- ORKA Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Oruka Therapeutics (ORKA) DEF 14ADefinitive proxy

Filed: 18 Apr 07, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

The Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

x | Definitive Proxy Statement | |||||

¨ | Definitive Additional Materials | |||||

¨ | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

NUVELO, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

April 18, 2007

Dear Stockholder:

Please join us for the 2007 Annual Meeting of Stockholders of Nuvelo, Inc. The meeting will be held on Thursday, May 31, 2007 at 11:00 a.m. Pacific Time at Sofitel San Francisco Bay, 223 Twin Dolphin Drive, Redwood City, California 94065, Tel: 650-598-9000.

At this year’s meeting, you will have the opportunity to elect two directors, approve an amendment of the 2004 Equity Incentive Plan (the “2004 Plan”) to increase the number of shares available under it, approve an amendment of the Nuvelo, Inc. Employee Stock Purchase Plan (“Purchase Plan”) to increase the number of shares available under it, ratify the selection of our independent registered public accounting firm, and transact any other business properly presented at the meeting, as more fully described in the accompanying Proxy Statement. If you own shares of common stock at the close of business on April 5, 2007, you will be entitled to vote at the annual meeting. In addition, immediately following the meeting, you will have the opportunity to hear what we have accomplished in our business in the past year and to ask questions. Additional information about the items of business to be discussed at our annual meeting is given in the enclosed Proxy Statement. You will find other detailed information about Nuvelo and our operations in the enclosed 2006 Annual Report, which includes my letter to the stockholders, and the Annual Report on Form 10-K for 2006, which contains Nuvelo’s audited consolidated financial statements.

We hope you can join us on May 31, 2007. If you are planning to attend, please send an e-mail to ir@nuvelo.com so that we may include you on the attendance list. Whether or not you can attend, please read the enclosed Proxy Statement. When you have done so, please mark your votes on the enclosed proxy card, sign, and date the proxy card and return it to us in the enclosed envelope. Your vote is important, so please return your proxy card promptly.

Sincerely,

/s/ Ted. W. Love, M.D.

Ted W. Love, M.D.

Chairman of the Board of Directors

and Chief Executive Officer

| 201 Industrial Road, Suite 310, San Carlos, CA 94070 | tel: 650/517-8000 | fax: 650/517-8001 | www.nuvelo.com | |||||

NUVELO, INC.

201 Industrial Road, Suite 310

San Carlos, California 94070

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 31, 2007

To the Stockholders of Nuvelo, Inc.:

NOTICE IS HEREBY GIVEN, that the annual meeting of stockholders of Nuvelo, Inc., a Delaware corporation (“Nuvelo” the “Company,” or “we”), will be held on May 31, 2007, at 11:00 a.m. Pacific Time, at Sofitel San Francisco Bay, 223 Twin Dolphin Drive, Redwood City, California, for the following purposes:

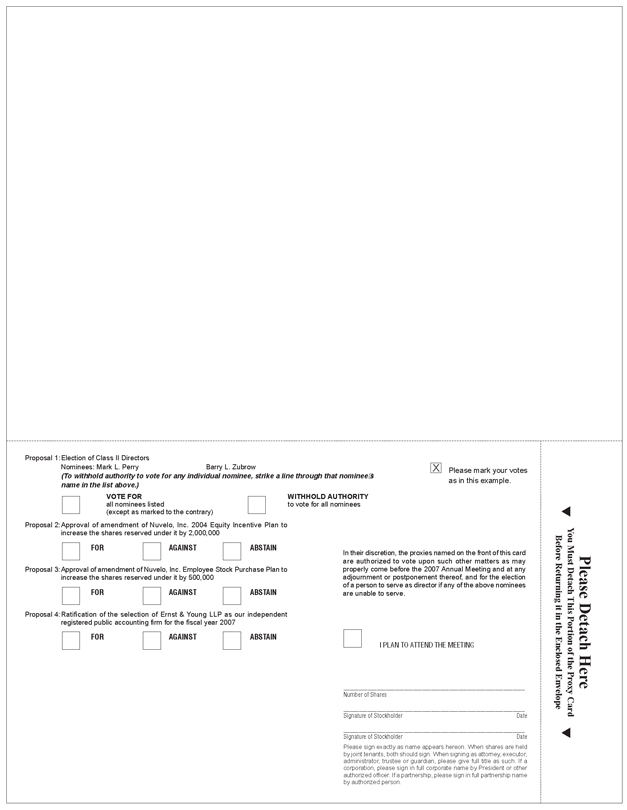

| 1 | to elect two directors to hold office until the 2010 annual meeting of stockholders or until the election and qualification of their respective successors; |

| 2 | to amend the Nuvelo, Inc. 2004 Equity Incentive Plan to increase the shares reserved under it by 2,000,000; |

| 3 | to amend the Nuvelo, Inc. Employee Stock Purchase Plan to increase the shares reserved under it by 500,000; |

| 4 | to ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year 2007; and |

| 5 | to transact any other business which is properly brought before the meeting or any adjournment or postponement thereof. |

Please refer to the accompanying proxy materials, which form a part of this Notice, for further information about the business to be transacted at the annual meeting.

Only stockholders of record at the close of business on April 5, 2007 are entitled to receive this notice and to vote at the annual meeting or any adjournment or postponement thereof. A complete list of stockholders entitled to vote at the annual meeting shall be open to inspection of any stockholder present at the annual meeting and, for any purpose germane to the annual meeting, during ordinary business hours at our corporate offices at 201 Industrial Road, Suite 310, San Carlos, California 94070, during the ten days prior to the annual meeting.

All stockholders are cordially invited to attend the annual meeting. Whether or not you plan to attend the annual meeting in person, we urge you to ensure your representation by voting by proxy as promptly as possible. You may vote by completing, signing, dating, and returning the enclosed proxy card by mail, as further described on the attached proxy card. A return envelope, which requires no postage if mailed in the United States, has been provided for your use. If you attend the annual meeting and vote your shares in person at the meeting, your proxy will not be used.

By order of the Board of Directors: |

/s/ Ted. W. Love

Ted. W. Love, M.D. |

| Chairman of the Board of Directors and Chief Executive Officer |

April 18, 2007

San Carlos, California 94070

NUVELO, INC.

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

May 31, 2007

INTRODUCTION

General

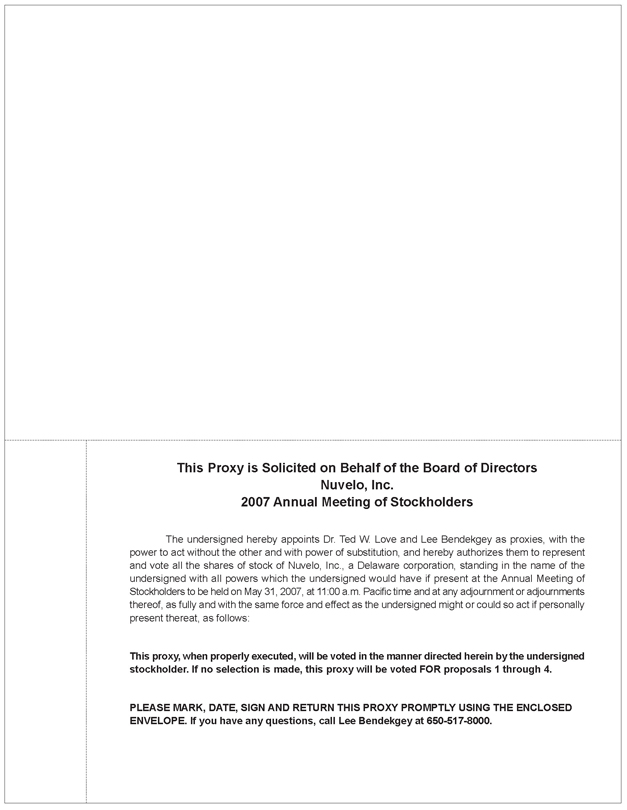

This Proxy Statement is furnished to our stockholders on behalf of our Board of Directors in connection with the solicitation of proxies for use at our annual meeting of stockholders to be held at Sofitel San Francisco Bay on May 31, 2007 at 11:00 a.m. Pacific Time, and at any adjournments or postponements of the annual meeting.

This solicitation is made on behalf of our Board of Directors and we will pay the costs of solicitation. Our directors, officers, and employees may also solicit proxies by telephone, telegraph, fax, or personal interview. We will not pay any additional compensation to directors, officers, or other employees for such services, but may reimburse them for reasonable out-of-pocket expenses in connection with such solicitation. We will reimburse banks, brokerage firms, and other custodians, nominees, and fiduciaries for reasonable expenses incurred by them for sending proxy materials to our stockholders. We have retained Mellon Investor Services to provide proxy solicitation services for us for a one-time fee of $7,500, plus reimbursement of expenses.

A copy of our Annual Report to Stockholders for the year ended December 31, 2006, this Proxy Statement, and accompanying proxy card will be first mailed to stockholders on or about April 18, 2007.

Sofitel San Francisco Bay is located at 223 Twin Dolphin Drive, Redwood City, California 94065, Tel: (650) 598-9000.

Quorum and Voting Requirements

Who Is Entitled to Vote; Record Date

Our issued and outstanding common stock constitutes the only class of securities entitled to vote at the annual meeting. Only holders of record of our common stock at the close of business on April 5, 2007 are entitled to receive this notice and to vote at the annual meeting.

Quorum Requirements

At the close of business on April 5, 2007, 53,302,460 shares of our common stock were issued and outstanding. The presence at the meeting, in person or by proxy, of a majority of the issued and outstanding shares will constitute a quorum. Abstentions and “broker non-votes” ( i.e., shares held by a broker or nominee which are represented at the meeting, but with respect to which the broker or nominee is not empowered to vote on a particular proposal) will be counted towards the quorum requirement. Broker non-votes will not be counted towards the vote total for any proposal. Each share of common stock is entitled to one vote.

Voting by Proxy; Revoking Your Proxy

Unless there are different instructions on the proxy, all shares represented by valid proxies (and not revoked before they are voted) will be voted at the meeting for the election of the two nominees for director and Proposals 2, 3, and 4. With respect to any other business that may properly come before the meeting and be submitted to a vote of stockholders, proxies will be voted in accordance with the best judgment of the designated proxy holders.

Stockholders of record may vote by doing one of the following: completing and returning the enclosed proxy card prior to the meeting, voting in person at the meeting, or submitting a signed proxy card at the meeting. All votes cast at the meeting will be tabulated by the persons appointed by us to act as inspectors of election for the meeting.

You may revoke your proxy at any time before it is actually voted at the meeting by:

| • | delivering written notice of revocation to our Secretary at 201 Industrial Road, Suite 310, San Carlos, California 94070; |

| • | submitting a later dated proxy; or |

| • | attending the meeting and voting in person. |

If You Receive More than One Proxy Card

If you receive two or more proxy cards, this means that you hold our shares in multiple accounts at the transfer agent or with the brokers or other custodians of your shares; in this case, please vote with respect to each proxy card in accordance with the procedures described therein to complete your representation.

How to Vote if Your Shares Are Registered in Your Name; You are the Stockholder of Record

If on April 5, 2007, your shares were registered directly in your name with the Company’s transfer agent, U.S. Stock Transfer Corporation, then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy. Your attendance at the meeting will not, by itself, constitute revocation of your proxy. You may also be represented by another person present at the meeting by executing a form of proxy designating that person to act on your behalf. Shares may only be voted by or on behalf of the record holder of shares as indicated in our stock transfer records.

How to Vote if Your Shares Are Registered in the Name of a Broker or Bank; You are the Beneficial Owner

If on April 5, 2007, your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker or other agent.

Voting Intentions of our Executive Officers and Directors; Recommendations of Our Directors

Our current executive officers and directors have informed us that they intend to vote, or cause to be voted, all 121,675 shares of common stock held by them at the close of business on April 5, 2007 for each of the nominees for director and for all of the other proposals in this Proxy Statement.

Our Directors recommend that stockholders vote “FOR” each of the nominees for director and all of the Proposals.

Voting on Proposal No. 1: Election of Board of Directors

Directors will be elected by a plurality of the votes cast for the election of directors, which means that abstentions and broker non-votes will not affect the election of the candidates receiving the plurality of votes. Accordingly, the directorships to be filled at the annual meeting will be filled by the nominees receiving the highest number of votes. In the election of directors, by checking the appropriate box on your proxy card, you

2

may cast your votes in favor of, or withhold your votes with respect to, some or all nominees. Votes that are withheld, or abstentions, will be excluded entirely from the vote on Proposal No. 1 and will have no effect on the outcome of the vote. If you hold your shares through a broker and you do not instruct the broker on how to vote on Proposal No. 1, your broker will have authority to vote your shares on Proposal No. 1.

Voting on Proposal No. 2: Amendment to Nuvelo, Inc. 2004 Equity Incentive Plan to Increase Shares Available for Issuance under this Plan

The affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote on Proposal No. 2 is required for approval of Proposal No. 2. Abstentions will be counted towards the vote total for Proposal No. 2, and will have the same effect as an “Against” vote.

If you hold your shares through a broker and you do not instruct the broker on how to vote on Proposal No. 2, your brokerwill not have authority to vote your shares on Proposal No. 2.

Voting on Proposal No. 3: Amendment to Nuvelo, Inc. Employee Stock Purchase Plan to Increase the Shares Available for Issuance under this Plan

The affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote on Proposal No. 3 is required for approval of Proposal No. 3. Abstentions will be counted towards the vote total for Proposal No. 3, and will have the same effect as an “Against” vote.

If you hold your shares through a broker and you do not instruct the broker on how to vote on Proposal No. 3, your brokerwill not have authority to vote your shares on Proposal No. 3.

Voting on Proposal No. 4: Ratification of Selection of Independent Registered Public Accounting Firm

The affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote on Proposal No. 4 is required for approval of Proposal No. 4. Abstentions will be counted towards the vote total for Proposal No. 4, and will have the same effect as an “Against” vote. If you hold your shares through a broker and you do not instruct the broker on how to vote on Proposal No. 4, your broker will have authority to vote your shares on Proposal No. 4.

Your vote is important. Accordingly, please sign and return the accompanying proxy card in the accompanying envelope, which is postage prepaid if you mail it in the United States, whether or not you plan to attend the meeting in person.

3

PROPOSAL NO. 1:

ELECTION OF BOARD OF DIRECTORS

General Information

Our Amended and Restated Certificate of Incorporation (“Certificate of Incorporation”) provides that the Board of Directors is divided into three classes to provide for staggered terms and that each director will serve for a term of three years or less depending on the class to which the Board of Directors has assigned a director not previously elected by the stockholders. There are currently three Class III directors, whose terms expire at the annual stockholders’ meeting in 2008, and two Class I directors, whose terms expire at the annual stockholders’ meeting in 2009. The Board of Directors has nominated two Class II directors, Mark L. Perry and Barry L. Zubrow, for election to the Board of Directors, each for a three-year term ending on the date of the annual meeting in 2010 or until a successor is duly elected and qualified or appointed. There are no vacancies in the current Board of Directors. We encourage our Board members to attend each annual meeting of stockholders. All of our then current Board members attended our 2006 annual meeting.

Each nominee for director has consented to being named in this Proxy Statement and has indicated his willingness to serve if elected. Unless your vote is withheld, proxies received by us will be voted for the nominees. Proxies cannot be voted for more than two persons. Although we do not anticipate that any nominee will be unavailable for election, if a nominee is unavailable for election, we will vote the proxies for any substitute nominee we may designate.

Each nominee for election to the Board of Directors currently serves as one of our directors and has continually served as a director since the date such person initially became a director, which is set forth below. Each of the nominees for director has previously been elected by our stockholders. In 2006, our Board of Directors met five times and acted by written consent two times. In 2006, each director attended 80% or more of the total meetings of the Board of Directors that were held during the period in 2006 for which the person was a director, except for Dr. Rathmann, who resigned from the Board in May 2006. In 2006, each director who was a member of the Compensation Committee or the Nominating and Corporate Governance Committee of the Board of Directors attended 100% of the meetings of those Committees on which the director served that were held during the period in 2006 for which the director was a Committee member. Each director who was a member of the Audit Committee attended 88% or more of the meetings of that Committee of the Board of Directors that occurred during 2006. The following table sets forth information as of March 31, 2007 with respect to our directors, including the two persons nominated for election at the meeting.

Name of Nominee or Director | Age | Position | Director Since | |||

Ted W. Love, M.D.* | 48 | Chairman of the Board and Chief Executive Officer | 2001 | |||

Barry L. Zubrow(2)* | 54 | Vice Chairman of the Board | 2004 | |||

James R. Gavin III, M.D., Ph.D.(3) | 61 | Director | 2006 | |||

Mary K. Pendergast(1)* | 56 | Director | 2002 | |||

Mark L. Perry(2)(3)* | 51 | Director | 2003 | |||

Kimberly Popovits(1)(3) | 48 | Director | 2005 | |||

Burton E. Sobel, M.D.(1)(2) | 69 | Director | 2004 |

| * | Each of the directors indicated served as a director of Nuvelo, Inc., a Nevada corporation, as of such dates listed, prior to the reincorporation of Nuvelo, Inc. from the State of Nevada to the State of Delaware, which became effective on March 25, 2004. |

| (1) | Member of Nominating and Corporate Governance Committee |

| (2) | Member of Audit Committee |

| (3) | Member of Compensation Committee |

4

The following information, which has been provided by our directors and director nominees, sets forth such person’s principal occupation, employment, and business experience during at least the past five years, and the period during which such person has served as a director of the Company:

Nominees for Election to the Board of Directors for a Three-Year Term Ending in 2010

Mark L. Perryhas served as a member of our Board of Directors since October 2003. Since February 2007, Mr. Perry has been the president and chief executive officer of Aerovance, Inc., a private biotechnology company. From April 2004 through January 2007, Mr. Perry was a senior business advisor for Gilead Sciences, Inc., reporting to the CEO. Mr. Perry was an executive officer of Gilead from 1994 to April 2004, serving in a variety of capacities, including general counsel, chief financial officer and most recently, executive vice president of operations, responsible for worldwide sales and marketing, legal, manufacturing and facilities. From 1981 to 1994, Mr. Perry was with the law firm Cooley Godward LLP in San Francisco and Palo Alto, serving as a partner of the firm from 1987 until 1994. Mr. Perry received his J.D. from the University of California, Davis in 1980 and is a member of the California bar. Mr. Perry also serves as a member of the board of directors of NVIDIA Corporation and Aerovance, Inc.

Barry L. Zubrowhas served as a member of our Board of Directors since February 2004, as vice chairman of our Board of Directors since March 2005, and as lead independent director as of September 2005. From 1977 to November 2003, Mr. Zubrow held a variety of positions at The Goldman Sachs Group, including chief administrative officer and head of the operations and administration divisions. He received his J.D. and M.B.A. from the University of Chicago. Mr. Zubrow serves as a member of the board of directors of GSC Capital Corp. and serves as chairman of the board of the New Jersey Schools Construction Corporation and Haverford College.

Directors Continuing in Office until the Annual Meeting of Stockholders in 2008

James R. Gavin III, M.D., Ph.D. has served as a member of our Board of Directors since May 2006. Since December 2004, Dr. Gavin has been a clinical professor of medicine at Emory University School of Medicine, and president and chief executive officer of MicroIslet, Inc. Dr. Gavin also has served as executive vice president for clinical affairs at Healing Our Village, Inc. since January 2005. From July 2002 to December 2004, Dr. Gavin was president of the Morehouse School of Medicine. He served as senior scientific officer at the Howard Hughes Medical Institute (HHMI) from 1991 to 2002 and director of HHMI-National Institutes of Health Research Scholars Program from 2000 to 2002. Dr. Gavin was on the faculty at the University of Oklahoma Health Sciences Center as a professor and as chief of the Diabetes Section, acting chief of the Section on Endocrinology, Metabolism and Hypertension, and William K. Warren Professor for Diabetes Studies. He is a member of many advisory boards and medical organizations, including the Institute of Medicine of the National Academy of Sciences and the American Diabetes Association, for which he is a past president. Dr. Gavin holds a B.S. in chemistry from Livingstone College, a Ph.D. in biochemistry from Emory University, and an M.D. from Duke University School of Medicine. Dr. Gavin also serves as a member of the board of directors of Baxter International, Inc., Amylin Pharmaceuticals, Inc., and MicroIslet, Inc.

Mary K. Pendergast has served as a member of our Board of Directors since May 2002. Since September 2003, Ms. Pendergast has been president of Pendergast Consulting. Ms. Pendergast served as executive vice president, government affairs for Elan Corporation from 1998 to December 2003. Ms. Pendergast was deputy commissioner and senior advisor to the Commissioner, Food and Drug Administration, Department of Health and Human Services from 1990 to 1998. Ms. Pendergast received her LL.M. from Yale Law School in 1977, her J.D. from the University of Iowa College of Law in 1976, and her B.A. from Northwestern University in 1972.

Kimberly Popovits has served as a member of our Board of Directors since July 2005. Since February 2002, Ms. Popovits has served as president, chief operating officer, and as a member of the board of directors of Genomic Health, Inc. Prior to joining Genomic Health, Inc., Ms. Popovits served in various roles at Genentech, Inc., most recently as senior vice president, marketing and sales from February 2001 to February 2002, and as

5

vice president, sales from October 1994 to February 2001. Prior to joining Genentech in 1987, she served as division manager for American Critical Care, a division of American Hospital Supply. Ms. Popovits holds a B.A. in business from Michigan State University and currently serves as a member of the board of directors of BayBio.

Directors Continuing in Office until the Annual Meeting of Stockholders in 2009

Ted W. Love, M.D. has served as our president since January 2001, as our chief executive officer since March 2001, as a member of our Board of Directors since February 2001, and as chairman of our Board of Directors since September 2005. Dr. Love served as our president and chief operating officer from January 2001 until March 2001. Prior to joining us, Dr. Love served as senior vice president of development at Theravance Inc. (formerly Advanced Medicine, Inc.) from 1998 to 2001 and as a research physician and vice president of product development at Genentech from 1992 to 1998. Dr. Love holds a B.A. in molecular biology from Haverford College and an M.D. from Yale Medical School. Dr. Love also serves as a member of the board of directors of Santarus, Inc., and Affymax, Inc.

Burton E. Sobel, M.D. has served as a member of our Board of Directors since September 2004. Since June 2005, Dr. Sobel has served as Amidon professor of medicine and biochemistry at the University of Vermont and Fletcher Allen Health Care where he formerly served as chair of the department of medicine from 1994 to June 2005. Dr. Sobel also serves as the director of the Cardiovascular Center for the University of Vermont and Fletcher Allen Health Care, which he has done since 2002. Dr. Sobel served as senior counsel to the executive dean of the University of Vermont College of Medicine and to the executive vice president of Fletcher Allen Health Care from 1996 to 1998. From 1994 to 1996, Dr. Sobel served as professor of medicine at Washington University in St. Louis, Missouri. Dr. Sobel received his M.D. from the Harvard Medical School, magna cum laude, and his A.B. from Cornell University. Dr. Sobel is President-elect for the Society for Experimental Biology and Medicine, and also serves as a member of the board of directors of Ariad Pharmaceuticals, Inc., Clinical Data, Inc., and New River Pharmaceuticals, Inc.

Director Compensation

DIRECTOR COMPENSATION TABLE

The following table sets forth the compensation earned by or awarded to the Company’s non-employee directors during the fiscal year ended December 31, 2006:

Name | Fees ($) | Stock ($) | Option ($) (1) (2) | Non-Equity ($) | Change in ($) | All Other ($) | Total ($) | ||||||||||

James R. Gavin III, M.D., Ph.D. | $ | 12,917 | — | $ | 133,784 | — | — | — | $ | 146,701 | |||||||

Mary K. Pendergast | $ | 30,000 | — | $ | 145,115 | — | — | — | $ | 175,115 | |||||||

Mark L. Perry | $ | 40,000 | — | $ | 145,115 | — | — | — | $ | 185,115 | |||||||

Kimberly Popovits | $ | 30,000 | — | $ | 167,921 | — | — | — | $ | 197,921 | |||||||

Burton E. Sobel, M.D. | $ | 35,000 | — | $ | 153,904 | — | — | — | $ | 188,904 | |||||||

Barry L. Zubrow | $ | 43,750 | — | $ | 194,782 | — | — | — | $ | 238,532 | |||||||

George B. Rathmann, Ph.D.(3) | — | — | $ | 280,620 | — | — | — | $ | 280,620 | ||||||||

| (1) | Amounts reflect the dollar amount recognized for financial statement reporting purposes for the year ended December 31, 2006, in accordance with Statement of Financial Accounting Standards No. 123 (revised |

6

2004),Share-Based Payment(SFAS 123R), and include amounts attributable to awards granted in and prior to 2006. Assumptions used in the calculation of these amounts are disclosed in Note 1 to the Company’s Consolidated Financial Statements for the year ended December 31, 2006 included in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 1, 2007. However, as required, amounts shown above exclude the impact of estimated forfeitures related to service-based vesting conditions. |

| (2) | The grant date fair values of options granted to each of the above directors in 2006 were as follows: $220,955 with respect to the option granted to Dr. Gavin; $132,573 with respect to each of the options granted to Ms. Pendergast, Mr. Perry, Ms. Popovits and Dr. Sobel, and $176,764 with respect to the option granted to Mr. Zubrow. Grant date fair values were determined in accordance with SFAS 123R. Assumptions used in the calculation of these amounts are disclosed in Note 1 to the Company’s Consolidated Financial Statements for the year ended December 31, 2006 included in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 1, 2007. As of December 31, 2006, the aforementioned directors held options to purchase the following number of shares of the Company’s common stock: Dr. Gavin, 25,000; Ms. Pendergast, 69,166; Mr. Perry, 0; Ms. Popovits, 40,000; Dr. Sobel, 27,500; Mr. Zubrow, 85,833; and Dr. Rathmann, 1,202,666. |

| (3) | Dr. Rathmann, who resigned from the Board in May 2006, elected to receive no cash compensation in 2006 for his Board service. |

2006 and 2007 Director Compensation

The Nominating and Corporate Governance Committee of the Board of Directors, in accordance with its Charter, is responsible for periodically making recommendations to the Board with respect to the compensation of Board members. The Committee performed an evaluation of Board member compensation in 2005, and may conduct another such evaluation during the second half of 2007.

Annual Cash Retainer Fees

Each non-employee director, other than Dr. Rathmann, who resigned from the Board in May 2006, is entitled to an annual retainer fee of $20,000. The Audit Committee chair is entitled to receive an additional $20,000 for service as the Audit Committee chair. If a non-employee director is the chair of any other Committee, that director is entitled to receive an additional $10,000 per chair. Each of the members of the Audit Committee, other than the chair, is entitled to receive an additional $10,000 for his or her service on the Audit Committee. For membership on any other Committee, except for the chair of such Committee, a non-employee director is entitled to receive an additional $5,000. Board members are not entitled to receive any other cash compensation for their Board service. Dr. Rathmann elected to receive no cash compensation in 2006 for his Board service. If a Board member were to resign or assume additional Board responsibilities within a year, the Board member’s cash compensation would be adjusted the next quarter to reflect the change. Finally, each director has the option to convert the previously mentioned retainer fees into deferred stock units, in accordance with the terms of a deferred stock unit plan pursuant to our 2004 Equity Incentive Plan.

Annual Stock Option Grants

On the date of the 2006 annual meeting of the stockholders, the vice chairman received a fully vested option to purchase 20,000 shares of the Company’s common stock under the 2004 Plan, and all other non-employee directors received a fully vested option to purchase 15,000 shares of the Company’s common stock under the 2004 Plan. The purchase price for these options is the average of the high and the low price for the Company’s common stock on the date of the Company’s 2006 annual meeting of stockholders.

On the date of the 2007 annual meeting of the stockholders, the vice chairman will receive a fully vested option to purchase 20,000 shares of the Company’s common stock under the 2004 Plan, and all other non-employee directors will receive a fully vested option to purchase 15,000 shares of the Company’s common

7

stock under the 2004 Plan. The purchase price for these options will be the average of the high and the low price for the Company’s common stock on the date of the Company’s 2007 annual meeting of stockholders.

Appointment Grants

If at any time the Board appoints a new, non-employee chairman of the Board, the new chairman will be granted an option to purchase 50,000 shares of the Company’s common stock at the average of the high and the low price for the Company’s common stock on the date of grant. If at any time the Board appoints a new, non-employee vice chairman of the Board, the new vice chairman will be granted an option to purchase 35,000 shares of the Company’s common stock at the average of the high and the low price for the Company’s common stock on the date of grant. If at any time the Board appoints a new non-employee director, the new director will be granted an option to purchase 25,000 shares of the Company’s common stock at average of the high and the low price for the Company’s common stock on the date of grant. These grants of our common stock for appointments will vest 50% on the date of grant and 50% on the first year anniversary of the date of grant.

The annual grants issued to our Board in 2006 were made, and the annual grants anticipated to be issued to our Board in 2007 will be made, pursuant to the forms of Stock Option Agreement and Notice of Grant of Stock Option filed as exhibits to the Form 8-K filed on September 20, 2004, as amended in March 2005. In March 2005, the Compensation Committee approved the amendment of the form of Stock Option Agreement for the members of our Board to provide that the period of exercisability of the stock option following termination of service as a director will begin to run upon the expiration of any lock-up agreement that the director has entered into to facilitate a Company transaction, rather than upon termination of Board service.

Board Independence and Corporate Governance

As part of its service, the Board of Directors strives to regularly evaluate the Company’s corporate governance policies and to compare those policies to standards established by current rules and regulations of various governmental authorities, other public companies and recommendations of other corporate governance groups and authorities. In connection with this process of self-evaluation, the Board, upon recommendation of its Nominating and Corporate Governance Committee, adopted a set of Corporate Governance Guidelines to assist in the exercise of its responsibilities in serving the best interests of the Company and its stockholders. In 2006, the independent directors of the Board of Directors met two times without management or the non-independent directors of the Board of Directors.

The Board of Directors has reviewed the relationships between each member of the Board of Directors, their immediate family members and affiliates, and the Company. Accordingly, the Board has determined that Dr. Gavin, Ms. Pendergast, Mr. Perry, Ms. Popovits, Dr. Sobel, and Mr. Zubrow, which individuals constitute a majority of the Board of Directors, qualify as “independent” directors in accordance with the listing standards of the Nasdaq Global Market (“Nasdaq”). As part of its ongoing evaluation process, the Board of Directors will continue to monitor best corporate governance practices. Based upon this process, the Board may from time to time adopt additional policies or procedures to comply with new laws and legislation and any changes to rules made by the Securities and Exchange Commission and Nasdaq.

In March 2007, the Board adopted an amended and restated Code of Business Conduct and Ethics (the “Code of Conduct”) that applies to all of the Company’s directors, officers, and employees, and establishes the Company’s expectations for its consultants, contractors, representatives, and agents. The Code of Conduct promotes the ethical and honest conduct of the Company’s directors, officers, and employees and addresses the use of Company assets, confidential information, gifts and gratuities, equal opportunity and unlawful harassment, workplace violence, health, safety, and the environment, the Company’s commitment to quality research and development, interactions with healthcare professionals, public communications, the importance of accurate and reliable company records, such as financial records and public reports, the identification and disclosure of conflicts of interest, securities and insider trading, the foreign corrupt practices act and improper payments, fair

8

competition and antitrust, political contributions and activities, advertising and promotional standards, and compliance with laws and regulations. The Board has determined that the Code of Conduct is a code of ethics in compliance with applicable Nasdaq rules.

The Company’s Corporate Governance Guidelines, Committee charters and Code of Conduct are located on the Company’s website at www.nuvelo.com in the section titled, “Investors,” under the subsection titled, “Corporate Governance.” If the Company makes any substantive amendments to the Code of Conduct or grants any waiver from a provision of the Code of Conduct to any executive officer or director, the Company will promptly disclose the nature of the amendment or waiver on its website and file any current report on Form 8-K required by applicable law or Nasdaq listing standards. Information found on our website is not incorporated by reference into this report.

Committees of the Board of Directors

Our Board of Directors has three standing Committees, the Compensation Committee, the Audit Committee and the Nominating and Corporate Governance Committee.

Compensation Committee

Our Compensation Committee reviews and approves the Company’s goals and objectives relevant to the compensation of executive officers and other senior management, sets compensation and bonus levels for the Company’s executive officers that correspond to the Company’s goals and objectives, and reviews and makes recommendations to our Board regarding our compensation policies, programs, practices, and procedures designed to contribute to our success, in accordance with its charter. The Compensation Committee also evaluates the Company’s goals and objectives related to the compensation of our chief executive officer and his performance in light of such goals and objectives and sets the chief executive officer’s compensation level and bonus based on this evaluation. Starting this year, the Compensation Committee also began to review with management the Compensation Discussion and Analysis and to consider whether to recommend its inclusion in this Proxy Statement and other filings. The Compensation Committee administers the 2004 Equity Incentive Plan and the Employee Stock Purchase Plan. The Compensation Committee also administers the 1995 Stock Option Plan, the Directors Plan, the Scientific Advisory Board/Consultants Stock Option Plan, and the 2002 Equity Incentive Plan. Since the approval of the 2004 Equity Incentive Plan by the stockholders at the 2004 annual meeting of the stockholders, the Company no longer makes grants under the 1995 Stock Option Plan, the Directors Plan, the Scientific Advisory Board/Consultants Stock Option Plan, or the 2002 Equity Incentive Plan. The Compensation Committee also makes recommendations to the Board regarding incentive-compensation plans and other equity-based plans. Under its charter, the Compensation Committee may form, and delegate authority to, subcommittees, as appropriate, to enhance the flexibility of option administration within the Company and to facilitate the timely grant of options to non-management employees. The Committee has delegated to Dr. Love the authority to approve option grants for officers who are not executive officers, subject to compliance with the Company’s policies, including guidelines that set ranges for option grants by salary range or job level, and subject to the Committee’s approval of a pool of stock options each year for annual performance grants. The Company’s Compensation Committee Charter is located on the Company’s website at www.nuvelo.com in the section titled, “Investors,” under the subsection titled, “Corporate Governance.”

In 2006, at the recommendation of management, the Committee approved the retention of Radford Consulting and Surveys, a division of Aon Corporation, or Radford, as compensation consultants for the Committee and the Company. At the Committee’s direction, Radford provided advice to management and the Board regarding the Company’s equity compensation practices in connection with its 2006 proposal to increase the number of shares available for grant under the 2004 Plan, executive compensation for all employees at the level of vice president and above, and the Company’s cash bonus program and 401(k) Plan matching contribution policy.

9

Mr. Perry, as the chairperson, Dr. Gavin and Ms. Popovits presently serve on the Compensation Committee. Mr. Perry, Ms. Popovits and Dr. Gavin all have extensive experience in executive management in the biotechnology industry, including experience with compensation practices and policies. The current members of the Compensation Committee are “independent” (as independence is defined by the Nasdaq listing standards). From January 1, 2006 through September 18, 2006, the Compensation Committee consisted of Ms. Popovits, Mr. Perry, and Mr. Zubrow. From September 18, 2006 through the end of the 2006 fiscal year, the Compensation Committee consisted of Dr. Gavin, Mr. Perry, and Ms. Popovits. The Compensation Committee met seven times during 2006, and met often in executive session. Each member of the Compensation Committee attended all of the meetings held during the period in 2006 for which the director was a Committee member. The report of our Compensation Committee is included on page 48 of this Proxy Statement.

The specific determinations of the Compensation Committee with respect to executive compensation for fiscal ending December 31, 2006, are described in greater detail in the Compensation Discussion and Analysis section of this Proxy Statement.

Audit Committee

Our Audit Committee reviews our annual audit and meets with our independent registered public accounting firm and management to review our internal controls, results of fiscal policies and financial management practices. The functions of the Audit Committee include selecting, evaluating, and where necessary, replacing the independent registered public accounting firm retained by the Company; consulting with our independent registered public accounting firm regarding their audit, their opinion, and the Company’s Forms 10-Q and 10-K; approving the audit and non-audit services of our independent registered public accounting firm and the terms of their engagement; meeting with our management; reviewing both the independent registered public accounting firm and management reports; recommending changes in financial policies and procedures that may be suggested by our independent registered public accounting firm; and preparing the Audit Committee report included in our Proxy Statement. Our Board has adopted a written charter for the Audit Committee, which is located on the Company’s website at www.nuvelo.com in the section titled, “Investors” under the subsection titled, “Corporate Governance.”

Mr. Zubrow, as the chairperson, Mr. Perry and Dr. Sobel presently serve on the Audit Committee, and served on the Audit Committee throughout the 2006 calendar year. The Audit Committee met nine times during 2006, and each then-current member attended eight or more of the nine meetings. The Board has determined that all three current Committee members are “independent” directors, as determined in accordance with Rule 10A-3(b)(1) of the Exchange Act and Rule 4350(d)(2)(A)(i) and (ii) of the Nasdaq listing standards. The Board has determined that Mr. Perry and Mr. Zubrow are each an “audit committee financial expert” as defined in Item 401(h) of Regulation S-K. Mr. Perry served as chief financial officer for Gilead Sciences, Inc. for four years, with financial oversight and supervisory responsibilities. Mr. Zubrow has over twenty-six years of corporate finance experience, and held such positions as chief administrative officer and head of operations for The Goldman Sachs Group, in which positions he had financial oversight and supervisory responsibilities. The report of our Audit Committee is included on page 50 of this Proxy Statement.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee, in accordance with its Charter, considers the qualifications of, proposes, and recommends individuals for Board membership and senior management positions. Other duties and responsibilities of the Nominating and Corporate Governance Committee include making recommendations to the Board regarding the Company’s corporate governance policies, business conduct, and ethics; evaluating the size and composition of the Board and its Committees; and reviewing the annual performance of the Board. The Company’s Nominating and Corporate Governance Committee Charter is accessible on the Company’s website at www.nuvelo.com, in the section titled, “Investors,” under the subsection titled, “Corporate Governance.”

10

Ms. Pendergast, Ms. Popovits and Dr. Sobel presently serve on the Nominating and Corporate Governance Committee, and served on the Committee throughout the 2006 calendar year. Each then current Nominating and Corporate Governance Committee member attended all of the six meetings of the Nominating and Corporate Governance Committee held during 2006. The Board determined that Ms. Pendergast, Ms. Popovits, and Dr. Sobel are “independent” members of the Nominating and Corporate Governance Committee (as independence is defined in the Nasdaq listing standards).

The Board has adopted a process for identifying and evaluating director nominees, including stockholder nominees. Before recommending an individual to the Board for Board membership, the Nominating and Corporate Governance Committee canvases its members and the Company’s management team for potential members of the Board of Directors. The Nominating and Corporate Governance Committee will consider stockholders’ recommendations for nominees to serve as director if notice is timely received by the Secretary of the Company. Candidates nominated by stockholders will be evaluated in the same manner as other candidates. The Nominating and Corporate Governance Committee keeps the Board regularly apprised of its discussions with potential nominees, and the names of potential nominees received from its current directors, management, and stockholders, if the stockholder notice of nomination is timely made. Although the Board has not adopted a fixed set of minimum qualifications for candidates for Board membership, the Nominating and Corporate Governance Committee generally considers several factors in its evaluation of each potential member, such as the potential member’s area of expertise, education, and professional background, experience in corporate governance, the reasonable availability of the potential member to devote time to the affairs of the Company, as well as any other criteria deemed relevant by the Board or the Nominating and Corporate Governance Committee. After determining that a potential candidate may be qualified, the Nominating and Corporate Governance Committee will make a further investigation and interview the candidate. The Nominating and Corporate Governance Committee will select, by majority vote, the most qualified candidate or candidates, for recommendation to the Board for approval as a director nominee. Dr. Gavin’s appointment to the Board in May 2006 was approved by all members of the Board, upon recommendation by the Nominating and Corporate Governance Committee to the Board, in accordance with the selection process described above. Neither the Company nor the Nominating and Corporate Governance Committee paid any fees to any third party to identify Board candidates during 2006 up through April 18, 2007.

Stockholders who wish to recommend individuals for consideration by the Nominating and Corporate Governance Committee to become nominees for election to the Board of Directors may do so by delivering a written recommendation to the Nominating and Corporate Governance Committee addressed to the Corporate Secretary, at least 120 days prior to the anniversary date of our last Annual Meeting of Stockholders. Recommendations must include the full name of the proposed nominee, a description of the proposed nominee’s business experience for at least the previous five years, complete biographical information, a description of the proposed nominee’s qualifications as a director and a representation that the recommending stockholder is a beneficial or record owner of our stock. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected. No such recommendation of a nominee to the Nominating and Corporate Governance Committee shall be deemed to satisfy the nomination requirements set forth in our Bylaws. To date, the Nominating and Corporate Governance Committee has not rejected a timely director nominee from a stockholder or stockholders holding more than 5% of our voting stock.

Stockholder Communications with the Board of Directors

We have adopted a formal process by which stockholders may communicate with our Board of Directors. This information is available on our website at www.nuvelo.com, under the section titled, “Investors,” under the subsection titled, “Corporate Governance.”

Required Vote and Board of Directors Recommendation

Directors will be elected by a plurality of the votes cast for the election of directors. The two nominees receiving the most “For” votes (among votes properly cast either in person or by proxy) will be elected. If you hold

11

your shares in your own name and abstain from voting on this matter, your abstention will have no effect on the vote. If you hold your shares through a broker and you do not instruct the broker on how to vote on this proposal, your broker will have authority to vote your shares on this proposal. Abstentions will be counted as present for purposes of determining the presence of a quorum but will not have any effect on the outcome of this proposal.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE FOR THE DIRECTORS

NOMINATED IN THIS PROPOSAL NO. 1.

12

PROPOSAL NO. 2:

AMENDMENT TO NUVELO, INC. 2004 EQUITY INCENTIVE PLAN

TO INCREASE SHARES AVAILABLE FOR ISSUANCE UNDER THIS PLAN

At the annual meeting of stockholders, the Company’s stockholders will be asked to approve an amendment to the Nuvelo, Inc. 2004 Equity Incentive Plan (the “2004 Plan”) to increase the number of shares of common stock available for issuance under the 2004 Plan by 2,000,000 shares. The 2004 Plan was originally adopted effective as of May 6, 2004, and replaced the Company’s 2002 Equity Incentive Plan, Director Stock Option Plan, Scientific Advisory Board/Consultants Stock Option Plan, 1995 Stock Option Plan and the Variagenics 1997 Employee, Director & Consultant Stock Option Plan (collectively the “Prior Plans’) and was subsequently amended and restated as of May 24, 2006.

The Board of Directors believes that we must offer a competitive equity incentive program if we are to continue to successfully attract and retain the best possible candidates for positions of responsibility. The Board of Directors expects that the 2004 Plan will continue to be an important factor in attracting, retaining, and rewarding the high caliber employees essential to our success and in motivating these individuals to strive to enhance our growth and profitability.

On March 14, 2007, the Board of Directors approved the amendment of the 2004 Plan, subject to stockholder approval, to increase the number of shares of common stock available for issuance under the 2004 Plan by 2,000,000 shares.

Limit on Grants Made under the 2004 Plan during 2006, 2007 and 2008

In our 2006 Proxy Statement, our Board of Directors committed to our stockholders that for fiscal years 2006, 2007 and 2008, the Board will not grant during such three fiscal years a number of shares subject to options or other awards to employees (whether under the 2004 Plan or other plans not approved by stockholders) such that the average number of shares granted during each of the three fiscal years is greater than 5.57% of the average number of shares of our common stock that were outstanding at the end of each of the three fiscal years. For fiscal year 2006, the number of options granted as a percentage of the number of shares of our common stock outstanding at December 31, 2006 was 4.19%. For purposes of calculating the number of shares granted in a year, stock awards and restricted stock awards, if any, will count as equivalent to (i) 1.5 option shares if our annual stock price volatility is 53% or higher, (ii) two option shares if our annual stock price volatility is between 25% and 52%, and (iii) four option shares if our annual stock price volatility is less than 25%. For fiscal year 2006, the Company’s stock price volatility measured approximately 176%. The above calculation does not include the grant of an option with an exercise price that is less than the fair market value on the date of grant because the 2004 Plan does not permit such stock option grants. Stock appreciation rights or full value shares settled in cash will not be included in the calculation of the shares granted in a year.

Summary of the 2004 Plan

Below is a summary of the principal provisions of the 2004 Plan, as amended and restated, which summary is qualified in its entirety by reference to the full text of the 2004 Plan. The 2004 Plan has been filed with the SEC as Appendix A to this Proxy Statement and may be accessed from the SEC’s homepage (www.sec.gov). Any stockholder that wishes to obtain a copy of the actual plan document may do so by written request to: Secretary, Nuvelo, Inc., 201 Industrial Road, Suite 310, San Carlos, California 94070.

General. The purpose of the 2004 Plan is to advance the interests of the Company by providing an incentive program that will enable the Company to attract and retain employees, consultants, and directors upon whose judgment, interest, and efforts the Company’s success is dependent and to provide them with an equity interest in the success of the Company in order to motivate superior performance. These incentives are provided through the grant of stock options (including indexed options), stock appreciation rights, restricted stock purchase rights, restricted stock bonuses, restricted stock units, performance shares, performance units, and deferred stock units.

13

Authorized Shares. As of March 31, 2007, a maximum of 9,735,444, reduced at any time by the number of shares subject to outstanding stock options granted under the Prior Plans, of the authorized but unissued or reacquired shares of our common stock may be issued under the 2004 Plan. The Board of Directors has amended the 2004 Plan, subject to stockholder approval, to increase the maximum number of shares that may be issued under the 2004 Plan to 13,904,085. However, the actual number of awards which may be granted under the 2004 Plan shall be reduced, at all times, by the number of stock options outstanding under the Prior Plans. As of March 31, 2007, stock options to purchase 595,396 shares of our common stock were outstanding under our Prior Plans, and stock options to purchase 7,553,680 shares and restricted stock units to receive 154,500 shares of our common stock were outstanding under the 2004 Plan.

No more than one million (1,000,000) shares of this 2004 Plan reserve may be issued upon the exercise or settlement of any restricted stock purchase rights, restricted stock bonuses, restricted stock units, performance shares, and performance units. If any award granted under the 2004 Plan, or under the Prior Plans, expires, lapses, or otherwise terminates for any reason without having been exercised or settled in full, or if shares subject to forfeiture or repurchase are forfeited or repurchased by the Company, any such shares that are reacquired or subject to such a terminated award will again become available for issuance under the 2004 Plan. Upon any stock dividend, stock split, reverse stock split, recapitalization, or similar change in our capital structure, appropriate adjustments will be made to the shares subject to the 2004 Plan, to the award grant limitations and to all outstanding awards. However, shares shall not become re-available for issuance under the 2004 Plan if they were (i) withheld or surrendered to satisfy tax withholding obligations, (ii) surrendered in payment of stock option exercise prices (either by means of a cashless exercise, attestation or actual surrender of shares), or (iii) subject to the grant of a stock appreciation right which was not issued upon settlement of the stock appreciation right.

Administration. The 2004 Plan will be administered by the Compensation Committee of the Board of Directors duly appointed to administer the 2004 Plan, or, in the absence of such Committee, by the Board of Directors. In the case of awards intended to qualify for the performance-based compensation exemption under Section 162(m) of the Internal Revenue Code of 1986, or the Code, administration must be by a compensation committee comprised solely of two or more “outside directors” within the meaning of Section 162(m). (For purposes of this summary, the term “Committee” will refer to either such duly appointed committee or the Board of Directors.) Subject to the provisions of the 2004 Plan, the Committee determines in its discretion the persons to whom and the times at which awards are granted, the types and sizes of such awards, and all of their terms and conditions. The Committee may, subject to certain limitations on the exercise of its discretion required by Section 162(m), amend, cancel, renew, or grant a new award in substitution for, any award, waive any restrictions or conditions applicable to any award, and accelerate, continue, extend, or defer the vesting of any award. However, the 2004 Plan forbids, without stockholder approval, the repricing of any outstanding stock option and/or stock appreciation right. In addition, the 2004 Plan forbids any restricted stock award to be granted, or subsequently amended to provide, for (1) any acceleration of vesting for any reason other than upon a Change in Control or after a participant’s death or disability, and (2) vesting of one hundred percent (100%) of any such award prior to the passage of three years of service (unless the award will vest after satisfying specified performance measurements). The 2004 Plan provides, subject to certain limitations, for indemnification by the Company of any director, officer, or employee against all reasonable expenses, including attorneys’ fees, incurred in connection with any legal action arising from such person’s action or failure to act in administering the 2004 Plan. The Committee will interpret the 2004 Plan and awards granted thereunder, and all determinations of the Committee will be final and binding on all persons having an interest in the 2004 Plan or any award.

Eligibility. Awards may be granted to employees, directors, and consultants of the Company or any present or future parent or subsidiary corporations of the Company. Incentive stock options may be granted only to employees who, as of the time of grant, are employees of the Company or any parent or subsidiary corporation of the Company. As of March 31, 2007, the Company had approximately 127 employees, including four executive officers, 11 consultants and six non-employee directors, all of who would be eligible under the 2004 Plan.

14

Stock Options. Each option granted under the 2004 Plan must be evidenced by a written agreement between the Company and the optionee specifying the number of shares subject to the option and the other terms and conditions of the option, consistent with the requirements of the 2004 Plan. The exercise price of each option may not be less than the fair market value of a share of Common Stock on the date of grant. For the purpose of the 2004 Plan, and this proposal, the term “fair market value” is defined by the 2004 Plan to mean the average of the high and low price of a share of our common stock as reported on the Nasdaq Global Market for any applicable date. Any incentive stock option granted to a person who at the time of grant owns stock possessing more than 10% of the total combined voting power of all classes of stock of the Company or any parent or subsidiary corporation of the Company (a “Ten Percent Stockholder”) must have an exercise price equal to at least 110% of the fair market value of a share of Common Stock on the date of grant. The exercise price of each indexed stock option, and the terms and adjustments which may be made to such an option, will be determined by the Committee in its sole discretion at the time of grant. On March 30, 2007, the closing price of the Company’s Common Stock on the Nasdaq Global Market was $3.68 per share. Subject to appropriate adjustment in the event of any change in the capital structure of the Company, no employee may be granted in any fiscal year of the Company options which in the aggregate are for more than seven hundred and fifty thousand (750,000) shares, provided however, that the Company may make an additional one-time grant to any newly-hired employee of a stock option for the purchase of up to an additional five hundred thousand (500,000) shares.

The 2004 Plan provides that the option exercise price may be paid in cash, by check, or in cash equivalent, by the assignment of the proceeds of a sale with respect to some or all of the shares being acquired upon the exercise of the option, to the extent legally permitted, by tender of shares of Common Stock owned by the optionee having a fair market value not less than the exercise price, by such other lawful consideration as approved by the Committee, or by any combination of these. Nevertheless, the Committee may restrict the forms of payment permitted in connection with any option grant. No option may be exercised unless the optionee has made adequate provision for federal, state, local, and foreign taxes, if any, relating to the exercise of the option, including, if permitted or required by the Company, through the optionee’s surrender of a portion of the option shares to the Company.

Options will become vested and exercisable at such times or upon such events and subject to such terms, conditions, performance criteria or restrictions as specified by the Committee. The maximum term of any option granted under the 2004 Plan is ten years, provided that an incentive stock option granted to a Ten Percent Stockholder must have a term not exceeding five years. The Committee will specify in each written option agreement, and solely in its discretion, the period of post-termination exercise applicable to each option.

Generally, stock options are nontransferable by the optionee other than by will or by the laws of descent and distribution, and are exercisable during the optionee’s lifetime only by the optionee. However, a nonstatutory stock option may be assigned or transferred to the extent permitted by the Committee in its sole discretion.

Stock Appreciation Rights. Each stock appreciation right granted under the 2004 Plan must be evidenced by a written agreement between the Company and the participant specifying the number of shares subject to the award and the other terms and conditions of the award, consistent with the requirements of the 2004 Plan. A stock appreciation right gives a participant the right to receive the appreciation in the fair market value of Company Common Stock between the date of grant of the award and the date of its exercise. The Company may pay the appreciation either in cash or in shares of Common Stock. The Committee may grant stock appreciation rights under the 2004 Plan in tandem with a related stock option or as a freestanding award. A tandem stock appreciation right is exercisable only at the time and to the same extent that the related option is exercisable, and its exercise causes the related option to be canceled. Freestanding stock appreciation rights vest and become exercisable at the times and on the terms established by the Committee. The maximum term of any stock appreciation right granted under the 2004 Plan is ten years. Subject to appropriate adjustment in the event of any change in the capital structure of the Company, no employee may be granted in any fiscal year of the Company stock appreciation rights which in the aggregate are for more than seven hundred and fifty thousand (750,000) shares, provided however, that the Company may make an additional one-time grant to any newly-

15

hired employee of a stock appreciation right for the purchase of up to an additional five hundred thousand (500,000) shares. Stock appreciation rights are generally nontransferable by the participant other than by will or by the laws of descent and distribution, and are generally exercisable during the participant’s lifetime only by the participant.

Restricted Stock Awards. The Committee may grant restricted stock awards under the 2004 Plan either in the form of a restricted stock purchase right, giving a participant an immediate right to purchase Common Stock, or in the form of a restricted stock bonus, for which the participant furnishes consideration in the form of services to the Company. The Committee determines the purchase price payable under restricted stock purchase awards, which may be less than the then current fair market value of our Common Stock. Restricted stock awards may be subject to vesting conditions based on such service or performance criteria as the Committee specifies, and the shares acquired may not be transferred by the participant until vested. Unless otherwise provided by the Committee, a participant will forfeit any shares of restricted stock as to which the restrictions have not lapsed prior to the participant’s termination of service. Participants holding restricted stock will have the right to vote the shares and to receive any dividends paid, except that dividends or other distributions paid in shares will be subject to the same restrictions as the original award. Subject to appropriate adjustment in the event of any change in the capital structure of the Company, no employee may be granted in any fiscal year of the Company more than four hundred thousand (400,000) shares of restricted stock on which the restrictions are based on performance criteria, provided however, that the Company may make an additional one-time grant to any newly-hired employee of a restricted stock award of up to an additional one hundred and fifty thousand (150,000) shares.

Restricted Stock Units. The Committee may grant restricted stock units under the 2004 Plan which represent a right to receive shares of Common Stock at a future date determined in accordance with the participant’s award agreement. No monetary payment is required for receipt of restricted stock units or the shares issued in settlement of the award, the consideration for which is furnished in the form of the participant’s services to the Company. The Committee may grant restricted stock unit awards subject to the attainment of performance goals similar to those described below in connection with performance shares and performance units, or may make the awards subject to vesting conditions similar to those applicable to restricted stock awards. Participants have no voting rights or rights to receive cash dividends with respect to restricted stock unit awards until shares of Common Stock are issued in settlement of such awards. However, the Committee may grant restricted stock units that entitle their holders to receive dividend equivalents, which are rights to receive additional restricted stock units for a number of shares whose value is equal to any cash dividends we pay. Subject to appropriate adjustment in the event of any change in the capital structure of the Company, no employee may be granted in any fiscal year of the Company more than four hundred thousand (400,000) shares of restricted stock on which the restrictions are based on performance criteria, provided however, that the Company may make an additional one-time grant to any newly-hired employee of a restricted stock award of up to an additional one hundred and fifty thousand (150,000) shares.

Performance Awards. The Committee may grant performance awards subject to such conditions and the attainment of such performance goals over such periods as the Committee determines in writing and sets forth in a written agreement between the Company and the participant. These awards may be designated as performance shares or performance units. Performance shares and performance units are unfunded bookkeeping entries generally having initial values, respectively, equal to the fair market value determined on the grant date of a share of Common Stock and $100 per unit. Performance awards will specify a predetermined amount of performance shares or performance units that may be earned by the participant to the extent that one or more predetermined performance goals are attained within a predetermined performance period. To the extent earned, performance awards may be settled in cash, shares of Common Stock (including shares of restricted stock) or any combination thereof. Subject to appropriate adjustment in the event of any change in the capital structure of the Company, for each fiscal year of the Company contained in the applicable performance period, no employee may be granted performance shares that could result in the employee receiving more than four hundred thousand (400,000) shares of Common Stock or performance units that could result in the employee receiving more than

16

two million dollars ($2,000,000). A participant may receive only one performance award with respect to any performance period.

Prior to the beginning of the applicable performance period or such later date as permitted under Section 162(m) of the Code, the Committee will establish one or more performance goals applicable to the award. Performance goals will be based on the attainment of specified target levels with respect to one or more measures of business or financial performance of the Company and each parent and subsidiary corporation consolidated therewith for financial reporting purposes, or such division or business unit of the Company as may be selected by the Committee. The Committee, in its discretion, may base performance goals on one or more of the following such measures: revenue, gross margin, operating margin, operating income, pre-tax profit, earnings before interest, taxes, depreciation and/or amortization, net income, cash flow, expenses, stock price, earnings per share, return on stockholder equity, return on capital, return on net assets, economic value added, number of customers, market share, same store sales, return on investment, profit after tax, product approval, and customer satisfaction. The target levels with respect to these performance measures may be expressed on an absolute basis or relative to a standard specified by the Committee. The degree of attainment of performance measures will, according to criteria established by the Committee, be computed before the effect of changes in accounting standards, restructuring charges, and similar extraordinary items occurring after the establishment of the performance goals applicable to a performance award.

Following completion of the applicable performance period, the Committee will certify in writing the extent to which the applicable performance goals have been attained and the resulting value to be paid to the participant. The Committee retains the discretion to eliminate or reduce, but not increase, the amount that would otherwise be payable to the participant on the basis of the performance goals attained. However, no such reduction may increase the amount paid to any other participant. In its discretion, the Committee may provide for the payment to a participant awarded performance shares of dividend equivalents with respect to cash dividends paid on the Company’s Common Stock. Performance award payments may be made in lump sum or in installments. If any payment is to be made on a deferred basis, the Committee may provide for the payment of dividend equivalents or interest during the deferral period.

Unless otherwise provided by the Committee, if a participant’s service terminates due to the participant’s death, disability, or retirement prior to completion of the applicable performance period, the final award value will be determined at the end of the performance period on the basis of the performance goals attained during the entire performance period but will be prorated for the number of months of the participant’s service during the performance period. If a participant’s service terminates prior to completion of the applicable performance period for any other reason, the 2004 Plan provides that, unless otherwise determined by the Committee, the performance award will be forfeited. No performance award may be sold or transferred other than by will or the laws of descent and distribution prior to the end of the applicable performance period.

Deferred Stock Awards. The 2004 Plan provides that certain participant’s who are executives or members of a select group of highly compensated employees may elect to receive, in lieu of payment in cash or stock of all or any portion of such participant’s cash and/or stock compensation, an award of deferred stock units. A participant electing to receive deferred stock units will be granted automatically, on the effective date of such deferral election, an award (a “Deferred Stock Unit Award”) for a number of stock units equal to the amount of the deferred compensation divided by an amount equal to the fair market value of a share of our Common Stock as quoted by securities exchange or market system on which the Common Stock is listed on the date of grant. A stock unit is an unfunded bookkeeping entry representing a right to receive one share of our Common Stock in accordance with the terms and conditions of the Deferred Stock Unit Award. Participants are not required to pay any additional cash consideration in connection with the settlement of a Deferred Stock Unit Award. A participant’s compensation not paid in the form of a Deferred Stock Unit Award will be paid in cash in accordance with the Company’s normal payment procedures.

Each Deferred Stock Unit Award will be evidenced by a written agreement between the Company and the participant specifying the number of stock units subject to the award and the other terms and conditions of the

17

Deferred Stock Unit Award, consistent with the requirements of the 2004 Plan. Deferred Stock Unit Awards are fully vested upon grant and will be settled by distribution to the participant of a number of whole shares of Common Stock equal to the number of stock units subject to the award within 30 days following the earlier of (i) the date on which the participant’s service terminates or (ii) an early settlement date elected by the participant in accordance with the terms of the 2004 Plan at the time of his or her election to receive the Deferred Stock Unit Award. A holder of a stock unit has no voting rights or other rights as a stockholder until shares of Common Stock are issued to the participant in settlement of the stock unit. However, participants holding stock units will be entitled to receive dividend equivalents with respect to any payment of cash dividends on an equivalent number of shares of Common Stock. Such dividend equivalents will be credited in the form of additional whole and fractional stock units determined by the fair market value of a share of Common Stock on the dividend payment date. Prior to settlement, no Deferred Stock Unit Award may be assigned or transferred other than by will or the laws of descent and distribution.

Change in Control. The 2004 Plan defines a “Change in Control” of the Company as any of the following events upon which the stockholders of the Company immediately before the event do not retain immediately after the event, in substantially the same proportions as their ownership of shares of the Company’s voting stock immediately before the event, direct or indirect beneficial ownership of a majority of the total combined voting power of the voting securities of the Company, its successor or the corporation to which the assets of the Company were transferred: (i) a sale or exchange by the stockholders in a single or series of related transactions of more than 50% of the Company’s voting stock; (ii) a merger or consolidation in which the Company is a party; (iii) the sale, exchange or transfer of all or substantially all of the assets of the Company; or (iv) a liquidation or dissolution of the Company. If a Change in Control occurs, the surviving, continuing, successor, purchasing, or parent corporation thereof may either assume all outstanding awards or substitute new awards having an equivalent value.

In the event of a Change in Control and the outstanding stock options and stock appreciation rights are not assumed or replaced, then all unexercisable, unvested, or unpaid portions of such outstanding awards will become immediately exercisable, vested, and payable in full immediately prior to the date of the Change in Control.

In the event of a Change in Control, the lapsing of all vesting conditions and restrictions on any shares subject to any restricted stock award, restricted stock unit, or performance award held by a participant whose service with the Company has not terminated prior to the Change in Control shall be accelerated effective as of the date of the Change in Control. For this purpose, the value of outstanding performance awards will be determined and paid on the basis of the greater of (i) the degree of attainment of the applicable performance goals prior to the date of the Change in Control or (ii) 100% of the pre-established performance goal target.