INVESTOR PRESENTATION UPDATED FEBRUARY 15, 2022

FORWARD LOOKING STATEMENTS Meta Financial Group, Inc. (NASDAQ: CASH) | Investor Presentation 2 This investor update contains “forward-looking statements” which are made in good faith by Meta Financial Group, Inc. (the “Company”) pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements by words such as “may,” “hope,” “will,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential,” “continue,” “could,” “future,” or the negative of those terms, or other words of similar meaning or similar expressions. These forward-looking statements are based on information currently available to us and assumptions about future events, and include statements with respect to the Company’s beliefs, expectations, estimates, and intentions, which are subject to significant risks and uncertainties, and are subject to change based on various factors, some of which are beyond the Company’s control. Such risks, uncertainties and other factors may cause our actual growth, results of operations, financial condition, cash flows, performance and business prospects and opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. Such statements address, among others, the following subjects: future operating results; our ability to remediate the material weakness in our internal controls over financial reporting and otherwise maintain effective internal controls over financial reporting; the expected impact of the ongoing COVID-19 pandemic and related governmental actions on our business, industry, and the capital markets; customer retention; expectations regarding the ability of the Company and its wholly-owned subsidiary MetaBank, N.A. (the “Bank”) to meet minimum capital ratios and capital conservation buffers; loan and other product demand; expectations concerning acquisitions and divestitures; new products and services; credit quality; the level of net charge-offs and the adequacy of the allowance for credit losses; technology; and management and other employees. The following factors, among others, could cause the Company's financial performance and results of operations to differ materially from the expectations, estimates, and intentions expressed in such forward-looking statements: successfully transitioning and maintaining our executive management team; expected growth opportunities may not be realized or may take longer to realize than expected; the potential adverse effects of the ongoing COVID-19 pandemic and any governmental or societal responses thereto including the efficacy of the COVID-19 vaccines, or other unusual and infrequently occurring events; successfully completing our announced rebranding and our ability to achieve brand recognition equal to or greater than we currently enjoy; changes in tax laws; the strength of the United States' economy, and the local economies in which the Company operates; changes in trade, monetary, and fiscal policies and laws, including actual changes in interest rates and the Fed funds rate; inflation, market, and monetary fluctuations; the timely and efficient development of new products and services offered by the Company or its strategic partners, as well as risks (including reputational and litigation) attendant thereto, and the perceived overall value and acceptance of these products and services by users; the Bank's ability to maintain its Durbin Amendment exemption; the risks of dealing with or utilizing third parties, including, in connection with the Company’s tax refund advance business; the risk of reduced volume of refund advance loans as a result of reduced customer demand for or usage of Meta’s strategic partners’ refund advance products; our relationship with, and any actions which may be initiated by our regulators; changes in financial services laws and regulations, including laws and regulations relating to the tax refund industry and the insurance premium finance industry and recent and potential changes in response to the ongoing COVID-19 pandemic; technological changes, including, but not limited to, the security of our electronic systems and information; the impact of acquisitions and divestitures; litigation risk; the growth of the Company’s business, as well as expenses related thereto; continued maintenance by the Bank of its status as a well-capitalized institution; changes in consumer spending and saving habits; losses from fraudulent or illegal activity; technological risks and developments, and cyber threats, attacks or events; and the success of the Company at maintaining its high quality asset level and managing and collecting assets of borrowers in default should problem assets increase. and the other factors described under the caption “Risk Factors” and in other sections of the Company’s Annual Report on Form 10-K for the Company's fiscal year ended September 30, 2021 and in other filings made by the Company with the Securities and Exchange Commission (“SEC”). The forward-looking statements included herein speak only as of the date of this investor presentation. The Company expressly disclaims any intent or obligation to update any forward-looking statements, whether written or oral, that may be made from time to time by or on behalf of the Company or its subsidiaries, whether as a result of new information, changed circumstances or future events or for any other reason.

3 WE STRIVE TO INCREASE FINANCIAL AVAILABILITY, CHOICE, AND OPPORTUNITY THROUGH FINANCIAL EMPOWERMENT. Meta helps fintechs and third-party providers access financial networks, navigate risk, and meet compliance requirements, while overseeing their activities to ensure quality, security, and fairness. Our national bank charter, coordination with regulators, and deep understanding of risk mitigation and compliance helps us disrupt traditional banking norms, guide our partners, and deliver financial products, services, and funding to the businesses and people who need them most. We believe in financial inclusion for all®. Meta Financial Group, Inc. (NASDAQ: CASH) | Investor Presentation

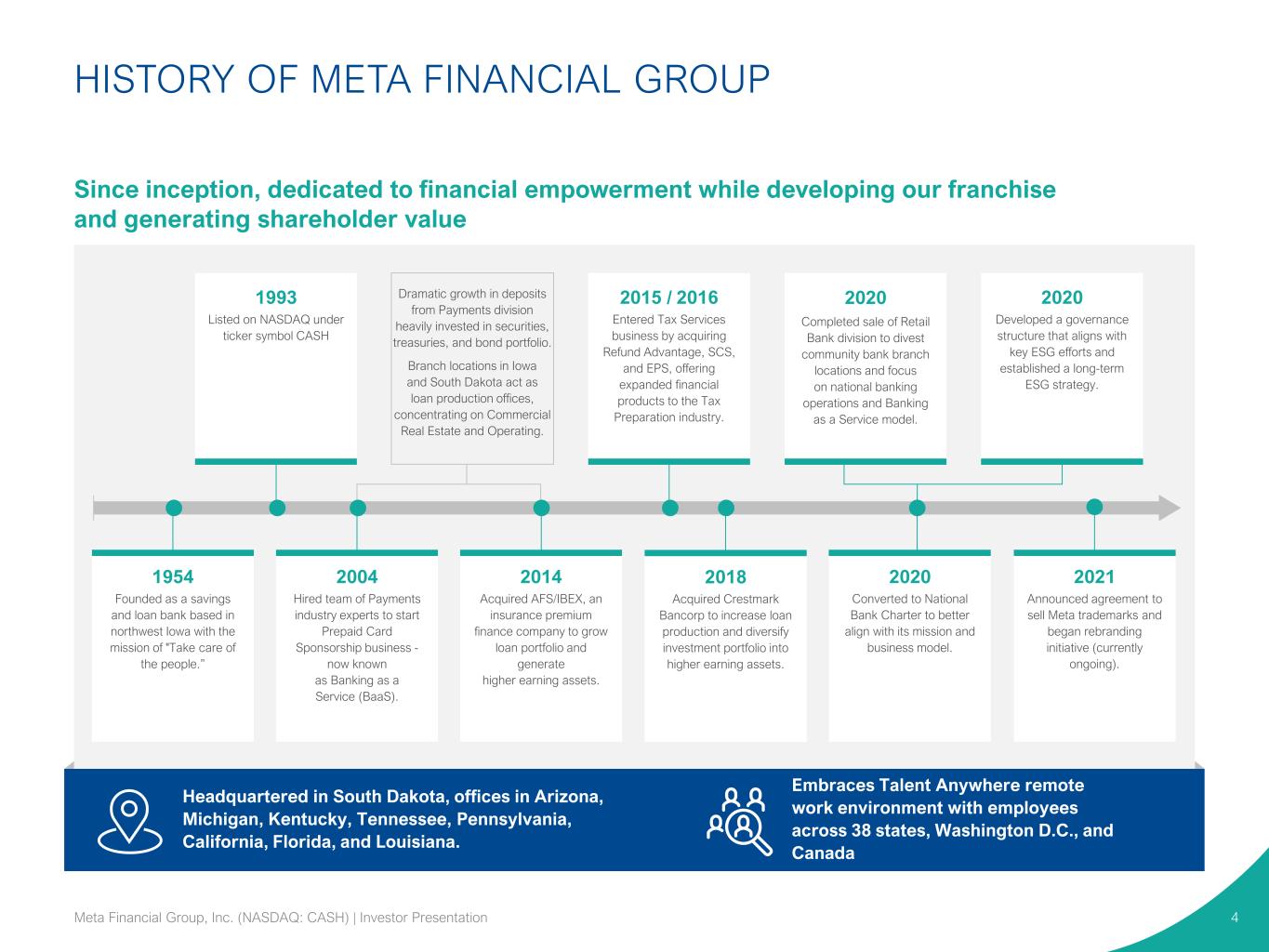

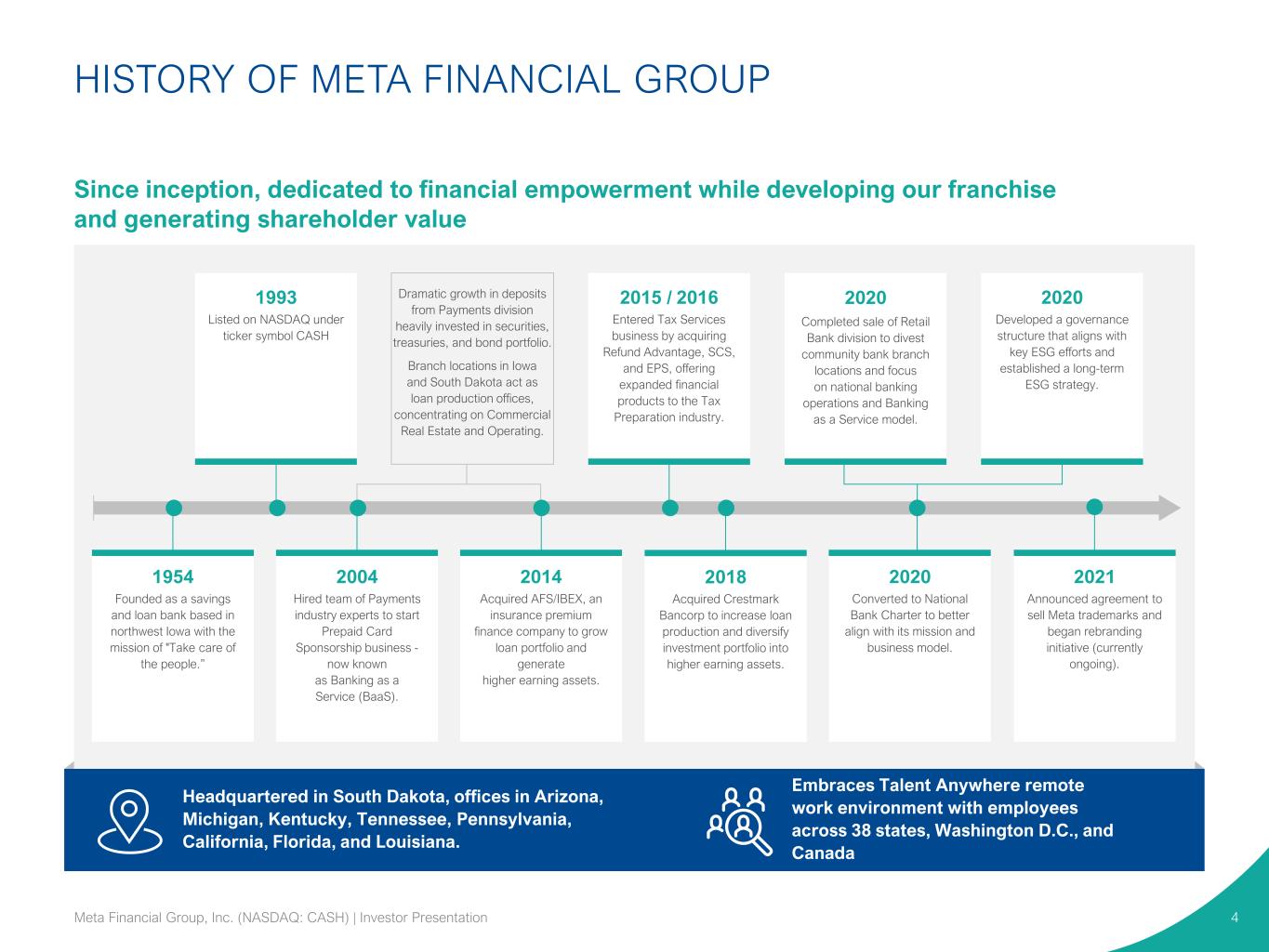

HISTORY OF META FINANCIAL GROUP 4 Founded in 1954 as First Federal Savings Bank of the Midwest Since inception, dedicated to financial empowerment while developing our franchise and generating shareholder value Headquartered in South Dakota, offices in Arizona, Michigan, Kentucky, Tennessee, Pennsylvania, California, Florida, and Louisiana. Embraces Talent Anywhere remote work environment with employees across 38 states, Washington D.C., and Canada 1993 Listed on NASDAQ under ticker symbol CASH 2015 / 2016 Entered Tax Services business by acquiring Refund Advantage, SCS, and EPS, offering expanded financial products to the Tax Preparation industry. 2020 Completed sale of Retail Bank division to divest community bank branch locations and focus on national banking operations and Banking as a Service model. 1954 Founded as a savings and loan bank based in northwest Iowa with the mission of "Take care of the people.” 2004 Hired team of Payments industry experts to start Prepaid Card Sponsorship business - now known as Banking as a Service (BaaS). 2014 Acquired AFS/IBEX, an insurance premium finance company to grow loan portfolio and generate higher earning assets. 2018 Acquired Crestmark Bancorp to increase loan production and diversify investment portfolio into higher earning assets. 2020 Converted to National Bank Charter to better align with its mission and business model. Dramatic growth in deposits from Payments division heavily invested in securities, treasuries, and bond portfolio. Branch locations in Iowa and South Dakota act as loan production offices, concentrating on Commercial Real Estate and Operating. 2020 Developed a governance structure that aligns with key ESG efforts and established a long-term ESG strategy. Meta Financial Group, Inc. (NASDAQ: CASH) | Investor Presentation 2021 Announced agreement to sell Meta trademarks and began rebranding initiative (currently ongoing).

EXECUTING A PROVEN STRATEGY TO GROW OUR FRANCHISE AND GENERATE HIGH SHAREHOLDER RETURNS 5 Leader in fast-growing Banking as a Service (BaaS) sector, with diversified portfolio of high-quality financial partners Differentiated business model is powering profitable growth Significant recurring revenue and clear growth drivers 2 3 4 Realizing operating efficiencies from disciplined expense management Cash-generative business enables ongoing return of capital to shareholders Strong and diverse management team and Board of Directors 5 6 7 1 8 National bank charter, investment in compliance and reporting, combined with Durbin threshold, create a powerful business model Financial inclusion for all® empowers lines of business, motivates Environmental, Social, Governance (ESG) and Diversity, Equity and Inclusion (DE&I) strategies Meta Financial Group, Inc. (NASDAQ: CASH) | Investor Presentation

FINANCIAL INCLUSION FOR ALL® EMPOWERS OUR BUSINESS LINES 6 1 2 3 4 5 6 7 8 Our Consumer Solutions division provides financial empowerment through expanded financial service access. With capabilities ranging from consumer loans to tax payments advances, America’s underbanked consumers can build credit, control spending, and enhance liquidity, creating pathways towards upward mobility. Consumer Solutions Our Payments division works with fintechs, third-party providers, and various other organizations to distribute prepaid cards, deposit accounts, and process payment-related transactions. Meta is the fiduciary that issues accounts and manages the money, moving billions of dollars each day. Payments Our Commercial Finance division helps America’s small and medium sized enterprises and some large businesses by providing flexible capital solutions such as factoring, asset-based lending, leasing, insurance premium finance, and government guaranteed lending they often cannot get elsewhere. Commercial Finance Meta Financial Group, Inc. (NASDAQ: CASH) | Investor Presentation

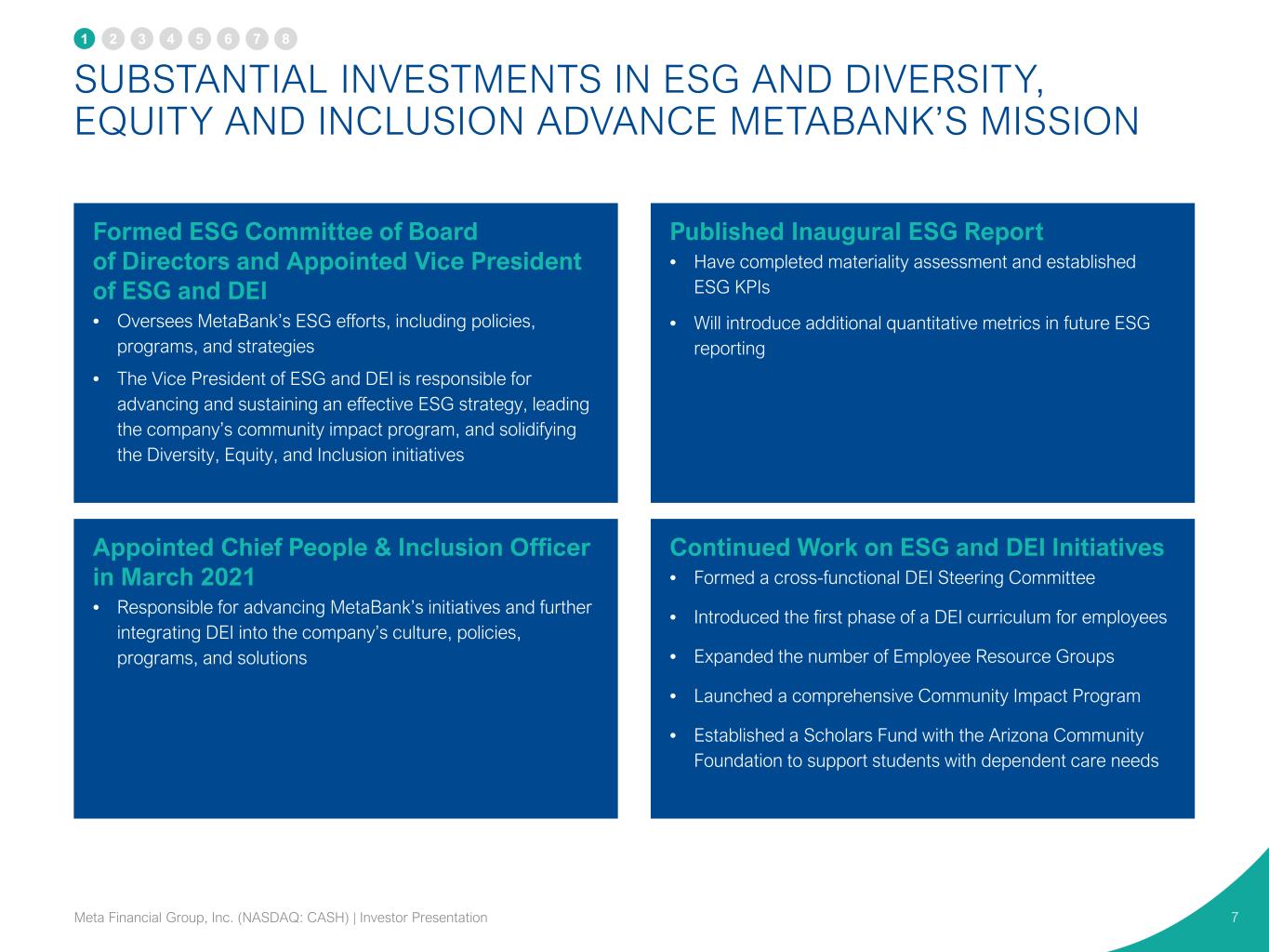

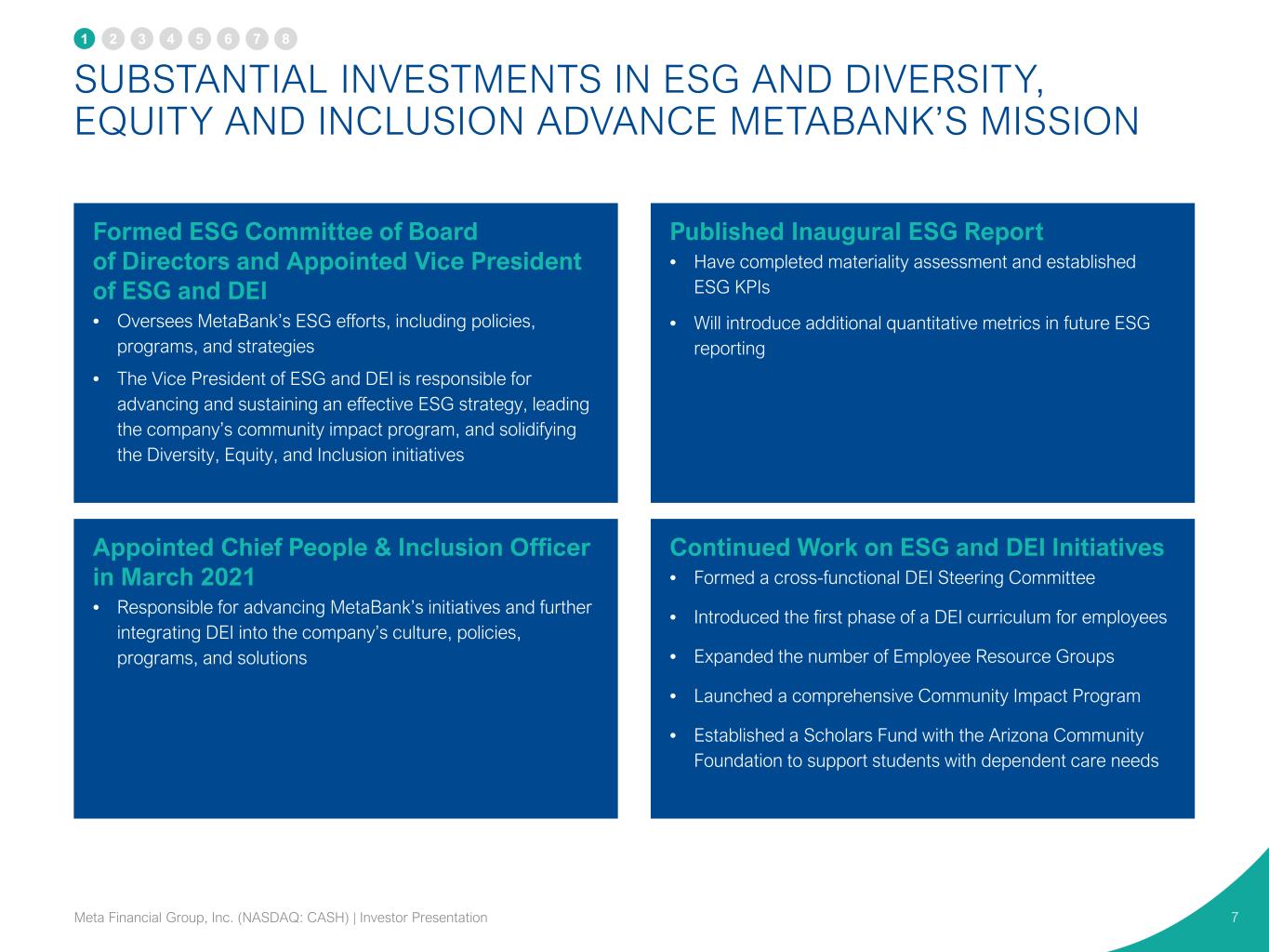

SUBSTANTIAL INVESTMENTS IN ESG AND DIVERSITY, EQUITY AND INCLUSION ADVANCE METABANK’S MISSION 7 Formed ESG Committee of Board of Directors and Appointed Vice President of ESG and DEI • Oversees MetaBank’s ESG efforts, including policies, programs, and strategies • The Vice President of ESG and DEI is responsible for advancing and sustaining an effective ESG strategy, leading the company’s community impact program, and solidifying the Diversity, Equity, and Inclusion initiatives Published Inaugural ESG Report • Have completed materiality assessment and established ESG KPIs • Will introduce additional quantitative metrics in future ESG reporting Appointed Chief People & Inclusion Officer in March 2021 • Responsible for advancing MetaBank’s initiatives and further integrating DEI into the company’s culture, policies, programs, and solutions Continued Work on ESG and DEI Initiatives • Formed a cross-functional DEI Steering Committee • Introduced the first phase of a DEI curriculum for employees • Expanded the number of Employee Resource Groups • Launched a comprehensive Community Impact Program • Established a Scholars Fund with the Arizona Community Foundation to support students with dependent care needs 1 2 3 4 5 6 7 8 Meta Financial Group, Inc. (NASDAQ: CASH) | Investor Presentation

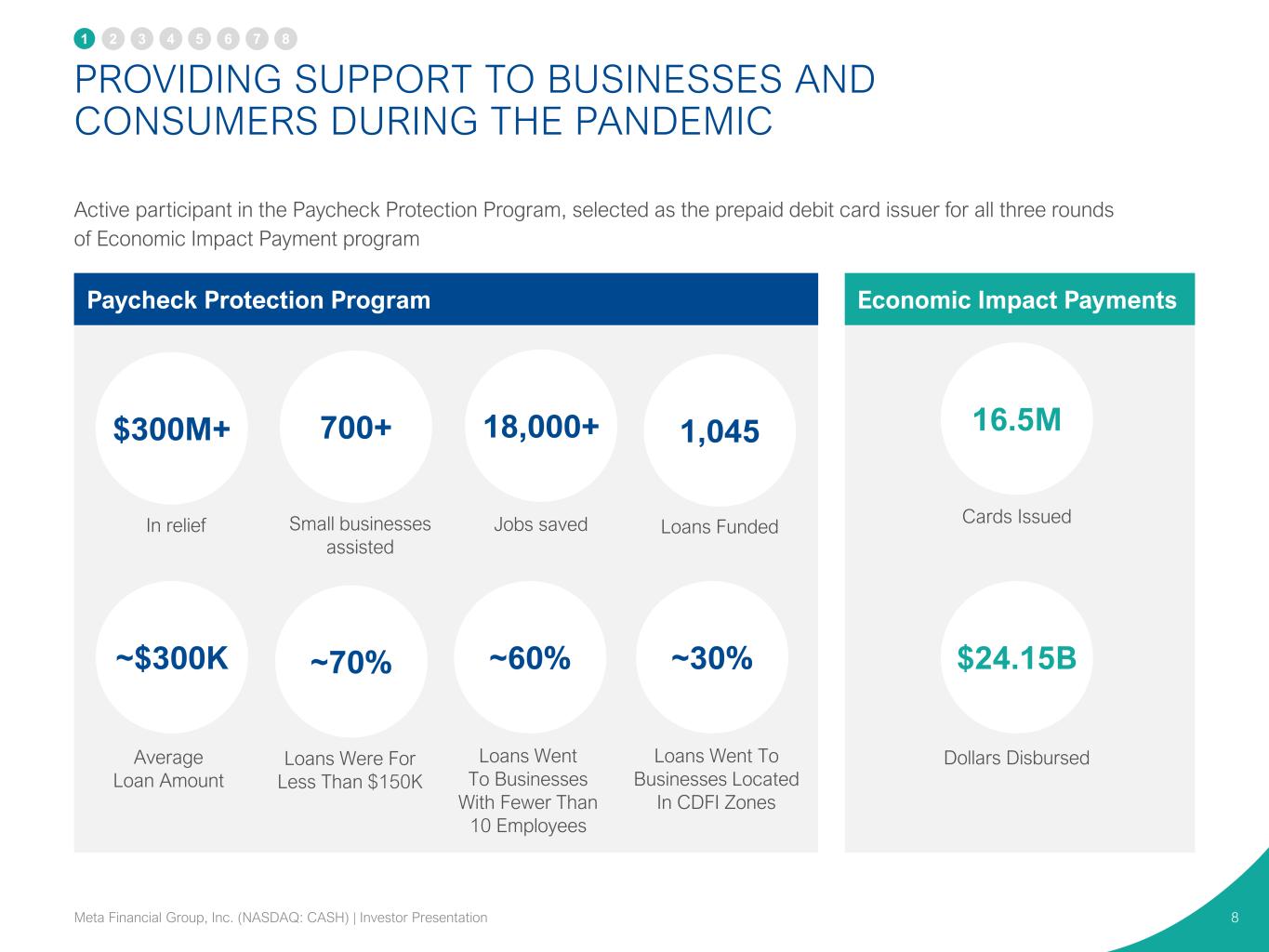

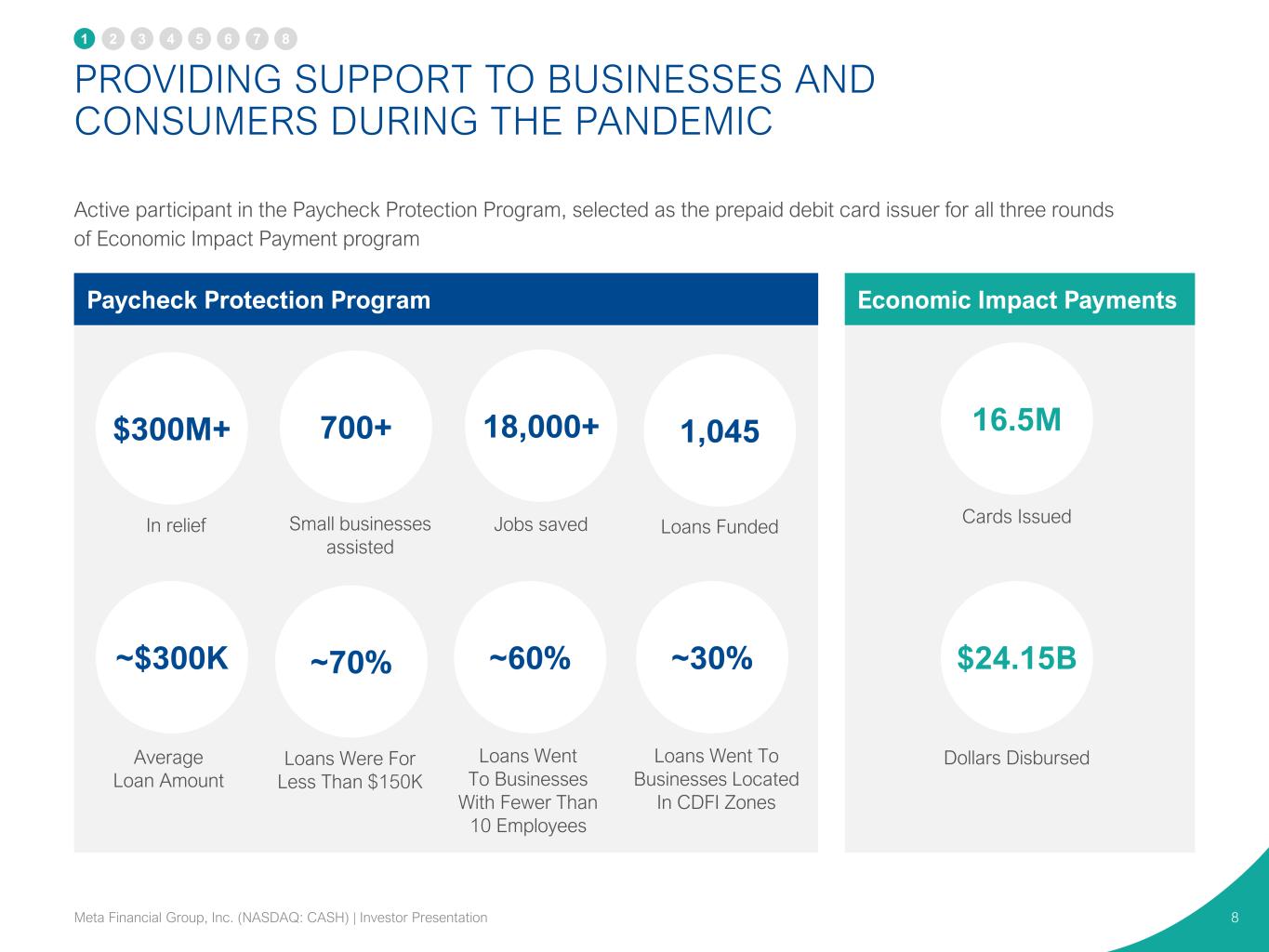

PROVIDING SUPPORT TO BUSINESSES AND CONSUMERS DURING THE PANDEMIC 8 1,045 ~$300K $300M+ 18,000+ ~70% ~60% ~30% Paycheck Protection Program Economic Impact Payments Cards Issued 16.5M Dollars Disbursed $24.15B Loans Went To Businesses Located In CDFI Zones Loans Went To Businesses With Fewer Than 10 Employees Jobs savedIn relief Average Loan Amount Loans Funded Loans Were For Less Than $150K Active participant in the Paycheck Protection Program, selected as the prepaid debit card issuer for all three rounds of Economic Impact Payment program 1 2 3 4 5 6 7 8 Meta Financial Group, Inc. (NASDAQ: CASH) | Investor Presentation 700+ Small businesses assisted

METABANK IS A WELL-RECOGNIZED LEADER IN BAAS 9 • Full range of payment and debit services • Leading issuer of prepaid debit cards • Agent for all three rounds of U.S. Treasury Economic Income Payments • Provide partners with regulatory and compliance oversight • Provide tax return transfer and loan solutions to two largest tax preparers and 25,000+ independent tax preparers • Payments capabilities enable tax preparers to provide underbanked consumers with access to electronic tax payments and refund advances • Lines of credit and consumer loans to fintechs, marketplace lenders, and payments and tax partners • Consumer Lending capabilities enable customers to reliably access funds and better control their financial futures Payments Capabilities, Regulatory and Compliance Expertise, are Core Strengths Tax Services Capabilities Create Value for Partners Consumer Lending Businesses Generate Higher NIM Demonstrated Ability to Provide Partners with a Full Range of Services Has Generated a High-Quality Portfolio of BaaS Clients Neobanks, Fintechs, Program Managers, Community Banks, Government Agencies, Tax Preparers 1 2 3 4 5 6 7 8 Meta Financial Group, Inc. (NASDAQ: CASH) | Investor Presentation

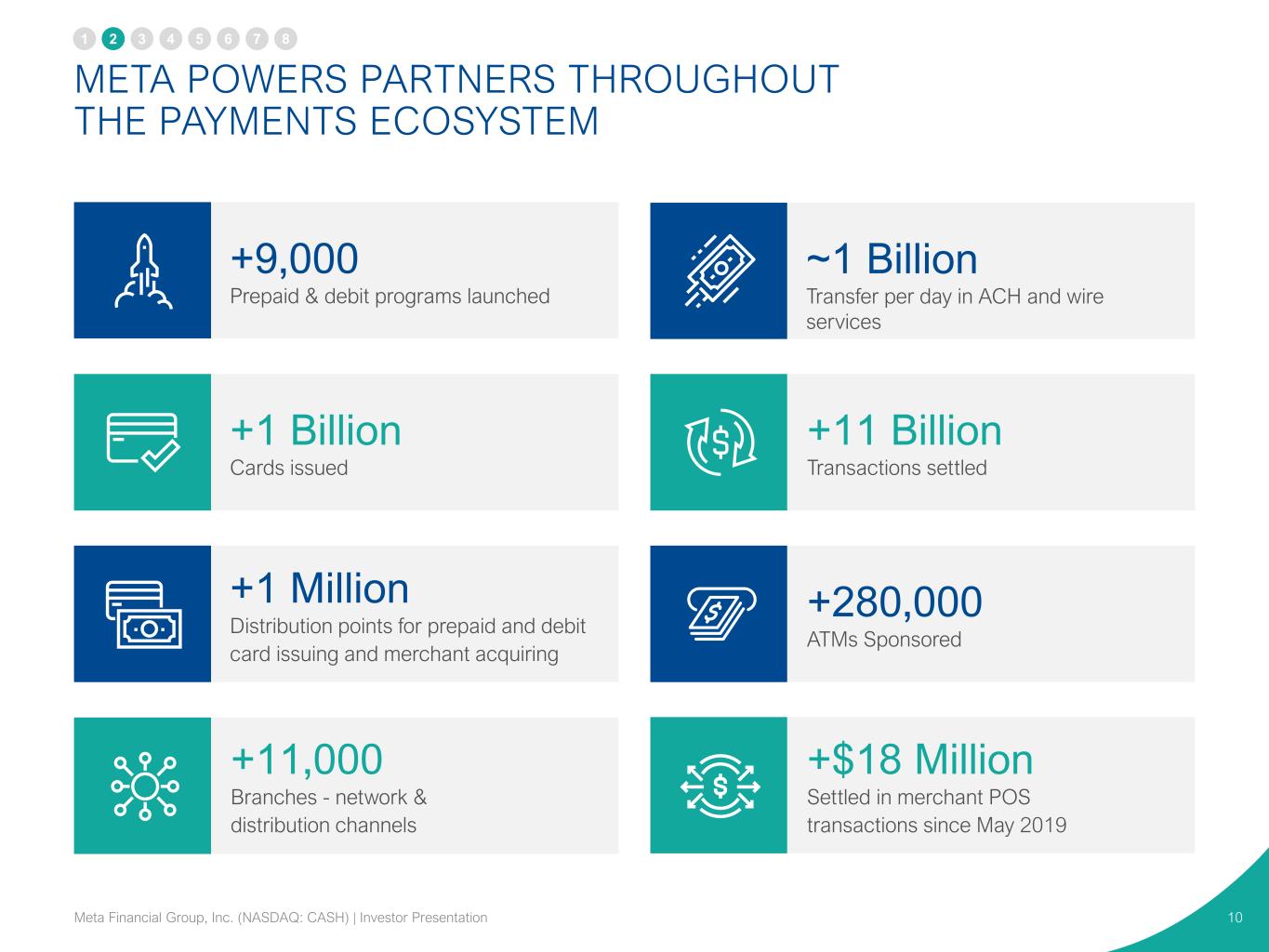

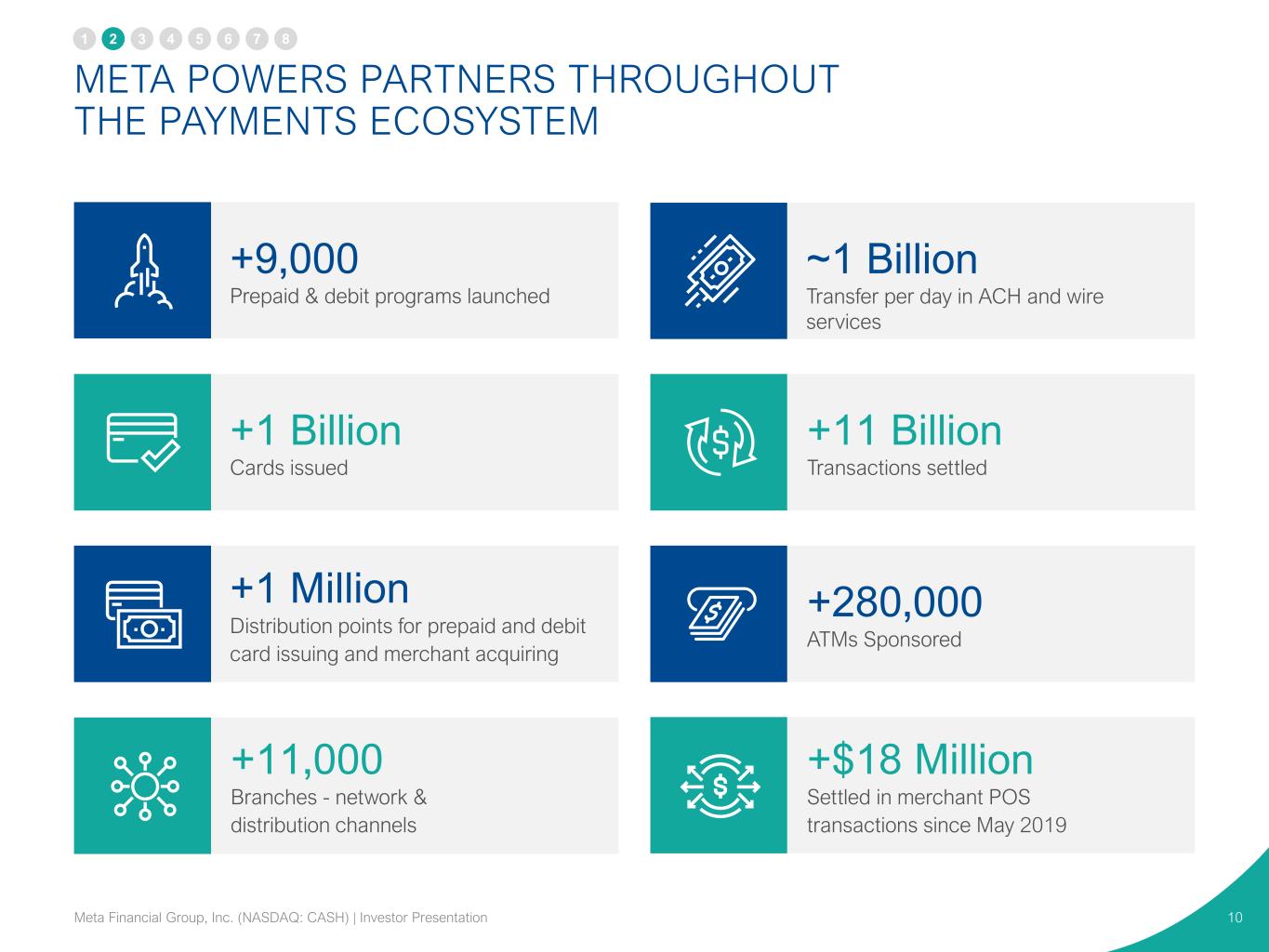

META POWERS PARTNERS THROUGHOUT THE PAYMENTS ECOSYSTEM 10 +9,000 Prepaid & debit programs launched ~1 Billion Transfer per day in ACH and wire services +1 Billion Cards issued +11 Billion Transactions settled +1 Million Distribution points for prepaid and debit card issuing and merchant acquiring +280,000 ATMs Sponsored +11,000 Branches - network & distribution channels +$18 Million Settled in merchant POS transactions since May 2019 1 2 3 4 5 6 7 8 Meta Financial Group, Inc. (NASDAQ: CASH) | Investor Presentation

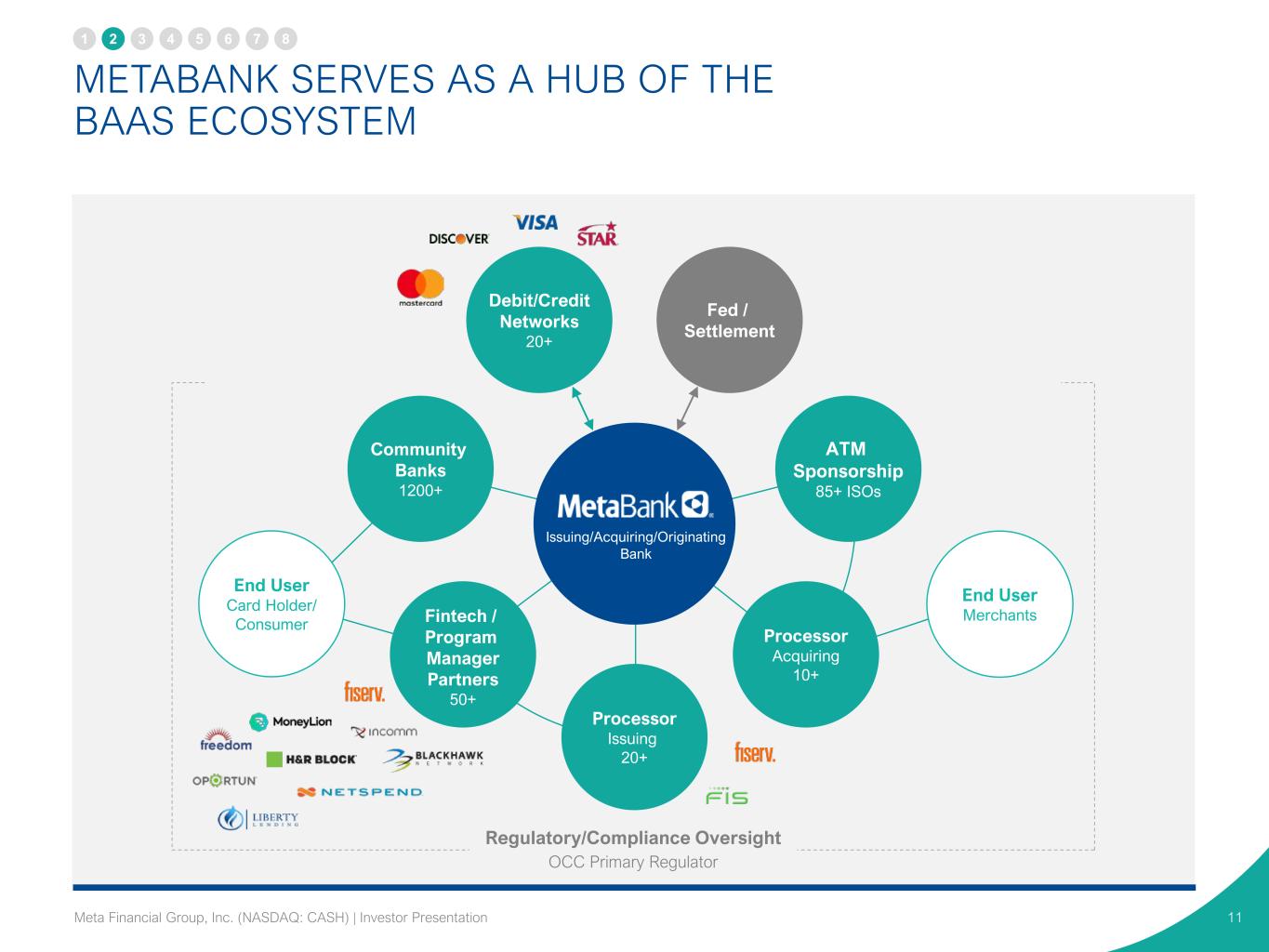

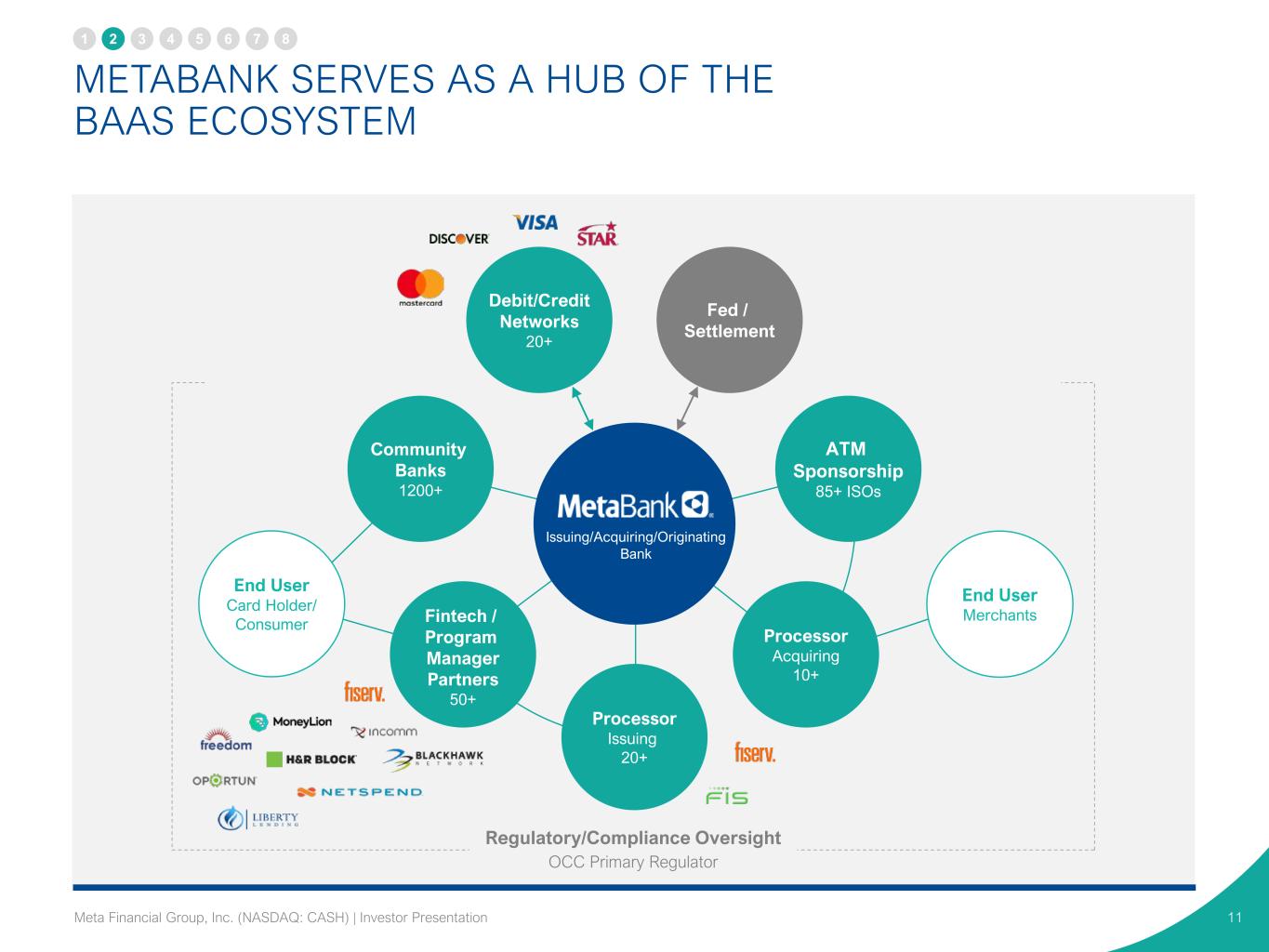

METABANK SERVES AS A HUB OF THE BAAS ECOSYSTEM 11 Regulatory/Compliance Oversight OCC Primary Regulator Issuing/Acquiring/Originating Bank End User Card Holder/ Consumer End User Merchants Processor Issuing 20+ Fintech / Program Manager Partners 50+ Community Banks 1200+ Debit/Credit Networks 20+ Fed / Settlement ATM Sponsorship 85+ ISOs Processor Acquiring 10+ 1 2 3 4 5 6 7 8 Meta Financial Group, Inc. (NASDAQ: CASH) | Investor Presentation

OFFERS PROGRAM MANAGERS A FULL SUITE OF BAAS SOLUTIONS 12 PARTNERS TAX SERVICES Refund Advance Refund Transfers PAYMENTS Prepaid (Gift, Payroll, General Purpose Reloadable, etc.) Consumer Banking Solutions (Debit, Savings) Faster Payments Transactional Payments (ACH, Wire, Receiving, Originating) Merchant Acquiring ATM Sponsorship CONSUMER LENDING Line of Credit Term Loans Secured Cards “Partnering with MetaBank to deliver our regulatory and compliance foundation gives us the ability to focus on customer needs and “de-risk” our market tests, enabling us to test more offerings rapidly.” Alex Kostecki, Co-Founder & COO, Clair Preparer Loans (Business Financing) 1 2 3 4 5 6 7 8 Meta Financial Group, Inc. (NASDAQ: CASH) | Investor Presentation

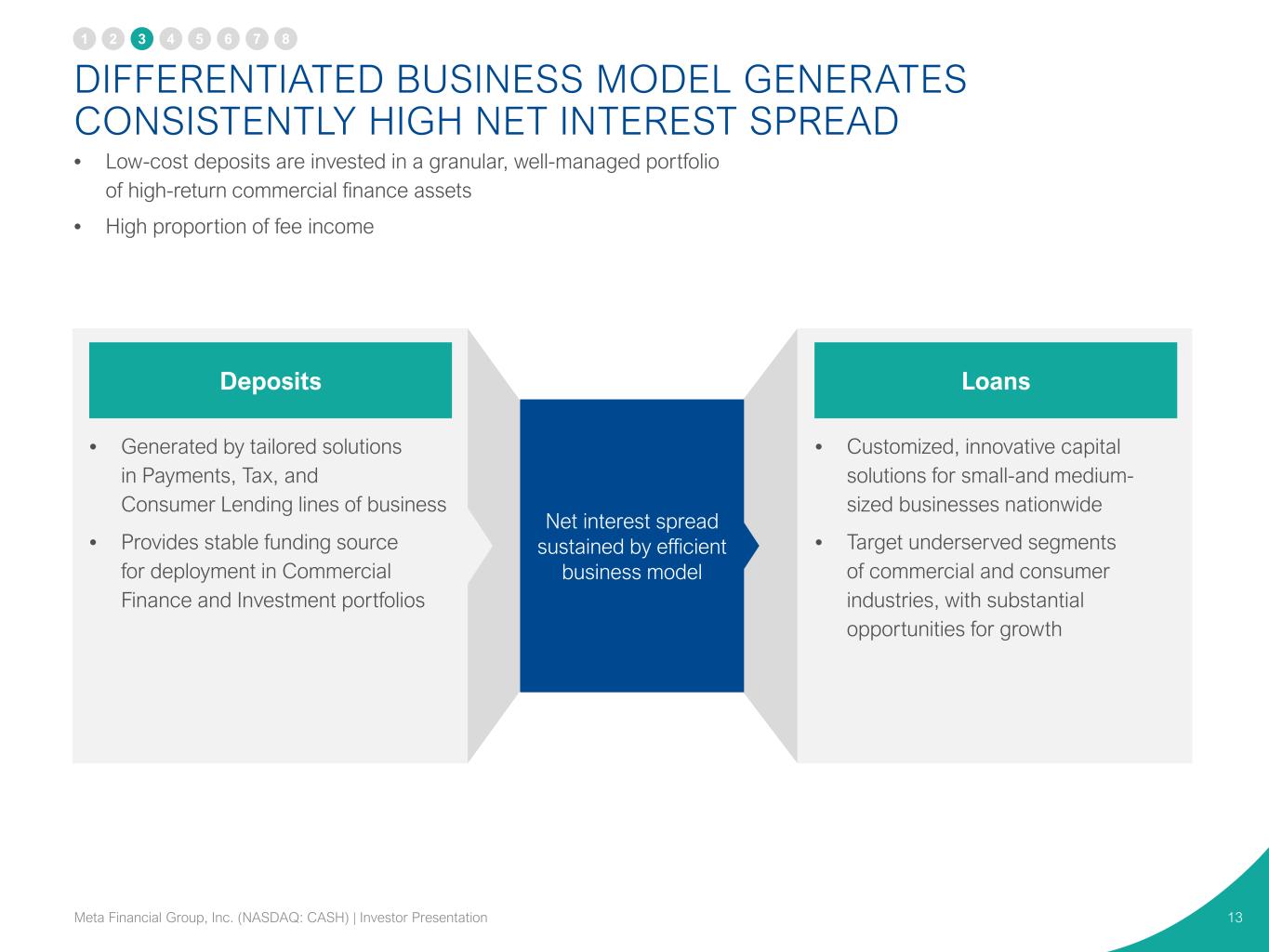

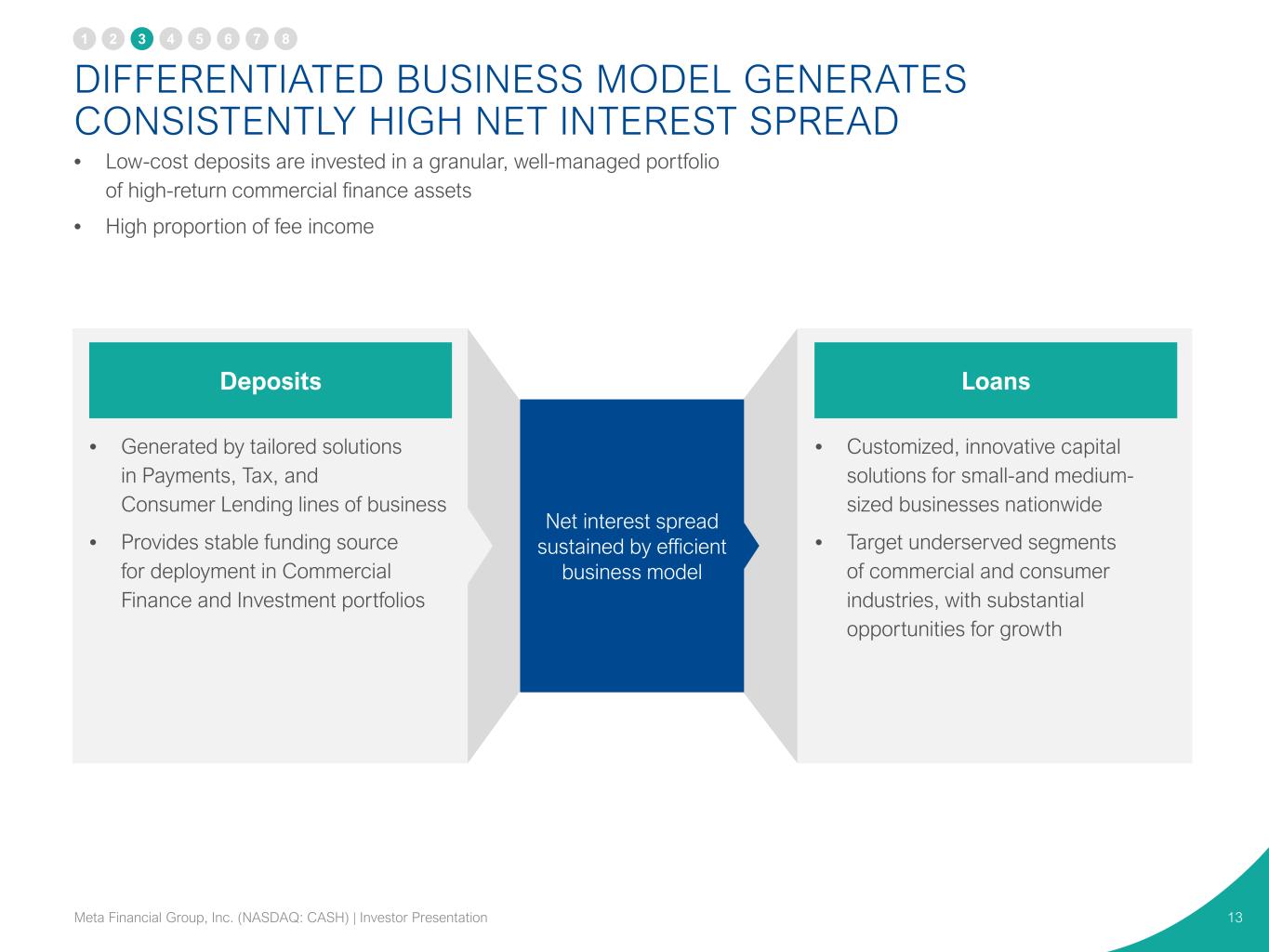

DIFFERENTIATED BUSINESS MODEL GENERATES CONSISTENTLY HIGH NET INTEREST SPREAD 13 • Low-cost deposits are invested in a granular, well-managed portfolio of high-return commercial finance assets • High proportion of fee income • Generated by tailored solutions in Payments, Tax, and Consumer Lending lines of business • Provides stable funding source for deployment in Commercial Finance and Investment portfolios • Customized, innovative capital solutions for small-and medium- sized businesses nationwide • Target underserved segments of commercial and consumer industries, with substantial opportunities for growth Deposits Net interest spread sustained by efficient business model Loans 1 2 3 4 5 6 7 8 Meta Financial Group, Inc. (NASDAQ: CASH) | Investor Presentation

COMMERCIAL FINANCE BUSINESS CONSISTS OF A GROUP OF SPECIALIZED LENDERS Meta Financial Group, Inc. (NASDAQ: CASH) | Investor Presentation 14 • Provide small and medium-sized businesses, as well as large enterprises, with flexible capital solutions they cannot get elsewhere • Collateral-based lending focused on risk management and administrative controls of borrowers’ assets – Focus on collateral and emphasizes long-term relationships vs. traditional credit and cash flow metrics – Provides guardrails against uncertainty – Helps MetaBank reach companies operating at the core of the “real economy” • Underwritten to ensure recovery of full loan exposure in the event of a default or liquidation • Closely monitored and managed • Solar lending provides conservative lending and generates tax credits, boosting returns. 1 2 3 4 5 6 7 8 Loan portfolio supports mission of financial inclusion for all®

SIGNIFICANT RECURRING REVENUE WITH CLEAR GROWTH DRIVERS • Payments and Tax relationships are “sticky,” produce high proportion of recurring revenue • Opportunity in Consumer Lending to provide products to strategic partners with payments and tax distribution potential • Participate in fintech industry growth and partnerships with new fintechs – Leverage existing relationships as a distribution channel to sell other payments products (Ex: H&R Block, MoneyLion, and Others) – Opportunity for increased cross-selling among Commercial Finance 15 1 2 3 4 5 6 7 8 Meta Financial Group, Inc. (NASDAQ: CASH) | Investor Presentation

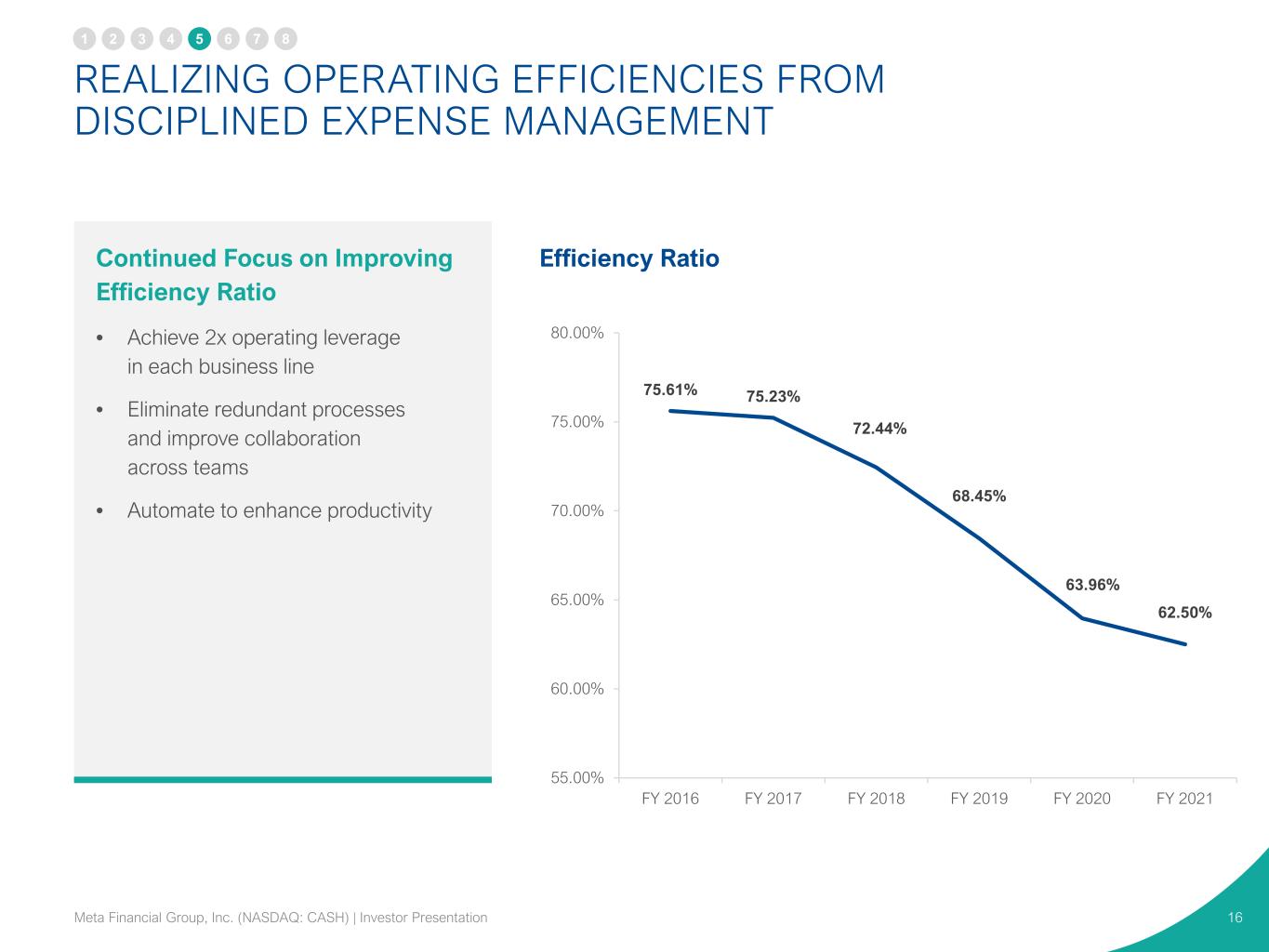

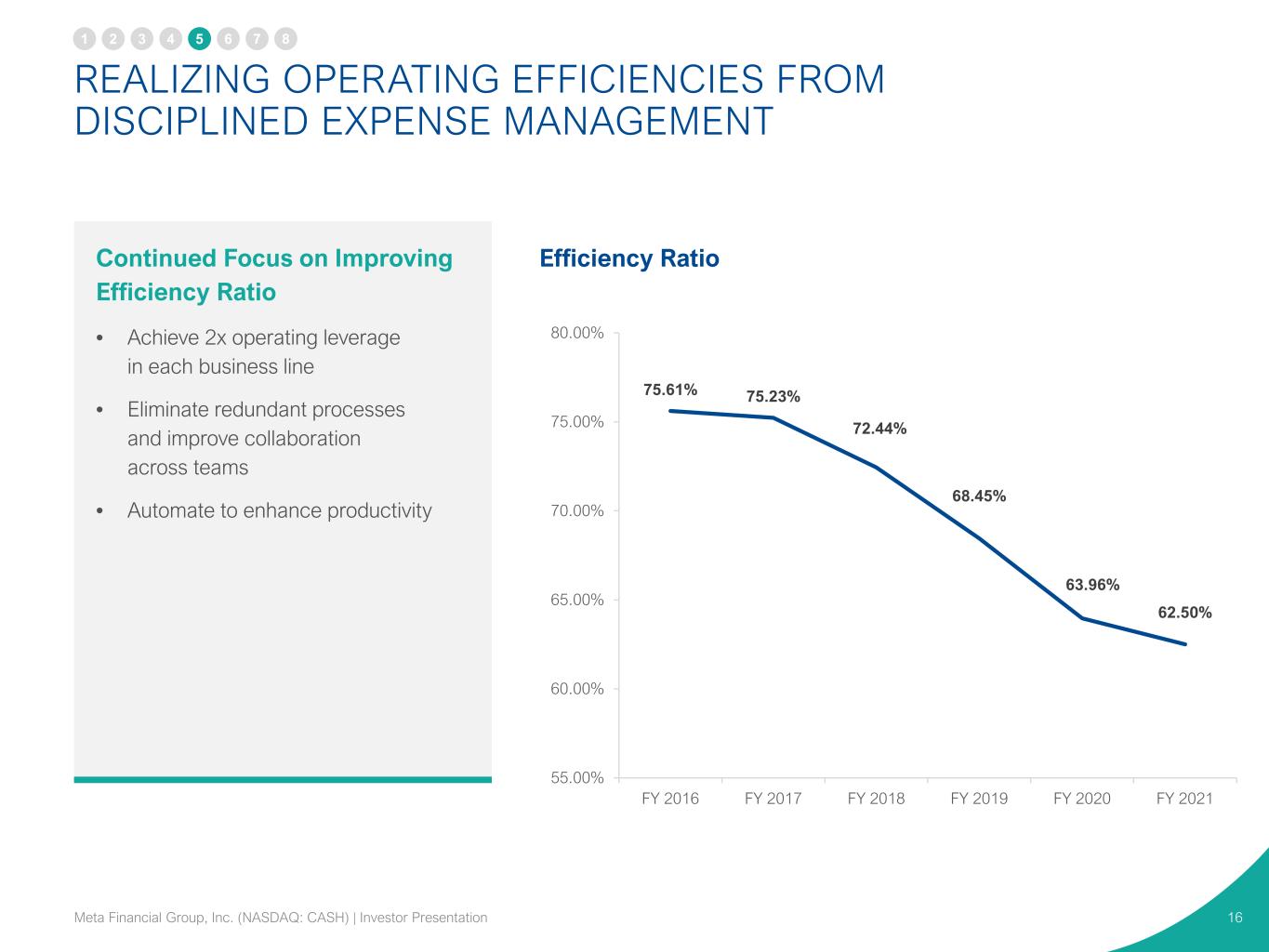

REALIZING OPERATING EFFICIENCIES FROM DISCIPLINED EXPENSE MANAGEMENT 16 Continued Focus on Improving Efficiency Ratio • Achieve 2x operating leverage in each business line • Eliminate redundant processes and improve collaboration across teams • Automate to enhance productivity Efficiency Ratio 1 2 3 4 5 6 7 8 Meta Financial Group, Inc. (NASDAQ: CASH) | Investor Presentation 75.61% 75.23% 72.44% 68.45% 63.96% 62.50% 55.00% 60.00% 65.00% 70.00% 75.00% 80.00% FY 2016 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021

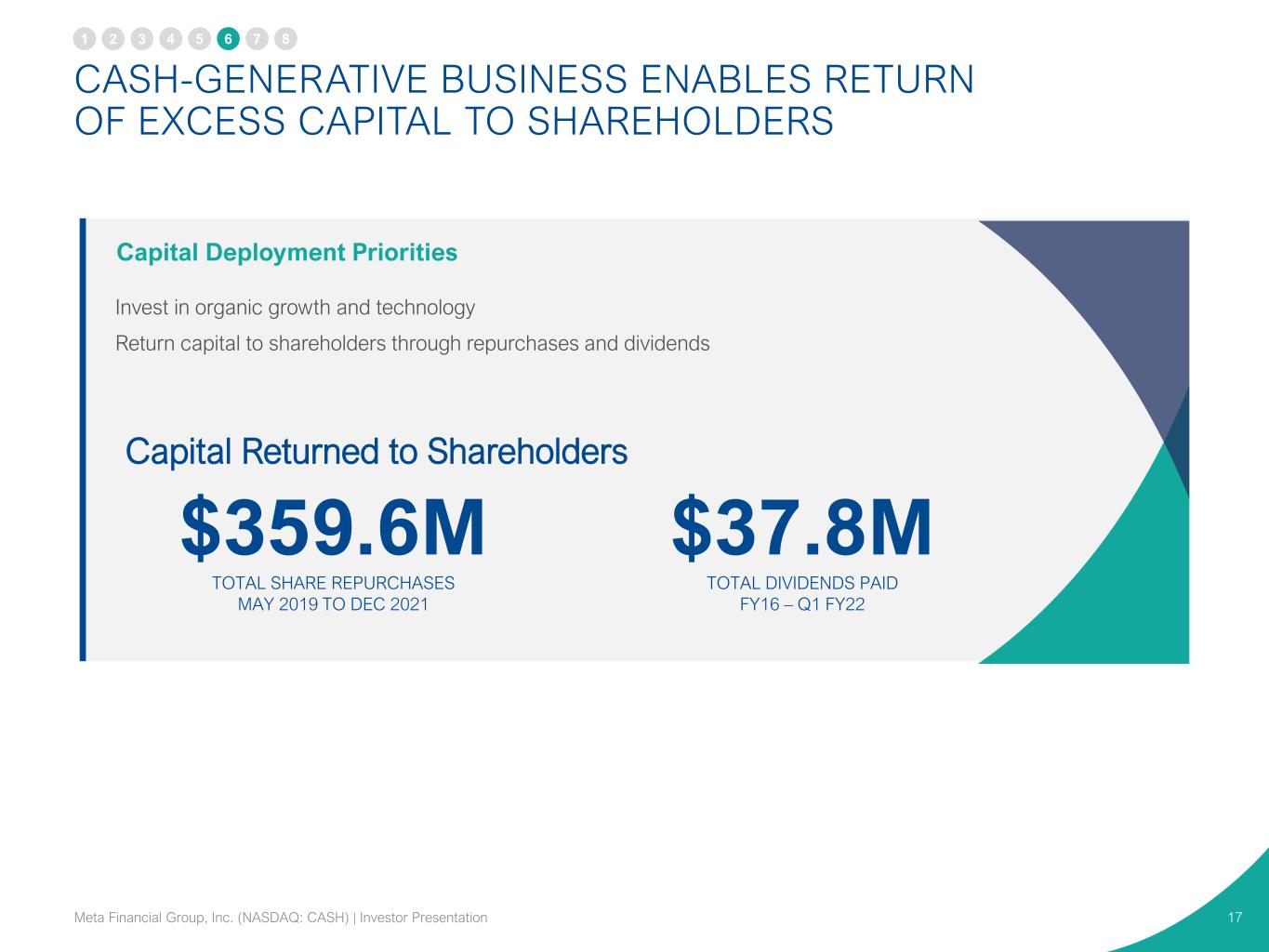

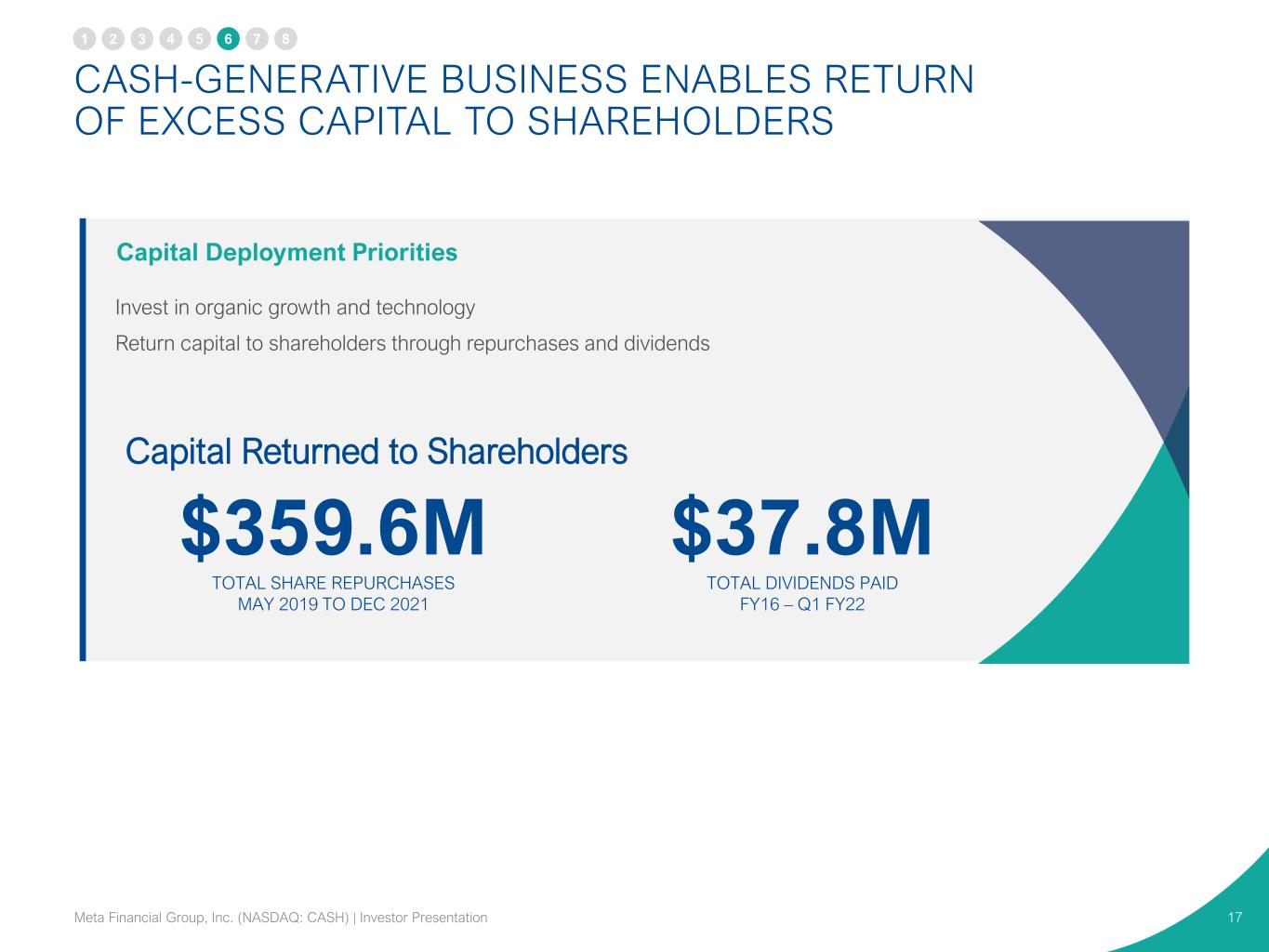

CASH-GENERATIVE BUSINESS ENABLES RETURN OF EXCESS CAPITAL TO SHAREHOLDERS 17 Capital Deployment Priorities $359.6M TOTAL SHARE REPURCHASES MAY 2019 TO DEC 2021 $37.8M TOTAL DIVIDENDS PAID FY16 – Q1 FY22 1 2 3 4 5 6 7 8 Meta Financial Group, Inc. (NASDAQ: CASH) | Investor Presentation Invest in organic growth and technology Return capital to shareholders through repurchases and dividends Capital Returned to Shareholders

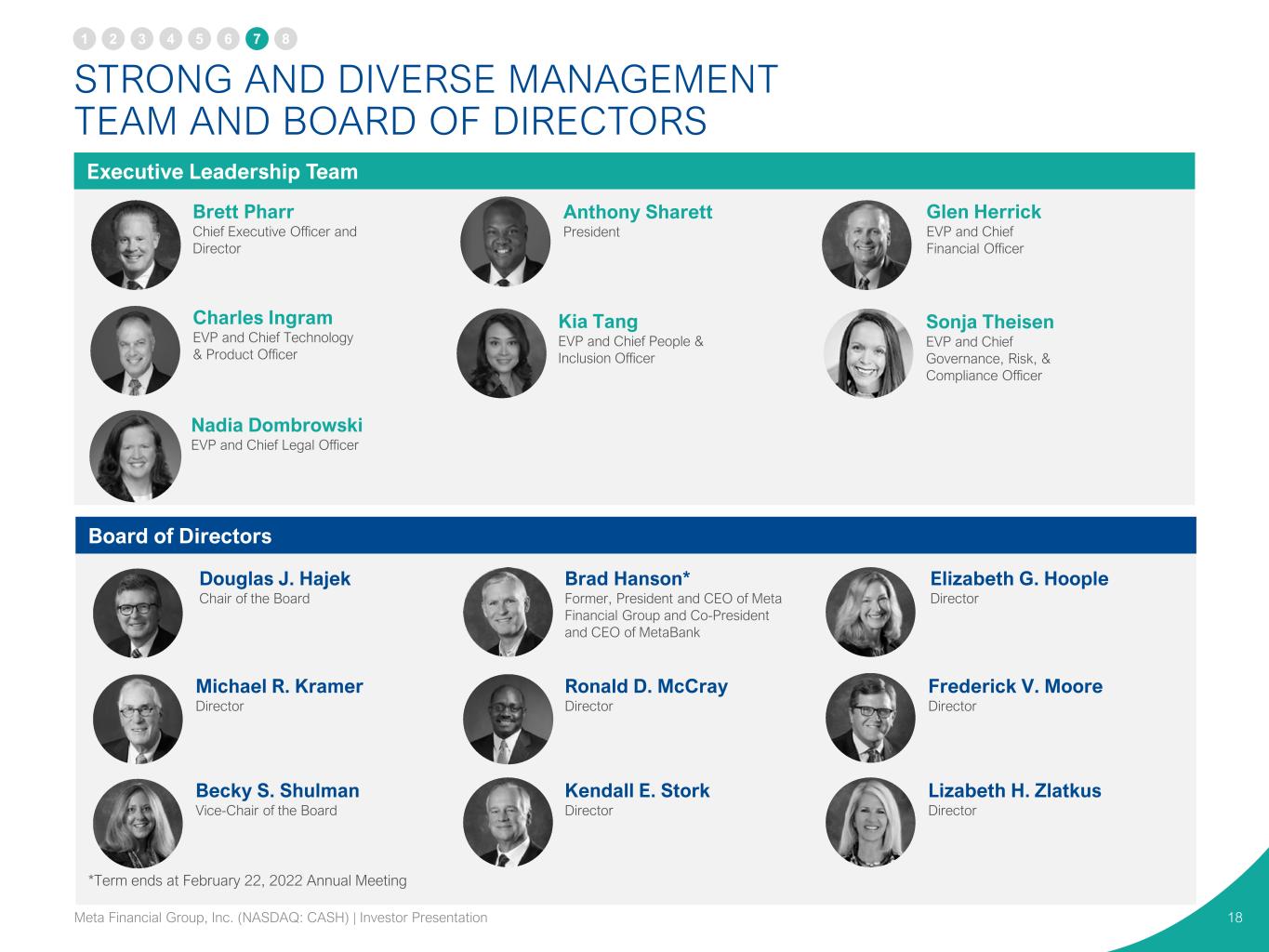

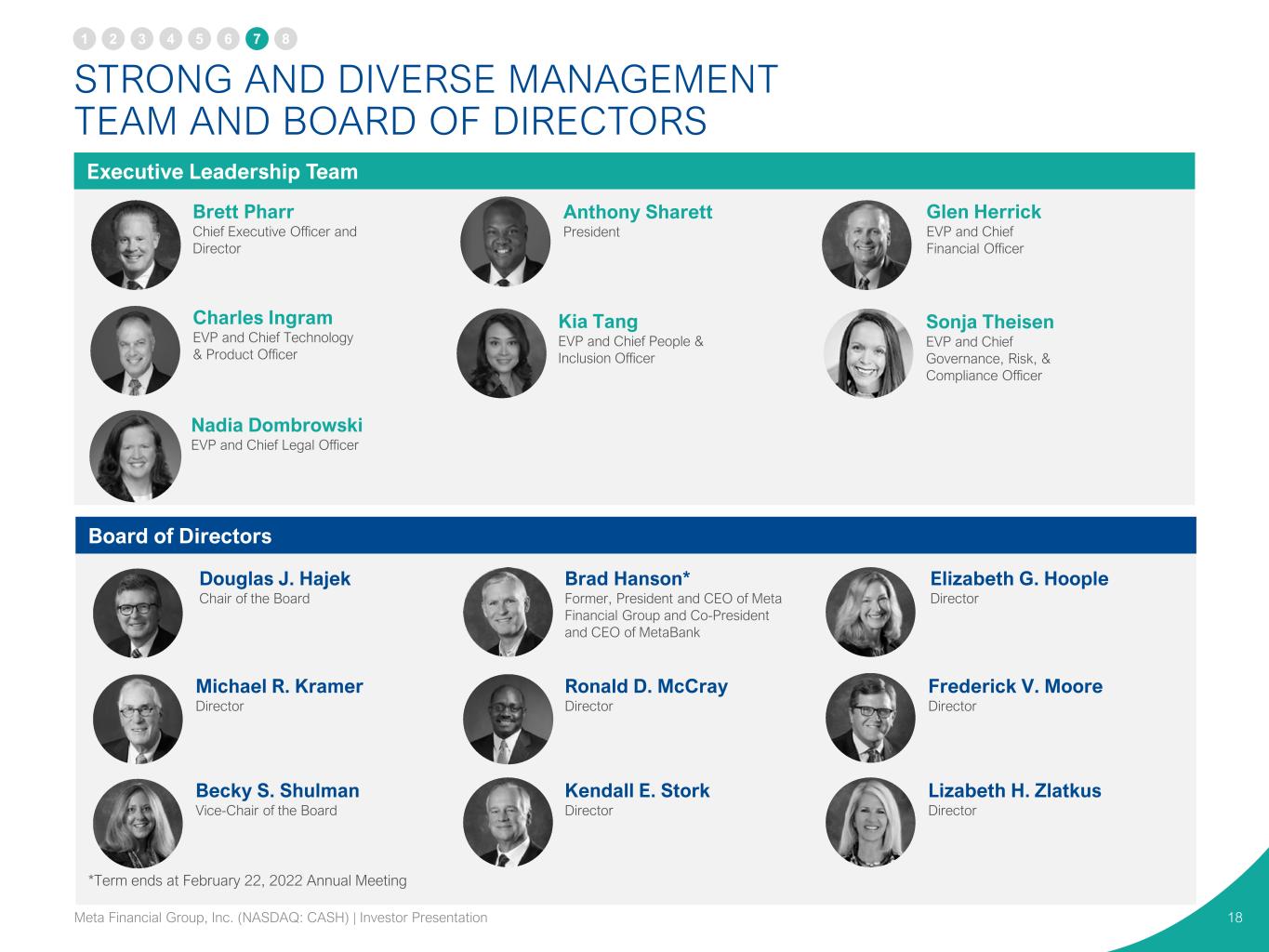

STRONG AND DIVERSE MANAGEMENT TEAM AND BOARD OF DIRECTORS 18 Brett Pharr Chief Executive Officer and Director Glen Herrick EVP and Chief Financial Officer Charles Ingram EVP and Chief Technology & Product Officer Sonja Theisen EVP and Chief Governance, Risk, & Compliance Officer Kia Tang EVP and Chief People & Inclusion Officer Executive Leadership Team Douglas J. Hajek Chair of the Board Brad Hanson* Former, President and CEO of Meta Financial Group and Co-President and CEO of MetaBank Elizabeth G. Hoople Director Michael R. Kramer Director Frederick V. Moore Director Ronald D. McCray Director Board of Directors Becky S. Shulman Vice-Chair of the Board Lizabeth H. Zlatkus Director Kendall E. Stork Director *Term ends at February 22, 2022 Annual Meeting Anthony Sharett President 1 2 3 4 5 6 7 8 Meta Financial Group, Inc. (NASDAQ: CASH) | Investor Presentation Nadia Dombrowski EVP and Chief Legal Officer

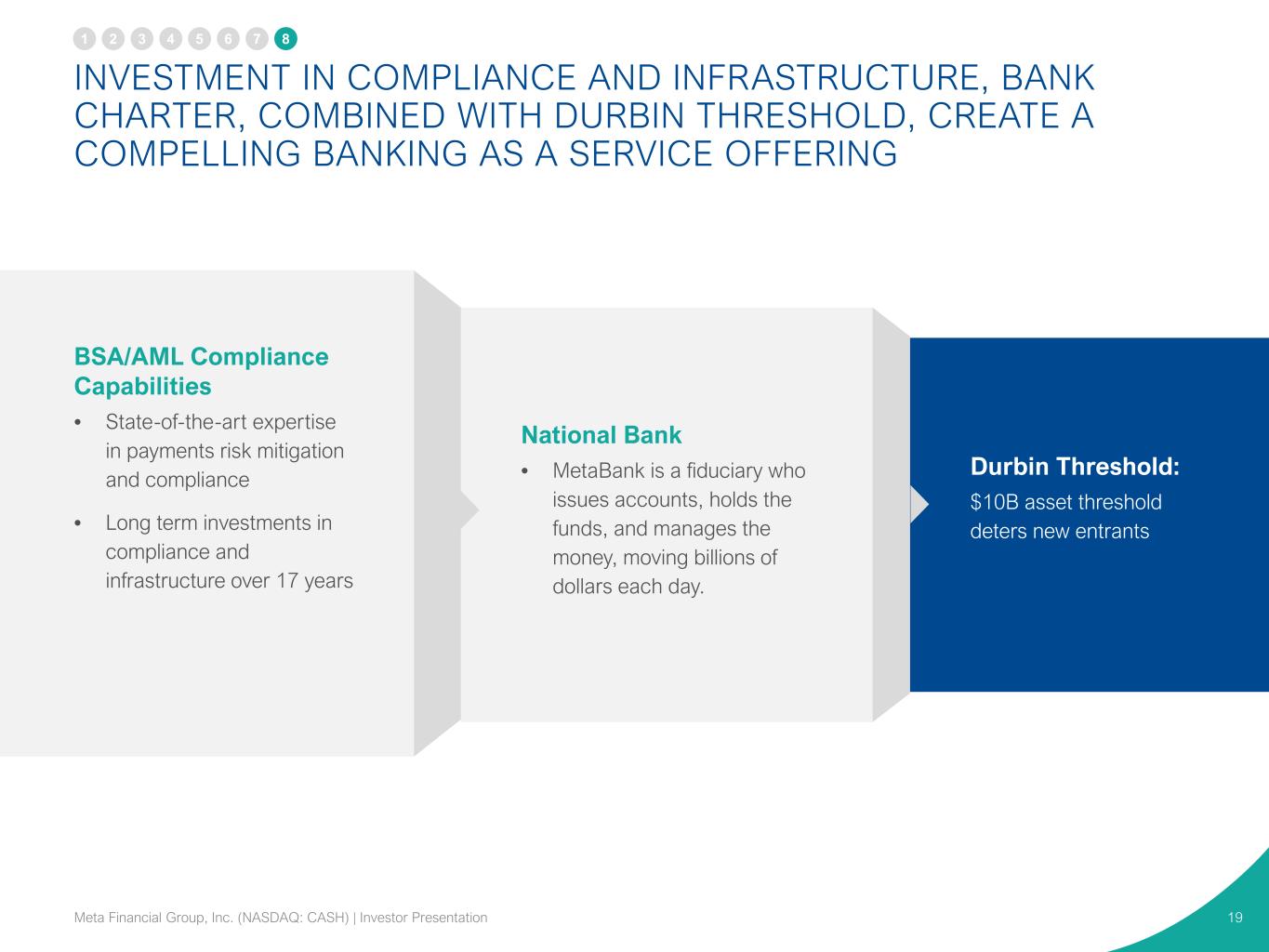

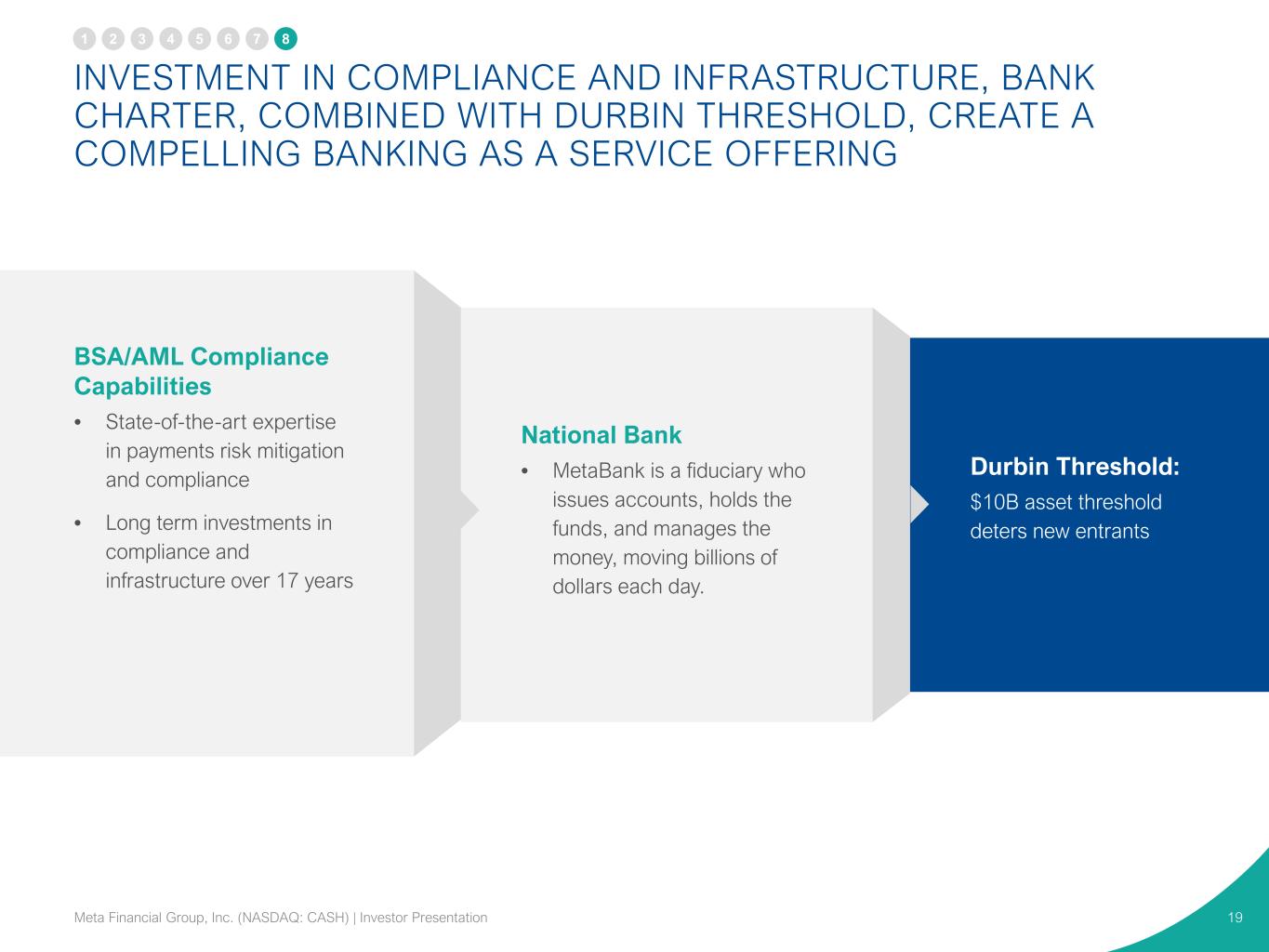

INVESTMENT IN COMPLIANCE AND INFRASTRUCTURE, BANK CHARTER, COMBINED WITH DURBIN THRESHOLD, CREATE A COMPELLING BANKING AS A SERVICE OFFERING 19 National Bank • MetaBank is a fiduciary who issues accounts, holds the funds, and manages the money, moving billions of dollars each day. BSA/AML Compliance Capabilities • State-of-the-art expertise in payments risk mitigation and compliance • Long term investments in compliance and infrastructure over 17 years Durbin Threshold: $10B asset threshold deters new entrants 1 2 3 4 5 6 7 8 Meta Financial Group, Inc. (NASDAQ: CASH) | Investor Presentation

APPENDIX 20Meta Financial Group, Inc. (NASDAQ: CASH) | Investor Presentation

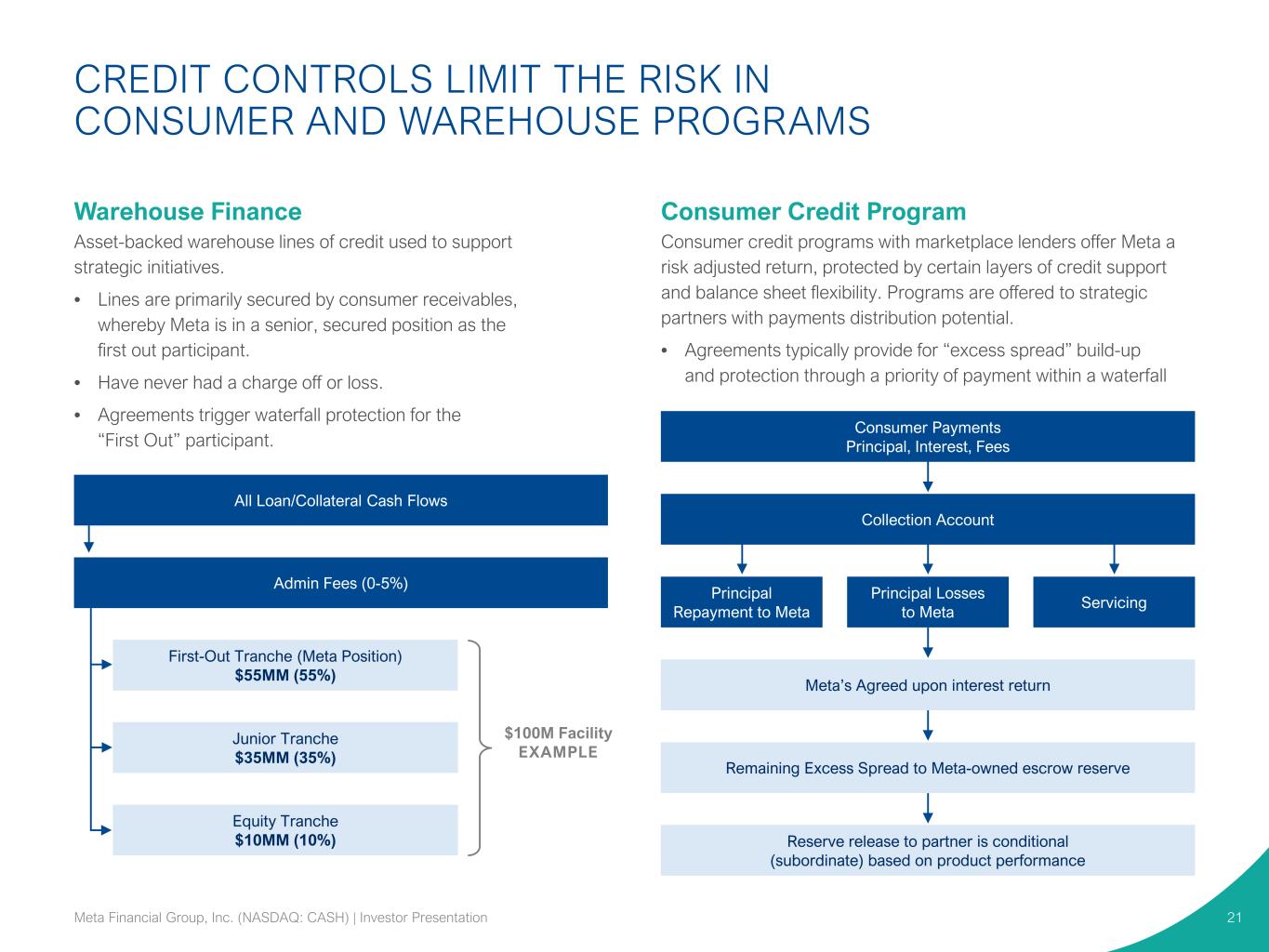

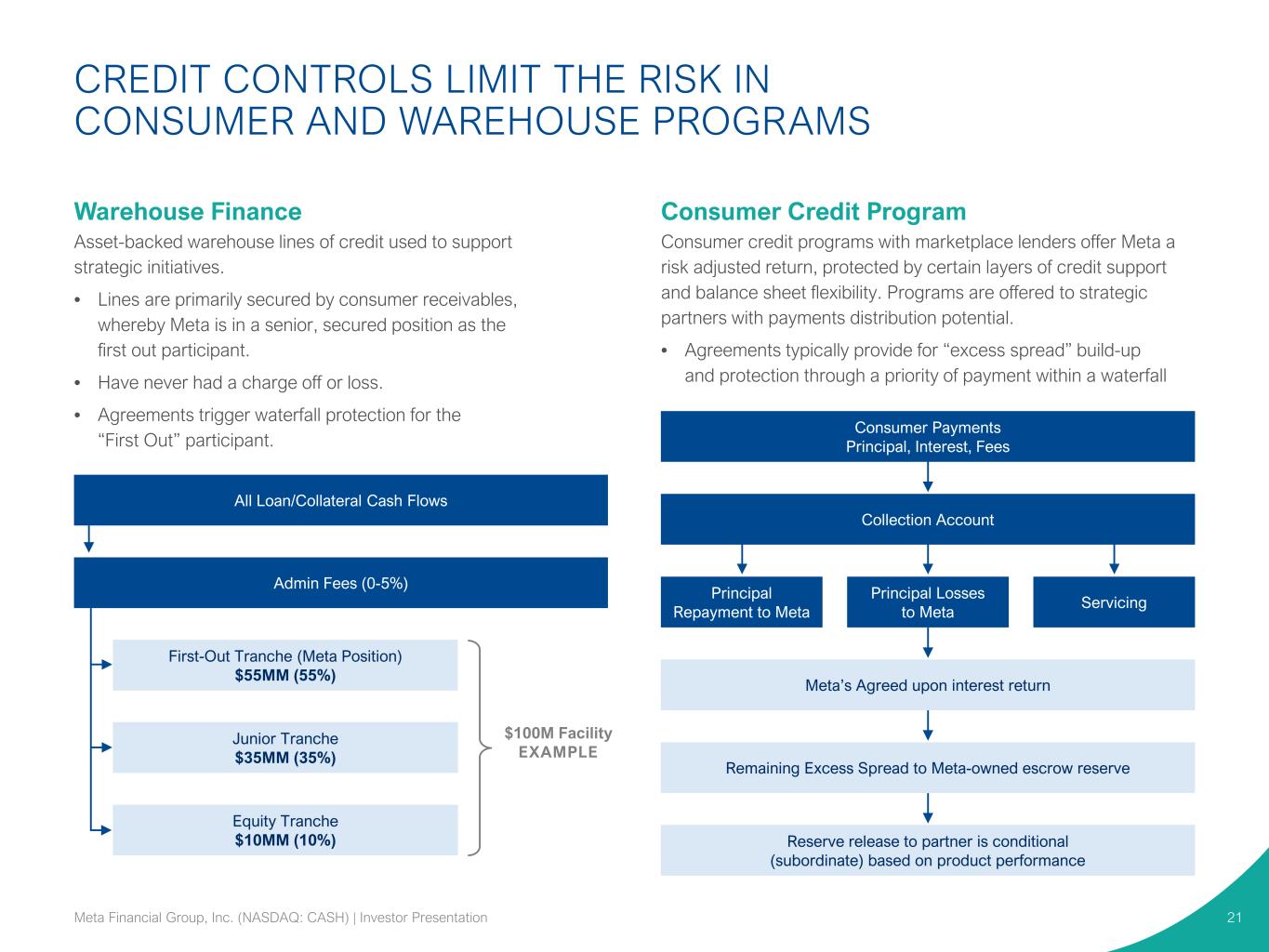

CREDIT CONTROLS LIMIT THE RISK IN CONSUMER AND WAREHOUSE PROGRAMS Consumer Credit Program Consumer credit programs with marketplace lenders offer Meta a risk adjusted return, protected by certain layers of credit support and balance sheet flexibility. Programs are offered to strategic partners with payments distribution potential. • Agreements typically provide for “excess spread” build-up and protection through a priority of payment within a waterfall 21 All Loan/Collateral Cash Flows Admin Fees (0-5%) Junior Tranche $35MM (35%) Equity Tranche $10MM (10%) First-Out Tranche (Meta Position) $55MM (55%) $100M Facility EXAMPLE Warehouse Finance Asset-backed warehouse lines of credit used to support strategic initiatives. • Lines are primarily secured by consumer receivables, whereby Meta is in a senior, secured position as the first out participant. • Have never had a charge off or loss. • Agreements trigger waterfall protection for the “First Out” participant. Consumer Payments Principal, Interest, Fees Collection Account Servicing Principal Losses to Meta Principal Repayment to Meta Meta’s Agreed upon interest return Remaining Excess Spread to Meta-owned escrow reserve Reserve release to partner is conditional (subordinate) based on product performance Meta Financial Group, Inc. (NASDAQ: CASH) | Investor Presentation

DEFINITIONS Industry Terms 22 Types of Payment Cards Banking-as-a-Service (BaaS): Providing financial services and solutions to third parties to offer through their distribution channels. Push-to-debit: The ability to move money directly to an end user. At Meta – our push-to-debit capabilities are called “Faster Payments”. Debit Card: A type of payment card typically tied to funds held in a deposit account. Credit Card: A type of payment card typically attached to a line of credit that a user can make purchases against. Prepaid Card: A type of payment card that holds a finite amount of funds and is not directly tied to a bank account or line of credit. Virtual Card: A digital counterpart to a payment card, generated with a unique card number to settle a particular transaction by an authorized user. These are often used for one-time, business-to-business payments. Meta Financial Group, Inc. (NASDAQ: CASH) | Investor Presentation

DEFINITIONS, CONTINUED Payment Players 23 Acquiring Bank: An acquiring bank provides merchant accounts that allow a business to accept card payments and works in conjunction with the acquirer processor. In some cases the acquiring bank and acquirer processor are a single entity. Acquiring Processors: Acquirer processors connect directly with merchants, the network and the acquiring bank, or via a payment gateway, to facilitate payment acceptance at the merchant. They provide the technical capabilities to create the system of record to communicate with authorization and settlement entities. In some cases the acquiring bank and acquirer processor are a single entity. Issuing Bank: The issuing bank enters into a relationship with the cardholder, program manager, and enables cards on a given network. The issuing bank fills three primary roles in payment processing: it is a “network sponsor,” which means it can issue cards on a given payments network; it is a holder of funds (for example, for gift cards, deposit accounts and other non-credit cards); and it is a “settlement point,” managing a consumer’s account and paying out to the merchant’s account after a purchase. Issuing Processor: Connects directly with the networks and issuing bank to provide the system of record, authorize transactions and communicate with settlement entities. Fintech: Fintech refers to the integration of technology into offerings by financial services companies in order to improve their use and delivery to consumers. Merchant: A merchant simply refers to any business that accepts card-based payments either via a physical swipe (at the point-of-sale) or virtually online. Program Manager: Businesses that manage various elements of a card program on behalf of the issuing bank. The Program Manager is responsible for defining the program, operating the program, and managing its profitability. The program manager typically is responsible for establishing relationships with processors, banks, payment networks and distributors and for establishing account(s) at banks. Meta Financial Group, Inc. (NASDAQ: CASH) | Investor Presentation

DEFINITIONS, CONTINUED 24 Commercial Lending Terms Asset-Based Lending: Asset-Based Lending (ABL) refers to business loans that are secured based on assets as collateral, generally accounts receivable, inventory, equipment or other balance sheet assets. Accounts Receivable: Accounts Receivable (A/R) financing refers to financing based on the value of a company’s accounts receivable (their invoices for goods or services) to another company. It is a subset of asset- based lending and is also known as factoring. Equipment Financing: Equipment Financing refers to a loan used to purchase business equipment. The financing is provided through leases such as $1 Buyout, Fair Market Value (FMV), or through term loans. Factoring: Factoring refers to financing based on the purchase of a company’s accounts receivables, their invoices for goods or services. It is a subset of asset-based lending and is also known as accounts receivable financing. Insurance Premium Finance: Insurance Premium Finance refers to short-term collateralized financing to facilitate the purchases of property, casualty, and liability insurance premiums for the commercial market. Government Guaranteed Lending: A government guaranteed loan is a loan guaranteed by a government agency and financed through a lending financial entity. Government guaranteed loans include SBA loans and USDA loans. SBA Loan: An SBA loan refers to financing that is guaranteed by the Small Business Administration (SBA) and provided by a lending financial institution. SBA loans, such as an SBA 7(a) loan, may be easier for a small business to obtain because of the reduced risk for the lender. Lenders must meet sufficient requirements to be eligible as a lending entity. Term Loan: A Term loan is a loan for a specific amount that has a specified interest rate and regular payment schedule to be repaid over a set period of time. USDA Loan: A USDA loan refers to financing guaranteed by the U.S. Department of Agriculture (USDA) as part of the Rural Development program and provided by a lending financial institution. USDA business loans, such as the USDA Business & Industry (B & I) loan, may be easier for a business to obtain because of the reduced risk for the lender. Lenders must meet sufficient requirements to be eligible as a lending entity. Meta Financial Group, Inc. (NASDAQ: CASH) | Investor Presentation