BorgWarner to Acquire Delphi Technologies: Strengthens Propulsion Systems Leadership February 2020

Forward-Looking Statements This communication may contain forward-looking statements as contemplated by the 1995 Private Securities Litigation Reform Act that reflect, when made, Delphi Technologies’ or BorgWarner’s respective current views with respect to future events, including the proposed transaction, and financial performance or that are based on their respective management’s current outlook, expectations, estimates and projections, including with respect to the combined group following the proposed transaction, if completed. Such forward-looking statements are subject to many risks, uncertainties and factors relating to Delphi Technologies’ or BorgWarner’s respective operations and business environment, which may cause the actual results of Delphi Technologies or BorgWarner to be materially different from any future results. All statements that address future operating, financial or business performance or Delphi Technologies’ or BorgWarner’s respective strategies or expectations are forward-looking statements. In some cases, you can identify these statements by forward-looking words such as “may,” “might,” “will,” “should,” “could,” “designed,” “effect,” “evaluates,” “forecasts,” “goal,” “guidance,” “initiative,” “intends,” “pursue,” “seek,” “target,” “when,” “will,” “expects,” “plans,” “intends,” “anticipates,” “believes,” “estimates,” “predicts,” “projects,” “potential,” “outlook” or “continue,” the negatives thereof and other comparable terminology. Factors that could cause actual results to differ materially from these forward-looking statements include, but are not limited to, the possibility that the proposed transaction will not be pursued; failure to obtain necessary regulatory approvals or required financing or to satisfy any of the other conditions to the proposed transaction; adverse effects on the market price of Delphi Technologies’ ordinary shares or BorgWarner’s shares of common stock and on Delphi Technologies’ or BorgWarner’s operating results because of a failure to complete the proposed transaction; failure to realize the expected benefits of the proposed transaction; failure to promptly and effectively integrate Delphi Technologies’ businesses; negative effects relating to the announcement of the proposed transaction or any further announcements relating to the proposed transaction or the consummation of the proposed transaction on the market price of Delphi Technologies’ ordinary shares or BorgWarner’s shares of common stock; significant transaction costs and/or unknown or inestimable liabilities; potential litigation associated with the proposed transaction; general economic and business conditions that affect the combined group following the consummation of the proposed transaction; changes in global, political, economic, business, competitive, market and regulatory forces; changes in tax laws, regulations, rates and policies; future business acquisitions or disposals; competitive developments; and the timing and occurrence (or non-occurrence) of other events or circumstances that may be beyond Delphi Technologies’ or BorgWarner’s control. For additional information about these and other factors, see the information under the caption “Risk Factors” in Delphi Technologies’ most recent Annual Report on Form 10-K filed with the SEC and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” filed on February 21, 2019, and the information under the caption “Risk Factors” in BorgWarner’s most recent Annual Report on Form 10-K filed with the SEC and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” on February 19, 2019. Delphi Technologies’ and BorgWarner’s forward-looking statements speak only as of the date of this communication or as of the date they are made. Delphi Technologies and BorgWarner each disclaim any intent or obligation to update or revise any “forward looking statement” made in this communication to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, except as may be required by law. All subsequent written and oral forward-looking statements attributable to Delphi Technologies, BorgWarner or their respective directors, executive officers or any person acting on behalf of any of them are expressly qualified in their entirety by this paragraph. © BorgWarner Inc. 2

A Propulsion Systems Leader, Well Positioned for the Future BorgWarner’s acquisition of Delphi Technologies will strengthen its propulsion systems leadership ✔▪ Reinforces leadership in electrified propulsion systems ✔▪ Increases electronics and power electronics scale, technology, talent and adds to system capabilities ✔▪ Enhances combustion, commercial vehicle, and aftermarket businesses, resulting in more balance across light and commercial vehicles as well as the aftermarket ✔▪ Consistent with BorgWarner’s stated balanced combustion, hybrid, and electric propulsion strategy ✔▪ Meaningfully accretive to earnings in second full year, while preserving a strong balance sheet © BorgWarner Inc. 3

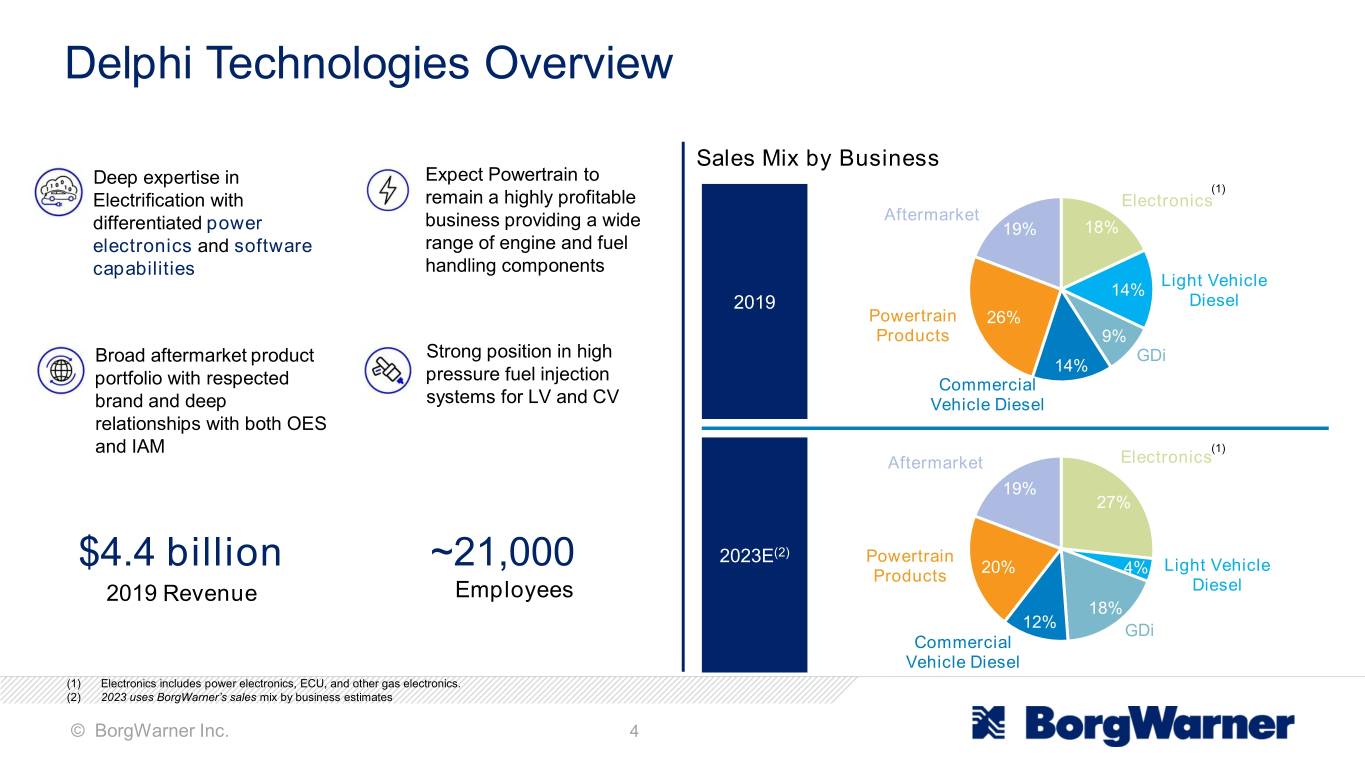

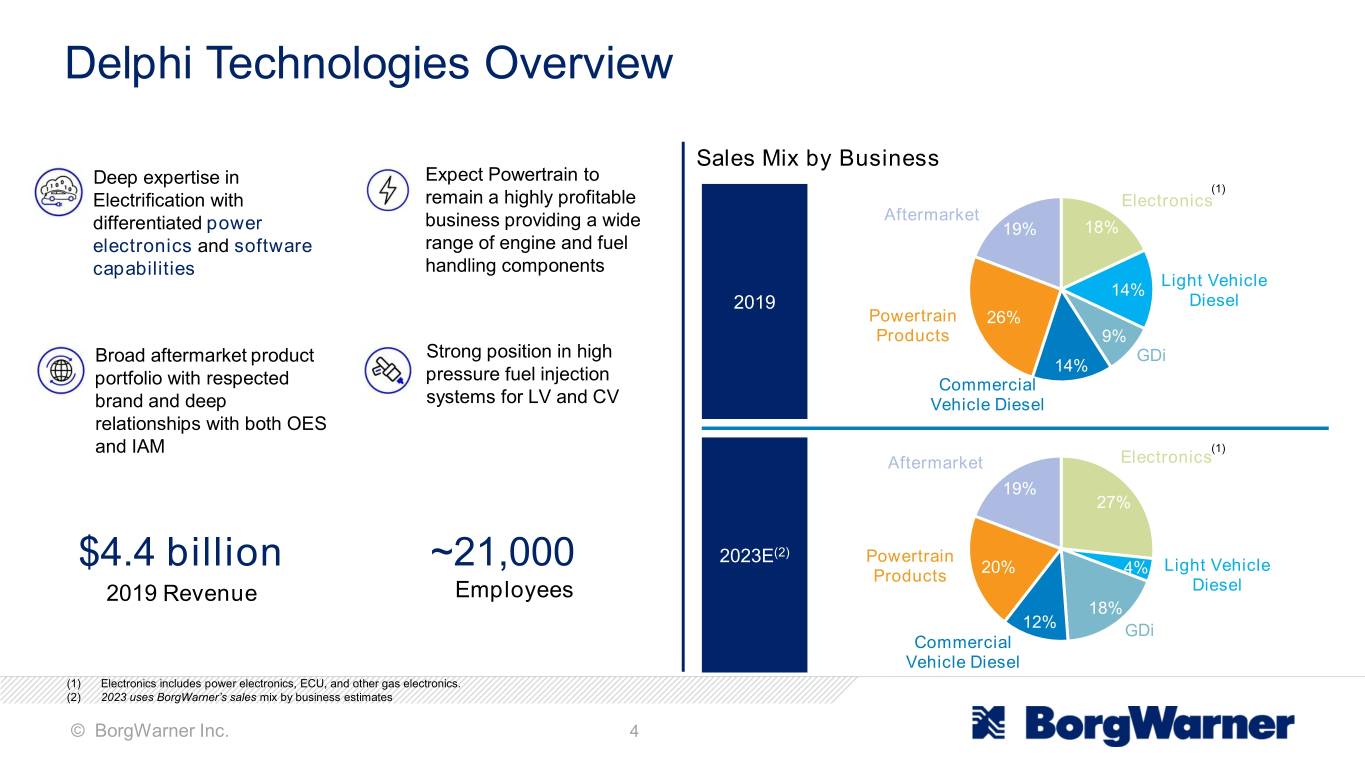

Delphi Technologies Overview Sales Mix by Business Deep expertise in Expect Powertrain to (1) Electrification with remain a highly profitable Electronics Aftermarket differentiated power business providing a wide 19% 18% electronics and software range of engine and fuel capabilities handling components Light Vehicle 14% 2019 Diesel Powertrain 26% Products 9% Broad aftermarket product Strong position in high GDi pressure fuel injection 14% portfolio with respected Commercial brand and deep systems for LV and CV Vehicle Diesel relationships with both OES and IAM (1) Aftermarket Electronics 19% 27% 2023E(2) Powertrain $4.4 billion ~21,000 20% Light Vehicle Products 4% 2019 Revenue Employees Diesel 18% 12% GDi Commercial Vehicle Diesel (1) Electronics includes power electronics, ECU, and other gas electronics. (2) 2023 uses BorgWarner’s sales mix by business estimates © BorgWarner Inc. 4

Delphi Technologies Electronics Overview 18% 2019 Power Electronics ECUs ▪ ~25% of electronics business ▪ Broad range of ECUs and systems & from power electronics software integration capabilities HV Inverters Engine Controller ▪ Broad high voltage power ▪ High level of vertical integration electronics portfolio to serve most emerging xEV architectures ▪ Transferable software, controls and DC-DC Converter system know-how Transmission Controllers ▪ State-of-the art high voltage inverter business ▪ Brings scale in purchasing, capacity and customer reach ▪ ~30% CAGR through 2023 Battery Pack On-Board Local Controllers Controller Chargers Combined Units Domain Controllers © BorgWarner Inc. 5

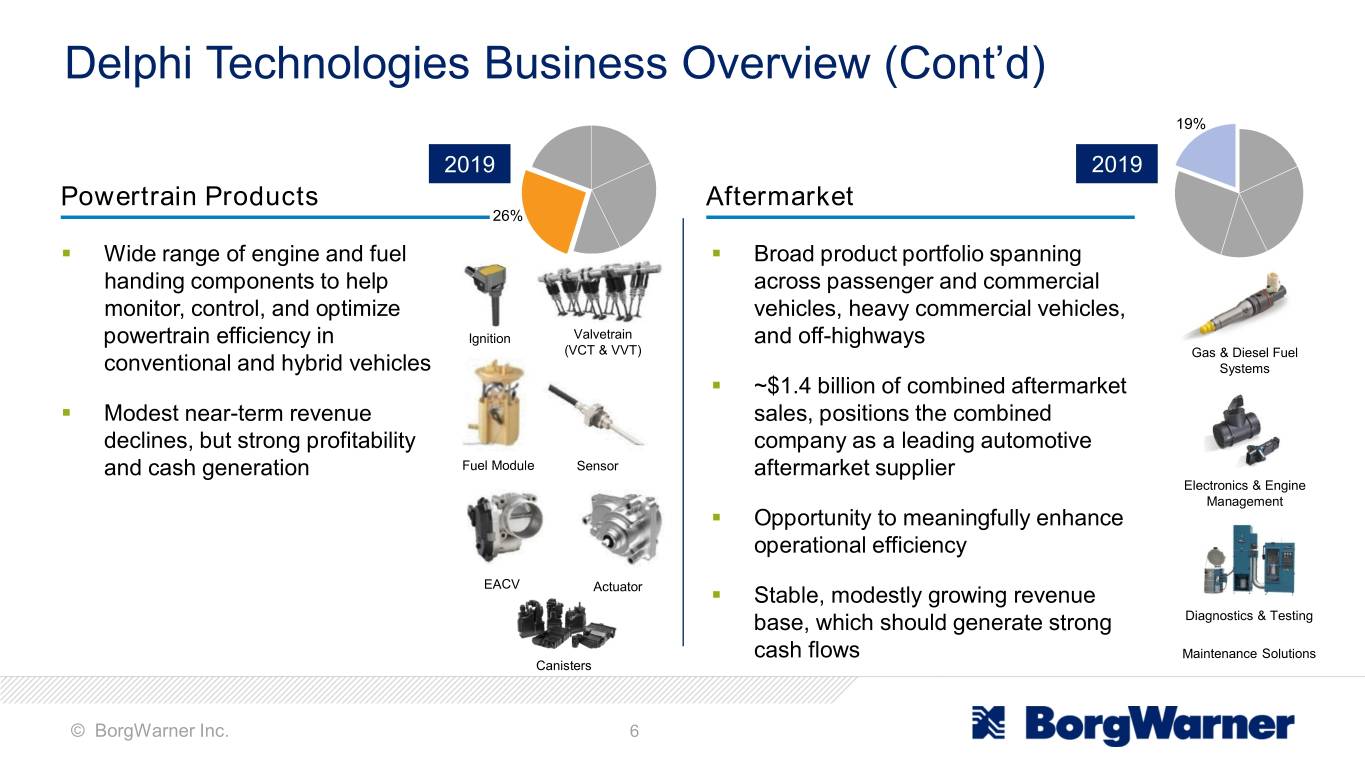

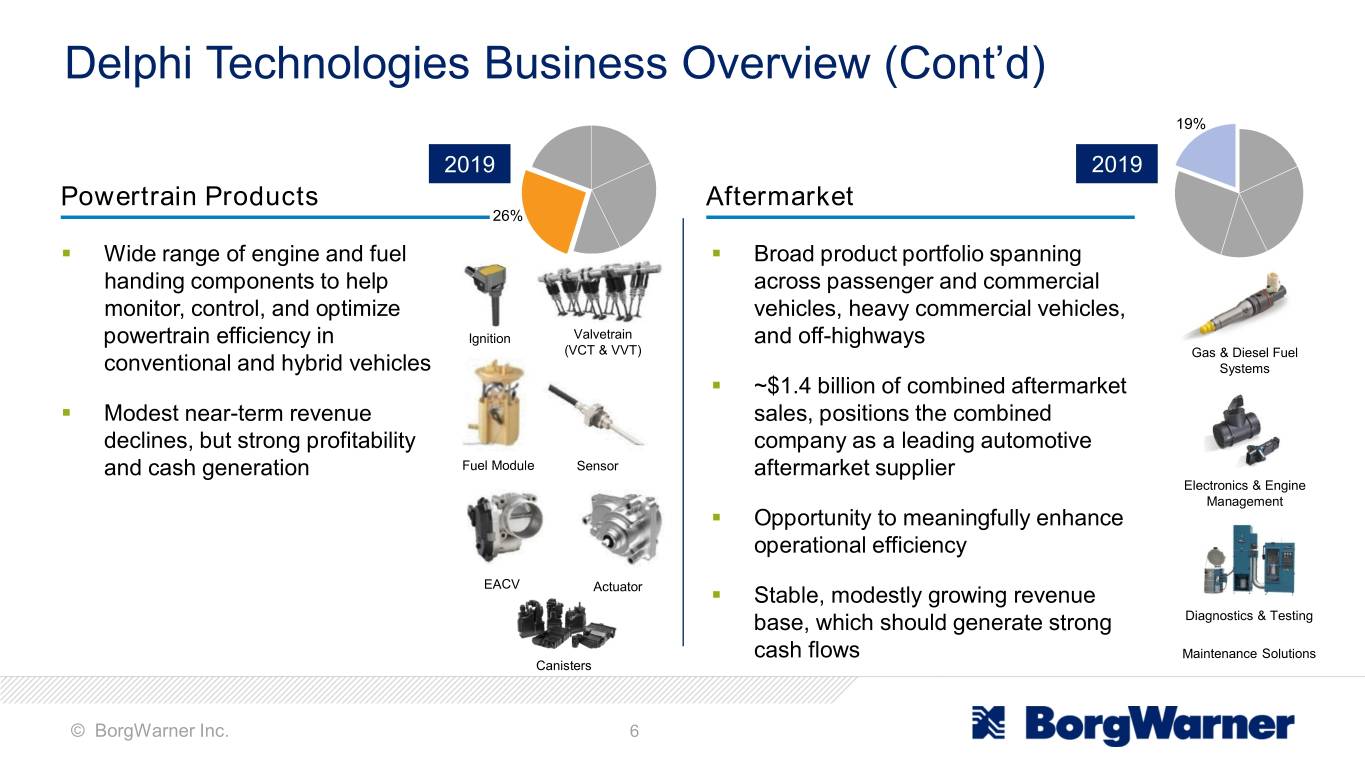

Delphi Technologies Business Overview (Cont’d) 19% 2019 2019 Powertrain Products Aftermarket 26% ▪ Wide range of engine and fuel ▪ Broad product portfolio spanning handing components to help across passenger and commercial monitor, control, and optimize vehicles, heavy commercial vehicles, powertrain efficiency in Ignition Valvetrain and off-highways (VCT & VVT) Gas & Diesel Fuel conventional and hybrid vehicles Systems ▪ ~$1.4 billion of combined aftermarket ▪ Modest near-term revenue sales, positions the combined declines, but strong profitability company as a leading automotive and cash generation Fuel Module Sensor aftermarket supplier Electronics & Engine Management ▪ Opportunity to meaningfully enhance operational efficiency EACV Actuator ▪ Stable, modestly growing revenue base, which should generate strong Diagnostics & Testing cash flows Maintenance Solutions Canisters © BorgWarner Inc. 6

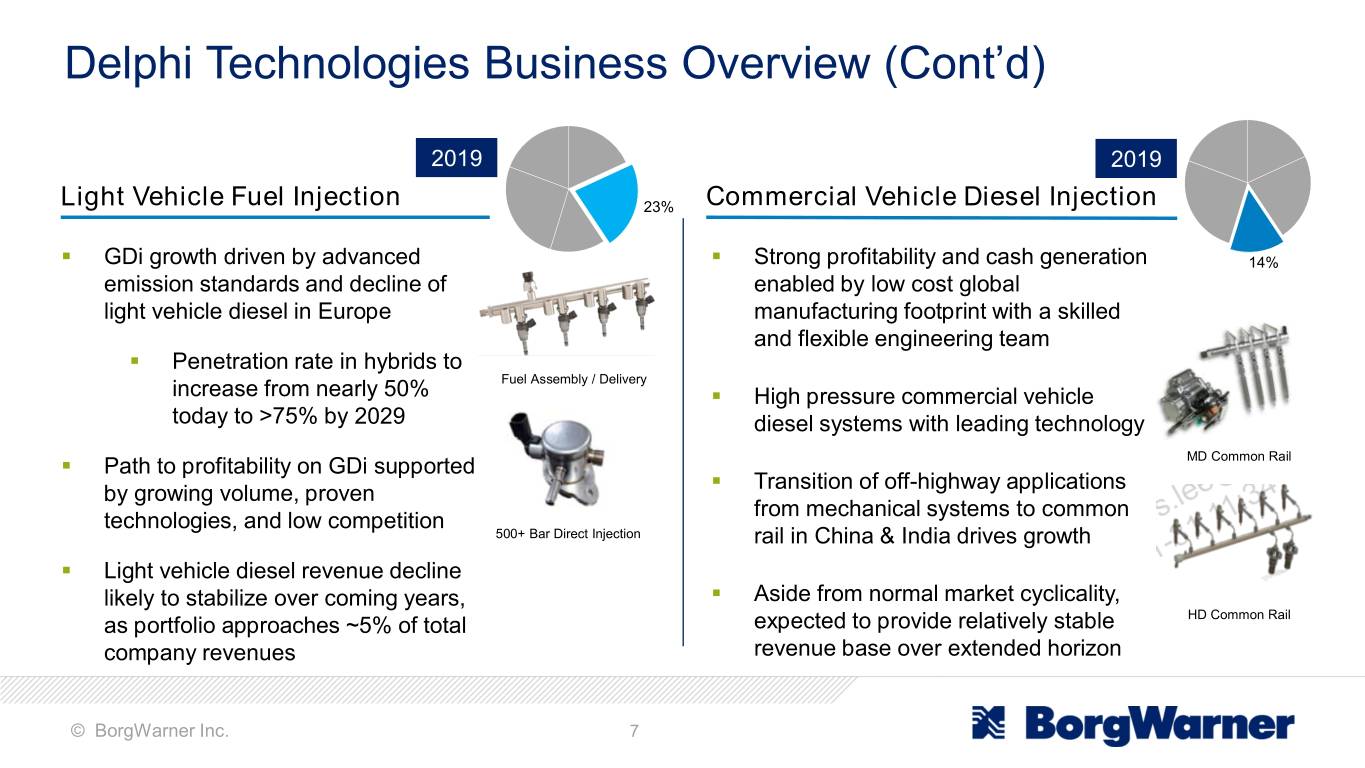

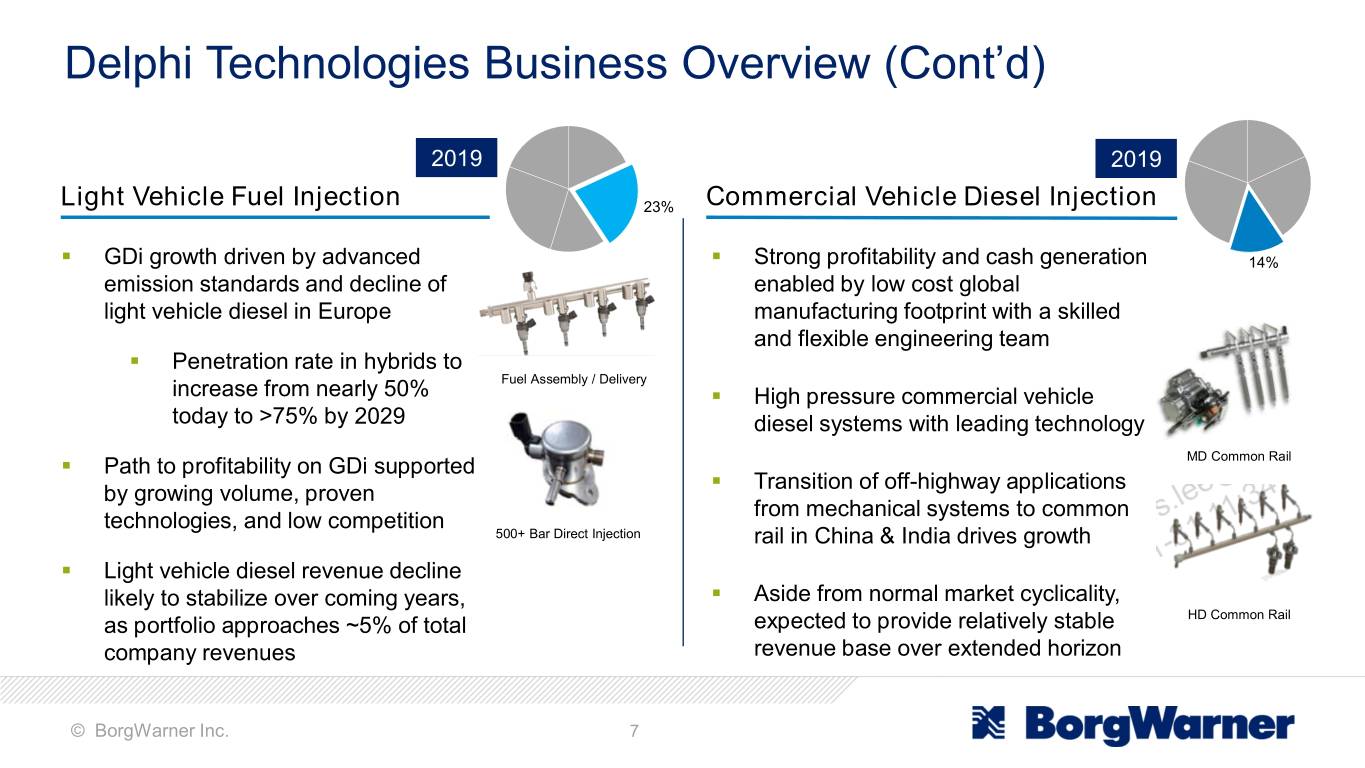

Delphi Technologies Business Overview (Cont’d) 2019 2019 Light Vehicle Fuel Injection 23% Commercial Vehicle Diesel Injection ▪ GDi growth driven by advanced ▪ Strong profitability and cash generation 14% emission standards and decline of enabled by low cost global light vehicle diesel in Europe manufacturing footprint with a skilled and flexible engineering team ▪ Penetration rate in hybrids to Fuel Assembly / Delivery increase from nearly 50% ▪ High pressure commercial vehicle today to >75% by 2029 diesel systems with leading technology ▪ Path to profitability on GDi supported MD Common Rail ▪ Transition of off-highway applications by growing volume, proven from mechanical systems to common technologies, and low competition 500+ Bar Direct Injection rail in China & India drives growth ▪ Light vehicle diesel revenue decline likely to stabilize over coming years, ▪ Aside from normal market cyclicality, as portfolio approaches ~5% of total expected to provide relatively stable HD Common Rail company revenues revenue base over extended horizon © BorgWarner Inc. 7

Compelling transaction for Delphi Technologies’ stakeholders Combination allows Delphi Technologies to become part of a pioneering propulsion technologies company with enhanced scale and unique capabilities Delphi Technologies’ shareholders receive ability to benefit from future upside and enhanced prospects of the combined company Provides greater flexibility to execute existing restructuring plan, with opportunity to accelerate profitable growth Combination of market leaders creates exciting opportunities for Delphi Technologies’ employees Common values and cultures based on respect, integrity, excellence, responsibility and teamwork © BorgWarner Inc. 8

Strengthens Scale and Expertise in Electrification Mechanical, clutching, Award-winning motors Leadership in power and hydraulic controls provide industry electronics, software, expertise leading technology and controls eGearDrive® Electric Drive High Voltage Integrated Drive Module Transmission Motor Inverter (iDM) Well positioned to take advantage of future propulsion migration Representative Example © BorgWarner Inc. 9

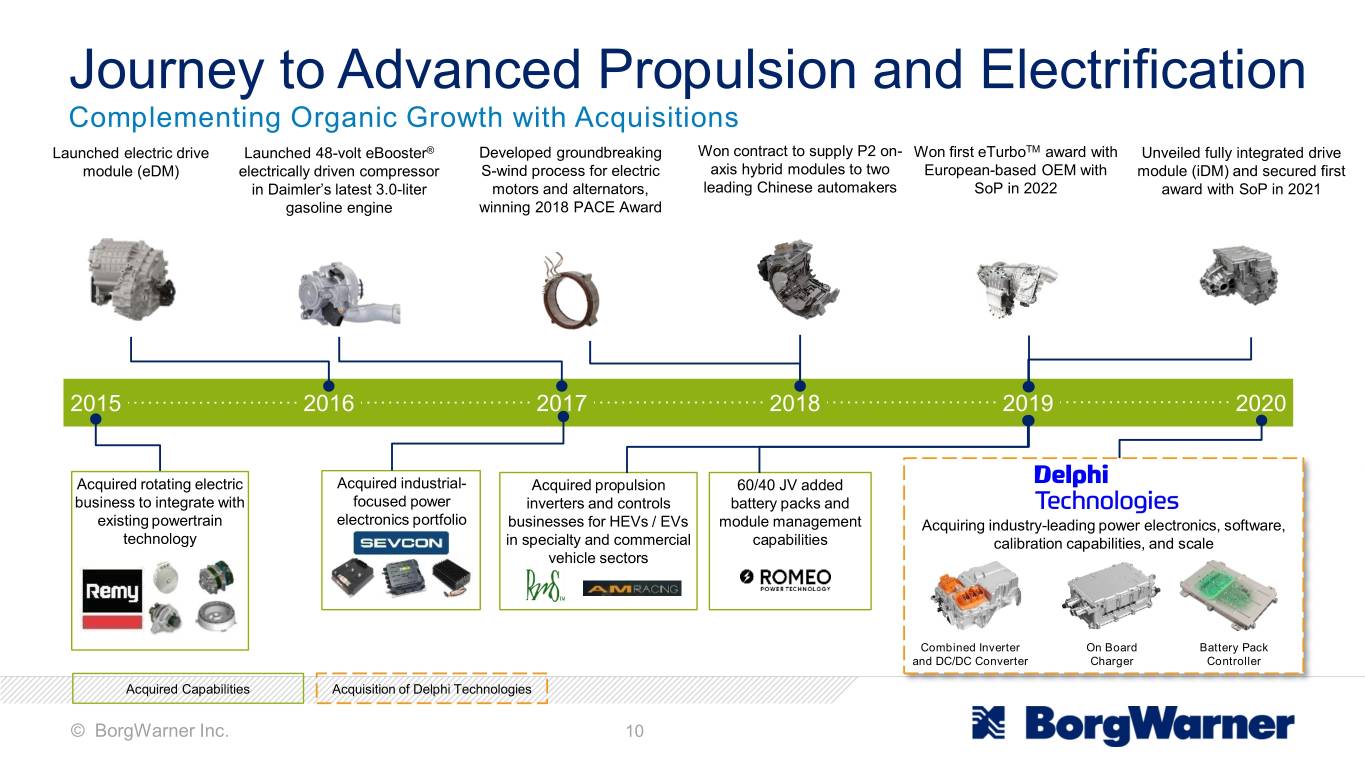

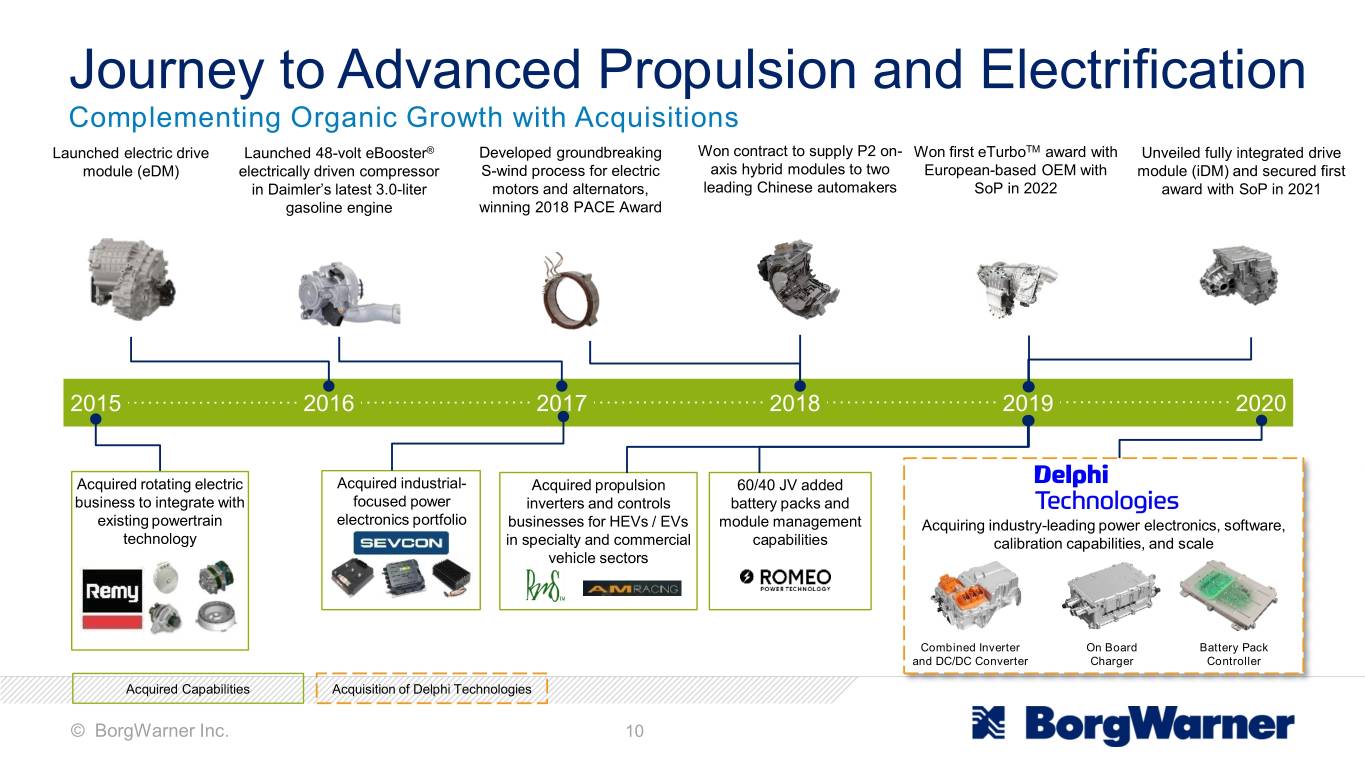

Journey to Advanced Propulsion and Electrification Complementing Organic Growth with Acquisitions Launched electric drive Launched 48-volt eBooster® Developed groundbreaking Won contract to supply P2 on- Won first eTurboTM award with Unveiled fully integrated drive module (eDM) electrically driven compressor S-wind process for electric axis hybrid modules to two European-based OEM with module (iDM) and secured first in Daimler’s latest 3.0-liter motors and alternators, leading Chinese automakers SoP in 2022 award with SoP in 2021 gasoline engine winning 2018 PACE Award 2015 2016 2017 2018 2019 2020 Acquired rotating electric Acquired industrial- Acquired propulsion 60/40 JV added business to integrate with focused power inverters and controls battery packs and existing powertrain electronics portfolio businesses for HEVs / EVs module management Acquiring industry-leading power electronics, software, technology in specialty and commercial capabilities calibration capabilities, and scale vehicle sectors Combined Inverter On Board Battery Pack and DC/DC Converter Charger Controller Acquired Capabilities Acquisition of Delphi Technologies © BorgWarner Inc. 10

Evolution of Combustion, Hybrid, and Electric (“C-H-E”) Mix 2023 Light Vehicle Market (Units) 2023 Light Vehicle Net Sales Mix 8% 6% 12% 8% 25% 30% 29% 29% Electric Hybrid Combustion 67% 64% 59% 63% IHS1 BWA1 DLPH2 Pro Forma3 BWA Consistent with BorgWarner’s stated C-H-E propulsion strategy Source: IHS light vehicle (Original Equipment) market data as of December 2019. BorgWarner and Delphi Technologies’ estimated breakdown based on LV sales. © BorgWarner Inc. 11

Strengthens Combustion Leadership so so Boosting Exhaust Gas Fuel Assembly / Engine / Transmission Technologies Management Delivery Controllers Air Path, Mechanical, and All Fuel Injection and Wheel Drive Electronics Representative Examples © BorgWarner Inc. 12

Enhances Market Balance End Market Mix (2019 Preliminary Sales) Geographic Mix (2019 Preliminary Sales) RoW Aftermarket Asia Pacific 2% 9% 27% Europe Commerical 39% 16% Vehicle OEM Light 75% Vehicle 32% OEM North America $14.5 billion pro forma revenue provides enhanced end market exposure to commercial vehicle and aftermarket while maintaining geographic mix © BorgWarner Inc. 13

Adds Scale and Capabilities Across Propulsion Portfolio ▪ Broad portfolio of combustion ▪ Broad portfolio of hybrid ▪ Broad portfolio of electric ▪ Broad portfolio of technologies technologies technologies combustion, hybrid, and electric technologies ▪ Ability to leverage operational ▪ Unique hybrid design and ▪ Grid-to-wheel electrified expertise across combustion integration expertise propulsion system portfolio capabilities ▪ Broad portfolio of complementary ▪ Recognized technology leader in power electronics with ▪ Commercial vehicle combustion technologies established products, production, customers, and supply base complementary technologies with competitive product ▪ Addition of fuel injection and ▪ Ability to integrate power electronics directly into existing portfolio electronics complementary to BorgWarner electrified systems or offer standalone products BorgWarner’s air management capabilities ▪ Significant Aftermarket revenue contribution across propulsion types and end markets © BorgWarner Inc. 14

Transaction Summary ▪ In a 100% stock transaction, Delphi Technologies’ shareholders will receive a fixed exchange ratio of 0.4534x BorgWarner shares per each of their existing Delphi Technologies shares at closing ▪ Implied purchase price of $17.39 per Delphi Technologies share (1) ▪ $1.5 billion in BorgWarner stock (40 million newly issued shares) ▪ Implied multiple of 6.4x 2019 preliminary adjusted EBITDA and 5.2x 2019 preliminary adjusted EBITDA including estimated run-rate Transaction cost synergies Considerations ▪ Upon closing of the transaction, BorgWarner shareholders are expected to own approximately 84% of the combined company, while current Delphi Technologies shareholders are expected to own approximately 16% ▪ BorgWarner maintains significant liquidity and financial flexibility ▪ Pro forma 2019 preliminary gross debt / adjusted EBITDA ~1.6x at closing Structure Financing ▪ Expect to maintain investment grade credit rating ▪ Subject to approval by Delphi Technologies’ shareholders and satisfaction of customary closing conditions and regulatory approvals ▪ Transaction expected to close in second half of 2020 Next Steps Next Next Steps Next (1) Based on BorgWarner’s share price as of January 27, 2020. © BorgWarner Inc. 15

Pro Forma Financial Outlook Pro Forma Avg. Annual Market Outgrowth (2021E-2023E) • Continued mid-term industry ~5% outgrowth ~4.5% ~3% • Significant long-term revenue synergy potential focused on electrified vehicles Pro Forma Adj. Margin Outlook Pro Forma with Synergies 12.1% • Sustained top tier margin profile ~11%(1) • ~$125 million of cost synergies ~10%(1) 7.2% more than offset purchase price amortization of ~$65 to $70 million 2019 Preliminary Adjusted 2019 Preliminary Adjusted Operating Margin Operating Margin (1) Includes preliminary estimate of $65 to $70 million of purchase accounting for amortization of newly acquired intangibles. © BorgWarner Inc. 16

Potential Revenue Synergies Support Long-term Outgrowth Opportunities Focused Pursuit Opportunities Light Vehicle Customers Products BEV iDM >$1.3B Customer A P4 iDM ▪ Represents top 15 HV P2 Customer B Motor + Inverter opportunities identified jointly HV P4 during due diligence Customer C BEV iDM P2 ▪ Projected awards over next Customer D BEV iDM >$0.7B 18 to 24 months Customer E HV P2 Customer F P2 ▪ Start of production generally Customer G P4 iDM in 2024 and 2025 Customer H BEV iDM Customer I Motor + Inverter Customer J Motor + Inverter Customer K Motor + Inverter 2025 2027 © BorgWarner Inc. 17

Cost Savings Support Meaningful EPS Accretion Cost Synergies Driven by Meaningful EPS Accretion SG&A and Procurement Savings ($ in millions) $125 Adj. GAAP Excl. Amort. of $0.50 Intangibles(1) SG&A $0.31 $0.11 Procurement ($0.07) 2021E 2022E 2023E 2021E 2022E Long-Term Revenue Synergies Provide New Share Repurchase Program Additional Opportunity Provides Additional Upside Potential (1) Includes preliminary estimate of $65 to $70 million of purchase accounting for amortization of newly acquired intangibles. © BorgWarner Inc. 18

Estimated Free Cash Flow Growth Timing ($ in billions) Relatively Flat Earnings, Restructuring >$0.9B Savings & Synergies Δ in Cash Restructuring Cost Earnings, ~$0.7B Cash Restructuring Restructuring Savings & Cost Synergies 2020 FCF 2021 FCF 2022 FCF © BorgWarner Inc. 19

$1 Billion Share Repurchase Program 2014-2018 Accumulated Capital New Share Repurchase Program Deployment Mix(1) ▪ Consistent with existing capital allocation strategy Dividends 19% ▪ To be executed over the next M&A Activity three years 48% Share Repurchases ▪ Demonstrates confidence in 33% long-term free cash flow generation Continued commitment to deliver value to our shareholders (1) Excludes increases in net debt, which were a source of cash from 2014-2018. © BorgWarner Inc. 20

A Propulsion Systems Leader, Well Positioned for the Future BorgWarner’s acquisition of Delphi Technologies will strengthen its propulsion systems leadership ✔▪ Reinforces leadership in electrified propulsion systems ✔▪ Increases power electronics scale, technology, talent and adds to system capabilities ✔▪ Enhances combustion, commercial vehicle, and aftermarket businesses, resulting in more balance across light and commercial vehicles as well as the aftermarket ✔▪ Consistent with BorgWarner’s stated balanced combustion, hybrid, and electric propulsion strategy ✔▪ Meaningfully accretive to earnings in second full year, while preserving a strong balance sheet © BorgWarner Inc. 21

Appendix

Combined Capabilities Across Propulsion Types Boosting All Wheel Drive & Engine Timing Technologies Cross Axle Systems Systems High Voltage Battery eGearDrive® Battery Module ® P2 Hybrid Modules eBooster electrically Integrated Belt On / Off Axis / Coolant Heater Transmission driven compressor Alternator Starter Exhaust Gas Starters & Systems Management Alternators Dual Clutch Electric All Power Electronics Thermal Transmission Variable Valvetrain Modules Turbochargers Power Electronics Electric Drive Electric Drive Management Technologies Systems Wheel Drive Motor Module Smart Remote Fuel Assembly / Delivery Engine Controller Inverters Combined Units Battery Pack Controller Local Controllers Software & Calibration Actuator Transmission Controllers Canisters Engine Air Control Valve DC-DC Converter On-Board Chargers Domain Controllers Power Modules Application-Specific Integrated Circuits Note: Representative selection of product portfolios. © BorgWarner Inc. 23

Additional Information and Where to Find It This presentation may be deemed solicitation material in respect of the proposed acquisition of Delphi Technologies by BorgWarner (the “proposed transaction”). In connection with the proposed transaction, Delphi Technologies will file with the Securities and Exchange Commission and furnish to Delphi Technologies’ shareholders a proxy statement and other relevant documents. This presentation does not constitute a solicitation of any vote or approval. Shareholders are urged to read the proxy statement when it becomes available and any other documents to be filed with the SEC in connection with the proposed transaction or incorporated by reference in the proxy statement because they will contain important information about the proposed transaction. Investors will be able to obtain free of charge the proxy statement and other documents filed with the SEC at the SEC’s website at http://www.sec.gov. In addition, the proxy statement and Delphi Technologies’ and BorgWarner’s respective annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to section 13(a) or 15(d) of the Securities Exchange Act of 1934 are available free of charge through Delphi Technologies’ and BorgWarner’s websites at www.delphi.com and www.borgwarner.com, respectively, as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC. The directors, executive officers and certain other members of management and employees of Delphi Technologies and BorgWarner, respectively, may be deemed “participants” in the solicitation of proxies from shareholders of Delphi Technologies in favor of the proposed transaction. Information regarding the foregoing will be set forth in the proxy statement and the other relevant documents to be filed with the SEC and available free of charge at the SEC’s website at http://www.sec.gov. You can find information about Delphi Technologies’ executive officers and directors in its Annual Report on Form 10-K for the fiscal year ended December 31, 2018 and in its definitive proxy statement filed with the SEC on Schedule 14A on March 15, 2019. © BorgWarner Inc. 24