QUARTERLY INVESTOR UPDATE SECOND QUARTER FISCAL YEAR 2022

FORWARD LOOKING STATEMENTS 2 This investor update contains “forward-looking statements” which are made in good faith by the Company pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements by words such as “may,” “hope,” “will,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential,” “continue,” “could,” “future,” or the negative of those terms, or other words of similar meaning or similar expressions. These forward-looking statements are based on information currently available to us and assumptions about future events, and include statements with respect to the Company’s beliefs, expectations, estimates, and intentions, which are subject to significant risks and uncertainties, and are subject to change based on various factors, some of which are beyond the Company’s control. Such risks, uncertainties and other factors may cause our actual growth, results of operations, financial condition, cash flows, performance and business prospects and opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. Such statements address, among others, the following subjects: future operating results; expectations in connection with the impact of the ongoing COVID-19 pandemic and related government actions on our business, our industry and the capital markets; customer retention; loan and other product demand; expectations concerning acquisitions and divestitures; new products and services, including those offered by Meta Payment Systems, Refund Advantage, EPS Financial and Specialty Consumer Services divisions; credit quality; the level of net charge-offs and the adequacy of the allowance for loan and lease losses; technology; and the Company's employees. The following factors, among others, could cause the Company's financial performance and results of operations to differ materially from the expectations, estimates, and intentions expressed in such forward-looking statements: maintaining our executive management team; expected growth opportunities may not be realized or may take longer to realize than expected; the potential adverse effects of the ongoing COVID-19 pandemic and any governmental or societal responses thereto, or other unusual and infrequently occurring events, including the impact on financial markets from geopolitical conflicts such as the military conflict between Russia and Ukraine; successfully completing our announced rebranding and our ability to achieve brand recognition for Pathward equal to or greater than we currently enjoy for MetaBank; changes in trade, monetary, and fiscal policies and laws, including actual changes in interest rates and the Fed Funds rate; changes in tax laws; the strength of the United States' economy, and the local economies in which the Company operates; inflation, market, and monetary fluctuations; the timely and efficient development of, new products and services offered by the Company or its strategic partners, as well as risks (including reputational and litigation) attendant thereto, and the perceived overall value of these products and services by users; MetaBank’s ability to maintain its Durbin Amendment exemption; the risks of dealing with or utilizing third parties, including, in connection with the Company’s prepaid card and tax refund advance business, the risk of reduced volume of refund advance loans as a result of reduced customer demand for or usage of the Company’s strategic partners’ refund advance products; our relationship with, and any actions which may be initiated by, our regulators; changes in financial services laws and regulations, including laws and regulations relating to the tax refund industry and the insurance premium finance industry; technological changes, including, but not limited to, the protection of our electronic systems and information; the impact of acquisitions and divestitures; litigation risk; the growth of the Company’s business, as well as expenses related thereto; continued maintenance by MetaBank of its status as a well-capitalized institution, changes in consumer spending and saving habits; losses from fraudulent or illegal activity, technological risks and developments and cyber threats, attacks or events; the success of the Company at maintaining its high quality asset level and managing and collecting assets of borrowers in default should problem assets increase; and the other factors described under the caption “Risk Factors” and in other sections of the Company’s Annual Report on Form 10-K for the Company's fiscal year ended September 30, 2021 and in other filings made by the Company with the Securities and Exchange Commission (“SEC”). The forward-looking statements included herein speak only as of the date of this investor update. The Company expressly disclaims any intent or obligation to update any forward-looking statements, whether written or oral, that may be made from time to time by or on behalf of the Company or its subsidiaries, whether as a result of new information, changed circumstances or future events or for any other reason. Meta Financial Group, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation

3 WE STRIVE TO INCREASE FINANCIAL AVAILABILITY, CHOICE, AND OPPORTUNITY THROUGH FINANCIAL EMPOWERMENT. We work to disrupt traditional banking norms by developing partnerships with fintechs, affinity groups, government agencies, and other banks to make a range of quality financial products and services available to the communities we serve nationally. Our national bank charter, coordination with regulators, and deep understanding of risk mitigation and compliance allows us to guide our partners and deliver the financial products and services that meet the needs of those who need them most. We believe in financial inclusion for allTM. Meta Financial Group, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation

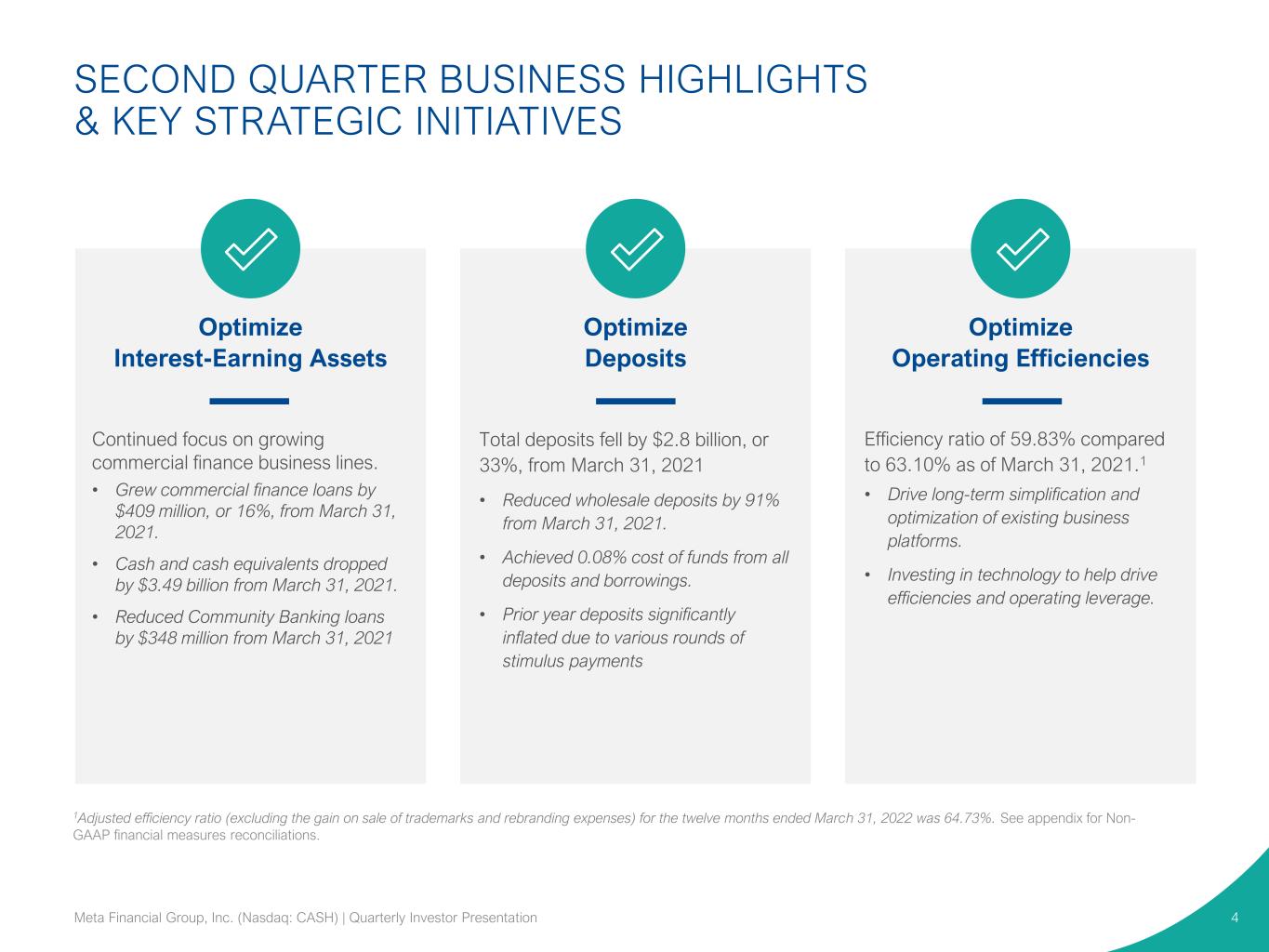

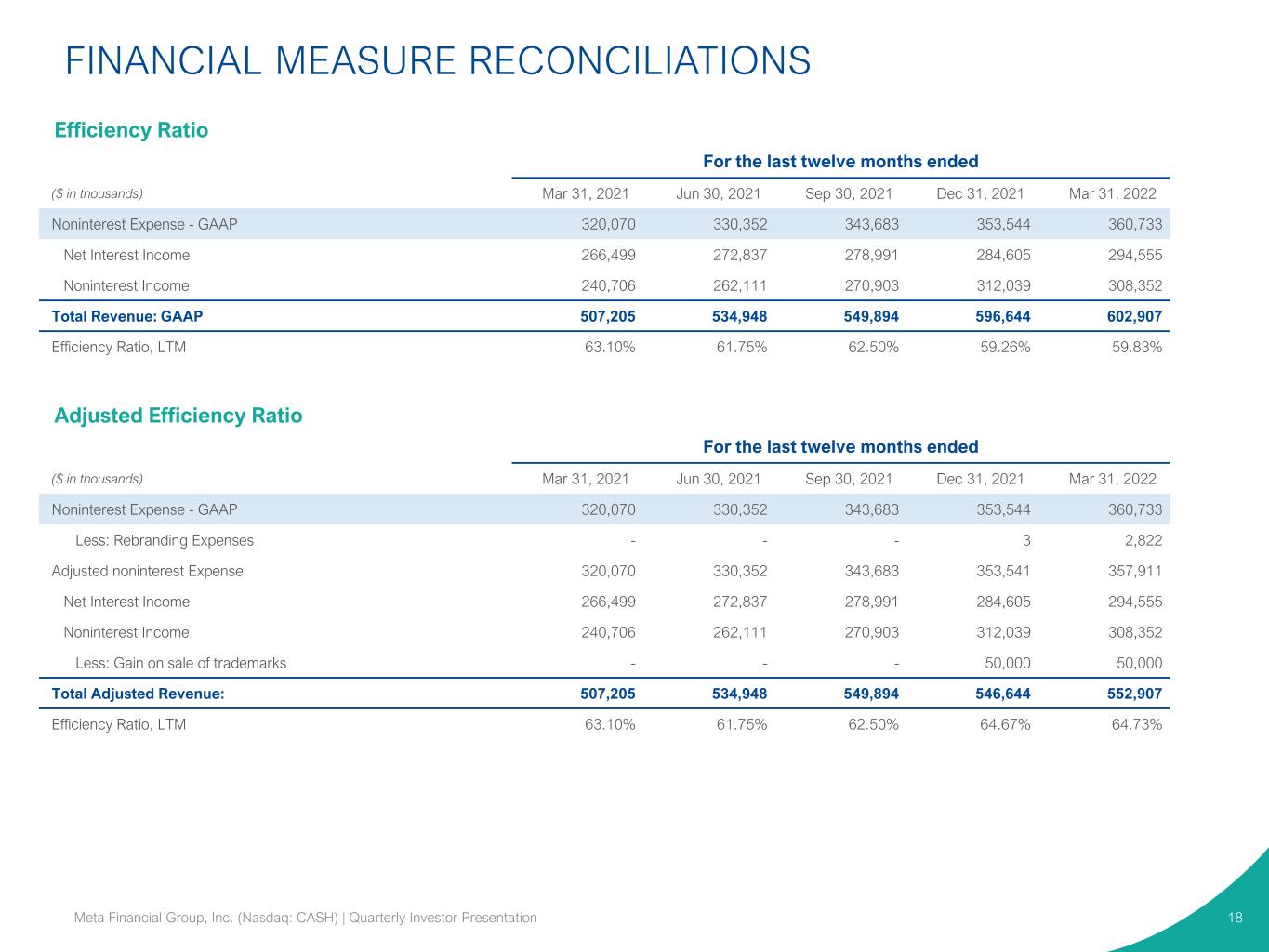

Optimize Interest-Earning Assets Optimize Deposits Optimize Operating Efficiencies Efficiency ratio of 59.83% compared to 63.10% as of March 31, 2021.1 • Drive long-term simplification and optimization of existing business platforms. • Investing in technology to help drive efficiencies and operating leverage. Total deposits fell by $2.8 billion, or 33%, from March 31, 2021 • Reduced wholesale deposits by 91% from March 31, 2021. • Achieved 0.08% cost of funds from all deposits and borrowings. • Prior year deposits significantly inflated due to various rounds of stimulus payments Continued focus on growing commercial finance business lines. • Grew commercial finance loans by $409 million, or 16%, from March 31, 2021. • Cash and cash equivalents dropped by $3.49 billion from March 31, 2021. • Reduced Community Banking loans by $348 million from March 31, 2021 SECOND QUARTER BUSINESS HIGHLIGHTS & KEY STRATEGIC INITIATIVES 4Meta Financial Group, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation 1Adjusted efficiency ratio (excluding the gain on sale of trademarks and rebranding expenses) for the twelve months ended March 31, 2022 was 64.73%. See appendix for Non- GAAP financial measures reconciliations.

OTHER BUSINESS DEVELOPMENTS SECOND QUARTER ENDED MARCH 31, 2022 5Meta Financial Group, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation • On March 29, 2022, the Company announced it is changing its name to Pathward Financial, Inc.TM, and its bank subsidiary, MetaBank, N.A., will be changing its name to PathwardTM, N.A. – Pathward signifies our Company’s purpose to power financial inclusion for all by creating a path forward for individuals and businesses to meet their financial goals. The name reflects our dedication to removing the barriers that prevent millions of Americans from accessing the financial system and will serve as a constant reminder of our mission to meet the needs of the unbanked, underbanked, and underserved to help them achieve economic mobility. – Certain changes will be made immediately, with a full transition to Pathward expected by the end of this calendar year, including the launch of a new brand identity and website. – The Company will continue to serve its customers under existing brand names during the transition. – The Company recognized $2.8 million of pre-tax expenses related to rebranding efforts during the second quarter of fiscal 2022. The Company estimates total rebranding expenses will range between $15 million to $20 million. • April 27, 2022 Meta published its second annual ESG report. – In addition to detailing the Company's community impact program and its diversity, equity, and inclusion efforts, the report contains enhanced quantitative reporting, which will be used to measure progress. – The updated report can be found on our investor relations website at https://www.metafinancialgroup.com/esg

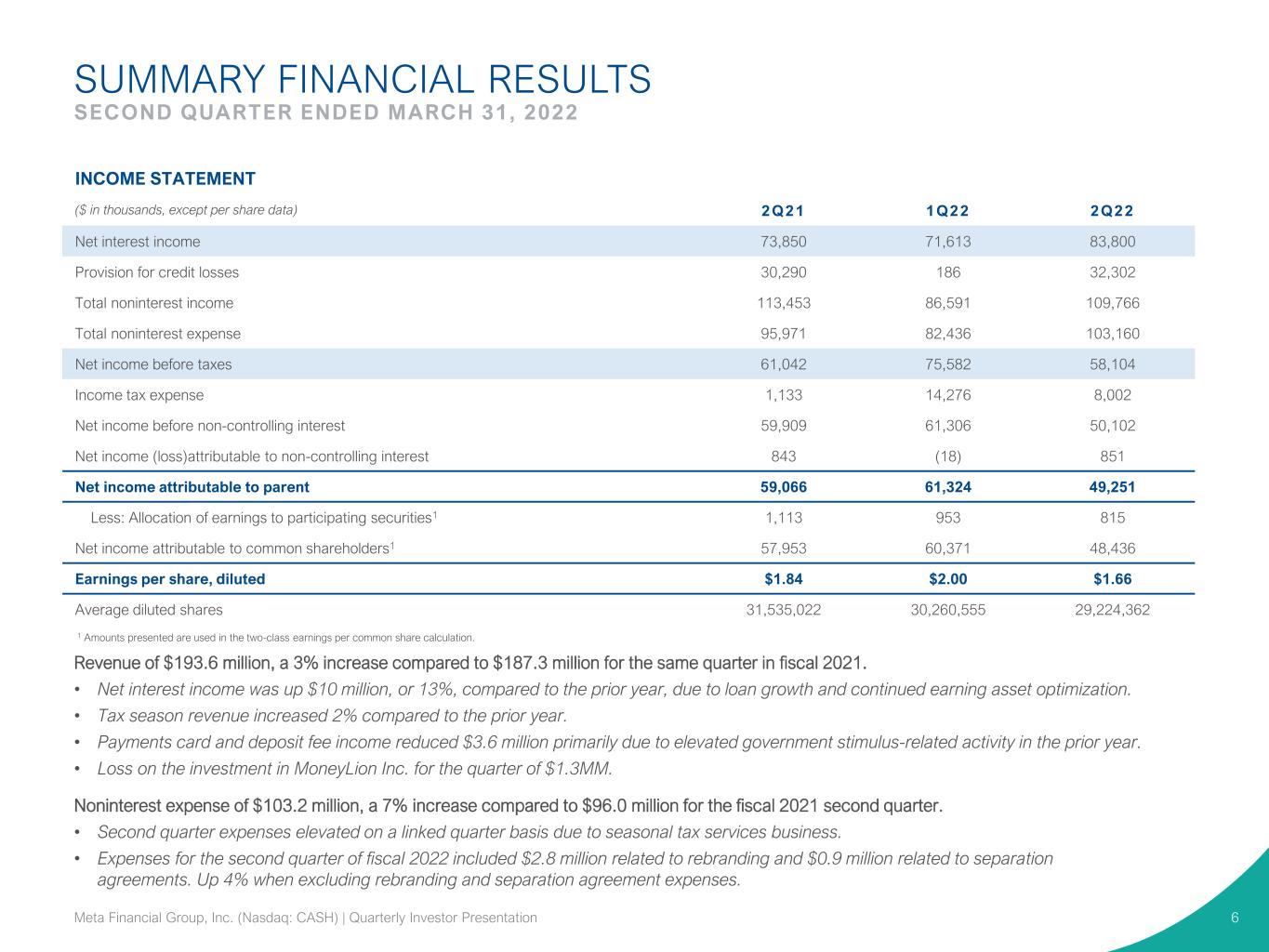

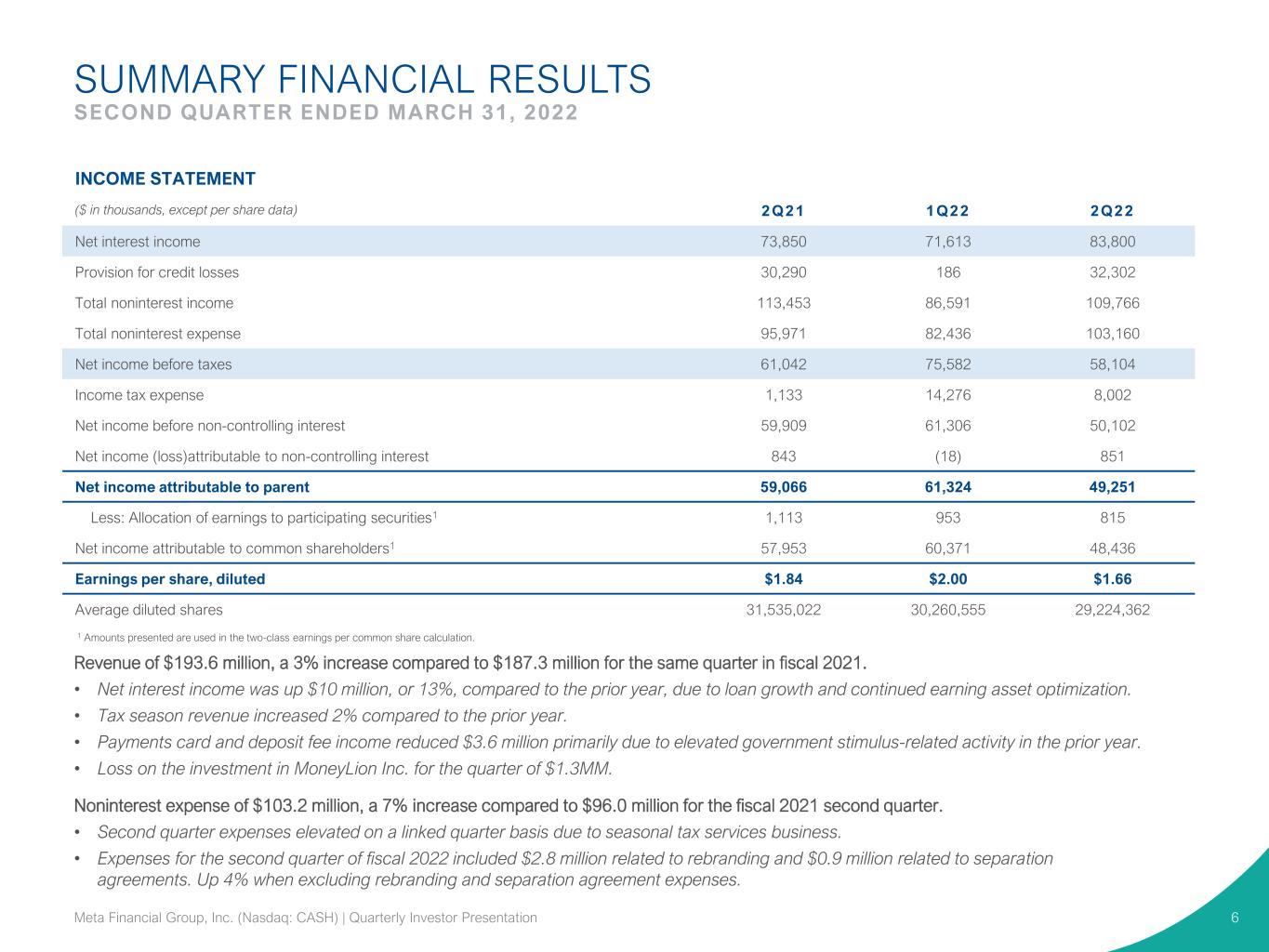

SUMMARY FINANCIAL RESULTS SECOND QUARTER ENDED MARCH 31, 2022 6 1 Amounts presented are used in the two-class earnings per common share calculation. INCOME STATEMENT ($ in thousands, except per share data) 2Q21 1Q22 2Q22 Net interest income 73,850 71,613 83,800 Provision for credit losses 30,290 186 32,302 Total noninterest income 113,453 86,591 109,766 Total noninterest expense 95,971 82,436 103,160 Net income before taxes 61,042 75,582 58,104 Income tax expense 1,133 14,276 8,002 Net income before non-controlling interest 59,909 61,306 50,102 Net income (loss)attributable to non-controlling interest 843 (18) 851 Net income attributable to parent 59,066 61,324 49,251 Less: Allocation of earnings to participating securities1 1,113 953 815 Net income attributable to common shareholders1 57,953 60,371 48,436 Earnings per share, diluted $1.84 $2.00 $1.66 Average diluted shares 31,535,022 30,260,555 29,224,362 Revenue of $193.6 million, a 3% increase compared to $187.3 million for the same quarter in fiscal 2021. • Net interest income was up $10 million, or 13%, compared to the prior year, due to loan growth and continued earning asset optimization. • Tax season revenue increased 2% compared to the prior year. • Payments card and deposit fee income reduced $3.6 million primarily due to elevated government stimulus-related activity in the prior year. • Loss on the investment in MoneyLion Inc. for the quarter of $1.3MM. Noninterest expense of $103.2 million, a 7% increase compared to $96.0 million for the fiscal 2021 second quarter. • Second quarter expenses elevated on a linked quarter basis due to seasonal tax services business. • Expenses for the second quarter of fiscal 2022 included $2.8 million related to rebranding and $0.9 million related to separation agreements. Up 4% when excluding rebranding and separation agreement expenses. Meta Financial Group, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation

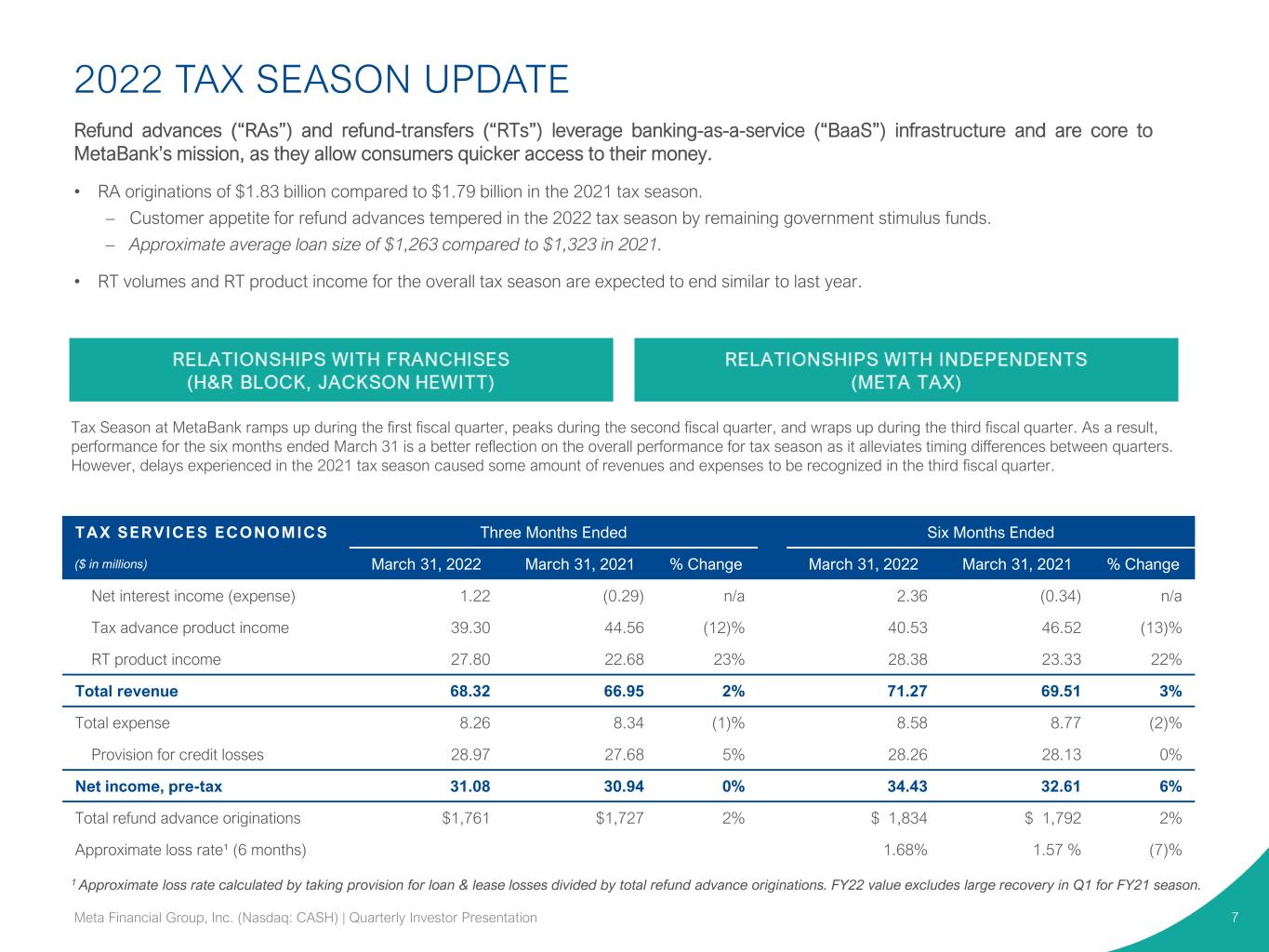

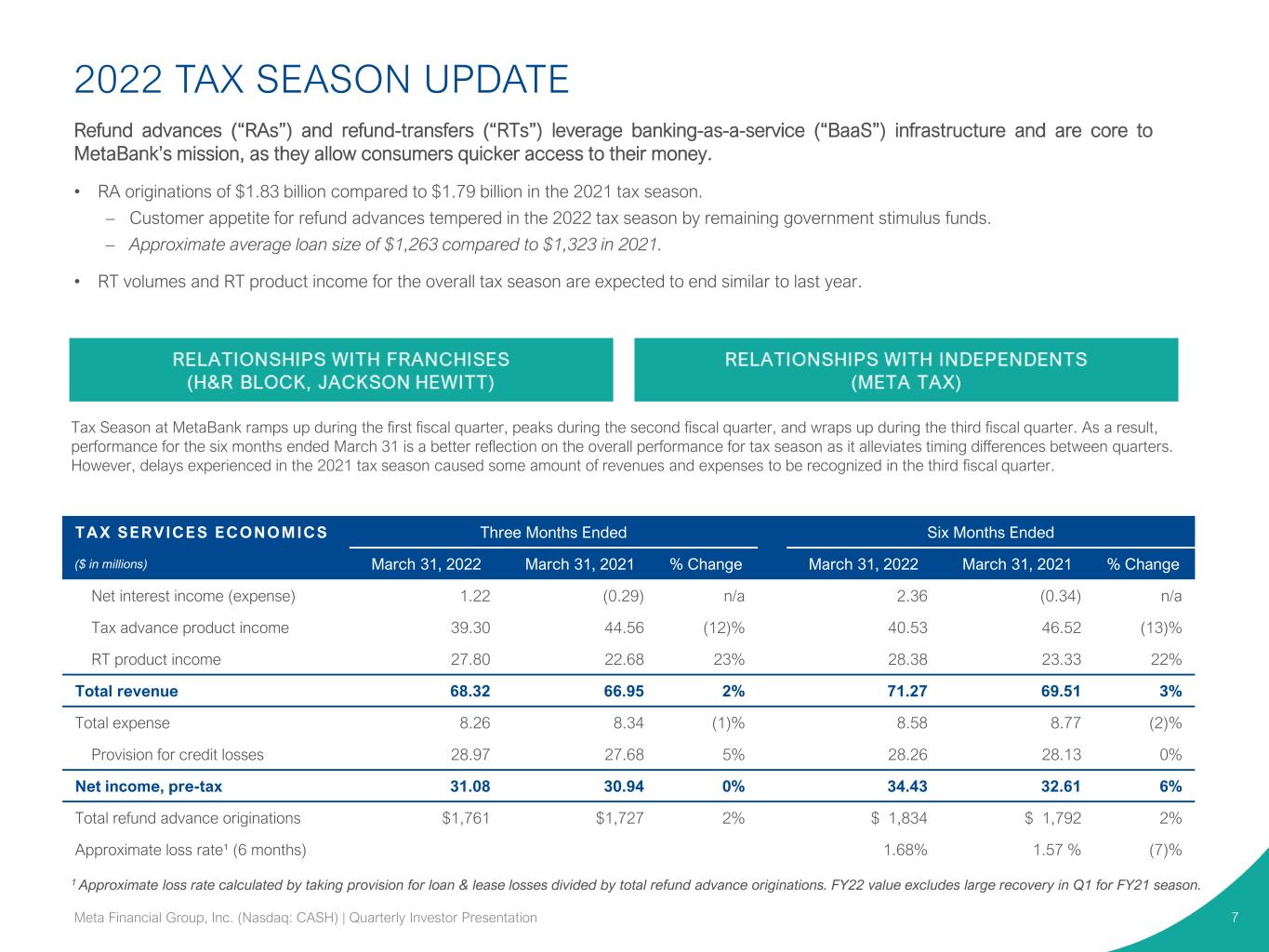

2022 TAX SEASON UPDATE 7 Refund advances (“RAs”) and refund-transfers (“RTs”) leverage banking-as-a-service (“BaaS”) infrastructure and are core to MetaBank’s mission, as they allow consumers quicker access to their money. • RA originations of $1.83 billion compared to $1.79 billion in the 2021 tax season. – Customer appetite for refund advances tempered in the 2022 tax season by remaining government stimulus funds. – Approximate average loan size of $1,263 compared to $1,323 in 2021. • RT volumes and RT product income for the overall tax season are expected to end similar to last year. Meta Financial Group, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation Tax Season at MetaBank ramps up during the first fiscal quarter, peaks during the second fiscal quarter, and wraps up during the third fiscal quarter. As a result, performance for the six months ended March 31 is a better reflection on the overall performance for tax season as it alleviates timing differences between quarters. However, delays experienced in the 2021 tax season caused some amount of revenues and expenses to be recognized in the third fiscal quarter. TAX SERVICES ECONOMICS Three Months Ended Six Months Ended ($ in millions) March 31, 2022 March 31, 2021 % Change March 31, 2022 March 31, 2021 % Change Net interest income (expense) 1.22 (0.29) n/a 2.36 (0.34) n/a Tax advance product income 39.30 44.56 (12)% 40.53 46.52 (13)% RT product income 27.80 22.68 23% 28.38 23.33 22% Total revenue 68.32 66.95 2% 71.27 69.51 3% Total expense 8.26 8.34 (1)% 8.58 8.77 (2)% Provision for credit losses 28.97 27.68 5% 28.26 28.13 0% Net income, pre-tax 31.08 30.94 0% 34.43 32.61 6% Total refund advance originations $1,761 $1,727 2% $ 1,834 $ 1,792 2% Approximate loss rate¹ (6 months) 1.68% 1.57 % (7)% 1 Approximate loss rate calculated by taking provision for loan & lease losses divided by total refund advance originations. FY22 value excludes large recovery in Q1 for FY21 season.

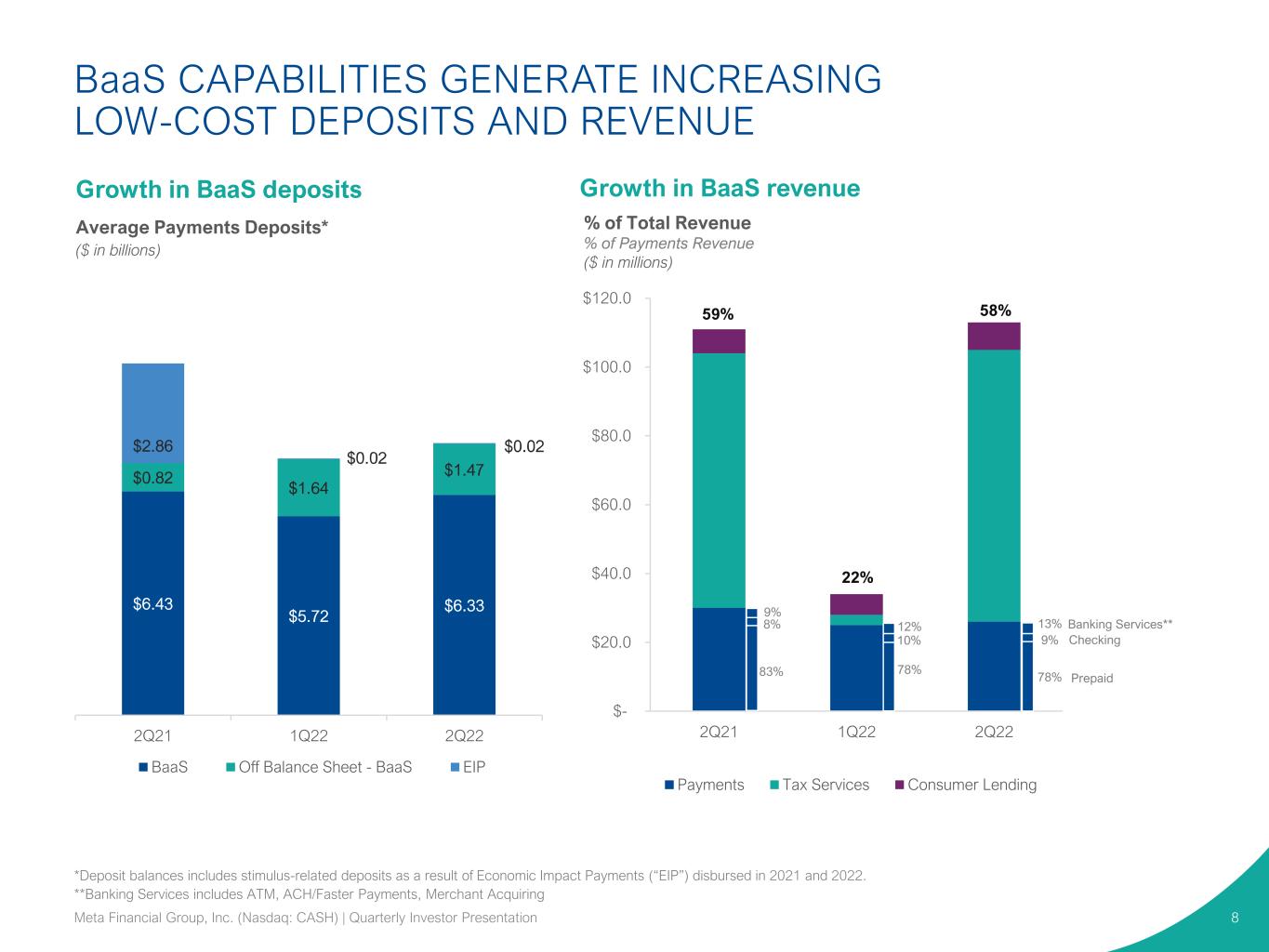

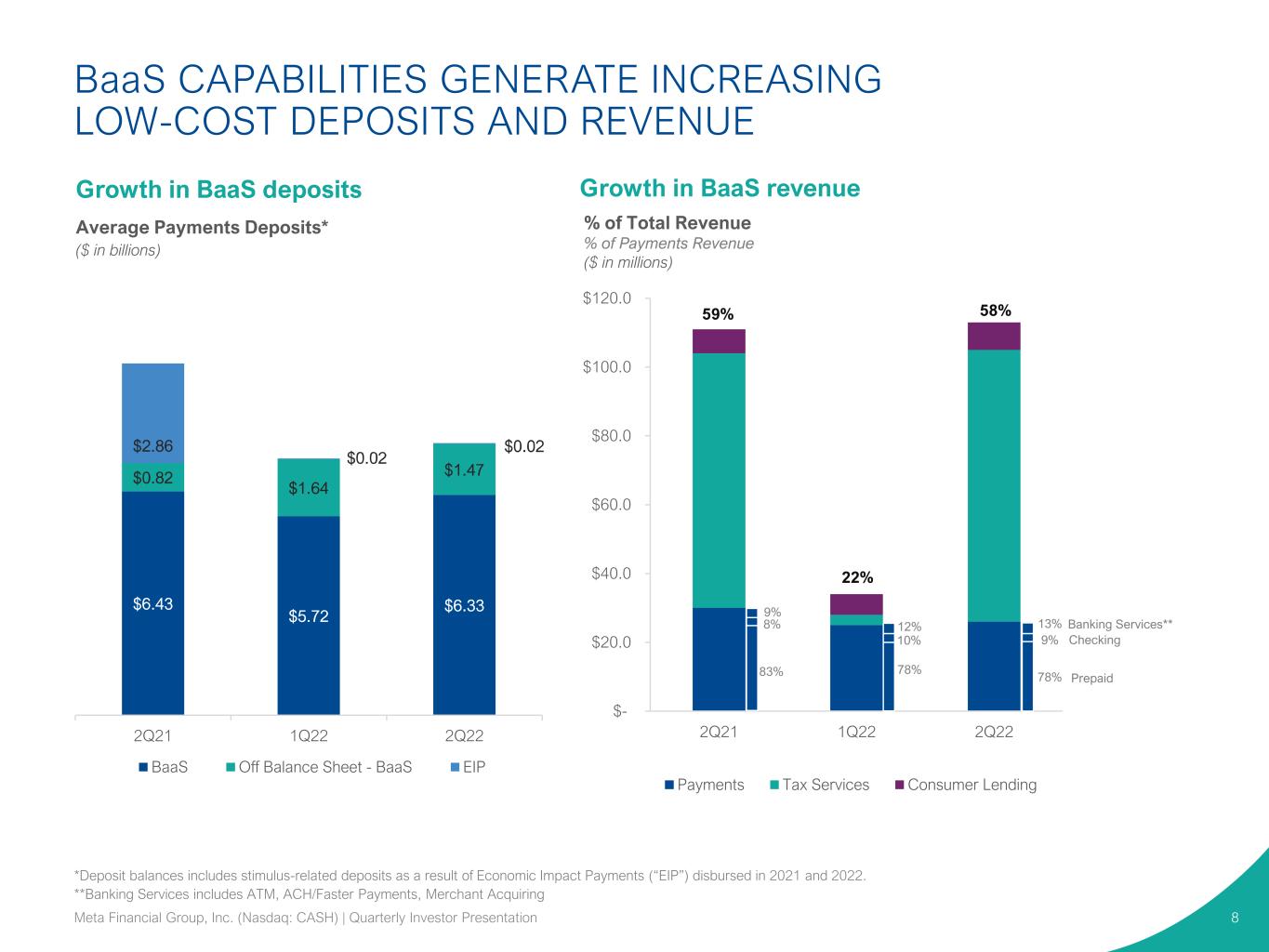

$- $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 2Q21 1Q22 2Q22 Payments Tax Services Consumer Lending BaaS CAPABILITIES GENERATE INCREASING LOW-COST DEPOSITS AND REVENUE 8 Growth in BaaS revenue Average Payments Deposits* ($ in billions) 59% 22% 58% % of Total Revenue % of Payments Revenue ($ in millions) *Deposit balances includes stimulus-related deposits as a result of Economic Impact Payments (“EIP”) disbursed in 2021 and 2022. **Banking Services includes ATM, ACH/Faster Payments, Merchant Acquiring Growth in BaaS deposits Banking Services** Checking Prepaid 13% 9% 78% Meta Financial Group, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation 9% 8% 83% 12% 10% 78% $6.43 $5.72 $6.33 $0.82 $1.64 $1.47 $2.86 $0.02 $0.02 2Q21 1Q22 2Q22 BaaS Off Balance Sheet - BaaS EIP

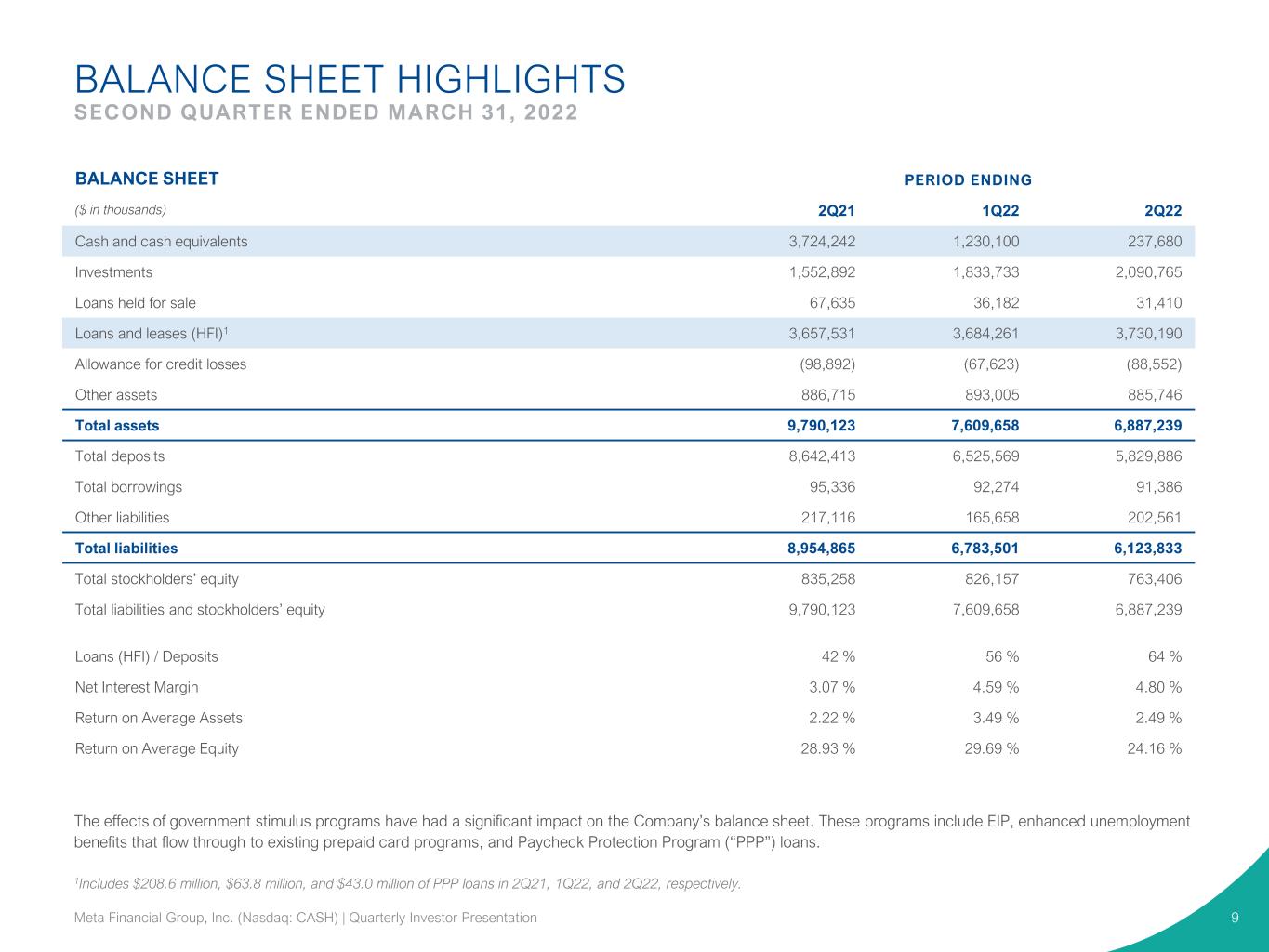

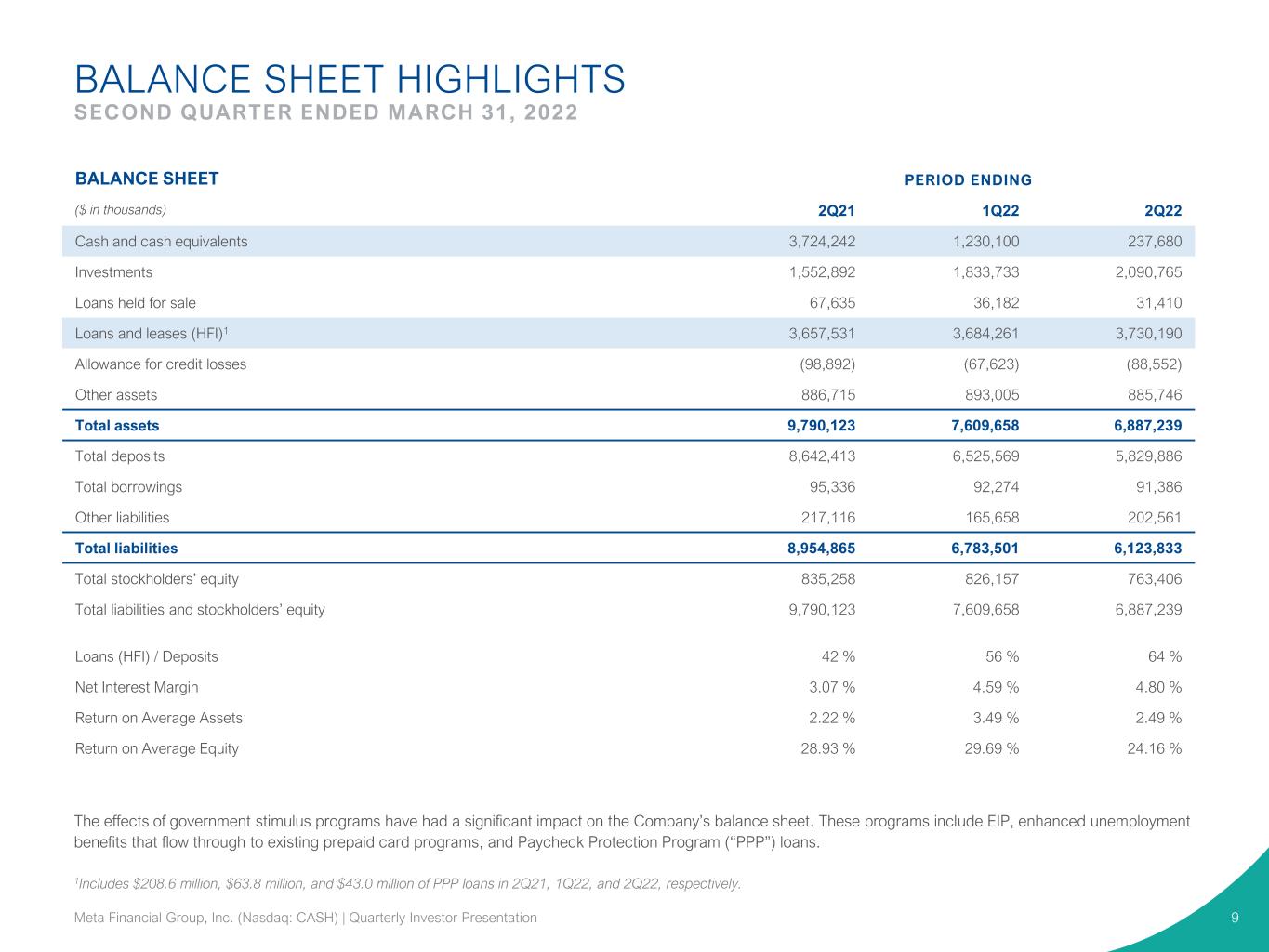

BALANCE SHEET HIGHLIGHTS SECOND QUARTER ENDED MARCH 31, 2022 9 BALANCE SHEET PERIOD ENDING ($ in thousands) 2Q21 1Q22 2Q22 Cash and cash equivalents 3,724,242 1,230,100 237,680 Investments 1,552,892 1,833,733 2,090,765 Loans held for sale 67,635 36,182 31,410 Loans and leases (HFI)1 3,657,531 3,684,261 3,730,190 Allowance for credit losses (98,892) (67,623) (88,552) Other assets 886,715 893,005 885,746 Total assets 9,790,123 7,609,658 6,887,239 Total deposits 8,642,413 6,525,569 5,829,886 Total borrowings 95,336 92,274 91,386 Other liabilities 217,116 165,658 202,561 Total liabilities 8,954,865 6,783,501 6,123,833 Total stockholders’ equity 835,258 826,157 763,406 Total liabilities and stockholders’ equity 9,790,123 7,609,658 6,887,239 Loans (HFI) / Deposits 42 % 56 % 64 % Net Interest Margin 3.07 % 4.59 % 4.80 % Return on Average Assets 2.22 % 3.49 % 2.49 % Return on Average Equity 28.93 % 29.69 % 24.16 % 1Includes $208.6 million, $63.8 million, and $43.0 million of PPP loans in 2Q21, 1Q22, and 2Q22, respectively. The effects of government stimulus programs have had a significant impact on the Company’s balance sheet. These programs include EIP, enhanced unemployment benefits that flow through to existing prepaid card programs, and Paycheck Protection Program (“PPP”) loans. Meta Financial Group, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation

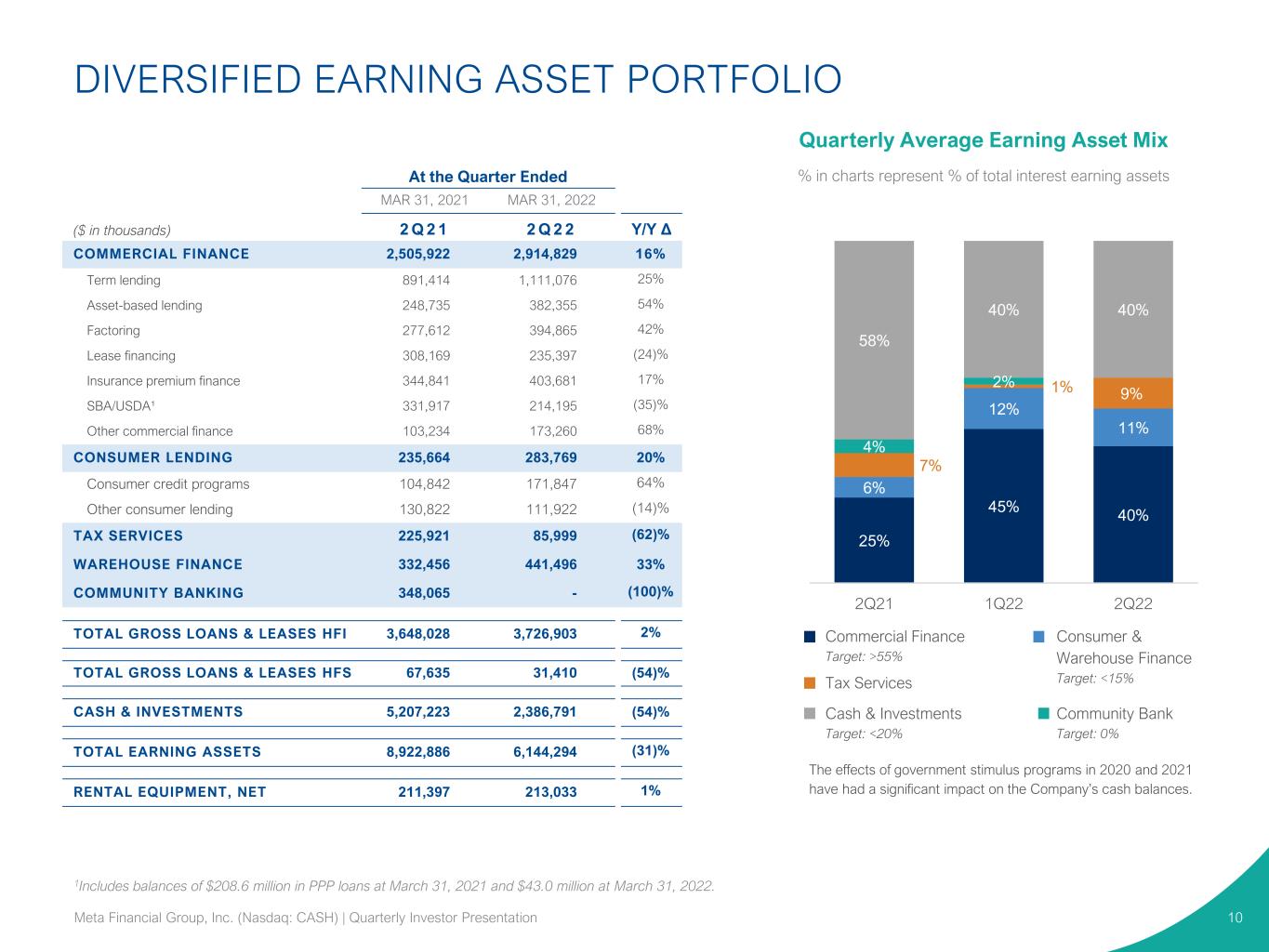

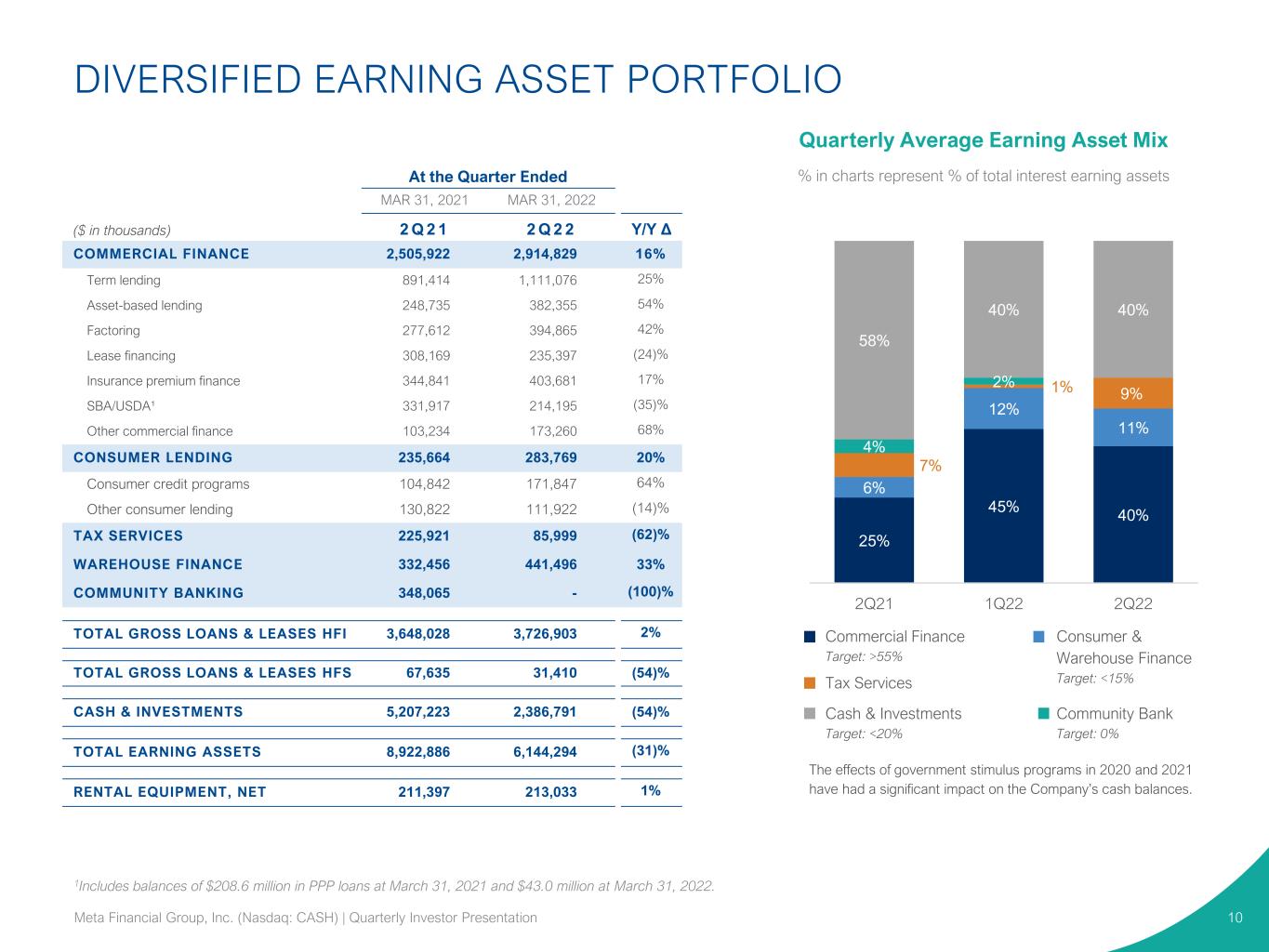

Quarterly Average Earning Asset Mix % in charts represent % of total interest earning assetsAt the Quarter Ended MAR 31, 2021 MAR 31, 2022 ($ in thousands) 2 Q 2 1 2 Q 2 2 Y/Y Δ COMMERCIAL FINANCE 2,505,922 2,914,829 16% Term lending 891,414 1,111,076 25% Asset-based lending 248,735 382,355 54% Factoring 277,612 394,865 42% Lease financing 308,169 235,397 (24)% Insurance premium finance 344,841 403,681 17% SBA/USDA¹ 331,917 214,195 (35)% Other commercial finance 103,234 173,260 68% CONSUMER LENDING 235,664 283,769 20% Consumer credit programs 104,842 171,847 64% Other consumer lending 130,822 111,922 (14)% TAX SERVICES 225,921 85,999 (62)% WAREHOUSE FINANCE 332,456 441,496 33% COMMUNITY BANKING 348,065 - (100)% TOTAL GROSS LOANS & LEASES HFI 3,648,028 3,726,903 2% TOTAL GROSS LOANS & LEASES HFS 67,635 31,410 (54)% CASH & INVESTMENTS 5,207,223 2,386,791 (54)% TOTAL EARNING ASSETS 8,922,886 6,144,294 (31)% RENTAL EQUIPMENT, NET 211,397 213,033 1% 1Includes balances of $208.6 million in PPP loans at March 31, 2021 and $43.0 million at March 31, 2022. DIVERSIFIED EARNING ASSET PORTFOLIO 10 25% 45% 40% 6% 12% 11% 7% 1% 9% 4% 2% 58% 40% 40% 2Q21 1Q22 2Q22 Commercial Finance Target: >55% Consumer & Warehouse Finance Target: <15%Tax Services Community Bank Target: 0% Cash & Investments Target: <20% The effects of government stimulus programs in 2020 and 2021 have had a significant impact on the Company’s cash balances. Meta Financial Group, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation

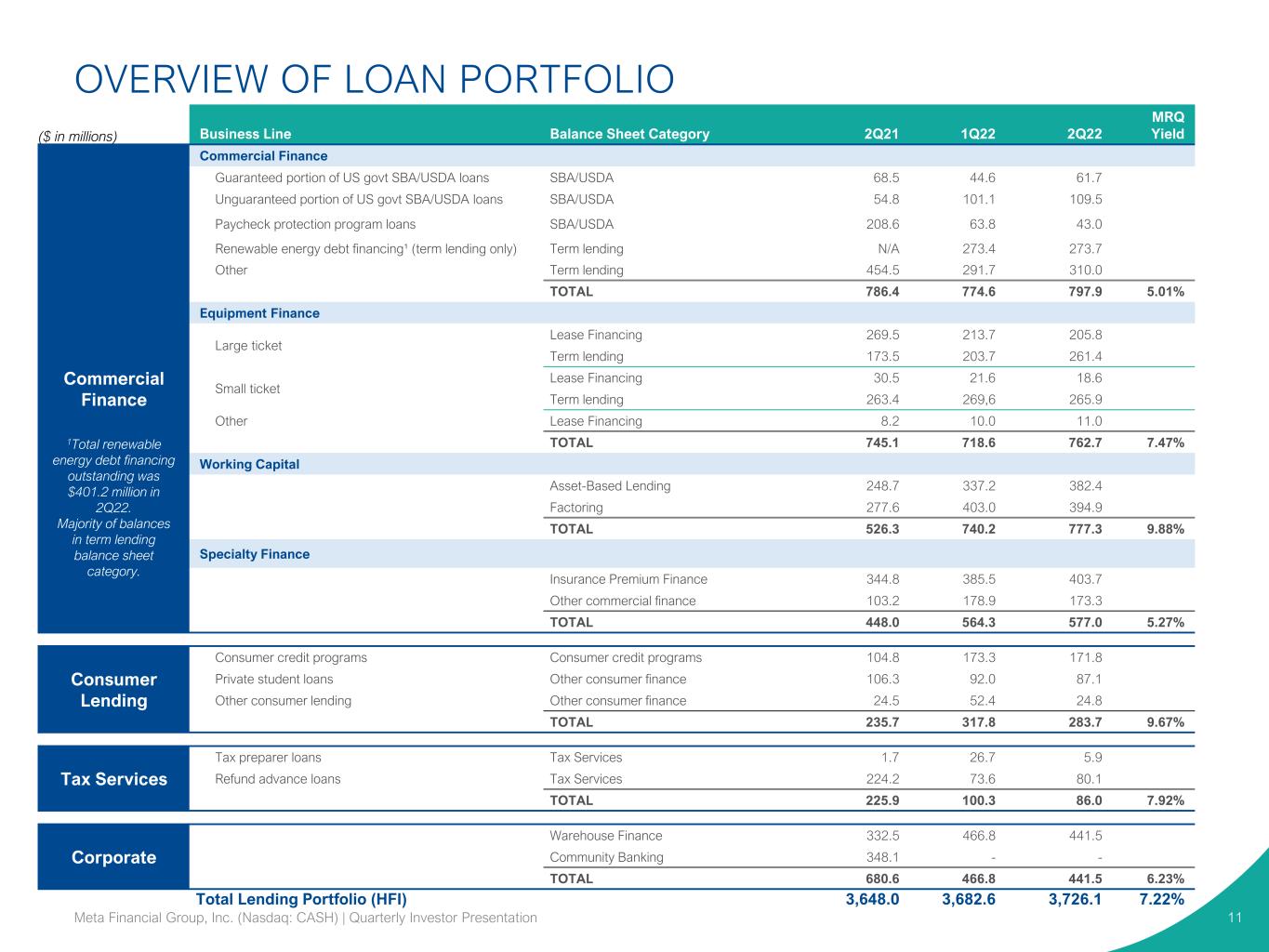

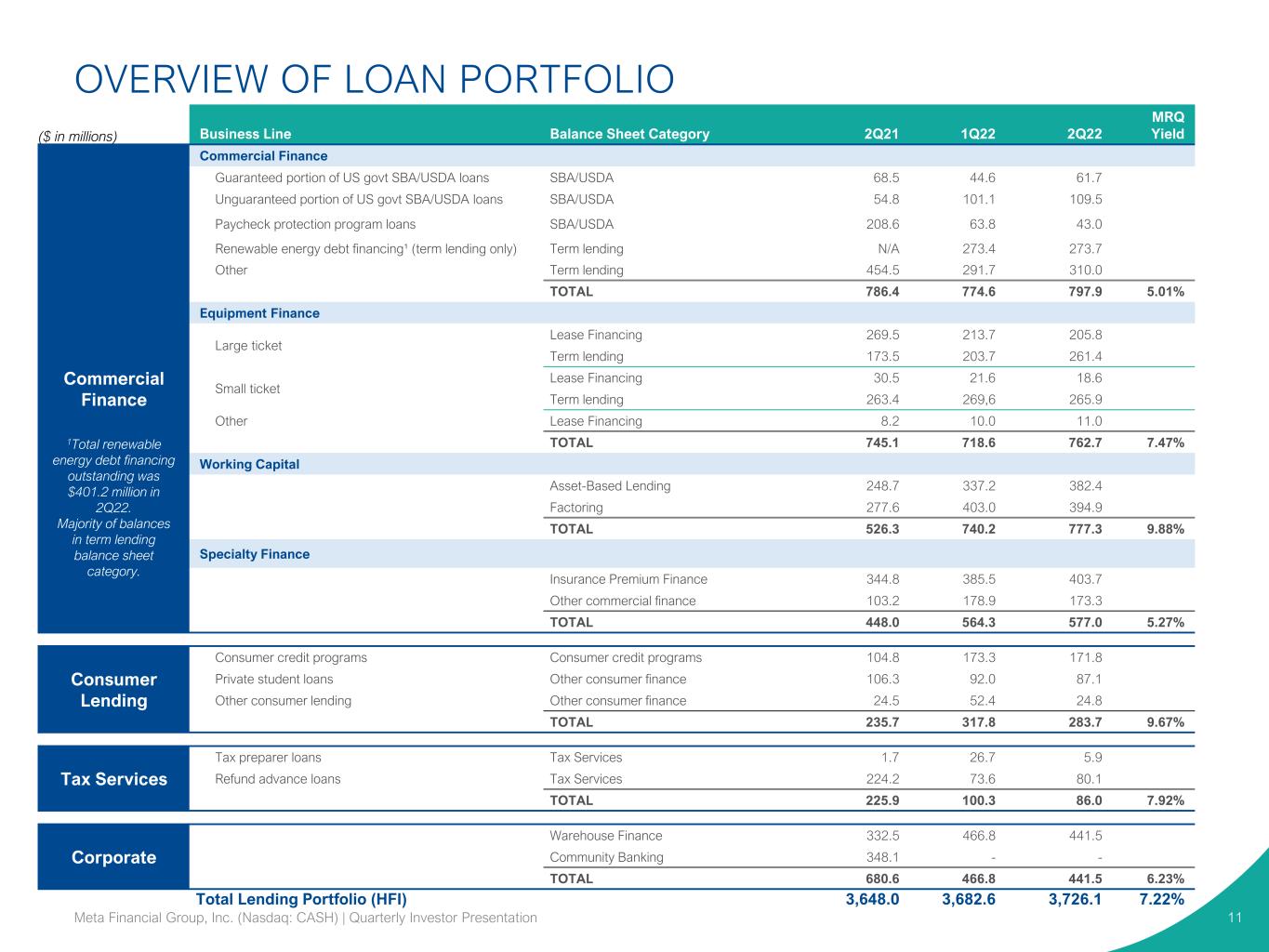

OVERVIEW OF LOAN PORTFOLIO 11 ($ in millions) Business Line Balance Sheet Category 2Q21 1Q22 2Q22 MRQ Yield Commercial Finance Commercial Finance Guaranteed portion of US govt SBA/USDA loans SBA/USDA 68.5 44.6 61.7 Unguaranteed portion of US govt SBA/USDA loans SBA/USDA 54.8 101.1 109.5 Paycheck protection program loans SBA/USDA 208.6 63.8 43.0 Renewable energy debt financing¹ (term lending only) Term lending N/A 273.4 273.7 Other Term lending 454.5 291.7 310.0 TOTAL 786.4 774.6 797.9 5.01% Equipment Finance Large ticket Lease Financing 269.5 213.7 205.8 Term lending 173.5 203.7 261.4 Small ticket Lease Financing 30.5 21.6 18.6 Term lending 263.4 269,6 265.9 Other Lease Financing 8.2 10.0 11.0 TOTAL 745.1 718.6 762.7 7.47% Working Capital Asset-Based Lending 248.7 337.2 382.4 Factoring 277.6 403.0 394.9 TOTAL 526.3 740.2 777.3 9.88% Specialty Finance Insurance Premium Finance 344.8 385.5 403.7 Other commercial finance 103.2 178.9 173.3 TOTAL 448.0 564.3 577.0 5.27% Consumer Lending Consumer credit programs Consumer credit programs 104.8 173.3 171.8 Private student loans Other consumer finance 106.3 92.0 87.1 Other consumer lending Other consumer finance 24.5 52.4 24.8 TOTAL 235.7 317.8 283.7 9.67% Tax Services Tax preparer loans Tax Services 1.7 26.7 5.9 Refund advance loans Tax Services 224.2 73.6 80.1 TOTAL 225.9 100.3 86.0 7.92% Corporate Warehouse Finance 332.5 466.8 441.5 Community Banking 348.1 - - TOTAL 680.6 466.8 441.5 6.23% Total Lending Portfolio (HFI) 3,648.0 3,682.6 3,726.1 7.22% Meta Financial Group, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation 1Total renewable energy debt financing outstanding was $401.2 million in 2Q22. Majority of balances in term lending balance sheet category.

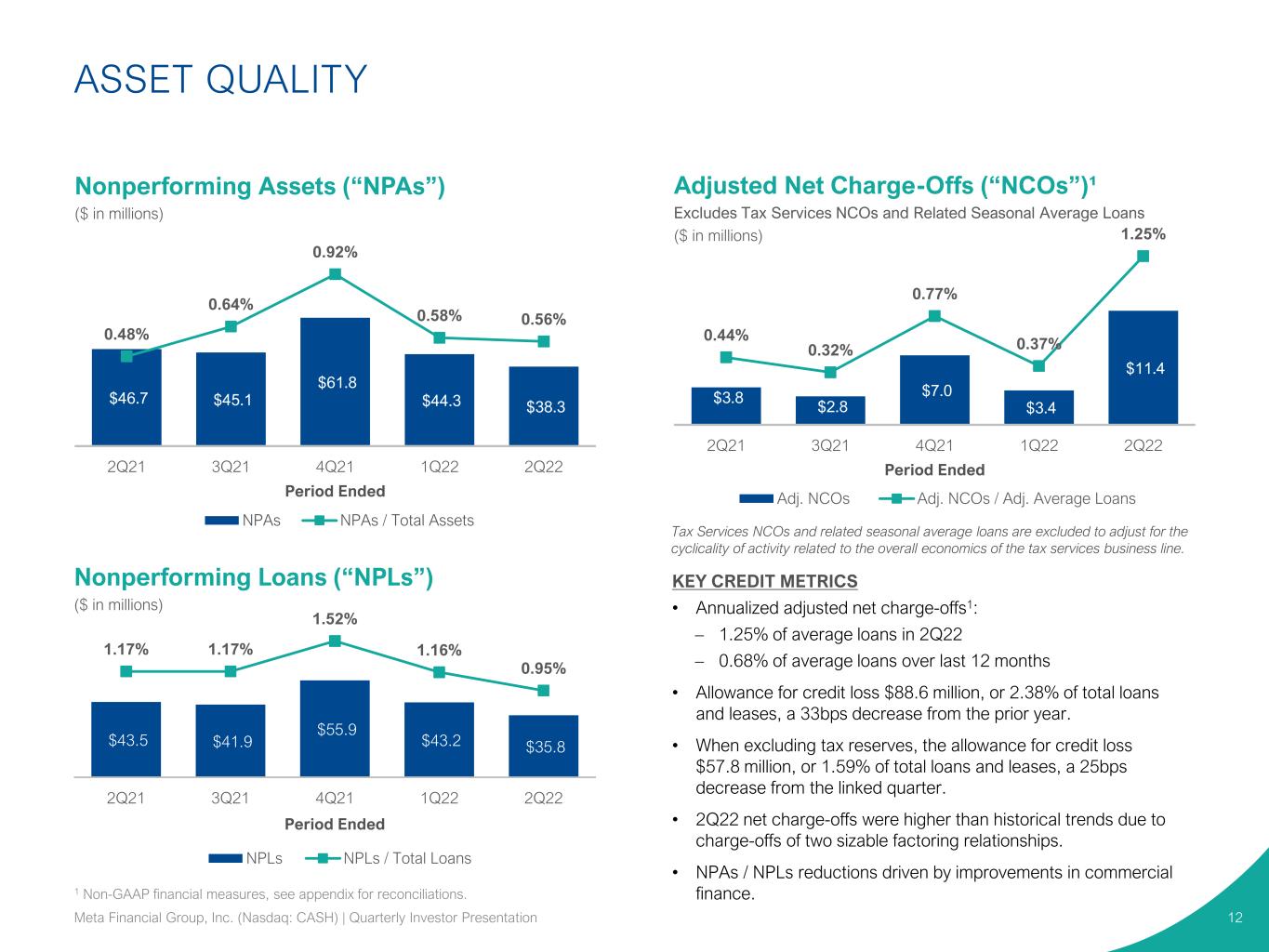

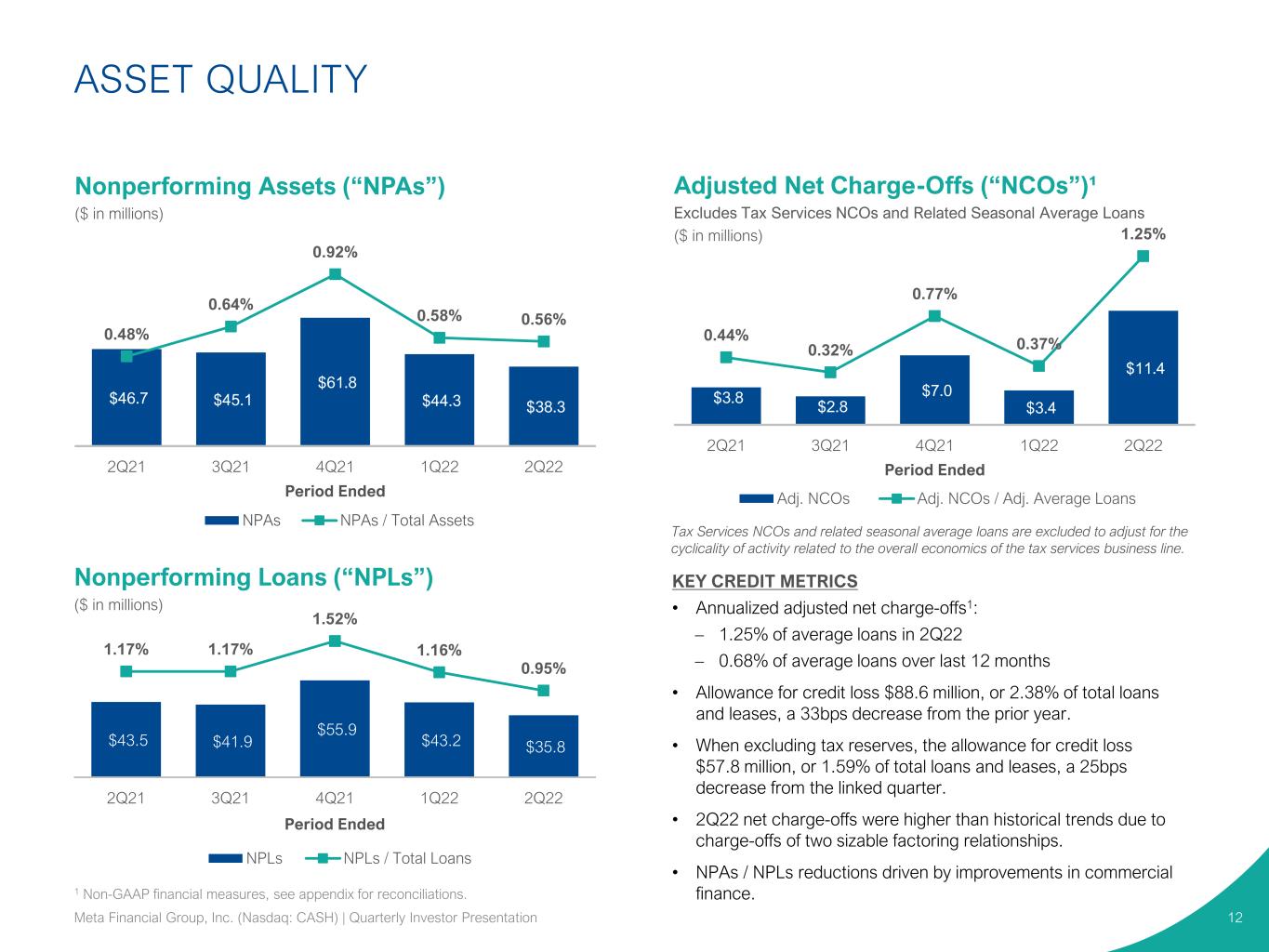

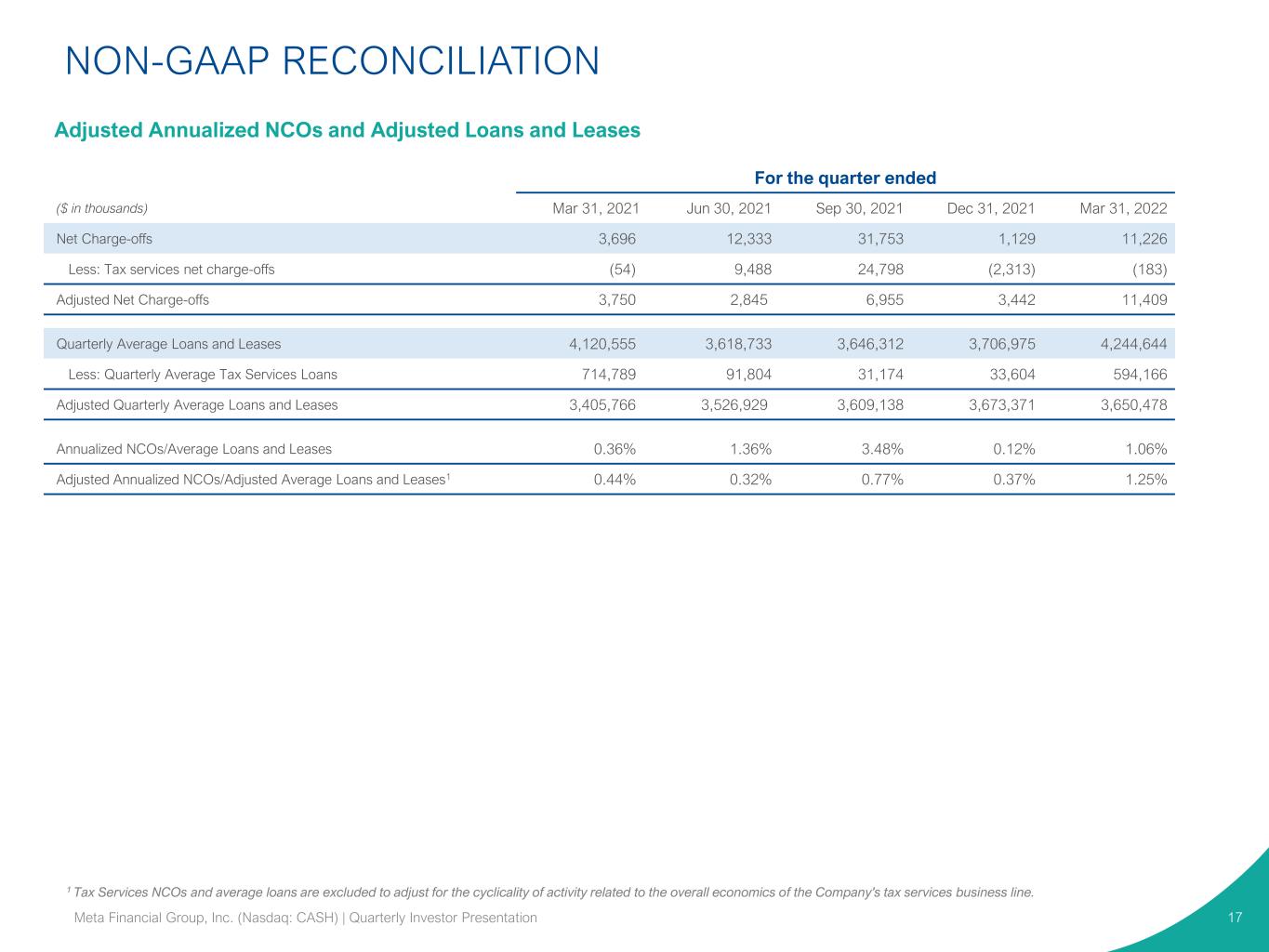

$3.8 $2.8 $7.0 $3.4 $11.4 0.44% 0.32% 0.77% 0.37% 1.25% 2Q21 3Q21 4Q21 1Q22 2Q22 Period Ended Adj. NCOs Adj. NCOs / Adj. Average Loans Adjusted Net Charge-Offs (“NCOs”)¹ Excludes Tax Services NCOs and Related Seasonal Average Loans ($ in millions) KEY CREDIT METRICS • Annualized adjusted net charge-offs1: – 1.25% of average loans in 2Q22 – 0.68% of average loans over last 12 months • Allowance for credit loss $88.6 million, or 2.38% of total loans and leases, a 33bps decrease from the prior year. • When excluding tax reserves, the allowance for credit loss $57.8 million, or 1.59% of total loans and leases, a 25bps decrease from the linked quarter. • 2Q22 net charge-offs were higher than historical trends due to charge-offs of two sizable factoring relationships. • NPAs / NPLs reductions driven by improvements in commercial finance. $46.7 $45.1 $61.8 $44.3 $38.3 0.48% 0.64% 0.92% 0.58% 0.56% 2Q21 3Q21 4Q21 1Q22 2Q22 Period Ended NPAs NPAs / Total Assets ASSET QUALITY 12 1 Non-GAAP financial measures, see appendix for reconciliations. Tax Services NCOs and related seasonal average loans are excluded to adjust for the cyclicality of activity related to the overall economics of the tax services business line. $43.5 $41.9 $55.9 $43.2 $35.8 1.17% 1.17% 1.52% 1.16% 0.95% 2Q21 3Q21 4Q21 1Q22 2Q22 Period Ended NPLs NPLs / Total Loans Nonperforming Assets (“NPAs”) ($ in millions) Nonperforming Loans (“NPLs”) ($ in millions) Meta Financial Group, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation

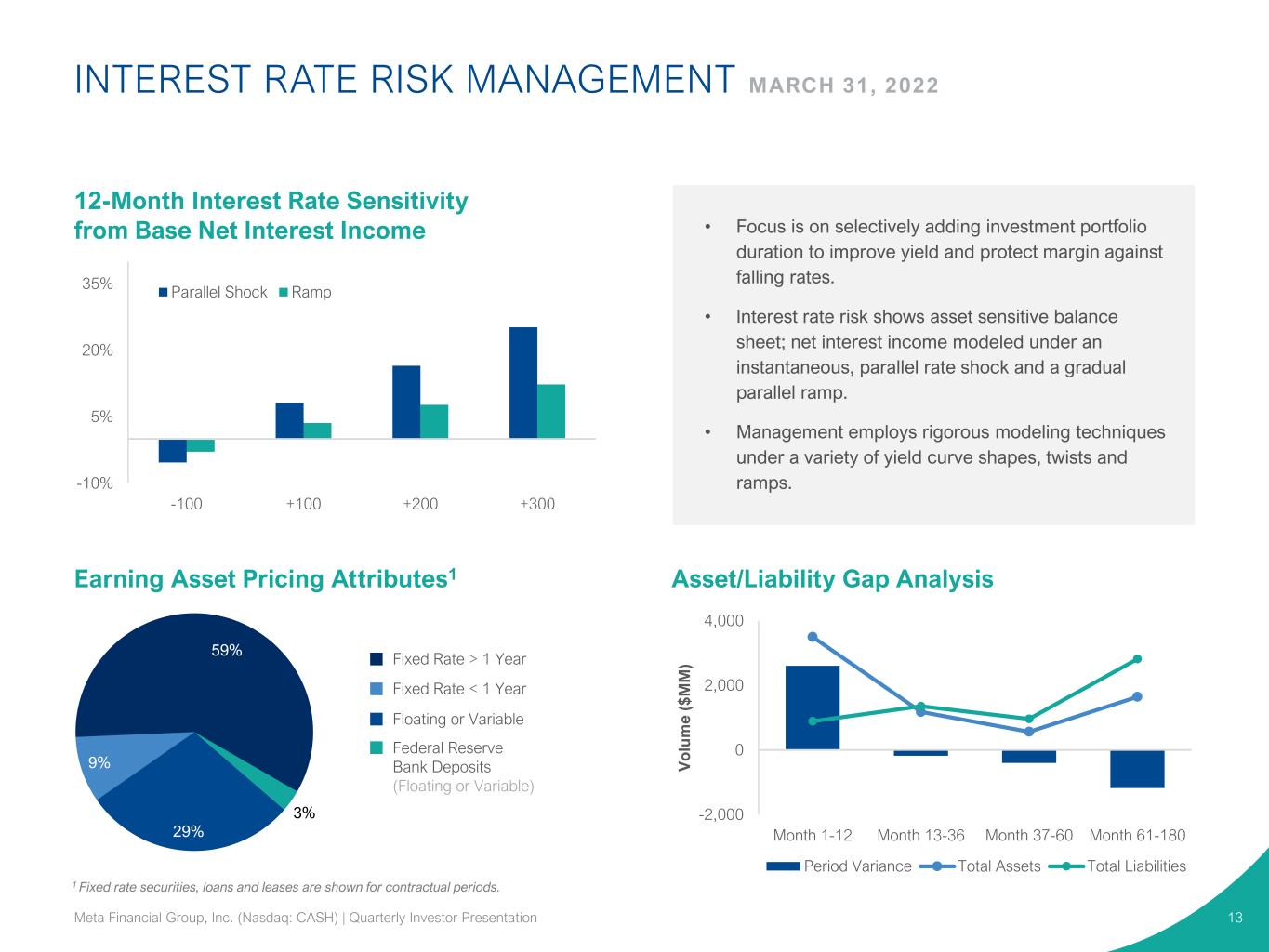

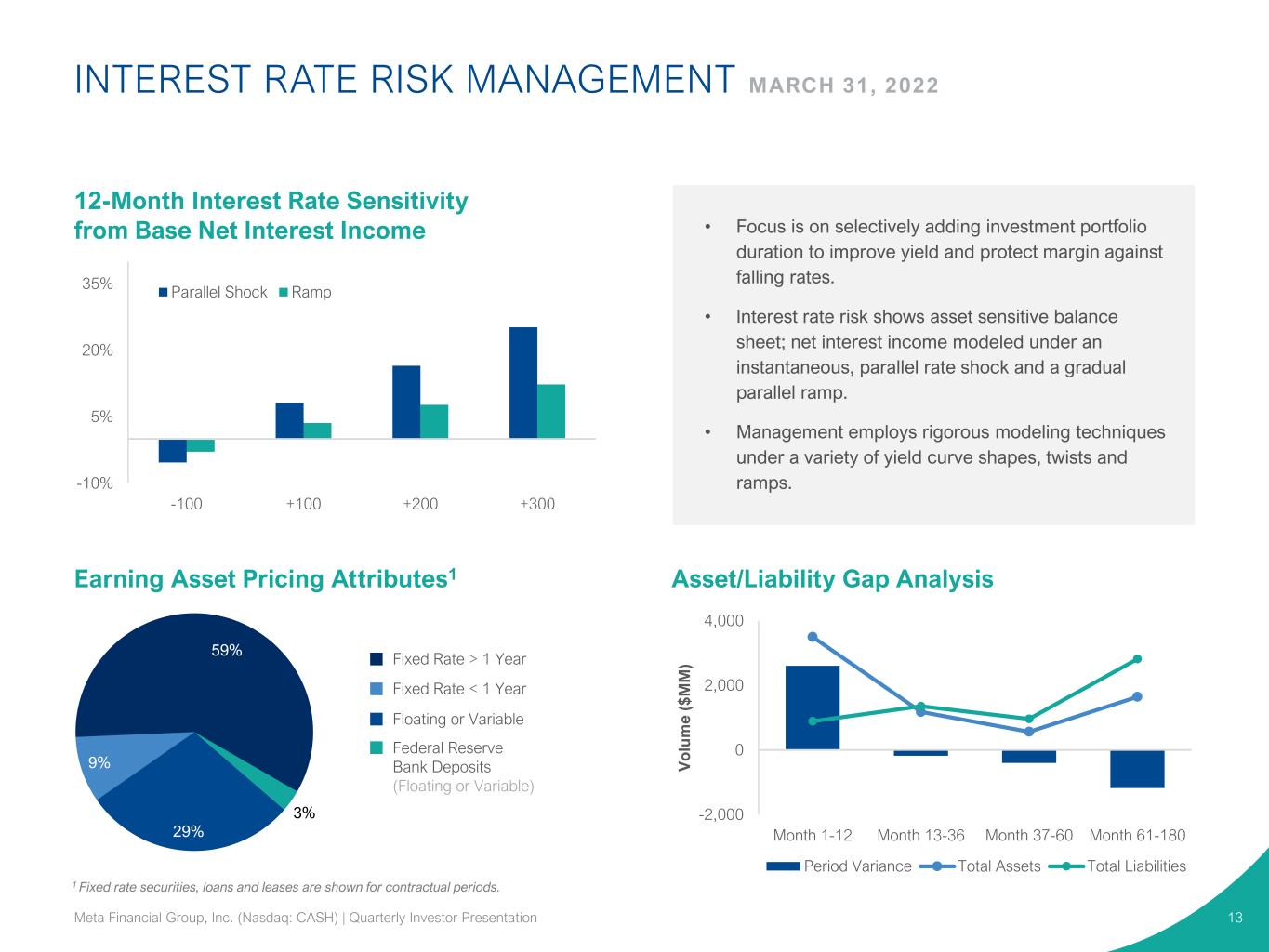

-10% 5% 20% 35% -100 +100 +200 +300 Parallel Shock Ramp 1 Fixed rate securities, loans and leases are shown for contractual periods. -2,000 0 2,000 4,000 Month 1-12 Month 13-36 Month 37-60 Month 61-180 V o lu m e ( $ M M ) Period Variance Total Assets Total Liabilities INTEREST RATE RISK MANAGEMENT MARCH 31, 2022 13 3% 29% 9% 59% • Focus is on selectively adding investment portfolio duration to improve yield and protect margin against falling rates. • Interest rate risk shows asset sensitive balance sheet; net interest income modeled under an instantaneous, parallel rate shock and a gradual parallel ramp. • Management employs rigorous modeling techniques under a variety of yield curve shapes, twists and ramps. Fixed Rate > 1 Year 12-Month Interest Rate Sensitivity from Base Net Interest Income Earning Asset Pricing Attributes1 Asset/Liability Gap Analysis Fixed Rate < 1 Year Floating or Variable Federal Reserve Bank Deposits (Floating or Variable) Meta Financial Group, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation

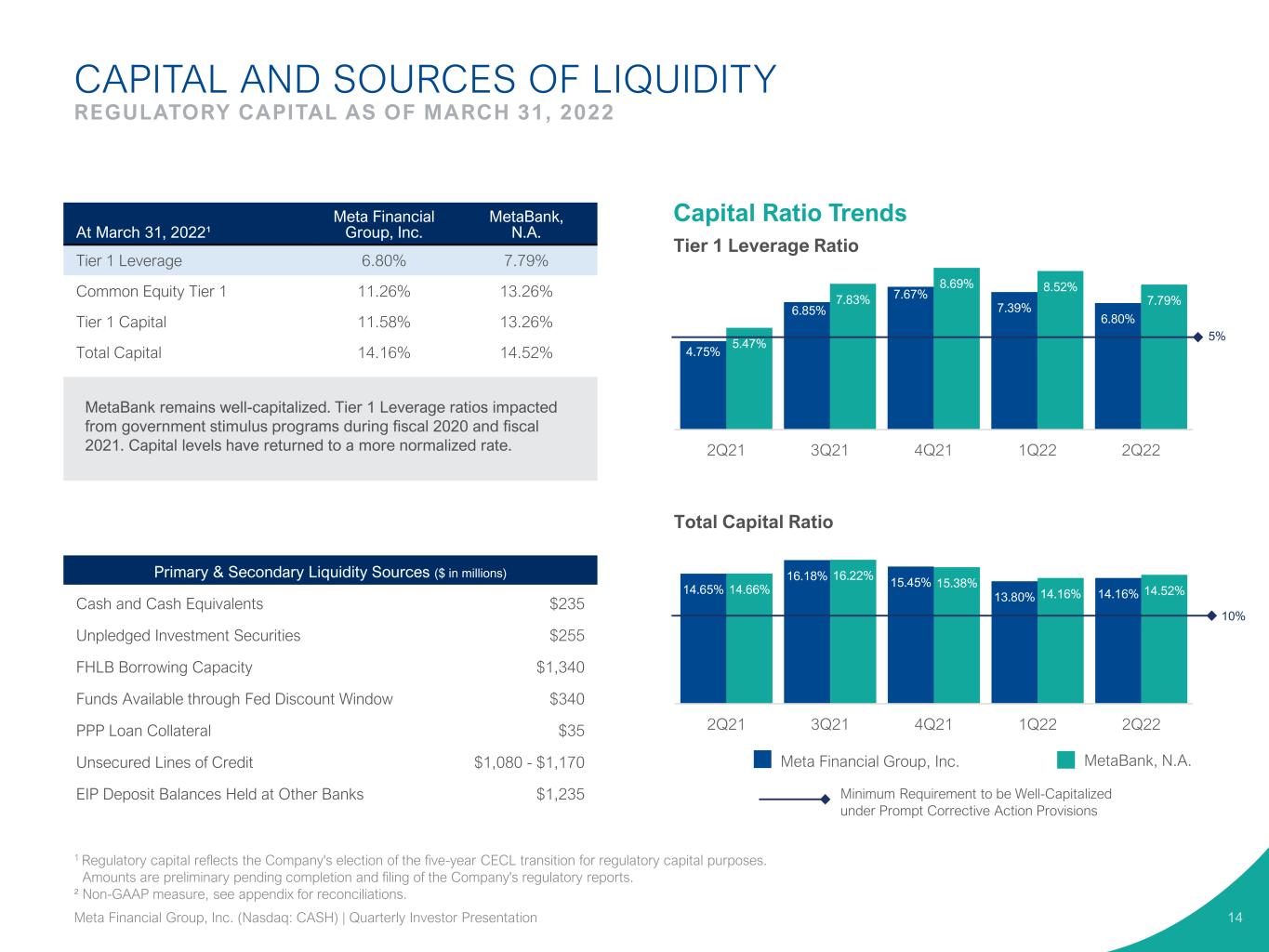

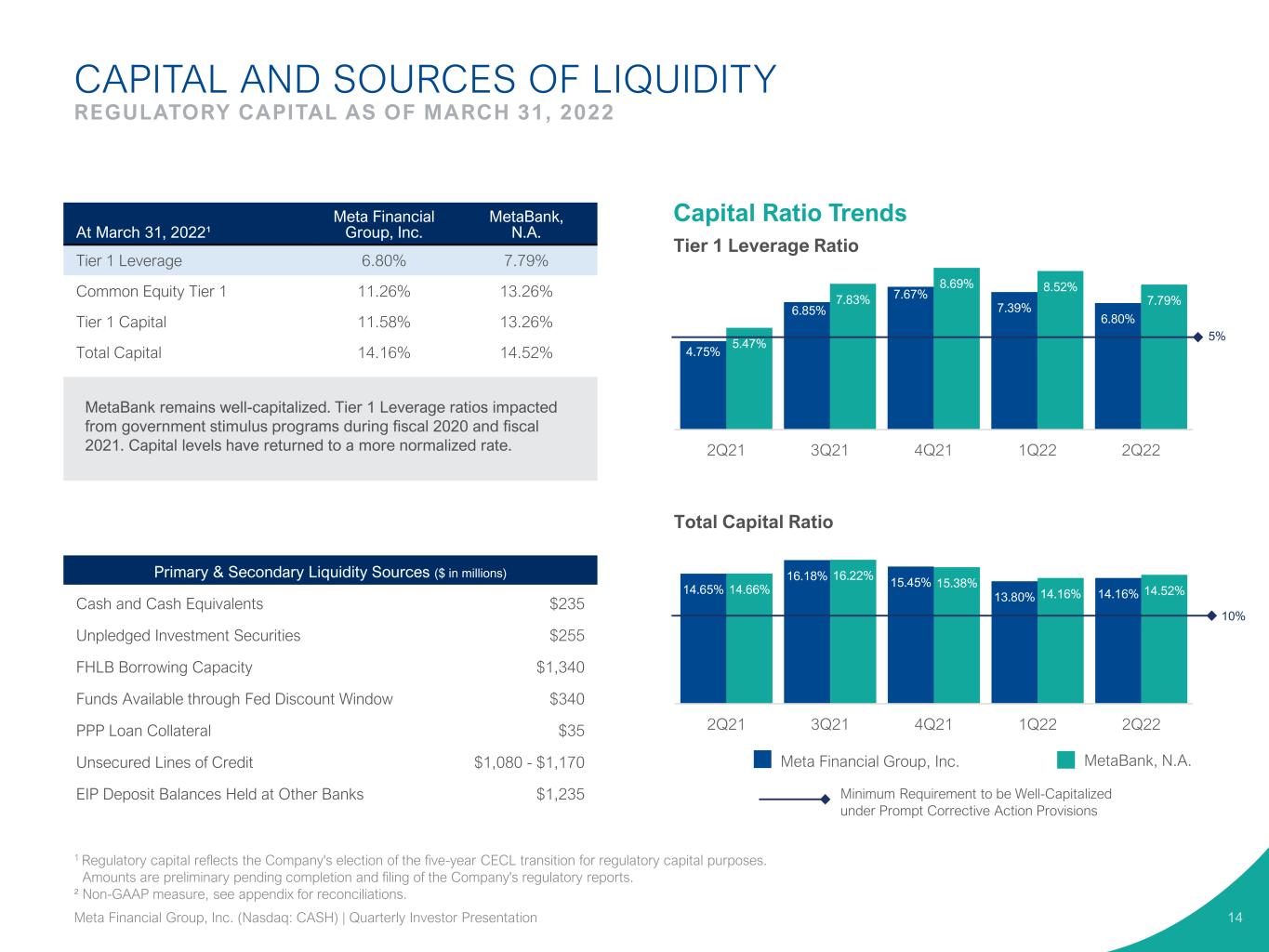

4.75% 6.85% 7.67% 7.39% 6.80% 5.47% 7.83% 8.69% 8.52% 7.79% 2Q21 3Q21 4Q21 1Q22 2Q22 CAPITAL AND SOURCES OF LIQUIDITY REGULATORY CAPITAL AS OF MARCH 31, 2022 Minimum Requirement to be Well-Capitalized under Prompt Corrective Action Provisions Meta Financial Group, Inc. MetaBank, N.A. Capital Ratio Trends At March 31, 2022¹ Meta Financial Group, Inc. MetaBank, N.A. Tier 1 Leverage 6.80% 7.79% Common Equity Tier 1 11.26% 13.26% Tier 1 Capital 11.58% 13.26% Total Capital 14.16% 14.52% MetaBank remains well-capitalized. Tier 1 Leverage ratios impacted from government stimulus programs during fiscal 2020 and fiscal 2021. Capital levels have returned to a more normalized rate. Primary & Secondary Liquidity Sources ($ in millions) Cash and Cash Equivalents $235 Unpledged Investment Securities $255 FHLB Borrowing Capacity $1,340 Funds Available through Fed Discount Window $340 PPP Loan Collateral $35 Unsecured Lines of Credit $1,080 - $1,170 EIP Deposit Balances Held at Other Banks $1,235 14.65% 16.18% 15.45% 13.80% 14.16%14.66% 16.22% 15.38% 14.16% 14.52% 2Q21 3Q21 4Q21 1Q22 2Q22 10% 5% 14 Total Capital Ratio Tier 1 Leverage Ratio 1 Regulatory capital reflects the Company's election of the five-year CECL transition for regulatory capital purposes. Amounts are preliminary pending completion and filing of the Company's regulatory reports. ² Non-GAAP measure, see appendix for reconciliations. Meta Financial Group, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation

APPENDIX 15Meta Financial Group, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation

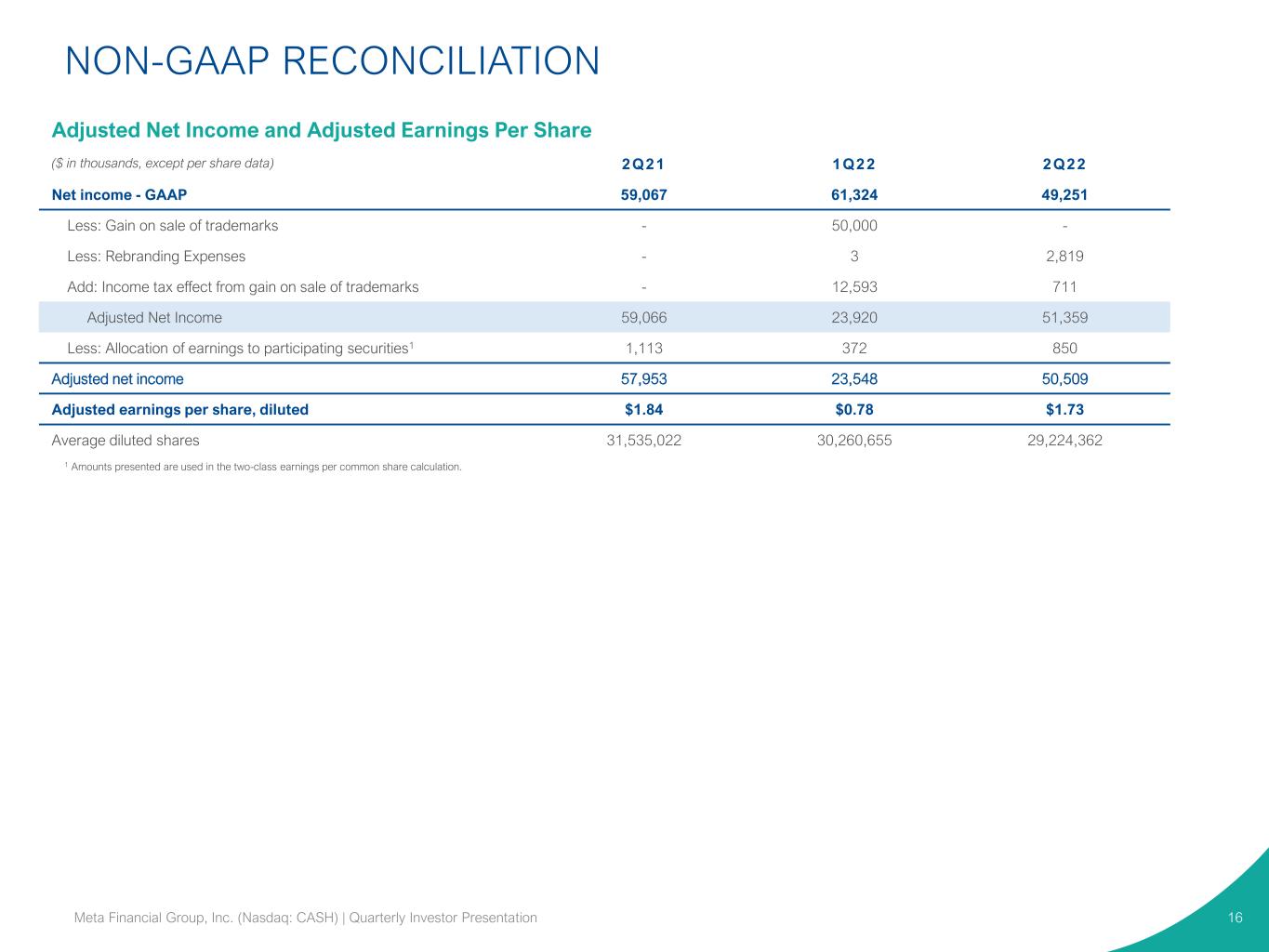

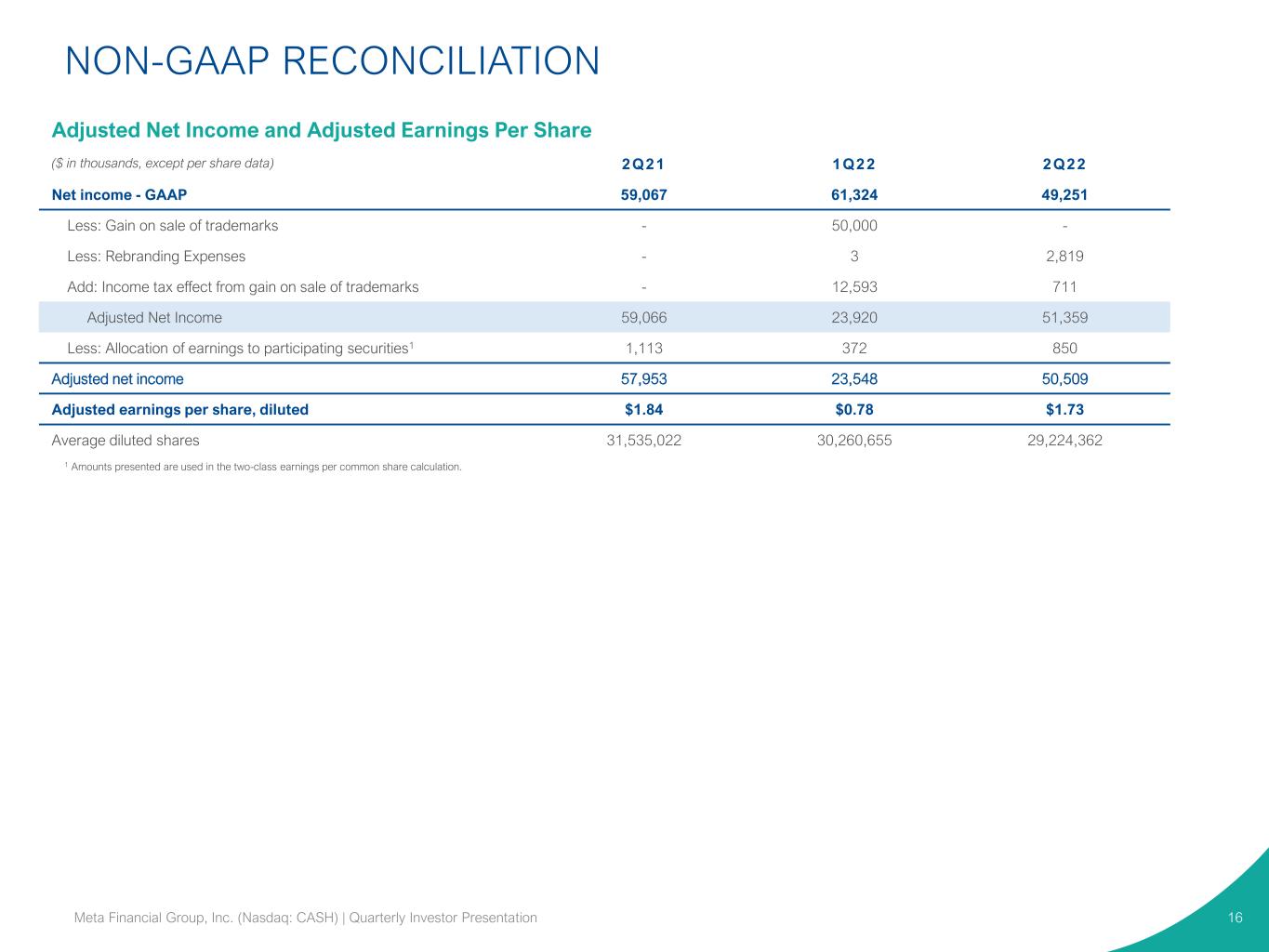

NON-GAAP RECONCILIATION 16Meta Financial Group, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation Adjusted Net Income and Adjusted Earnings Per Share ($ in thousands, except per share data) 2Q21 1Q22 2Q22 Net income - GAAP 59,067 61,324 49,251 Less: Gain on sale of trademarks - 50,000 - Less: Rebranding Expenses - 3 2,819 Add: Income tax effect from gain on sale of trademarks - 12,593 711 Adjusted Net Income 59,066 23,920 51,359 Less: Allocation of earnings to participating securities1 1,113 372 850 Adjusted net income 57,953 23,548 50,509 Adjusted earnings per share, diluted $1.84 $0.78 $1.73 Average diluted shares 31,535,022 30,260,655 29,224,362 1 Amounts presented are used in the two-class earnings per common share calculation.

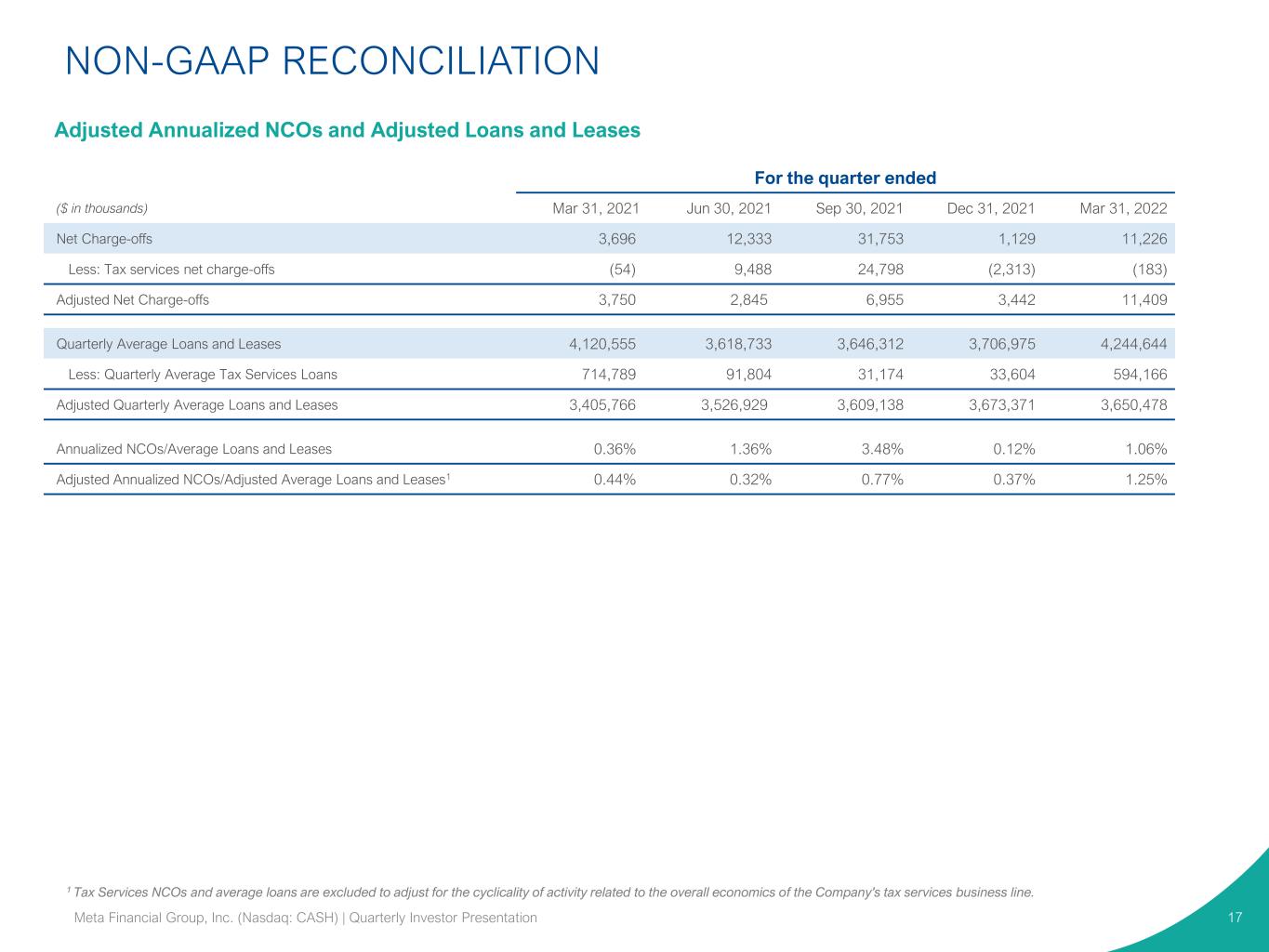

1 Tax Services NCOs and average loans are excluded to adjust for the cyclicality of activity related to the overall economics of the Company's tax services business line. 17 For the quarter ended ($ in thousands) Mar 31, 2021 Jun 30, 2021 Sep 30, 2021 Dec 31, 2021 Mar 31, 2022 Net Charge-offs 3,696 12,333 31,753 1,129 11,226 Less: Tax services net charge-offs (54) 9,488 24,798 (2,313) (183) Adjusted Net Charge-offs 3,750 2,845 6,955 3,442 11,409 Quarterly Average Loans and Leases 4,120,555 3,618,733 3,646,312 3,706,975 4,244,644 Less: Quarterly Average Tax Services Loans 714,789 91,804 31,174 33,604 594,166 Adjusted Quarterly Average Loans and Leases 3,405,766 3,526,929 3,609,138 3,673,371 3,650,478 Annualized NCOs/Average Loans and Leases 0.36% 1.36% 3.48% 0.12% 1.06% Adjusted Annualized NCOs/Adjusted Average Loans and Leases1 0.44% 0.32% 0.77% 0.37% 1.25% Meta Financial Group, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation NON-GAAP RECONCILIATION Adjusted Annualized NCOs and Adjusted Loans and Leases

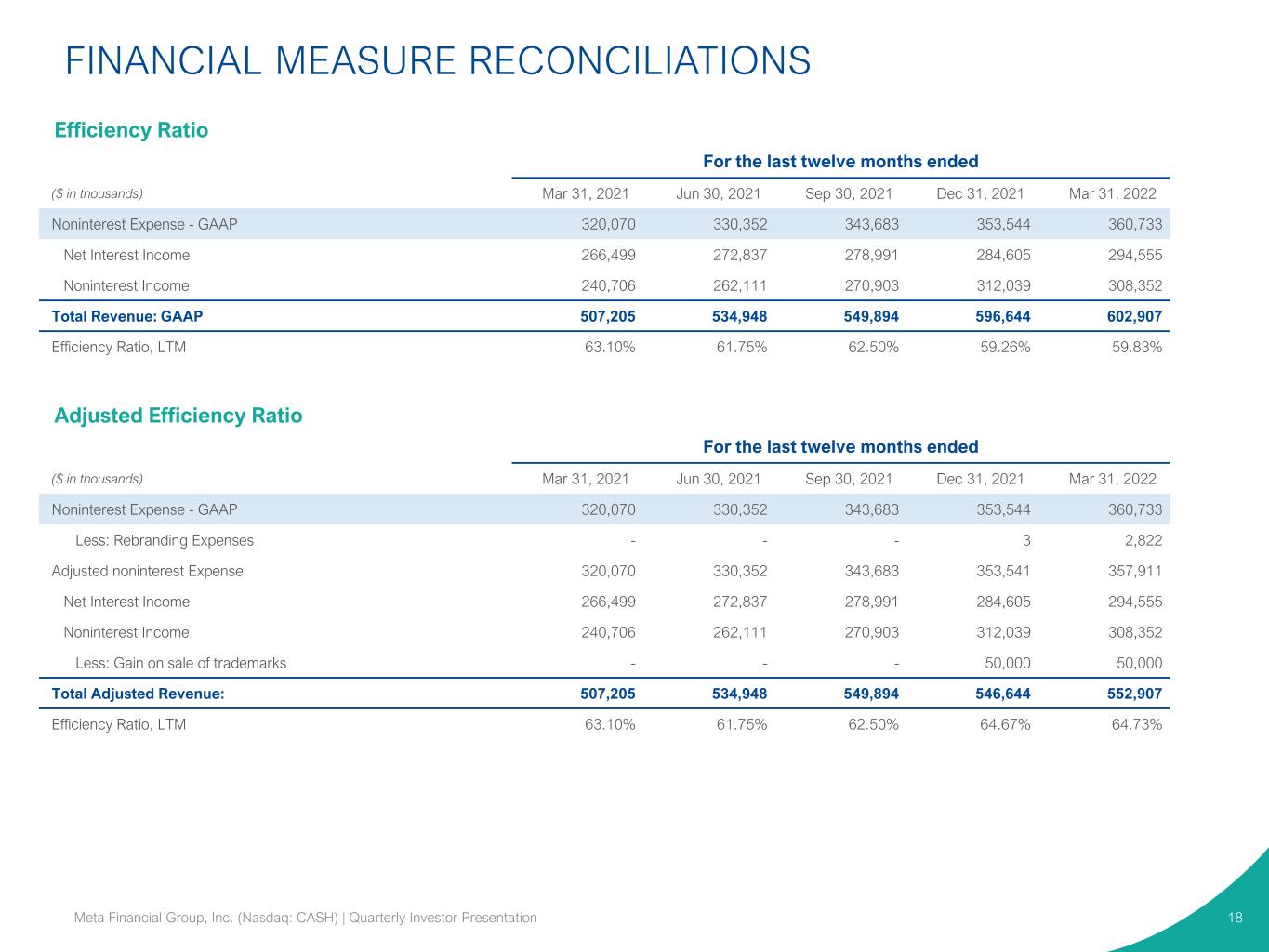

FINANCIAL MEASURE RECONCILIATIONS 18Meta Financial Group, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation For the last twelve months ended ($ in thousands) Mar 31, 2021 Jun 30, 2021 Sep 30, 2021 Dec 31, 2021 Mar 31, 2022 Noninterest Expense - GAAP 320,070 330,352 343,683 353,544 360,733 Net Interest Income 266,499 272,837 278,991 284,605 294,555 Noninterest Income 240,706 262,111 270,903 312,039 308,352 Total Revenue: GAAP 507,205 534,948 549,894 596,644 602,907 Efficiency Ratio, LTM 63.10% 61.75% 62.50% 59.26% 59.83% For the last twelve months ended ($ in thousands) Mar 31, 2021 Jun 30, 2021 Sep 30, 2021 Dec 31, 2021 Mar 31, 2022 Noninterest Expense - GAAP 320,070 330,352 343,683 353,544 360,733 Less: Rebranding Expenses - - - 3 2,822 Adjusted noninterest Expense 320,070 330,352 343,683 353,541 357,911 Net Interest Income 266,499 272,837 278,991 284,605 294,555 Noninterest Income 240,706 262,111 270,903 312,039 308,352 Less: Gain on sale of trademarks - - - 50,000 50,000 Total Adjusted Revenue: 507,205 534,948 549,894 546,644 552,907 Efficiency Ratio, LTM 63.10% 61.75% 62.50% 64.67% 64.73% Efficiency Ratio Adjusted Efficiency Ratio