QUARTERLY INVESTOR UPDATE THIRD QUARTER FISCAL YEAR 2022 Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation 1

FORWARD LOOKING STATEMENTS 2 This investor update contains “forward-looking statements” which are made in good faith by the Company pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements by words such as “may,” “hope,” “will,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential,” “continue,” “could,” “future,” or the negative of those terms, or other words of similar meaning or similar expressions. These forward-looking statements are based on information currently available to us and assumptions about future events, and include statements with respect to the Company’s beliefs, expectations, estimates, and intentions, which are subject to significant risks and uncertainties, and are subject to change based on various factors, some of which are beyond the Company’s control. Such risks, uncertainties and other factors may cause our actual growth, results of operations, financial condition, cash flows, performance and business prospects and opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. Such statements address, among others, the following subjects: future operating results; the impact of measures expected to increase efficiencies or reduce expenses; customer retention; loan and other product demand; expectations concerning acquisitions and divestitures; new products and services; credit quality; the level of net charge-offs and the adequacy of the allowance for loan and lease losses; technology; and the Company's employees. The following factors, among others, could cause the Company's financial performance and results of operations to differ materially from the expectations, estimates, and intentions expressed in such forward-looking statements: maintaining our executive management team; expected growth opportunities may not be realized or may take longer to realize than expected; the potential adverse effects of the ongoing COVID-19 pandemic and any governmental or societal responses thereto, or other unusual and infrequently occurring events, including the impact on financial markets from geopolitical conflicts such as the military conflict between Russia and Ukraine; successfully completing our announced rebranding and our ability to achieve brand recognition for Pathward equal to or greater than currently enjoyed for MetaBank; our ability to successfully implement measures designed to reduce expenses and increase efficiencies; changes in trade, monetary, and fiscal policies and laws, including actual changes in interest rates and the Fed Funds rate; changes in tax laws; the strength of the United States' economy, and the local economies in which the Company operates; inflation, market, and monetary fluctuations; the timely and efficient development of, new products and services offered by the Company or its strategic partners, as well as risks (including reputational and litigation) attendant thereto, and the perceived overall value of these products and services by users; Pathward’s ability to maintain its Durbin Amendment exemption; the risks of dealing with or utilizing third parties, including, in connection with the Company’s prepaid card and tax refund advance business, the risk of reduced volume of refund advance loans as a result of reduced customer demand for or usage of the Company’s strategic partners’ refund advance products; our relationship with, and any actions which may be initiated by, our regulators; changes in financial services laws and regulations, including laws and regulations relating to the tax refund industry and the insurance premium finance industry; technological changes, including, but not limited to, the protection of our electronic systems and information; the impact of acquisitions and divestitures; litigation risk; the growth of the Company’s business, as well as expenses related thereto; continued maintenance by Pathward of its status as a well-capitalized institution, changes in consumer spending and saving habits; losses from fraudulent or illegal activity, technological risks and developments and cyber threats, attacks or events; the success of the Company at maintaining its high quality asset level and managing and collecting assets of borrowers in default should problem assets increase; and the other factors described under the caption “Risk Factors” and in other sections of the Company’s Annual Report on Form 10-K for the Company's fiscal year ended September 30, 2021 and in other filings made by the Company with the Securities and Exchange Commission (“SEC”). The forward-looking statements included herein speak only as of the date of this investor update. The Company expressly disclaims any intent or obligation to update any forward-looking statements, whether written or oral, that may be made from time to time by or on behalf of the Company or its subsidiaries, whether as a result of new information, changed circumstances or future events or for any other reason. Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation

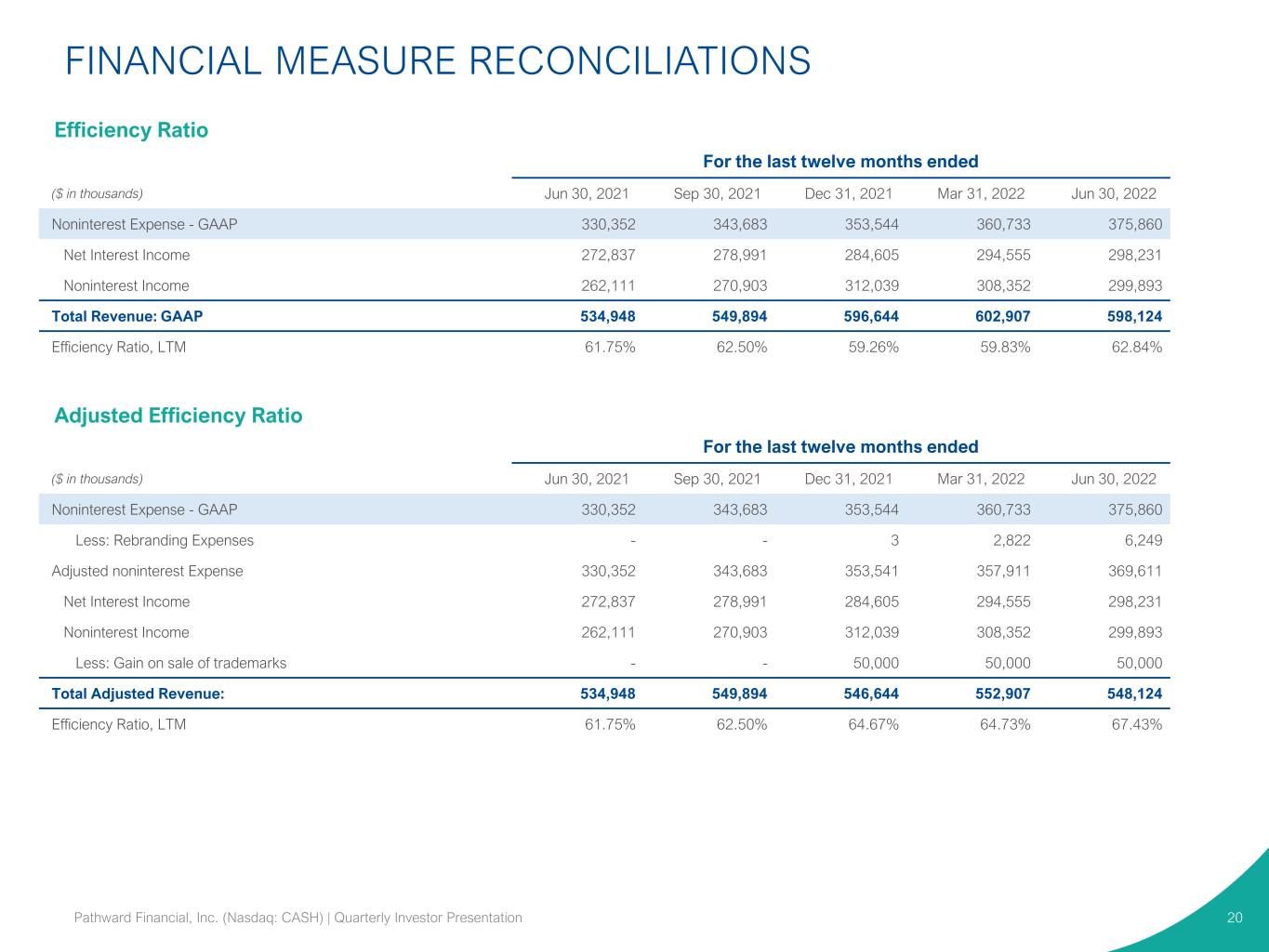

3 WE STRIVE TO INCREASE FINANCIAL AVAILABILITY, CHOICE, AND OPPORTUNITY THROUGH FINANCIAL EMPOWERMENT. We work to disrupt traditional banking norms by developing partnerships with fintechs, affinity groups, government agencies, and other banks to make a range of quality financial products and services available to the communities we serve nationally. Our national bank charter, coordination with regulators, and deep understanding of risk mitigation and compliance allows us to guide our partners and deliver the financial products and services that meet the needs of those who need them most. We believe in financial inclusion for allTM. Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation

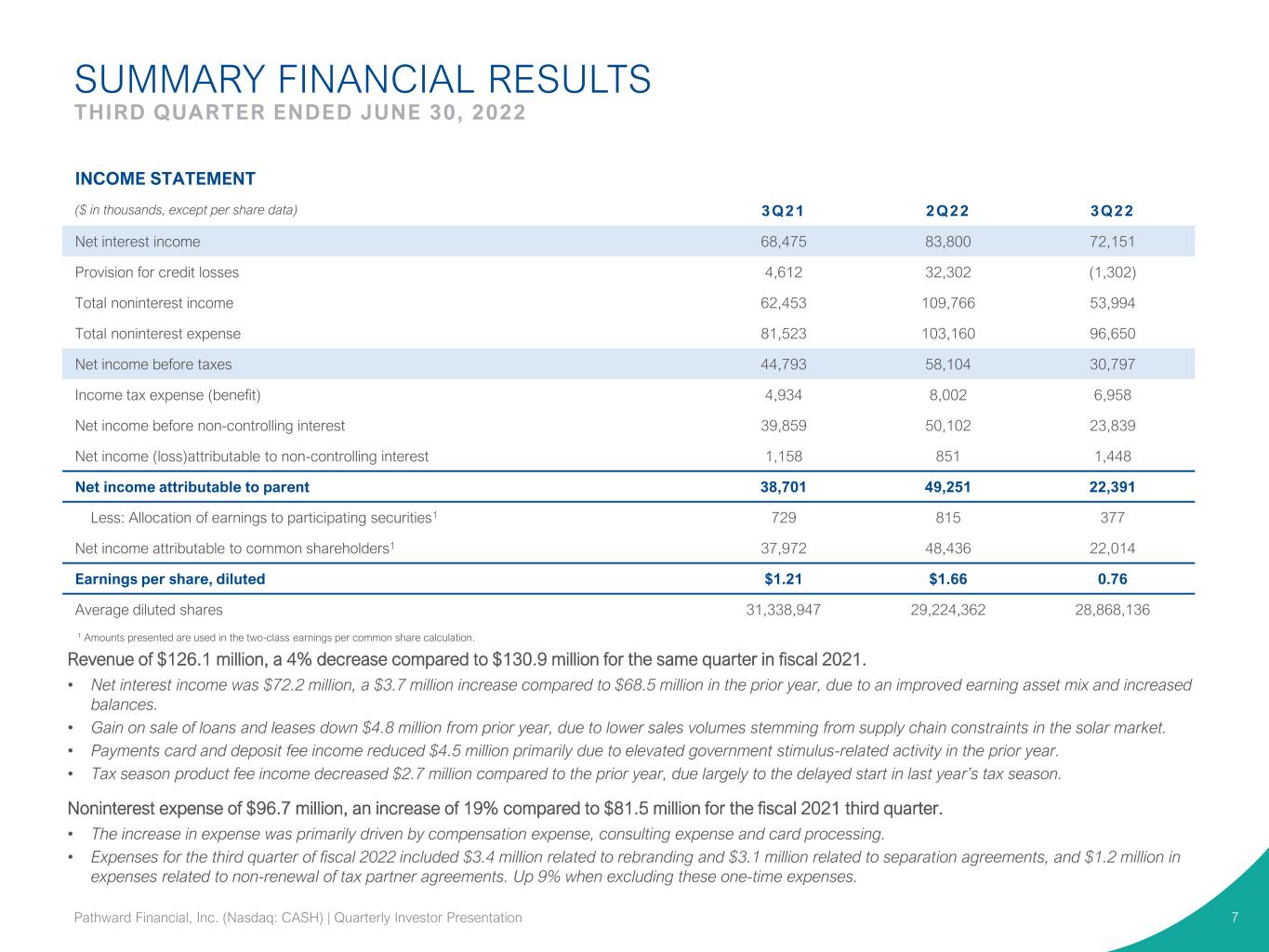

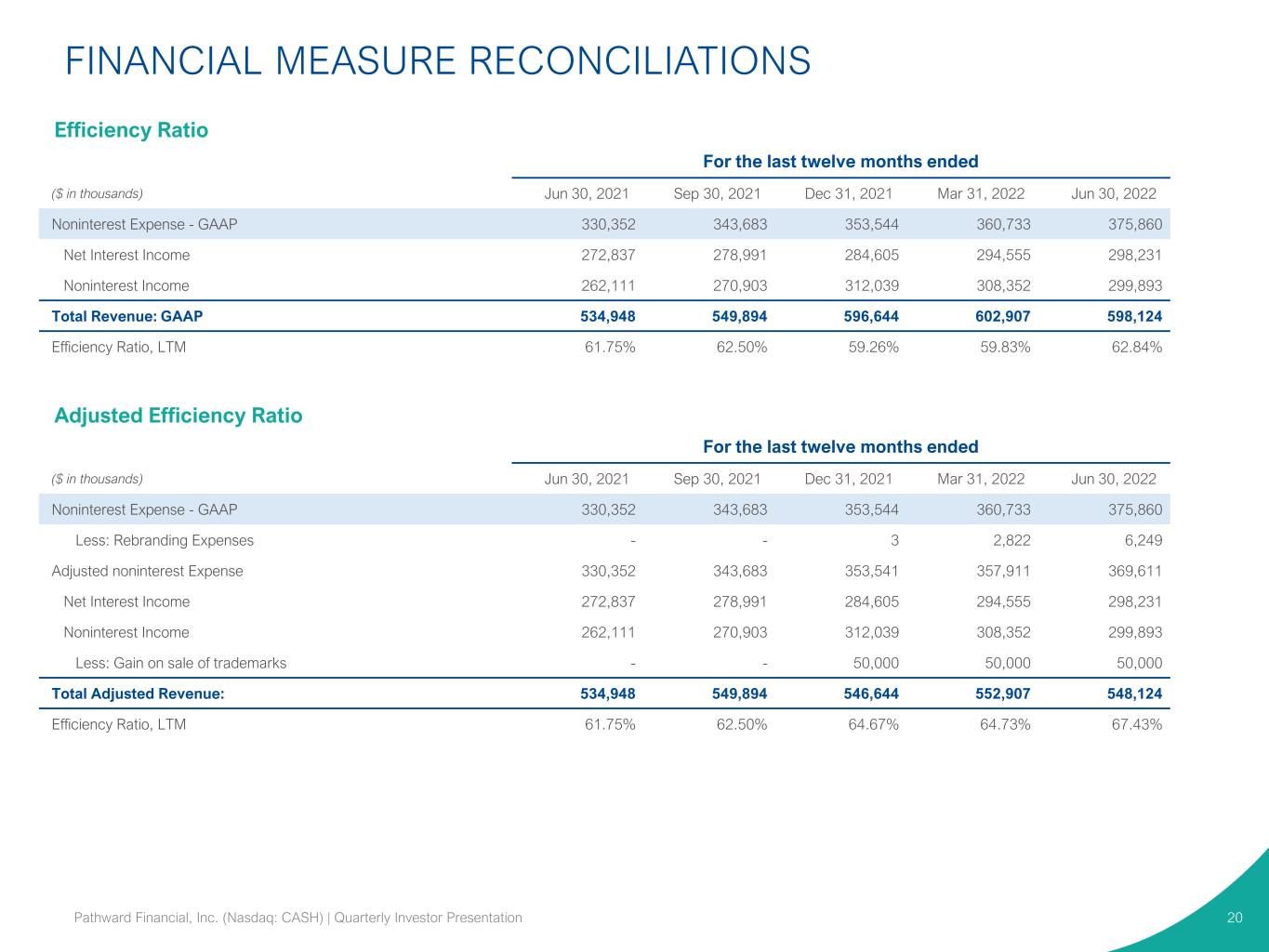

Optimize Interest-Earning Assets Optimize Deposits Optimize Operating Efficiencies Efficiency ratio of 62.84% compared to 61.75% as of June 30, 2021.1 • Drive long-term simplification and optimization of existing business platforms. • Exiting two tax partner relationships, driving simplification and anticipated expense efficiencies over time. • Acted on expense reduction initiatives which resulted in $3.1 million in separation agreement expenses for the June 30, 2022 quarter. Total deposits fell by $178 million, or 3%, from June 30, 2021 • Reduced wholesale deposits by 92% from June 30, 2021. • Achieved 0.12% cost of funds from all deposits and borrowings. Continued focus on growing commercial finance business lines. • Grew commercial finance loans by $361 million, or 14%, from June 30, 2021. • Cash and cash equivalents dropped by $563 million from June 30, 2021. • Divestment from the Community Banking loans led to reduction of $304 million from June 30, 2021 THIRD QUARTER BUSINESS HIGHLIGHTS & KEY STRATEGIC INITIATIVES 4Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation 1Adjusted efficiency ratio (excluding the gain on sale of trademarks and rebranding expenses) for the twelve months ended June 30, 2022 was 67.43%. See appendix for Non-GAAP financial measures reconciliations.

OTHER BUSINESS DEVELOPMENTS THIRD QUARTER ENDED JUNE 30, 2022 5Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation • On July 13, 2022, the Company announced it is changing its name to Pathward Financial, Inc.TM, and its bank subsidiary, MetaBank, N.A., will be changing its name to PathwardTM, N.A. – Certain changes were made immediately, with a full transition to Pathward expected by the end of this calendar year, including the launch of a new brand identity and website. The Company will continue to serve its customers under existing brand names during the transition. – The Company recognized $3.4 million of pre-tax expenses related to rebranding efforts during the third quarter of fiscal 2022 and $6.2 million fiscal year to date. The Company estimates total rebranding expenses will range between $15 million to $20 million. – More information can be found at www.pathwardfinancial.com • As part of the Company's priority to work with partners who offer their customers a broader suite of capabilities and multi- product solutions that it provides, the Company will not be renewing its agreements with Liberty Tax and Jackson Hewitt. This change is expected to boost operational efficiencies over time. Taxpayer advance volumes are expected to be reduced by approximately 30% next year. No significant impact is anticipated to refund transfer volumes. During the third quarter, the Company recognized $1.2 million of pre-tax one-time partner termination related expenses.

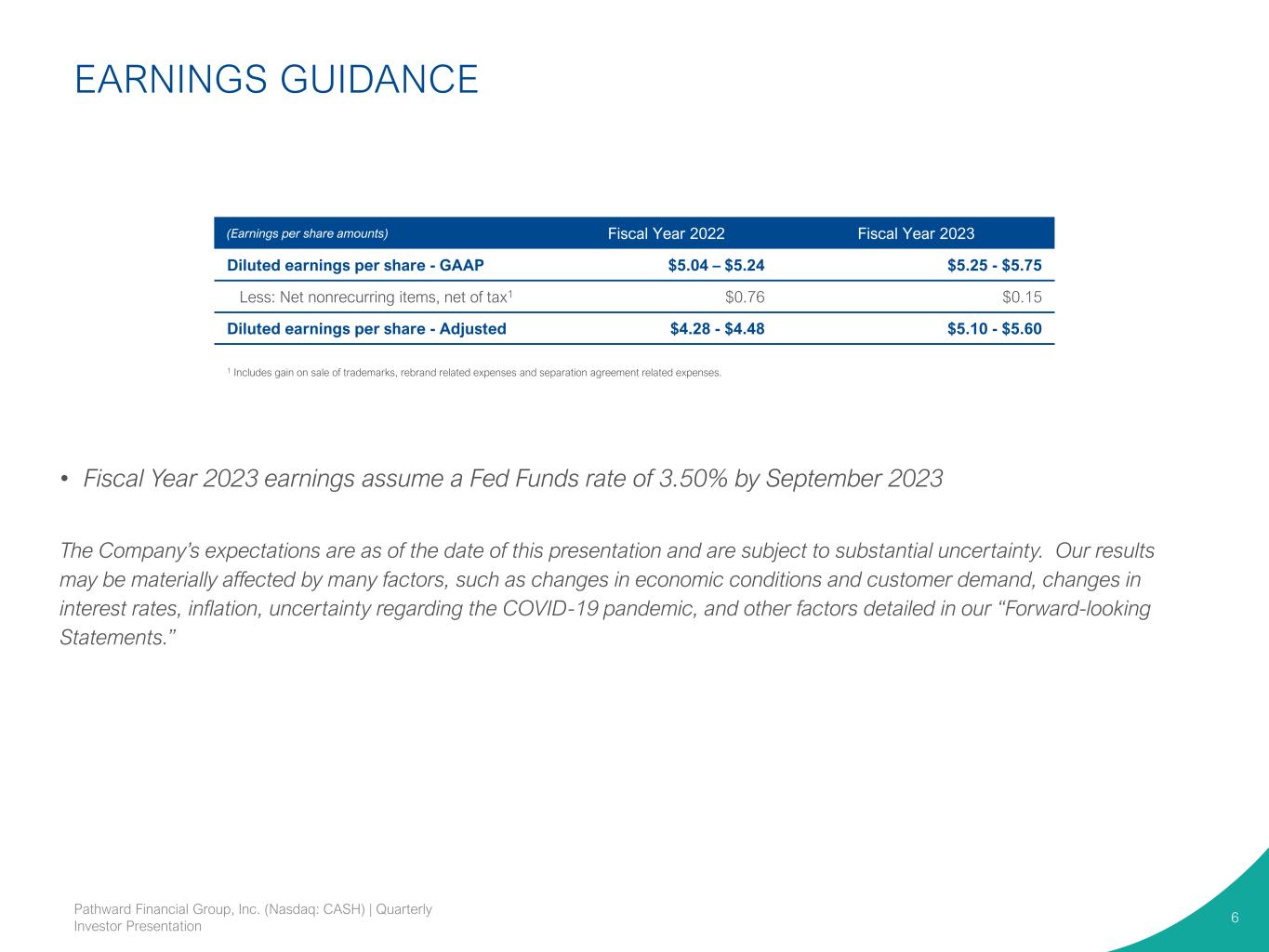

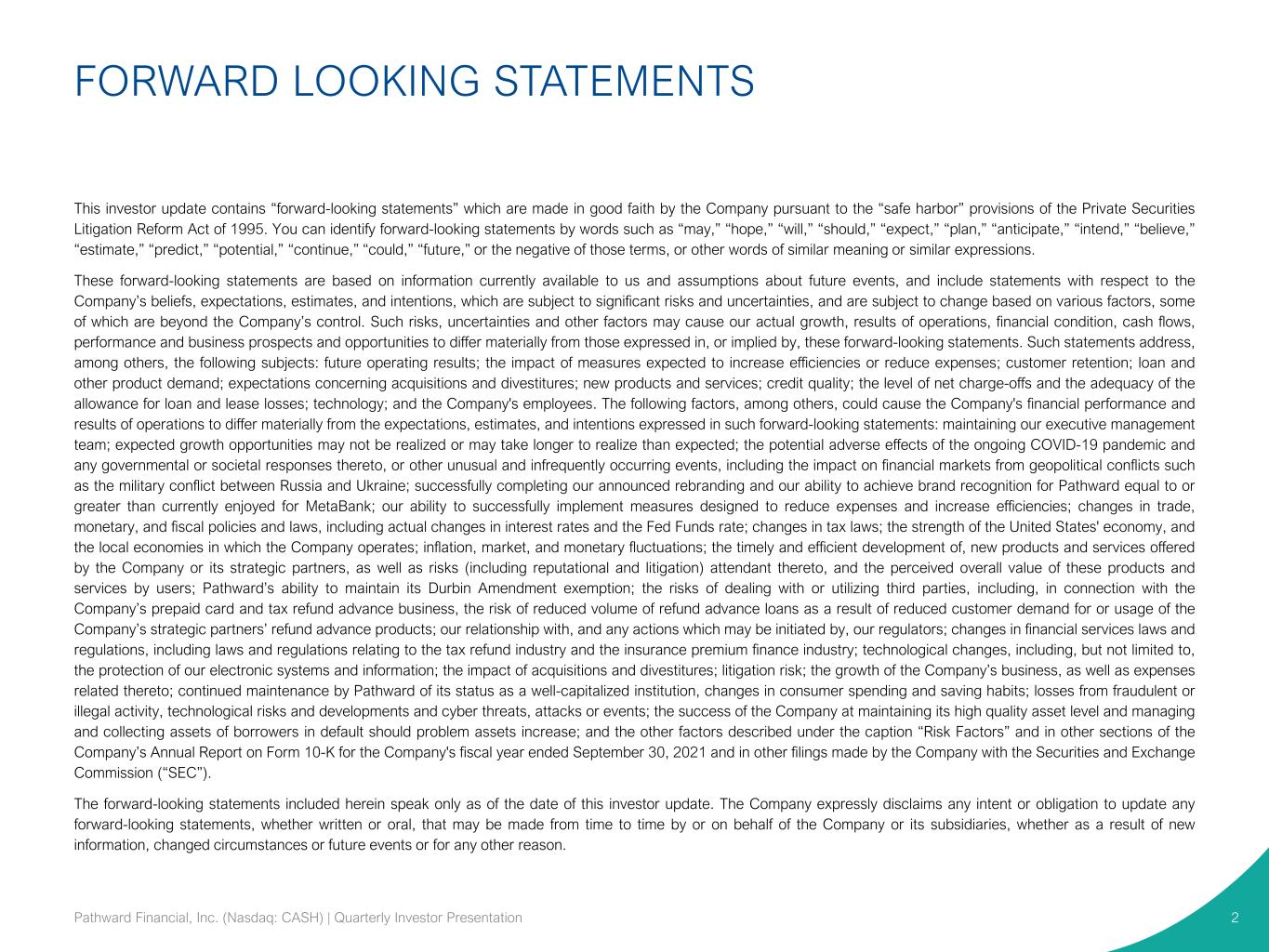

EARNINGS GUIDANCE • Fiscal Year 2023 earnings assume a Fed Funds rate of 3.50% by September 2023 The Company’s expectations are as of the date of this presentation and are subject to substantial uncertainty. Our results may be materially affected by many factors, such as changes in economic conditions and customer demand, changes in interest rates, inflation, uncertainty regarding the COVID-19 pandemic, and other factors detailed in our “Forward-looking Statements.” Pathward Financial Group, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation 6 (Earnings per share amounts) Fiscal Year 2022 Fiscal Year 2023 Diluted earnings per share - GAAP $5.04 – $5.24 $5.25 - $5.75 Less: Net nonrecurring items, net of tax1 $0.76 $0.15 Diluted earnings per share - Adjusted $4.28 - $4.48 $5.10 - $5.60 1 Includes gain on sale of trademarks, rebrand related expenses and separation agreement related expenses.

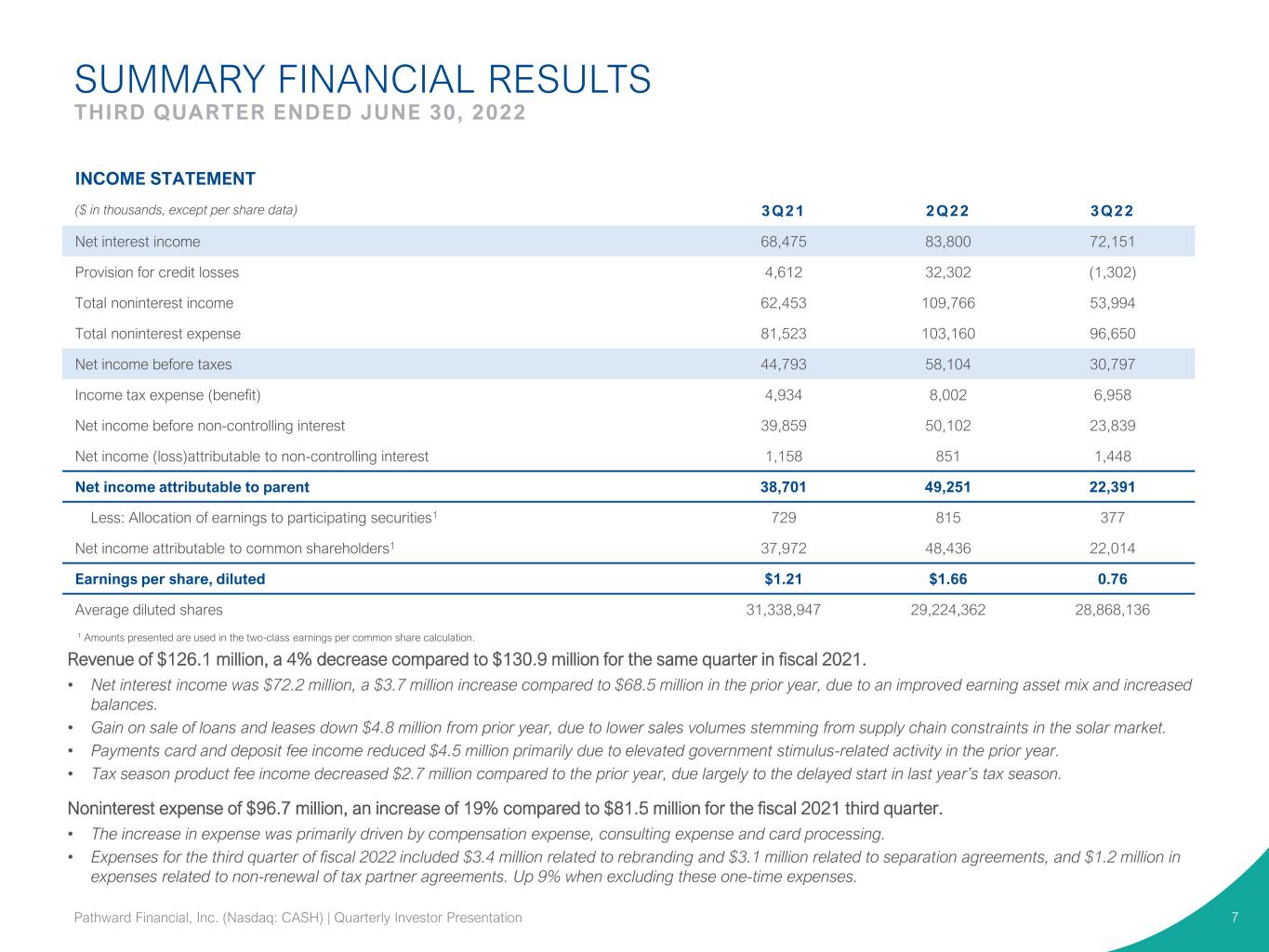

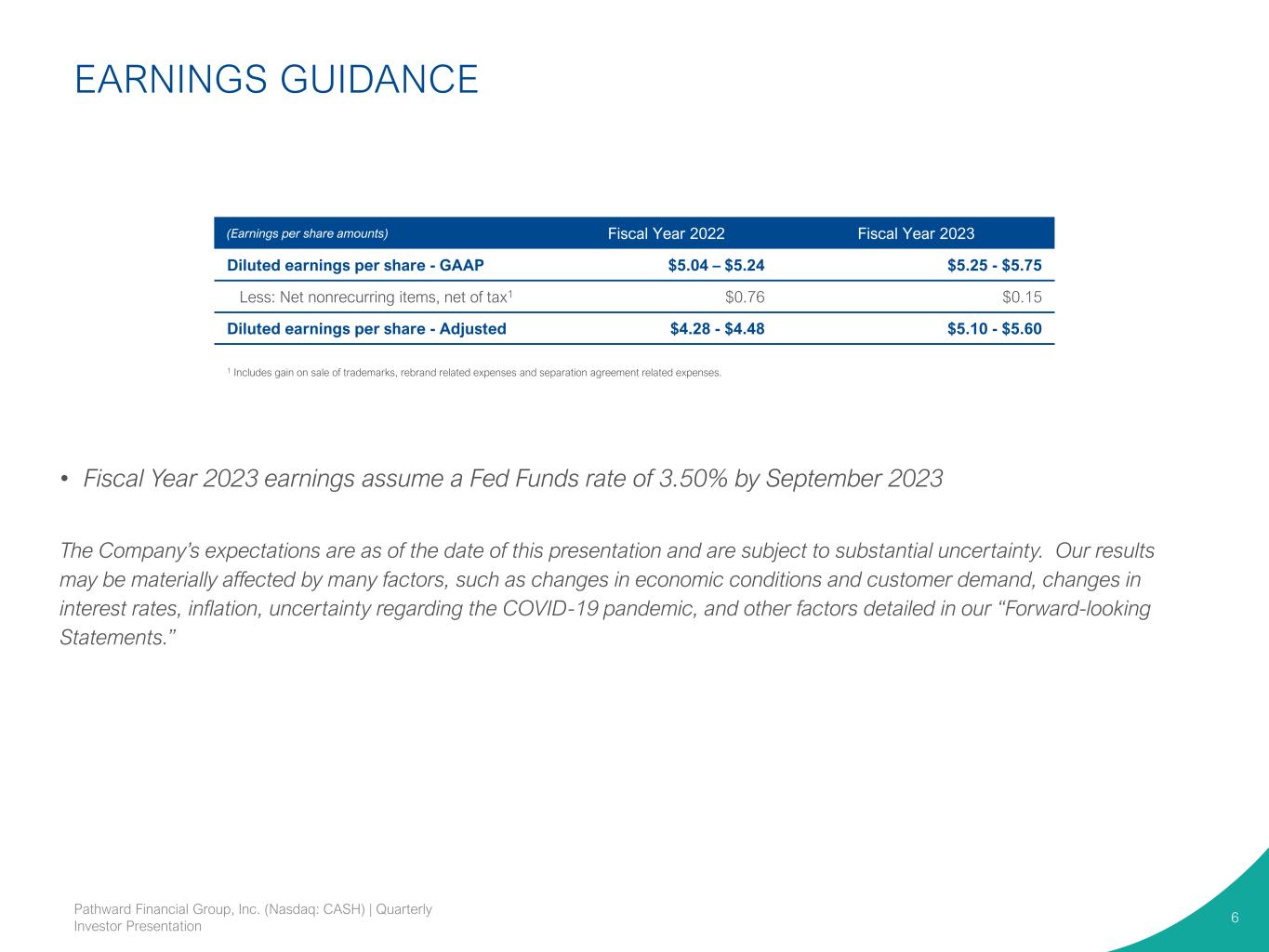

SUMMARY FINANCIAL RESULTS THIRD QUARTER ENDED JUNE 30, 2022 7 1 Amounts presented are used in the two-class earnings per common share calculation. INCOME STATEMENT ($ in thousands, except per share data) 3Q21 2Q22 3Q22 Net interest income 68,475 83,800 72,151 Provision for credit losses 4,612 32,302 (1,302) Total noninterest income 62,453 109,766 53,994 Total noninterest expense 81,523 103,160 96,650 Net income before taxes 44,793 58,104 30,797 Income tax expense (benefit) 4,934 8,002 6,958 Net income before non-controlling interest 39,859 50,102 23,839 Net income (loss)attributable to non-controlling interest 1,158 851 1,448 Net income attributable to parent 38,701 49,251 22,391 Less: Allocation of earnings to participating securities1 729 815 377 Net income attributable to common shareholders1 37,972 48,436 22,014 Earnings per share, diluted $1.21 $1.66 0.76 Average diluted shares 31,338,947 29,224,362 28,868,136 Revenue of $126.1 million, a 4% decrease compared to $130.9 million for the same quarter in fiscal 2021. • Net interest income was $72.2 million, a $3.7 million increase compared to $68.5 million in the prior year, due to an improved earning asset mix and increased balances. • Gain on sale of loans and leases down $4.8 million from prior year, due to lower sales volumes stemming from supply chain constraints in the solar market. • Payments card and deposit fee income reduced $4.5 million primarily due to elevated government stimulus-related activity in the prior year. • Tax season product fee income decreased $2.7 million compared to the prior year, due largely to the delayed start in last year’s tax season. Noninterest expense of $96.7 million, an increase of 19% compared to $81.5 million for the fiscal 2021 third quarter. • The increase in expense was primarily driven by compensation expense, consulting expense and card processing. • Expenses for the third quarter of fiscal 2022 included $3.4 million related to rebranding and $3.1 million related to separation agreements, and $1.2 million in expenses related to non-renewal of tax partner agreements. Up 9% when excluding these one-time expenses. Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation

2022 TAX SEASON RECAP 8 Refund advances (“RAs”) and refund-transfers (“RTs”) leverage banking-as-a-service (“BaaS”) infrastructure and are core to our Pathwardmission, as they allow consumers quicker access to their money. • RA originations of $1.83 billion compared to $1.79 billion in the 2021 tax season. – Customer appetite for refund advances tempered in the 2022 tax season by remaining government stimulus funds. – Approximate average loan size of $1,263 compared to $1,323 in 2021. • RT volumes and RT product income for the overall tax season are expected to end higher than last year Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation Tax Season ramps up during the first fiscal quarter, peaks during the second fiscal quarter, and wraps up during the third fiscal quarter. As a result, performance for the nine months ended June 30th is a better reflection on the overall performance for tax season as it alleviates timing differences between quarters. However, delays experienced in the 2021 tax season caused some additional amounts of revenues and expenses to be recognized in the third and fourth fiscal quarters TAX SERVICES ECONOMICS Three Months Ended Nine Months Ended ($ in millions) June 30, 2022 June 30, 2021 % Change June 30, 2022 June 30, 2021 % Change Net interest income (expense) 0.05 0.61 (91%) 3.39 1.03 229% Tax advance product income (0.02) 0.89 (102%) 40.51 47.41 (15%) RT product income 10.29 12.07 (15%) 38.67 35.40 9% Total revenue 10.32 13.57 (24%) 82.57 83.84 (2%) Total expense 2.43 2.41 1% 11.01 11.18 (1%) Provision for credit losses (0.17) 4.69 (104%) 28.09 32.82 (14%) Net income, pre-tax 8.06 6.47 25% 43.47 39.85 9% Total refund advance originations - - $1,834 $ 1,793 2% Approximate loss rate¹ (9 months) 1.67 % 1.83 % 1 Approximate loss rate calculated by taking provision for loan & lease losses divided by total refund advance originations. FY22 value excludes large recovery in Q1 for FY21 season.

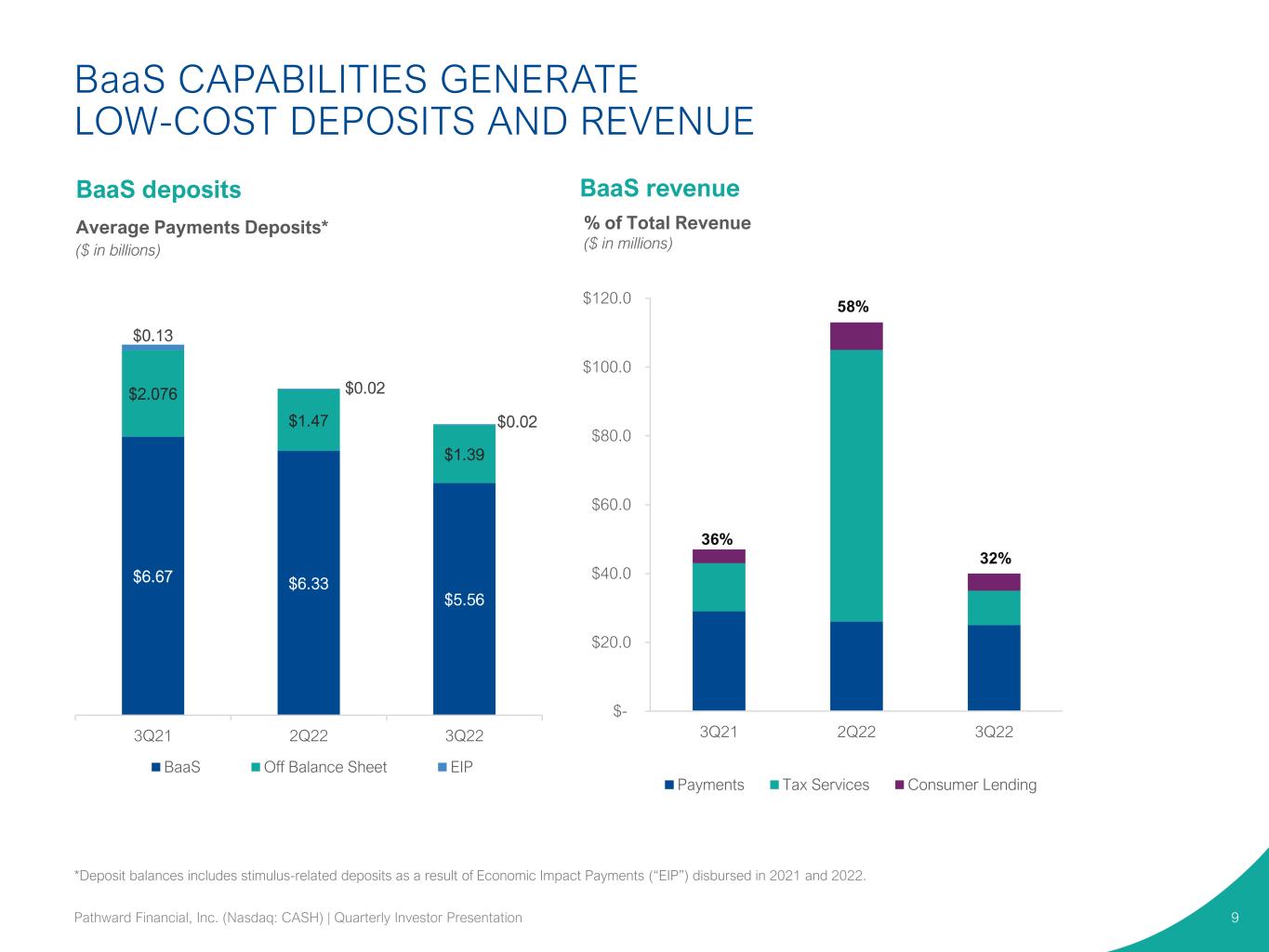

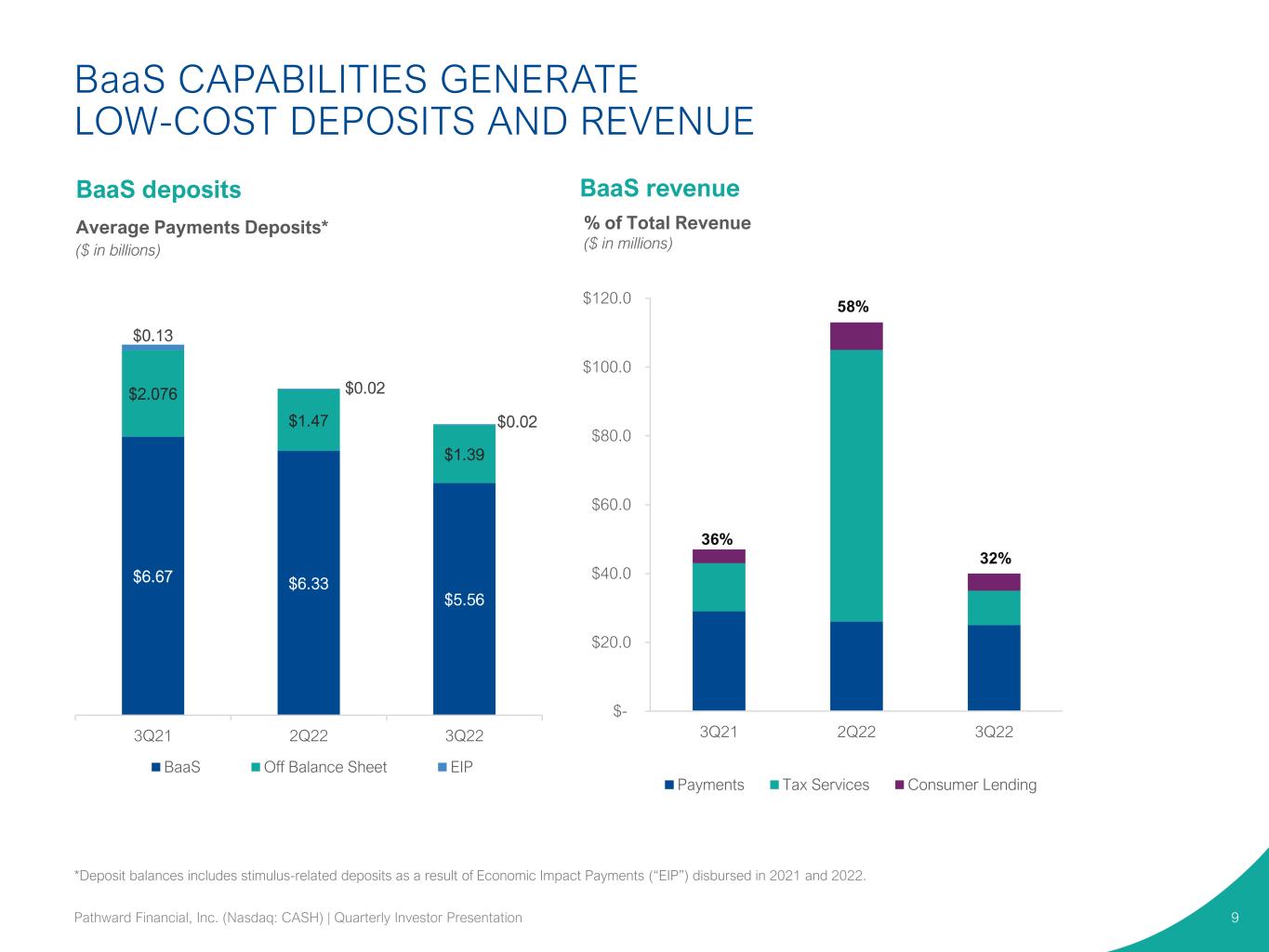

$- $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 3Q21 2Q22 3Q22 Payments Tax Services Consumer Lending BaaS CAPABILITIES GENERATE LOW-COST DEPOSITS AND REVENUE 9 BaaS revenue Average Payments Deposits* ($ in billions) 36% 58% 32% % of Total Revenue ($ in millions) *Deposit balances includes stimulus-related deposits as a result of Economic Impact Payments (“EIP”) disbursed in 2021 and 2022. BaaS deposits Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation $6.67 $6.33 $5.56 $2.076 $1.47 $1.39 $0.13 $0.02 $0.02 3Q21 2Q22 3Q22 BaaS Off Balance Sheet EIP

BALANCE SHEET HIGHLIGHTS THIRD QUARTER ENDED JUNE 30, 2022 10 BALANCE SHEET PERIOD ENDING ($ in thousands) 3Q21 2Q22 3Q22 Cash and cash equivalents 720,243 237,680 157,260 Investments 1,981,852 2,090,765 2,000,400 Loans held for sale 87,905 31,410 67,571 Loans and leases (HFI)1 3,496,670 3,730,190 3,688,566 Allowance for credit losses (91,208) (88,552) (75,206) Other assets 856,350 885,746 889,587 Total assets 7,051,812 6,887,239 6,728,178 Total deposits 5,888,871 5,829,886 5,710,799 Total borrowings 93,634 91,386 16,616 Other liabilities 192,674 202,561 275,989 Total liabilities 6,175,179 6,123,833 6,003,404 Total stockholders’ equity 876,633 763,406 724,774 Total liabilities and stockholders’ equity 7,051,812 6,887,239 6,728,178 Loans (HFI) / Deposits 59 % 64 % 65 % Net Interest Margin 3.75 % 4.80 % 4.76 % Return on Average Assets 1.90 % 2.49 % 1.32 % Return on Average Equity 18.07 % 24.16 % 11.93 % 1Includes $143.3 million, $43.0 million, and $21.1 million of PPP loans in 3Q21, 2Q22, and 3Q22, respectively. The effects of government stimulus programs have had a significant impact on the Company’s balance sheet. These programs include EIP, enhanced unemployment benefits that flow through to existing prepaid card programs, and Paycheck Protection Program (“PPP”) loans. Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation

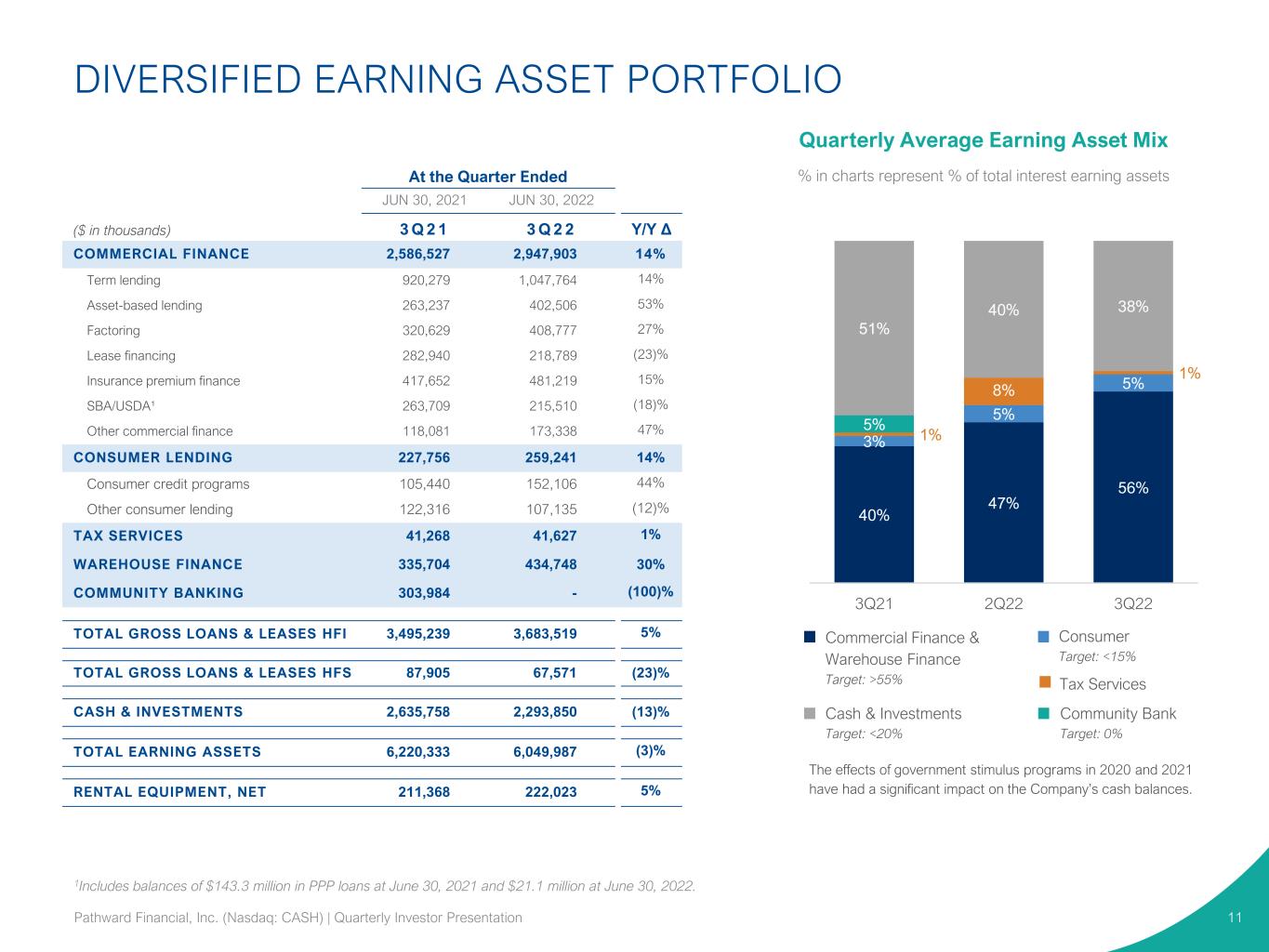

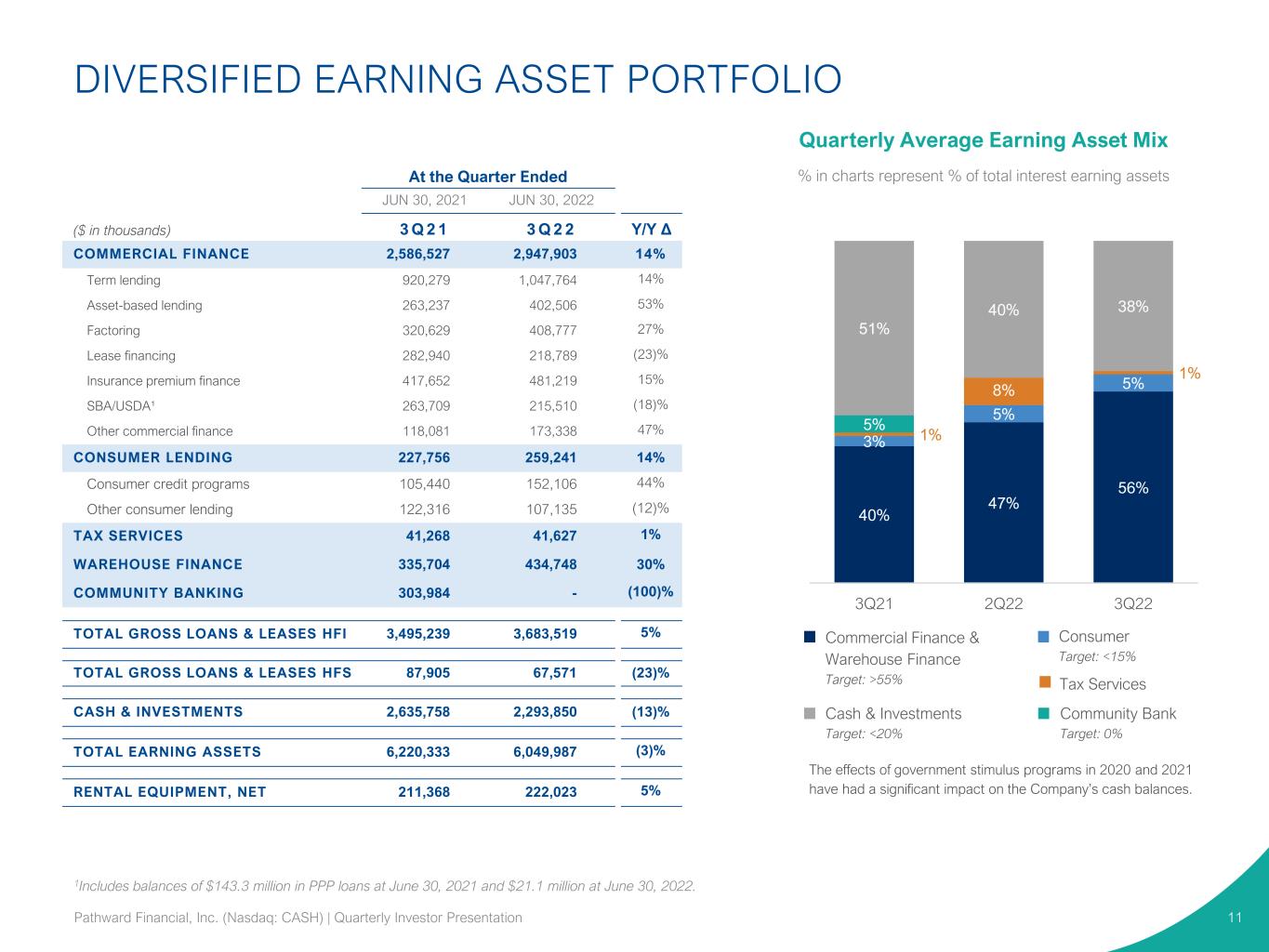

Quarterly Average Earning Asset Mix % in charts represent % of total interest earning assetsAt the Quarter Ended JUN 30, 2021 JUN 30, 2022 ($ in thousands) 3 Q 2 1 3 Q 2 2 Y/Y Δ COMMERCIAL FINANCE 2,586,527 2,947,903 14% Term lending 920,279 1,047,764 14% Asset-based lending 263,237 402,506 53% Factoring 320,629 408,777 27% Lease financing 282,940 218,789 (23)% Insurance premium finance 417,652 481,219 15% SBA/USDA¹ 263,709 215,510 (18)% Other commercial finance 118,081 173,338 47% CONSUMER LENDING 227,756 259,241 14% Consumer credit programs 105,440 152,106 44% Other consumer lending 122,316 107,135 (12)% TAX SERVICES 41,268 41,627 1% WAREHOUSE FINANCE 335,704 434,748 30% COMMUNITY BANKING 303,984 - (100)% TOTAL GROSS LOANS & LEASES HFI 3,495,239 3,683,519 5% TOTAL GROSS LOANS & LEASES HFS 87,905 67,571 (23)% CASH & INVESTMENTS 2,635,758 2,293,850 (13)% TOTAL EARNING ASSETS 6,220,333 6,049,987 (3)% RENTAL EQUIPMENT, NET 211,368 222,023 5% 1Includes balances of $143.3 million in PPP loans at June 30, 2021 and $21.1 million at June 30, 2022. DIVERSIFIED EARNING ASSET PORTFOLIO 11 40% 47% 56% 3% 5% 5% 1% 8% 1% 5% 51% 40% 38% 3Q21 2Q22 3Q22 Commercial Finance & Warehouse Finance Target: >55% Consumer Target: <15% Tax Services Community Bank Target: 0% Cash & Investments Target: <20% The effects of government stimulus programs in 2020 and 2021 have had a significant impact on the Company’s cash balances. Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation

OVERVIEW OF LOAN PORTFOLIO 12 ($ in millions) Business Line Balance Sheet Category 3Q21 2Q22 3Q22 MRQ Yield Commercial Finance Commercial Finance Guaranteed portion of US govt SBA/USDA loans SBA/USDA 71.9 61.7 59.3 Unguaranteed portion of US govt SBA/USDA loans SBA/USDA 48.6 109.5 135.1 Paycheck Protection Program (PPP) loans SBA/USDA 143.3 43.0 21.1 Renewable energy debt financing¹ (term lending only) Term lending 231.2 273.7 212.6 Other Term lending 218.3 310.0 294.7 TOTAL 713.2 797.9 732.4 5.22% Equipment Finance Large ticket Lease Financing 247.0 205.8 192.7 Term lending 195.9 261.4 268.1 Small ticket Lease Financing 27.6 18.6 16.3 Term lending 274.9 265.9 263.0 Other Lease Financing 8.3 11.0 9.7 TOTAL 753.7 762.7 732.8 6.97% Working Capital Asset-Based Lending 263.2 382.4 402.5 Factoring 320.6 394.9 408.8 TOTAL 583.8 777.3 811.3 9.93% Specialty Finance Insurance Premium Finance 417.7 403.7 481.2 Other commercial finance 118.1 173.3 173.3 TOTAL 535.8 577.0 654.5 5.18% Consumer Lending Consumer credit programs Consumer credit programs 105.4 171.8 152.1 Private student loans Other consumer finance 101.4 87.1 83.3 Other consumer lending Other consumer finance 20.9 24.8 23.8 TOTAL 227.7 283.7 259.2 6.63% Tax Services Tax preparer loans Tax Services 0.3 5.9 - Refund advance loans Tax Services 41.0 80.1 41.6 TOTAL 41.3 86.0 41.6 0.34% Corporate Warehouse Finance 335.7 441.5 434.7 Community Banking 304.0 - - TOTAL 639.7 441.5 434.7 6.22% Total Lending Portfolio (HFI) 3,495.2 3,726.1 3,683.5 6.69% Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation 1Total renewable energy debt financing outstanding was $373.1 million in 3Q22. Majority of balances in term lending balance sheet category.

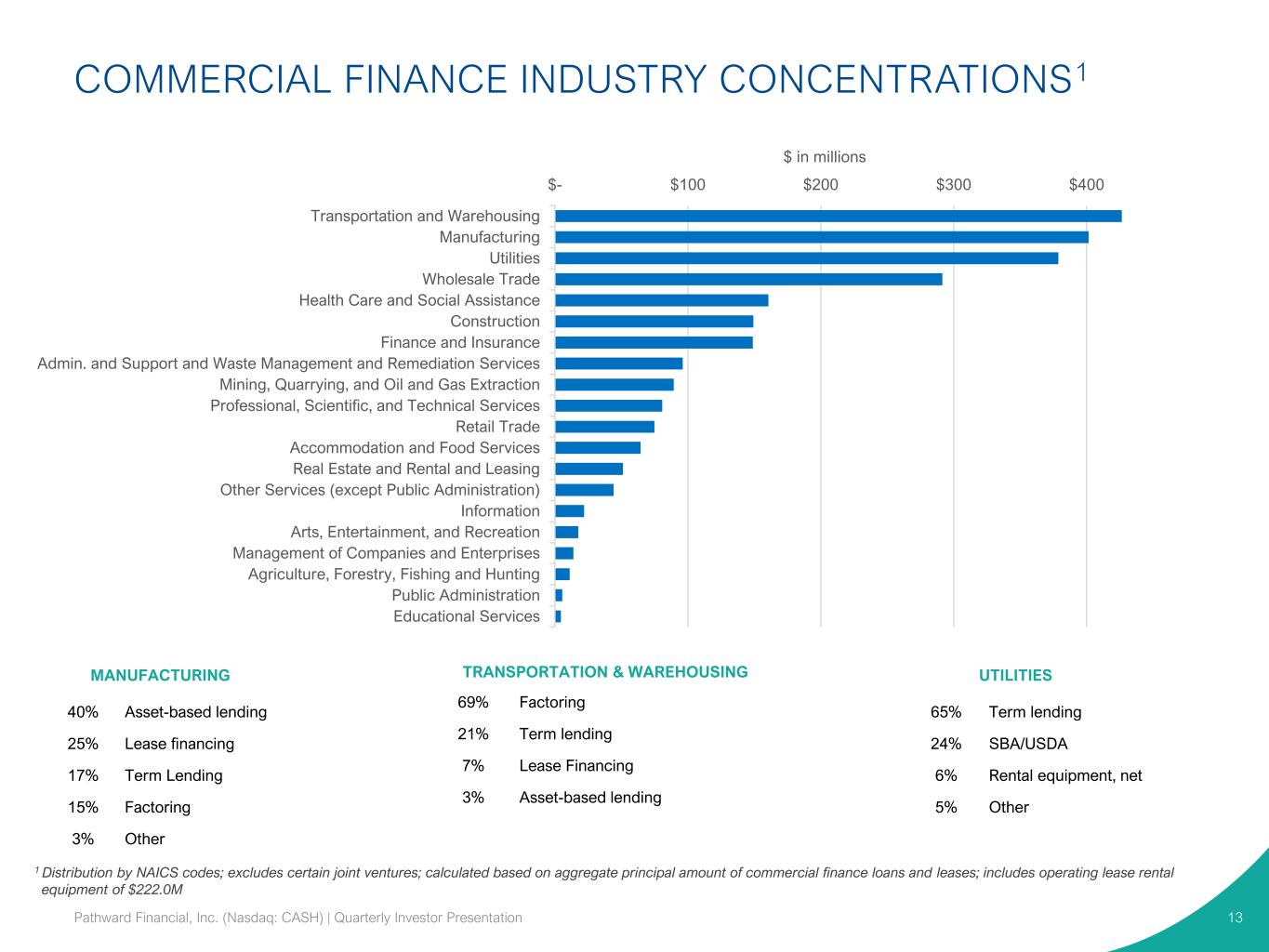

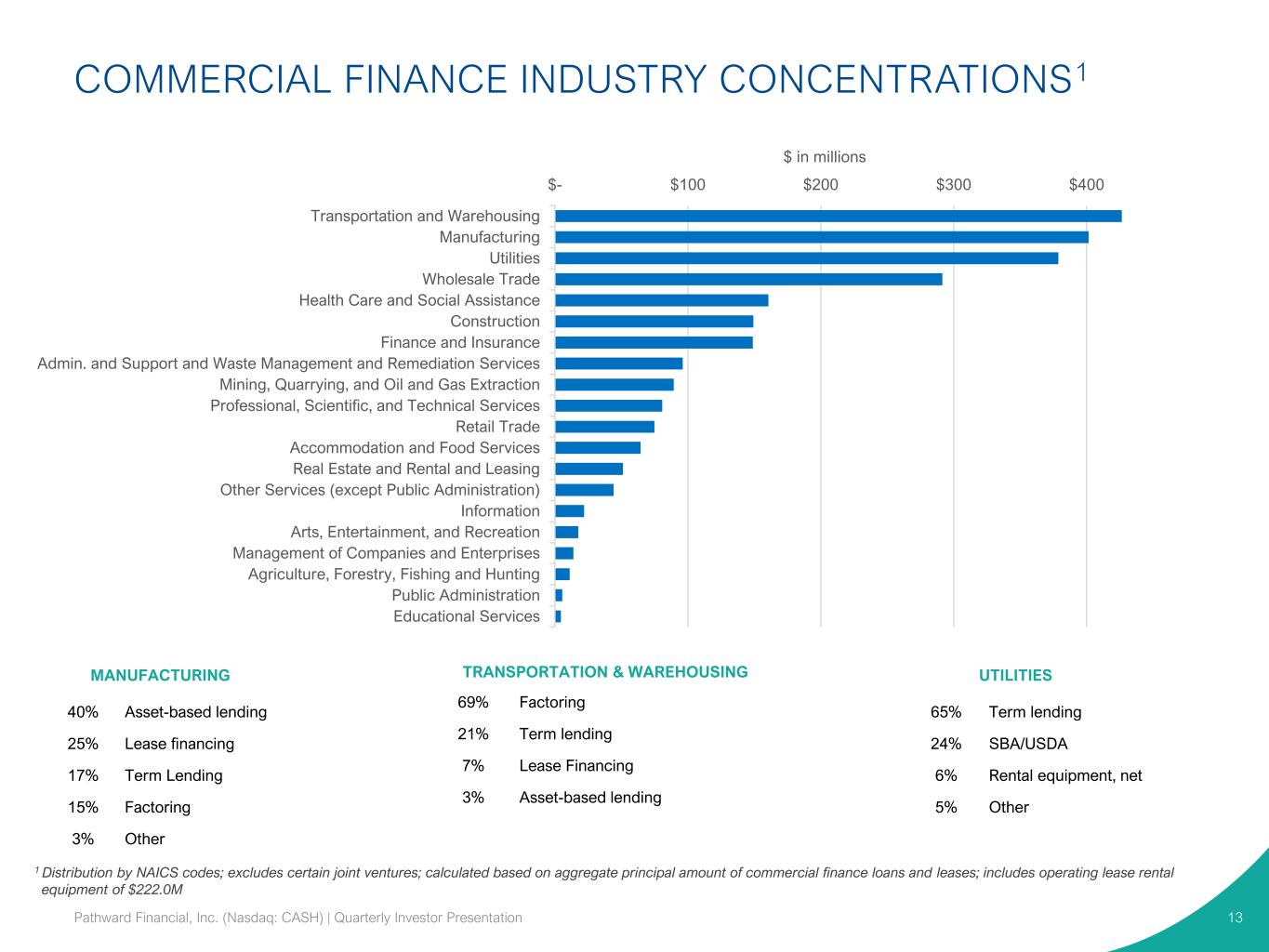

COMMERCIAL FINANCE INDUSTRY CONCENTRATIONS1 13Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation 1Total renewable energy debt financing outstanding was $401.2 million in 2Q22. Majority of balances in term lending balance sheet category. Transportation and Warehousing Manufacturing Utilities Wholesale Trade Health Care and Social Assistance Construction Finance and Insurance Admin. and Support and Waste Management and Remediation Services Mining, Quarrying, and Oil and Gas Extraction Professional, Scientific, and Technical Services Retail Trade Accommodation and Food Services Real Estate and Rental and Leasing Other Services (except Public Administration) Information Arts, Entertainment, and Recreation Management of Companies and Enterprises Agriculture, Forestry, Fishing and Hunting Public Administration Educational Services $- $100 $200 $300 $400 $ in millions 1 Distribution by NAICS codes; excludes certain joint ventures; calculated based on aggregate principal amount of commercial finance loans and leases; includes operating lease rental equipment of $222.0M MANUFACTURING 40% Asset-based lending 25% Lease financing 17% Term Lending 15% Factoring 3% Other TRANSPORTATION & WAREHOUSING 69% Factoring 21% Term lending 7% Lease Financing 3% Asset-based lending UTILITIES 65% Term lending 24% SBA/USDA 6% Rental equipment, net 5% Other

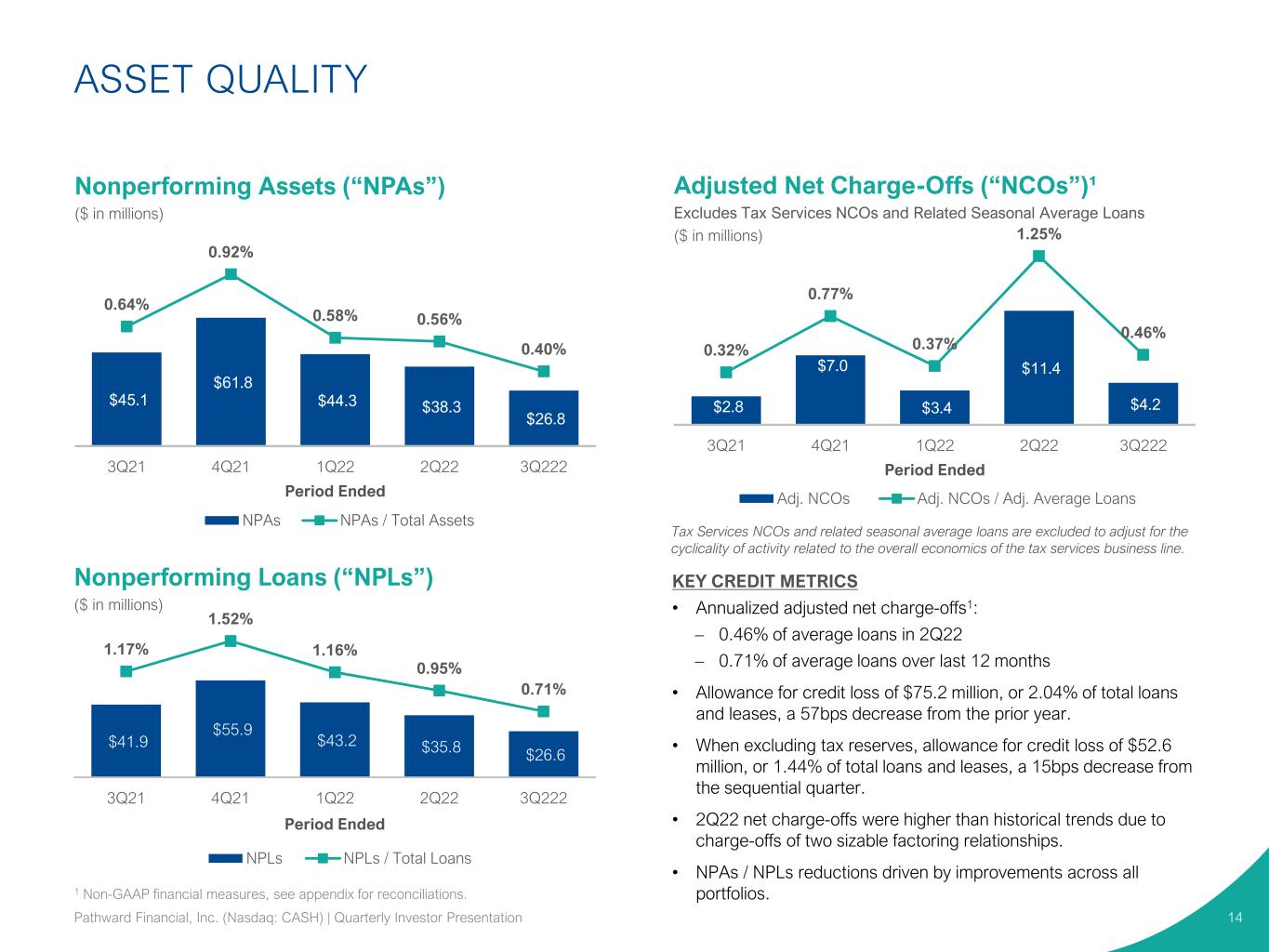

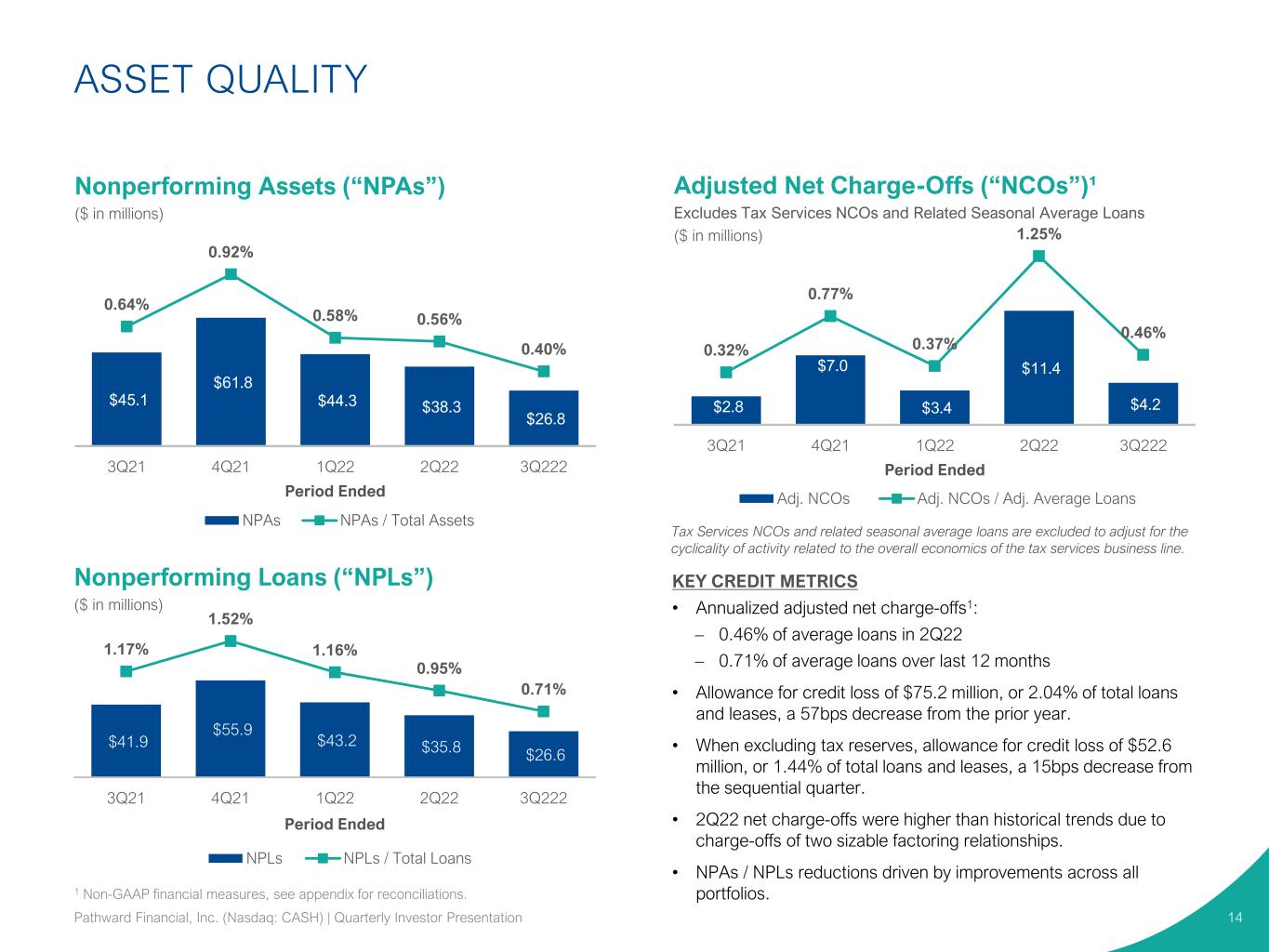

$2.8 $7.0 $3.4 $11.4 $4.2 0.32% 0.77% 0.37% 1.25% 0.46% 3Q21 4Q21 1Q22 2Q22 3Q222 Period Ended Adj. NCOs Adj. NCOs / Adj. Average Loans Adjusted Net Charge-Offs (“NCOs”)¹ Excludes Tax Services NCOs and Related Seasonal Average Loans ($ in millions) KEY CREDIT METRICS • Annualized adjusted net charge-offs1: – 0.46% of average loans in 2Q22 – 0.71% of average loans over last 12 months • Allowance for credit loss of $75.2 million, or 2.04% of total loans and leases, a 57bps decrease from the prior year. • When excluding tax reserves, allowance for credit loss of $52.6 million, or 1.44% of total loans and leases, a 15bps decrease from the sequential quarter. • 2Q22 net charge-offs were higher than historical trends due to charge-offs of two sizable factoring relationships. • NPAs / NPLs reductions driven by improvements across all portfolios. $45.1 $61.8 $44.3 $38.3 $26.8 0.64% 0.92% 0.58% 0.56% 0.40% 3Q21 4Q21 1Q22 2Q22 3Q222 Period Ended NPAs NPAs / Total Assets ASSET QUALITY 14 1 Non-GAAP financial measures, see appendix for reconciliations. Tax Services NCOs and related seasonal average loans are excluded to adjust for the cyclicality of activity related to the overall economics of the tax services business line. $41.9 $55.9 $43.2 $35.8 $26.6 1.17% 1.52% 1.16% 0.95% 0.71% 3Q21 4Q21 1Q22 2Q22 3Q222 Period Ended NPLs NPLs / Total Loans Nonperforming Assets (“NPAs”) ($ in millions) Nonperforming Loans (“NPLs”) ($ in millions) Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation

-10% 5% 20% 35% -100 +100 +200 +300 Parallel Shock Ramp 1 Fixed rate securities, loans and leases are shown for contractual periods. -2,000 0 2,000 4,000 Month 1-12 Month 13-36 Month 37-60 Month 61-180 V o lu m e ( $ M M ) Period Variance Total Assets Total Liabilities INTEREST RATE RISK MANAGEMENT JUNE 30, 2022 15 2% 25% 10% 63% • Focus is on selectively adding duration to improve yield and protect margin against falling rates. • Interest rate risk shows asset sensitive balance sheet; net interest income modeled under an instantaneous, parallel rate shock and a gradual parallel ramp. • Management employs rigorous modeling techniques under a variety of yield curve shapes, twists and ramps. Fixed Rate > 1 Year 12-Month Interest Rate Sensitivity from Base Net Interest Income Earning Asset Pricing Attributes1 Asset/Liability Gap Analysis Fixed Rate < 1 Year Floating or Variable Federal Reserve Bank Deposits (Floating or Variable) Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation

6.85% 7.67% 7.39% 6.80% 8.23% 7.83% 8.69% 8.52% 7.79% 8.22% 3Q21 4Q21 1Q22 2Q22 3Q22 CAPITAL AND SOURCES OF LIQUIDITY REGULATORY CAPITAL AS OF JUNE 30, 2022 Minimum Requirement to be Well-Capitalized under Prompt Corrective Action Provisions Pathward Financial, Inc. Pathward, N.A. Capital Ratio Trends At June 30, 2022¹ Pathward Financial, Inc. Pathward, N.A. Tier 1 Leverage 8.23% 8.22% Common Equity Tier 1 11.87% 12.17% Tier 1 Capital 12.19% 12.18% Total Capital 13.44% 13.43% Pathward remains well-capitalized. Tier 1 Leverage ratios impacted from government stimulus programs during fiscal 2020 and fiscal 2021. Capital levels have returned to a more normalized rate. Primary & Secondary Liquidity Sources ($ in millions) Cash and Cash Equivalents $155 Unpledged Investment Securities $250 FHLB Borrowing Capacity $665 Funds Available through Fed Discount Window $215 PPP Loan Collateral $15 Unsecured Lines of Credit $1,005 - $1,095 Deposit Balances Held at Other Banks $1,219 16.18% 15.45% 13.80% 14.16% 13.44% 16.22% 15.38% 14.16% 14.52% 13.43% 3Q21 4Q21 1Q22 2Q22 3Q22 10% 5% 16 Total Capital Ratio Tier 1 Leverage Ratio 1 Regulatory capital reflects the Company's election of the five-year CECL transition for regulatory capital purposes. Amounts are preliminary pending completion and filing of the Company's regulatory reports. ² Non-GAAP measure, see appendix for reconciliations. Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation

APPENDIX 17Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation

NON-GAAP RECONCILIATION 18Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation Adjusted Net Income and Adjusted Earnings Per Share For the quarter ended For the nine months ended ($ in thousands, except per share data) 3Q21 2Q22 3Q22 3Q21 3Q22 Net income - GAAP 38,701 49,251 22,391 125,805 132,966 Less: Gain on sale of trademarks - - - - 50,000 Add: Rebranding Expenses - 2,819 3,427 - 6,249 Add: Separation related expenses 1,161 878 3,116 2,509 4,080 Add: Income tax effect (290) (930) (1,677) (627) 9,965 Adjusted Net Income 39,572 52,018 27,257 127,687 103,260 Less: Allocation of earnings to participating securities1 746 861 458 2,447 1,682 Adjusted net income attributable to common shareholders 38,826 51,157 26,799 125,240 101,578 Adjusted earnings per common share, diluted $1.24 $1.75 $0.93 $3.93 $3.45 Average diluted shares 31,338,947 29,224,362 28,868,136 31,900,597 29,454,586 1 Amounts presented are used in the two-class earnings per common share calculation.

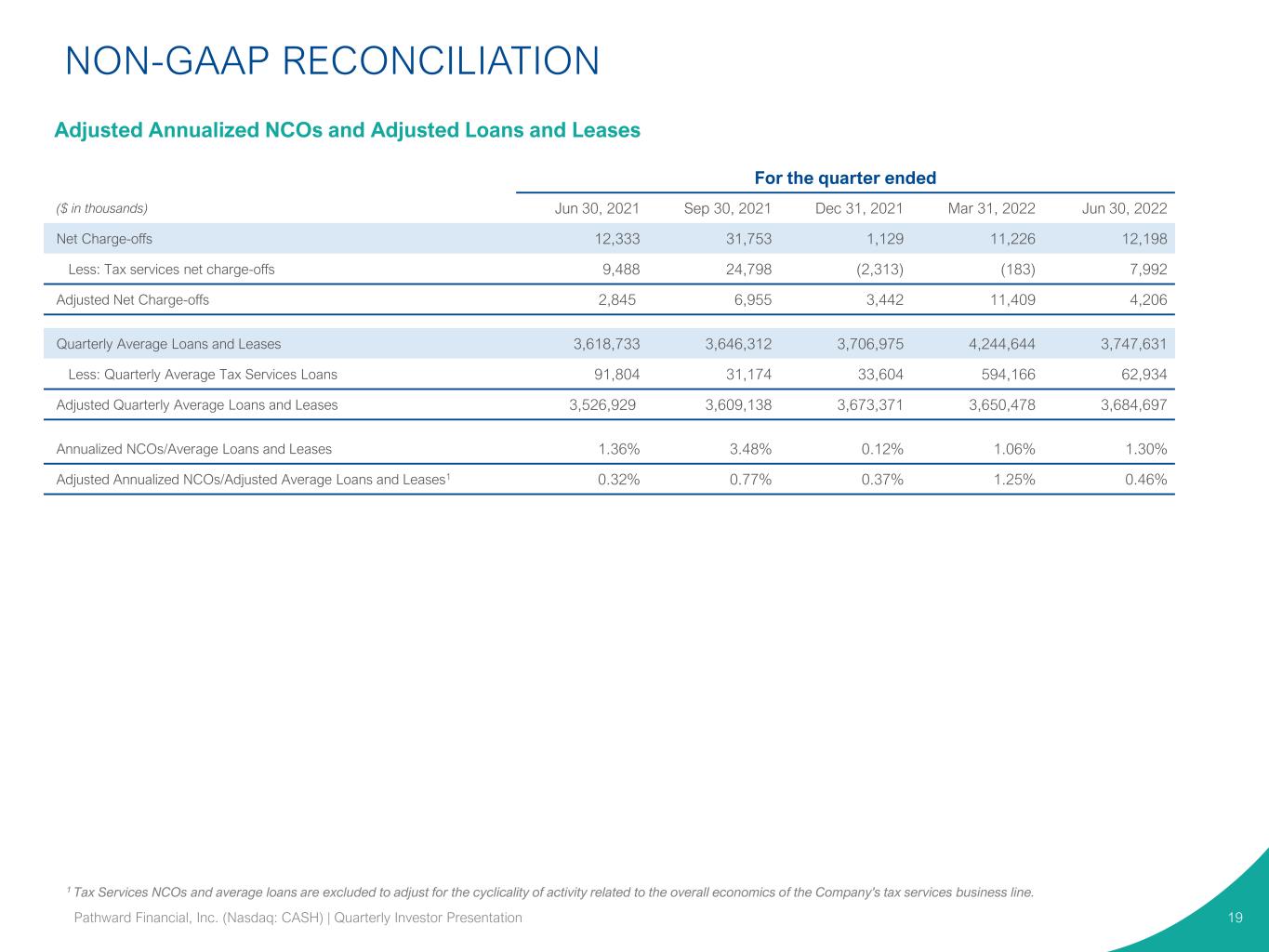

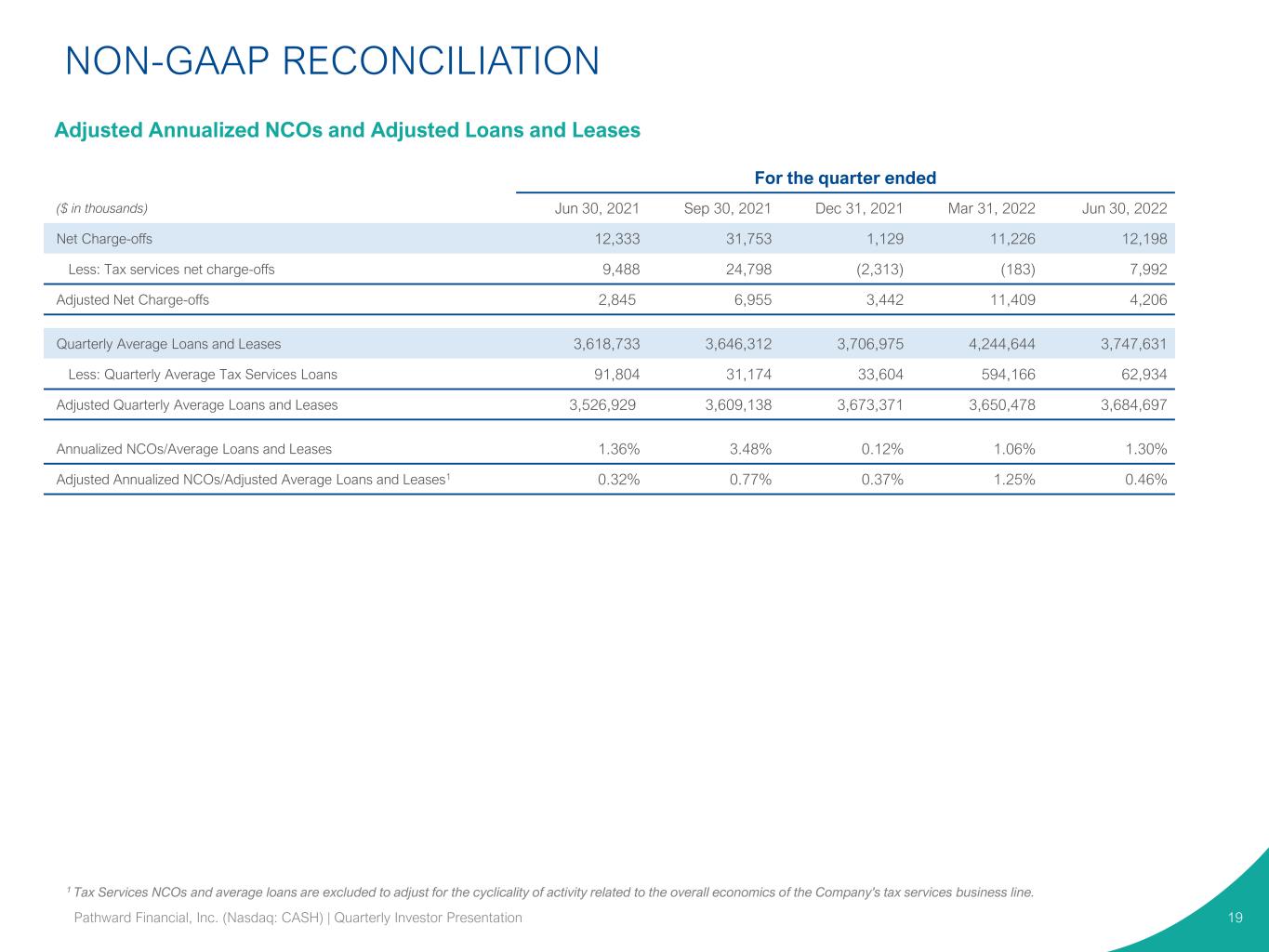

1 Tax Services NCOs and average loans are excluded to adjust for the cyclicality of activity related to the overall economics of the Company's tax services business line. 19 For the quarter ended ($ in thousands) Jun 30, 2021 Sep 30, 2021 Dec 31, 2021 Mar 31, 2022 Jun 30, 2022 Net Charge-offs 12,333 31,753 1,129 11,226 12,198 Less: Tax services net charge-offs 9,488 24,798 (2,313) (183) 7,992 Adjusted Net Charge-offs 2,845 6,955 3,442 11,409 4,206 Quarterly Average Loans and Leases 3,618,733 3,646,312 3,706,975 4,244,644 3,747,631 Less: Quarterly Average Tax Services Loans 91,804 31,174 33,604 594,166 62,934 Adjusted Quarterly Average Loans and Leases 3,526,929 3,609,138 3,673,371 3,650,478 3,684,697 Annualized NCOs/Average Loans and Leases 1.36% 3.48% 0.12% 1.06% 1.30% Adjusted Annualized NCOs/Adjusted Average Loans and Leases1 0.32% 0.77% 0.37% 1.25% 0.46% Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation NON-GAAP RECONCILIATION Adjusted Annualized NCOs and Adjusted Loans and Leases

FINANCIAL MEASURE RECONCILIATIONS 20Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation For the last twelve months ended ($ in thousands) Jun 30, 2021 Sep 30, 2021 Dec 31, 2021 Mar 31, 2022 Jun 30, 2022 Noninterest Expense - GAAP 330,352 343,683 353,544 360,733 375,860 Net Interest Income 272,837 278,991 284,605 294,555 298,231 Noninterest Income 262,111 270,903 312,039 308,352 299,893 Total Revenue: GAAP 534,948 549,894 596,644 602,907 598,124 Efficiency Ratio, LTM 61.75% 62.50% 59.26% 59.83% 62.84% For the last twelve months ended ($ in thousands) Jun 30, 2021 Sep 30, 2021 Dec 31, 2021 Mar 31, 2022 Jun 30, 2022 Noninterest Expense - GAAP 330,352 343,683 353,544 360,733 375,860 Less: Rebranding Expenses - - 3 2,822 6,249 Adjusted noninterest Expense 330,352 343,683 353,541 357,911 369,611 Net Interest Income 272,837 278,991 284,605 294,555 298,231 Noninterest Income 262,111 270,903 312,039 308,352 299,893 Less: Gain on sale of trademarks - - 50,000 50,000 50,000 Total Adjusted Revenue: 534,948 549,894 546,644 552,907 548,124 Efficiency Ratio, LTM 61.75% 62.50% 64.67% 64.73% 67.43% Efficiency Ratio Adjusted Efficiency Ratio