We have prepared a brief slide show to review the company’s recent and future development projects, and to highlight our core portfolio operating performance and the resulting returns delivered to shareholders over our long history as a public REIT. 1 Exhibit 99. (a)

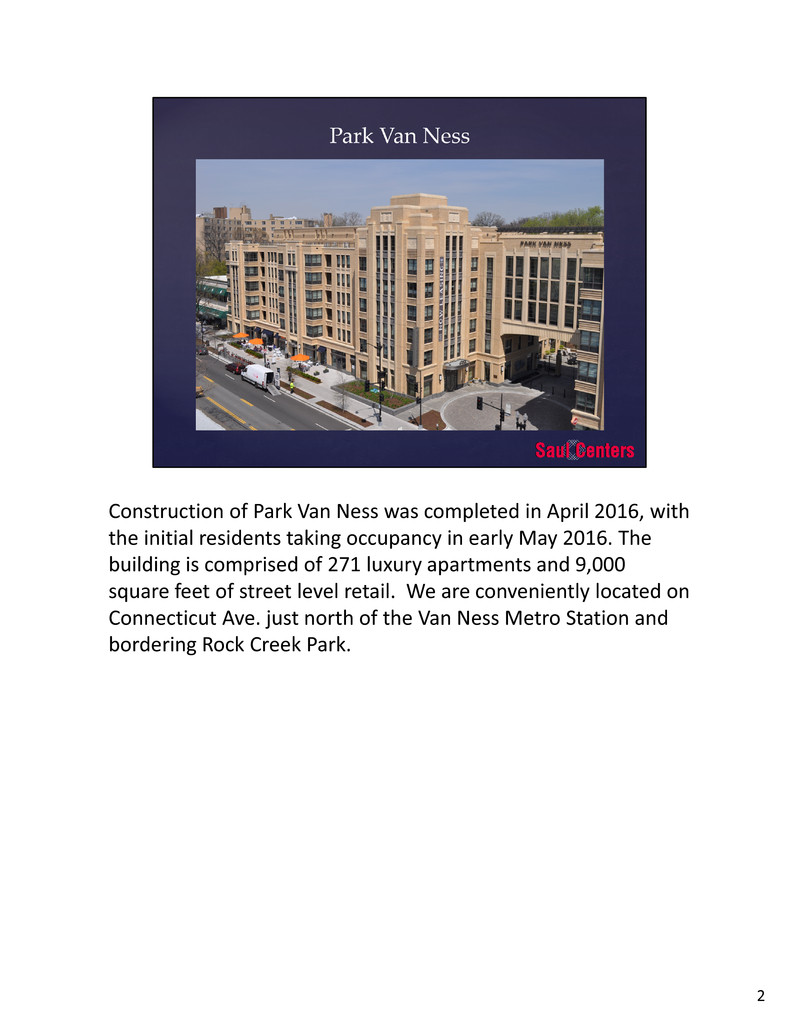

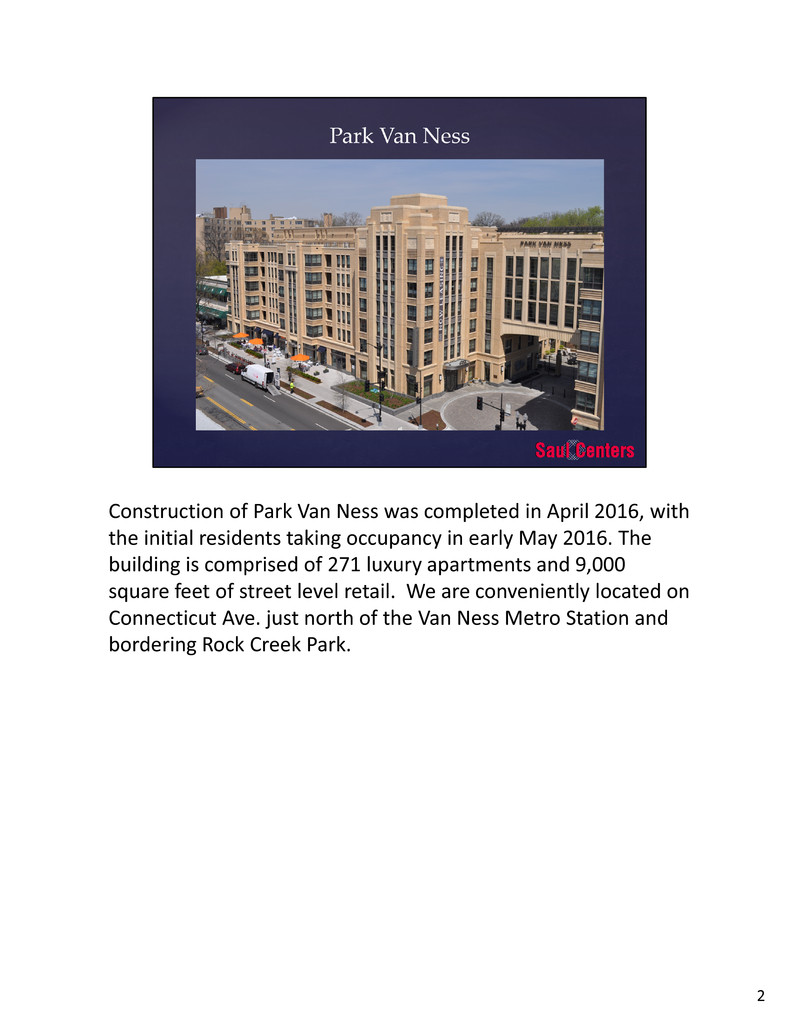

Construction of Park Van Ness was completed in April 2016, with the initial residents taking occupancy in early May 2016. The building is comprised of 271 luxury apartments and 9,000 square feet of street level retail. We are conveniently located on Connecticut Ave. just north of the Van Ness Metro Station and bordering Rock Creek Park. 2

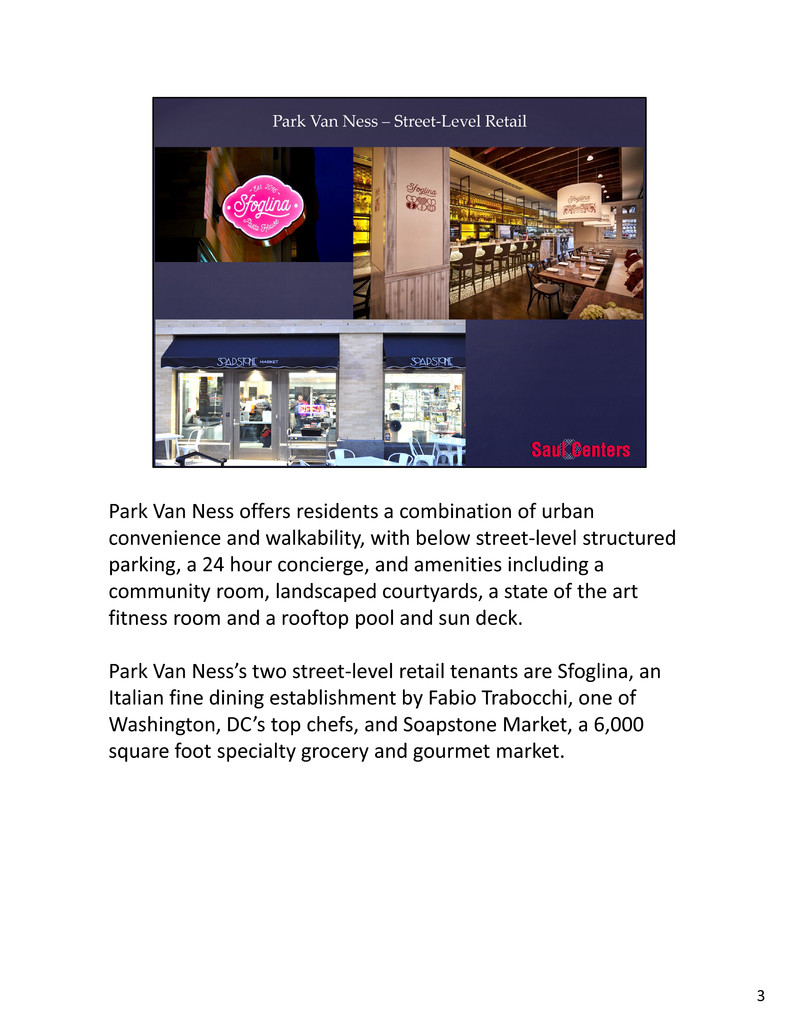

Park Van Ness offers residents a combination of urban convenience and walkability, with below street‐level structured parking, a 24 hour concierge, and amenities including a community room, landscaped courtyards, a state of the art fitness room and a rooftop pool and sun deck. Park Van Ness’s two street‐level retail tenants are Sfoglina, an Italian fine dining establishment by Fabio Trabocchi, one of Washington, DC’s top chefs, and Soapstone Market, a 6,000 square foot specialty grocery and gourmet market. 3

Park Van Ness rises 11 stories above the park, providing residents breathtaking views and access to the park. The 271 apartment units consist of a mix of 1 to 3 bedroom units, with over 60% having views of Rock Creek Park. Just one year after our first residents moved in, we have leased 251 units, or 92.6% of the total. While a drag on earnings during 2016, we expect Park Van Ness to be accretive to FFO during 2017 as lease‐up of this $93 million development is completed over the coming months. 4

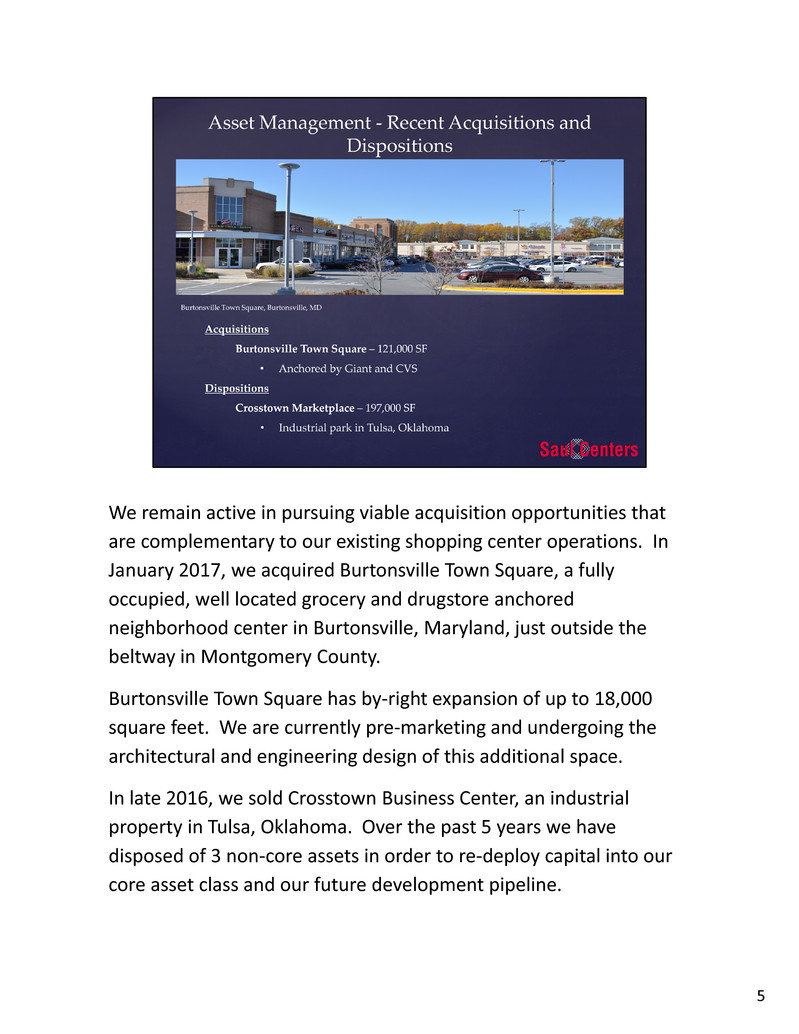

We remain active in pursuing viable acquisition opportunities that are complementary to our existing shopping center operations. In January 2017, we acquired Burtonsville Town Square, a fully occupied, well located grocery and drugstore anchored neighborhood center in Burtonsville, Maryland, just outside the beltway in Montgomery County. Burtonsville Town Square has by‐right expansion of up to 18,000 square feet. We are currently pre‐marketing and undergoing the architectural and engineering design of this additional space. In late 2016, we sold Crosstown Business Center, an industrial property in Tulsa, Oklahoma. Over the past 5 years we have disposed of 3 non‐core assets in order to re‐deploy capital into our core asset class and our future development pipeline. 5

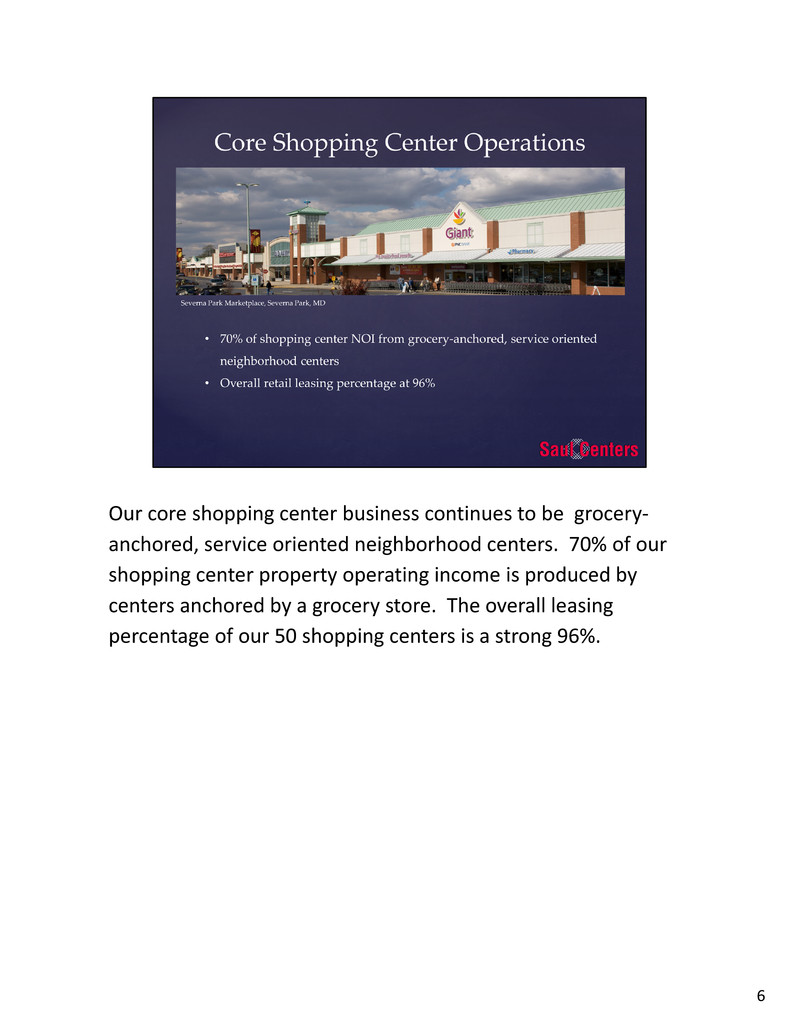

Our core shopping center business continues to be grocery‐ anchored, service oriented neighborhood centers. 70% of our shopping center property operating income is produced by centers anchored by a grocery store. The overall leasing percentage of our 50 shopping centers is a strong 96%. 6

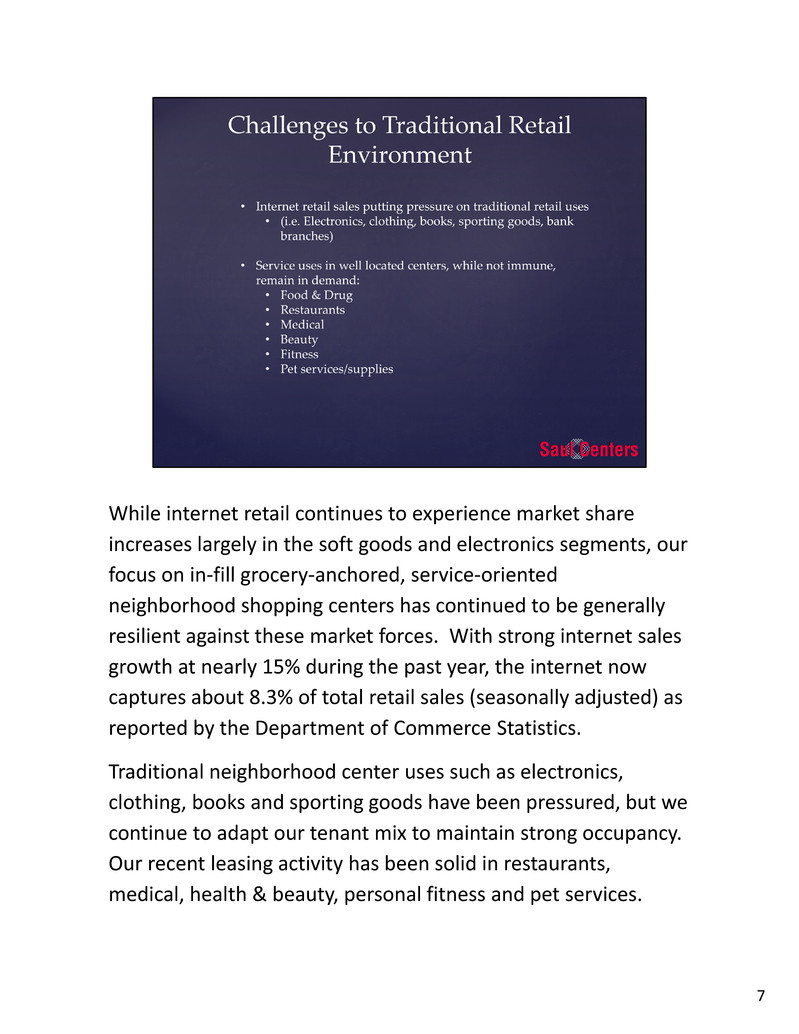

While internet retail continues to experience market share increases largely in the soft goods and electronics segments, our focus on in‐fill grocery‐anchored, service‐oriented neighborhood shopping centers has continued to be generally resilient against these market forces. With strong internet sales growth at nearly 15% during the past year, the internet now captures about 8.3% of total retail sales (seasonally adjusted) as reported by the Department of Commerce Statistics. Traditional neighborhood center uses such as electronics, clothing, books and sporting goods have been pressured, but we continue to adapt our tenant mix to maintain strong occupancy. Our recent leasing activity has been solid in restaurants, medical, health & beauty, personal fitness and pet services. 7

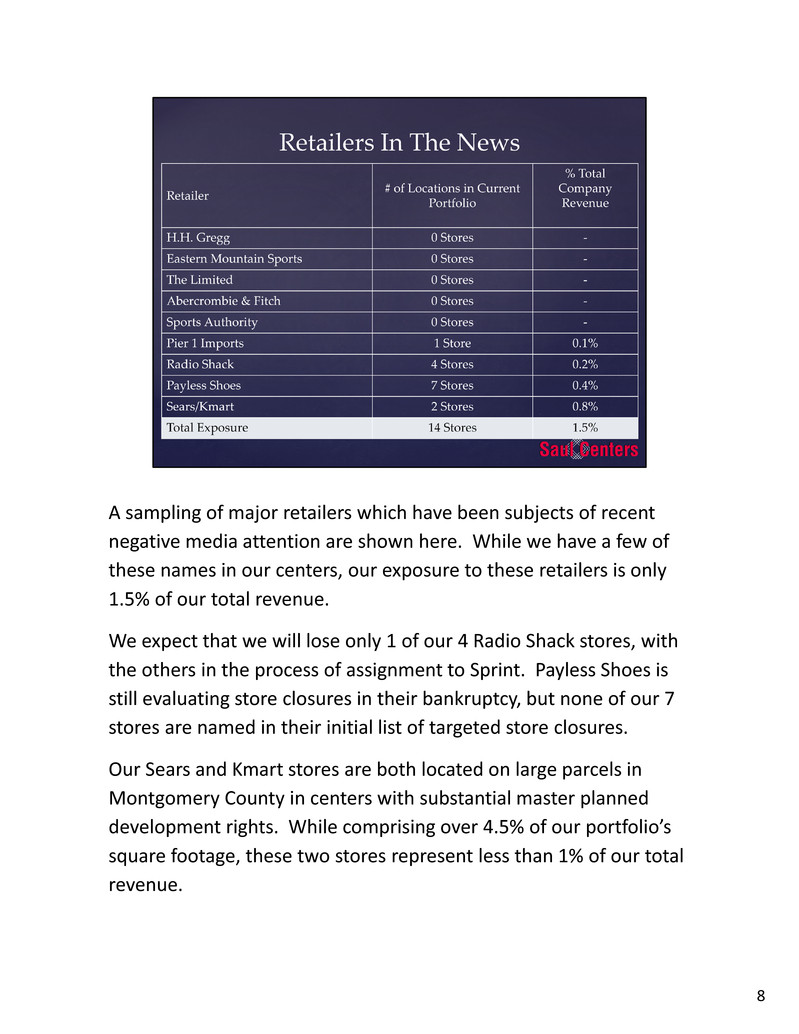

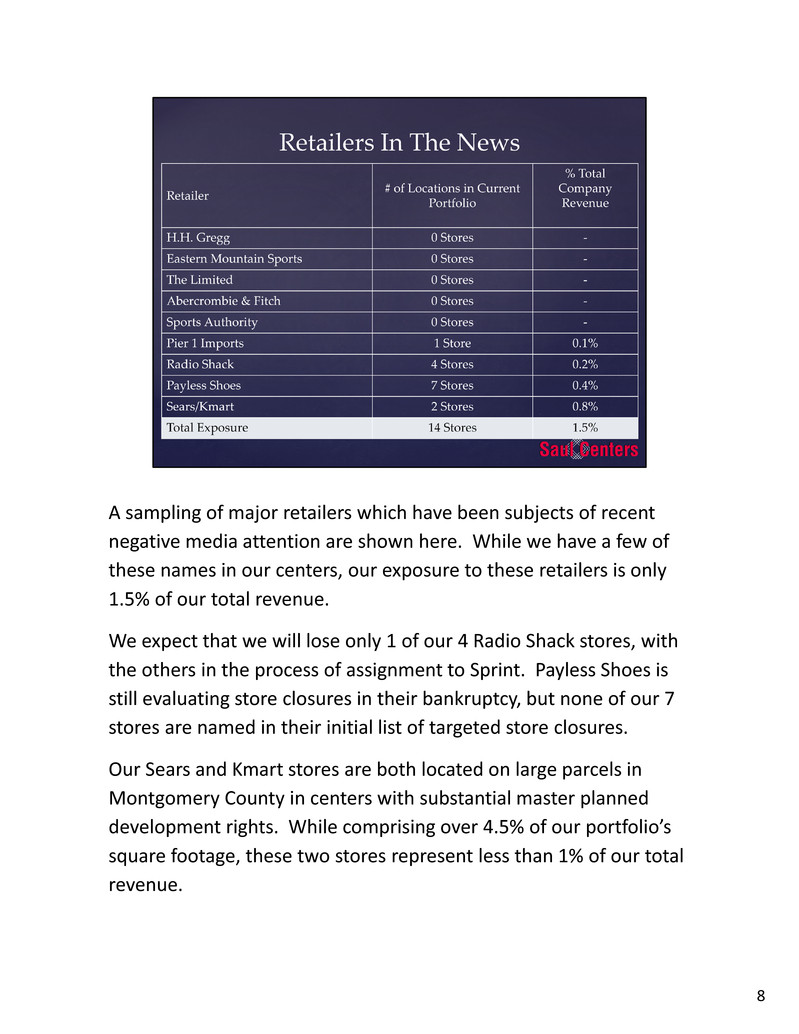

A sampling of major retailers which have been subjects of recent negative media attention are shown here. While we have a few of these names in our centers, our exposure to these retailers is only 1.5% of our total revenue. We expect that we will lose only 1 of our 4 Radio Shack stores, with the others in the process of assignment to Sprint. Payless Shoes is still evaluating store closures in their bankruptcy, but none of our 7 stores are named in their initial list of targeted store closures. Our Sears and Kmart stores are both located on large parcels in Montgomery County in centers with substantial master planned development rights. While comprising over 4.5% of our portfolio’s square footage, these two stores represent less than 1% of our total revenue. 8

Safeway, our 3rd largest tenant by percentage of total revenue, closed 2 of their 9 stores in our portfolio during 2016 ‐ Briggs Chaney Plaza in Silver Spring, Maryland and Broadlands Village in Ashburn, Virginia. Global Food, a regional grocer with six locations in the Washington, DC metropolitan area, just opened at Briggs Chaney, taking 100% of the former Safeway space. Rents received for this space have been unaffected. We recently terminated the Safeway lease at Broadlands Village and have executed a lease with Aldi Food Market to replace 20,000 square feet of the 58,000 square feet that was vacated. Aldi is expected to open in late 2017 and we continue to market the balance of the space. 9

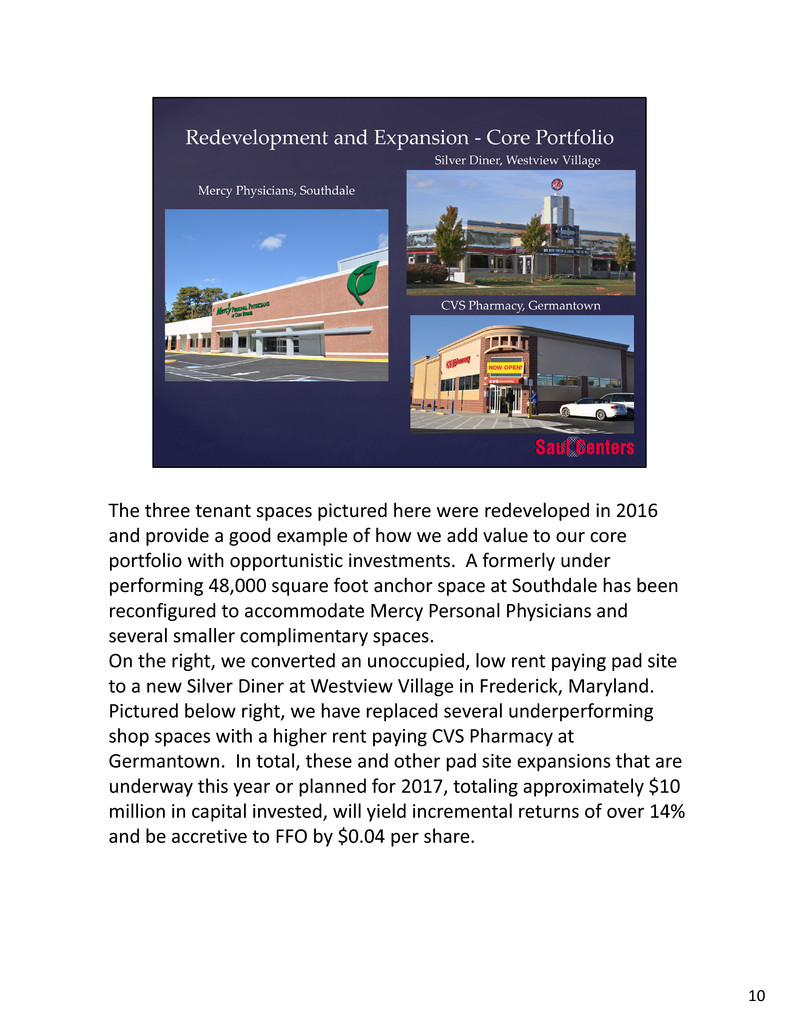

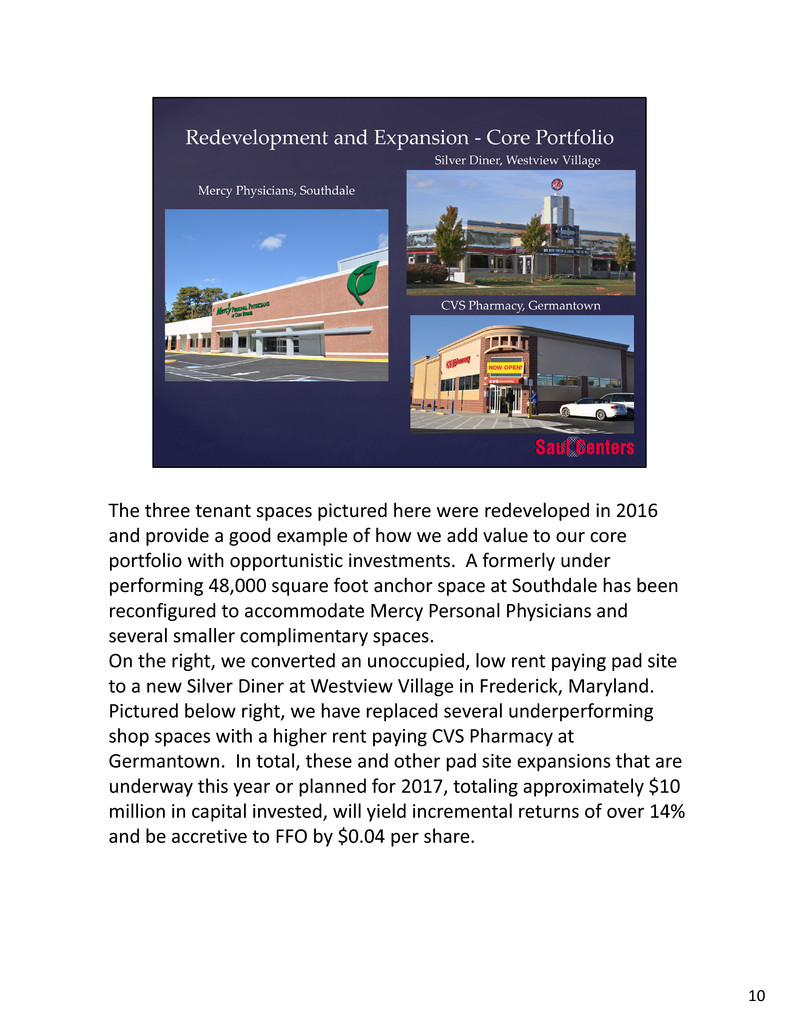

The three tenant spaces pictured here were redeveloped in 2016 and provide a good example of how we add value to our core portfolio with opportunistic investments. A formerly under performing 48,000 square foot anchor space at Southdale has been reconfigured to accommodate Mercy Personal Physicians and several smaller complimentary spaces. On the right, we converted an unoccupied, low rent paying pad site to a new Silver Diner at Westview Village in Frederick, Maryland. Pictured below right, we have replaced several underperforming shop spaces with a higher rent paying CVS Pharmacy at Germantown. In total, these and other pad site expansions that are underway this year or planned for 2017, totaling approximately $10 million in capital invested, will yield incremental returns of over 14% and be accretive to FFO by $0.04 per share. 10

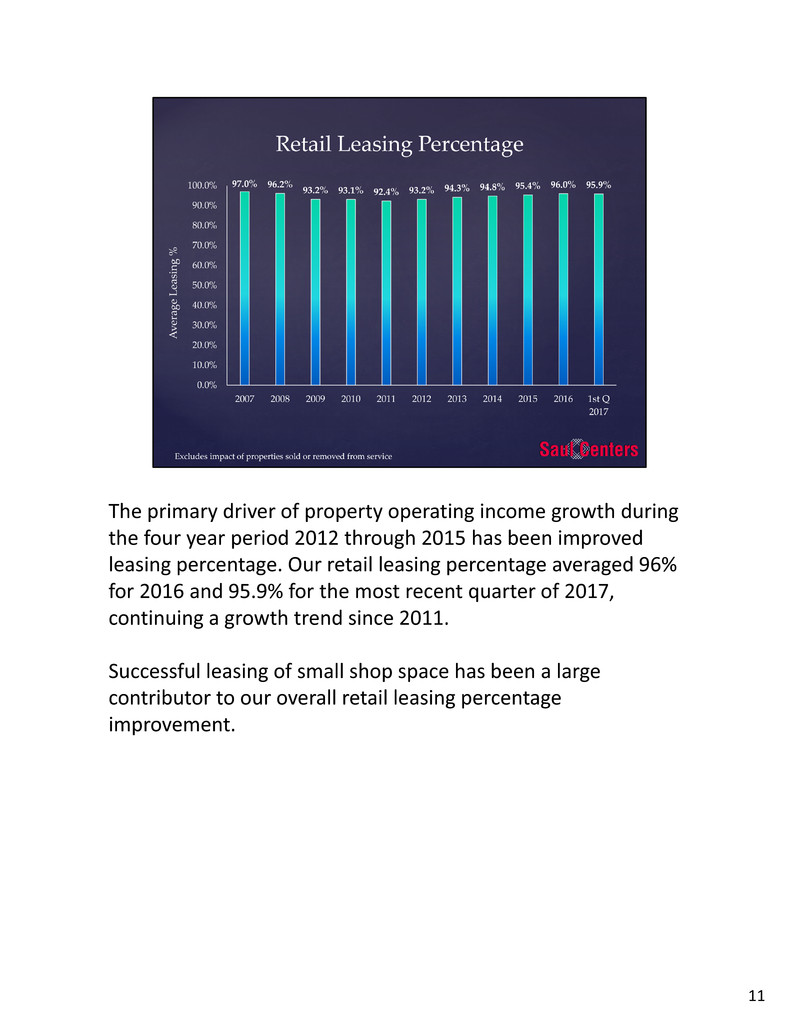

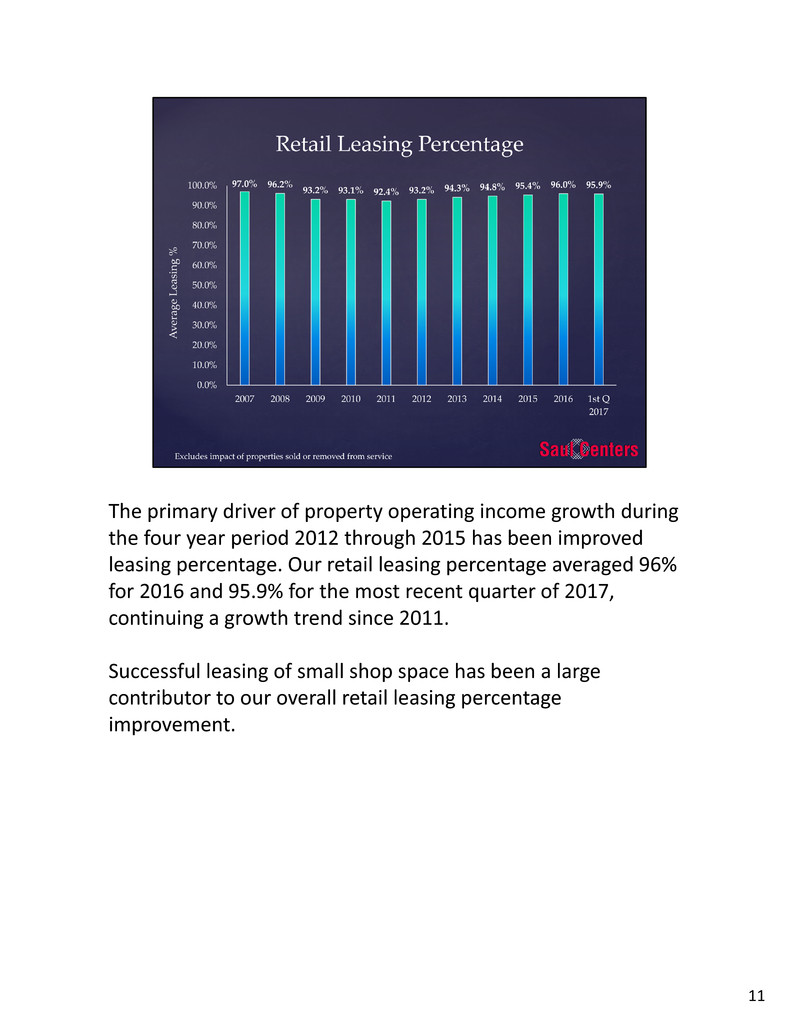

The primary driver of property operating income growth during the four year period 2012 through 2015 has been improved leasing percentage. Our retail leasing percentage averaged 96% for 2016 and 95.9% for the most recent quarter of 2017, continuing a growth trend since 2011. Successful leasing of small shop space has been a large contributor to our overall retail leasing percentage improvement. 11

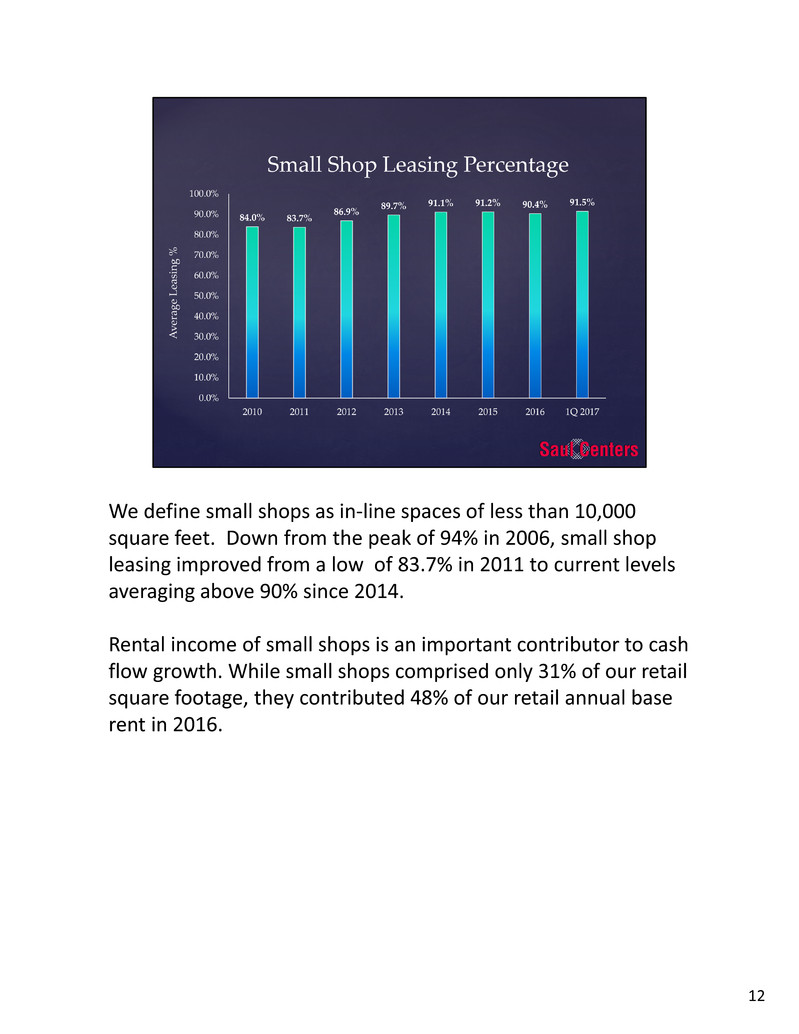

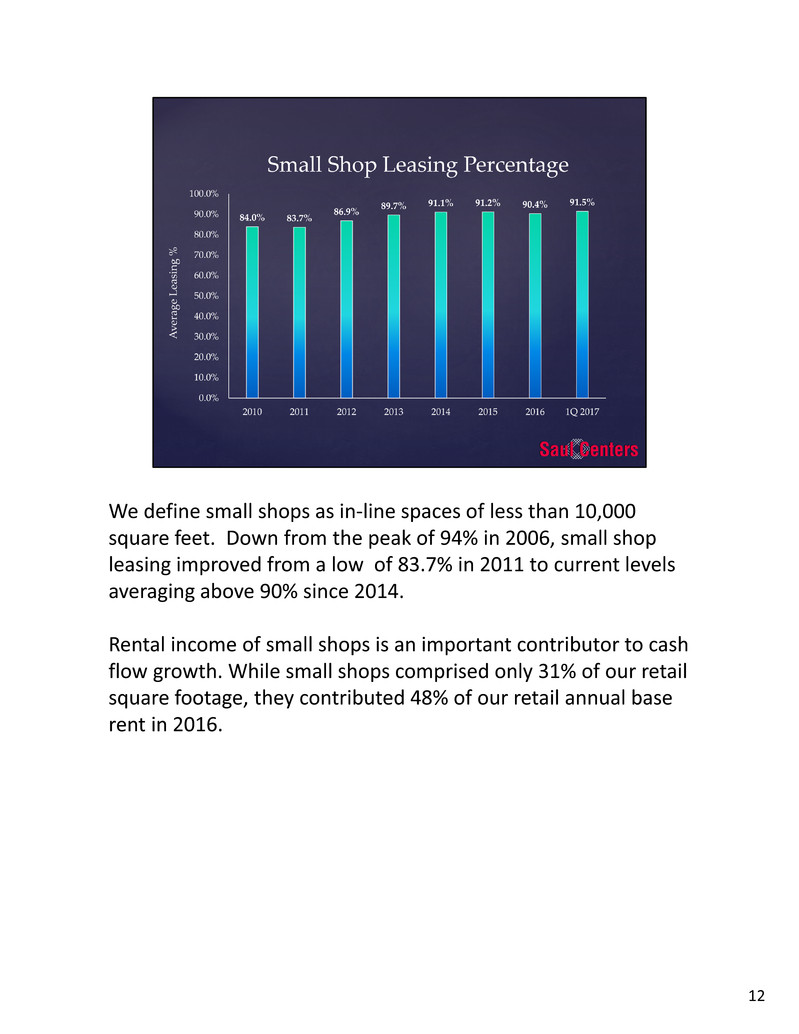

We define small shops as in‐line spaces of less than 10,000 square feet. Down from the peak of 94% in 2006, small shop leasing improved from a low of 83.7% in 2011 to current levels averaging above 90% since 2014. Rental income of small shops is an important contributor to cash flow growth. While small shops comprised only 31% of our retail square footage, they contributed 48% of our retail annual base rent in 2016. 12

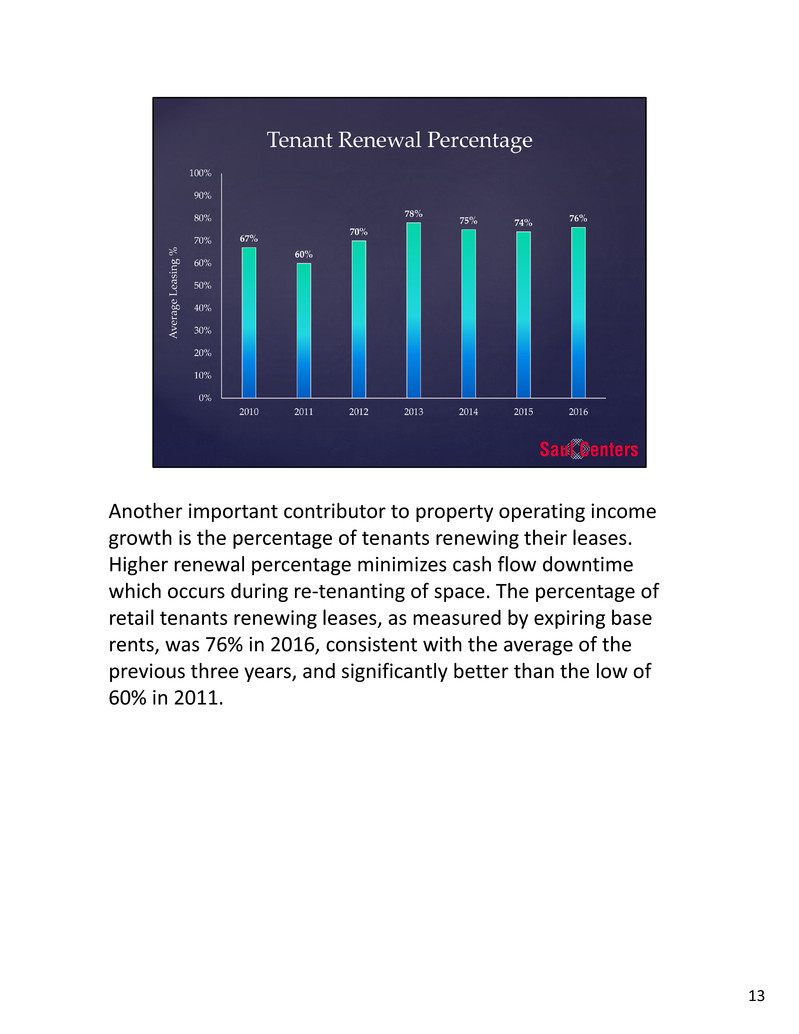

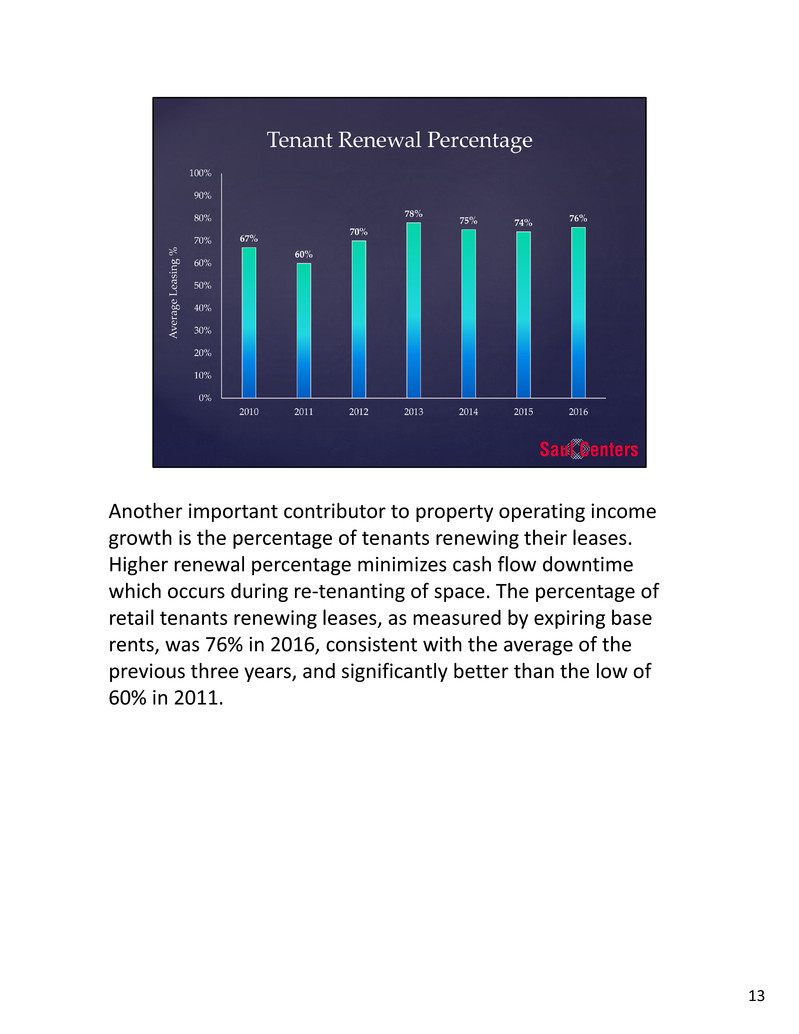

Another important contributor to property operating income growth is the percentage of tenants renewing their leases. Higher renewal percentage minimizes cash flow downtime which occurs during re‐tenanting of space. The percentage of retail tenants renewing leases, as measured by expiring base rents, was 76% in 2016, consistent with the average of the previous three years, and significantly better than the low of 60% in 2011. 13

A third contributor to improving property operating income is the growth in rental rates. On a same space basis, retail rental rate increases over expiring rents averaged over 10% during the two years leading up to the economic downturn. After 3 years of rental rate declines from 2009 to 2011, retail rents have since increased an annual average of 2.6%. These still low, yet positive, rent increases largely result from improved leasing percentage and successful tenants as measured by their stable reported tenant sales. 14

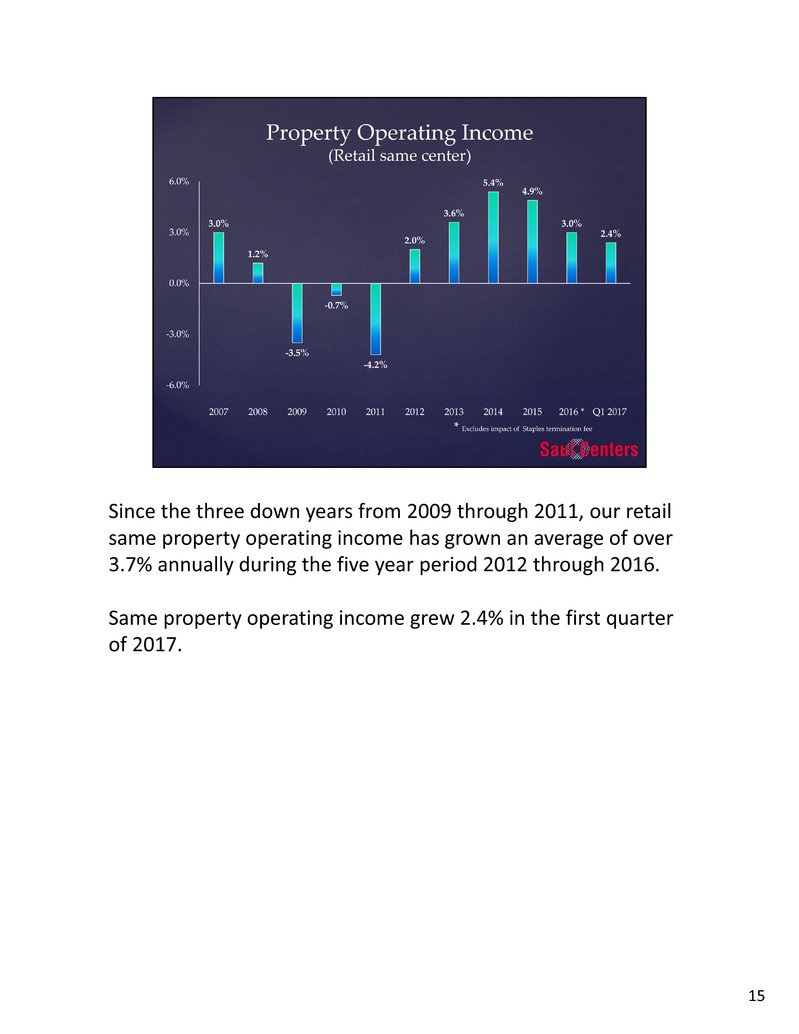

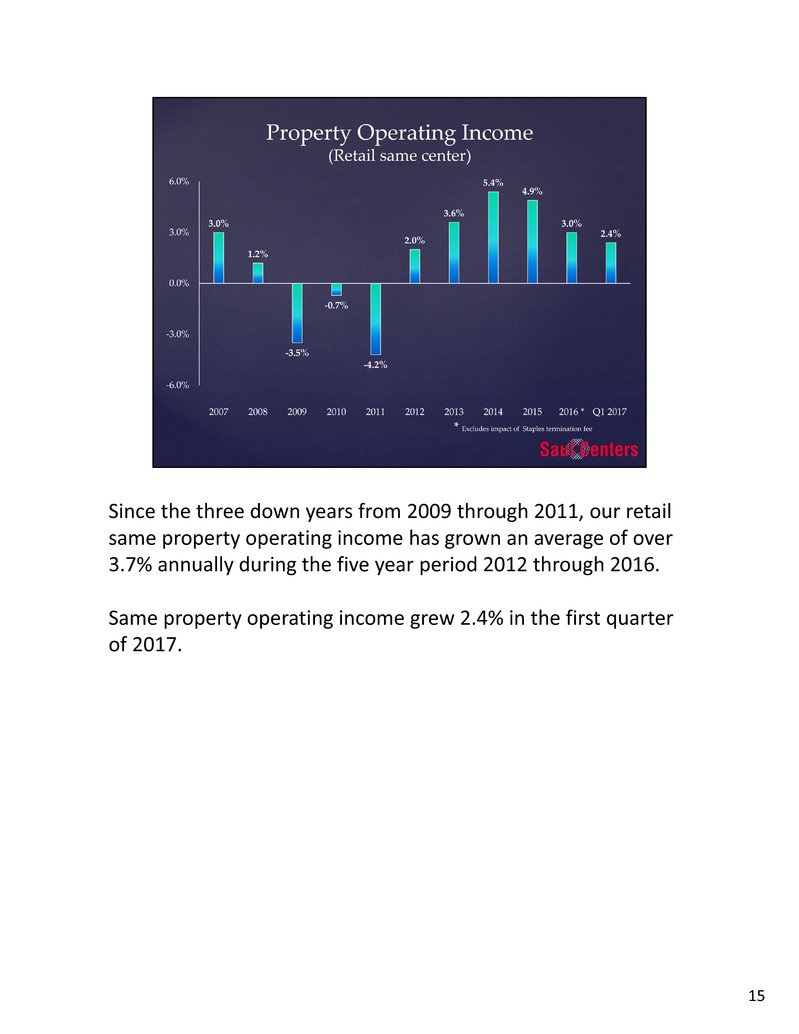

Since the three down years from 2009 through 2011, our retail same property operating income has grown an average of over 3.7% annually during the five year period 2012 through 2016. Same property operating income grew 2.4% in the first quarter of 2017. 15

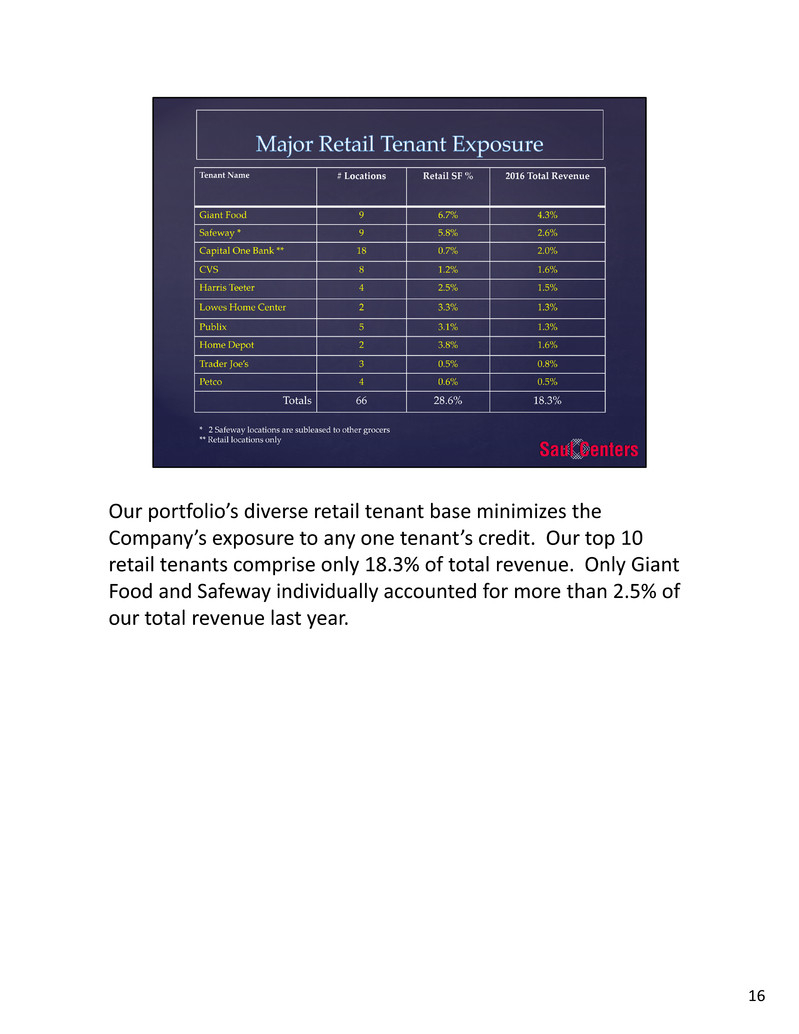

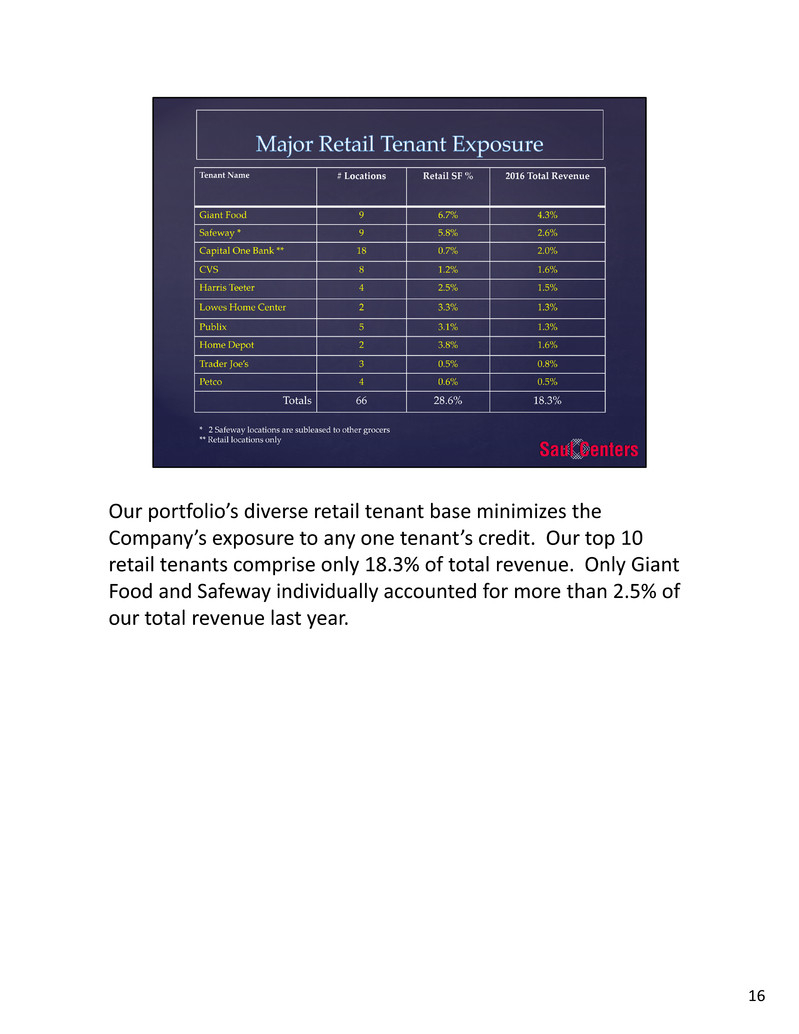

Our portfolio’s diverse retail tenant base minimizes the Company’s exposure to any one tenant’s credit. Our top 10 retail tenants comprise only 18.3% of total revenue. Only Giant Food and Safeway individually accounted for more than 2.5% of our total revenue last year. 16

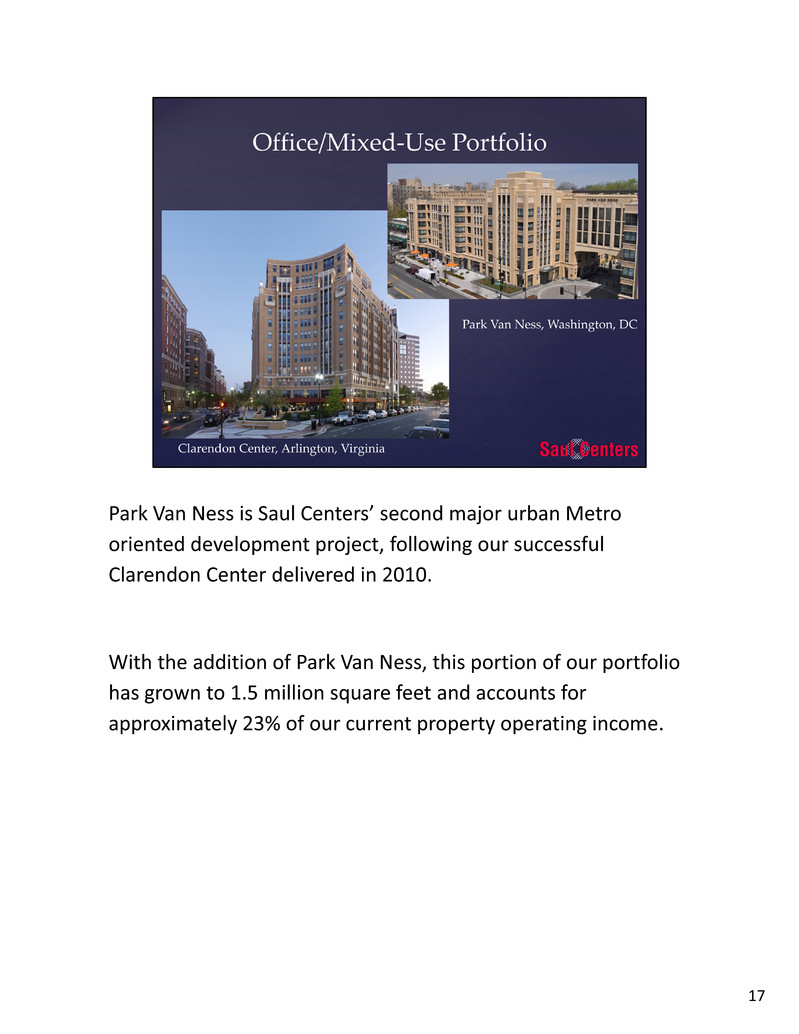

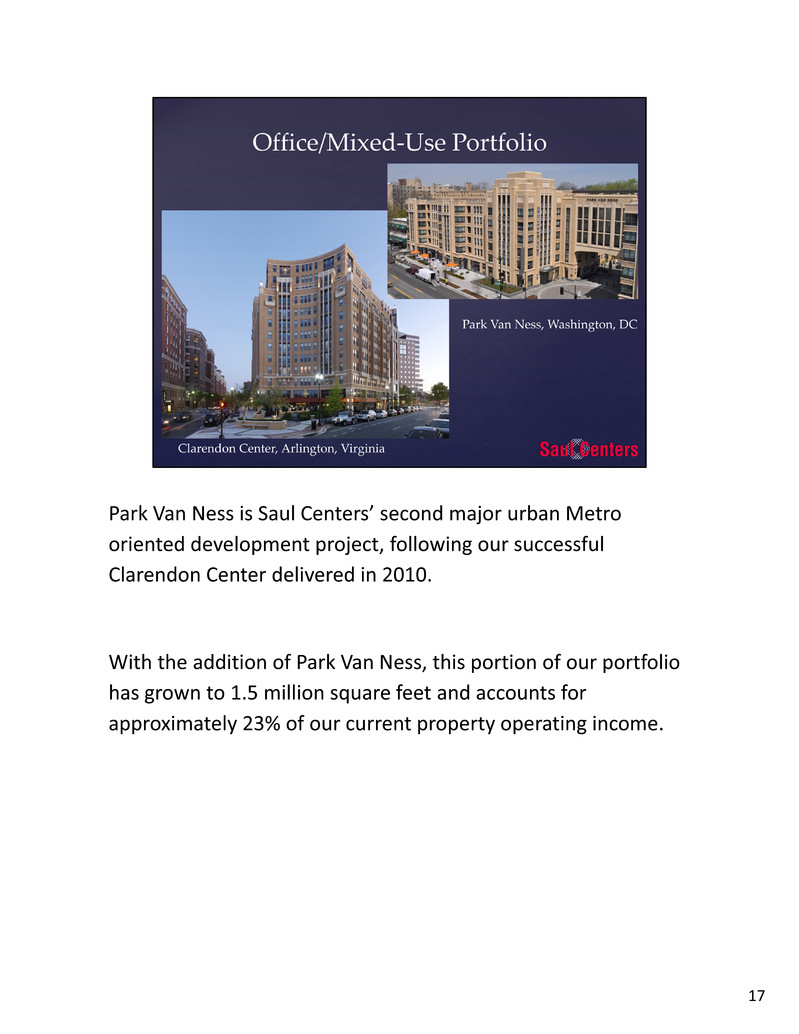

Park Van Ness is Saul Centers’ second major urban Metro oriented development project, following our successful Clarendon Center delivered in 2010. With the addition of Park Van Ness, this portion of our portfolio has grown to 1.5 million square feet and accounts for approximately 23% of our current property operating income. 17

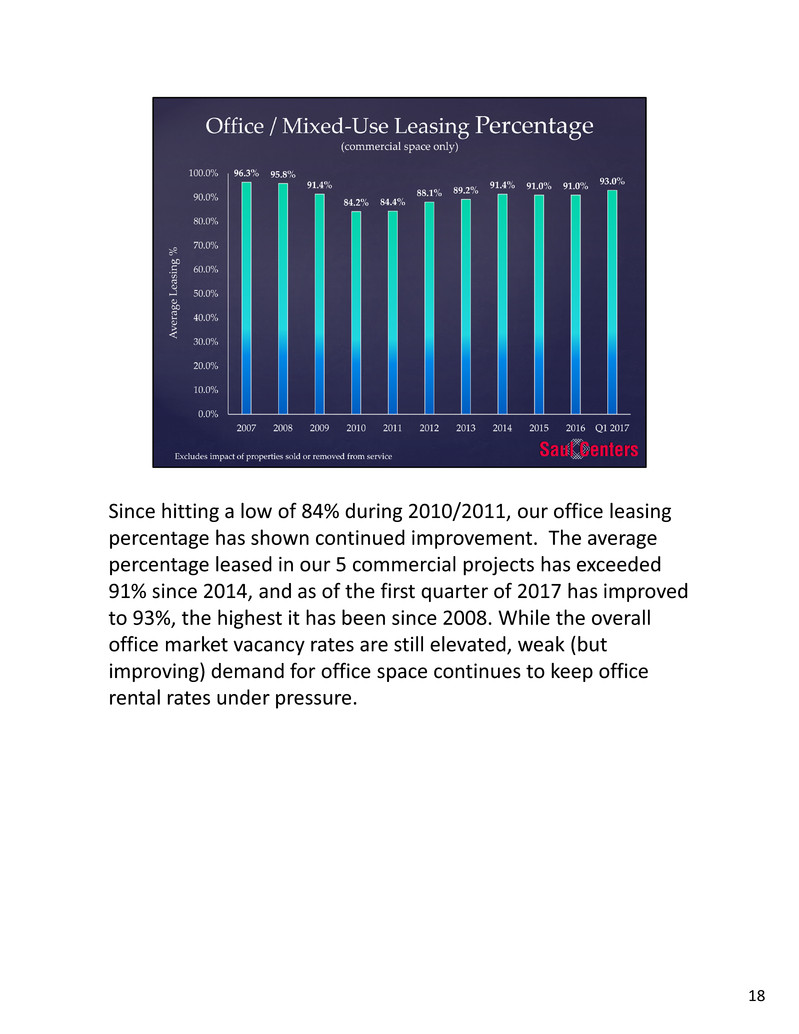

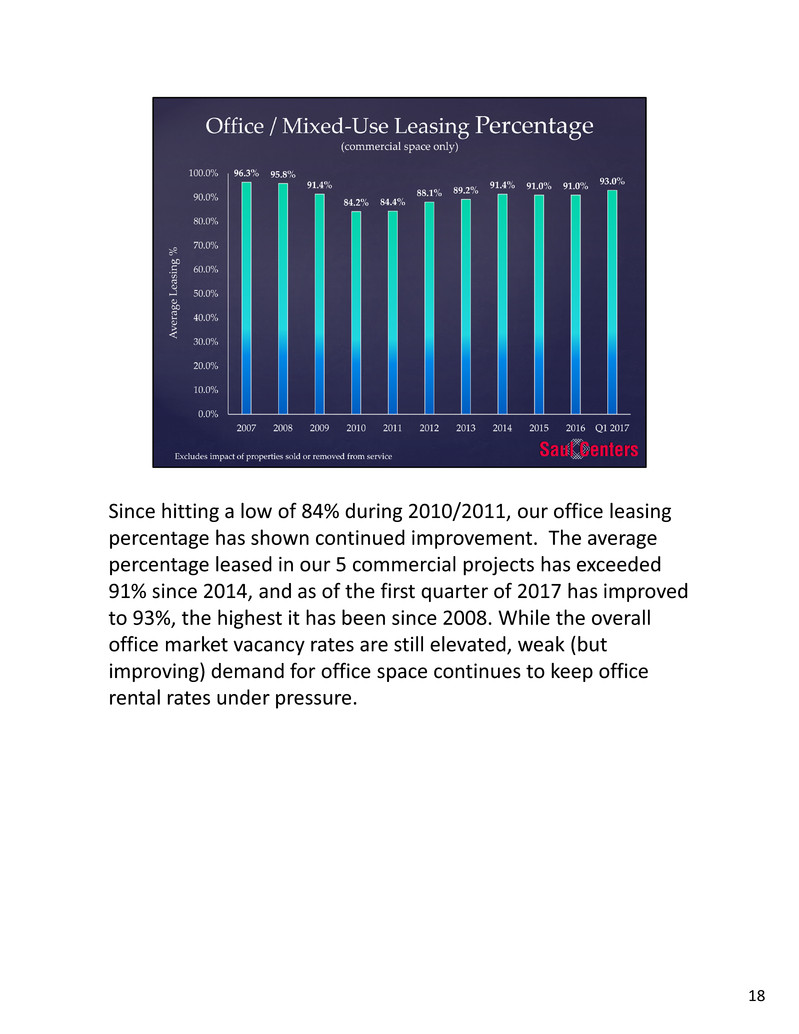

Since hitting a low of 84% during 2010/2011, our office leasing percentage has shown continued improvement. The average percentage leased in our 5 commercial projects has exceeded 91% since 2014, and as of the first quarter of 2017 has improved to 93%, the highest it has been since 2008. While the overall office market vacancy rates are still elevated, weak (but improving) demand for office space continues to keep office rental rates under pressure. 18

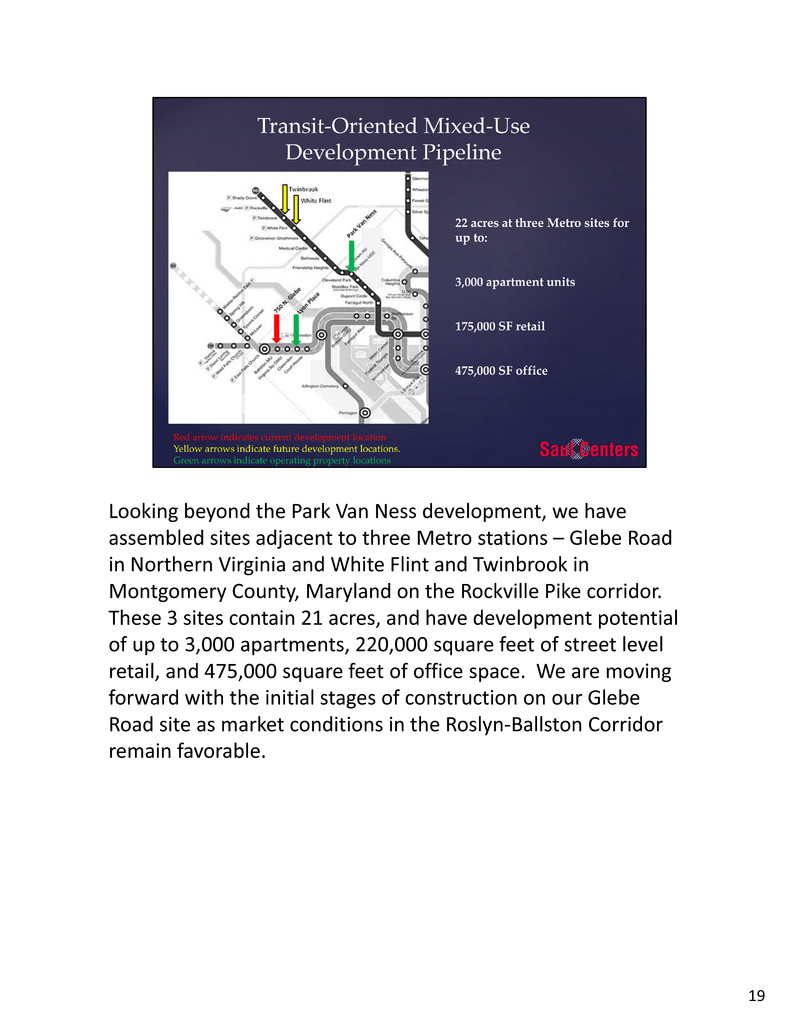

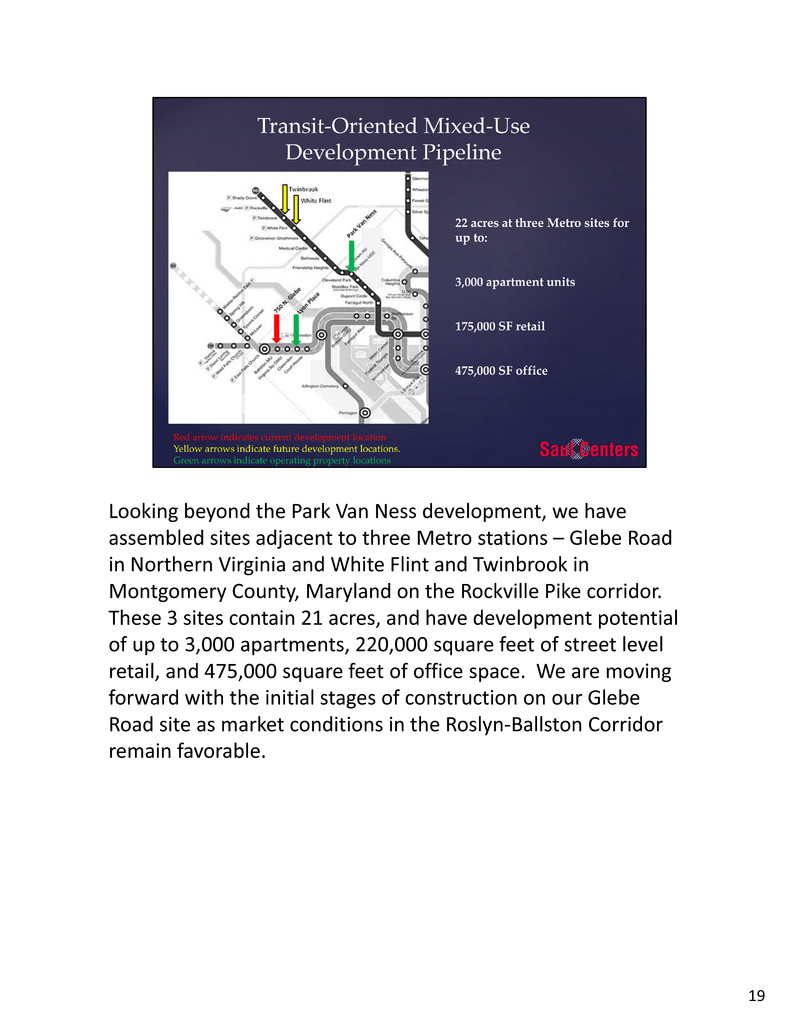

Looking beyond the Park Van Ness development, we have assembled sites adjacent to three Metro stations – Glebe Road in Northern Virginia and White Flint and Twinbrook in Montgomery County, Maryland on the Rockville Pike corridor. These 3 sites contain 21 acres, and have development potential of up to 3,000 apartments, 220,000 square feet of street level retail, and 475,000 square feet of office space. We are moving forward with the initial stages of construction on our Glebe Road site as market conditions in the Roslyn‐Ballston Corridor remain favorable. 19

Final zoning approvals were received in June 2016 for a mixed‐ use building comprised of 490 luxury apartments and 62,000 square feet of street‐level retail space on our 2.8 acre‐site in the Ballston area of Arlington, VA. Existing retail space was razed in late 2016 and we expect excavation to occur during the second quarter of 2017, pending receipt of permits from Arlington County. The project’s total development cost is expected to be approximately $275 million, of which $60 million has already been incurred assembling the land and finalizing zoning and site plan approvals. We have reached terms for project financing, subject to the lender’s final loan committee approval, expected this May. Disclosure of the specifics will be forthcoming. 20

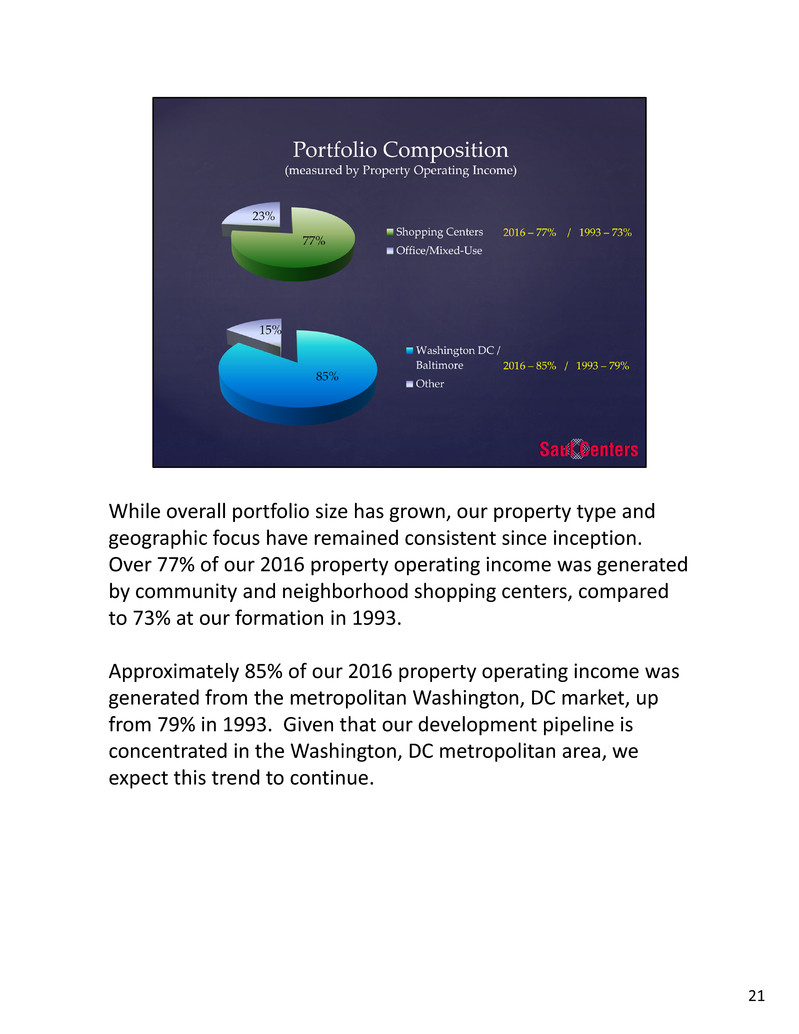

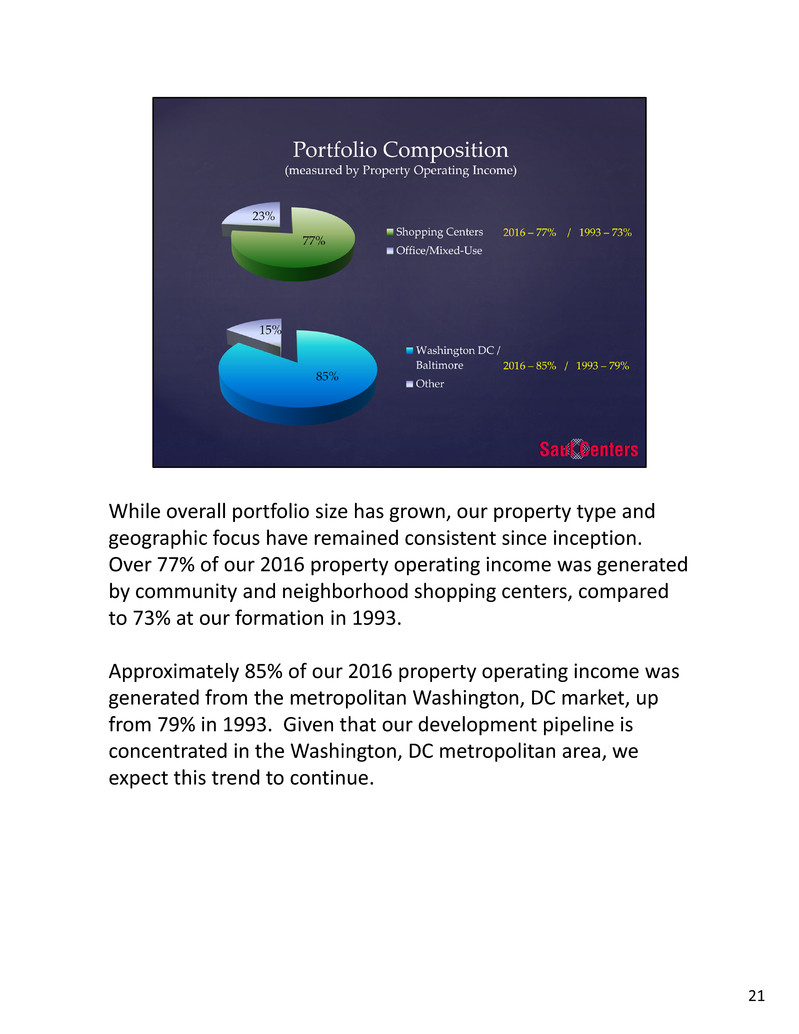

While overall portfolio size has grown, our property type and geographic focus have remained consistent since inception. Over 77% of our 2016 property operating income was generated by community and neighborhood shopping centers, compared to 73% at our formation in 1993. Approximately 85% of our 2016 property operating income was generated from the metropolitan Washington, DC market, up from 79% in 1993. Given that our development pipeline is concentrated in the Washington, DC metropolitan area, we expect this trend to continue. 21

FFO has continued to improve, since dropping to a low during the recession of $2.03 per share in 2011, reaching $3.03 per share in 2016. This is the company’s fourth consecutive year of FFO growth, with 2016 up 2.7% per share from 2015. After four years of $1.44 per share dividend pay‐out from 2010 to 2013, we have raised the dividend annually beginning in 2014. We most recently increased the dividend in January 2017, by 8.5%, to the current annualized rate of $2.04 per share, our historically highest level. 22

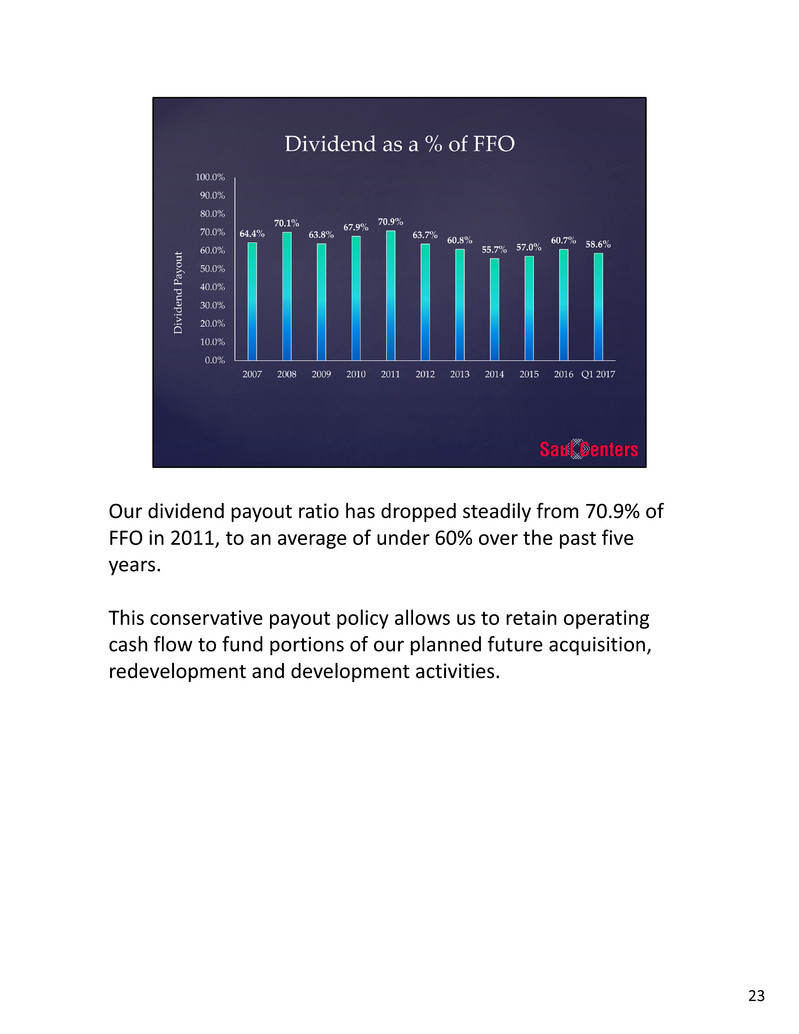

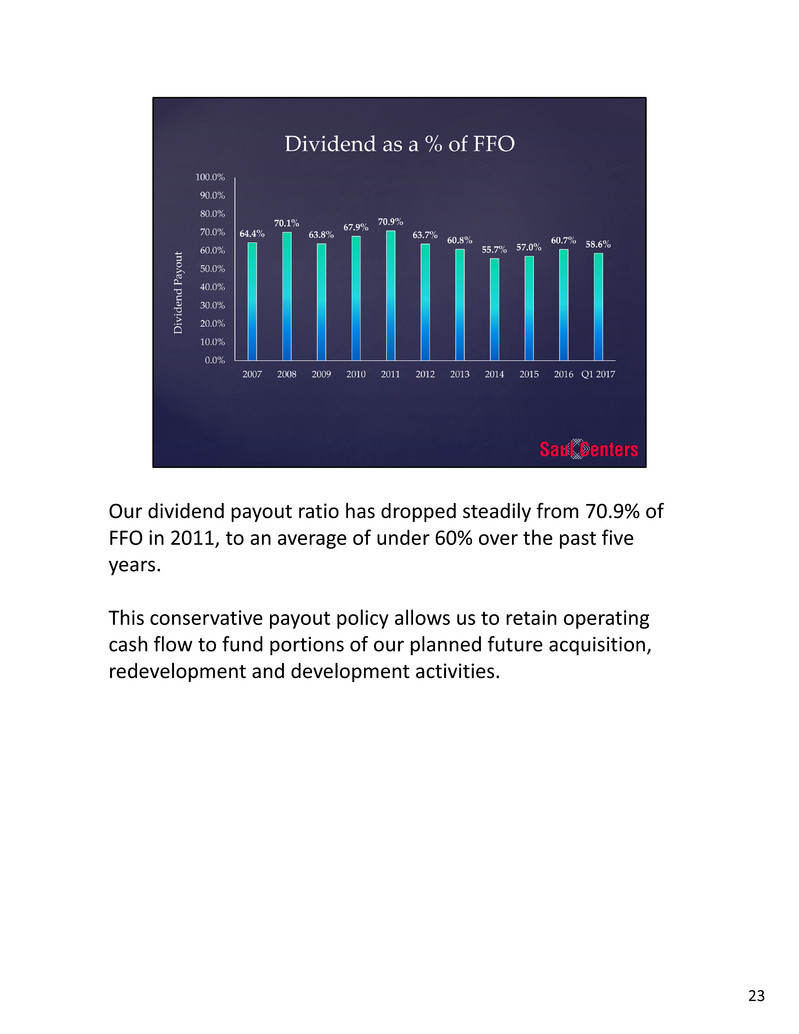

Our dividend payout ratio has dropped steadily from 70.9% of FFO in 2011, to an average of under 60% over the past five years. This conservative payout policy allows us to retain operating cash flow to fund portions of our planned future acquisition, redevelopment and development activities. 23

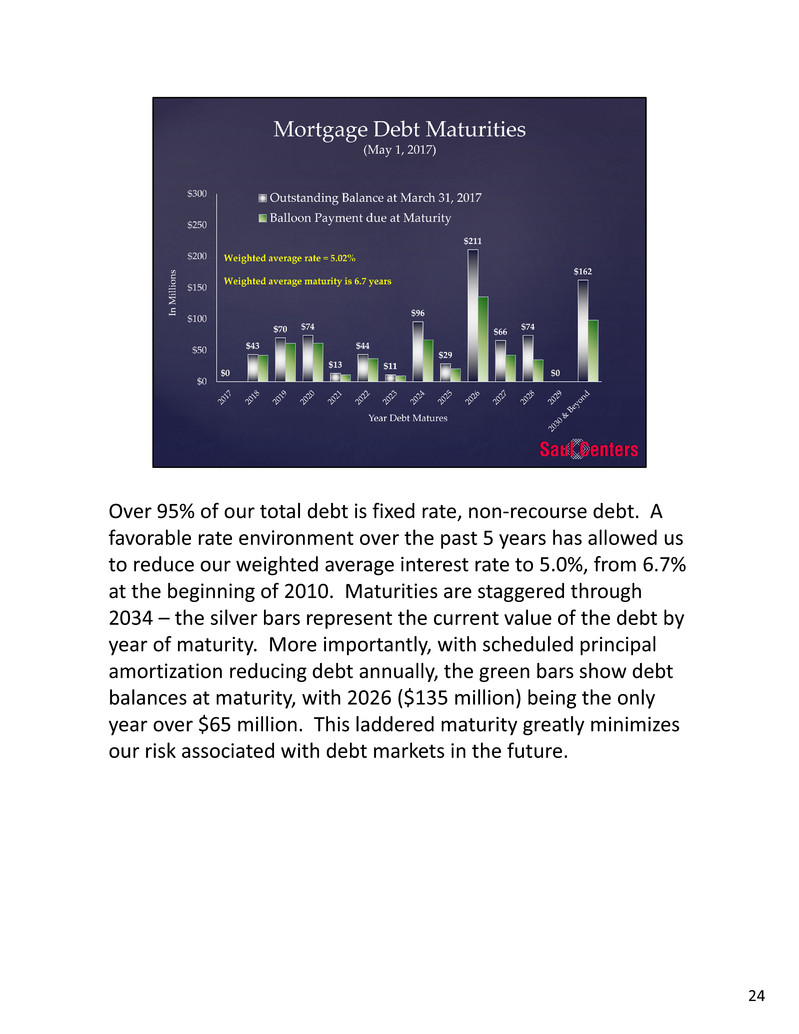

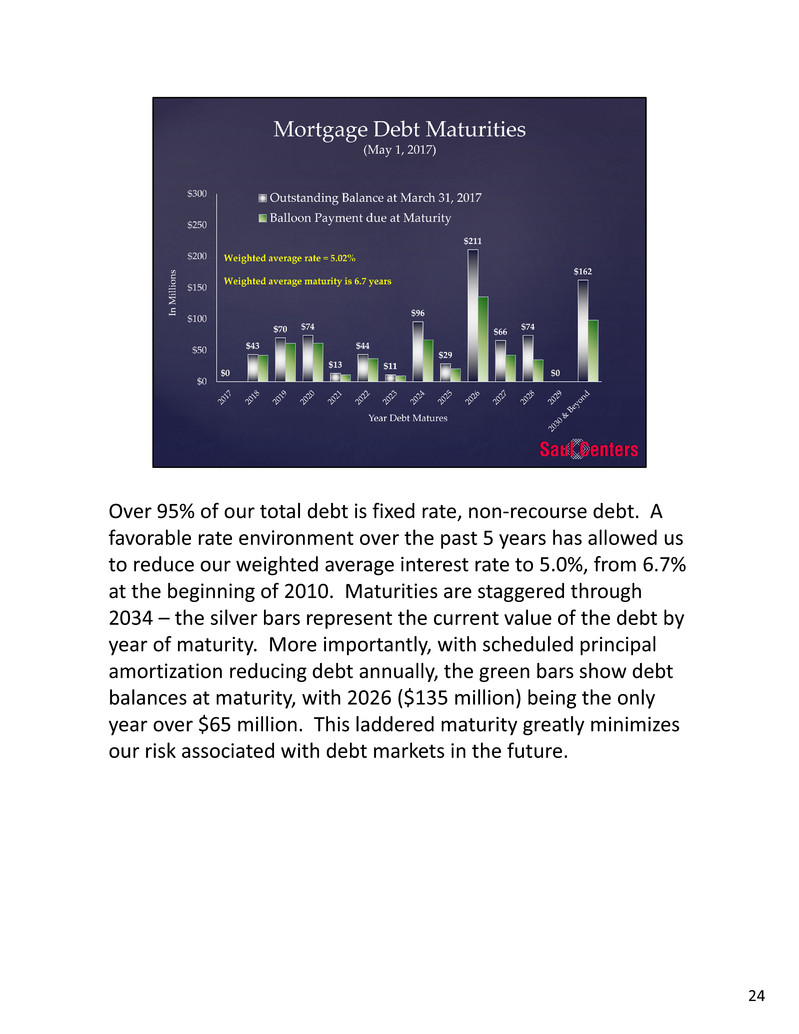

Over 95% of our total debt is fixed rate, non‐recourse debt. A favorable rate environment over the past 5 years has allowed us to reduce our weighted average interest rate to 5.0%, from 6.7% at the beginning of 2010. Maturities are staggered through 2034 – the silver bars represent the current value of the debt by year of maturity. More importantly, with scheduled principal amortization reducing debt annually, the green bars show debt balances at maturity, with 2026 ($135 million) being the only year over $65 million. This laddered maturity greatly minimizes our risk associated with debt markets in the future. 24

Beginning in 1993, we were a company of 29 properties containing 5.3 million square feet of retail and office space. As a result of core property redevelopment, supplemented with acquisitions and new developments and with the latest addition of Park Van Ness, we now have 56 operating properties with approximately 9.5 million square feet. Property operating income of $43 million in 1994 has increased to over $163 million in 2016, a 6.2% compounded annual growth rate over our 23 year history. 25

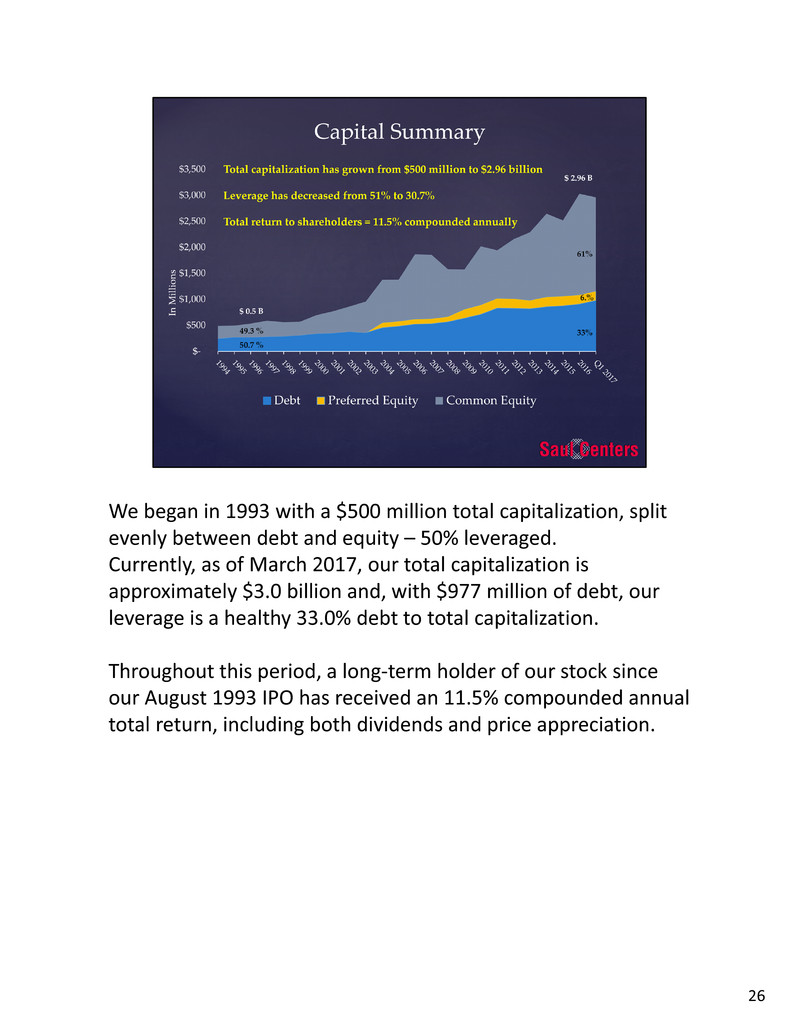

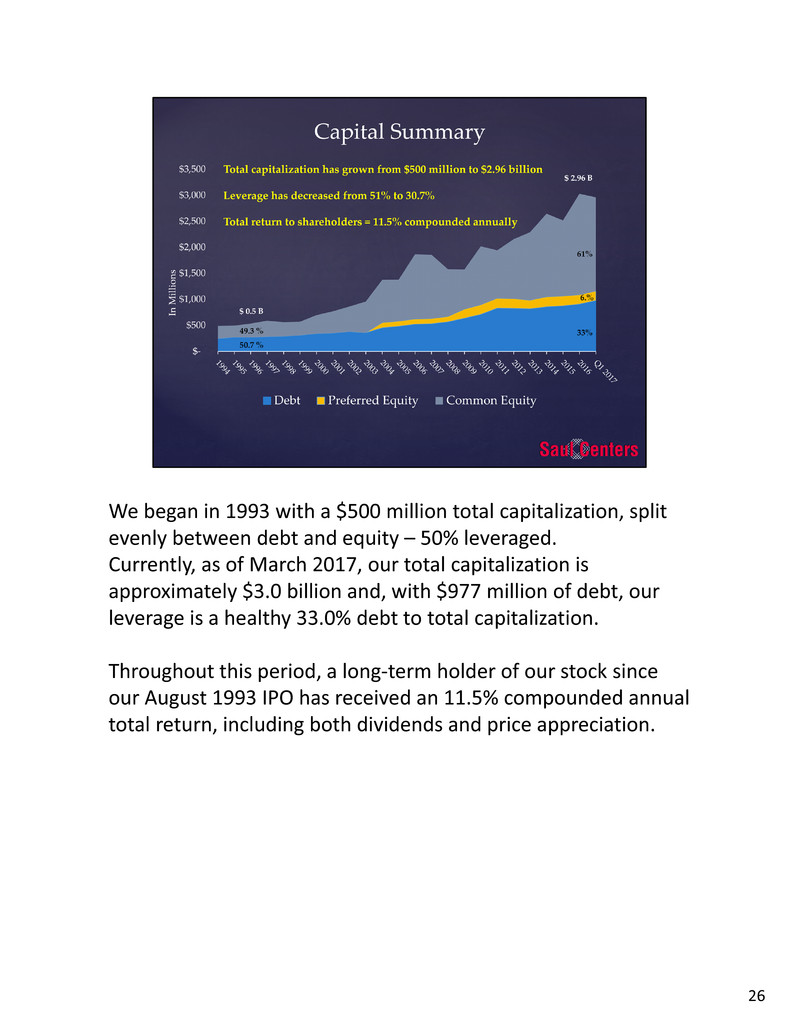

We began in 1993 with a $500 million total capitalization, split evenly between debt and equity – 50% leveraged. Currently, as of March 2017, our total capitalization is approximately $3.0 billion and, with $977 million of debt, our leverage is a healthy 33.0% debt to total capitalization. Throughout this period, a long‐term holder of our stock since our August 1993 IPO has received an 11.5% compounded annual total return, including both dividends and price appreciation. 26

We remain committed to, and confident in, the long‐term growth prospects for our retail and mixed‐use properties. Our balance sheet is strong, and we are prepared for new opportunities moving forward. I now welcome any questions you may have. Adjournment (after questions) 27

28