Exhibit 99.1

1: January 2015 Corporate Presentation SubTitle: January 12, 2015

2: Forward Looking Statements Other Placeholder: 2 This presentation contains forward-looking statements regarding Dyax’s business plans, strategies and outlook. These statements may include, without limitation: statements regarding the potential benefits and usage of KALBITOR® (ecallantide) for treating HAE; the commercial potential of KALBITOR, including revenues and costs; prospects for therapeutic benefits and clinical development of DX-2930 and other potential product candidates to address HAE and other plasma-kallikrein-mediated disorders; prospects for future milestone payments and/or royalties with respect to licensee product candidates in our Licensing and Funded Research Portfolio (LFRP); the potential to enter into additional collaborative and licensing arrangements for ecallantide and for other compounds in development; the sufficiency of our cash, cash equivalents and short-term investments; and expected future revenues, operating results and cash flows.Statements that are not historical facts are based on our current expectations, beliefs, assumptions, estimates, forecasts and projections about the industry and markets in which Dyax competes. The statements contained in this presentation are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed in such forward-looking statements. We caution investors not to place undue reliance on such forward looking statements. There are many factors that could cause actual results to differ materially from those in these forward-looking statements. These factors include the following:• future sales levels of KALBITOR and other commercial products and the profitability of such sales, if any; • DX-2930 may not show sufficient therapeutic effect or an acceptable safety profile in clinical trials for the treatment of HAE or could take significantly longer time to gain regulatory approval than Dyax expects or may never gain such approval;even if DX-2930 progresses through clinical trials and gains regulatory approval, it may not gain market acceptance;others may develop technologies or products superior to DX-2930 or that reach the market before DX-2930;Dyax is dependent on the expertise, effort, priorities and contractual obligations of third parties in the manufacture, quality control, storage and clinical development of KALBITOR and our pipeline products, including DX-2930;• the amount and timing of milestone and royalty payments from our LFRP collaborators and licensees related to their progress in developing and commercializing products;• the costs of prosecuting, maintaining, defending and enforcing our patents and other intellectual property rights; • the overall condition of the financial markets; and • a variety of other risks common to our industry. Additional factors that could cause actual results to differ materially from those projected or suggested in any forward-looking statements are contained in our recent annual and quarterly reports filed with the Securities and Exchange Commission, including those factors discussed under the caption "Risk Factors" in such filings, which are incorporated in this presentation by this reference. Forward-looking statements speak only as of the date of this presentation, and we undertake no obligation to update or revise them, except as may be required by law.

3: Dyax: An Evolving Orphan Disease Company Other Placeholder: 3 Platform company HAE company Kinin pathway company Orphan disease company Phage display technology(Licensing & Funded Research Portfolio) DX-2930, preclinical candidates Future pipeline candidates

4: Multiple Value Drivers Other Placeholder: 4 KALBITOR® (ecallantide)DX-2930Future Pipeline Candidates Approved ProductClinical Stage Product CandidatesRoyalties/Milestones PRODUCT & DEVELOPMENT PORTFOLIO LICENSING PORTFOLIO

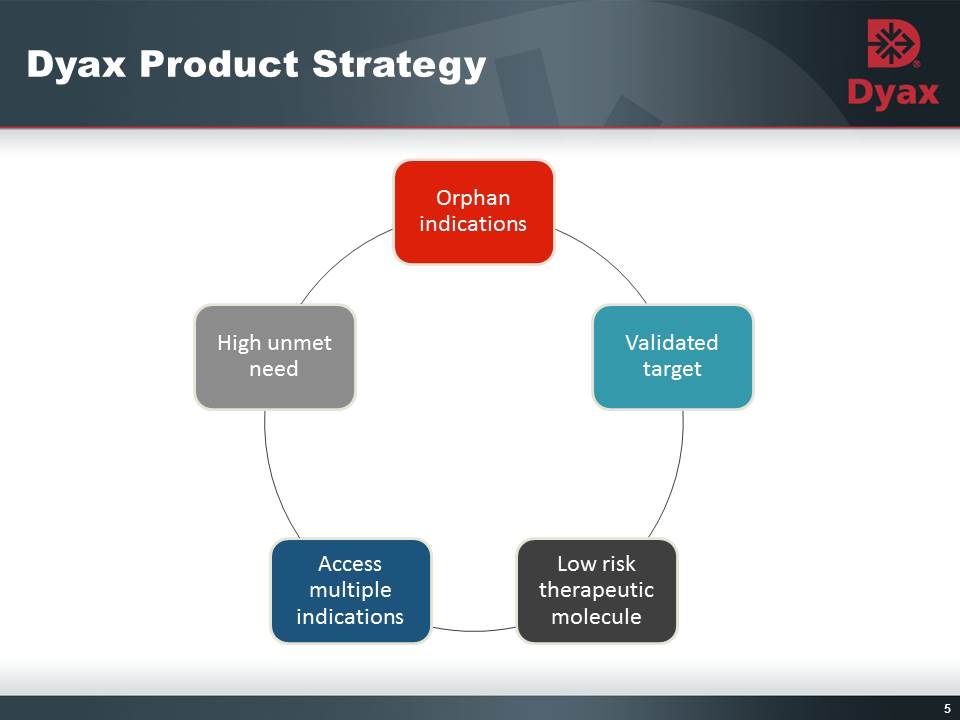

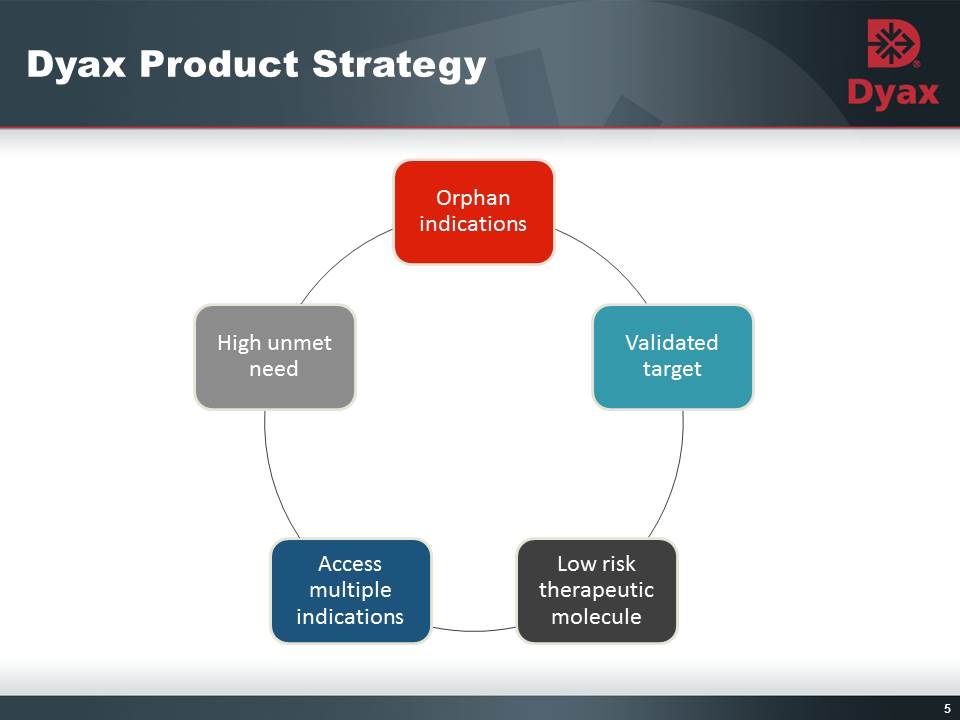

5 : Dyax Product Strategy

6: Product and Development Portfolio Other Placeholder: Current focus on plasma kallikrein-kinin systemKALBITOR® (ecallantide) FDA approved product for the treatment of acute attacks of hereditary angioedema (HAE) in patients 12 years of age and olderPeptide inhibitor of plasma kallikreinDX-2930Clinical product being developed for the prevention of HAE attacksFully human monoclonal antibody inhibitor of plasma kallikrein Identifying other plasma-kallikrein-mediated (PKM) disorders

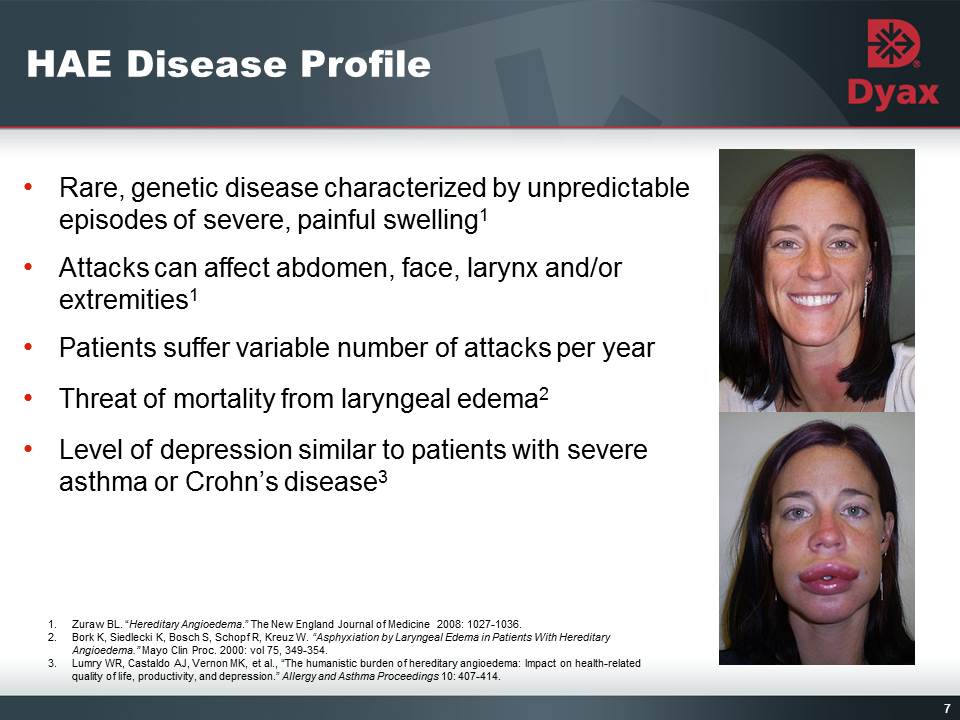

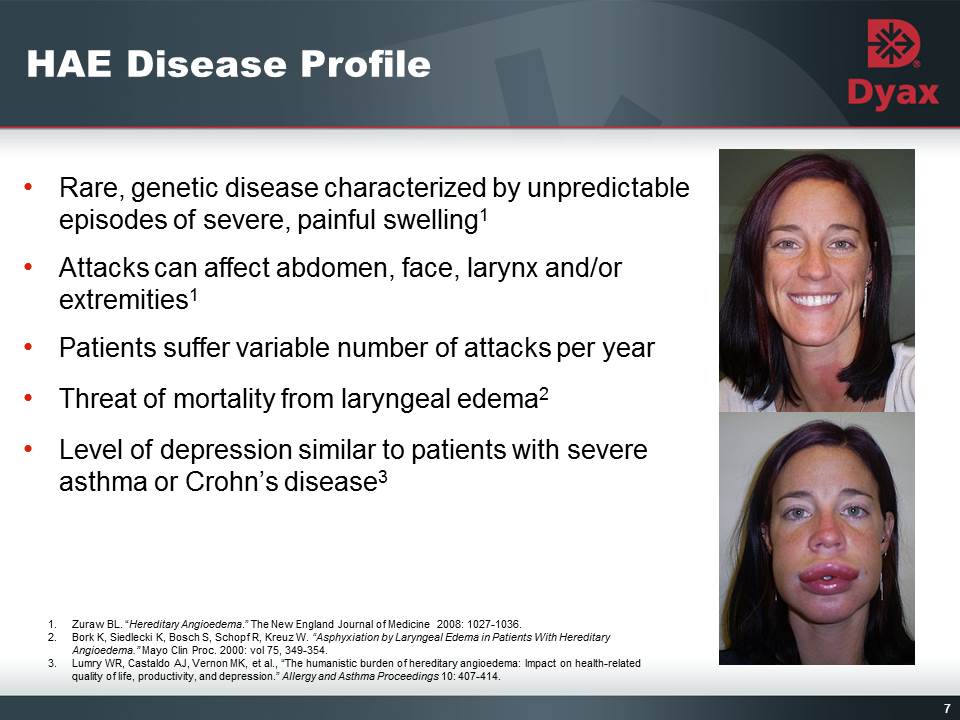

7: HAE Disease Profile Other Placeholder: 7 Rare, genetic disease characterized by unpredictable episodes of severe, painful swelling1Attacks can affect abdomen, face, larynx and/or extremities1 Patients suffer variable number of attacks per yearThreat of mortality from laryngeal edema2Level of depression similar to patients with severe asthma or Crohn’s disease3 Zuraw BL. “Hereditary Angioedema.” The New England Journal of Medicine 2008: 1027-1036.Bork K, Siedlecki K, Bosch S, Schopf R, Kreuz W. “Asphyxiation by Laryngeal Edema in Patients With Hereditary Angioedema.” Mayo Clin Proc. 2000: vol 75, 349-354.Lumry WR, Castaldo AJ, Vernon MK, et al., “The humanistic burden of hereditary angioedema: Impact on health-related quality of life, productivity, and depression.” Allergy and Asthma Proceedings 10: 407-414.

8: KALBITOR®(ecallantide) Other Placeholder: 8 Available in the U.S. to treat acute HAE attacks in patients age 12+Approved for treating all attack locations including hands, feet, face, abdomen, genitals and throatIn clinical trials, KALBITOR improved attack symptoms at 4 hours and demonstrated sustained efficacy through 24 hoursConsistent safety profile Requires administration by a healthcare professional to manage potentially serious hypersensitivity reactionsPatent protected through 2023

9: KALBITOR Business Other Placeholder: KALBITOR business is profitable and cash flow positive3Q14 net sales were $20.3 million (nine months YTD = $49.4 million)Recent revenue growth driven by:Treatment rateNew patientsPatient focused market strategy: identifying and helping the right HAE patients receive and stay on KALBITOR therapy Understanding patient needsComprehensive patient engagement and support programsIndividualized patient approach

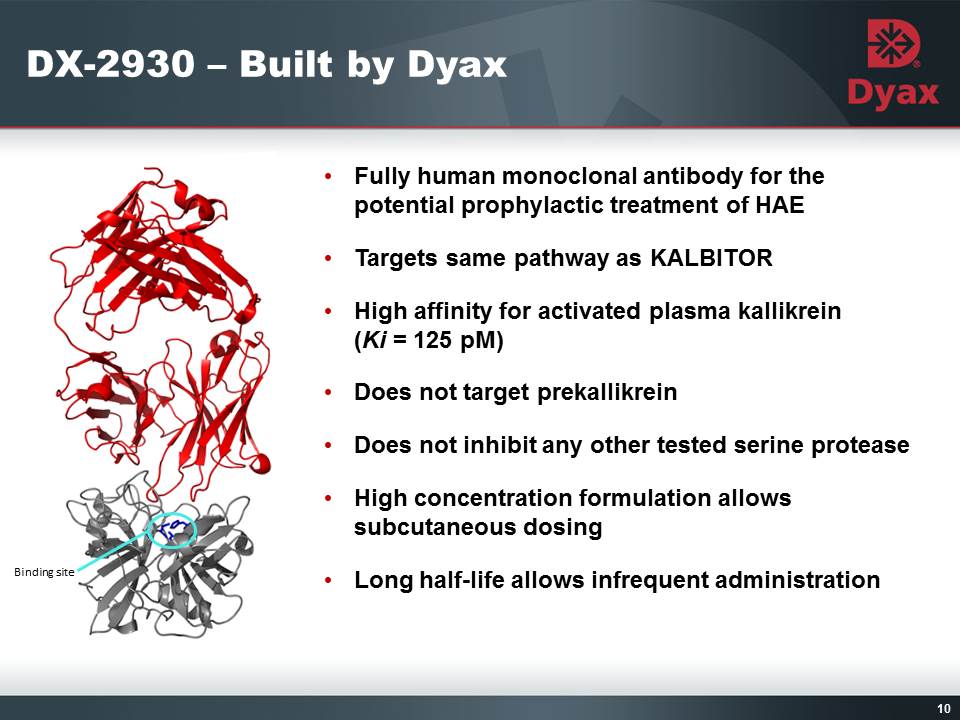

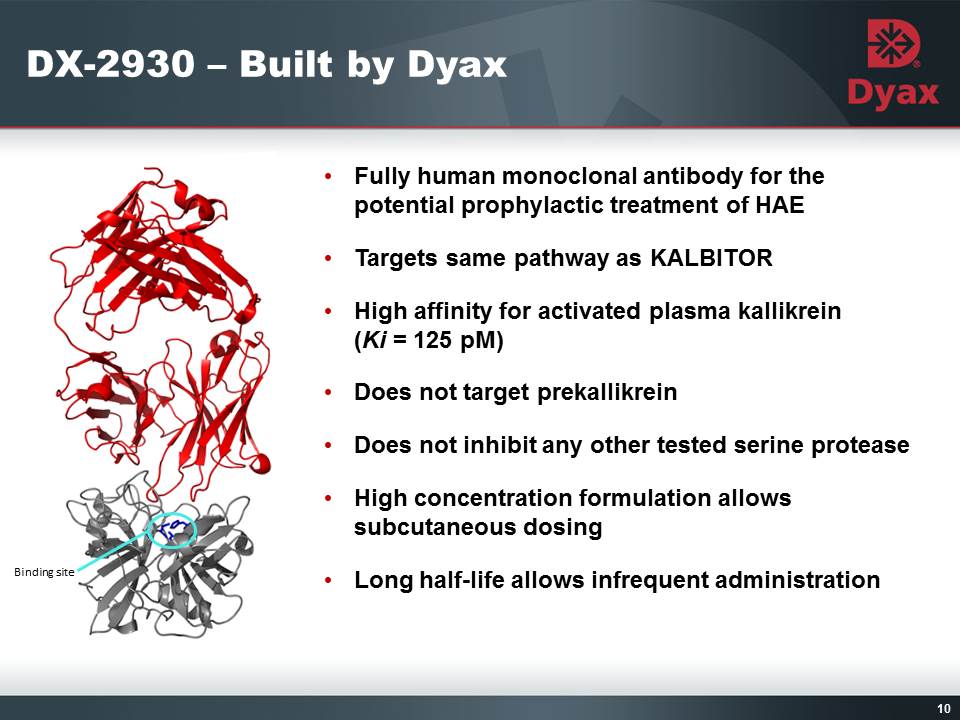

10: DX-2930 – Built by Dyax Fully human monoclonal antibody for the potential prophylactic treatment of HAETargets same pathway as KALBITORHigh affinity for activated plasma kallikrein (Ki = 125 pM)Does not target prekallikreinDoes not inhibit any other tested serine proteaseHigh concentration formulation allows subcutaneous dosingLong half-life allows infrequent administration

11: DX-2930 Phase 1b Study in HAE Patients Other Placeholder: Ascending repeat dose study of subcutaneous DX-2930 in HAE patients to assess safety, pharmacokinetics and pharmacodynamicsRandomized, double-blind, placebo-controlledEnrollment of 36 patients5 dose groups: 30 mg, 100 mg, 300 mg, 400 mg, 400 mg Patients randomized to active drug or placebo in a 2:1 ratio15 week follow-up after the second dose for each patientPlan to report complete Phase 1b data in early 2015

12: Summary of DX-2930 Phase 1a Study Other Placeholder: Pharmacokinetic (PK) profile suggests feasibility of attaining stable target blood levelDose proportional exposure Long half-life (approximately 17-21 days) following single dose in healthy subjectsPharmacodynamic (PD) data consistent with observed PK profileDose and time dependent inhibition of plasma kallikreinBiomarker data suggests sustained bioactivity of several weeks from single dose in healthy subjectsLow administration burdenSC administration with low injection volumesNo injection site reactions in healthy subjects after single dosePK data supports the potential for infrequent dosing in HAE patientsSource: Dyax Phase 1a DX-2930 data presentation; Feb. 25, 2014

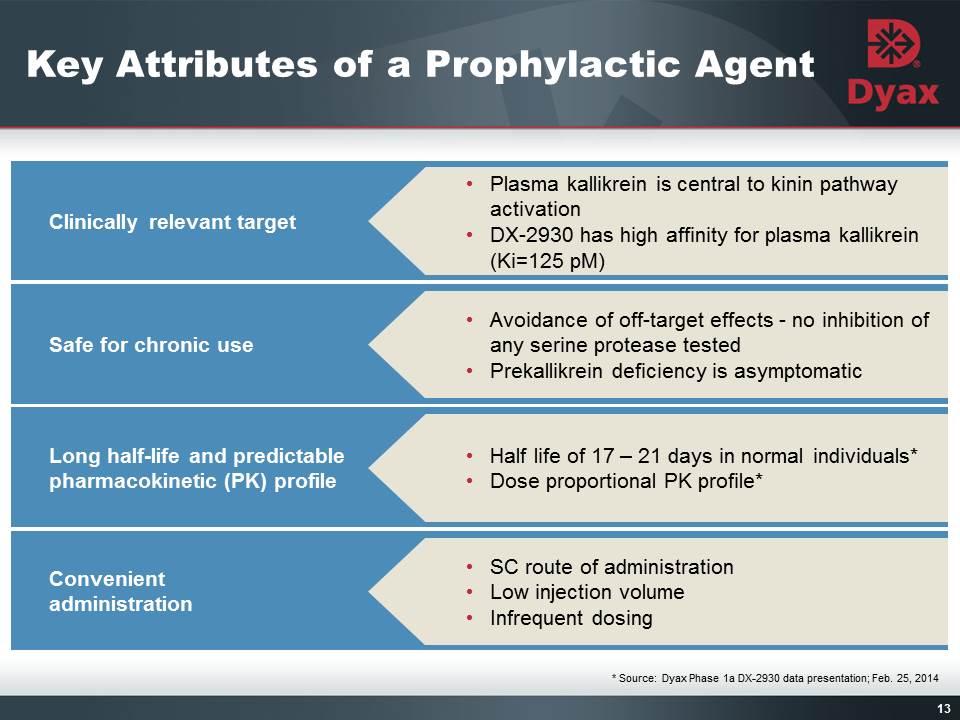

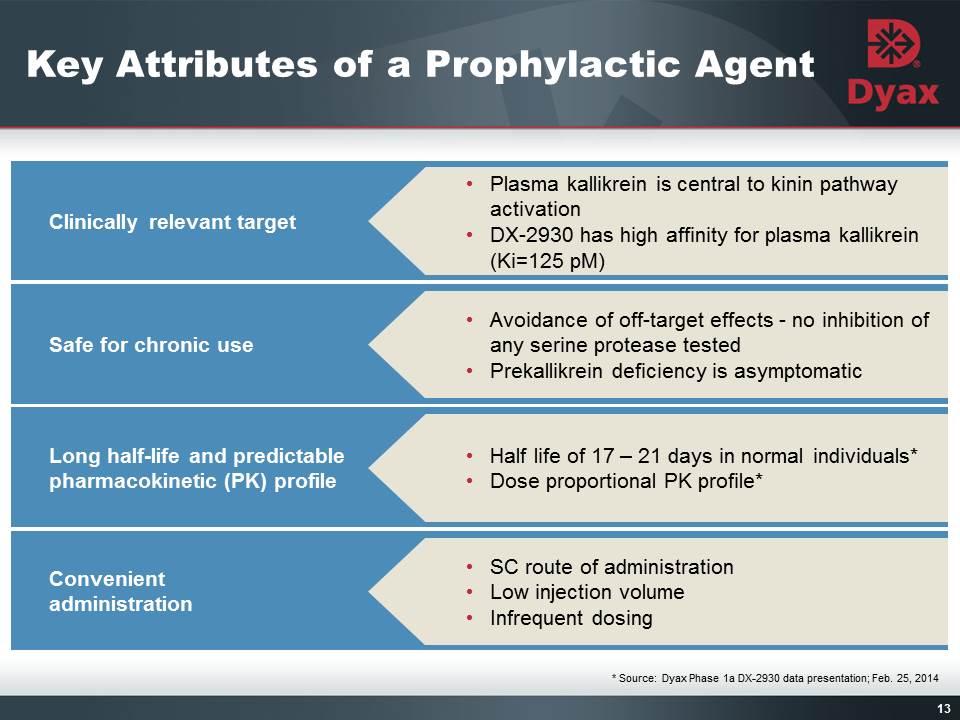

13 Clinically relevant target Plasma kallikrein is central to kinin pathway activationDX-2930 has high affinity for plasma kallikrein (Ki=125 pM) Safe for chronic use Avoidance of off-target effects - no inhibition of any serine protease testedPrekallikrein deficiency is asymptomatic Long half-life and predictable pharmacokinetic (PK) profile Half life of 17 – 21 days in normal individuals*Dose proportional PK profile* Convenient administration SC route of administrationLow injection volumeInfrequent dosing Title: Key Attributes of a Prophylactic Agent Other Placeholder: 13 * Source: Dyax Phase 1a DX-2930 data presentation; Feb. 25, 2014

14: PKM Disorders Beyond HAE Other Placeholder: Determine if plasma kallikrein activation occurs as part of other inflammatory disorders:Diabetic macular edemaUlcerative colitis Crohn’s diseaseRheumatoid arthritisUsing a number of tools to explore the plasma kallikrein pathway:Biomarker assaysLiteratureKey Opinion LeadersCurrent focus on plasma kallikrein-kinin system

15: Licensing Portfolio Other Placeholder: 15

16: Dyax Licensing Portfolio Other Placeholder: Built around proprietary antibody discovery technologyAddressing significant therapeutic marketsLicensing agreements with top-tier companiesMultiple late-stage clinical programs Several product development events projected in the next 12 months All antibody product candidates have 2-3% royalties (net to Dyax) for 10 years from first commercial saleDyax royalties commenced in mid-2014 with the launch of Eli Lilly and Company’s CYRAMZA® (ramucirumab) Other Placeholder: 16 The trademarks and registered trademarks shown herein are the property of their respective owners.

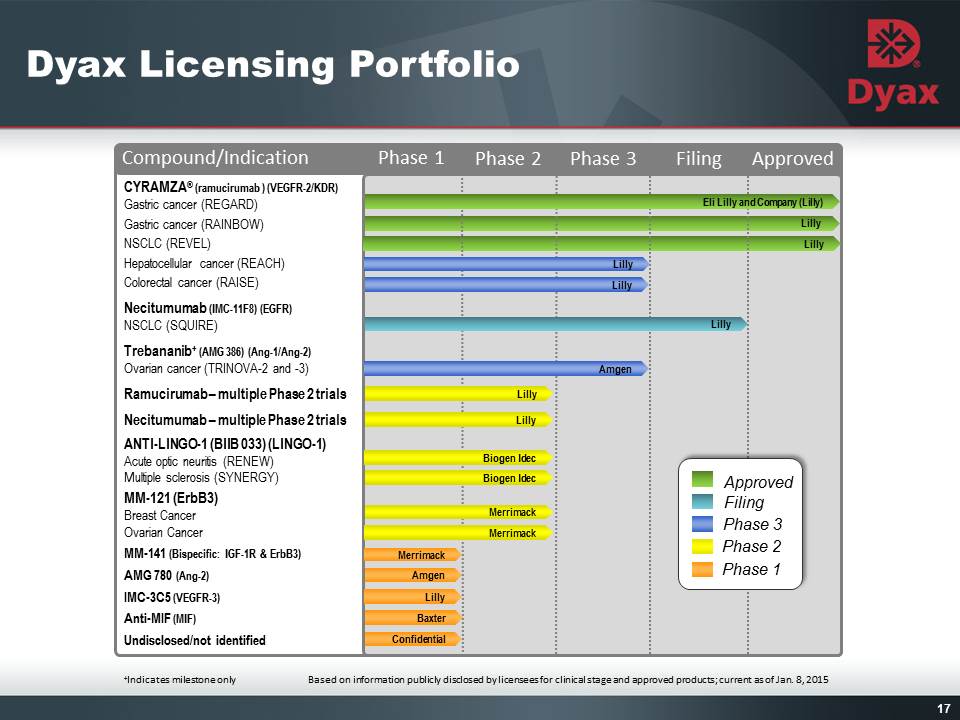

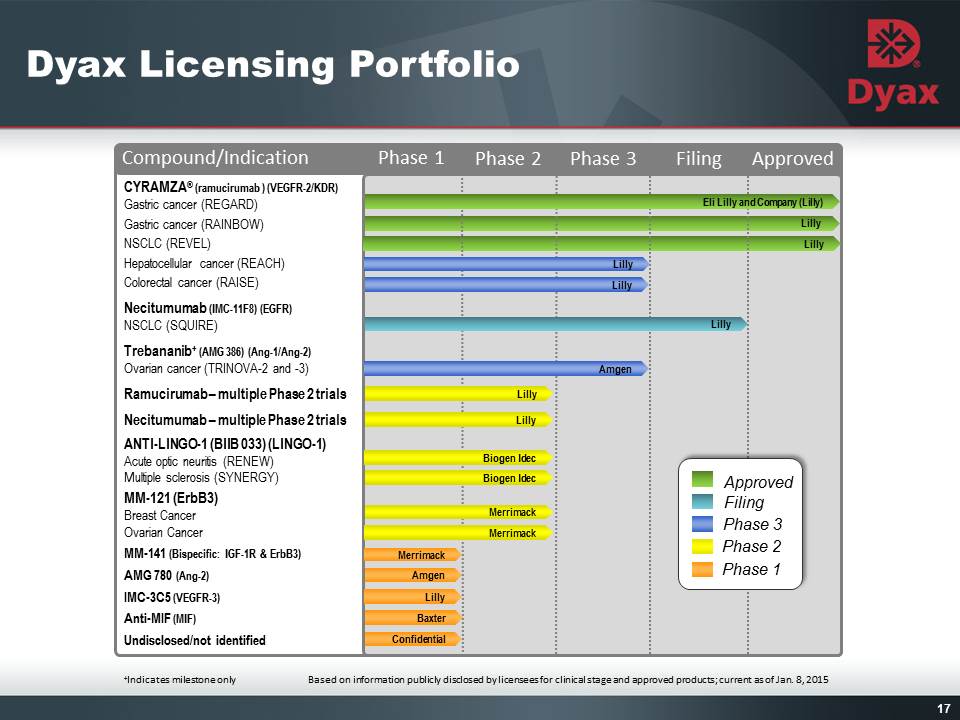

17 Lilly Lilly CYRAMZA® (ramucirumab ) (VEGFR-2/KDR)Gastric cancer (REGARD)Gastric cancer (RAINBOW)NSCLC (REVEL)Hepatocellular cancer (REACH)Colorectal cancer (RAISE)Necitumumab (IMC-11F8) (EGFR)NSCLC (SQUIRE)Trebananib+ (AMG 386) (Ang-1/Ang-2)Ovarian cancer (TRINOVA-2 and -3)Ramucirumab – multiple Phase 2 trialsNecitumumab – multiple Phase 2 trialsANTI-LINGO-1 (BIIB 033) (LINGO-1)Acute optic neuritis (RENEW)Multiple sclerosis (SYNERGY)MM-121 (ErbB3)Breast CancerOvarian CancerMM-141 (Bispecific: IGF-1R & ErbB3)AMG 780 (Ang-2)IMC-3C5 (VEGFR-3)Anti-MIF (MIF)Undisclosed/not identified Merrimack Amgen Lilly Baxter Phase 3 Phase 2 Phase 1 Filing +Indicates milestone only Eli Lilly and Company (Lilly) Lilly Confidential Lilly Lilly Amgen Lilly Lilly Merrimack Other Placeholder: 17 Compound/Indication Phase 1 Phase 2 Phase 3 Filing Approved Based on information publicly disclosed by licensees for clinical stage and approved products; current as of Jan. 8, 2015 Approved Dyax Licensing Portfolio Merrimack Biogen Idec Biogen Idec

18 Title: Financials and Key Drivers

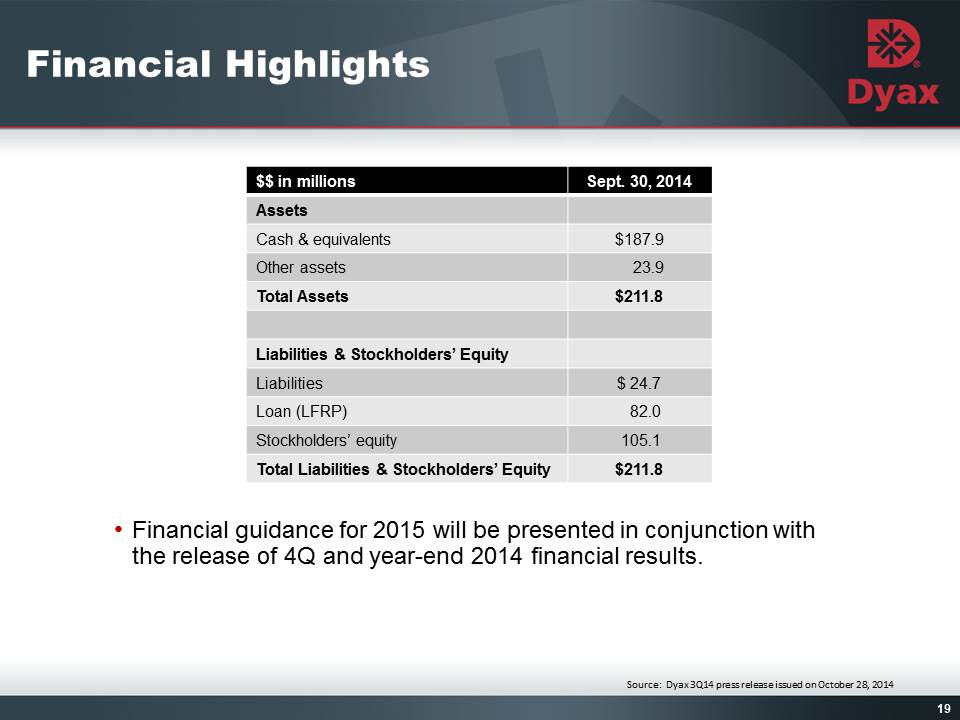

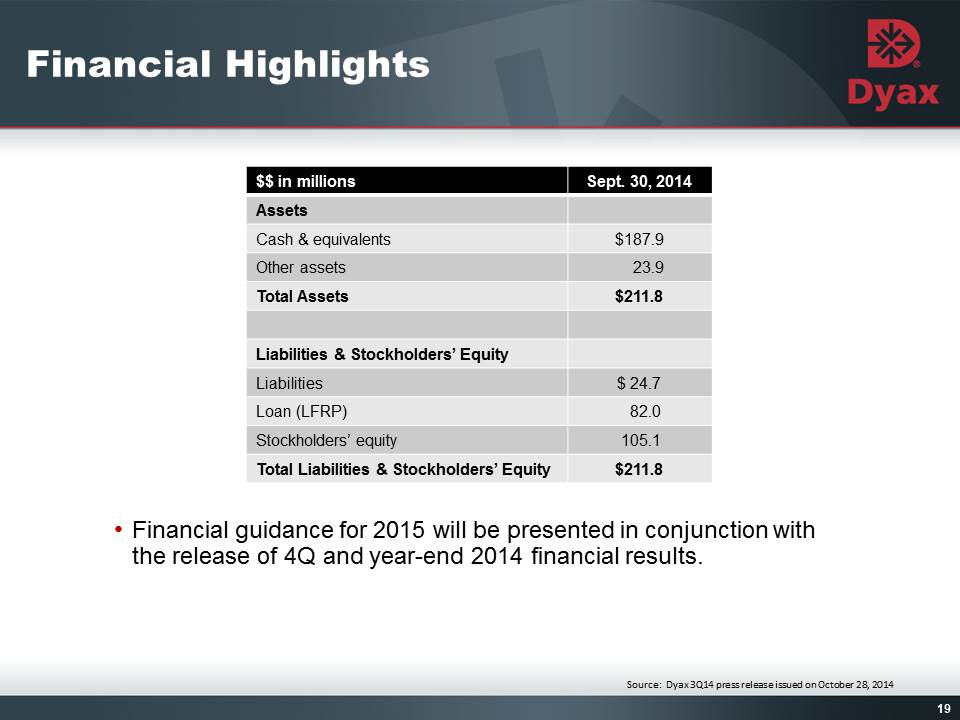

19: Financial Highlights Financial guidance for 2015 will be presented in conjunction with the release of 4Q and year-end 2014 financial results. Other Placeholder: 19 Source: Dyax 3Q14 press release issued on October 28, 2014

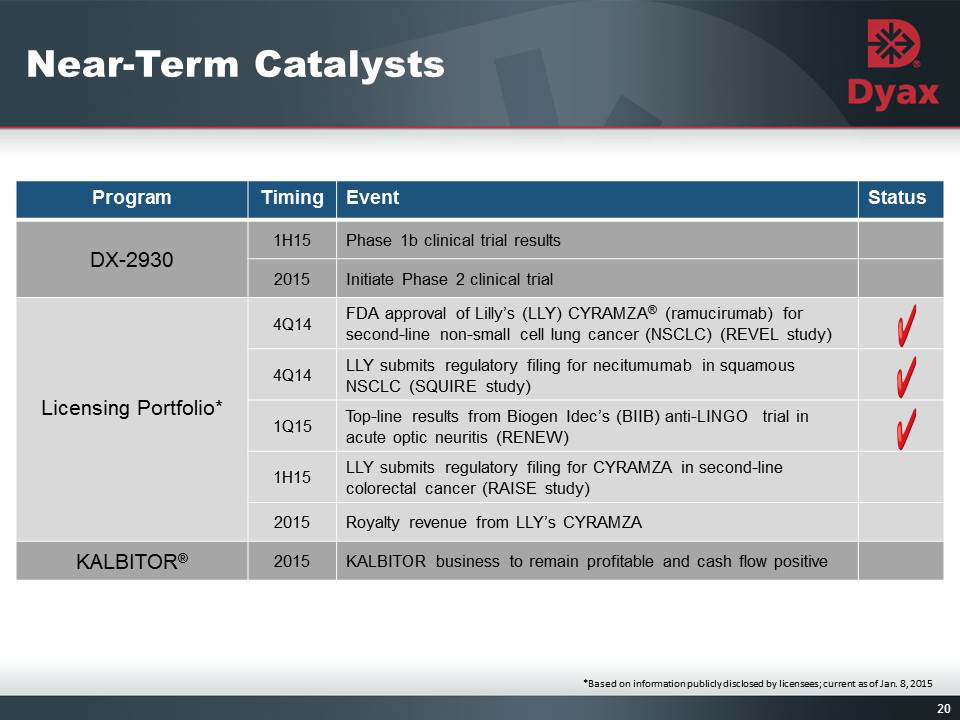

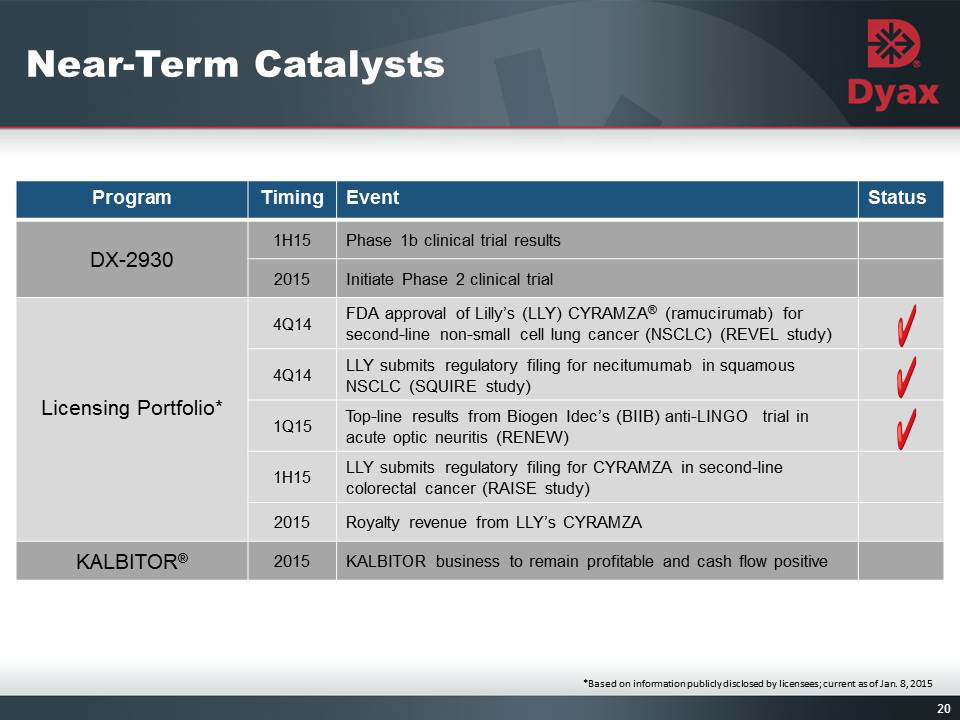

20: Near-Term Catalysts *Based on information publicly disclosed by licensees; current as of Jan. 8, 2015

21: IR Contact:Mary jenkinsmjenkins@dyax.com617-250-5543 January 2015 Corporate Presentation