UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-07816

PCM Fund, Inc.

(Exact name of registrant as specified in charter)

840 Newport Center Drive, Newport Beach, CA 92660

(Address of principal executive offices)

John P. Hardaway

Treasurer and Principal Financial Officer

PIMCO Funds

840 Newport Center Drive

Newport Beach, CA 92660

(Name and address of agent for service)

Copies to:

Brendan Fox

Dechert LLP

1775 I Street, N.W.

Washington, D.C. 20006

Registrant’s telephone number, including area code: (866) 746-2606

Date of fiscal year end: December 31

Date of reporting period: December 31, 2007

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Shareholders.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1).

Table of Contents

Pacific Investment Management Company LLC (“PIMCO”), an investment adviser with in excess of $746 billion of assets under management as of December 31, 2007, is responsible for the management and administration of PCM Fund, Inc. (formerly known as PIMCO Commercial Mortgage Securities Trust, Inc.) (the “Fund”). Founded in 1971, PIMCO manages assets on behalf of mutual fund and institutional clients located around the world. Renowned for its fixed-income management expertise, PIMCO manages assets for many of the largest corporations, foundations, endowments and governmental bodies in the United States and the world.

Chairman’s Letter

Dear PCM Fund Shareholder:

It is our pleasure to present to you the annual report for PCM Fund, Inc. (the “Fund”), covering the twelve-month period ended December 31, 2007, the Fund’s fiscal year end. At the end of the reporting period, the Fund’s net assets stood at $128 million.

Reflecting the work of an extraordinary team of PIMCO investment professionals in very challenging market conditions, Morningstar named Bill Gross and the PIMCO investment team as the 2007 Fixed-Income Manager of the Year. To receive the Morningstar Fixed-Income Manager of the Year award for an unprecedented third time is a particularly satisfying recognition of PIMCO’s commitment to consistent, risk-controlled results over the long-term.

Highlights of the financial markets during the reporting period include:

| n | | Last year turned out to be one of the most difficult for financial markets worldwide in some time as the pronounced downturn in the U.S. residential housing market, in concert with the subprime mortgage debacle, helped to foster a global liquidity crisis. Central banks around the world responded to the crisis by injecting liquidity into financial markets and adjusting monetary policy to a neutral or an easing bias. During the reporting period, the Federal Reserve reduced the Federal Funds Rate three times from 5.25% to 4.25% and lowered the discount rate (the interest rate charged to commercial banks and other depository institutions) from 6.25% to 4.75%. The Bank of England reduced its key-lending rate once from 5.75% to 5.50%, while the European Central Bank and the Bank of Japan both remained on hold after each raised interest rates once earlier in the year. |

| n | | Returns of commercial mortgage-backed securities (“CMBS”) lagged U.S. Treasuries in 2007 amid an environment of heightened volatility and increasing risk aversion. Fears over the deterioration in the subprime mortgage sector prompted many investors to avoid spread products and move into U.S. Treasuries, driving the 10-year U.S. Treasury yield from a mid-June peak of 5.29% to a low of 3.84% in late November. On December 31, 2007 the U.S. Treasury yielded 4.02%, or 0.68% lower than at the beginning of the year. In general, the Fund’s exposure to the subprime mortgage market was limited due to a focus on CMBS. |

| n | | High-yield CMBS lagged investment-grade issues as investors penalized lower-rated issues in the flight-to-quality. Despite the underperformance, the credit performance of CMBS was strong as delinquencies declined throughout the year to levels near historical lows. CMBS issuance also reached record levels during the year, driven by aggressive underwriting standards. |

| n | | Returns of mortgage-backed securities (“MBS”) also trailed U.S. Treasuries during the year, driven by increasing volatility, heavy supply, and diminishing demand. In fact, as hedge funds attempted to de-lever in an environment of decreasing liquidity, Agency MBS were one of the few asset types that could actually receive a bid, making them excellent sell candidates due to their relatively higher liquidity. |

| | | | | | |

| | Annual Report | | December 31, 2007 | | 1 |

Chairman’s Letter (Cont.)

On January 22, 2008, the Federal Reserve reduced the Federal Funds Rate by 0.75% from 4.25% to 3.50% in response to a weakening economic outlook and a tightening credit environment. This action represented the first emergency rate reduction since 2001. Furthermore, on January 30, 2008, the Federal Reserve reduced the Federal Funds Rate again by 0.50% to 3.00% and also reduced the discount rate by 0.50% to 3.50%.

In these pages please find a more complete Fund review as it relates to financial-market activities, as well as details about total return investment performance for the twelve-month reporting period.

If you have any questions regarding your Fund investment, please contact us at 1-866-746-2606. Additionally, you can visit the Fund’s website at www.pcmfund.com. Thank you for the trust you have placed in us. We will continue to work diligently to meet your investment needs.

Sincerely,

Brent R. Harris

Chairman, PCM Fund, Inc.

January 31, 2008

Important Information About the Fund

Background and Investment Objectives

The Fund is a non-diversified, closed-end bond fund that trades on the New York Stock Exchange under the symbol “PCM.” Formed in 1993, the Fund’s primary investment objective is to achieve high current income by investing in a portfolio comprised primarily of commercial mortgage-backed securities. These securities are fixed income instruments representing an interest in mortgage loans on commercial real estate properties such as office buildings, shopping malls, hotels, apartment buildings, nursing homes and industrial properties. Capital gains from the disposition of investments is a secondary objective of the Fund.

Primary Investments

On June 1, 2007, the Fund changed its name from PIMCO Commercial Mortgage Securities Trust, Inc. to PCM Fund, Inc. Effective June 1, 2007, the Fund seeks to achieve its investment objective by investing under normal circumstances at least 65% of its total assets in commercial mortgage-backed securities (“CMBS”), which may be represented by forwards or derivatives, such as options, futures contracts or swap agreements. For purposes of applying the Fund’s investment policies and restrictions, swap agreements are generally valued by the Fund at market value. In the case of credit default swaps sold by the Fund (i.e. where the Fund is selling credit default protection), the Fund will value the swap at its notional amount. Prior to June 1, 2007, the Fund sought to achieve its investment objective by investing under normal circumstances at least 80% of its net assets plus the amount of borrowings for investment purposes in CMBS.

Effective February 27, 2007, the Fund changed its investment policies to permit investment in credit derivatives. This change permits the use of credit derivatives, such as credit default swaps, and other derivative instruments for gaining synthetic exposures.

Effective February 27, 2007, the Fund changed its policies so that it is permitted to use Fitch Ratings as a rating agency for purposes of credit quality investment restrictions. The Fund may now use Moody’s, S&P or Fitch ratings, or, if an issue is unrated, PIMCO’s assessment of the issue’s credit quality.

Summary of Risks

We believe that bond funds have an important role to play in a well diversified investment portfolio. It is important to note, however, that in an environment where interest rates may trend upward, rising rates would negatively impact the performance of most bond funds, and fixed-income securities held by a fund are likely to decrease in value. The price volatility of fixed-income securities can also increase during periods of rising interest rates resulting in increased losses to a fund. Bond funds and individual bonds with a longer duration (a measure of the

| | | | | | |

| | Annual Report | | December 31, 2007 | | 3 |

Important Information About the Fund (Cont.)

expected life of a security) tend to be more sensitive to changes in interest rates, usually making them more volatile than securities or funds with shorter durations.

The Fund may be subject to various risks in addition to those described above. Some of these risks may include, but are not limited to, the following: mortgage risk, prepayment risk, real rate risk, real estate risk, derivative risk, smaller company risk, non-U.S. security risk, high yield security risk, leverage risk and specific sector investment risks. The Fund may use derivative instruments for hedging purposes or as part of an investment strategy. Use of these instruments may involve certain costs and risks such as liquidity risk, interest rate risk, market risk, credit risk, management risk, leveraging risk and the risk that the Fund could not close out a position when it would be most advantageous to do so. The Fund’s investments in derivatives could result in losses greater than the principal amount. Investing in non-U.S. securities may entail risk due to non-U.S. economic and political developments; this risk may be enhanced when investing in emerging markets. High-yield bonds typically have a lower credit rating than other bonds. Lower rated bonds generally involve a greater risk to principal than higher rated bonds. Smaller companies may be more volatile than larger companies and may entail more risk. Concentrating investments in individual sectors, such as the real estate sector, may add additional risk and volatility compared to a diversified portfolio. The credit quality of a particular security or group of securities does not ensure the stability or safety of the overall portfolio.

An investment in the Fund is not a deposit of a bank and is not guaranteed or insured by the Federal Deposit Insurance Corporation or any other government agency. It is possible to lose money on an investment in the Fund.

Sarbanes-Oxley Act and Other Information Available to Shareholders

PIMCO has adopted written proxy voting policies and procedures (“Proxy Policy”) as required by Rule 206(4)-6 under the Investment Advisers Act of 1940, as amended. The Proxy Policy has been adopted by the Fund as the policies and procedures that PIMCO will use when voting proxies on behalf of the Fund. A description of the policies and procedures that PIMCO will use to vote proxies relating to portfolio securities of the Fund, and information about how the Fund voted proxies relating to portfolio securities held during the most recent twelve-month period ended June 30, are available without charge, upon request, by calling the Fund at 1-866-746-2606, on the Fund’s website at http://www.pcmfund.com and on the Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov.

The Fund files its complete schedule of Fund holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. A copy of the Fund’s Form N-Q is also available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington D.C. and is available, upon request, by calling the Fund at 1-866-746-2606 and on the Fund’s website at http://www.pcmfund.com. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

On May 8, 2007, the Fund submitted a CEO annual certification to the New York Stock Exchange (NYSE) on which the Fund’s principal executive officer certified that he was not aware, as of that date, of any violation by the Fund of the NYSE’s Corporate Governance listing standards. In addition, as required by Section 302 of the Sarbanes-Oxley Act of 2002 and related SEC rules, the Fund’s principal executive and principal financial officers have made quarterly certifications, included in filings with the SEC on Forms N-CSR and N-Q, relating to, among other things, the Fund’s disclosure controls and procedures and internal control over financial reporting, as applicable.

Change in Dividend Policy

The Fund announced on February 27, 2007, a decrease in the Fund’s monthly dividend from 9.375 cents per common share to 7.00 cents per common share due to certain factors at the time. These factors included the dramatic increase in short-term interest rates and the prolonged inversion of the U.S. yield curve, which increased borrowing costs for the Fund, and the narrowing of risk premiums offered by the bond market, which led to lower reinvestment yields.

| | | | | | |

| | Annual Report | | December 31, 2007 | | 5 |

Fund Summary PCM Fund, Inc.

Objectives: The Fund’s primary investment objective is to achieve high current income, with capital gains from the disposition of investments as a secondary objective.

Primary Investments: Commercial mortgage-backed securities

Inception Date: September 2, 1993

Total Net Assets: $128 million

Portfolio Manager: Dan Ivascyn

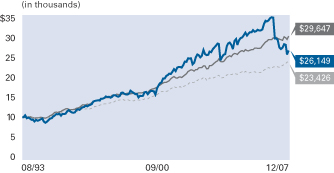

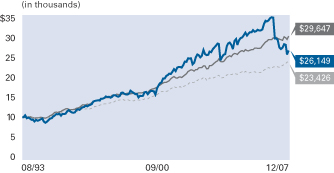

Cumulative Returns Through December 31, 2007

Past performance is no guarantee of future results. The line graph depicts the value of a net $10,000 investment made at the Fund’s inception on September 2, 1993 and held through December 31, 2007, compared to the Lehman Brothers Aggregate Bond Index, an unmanaged market index. Investment performance assumes the reinvestment of dividends and capital gains distribution, if any. The Fund’s NYSE Share Price performance does not reflect the effect of sales loads or broker commissions. The performance data quoted represents past performance. Investment return and share value will fluctuate so that Fund shares, when sold, may be worth more or less than their original cost. Returns shown do not reflect the deduction of taxes that a shareholder would pay on the sale of Fund shares.

| | | | | | | | | | |

| Average Annual Total Return for the period ended December 31, 2007 |

| | | | | 1 Year | | 5 Years | | 10 Years | | Fund

Inception(a) |

| | PCM Based on NYSE Share Price | | -23.17% | | 1.25% | | 6.09% | | 6.95% |

| | PCM Based on Net Asset Value | | 2.83% | | 6.55% | | 7.43% | | 7.90% |

- - - | | Lehman Brothers Aggregate Bond Index(b) | | 6.97% | | 4.42% | | 5.97% | | 6.12% |

All Fund returns are net of fees and expenses.

(a) | The Fund began operations on 09/02/93. Index comparisons began on 08/31/93. |

(b) | Lehman Brothers Aggregate Bond Index represents securities that are SEC-registered, taxable, and U.S. dollar-denominated. The index covers the U.S. investment grade fixed-rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. These major sectors are subdivided into more specific indices that are calculated and reported on a regular basis. It is not possible to invest directly in this index. The index does not reflect deductions for fees, expenses or taxes. |

Past performance is no guarantee of future results. Performance data current to the most recent month-end is available at www.pcmfund.com or by calling 1-866-746-2606.

| | |

| Allocation Breakdown % of Total Investments as of December 31, 2007 | | |

| Commercial Mortgage-Backed Securities | | 71.6% |

| Real Estate Asset-Backed Securities | | 17.8% |

| Corporate Bonds & Notes | | 7.0% |

| Other | | 3.6% |

Portfolio Insights

| » | | Duration positioning above that of the index for most of the period added to returns as the ten-year U.S. Treasury yield declined from 4.70% to 4.02%. |

| » | | A curve steepening bias added to returns as the two-year U.S. Treasury yield declined more than the 30-year U.S. Treasury yield. |

| » | | An emphasis on BBB-rated commercial mortgage-backed securities (“CMBS”) was negative for returns as they lagged higher-rated CMBS. |

| » | | Exposure to below-investment grade CMBS was negative for returns as they significantly underperformed investment-grade CMBS issues. |

| » | | An underweight to corporate debt benefited performance as corporate debt was one of the worst performing sectors in the Lehman Brothers Aggregate Bond Index, beating only the performance of asset-backed securities during the period. |

| » | | An allocation to high-yield corporate debt detracted from returns as corporate debt underperformed the investment-grade market. |

| | | | | | |

| | Annual Report | | December 31, 2007 | | 7 |

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

| Selected per Share Data for the Year Ended: | | 12/31/2007 | | | 12/31/2006 | | | 12/31/2005 | | | 12/31/2004 | | | 12/31/2003 | |

| Net Asset Value Beginning of Year | | $ | 11.85 | | | $ | 11.94 | | | $ | 12.49 | | | $ | 12.53 | | | $ | 12.80 | |

| Net Investment Income (a) | | | 0.80 | | | | 0.90 | | | | 0.98 | | | | 1.01 | | | | 1.09 | |

| Net Realized/Unrealized Gain (Loss) on Investments | | | (0.48 | ) | | | 0.14 | | | | (0.40 | ) | | | 0.08 | | | | (0.23 | ) |

Total Income from Investment Operations | | | 0.32 | | | | 1.04 | | | | 0.58 | | | | 1.09 | | | | 0.86 | |

Dividends from Net Investment Income | | | (0.89 | ) | | | (1.13 | ) | | | (1.13 | ) | | | (1.13 | ) | | | (1.13 | ) |

| Net Asset Value End of Year | | $ | 11.28 | | | $ | 11.85 | | | $ | 11.94 | | | $ | 12.49 | | | $ | 12.53 | |

| NYSE Share Price End of Year | | $ | 10.25 | | | $ | 14.40 | | | $ | 14.03 | | | $ | 13.17 | | | $ | 14.53 | |

| Total Investment Return | | | | | | | | | | | | | | | | | | | | |

Per Share NYSE Share Price (b) | | | (23.17 | )% | | | 11.17 | % | | | 15.40 | % | | | (1.62 | )% | | | 9.76 | % |

| Total Investment Return | | | | | | | | | | | | | | | | | | | | |

Per Share Net Asset Value (c) | | | 2.83 | % | | | 9.17 | % | | | 4.78 | % | | | 9.07 | % | | | 7.03 | % |

| Net Assets End of Year (000s) | | $ | 128,092 | | | $ | 134,259 | | | $ | 134,792 | | | $ | 140,267 | | | $ | 139,891 | |

Ratio of Expenses to Average Net Assets | | | 4.03 | % | | | 3.69 | % | | | 2.77 | % | | | 1.75 | % | | | 1.52 | % |

| Ratio of Expenses to Average Net Assets Excluding Interest Expense | | | 1.08 | % | | | 1.03 | % | | | 1.07 | % | | | 1.00 | % | | | 1.05 | % |

| Ratio of Net Investment Income to Average Net Assets | | | 6.94 | % | | | 7.64 | % | | | 8.00 | % | | | 8.09 | % | | | 8.62 | % |

| Amount of Borrowings Outstanding End of Year (000s) | | $ | 80,050 | | | $ | 69,574 | | | $ | 67,880 | | | $ | 67,702 | | | $ | 71,025 | |

| Portfolio Turnover Rate | | | 17 | % | | | 21 | % | | | 8 | % | | | 24 | % | | | 40 | % |

| (a) | Per share amounts based on average number of shares outstanding during the year. |

| (b) | Total investment return on market value is the combination of reinvested dividend income, reinvested capital gains distributions, if any, and changes in market price per share. Total investment returns exclude the effects of sales loads. |

| (c) | Total investment return on net asset value is the combination of reinvested dividend income, reinvested capital gains distributions, if any, and changes in net asset value per share. |

| | | | |

| 8 | | PCM Fund, Inc. | | See Accompanying Notes |

| | |

| |

| Statement of Assets and Liabilities | | December 31, 2007 |

| | | | |

| (Amounts in thousands, except per share amounts) | | | |

| Assets: | | | |

| Investments, at value | | $ | 207,220 | |

| Repurchase agreements, at value | | | 1,150 | |

| Cash | | | 228 | |

| Deposits with brokers for futures contracts | | | 35 | |

| Interest and dividends receivable | | | 1,682 | |

| Swap premiums paid | | | 729 | |

| Unrealized appreciation on swap agreements | | | 19,888 | |

| Other assets | | | 8 | |

| | | | 230,940 | |

| |

| Liabilities: | | | | |

| Payable for the reverse repurchase agreements | | $ | 80,050 | |

| Dividends payable | | | 795 | |

| Accrued investment manager fee | | | 237 | |

| Accrued administrative fee | | | 33 | |

| Accrued custodian expense | | | 8 | |

| Accrued audit fee | | | 22 | |

| Accrued printing expense | | | 14 | |

| Swap premiums received | | | 13,762 | |

| Unrealized depreciation on swap agreements | | | 7,927 | |

| | | | 102,848 | |

| |

| Net Assets | | $ | 128,092 | |

| |

| Net Assets Consist of: | | | | |

| Capital stock–authorized 300 million shares, $.001 par value; outstanding 11,355,683 shares | | $ | 11 | |

| Paid in capital | | | 155,200 | |

| (Overdistributed) net investment income | | | (361 | ) |

| Accumulated undistributed net realized (loss) | | | (34,983 | ) |

| Net unrealized appreciation | | | 8,225 | |

| | | $ | 128,092 | |

| |

| Net Asset Value Per Share Outstanding | | $ | 11.28 | |

| |

| Cost of Investments Owned | | $ | 210,956 | |

| |

| Cost of Repurchase Agreements Owned | | $ | 1,150 | |

| | | | | | |

| | Annual Report | | December 31, 2007 | | 9 |

| | |

| |

| Statement of Operations | | Year Ended December 31, 2007 |

| | | | |

| (Amounts in thousands) | | | |

| Investment Income: | | | |

| Interest | | $ | 14,358 | |

Total Income | | | 14,358 | |

| |

| Expenses: | | | | |

| Investment manager fees | | | 945 | |

| Administrative fees | | | 130 | |

| Transfer agent fees | | | 29 | |

| Directors’ fees | | | 55 | |

| Printing expense | | | 43 | |

| Proxy expense | | | 23 | |

| Legal fees | | | 90 | |

| Audit fees | | | 23 | |

| Custodian fees | | | 44 | |

| Interest expense | | | 3,861 | |

| Miscellaneous expense | | | 41 | |

Total Expenses | | | 5,284 | |

| |

| Net Investment Income | | | 9,074 | |

| |

| Net Realized and Unrealized Gain (Loss): | | | | |

| Net realized (loss) on investments | | | (1,049 | ) |

| Net realized (loss) on futures contracts, written options and swaps | | | (19,162 | ) |

| Net change in unrealized (depreciation) on investments | | | (1,945 | ) |

| Net change in unrealized appreciation on futures contracts, written options and swaps | | | 16,724 | |

Net (Loss) | | | (5,432 | ) |

| |

| Net Increase in Net Assets Resulting from Operations | | $ | 3,642 | |

| | | | |

| 10 | | PCM Fund, Inc. | | See Accompanying Notes |

Statements of Changes in Net Assets

| | | | | | | | |

| (Amounts in thousands, except share amounts) | | | | | | |

| (Decrease) in Net Assets from: | | Year Ended December 31, 2007 | | | Year Ended December 31, 2006 | |

| | |

| Operations: | | | | | | | | |

| Net investment income | | $ | 9,074 | | | $ | 10,218 | |

| Net realized gain (loss) | | | (20,211 | ) | | | 2,697 | |

| Net change in unrealized appreciation (depreciation) | | | 14,779 | | | | (1,373 | ) |

| Net increase resulting from operations | | | 3,642 | | | | 11,542 | |

| | |

| Distributions to Shareholders: | | | | | | | | |

| From net investment income | | | (10,074 | ) | | | (12,726 | ) |

| | |

| Total Distributions | | | (10,074 | ) | | | (12,726 | ) |

| | |

| Fund Share Transactions: | | | | | | | | |

| Issued as reinvestment of distributions (21,409 and 48,723 shares, respectively) | | | 265 | | | | 651 | |

| Net increase resulting from Fund share transactions | | | 265 | | | | 651 | |

| | |

| Total (Decrease) in Net Assets | | | (6,167 | ) | | | (533 | ) |

| | |

| Net Assets: | | | | | | | | |

| Beginning of year | | | 134,259 | | | | 134,792 | |

| End of year* | | $ | 128,092 | | | $ | 134,259 | |

| | |

| * Including (overdistributed) net investment income of: | | $ | (361 | ) | | $ | (792 | ) |

| | | | | | |

| | Annual Report | | December 31, 2007 | | 11 |

| | |

| |

| Statement of Cash Flows | | Year Ended December 31, 2007 |

| | | | |

| (Amounts in thousands) | | | |

| Increase in Cash from: | | | |

| |

| Cash flows provided by operating activities: | | | | |

| Net increase in net assets resulting from operations | | $ | 3,642 | |

| |

Adjustments to reconcile net increase in net assets from operations to net cash used for operating activities: | | | | |

| Purchases of long-term securities | | | (48,843 | ) |

| Proceeds from sales of long-term securities | | | 42,695 | |

| Sale of short-term portfolio investments, net | | | (2,212 | ) |

| Increase in interest receivable | | | (70 | ) |

| Decrease in receivable for investments sold | | | 1 | |

| Deposits with brokers for open futures contracts | | | (35 | ) |

| Increase in other asset | | | (8 | ) |

| Decrease in swap premiums paid | | | (343 | ) |

| Proceeds from futures contracts transactions | | | (206 | ) |

| Decrease in payable to manager | | | (12 | ) |

| Decrease in administrative fees | | | (1 | ) |

| Increase in printing expense | | | 12 | |

| Decrease in custodian fees | | | (1 | ) |

| Increase in audit fees | | | 6 | |

| Decrease in other fees | | | (49 | ) |

| Unrealized appreciation on investments | | | (14,779 | ) |

| Net realized loss on investments | | | 20,211 | |

| Net amortization on investments | | | (196 | ) |

| Net cash used for operating activities | | | (188 | ) |

| |

| Cash flows received from financing activities*: | | | | |

| Net borrowing from reverse repurchase agreements | | | 10,476 | |

| Cash dividend paid | | | (10,077 | ) |

| Net cash received from financing activities | | | 399 | |

| |

| Net Increase in Cash | | | 211 | |

| |

| Cash: | | | | |

| Beginning of year | | | 17 | |

| End of year | | $ | 228 | |

| * | Includes reinvestment of dividends of $265 |

| | | | |

| 12 | | PCM Fund, Inc. | | See Accompanying Notes |

| | |

| |

Schedule of Investments

PCM Fund, Inc. | | December 31, 2007 |

| | | | | | | | |

| | | | | PRINCIPAL

AMOUNT

(000S) | | | | VALUE (000S) |

| COMMERCIAL MORTGAGE-BACKED SECURITIES 116.5% |

| | | | | | | | |

| HEALTHCARE 0.8% | | | | | | | | |

| RMF Commercial Mortgage Pass-Through Certificates |

7.471% due 01/15/2019 (f) | | $ | | 1,000 | | $ | | 523 |

9.150% due 11/28/2027 (f) | | | | 471 | | | | 466 |

9.468% due 01/15/2019 (a)(f) | | | | 276 | | | | 76 |

| | | | | | | | |

| | | | | | | | 1,065 |

| | | | | | | | |

| | | | | | | | |

| HOSPITALITY 8.8% | | | | | | | | |

| Bear Stearns Commercial Mortgage Securities |

5.817% due 05/14/2016 (c)(f) | | | | 1,500 | | | | 1,525 |

| |

| Commercial Mortgage Pass-Through Certificates |

5.570% due 02/05/2019 (f) | | | | 2,000 | | | | 1,930 |

| |

| Hilton Hotel Pool Trust | | | | | | | | |

0.601% due 10/03/2015 (b)(c)(f) | | | | 31,113 | | | | 526 |

| |

| Host Marriot Pool Trust | | | | | | | | |

8.310% due 08/03/2015 (f) | | | | 2,000 | | | | 2,103 |

| |

| Office Portfolio Trust | | | | | | | | |

6.778% due 02/03/2016 (f) | | | | 1,000 | | | | 1,029 |

| |

| Times Square Hotel Trust | | | | | | | | |

8.528% due 08/01/2026 (f) | | | | 3,608 | | | | 4,208 |

| | | | | | | | |

| | | | | | | | 11,321 |

| | | | | | | | |

| | | | | | | | |

| MULTI-CLASS 101.0% | | | | | | | | |

| Banc of America Commercial Mortgage, Inc. |

5.276% due 03/11/2041 (f) | | | | 2,000 | | | | 1,948 |

5.918% due 04/11/2036 (c)(f) | | | | 924 | | | | 944 |

6.290% due 06/11/2035 (f) | | | | 700 | | | | 690 |

7.224% due 04/15/2036 (c) | | | | 2,500 | | | | 2,684 |

7.684% due 11/15/2031 (c) | | | | 2,800 | | | | 2,966 |

| |

| Bear Stearns Commercial Mortgage Securities |

5.060% due 11/15/2016 | | | | 7 | | | | 7 |

5.545% due 02/11/2041 (f) | | | | 1,000 | | | | 843 |

5.809% due 05/11/2039 (f) | | | | 1,000 | | | | 979 |

5.992% due 09/11/2042 (c)(f) | | | | 2,000 | | | | 1,680 |

6.500% due 02/15/2032 (f) | | | | 1,332 | | | | 1,291 |

6.625% due 10/15/2032 (f) | | | | 1,258 | | | | 1,117 |

7.000% due 05/20/2030 (c) | | | | 1,541 | | | | 1,732 |

| |

| Carey Commercial Mortgage Trust |

5.970% due 09/20/2019 (c)(f) | | | | 1,316 | | | | 1,336 |

| |

| Chase Commercial Mortgage Securities Corp. |

6.275% due 02/12/2016 (c)(f) | | | | 1,000 | | | | 1,048 |

6.650% due 07/15/2032 (f) | | | | 2,600 | | | | 2,661 |

6.887% due 10/15/2032 (f) | | | | 1,500 | | | | 1,472 |

| |

| Citigroup/Deutsche Bank Commercial Mortgage Trust |

5.225% due 07/15/2044 | | | | 1,015 | | | | 967 |

| |

| | | | | | | | |

| | | | | PRINCIPAL

AMOUNT

(000S) | | | | VALUE

(000S) |

| Commercial Mortgage Asset Trust |

6.975% due 01/17/2032 (c) | | $ | | 2,500 | | $ | | 2,722 |

| |

| Commercial Mortgage Pass-Through Certificates |

6.586% due 07/16/2034 (c)(f) | | | | 1,500 | | | | 1,594 |

6.811% due 07/16/2034 (f) | | | | 1,500 | | | | 1,587 |

6.830% due 02/14/2034 (c)(f) | | | | 2,893 | | | | 3,058 |

8.191% due 08/15/2033 (f) | | | | 1,500 | | | | 1,588 |

| |

| Credit Suisse Mortgage Capital Certificates |

5.467% due 09/15/2039 (c) | | | | 5,000 | | | | 5,048 |

| |

| CS First Boston Mortgage Securities Corp. |

0.421% due 12/15/2035 (b)(c)(f) | | | | 23,933 | | | | 869 |

5.322% due 08/15/2036 (f) | | | | 2,000 | | | | 1,816 |

5.383% due 12/15/2036 (f) | | | | 2,600 | | | | 2,532 |

7.170% due 05/17/2040 (c) | | | | 3,000 | | | | 3,169 |

7.460% due 01/17/2035 (c)(f) | | | | 2,000 | | | | 2,233 |

| |

| CVS Lease Pass-Through | | | | | | | | |

5.880% due 01/10/2028 (f) | | | | 1,912 | | | | 1,853 |

| |

| DLJ Commercial Mortgage Corp. |

7.031% due 11/12/2031 | | | | 135 | | | | 137 |

| |

| Federal Housing Administration |

7.380% due 04/01/2041 | | | | 2,398 | | | | 2,432 |

| |

| FFCA Secured Lending Corp. |

1.346% due 09/18/2027 (b)(f) | | | | 5,917 | | | | 172 |

| |

| First Union-Lehman Brothers-Bank of America |

6.778% due 11/18/2035 (c) | | | | 2,000 | | | | 2,160 |

| |

| First Union National Bank-Bank of America Commercial Mortgage Trust |

6.000% due 01/15/2011 (f) | | | | 1,000 | | | | 969 |

| |

| GE Capital Commercial Mortgage Corp. |

5.113% due 07/10/2045 (f) | | | | 1,000 | | | | 938 |

5.121% due 05/10/2043 (c) | | | | 1,000 | | | | 934 |

| |

| GMAC Commercial Mortgage Securities, Inc. |

6.500% due 05/15/2035 | | | | 20 | | | | 21 |

6.500% due 05/15/2035 (c) | | | | 2,500 | | | | 2,530 |

6.500% due 05/15/2035 (f) | | | | 2,000 | | | | 2,053 |

7.035% due 05/15/2030 (f) | | | | 1,500 | | | | 1,444 |

8.067% due 09/15/2035 (f) | | | | 1,500 | | | | 1,618 |

| |

| Greenwich Capital Commercial Funding Corp. |

5.419% due 01/05/2036 (f) | | | | 1,500 | | | | 1,477 |

| |

| GS Mortgage Securities Corp. II |

5.560% due 11/10/2039 (c) | | | | 5,750 | | | | 5,850 |

5.740% due 11/10/2039 | | | | 2,000 | | | | 1,810 |

6.302% due 03/06/2020 (f) | | | | 2,000 | | | | 1,818 |

6.615% due 02/14/2016 (c)(f) | | | | 3,500 | | | | 3,709 |

7.397% due 08/05/2018 (f) | | | | 3,480 | | | | 3,622 |

| |

| GSMPS Mortgage Loan Trust | | | | |

8.000% due 09/19/2027 (c)(f) | | | | 1,280 | | | | 1,389 |

| |

| | | | | | |

| | Annual Report | | December 31, 2007 | | 13 |

Schedule of Investments PCM Fund, Inc. (Cont.)

| | | | | | | | |

| | | | | PRINCIPAL

AMOUNT

(000S) | | | | VALUE (000S) |

| JPMorgan Chase Commercial Mortgage Securities Corp. |

0.611% due 03/12/2039 (b)(f) | | $ | | 12,033 | | $ | | 392 |

5.267% due 05/15/2041 (f) | | | | 1,500 | | | | 1,376 |

6.162% due 05/12/2034 (c) | | | | 2,000 | | | | 2,101 |

6.465% due 11/15/2035 (c) | | | | 3,000 | | | | 3,171 |

| |

| LB Commercial Conduit Mortgage Trust |

6.000% due 10/15/2035 (c)(f) | | | | 5,000 | | | | 5,015 |

| |

| LB-UBS Commercial Mortgage Trust |

5.683% due 07/15/2035 (f) | | | | 1,500 | | | | 1,404 |

6.950% due 03/15/2034 (c)(f) | | | | 1,572 | | | | 1,675 |

7.290% due 09/15/2034 (f) | | | | 2,000 | | | | 2,128 |

| |

| Merrill Lynch Countrywide Commercial Mortgage Trust |

5.957% due 08/12/2049 | | | | 2,000 | | | | 1,692 |

| |

| Merrill Lynch Mortgage Investors, Inc. |

6.904% due 12/15/2030 | | | | 1,500 | | | | 1,643 |

7.042% due 02/15/2030 (c) | | | | 2,000 | | | | 2,052 |

| |

| Morgan Stanley Capital I |

5.204% due 11/14/2042 (c) | | | | 500 | | | | 471 |

5.379% due 08/13/2042 (f) | | | | 100 | | | | 92 |

6.990% due 12/15/2031 (c) | | | | 200 | | | | 204 |

7.562% due 04/30/2039 (c)(f) | | | | 1,138 | | | | 1,155 |

| |

| Nationslink Funding Corp. |

7.050% due 03/20/2030 (f) | | | | 2,000 | | | | 2,009 |

7.105% due 08/20/2030 (f) | | | | 2,500 | | | | 2,546 |

| |

| Prudential Securities Secured Financing Corp. |

6.755% due 06/16/2031 (f) | | | | 2,000 | | | | 2,140 |

| |

| Trizec Hahn Office Properties |

7.604% due 05/15/2016 (f) | | | | 3,000 | | | | 3,210 |

| |

| Wachovia Bank Commercial Mortgage Trust |

0.206% due 10/15/2041 (b)(c)(f) | | | | 47,343 | | | | 938 |

4.982% due 02/15/2035 (f) | | | | 1,020 | | | | 909 |

5.188% due 02/15/2041 (f) | | | | 2,500 | | | | 2,172 |

5.338% due 01/15/2041 (f) | | | | 1,500 | | | | 1,322 |

6.290% due 04/15/2034 (f) | | | | 2,000 | | | | 1,983 |

| | | | | | | | |

| | | | | | | | 129,317 |

| | | | | | | | |

| | | | | | | | |

| MULTI-FAMILY 5.9% |

| Commercial Capital Access One, Inc. |

7.706% due 11/15/2028 (f) | | | | 3,000 | | | | 3,040 |

| |

| Dickinson County, Iowa Revenue Notes, Series 2006 |

7.750% due 12/01/2012 | | | | 345 | | | | 350 |

| |

| Fannie Mae |

5.237% due 06/01/2023 (c) | | | | 1,428 | | | | 1,440 |

7.095% due 08/01/2026 (c) | | | | 113 | | | | 115 |

9.375% due 04/01/2016 (c) | | | | 160 | | | | 179 |

| |

| | | | | | | | |

| | | | | PRINCIPAL

AMOUNT

(000S) | | | | VALUE (000S) |

| Federal Housing Administration |

7.430% due 07/01/2018 | | $ | | 226 | | $ | | 228 |

8.360% due 01/01/2012 | | | | 125 | | | | 128 |

| |

| Multi-Family Capital Access One, Inc. |

8.837% due 01/15/2024 | | | | 2,000 | | | | 2,094 |

| | | | | | | | |

| | | | | | | | 7,574 |

| | | | | | | | |

| Total Commercial Mortgage-Backed Securities (Cost $154,182) | | 149,277 |

| | | | | | | | |

| | | | | | | | |

| CORPORATE BONDS & NOTES 11.4% |

| | | | | | | | |

| BANKING & FINANCE 2.2% |

| Bear Stearns Cos., Inc. | | | | | | | | |

6.950% due 08/10/2012 | | | | 1,000 | | | | 1,029 |

| |

| CCCA LLC | | | | | | | | |

7.800% due 10/15/2008 (f) | | | | 449 | | | | 456 |

| |

| Ford Motor Credit Co. LLC | | | | | | |

8.000% due 12/15/2016 (c) | | | | 500 | | | | 426 |

| |

| GMAC LLC | | | | | | | | |

6.000% due 09/15/2008 | | | | 180 | | | | 173 |

| |

| Tenneco, Inc. | | | | | | | | |

8.625% due 11/15/2014 (c) | | | | 750 | | | | 741 |

| | | | | | | | |

| | | | | | | | 2,825 |

| | | | | | | | |

| | | | | | | | |

| INDUSTRIALS 7.6% |

| Archer-Daniels-Midland Co. | | | | |

6.450% due 01/15/2038 | | | | 1,000 | | | | 1,043 |

| |

| Bon-Ton Stores, Inc. |

10.250% due 03/15/2014 (c) | | | | 500 | | | | 380 |

| |

| CCO Holdings LLC |

8.750% due 11/15/2013 | | | | 500 | | | | 480 |

| |

| CSC Holdings, Inc. |

7.875% due 02/15/2018 | | | | 500 | | | | 470 |

| |

| Dynegy Holdings, Inc. |

7.125% due 05/15/2018 (c) | | | | 500 | | | | 445 |

| |

| EchoStar DBS Corp. |

7.125% due 02/01/2016 (c) | | | | 500 | | | | 512 |

| |

| HCA, Inc. |

6.750% due 07/15/2013 (c) | | | | 1,250 | | | | 1,119 |

9.250% due 11/15/2016 (c) | | | | 275 | | | | 289 |

9.250% due 11/15/2016 (f) | | | | 325 | | | | 341 |

| |

| Intelsat Bermuda Ltd. |

9.250% due 06/15/2016 (c) | | | | 1,000 | | | | 1,010 |

| |

| RH Donnelley Corp. |

8.875% due 01/15/2016 | | | | 950 | | | | 893 |

| |

| SemGroup LP |

8.750% due 11/15/2015 (f) | | | | 500 | | | | 478 |

| |

| | | | |

| 14 | | PCM Fund, Inc. | | See Accompanying Notes |

| | | | | | | | |

| | | | | PRINCIPAL

AMOUNT

(000S) | | | | VALUE (000S) |

| Sungard Data Systems, Inc. |

9.125% due 08/15/2013 | | $ | | 500 | | $ | | 511 |

| |

| United Airlines, Inc. |

6.636% due 07/02/2022 (f) | | | | 1,000 | | | | 981 |

| |

| Verso Paper Holdings LLC and Verson Paper, Inc. |

9.125% due 08/01/2014 | | | | 800 | | | | 812 |

| | | | | | | | |

| | | | | | | | 9,764 |

| | | | | | | | |

| | | | | | | | |

| UTILITIES 1.6% |

| Cincinnati Bell, Inc. |

8.375% due 01/15/2014 | | | | 500 | | | | 490 |

| |

| NGPL Pipe Co. LLC | | | | | | | | |

7.768% due 12/15/2037 (f) | | | | 1,000 | | | | 1,049 |

| |

| NRG Energy, Inc. | | | | | | | | |

7.250% due 02/01/2014 | | | | 350 | | | | 342 |

7.375% due 02/01/2016 | | | | 150 | | | | 147 |

| | | | | | | | |

| | | | | | | | 2,028 |

| | | | | | | | |

| Total Corporate Bonds & Notes (Cost $14,994) | | 14,617 |

| | | | | | | | |

| | | | | | | | |

| REAL ESTATE ASSET-BACKED SECURITIES 29.0% |

| Access Financial Manufactured Housing Contract Trust |

7.650% due 05/15/2021 | | | | 2,500 | | | | 2,219 |

| |

| ACE Securities Corp. |

8.115% due 04/25/2035 (f) | | | | 2,213 | | | | 1,052 |

| |

| Ameriquest Mortgage Securities, Inc. |

8.665% due 02/25/2033 | | | | 450 | | | | 144 |

| |

| Asset-Backed Securities Corp. Home Equity |

7.615% due 06/21/2029 | | | | 267 | | | | 70 |

| |

| Bear Stearns Second Lien Trust |

7.365% due 12/25/2036 (f) | | | | 2,316 | | | | 212 |

| |

| CDC Mortgage Capital Trust |

8.946% due 03/25/2033 | | | | 283 | | | | 22 |

| |

| Conseco Finance Securitizations Corp. |

7.960% due 02/01/2032 | | | | 2,000 | | | | 1,664 |

7.970% due 05/01/2032 | | | | 835 | | | | 625 |

| |

| CS First Boston Mortgage Securities Corp. |

7.000% due 02/25/2033 (c) | | | | 375 | | | | 376 |

| |

| Fannie Mae |

5.000% due 11/25/2035 (c) | | | | 444 | | | | 395 |

6.025% due 09/25/2023 (c) | | | | 43 | | | | 45 |

6.109% due 07/01/2012 (c) | | | | 4,717 | | | | 4,960 |

7.000% due 10/15/2022 - 10/01/2033 (c) | | | | 1,190 | | | | 1,217 |

7.875% due 11/01/2018 (c) | | | | 19 | | | | 20 |

| | | | | | | | |

| | | | | PRINCIPAL

AMOUNT

(000S) | | | | VALUE (000S) |

8.000% due 07/01/2009 - 07/25/2022 (c) | | $ | | 284 | | $ | | 298 |

8.000% due 10/01/2010 - 06/01/2015 | | | | 15 | | | | 16 |

8.500% due 07/01/2008 - 03/01/2029 | | | | 44 | | | | 47 |

8.500% due 09/01/2021 - 04/01/2032 (c) | | | | 602 | | | | 648 |

9.000% due 03/25/2020 (c) | | | | 272 | | | | 305 |

| |

| Freddie Mac |

5.000% due 02/15/2036 (c) | | | | 355 | | | | 285 |

7.000% due 09/01/2010 - 12/01/2015 | | | | 14 | | | | 15 |

7.000% due 07/01/2012 - 10/01/2037 (c) | | | | 10,844 | | | | 11,207 |

7.057% due 11/01/2029 (c) | | | | 327 | | | | 330 |

7.240% due 04/01/2032 (c) | | | | 212 | | | | 213 |

7.384% due 03/01/2032 (c) | | | | 261 | | | | 267 |

7.466% due 08/01/2030 (c) | | | | 294 | | | | 300 |

8.000% due 07/01/2010 - 06/01/2015 | | | | 18 | | | | 19 |

8.500% due 11/15/2021 (c) | | | | 519 | | | | 565 |

| |

| Green Tree Financial Corp. |

6.180% due 04/01/2030 | | | | 130 | | | | 128 |

6.220% due 03/01/2030 (c) | | | | 515 | | | | 539 |

6.530% due 02/01/2031 | | | | 743 | | | | 651 |

6.760% due 03/01/2030 | | | | 396 | | | | 423 |

6.810% due 12/01/2027 (c) | | | | 438 | | | | 443 |

7.050% due 01/15/2027 | | | | 922 | | | | 849 |

7.070% due 01/15/2029 | | | | 118 | | | | 124 |

| |

| Greenpoint Manufactured Housing |

7.590% due 11/15/2028 | | | | 83 | | | | 87 |

8.300% due 10/15/2026 | | | | 2,000 | | | | 2,067 |

| |

| Keystone Owner Trust |

9.000% due 01/25/2029 (f) | | | | 403 | | | | 339 |

| |

| Merrill Lynch Mortgage Investors, Inc. |

5.117% due 08/25/2033 (f) | | | | 798 | | | | 712 |

| |

| Oakwood Mortgage Investors, Inc. |

5.258% due 05/15/2013 | | | | 120 | | | | 107 |

6.890% due 11/15/2032 | | | | 1,000 | | | | 522 |

| |

| Ocwen Residential Mortgage-Backed Securities Corp. |

6.837% due 06/25/2039 (f) | | | | 577 | | | | 443 |

7.000% due 10/25/2040 (f) | | | | 1,197 | | | | 860 |

| |

| Saxon Asset Securities Trust |

8.640% due 12/25/2032 | | | | 547 | | | | 519 |

| |

| Structured Asset Investment Loan Trust |

7.865% due 10/25/2033 | | | | 68 | | | | 1 |

| |

| UCFC Manufactured Housing Contract |

7.900% due 01/15/2028 | | | | 1,000 | | | | 511 |

| |

| | | | | | |

| | Annual Report | | December 31, 2007 | | 15 |

Schedule of Investments PCM Fund, Inc. (Cont.)

| | | | | | | | |

| | | | | PRINCIPAL

AMOUNT

(000S) | | | | VALUE (000S) |

| Wilshire Mortgage Loan Trust |

8.990% due 05/25/2028 (f) | | $ | | 283 | | $ | | 254 |

| | | | | | | | |

| Total Real Estate Asset-Backed Securities (Cost $37,084) | | | | 37,115 |

| | | | | | | | |

| | | | | | | | |

| OTHER BONDS & NOTES 3.6% |

| Denver Arena Trust |

6.940% due 11/15/2019 (f) | | | | 1,640 | | | | 1,661 |

| |

| First International Bank N.A. |

10.778% due 04/15/2026 (f) | | | | 1,856 | | | | 158 |

| |

| Lexington, Virginia Industrial Development |

| Authority Revenue Notes, Series 2007 |

8.000% due 01/01/2015 | | | | 620 | | | | 641 |

| |

Little Rock, Arkansas Municipal Property Owners Multipurpose Improvement District Special Tax Bonds, (GO OF DIST Insured),

Series 2007 |

7.200% due 03/01/2032 | | | | 1,000 | | | | 1,004 |

| |

| PPM America High Yield CBO Ltd. |

5.762% due 06/01/2011 | | | | 177 | | | | 134 |

| |

| U.S. Airways Group, Inc. |

9.330% due 01/01/2049 (a) | | | | 633 | | | | 5 |

| |

| West Virginia State Tobacco Settlement Financing Corporations Revenue Bonds, Series 2007 |

7.467% due 06/01/2047 | | | | 1,000 | | | | 962 |

| | | | | | | | |

Total Other Bonds & Notes

(Cost $6,095) | | | | 4,565 |

| | | | | | | | |

|

| | | | | | | | | |

| | | | | PRINCIPAL

AMOUNT

(000S) | | | | VALUE (000S) | |

| SHORT-TERM INSTRUMENTS 2.1% | |

| | | | | | | | | |

| COMMERCIAL PAPER 0.8% | |

| Freddie Mac | | | | | | | | | |

3.000% due 01/02/2008 | | $ | | 1,000 | | $ | | 1,000 | |

| | | | | | | | | |

| | | | | | | | | |

| REPURCHASE AGREEMENTS 0.9% | |

| State Street Bank and Trust Co. | |

3.900% due 01/02/2008 | | | | 1,150 | | | | 1,150 | |

| | | | | | | | | |

(Dated 12/31/2007. Collateralized by Federal Home Loan Bank 4.125% due 02/15/2008 valued at $1,177. Repurchase proceeds are $1,150.) | |

| | | | | | | | | |

| U.S. TREASURY BILLS 0.4% | |

3.044% due 03/13/2008 (d) | | | | 500 | | | | 495 | |

| | | | | | | | | |

| Total Short-Term Instruments (Cost $2,647) | | | | 2,645 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| PURCHASED OPTIONS (h) 0.1% | |

| (Cost $104) | | | | | | | | 151 | |

| | |

Total Investments 162.7% (Cost $212,106) | | $ | | 208,370 | |

| | | | | | | | | |

Other Assets and Liabilities (Net) (62.7%) | | | | (80,278 | ) |

| | | | | | | | | |

| Net Assets (e) 100.0% | | | | | | $ | | 128,092 | |

| | | | | | | | | |

Notes to Schedule of Investments (amounts in thousands*):

| * | A zero balance may reflect actual amounts rounding to less than one thousand. |

| (a) | Security is in default. |

| (b) | Interest only security. |

| (c) | The average amount of borrowings outstanding during the period ended December 31, 2007 was $71,457 at a weighted average interest rate of 5.310%. On December 31, 2007, securities valued at $91,653 were pledged as collateral for reverse repurchase agreements. |

| (d) | Securities with an aggregate market value of $495 have been pledged as collateral for swap and swaption contracts on December 31, 2007. |

| (e) | As of December 31, 2007, portfolio securities with an aggregate value of $3,985 were valued in good faith and pursuant to the guidelines established by the Board of Directors. |

| (f) | Securities purchased under Rule 144A of the 1933 Securities Act and, unless registered under the Act or exempt from registration, may only be sold to qualified institutional investors. |

| | | | |

| 16 | | PCM Fund, Inc. | | See Accompanying Notes |

| (g) | Swap agreements outstanding on December 31, 2007: |

Credit Default Swaps on Securities

| | | | | | | | | | | | | | | |

| Counterparty | | Reference Entity | | Buy/Sell

Protection(1) | | (Pay)/Receive

Fixed Rate | | Expiration

Date | | Notional

Amount | | Unrealized

(Depreciation) | |

JPMorgan Chase & Co. | | Lennar Corp. 5.950%

due 03/01/2013 | | Sell | | 5.400% | | 12/20/2012 | | $ | 1,000 | | $ | (29 | ) |

Lehman Brothers, Inc. | | Windstream Corp. 8.125% due 08/01/2013 | | Sell | | 1.050% | | 06/20/2012 | | | 2,000 | | | (46 | ) |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | $ | (75 | ) |

| | | | | | | | | | | | | | | |

Credit Default Swaps on Credit Indices

| | | | | | | | | | | | | | | |

| Counterparty | | Reference Entity | | Buy/Sell

Protection(1) | | (Pay)/Receive

Fixed Rate | | Expiration

Date | | Notional

Amount | | Unrealized

(Depreciation) | |

Credit Suisse USA, Inc. | | Home Equity Index AA Rating 2007-1 | | Sell | | 0.150% | | 08/25/2037 | | $ | 1,000 | | $ | (175 | ) |

| | | | | | | | | | | | | | | |

(1) If the Fund is a seller of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will pay to the buyer of the protection an amount up to the notional value of the swap and in certain instances, take delivery of the security.

Interest Rate Swaps

| | | | | | | | | | | | | | | |

| Counterparty | | Floating Rate Index | | Pay/Receive

Floating Rate | | Fixed

Rate | | Expiration

Date | | Notional

Amount | | Unrealized

Appreciation/

(Depreciation) | |

Barclays Bank PLC | | 3-Month USD-LIBOR | | Pay | | 5.700% | | 06/21/2025 | | $ | 40,000 | | $ | 3,615 | |

Barclays Bank PLC | | 3-Month USD-LIBOR | | Pay | | 5.600% | | 06/21/2026 | | | 28,000 | | | 2,153 | |

Barclays Bank PLC | | 3-Month USD-LIBOR | | Receive | | 5.000% | | 12/20/2026 | | | 1,300 | | | (111 | ) |

Merrill Lynch & Co., Inc. | | 3-Month USD-LIBOR | | Receive | | 5.700% | | 06/19/2025 | | | 230,500 | | | (6,245 | ) |

Merrill Lynch & Co., Inc. | | 3-Month USD-LIBOR | | Pay | | 5.650% | | 06/21/2026 | | | 165,000 | | | 13,996 | |

Royal Bank of Scotland Group PLC | | 3-Month USD-LIBOR | | Receive | | 4.660% | | 02/25/2017 | | | 62,900 | | | (772 | ) |

Royal Bank of Scotland Group PLC | | 3-Month USD-LIBOR | | Pay | | 5.840% | | 02/25/2017 | | | 62,900 | | | 124 | |

Royal Bank of Scotland Group PLC | | 3-Month USD-LIBOR | | Receive | | 5.000% | | 06/18/2038 | | | 5,400 | | | (141 | ) |

UBS Warburg LLC | | 3-Month USD-LIBOR | | Receive | | 5.000% | | 12/20/2026 | | | 4,200 | | | (408 | ) |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | $ | 12,211 | |

| | | | | | | | | | | | | | | |

| (h) | Purchased options outstanding on December 31, 2007: |

Interest Rate Swaptions

| | | | | | | | | | | | | | | | | | | |

| Description | | Counterparty | | Floating Rate Index | | Pay/

Receive

Floating

Rate | | Exercise

Rate | | Expiration

Date | | Notional

Amount | | Cost | | Value |

Call - OTC 9-Year Interest Rate Swap | | Royal Bank

of Scotland Group PLC | | 3-Month USD-LIBOR | | Pay | | 4.660% | | 02/21/2008 | | $ | 9,400 | | $ | 62 | | $ | 151 |

Put - OTC 9-Year Interest Rate Swap | | Royal Bank

of Scotland Group PLC | | 3-Month USD-LIBOR | | Receive | | 5.840% | | 02/21/2008 | | | 9,400 | | | 42 | | | 0 |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | $ | 104 | | $ | 151 |

| | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | Annual Report | | December 31, 2007 | | 17 |

Notes to Financial Statements

1. ORGANIZATION

Effective June 1, 2007, the Fund’s name changed from the PIMCO Commercial Mortgage Securities Trust, Inc. to the PCM Fund, Inc. (the”Fund”). The Fund commenced operations on September 2, 1993. The Fund is registered under the Investment Company Act of 1940, as amended (the “Act”), as a closed-end, non-diversified, management investment company organized as a Maryland corporation. The stock exchange symbol of the Fund is PCM. Shares are traded on the New York Stock Exchange (“NYSE”).

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts and disclosures on the financial statements. Actual results could differ from those estimates.

(a) Determination of Net Asset Value The Net Asset Value (“NAV”) of the Fund’s shares is valued as of the close of regular trading (normally 4:00 p.m., Eastern time) (the “NYSE Close”) on each day that the NYSE is open. Information that becomes known to the Fund or its agents after the NAV has been calculated on a particular day will not generally be used to retroactively adjust the price of a security or the NAV determined earlier that day.

(b) Security Valuation For purposes of calculating the NAV, portfolio securities and other assets for which market quotes are readily available are valued at market value. Market value is generally determined on the basis of last reported sales prices, or if no sales are reported, based on quotes obtained from a quotation reporting system, established market makers, or pricing services.

Domestic and foreign fixed income securities and non-exchange traded derivatives are normally valued on the basis of quotes obtained from brokers and dealers or pricing services using data reflecting the earlier closing of the principal markets for those securities. Prices obtained from independent pricing services use information provided by market makers or estimates of market values obtained from yield data relating to investments or securities with similar characteristics. Certain fixed income securities purchased on a delayed-delivery basis are marked to market daily until settlement at the forward settlement date. Short-term investments having a maturity of 60 days or less are generally valued at amortized cost. Exchange traded options, futures and options on futures are valued at the settlement price determined by the relevant exchange. With respect to any portion of the Fund’s assets that are invested in one or more open-end management investment companies, the Fund’s NAV will be calculated based upon the NAVs of such investments. The Fund will normally use pricing data for domestic equity securities received shortly after the NYSE Close and do not normally take into account trading, clearances or settlements that take place after the NYSE Close.

Investments initially valued in currencies other than the U.S. dollar are converted to the U.S. dollar using exchange rates obtained from pricing services. As a result, the NAV of the Fund’s shares may be affected by changes in the value of currencies in relation to the U.S. dollar. The value of securities traded in markets outside the United States or denominated in currencies other than the U.S. dollar may be affected significantly on a day that the NYSE is closed and the NAV may change on days when an investor is not able to purchase, redeem or exchange shares.

Securities and other assets for which market quotes are not readily available are valued at fair value as determined in good faith by the Board of Directors or persons acting at their direction. The Board of Directors has adopted methods for valuing securities and other assets in circumstances where market quotes are not readily available, and has delegated to Pacific Investment Management Company LLC (“PIMCO”) the responsibility for applying the valuation methods. For instance, certain securities or investments for which daily market quotes are not readily available may be valued, pursuant to guidelines established by the Board of Directors, with reference to other securities or indices. In the event that market quotes are not readily available, and the security or asset cannot be valued pursuant to one of the valuation methods, the value of the security or asset will be determined in good faith by the Valuation Committee of the Board of Directors, generally based upon recommendations provided by PIMCO.

Market quotes are considered not readily available in circumstances where there is an absence of current or reliable market-based data (e.g., trade information, bid/asked information, broker quotes), including where events occur after the close of the relevant market, but prior to the NYSE Close, that materially affect the values of the

Fund’s securities or assets. In addition, market quotes are considered not readily available when, due to extraordinary circumstances, the exchanges or markets on which the securities trade, do not open for trading for the entire day and no other market prices are available. The Board of Directors is responsible for monitoring significant events that may materially affect the values of the Fund’s securities or assets and for determining whether the value of the applicable securities or assets should be re-evaluated in light of such significant events.

When the Fund uses fair value pricing to determine its NAV, securities will not be priced on the basis of quotes from the primary market in which they are traded, but rather may be priced by another method that the Board of Directors or persons acting at their direction believe accurately reflects fair value. Fair value pricing may require subjective determinations about the value of a security. While the Fund’s policy is intended to result in a calculation of the Fund’s NAV that fairly reflects security values as of the time of pricing, the Fund cannot ensure that fair values determined by the Board of Directors or persons acting at their direction would accurately reflect the price that the Fund could obtain for a security if it were to dispose of that security as of the time of pricing (for instance, in a forced or distressed sale). The prices used by the Fund may differ from the value that would be realized if the securities were sold and the differences could be material to the financial statements.

(c) Securities Transactions and Investment Income Securities transactions are recorded as of the trade date for financial reporting purposes. Securities purchased or sold on a when-issued or delayed-delivery basis may be settled a month or more after the trade date. Realized gains and losses from securities sold are recorded on the identified cost basis. Dividend income is recorded on the ex-dividend date, except certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Interest income, adjusted for the accretion of discounts and amortization of premiums, is recorded on the accrual basis. Paydown gains and losses on mortgage-related and other asset-backed securities are recorded as components of interest income on the Statement of Operations.

(d) Dividends and Distributions to Shareholders The Fund intends to distribute all its net investment income monthly. Net realized capital gains earned by the Fund, if any, will be distributed no less frequently than once each year.

Income dividends and capital gain distributions are determined in accordance with income tax regulations which may differ from U.S. GAAP. Differences between tax regulations and U.S. GAAP may change the fiscal year when income and capital items are recognized for tax and U.S. GAAP purposes. Examples of events that give rise to timing differences include wash sales, straddles, net operating losses and capital loss carryforwards. Further, the character of investment income and capital gains may be different for certain transactions under the two methods of accounting. Examples of characterization differences include the treatment of mortgage paydowns, swaps, foreign currency transactions and contingent debt instruments. As a result, income dividends and capital gain distributions declared during a fiscal period may differ significantly from the net investment income and realized capital gain reported on the Fund’s annual financial statements presented under U.S. GAAP.

(e) Options Contracts The Fund may write call and put options on futures, swaps (“swaptions”), securities or currencies it owns or in which it may invest. Writing put options tends to increase the Fund’s exposure to the underlying instrument. Writing call options tends to decrease the Fund’s exposure to the underlying instrument. When the Fund writes a call or put option, an amount equal to the premium received is recorded as a liability and subsequently marked to market to reflect the current value of the option written. These liabilities are reflected as written options outstanding on the Statement of Assets and Liabilities. Certain options may be written with premiums to be determined on a future date. The premiums for these options are based upon implied volatility parameters at specified terms. Premiums received from writing options which expire are treated as realized gains. Premiums received from writing options which are exercised or closed are added to the proceeds or offset against amounts paid on the underlying future, swap, security or currency transaction to determine the realized gain or loss. The Fund as a writer of an option has no control over whether the underlying instrument may be sold (call) or purchased (put) and as a result bears the market risk of an unfavorable change in the price of the instrument underlying the written option. There is the risk the Fund may not be able to enter into a closing transaction because of an illiquid market.

The Fund may also purchase put and call options. Purchasing call options tends to increase the Fund’s exposure to the underlying instrument. Purchasing put options tends to decrease the Fund’s exposure to the underlying instrument. The Fund pays a premium which is included on the Statement of Assets and Liabilities as an investment and subsequently marked to market to reflect the current value of the option. Premiums paid for purchasing options

| | | | | | |

| | Annual Report | | December 31, 2007 | | 19 |

Notes to Financial Statements (Cont.)

which expire are treated as realized losses. Certain options may be purchased with premiums to be determined on a future date. The premiums for these options are based upon implied volatility parameters at specified terms. The risk associated with purchasing put and call options is limited to the premium paid. Premiums paid for purchasing options which are exercised or closed are added to the amounts paid or offset against the proceeds on the underlying investment transaction to determine the realized gain or loss.

(f) Repurchase Agreements The Fund may engage in repurchase transactions. Under the terms of a typical repurchase agreement, the Fund takes possession of an underlying debt obligation (collateral) subject to an obligation of the seller to repurchase, and the Fund to resell, the obligation at an agreed-upon price and time. The underlying securities for all repurchase agreements are held in safekeeping at the Fund’s custodian or designated subcustodians under tri-party repurchase agreements. The market value of the collateral must be equal to or exceed the total amount of the repurchase obligations, including interest. Securities purchased under repurchase agreements are reflected as an asset on the Statement of Assets and Liabilities. Generally, in the event of counterparty default, the Fund has the right to use the collateral to offset losses incurred. If the counterparty should default, the Fund will seek to sell the securities which it holds as collateral. This could involve procedural costs or delays in addition to a loss on the securities if their value should fall below their repurchase price.

(g) Reverse Repurchase Agreements The Fund may enter into reverse repurchase agreements. Reverse repurchase agreements involve the sale of a portfolio-eligible security by the Fund, coupled with an agreement to repurchase the security at a specified date and price. Reverse repurchase agreements involve the risk that the market value of securities retained by the Fund may decline below the repurchase price of the securities sold by the Fund, which it is obligated to repurchase. Reverse repurchase agreements are considered to be borrowing by the Fund. To the extent the Fund collateralizes its obligations under reverse repurchase agreements, such transactions will not be deemed subject to the 300% asset coverage requirements imposed by the Act. The Fund will segregate assets determined to be liquid by PIMCO or otherwise cover its obligations under reverse repurchase agreements.

(h) Swap Agreements The Fund may invest in swap transactions, including, but not limited to, swap agreements on interest rates, security or commodity indexes, specific securities and commodities, and credit and event-linked swaps. To the extent the Fund may invest in foreign currency denominated securities, it also may invest in currency exchange rate swap agreements. Swap transactions are privately negotiated agreements between the Fund and a counterparty to exchange or swap investment cash flows, assets, foreign currencies or market-linked returns at specified, future intervals. The Fund may enter into interest rate, total return, cross-currency, credit default and other forms of swap agreements to manage its exposure to interest rates, currency and credit risk. In connection with these agreements, securities may be identified as collateral in accordance with the terms of the respective swap agreements.

Interest rate swap agreements involve the exchange by the Fund with another party of their respective commitments to pay or receive interest, e.g., an exchange of floating rate payments for fixed rate payments with respect to the notional amount of principal. Certain forms of interest rate swap agreements may include: (i) interest rate caps, under which, in return for a premium, one party agrees to make payments to the other to the extent that interest rates exceed a specified rate, or “cap”, (ii) interest rate floors, under which, in return for a premium, one party agrees to make payments to the other to the extent that interest rates fall below a specified rate, or “floor”, or (iii) interest rate collars, under which a party sells a cap and purchases a floor or vice versa in an attempt to protect itself against interest rate movements exceeding given minimum or maximum levels.

Total return swap agreements involve commitments to pay interest in exchange for a market-linked return, both based on notional amounts. To the extent the total return of the security or index underlying the transaction exceeds or falls short of the offsetting interest rate obligation, the Fund will receive a payment from or make a payment to the counterparty.

Cross-currency swap agreements involve two parties exchanging two different currencies with an agreement to reverse the exchange at a later date at specified exchange rates. The exchange of currencies at the inception date of the contract takes place at the current spot rate. The re-exchange at maturity may take place at the same exchange rate, a specified rate, or the then current spot rate. Interest payments, if applicable, are made between the parties based on interest rates available in the two currencies at the inception of the contract. The terms of cross-currency swap contracts may extend for many years. Cross-currency swaps are usually negotiated with commercial and investment banks. Contracts are subject to risk of default by the counterparty and, depending on

their terms, may be subject to exchange rate risk. Some cross-currency swaps may not provide for exchanging principal cash flows, only for exchanging interest cash flows.

Credit default swap agreements on corporate issues or sovereign issues of an emerging country involve one party making a stream of payments to another party in exchange for the right to receive a specified return in the event of a default. The Fund may use credit default swaps on corporate issues or sovereign issues of an emerging country to provide a measure of protection against defaults of the issuers (i.e., to reduce risk where the Fund owns or has exposure to the reference obligation) or to take an active long or short position with respect to the likelihood of a particular issuer’s default. As a seller of protection, the Fund generally receives an upfront payment or a fixed rate of income throughout the term of the swap provided that there is no credit event. If the Fund is a seller of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will pay to the buyer of the protection an amount up to the notional value of the swap and in certain instances take delivery of the security. As the seller, a Fund would effectively add leverage to its portfolio because, in addition to its total net assets, the Fund would be subject to investment exposure on the notional amount of the swap. As a buyer of protection, the Fund generally receives an amount up to the notional value of the swap if a credit event occurs.

Credit default swap agreements on credit indices involve one party making a stream of payments to another party in exchange for the right to receive a specified return in the event of a write-down, principal shortfall, interest shortfall or default of all or part of the reference entities comprising the credit index. A credit index is a list of credit instruments or exposures designed to be representative of some part of the credit market as a whole. These indices are made up of reference credits that are judged by a poll of dealers to be the most liquid entities in the credit default swap market based on the sector of the index. Components of the indices may include, but is not limited to, credit default swaps on investment grade securities, high yield securities, asset backed securities, emerging markets, and/or various credit ratings within each sector. Credit indices are traded using credit default swaps with standardized terms including a fixed spread and standard maturity dates. An index credit default swap references all the names in the index, and if there is a default, the credit event is settled based on that name’s weight in the index. The composition of the indices changes periodically, usually every six months, and for most indices, each name has an equal weight in the index.

The treatment of credit default swaps and other swap agreements that provide for contingent, non-periodic, bullet-type payments as “notional principal contracts” for U.S. federal income tax purposes is uncertain. If the U.S. Internal Revenue Service were to take the position that a credit default swap or other bullet-type swap is not a “notional principal contract” for U.S. federal income tax purposes, payments received by a Fund from such investments might be subject to U.S. excise or income taxes.

Swaps are marked to market daily based upon values from third party vendors or quotations from market makers to the extent available and the change in value, if any, is recorded as unrealized gain or loss on the Statement of Operations. In the event that market quotations are not readily available or deemed reliable, certain swap agreements may be valued, pursuant to guidelines established by the Board of Directors, with reference to other securities or indices. In the event that market quotes are not readily available, and the swap cannot be valued pursuant to one of the valuation methods, the value of the swap will be determined in good faith by the Valuation Committee of the Board of Directors, generally based upon recommendations provided by PIMCO. Payments received or made at the beginning of the measurement period are reflected as such on the Statement of Assets and Liabilities. These upfront payments are recorded as realized gain or loss on the Statement of Operations upon termination or maturity of the swap. A liquidation payment received or made at the termination of the swap is recorded as realized gain or loss on the Statement of Operations. Net periodic payments received or paid by the Fund is included as part of realized gain or loss on the Statement of Operations. Entering into these agreements involves, to varying degrees, elements of credit, market and documentation risk in excess of the amounts recognized on the Statement of Assets and Liabilities. Such risks involve the possibility that there will be no liquid market for these agreements, that the counterparty to the agreements may default on its obligation to perform or disagree as to the meaning of contractual terms in the agreements and that there may be unfavorable changes in interest rates.

(i) Mortgage-Related and Other Asset-Backed Securities The Fund may invest in mortgage-related and other asset-backed securities. These securities include mortgage pass-through securities, collateralized mortgage obligations (“CMOs”), commercial mortgage-backed securities, mortgage dollar rolls, CMO residuals, stripped mortgage-backed securities (“SMBSs”) and other securities that directly or indirectly represent a participation in, or are secured by and payable from, mortgage loans on real property. The value of some mortgage-related and asset-

| | | | | | |

| | Annual Report | | December 31, 2007 | | 21 |

Notes to Financial Statements (Cont.)

backed securities may be particularly sensitive to changes in prevailing interest rates. Early repayment of principal on some mortgage-related securities may expose the Fund to a lower rate of return upon reinvestment of principal. The value of these securities may fluctuate in response to the market’s perception of the creditworthiness of the issuers. Additionally, although mortgages and mortgage-related securities are generally supported by some form of government or private guarantee and/or insurance, there is no assurance that private guarantors or insurers will meet their obligations.

One type of SMBSs has one class receiving all or a portion of the interest from the mortgage assets (the interest-only, or “IO” and/or the high coupon rate with relatively low principal amount, or “IOette” class), while the other class will receive all of the principal (the principal-only, or “PO” class). Payments received for IOs and IOettes are included in interest income on the Statement of Operations. Because little to no principal will be received at the maturity of an IO or IOettes, adjustments are made to the book value of the security on a daily basis until maturity. These adjustments are included in interest income on the Statement of Operations. Payments received for POs are treated as reductions to the cost and par value of the securities.

(j) U.S. Government Agencies or Government-Sponsored Enterprises Securities issued by U.S. Government agencies or government-sponsored enterprises may not be guaranteed by the U.S. Treasury. The Government National Mortgage Association (“GNMA” or “Ginnie Mae”), a wholly owned U.S. Government corporation, is authorized to guarantee, with the full faith and credit of the U.S. Government, the timely payment of principal and interest on securities issued by institutions approved by GNMA and backed by pools of mortgages insured by the Federal Housing Administration or guaranteed by the Department of Veterans Affairs. Government-related guarantors (i.e., not backed by the full faith and credit of the U.S. Government) include the Federal National Mortgage Association (“FNMA” or “Fannie Mae”) and the Federal Home Loan Mortgage Corporation (“FHLMC” or “Freddie Mac”). Pass-through securities issued by FNMA are guaranteed as to timely payment of principal and interest by FNMA but are not backed by the full faith and credit of the U.S. Government. FHLMC guarantees the timely payment of interest and ultimate collection of principal, but its participation certificates are not backed by the full faith and credit of the U.S. Government.

(k) New Accounting Policies In September 2006, the Financial Accounting Standards Board (“FASB”) issued Statement of Financial Accounting Standards No. 157, “Fair Value Measurements” (the “Statement”). The Statement is effective for fiscal years beginning after November 15, 2007 and will require expanded disclosure about fair value measurements, separately for each major category of assets and liabilities, that enables shareholders to assess the inputs used to develop those measurements, and for recurring fair value measurements using significant unobservable inputs the effect of the measurements on changes in net assets for the reporting period. Management is currently evaluating the application of the Statement to the Fund and will provide additional information in relation to the Statement on the Fund’s financial statements for the period ending June 30, 2008.

3. FEES AND EXPENSES

(a) Investment Manager Fee PIMCO is a majority-owned subsidiary of Allianz Global Investors of America L.P. (“AGI”), and serves as investment manager (the “Manager”) to the Fund, pursuant to an investment advisory contract. The Manager receives a quarterly fee from the Fund at an annual rate of 0.725% based on average weekly net assets of the Fund.

(b) Administrative Fee PIMCO serves as administrator (the “Administrator”), and provides administrative services to the Fund for which it receives from the Fund a quarterly administrative fee at an annual rate of 0.10% based on average weekly net assets of the Fund.

(c) Fund Expenses The Fund is responsible for the following expenses: (i) independent auditors’ fees; (ii) printing fees; (iii) transfer agent fees; (iv) custody and accounting fees; (v) taxes and governmental fees, (vi) brokerage fees and commissions and other portfolio transaction expenses (vii) the costs of borrowing money, including interest expenses and bank overdraft charges; (viii) fees and expenses of the Directors who are not “interested persons”, as defined in the Act, of PIMCO or the Fund (each an “Independent Director”), and any counsel retained exclusively for their benefit; (ix) legal fees; (x) extraordinary expenses, including costs of litigation and indemnification expenses.

Each Director, other than those affiliated with PIMCO or its affiliates, receives an annual retainer of $6,000, plus $1,000 for each Board of Directors meeting attended in person, $250 for each committee meeting attended and