Charging Forward Investor Day 2021 1

Investor Day Patrick Nolan – Vice President, Investor Relations March 23, 2021 Charging Forward Welcome and Agenda 2

Forward-Looking Statements This presentation may contain forward-looking statements as contemplated by the 1995 Private Securities Litigation Reform Act that are based on management’s current outlook, expectations, estimates and projections. Words such as “anticipates,” “believes,” “continues,” “could,” “designed,” “effect,” “estimates,” “evaluates,” “expects,” “forecasts,” “goal,” “guidance,” “initiative,” “intends,” “may,” “outlook,” “plans,” “potential,” “predicts,” “project,” “pursue,” “seek,” “should,” “target,” “when,” “will,” “would,” and variations of such words and similar expressions are intended to identify such forward-looking statements. Further, all statements, other than statements of historical fact contained or incorporated by reference in this presentation that we expect or anticipate will or may occur in the future regarding our financial position, business strategy and measures to implement that strategy, including changes to operations, competitive strengths, goals, expansion and growth of our business and operations, plans, references to future success and other such matters, are forward-looking statements. Accounting estimates, such as those described under the heading “Critical Accounting Policies and Estimates” in Item 7 of our Annual Report on Form 10-K for the year ended December 31, 2020 (“Form 10- K”), are inherently forward-looking. All forward-looking statements are based on assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances. Forward-looking statements are not guarantees of performance, and the Company’s actual results may differ materially from those expressed, projected or implied in or by the forward-looking statements. 3

You should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Forward-looking statements are subject to risks and uncertainties, many of which are difficult to predict and generally beyond our control, that could cause actual results to differ materially from those expressed, projected or implied in or by the forward-looking statements. These risks and uncertainties, among others, include: the difficulty in forecasting margin performance and free cash flow through 2025 in light of the variables that can impact those results over that period of time; the difficulty in forecasting demand for electric vehicles and our EV revenue growth to 2030; the ability to identify targets and consummate acquisitions on acceptable terms; failure to realize the expected benefits of acquisitions; the ability to identify appropriate combustion portfolio businesses for disposition and consummate planned dispositions on acceptable terms; competitive challenges from existing and new competitors including OEM customers; the challenges associated with rapidly-changing technologies, particularly as relates to electric vehicles, and our ability to innovate in response; uncertainties regarding the extent and duration of impacts of matters associated with COVID- 19, including additional production disruptions; the failure to realize the expected benefits of the acquisition of Delphi Technologies PLC that the Company completed on October 1, 2020; the failure to promptly and effectively integrate acquired businesses; the potential for unknown or inestimable liabilities relating to the acquired businesses; the possibility that the proposed transaction between the Company and AKASOL AG will not be consummated; failure to obtain necessary regulatory approvals or to satisfy any of the other conditions to the proposed transaction; our dependence on automotive and truck production, both of which are highly cyclical and subject to disruptions; our reliance on major OEM customers; commodities availability and pricing; supply disruptions; fluctuations in interest rates and foreign currency exchange rates; availability of credit; our dependence on key management; our dependence on information systems; the uncertainty of the global economic environment; the outcome of existing or any future legal proceedings; future changes in laws and regulations, including, by way of example, tariffs, in the countries in which we operate; impacts from any potential future acquisition or divestiture transactions; and the other risks noted in reports that we file with the Securities and Exchange Commission, including Item 1A, “Risk Factors” in our most recently-filed Form 10-K. We do not undertake any obligation to update or announce publicly any updates to or revisions to any of the forward-looking statements in this presentation to reflect any change in our expectations or any change in events, conditions, circumstances, or assumptions underlying the statements. 4

Non-GAAP Financial Measures This presentation contains information about BorgWarner’s financial results that is not presented in accordance with accounting principles generally accepted in the United States (“GAAP”). Such non-GAAP financial measures are reconciled to their closest GAAP financial measures in the Appendix. The provision of these comparable GAAP financial measures for 2021 and later is not intended to indicate that BorgWarner is explicitly or implicitly providing projections on those GAAP financial measures, and actual results for such measures are likely to vary from those presented. The reconciliations include all information reasonably available to the company at the date of this presentation and the adjustments that management can reasonably predict. Management believes that these non-GAAP financial measures are useful to management, investors, and banking institutions in their analysis of the Company's business and operating performance. Management also uses this information for operational planning and decision-making purposes. Non-GAAP financial measures are not and should not be considered a substitute for any GAAP measure. Additionally, because not all companies use identical calculations, the non-GAAP financial measures as presented by BorgWarner may not be comparable to similarly titled measures reported by other companies. 5

Today’s Agenda Accelerating Our Electrification Strategy Fred Lissalde, Chief Executive Officer Technology Leadership in Electrification Stefan Demmerle, President, PowerDrive Systems Financial Performance and Outlook Kevin Nowlan, Chief Financial Officer Closing Remarks Fred Lissalde Break All Q&A All 6

Questions FOR THOSE DIALING IN United States: (844) 264-9340 International: (267) 753-2116 Conference ID: 9958459 To ask a question: Press *1 FOR THOSE LISTENING ON-LINE Submit your questions to ir@BorgWarner.com during the call 7

Investor Day Fred Lissalde – Chief Executive Officer March 23, 2021 Charging Forward Accelerating Our Electrification Strategy 8

Intentional Growth for a Sustainable Future • This high-impact change is a product of our vision and strategy • Our vision of a clean, energy- efficient world is as relevant today as ever • And our accelerated electrification strategy to advance that vision is today’s story 1 Estimate at the midpoint of FY21 guidance Source: BorgWarner estimate ~$350M 2021 EV Revenue ~45%<3%1 ~$10B 2030 EV Revenue Revenue from EVs 9

BorgWarner Is Evolving Its Mission Our mission was focused on balance: Today and Tomorrow We deliver innovative and sustainable mobility solutions for the vehicle market We’re accelerating toward electrification Propulsion System Leader for Combustion, Hybrid and Electric Vehicles 10

This Evolution Is Consistent with Our Commitment to Sustainability 60 80 100 120 2015 2018 2021 2024 2027 2030 GHG: 50% Reduction by 2030 Energy: 37% Reduction by 2030 tCO2e / $M sales 20 30 40 50 2015 2018 2021 2024 2027 2030 40.9 Baseline 89.5 Progress as of 2019 Goal 20.5 MWh / $M sales 32.0 Progress as of 2019 109.0 Baseline Goal 69.0 Our sustainability objectives go hand in hand with our strategy to generate financial results Committed to being CARBON NEUTRAL by 2035 Includes Scope 1 & 2 emissions 11

We Empower Our Diverse Teams Gender Pay Parity1 98.7% Gender Diversity Overall 25.6% New Hires 33.2% 14.6%Leadership Local Accountability Global Strength 1 This study was facilitated by Mercer on behalf of BorgWarner. Baseline data: Regions studied: US and Canada, China, Germany, W. Europe, E. Europe, Latin America, Asia | 6,210 salaried employees Grades 10-19 | Measured pay against gender Empower Our i erse Teams Minorities (USA) Overall 21.2% New Hires 24.7% 13.9% Leadership 12

External Factors Are Accelerating Demand for Cleaner, More Efficient Vehicles Rising Temperatures Drive Demand for Clean, Efficient Vehicles 40 60 80 100 120 140 160 180 200 2010 2015 2020 2025 2030 China Europe U.S. NASA figure adapted from Goddard Institute for Space Studies Surface Temperature Analysis Now is the optimal time to accelerate BorgWarner’s shift toward electrification CO2 Emissions Regulatory Standards Normalized to NEDC NEDC figures adapted from The International Council on Clean Transportation Analysis -0.8 -0.2 0.4 1 1880 1900 1920 1940 1960 1980 2000 2020 Global Surface Temperature Anomalies – 5-year average D e g re e s C e ls iu s g /k m 13

We’re Moving Electrification to the Forefront of Our Strategy These actions alone expected to lead to ~45% revenue from EV by 2030 …and future actions could increase this further as appropriate 2021-2025: Accelerating Our Shift • Significantly shifting our organic investments towards electrification • More aggressively deploying capital toward M&A • Steadily optimizing our combustion portfolio, targeting dispositions of products with $3B to $4B in annual revenue 14

$399 $118 $509 $2,640 2020 Product Portfolio 2020 2017 2019 2016 2018 2015 2021 Est. 2025 Content Opportunity per eLV 2014 Portfolio Remy Acquisition — Motors Organic Product Development Delphi/Sevcon Acquisitions — Power Electronics $1,614 Rotating electric (i.e., motors) Industrial-focused power electronics Electronics for start- up EV customers Battery packs and modules (60/40 JV) Power electronics and software Battery packs and modules (pending) We’ve Grown Our Electrification Portfolio Deliberately over Time 15

We Know How to Evolve to Meet Tomorrow’s Needs Decades of leadership through strategic evolution — and our next phase is underway BorgWarner pivots to turbos through series of strategic acquisitions, including the merger of 3K and Schwitzer BorgWarner significantly accelerates dual clutch module sales in China through wholly-owned and joint ventures Late 1990s 2010s ~4,000 ~2M 2012 2020 DCT Units in Vehicles ~2M ~13M 1998 2019 Total Turbos 16

Electric Vehicles (% Sales) <3% >25% ~45% 2021¹ 2025 2030 1 Estimate at the midpoint of FY21 guidance Source: BorgWarner estimate 17

$200 to $225 2021 2022 2023 2024 2025 Organic Investment Will Play a Major Role in Advancing eLV… Organic Investment Strategy • Combined R&D and capital spending for eProducts >$3B over next 5 years • eProducts approaching 50% of R&D before acquisitions by 2025 • Spending driven by secured programs or targeted pursuits Estimated R&D Spend for eProducts ($M) Source: BorgWarner estimate 18

$907 $1,875 …and We’re Well Positioned to Seize Market Opportunity $2,640 Combustion Based Electric ~2.9X Combustion $$ Addressable Market $100B $38B Est. 2025 BorgWarner Content Opportunity Per Light Vehicle Summary Combustion Hybrid Sources: BorgWarner TAM; IHS Markit, KGP. Excludes: Romeo Power Battery JV opportunities, Service & Aftermarket 19

~$250M 2021 2025 2030 Organic M&A through 2025 We’re Prepared to Profitably Scale eLV and Accelerate Expansion ~$3.5B ~$8B Estimated BorgWarner eLV Revenue Charging Forward Initiatives 1 1 Estimate at the midpoint of FY21 guidance. Source: BorgWarner estimate. Our Objectives • Deliver on organic growth initiatives • Leverage next-generation products and technologies • Proactively pursue inorganic growth opportunities to strengthen e-propulsion capabilities and scale Growth with End Markets 20

We’re Expanding into eCV Based on Growth, Size, Profit Potential and Fit… eCV Thematic Findings • Large, fast-growing market that builds on existing BorgWarner technologies and capabilities • Existing customer relationships will support penetration • BorgWarner is at an earlier stage of its evolution in eCV Estimated eCV Total Addressable Market (TAM) ~$8B ~$29B 2021 2030 Electric Penetration ~6% ~14% Estimates include forklift chargers, batteries for trucks and buses, material handling, rail, marine, construction & mining and inverters, motors, and eGear drives for global on-road EV trucks and buses as well as off-road estimates. Source: BorgWarner estimate. 21

…Creating an Expanded eCV Portfolio… Electric Drive Modules eMotors Inverters On-Board Chargers Battery Modules & Packs Charging Stations eHeaters Product Offerings • Leverage existing eLV portfolio • Other offerings for fuel-cell- based eCVs 22

…With Significant Potential for Growth 2021 2025 2030 Organic AKASOL Other M&A through 2025 ~$100M >$1B >$2B Our Objectives • Execute organic growth plan • Explore potential partnerships or collaborations for stronger move into eCV market • Complement existing portfolio through acquisitions Estimated BorgWarner eCV Revenue Charging Forward Initiatives Growth with End Markets 1 1 Estimate at the midpoint of FY21 guidance. Source: BorgWarner estimate. 23

A More Focused Combustion Business Areas of Focus • Support our customers as they bridge to electrification • Focus on technologies that interconnect with EVs and future mobility needs • Deliver strong margins, cash flow and scale benefits • Dispose $3B to $4B in annual revenue by 2025 Leading market positions Growing through 2025+ Strong margins and cash flow Potential Dispositions Not a product leader Low growth through 2025 More challenged margin profile Combustion Portfolio Profile 24

30% 2030 BorgWarner Planning Assumption Electric Vehicle Combustion and Hybrid How We’ll Measure Success 2021 2025 2030 eLV eCV Combustion Based Aftermarket & Other 1 Estimate at the midpoint of FY21 guidance Source: BorgWarner estimate Expected Revenue Mix Electric Vehicles ~45% 2030 Light Vehicle Market Mix 36% 102M Units $15B1 ~$18B $22B+ Hybrid 34% 25

• We have both the strategies and execution capabilities to lead the industry • Sustainability is core with a commitment to carbon neutrality by 2035 • Our actions through 2025 are expected to achieve ~45% of revenue from EV by 2030, with potential for more to come 26

27 Investor Day Stefan Demmerle – President, PowerDrive Systems March 23, 2021 Charging Forward Technology Leadership Positions BorgWarner to Capture Electrification Opportunities

Delphi Engineering Integration is a Key Near-Term Focus Bring together • Product Leadership from BorgWarner • Technology Leadership in Power Electronics from Delphi Technologies • Regional Autonomy for Speed and Accountability Engineering priorities moving forward • Execution: Securing Program Launches • Pursuit: Driving Growth • Innovation: Positioning for the Future 28

Product AND System Capability Are Core to Our Electric Vehicle Strategy Inverters Motors Gearboxes Efficient System Customers Integrated Drive Module (iDM) 29

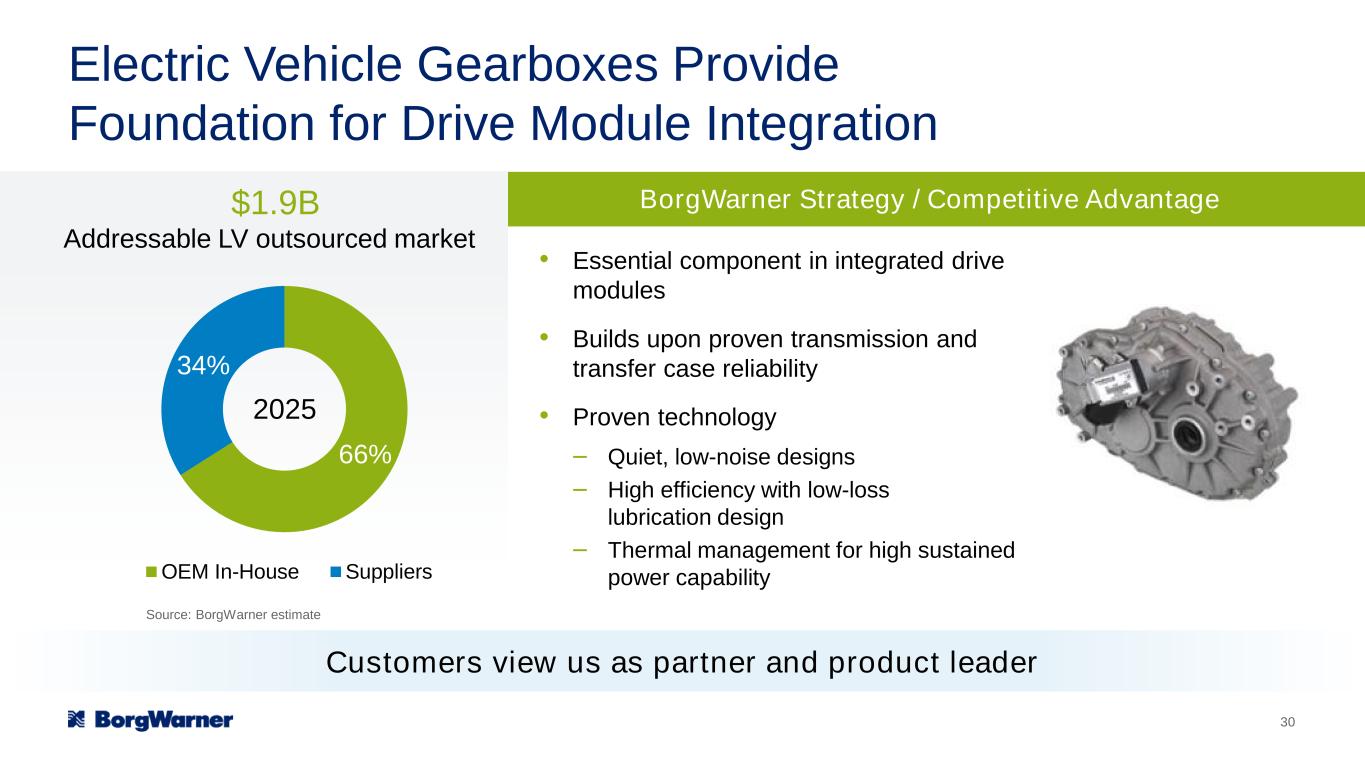

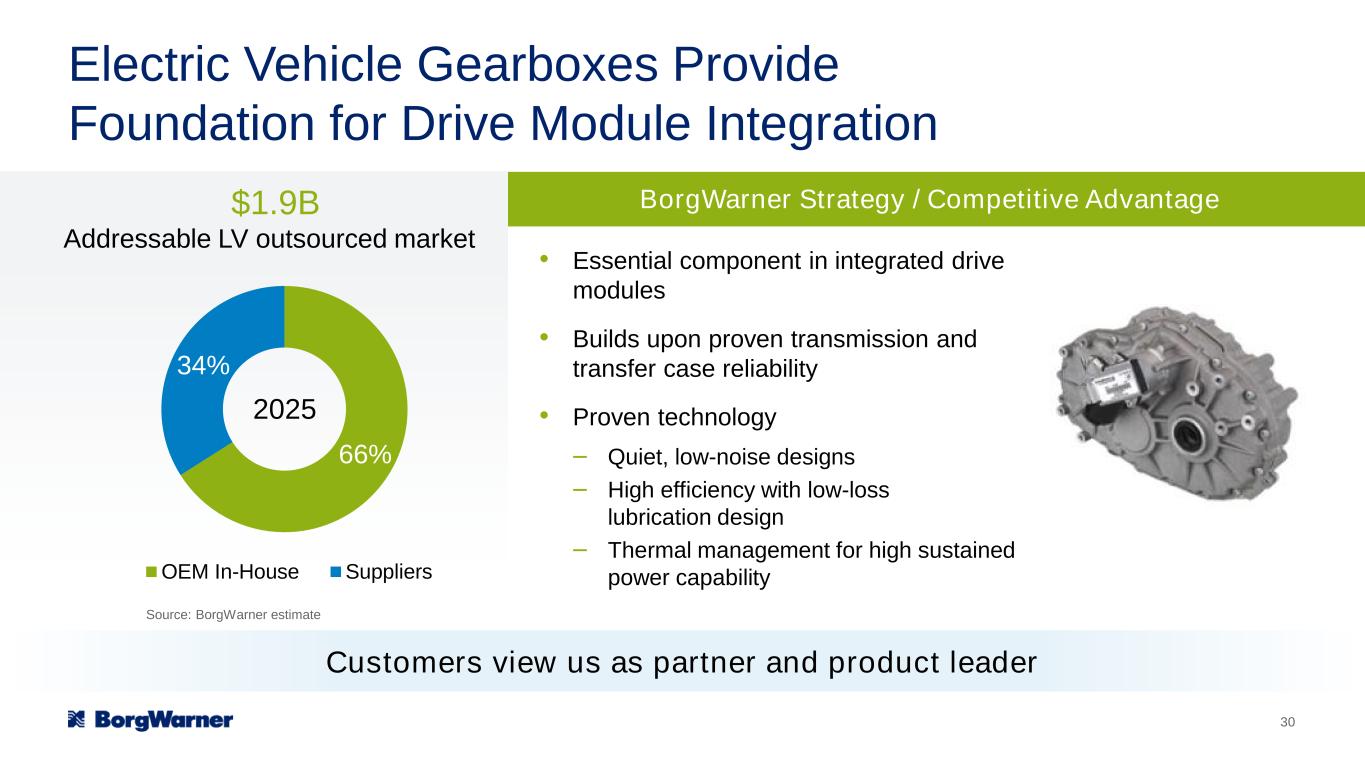

Electric Vehicle Gearboxes Provide Foundation for Drive Module Integration 66% 34% OEM In-House Suppliers 2025 $1.9B Addressable LV outsourced market Customers view us as partner and product leader • Essential component in integrated drive modules • Builds upon proven transmission and transfer case reliability • Proven technology – Quiet, low-noise designs – High efficiency with low-loss lubrication design – Thermal management for high sustained power capability BorgWarner Strategy / Competitive Advantage Source: BorgWarner estimate 30

Ford Mustang Mach-e iDM is a Great Example High torque capacity • Potential for other platform applications, such as light commercial vehicles Integrated Gearbox • Stepped planetary gearset with differential • Optimized for quietness Integrated Drive Module with gearbox, electric motor, and inverter Integrated Parking Module (electrically activated) Built-in lubrication pump and distribution • Optimized for efficiency Application showcases our integration expertise 31

Electric Motors are Supportive of Drive Module Opportunities and eCV Expansion 42% 58% OEM In-House Suppliers 2025 $4.2B Addressable LV outsourced market • Broad range of motors for 400V, 800V & 48V • Technology focused on driving superior power density • Product and process innovation focus: winding pattern, new materials and cooling capabilities • eLV pursuits to focus on combination products and full iDM modules • Expanding standalone and combination opportunities in eCV BorgWarner Strategy / Competitive Advantage Motors enable full module offerings to our customers Source: BorgWarner estimate 32

Why We Are Winning — 800V Electric Motor for European Commercial Vehicle OEM High-voltage hairpin technology High efficiency – 97% maximum Sized for high power: over 400kW peak Patented stator winding technology 2024 SOP2024 The biggest drivers of the win were POWER DENSITY and STRONG CUSTOMER RELATIONSHIP 33

Inverter Innovation and Technology Will Remain Drivers of Future Business Awards 18% 82% OEM In-House Suppliers 2025 $8.8B Addressable LV outsourced market Strong technology advantages create value add for our customers • Scale in Electronics • Efficient speed-to-market with products covering 400V SiC, 800V SiC & 48V • Proprietary inverter power module design • Vertical integration – Power modules, integrated circuit development and full software capability in house BorgWarner Strategy / Competitive Advantage Source: BorgWarner estimate 34

800V and Silicon Carbide Inverters Will Be Drivers of Change 800V is an emerging trend for EVs. Enables: • High power density (2x possible at 400V) for high performance automotive and commercial EVs • 50% reduction in charging time Silicon Carbide is an increasing trend for Inverters. Enables: • Significantly higher efficiency, especially at low- to medium-power levels seen in typical daily driving • Improved e-Machine NVH 35

Custom Integrated Circuits Will Drive Further Innovation… Silicon “die” Electronics Circuitry Benefits • Reduced size • Reduced cost • Added functionality • Unique selling proposition • Effective IP protection Condenses part of the circuit onto a small silicon chip Award- winning, in-house design team 36

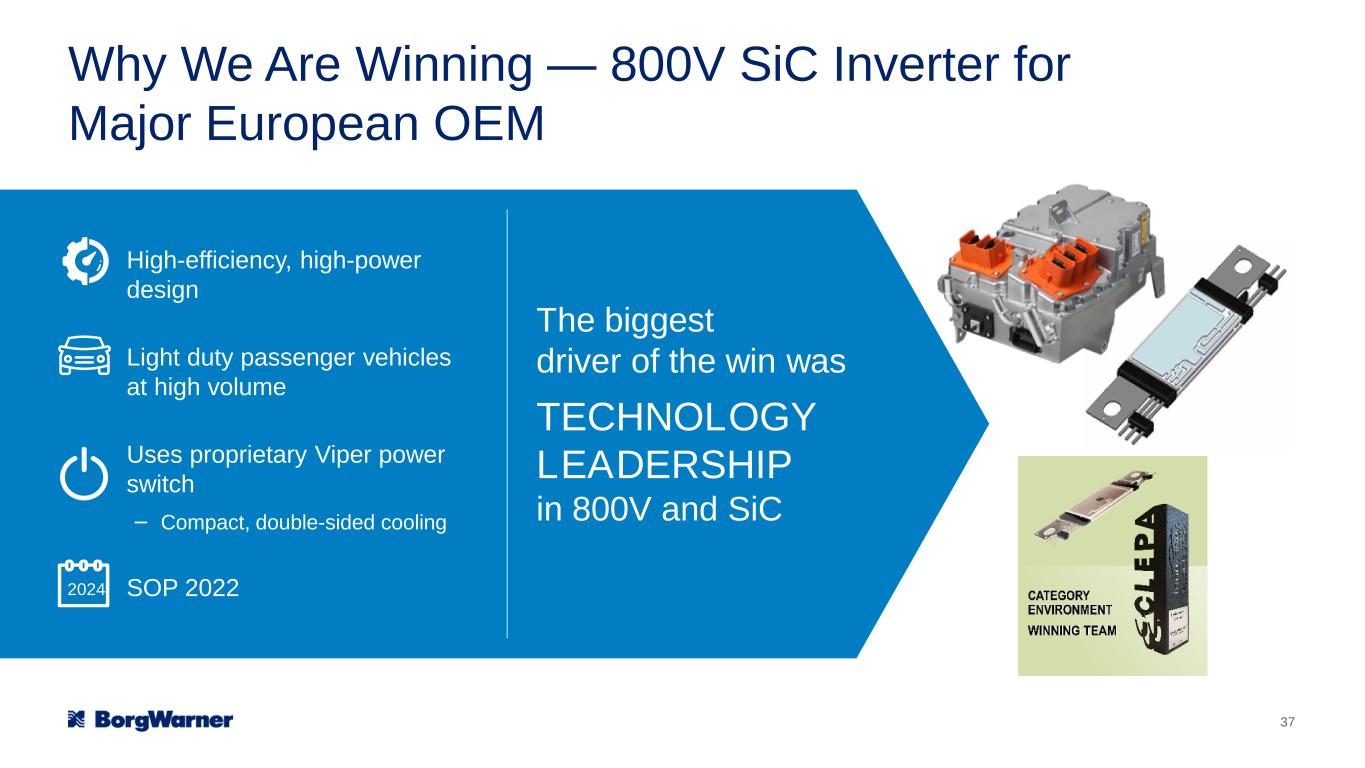

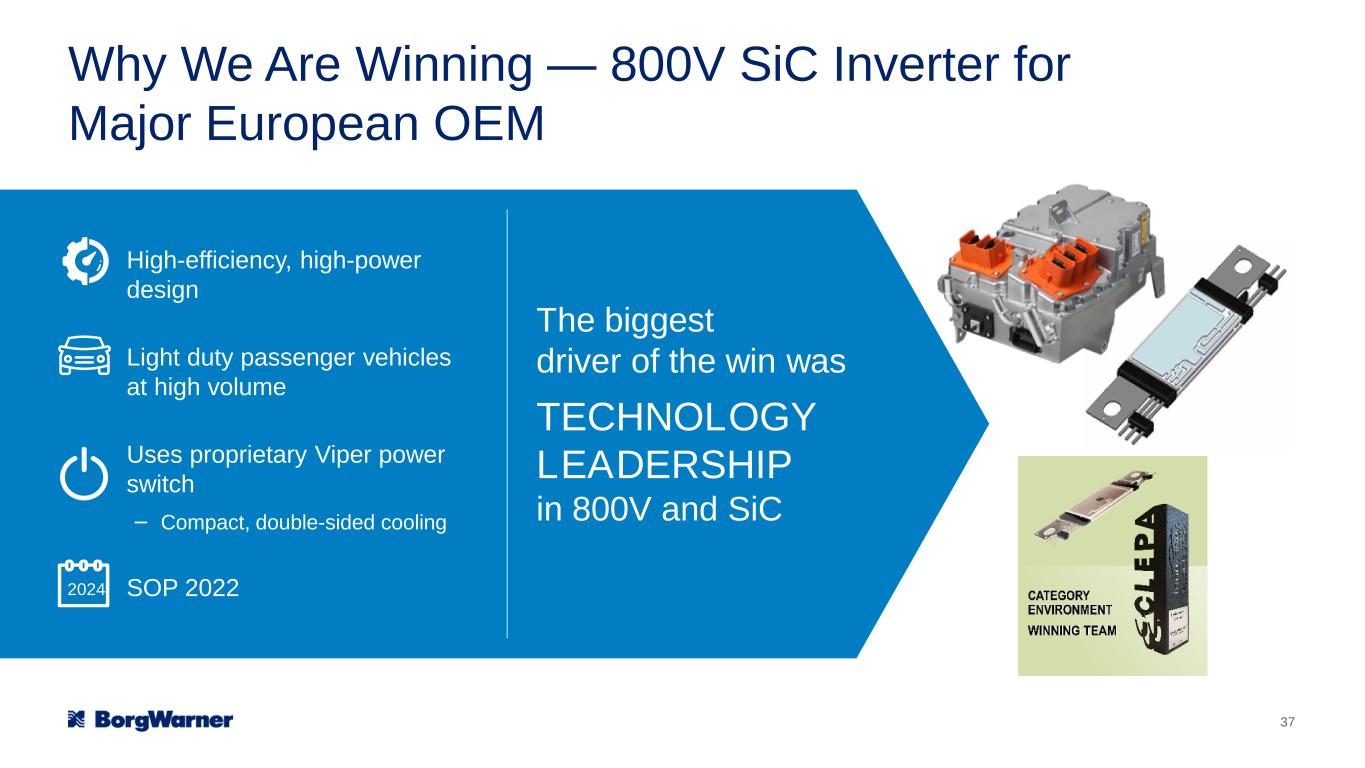

Why We Are Winning — 800V SiC Inverter for Major European OEM High-efficiency, high-power design Light duty passenger vehicles at high volume Uses proprietary Viper power switch – Compact, double-sided cooling SOP 2022 The biggest driver of the win was TECHNOLOGY LEADERSHIP in 800V and SiC 2024 37

…And We Are Seeing Further Opportunities for Combination Units of Other Power Electronics Benefits and Features • Combines multiple electronic units for both 400V & 800V applications • Saves space, eliminates cables and hoses • Single unit to install in the vehicle • Leverages BorgWarner’s packaging & integration strengths Example (in production) Combined dual inverter, DC/DC Converter and Hybrid supervisory control ECU 17% 83% OEM In-House Suppliers 2025 $9.7B Addressable LV outsourced market Source: BorgWarner estimate 38

Three Measures of Success in the Coming Years Growth Innovation Speed Inverters Globally iDMs in Asia eCV Opportunities Near-term Revenue Focus for ePropulsion 39

© BorgWarner Inc. 40 Investor Day Kevin Nowlan – Chief Financial Officer March 23, 2021 Charging Forward Financial Performance and Outlook

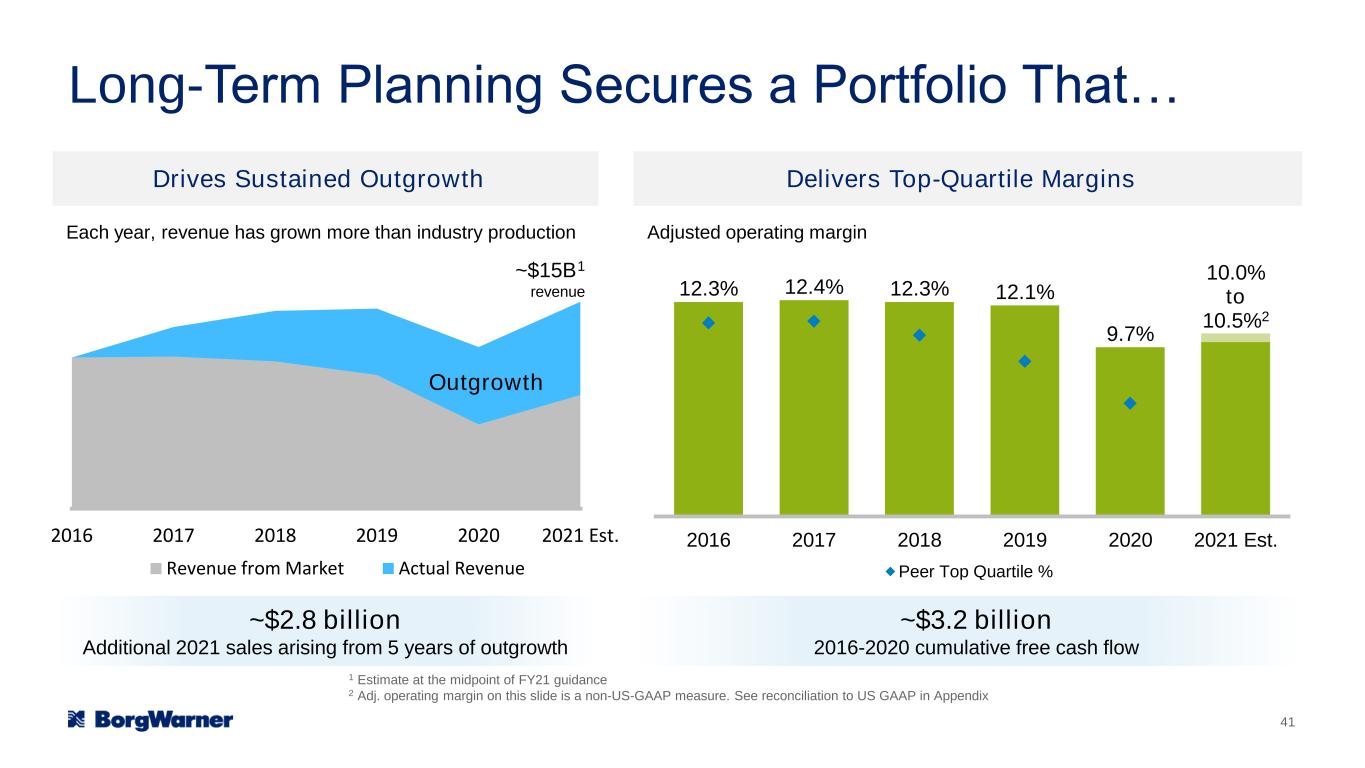

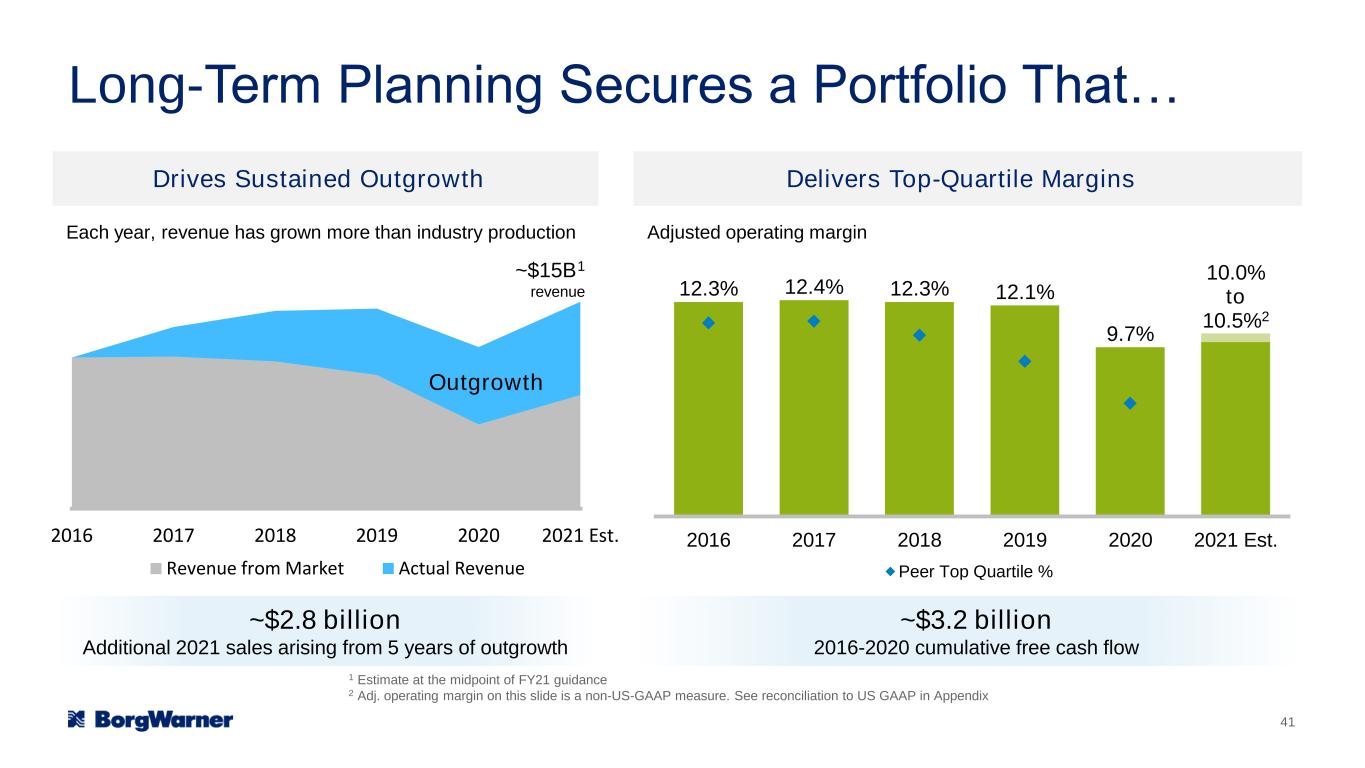

2016 2017 2018 2019 2020 2021 Est. Revenue from Market Actual Revenue 12.3% 12.4% 12.3% 12.1% 9.7% 10.0% to 10.5%2 2016 2017 2018 2019 2020 2021 Est. Peer Top Quartile % Long-Term Planning Secures a Portfolio That… Each year, revenue has grown more than industry production Adjusted operating margin ~$3.2 billion 2016-2020 cumulative free cash flow ~$2.8 billion Additional 2021 sales arising from 5 years of outgrowth Drives Sustained Outgrowth Delivers Top-Quartile Margins Outgrowth ~$15B1 revenue 1 Estimate at the midpoint of FY21 guidance 2 Adj. operating margin on this slide is a non-US-GAAP measure. See reconciliation to US GAAP in Appendix 41

Balanced, Disciplined Capital Deployment Capital allocation strategy has supported growth while returning value to shareholders • Organic investments have driven meaningful outgrowth • M&A has accelerated company’s positioning in electrified propulsion • Have maintained shareholder return commitments throughout COVID-19 34% 9% 9% 12% 36% 2016-2020 Capital Allocation Capital expenditures M&A activity1 Net debt repayment Share repurchases Dividends 1 Includes ~$1.5B for value of shares issued to acquire Delphi Technologies and $172M for derecognition of subsidiary 42

$399 $118 $509 $1,614 $399 $2,640 2014 Product Portfolio 2020 Product Portfolio Acquisitions Are Driving Long-Term Value Creation SiC Inverters GDi systems Delphi Integration On Track $15M $90M $175M 2020 2021 Guidance 2023 Est. Cumulative Cost Synergies M&A Has Enhanced Content Opportunity Per Vehicle Multiple Program Awards Post Signing Est. 2025 Content Opportunity Per Electric Vehicle 2014 Portfolio Remy Acquisition — Motors Organic Product Development Delphi/Sevcon Acquisitions — Power Electronics 43

eLV Addressable Market 2021 2025 2030 1 Includes high-voltage air heater and high-voltage coolant heater for light vehicle EVs only 2 Includes inverter, DCDC, OBC, CIDD, HV Box and BMS for light vehicle EVs only 3 Includes motors and eGearDrives® for light vehicle EVs only Source: BorgWarner estimate ~$76B ~$38B ~$11B eHeater/Other1 Power Electronics2 Motor+Gear3 15% CAGR 35% CAGR eLV Market Expected to Experience Profound Growth Over Next Decade BorgWarner has positioned itself to capitalize on this growth EV Market Penetration 5% 15% 30% 44

eCV Addressable Market 1 Includes batteries for trucks and buses, material handling, rail, marine, construction & mining 2 Includes inverters, motors, and eGearDrives® for global on-road EV trucks and buses as well as off-road estimates Source: BorgWarner estimate Forklift Chargers Battery1 Inverter2 ~$8B ~$16B ~$29B 2021 2025 2030 Motor+Gear2 13% CAGR 19% CAGR EV Market Penetration 6% 8% 14% eCV Market Also Poised for Significant Acceleration BorgWarner enhancing its focus in this area to participate in rapid growth EU & North America Rest of World 45

Clear Roadmap to Driving Sustainable Growth Through 2030 1 Estimate at the midpoint of FY21 guidance. Source: BorgWarner estimate. Estimated Organic Growth and Portfolio Realignment… …Sets Up Second Half of Decade ~$4B $2B to $3B $(3B) to $(4B) 2021 Organic Growth Acquisitions Dispositions 2025 2030 eLV eCV Combustion Based Aftermarket & Other $15B1 ~$18B $22B+ Growth attributable to market mix ~45% of total >25% of total 46

-23.0% -13.0% -3.0% 7.0% 17.0% 27.0% $(500) $(300) $(100) $100 $300 $500 $700 Gross Profit $ R&D $ Operating Margin Profitability on EV Portfolio Expected to Improve as Programs Launch Current profitability already reflects elevated R&D spending for EVs Growth in R&D spending not commensurate with sales trajectory Improving gross margin reflects expected incremental margins on increasing sales – + Breakeven 2021 2022 2023 2024 2025 Source: BorgWarner estimate Estimated EV Profitability Characteristics 47

10.3% >11.0% 9.0% 2021 2023 2030 Committed to Top-Quartile Margin Profile Source: BorgWarner estimate at the midpoint of FY21 guidance and estimated FY23 outlook Adj. Operating Margin Performance Strong margins are part of the BorgWarner culture • Sales growth and proactive cost management sustain margin profile • R&D for rapidly growing EV portfolio is overhang in medium term until corresponding revenue materializes − Maintaining ROIC discipline on EV programs expected to deliver comparable, long-term margin profile Double-digit margin even with revenue mix shift 48

Strong Free Cash Flow Generation Expected to Continue $0.8B to $0.9B >$1.0B 2021 2025 ~$4.5B in FCF expected over 5 years, building on record 2020 performance • Expect to continue delivering strong conversion of earnings into FCF • Working capital in support of revenue growth encompassed in cash generation • Cash flow contemplates funding of all current restructuring programs and potential future actions Estimated Free Cash Flow Source: BorgWarner estimate excluding acquisitions and dispositions 49

Dispositions Increase EV Focus and Allow for Capital Redeployment ~$1B in sales over next 12-18 months ~$3B to $4B in sales by 2025 Prioritizes BorgWarner vision of a clean, energy-efficient world Supports future propulsion mix objectives Based on evaluation of medium-term financial prospects of product portfolio Opportunities for value-maximizing transactions Portfolio management becomes increasingly important Disposition Planning Assumptions 50

Significant Capital Available to Accelerate Positioning in EV • Strong cash flow and investment- grade balance sheet support M&A • Dispositions provide additional source of capital • Discipline of returning capital to shareholders remains intact – Dividends sustainable through downturns – Share repurchase timing subject to M&A execution $5.0B+ 1 Est. disposition proceeds net of loss of FCF through 2025 associated with dispositions 2 Est. incremental debt that could be issued while maintaining 1.8x gross-debt-to-EBITDA ratio BorgWarner estimate ~$4.5B Free Cash Flow >$1.0B Available Leverage2 ~$1.5B Dispositions1 $0.8B Dividends Sources of Capital Uses of Capital ~$5.5B Available for M&A >$7B 2021-2025 Estimated Capital Flows $0.8B Share Repurchases 51

14.7% 16.8% 15.3% 10.3% ~12% 2017 2018 2019 2020 2021 Est. ROIC Focus Will Continue to Drive Capital Allocation Decisions Return on Invested Capital Will maintain ROIC discipline as electrification investments accelerate • Have delivered consistently strong ROIC, even during COVID-19 pandemic • Although EV investments can have longer return profiles, intend to maintain life-of-project ROIC focus Cost of Capital1 1 As disclosed in 2020 proxy 52

Financial Summary • Strategic growth actions expected to drive EV revenue of: − >25% of sales in 2025 − ~45% of sales in 2030 • Top-quartile margin performance expected to be sustained, even while funding EV investments • Strong FCF generation expected to continue through 2025 & beyond • More aggressive portfolio management also expected to contribute to positioning in EVs 53

54 Appendix

Adjusted Operating Income and Margin Reconciliation to US GAAP The Company defines adjusted operating income as operating income adjusted to eliminate the impact of restructuring expense, merger, acquisition and divestiture expense, other net expenses, discontinued operations, and other gains and losses not reflective of the Company’s ongoing operations. The company defines adjusted operating margin as adjusted operating income divided by net sales $ in millions 2016 2017 2018 2019 2020 Low High Low High Sales $9,071 $9,799 $10,530 $10,168 $10,165 $14,700 $15,300 $15,500 $17,500 Operating income $973 $1,072 $1,190 $1,303 $618 $1,260 $1,450 >$1,605 >$1,825 Operating margin % 10.7% 10.9% 11.3% 12.8% 6.1% 8.6% 9.5% >10.4% >10.4% Non-comparable items: Restructuring expense 27 59 67 72 203 200 150 100 100 Merger, acquisition and divestiture expense 24 10 6 11 96 10 10 - - Intangible asset accelerated amortization - - - - 38 - - - - Amortization of inventory step-up - - - - 27 - - - - Asset impairment and loss on divestiture 127 71 25 7 17 - - - - Net gain on insurance recovery for property damage - - - - (9) - - - - Unfavorable arbitration loss - - - 14 - - - - - Officer stock awards modification - - 8 2 - - - - - Asbestos related charge (49) - 23 - - - - - - Gain on sale of building - - (19) - - - - - Gain on derecognition of subsidiary - - - (177) - - - - - Other 12 7 (4) - - - - - - Adjusted operating income $1,114 $1,219 $1,296 $1,232 $990 $1,470 $1,610 >$1,705 >$1,925 Adjusted operating margin 12.3% 12.4% 12.3% 12.1% 9.7% 10.0% 10.5% >11.0% >11.0% 1 Significant variability in low and high sales expectations relates to potential variability in acquisitions and dispositions Year Ended December 31, Full Year 2021 Guidance Full Year 2023 Estimate 1

Free Cash Flow Reconciliation to US GAAP The Company defines free cash flow as net cash provided by operating activities minus capital expenditures, including tooling outlays. The measure is useful to both management and investors in evaluating the Company’s ability to service and repay its debt. Total Years Ended December 31, $ in millions 2016 2017 2018 2019 2020 2021 1 2025 Est. 2021-2025 Est. Net cash provided by operating activities $1,036 $1,180 $1,126 $1,008 $1,184 $1,525 >$2,000 $8,800 Derecognition of subsidiary - - - 172 - - - - Capital expenditures, including tooling outlays (501) (560) (546) (481) (441) (675) (1,000) (4,300) Free cash flow $535 $620 $580 $699 $743 $850 >$1,000 $4,500 1 Estimate at the midpoint of FY21 guidance Source: BorgWarner estimate excluding the impact of any new acquisitions and dispositions Year Ended December 31, Year Ended December 31,

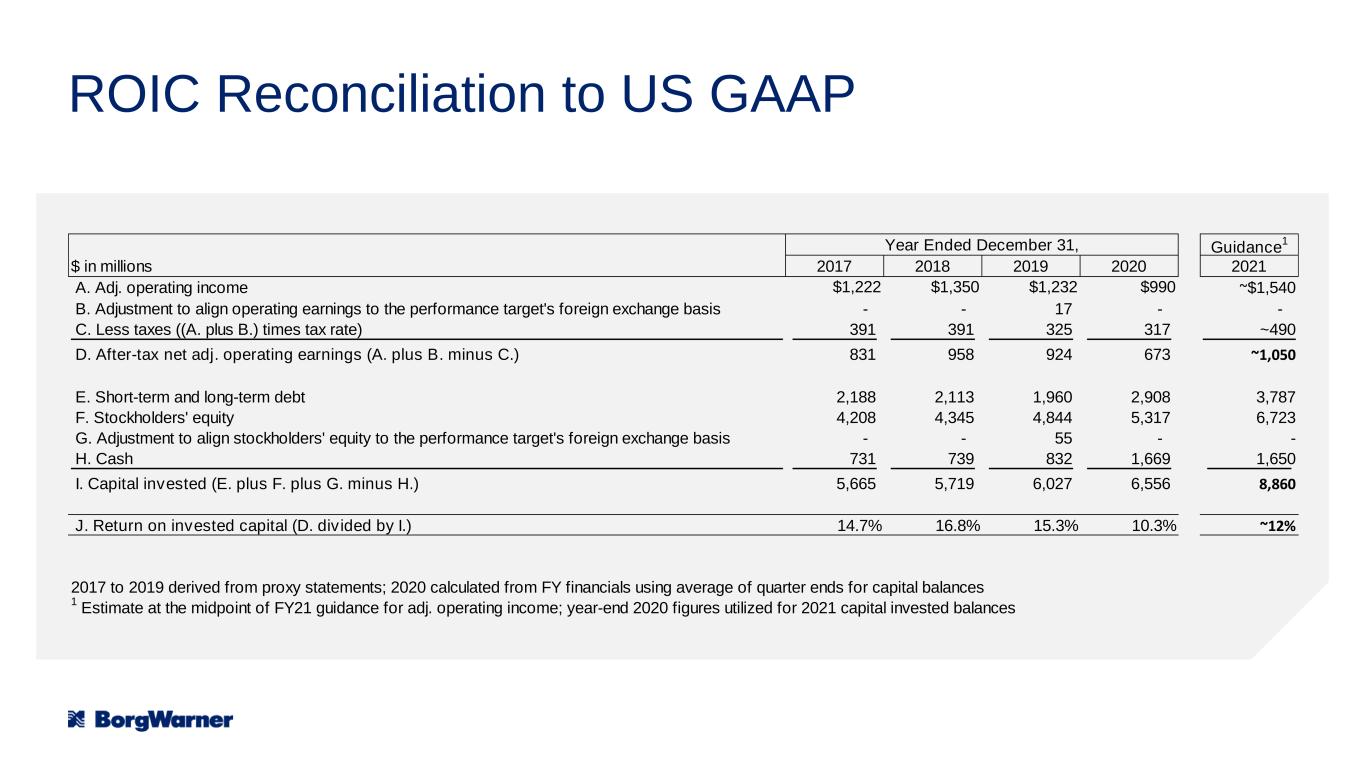

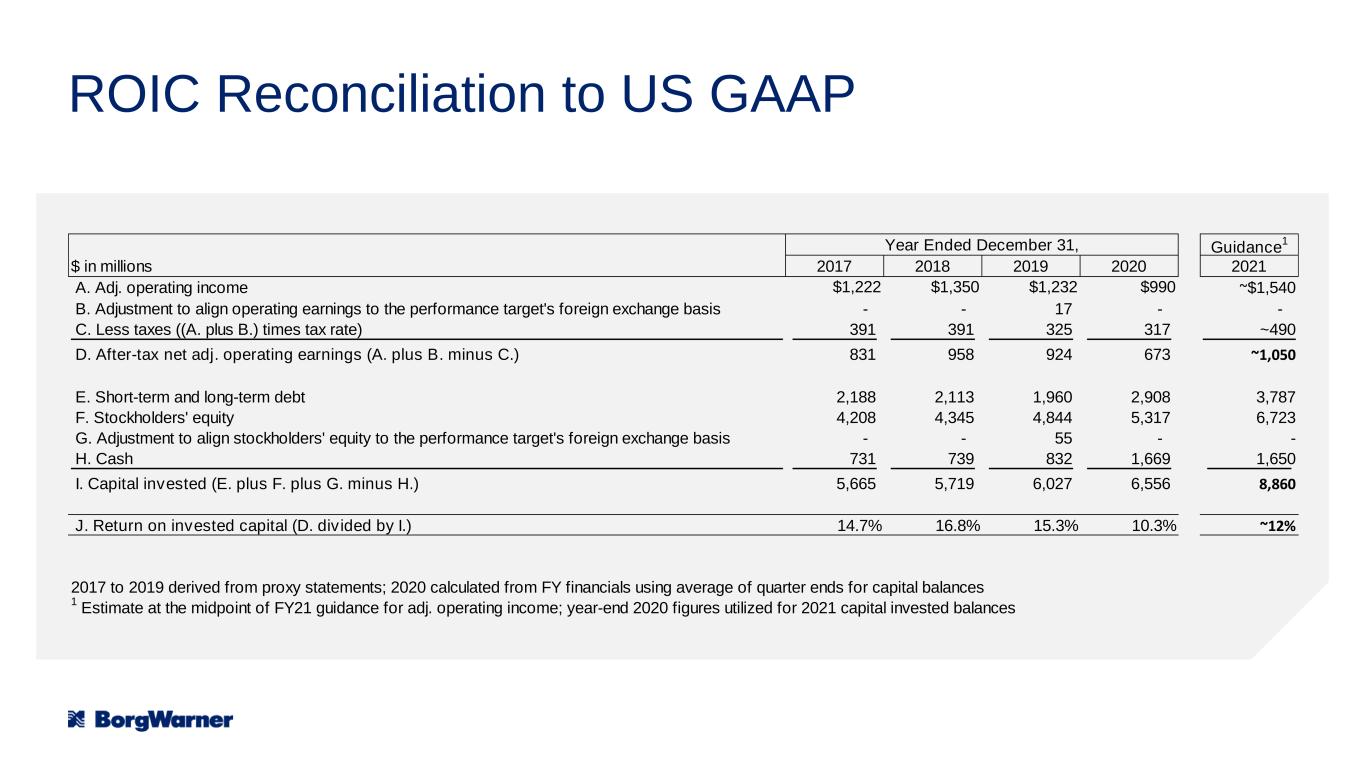

ROIC Reconciliation to US GAAP Guidance 1 $ in millions 2017 2018 2019 2020 2021 A. Adj. operating income $1,222 $1,350 $1,232 $990 ~$1,540 B. Adjustment to align operating earnings to the performance target's foreign exchange basis - - 17 - - C. Less taxes ((A. plus B.) times tax rate) 391 391 325 317 ~490 D. After-tax net adj. operating earnings (A. plus B. minus C.) 831 958 924 673 ~1,050 E. Short-term and long-term debt 2,188 2,113 1,960 2,908 3,787 F. Stockholders' equity 4,208 4,345 4,844 5,317 6,723 G. Adjustment to align stockholders' equity to the performance target's foreign exchange basis - - 55 - - H. Cash 731 739 832 1,669 1,650 I. Capital invested (E. plus F. plus G. minus H.) 5,665 5,719 6,027 6,556 8,860 J. Return on invested capital (D. divided by I.) 14.7% 16.8% 15.3% 10.3% ~12% 2017 to 2019 derived from proxy statements; 2020 calculated from FY financials using average of quarter ends for capital balances 1 Estimate at the midpoint of FY21 guidance for adj. operating income; year-end 2020 figures utilized for 2021 capital invested balances Year Ended December 31,