Quarterly Investor Update FOUR TH QUAR TER & F ISCA L YEAR END 2022 Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation

Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation2 FORWARD LOOKING STATEMENTS This investor update contains “forward-looking statements” which are made in good faith by the Company pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements by words such as “may,” “hope,” “will,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential,” “continue,” “could,” “future,” or the negative of those terms, or other words of similar meaning or similar expressions. These forward-looking statements are based on information currently available to us and assumptions about future events, and include statements with respect to the Company’s beliefs, expectations, estimates, and intentions, which are subject to significant risks and uncertainties, and are subject to change based on various factors, some of which are beyond the Company’s control. Such risks, uncertainties and other factors may cause our actual growth, results of operations, financial condition, cash flows, performance and business prospects and opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. Such statements address, among others, the following subjects: future operating results; the impact of measures expected to increase efficiencies or reduce expenses; customer retention; loan and other product demand; expectations concerning acquisitions and divestitures; new products and services; credit quality; the level of net charge-offs and the adequacy of the allowance for loan and lease losses; technology; and the Company's employees. The following factors, among others, could cause the Company's financial performance and results of operations to differ materially from the expectations, estimates, and intentions expressed in such forward-looking statements: maintaining our executive management team; expected growth opportunities may not be realized or may take longer to realize than expected; the potential adverse effects of the ongoing COVID-19 pandemic and any governmental or societal responses thereto, or other unusual and infrequently occurring events, including the impact on financial markets from geopolitical conflicts such as the military conflict between Russia and Ukraine; our ability to achieve brand recognition for Pathward equal to or greater than currently enjoyed for MetaBank; our ability to successfully implement measures designed to reduce expenses and increase efficiencies; changes in trade, monetary, and fiscal policies and laws, including actual changes in interest rates and the Fed Funds rate; changes in tax laws; the strength of the United States' economy, and the local economies in which the Company operates; inflation, market, and monetary fluctuations; the timely and efficient development of, new products and services offered by the Company or its strategic partners, as well as risks (including reputational and litigation) attendant thereto, and the perceived overall value of these products and services by users; Pathward’s ability to maintain its Durbin Amendment exemption; the risks of dealing with or utilizing third parties, including, in connection with the Company’s prepaid card and tax refund advance business, the risk of reduced volume of refund advance loans as a result of reduced customer demand for or usage of the Company’s strategic partners’ refund advance products; our relationship with, and any actions which may be initiated by, our regulators; changes in financial services laws and regulations, including laws and regulations relating to the tax refund industry and the insurance premium finance industry; technological changes, including, but not limited to, the protection of our electronic systems and information; the impact of acquisitions and divestitures; litigation risk; the growth of the Company’s business, as well as expenses related thereto; continued maintenance by Pathward of its status as a well-capitalized institution, changes in consumer spending and saving habits; losses from fraudulent or illegal activity, technological risks and developments and cyber threats, attacks or events; the success of the Company at maintaining its high quality asset level and managing and collecting assets of borrowers in default should problem assets increase; and the other factors described under the caption “Risk Factors” and in other sections of the Company’s Annual Report on Form 10-K for the Company's fiscal year ended September 30, 2021 and in other filings made by the Company with the Securities and Exchange Commission (“SEC”). The foregoing list of factors is not exclusive. We caution you not to place undue reliance on these forward-looking statements. The forward-looking statements included herein speak only as of the date of this investor update. The Company expressly disclaims any intent or obligation to update any forward-looking statements, whether written or oral, that may be made from time to time by or on behalf of the Company or its subsidiaries, whether as a result of new information, changed circumstances or future events or for any other reason.

Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation Since our founding, we have worked to advance financial inclusion. We seek out diverse partners, including fintechs, affinity groups, government agencies, and other banks and work with them to identify markets where people and businesses are underserved. Our national bank charter, coordination with regulators, and deep understanding of risk mitigation and compliance allow us to guide our partners and deliver financial products, services and funding to the people and businesses who need them the most. We are powering financial inclusion for allTM. AT PATHWARD, LEADING THE WAY TO FINANCIAL ACCESS IS THE HEART OF OUR BUSINESS. 3

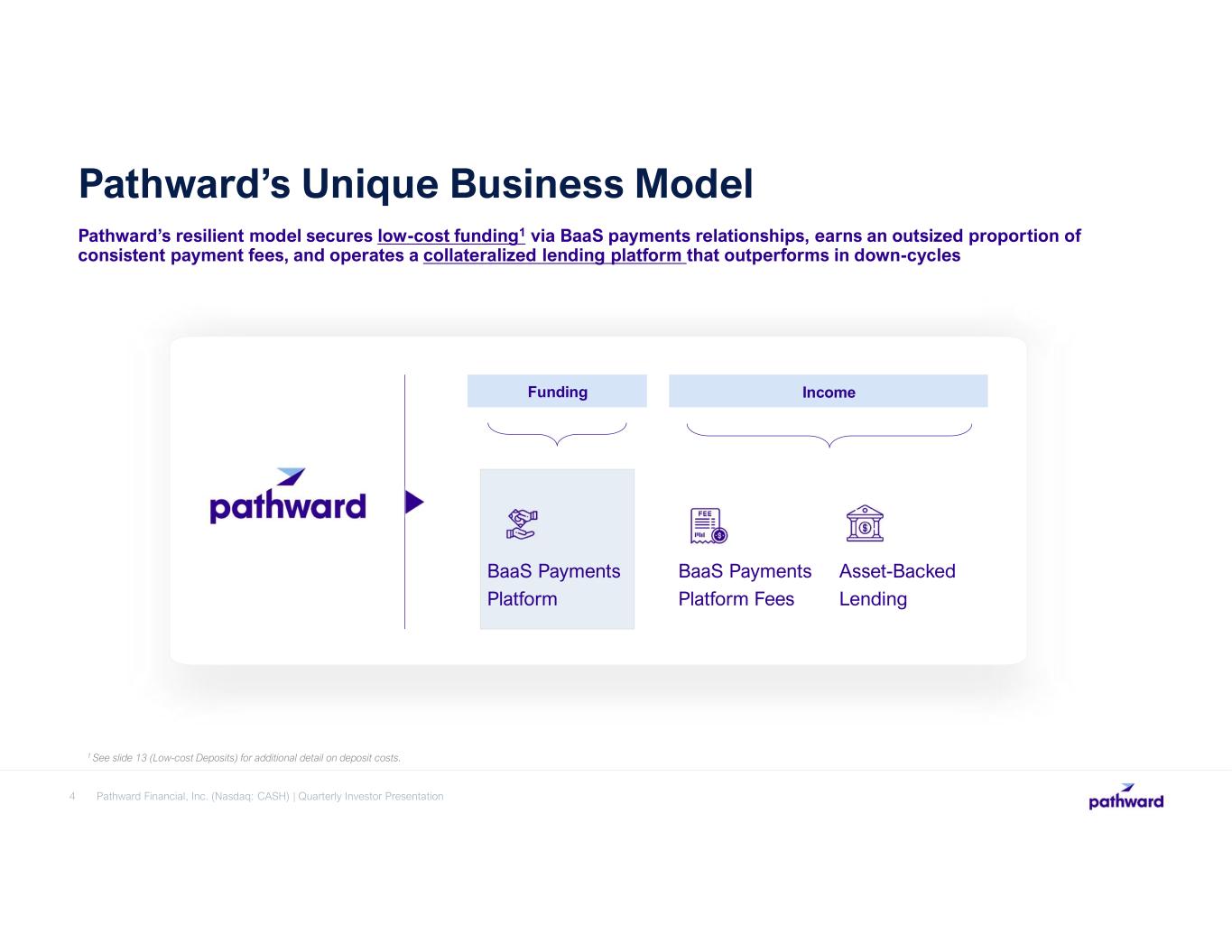

Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation4 Pathward’s Unique Business Model Pathward’s resilient model secures low-cost funding1 via BaaS payments relationships, earns an outsized proportion of consistent payment fees, and operates a collateralized lending platform that outperforms in down-cycles BaaS Payments Platform Funding BaaS Payments Platform Fees Asset-Backed Lending Income 1 See slide 13 (Low-cost Deposits) for additional detail on deposit costs.

2 3 4 1 Record of strong earnings growth and profitability above banking industry averages Resilient Commercial Finance loan portfolio produces attractive returns throughout economic cycles Leader in fast-growing Banking as a Service (BaaS) sector, with diversified portfolio of high-quality financial partners Highly advantageous national bank charter, with well-developed risk mitigation and compliance capabilities Why Invest? Excess capital generating business enables ongoing return of value to shareholders 5

Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation6 Record of Strong Earnings Growth and Profitability 2.20% 1.13% 1.12% 1.55% 1.45% 1.74% 1.88% 2017 2018 2019 2020 2021 2022 Return on Average Assets ROAA inclusive of one-time items Net Interest Margin Return on Average Tangible Equity 35.42% 17.63% 16.78% 22.34% 21.87% 28.66% 30.25% 2017 2018 2019 2020 2021 2022 ROATE inclusive of one-time items Earnings Per Common Share $5.26 $1.61 $1.67 $2.49 $2.94 $4.38 $4.49 2017 2018 2019 2020 2021 2022 EPS inclusive of one-time items FY17-FY21 display GAAP earnings; FY22 reflects GAAP and Adjusted earnings 2.58% 3.14% 4.91% 4.09% 3.83% 4.84% 2017 2018 2019 2020 2021 2022

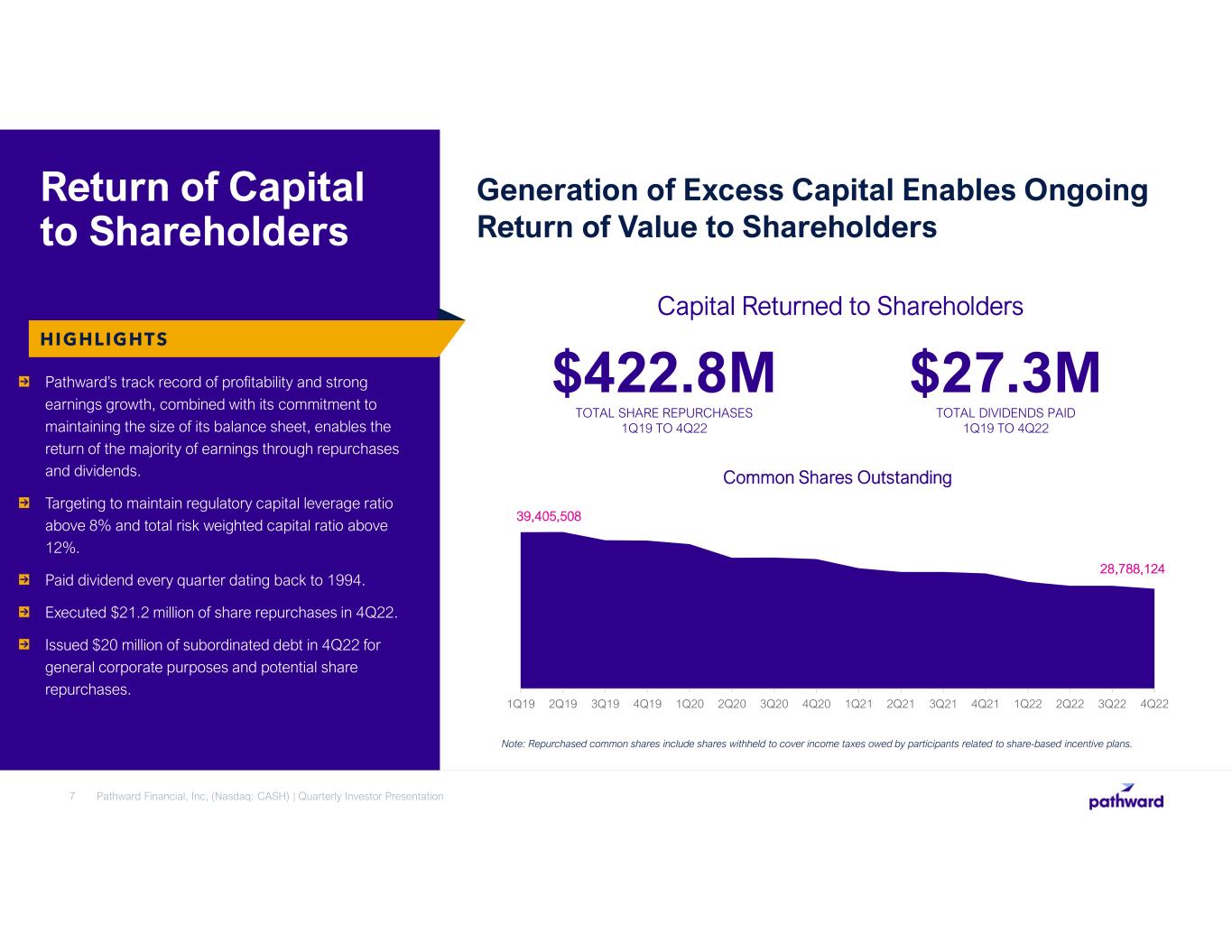

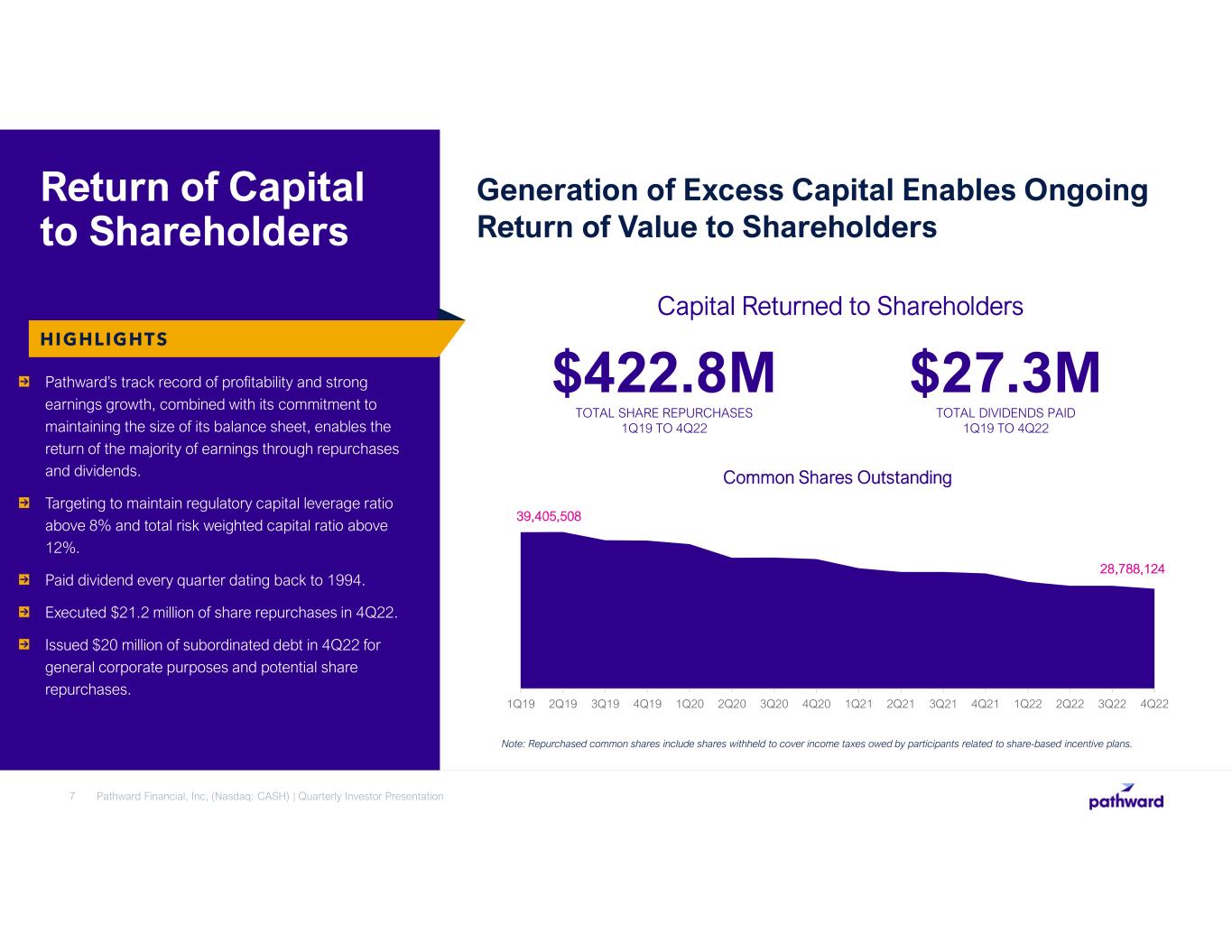

Pathward’s track record of profitability and strong earnings growth, combined with its commitment to maintaining the size of its balance sheet, enables the return of the majority of earnings through repurchases and dividends. Targeting to maintain regulatory capital leverage ratio above 8% and total risk weighted capital ratio above 12%. Paid dividend every quarter dating back to 1994. Executed $21.2 million of share repurchases in 4Q22. Issued $20 million of subordinated debt in 4Q22 for general corporate purposes and potential share repurchases. Pathward Financial, Inc, (Nasdaq: CASH) | Quarterly Investor Presentation7 Return of Capital to Shareholders HIGHLIGHTS Generation of Excess Capital Enables Ongoing Return of Value to Shareholders $422.8M TOTAL SHARE REPURCHASES 1Q19 TO 4Q22 $27.3M TOTAL DIVIDENDS PAID 1Q19 TO 4Q22 Capital Returned to Shareholders Note: Repurchased common shares include shares withheld to cover income taxes owed by participants related to share-based incentive plans. 39,405,508 28,788,124 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 Common Shares Outstanding

Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation8 Continued Progress on Key Strategic Initiatives OPTIMIZE INTEREST-EARNING PORTFOLIO, TO EMPHASIZE HIGHER -RETURN ASSETS • Improved yield on earning assets to 5.26% for 4Q22 as compared to 4.45% for 4Q21. • Grew commercial finance loans by $298 million, or 11%, from September 30, 2021. • $1.9 billion securities portfolio provides cash flow for future commercial finance loan growth. • Executed the sale of the $82 million student loan portfolio in fourth quarter of fiscal year 2022. OPTIMIZE DEPOSIT MIX , TO MAINTAIN A STABLE, LOW- COST DEPOSIT BASE • Low cost of deposits2 driven by high levels of noninterest deposits (96% of total deposits). • Achieved 0.03% cost of funds from all deposits and borrowings and total cost of deposits of 0.01% for 4Q22. • $1.31 billion of off-balance sheet customer deposits in custody of partner banks. • Prioritizing acquisition of stable BaaS deposits, which can generate higher levels of fee income. TARGET OF 2X OPER ATING LEVER AGE • Efficiency ratio of 64.09% compared to 62.50% as of September 30, 2021.1 • Ongoing initiatives to drive long-term simplification and optimize existing business platforms through the establishment of a business transformation office in fiscal year 2022. • Reduced office space footprint in fiscal year 2022. • Acted on expense reduction initiatives which included $5.1 million in separation agreement expenses for fiscal year 2022. 1 Adjusted efficiency ratio (excluding the gain on sale of trademarks and rebranding expenses) for the twelve months ended September 30, 2022 was 67.52%. See appendix for Non-GAAP financial measures reconciliations. 2 See slide 13 (Low-cost Deposits) for additional detail on deposit costs.

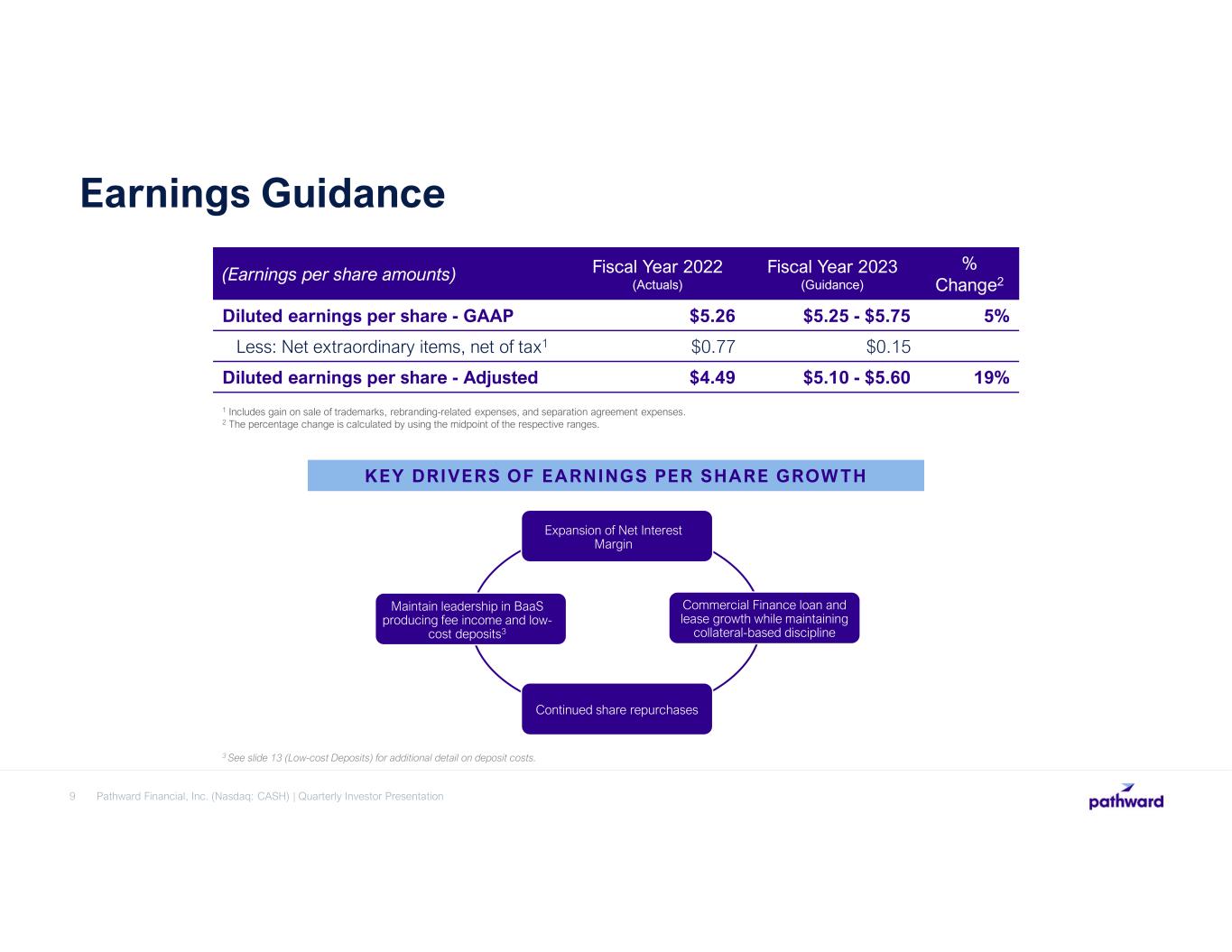

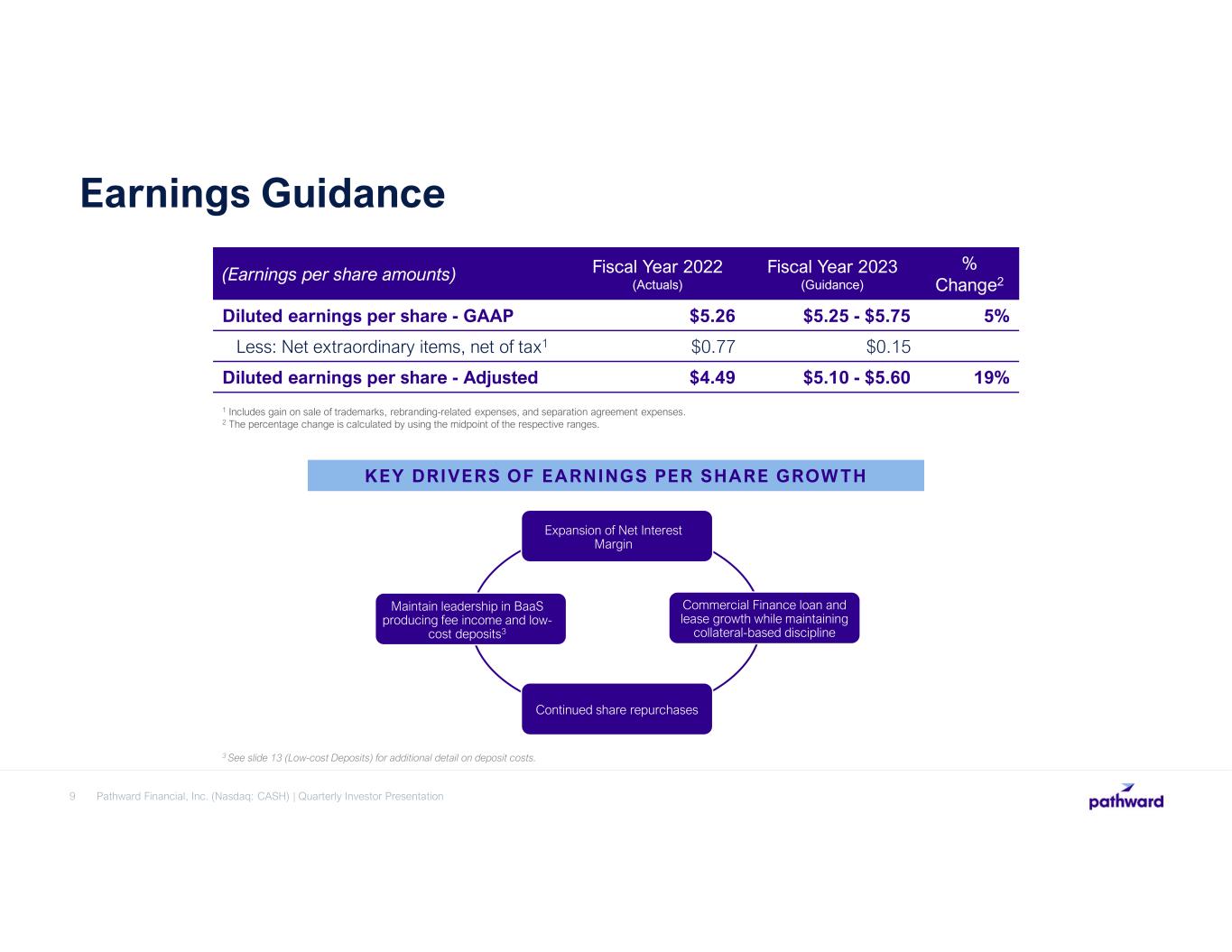

Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation9 Earnings Guidance 1 Includes gain on sale of trademarks, rebranding-related expenses, and separation agreement expenses. 2 The percentage change is calculated by using the midpoint of the respective ranges. (Earnings per share amounts) Fiscal Year 2022 (Actuals) Fiscal Year 2023 (Guidance) % Change2 Diluted earnings per share - GAAP $5.26 $5.25 - $5.75 5% Less: Net extraordinary items, net of tax1 $0.77 $0.15 Diluted earnings per share - Adjusted $4.49 $5.10 - $5.60 19% KEY DRIVERS OF EARNINGS PER SHARE GROW TH Commercial Finance loan and lease growth while maintaining collateral-based discipline Maintain leadership in BaaS producing fee income and low- cost deposits3 Expansion of Net Interest Margin Continued share repurchases 3 See slide 13 (Low-cost Deposits) for additional detail on deposit costs.

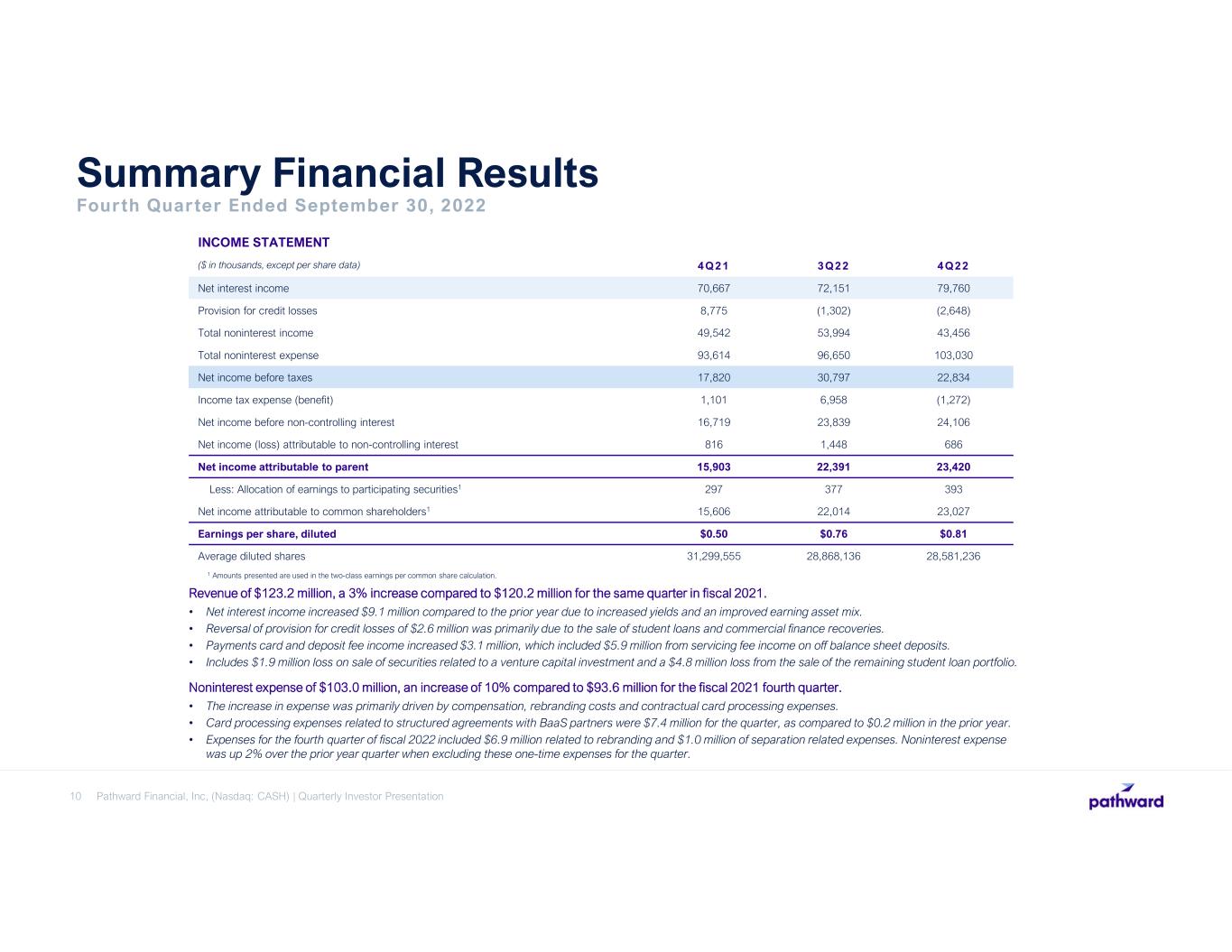

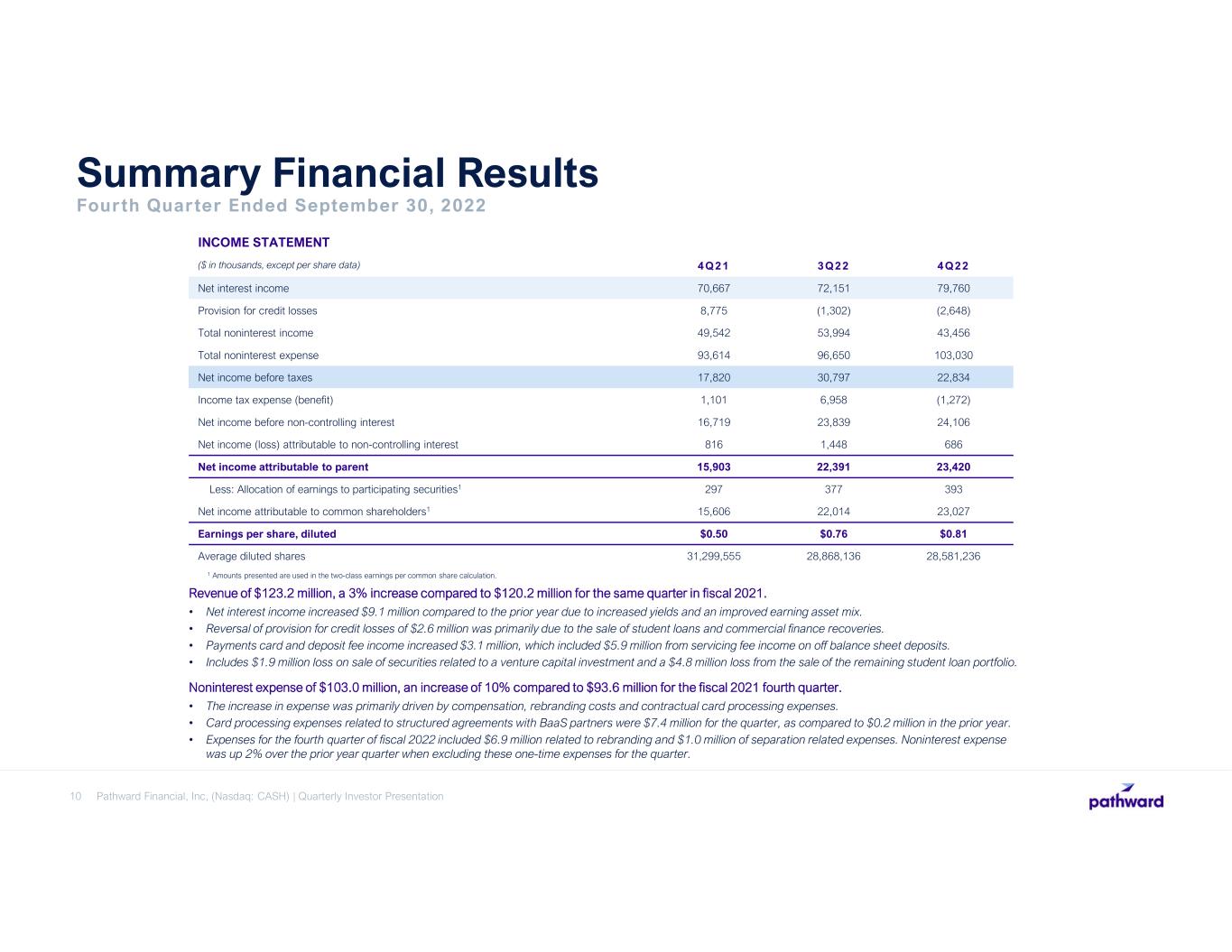

Pathward Financial, Inc, (Nasdaq: CASH) | Quarterly Investor Presentation10 Summary Financial Results Fourth Quarter Ended September 30, 2022 INCOME STATEMENT ($ in thousands, except per share data) 4Q21 3Q22 4Q22 Net interest income 70,667 72,151 79,760 Provision for credit losses 8,775 (1,302) (2,648) Total noninterest income 49,542 53,994 43,456 Total noninterest expense 93,614 96,650 103,030 Net income before taxes 17,820 30,797 22,834 Income tax expense (benefit) 1,101 6,958 (1,272) Net income before non-controlling interest 16,719 23,839 24,106 Net income (loss) attributable to non-controlling interest 816 1,448 686 Net income attributable to parent 15,903 22,391 23,420 Less: Allocation of earnings to participating securities1 297 377 393 Net income attributable to common shareholders1 15,606 22,014 23,027 Earnings per share, diluted $0.50 $0.76 $0.81 Average diluted shares 31,299,555 28,868,136 28,581,236 Revenue of $123.2 million, a 3% increase compared to $120.2 million for the same quarter in fiscal 2021. • Net interest income increased $9.1 million compared to the prior year due to increased yields and an improved earning asset mix. • Reversal of provision for credit losses of $2.6 million was primarily due to the sale of student loans and commercial finance recoveries. • Payments card and deposit fee income increased $3.1 million, which included $5.9 million from servicing fee income on off balance sheet deposits. • Includes $1.9 million loss on sale of securities related to a venture capital investment and a $4.8 million loss from the sale of the remaining student loan portfolio. Noninterest expense of $103.0 million, an increase of 10% compared to $93.6 million for the fiscal 2021 fourth quarter. • The increase in expense was primarily driven by compensation, rebranding costs and contractual card processing expenses. • Card processing expenses related to structured agreements with BaaS partners were $7.4 million for the quarter, as compared to $0.2 million in the prior year. • Expenses for the fourth quarter of fiscal 2022 included $6.9 million related to rebranding and $1.0 million of separation related expenses. Noninterest expense was up 2% over the prior year quarter when excluding these one-time expenses for the quarter. 1 Amounts presented are used in the two-class earnings per common share calculation.

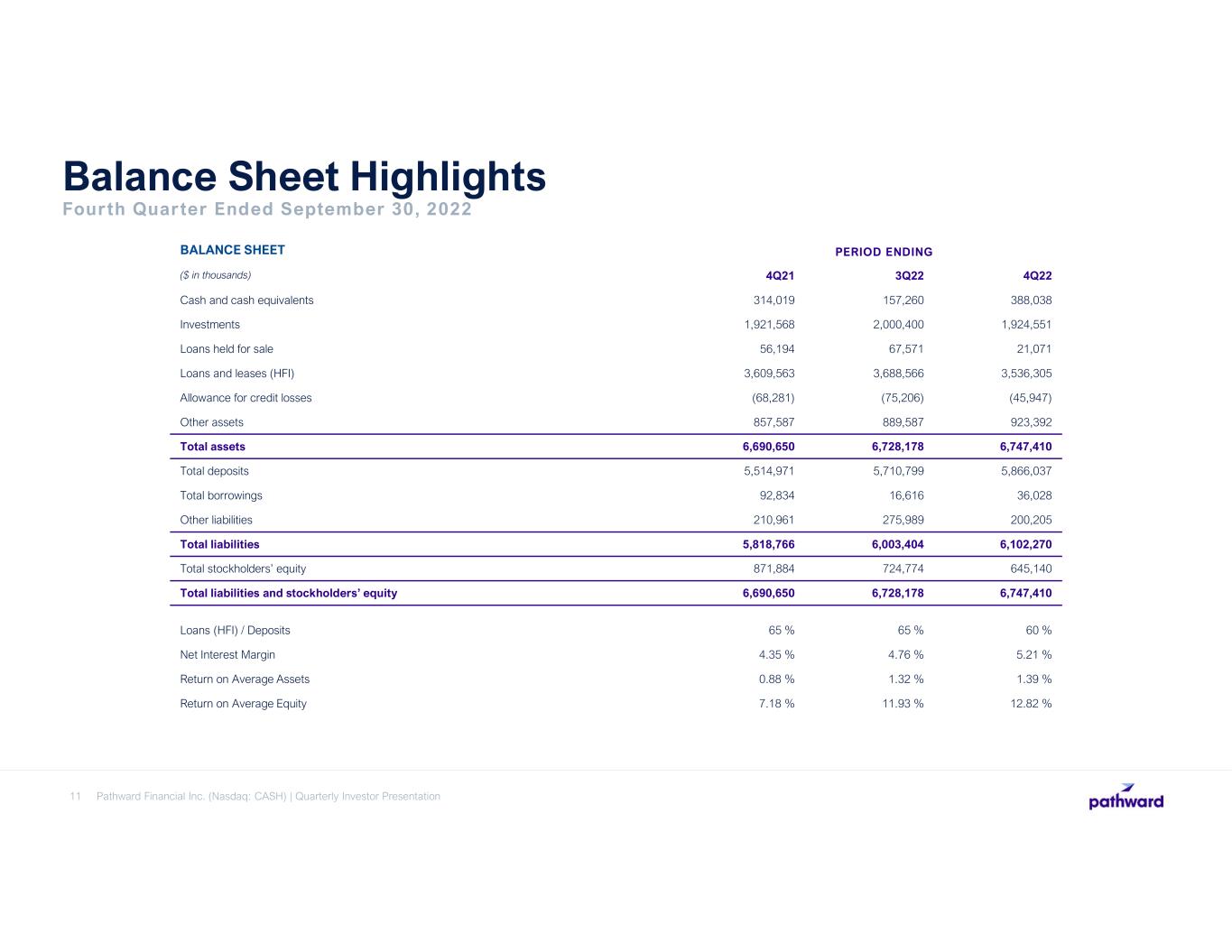

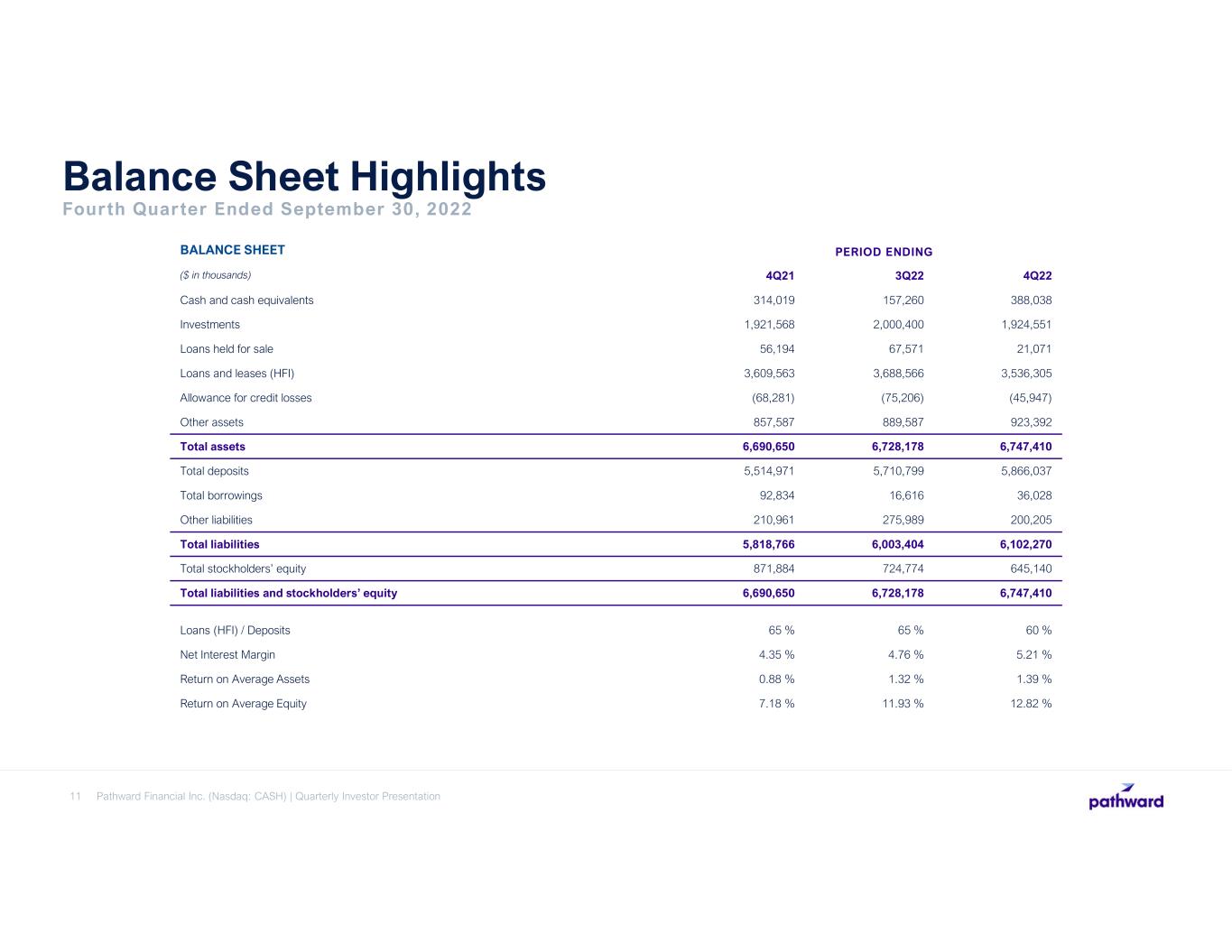

Pathward Financial Inc. (Nasdaq: CASH) | Quarterly Investor Presentation11 Balance Sheet Highlights Fourth Quarter Ended September 30, 2022 BALANCE SHEET PERIOD ENDING ($ in thousands) 4Q21 3Q22 4Q22 Cash and cash equivalents 314,019 157,260 388,038 Investments 1,921,568 2,000,400 1,924,551 Loans held for sale 56,194 67,571 21,071 Loans and leases (HFI) 3,609,563 3,688,566 3,536,305 Allowance for credit losses (68,281) (75,206) (45,947) Other assets 857,587 889,587 923,392 Total assets 6,690,650 6,728,178 6,747,410 Total deposits 5,514,971 5,710,799 5,866,037 Total borrowings 92,834 16,616 36,028 Other liabilities 210,961 275,989 200,205 Total liabilities 5,818,766 6,003,404 6,102,270 Total stockholders’ equity 871,884 724,774 645,140 Total liabilities and stockholders’ equity 6,690,650 6,728,178 6,747,410 Loans (HFI) / Deposits 65 % 65 % 60 % Net Interest Margin 4.35 % 4.76 % 5.21 % Return on Average Assets 0.88 % 1.32 % 1.39 % Return on Average Equity 7.18 % 11.93 % 12.82 %

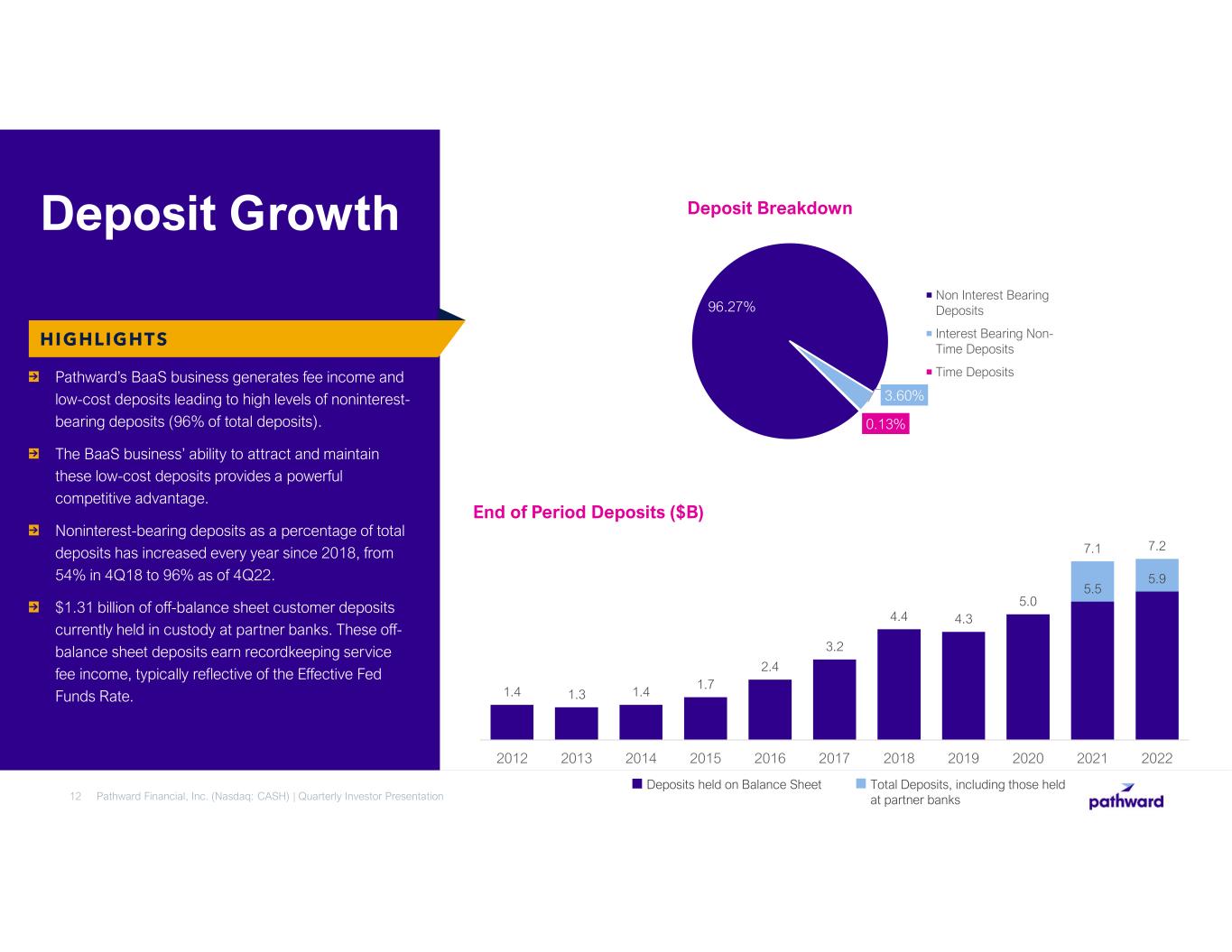

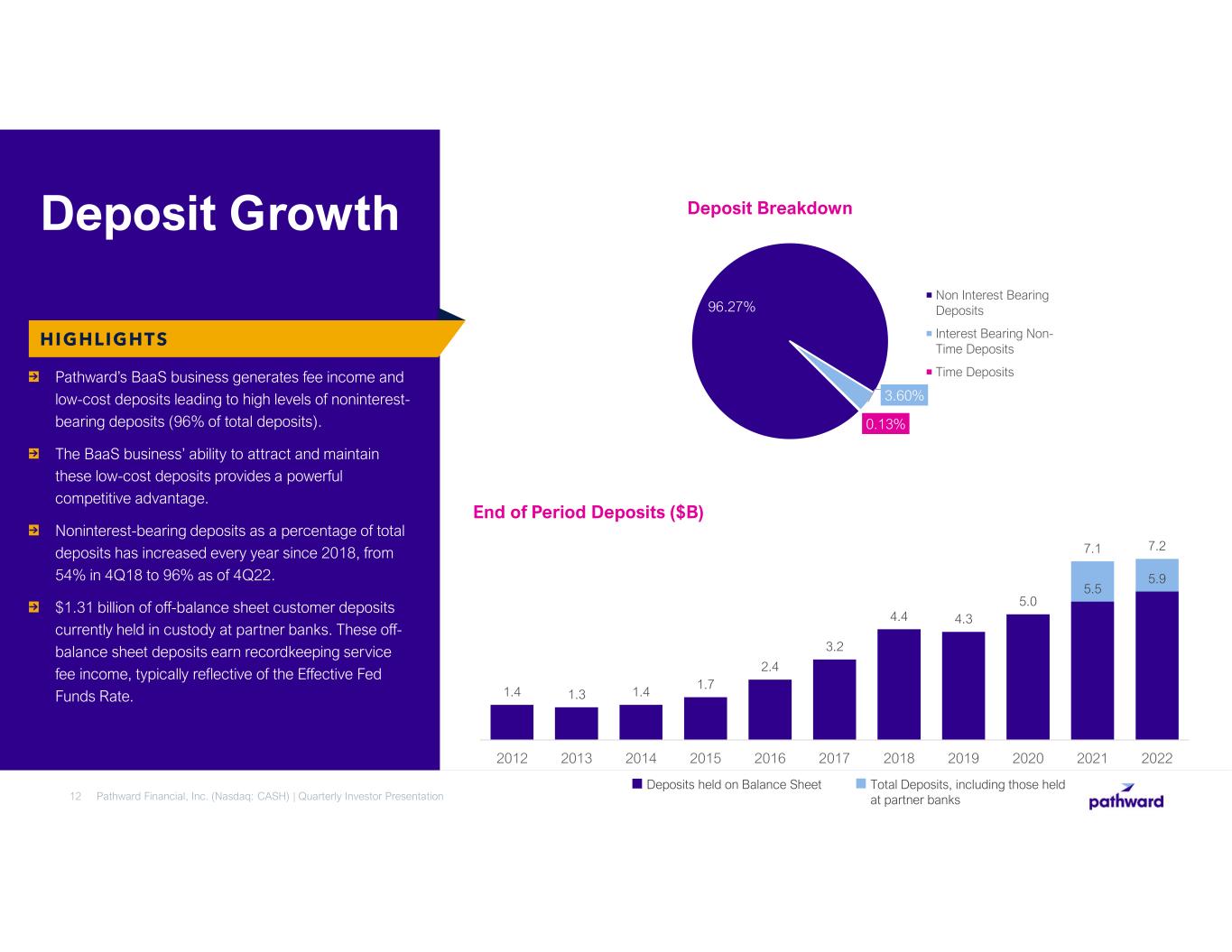

Deposits held on Balance Sheet Pathward’s BaaS business generates fee income and low-cost deposits leading to high levels of noninterest- bearing deposits (96% of total deposits). The BaaS business’ ability to attract and maintain these low-cost deposits provides a powerful competitive advantage. Noninterest-bearing deposits as a percentage of total deposits has increased every year since 2018, from 54% in 4Q18 to 96% as of 4Q22. $1.31 billion of off-balance sheet customer deposits currently held in custody at partner banks. These off- balance sheet deposits earn recordkeeping service fee income, typically reflective of the Effective Fed Funds Rate. Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation12 Deposit Growth HIGHLIGHTS Deposit Breakdown End of Period Deposits ($B) 7.1 7.2 1.4 1.3 1.4 1.7 2.4 3.2 4.4 4.3 5.0 5.5 5.9 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Total Deposits, including those held at partner banks 96.27% 3.60% 0.13% Non Interest Bearing Deposits Interest Bearing Non- Time Deposits Time Deposits

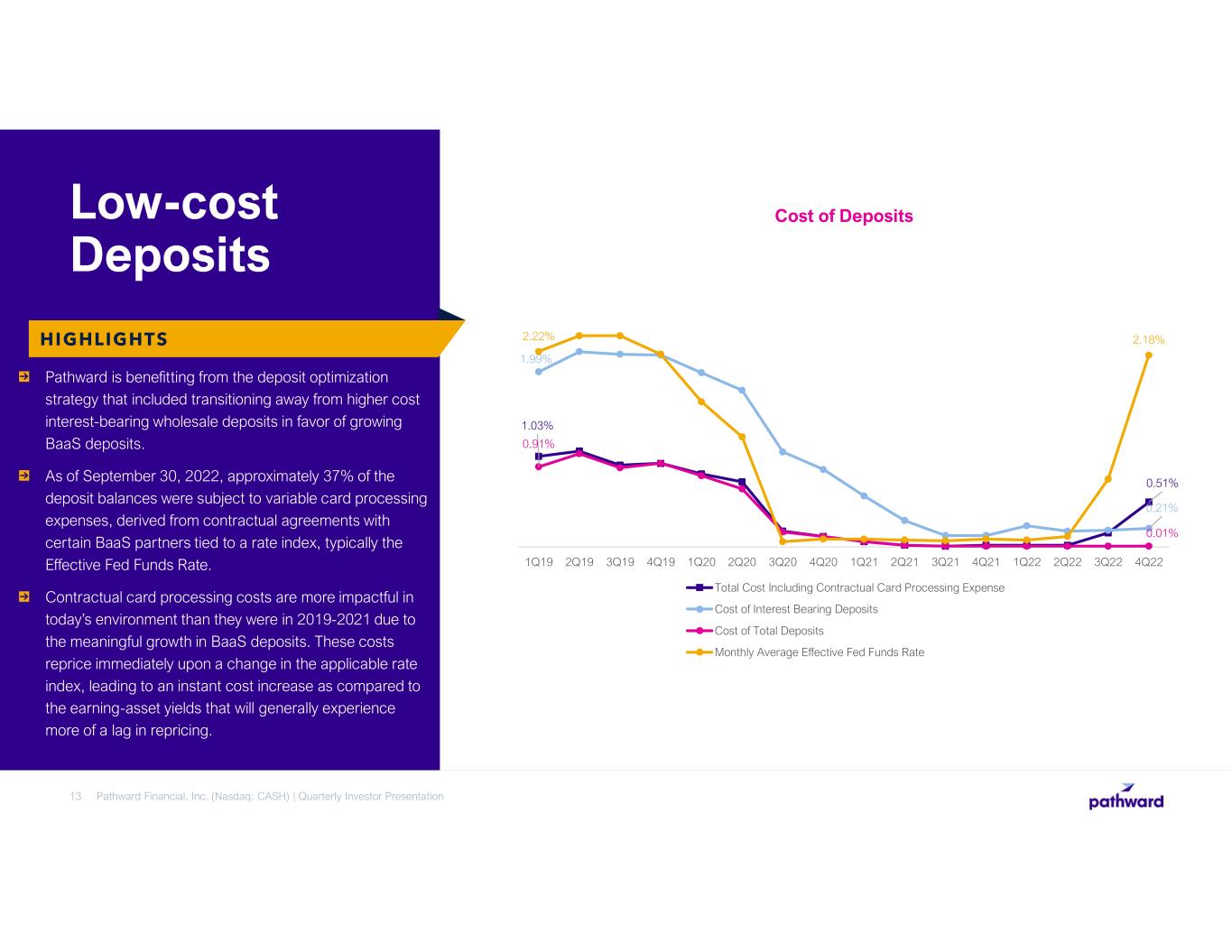

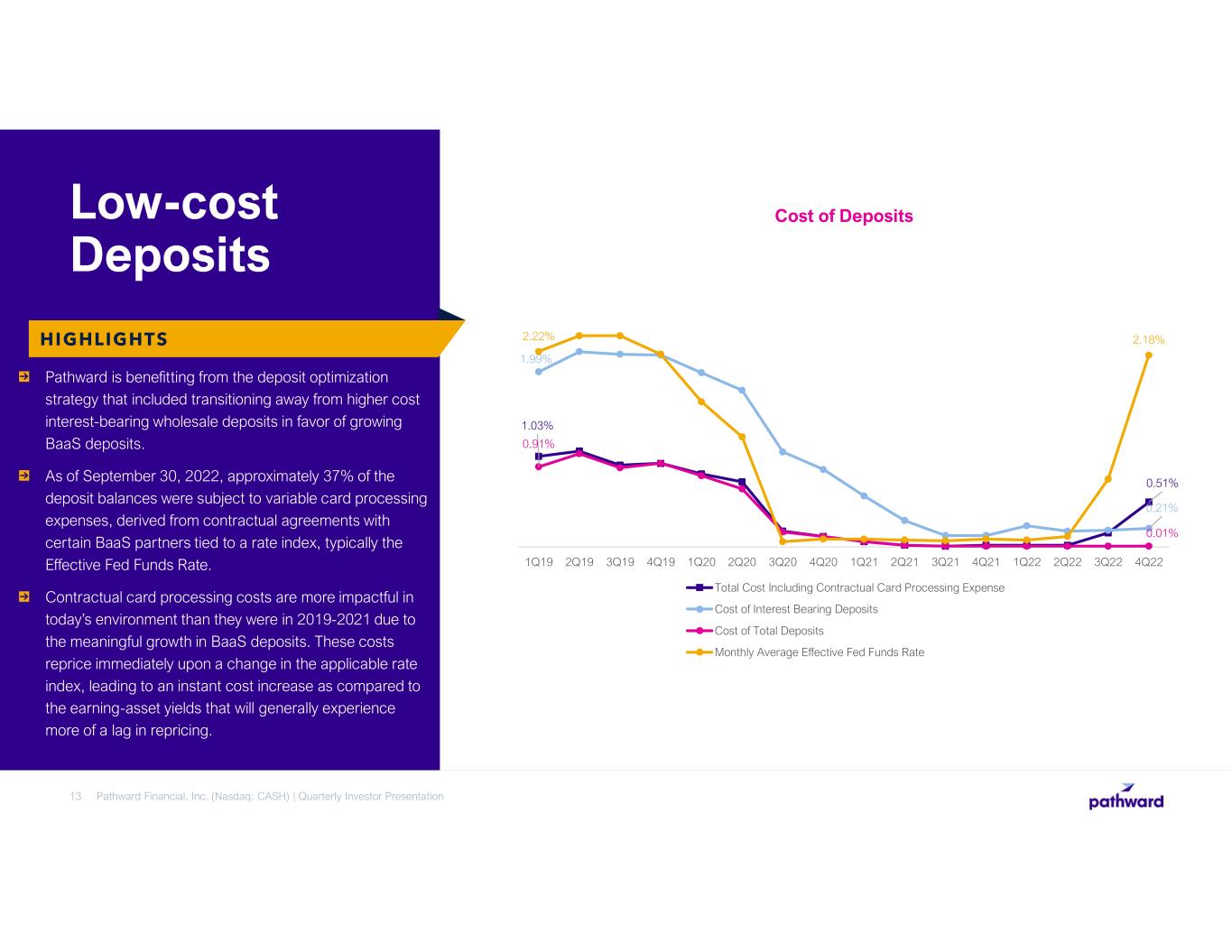

Pathward is benefitting from the deposit optimization strategy that included transitioning away from higher cost interest-bearing wholesale deposits in favor of growing BaaS deposits. As of September 30, 2022, approximately 37% of the deposit balances were subject to variable card processing expenses, derived from contractual agreements with certain BaaS partners tied to a rate index, typically the Effective Fed Funds Rate. Contractual card processing costs are more impactful in today’s environment than they were in 2019-2021 due to the meaningful growth in BaaS deposits. These costs reprice immediately upon a change in the applicable rate index, leading to an instant cost increase as compared to the earning-asset yields that will generally experience more of a lag in repricing. Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation13 Low-cost Deposits HIGHLIGHTS Cost of Deposits 1.03% 0.51% 1.99% 0.21% 0.91% 0.01% 2.22% 2.18% 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 Total Cost Including Contractual Card Processing Expense Cost of Interest Bearing Deposits Cost of Total Deposits Monthly Average Effective Fed Funds Rate

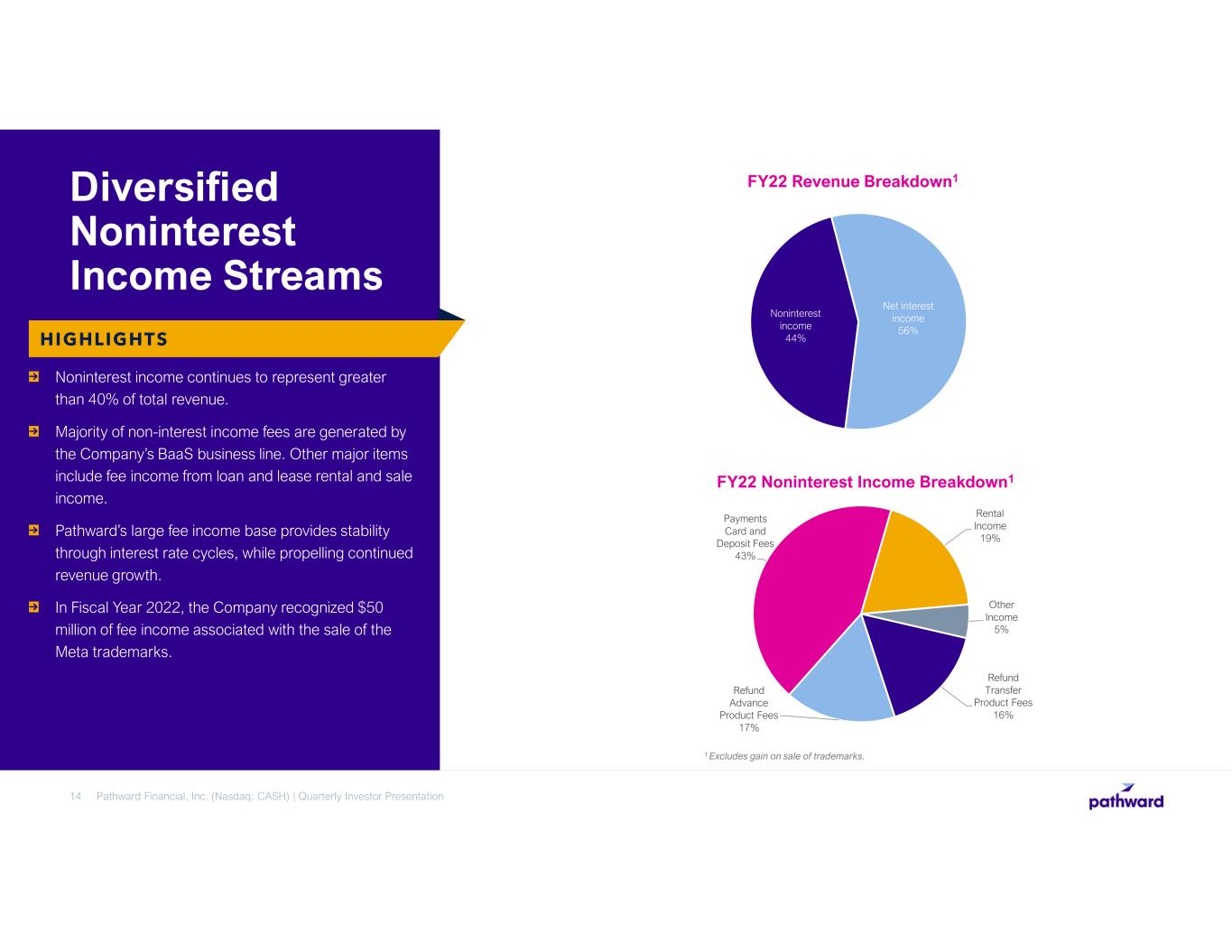

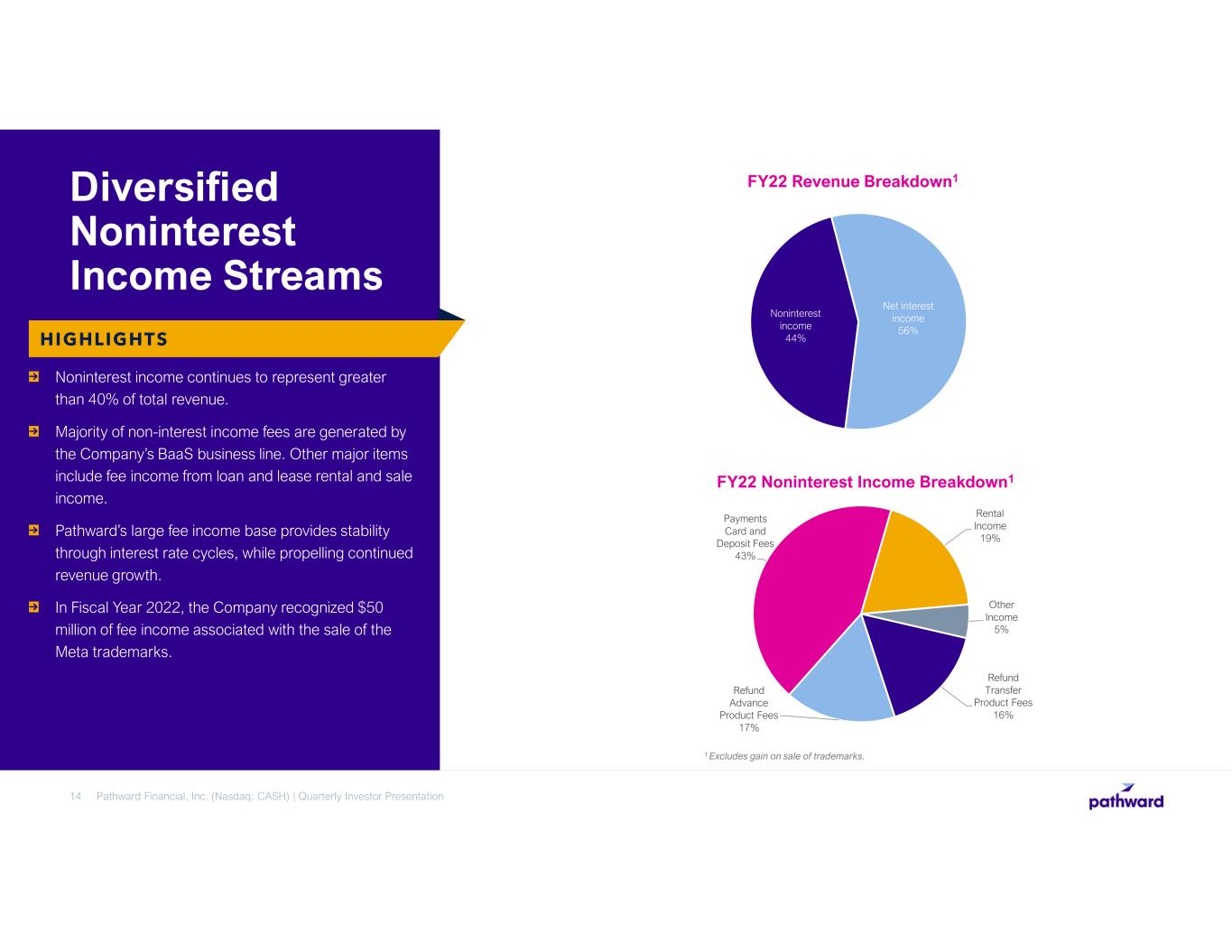

Noninterest income continues to represent greater than 40% of total revenue. Majority of non-interest income fees are generated by the Company’s BaaS business line. Other major items include fee income from loan and lease rental and sale income. Pathward’s large fee income base provides stability through interest rate cycles, while propelling continued revenue growth. In Fiscal Year 2022, the Company recognized $50 million of fee income associated with the sale of the Meta trademarks. Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation14 Diversified Noninterest Income Streams HIGHLIGHTS Refund Transfer Product Fees 16% Refund Advance Product Fees 17% Payments Card and Deposit Fees 43% Rental Income 19% Other Income 5% FY22 Noninterest Income Breakdown1 1 Excludes gain on sale of trademarks. Noninterest income 44% Net interest income 56% FY22 Revenue Breakdown1

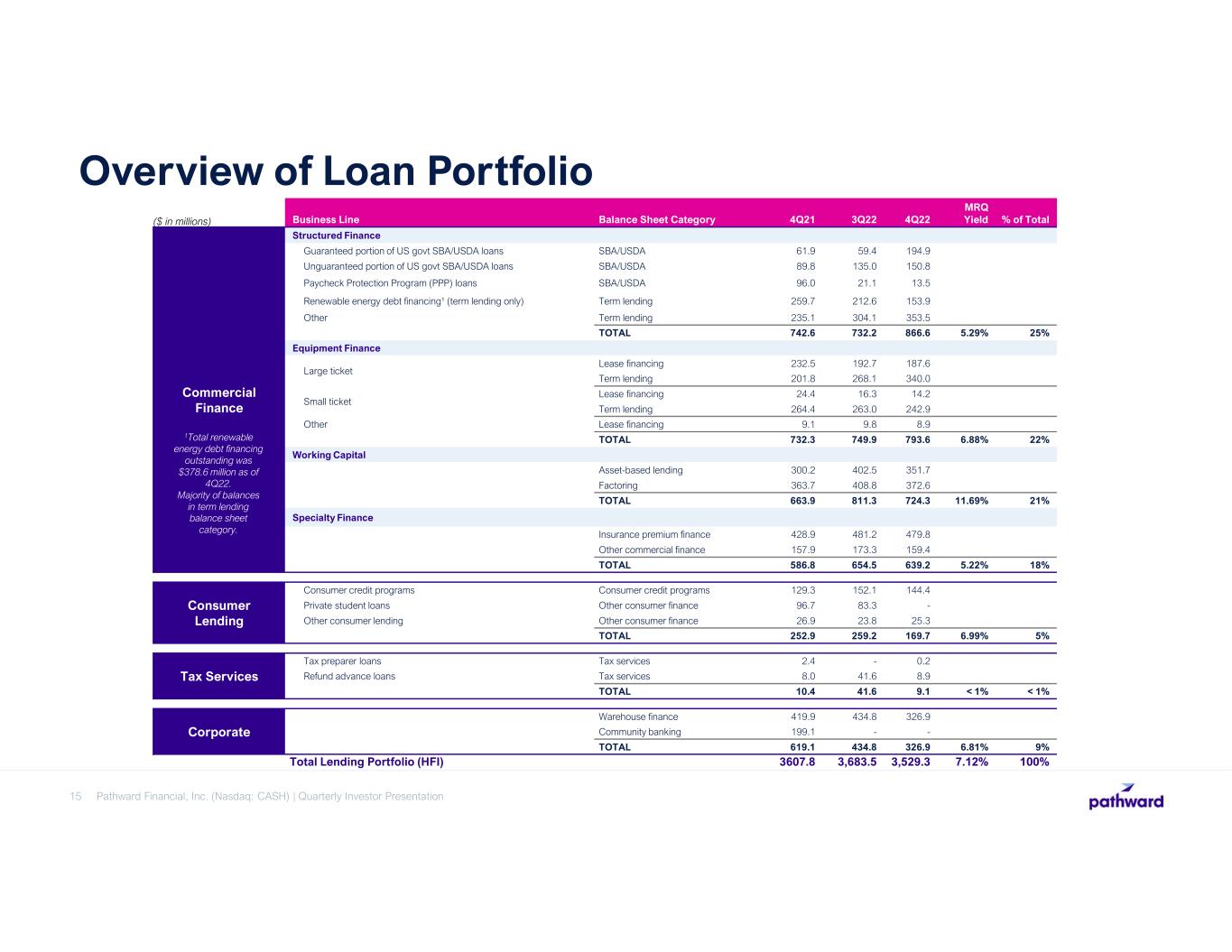

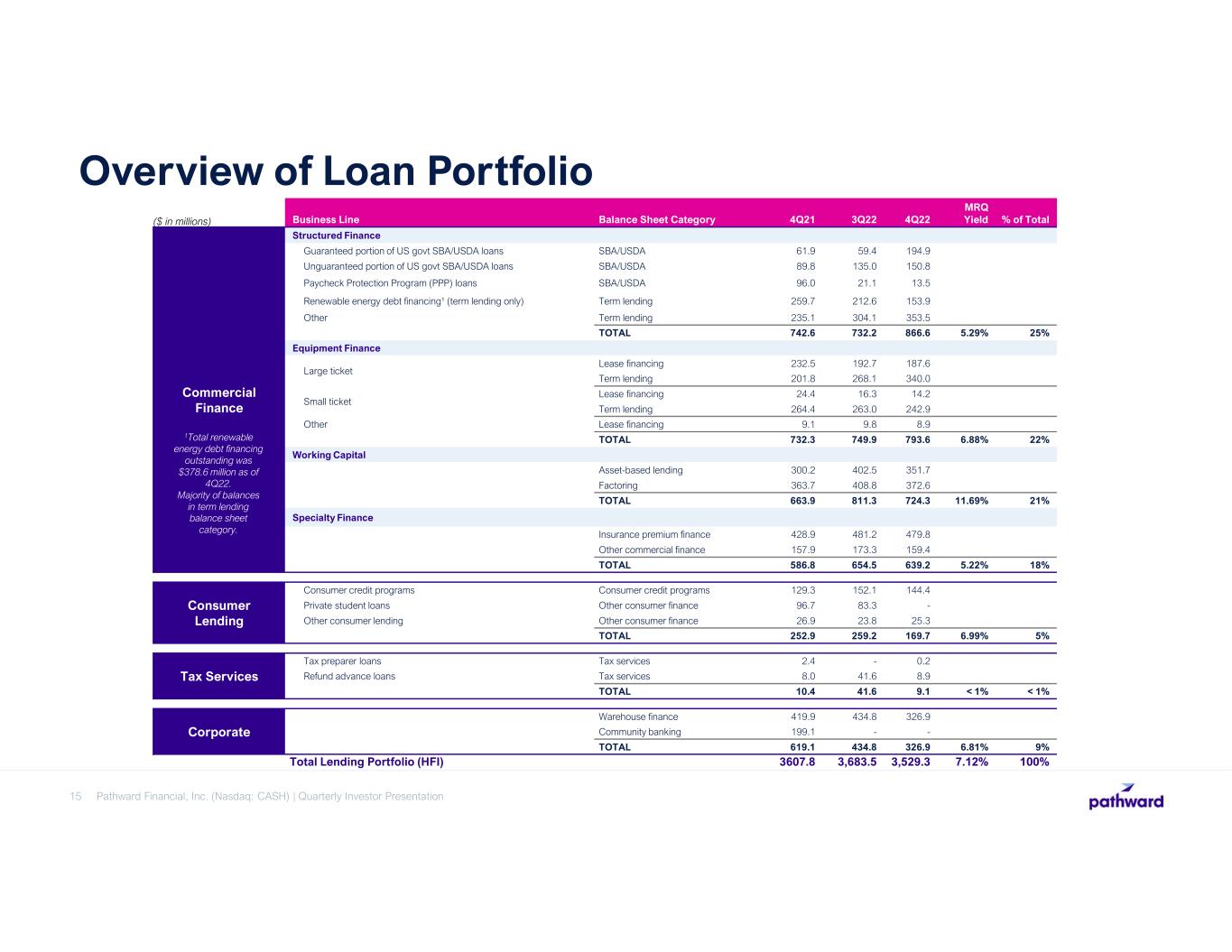

Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation 15 Overview of Loan Portfolio ($ in millions) Business Line Balance Sheet Category 4Q21 3Q22 4Q22 MRQ Yield % of Total Commercial Finance Structured Finance Guaranteed portion of US govt SBA/USDA loans SBA/USDA 61.9 59.4 194.9 Unguaranteed portion of US govt SBA/USDA loans SBA/USDA 89.8 135.0 150.8 Paycheck Protection Program (PPP) loans SBA/USDA 96.0 21.1 13.5 Renewable energy debt financing¹ (term lending only) Term lending 259.7 212.6 153.9 Other Term lending 235.1 304.1 353.5 TOTAL 742.6 732.2 866.6 5.29% 25% Equipment Finance Large ticket Lease financing 232.5 192.7 187.6 Term lending 201.8 268.1 340.0 Small ticket Lease financing 24.4 16.3 14.2 Term lending 264.4 263.0 242.9 Other Lease financing 9.1 9.8 8.9 TOTAL 732.3 749.9 793.6 6.88% 22% Working Capital Asset-based lending 300.2 402.5 351.7 Factoring 363.7 408.8 372.6 TOTAL 663.9 811.3 724.3 11.69% 21% Specialty Finance Insurance premium finance 428.9 481.2 479.8 Other commercial finance 157.9 173.3 159.4 TOTAL 586.8 654.5 639.2 5.22% 18% Consumer Lending Consumer credit programs Consumer credit programs 129.3 152.1 144.4 Private student loans Other consumer finance 96.7 83.3 - Other consumer lending Other consumer finance 26.9 23.8 25.3 TOTAL 252.9 259.2 169.7 6.99% 5% Tax Services Tax preparer loans Tax services 2.4 - 0.2 Refund advance loans Tax services 8.0 41.6 8.9 TOTAL 10.4 41.6 9.1 < 1% < 1% Corporate Warehouse finance 419.9 434.8 326.9 Community banking 199.1 - - TOTAL 619.1 434.8 326.9 6.81% 9% Total Lending Portfolio (HFI) 3607.8 3,683.5 3,529.3 7.12% 100% 1Total renewable energy debt financing outstanding was $378.6 million as of 4Q22. Majority of balances in term lending balance sheet category.

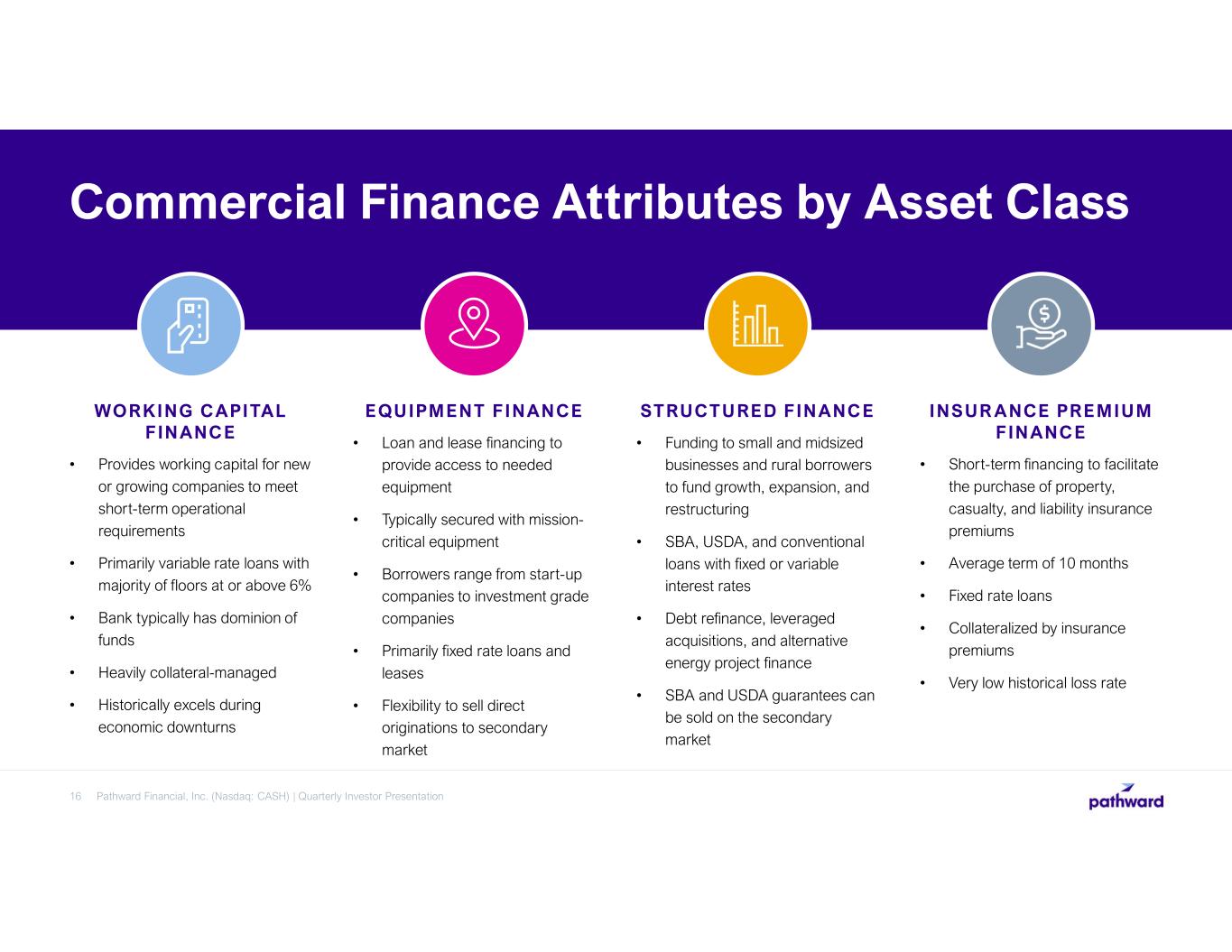

Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation16 Commercial Finance Attributes by Asset Class WORKING CAPITAL FINANCE • Provides working capital for new or growing companies to meet short-term operational requirements • Primarily variable rate loans with majority of floors at or above 6% • Bank typically has dominion of funds • Heavily collateral-managed • Historically excels during economic downturns EQUIPMENT FINANCE • Loan and lease financing to provide access to needed equipment • Typically secured with mission- critical equipment • Borrowers range from start-up companies to investment grade companies • Primarily fixed rate loans and leases • Flexibility to sell direct originations to secondary market STRUCTURED FINANCE • Funding to small and midsized businesses and rural borrowers to fund growth, expansion, and restructuring • SBA, USDA, and conventional loans with fixed or variable interest rates • Debt refinance, leveraged acquisitions, and alternative energy project finance • SBA and USDA guarantees can be sold on the secondary market INSUR ANCE PREMIUM FINANCE • Short-term financing to facilitate the purchase of property, casualty, and liability insurance premiums • Average term of 10 months • Fixed rate loans • Collateralized by insurance premiums • Very low historical loss rate

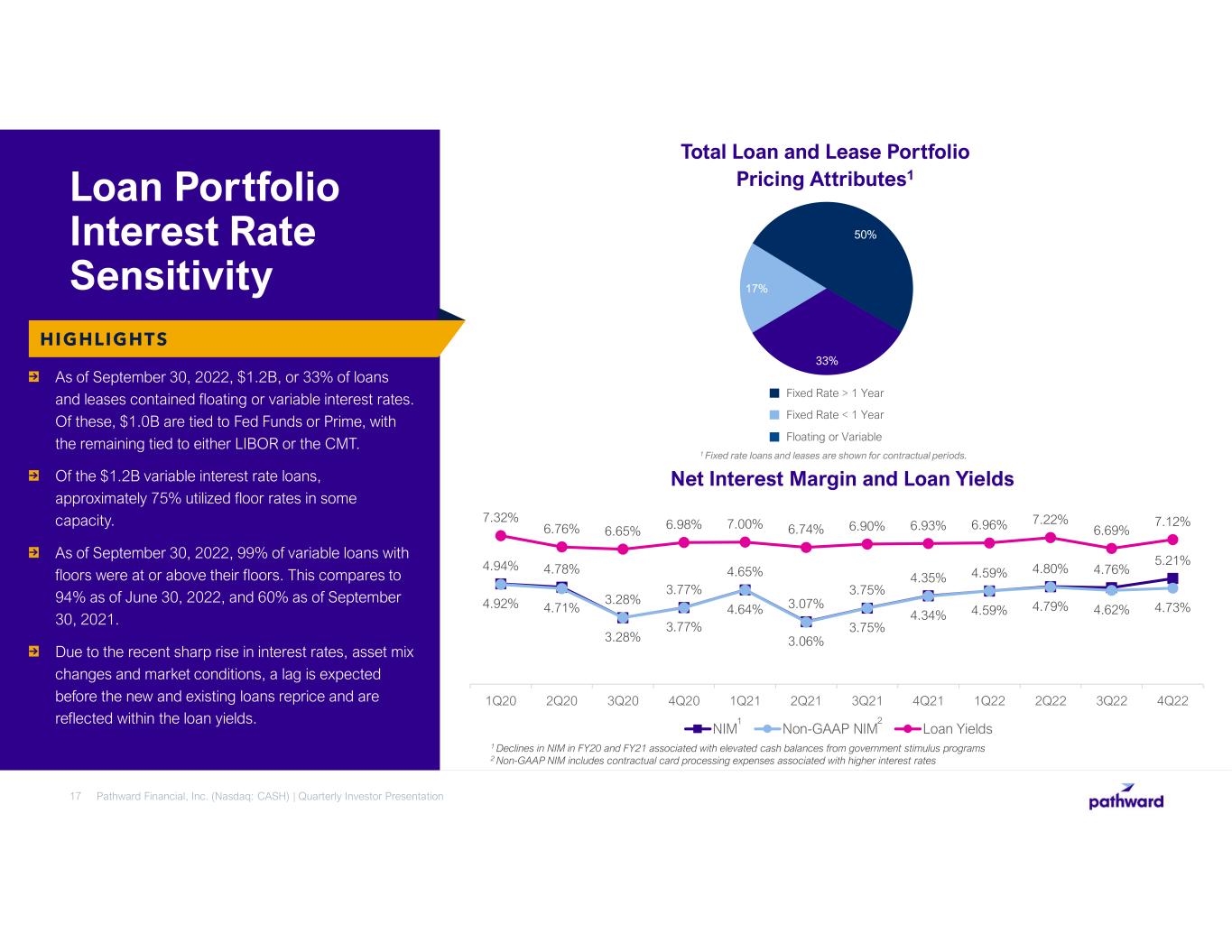

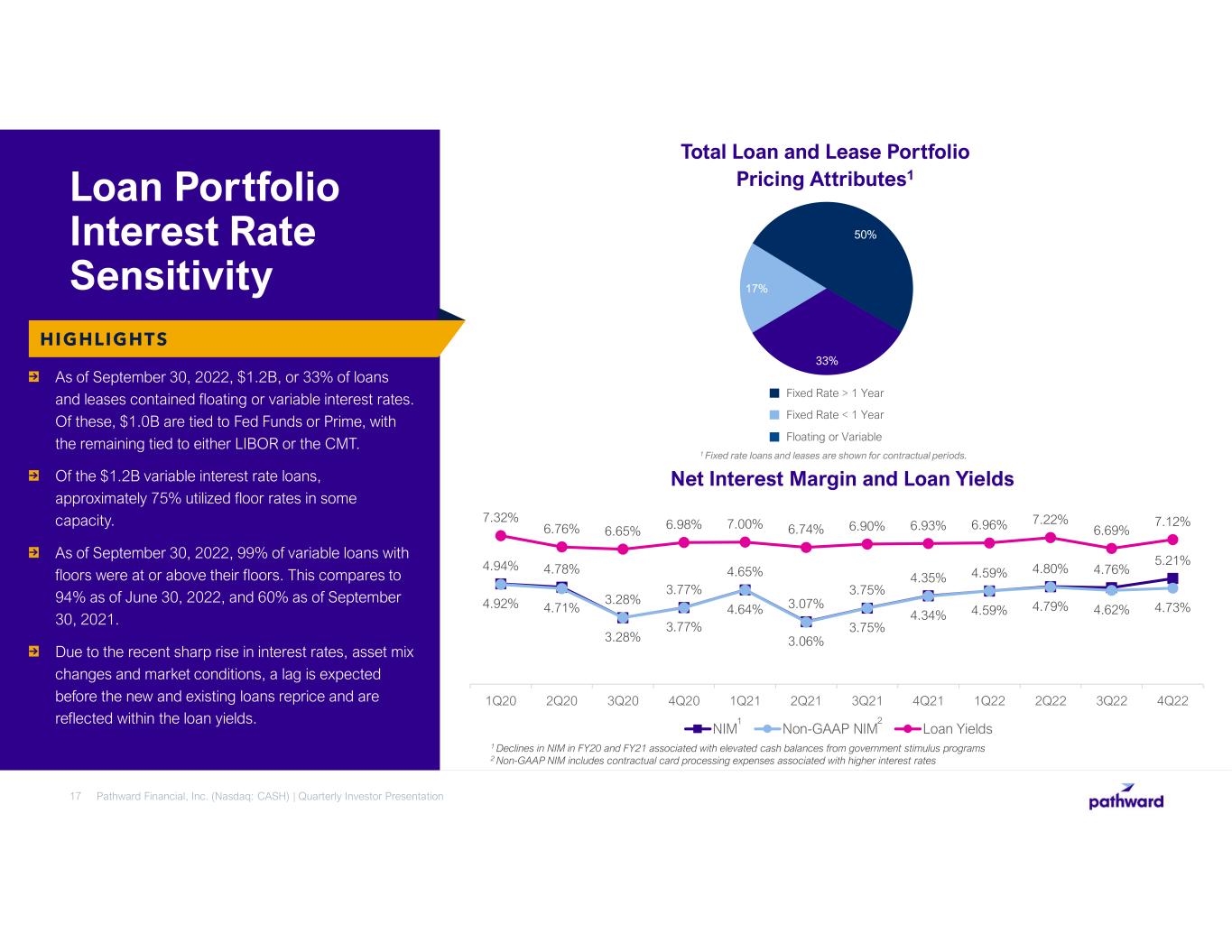

As of September 30, 2022, $1.2B, or 33% of loans and leases contained floating or variable interest rates. Of these, $1.0B are tied to Fed Funds or Prime, with the remaining tied to either LIBOR or the CMT. Of the $1.2B variable interest rate loans, approximately 75% utilized floor rates in some capacity. As of September 30, 2022, 99% of variable loans with floors were at or above their floors. This compares to 94% as of June 30, 2022, and 60% as of September 30, 2021. Due to the recent sharp rise in interest rates, asset mix changes and market conditions, a lag is expected before the new and existing loans reprice and are reflected within the loan yields. Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation17 Loan Portfolio Interest Rate Sensitivity HIGHLIGHTS 1 Fixed rate loans and leases are shown for contractual periods. 33% 17% 50% Fixed Rate > 1 Year Total Loan and Lease Portfolio Pricing Attributes1 Fixed Rate < 1 Year Floating or Variable Net Interest Margin and Loan Yields 4.94% 4.78% 3.28% 3.77% 4.65% 3.07% 3.75% 4.35% 4.59% 4.80% 4.76% 5.21% 4.92% 4.71% 3.28% 3.77% 4.64% 3.06% 3.75% 4.34% 4.59% 4.79% 4.62% 4.73% 7.32% 6.76% 6.65% 6.98% 7.00% 6.74% 6.90% 6.93% 6.96% 7.22% 6.69% 7.12% 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 NIM Non-GAAP NIM Loan Yields 1 Declines in NIM in FY20 and FY21 associated with elevated cash balances from government stimulus programs 2 Non-GAAP NIM includes contractual card processing expenses associated with higher interest rates 1 2

Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation18 Interest Rate Risk Management September 30, 2022 -2,000 0 2,000 4,000 Month 1-12 Month 13-36 Month 37-60 Month 61-180 V ol um e ($ M M ) Period Variance Total Assets Total Liabilities Asset/Liability Gap Analysis 1 Fixed rate securities, loans and leases are shown for contractual periods. 6% 22% 10% 62% Fixed Rate > 1 Year Earning Asset Pricing Attributes1 Fixed Rate < 1 Year Floating or Variable Federal Reserve Bank Deposits (Floating or Variable) • Data presented on this page is reflective of the company’s asset mix at a point in time and calculated for regulatory purposes. Future rate changes would impact a multitude of variables beyond the company’s control, and as a result, the data presented is not intended to be used for forward-looking modeling purposes. • Management’s focus is on selectively adding duration to improve yield and protect margin against falling rates. • Interest rate risk modeling shows asset sensitive balance sheet; net interest income graph shows impact of an instantaneous, parallel rate shock, a gradual parallel ramp, and an alternative view. • Management employs rigorous modeling techniques under a variety of yield curve shapes, twists and ramps. -10% 5% 20% 35% -100 +100 +200 +300 Parallel Shock Ramp Alternative Year 1 12-Month Interest Rate Sensitivity from Base Net Interest Income Parallel Shock is a statutorily required calculation of the impact of an immediate rise in rates, assuming other variables remain unchanged. Ramp reflects additional modeling of more gradual increases in interest rates. Alternative Year 1 mirrors the Parallel Shock scenario with the additional incorporation of the company’s card fee income and card processing expenses impacted by interest rates.

Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation19 Asset Quality $7.0 $3.4 $11.4 $4.2 $4.1 0.77% 0.37% 1.25% 0.46% 0.45% 0.50% 0.48% 0.68% 0.71% 0.63% 4Q21 1Q22 2Q22 3Q22 4Q22 Period Ended Adj. NCOs Adj. NCOs / Adj. Average Loans Adj. NCOs / Adj. Average Loans - LTM Adjusted Net Charge-Offs (“NCOs”)1 Excludes Tax Services NCOs and Related Seasonal Average Loans ($ in millions) KEY CREDIT METRICS • Annualized adjusted net charge-offs1: – 0.45% of average loans in 4Q22 – 0.63% of average loans over last 12 months • Allowance for credit loss of $45.9 million, or 1.30% of total loans and leases, a 59bps decrease from the prior year. • Reduction in the 4Q22 allowance for credit loss compared to 3Q22 was attributable to seasonal tax loan charge-offs, release of allowance stemming from the sale of the student loan portfolio, and a decrease in the commercial finance coverage ratio due to the resolution of two longstanding workouts. • The slight increase in NPAs / NPLs was driven by an increase in past due tax loans, which is due to seasonal timing. Commercial finance and consumer finance both improved in 4Q22 as compared to 3Q22. $61.8 $44.3 $38.3 $26.8 $30.9 0.92% 0.58% 0.56% 0.40% 0.46% 4Q21 1Q22 2Q22 3Q22 4Q22 Period Ended NPAs NPAs / Total Assets 1 Non-GAAP financial measures, see appendix for reconciliations. Tax services NCOs and related seasonal average loans are excluded to adjust for the cyclicality of activity related to the overall economics of the tax services business line. $55.9 $43.2 $35.8 $26.6 $29.2 1.52% 1.16% 0.95% 0.71% 0.82% 4Q21 1Q22 2Q22 3Q22 4Q22 Period Ended NPLs NPLs / Total Loans Nonperforming Assets (“NPAs”) ($ in millions) Nonperforming Loans (“NPLs”) ($ in millions)

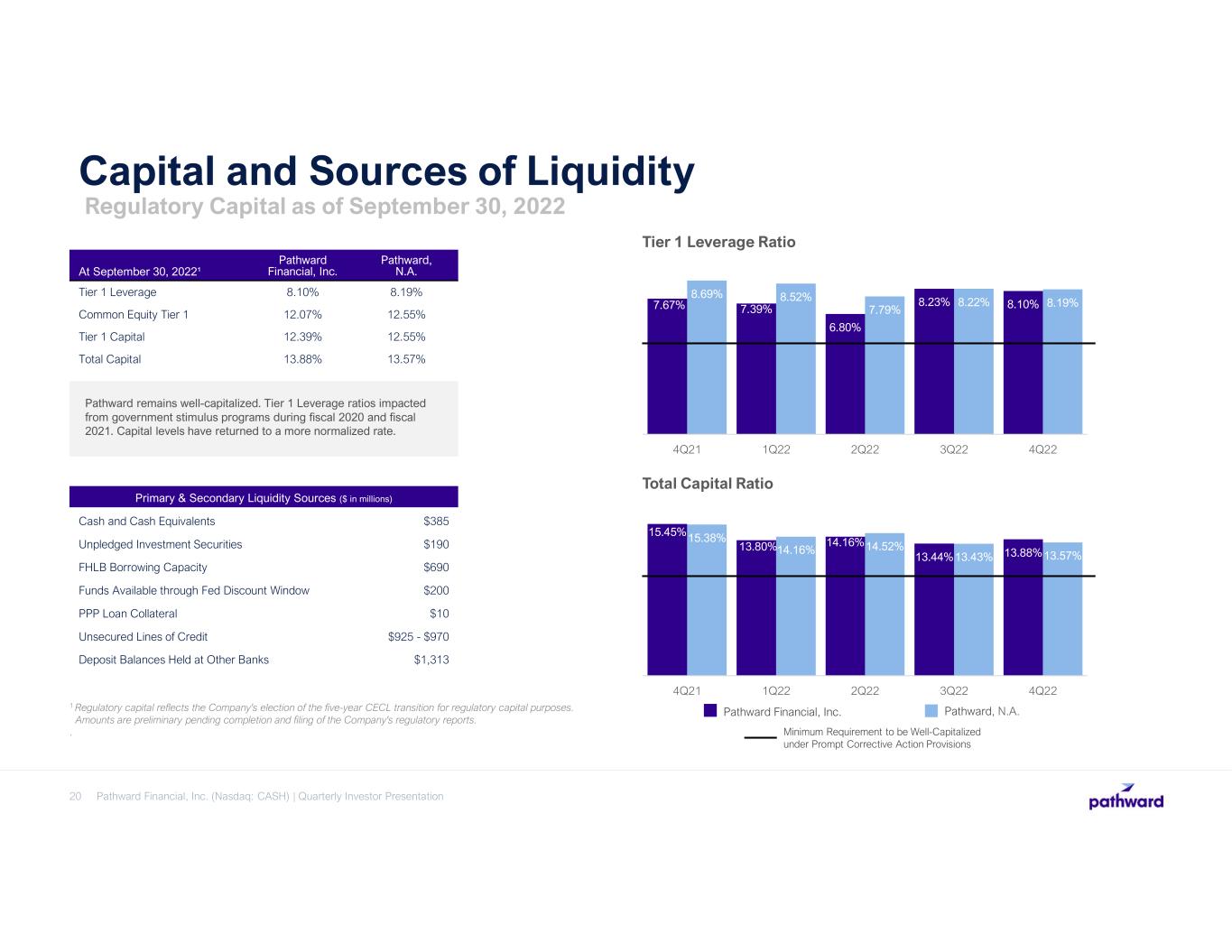

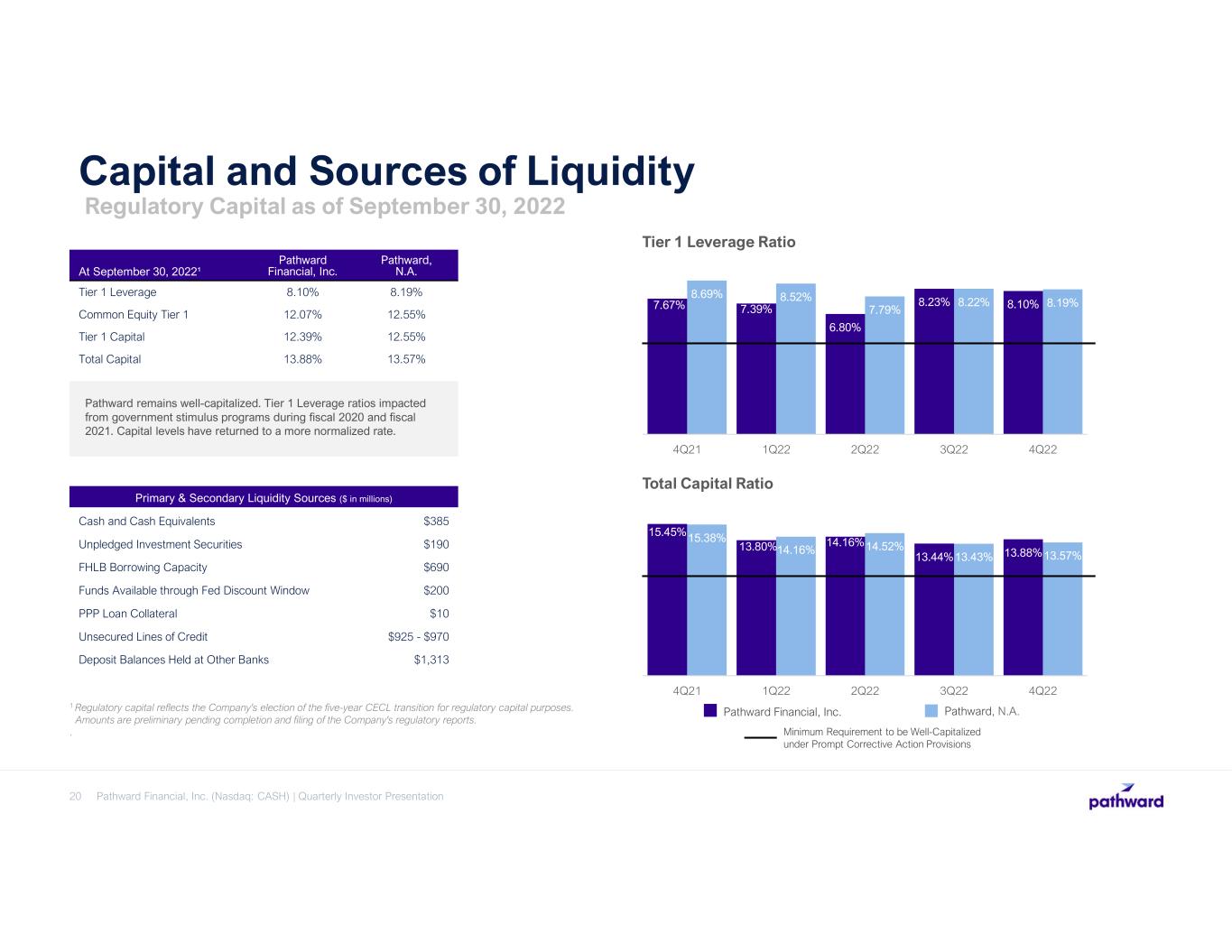

Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation20 Capital and Sources of Liquidity Regulatory Capital as of September 30, 2022 At September 30, 2022¹ Pathward Financial, Inc. Pathward, N.A. Tier 1 Leverage 8.10% 8.19% Common Equity Tier 1 12.07% 12.55% Tier 1 Capital 12.39% 12.55% Total Capital 13.88% 13.57% Pathward remains well-capitalized. Tier 1 Leverage ratios impacted from government stimulus programs during fiscal 2020 and fiscal 2021. Capital levels have returned to a more normalized rate. Primary & Secondary Liquidity Sources ($ in millions) Cash and Cash Equivalents $385 Unpledged Investment Securities $190 FHLB Borrowing Capacity $690 Funds Available through Fed Discount Window $200 PPP Loan Collateral $10 Unsecured Lines of Credit $925 - $970 Deposit Balances Held at Other Banks $1,313 1 Regulatory capital reflects the Company's election of the five-year CECL transition for regulatory capital purposes. Amounts are preliminary pending completion and filing of the Company's regulatory reports. . 7.67% 7.39% 6.80% 8.23% 8.10% 8.69% 8.52% 7.79% 8.22% 8.19% 4Q21 1Q22 2Q22 3Q22 4Q22 Tier 1 Leverage Ratio 15.45% 13.80% 14.16% 13.44% 13.88% 15.38% 14.16% 14.52% 13.43% 13.57% 4Q21 1Q22 2Q22 3Q22 4Q22 Total Capital Ratio Pathward Financial, Inc. Pathward, N.A. Minimum Requirement to be Well-Capitalized under Prompt Corrective Action Provisions

APPENDIX

Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation22 Non-GAAP Reconciliation Adjusted Net Income and Adjusted Earnings Per Share For the quarter ended For the year ended ($ in thousands, except per share data) 4Q21 3Q 22 4Q 22 2021 2022 Net income - GAAP 15,903 22,391 23.420 141,708 156,386 Less: Gain on sale of trademarks - - - - 50,000 Add: Rebranding Expenses - 3,427 6,899 - 13,148 Add: Separation related expenses 36 3,116 1,029 2,545 5,109 Add: Income tax effect (9) (1,677) (1,029) (636) 8,936 Adjusted Net Income 15,930 27,257 30,319 143,617 133,579 Less: Allocation of earnings to participating securities1 297 458 508 2,734 2,191 Adjusted net income attributable to common shareholders 15,633 26,799 29,811 140,883 131,388 Adjusted earnings per common share, diluted $0.50 $0.93 $1.04 $4.44 $4.49 Average diluted shares 31,299,555 28,868,136 28,581,236 31,751,522 29,232,247 1 Amounts presented are used in the two-class earnings per common share calculation.

Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation23 Non-GAAP Reconciliation 1 Tax Services NCOs and average loans are excluded to adjust for the cyclicality of activity related to the overall economics of the Company's tax services business line. For the quarter ended ($ in thousands) Sep 30, 2021 Dec 31, 2021 Mar 31, 2022 Jun 30, 2022 Sep 30, 2022 Net Charge-offs 31,753 1,129 11,226 12,198 26,664 Less: Tax services net charge-offs 24,798 (2,313) (183) 7,992 22,594 Adjusted Net Charge-offs 6,955 3,442 11,409 4,206 4,050 Quarterly Average Loans and Leases 3,646,312 3,706,975 4,244,644 3,747,631 3,618,678 Less: Quarterly Average Tax Services Loans 31,174 33,604 594,166 62,934 35,484 Adjusted Quarterly Average Loans and Leases 3,609,138 3,673,371 3,650,478 3,684,697 3,583,194 Annualized NCOs/Average Loans and Leases 3.48% 0.12% 1.06% 1.30% 2.95% Adjusted Annualized NCOs/Adjusted Average Loans and Leases1 0.77% 0.37% 1.25% 0.46% 0.45% Adjusted Annualized NCOs and Adjusted Loans and Leases

Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation24 Non-GAAP Reconciliation For the last twelve months ended ($ in thousands) Sep 30, 2021 Dec 31, 2021 Mar 31, 2022 Jun 30, 2022 Sep 30, 2022 Noninterest Expense - GAAP 343,683 353,544 360,733 375,860 385,275 Net Interest Income 278,991 284,605 294,555 298,231 307,324 Noninterest Income 270,903 312,039 308,352 299,893 293,807 Total Revenue: GAAP 549,894 596,644 602,907 598,124 601,131 Efficiency Ratio, LTM 62.50% 59.26% 59.83% 62.84% 64.09% For the last twelve months ended ($ in thousands) Sep 30, 2021 Dec 31, 2021 Mar 31, 2022 Jun 30, 2022 Sep 30, 2022 Noninterest Expense - GAAP 343,683 353,544 360,733 375,860 385,275 Less: Rebranding Expenses - 3 2,822 6,249 13,148 Adjusted noninterest Expense 343,683 353,541 357,911 369,611 372,127 Net Interest Income 278,991 284,605 294,555 298,231 307,324 Noninterest Income 270,903 312,039 308,352 299,893 293,807 Less: Gain on sale of trademarks - 50,000 50,000 50,000 50,000 Total Adjusted Revenue: 549,894 546,644 552,907 548,124 551,131 Efficiency Ratio, LTM 62.50% 64.67% 64.73% 67.43% 67.52% Efficiency Ratio Adjusted Efficiency Ratio

Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation25 Commercial Finance Industry Concentrations1 Manufacturing Transportation and Warehousing Utilities Wholesale Trade Health Care and Social Assistance Finance and Insurance Construction Administrative and Support and Waste Management and Remediation… Professional, Scientific, and Technical Services Mining, Quarrying, and Oil and Gas Extraction Accommodation and Food Services Retail Trade Real Estate and Rental and Leasing Other Services (except Public Administration) Information Arts, Entertainment, and Recreation Agriculture, Forestry, Fishing and Hunting Management of Companies and Enterprises Educational Services Public Administration $- $100 $200 $300 $400 $ in millions 1 Distribution by NAICS codes; excludes certain joint ventures; calculated based on aggregate principal amount of commercial finance loans and leases; includes operating lease rental equipment of $204.4M MANUFACTURING 41% Asset-based lending 18% Other 14% Lease financing 14% Factoring 13% Term lending TRANSPORTATION & WAREHOUSING 42% Factoring 36% Insurance premium finance 14% Term lending 8% Other UTILITIES 47% SBA/USDA 45% Term lending 5% Rental equipment, net 3% Other