Meta Financial Group, Inc. Transformational Merger with Crestmark Bancorp, Inc. Investor Presentation January 9, 2018 Exhibit 99.4

Forward-Looking Statements Meta Financial Group, Inc.® (the “Company” or “Meta”) and its wholly-owned subsidiary, MetaBank® (the “Bank”), may from time to time make written or oral “forward-looking statements,” including statements contained in this investor presentation, the Company’s filings with the Securities and Exchange Commission (“SEC”), the Company’s reports to stockholders, and in other communications by the Company and the Bank, which are made in good faith by the Company pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements by words such as “may,” “hope,” “will,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential,” “continue,” “could,” “future,” or the negative of those terms, or other words of similar meaning or similar expressions. You should carefully read statements that contain these words because they discuss management’s future expectations or state other “forward-looking” information. These forward-looking statements are based on information currently available to Meta and assumptions about future events, and include statements with respect to the Company’s beliefs, expectations, estimates, and intentions, which are subject to significant risks and uncertainties, and are subject to change based on various factors, some of which are beyond the control of Meta, Crestmark, and the combined company. Such risks, uncertainties and other factors may cause our actual growth, results of operations, financial condition, cash flows, performance and business prospects and opportunities to differ materially from those expressed in or implied by these forward-looking statements. These statements include, among others, statements regarding the potential benefits of, and other expectations for the combined company giving effect to, the proposed merger transaction, including, but not limited to, the proposed transaction’s accretive impact on earnings per share and the anticipated tangible book value dilution and earn-back period, anticipated synergies of the combined businesses, the possibility that the transaction will facilitate Meta’s growth through complementary product and service offerings, the anticipated addition of persons to Meta’s Board of Directors and executive management team, and the expected timetable for completing the transaction. The potential risks, uncertainties and other factors that could cause actual results to differ from those projected include, among other things, the risk that the transaction may not occur on a timely basis or at all; the parties’ ability to obtain regulatory approvals and approval of their respective shareholders, and otherwise satisfy the other conditions to closing, on a timely basis or at all; the risk that the businesses of Meta and MetaBank, on the one hand, and Crestmark and Crestmark Bank, on the other hand, may not be combined successfully, or such combination may take longer, be more difficult, time-consuming or costly to accomplish than expected; the expected growth opportunities, beneficial synergies and/or operating efficiencies from the proposed transaction may not be fully realized or may take longer to realize than expected; customer losses and business disruption following the announcement or consummation of the proposed transaction; potential litigation relating to the proposed merger transaction; and the risk that the Company may incur unanticipated or unknown losses or liabilities if it completes the proposed transaction with Crestmark and Crestmark Bank. The following additional factors, among others, could cause the Company's financial performance and results of operations to differ materially from the expectations, estimates, and intentions expressed in such forward-looking statements: maintaining our executive management team; the strength of the United States' economy, in general, and the strength of the local economies in which the Company conducts operations; the effects of, and changes in, trade, monetary, and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System (the “Federal Reserve”), as well as efforts of the United States Treasury in conjunction with bank regulatory agencies to stimulate the economy and protect the financial system; inflation, interest rate, market, and monetary fluctuations; the timely development and acceptance of new products and services offered by the Company or its strategic partners, as well as risks (including reputational and litigation) attendant thereto, and the perceived overall value of these products and services by users; the risks of dealing with or utilizing third parties, including, in connection with the Company’s refund advance business, the risks of reduced volume of refund advance loans as a result of reduced customer demand for or acceptance or usage of Meta’s strategic partners’ refund advance products; any actions which may be initiated by our regulators in the future; the impact of changes in financial services laws and regulations, including, but not limited to, laws and regulations relating to the tax refund industry and the insurance premium finance industry; our relationship with our primary regulators, the Office of the Comptroller of the Currency and the Federal Reserve, as well as the Federal Deposit Insurance Corporation, which insures the Bank’s deposit accounts up to applicable limits; technological changes, including, but not limited to, the protection of electronic files or databases; acquisitions; litigation risk, in general, including, but not limited to, those risks involving the Bank's divisions; the growth of the Company’s business, as well as expenses related thereto; continued maintenance by the Bank of its status as a well-capitalized institution, particularly in light of our growing deposit base, a portion of which has been characterized as “brokered;" changes in consumer spending and saving habits; and the success of the Company at maintaining its high-quality asset level and managing and collecting assets of borrowers in default should problem assets increase. The foregoing list of factors is not exclusive. We caution you not to place undue reliance on these forward-looking statements. The forward-looking statements included herein speak only as of the date of this investor presentation. All subsequent written and oral forward-looking statements attributable to Meta or any person acting on Meta’s behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this cautionary note. Additional discussions of factors affecting the Company’s business and prospects are reflected under the caption “Risk Factors” and in other sections of the Company’s Annual Report on Form 10-K for the Company's fiscal year ended September 30, 2017 and in other filings made with the SEC. The Company expressly disclaims any intent or obligation to update any forward-looking statements, whether written or oral, that may be made from time to time by or on behalf of the Company or its subsidiaries, whether as a result of new information, changed circumstances or future events or for any other reason.

Additional Information About the Proposed Transaction and Where to Find It In connection with the proposed merger transaction, Meta intends to file a registration statement on Form S-4 with the SEC, which will include a joint proxy statement of Meta and Crestmark, which will also constitute a prospectus of Meta, that Meta and Crestmark will send to their respective shareholders. Before making any voting or investment decision, investors and security holders of Meta and Crestmark are urged to carefully read the entire registration statement and proxy statement/prospectus as well as any amendments or supplements to these documents and any other relevant materials, when they become available, because they will contain important information about the proposed transaction. When filed, investors and security holders will be able to obtain the registration statement and the proxy statement/prospectus free of charge from the SEC’s website at www.sec.gov or from Meta by sending a request to Meta Financial Group, Inc., 5501 S. Broadband Lane, Sioux Falls, SD 57108; Attention: Investor Relations. In addition, copies of the proxy statement/prospectus, when available, will be provided free of charge by Meta to its stockholders. This communication and the information contained herein does not and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities in connection with the proposed merger shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Meta, Crestmark and certain of their respective directors and executive officers may be deemed under the rules of the SEC to be participants in the solicitation of proxies from the respective shareholders of Meta and Crestmark in connection with the proposed merger transaction. Certain information regarding the interests of these participants and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the joint proxy statement/prospectus regarding the proposed transaction when it becomes available. Additional information about Meta and its directors and officers may be found in the definitive proxy statement of Meta relating to its 2018 Annual Meeting of Stockholders filed with the SEC on December 4, 2017 and Meta’s annual report on Form 10-K for the year ended September 30, 2017 filed with the SEC on November 29, 2017. The definitive proxy statement and annual report on Form 10-K can be obtained free of charge from the SEC’s website at www.sec.gov.

Transaction Overview Transaction Merger of Crestmark with and into Meta, and Crestmark Bank with and into MetaBank Consideration Meta to exchange each outstanding share of Crestmark for 2.65 shares of Meta common stock (approximately 3.3 million shares to be issued) Crestmark in-the-money stock options to be cashed out at closing $320.6 million transaction value based on Meta’s closing price of $91.35 on January 8, 2018 (includes cash-out value of options) Ownership Post-Closing Approximately 75% Meta shareholders / 25% Crestmark shareholders Board Composition W. David Tull, Chairman and CEO of Crestmark, and one other mutually agreeable director, to join the boards of Meta and MetaBank, expanding boards to 9 members Management Michael “Mick” Goik, President and COO of Crestmark, entered into a new employment agreement which provides that, upon closing, he will become EVP of MetaBank and President of the Crestmark division of MetaBank Assumptions(1) Anticipated Transaction costs Targeted Cost Savings Fair Value Mark Approximately $18 million pre-tax Approximately 6% of Crestmark standalone non-interest expense Loan portfolio mark is approximately 1.7% of gross loans Compelling Metrics FY2019 EPS Accretion TBV Earnback period Price to Forward Earnings(2) For illustrative purposes, based on consensus estimates for Meta, approximately: 10% 2.2 Years 9.6x expected fiscal year 2018 earnings and 7.2x expected fiscal year 2019 earnings plus cost savings Approvals Customary regulatory and shareholders of Meta and Crestmark Targeted Closing Second calendar quarter of 2018 All modeling assumptions are estimates based on preliminary transaction information and subject to change Fiscal year ending September 30

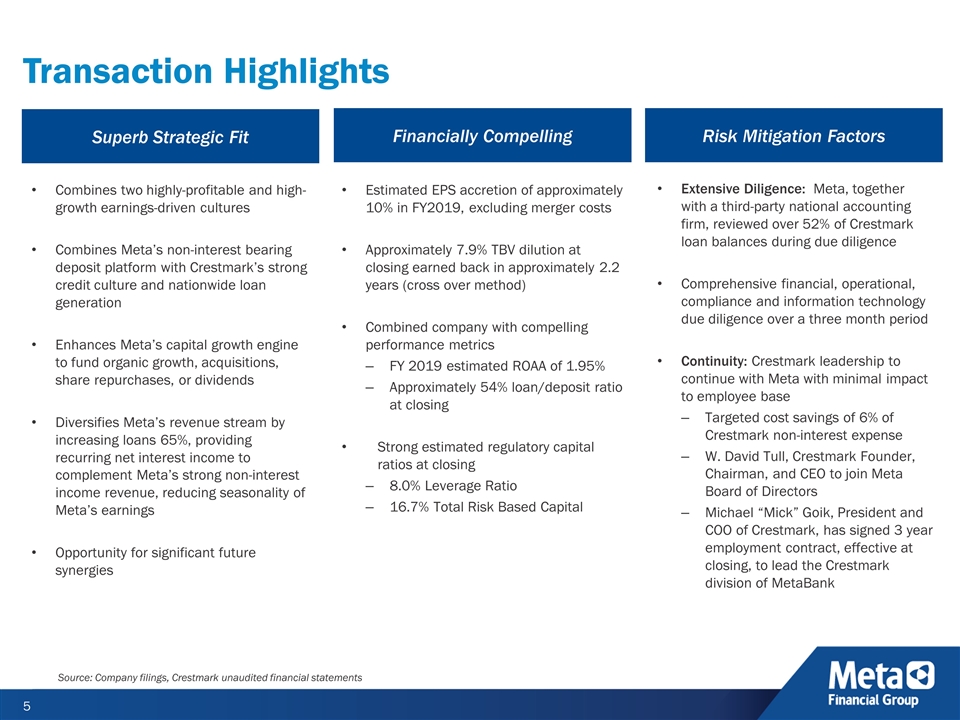

Combines two highly-profitable and high-growth earnings-driven cultures Combines Meta’s non-interest bearing deposit platform with Crestmark’s strong credit culture and nationwide loan generation Enhances Meta’s capital growth engine to fund organic growth, acquisitions, share repurchases, or dividends Diversifies Meta’s revenue stream by increasing loans 65%, providing recurring net interest income to complement Meta’s strong non-interest income revenue, reducing seasonality of Meta’s earnings Opportunity for significant future synergies Estimated EPS accretion of approximately 10% in FY2019, excluding merger costs Approximately 7.9% TBV dilution at closing earned back in approximately 2.2 years (cross over method) Combined company with compelling performance metrics FY 2019 estimated ROAA of 1.95% Approximately 54% loan/deposit ratio at closing Strong estimated regulatory capital ratios at closing 8.0% Leverage Ratio 16.7% Total Risk Based Capital Extensive Diligence: Meta, together with a third-party national accounting firm, reviewed over 52% of Crestmark loan balances during due diligence Comprehensive financial, operational, compliance and information technology due diligence over a three month period Continuity: Crestmark leadership to continue with Meta with minimal impact to employee base Targeted cost savings of 6% of Crestmark non-interest expense W. David Tull, Crestmark Founder, Chairman, and CEO to join Meta Board of Directors Michael “Mick” Goik, President and COO of Crestmark, has signed 3 year employment contract, effective at closing, to lead the Crestmark division of MetaBank Superb Strategic Fit Financially Compelling Risk Mitigation Factors 5 Source: Company filings, Crestmark unaudited financial statements Transaction Highlights

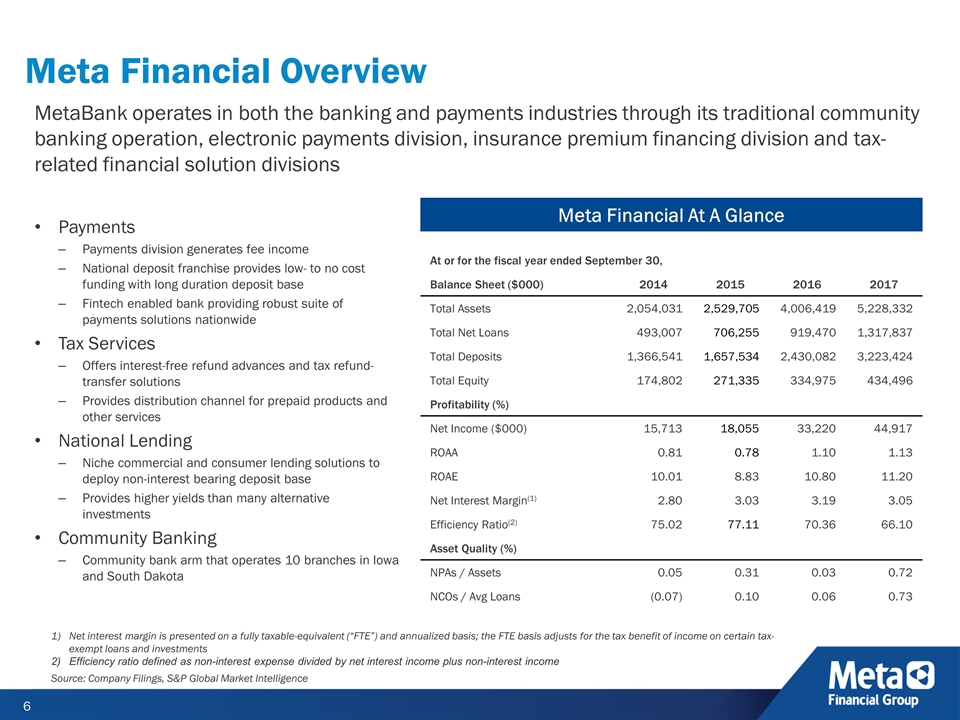

Meta Financial Overview MetaBank operates in both the banking and payments industries through its traditional community banking operation, electronic payments division, insurance premium financing division and tax-related financial solution divisions Payments Payments division generates fee income National deposit franchise provides low- to no cost funding with long duration deposit base Fintech enabled bank providing robust suite of payments solutions nationwide Tax Services Offers interest-free refund advances and tax refund-transfer solutions Provides distribution channel for prepaid products and other services National Lending Niche commercial and consumer lending solutions to deploy non-interest bearing deposit base Provides higher yields than many alternative investments Community Banking Community bank arm that operates 10 branches in Iowa and South Dakota Meta Financial At A Glance At or for the fiscal year ended September 30, Balance Sheet ($000) 2014 2015 2016 2017 Total Assets 2,054,031 2,529,705 4,006,419 5,228,332 Total Net Loans 493,007 706,255 919,470 1,317,837 Total Deposits 1,366,541 1,657,534 2,430,082 3,223,424 Total Equity 174,802 271,335 334,975 434,496 Profitability (%) Net Income ($000) 15,713 18,055 33,220 44,917 ROAA 0.81 0.78 1.10 1.13 ROAE 10.01 8.83 10.80 11.20 Net Interest Margin(1) 2.80 3.03 3.19 3.05 Efficiency Ratio(2) 75.02 77.11 70.36 66.10 Asset Quality (%) NPAs / Assets 0.05 0.31 0.03 0.72 NCOs / Avg Loans (0.07) 0.10 0.06 0.73 Net interest margin is presented on a fully taxable-equivalent (“FTE”) and annualized basis; the FTE basis adjusts for the tax benefit of income on certain tax-exempt loans and investments Efficiency ratio defined as non-interest expense divided by net interest income plus non-interest income Source: Company Filings, S&P Global Market Intelligence

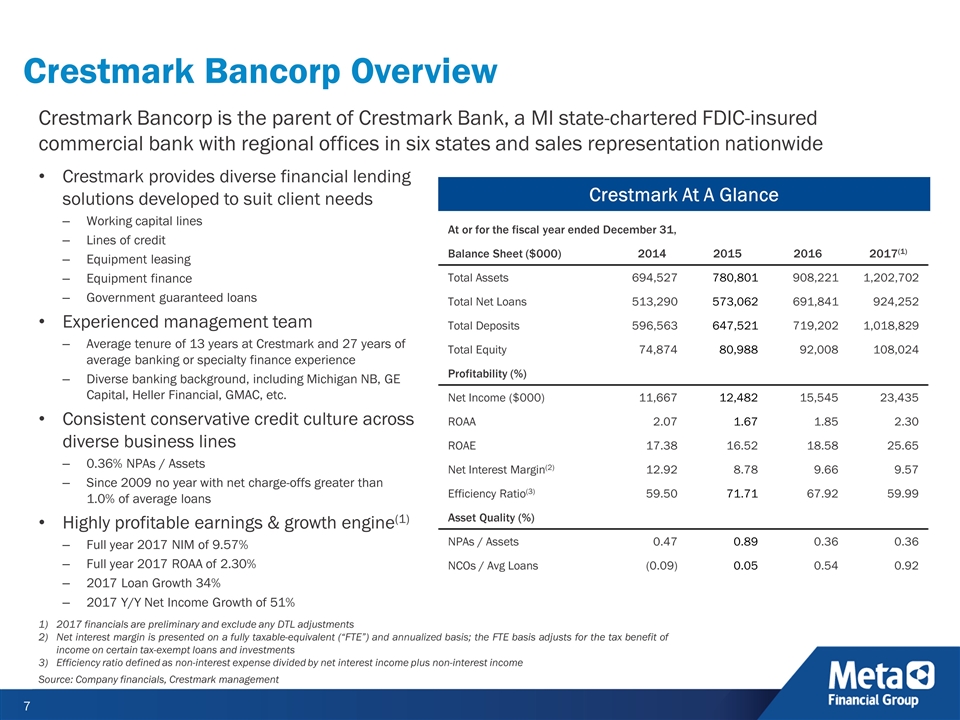

Crestmark provides diverse financial lending solutions developed to suit client needs Working capital lines Lines of credit Equipment leasing Equipment finance Government guaranteed loans Experienced management team Average tenure of 13 years at Crestmark and 27 years of average banking or specialty finance experience Diverse banking background, including Michigan NB, GE Capital, Heller Financial, GMAC, etc. Consistent conservative credit culture across diverse business lines 0.36% NPAs / Assets Since 2009 no year with net charge-offs greater than 1.0% of average loans Highly profitable earnings & growth engine(1) Full year 2017 NIM of 9.57% Full year 2017 ROAA of 2.30% 2017 Loan Growth 34% 2017 Y/Y Net Income Growth of 51% Crestmark Bancorp is the parent of Crestmark Bank, a MI state-chartered FDIC-insured commercial bank with regional offices in six states and sales representation nationwide 7 Crestmark Bancorp Overview Crestmark At A Glance At or for the fiscal year ended December 31, Balance Sheet ($000) 2014 2015 2016 2017(1) Total Assets 694,527 780,801 908,221 1,202,702 Total Net Loans 513,290 573,062 691,841 924,252 Total Deposits 596,563 647,521 719,202 1,018,829 Total Equity 74,874 80,988 92,008 108,024 Profitability (%) Net Income ($000) 11,667 12,482 15,545 23,435 ROAA 2.07 1.67 1.85 2.30 ROAE 17.38 16.52 18.58 25.65 Net Interest Margin(2) 12.92 8.78 9.66 9.57 Efficiency Ratio(3) 59.50 71.71 67.92 59.99 Asset Quality (%) NPAs / Assets 0.47 0.89 0.36 0.36 NCOs / Avg Loans (0.09) 0.05 0.54 0.92 2017 financials are preliminary and exclude any DTL adjustments Net interest margin is presented on a fully taxable-equivalent (“FTE”) and annualized basis; the FTE basis adjusts for the tax benefit of income on certain tax-exempt loans and investments Efficiency ratio defined as non-interest expense divided by net interest income plus non-interest income Source: Company financials, Crestmark management

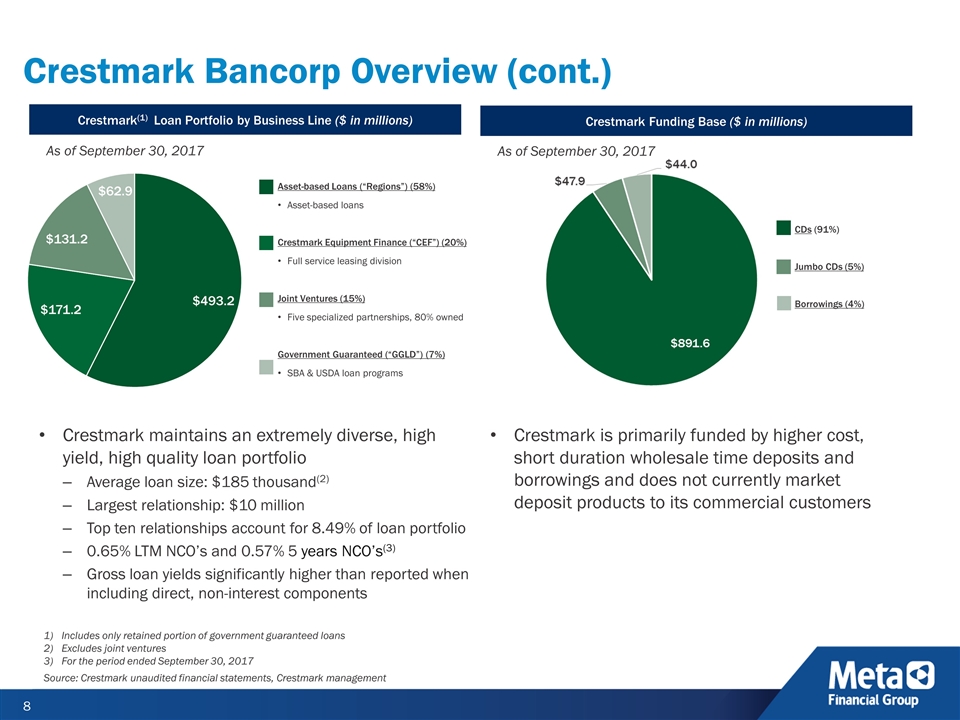

Crestmark Bancorp Overview (cont.) Crestmark is primarily funded by higher cost, short duration wholesale time deposits and borrowings and does not currently market deposit products to its commercial customers Crestmark maintains an extremely diverse, high yield, high quality loan portfolio Average loan size: $185 thousand(2) Largest relationship: $10 million Top ten relationships account for 8.49% of loan portfolio 0.65% LTM NCO’s and 0.57% 5 years NCO’s(3) Gross loan yields significantly higher than reported when including direct, non-interest components Crestmark Funding Base ($ in millions) As of September 30, 2017 CDs (91%) Jumbo CDs (5%) Borrowings (4%) Crestmark(1) Loan Portfolio by Business Line ($ in millions) Asset-based Loans (“Regions”) (58%) Asset-based loans Crestmark Equipment Finance (“CEF”) (20%) Full service leasing division Joint Ventures (15%) Five specialized partnerships, 80% owned Government Guaranteed (“GGLD”) (7%) SBA & USDA loan programs As of September 30, 2017 Includes only retained portion of government guaranteed loans Excludes joint ventures For the period ended September 30, 2017 Source: Crestmark unaudited financial statements, Crestmark management

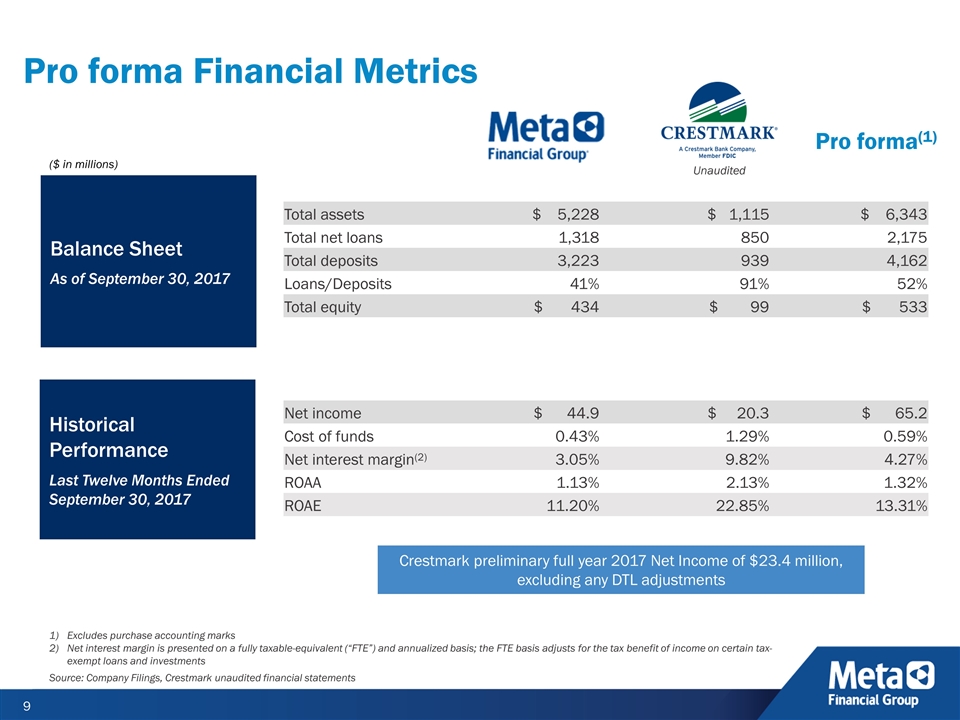

Total assets $ 5,228 $ 1,115 $ 6,343 Total net loans 1,318 850 2,175 Total deposits 3,223 939 4,162 Loans/Deposits 41% 91% 52% Total equity $ 434 $ 99 $ 533 Net income $ 44.9 $ 20.3 $ 65.2 Cost of funds 0.43% 1.29% 0.59% Net interest margin(2) 3.05% 9.82% 4.27% ROAA 1.13% 2.13% 1.32% ROAE 11.20% 22.85% 13.31% Pro forma Financial Metrics Historical Performance Last Twelve Months Ended September 30, 2017 Balance Sheet As of September 30, 2017 ($ in millions) Unaudited Pro forma(1) Excludes purchase accounting marks Net interest margin is presented on a fully taxable-equivalent (“FTE”) and annualized basis; the FTE basis adjusts for the tax benefit of income on certain tax-exempt loans and investments Source: Company Filings, Crestmark unaudited financial statements Crestmark preliminary full year 2017 Net Income of $23.4 million, excluding any DTL adjustments

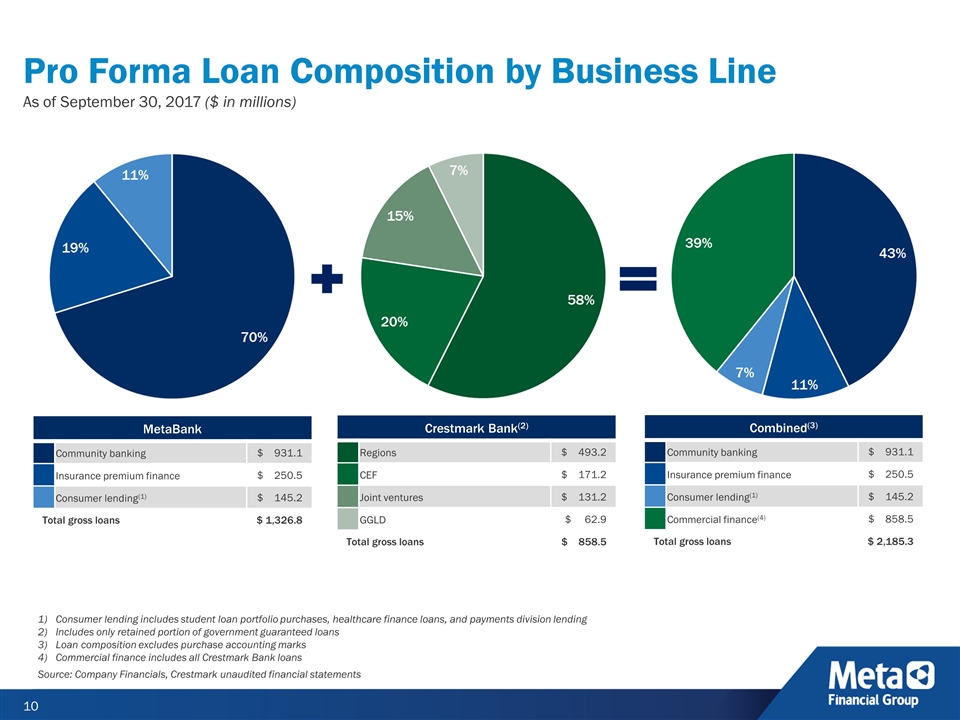

Pro Forma Loan Composition by Business Line As of September 30, 2017 ($ in millions) Combined(3) Community banking $ 931.1 Insurance premium finance $ 250.5 Consumer lending(1) $ 145.2 Commercial finance(4) $ 858.5 Total gross loans $ 2,185.3 MetaBank Community banking $ 931.1 Insurance premium finance $ 250.5 Consumer lending(1) $ 145.2 Total gross loans $ 1,326.8 Crestmark Bank(2) Regions $ 493.2 CEF $ 171.2 Joint ventures $ 131.2 GGLD $ 62.9 Total gross loans $ 858.5 Consumer lending includes student loan portfolio purchases, healthcare finance loans, and payments division lending Includes only retained portion of government guaranteed loans Loan composition excludes purchase accounting marks Commercial finance includes all Crestmark Bank loans Source: Company Financials, Crestmark unaudited financial statements

Compelling Earnings Enhancement & Growth Estimated 10% earnings accretion based on conservative cost savings assumptions Targeting 6% of Crestmark base non-interest expense No net staff savings contemplated Provides significant upside opportunity from potential, additional synergies Opportunity to increase growth in Crestmark’s loan portfolio by offering a larger balance sheet with higher lending limits, a low loan-to-deposit ratio and a more competitive and stable funding structure Ability to replace lower yielding investment securities with higher yielding commercial loans Ability to cross-sell Meta’s insurance premium finance business to Crestmark’s commercial customer base Leveraging platform and leadership team with additional lending teams and acquisitions Combined institution becomes highly attractive with both unique asset and funding models Utilizing Meta’s technology proficiency to drive new products and efficiency within Crestmark Future opportunities to offer Meta’s payment solutions to Crestmark’s commercial customers

Conclusion Offers compelling earnings enhancement and growth potential for shareholders Combines Meta’s balance sheet capacity and low-cost deposit base with Crestmark’s national high quality lending platform and conservative credit culture Significantly diversifies Meta’s revenue stream to complement non-interest income with a meaningful increase in net interest income Limits execution risk given expected key leadership retention and low targeted cost savings Provides significant upside opportunity from potential future synergies