Table of Contents

Filed Pursuant to 424(B)(3)

Registration No. 333-118821

The information in this preliminary prospectus supplement and the accompanying prospectus is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell these securities and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS SUPPLEMENT | Subject to Completion | January 24, 2005 |

(To Prospectus dated December 6, 2004)

7,000,000 Shares

Common Stock

We are offering all of the 7,000,000 shares of our common stock offered by this prospectus supplement. We will receive all of the net proceeds from the sale of such common stock.

Our common stock is quoted on The Nasdaq National Market under the symbol “NUVO.” The last reported sale price for our common stock on January 20, 2005 was $9.19 per share.

Investing in our common stock involves a high degree of risk. Before buying any shares you should carefully read the discussion of material risks of investing in our common stock under the heading “Risk factors” beginning on page S-9 of this prospectus supplement and on page 1 of the accompanying prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus are truthful or complete. Any representation to the contrary is a criminal offense.

| Per share | Total | |||

Public offering price | $ | $ | ||

Underwriting discounts and commissions | $ | $ | ||

Proceeds, before expenses, to us | $ | $ |

The underwriters may also purchase up to an additional 1,050,000 shares of common stock from us at the public offering price, less underwriting discounts and commissions payable by us to cover over-allotments, if any, within 30 days from the date of this prospectus supplement. If the underwriters exercise the option in full, the total underwriting discounts and commissions will be , and the total proceeds, before expenses, to us will be $ .

The underwriters are offering the shares of common stock as set forth under “Underwriting.” Delivery of the shares will be made on or about February , 2005.

| Sole Book-Running Manager | ||

| UBS Investment Bank | Deutsche Bank Securities |

| CIBC World Markets | Needham & Company, Inc. |

Table of Contents

You should rely only on the information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus. We have not, and the underwriters have not, authorized anyone to provide you with additional or different information. We are not making an offer of these securities in any jurisdiction where the offer is not permitted. You should assume that the information in this prospectus supplement is accurate only as of the date on the front of the document and that any information we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus supplement and the accompanying prospectus or of any sale of our common stock. Unless the context otherwise requires, references to “we,” or the “company” in this prospectus supplement and the accompanying prospectus mean Nuvelo, Inc. and its subsidiaries.

| Prospectus Supplement | Page | |

| S-1 | ||

| S-9 | ||

| S-32 | ||

| S-32 | ||

| S-33 | ||

| S-33 | ||

| S-34 | ||

| S-36 | ||

| S-37 | ||

| S-40 | ||

| S-43 | ||

| S-43 | ||

| S-43 | ||

| S-43 | ||

| Prospectus | Page | |

| 1 | ||

| 1 | ||

| 1 | ||

| 2 | ||

| 2 | ||

| 2 | ||

| 3 | ||

| 12 | ||

| 14 | ||

| 16 | ||

| 18 | ||

| 20 | ||

| 20 | ||

| 20 | ||

We own or have rights to use trademarks or trade names that we use in conjunction with the operation of our business. Nuvelo is a registered trade and service mark of ours. All other trademarks, service marks and trade names referred to in this prospectus supplement or the accompanying prospectus are the property of their respective owners.

Table of Contents

This summary highlights information contained elsewhere or incorporated by reference in this prospectus supplement and the accompanying prospectus. This summary does not contain all of the information that you should consider before investing in our common stock. You should carefully read the entire prospectus supplement and the accompanying prospectus, including the “Risk factors” section, as well as the financial statements and the other information incorporated by reference herein before making an investment decision.

BUSINESS OVERVIEW

We are a biopharmaceutical company strategically focused on the discovery, development and commercialization of therapeutics for the treatment of acute cardiovascular indications and cancer.

We currently have three drug candidates in clinical trials. Our lead drug candidate, alfimeprase, is a thrombolytic agent, or blood clot dissolver. In 2004, we completed two separate Phase 2 clinical trials for alfimeprase for the treatment of acute peripheral arterial occlusion, or PAO, and catheter occlusion. We anticipate initiating a Phase 3 trial for alfimeprase in acute PAO in the first half of 2005 and a Phase 3 trial for alfimeprase in patients with occluded central venous catheters in the second half of 2005.

Our second drug candidate, recombinant nematode anticoagulant protein c2, or rNAPc2, is a recombinant version of a naturally occurring protein that has anticoagulant properties. These properties arise from its ability to block the factor VIIa/tissue factor protease complex, which is responsible for the initiation of the process leading to blood clot formation. rNAPc2 is currently undergoing a Phase 2a double-blind, placebo-controlled clinical trial for use in treating acute coronary syndromes, or ACS, including unstable angina, or UA, and non-ST segment elevation myocardial infarction, or NSTEMI. We expect to complete enrollment of this trial in the first half of 2005.

Our third drug candidate is ARC183, a novel thrombin inhibitor which is currently in a Phase 1 clinical development program for use as an anticoagulant in coronary artery bypass graft, or CABG, surgery. We entered into a 50/50 cost/profit sharing collaboration agreement with Archemix Corporation in January 2004 for the development and commercialization of ARC183. We anticipate completing enrollment of the Phase 1 clinical program for ARC183 in the first half of 2005.

We have exclusive worldwide rights to develop and commercialize alfimeprase and, for the indications we are currently pursuing, rNAPc2, and we share worldwide commercialization rights to ARC183 with Archemix.

In addition to our clinical and development stage drug candidates, we have an on-going discovery effort that is focused on therapeutic secreted proteins and antibody targets. Our secreted protein program includes our collaboration with the pharmaceutical division of Kirin Brewery Company, Ltd. and our internal discovery program. Our antibody program is focused on screening our proprietary gene sequence collection to identify proteins located on the surface of tumor cells that could be targeted by therapeutic monoclonal antibodies. We recently initiated pre-clinical studies on our first internally-discovered drug candidate, NU206. We expect to leverage discoveries in our research programs to extend and expand our drug pipeline and to create revenue-generating licensing and partnering arrangements.

S-1

Table of Contents

OUR LEAD DRUG CANDIDATES

ALFIMEPRASE

Alfimeprase, our lead development candidate, recently completed Phase 2 clinical trials in two distinct indications, acute PAO and catheter occlusion. Alfimeprase is a thrombolytic agent, or blood clot dissolver, with a novel mechanism of action. It is a modified and recombinant version of fibrolase, a naturally occurring enzyme that directly degrades fibrin, the protein that provides the structural scaffold of blood clots. Thrombolytics currently on the market such as urokinase (Abbokinase) or alteplase (Activase), are plasminogen activators that work by activating plasminogen to form plasmin which, in turn, degrades fibrin. In contrast, alfimeprase directly degrades fibrin, creating the potential for more rapid clot dissolution or lysis. Alfimeprase is locally delivered at the site of the blood clot and is inactivated quickly by a naturally occurring protein in the bloodstream. We believe this clearance mechanism limits the amount of drug in systemic circulation and implies that patients may experience fewer associated side effects. Phase 2 clinical data suggest that alfimeprase has the potential to rapidly lyse clots while also reducing the bleeding complications resulting from currently available agents.

Alfimeprase was identified through a research program at Amgen Inc. In January 2002 we entered into a 50/50 cost/profit sharing arrangement with Amgen for the development and commercialization of alfimeprase. In October 2004, Amgen exercised its rights pursuant to the terms of this collaboration agreement to terminate its collaboration with us and enter instead into an exclusive license whereby we are granted the worldwide rights to develop and commercialize alfimeprase in exchange for the payment to Amgen of previously negotiated milestone payments and royalties. Under the terms of our license agreement with Amgen, Amgen will transfer the technology necessary for the manufacture of alfimeprase to us or to a manufacturer acceptable to Amgen. Amgen is required to continue to supply alfimeprase to us during the transition period. On January 21, 2005, we entered into an Interim Agreement with Avecia Limited for the manufacture of alfimeprase, and we are currently in negotiations with Avecia for a definitive agreement. In connection with the termination of the collaboration agreement with Amgen, we also entered into an opt-out, termination, settlement and release agreement with Amgen in October 2004, whereby we made a payment of $8.5 million to Amgen, of which $8.3 million was related to the remaining reimbursement of its manufacturing costs incurred under the collaboration agreement.

Alfimeprase in Acute Peripheral Arterial Occlusion (PAO)

Our lead medical indication for alfimeprase is acute PAO. Acute PAO is a significant cause of morbidity in the United States with over 100,000 cases reported annually. Acute PAO occurs when arterial blood flow is blocked to a distant part of the body, usually the leg, by a blood clot. Traditionally, bypass surgery and angioplasty have been used to treat acute PAO. However, thrombolytic agents such as urokinase (Abbokinase) or alteplase (Activase) have been increasingly used as a less-invasive alternative, even though they have not received regulatory approval to treat acute PAO. Studies have shown that patients receiving current thrombolytic therapies experience intracerebral hemorrhage at rates of between one to two percent. We believe alfimeprase has the potential to be a more effective agent than existing agents for use in treating acute PAO by reducing the treatment time and potential bleeding side effects.

We completed our Phase 2 alfimeprase trial in patients with acute PAO in the second quarter of 2004. This trial was a multi-center, open label, dose-escalation study to evaluate the safety and activity of alfimeprase, and involved 113 patients across centers in the United States, Western Europe, Hungary, Russia and South Africa. The Phase 2 results indicate that alfimeprase has the potential to offer significant advances in the rapid resolution of a clot while minimizing potentially fatal side effects such as hemorrhagic stroke and other bleeding complications. In analysis of the Phase 2 results, alfimeprase showed potential to break up blood clots within four hours of initiation of dosing with rates of up to 76 percent, and partial or complete clot lysis and restoration of arterial flow with rates of up to 60 percent. Up to 69 percent of study patients were able to avoid open vascular surgical intervention in

S-2

Table of Contents

the 30 days following treatment with alfimeprase. Among the 113 patients enrolled, there were no intracerebral hemorrhages or deaths at 30 days. There were 7 major bleeding events reported.

Of these, only one was categorized by the investigator as possibly related to alfimeprase. Incidents of transient hypotension were also reported and were dose related.

We expect to initiate a multi-center, multi-national, randomized, double-blind, placebo-controlled Phase 3 program to determine the efficacy and safety of alfimeprase for the treatment of patients with acute PAO in the first half of 2005. This Phase 3 program, also known as NAPA-2, or Novel Arterial Perfusion with Alfimprase-2, will be led by Dr. Kenneth Ouriel, chairman of the division of surgery at the Cleveland Clinic and Dr. Gunnar Tepe, associate professor of radiology in the department of diagnostic radiology at the University of Tubingen, Germany. This program is expected to consist of two overlapping trials that will include a total of approximately 700 patients, who will be randomized to receive either 0.3 mg/kg of alfimeprase or placebo. The primary endpoint will be avoidance of open vascular surgery within 30 days. Secondary endpoints will include restoration of arterial blood flow and increase in ankle brachial index, which is a measure of ankle blood pressure. We have obtained orphan drug status for alfimeprase in the United States for the treatment of acute PAO, which may provide us with seven years of market exclusivity in the United States.

Alfimeprase in catheter occlusion

Our second medical indication for alfimeprase is catheter occlusion. Catheter occlusion is the obstruction of blood flow through a central venous catheter by a blood clot. It is estimated that about five million catheters are implanted in patients each year in the United States, and approximately 25% become occluded. Current treatment for catheter occlusion includes invasive surgery to remove and replace the catheter, or treatment with alteplase (Cathflo Activase). Based on clinical trial evidence of alfimeprase’s activity, we believe alfimeprase has the potential to restore flow to these occluded catheters more rapidly than Cathflo Activase.

In the third quarter of 2004 we announced that we had closed patient enrollment in a Phase 2 multi-center, double-blind, randomized study in patients with occluded central venous catheters comparing three doses (0.3 mg, 1.0 mg and 3.0 mg) of alfimeprase against the approved dose of Cathflo Activase (2.0 mg). We treated 55 patients in this U.S. trial. The alfimeprase 3.0 mg dose produced cumulative flow rates of 50% at 15 minutes after the first dose, 60% at 120 minutes after the first dose, and 80% at 120 minutes after the second dose. This is compared to CathfloActivase (2.0 mg) which produced flow rates of 0% at 15 minutes after the first dose, 46% at 120 minutes after the first dose, and 62% at 120 minutes after the second dose. No major hemorrhagic events were reported in any treated patients and only one patient had a catheter-related infection. Results from this Phase 2 study support further evaluation of alfimeprase in fixed doses ranging from 1.0 mg to 3.0 mg for the treatment of occluded catheters. We expect to initiate a Phase 3 pivotal trial of alfimeprase in catheter occlusion in the second half of 2005.

rNAPc2

Our second drug candidate, rNAPc2, is a recombinant version of a naturally occurring protein that has anticoagulant properties. Specifically, rNAPc2 has been shown to block the factor VIIa/tissue factor protease complex, which is responsible for the initiation of the process leading to blood clot formation. Compared to other commercially available anticoagulants, which all exert their effects at later stages of the blood coagulation cascade, rNAPc2 is designed to block the first step in the clotting cascade. By blocking the coagulation cascade before amplification of the coagulation process, rNAPc2 could prove to be more effective in treating patients with conditions such as acute coronary syndrome or as a prophylactic against clot formation in conditions such as deep venous thrombosis.

ACS occurs when an atherosclerotic plaque ruptures in a coronary artery which triggers the coagulation cascade and results in the formation of a blood clot. The clot blocks the flow of blood to the heart

S-3

Table of Contents

muscle, depriving it of oxygen and causing chest pain and, if severe, permanent heart muscle death. In the United States, ACS accounts for approximately 1.4 million hospital admissions annually. Patients with ACS are traditionally given aspirin and heparin, among other agents, to stabilize their medical condition. Recent guidelines also recommend the addition of the antiplatelet agent clopidogrel (Plavix) to the standard of care. However, based upon the significant number of patients with ACS who continue to experience poor outcomes such as recurrent angina, myocardial infarction or death, we believe there is a clear need for better antithrombotic therapy.

rNAPc2, given alone or with standard therapy, may reduce the risk of subsequent heart attack or death in patients suffering from ACS. Unlike aspirin and heparin, or current antithrombotic agents, which all exert their effects at later stages of the blood coagulation cascade, rNAPc2 blocks the first step in the clotting cascade. A medical regimen that includes rNAPc2 could, therefore, enable a multi-pronged attack at several points along the blood coagulation process. Alternatively, by stopping coagulation at the outset, rNAPc2 could also prove effective as a stand-alone therapy.

We licensed the worldwide rights for all indications of rNAPc2 and all of the rNAPc molecules owned by Dendreon Corporation in February 2004. The United States government may claim a non-exclusive right to use rNAPc2 with respect to the treatment of hemorrhagic fever. We don’t currently contemplate development of rNAPc2 to treat hemorrhagic fever. To date, rNAPc2 has been shown to be well-tolerated in over 500 patients and healthy volunteers in several Phase 1 and 2 studies.

In May of 2004 we reinitiated a Phase 2a double-blind, placebo controlled clinical trial to determine a safe and effective dose of rNAPc2 in moderate to high-risk patients with ACS. The study is being conducted in three parts, each of which is investigating rNAPc2 in combination with current anticoagulant and antiplatelet therapies. Currently, the study is being conducted with the TIMI Study Group led by Dr. Eugene Braunwald of Brigham and Women’s Hospital and Harvard Medical School. We plan to complete patient enrollment of the Phase 2a study in the first half of 2005.

ARC183

Our third drug candidate, ARC183, is a DNA aptamer, a single-stranded nucleic acid that binds to thrombin with high affinity and specificity. The key advantage of ARC183 compared to other thrombin inhibitors is its rapid onset of action and short half-life, giving it the potential to be highly effective for medical procedures that require rapid reversal of anticoagulation shortly after the procedure is completed.

In January of 2004 we announced a collaboration agreement with Archemix, a privately held biotechnology company, located in Cambridge, Massachusetts, for the development and commercialization of ARC183. Our lead indication for ARC183 is as a thrombin inhibitor for use in CABG surgery.

According to the American Heart Association, more than 500,000 CABG procedures are performed in the United States annually. Currently, heparin is used to limit blood clotting in this indication, but it is difficult to dose and can cause side effects such as bleeding and heparin-induced thrombocytopenia, or HIT. Moreover, the effect of heparin must be reversed with the use of an antidote called protamine. Protamine is not approved by the FDA for reversal of heparin in CABG surgery and is associated with significant complications including hypotension, platelet dysfunction, complement activation and thrombus formation. We believe that there is a significant unmet medical need for a safe, fast-acting anticoagulant for use in CABG surgery that is easier to administer, does not require a reversal agent and limits adverse side effects such as bleeding and HIT.

S-4

Table of Contents

ARC183 has shown potential in pre-clinical studies to be equally effective, with fewer side effects, than heparin and protamine in combination. Due to its very short half-life, we believe ARC183 has the potential for more predictable dosing as well as reduced incidence of bleeding side effects compared to heparin.

In August 2004 we and our partner, Archemix, initiated a Phase 1 clinical program for ARC183 for use in CABG surgery. These studies are evaluating the safety, tolerability, anticoagulation activity and titratability of ARC183. We expect to complete enrollment of the Phase 1 clinical program of ARC183 in the first half of 2005.

RESEARCH AND DEVELOPMENT PROGRAMS

In addition to our clinical and development stage drug candidates, we have an ongoing discovery program focused on the identification of novel human genes that encode proteins with therapeutic potential. Over the long-term, we intend to develop additional product opportunities from our ongoing discovery efforts focused on secreted proteins and antibody targets.

In the second half of 2004, we initiated pre-clinical studies for our first internally-generated drug candidate, NU206. In addition to the development of internal therapeutic candidates, we intend to leverage these discoveries to create revenue-generating licensing and partnering arrangements.

The secreted protein program includes our collaboration with Kirin and our internal discovery program. We have already advanced several secreted protein candidates to more extensive studies to better define their therapeutic utility based upon early findings in initial mouse models. Within our internal secreted protein discovery program, we have developed a fast and efficient method of expressing human secreted proteins in mice. This program could significantly bolster our ability to identify which secreted proteins within our patent estate have the greatest potential for therapeutic use.

The antibody program is focused on screening our proprietary gene sequence collection to identify proteins located on the surface of tumor cells that could be targeted by therapeutic monoclonal antibodies.

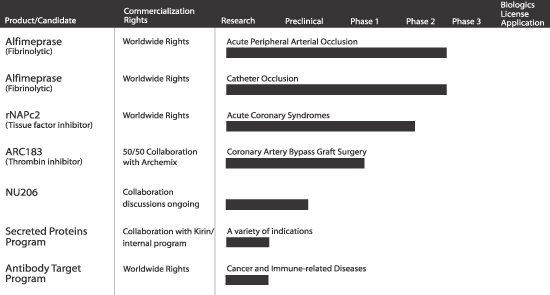

PRODUCT PIPELINE

The following table summarizes key information about our current product pipeline:

S-5

Table of Contents

OUR STRATEGY

We are focused on building a successful biopharmaceutical business and committed to creating a valuable product-focused company that leverages our drug discovery and development expertise. Key elements of our strategy are to:

Successfully develop and commercialize our lead drug candidate, alfimeprase

We are seeking to successfully develop and commercialize our lead drug candidate, alfimeprase, for the treatment of acute PAO and catheter occlusion. We recently completed Phase 2 clinical trials in these two indications, and we expect to initiate pivotal, Phase 3 trials in both indications in 2005. We have acquired worldwide, exclusive rights to this compound and are currently exploring potential partnering opportunities that would enable us to participate in its commercialization, particularly in the United States.

Leverage our expertise in cardiovascular disease to advance our clinical development program

We are primarily focused on the development of acute, hospital-based, cardiovascular drug candidates. We believe this portfolio leverages our expertise in cardiovascular drug development, provides synergy with alfimeprase during both development and commercialization and enables us to pursue a more rapid path toward drug development.

Build a diversified pipeline of product candidates

We are pursuing several drug development candidates in various stages of clinical and pre-clinical development. We believe this strategy reduces our exposure to the impact of any single product failure and increases our flexibility to eliminate programs we deem less promising. By broadening our product portfolio, we intend to increase the probability of clinical and commercial success. In addition, we focus on molecules that we believe have a greater chance of success due to the predictability of pre-clinical models used in their development.

Opportunistically seek to license or acquire complementary products and technologies

We intend to supplement our internal drug discovery efforts through the acquisition of products and technologies that complement our development strategy. We continue to identify, evaluate and pursue the acquisition or licensing of strategically valuable product opportunities.

CORPORATE INFORMATION

We were incorporated as “Hyseq, Inc.” in Illinois in 1992 and reincorporated in Nevada in 1993. On January 31, 2003, we merged with Variagenics, Inc., a publicly traded Delaware corporation based in Massachusetts, and, in connection with the merger, changed our name to “Nuvelo, Inc.” On March 25, 2004, we reincorporated from Nevada to the State of Delaware. Our principal executive offices are located at 675 Almanor Avenue, Sunnyvale, California 94085 and our telephone number is (408) 215-4000. Our World Wide Web address is http://www.nuvelo.com. We have not incorporated by reference into this prospectus supplement or the accompanying prospectus the information contained on our website and you should not consider it to be part of this prospectus supplement or the accompanying prospectus.

S-6

Table of Contents

The offering

Common stock we are offering | 7,000,000 shares | |

Common stock to be outstanding after this offering | 39,228,732 shares | |

Use of proceeds | We estimate the net proceeds to us from this offering will be approximately $59.9 million, after payment of underwriting discounts and commissions and estimated expenses of this offering, or approximately $68.9 million if the underwriters exercise their over-allotment option in full. We intend to use the net proceeds to us from this offering for general corporate purposes, including capital expenditures, working capital needs, current and future clinical trials of our lead drug candidate, alfimeprase, as well as other research and drug development activities. See “Use of proceeds.” | |

Nasdaq National Market Symbol | NUVO | |

Risk factors | See “Risk factors” beginning on page S-9 for a discussion of factors you should carefully consider before deciding to invest in shares of our common stock. | |

The number of shares of our common stock to be outstanding immediately after the closing of this offering is based on 32,228,732 shares of our common stock outstanding as of December 31, 2004, but excludes:

| Ø | an aggregate of 3,871,594 shares of our common stock issuable upon exercise of stock options outstanding as of December 31, 2004, granted under our 2004 Equity Incentive Plan, 2002 Equity Incentive Plan, 1995 Stock Option Plan, Non-Employee Director Stock Option Plan, Scientific Advisory Board/Consultants Stock Option Plan and the Variagenics, Inc. Amended 1997 Employee, Director and Consultant Stock Option Plan, and as of December 31, 2004, an aggregate of 895,075 shares of common stock issuable upon the exercise of stock options granted outside of any of our stock option plans, with exercise prices of all outstanding options ranging from $0.03 to $304.31 per share and a weighted average exercise price of $18.77 per share; |

| Ø | an aggregate of 3,760,298 shares of common stock reserved for issuance pursuant to future option grants under the 2004 Equity Incentive Plan, based on options outstanding as of December 31, 2004; |

| Ø | an aggregate of 56,736 shares of common stock issuable under our Employee Stock Purchase Plan as of December 31, 2004; |

| Ø | an aggregate of 1,516,792 shares of our common stock issuable upon the exercise of warrants, with exercise prices ranging from $4.05 to $25.53 per share, and a weighted average exercise price of $20.88 per share, outstanding as of December 31, 2004; and |

| Ø | 542,235 shares of common stock issuable at our option to repay our note held by Affymetrix and 907,113 shares of common stock issuable upon mutual agreement to convert the promissory note under the Rathmann line of credit, both as of December 31, 2004. |

Unless otherwise stated, all information contained in this prospectus supplement assumes that the underwriters do not exercise their over-allotment option to purchase up to an additional 1,050,000 shares of common stock and all currency amounts are in United States dollars.

S-7

Table of Contents

Summary consolidated financial data

The tables below present summary consolidated statement of operations and balance sheet data. The summary financial data for the years ended December 31, 2001 through December 31, 2003 are derived from our audited consolidated financial statements for those periods. The summary data for the nine month period ended September 30, 2004, is derived from our unaudited condensed consolidated financial statements for that period. This information is only a summary and should be read in conjunction with our historical consolidated financial statements and related notes contained in our annual reports, quarterly reports and recent current reports on file with the SEC incorporated by reference in this prospectus supplement and the accompanying prospectus. For more details on how you can obtain our SEC filings, you should read the section of this prospectus supplement entitled “Incorporation by reference” beginning on page S-43. Our consolidated statement of operations data includes the results of operations of Variagenics, Inc. from February 1, 2003. The as adjusted consolidated balance sheet data gives effect to the sale by us of 7,000,000 shares of our common stock in this offering, assuming a public offering price of $9.19 per share and after deducting the underwriting discounts and commissions and estimated offering expenses payable by us.

| Year ended December 31, | Nine months ended September 30, | |||||||||||||||||||

| Consolidated statement of operations data: | 2001 | 2002 | 2003 | 2003 | 2004 | |||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||

Revenue | $ | 24,590 | $ | 26,433 | $ | 2,290 | $ | 1,940 | $ | 2,219 | ||||||||||

Research and development expenses | 46,506 | 50,157 | 33,084 | 26,421 | 34,845 | |||||||||||||||

General and administrative expenses | 13,452 | 18,108 | 17,223 | 14,384 | 6,667 | |||||||||||||||

Total operating expenses | 60,783 | 70,368 | 51,532 | 42,017 | 41,487 | |||||||||||||||

Interest income (expense), net | (572 | ) | (1,155 | ) | (945 | ) | (720 | ) | (239 | ) | ||||||||||

Net loss | (36,472 | ) | (44,978 | ) | (50,187 | ) | (40,797 | ) | (39,507 | ) | ||||||||||

Net loss per common share, basic and diluted | $ | (6.78 | ) | $ | (6.24 | ) | $ | (2.37 | ) | $ | (2.08 | ) | $ | (1.30 | ) | |||||

Shares used in computation of basic and diluted net loss per share | 5,386 | 7,220 | 21,054 | 19,656 | 30,427 | |||||||||||||||

| September 30, 2004 | ||||||||

| Consolidated balance sheet data: | Actual | As adjusted | ||||||

| (unaudited) | ||||||||

Cash, cash equivalents and short-term investments | $ | 70,671 | $ | 130,521 | ||||

Working capital | 53,663 | 113,513 | ||||||

Total assets | 100,339 | 160,189 | ||||||

Current portion of capital lease, note and line of credit obligations | 6,698 | 6,698 | ||||||

Non-current portion of capital lease, note and line of credit obligations | 9,886 | 9,886 | ||||||

Accumulated deficit | (243,066 | ) | (243,066 | ) | ||||

Total stockholders’ equity | 58,516 | 118,366 | ||||||

S-8

Table of Contents

Investing in our common stock involves a high degree of risk. You should consider carefully the risk factors described below, in the accompanying prospectus and all other information contained in or incorporated by reference in this prospectus supplement and the accompanying prospectus before deciding to invest in our common stock. If any of the following risks actually occur, they may materially harm our business, financial condition, operating results and cash flow. As a result, the market price of our common stock could decline, and you could lose all or part of your investment. Additional risks and uncertainties that are not yet identified or that we think are immaterial may also materially harm our business, operating results and financial condition and could result in a complete loss of your investment.

RISKS RELATED TO OUR BUSINESS

Development of our products will take years, and our products require regulatory approval before they can be sold.

We have three clinical stage drug candidates. All of our other potential products currently are in research or pre-clinical development and revenues from the sales of any products resulting from this research and development may not occur for several years, if at all. We cannot be certain that any of our products will be demonstrated to be safe and effective or that we will obtain regulatory approvals. We cannot predict whether we will be able to develop and commercialize any of our drug candidates successfully. If we are unable to obtain regulatory approval and successfully commercialize our potential products, our business, results of operations and financial condition will be affected in a materially adverse manner.

We do not yet have products in the commercial markets. We must demonstrate that our product candidates satisfy rigorous standards of safety and efficacy before the FDA and comparable agencies in foreign markets. We cannot apply for regulatory approval of our potential products until we have performed significant additional research and development and testing. We cannot be certain that we, or our strategic partners, will be permitted to undertake clinical testing of our potential products or continue clinical testing of alfimeprase, rNAPc2, or ARC183. If we are successful in initiating clinical trials, we may experience delays in conducting them. Our clinical trials may not demonstrate the safety and efficacy of our potential products, and we may encounter unacceptable side effects or other problems in the clinical trials that may prevent or limit the use of our products. Should this occur, we may have to delay or discontinue development of the potential product that causes the problem. After a successful clinical trial, we cannot market products in the United States until we receive regulatory approval. Even if we are able to gain regulatory approval of our products after successful clinical trials and then commercialize and sell those products, we may be unable to manufacture enough products to maintain our business, which could have a negative impact on our financial condition.

Our clinical trials may not yield results that will enable us to obtain regulatory approval for our products.

We will only receive regulatory approval for a drug candidate if we can demonstrate in carefully designed and conducted clinical trials that the drug candidate is safe and effective. We do not know whether our pending or any future clinical trials will demonstrate sufficient safety and efficacy to obtain the requisite regulatory approvals or will result in marketable products. Clinical trials are lengthy, complex, and expensive processes with uncertain results. It will take us several years to complete our testing, and failure can occur at any stage of testing. Results attained in pre-clinical testing and early clinical studies, or trials, may not be predictive of results that are obtained in later studies. We may suffer significant setbacks in advanced clinical trials, even after promising results in earlier studies. Based on results at any stage of clinical trials, we may decide to repeat or redesign a trial or discontinue development of one or more of our drug candidates. If we fail to adequately demonstrate the safety and efficacy of our products

S-9

Table of Contents

Risk factors

under development, we will not be able to obtain the required regulatory approvals to commercialize our drug candidates, and our business, results of operations and financial condition will be materially adversely affected.

Clinical trials are subject to continuing oversight by governmental regulatory authorities and institutional review boards, or IRBs, and must meet the requirements of these authorities in the United States, including those for informed consent and good clinical practices. We may not be able to comply with these requirements and the FDA, an IRB or we may suspend or terminate clinical trials at any time.

Administering our drug candidates to humans may produce undesirable side effects. These side effects could interrupt, delay or halt clinical trials of our drug candidates and could result in the FDA or other regulatory authorities denying approval of our drug candidates for any or all targeted indications.

We rely on third parties, including contract research organizations and outside consultants, to assist us in managing and monitoring clinical trials. Our reliance on these third parties may result in delays in completing, or in failing to complete, these trials if they fail to perform with the speed and competency we expect.

If clinical trials for a drug candidate are unsuccessful, we will be unable to commercialize the drug candidate. If one or more of our clinical trials are delayed, we will be unable to meet our anticipated development or commercialization timelines. Either circumstance could cause the price of our shares to decline.

If we encounter difficulties enrolling patients in our clinical trials, our trials could be delayed or otherwise adversely affected.

Clinical trials for our drug candidates require that we identify and enroll a large number of patients with the disorder under investigation. We may not be able to enroll a sufficient number of patients to complete our clinical trials in a timely manner.

Patient enrollment is affected by factors including:

| Ø | design of the protocol; |

| Ø | the size of the patient population; |

| Ø | eligibility criteria for the study in question; |

| Ø | perceived risks and benefits of the drug under study; |

| Ø | availability of competing therapies; |

| Ø | efforts to facilitate timely enrollment in clinical trials; |

| Ø | patient referral practices of physicians; and |

| Ø | availability of clinical trial sites. |

If we have difficulty enrolling a sufficient number of patients to conduct our clinical trials as planned, we may need to delay or terminate ongoing or planned clinical trials, either of which would have a negative effect on our business. Delays in enrolling patients in our clinical trials would also adversely affect our ability to generate product and royalty revenues and could impose significant additional costs on us or our collaborators. In addition, we have never conducted Phase 3 clinical trials, and we may be unable to successfully conduct multiple Phase 3 clinical trials involving the numbers of clinical sites and the numbers of patients planned for our alfimeprase Phase 3 clinical trials.

S-10

Table of Contents

Risk factors

We face heavy government regulation, and FDA regulatory approval of our products is uncertain.

The research, testing, manufacturing and marketing of drug products such as those proposed to be developed by us or our collaboration partners are subject to extensive regulation by federal, state and local governmental authorities, including the FDA, and comparable agencies in other countries. To obtain regulatory approval of a drug product, we or our collaboration partners must demonstrate to the satisfaction of the applicable regulatory agency, among other things, that the product is safe and effective for its intended uses. In addition, we must show that the manufacturing facilities used to produce the products are in compliance with current Good Manufacturing Practices, or cGMP, requirements.

The process of obtaining FDA and other required regulatory approvals and clearances typically takes several years and will require us to expend substantial capital and resources. Despite the time and expense expended, regulatory approval is never guaranteed. The number of pre-clinical and clinical tests that will be required for FDA approval varies depending on the drug candidate, the disease or condition that the drug candidate is in development for, and the regulations applicable to that particular drug candidate. The FDA or comparable international regulatory authorities can delay, limit or deny approval of a drug candidate for many reasons, including:

| Ø | a drug candidate may not be safe or effective; |

| Ø | FDA or comparable international regulatory authorities may interpret data from pre-clinical and clinical testing in different ways than we and our collaboration partners interpret them; |

| Ø | the FDA or comparable international regulatory authorities may not approve our manufacturing processes or facilities or the processes or facilities of our collaboration partners; or |

| Ø | the FDA or comparable international regulatory officials may change their approval polices or adopt new regulations. |

Moreover, if and when our products do obtain such approval or clearances, the marketing, distribution and manufacture of such products would remain subject to extensive ongoing regulatory requirements. Failure to comply with applicable regulatory requirements could result in:

| Ø | warning letters; |

| Ø | fines; |

| Ø | civil penalties; |

| Ø | injunctions; |

| Ø | recall or seizure of products; |

| Ø | total or partial suspension of production; |

| Ø | refusal of the government to grant approvals; or |

| Ø | withdrawal of approvals and criminal prosecution. |

Any delay or failure by us or our collaboration partners to obtain regulatory approvals for our product candidates:

| Ø | would adversely affect our ability to generate product and royalty revenues; |

| Ø | could impose significant additional costs on us or our collaboration partners; |

| Ø | could diminish competitive advantages that we may attain; |

| Ø | would adversely affect the marketing of our products; and |

| Ø | could cause the prices of our shares to decline. |

S-11

Table of Contents

Risk factors

Even if we do receive regulatory approval for our drug candidates, the FDA or international regulatory authorities may impose limitations on the indicated uses for which our products may be marketed, subsequently withdraw approval or take other actions against us or our products that are adverse to our business. The FDA and comparable international regulatory authorities generally approve products for particular indications. An approval for a limited indication reduces the size of the potential market for the product. Product approvals, once granted, may be withdrawn if problems occur after initial marketing.

We also are subject to numerous federal, state and local laws, regulations and recommendations relating to safe working conditions, laboratory and manufacturing practices, the experimental use of animals, the environment and the use and disposal of hazardous substances used in connection with our discovery, research and development work, including radioactive compounds and infectious disease agents. In addition, we cannot predict the extent of government regulations or the impact of new governmental regulations that might significantly harm the discovery, development, production and marketing of our products. We may be required to incur significant costs to comply with current or future laws or regulations, and we may be adversely affected by the cost of such compliance.

If we fail to maintain existing third-party arrangements and collaborative agreements or fail to develop new collaborative arrangements, our business will be harmed.

The success of our business is dependent, in significant part, upon our ability to enter into multiple collaboration agreements and to manage effectively the numerous issues that arise from such arrangements. Management of our relationships with these third parties has required and will require:

| Ø | a significant amount of our management team’s time and effort; |

| Ø | effective allocation of our and third-party resources to multiple projects; |

| Ø | agreements with third parties as to ownership of proprietary rights and development plans, including clinical trials or regulatory approval strategy; and |

| Ø | an ability to obtain and retain management, scientific and other personnel. |

In October 2004, Amgen Inc., exercised its rights under the collaboration agreement entered into by us and Amgen in January 2002, to convert the relationship from a collaboration into a licensing arrangement in accordance with terms agreed upon by us and Amgen. In November 2004, we and Amgen entered into a license agreement granting us worldwide rights to develop and commercialize alfimeprase in exchange for payment of previously negotiated development milestones and royalties. Under the terms of the license agreement, Amgen will transfer the technology necessary for the manufacture of alfimeprase to us or a manufacturer acceptable to Amgen. Amgen is required to continue to supply alfimeprase to us during the transition period. On January 21, 2005, we entered into an Interim Agreement with Avecia Limited for the manufacture of alfimeprase. Either party may terminate this agreement at any time. While we currently believe we have enough supplies of alfimeprase for phase 3 trials for the treatment of PAO and catheter occlusion, additional supplies may be necessary, and we do not yet have a definitive agreement for the manufacture of additional supplies of alfimeprase. We cannot be certain that we will be able to reach a definitive agreement with Avecia or any other manufacturer, upon commercially reasonable terms for alfimeprase’s manufacture or that Avecia or any other manufacturer will be able to produce alfimeprase in the quantities and with the quality we need for our clinical trials. If we are unable to find a manufacturer, or manufacturers, to produce alfimeprase in the quantities and with the quality we need, at a commercially reasonable price, we may incur significant, additional expenses and our efforts to complete our clinical trials and obtain FDA approval to market alfimeprase could be significantly delayed.

S-12

Table of Contents

Risk factors

In our collaboration with Archemix for the development and commercialization of ARC183, we have been sharing all research and developments costs equally since the third quarter of 2004 when we completed funding of the first $4.0 million in research and development costs, and will share any revenue from this collaboration. We will make milestone payments of $10.0 million upon commencement of a Phase 2 trial and $1.0 million upon the designation of any backup compound selected by both Nuvelo and Archemix for pre-clinical studies. We are obligated to make the Phase 2 milestone payment to Archemix even if Archemix terminates the collaboration or Archemix does not meet its obligations under the agreement and we terminate the collaboration for Archemix’s default. We have the option to lead commercialization in which both parties may participate if we establish commercialization capabilities; however, if we do not establish such commercialization capabilities, Archemix, or a third party selected by the parties’ joint steering committee, will have the option to lead commercialization. We do not currently have established commercialization experience or an internal trained sales force and we may not successfully develop such capabilities without incurring additional expenses. If we cannot develop an internal sales force, we will not be able to lead commercialization activities on our own. If we do not lead the commercialization efforts, we are dependent on Archemix or a third party’s experience in commercialization and ability to perform and we may also incur additional expenses for a third party to undertake commercialization efforts.

We are subject to a number of additional risks associated with our collaboration with Archemix for ARC183, including the right of Archemix to terminate its collaboration with us on limited notice and for reasons outside our control, and to the loss of significant rights if the collaboration is terminated because we fail to meet our obligations under it. In particular, if Archemix terminates the collaboration for our breach, all of our rights to ARC183 and other collaboration products will become the property of Archemix, and we may not practice certain activities related to anti-thrombin compounds in the field of modifying blood-clotting times in therapeutic applications through the use of aptamers such as ARC183, including research and development, manufacturing and commercialization activities.

Pursuant to our licensing arrangement with Dendreon relating to rNAPc2, we are obligated to make milestone payments ranging from $2.0 million to $6.0 million each upon the first dosing of the first patient in a Phase 3 clinical trial, upon submission of a new drug application, or NDA, and upon commercialization for the first and second indications. If all milestones are achieved, total milestone payments to Dendreon can reach as much as $23.5 million.

Our efforts to manage simultaneously a number of collaboration arrangements may not be successful, and our failure to manage effectively such collaborations would significantly harm our business, financial condition and results of operations.

Due to these factors and other possible disagreements with Amgen, Archemix, Dendreon and Kirin, we may be delayed or prevented from developing or commercializing alfimeprase, ARC183 and rNAPc2 or our pre-clinical product candidates or we may become involved in litigation or arbitration, which would be time-consuming or expensive and could have a material adverse effect on our stock price.

In addition to our existing collaborations, we will focus on effecting new collaborative arrangements where we would share costs of identifying, developing and marketing drug candidates. We cannot assure you that we will be able to negotiate new collaboration arrangements of this type on acceptable terms, or at all.

We are currently dependent on third parties for a variety of functions and may enter into future collaborations for the manufacture and sale of our products. Our arrangements with these third parties may not provide us with the benefits we expect.

We currently rely upon third parties to perform administrative functions and functions related to the research, development, pre-clinical testing and clinical trials of our drug candidates. In addition, because

S-13

Table of Contents

Risk factors

we do not have the resources, facilities or experience to manufacture our drug candidates on our own, we currently rely, and will continue to rely, on third parties to manufacture our drug candidates for clinical trials, and, if our products are approved, in quantities for commercial sales. We currently rely on a number of sole-source service providers and suppliers and do not have long-term supply agreements with our third-party manufacturers.

We do not currently have significant manufacturing facilities for clinical or commercial production of our drug candidates and depend on contract research and manufacturing organizations. We may not be able to finalize contractual arrangements, transfer technology or maintain relationships with such organizations in order to file an investigational new drug application, or IND, with the FDA, and proceed with clinical trials for any of our drug candidates. We currently rely on Amgen to manufacture our clinical drug product, alfimeprase. We have entered into an Interim Agreement with Avecia and are in the process of transitioning manufacture of alfimeprase from Amgen to Avecia, but do not yet have a definitive agreement with Avecia. If our efforts are unsuccessful, we may not have adequate supplies of alfimeprase to complete our clinical trials or to commercialize alfimeprase on our anticipated schedule.

We are dependent on third-party contract research organizations to conduct certain research, including good laboratory practices toxicology studies, in order to gather the data necessary to file INDs with the FDA for any of our drug candidates. Our drug candidates have never been manufactured on a commercial scale. Third-party manufacturers may not be able to manufacture these drug candidates at a cost or in quantities necessary to make them commercially viable. In addition, if and when any of our other drug candidates enter the clinical trial phase, we will initially depend on third-party contract manufacturers to produce the volume of current good manufacturing practices materials needed to complete such trials. We will need to enter into contractual relationships with these or other organizations in order to (1) complete the Good Laboratory Practices, or GLP, toxicology and other studies necessary to file an IND with the FDA, and (2) produce a sufficient volume of current cGMP grade material in order to conduct clinical trials of ARC183 and our other drug candidates. We cannot be certain that we will be able to do so on a timely basis or that we will be able to obtain sufficient quantities of material on commercially reasonable terms. In addition, the failure of any of these relationships with third-party contract organizations may delay our filing for an IND or impede our progress through the clinical trial phase. Any significant delay or interruption would have a material adverse effect on our ability to file an IND with the FDA and/or proceed with the clinical trial phase for any of our drug candidates.

Moreover, contract manufacturers that we may use must continually adhere to current cGMP regulations enforced by the FDA through a facilities inspection program. If one of our contract manufacturers fails to maintain compliance, the production of our product candidates could be interrupted, resulting in delays, additional costs and potentially lost revenues. In addition, if the facilities of such manufacturers do not pass a pre-approval plant inspection, the FDA will not grant pre-market approval of our products.

Our reliance on these relationships poses a number of risks, including:

| Ø | disagreements with third parties that could disrupt our operation or delay or terminate the research, development or manufacturing of drug candidates, or result in litigation or arbitration; |

| Ø | our inability to effectively control the resources devoted by our partners to our programs or products; |

| Ø | inadequate contractual protection or difficulty in enforcing the contracts if one of our partners fails to perform; |

| Ø | failure of these third parties to comply with regulatory requirements; |

| Ø | conflicts of interest between third parties’ work for us and their work for another entity, and the resulting loss of their services; |

S-14

Table of Contents

Risk factors

| Ø | failure to identify acceptable manufacturers or other suppliers or enter into favorable long-term agreements with them; |

| Ø | inability of third parties to manufacture our drug candidates in a cost-effective or timely manner or in quantities needed for clinical trials or commercial sales; |

| Ø | delays in, or failures to achieve, scale-up to commercial quantities, or changes to current raw material suppliers or product manufacturers (whether the change is attributable to us or the supplier or manufacturer), resulting in delayed clinical studies, regulatory submissions and commercialization of our drug candidates; and |

| Ø | lack of all necessary intellectual property rights to manufacture and sell our drug candidates. |

Given these risks, our current and future collaborative efforts with third parties may not be successful. If these efforts fail, we would be required to devote additional internal resources to the activities currently performed, or to be performed, by third parties, to seek alternative third-party collaborators, or to delay our product development or commercialization.

We may not achieve our projected development goals in the time frames we announce and expect.

We set goals for and make public statements regarding the timing of certain accomplishments, such as the commencement and completion of clinical trials, anticipated regulatory approval dates and time of product launch, which we sometimes refer to as milestones. The actual timing of these events can vary dramatically due to a number of factors such as delays or failures in our clinical trials, the uncertainties inherent in the regulatory approval process and delays in achieving manufacturing or marketing arrangements sufficient to commercialize our products. There can be no assurance that our clinical trials will be completed, that we will make regulatory submissions or receive regulatory approvals as planned or that we will be able to adhere to our current schedule for the launch of any of our products. If we fail to achieve one or more of these milestones as planned, our business will be materially adversely affected and the price of our shares could decline.

The success of our potential products in pre-clinical studies does not guarantee that these results will be replicated in humans.

Although our clinical development-stage drug candidates have shown results in pre-clinical studies, these results may not be replicated in our clinical trials with humans. Consequently, there is no assurance that the results in our pre-clinical studies are predictive of the results that we will see in our clinical trials with humans or that they are predictive of whether the resulting products will be safe and effective in humans.

We are dependent on key personnel and we must attract and retain qualified employees, collaborators and consultants.

The success of our business is highly dependent on the principal members of our scientific and management staff, including our senior management team. The loss of the services of any such individual might seriously harm our product development and commercialization efforts. In addition, we will require additional skilled personnel in areas such as clinical development. Retaining and training personnel with the requisite skills is challenging, and, if general economic conditions improve, is likely to become extremely competitive, particularly in Northern California where we are located.

Our success will depend on our ability to attract and retain qualified employees to help develop our potential products and execute our research and development strategy. We have programs in place to retain personnel, including programs to create a positive work environment and competitive compensation packages. Because competition for employees in our field is intense, however, we may be unable to retain our existing personnel or attract additional qualified employees. Our success also

S-15

Table of Contents

Risk factors

depends on the continued availability of outside scientific collaborators, including collaborators at research institutions, to perform research and develop processes to advance and augment our internal research efforts. Competition for collaborators is intense. We also rely on services provided by outside consultants. Attracting and retaining qualified outside consultants is competitive, and, generally, outside consultants can terminate their relationship with us at will. If we do not attract and retain qualified personnel, outside consultants and scientific collaborators, or if we experience turnover or difficulties recruiting new employees or outside consultants, our research and development programs could be delayed and we could experience difficulties in generating sufficient revenue to maintain our business.

In addition, we do not currently have a marketing and sales organization. As the potential commercialization of our products approaches, we intend to hire marketing and sales personnel to enable us to participate in the commercialization of our products in the United States. If we are unsuccessful in hiring and retaining sales and marketing personnel with appropriate qualifications and talent, our ability to generate product revenues would be adversely affected.

Because we have not yet commercialized any of our drug candidates, our ability to develop and subsequently commercialize products is unproven.

We have not yet commercialized any of our in-licensed therapeutic product candidates. Moreover, we have not developed any therapeutic products using proteins produced by the genes we have discovered in our internal research programs. Before we make any products available to the public from our internal research and development programs, we or our collaboration partners will need to conduct further research and development and complete laboratory testing and animal and human studies. We or our collaboration partners will need to obtain regulatory approval before releasing any drug products. We have spent, and expect to continue to spend, significant amounts of time and money in our internal research programs in determining the function of genes and the proteins they produce, using our own capabilities and those of our collaboration partners. Such a determination process constitutes the first step in developing commercial products from our internal research programs. We also have spent and will continue to spend significant amounts of time and money in developing processes for manufacturing of our recombinant proteins under pre-clinical development, yet we may not be able to produce sufficient proteins for pre-clinical studies. A commercially viable product may never be developed from our gene discoveries.

Our commercialization of products is subject to several risks, including but not limited to:

| Ø | the possibility that a product is toxic, ineffective or unreliable; |

| Ø | failure to obtain regulatory approval for the product; |

| Ø | difficulties in manufacturing the product on a large scale, or inability to market in an economically feasible manner; |

| Ø | competition from superior products; or |

| Ø | third-party patents that preclude us from marketing a product. |

Our internally developed drug development programs are currently in the research stage or in pre-clinical development. None of our potential therapeutic protein candidates from our own portfolio has advanced to Phase 1 clinical trials. Our programs may not move beyond their current stages of development. Even if our internal research does advance, we will need to engage in certain additional pre-clinical development efforts to determine whether a product is sufficiently safe and effective to enter clinical trials. We have little experience with these activities and may not be successful in developing or commercializing products.

S-16

Table of Contents

Risk factors

Under our Kirin collaboration arrangement, Kirin has primary responsibility for clinical development in its territory and we have primary responsibility in our territory. Under our collaboration with Archemix, Archemix leads development until Phase 2 clinical trials are reached, and thereafter, a joint steering committee will designate one party to lead development until commercialization. With respect to these arrangements, we run the risk that Kirin or Archemix may not pursue clinical development in a timely or effective manner.

Any regulatory approvals that we or our collaboration partners receive for our product candidates may be subject to limitations on the intended uses for which the product candidates may be marketed or contain requirements for potentially costly post-marketing follow-up studies. In addition, if the FDA approved of our or our collaboration partners’ product candidates, the labeling, packaging, adverse event reporting, storage, advertising, promotion and record-keeping for the products will be subject to extensive regulatory requirements.

We, our collaborators and our suppliers may also not be able to produce any products in commercial quantities at a reasonable cost or may not be able to successfully market such products. If we do not develop a commercially viable product, then we will suffer significant harm to our business, financial condition and operating results.

We lack marketing and commercialization experience for biopharmaceutical products and we may have to rely on third parties for these capabilities.

We currently have no sales, marketing or distribution capability. As the potential commercialization of our products approaches, we intend to hire marketing and sales personnel to enable us to participate in the commercialization of our products in the United States. If we are unsuccessful in hiring and retaining sales and marketing personnel with appropriate technical and sales expertise or in developing an adequate distribution capability to support them, our ability to generate product revenues would be adversely affected. To the extent we cannot or choose not to use internal resources for the marketing, sales or distribution of any potential products in the United States or elsewhere, we intend to rely on collaboration partners or licensees. We may not be able to establish or maintain such relationships. To the extent that we depend on collaboration partners or other third parties for marketing and distribution, any revenues we receive will depend upon their efforts. Such efforts may not be successful, and we will not be able to control the amount and timing of resources that collaboration partners or other third parties devote to our products.

Our products may not be accepted in the marketplace, and we may not be able to generate significant revenue, if any.

Even if they are approved for marketing, our products, if any, may never achieve market acceptance among physicians, patients and the medical community. Our products, if successfully developed, will compete with a number of traditional drugs and therapies manufactured and marketed by major pharmaceutical and other biotechnology companies. Our products will also compete with new products currently under development by such companies and others. The degree of market acceptance of any products developed by us, alone, or in conjunction with our collaboration partners, will depend on a number of factors, including:

| Ø | the establishment and demonstration of the clinical efficacy and safety of the products; |

| Ø | convenience and ease of administration; |

| Ø | cost-effectiveness; |

| Ø | our products’ potential advantages over alternative treatment methods; |

S-17

Table of Contents

Risk factors

| Ø | marketing, sales and distribution support of our products; and |

| Ø | reimbursement policies of government and third-party payers. |

Physicians, patients or the medical community in general may not accept and utilize any of the products that we alone, or in conjunction with our collaboration partners, develop. In practice, competitors may be more effective in marketing their drugs. The lack of such market acceptance would significantly harm our business, financial condition and results of operations.

We face intense competition.

The biopharmaceutical industry is intensely competitive and is accentuated by the rapid pace of technological development. We expect to face increased competition in the future as new companies enter our markets. Research and discoveries by others may result in breakthroughs that render our potential products obsolete even before they begin to generate any revenue. Our competitors include major pharmaceutical and biotechnology firms, many of which have substantially greater research and product development capabilities and financial, scientific, marketing and human resources than we have. Our lead product candidate alfimeprase, if approved, will face competition in the catheter occlusion indication from alteplase, an approved Genentech, Inc. product, and will potentially face competition in the peripheral arterial occlusion, or PAO, indication from product candidates being developed and/or marketed by Abbot Laboratories, Centocor, Inc. and Genentech.

Our competitors may obtain patents and regulatory approvals for their competing products more rapidly than we or our collaboration partners, or develop products that are more effective than those developed by us or our collaboration partners. Any potential products based on genes we identify ultimately will face competition from other companies developing gene-based products as well as from companies developing other forms of treatment for diseases which may be caused by, or related to, the genes we identify. Similarly, our products will face competition from other companies developing similar products as well as from companies developing other forms of treatment for the same conditions.

Many of the companies developing competing products have significantly greater financial resources than we have. Many such companies also have greater expertise than we or our collaboration partners have in discovery, research and development, manufacturing, pre-clinical and clinical testing, obtaining regulatory approvals and marketing. Other smaller companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies. These companies and institutions compete with us in recruiting and retaining qualified scientific and management personnel as well as in acquiring technologies complementary to our programs. We will face competition with respect to:

| Ø | product efficacy and safety; |

| Ø | the timing and scope of regulatory approvals; |

| Ø | availability of resources; |

| Ø | reimbursement coverage; and |

| Ø | price and patent position, including the potentially dominant patent positions of others. |

There can be no assurance that research and development by others will not render the products that we may develop obsolete or uneconomical, or result in treatments or cures superior to any therapy developed by us or that any therapy we develop will be preferred to any existing or newly developed alternative products.

S-18

Table of Contents

Risk factors

We face uncertainty with respect to coverage, pricing, third-party reimbursements and health care reform.

Our ability to collect significant royalties from our products may depend on our ability, and the ability of our collaboration partners or customers, to obtain adequate levels of coverage for our products and reimbursement from third-party payers such as:

| Ø | government health administration authorities; |

| Ø | private health insurers; |

| Ø | health maintenance organizations; |

| Ø | pharmacy benefit management companies; and |

| Ø | other health care related organizations. |

Third-party payers may deny coverage or offer inadequate levels of reimbursement if they determine that a prescribed product or device has not received appropriate clearances from the FDA or other government regulators, is not used in accordance with cost-effective treatment methods as determined by the third-party payer, or is experimental, unnecessary or inappropriate. If third-party payers deny coverage or offer inadequate levels of reimbursement, we may not be able to market our products effectively. We also face the risk that we will have to offer our products at prices lower than anticipated as a result of the current trend in the United States towards managed health care through health maintenance organizations. Currently, third-party payers are increasingly challenging the prices charged for medical products and services. Prices could be driven down by health maintenance organizations that control or significantly influence purchases of health care services and products. Existing U.S. laws, such as the Medicare Prescription Drug and Modernization Act of 2003, or future legislation to reform health care or reduce government insurance programs could also adversely affect prices of our approved products, if any. The cost containment measures that health care providers are instituting and the results of potential health care reforms may prevent us from maintaining prices for our products that are sufficient for us to realize profits and may otherwise significantly harm our business, financial condition and operating results. In addition, to the extent that our products are marketed outside of the United States, foreign government pricing controls and other regulations may prevent us from maintaining prices for our products that are sufficient for us to realize profits and may otherwise significantly harm our business, financial condition and operating results.

If we fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results or prevent fraud.

Effective internal controls are necessary for us to provide reliable financial reports and effectively prevent fraud. Any inability to provide reliable financial reports or prevent fraud could harm our business. We are in the process of evaluating our internal procedures to satisfy the requirements of the Sarbanes-Oxley Act of 2002, which require management and our auditors to evaluate and assess the effectiveness of our internal controls. We are continuing to evaluate and, where appropriate, enhance our policies, procedures and internal controls. If we fail to maintain the adequacy of our internal controls, as such standards are modified, supplemented or amended from time to time, we could be subject to regulatory scrutiny, civil or criminal penalties or shareholder litigation. In addition, failure to maintain adequate internal controls could result in financial statements that do not accurately reflect our financial condition. We might not be able to complete the work necessary to fully comply with the requirements of the Sarbanes-Oxley Act. Our auditors might not complete their review and assessment of our internal controls in a timely manner. Finally, our management and our auditors might not conclude that our internal controls are effective.

S-19

Table of Contents

Risk factors

We may merge with or acquire other companies and our failure to receive the anticipated benefits in these transactions could harm our business.

In January 2003, we merged with Variagenics, and we may merge with or acquire other companies in the future. The success of any merger or acquisition depends, in part, on our ability to realize the anticipated synergies, cost savings and growth opportunities from integrating the business of the merged or acquired company with our business. The integration of two independent companies is a complex, costly and time-consuming process. The difficulties of combining the operations of the companies and/or our subsidiary include, among others:

| Ø | consolidating research and development operations; |

| Ø | retaining key employees; |

| Ø | consolidating corporate and administrative infrastructures; |

| Ø | preserving the research and development and other important relationships of the companies; |

| Ø | integrating and managing the technology of two companies; |

| Ø | using the merged or acquired company’s liquid capital and other assets efficiently to develop the business of the combined company; |

| Ø | minimizing the diversion of management’s attention from ongoing business concerns; and |

| Ø | coordinating geographically separate organizations. |

Moreover, we have assumed the costs of defending against litigation claims asserted against Variagenics, and anytime we or our subsidiary merge with or acquire another company, we will be exposed to similar costs. In addition, we may be exposed to a number of other risks in connection with future transactions, including:

| Ø | we may experience unbudgeted expenses in attempting to complete the transaction and integration process and exposure to unknown liabilities of the merged or acquired business; and |

| Ø | our stock price may suffer if the former stockholders of the merged or acquired entity dispose of significant numbers of shares of our common stock that they receive in the transaction within a short period of time. |

We cannot assure you that we will receive all of the anticipated benefits of any mergers or acquisitions, or that any of the risks described above will not occur. Our failure to receive anticipated benefits of, and our exposure to inherent risks in, any such merger or acquisition transaction could significantly harm our business, financial condition and operating results.

We may not receive any benefits from and we may have lost potential income as a result of the sale of our equity holdings in our former Callida subsidiary.

On December 3, 2004, we entered into and consummated a Stock Purchase Agreement with SBH Genomics, Inc., Radoje Drmanac, Snezana Drmanac and Affymetrix, Inc., pursuant to which we sold all of the stock we held in our subsidiary, Callida Genomics, Inc., or Callida, to SBH Genomics, Inc., a privately held Delaware corporation. Prior to the sale, we owned approximately 90% of Callida’s issued and outstanding capital stock. Affymetrix, a minority stockholder in Callida, also sold its Callida shares to SBH Genomics as part of the same negotiated transaction. We and Affymetrix sold our stock in Callida in exchange for convertible promissory notes in the principal amount of $1 million and potential additional payments to us from SBH Genomics based on future revenues. The notes are convertible into preferred shares of SBH Genomics under certain circumstances. The notes may prove uncollectible, and we cannot assure you that we will receive the anticipated benefits, if any, of our sale of Callida stock,

S-20

Table of Contents