UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

BANK BUILDING CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | $125 per Exchange Act Rules 0-11(c)(1)(ii), 14a-6(i)(1), 14a-6(i)(2) or Item 22(a)(2) of Rule 14A |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| x | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

$316.00

| | (2) | Form, Schedule or Registration Statement No.: |

Preliminary Schedule 14A

Bank Building Corporation

January 17, 2008

[BANK BUILDING CORPORATION LETTERHEAD]

[ ], 2008

Dear Stockholders:

The board of directors of Bank Building Corporation is excited to inform you that on January 8, 2008 Bank Building and Carter Bank & Trust entered into a definitive agreement for Carter Bank to acquire Bank Building pursuant to a merger whereby Bank Building will be merged with and into Carter Bank. Carter Bank will be the surviving corporation following the merger. The merger agreement and related plan of merger were unanimously approved by the members of a special committee of the board of directors of Carter Bank present at the meeting and the board of directors of Bank Building.

Pursuant to the merger agreement and related plan of merger, holders of Bank Building common stock will receive 2.255 shares of Carter Bank common stock for each share of Bank Building common stock they hold as of the record date.1

A special meeting of our stockholders will be held on [March 25], 2008, at 1:00 p.m., local time, to vote on a proposal to approve and adopt the merger agreement and the related plan of merger so that the merger can occur. The special meeting of stockholders will be held at the Bank Services of Virginia Operations Center, 320 College Drive, Martinsville, Virginia 24112. Notice of the special meeting is enclosed. This proxy statement gives you detailed information about the special meeting and the merger and includes the merger agreement and the related plan of merger asAnnex A. We encourage you to read the proxy statement, the merger agreement and the related plan of merger carefully.

Your vote is important. We cannot complete the merger unless the holders of two-thirds of the outstanding shares of our common stock on the record date approve and adopt the merger agreement and the related plan of merger.Our board of directors recommends that you vote “FOR” approval and adoption of the merger proposal. The failure of any stockholder to vote on the merger proposal will have the same effect as a vote “AGAINST” the merger. Each of our directors and executive officers has indicated that he or she intends to vote his or her own shares in favor of the merger proposal.

Whether or not you plan to attend the special meeting, please vote your shares promptly by completing, signing and dating the accompanying proxy card and returning it in the enclosed prepaid envelope.

Very truly yours,

Worth Harris Carter, Jr.

Chairman of the Board and President

Neither the Securities and Exchange Commission, the Federal Deposit Insurance Corporation, nor any state securities regulator has approved or disapproved of the Carter Bank common stock to be issued in the merger or determined if this proxy statement/offering circular is accurate or adequate. Any representation to the contrary is a criminal offense. The shares of Carter Bank common stock to be issued in the merger are not savings or deposit accounts or other obligations of any bank or savings association and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency.

This proxy statement/offering circular is dated [ ], 2008 and is first being mailed to stockholders on or about [ ], 2008.

1 | Explanatory Note: The minimum exchange ratio is 2.255 and is subject to upward adjustment pursuant to an appraisal of the real estate assets of Bank Building. The final exchange ratio will be included in this proxy statement prior to mailing to the Bank Building stockholders. |

[BANK BUILDING CORPORATION, LOGO]

BANK BUILDING CORPORATION

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON [MARCH 25, 2008]

YOU ARE HEREBY NOTIFIED of and invited to attend a special meeting of stockholders of Bank Building Corporation, a Virginia corporation, to be held at the Bank Services of Virginia Operations Center, 320 College Drive, Martinsville, Virginia 24112, on [March 25], 2008, at 1:00 p.m., local time, for the purpose of considering and voting upon the following:

| | 1. | A proposal to approve and adopt the agreement and plan of merger, dated January 8, 2008, between Carter Bank & Trust and Bank Building Corporation, the plan of merger attached to the agreement and plan of merger, and the transactions contemplated thereby. The agreement and plan of merger and the related plan of merger provide that Bank Building Corporation will merge with and into Carter Bank & Trust, a Virginia state-chartered bank, upon the terms and subject to the conditions set forth in the agreement and plan of merger, as more fully described in the accompanying proxy statement/offering circular. (See Proposal I.) |

| | 2. | A proposal to adjourn the meeting to a later date or dates, if necessary, to permit further solicitation of proxies in the event there are not sufficient votes at the time of the meeting to approve the matters to be considered by the stockholders at the meeting, as more fully described in the accompanying proxy statement/offering circular. (See Proposal II.) |

Our board of directors has determined that the terms of the merger are fair to and in the best interests of Bank Building Corporation and our stockholders, has approved and adopted the agreement and plan of merger and the related plan of merger, and unanimously recommends that our stockholders vote “FOR” the approval and adoption of the agreement and plan of merger and the related plan of merger.

Our board of directors has fixed the close of business on [ ], 2008 as the record date for determination of our stockholders entitled to receive notice of and to vote at the special meeting. The special meeting may be adjourned or postponed from time to time upon approval of our stockholders without any notice other than by announcement at the special meeting of any adjournment or postponement thereof, and any and all business for which notice is hereby given may be transacted at such adjourned or postponed special meeting.

The affirmative vote of the holders of two-thirds of the outstanding shares of our common stock on the record date is required to approve and adopt the agreement and plan of merger and the related plan of merger. Please complete, date, sign and promptly return the enclosed proxy, which is solicited by your board of directors, in the enclosed envelope, whether or not you expect to attend the special meeting. You may revoke the proxy at any time before its exercise by delivering to us a written notice of revocation, delivering to us a duly executed proxy bearing a later date or by voting in person at the special meeting. Failure to return a properly executed proxy, or to vote at the special meeting, will have the same effect as a vote against the agreement and plan of merger, the plan of merger and the transactions contemplated thereby.

By Order of the Board of Directors

Worth Harris Carter, Jr.

Chairman of the Board and President

[ ], 2008

TABLE OF CONTENTS

| | | | |

| | | Page |

SUMMARY | | 1 |

| |

QUESTIONS AND ANSWERS ABOUT THE MERGER AND THE STOCKHOLDER MEETING | | 5 |

| |

COMPARATIVE UNAUDITED PER SHARE DATA | | 7 |

| |

SELECTED FINANCIAL DATA | | 8 |

| |

FORWARD-LOOKING STATEMENTS | | 9 |

| |

RISK FACTORS | | 10 |

| |

BANK BUILDING SPECIAL MEETING | | 14 |

General | | 14 |

Matters to be Considered | | 14 |

Proxies | | 14 |

Solicitation of Proxies | | 14 |

Record Date and Voting Rights | | 15 |

Vote Required | | 15 |

Recommendation of the Board of Directors | | 15 |

| |

PROPOSAL I - APPROVAL OF THE MERGER | | 16 |

Merger | | 16 |

Background of the Merger | | 16 |

Board Recommendations and Reasons for the Merger | | 18 |

Opinion of Bank Building’s Financial Advisor | | 20 |

Real Estate Appraisal | | 25 |

Merger Consideration | | 25 |

Manner and Basis of Converting Shares; Procedure; No Fractional Shares; Effect on Certificates | | 26 |

Resales of Carter Bank Common Stock | | 26 |

Interests of Certain Persons in the Merger | | 26 |

Management and Operations after the Merger | | 27 |

Regulatory Approvals | | 27 |

Virginia Affiliated Transactions Statute | | 28 |

Control Share Acquisitions Statute | | 28 |

Accounting Treatment | | 29 |

Appraisal Rights | | 29 |

| |

PROPOSAL II - ADJOURNMENT OF THE MEETINGS | | 30 |

| |

THE MERGER AGREEMENT | | 31 |

The Merger | | 31 |

Merger Consideration | | 31 |

Fractional Shares | | 32 |

Appraisal Rights | | 32 |

Articles of Incorporation and Bylaws | | 32 |

Directors and Officers | | 32 |

Conversion of the Shares | | 32 |

Representations and Warranties | | 33 |

Conduct of Business Pending the Merger | | 34 |

Efforts to Complete the Merger | | 34 |

Conditions to the Merger | | 35 |

No Solicitation of Other Offers | | 36 |

Termination of the Merger Agreement | | 37 |

Termination Fees | | 38 |

Amendment, Extension and Waiver | | 38 |

Material Adverse Effect | | 39 |

| |

CERTAIN FEDERAL INCOME TAX CONSEQUENCES OF THE MERGER | | 40 |

Tax Consequences of the Merger to Bank Building Stockholders | | 41 |

| |

INFORMATION ABOUT BANK BUILDING AND CARTER BANK | | 42 |

Bank Building | | 42 |

Carter Bank | | 45 |

| |

PRO FORMA UNAUDITED COMBINED CONSOLIDATED FINANCIAL INFORMATION | | 48 |

| |

DESCRIPTION OF CARTER BANK COMMON STOCK | | 50 |

| |

COMPARATIVE RIGHTS OF STOCKHOLDERS | | 51 |

| |

LEGAL MATTERS | | 55 |

| |

EXPERTS | | 55 |

| |

STOCKHOLDER PROPOSALS | | 55 |

| |

OTHER MATTERS | | 55 |

| |

WHERE YOU CAN FIND MORE INFORMATION | | 55 |

| |

FINANCIAL STATEMENTS OF BANK BUILDING CORPORATION | | |

Bank Building Corporation annual report on Form 10-KSB for the year ended December 31, 2006 | | |

Bank Building Corporation quarterly report on Form 10-QSB for the quarter ended September 30, 2007 | | |

| |

FINANCIAL STATEMENTS OF CARTER BANK & TRUST | | |

Carter Bank & Trust annual report on Form 10-K for the year ended December 31, 2006 | | |

Carter Bank & Trust quarterly report on Form 10-Q for the quarter ended September 30, 2007 | | |

Selected Financial Data for Carter Bank & Trust excerpted from the joint proxy statement/offering circular for Blue Ridge Bank, N.A., Central National Bank, Community National Bank, First National Bank, First National Exchange Bank, Mountain National Bank, Patrick Henry National Bank, Patriot Bank, N.A., Peoples National Bank and Shenandoah National Bank on Schedule 14A dated September 27, 2006 | | |

Pro Forma Unaudited Combined Consolidated Financial Information for Carter Bank & Trust excerpted from the joint proxy statement/offering circular for Blue Ridge Bank, N.A., Central National Bank, Community National Bank, First National Bank, First National Exchange Bank, Mountain National Bank, Patrick Henry National Bank, Patriot Bank, N.A., Peoples National Bank and Shenandoah National Bank on Schedule 14A dated September 27, 2006 | | |

| |

FINANCIAL STATEMENTS OF MERGED BANKS | | |

Blue Ridge Bank, N.A. annual report for the year ended December 31, 2005 | | |

Blue Ridge Bank, N.A. quarterly report for the quarter ended September 30, 2006 | | |

Central National Bank annual report on Form 10-KSB/A for the year ended December 31, 2005 | | |

Central National Bank quarterly report on Form 10-QSB for the quarter ended September 30, 2006 | | |

Community National Bank annual report for the year ended December 31, 2005 | | |

Community National Bank quarterly report for the quarter ended September 30, 2006 | | |

First National Bank annual report on Form 10-KSB for the year ended December 31, 2005 | | |

First National Bank quarterly report on Form 10-QSB for the quarter ended September 30, 2006 | | |

First National Exchange Bank annual report on Form 10-KSB for the year ended December 31, 2005 | | |

First National Exchange Bank quarterly report on Form 10-QSB for the quarter ended September 30, 2006 | | |

Mountain National Bank annual report on Form 10-KSB/A for the year ended December 31, 2005 | | |

Mountain National Bank quarterly report on Form 10-QSB for the quarter ended September 30, 2006 | | |

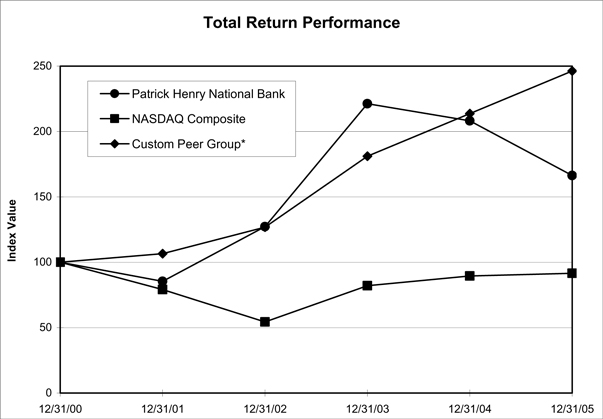

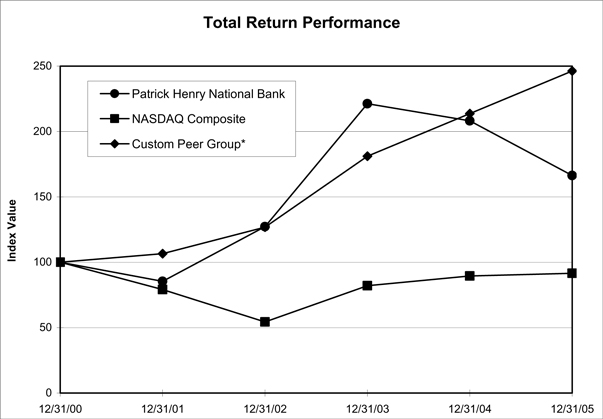

Patrick Henry National Bank annual report on Form 10-K for the year ended December 31, 2005 | | |

Patrick Henry National Bank quarterly report on Form 10-Q for the quarter ended September 30, 2006 | | |

Patriot Bank, N.A. annual report on Form 10-KSB for the year ended December 31, 2005 | | |

Patriot Bank, N.A. quarterly report on Form 10-QSB for the quarter ended September 30, 2006 | | |

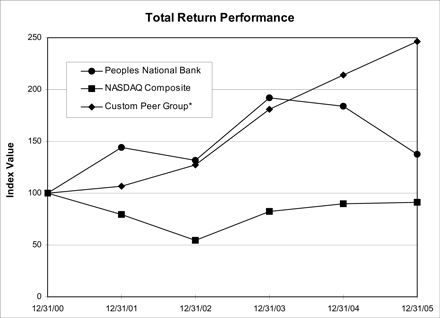

Peoples National Bank annual report on Form 10-K/A for the year ended December 31, 2005 | | |

Peoples National Bank quarterly report on Form 10-Q for the quarter ended September 30, 2006 | | |

Shenandoah National Bank annual report on Form 10-KSB/A for the year ended December 31, 2005 | | |

Shenandoah National Bank quarterly report on Form 10-QSB for the quarter ended September 30, 2006 | | |

i

| | |

| Annex A — | | Agreement and Plan of Merger dated as of January 8, 2008 between Carter Bank & Trust and Bank Building Corporation |

| Annex B — | | Opinion of Davenport & Company LLC to the board of directors of Bank Building Corporation |

| Annex C — | | Real Estate Appraisals of Bank Building Corporation Properties |

| Annex D — | | Section 13.1-730 of the Virginia Stock Corporation Act |

ii

SUMMARY

This brief summary highlights selected information from this proxy statement/offering circular. It does not contain all of the information that is important to you. We urge you to read carefully the entire proxy statement/offering circular and the other documents to which this proxy statement/offering circular refers to fully understand the merger and the other matters to be considered at the stockholder meeting. See “Where You Can Find More Information” beginning on page [ ]. Each item in this summary includes a page reference directing you to a more complete description of that item.

Throughout this proxy statement/offering circular, Bank Building Corporation is referred to as “Bank Building,” Carter Bank & Trust is referred to as “Carter Bank,” the merger between Bank Building and Carter Bank is referred to as the “merger,” the Agreement and Plan of Merger, dated January 8, 2008, between Bank Building and Carter Bank, including the related Plan of Merger, is referred to collectively as the “merger agreement,” and this proxy statement/offering circular, including the financial statements included herein, is referred to as this “proxy statement.”

The Merger (page [ ])

We have included the merger agreement in this proxy statement asAnnex A. Please read the merger agreement. It is the legal document that governs the merger.

In the merger, Bank Building, a Virginia corporation, will be merged with and into Carter Bank, a Virginia state-chartered bank, which will be the surviving entity. The officers and employees of Carter Bank will not change after the merger. Each share of Bank Building common stock outstanding will be cancelled in the merger and will be converted into shares of Carter Bank common stock as further described below. We expect to complete the merger in the first quarter of 2008.

The Parties (pages [ ])

The parties involved in the merger are Bank Building and Carter Bank.

Bank Building

Bank Building is a corporation organized under the laws of the Commonwealth of Virginia. Bank Building’s principal business activity is to acquire and develop property for lease as bank offices to Carter Bank.

As of September 30, 2007, Bank Building reported total assets of $31.7 million, total liabilities of $30.1 million and total stockholders’ equity of $1.6 million.

Carter Bank

Carter Bank is a banking institution incorporated under Virginia law. Carter Bank’s services include commercial, real estate and installment loans and checking, savings and time deposit accounts.

As of September 30, 2007, Carter Bank reported total assets of $2.6 billion, net loans of $1.4 billion, deposits of $2.2 billion and total stockholders’ equity of $292 million.

Our Reasons for the Merger (page [ ])

The board of directors of Bank Building is proposing the merger because, among other reasons:

| | • | | the board’s belief that the proposed merger is in the best interests of Bank Building and its stockholders; |

| | • | | the opinion of Davenport & Company LLC rendered to the board of directors of Bank Building as to the fairness, from a financial point of view, of the merger consideration to holders of Bank Building common stock; See “Opinion of Bank Building’s Financial Advisor;” |

| | • | | the board’s belief that merging with Carter Bank is the best way to maximize stockholder value for the stockholders of Bank Building; |

| | • | | the merger consideration is based on independent appraisals of the fair market value of the real estate assets of Bank Building; |

| | • | | there is no established trading market for the Bank Building common stock; and |

1

| | • | | the merged entity will have thousands of stockholders with a market capitalization of approximately $240,000,000, and may seek to have its common stock listed for trading on a national exchange such as the New York Stock Exchange, American Stock Exchange or the NASDAQ Stock Market, which will provide more liquidity for stockholders. |

What Will Stockholders Receive (page [ ])

Your shares of Bank Building common stock will be converted into shares of Carter Bank common stock based on an exchange ratio. In the proposed merger, Bank Building stockholders will receive 2.255 shares of Carter Bank common stock for each share of Bank Building common stock they hold as of the record date.2

Carter Bank will not issue any fractional shares in the merger. Instead, you will receive cash for any fractional share of Carter Bank common stock owed to you. The amount of cash you will receive for any such fractional shares will be calculated by multiplying the fractional share amount by $9.25, which has been determined by the board of directors of Carter Bank to be the fair value of a share of Carter Bank common stock for fractional shares.

The exchange ratio for the merger is a “fixed” exchange ratio, meaning that the number of shares of Carter Bank common stock to be issued in the merger for each share of common stock of Bank Building will not change.

Appraisal Rights (page [ ])

Our stockholders will have appraisal rights in connection with the merger as provided under Section 13.1-730 of the Virginia Stock Corporation Act. Pursuant to the Virginia Stock Corporation Act, a stockholder may dissent to a merger and receive cash for the value of shares held by the stockholder. Any stockholder seeking appraisal rights must follow the process described under the Virginia Stock Corporation Act.

The cash received for shares by dissenting stockholders instead of stock in Carter Bank will be taxable to the stockholders. Stockholders who do not elect their appraisal rights and, therefore, receive stock in Carter Bank will not be subject to federal and/or state income tax in connection therewith, except for cash paid for fractional shares.

Our Recommendations (page [ ])

Our board of directors believes that the merger is fair to the stockholders of Bank Building and unanimously recommends that the stockholders vote “FOR” the merger and “FOR” the continuation of the special meeting if necessary.

Opinion of Financial Advisor (page [ ])

Davenport & Company LLC delivered a written opinion to our board of directors on January 8, 2008 that, as of the date the merger agreement was signed, the merger consideration to be received by the stockholders of Bank Building is fair to the stockholders from a financial point of view. We have enclosed a copy of this opinion in this proxy statement asAnnex B. You should read the opinion completely to understand the assumptions made, matters considered and limitations of the review undertaken by Davenport & Company LLC in providing its opinion.

Real Estate Appraisals (page [ ])

The merger agreement provides that the parties will conduct an appraisal of the real property assets of Bank Building within 45 days of the date of the merger agreement. Based on the results of the real estate appraisals, the parties determined the final exchange ratio for converting Bank Building common stock into Carter Bank common stock.

Accounting Treatment (page [ ])

The merger will be accounted for under the purchase method of accounting.

Certain Federal Income Tax Consequences (page [ ])

Tax laws are complex, and the tax consequences of the merger may vary depending upon your particular circumstances or treatment under United States federal income tax law. For these reasons, we recommend that you consult your tax advisor concerning the United States federal, state, local and foreign income and other tax consequences of the merger to you.

2 | Explanatory Note: The minimum exchange ratio is 2.255 and is subject to upward adjustment pursuant to an appraisal of the real estate assets of Bank Building. The final exchange ratio will be included in this proxy statement prior to mailing to the Bank Building stockholders. |

2

A Bank Building stockholder that exchanges shares of Bank Building common stock solely for shares of Carter Bank common stock in the merger generally will not recognize gain or loss, except with respect to any cash received instead of fractional share interests in Carter Bank common stock. A Bank Building stockholder that exercises his or her appraisal rights with respect to his or her shares and receives a cash payment with respect to those shares generally will recognize gain or loss equal to the difference between the amount of the cash received and such stockholder’s tax basis in those shares. Such gain or loss will generally constitute capital gain or loss. The completion of the merger is conditioned on the receipt of tax opinions from Troutman Sanders LLP, dated as of the effective date of the merger, to the effect that the merger will qualify as a “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended.

The Stockholders’ Meeting (page [ ] and pages [ ])

The special meeting for the stockholders of Bank Building will be held on [March 25], 2008 at 1:00 pm, local time.

At the special meeting, the stockholders of Bank Building will be asked:

| | • | | to approve the merger agreement and the transactions contemplated thereby (See Proposal I); or |

| | • | | to consider and vote upon a proposal to adjourn the meeting to a later date or dates, if necessary, to permit further solicitation of proxies in the event there are not sufficient votes at the time of the meeting to approve the matters to be considered by the stockholders at the meeting (See Proposal II). |

Record Dates; Votes Required (pages [ ])

You can vote at the special meeting of stockholders if you owned common stock of Bank Building at the close of business on [ , 2008]. On that date, Bank Building had 398,244 shares of common stock outstanding and entitled to vote.

You can cast one vote on each matter to be voted upon by the stockholders of Bank Building at the special meeting for each share of common stock you owned on the record date.

THE MERGER AGREEMENT (page [ ])

Conditions to Completion of the Merger (page [ ])

The obligations to complete the merger depend on a number of conditions being met. These include:

| | • | | Bank Building stockholders’ approval of the merger agreement; |

| | • | | the absence of any order, injunction, decree, law or regulation that would prohibit the merger or make it illegal; and |

| | • | | receipt of an opinion that, for United States federal income tax purposes, the transaction will constitute a reorganization within the meaning of Section 368 of the Internal Revenue Code. |

Where the law permits, either Bank Building or Carter Bank could choose to waive a condition to their obligations to complete the merger although that condition has not been satisfied. We cannot be certain when, or if, the conditions to the merger will be satisfied or waived, or that the merger will be completed.

Termination of the Merger Agreement; Expenses (page [ ])

Bank Building and Carter Bank can mutually agree at any time to terminate the merger agreement without completing the merger, even if the Bank Building stockholders have approved it. Also, either party can decide, without the consent of the other, to terminate the merger agreement in a number of other situations, including:

| | • | | the failure of Bank Building to obtain the required stockholder vote; |

| | • | | an unremedied breach of the merger agreement by another party, so long as the party that is seeking to terminate the merger agreement has not itself breached the merger agreement; and |

3

| | • | | the failure to complete the merger by June 30, 2008. |

Upon a termination, each party shall bear its own expenses.

Waiver and Amendment (page [ ])

The parties may amend the merger agreement, and either of the parties may waive the right to require another party to adhere to the terms and conditions of the merger agreement. However, neither party may do so after the stockholders of Bank Building approve the necessary transactions if the amendment or waiver reduces or changes the consideration that will be received by you or adversely affects the tax consequences of the consideration received by you.

Potential Conflicts of Interest (page [ ])

The boards of directors of Carter Bank and Bank Building may have certain conflicts of interest. All five members of our board of directors are also members of the Carter Bank board of directors. In addition, Worth Harris Carter, Jr. is the Chairman of the Board and President of both companies. All of the directors of Bank Building own shares of Carter Bank common stock.

Material Differences in the Rights of the Stockholders of Bank Building and the Stockholders of Carter Bank (pages [ ])

Rights of the stockholders of Bank Building are governed by the Securities and Exchange Act of 1934, by the Virginia Stock Corporation Act and by Bank Building’s articles of incorporation and bylaws. The rights of the stockholders of Carter Bank are governed by the Federal Deposit Insurance Corporation Act, by the Virginia Stock Corporation Act and by Carter Bank’s articles of incorporation and bylaws. Upon completion of the merger, the rights of the stockholders of Bank Building will be governed by the Federal Deposit Insurance Corporation Act, by the Virginia Stock Corporation Act and by Carter Bank’s articles of incorporation and bylaws.

Management of Carter Bank After the Merger

The officers and employees of Carter Bank after the merger will remain unchanged. Mr. Carter will continue to serve as Chairman of the Board and President of Carter Bank and all other executive officers of Carter Bank will remain unchanged.

4

QUESTIONS AND ANSWERS

ABOUT THE MERGER AND THE STOCKHOLDER MEETING

| A: | By either attending the special meeting of stockholders or by mailing your signed proxy card as soon as possible. |

| Q: | When and where is the stockholder meeting? |

| A: | The Bank Building special meeting of stockholders is scheduled to take place on [March 25], 2008, at 1:00 p.m., local time, at the Bank Services of Virginia Operations Center, 320 College Drive, Martinsville, Virginia. |

| A: | Mail your signed proxy in the enclosed return envelope as soon as possible so that your shares may be represented at the stockholder meeting for Bank Building. It is important that your proxy be returned as soon as possible and in any event before the stockholder meeting. |

| Q: | How will I receive my shares of Carter Bank common stock and cash for fractional shares if I vote “FOR” the proposed merger? |

| A: | After consummation of the merger on the anticipated effective date of [ , 2008] or as soon thereafter as possible, you will receive a letter of instruction explaining how stockholders should send in their stock certificates to Bank Services of Virginia, Inc., which will serve as Exchange Agent for the transaction. The letter of instruction will also include the appropriate forms to be completed by stockholders and an envelope for mailing your stock certificates. Following the Exchange Agent’s receipt of stock certificates, the Exchange Agent will mail to stockholders stock certificates representing their interests in Carter Bank and a check for the amount of any fractional share involved in each of the exchange transactions. |

| Q: | Can I change my vote after I mail my proxy? |

| A: | Yes. You can change your vote at any time before your proxy is voted at the stockholder meeting. You can do this in one of three ways: |

| | • | | First, you can send a written notice stating that you would like to revoke your proxy. |

| | • | | Second, you can complete and submit a new proxy. |

| | • | | Third, you can attend the stockholder meeting and vote in person. Simply attending the stockholder meeting, however, will not revoke your proxy. |

If you choose either of the first or second methods, you must submit your notice of revocation or your new proxy to Bank Building prior to the applicable stockholder meeting. Your submissions must be mailed to Bank Building at the following applicable address:

Bank Building Corporation

1300 Kings Mountain Rd.

Martinsville, Virginia 24112

Attention: Mr. Worth Harris Carter, Jr.

5

| Q: | What if I do not vote or I abstain from voting? |

| A: | If you do not vote or you abstain from voting, your abstention will count as a “NO” vote on the merger and the other items being considered. |

| Q: | If my shares are held by my broker in “street name,” will my broker vote my shares for me on the merger proposal? |

| A: | Your broker will vote your shares on the merger proposal only if you provide instructions on how to vote. You should follow the directions provided by your broker to vote your shares. If you do not provide your broker with instructions on how to vote your shares held in “street name,” your broker will not be permitted to vote your shares on the merger proposal, which will have the effect of a “NO” vote on the merger proposal. |

| Q: | Will I be able to sell the Carter Bank common stock I receive in the merger? |

| A: | Yes. The shares of Carter Bank common stock to be issued in the merger will be freely transferable. Carter Bank is a “bank” as defined in the Securities Act of 1933 and, as such, is exempt from registering its shares of common stock for sale or exchange under Section 3(a)(2) of the Securities Act of 1933, as amended. |

| Q: | Who should stockholders call with questions? |

| A: | If you have more questions about the merger you should contact: |

Mr. Worth Harris Carter, Jr.

Bank Building Corporation

1300 Kings Mountain Road

Martinsville, Virginia 24112

276-656-1776

| Q: | Where can I find more information about Bank Building and Carter Bank? |

| A: | Bank Building and Carter Bank file periodic reports and other information with the Securities and Exchange Commission and the Federal Deposit Insurance Corporation respectively. Any such information about Bank Building is available without charge via the Security and Exchange Commission’s website http://www.sec.gov. Any such information about Carter Bank is available without charge upon oral or written request to: |

Mr. Worth Harris Carter, Jr.

Carter Bank & Trust

1300 Kings Mountain Road

Martinsville, Virginia 24112

(276) 656-1776

If you would like to request any documents, please do so by [ , 2008] in order to receive them before the special stockholder meeting. Please refer to “Where You Can Find More Information” on page [ ] of this proxy statement.

6

COMPARATIVE UNAUDITED PER SHARE DATA

The following table shows per share data for the periods presented regarding net income, book value and cash dividends declared for Carter Bank and Bank Building on a historical and pro forma basis. The pro forma equivalent per share amounts are calculated by multiplying the pro forma combined data by the exchange ratio of 2.2553 shares of Carter Bank common stock for each share of Bank Building common stock so that the per share amounts equate to the respective values for one share of Bank Building common stock. See “Merger Consideration” beginning on page [ ].

The information set forth below, while helpful in illustrating the financial characteristics of the combined company under one set of assumptions, may not reflect all of these anticipated financial expenses and, accordingly, does not attempt to predict or suggest future results. It also does not necessarily reflect what the historical results of the combined company would have been had our companies been combined during the periods presented.

The information in the following table is based on, and you should read it together with, the historical financial information and the notes thereto for each of Carter Bank and Bank Building contained in this proxy statement. See “Financial Statements of Bank Building Corporation” and “Financial Statements of Carter Bank & Trust.”

| | | | | | |

| | | Nine Months Ended

September 30, 2007 | | Year Ended

December 31, 2006 |

Carter Bank | | | | | | |

| | |

Basic and diluted earnings per common share: | | | | | | |

Historical | | $ | 0.42 | | $ | 0.76 |

Pro Forma | | | 0.41 | | | 0.59 |

| | |

Cash earnings per common share(1): | | | | | | |

Historical | | | 0.41 | | | 0.76 |

Pro Forma | | | 0.40 | | | 0.59 |

| | |

Dividends declared on common stock: | | | | | | |

Historical | | | 0.30 | | | 0.80 |

Pro Forma | | | 0.30 | | | 0.80 |

| | |

Book value per common share: | | | | | | |

Historical | | | 11.69 | | | 11.57 |

Pro Forma | | | 11.59 | | | 11.61 |

| | |

Bank Building | | | | | | |

| | |

Basic and diluted earnings per common share: | | | | | | |

Historical | | $ | 0.50 | | $ | 0.57 |

Pro Forma Equivalent | | | 0.92 | | | 1.33 |

| | |

Cash earnings per common share(1): | | | | | | |

Historical | | | 0.50 | | | 0.57 |

Pro Forma Equivalent | | | 0.90 | | | 1.33 |

| | |

Dividends declared on common stock: | | | | | | |

Historical | | | — | | | — |

Pro Forma Equivalent | | | 0.68 | | | 1.80 |

| | |

Book value per common share: | | | | | | |

Historical | | | 3.98 | | | 3.48 |

Pro Forma Equivalent | | | 25.79 | | | 26.18 |

| (1) | “Cash earnings per common share” is defined as basic and diluted earnings per share plus core deposit intangible amortization, net of income taxes. |

3 | Explanatory Note: The minimum exchange ratio is 2.255 and is subject to upward adjustment pursuant to an appraisal of the real estate assets of Bank Building. The final exchange ratio will be included in this proxy statement prior to mailing to the Bank Building stockholders. |

7

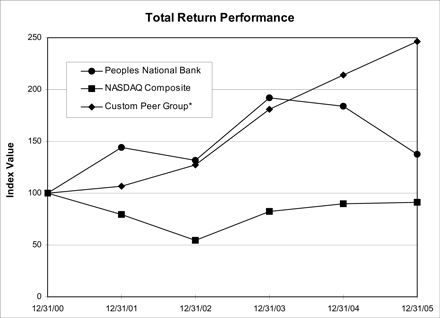

SELECTED FINANCIAL DATA

The following table sets forth certain of Carter Bank’s consolidated financial data as of and for the nine months ended September 30, 2007 and the years ended December 31, 2006, 2005, 2004, 2003 and 2002. The financial information for the years ended December 31, 2006, 2005 and 2004 is derived from Carter Bank’s audited consolidated financial statements, included in this proxy statement. See “Financial Statements of Carter Bank & Trust.” The consolidated financial information for the years ended December 31, 2003 and 2002 is derived from Peoples National Bank, the predecessor to Carter Bank, and is included in this proxy statement. See “Financial Statements of Merged Banks–Peoples National Bank.” The consolidated financial information as of and for the nine months ended September 30, 2007 is derived from Carter Bank’s unaudited consolidated financial statements included inthis proxy statement. See “Financial Statements of Carter Bank of Trust.” In Carter Bank’s opinion, such unaudited consolidated financial statements include all adjustments (consisting of normal recurring adjustments) necessary for a fair presentation of its financial position and results of operations for such periods. Interim results for the nine months ended September 30, 2007 are not necessarily indicative of, and are not projections for, the results to be expected for the full year ended December 31, 2007.

Carter Bank did not commence business until December 29, 2006, when ten banking institutions (the “Merged Banks”), each of which had been in business for a number of years, were merged into Carter Bank concurrently (the “Bank Merger”). Selected financial data with respect to each of the Merged Banks for the years 2005, 2004, 2003 and 2002 is included inthis proxy statement. See “Financial Statements of Carter Bank & Trust–Selected Financial Data.” Certain additional information with respect to Carter Bank, presented on a pro forma basis for the year ended December 31, 2006, and the six months ended June 30, 2007, is included in this proxy statement. See “Financial Statements of Carter Bank & Trust–Pro Forma Unaudited Combined Consolidated Financial Information.”

The selected historical financial data belowshould be read in conjunction with the consolidated financial statements and their accompanying notes that are included as part of this proxy statement.

| | | | | | | | | | | | | | | | | | | | | |

| | | As of and for the Nine

Months Ended

September 30, | | As of and for the Years Ended December 31, |

| | | 2007 | | 2006 | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 |

| | | (In thousands except per share data) |

Income Statement Data | | | | | | | | | | | | | | | | | | | | | |

Total Interest income | | $ | 110,883 | | $ | 14,654 | | $ | 20,477 | | $ | 17,364 | | $ | 17,741 | | $ | 18,982 | | $ | 20,766 |

Total Interest expense | | | 56,695 | | | 6,765 | | | 9,728 | | | 7,385 | | | 6,963 | | | 7,935 | | | 10,223 |

Net interest income | | | 54,188 | | | 7,889 | | | 10,749 | | | 9,979 | | | 10,778 | | | 11,047 | | | 10,543 |

Provision for loan losses | | | 648 | | | 90 | | | 120 | | | 120 | | | 120 | | | 821 | | | 120 |

Net interest income after provision for loan losses | | | 53,540 | | | 7,799 | | | 10,629 | | | 9,859 | | | 10,658 | | | 10,226 | | | 10,423 |

Noninterest income | | | 6,935 | | | 704 | | | 1,017 | | | 1,119 | | | 1,294 | | | 1,118 | | | 1,110 |

Noninterest expense | | | 47,419 | | | 6,323 | | | 8,973 | | | 8,299 | | | 7,841 | | | 7,001 | | | 6,573 |

Income before income taxes | | | 13,056 | | | 2,180 | | | 2,673 | | | 2,679 | | | 4,111 | | | 4,343 | | | 4,960 |

Income tax expense | | | 2,627 | | | 645 | | | 782 | | | 660 | | | 1,275 | | | 1,374 | | | 1,600 |

Net income | | $ | 10,429 | | $ | 1,535 | | $ | 1,891 | | $ | 2,019 | | $ | 2,836 | | $ | 2,969 | | $ | 3,360 |

Per Share Data | | | | | | | | | | | | | | | | | | | | | |

Net income – basic and diluted | | $ | 0.42 | | $ | 0.65 | | $ | 0.76 | | $ | 0.85 | | $ | 1.19 | | $ | 1.25 | | $ | 1.41 |

Cash dividends declared per share | | | 0.30 | | | 0.60 | | | 0.80 | | | 0.80 | | | 0.80 | | | 0.75 | | | 0.80 |

Book value per share | | | 11.69 | | | 15.96 | | | 11.57 | | | 15.92 | | | 15.87 | | | 15.48 | | | 14.98 |

Balance Sheet Data | | | | | | | | | | | | | | | | | | | | | |

Total Assets | | $ | 2,568,800 | | $ | 363,270 | | $ | 2,690,178 | | $ | 357,244 | | $ | 356,992 | | $ | 371,213 | | $ | 359,641 |

Loans, net | | | 1,398,919 | | | 211,476 | | | 1,395,316 | | | 204,563 | | | 206,689 | | | 195,653 | | | 213,674 |

Investment securities | | | 552,880 | | | 88,851 | | | 452,181 | | | 95,665 | | | 75,613 | | | 118,250 | | | 105,952 |

Deposits | | | 2,244,619 | | | 322,463 | | | 2,371,550 | | | 318,818 | | | 318,710 | | | 333,337 | | | 321,543 |

Shareholders’ equity | | | 292,176 | | | 37,929 | | | 289,292 | | | 37,820 | | | 37,701 | | | 36,766 | | | 35,577 |

Shares outstanding | | | 24,997 | | | 2,376 | | | 24,997 | | | 2,376 | | | 2,376 | | | 2,376 | | | 2,160 |

8

FORWARD-LOOKING STATEMENTS

Certain statements, data and information contained in this proxy statement may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933. These forward-looking statements are based on current expectations that involve a number of risks and uncertainties regarding, among other things, the timing and completion of the merger of Bank Building with and into Carter Bank and the expected effect of the merger. Actual results may differ materially from the results expressed in these forward-looking statements. A number of important factors could cause actual events to differ materially from those indicated by such forward looking statements. These factors include, but are not limited to: the ability to complete the merger on the terms contemplated, the ability of the companies to obtain the required stockholder or regulatory approvals for the merger, the anticipated impact of the merger on Bank Building’s operations and financial results, a material adverse change in the financial condition, operations or prospects of either Bank Building or Carter Bank, a change in general business or economic conditions, a change in real estate values, a change in accounting principles or guidelines, a change in legislation or regulation, other risk factors described in this proxy statement and other “forward looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including those in Bank Building’s Annual Report on Form 10-KSB filed with the Securities and Exchange Commission on March 30, 2007 and other filings with the Securities and Exchange Commission, which investors are urged to carefully review and consider. These risks and uncertainties should be considered in evaluating the forward-looking statements contained herein, and readers are cautioned not to place undue reliance on such statements, which speak only as of the date of this proxy statement. Bank Building does not undertake any obligation to update or clarify these forward-looking statements, whether as a result of new information, future events or otherwise.

9

RISK FACTORS

You should carefully read and consider the following risk factors associated with the merger and with Carter Bank before you decide whether to vote to approve the merger and/or the other matters to be considered and voted upon at the stockholder meetings.

Risks Associated with the Merger

The merger may distract management from its other responsibilities.

Completion of the merger could present challenges for management and cause management to focus its time and energies on matters related to the merger that otherwise would be directed to the business and operations of Carter Bank. Any significant, merger-related distraction of management could impact management’s ability to service existing business and develop new business and adversely affect the business and earnings of Carter Bank.

The parties may be subject to certain conflicts of interest.

The terms of the merger agreement were negotiated between the boards of directors of Carter Bank and Bank Building. Worth Harris Carter, Jr. is Chairman of the Board and President of Carter Bank and Bank Building. In addition to Mr. Carter, all members of the board of directors of Bank Building also serve as members of the board of directors of Carter Bank. All members of the board of directors of Bank Building own shares of common stock in both Bank Building and Carter Bank.

Additionally, Mr. Carter and each other person serving as a director of both companies owe separate fiduciary duties to each entity that they represent and those entities’ respective stockholders. Under certain circumstances, these individuals could have potential conflicts of interest by reason of the separate fiduciary duties they owe to each entity.

The merger consideration is fixed, despite potential changes in relative prices of the common stock of Carter Bank.

The exchange ratio for the merger is a “fixed” exchange ratio. This means that the number of shares of Carter Bank common stock to be issued in the merger for each share of common stock of Bank Building will not change, even if the price of Carter Bank stock changes after the exchange ratio has been fixed. As such, stockholders of Bank Building will not know the value of the consideration they are receiving in the merger until the date the merger is consummated. The price for common stock of Carter Bank before the merger may vary from the price at the date of this document and the date of Bank Building’s special meeting. Variations in common stock prices of Carter Bank could result from changes in the business operations or prospects, market assessments of the likelihood that the merger will be consummated and the timing thereof, regulatory considerations, general market and economic conditions and other factors. Such changes in price could reduce the monetary value of the consideration received in the merger by Bank Building stockholders.

The merger agreement limits Bank Building’s ability to pursue alternatives to the merger.

The merger agreement contains terms and conditions that make it more difficult for Bank Building to sell their businesses to a party other than Carter Bank. These “no shop” provisions impose restrictions on Bank Building that, subject to certain exceptions, limit Bank Building’s ability to discuss or facilitate competing third-party proposals to acquire all or a significant part of Bank Building, except where the failure to do so, on the advice of counsel, would be inconsistent with the fiduciary duties of the board of directors of Bank Building to its stockholders.

These provisions might discourage a third party that might have an interest in acquiring Bank Building from considering or proposing that acquisition.

10

Risks Associated with Carter Bank

Carter Bank’s business is subject to interest rate risk and fluctuations in interest rates may adversely affect its earnings and capital levels.

The majority of Carter Bank’s assets are monetary in nature and, as a result, Carter Bank is subject to significant risk from changes in interest rates. Changes in interest rates can impact Carter Bank’s net interest income as well as the valuation of its assets and liabilities. Also, Carter Bank’s earnings are significantly dependent on its net interest income, which is the difference between interest income on interest-earning assets, such as loans and securities, and interest expense on interest-bearing liabilities, such as deposits and borrowings. Carter Bank expects that it will periodically experience “gaps” in the interest rate sensitivities of its assets and liabilities, meaning that either its interest-bearing liabilities will be more sensitive to changes in market interest rates than its interest-earning assets, or vice versa. In either event, if market interest rates should move contrary to Carter Bank’s position, this “gap” will work against it and its earnings may be negatively affected.

An increase in the general level of interest rates may also, among other things, reduce the demand for loans and Carter Bank’s ability to originate loans or increase the rate of default on existing loans. Conversely, a decrease in the general level of interest rates may, among other things, lead to an increase in prepayments on loan and increased competition for deposits. Accordingly, changes in the general level of market interest rates may affect net yield on interest-earning assets, loan origination volume, loan portfolios and Carter Bank’s overall results.

Although Carter Bank’s asset-liability management strategy is designed to control its risk from changes in the general level of market interest rates, market interest rates will be affected by many factors outside of its control, including inflation, recession, changes in unemployment, money supply and international disorder and instability in domestic and foreign financial markets. It is possible that significant or unexpected changes in interest rates may take place in the future, and Carter Bank cannot always accurately predict the nature or magnitude of such changes or how such changes may affect its business.

Carter Bank’s profitability depends significantly on local economic conditions.

Carter Bank’s success depends primarily on the general economic conditions of the geographic markets in which it operates. The local economic conditions in the areas where it operates has a significant impact on its commercial, real estate and construction loans, the ability of its borrowers to repay their loans and the value of the collateral securing these loans. A significant decline in general economic conditions, caused by inflation, recession, acts of terrorism, outbreak of hostilities or other international or domestic calamities, unemployment or other factors could impact these local economic conditions and negatively affect Carter Bank’s financial results.

Carter Bank faces strong competition from financial services companies and other companies that offer banking services which could negatively affect its business.

Carter Bank conducts its banking operations primarily in Virginia and North Carolina, including Roanoke, Lynchburg, Danville, Fredericksburg, Northern Virginia, Greensboro, Durham, Wilson and Fayetteville. Increased competition in these markets may result in reduced loans and deposits. Ultimately, Carter Bank may not be able to compete successfully against current and future competitors. Many competitors offer the same banking services that Carter Bank offers in its service area. These competitors include national banks, regional banks and other community banks. Carter Bank also faces competition from many other types of financial institutions, including without limitation, savings and loan institutions, finance companies, brokerage firms, insurance companies, credit unions, mortgage banks and other financial intermediaries. In particular, Carter Bank’s competitors include several major financial companies whose greater resources may afford them a marketplace advantage by enabling them to maintain numerous banking locations and ATMs and conduct extensive promotional and advertising campaigns.

Additionally, banks and other financial institutions with larger capitalization and financial intermediaries not subject to bank regulatory restrictions have larger lending limits and are thereby able to serve the credit needs of larger customers. Areas of competition include interest rates for loans and deposits, efforts to obtain deposits, and range and quality of products and services provided, including new technology-driven products and services. Technological innovation continues to contribute to greater competition in domestic and international financial services markets as technological advances enable more companies to provide financial services. Carter Bank also

11

faces competition from out-of-state financial intermediaries that have opened low-end production offices or that solicit deposits in its market areas. If Carter Bank is unable to attract and retain banking customers, it may be unable to continue to grow its loan and deposit portfolios and its results of operations and financial condition may otherwise be adversely affected.

A large percentage of Carter Bank’s loans are secured by real estate, and an adverse change in the real estate market may result in losses and adversely affect Carter Bank’s profitability.

Approximately 70% of Carter Bank’s loan portfolio as of September 30, 2007 was comprised of loans secured by real estate, exclusive of municipal loans. An adverse change in the economy affecting values of real estate generally or in the market areas to be served by Carter Bank specifically could impair the value of Carter Bank’s collateral and its ability to sell the collateral upon foreclosure. In the event of a default with respect to any of these loans, the amounts Carter Bank receives upon sale of the collateral may be insufficient to recover outstanding principal and interest on the loan. As a result, Carter Bank’s profitability and financial condition could be negatively impacted by an adverse change in the real estate market.

Carter Bank is dependent on its management team, and the loss of its senior executive officers or other key employees could impair its relationship with its customers and adversely affect its business and financial results.

The success of Carter Bank is dependent upon the continued service and skills of Worth Harris Carter, Jr. and other senior officers. The unexpected loss of services of one or more of these key personnel could have an adverse impact on the business of Carter Bank because of their skills, knowledge of the market, years of industry experience and the difficulty of promptly finding qualified replacement personnel.

An interruption in or breach in security of Carter Bank’s information systems may result in a loss of customer business and negatively affect its results of operations and financial condition.

Carter Bank relies heavily on communications and information systems to conduct its business. Any failure or interruption or breach in security of these systems could result in failures or disruptions in customer relationship management, general ledger, deposits, servicing or loan origination systems. Carter Bank cannot assure its stockholders that such failures or interruptions will not occur or, if they do occur, that they will be adequately addressed by the bank. The occurrence of any failures or interruptions could result in a loss of customer business, costs to Carter Bank or damages to others and have a negative effect on Carter Bank’s results of operations and financial condition.

Carter Bank operates in a highly regulated environment and, as a result, is subject to extensive regulation and supervision that could adversely affect its financial performance.

Carter Bank is subject to extensive regulation, supervision and examination by federal and state banking authorities. Any change in applicable regulations or federal or state legislation could have a substantial impact on Carter Bank, its subsidiaries and its operations. Additional legislation and regulations may be enacted or adopted in the future that could significantly affect Carter Bank’s powers, authority and operations, which could have a material adverse effect on Carter Bank’s financial condition and results of operations. Further, regulators have significant discretion and power to prevent or remedy unsafe or unsound practices or violations of laws by banks in the performance of their supervisory and enforcement duties. The exercise of this regulatory discretion and power may have a negative impact on Carter Bank and could limit growth and the return to investors by restricting activities such as the payment of dividends, mergers with, or acquisitions by, other institutions, investments, loans and interest rates, interest rates paid on deposits and the creation of branch offices. Although these regulations impose costs upon Carter Bank, they are intended to protect depositors, and stockholders should not assume that they protect their interests as a stockholder.

The trading volume in Carter Bank’s common stock may be low following the merger.

Carter Bank is a bank that is establishing its identity and credibility in the markets. There is currently no established public market for Carter Bank’s common stock and its common stock is not listed or traded on any national securities exchange or included in any automatic quotation system. Although Carter Bank intends to apply

12

to have its common stock listed for trading on a national securities exchanges such as the New York Stock Exchange, American Stock Exchange or the NASDAQ Stock Market, no assurance can be given that such application will be successful. A public trading market having the desired characteristics of depth, liquidity and orderliness depends on the presence in the market place of willing buyers and sellers of Carter Bank’s common stock at any given time. This presence depends on the individual decisions of investors and general economic and market conditions over which Carter Bank has no control. Accordingly, it is uncertain at what price the shares of Carter Bank will trade upon completion of the merger or upon listing, if any, on a national securities exchange. Given the absence of an established public market, significant sales of its common stock by stockholders, or the expectation of these sales, could adversely affect Carter Bank’s stock price and increase its volatility.

13

BANK BUILDING SPECIAL MEETING

General

This proxy statement is first being mailed by Bank Building to the holders of Bank Building common stock, no par value per share, on or about [ , 2008], and is accompanied by the notice of the Bank Building special meeting and a form of proxy that is solicited by the board of directors of Bank Building for use at the Bank Building special meeting, to be held as follows:

| | |

Date: | | [March 25], 2008 |

| Time: | | 1:00 p.m., local time |

| Location: | | Bank Services of Virginia Operations Center |

| | 320 College Drive |

| | Martinsville, Virginia 24112 |

This special meeting may continue at any adjournment or postponement of that meeting.

Matters to be Considered

At the special meeting, the stockholders of Bank Building will be asked:

| | • | | to approve the merger agreement and the transactions contemplated thereby (See Proposal I); or |

| | • | | to consider and vote upon a proposal to adjourn the meeting to a later date or dates, if necessary, to permit further solicitation of proxies in the event there are not sufficient votes at the time of the meeting to approve the matters to be considered by the stockholders at the meeting (See Proposal II). |

Proxies

The accompanying form of proxy is for use at the special meeting if you are unable or do not desire to attend in person. You may attend the special meeting even if you have previously delivered a proxy to Bank Building. You can revoke your proxy at any time before the vote is taken at the special meeting by submitting to Bank Building written notice of revocation or a properly executed proxy of a later date, or by attending the special meeting and electing to vote in person. Written notices of revocation and other communications about revoking your proxy should be addressed to:

Worth Harris Carter, Jr.

Bank Building Corporation

1300 Kings Mountain Road

Martinsville, Virginia 24112

All shares represented by valid proxies that Bank Building receives through this solicitation, and not revoked before they are exercised, will be voted in the manner specified in such proxies. If you make no specification on your returned proxy, your proxy will be voted “FOR” the matters to be considered at the special meeting as described above.

Solicitation of Proxies

Bank Building will bear the entire cost of soliciting proxies from you. In addition to solicitation of proxies by mail, Bank Building will request banks, brokers and other record holders to send proxies and proxy material to the beneficial owners of the stock and secure their voting instructions, if necessary. Bank Building will reimburse those record holders for their reasonable expenses in taking those actions. If necessary, Bank Building also may use its executive officers, who will not be specially compensated, to solicit proxies from its stockholders, either personally or by telephone, the Internet, fax, letter or special delivery letter.

14

Record Date and Voting Rights

[ , 2008] has been fixed as the record date for determining the stockholders entitled to notice of and to vote at the special meeting. Accordingly, you are only entitled to notice of, and to vote at, the special meeting if you were a record holder of the common stock of Bank Building at the close of business on the record date. At that time, 398,244 shares of Bank Building common stock were outstanding, held by approximately 2,650 holders of record.

You are entitled to one vote for each outstanding share of the common stock of Bank Building you held as of the close of business on the record date.

Holders of shares of Bank Building common stock present in person at the special meeting but not voting, and shares of the common stock for which Bank Building has received proxies indicating that their holders have abstained, will be counted as present at the special meeting for purposes of determining whether Bank Building has a quorum for transacting business. Shares held in street name that have been designated by brokers on proxies as not voted will not be counted as votes cast for or against any proposal. These broker non-votes will, however, be counted for purposes of determining whether a quorum exists.

Vote Required

The approval of the merger agreement and the transactions contemplated thereby requires the affirmative vote of the holders of two-thirds of Bank Building’s outstanding shares.

Less than a quorum may adjourn the meeting.

Because approval of the merger agreement and the transactions contemplated thereby require the affirmative vote of the holders of two-thirds of the outstanding shares of Bank Building’s common stock entitled to vote at the special meeting, abstentions and broker non-votes will have the same effect as votes against these matters. Accordingly, Bank Building’s board of directors urges you to complete, date and sign the accompanying proxy and return it promptly in the enclosed pre-addressed, postage-paid envelope.

As of the record date, directors and executive officers of Bank Building beneficially owned 51,945 shares of Bank Building’s common stock, entitling them to exercise approximately 13.04% of the voting power of Bank Building common stock entitled to vote at the special meeting. In addition, the directors and executive officers of Carter Bank, other than the persons who are also directors and executive officers of Bank Building, beneficially owned 37,373 shares of Bank Building’s common stock, entitling them to exercise approximately 9.4% of the voting power of Bank Building common stock entitled to vote at the special meeting. Each director and executive officer of Bank Building and Carter Bank has indicated he or she will vote each share of his common stock that he or she owns “FOR” approval of the merger agreement and the transactions contemplated thereby.

Recommendation of the Board of Directors

The board of directors of Bank Building has unanimously approved the merger agreement and the transactions contemplated thereby, including the merger. The Bank Building board believes that the merger agreement and the transactions contemplated thereby, including the merger, are fair to, and are in the best interests of Bank Building and its stockholders and unanimously recommends that stockholders vote “FOR” approval of the merger agreement and the transactions contemplated thereby.

15

PROPOSAL I - APPROVAL OF THE MERGER

This summary of the material terms and provisions of the merger agreement is qualified in its entirety by reference to such documents. The merger agreement is included asAnnex A of this proxy statement. Bank Building incorporates this document into this summary by reference.

Merger

Subject to satisfaction or waiver of all conditions in the merger agreement, Bank Building, a Virginia corporation, will merge with and into Carter Bank, a Virginia state-chartered bank. Upon completion of the merger, Bank Building’s corporate existence will terminate and Carter Bank will continue as the surviving entity. All of the executive officers and directors of Bank Building also are executive officers and directors of Carter Bank. Following the merger, the executive officers and directors of Bank Building will cease to be executive officers and directors of Bank Building, but will continue in their current roles with Carter Bank.

Background of the Merger

Bank Building and Carter Bank have a common heritage involving overlapping board memberships, management, and operations, as well as other similar characteristics and joint activities. Bank Building was formed by a spin off from several of the individual banks that merged to become Carter Bank. Since the inception of Bank Building, Bank Building has shared common senior management, operations and has had an overlapping board of directors with Carter Bank. Included in this overlap, Worth Harris Carter, Jr. has served since the inception of Bank Building and Carter Bank as the Chairman of the Board and President of both companies.

The original purposes behind Bank Building was to acquire and develop property for lease as bank offices to several of the individual banks that merged to become Carter Bank.

On November 16, 2007, MacKenzie Patterson Fuller, LP, on behalf of several of its affiliates (“MacKenzie”), delivered a letter to Bank Building, published a tombstone advertisement in the Investor’s Business Daily and filed its tender offer documents under cover of Schedule TO with the Securities and Exchange Commission (“SEC”) announcing the commencement of a tender offer. After receipt of MacKenzie’s letter on November 16, 2007, Bank Building retained Troutman Sanders LLP (“Troutman Sanders”), its regular outside counsel, to provide legal advice with respect to the tender offer.

On November 20, 2007, Bank Building retained Davenport & Company LLC (“Davenport”) to act as its financial advisor with respect to the tender offer and in connection with any potential strategic transactions. Bank Building selected Davenport as its financial advisor because it is a recognized investment banking firm with substantial experience in transactions similar to the tender offer and with banks and banking properties and because of its prior familiarity with Bank Building.

Between November 20, 2007 and January 7, 2008, representatives of Davenport met with Mr. Carter and other members of senior management of Bank Building numerous times by telephone to discuss background information regarding Bank Building and its properties, assets, operations and financial condition.

The board of directors of Bank Building met in Martinsville, Virginia on November 21, 2007 with one director participating telephonically. Also present at the meeting were representatives of senior management of Bank Building. Representatives of Troutman Sanders and Davenport participated telephonically. The board held preliminary discussions regarding the tender offer and received an overview of the applicable legal and fiduciary principles from its legal counsel and advisors. The board discussed with management and its advisors the financial, legal and other considerations arising out of MacKenzie’s proposal but determined that it needed to gather additional information in order to fully complete its analysis and to formulate a proper response. The board scheduled its next meeting to be held on November 27, 2007.

On November 27, 2007, the board of directors of Bank Building met in Martinsville to further consider the tender offer. Also present at the meeting were representatives of senior management of Bank Building, Troutman Sanders and Davenport. At the meeting, management briefly reviewed with the board the history of Bank Building. Representatives of Troutman Sanders reviewed with members of the board their fiduciary duties under Virginia law

16

in considering and acting on the proposed tender offer and possible strategic alternatives. Representatives of Davenport reviewed in detail the terms and conditions of the tender offer, their preliminary financial analysis regarding the underlying value of Bank Building’s assets and certain strategic alternatives to the tender offer. The board carefully considered Bank Building’s business, financial condition, prospects, the terms and conditions of the tender offer and other matters, including discussions with and presentations by management and its financial and legal advisors. Among these matters were discussions of a potential acquisition of Bank Building by Carter Bank which would provide Bank Building’s stockholders significantly more value per share than the tender offer. After extensive deliberation and consideration of alternatives, the board unanimously determined that the tender offer was not in the best interest of Bank Building’s stockholders and unanimously decided to recommend rejection of the tender offer. The board authorized Davenport and representatives of senior management to initiate discussions with Carter Bank regarding a potential transaction. Because Troutman Sanders also serves as regular outside counsel to Carter Bank, the board of directors of Bank Building authorized senior management to engage Young, Haskins, Mann, Gregory, McGarry & Wall P.C. (“Young Haskins”) to provide legal representation with respect to merger negotiations between itself and Carter Bank.

On November 28, 2007, Bank Building retained Young Haskins as special outside legal counsel.

On November 28, 2007, the board of directors of Carter Bank met and considered the proposal from Bank Building regarding a potential acquisition of Bank Building by Carter Bank. Also present at the meeting were representatives of Davenport, Troutman Sanders and Young Haskins. The board of directors of Carter Bank created a special committee (the “Special Committee”) comprised of all 21 disinterested members of the board of directors of Carter Bank (excluding the five members who are also members of the board of directors of Bank Building). The Special Committee held a meeting immediately following the Carter Bank board meeting and authorized senior management of Carter Bank to pursue a potential acquisition of Bank Building.

The Special Committee authorized senior management to retain Troutman Sanders, its regular outside counsel, to provide legal representation with respect to merger negotiations between itself and Bank Building, and Troutman Sanders was retained.

Effective November 28, 2007, Bank Building and Carter Bank executed a mutual non-disclosure agreement.

On November 30, 2007, Bank Building filed its response to MacKenzie’s tender offer on Schedule 14D-9 with the SEC recommending that stockholders of Bank Building not tender their shares in connection with MacKenzie’s offer. On the same day, Bank Building and Carter Bank issued a joint press release announcing preliminary discussions regarding a potential acquisition of Bank Building by Carter Bank.

On December 17, 2007, Troutman Sanders distributed an initial draft of the merger agreement to Bank Building and its outside advisors. Between December 18, 2007 and January 7, 2008, Carter Bank and its legal and financial advisors and Bank Building and its legal and financial advisors negotiated the merger agreement.

On December 18, 2007, Carter Bank retained Boxwood Partners, LLC (“Boxwood”) to act as its financial advisor with respect to the proposed merger. Carter Bank selected Boxwood as its financial advisor because it is a recognized boutique mergers and acquisition advisory investment banking firm with experience in transactions similar to the merger and with companies similar in size to Bank Building.

Between December 18, 2007 and January 3, 2008, representatives of Boxwood conducted numerous telephonic meetings with representatives of senior management of Carter Bank to understand the background of the potential transaction and to assemble relevant information needed to perform its analysis. On December 27, 2007, Boxwood met in Martinsville with Mr. Carter and other representatives of senior management of Carter Bank to perform additional due diligence, obtain information and review Boxwood’s progress through that date. During this time, representatives of Boxwood and representatives of Davenport also had several telephonic meetings to discuss valuations and the financial terms of the merger.

On January 2, 2008, MacKenzie filed Amendment No. 1 to its Schedule TO announcing that the tender offer had expired and that MacKenzie had received and accepted for payment 11,482 validly tendered shares of Bank Building common stock representing approximately 2.9% of the issued and outstanding shares.

17

The Special Committee met on January 4, 2008 in Martinsville, Virginia to consider a proposed merger agreement between Carter Bank and Bank Building. Also present at the meeting were representatives of senior management of Carter Bank, Troutman Sanders and Boxwood. Also present but not participating were representatives of Davenport and Young Haskins. At the meeting, senior management of Carter Bank briefly reviewed with the Special Committee the history of Bank Building. Representatives of Troutman Sanders reviewed with members of the Special Committee their fiduciary duties under Virginia law in considering and acting on the proposed merger. Representatives of Boxwood reviewed in general the terms and conditions of the merger agreement, and presented their financial analysis regarding the underlying value of Bank Building’s assets and the potential effects of the merger on Carter Bank. The board carefully considered Bank Building’s business, financial condition, prospects, the terms and conditions of the merger and other matters, including discussions with and presentations by management and its financial and legal advisors. After deliberation and consideration, the Special Committee determined that the merger agreement was in the best interest of Carter Bank’s stockholders and the 18 members of the Special Committee present at the meeting unanimously approved the merger. Following the vote of the Special Committee, the board of directors of Carter Bank met and approved the merger with the five members who were also on the board of directors of Bank Building abstaining.

The board of directors of Bank Building also met in Martinsville, Virginia on January 4, 2008 to consider the merger agreement. Also present at the meeting were representatives of senior management of Bank Building, Young Haskins and Davenport. Also present but not participating were representatives of Troutman Sanders and Boxwood. At the meeting, senior management briefly reviewed with the board the history of Bank Building. Representatives of Young Haskins reviewed with members of the board their fiduciary duties under Virginia law in considering and acting on the proposed merger. Representatives of Davenport reviewed in detail the terms and conditions of the merger, their financial analysis regarding the underlying value of Bank Building’s assets and provided a written fairness opinion. The board carefully considered Bank Building’s business, financial condition, prospects, the terms and conditions of the merger agreement, the fairness opinion provided by Davenport and other matters, including discussions with and presentations by management and its financial and legal advisors. After deliberation and consideration of alternatives, the board decided to meet again on January 8, 2008 to consider the merger.

On January 8, 2008, the board of directors of Bank Building met telephonically to consider the merger. Also present were representatives of senior management of Bank Building, Davenport and Young Haskins. Davenport confirmed its opinion given on January 4, 2008 and delivered an updated written fairness opinion. Representatives of Young Haskins advised the board of directors with respect to the merger agreement. After deliberations and consideration, the board of directors of Bank Building unanimously approved the merger agreement. The board unanimously decided to submit the merger agreement to the stockholders of Bank Building and recommend the stockholders vote to approve the merger.