for the Project actually incurred by the Company over (ii) the sum of (A) the Budgeted Development Costs, (B) Approved Cost Overruns to the extent such costs are not included in the Budgeted Development Costs as a result of any amendment, modification or supplement to the Development Budget approved by the Members and (C) Permitted Cost Overruns to the extent such costs are not included in the Budgeted Development Costs as a result of any amendment, modification or supplement to the Development Budget approved by the Members. For purposes of this definition, and of any guaranties of Cost Overruns hereunder by Morgans Parent, the terms “Cost Overruns” and “Development Costs” shall not include (i) any Financing Costs incurred by the Company for the period commencing on the date hereof and ending six months after the Target Opening Date or (ii) the Company’s allocable share of the costs of the Echelon Place Master Plan Improvements.

“Development Budget” shall mean the final development budget for the Project, setting forth by line item all Development Costs and indicating the Budgeted Development Costs, as such final budget shall be approved, amended, modified or supplemented pursuant to the terms of this Agreement. The proposed form of Development Budget is attached hereto asExhibit A.

“Development Costs” shall mean all Predevelopment Costs, Financing Costs and all other direct and indirect costs and expenses actually incurred by or on behalf of the Company through the Completion Date with respect to the acquisition and carrying costs for the Property, designing, constructing, permitting installing, furnishing and equipping the Hotels and the Improvements, and opening the Hotels for business, and pre-opening sales, marketing and training costs, the Company’s allocable share (as approved by the Members) of the costs of the Echelon Place Master Plan Improvements, including all costs and expenses of the types enumerated as line items in the Development Budget and all other costs and expenses of any

4

kind or nature incurred to cause Completion of the Project in accordance with the Plans and Specifications and the Pre-Opening Plan.

“Echelon Place” shall mean a master plan development on the Echelon Place Parcel comprising the Echelon Place Components and the Echelon Place Master Plan Improvements.

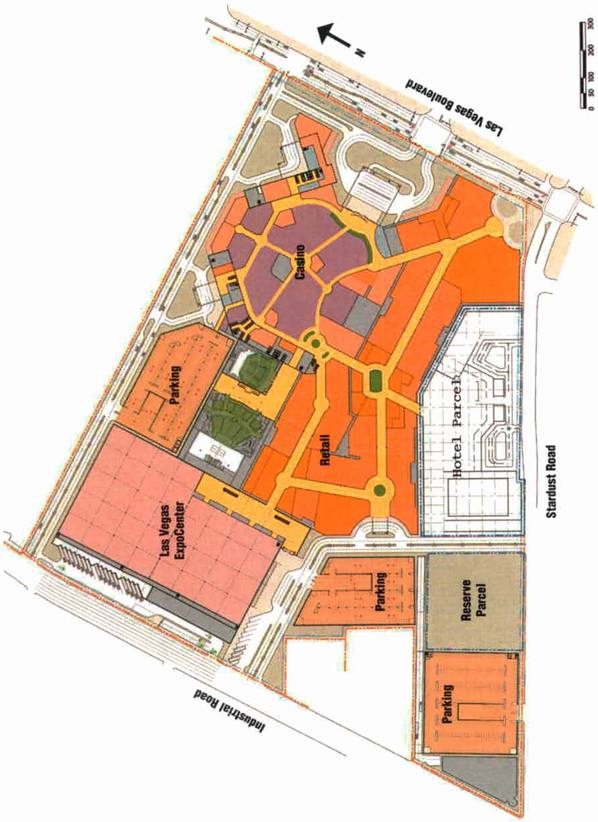

“Echelon Place Components” shall mean each of the individual projects developed on the Echelon Place Parcel, including the Hotels, a casino, casino-hotels, convention center, theater, retail, dining area, parking facilities and any other projects pursued by Boyd or an Affiliate thereof on the Echelon Place Parcel.

“Echelon Place Components Site Plan” shall mean the preliminary site plan for the Echelon Place Parcel, showing each of the Echelon Place Components as currently configured, which is attached hereto asExhibit B.

“Echelon Place Cost Overrun” shall mean the amount, if any, by which the Company’s actual allocable share of the costs of the Echelon Place Master Plan Improvements through the Completion Date exceed the amount budgeted for such costs as set forth in the Development Budget. Notwithstanding the foregoing, such excess shall not include and there shall be no Echelon Place Cost Overrun to the extent such excess costs (i) arise from acts of God, (ii) would not have otherwise been incurred but for delays in the Completion Date occurring after the date specified in the Construction Schedule, or (iii) arise from changes to the Echelon Master Plan or the Plans and Specifications approved by both Members.

“Echelon Place Master Plan” shall mean the engineering, design and specifications for (i) the entirety of the infrastructure and other improvements that will jointly benefit or be used in common by the Echelon Place Components, including without limitation, all common amenities, landscaping, irrigation, signage, lighting and fencing, all roads leading to and from the porte-cochères and the preparation of sub-grade up to the underside of the porte-cochère road paving surface, all traffic, shared parking, and circulation improvements (including, without limitation, roads, bridges, walkways, monorail systems and other means of transportation within, adjoining or servicing the Echelon Place Parcel and all landscaping, lighting and fencing related thereto); and (ii) all Government Improvements; excluding only the engineering and design of those improvements that specifically, solely, and individually comprise each Echelon Place Component. The Echelon Place Master Plan, as currently configured, is attached hereto asExhibit C.

“Echelon Place Master Plan Improvements” shall mean any and all improvements included in or built or to be built pursuant to the Echelon Place Master Plan.

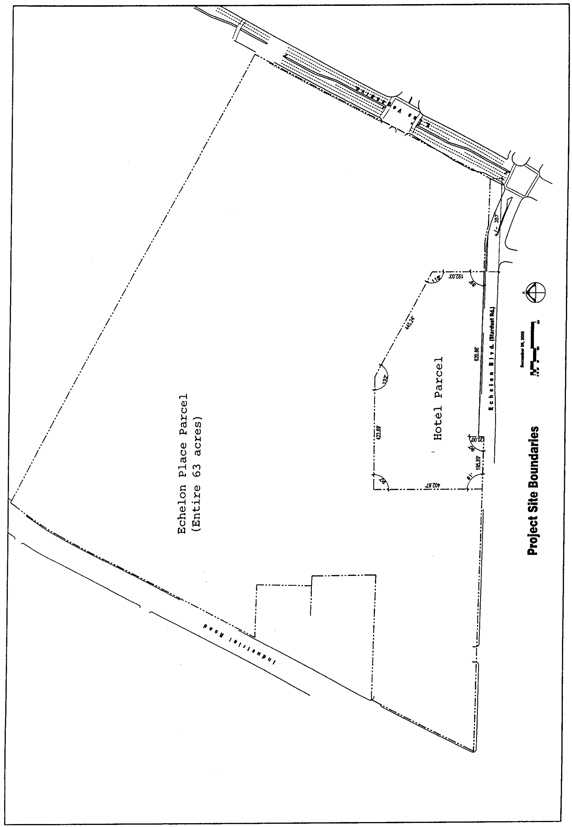

“Echelon Place Parcel” shall mean approximately 63 acres of land located at 3000 Las Vegas Boulevard South, Las Vegas more specifically described onExhibit D.

“Emergency Costs” shall mean costs and expenses required to (a) correct a condition that if not corrected would endanger the preservation or safety of the Hotel or the Property or the safety of tenants, guests, employees or other persons at or using the Hotel or the Property, (b) avoid the imminent suspension of any necessary service in or to the Hotel or the

5

Property, or (c) prevent any of the Members from being subjected to criminal or substantial civil penalties or damage.

“Entitlements” shall mean any and all present and future approvals, permits, licenses and other entitlements, whether discretionary or of a ministerial or administrative nature, now or hereafter given or issued by any Governmental Authority, including, without limitation, any development agreement and all related conditions of approval and mitigation measures, in connection with or relating in any respect to the development, construction, opening, use, ownership, management, marketing, operation or occupancy of the Hotel, the Improvements or the Project.

“Event of Bankruptcy” shall mean, with respect to any Person, (a) the commencement by such Person of a proceeding seeking relief under any provision or chapter of the Bankruptcy Code or any other federal or state law relating to insolvency, bankruptcy or reorganization; (b) an adjudication that such Person is insolvent or bankrupt; (c) the entry of an order for relief under the Bankruptcy Code with respect to such Person; (d) the filing of any such petition or the commencement of any such case or proceeding against such Person, unless such petition and the case or proceeding initiated thereby are dismissed within ninety (90) days from the date of such filing; (e) the filing of an answer by such Person admitting the material allegations of any such petition; (f) the appointment of a trustee, receiver or custodian for all or substantially all of the assets of such Person unless such appointment is vacated or dismissed within ninety (90) days from the date of such appointment but not less than five (5) days before the proposed sale of any assets of such Person; (g) the insolvency of such Person or the execution by such Person of a general assignment for the benefit of creditors; (h) the convening by such Person of a meeting of its creditors, or any class thereof, for purposes of effecting a moratorium upon or composition of its debts or an extension of its debts; (i) the failure of such Person to pay its debts generally as they mature; (j) the levy, attachment, execution or other seizure of substantially all of the assets of such Person where such seizure is not discharged within ten (10) days thereafter; or (k) the admission by such Person in writing of its inability to pay its debts generally as they mature or that it is generally not paying its debts as they become due.

“FF&E” shall mean all furniture, furnishings, fixtures and equipment, systems, apparatus, goods and other personal property used in, or held in storage for use in or required in connection with the operation of the Hotels, and shall include Operating Equipment, specialized hotel equipment, guest room, corridor, restaurant, and lounge furnishings, office furniture and equipment, carpets, electrical appliances, kitchen appliances and apparatus, floor coverings, soft furnishings, artwork, decorative lighting, beverage and bar apparatus and appliances, telephones and telephone systems, television receivers and other electrical and electronic equipment, computer hardware and software, laundry apparatus and appliances, maintenance and engineering apparatus and appliances, function, banquet and conference furniture and apparatus, exterior and interior signage, office and back of house apparatus and appliances, motor vehicles and courtesy vehicles, and all alterations, substitutions, additions and replacements therefor.

“Financing Costs” shall mean all costs of obtaining financing for the Company including, interest carry, origination fees, commitment fees, interest rate swap and lock fees, reimbursement of lender expenses, closing costs, title insurance premiums, lender and borrower

6

attorneys fees, transaction or recording taxes, agent or syndication fees and mortgage brokerage fees.

“Governmental Authority” shall mean the United States of America or any State thereof, and any agency, quasi-governmental agency, department, commission, board, bureau, instrumentality or political subdivision (including any city, county or district) of any of the foregoing, now existing or hereafter created, having jurisdiction over the Company, any of the Members or their Affiliates, the Hotel or the Property or any portion thereof, including, without limitation, the Nevada Gaming Control Board and the Nevada Gaming Commission.

“Government Improvements” shall mean all off-site and on-site improvements required by any federal, state, county, municipal or other governmental or quasi-governmental agency or by any utility provider, in order to enable the construction of each of the Echelon Place Components, including without limitation, the construction or relocation of any required common air and water quality infrastructure, solid waste, ground water and storm water runoff facilities and other similar improvements or projects, and the construction of all improvements required to bring all necessary utilities to Echelon Place (including without limitation, water, gas, electricity, sewer and telephone), and the relocation of any existing utility service or installation located upon the Echelon Place Parcel that would obstruct the intended development thereof.

“Hotels” shall mean the two full service hotels to be developed on the Land consisting of (1) the Delano Las Vegas, an approximately 600-room hotel to be similar in design, service, and market position to the Delano hotel operated by MHG in South Beach, Miami Beach, Florida, and (2) an as-yet untitled approximately 1000-room business-focused hotel, which shall be similar in design, service, and market position to the “Mondrian” hotel brand, together with all meeting space, business centers, restaurants, spas, retail stores, concessions, pools, recreational facilities, driveways, parking areas, FF&E, Operating Supplies, and other facilities and equipment contained therein or appurtenant thereto, as any of the foregoing may be improved, modified, altered or expanded during the term hereof. The Members acknowledge and agree that (i) the Company is not the owner of the “Delano” brand and proprietary marks or the Morgans’ to be developed business brand and proprietary marks and (ii) the Company’s entitlement to use such brands and other proprietary marks shall be as provided in the Morgans Hotel Management Agreement.

“Hotel Management Agreement” shall mean (a) the Morgans Hotel Management Agreement, or (b) in the event that the agreement described in the preceding clause (a) shall no longer be in effect, any new management agreement between the Company and any other manager or operator of the Hotel.

“Hotel Manager” shall mean (a) for so long as the Morgans Hotel Management Agreement shall be in effect, Morgans/LV Management LLC, a Delaware limited liability company, and its permitted successors and assigns under the Morgans Hotel Management Agreement, or (b) if the Morgans Hotel Management Agreement shall no longer be in effect, any other Person operating or managing the Hotels pursuant to a new hotel management agreement with the Company.

7

“Improvements” shall mean the Hotels, together with all roads, sidewalks, parking areas, landscaping, utilities and related equipment and other infrastructure set forth on the Plans and Specifications or subsequently constructed on, at or underneath the Property.

“Initial Capital Contributions” shall mean the Capital Contributions of the Members funded pursuant to Section 5.01.

“Interest” shall mean, with respect to any Member, such Member’s beneficial ownership interest in the Company as provided in this Agreement.

“Interior Designer” shall mean the interior design firm or firms retained by the Company in connection with the Project.

“Joint Decisions” shall mean those decisions or actions, to be jointly approved by Morgans and Boyd, which are set forth onExhibit E.

“Land” shall mean the real property (including any easements, rights of way, access rights, approvals and Entitlements, and any other rights, benefits or obligations appurtenant thereto) located on an approximately 6.5 acre parcel of land (which acreage amount shall be subject to modification as provided in the next sentence) at the southernmost boundary of Echelon Place as more particularly described on the Preliminary Site Plan. The Members acknowledge that the site shape and area of the Land may change during the Predevelopment Period, such changes to be subject to the approval of both Members, but the area of the Land will not be less than a minimum of 6 acres or such other area as mutually agreed by the Members.

“Landscape Architect” shall mean the landscape architect(s) or landscape planner(s) retained by the Company in connection with the Project.

“Legal Requirements” shall mean any and all laws, rules, regulations, constitutions, orders, ordinances, charters, statutes, codes, executive orders and requirements, (including any Entitlements) of any Governmental Authority having jurisdiction over a Person (as applicable) and/or the Property or any street, road, avenue or sidewalk comprising a part of, or lying in front of, the Property or any vault in, or under the Property (including, without limitation, any of the foregoing relating to handicapped or disabled access, accommodations, or parking, and the laws, rules, regulations, orders, ordinances, statutes, codes and requirements of any applicable fire rating bureau or other body exercising similar functions).

“Loan Documents” shall mean, collectively, the Construction Loan Documents and any other documents, instruments or agreements evidencing, securing or guaranteeing any other indebtedness or financing obtained by the Company.

“Managing Member” shall mean Morgans and its successors and permitted assigns.

“Management Fee” shall mean, with respect to any period, the management fee paid by the Company to the Hotel Manager with respect to such period, in the amount set forth in the Hotel Management Agreement.

8

“Material Vendor” shall mean each of the following: (i) any lobbyist engaged by the Company, (ii) any supplier or vendor receiving payments from the Company in excess of $500,000 during any twelve month period, (iii) any consultant receiving payments from the Company in excess of $50,000 during any twelve month period and (iv) any lessee or tenant of the Company if aggregate rental due during the term of the lease, including renewals, exceeds $350,000. Notwithstanding the foregoing, term “Material Vendor shall not include any licensed attorney, certified public accountant, law firm, accounting firm, financial institution regulated by any federal or state law, investment banker regulated by any state and any licensed real estate broker).

“Member” shall mean Morgans, Boyd or any other Person who, at such time, is admitted to the Company as a member in accordance with the terms of this Agreement.

“Morgans Capital Commitment” shall mean an amount equal to the Capital Contribution funded by Morgans pursuant to Section 5.01(b), and which amount shall equal the fair market value of the Land contributed by Boyd to the Company on the Contribution Date, as determined pursuant to Section 5.01(c).

“Morgans Competitive Hotel” shall mean the following hotels or hotel brands, and other hotels that are substantially similar to the following hotels or hotel brands: Mondrian, Delano, W Hotels, 60 Thompson, Soho Grand, Tribeca Grand or Hotel Gansevoort. The Members agree that the following hotel brands, and those substantially similar thereto, are not substantially similar to the foregoing hotel brands and shall not be deemed a Morgans Competitive Hotel: Ritz Carlton, Fairmont, St. Regis, Four Seasons, Solis, Capella, Bulgari, Rosewood, and Raffles.

“Morgans Controlled Affiliate” shall mean any Person, directly or indirectly, 100 percent owned and controlled by the Morgans Parent.

“Morgans Hotel Management Agreement” shall mean the Hotel Management Agreement between the Company and Morgans/LV Management LLC, dated as of the date hereof, as amended, modified or supplemented.

“Morgans Parent” shall mean Morgans Hotel Group LLC, a Delaware limited liability company, or any successor thereto, including any successor arising from or in connection with the pending initial public offering of substantially all of the assets owned or controlled by Morgans Hotel Group LLC.

“Mortgage” shall mean any mortgage, deed of trust, security agreement or other instrument in the nature thereof at any time and from time to time constituting a lien or grant of security title or a security interest in and upon any interest or estate in the Property or any portion thereof.

“Necessary Expenditures” shall mean (a) all Emergency Costs, and (b) all other expenditures whether or not of a recurring nature that are necessary for the Company to preserve, operate, maintain, improve or protect the Property consistent with the Annual Plan, including payments in respect of liens, payments of principal, interest and any other amounts pursuant to any Loan Documents, payments of mechanics’ liens (unless the Company is diligently and continuously prosecuting a proceeding contesting the payment of the lien by a proper legal

9

proceeding which operates to suspend collection of such lien, the Company has sufficient funds reserved for such payment and such contest shall not be prohibited by the Loan Documents), insurance payments, real estate tax payments, utility costs, repair and maintenance costs, costs of compliance with federal, state and local laws, codes, rules or regulations, and any other operating expenses or capital expenses set forth in the Annual Plan or otherwise approved by the Members.

“Net Capital Proceeds” shall mean any Net Disposition Proceeds or Net Refinancing Proceeds.

“Net Disposition Proceeds” shall mean the gross receipts (including condemnation and casualty insurance proceeds) from the sale, exchange, transfer, conveyance, lease, or other disposition of a Hotel, the Property, FF&E, or any other assets of the Company other than in the ordinary course of business, less (a) any indebtedness relating to or secured by such assets (other than Priority Loans) which is repaid out of such gross receipts, (b) the costs and expenses incurred by the Company in connection with the sale, exchange, transfer, conveyance, lease or other disposition, including brokerage commissions, and (c) in the case of condemnation or casualty, the costs incurred by the Company in connection with any collection of condemnation or casualty proceeds, or repair or restoration of the Property.

“Net Operating Cash Flow” shall mean, for any period, the excess of Cash Receipts for such period over Cash Disbursements for such period.

“Net Refinancing Proceeds” shall mean, with respect to any financing or refinancing of any loan or encumbrance now or hereafter placed on the Property, all cash received by the Company from such financing or refinancing, less the sum of (a) all costs incurred by the Company in connection with such financing or refinancing, (b) all amounts paid to the holder of any Mortgage or other encumbrance on the Property, or to the holder of any other indebtedness of the Company (other than Priority Loans), as a consequence of such financing, (c) all amounts which are required to be held in reserve by the Company, or which are otherwise not made unconditionally available to the Company for distribution to the Members pursuant to the terms of such financing or refinancing, and (d) amounts applied by the Company to pay its costs and expenses or set aside in connection with such financing or refinancing as a reserve and/or escrow by the Company for its reasonably anticipated expenses and obligations.

“Opening Date” shall mean the date on which all of the following has occurred (i) the Hotel is opened for business to the public, (ii) the Company has obtained all material licenses and permits required by Legal Requirements, the Hotel Management Agreement and this Agreement for the occupancy and operation of the Hotel (including, without limitation, certificates of occupancy (which may be temporary), restaurant licenses, and liquor licenses); (iii) all FF&E and Operating Supplies reasonably required to operate the Hotel in accordance with the Hotel Management Agreement and this Agreement have been delivered to and, as applicable, installed in the Hotel and are in working order; (iv) all elements of the building comprising the Hotel and all other structures necessary for operation, access to, and use of the Hotel in accordance with this Agreement and the Hotel Management Agreement, shall have been substantially completed and the Company shall have obtained certificates of occupancy (which may be temporary) and all other licenses and permits required by applicable Legal Requirements for the operation and management thereof, with respect to same; (v) the Company has received

10

all consents and approvals from all governmental and regulatory authorities and all other Persons as are necessary for the operation of the Hotel in accordance with this Agreement and the Hotel Management Agreement.

“Operating and Capital Budget” shall mean, collectively, the consolidated operating and capital budgets for the Company for any Fiscal Year (or portion thereof) following the Opening Date, as set forth in the Annual Plan for such Fiscal Year and as approved by Boyd.

“Operating Equipment” means all cooking utensils, chinaware, glassware, linens, silverware, uniforms, menus and other similar items used at the Hotels.

“Operating Supplies” means all paper supplies, cleaning materials, fuel, food and beverages, light bulbs and other consumable and expendable items used at, or stored for usage at, the Hotels.

“Outside Start Date” shall mean June 30, 2008.

“Percentage Interest” shall mean, with respect to any Member, such Member’s Percentage Interest as set forth in Section 5.01(d), as such Percentage Interest may be modified from time to time in accordance with the terms hereof.

“Permitted Cost Overruns” shall mean unbudgeted Development Costs (i) arising from acts of God or (ii) that would not have otherwise been incurred but for changes made by Boyd or its Affiliates in Echelon Place following the approval of the Development Budget.

“Permitted Encumbrances” shall means the title exceptions set forth inExhibit F attached hereto, but only to the extent that such title exceptions do not, individually or in the aggregate, have a material adverse effect on the use, utility or value of the Land for the purposes of the development and operation of the Hotels and the other Project improvements thereon.

“Person” shall mean an individual, corporation, partnership, association, trust, limited liability company or any other entity or organization, including a government or political subdivision or an agency or instrumentality thereof.

“Plans and Specifications” shall mean the drawings, plans and specifications for the Project (including any applicable site plan, master plan or similar document) prepared by the Architects and Project Consultants, as approved, amended, modified or supplemented pursuant to the terms of this Agreement.

“Predevelopment Budget” shall mean the predevelopment budget for the Project, setting forth by line item all Predevelopment Costs, a copy of which is attached hereto asExhibit G, as such budget shall be amended, modified or supplemented pursuant to the terms of this Agreement.

“Predevelopment Costs” shall mean all costs incurred in connection with (i) the Plans and Specifications and construction documents for the Project including, without limitation, all architectural, engineering, attorneys’ and other professionals’ fees relating thereto; (ii) obtaining all construction permits; (iii) obtaining the Construction Loan, including, without

11

limitation, all application fees, discount points, commitment fees, appraisal fees, documentary stamp and intangible taxes, recording costs, marketing, equity requirements, and other costs of meeting the lender’s requirements to funding the Construction Loan and lender’s attorneys’ fees; and (iv) obtaining all Entitlements and satisfying all Legal Requirements for the Project together with any other development approvals and permits necessary to pursue the Project, including, without limitation, the cost of all presentations and presentation materials, architectural, engineering, and attorneys’, consultants’ and other professionals’ fees relating thereto.

“Predevelopment Period” shall mean the period commencing on the date of this Agreement and ending on the Contribution Date.

“Preliminary Site Plan” shall mean the preliminary site plan for the Project attached hereto asExhibit H.

“Pre-Opening Plan” shall mean the written statement, prepared by Hotel Manager and approved by Boyd on behalf of the Company detailing a program of pre-opening activities to be undertaken by the Hotel Manager through and including the Opening Date to prepare the Hotel for the Opening Date and which will include, without limitation: (i) using commercially reasonable efforts to recruit, relocate, train, and compensate employees (including the executive staff); (ii) pre-opening advertising, promotion and literature; (iii) using commercially reasonable efforts to assist the Company in obtaining all necessary licenses and permits for the operation of the Hotel; (iv) preparing the administrative offices including telephone, telex and fax services; (v) entertaining prospective business clients (including opening celebrations and ceremonies); (vi) purchasing Operating Supplies and FF&E necessary for the Hotel to commence operations; and (vii) other activities deemed reasonably necessary by the Hotel Manager to ensure that the Hotel and its operation will be in accordance with the applicable brand standard.

“Project” shall mean the design, development, construction, financing, equipping, furnishing, pre-opening and opening of the Hotels and the other new Improvements as provided in the Plans and Specifications and the Pre-Opening Plan.

“Project Consultant” shall mean, collectively, any design consultant, engineering consultant or other consultant retained by the Company in connection with the Project.

“Property” shall mean the Land and all improvements existing or constructed thereon from time to time (including the Hotel and other Improvements).

“Pro Rata” shall mean, with respect to the Members as of any relevant date, in proportion to such Members’ respective Percentage Interests as of such date.

“REA” shall mean a reciprocal easement agreement and/or master covenants and restrictions recorded by Boyd or its Affiliate against the Echelon Place Parcel detailing (i) the obligation of the Affiliate of Boyd that owns the Echelon Place Parcel to construct and operate the Echelon Place Components and the infrastructure and improvements set forth in the Echelon Place Master Plan (which obligation shall be subject to the limitations set forth in the REA), (ii) the services and amenities that will be provided to the Echelon Place Components in accordance with the Echelon Place Master Plan and (iii) the allocable share of the each Echelon Place Component of the expenses and costs associated with such services and amenities. The REA

12

shall be consistent with the terms and conditions set forth onExhibit I and shall be subject to the approval of Morgans (acting on behalf of the Company).

“Regulations” shall mean the Treasury Regulations, including Temporary or Proposed Regulations, promulgated under the Code, as such regulations are in effect from time to time. References to specific provisions of the Regulations include references to corresponding provisions of successor regulations.

“Reserve Parcel” shall mean the area identified on the Echelon Place Components Site Plan as the Reserve Parcel.

“Structural Engineer” shall mean the structural engineer or engineers retained by the Company in connection with the Project.

“Target Opening Date” shall mean the date approved by the Members in the Construction Schedule as the projected date of the opening of the Hotels to the public, as such date may be modified with the approval of the Members.

“Transfer” shall mean any direct or indirect sale, assignment, conveyance, disposition, exchange, mortgage, pledge or granting of a security interest.

“Uniform System” shall mean the “Uniform System of Accounts for the Lodging Industry (9th revised edition, Copyright 1996)” by the Hotel Association of New York City, Inc. and published by the Educational Institute of the American Hotel & Motel Association, as the same may be revised from time to time.

Each of the following terms is defined in the Section set forth opposite such term:

Term | Section | |

Act | Recitals | |

Additional Member | 12.04(a) | |

Affiliate Agreement | 8.02 | |

Agreement | Preamble | |

Appointment Notice | 12.05(e) | |

Boyd | Preamble | |

Boyd Cost Overrun | 5.06(a) | |

Boyd Default Loan | 5.06(b) | |

Capital Account | 6.01(a) | |

Capital Call Due Date | 5.03 | |

Capital Call Notice | 5.03 | |

CERCLA | 3.02(k) | |

Certificate | Recitals | |

Change | 9.04 | |

Company | Recitals |

13

Term | Section | |

Confidential Information | 14.11 | |

Contributing Member | 5.04(a) | |

Conversion Notice | 5.04(c) | |

Defaulting Member | 5.04(d) | |

Environmental Laws | 3.02(k) | |

Environmental Liabilities | 3.02(k) | |

Failed Contribution | 5.04(a) | |

Fair Market Value | 12.05(d) | |

Fiscal Year | 10.05 | |

Funded Amount | 5.04(a) | |

Hazard Materials | 3.02(k) | |

Indemnified Party | 11.02(a) | |

Laws | 3.02(k) | |

Liquidating Event | 13.02 | |

Morgans | Preamble | |

Morgans Cost Overrun Funding | 5.06(b) | |

Morgans Default Loan | 5.06(a) | |

Morgans Indemnified Party | 11.02(b) | |

Morgans Transfer Closing Date | 12.05(c) | |

Non-Contributing Member | 5.04(a) | |

Permitted Transfer | 12.02 | |

Priority Loan | 5.04(b) | |

Sophisticated Purchaser | 12.05(d) | |

Substitute Member | 12.03 | |

Tax Matters Member | 10.07(a) |

Section 1.02Certain Other Terms. In this Agreement, unless otherwise specified (a) singular words include the plural and plural words include the singular; (b) words which include a number of constituent parts, things or elements, including the terms “Project” or “Property” shall be construed as referring separately to each constituent part, thing or element thereof, as well as to all such constituent parts, things or elements as a whole; (c) words importing any gender include the other gender; (d) references to any Member include such Member’s permitted successors and assigns; (e) references to any statute or other law include all applicable rules, regulations and orders adopted or made thereunder and all statutes or other laws amending, consolidating or replacing the statute or law referred to; (f) references to any agreement or other document, including this Agreement, include all subsequent amendments, modifications, or supplements to such agreement or document; (g) the words “include” and “including” and words of similar import, shall be deemed to be followed by the words “without limitation”; (h) the words “hereto,” “herein,” “hereof,” “hereunder” and words of similar import, refer to this Agreement in its entirety; (i) references to Articles, Sections, paragraphs, Schedules

14

and Exhibits are to the Articles, Sections, paragraphs, Schedules and Exhibits of this Agreement; (j) numberings and headings of Articles, Sections, paragraphs, Schedules and Exhibits are inserted as a matter of convenience and shall not affect the construction of this Agreement; and (k) all Schedules and Exhibits to this Agreement are incorporated herein by this reference thereto as if fully set forth herein, and all references herein to this Agreement shall be deemed to include all such incorporated Schedules and Exhibits.

Section 1.03Accounting Terms. Unless otherwise specified, (a) all accounting terms used herein shall be interpreted, (b) all accounting determinations hereunder shall be made and (c) all financial statements required to be delivered hereunder shall be prepared, in accordance with generally accepted accounting principles as modified by the Uniform System, as in effect from time to time, consistently applied.

ARTICLE 2

FORMATION AND PURPOSE OF THE COMPANY

Section 2.01Formation of the Company. The Company has been formed and established under the provisions of the Act. Effective as of the date hereof, the rights and liabilities of the Members shall be as provided in this Agreement and, except as herein otherwise expressly provided, in the Act.

Section 2.02Name of the Company. The name of the Company shall be “Morgans Las Vegas, LLC.”

Section 2.03Purpose of the Company. The purpose of the Company is to engage in any lawful activity permitted under the Act, including, without limitation, the following:

(a) entering into and performing its obligations and exercising its rights under the agreements with Architects and Project Consultants, the Construction Loan Documents, the Hotel Management Agreement and any other agreements or contracts contemplated by the foregoing or this Agreement or required in connection with the development, design, construction, operation, financing, maintenance, management, improvement, repair, renovation, alteration, leasing and/or sale of the Hotels and the Property, and carrying out the terms of and engaging in the transactions contemplated by such agreements, in each case either directly or through subsidiaries;

(b) owning, designing, developing, constructing, managing, servicing, maintaining, repairing, renovating, improving, leasing, restructuring, financing (including entering into and performing its obligations and exercising its rights under any loan financing documents), refinancing, selling or otherwise dealing with and disposing of the Hotels and the Property and any proceeds of the Hotels and the Property, in each case either directly or through subsidiaries; and

(c) entering into, making and performing all contracts and undertakings, and engaging in any activity and executing any powers permitted under the Act that are incidental to, or connected with, the foregoing and necessary, suitable or convenient to accomplish the foregoing.

15

Section 2.04Place of Business of the Company. The principal place of business of the Company shall be located c/o Morgans, 475 Tenth Avenue, 11th Floor, New York, New York 10018; provided, however, that as soon as reasonably practicable the Company shall establish its principal place of business on the Land.

Section 2.05Registered Office and Registered Agent. The Company shall establish and maintain a registered office and agent for the Company in the State of Delaware.

Section 2.06Duration of the Company. The Company shall continue until its termination in accordance with the provisions of Article 13.

Section 2.07Title to the Company Property. All property of the Company, whether real or personal, tangible or intangible, shall be deemed to be owned by the Company as an entity, and no Member, individually, shall have any direct ownership interest in such property.

Section 2.08Filing of Certificates. Morgans shall file and publish all such certificates, notices, statements or other instruments required by law for the formation and operation of a limited liability company in all jurisdictions where the Company may elect to do business.

Section 2.09Limitation on Liability. Except as required by the Act or as expressly provided in this Agreement, the debts, obligations and liabilities of the Company, whether arising in contract, tort or otherwise, shall be solely the debts, obligations and liabilities of the Company, and no Member shall be obligated personally for any such debt, obligation or liability of the Company solely by reason of being a Member.

Section 2.10No Responsibility for Liability of Other Member. Except as expressly provided herein, neither the Company nor any Member shall be responsible or liable for any indebtedness or obligation of another Member incurred either before or after the execution of this Agreement, except as to those responsibilities, liabilities and obligations incurred pursuant to the terms of this Agreement, and each Member shall indemnify and hold each other Member harmless from such obligations and indebtedness incurred or assumed by the indemnifying Member except as aforesaid. This Agreement shall not be deemed to create a joint venture between the Members with respect to any activities or enterprises whatsoever other than those within the purposes of the Company as specified in Section 2.03.

ARTICLE 3

REPRESENTATIONS AND WARRANTIES

Section 3.01Representations and Warranties of Morgans. Morgans represents and warrants to Boyd as follows:

(a) It is duly organized, validly existing and in good standing under the laws of its jurisdiction of formation with all requisite power and authority to enter into this Agreement and to conduct the business of the Company.

(b) This Agreement constitutes the legal, valid and binding obligation of Morgans enforceable in accordance with its terms, subject to the application of principles of equity and laws governing insolvency and creditors’ rights generally.

16

(c) No consents or approvals are required from any Governmental Authority or other Person for Morgans to enter into this Agreement. All limited liability company, corporate or partnership action on the part of Morgans necessary for the authorization, execution and delivery of this Agreement, and the consummation of the transactions contemplated under this Agreement, have been duly taken.

(d) The execution and delivery of this Agreement by Morgans, and the consummation of the transactions contemplated under this Agreement, do not conflict with or contravene any provision of Morgans’ organizational documents or any agreement or instrument by which it or its properties are bound or any law, rule, regulations, order or decree to which it or its properties are subject.

(e) Morgans has not retained any broker, finder or other commission or fee agent, and no such person has acted on its behalf in connection with the execution and delivery of this Agreement or the acquisition (directly or indirectly) by the Company of the Property.

(f) Morgans is an indirect wholly-owned subsidiary of the Morgans Parent.

Section 3.02Representations and Warranties of Boyd. Boyd represents and warrants to Morgans as follows:

(a) It is duly organized, validly existing and in good standing under the laws of its jurisdiction of formation with all requisite power and authority to enter into this Agreement and to conduct the business of the Company.

(b) This Agreement constitutes the legal, valid and binding obligation of Boyd enforceable in accordance with its terms, subject to the application of principles of equity and laws governing insolvency and creditors’ rights generally.

(c) No consents or approvals are required from any Governmental Authority or other Person for Boyd to enter into this Agreement. All limited liability company, corporate or partnership action on the part of Boyd necessary for the authorization, execution and delivery of this Agreement, and the consummation of the transactions contemplated under this Agreement, have been duly taken.

(d) The execution and delivery of this Agreement by Boyd, and the consummation of the transactions contemplated under this Agreement, do not conflict with or contravene any provision of Boyd’s organizational documents or any agreement or instrument by which it or its properties are bound or any law, rule, regulations, order or decree to which it or its properties are subject.

(e) Boyd has not retained any broker, finder or other commission or fee agent, and no such person has acted on its behalf in connection with the execution and delivery of this Agreement or the acquisition (directly or indirectly) by the Company of the Property.

(f) Boyd is a wholly-owned subsidiary of the Boyd Parent.

17

(g) Boyd or an Affiliate holds good and marketable fee simple title to the Echelon Place Parcel and the Land, in each case free and clear of all liens, except for the Permitted Encumbrances.

(h) Boyd will, prior to the Contribution Date, operate and maintain the Land in a reasonable commercial manner and substantially in accordance with the past practices of Boyd and its Affiliates with respect to the Land, and shall not further encumber the Land or permit the Land to be further encumbered.

(i) There is no litigation pending or, to the best knowledge of Boyd, threatened in writing against the Land, the Echelon Place Parcel or Boyd or its Affiliates which would affect the Land or the Echelon Place Parcel. No petition in bankruptcy (voluntary or otherwise), assignment for the benefit of creditors, or petition seeking reorganization or arrangement or other action under Federal or state bankruptcy or insolvency law is pending against or contemplated by Boyd or its Affiliates.

(j) There are no existing condemnation proceedings affecting the Land or the Echelon Place Parcel (or any portion thereof) and neither Boyd nor any Affiliate of Boyd has received written notice of the threatened commencement of any such action affecting the Land or the Echelon Place Parcel (or any portion thereof). To the best of Boyd’s knowledge, there are no proffers, development agreements or other restrictions affecting the use or development of the Land or the Echelon Place Parcel other than the Project.

(k) The Land and the Echelon Place Parcel are in compliance in all material respects with all Legal Requirements of any Governmental Authority or any insurance carrier (“Laws”) affecting the Land, the Echelon Place Parcel or any portion thereof (including, without limitation, Comprehensive Environmental Response, Compensation and Liability Act of 1980 (“CERCLA”), 42 U.S.C. 9601(14), or any Laws regulating pollutants or contaminants as defined in CERCLA, 42 U.S.C. 9601(33), or hazardous waste as defined by the Resource Conservation and Recovery Act, 42 U.S.C. 6903(5), or other Laws regulating or relating to Hazardous Materials (as defined below) or human health or safety or the environment (collectively, the “Environmental Laws”)), and neither Boyd nor any Affiliate of Boyd has received notice of any violations of any of the foregoing Laws with respect to the Land or the Echelon Place Parcel. In connection with or relating to the Land or the Echelon Place Parcel, no written notice, notification, demand, request for information, citation, summons or order has been received, no complaint has been filed, no penalty has been assessed and no suit or action is pending or, to Boyd’s knowledge, threatened by any Governmental Authority or other Person with respect to any matters relating to or arising out of any Environmental Law, except to the extent any of the foregoing has been withdrawn, rescinded, dismissed, overruled, terminated, expired, completed, resolved, satisfied, discharged or otherwise rendered inoperative or ineffective. In connection with or relating to the Land or the Echelon Place Parcel, to Boyd’s knowledge, there are no Environmental Liabilities or facts, events, conditions, situations or set of circumstances which would reasonably be expected to result in or be the basis for any Environmental Liabilities. “Environmental Liabilities,” as used in this subparagraph, means any and all liabilities to the extent arising in connection with or relating to the Land or the Echelon Place Parcel or any activities or operations occurring or conducted thereon (including offsite disposal), whether accrued, contingent, absolute, determined, determinable or otherwise, which arise under or relate

18

to any applicable Environmental Law. For purposes of this Agreement, the term “Hazardous Materials” includes, without limitation, (a) any chemical, material or other substance defined as or included within the definition of “hazardous substances,” “hazardous wastes,” “extremely hazardous substances,” “toxic substances,” “toxic material,” “restricted hazardous waste,” “special waste,” or words of similar import under any Environmental Law; (b) any oil, petroleum, or petroleum-derived substances, any flammable substances or explosives, any radioactive materials, any asbestos or any substances containing more than 0.1 percent asbestos, any oil or dielectric fluid containing levels of polychlorinated biphenyls in excess of 50 parts per million, and any urea formaldehyde insulation; and (c) any other chemical, material or substance, exposure to which is prohibited, limited or regulated under any Environmental Law.

(l) To the best of Boyd’s knowledge, no work has been performed at the Land, and no materials have been furnished to the Land, which though not presently the subject of a lien, might give rise to mechanics’, materialmen’s or other liens against Boyd’s interest in the Land or any portion thereof if not paid as agreed.

(m) Boyd is not, and as of the Contribution Date will not be, a party to any agreement or undertaking of any kind whatsoever, written or oral, which will be binding upon the Company from and after the Contribution Date or which will adversely affect the Land, other than those furnished to Morgan and approved by Morgan in writing.

(n) There are no commercial or residential leases, subleases, licenses, occupancy agreements, or any other agreements or licenses in effect as of the date of this Agreement, nor shall there be as of the Contribution Date, granting to any person, entity or party a right to possess, occupy, use or purchase the Land or any portion thereof.

(o) Except as otherwise expressly set forth in this Agreement, the Land is being contributed in an “AS IS, WHERE IS” condition and “WITH ALL FAULTS” as of the date of this Agreement and the Contribution Date. Except as expressly set forth in this Agreement, no representations or warranties, express or implied, have been made or are being made and no responsibility has been or is being assumed by Boyd or by any partner, officer, employee, director, shareholder, person, firm, agent, attorney, or representative acting or purporting to act on behalf of Boyd as to the condition or fitness for any particular purpose or merchantability or repair of the Land or the value, expense of operation, or income potential thereof or as to any other fact or condition which has or might affect the Land or the condition, repair, value, expense of operation or income potential of the Land or any portion thereof. This Agreement has been entered into by the parties after full investigation, or with the parties satisfied with the opportunity afforded for investigation, and neither party is relying upon any statement or representation made by, or made by any person or entity purporting to act on behalf of, the other, unless such statement or representation is specifically and expressly embodied in this Agreement.

ARTICLE 4

PREDEVELOPMENT MATTERS

Section 4.01Predevelopment. During the Predevelopment Period, subject to the approval of Boyd to the extent required hereunder, Morgans shall use commercially reasonable

19

efforts to perform all predevelopment duties customarily performed by a developer of projects of like size and scope in accordance with the Predevelopment Budget and shall use reasonable commercial efforts to take or cause to be taken all action and promptly to do or cause to be done all things necessary, proper or advisable to facilitate the overall goal of causing (i) the Contribution Date to occur no later than the Outside Start Date and (ii) the opening the Hotels to the public in the first quarter of 2010 contemporaneously with completion of Echelon Place, including, without limitation, the following:

(a) Identifying and selecting the Architects, Interior Designer, Landscape Architects, Structural Engineer and other Project Consultants and overseeing all such parties;

(b) Together with Boyd, interfacing with all Governmental Authorities and determining all Entitlements required in order to pursue the Project and the timeline for obtaining the same;

(c) Approving, on behalf of the Company, those provisions of the REA affecting the Company and/or the Property;

(d) Taking all action necessary, proper or advisable to plan, design and obtain Entitlements for the construction of the Project;

(e) Preparing or causing to be prepared for approval by Boyd, (i) the concept and program development and specific site boundaries for the Land consistent with the Preliminary Site Plan with the goal of obtaining Boyd’s approval on or before, March 31, 2006, (ii) schematic designs and timeline with the goal of obtaining Boyd’s approval on or before, July 31, 2006, (iii) the Plans and Specifications, the Pre-Opening Plan, the Development Budget and the Construction Schedule with the goal of obtaining Boyd’s approval on or before January 1, 2007 and both parties agree to use reasonable commercial, good faith efforts to obtain such approvals on or prior to such dates, and any such approvals shall not be unreasonably delayed, withheld or conditioned;

(f) Obtaining clearance from Boyd’s governmental compliance committee for any Person that may be a Material Vendor before engaging such Person;

(g) On or before the Outside Start Date, identifying Construction Lenders and identifying, completing and endeavoring to cause the Company to satisfy all requirements in order for the Company to commence construction of the Project and close the Construction Loan and receive funding thereunder.

Section 4.02Echelon Place Master Plan and Components.

(a) Boyd and its Affiliates shall use commercially reasonable efforts to assist and cooperate with Morgans in connection with the performance of Morgans’ predevelopment duties set forth in Section 4.01. During the Predevelopment Period, Boyd and its Affiliates shall also use commercially reasonable efforts to proceed with the expeditious design and planning of Echelon Place, and to complete timely and provide to Morgans, the planning of the material components of the Echelon Place Master Plan that are reasonably necessary for Morgans to satisfy its predevelopment obligations as set forth in Section 4.02. In amplification of, and not in

20

limitation of, the foregoing, during the Predevelopment Period, Boyd and its Affiliates shall use reasonable commercial efforts to take or cause to be taken all action and promptly to do or cause to be done all things necessary, proper or advisable to facilitate the overall goal of closing the Construction Loan no later than the Outside Start Date and opening the Hotels to the public in the first quarter of 2010 contemporaneously with completion of the other material components of the Echelon Place Master Plan and the Echelon Place Components, including, without limitation, the following:

(i) provide assistance and advice as reasonably requested by Morgans, and otherwise fully cooperate in all respects with Morgans, to apply for and obtain the Entitlements for the Project;

(ii) take all action necessary, proper or advisable to plan, design and obtain Entitlements for the construction of the Echelon Place Components and the Echelon Place Master Plan Improvements, including obtaining all approvals, licenses and permits in connection therewith;

(iii) take all action necessary, proper or advisable to safely demolish and remove the existing structures on the Land and to remove and or remediate, in accordance with applicable Laws, any Hazardous Materials on the Land and to convey the Land to the Company on the Contribution Date vacant of any and all structures and debris.

(b) Without limiting any of the foregoing, during the Predevelopment Period Boyd shall not and shall not permit any Affiliate to (i) sell, contribute, assign or create any right, title or interest in or to the Land or cause any additional Lien or liability to be placed in record against the Land that is inconsistent with the Project or that would materially affect the ability of Boyd or its Affiliates to comply with its obligations hereunder, (ii) enter into any new (or extend or renew any existing) permit, covenant, restriction, agreement or obligation affecting the Land that is inconsistent with the Project or that would materially affect the ability of Boyd or its Affiliates to comply with its obligations hereunder or (iii) take or commit any action that could likely result in a violation or breach of any agreement, covenant, representation or warranty contained in this Agreement.

(c) Boyd and its Affiliates and Morgans (on behalf of the Company) shall use all reasonable commercial efforts, and shall work expeditiously and in good faith, to finalize, execute and record against the Echelon Place Parcel (as soon as reasonably practicable after the execution of this Agreement, which the Members understand may take 12 to 18 months) an REA on terms and conditions consistent with the terms set forth inExhibit I hereof.

(d) Notwithstanding the foregoing or anything in this Agreement to the contrary and although it is the present intention of Boyd and its Affiliates to proceed in good faith with the planning, development and ultimate construction of Echelon Place, each of the Members acknowledge and agree: (i) the development of Echelon Place as currently proposed is in a preliminary stage, (ii) there are many factors both within and outside of the control of the Members that could preclude the successful development of Echelon Place, (iii) there is no assurance that the Boyd or any Affiliate of Boyd will ultimately develop, construct and/or

21

operate Echelon Place; (iv) there is no assurance that the Boyd or any Affiliate of Boyd will not materially modify Echelon Place as it is presently proposed and (v) in the event Boyd or its Affiliate elects, in its sole discretion, to modify Echelon Place in any manner or not to proceed with the construction of any portion of Echelon Place, nothing in this Agreement shall be deemed to bind Boyd or any Affiliate thereof to complete Echelon Place or any part thereof, nor shall such election by Boyd or its Affiliate give rise to any cause of action against Boyd, or any Affiliate thereof, by Morgans under this Agreement; provided, however, that (A) if the Company and an Affiliate of Boyd approve an REA and the development and construction of Echelon Place proceeds, then the obligations of Boyd and its Affiliates to the Company with respect to the design (including any modifications thereto), construction, completion and operation of Echelon Place shall be as set forth in, and governed by, the REA, and (B) in the event that any failure of Boyd or its Affiliates to proceed with the development of Echelon Place, or any modification by Boyd or its Affiliates of the master plan or site plan for Echelon Place, shall result in a failure of the Company to obtain or close the Construction Loan or to satisfy any conditions to the Construction Loan or the Contribution Date prior to the Outside Start Date, then the provisions of Section 4.03 shall apply.

Section 4.03Outside Start Date. Notwithstanding anything to the contrary contained herein, if for any reason the Contribution Date has not occurred on or prior to the Outside Start Date, then, as provided in Section 13.02(d), either Member may dissolve the Company and upon such dissolution this Agreement shall terminate, and neither Member shall have any claim against the other Member for any costs or expenses incurred or spent as of such dissolution date, including but not limited to the Predevelopment Costs funded by such Member and any other pursuit costs incurred by such Member nor shall either Member have any other liability or obligation to each other of any kind pursuant to this Agreement, excepting any obligations or liabilities that expressly survive the termination of this Agreement as provided in this Section 4.03; provided, however, if the failure to satisfy this condition is specifically due to the actions of a Member in material breach of this Agreement, then the non breaching Member shall have claim against the other Member for any out of pocket costs or expenses incurred by the non-breaching Member as of the dissolution date. In the event of any dissolution of the Company and termination of this Agreement pursuant to this Section 4.03, neither Member shall have the right to use the plans, specifications, reports, test results or other work product prepared in connection with the Project without the consent of the other Member. The provisions of this Section 4.03 shall survive the dissolution of the Company or the termination or expiration of this Agreement.

ARTICLE 5

CAPITAL CONTRIBUTIONS

Section 5.01Initial Capital Contributions.

(a) During the Predevelopment Period, Boyd and Morgans shall be required to make Capital Contributions, on a Pro Rata basis, from time to time for funding Predevelopment Costs in accordance with the Predevelopment Budget.

(b) On the Contribution Date and provided as of such date (i) the representations and warranties of Boyd herein shall be true and correct in all material respects as

22

if made on the Contribution Date and Boyd is not in breach of any material provision of this Agreement, (ii) the Members have approved the Plans and Specifications, the Development Budget, the Construction Schedule and the Pre-Opening Plan, and (iii) the REA has been executed, delivered and recorded in the local land records, Morgans shall fund to the Company by wire transfer of immediately available funds an amount equal to the excess of (A) the Morgans Capital Commitment over (B) the Predevelopment Costs previously funded by Morgans.

(c) Contemporaneously with Morgans funding the Capital Contribution required of Morgans pursuant to Section 5.01(b) and provided, as of such date, (i) the representations and warranties of Morgans herein shall be true and correct in all material respects as if made on the Contribution Date and Morgans is not in breach of any material provision of this Agreement, (ii) the Members have approved the Plans and Specifications, the Development Budget, the Construction Schedule and the Pre-Opening Plan, and (iii) the REA has been executed, delivered and recorded in the local land records, Boyd shall convey the Land to the Company pursuant to normal and customary deeds and other conveyance instruments consistent with local practices and subject only to the Permitted Encumbrances, and with all improvements thereon having been demolished and removed at Boyd’s cost. Boyd shall be deemed to have made a Capital Contribution to the Company in an amount equal to the fair market value of Land. The Members acknowledge and agree that the fair market value of the Land shall be equal to $15 Million for each acre (or proportionate share thereof for any fractional acre) comprising Land that is conveyed to the Company. For example, and for illustration purposes only, if the Land consists of 6.5 acres then the Capital Contribution of Boyd would equal Ninety Seven Million Five Hundred Thousand Dollars ($97,500,000) and, in such event, the Morgans Capital Commitment would equal Ninety Seven Million Five Hundred Thousand Dollars ($97,500,000). The Company, out of the Capital Contribution funded by Morgans pursuant to Section 5.01(b) and simultaneously with the conveyance of the Land to the Company, shall reimburse Boyd the amount of Predevelopment Costs funded by Boyd through such date.

(d) As of the Contribution Date, the Percentage Interests of the Members shall be as follows:

Name | Percentage Interest | ||

Morgans | 50 | % | |

Boyd | 50 | % |

Section 5.02Additional Capital Contributions. From and after the Contribution Date, Morgans and Boyd shall be required to make additional Capital Contributions, on a Pro Rata basis, from time to time during the Construction Period for the following purposes: (a) Capital Contributions for Permitted Cost Overruns; and (b) Capital Contributions for Approved Cost Overruns. Subsequent to the Construction Period, Morgans and Boyd shall be required to make Capital Contributions, on a Pro Rata basis, for Necessary Expenditures. All such Capital Contributions shall be made in accordance with the procedures set forth in this Article 5.

23

Section 5.03Procedures for Capital Contributions.

Morgans shall issue Capital Calls to the Members in writing (a “Capital Call Notice”) to fund any Capital Contributions required pursuant to Section 5.01(a) or Section 5.02. Each such Capital Call Notice shall set forth the amount of the required Capital Contribution, and shall specify a date (the “Capital Call Due Date”) for contribution of such funds. Morgans shall make Capital Calls for Predevelopment Costs consistent with the Predevelopment Budget. Upon receipt of a Capital Call Notice, each Member shall be required to fund its Pro Rata share of the total funds specified in the Capital Call Notice. The Capital Call Due Date shall be at least (x) two (2) Business Days after receipt of the Capital Call Notice, for Emergency Costs and (y) ten (10) Business Days after receipt of the Capital Call Notice, for all other funds, unless a shorter time is reasonably designated by Morgans. All Capital Contributions shall be made by wire transfer of immediately available funds to an account of the Company specified by Morgans in the Capital Call Notice. If, for any reason, Morgans fails to issue a Capital Call as required in this Section 5.03, then Boyd shall also have the right to issue a Capital Call if Morgans fails to make a Capital Call for such items within ten (10) Business Days after notice from Boyd of such failure.

Section 5.04Failure to Fund Capital Contributions.