Investor Presentation Fiscal Third Quarter 2019

Forward-Looking Statements The Company and MetaBank may from time to time make written or oral “forward-looking statements,” including statements contained in this presentation, the Company’s filings with the Securities and Exchange Commission (“SEC”), the Company’s reports to stockholders, and in other communications by the Company and MetaBank, which are made in good faith by the Company pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements by words such as “may,” “hope,” “will,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential,” “continue,” “could,” “future,” or the negative of those terms, or other words of similar meaning or similar expressions. You should carefully read statements that contain these words because they discuss our future expectations or state other “forward-looking” information. These forward-looking statements are based on information currently available to us and assumptions about future events, and include statements with respect to the Company’s beliefs, expectations, estimates, and intentions, which are subject to significant risks and uncertainties, and are subject to change based on various factors, some of which are beyond the Company’s control. Such risks, uncertainties and other factors may cause our actual growth, results of operations, financial condition, cash flows, performance and business prospects and opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. Such statements address, among others, the following subjects: future operating results; our ability to remediate the material weakness in our internal controls over financial reporting and otherwise maintain effective internal controls over financial reporting; customer retention; loan and other product demand; important components of the Company's statements of financial condition and operations; growth and expansion; new products and services, such as those offered by MetaBank or the Company's Payments divisions (which include Meta Payment Systems, Refund Advantage, EPS Financial and Specialty Consumer Services); credit quality and adequacy of reserves; technology; and the Company's employees. The following factors, among others, could cause the Company's financial performance and results of operations to differ materially from the expectations, estimates, and intentions expressed in such forward-looking statements: maintaining our executive management team; the expected growth opportunities, beneficial synergies and/or operating efficiencies from the Crestmark acquisition may not be fully realized or may take longer to realize than expected; customer losses and business disruption related to the Crestmark acquisition; unanticipated or unknown losses and liabilities may be incurred by the Company following the Crestmark acquisition; the costs, risks and effects on the Company of the ongoing federal investigation and bankruptcy proceedings involving DC Solar Solutions, Inc., DC Solar Distribution, Inc., and their affiliates, including the potential financial impact of those matters on the net book value of Company assets leased to DC Solar Distribution and the Company’s ability to recognize certain investment tax credits associated with such assets, and the results of the Company’s review of its due diligence processes with respect to the Company’s alternative energy assets; factors relating to the Company’s share repurchase program; actual changes in interest rates and the Fed Funds rate; additional changes in tax laws; the strength of the United States' economy, in general, and the strength of the local economies in which the Company conducts operations; risks relating to the recent U.S. government shutdown, including any adverse impact on our ability to originate or sell SBA/USDA loans and any delay by the Internal Revenue Service in processing taxpayer refunds, thereby increasing the cost to us of our refund advance loans; the effects of, and changes in, trade, monetary, and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System (the “Federal Reserve”), as well as efforts of the United States Congress and the United States Treasury in conjunction with bank regulatory agencies to stimulate the economy and protect the financial system; inflation, market, and monetary fluctuations; the timely and efficient development of, and acceptance of, new products and services offered by the Company or its strategic partners, as well as risks (including reputational and litigation) attendant thereto, and the perceived overall value of these products and services by users; the risks of dealing with or utilizing third parties, including, in connection with the Company’s refund advance business, the risk of reduced volume of refund advance loans as a result of reduced customer demand for or acceptance of usage of Meta’s strategic partners’ refund advance products; any actions which may be initiated by our regulators in the future; the impact of changes in financial services laws and regulations, including, but not limited to, laws and regulations relating to the tax refund industry and the insurance premium finance industry; our relationship with our primary regulators, the Office of the Comptroller of the Currency and the Federal Reserve, as well as the Federal Deposit Insurance Corporation, which insures MetaBank’s deposit accounts up to applicable limits; technological changes, including, but not limited to, the protection of electronic files or databases; acquisitions; litigation risk, in general, including, but not limited to, those risks involving MetaBank's divisions; the growth of the Company’s business, as well as expenses related thereto; continued maintenance by MetaBank of its status as a well-capitalized institution, particularly in light of our growing deposit base, a portion of which has been characterized as “brokered;” changes in consumer spending and saving habits; and the success of the Company at maintaining its high quality asset level and managing and collecting assets of borrowers in default should problem assets increase. The foregoing list of factors is not exclusive. We caution you not to place undue reliance on these forward-looking statements. The forward-looking statements included herein speak only as of the date of this presentation. All subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this cautionary note. Additional discussions of factors affecting the Company’s business and prospects are reflected under the caption “Risk Factors” and in other sections of the Company’s Annual Report on Form 10-K for the Company's fiscal year ended September 30, 2018 and in other filings made with the SEC. The Company expressly disclaims any intent or obligation to update any forward-looking statements, whether written or oral, that may be made from time to time by or on behalf of the Company or its subsidiaries, whether as a result of new information, changed circumstances or future events or for any other reason. 2 Fiscal Third Quarter 2019 | Nasdaq: CASH

Long-Term Value Drivers Differentiated Model • Target niche commercial and consumer industries to provide opportunities for growth Low-Cost Funding Advantage • National payments business drives low-cost deposits • Re-focus on increasing percentage of funding from core deposits Scalable Lending Platforms • Crestmark acquisition provides scalable commercial finance platform, leveraged to optimize earning asset mix Cross-Selling Opportunities • Cross-selling expected to further enhance efficiencies with lower cost of customer acquisition, utilizing current product distribution channels Positioning in a shifting rate environment • Balance sheet well-positioned for a flat rate environment with emphasis of growing low-cost deposits and replacing lower-yielding assets with higher-yielding assets. Aspirational Target Qualitative Metrics • ROA > 2.0% • Efficiency ratio < 65% 3 Fiscal Third Quarter 2019 | Nasdaq: CASH

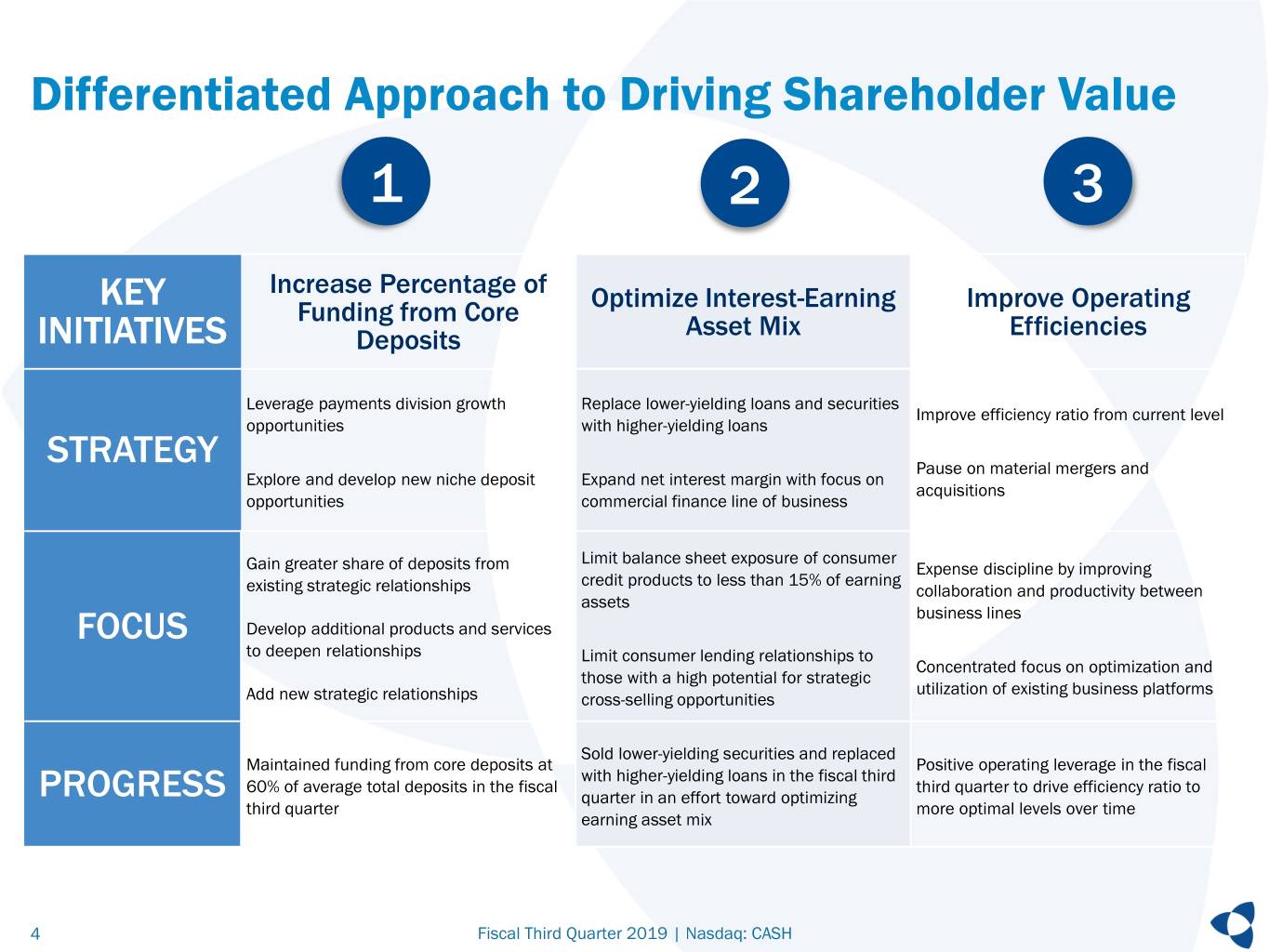

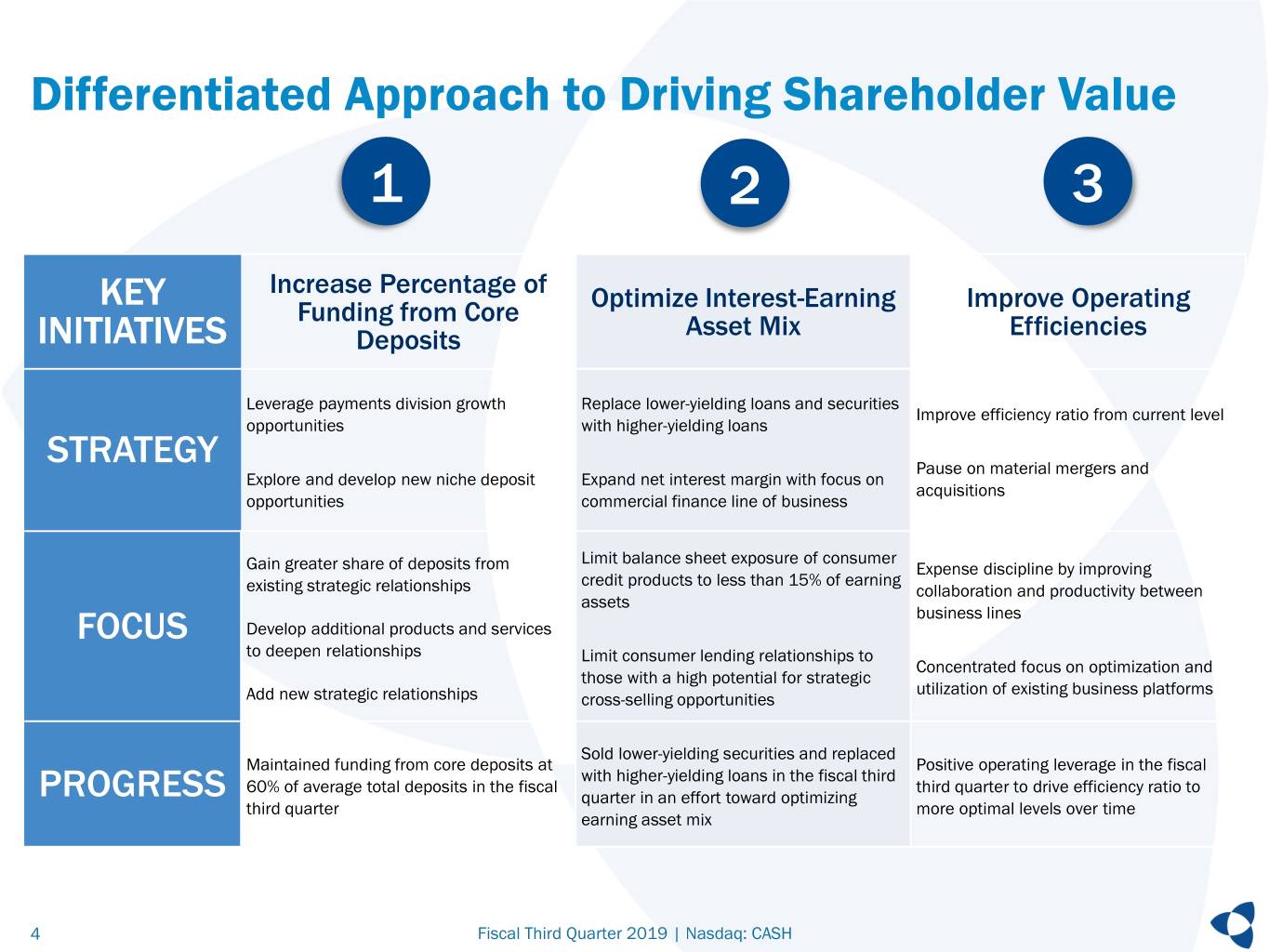

Differentiated Approach to Driving Shareholder Value 1 2 3 KEY Increase Percentage of Optimize Interest-Earning Improve Operating Funding from Core Asset Mix Efficiencies INITIATIVES Deposits Leverage payments division growth Replace lower-yielding loans and securities Improve efficiency ratio from current level opportunities with higher-yielding loans STRATEGY Pause on material mergers and Explore and develop new niche deposit Expand net interest margin with focus on acquisitions opportunities commercial finance line of business Limit balance sheet exposure of consumer Gain greater share of deposits from Expense discipline by improving credit products to less than 15% of earning existing strategic relationships collaboration and productivity between assets business lines FOCUS Develop additional products and services to deepen relationships Limit consumer lending relationships to Concentrated focus on optimization and those with a high potential for strategic utilization of existing business platforms Add new strategic relationships cross-selling opportunities Sold lower-yielding securities and replaced Maintained funding from core deposits at Positive operating leverage in the fiscal with higher-yielding loans in the fiscal third 60% of average total deposits in the fiscal third quarter to drive efficiency ratio to PROGRESS quarter in an effort toward optimizing third quarter more optimal levels over time earning asset mix 4 Fiscal Third Quarter 2019 | Nasdaq: CASH

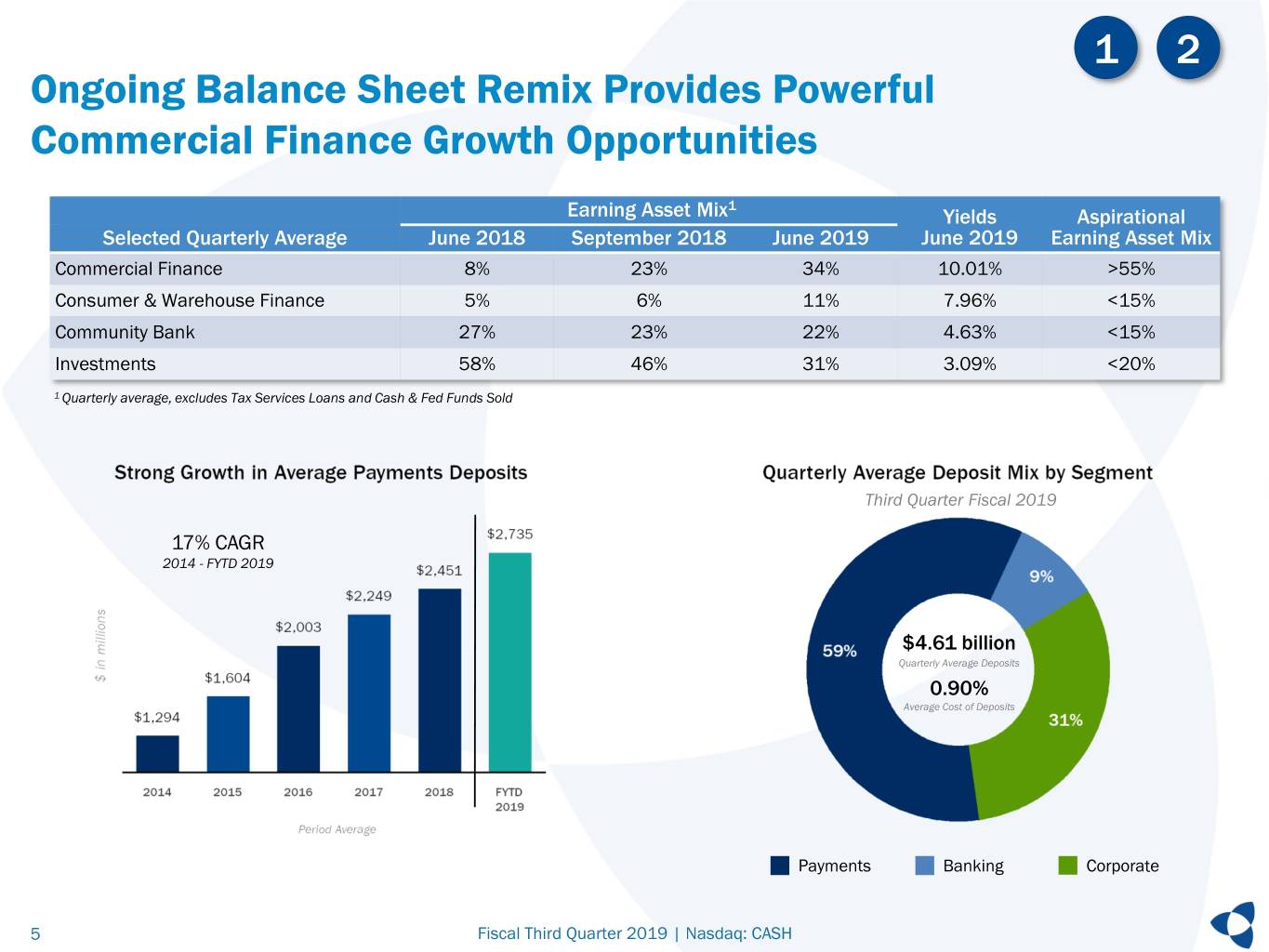

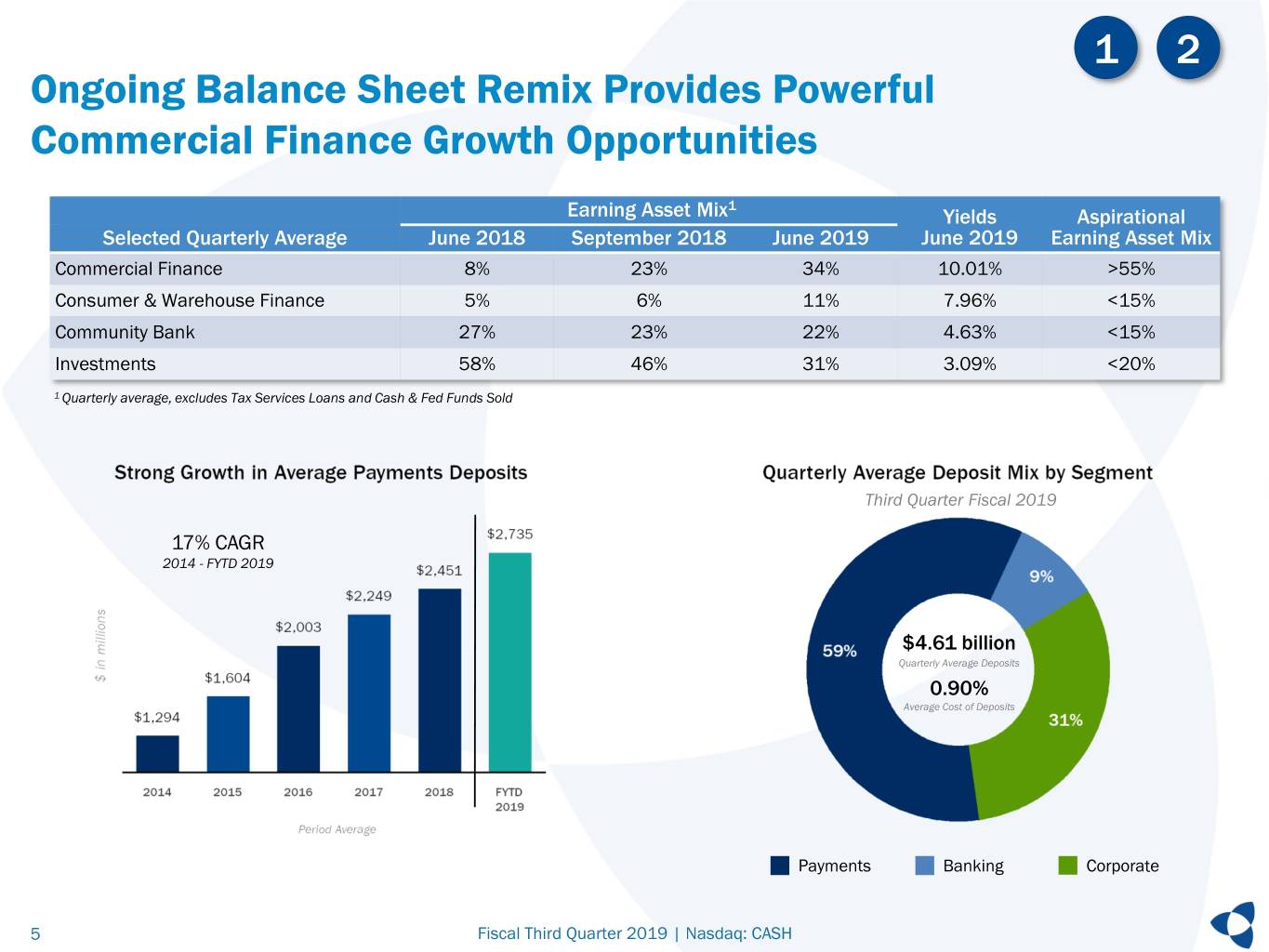

1 2 Ongoing Balance Sheet Remix Provides Powerful Commercial Finance Growth Opportunities 1 Earning Asset Mix Yields Aspirational Selected Quarterly Average June 2018 September 2018 June 2019 June 2019 Earning Asset Mix Commercial Finance 8% 23% 34% 10.01% >55% Consumer & Warehouse Finance 5% 6% 11% 7.96% <15% Community Bank 27% 23% 22% 4.63% <15% Investments 58% 46% 31% 3.09% <20% 1 Quarterly average, excludes Tax Services Loans and Cash & Fed Funds Sold Third Quarter Fiscal 2019 17% CAGR 2014 - FYTD 2019 $4.61 billion Quarterly Average Deposits 0.90% Average Cost of Deposits Payments Banking Corporate 5 Fiscal Third Quarter 2019 | Nasdaq: CASH

2 Rising Loan Yields and More Compelling Asset Mix Driving Differentiated NIM Expansion Closed Crestmark Acquisition August 1, 2018. Yield on Loans Net Interest Margin SNL U.S. Banks $2B-$10B1 Net Interest Margin 1 SNL U.S. Bank $2-10B; includes all Banks in SNL's coverage universe with $2B to $10B in Assets. Q3 2019 (June 30) SNL data not yet available. 6 Fiscal Third Quarter 2019 | Nasdaq: CASH

2 Diversified Loan Growth At the Quarter Ended June 30, 2018 March 31, 2019 June 30, 2019 3Q19 % Change From ($ in thousands) 3Q18 2Q19 3Q19 2Q19 3Q18 Commercial Finance 315,021 1,665,891 1,835,850 10.2% 482.8% Asset based lending — 572,210 615,309 7.5% NM Factoring — 287,955 320,344 11.2% NM Lease financing — 321,414 341,957 6.4% NM Insurance premium finance 303,603 307,875 358,772 16.5% 18.2% SBA/USDA — 77,481 99,791 28.8% NM Other commercial finance 11,418 98,956 99,677 0.7% 773.0% Consumer Finance 220,927 310,441 320,266 3.2% 45.0% National National Lending Consumer Credit Programs 26,583 139,617 155,539 11.4% 485.1% Other consumer finance 194,344 170,824 164,727 (3.6)% (15.2)% Tax Services 14,281 84,824 24,410 (71.2)% 70.9% Warehouse Finance — 186,697 250,003 33.9% NM Community Banking 1,048,946 1,187,163 1,195,434 0.7% 14.0% Commercial Real Estate & Op. 751,146 869,917 877,412 0.9% 16.8% 1-4 Family Real Estate & Other 237,704 257,079 256,853 (0.1)% 8.1% Agricultural loans 60,096 60,167 61,169 1.7% 1.8% Total National Lending 550,229 2,247,853 2,430,529 8.1% 341.7% Total Community Banking 1,048,946 1,187,163 1,195,434 0.7% 14.0% Total Gross Loans & Leases 1,599,175 3,435,016 3,625,963 5.6% 126.7% 7 Fiscal Third Quarter 2019 | Nasdaq: CASH

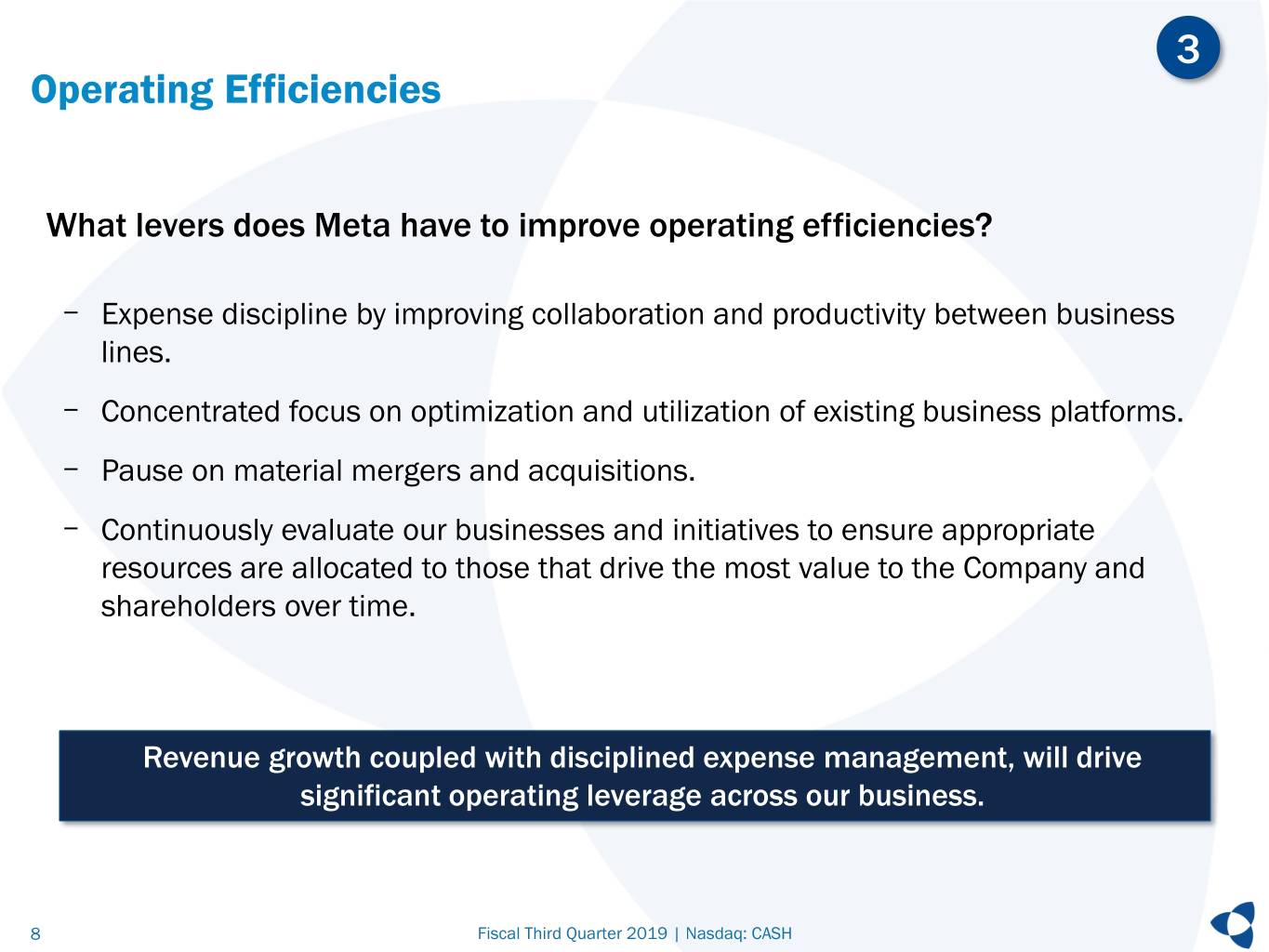

3 Operating Efficiencies What levers does Meta have to improve operating efficiencies? - Expense discipline by improving collaboration and productivity between business lines. - Concentrated focus on optimization and utilization of existing business platforms. - Pause on material mergers and acquisitions. - Continuously evaluate our businesses and initiatives to ensure appropriate resources are allocated to those that drive the most value to the Company and shareholders over time. Revenue growth coupled with disciplined expense management, will drive significant operating leverage across our business. 8 Fiscal Third Quarter 2019 | Nasdaq: CASH

Company Targeted Focus Areas Strategic, tailored solutions to facilitate money movement, enabling payments providers to Payments grow their businesses and build more profitable customer relationships by creating, delivering and sponsoring payment solutions Incorporated in 1993, is the holding company for its full-service banking subsidiary, MetaBank. Provide customized national business capital Commercial solutions for small-and medium-sized businesses with innovative financial solutions Lending to niche markets; also provide traditional Founded in 1954, MetaBank has grown to operate in several different financial banking services within local branch footprint sectors, including: payments, commercial finance, tax services, community banking and consumer lending. Consumer Focused on strategic relationships to build greater cross-sell opportunities, particularly with Lending our market-leading payments relationships 9 Fiscal Third Quarter 2019 | Nasdaq: CASH

Payments 10 Fiscal Third Quarter 2019 | Nasdaq: CASH

Payments Solutions Prepaid Demand Deposits ACH Meta is a leader in applying innovative How DDA delivers value for consumers Turnkey and flexible ACH payments prepaid solutions to address key consumer implementation and business payments needs. Promotes strong direct deposit relationship, acceptance with online and - Enables organizations to debit and credit digital funds transfer accounts using checking and routing numbers ISSUED Access to overdraft protection to - Affordable flexible multiple window processing MORE 1 BILLION support users during times of income with available Same Day Services THAN CARDS shortfalls - Leverage Meta’s expertise to design, Enables financial independence, better implement, and manage complex payment Consumer gifts money management and self-service systems with ease digital lifestyle Travel Cards - Partner-driven approach with ability to Provides digital bank account appeal for Commercial Prepaid support third-party service providers as well Gen Y/ Millennials, economic strivers as third-party senders and gig workers Payroll Of NACHA’s 2018 Top 50 Banks Receiving Employee or Consumer Incentives Key Product Features and Originating Payments, MetaBank ranked: Tax Refunds - Online account opening and real-time account 7.0% origination with online and mobile account access 25 Receiving volume Retail General Purpose Reloadable - Multiple ways to fund account including: ACH and Debits and Credits Y/Y direct deposit, mobile remote deposit capture, Corporate Refunds or Disbursements and even cash deposits at licensed money transmitters 6.0% - Use where major credit cards are accepted 34 Originating volume Prepaid offers several use cases to Debits and Credits Y/Y improve the electronic exchange of value - Live customer service agents to assist with chargebacks and disputes, error resolutions Source: https://www.nacha.org/system/files/2019-05/Nacha-Top-50-of-2018.pdf 11 Fiscal Third Quarter 2019 | Nasdaq: CASH

Commercial Finance 12 Fiscal Third Quarter 2019 | Nasdaq: CASH

Commercial Finance Growth Engine Asset Based Lending. Provide asset-based loans secured by assets such as inventory, accounts receivable, machinery & equipment, work-in-process and other assets. Other $99.7M SBA/USDA $99.8M Lease Financing. Provide flexible leasing solutions for technology, capital equipment and select transportation assets like tractors, trailers and construction equipment. Asset Based Factoring Lending $320.3M $615.3M Insurance Premium Finance. Provide short-term, primarily collateralized financing to facilitate the commercial $1.84 billion customers’ purchase of insurance for various forms of risk. National Commercial Finance Portfolio as of June 30, 2019 Factoring. Provide factoring services where clients provide detailed inventory, accounts receivable, and work-in-process reports for lending arrangements. Lease Financing $342.0M SBA/USDA. Originate loans through programs partially Insurance Premium Finance $358.8M guaranteed by the SBA or USDA. Other Commercial Finance. Includes healthcare receivables loan portfolio primarily comprised of loans to individuals for medical services received. Majority of these loans are guaranteed by the hospital. Also includes providing other See Appendix, slide 20, for an overview of the underlying credit philosophy for the Company's commercial finance portfolio lending solutions to commercial finance customers. 13 Fiscal Third Quarter 2019 | Nasdaq: CASH

Experienced Management Team Offers Consultative Approach to Targeted Commercial Finance Clients on Nationwide Basis • Seasoned management team Commercial Finance Industry Concentrations1 – Average tenure at Crestmark of 13 years – Average of over 25 years of banking or specialty finance experience • Well-known to turnaround specialists, lawyers and CPAs for assisting highly-leveraged companies with low liquidity and cash needs • Active involvement in trade associations and cooperatives to develop referral sources • Competition includes independent factoring companies, merchant cash advances, finance companies, equipment leasing companies and middle-market banks Commercial Finance Geographic Concentrations1 CA 19.7% Other 2 34.7% TX 11.3% MI MO 9.2% 3.2% NC 3.3% NY FL 3.7% IL 6.4% 2 3.8% OH 4.7% 1 Excludes joint ventures and commercial insurance premium finance portfolios; percentages calculated based on aggregate principal amount of loans 2 Other represents any concentration that makes up less than 5% of a given industry and less than 3% for a geographic concentration 14 Fiscal Third Quarter 2019 | Nasdaq: CASH

Risk Management in Commercial Finance Underlying credit philosophy is fundamentally collateral-based lending with underwriting and monitoring focused on the risk management and administrative controls of the collateral borrowing base. Loans are underwritten to ensure that the Bank can recover the full loan exposure from the collateral in the event of a default or liquidation scenario. • Asset-Based Lending ("ABL") and Factoring - The Bank adjusts the advance rate, loan size and credit terms primarily based on an assessment of the collateral and the cash flow of the borrower. Typical advance rates of A/R are 70%-85% of eligible collateral. Advance rates for inventory are typically in the range of 40%-50%. – For most clients, through dominion of funds, all client funds are received through a Bank-controlled lockbox arrangement, whereby cash is applied directly to pay down the revolving loan balance, often on a daily basis. ABL products are "demand" products, and the Bank is under no obligation to make future advances. The Bank conducts regular client site visits in order to conduct field examinations of books, records and to substantiate collateral values. • Insurance Premium Finance loans are collateralized by unearned insurance premiums, typically under 9- or 10-month terms. Candidates for lease financing and longer-term asset financing are analyzed similar to traditional bank underwriting methods where cash flow, liquidity, balance sheet strength and, to a lesser extent, collateral quality are the focus. • Direct financing leases are underwritten with and without residual exposure. For leases with residual exposure, the Bank estimates the residual value of the asset at the time of financing based on the cost of the asset, the term of the lease, the effective lease rate and the expected value of the leased asset at the end of the financing term. Finance leases without residuals are structured so that the Bank does not have financial asset value exposure at end of lease as the lessor retains the rights to the residual value. The Bank may structure leases with a large first payment that serves as an effective down payment to mitigate counterparty risk. • The Small Business Administration (the "SBA") guarantees 75% of a 7(a) loan, and this portion can be sold for a premium with funds then available for redeployment by the Bank. Completed submission packages with full underwriting are provided to the SBA for pre-approval. The USDA loan program, primarily utilized for alternative energy sector, leverages expertise in these industries where the Bank has generated significant tax credits, with guarantees up to 80% and other terms often more attractive than the SBA program. 15 Fiscal Third Quarter 2019 | Nasdaq: CASH

Quarterly Financial Highlights Third Quarter Fiscal Year 2019 16 Fiscal Third Quarter 2019 | Nasdaq: CASH

Financial Highlights Third Quarter Ended June 30, 2019 • Net income of $29.3 million, or $0.75 per diluted share, for the quarter. • Net interest margin ("NIM") increased to 5.07% for the fiscal 2019 third quarter, up 213 basis points from the fiscal 2018 third quarter. – Net purchase accounting accretion contributed 25 basis points for the fiscal 2019 third quarter. • Total gross loans and leases increased by $2.03 billion, or 127%, compared to June 30, 2018, and $190.9 million, or 5.6%, compared to the linked-quarter. • Average payments deposits grew 10.8% compared to the prior fiscal year third quarter average. • Repurchased 1,574,734 shares under the stock repurchase program at an average price of $27.31 per share. Quarter Ended Quarter Ended Quarterly Average 17 Fiscal Third Quarter 2019 | Nasdaq: CASH

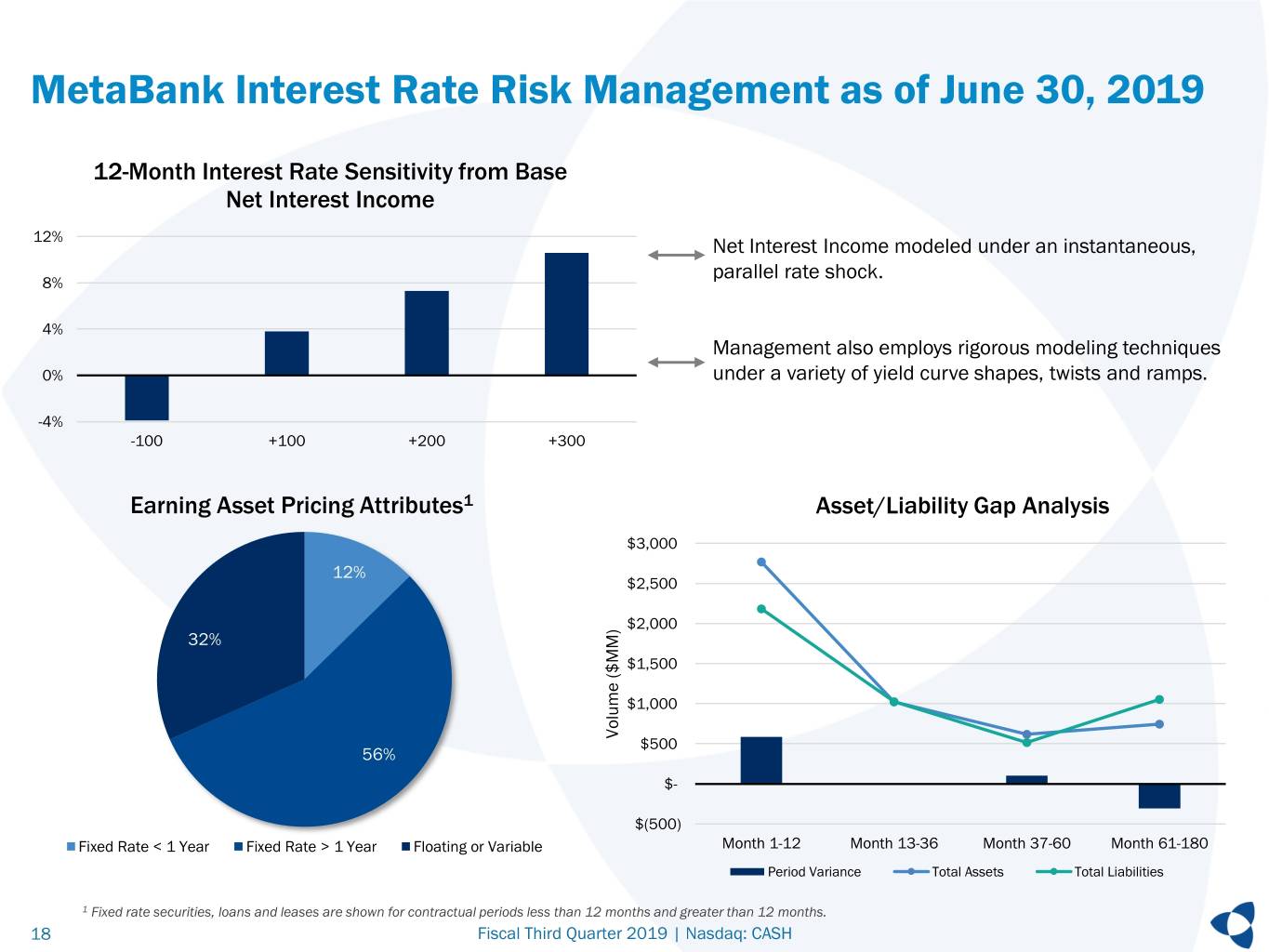

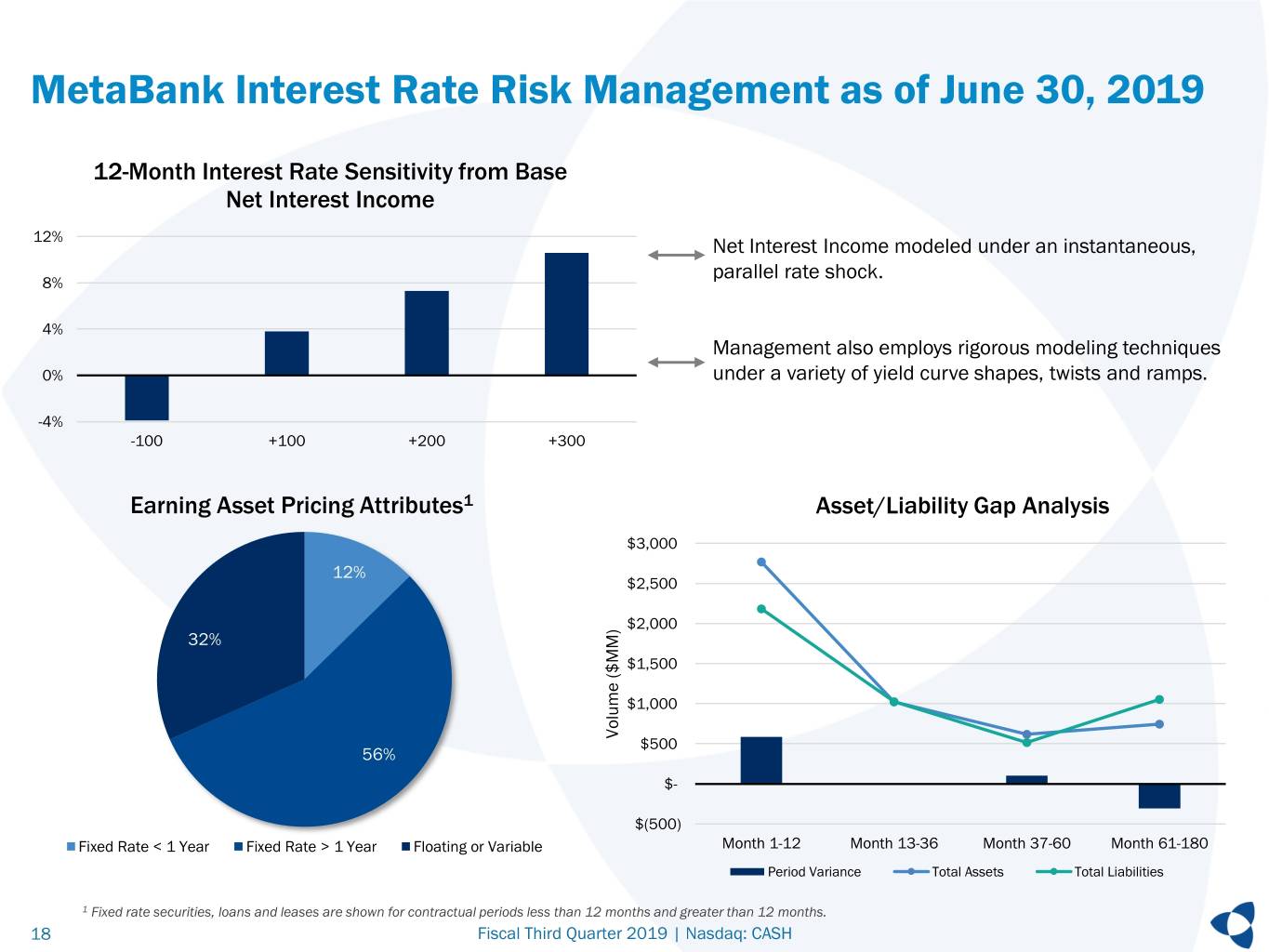

MetaBank Interest Rate Risk Management as of June 30, 2019 12-Month Interest Rate Sensitivity from Base Net Interest Income 12% Net Interest Income modeled under an instantaneous, parallel rate shock. 8% 4% Management also employs rigorous modeling techniques 0% under a variety of yield curve shapes, twists and ramps. -4% -100 +100 +200 +300 Earning Asset Pricing Attributes1 Asset/Liability Gap Analysis $3,000 12% $2,500 $2,000 32% $1,500 $1,000 Volume($MM) $500 56% $- $(500) Fixed Rate < 1 Year Fixed Rate > 1 Year Floating or Variable Month 1-12 Month 13-36 Month 37-60 Month 61-180 Period Variance Total Assets Total Liabilities 1 Fixed rate securities, loans and leases are shown for contractual periods less than 12 months and greater than 12 months. 18 Fiscal Third Quarter 2019 | Nasdaq: CASH

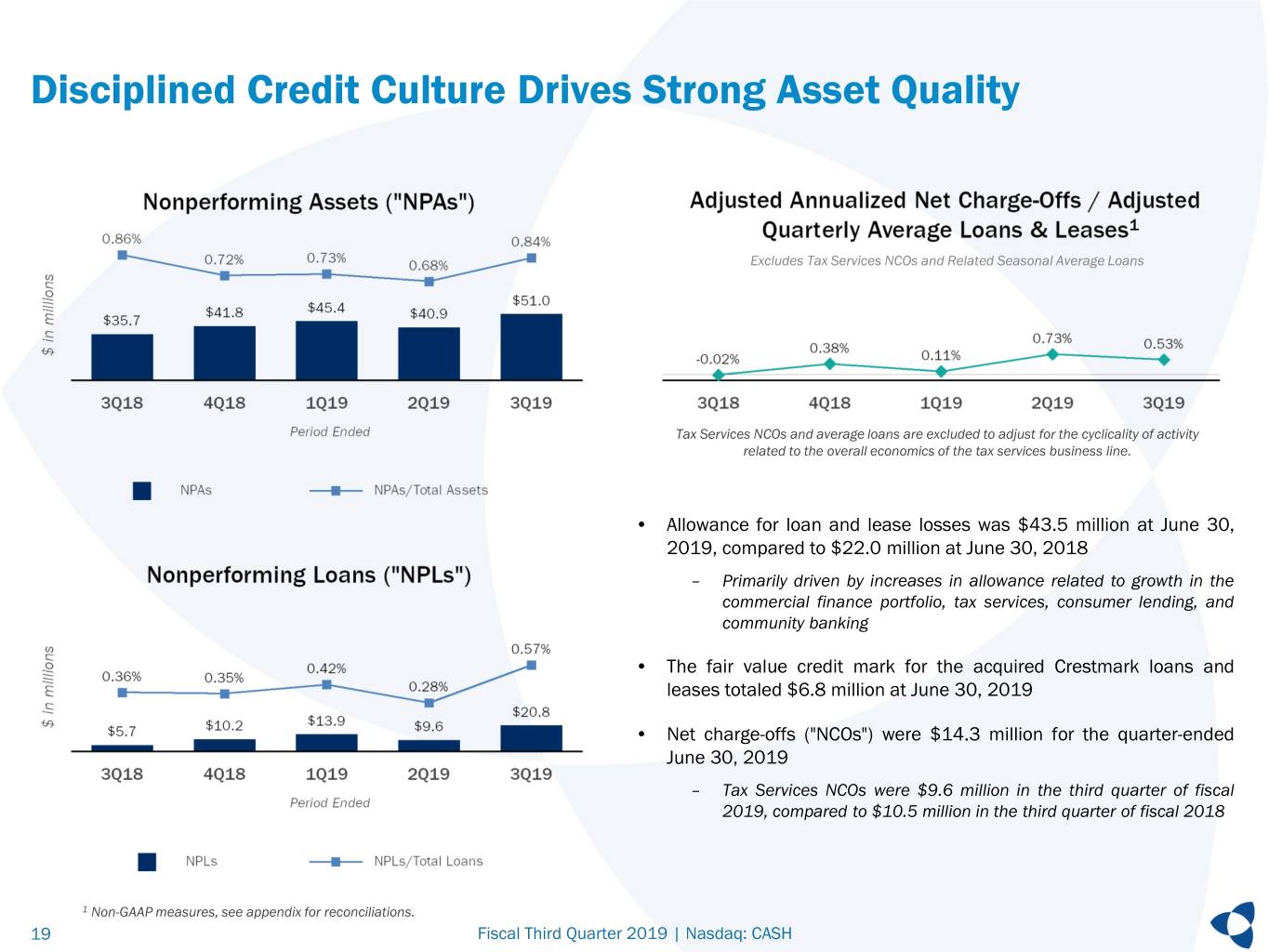

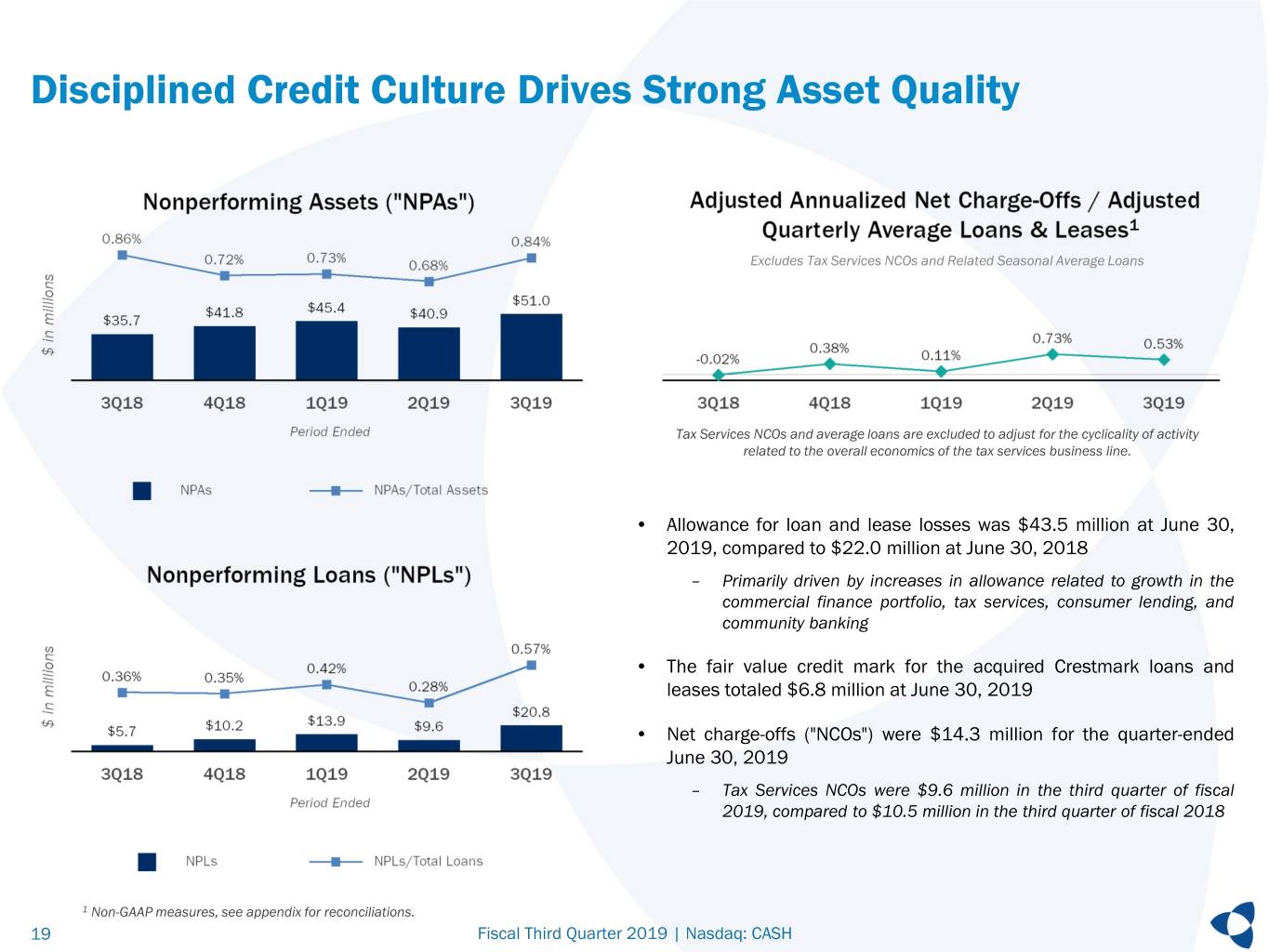

Disciplined Credit Culture Drives Strong Asset Quality 1 Excludes Tax Services NCOs and Related Seasonal Average Loans Tax Services NCOs and average loans are excluded to adjust for the cyclicality of activity related to the overall economics of the tax services business line. • Allowance for loan and lease losses was $43.5 million at June 30, 2019, compared to $22.0 million at June 30, 2018 – Primarily driven by increases in allowance related to growth in the commercial finance portfolio, tax services, consumer lending, and community banking • The fair value credit mark for the acquired Crestmark loans and leases totaled $6.8 million at June 30, 2019 • Net charge-offs ("NCOs") were $14.3 million for the quarter-ended June 30, 2019 – Tax Services NCOs were $9.6 million in the third quarter of fiscal 2019, compared to $10.5 million in the third quarter of fiscal 2018 1 Non-GAAP measures, see appendix for reconciliations. 19 Fiscal Third Quarter 2019 | Nasdaq: CASH

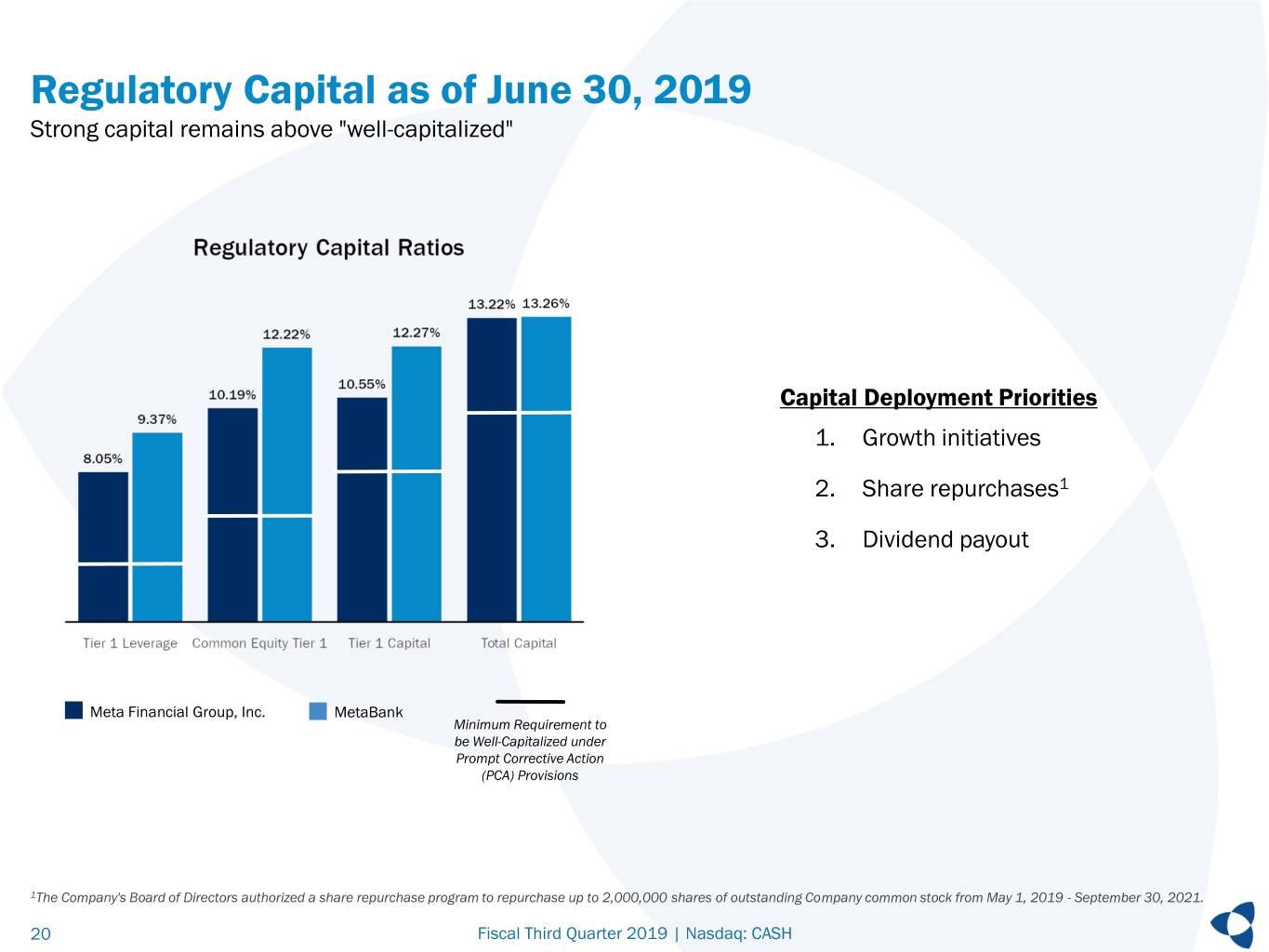

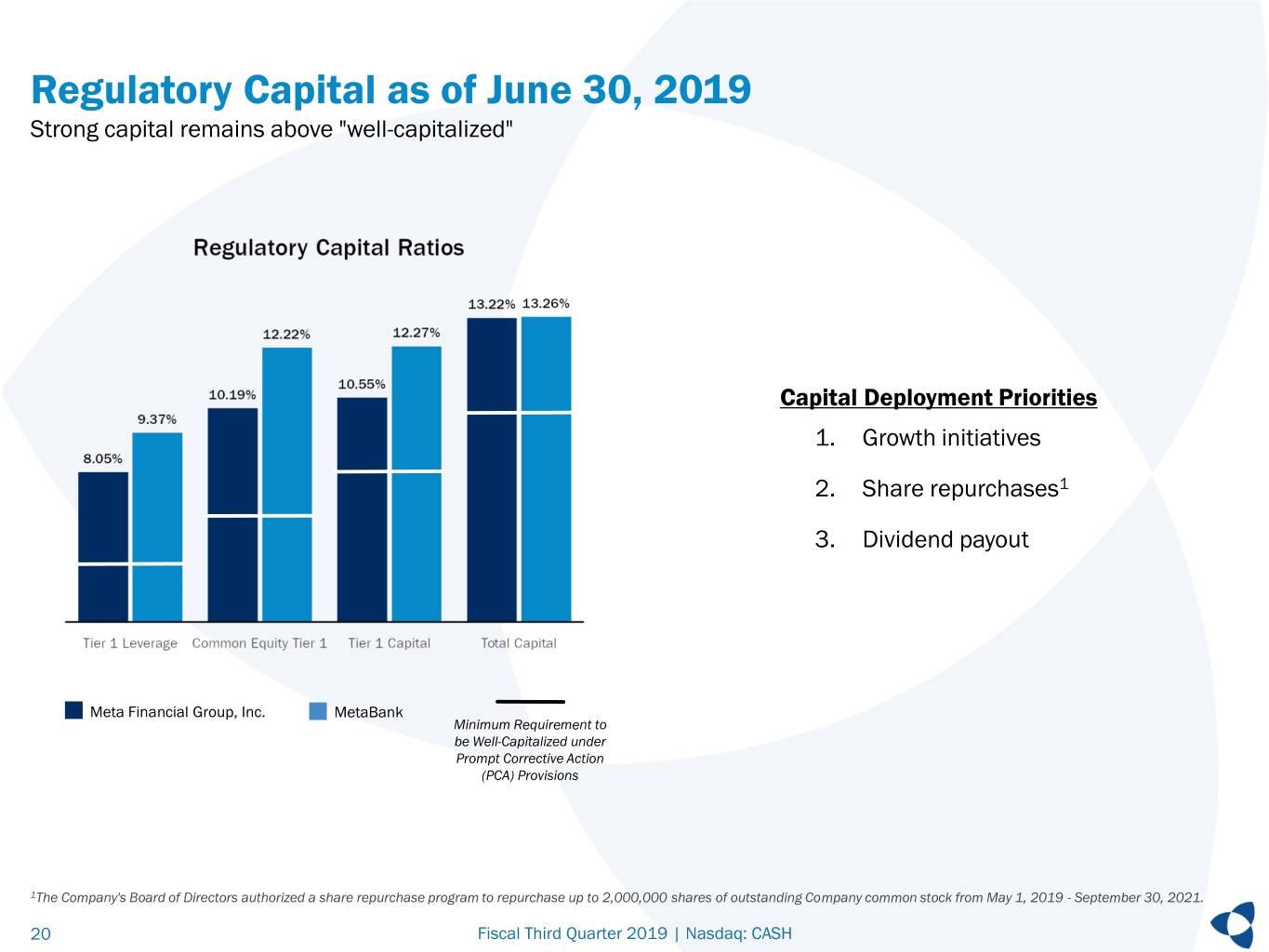

Regulatory Capital as of June 30, 2019 Strong capital remains above "well-capitalized" Capital Deployment Priorities 1. Growth initiatives 2. Share repurchases1 3. Dividend payout Meta Financial Group, Inc. MetaBank Minimum Requirement to be Well-Capitalized under Prompt Corrective Action (PCA) Provisions 1The Company's Board of Directors authorized a share repurchase program to repurchase up to 2,000,000 shares of outstanding Company common stock from May 1, 2019 - September 30, 2021. 20 Fiscal Third Quarter 2019 | Nasdaq: CASH

Investment Highlights Differentiated Model Low-Cost Funding Advantage Scalable Lending Platforms Cross-Selling Opportunities Positioning in a shifting rate environment 21 Fiscal Third Quarter 2019 | Nasdaq: CASH

Appendix 22 Fiscal Third Quarter 2019 | Nasdaq: CASH

Quarterly Income Statement 3Q19 Change From ($ in millions, except per share data) 3Q18 2Q19 3Q19 2Q19 3Q18 $ % $ % Net Interest Income 28.4 71.4 67.0 (4.4) (6)% 38.6 136% Card & Deposit Fee Income 23.9 25.1 21.9 (3.3) (13)% (2.1) (9)% Refund Transfer Product Fee Income 7.4 31.6 6.7 (24.9) (79)% (0.7) (9)% Tax Advance Fee Income — 33.0 — (33.0) NM 0.1 NM Rental Income — 9.9 9.4 (0.5) (5)% 9.4 NM Gain/(Loss) on Sale of Loans and Leases — 1.1 1.9 0.8 76% 1.9 NM Other Income 2.0 4.3 3.9 (0.4) (9)% 1.9 97% Total Revenue $ 61.6 $ 176.4 $ 110.8 $ (65.6) (37)% $ 49.1 80% Compensation and Benefits 24.4 49.2 35.2 (14.0) (28)% 10.7 44% Card Processing Expense 7.1 7.0 4.6 (2.4) (34)% (2.5) (35)% Tax Product Expense 1.7 9.4 0.7 (8.7) (93)% (1.0) (57)% Intangible Amortization 1.7 5.6 4.4 (1.2) (22)% 2.7 163% Operating Lease Equipment Depreciation — 4.5 6.0 1.5 34% 6.0 NM All Other Expense 14.2 34.6 21.6 (13.1) (38)% 7.4 52% Total Expense $ 49.1 $ 110.3 $ 72.5 $ (37.8) (34)% $ 23.4 48% Provision for Loan and Lease Loss 5.3 33.3 9.1 (24.2) (73)% 3.8 71% Net Income Before Taxes 7.3 32.8 29.2 (3.6) (11)% 21.9 301% Income Tax Expense (Benefit) 0.5 (0.4) (1.2) (0.8) 193% (1.6) (343)% Net Income before non-controlling interest 6.8 33.2 30.3 (2.9) (9)% 23.5 346% Net Income attributable to non-controlling interest — 1.1 1.0 — (3)% 1.0 NM Net Income attributable to parent $ 6.8 $ 32.1 $ 29.3 $ (2.8) (9)% $ 22.5 331% Earnings Per Share, Diluted $ 0.23 $ 0.81 $ 0.75 $ (0.06) (7)% $ 0.52 226% Average Diluted Shares 29,218,980 39,496,832 38,977,690 (519,142) (1)% 9,758,710 33% 23 Fiscal Third Quarter 2019 | Nasdaq: CASH

Average Balance Sheet Fiscal Quarter Average - for the quarter ended Jun 30, 2018 Sep 30, 2018 Dec 31, 2018 Mar 31, 2019 Jun 30, 2019 3Q19 Change From ($ in millions) 3Q18 4Q18 1Q19 2Q19 3Q19 2Q19 3Q18 $ % $ % Cash and fed funds sold 57 61 45 281 80 (201) (71)% 23 40% Total Investments 2,253 2,201 2,028 1,728 1,620 (108) (6)% (633) (28)% Commercial finance1 300 1,091 1,562 1,650 1,776 126 8% 1,476 493% Consumer finance2 209 245 291 327 365 38 12% 156 75% Tax services loans 22 13 11 369 45 (324) (88)% 23 103% Warehouse finance — 57 100 182 224 42 23% 224 NM Total National Lending Loans & Leases 531 1,407 1,964 2,529 2,409 (120) (5)% 1,878 354% Total Community Banking Loans 1,030 1,076 1,156 1,181 1,190 9 1% 160 16% Other assets 369 635 788 1,068 820 (248) (23)% 451 122% Total Assets $ 4,240 $ 5,380 $ 5,981 $ 6,788 $ 6,119 (669) (10)% 1,879 44% Noninterest-bearing deposits 2,466 2,375 2,489 2,953 2,710 (243) (8)% 245 10% Interest-bearing deposits (core) 265 411 416 411 379 (32) (8)% 114 43% Wholesale deposits 454 1,328 1,698 2,283 1,522 (761) (33)% 1,068 235% Total borrowings 512 467 497 217 532 315 145% 21 4% Other liabilities 99 146 129 130 149 19 15% 50 51% Total Liabilities $ 3,795 $ 4,727 $ 5,229 $ 5,994 $ 5,292 (702) (12)% 1,497 39% Shareholder's equity 445 653 752 794 827 33 4% 382 86% Liabilities and Equity $ 4,240 $ 5,380 $ 5,981 $ 6,788 $ 6,119 (669) (10)% 1,879 44% 1 Commercial finance includes loans from the AFS/IBEX and Crestmark Divisions, and healthcare receivables 2 Consumer finance includes the Company's purchased student loan portfolios and loans generated from its national consumer lending business 24 Fiscal Third Quarter 2019 | Nasdaq: CASH

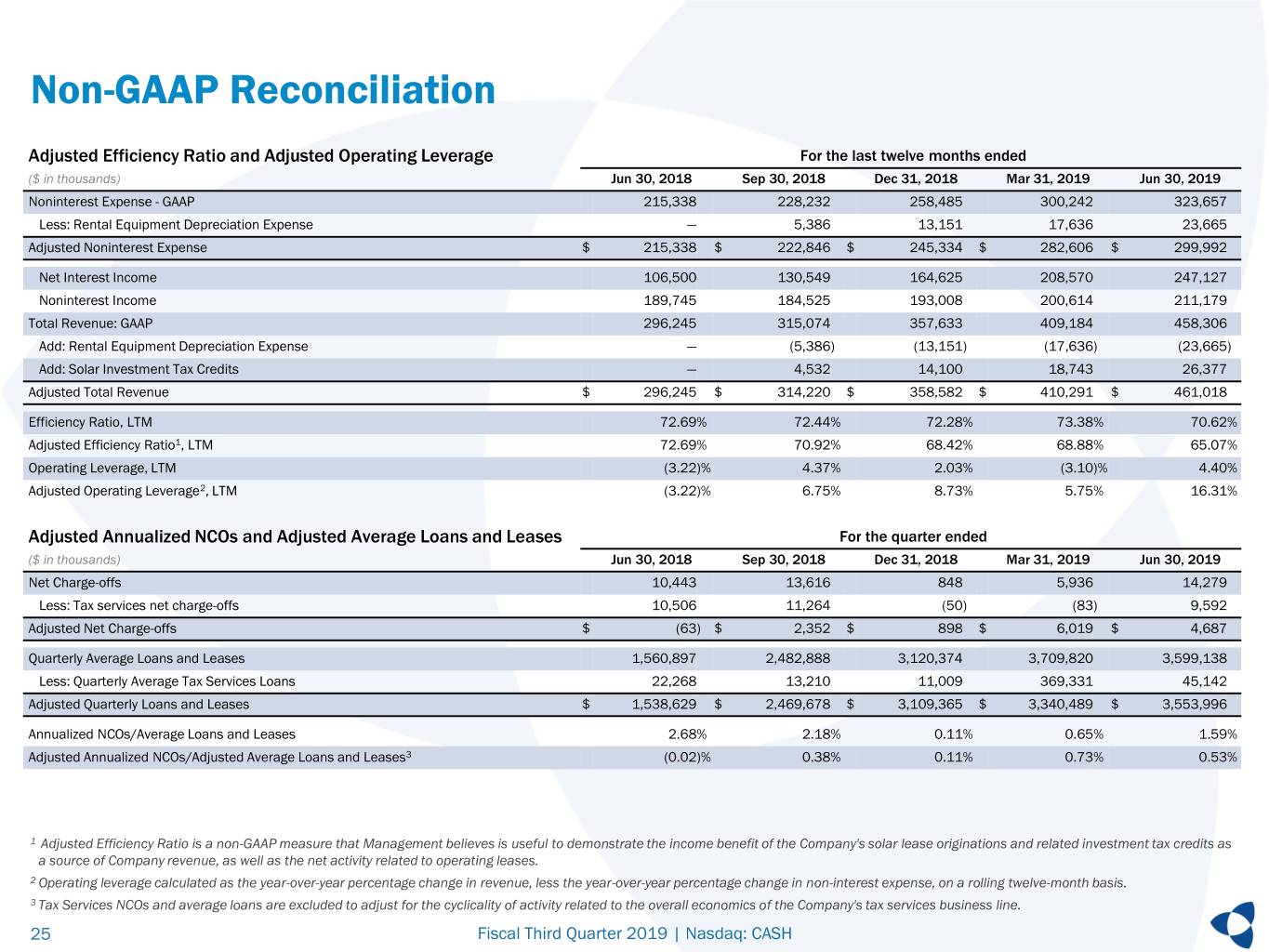

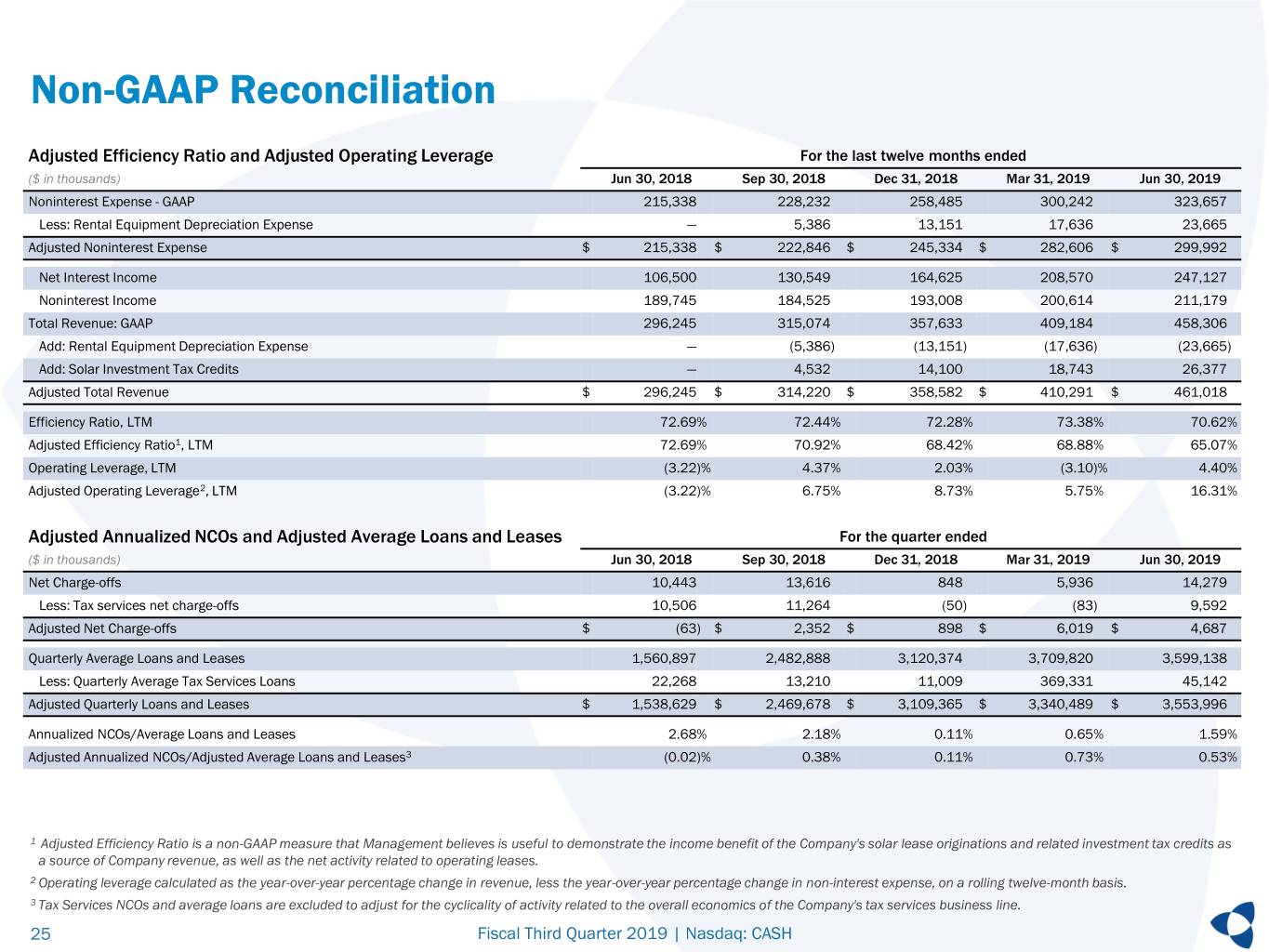

Non-GAAP Reconciliation Adjusted Efficiency Ratio and Adjusted Operating Leverage For the last twelve months ended ($ in thousands) Jun 30, 2018 Sep 30, 2018 Dec 31, 2018 Mar 31, 2019 Jun 30, 2019 Noninterest Expense - GAAP 215,338 228,232 258,485 300,242 323,657 Less: Rental Equipment Depreciation Expense — 5,386 13,151 17,636 23,665 Adjusted Noninterest Expense $ 215,338 $ 222,846 $ 245,334 $ 282,606 $ 299,992 Net Interest Income 106,500 130,549 164,625 208,570 247,127 Noninterest Income 189,745 184,525 193,008 200,614 211,179 Total Revenue: GAAP 296,245 315,074 357,633 409,184 458,306 Add: Rental Equipment Depreciation Expense — (5,386) (13,151) (17,636) (23,665) Add: Solar Investment Tax Credits — 4,532 14,100 18,743 26,377 Adjusted Total Revenue $ 296,245 $ 314,220 $ 358,582 $ 410,291 $ 461,018 Efficiency Ratio, LTM 72.69% 72.44% 72.28% 73.38% 70.62% Adjusted Efficiency Ratio1, LTM 72.69% 70.92% 68.42% 68.88% 65.07% Operating Leverage, LTM (3.22)% 4.37% 2.03% (3.10)% 4.40% Adjusted Operating Leverage2, LTM (3.22)% 6.75% 8.73% 5.75% 16.31% Adjusted Annualized NCOs and Adjusted Average Loans and Leases For the quarter ended ($ in thousands) Jun 30, 2018 Sep 30, 2018 Dec 31, 2018 Mar 31, 2019 Jun 30, 2019 Net Charge-offs 10,443 13,616 848 5,936 14,279 Less: Tax services net charge-offs 10,506 11,264 (50) (83) 9,592 Adjusted Net Charge-offs $ (63) $ 2,352 $ 898 $ 6,019 $ 4,687 Quarterly Average Loans and Leases 1,560,897 2,482,888 3,120,374 3,709,820 3,599,138 Less: Quarterly Average Tax Services Loans 22,268 13,210 11,009 369,331 45,142 Adjusted Quarterly Loans and Leases $ 1,538,629 $ 2,469,678 $ 3,109,365 $ 3,340,489 $ 3,553,996 Annualized NCOs/Average Loans and Leases 2.68% 2.18% 0.11% 0.65% 1.59% Adjusted Annualized NCOs/Adjusted Average Loans and Leases3 (0.02)% 0.38% 0.11% 0.73% 0.53% 1 Adjusted Efficiency Ratio is a non-GAAP measure that Management believes is useful to demonstrate the income benefit of the Company's solar lease originations and related investment tax credits as a source of Company revenue, as well as the net activity related to operating leases. 2 Operating leverage calculated as the year-over-year percentage change in revenue, less the year-over-year percentage change in non-interest expense, on a rolling twelve-month basis. 3 Tax Services NCOs and average loans are excluded to adjust for the cyclicality of activity related to the overall economics of the Company's tax services business line. 25 Fiscal Third Quarter 2019 | Nasdaq: CASH