UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

Report of foreign private issuer

pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934.

For the Month of December, 2013

Commission File Number: 001-12126

CHINA ENTERPRISES LIMITED

(Exact name of registrant as specified in its charter)

25/F., Paul Y. Centre, 51 Hung To Road, Kwun Tong, Kowloon, Hong Kong

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

x Form 20-F ¨ Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

¨ Yes x No

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .

CHINA ENTERPRISES LIMITED

TABLE OF CONTENTS

CHINA ENTERPRISES LIMITED

(Exact Name of Registrant as Specified in its Charter)

Bermuda

(Jurisdiction of Incorporation or Organization)

25th Floor, Paul Y. Centre, 51 Hung To Road, Kwun Tong, Kowloon, Hong Kong

(Address of Principal Executive Office)

ANNUAL GENERAL MEETING

2011, 2012 AND 2013

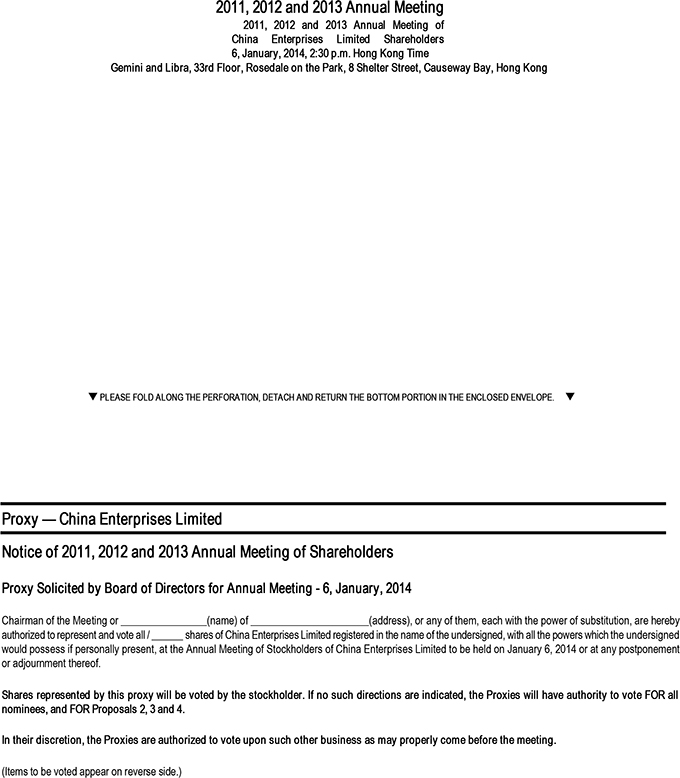

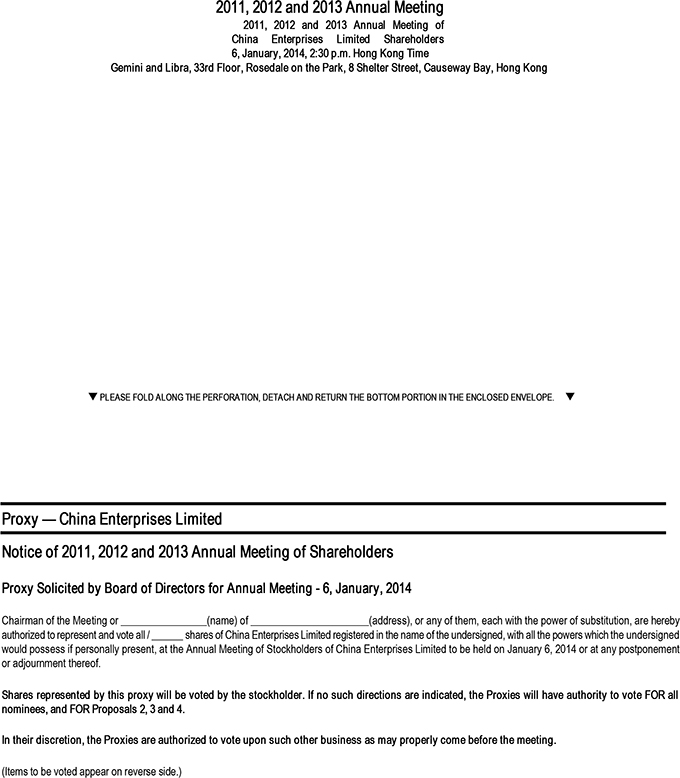

Enclosed herewith a notice convening an annual general meeting of China Enterprises Limited (“the Company”) to be held at 2:30 p.m. on January 6, 2014 (Hong Kong time) at Gemini and Libra, 33rd Floor, Rosedale on the Park, 8 Shelter Street, Causeway Bay, Hong Kong is set out on page 4 of this circular.

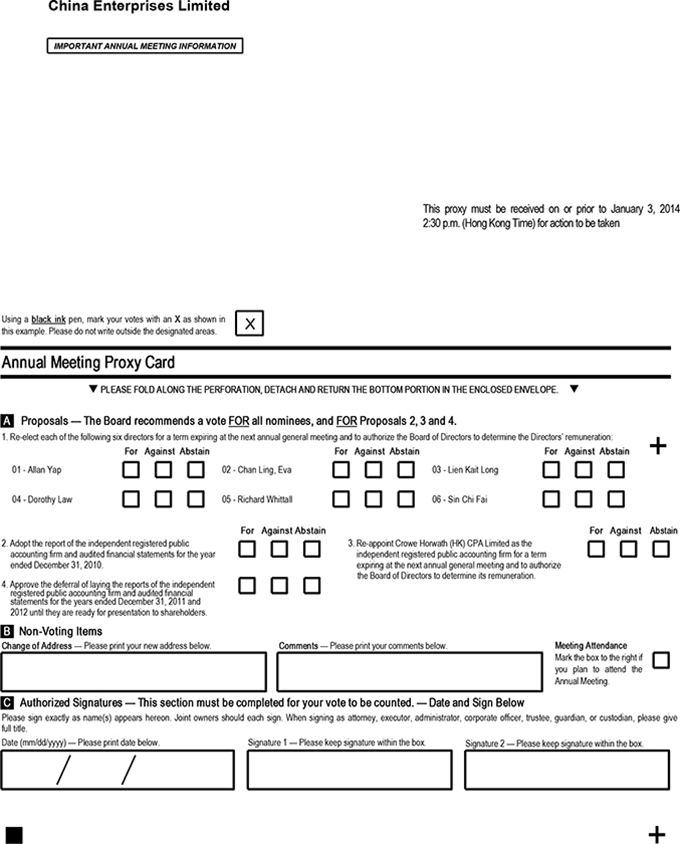

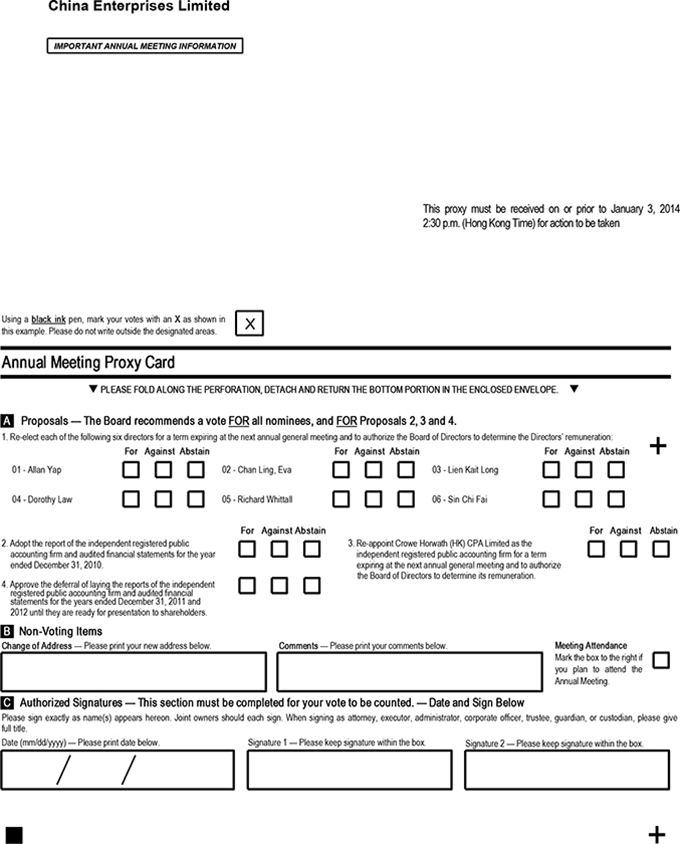

Whether or not you intend to attend the annual general meeting, you are requested to complete the enclosed proxy card in accordance with the instructions printed thereon to the Company. The proxy card must be received on or prior to January 3, 2014 ( Hong Kong time) for action to be taken. Completion and return of the proxy card will not preclude you from attending and voting in person at the meeting should you so wish.

CONTENTS

- i -

PART I

CORPORATE INFORMATION

- 1 -

CORPORATE INFORMATION

| | |

| ANNUAL GENERAL MEETING | | REGISTRAR, TRANSFER AGENT |

| |

Date and time: January 6, 2014 | | Bermuda: |

at 2:30 p.m. | | MUFG Fund Services (Bermuda) |

(Hong Kong time) | | Limited |

Venue: Gemini and Libra | | 26 Burnaby Street |

33rd Floor | | Hamilton HM 11 |

Rosedale on the Park | | Bermuda |

8 Shelter Street | | |

Causeway Bay, Hong Kong | | United States: |

| |

| TRADING VENUE | | Address: |

| | Computershare Trust Company, N. A . |

| OTC Securities Market | | P.O. Box 43078 |

| Trading Symbol:CSHEF | | Providence, RI 02940 -3078 |

| |

| PRINCIPAL PLACE OF BUSINESS | | Private Couriers/Registered Mail: |

| | Computershare Trust Company, N. A . |

| 25th Paul Y. Centre | | 250 Royall Street |

| 51 Hung To Road, Kwun Tong | | Canton, MA 02021 |

| Kowloon, Hong Kong | | |

| Telephone: (852) 3151- 0300 | | Computershare Phone #: (800) 522- 6645 |

| Fax: (852) 2372- 0620 | | |

| | Questions & Inquiries via |

| REGISTERED OFFICE | | Computershare’s Website: |

| | http://www.computershare.com |

| Clarendon House | | Hearing Impaired #: TDD: 1-800 -952-9245 |

| 2 Church Street | | |

| Hamilton HM 11 | | PUBLIC RELATIONS |

| Bermuda | | |

| | Pristine Advisers LLC |

| OFFICIAL WEBSITE | | 8 Walnut Ave E |

| | Farmingdale, NY11735 |

| http://www.chinaenterpriseslimited.com | | Telephone: (631) 756 -2486 |

| | Fax: (646) 478-9415 |

| |

| COUNSEL | | FORM 20 -F |

| |

| Conyers Dill & Pearman | | |

| 2901 One Exchange Square | | Form 20 -F for China Enterprises Limited |

| 8 Connaught Place | | is available on the U. S. Securities and |

| Central | | Exch a nge C om m ission’s websit e at |

| Hong Kong | | www.sec.gov after its filing with the U.S. |

| Telephone: (852) 2524 -7106 | | Securities Exchange Commission. |

| Fax: (852) 2845-9268 | | |

| |

| INDEPENDENT REGISTERED PUBLIC | | |

| ACCOUNTING FIRM | | |

| |

| Crowe Horwath (HK) CPA Limited | | |

| 9/F Leighton Centre | | |

| 77 Leighton Road | | |

| Causeway Bay, Hong Kong | | |

| Telephone: (852) 2894-6888 | | |

| Fax: (852) 2895-3752 | | |

- 2 -

PART II

NOTICE OF 2011, 2012 AND 2013

ANNUAL GENERAL MEETING

- 3 -

NOTICE OF 2011, 2012 AND 2013 ANNUAL GENERAL MEETING

CHINA ENTERPRISES LIMITED

(incorporated in Bermuda with limited liability)

Principal Place of Business:

25th Floor, Paul Y. Centre, 51 Hung To Road, Kwun Tong, Kowloon, Hong Kong

Registered Office:

Clarendon House, 2 Church Street, Hamilton HM 11, Bermuda

To the Shareholders of

China Enterprises Limited:

The annual general meeting of China Enterprises Limited (“the Company”) is called and will be held at 2:30 p.m. on January 6, 2014 at Gemini and Libra, 33rd Floor, Rosedale on the Park, 8 Shelter Street, Causeway Bay, Hong Kong (“Annual General Meeting”), for the following purposes:

| | (1) | To re-elect each of the following six directors for a term expiring at the next annual general meeting and to authorize the Board of Directors to determine the Directors’ remuneration: |

Dr. Yap, Allan

Ms. Chan Ling, Eva

Mr. Lien Kait Long

Ms. Dorothy Law

Mr. Richard Whittall

Mr. Sin Chi Fai;

| | (2) | To consider and adopt the report of the independent registered public accounting firm and audited financial statements for the year ended December 31, 2010; |

| | (3) | To re-appoint Crowe Horwath (HK) CPA Limited as the independent registered public accounting firm for a term expiring at the next annual general meeting and to authorize the Board of Directors to determine its remuneration; and |

| | (4) | To consider and approve the deferral of laying the reports of the independent registered public accounting firm and audited financial statements for the years ended December 31, 2011 and 2012 until they are ready for presentation to shareholders. |

Only shareholders of record at the close of business on November 18, 2013 are entitled to attend and to vote at the Annual General Meeting.

It is requested that you sign, date and mail the enclosed proxy card whether or not you plan to attend the Annual General Meeting. You may revoke your voted proxy at any time prior to the meeting or vote in person if you attend the meeting.

We thank you for your assistance and appreciate your cooperation.

|

By order of the Board of Directors Yap, Allan Chairman |

December 5, 2013

- 4 -

PART III

PROXY STATEMENT

- 5 -

PROXY STATEMENT

CHINA ENTERPRISES LIMITED

(incorporated in Bermuda with limited liability)

The accompanying proxy is solicited by the Board of Directors and is revocable at any time before it is exercised. The cost of solicitation will be borne by the Company. The report of the independent registered public accounting firm and the audited consolidated financial statements for the year ended December 31, 2010 are enclosed with this Proxy Statement.

PROPOSAL NO. 1

RE-ELECTION OF DIRECTORS

The shareholders of the Company will be asked to re-elect six persons to the Board of Directors to serve until the next annual general meeting of shareholders and until their successors have been duly elected and qualified and to authorize the Board of Directors to determine the Directors’ remuneration. All nominees are currently Directors of the Company. The persons named in the accompanying proxy will vote all properly executed proxies for the election of the persons named in the following table unless authority to vote for one or more of the nominees is withheld.

| | | | | | |

| | | | | | | Employed |

| Name | | Age | | Position | | Since |

| Yap, Allan | | 58 | | Chairman of the Board of the Company | | 2001 |

| Chan Ling, Eva | | 48 | | Deputy Chairman of the Board of the Company | | 2004 |

| Lien Kait Long | | 65 | | Director | | 1999 |

| Dorothy Law | | 44 | | Director | | 2000 |

| Richard Whittall | | 54 | | Independent Director | | 2000 |

| Sin Chi Fai | | 54 | | Independent Director | | 2010 |

Compensation of Directors and Officers

For the year ended December 31, 2010, the aggregate amount of remuneration paid by the Company to all directors and executive officers, for services in all capacities, was US$110,700 (2009: US$120,000). No bonus has been paid for the year ended December 31, 2010.

Required Vote

The affirmative vote of the holders of a majority of the votes cast, either in person or by proxy, at the Annual General Meeting is required for the election of the nominees to the Board of Directors of the Company, and to authorize the Board of Directors to determine the Directors’ remuneration.

The Company’s Board of Directors recommends that the shareholders vote FOR this proposal including the election of six nominees listed above and authorizing the Board of Directors to determine the Directors’ remuneration.

- 6 -

PROXY STATEMENT

PROPOSAL NO. 2

ADOPTION OF THE REPORT OF THE INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM AND 2010 FINANCIAL STATEMENTS

The Board of Directors approved the report of the independent registered public accounting firm and the audited financial statements of the Company for the year ended December 31, 2010 and the same will be presented at the Annual General Meeting for the shareholders’ consideration and adoption. The shareholders will be asked to approve adoption of the report of the independent registered public accounting firm and the Company’s audited financial statements for the year ended December 31, 2010 at the Annual General Meeting.

Required Vote

The affirmative vote of a majority of the votes cast, either in person or by proxy, at the Annual General Meeting is required to adopt the report of the independent registered public accounting firm and the Company’s audited financial statements for the year ended December 31, 2010.

The Company’s Board of Directors recommends that the shareholders vote FOR this proposal.

PROPOSAL NO. 3

RE-APPOINTMENT OF CROWE HORWATH (HK) CPA LIMITED AS

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

In accordance with applicable law, the Company’s shareholders have the right to appoint independent registered public accounting firm of the Company and to authorize the Board of Directors to fix the independent registered public accounting firm’s remuneration. On November 14, 2013, the Board of Directors recommended that Crowe Horwath (HK) CPA Limited be re-appointed as independent registered public accounting firm of the Company for a term expiring at the next annual general meeting and the Board of Directors be authorized to fix the independent registered public accounting firm’s remuneration. The aggregate fees billed by Crowe Horwath (HK) CPA Limited for the fiscal year ended December 31, 2010 were totaling HK$650,000. Accordingly, the shareholders will be asked to approve such re-appointment at the Annual General Meeting and to authorize the Board of Directors to fix the independent registered public accounting firm’s remuneration.

Required Vote

The affirmative vote of a majority of the votes cast, either in person or by proxy, at the Annual General Meeting is required to approve the re-appointment of Crowe Horwath (HK) CPA Limited as the Company’s independent registered public accounting firm and to authorize the Board of Directors to fix its remuneration.

The Company’s Board of Directors recommends that the shareholders vote FOR this proposal.

- 7 -

PROXY STATEMENT

PROPOSAL NO. 4

APPROVAL OF DEFERRAL OF LAYING THE REPORTS OF THE

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM AND

AUDITED FINANCIAL STATEMENTS FOR THE YEARS ENDED

DECEMBER 31, 2011 AND 2012 UNTIL THEY ARE READY FOR

PRESENTATION TO THE SHAREHOLDERS OF THE COMPANY

The audited financial statements for the year ended December 31, 2010 will be presented in the Annual General Meeting. Thereafter, the Company will arrange with the independent registered public accounting firm to complete auditing of the subsequent years’ financial statements. Accordingly, the shareholders will be asked to approve the deferral of laying the reports of the independent registered public accounting firm and the Company’s financial statements for the years ended December 31, 2011 and 2012 for adoption when they are ready for presentation to the shareholders of the Company.

Required Vote

The affirmative vote of holders of majority of the votes cast, either in person or by proxy, at the Annual General Meeting is required to approve the deferral of laying the reports of the independent registered public accounting firm and audited financial statements for the years ended December 31, 2011 and 2012 until they are ready for presentation to the shareholders of the Company.

The Company’s Board of Directors recommends that the shareholders vote FOR this proposal.

IT IS IMPORTANT THAT PROXIES BE RETURNED PROMPTLY, AND THEREFORE, SHAREHOLDERS WHO DO NOT EXPECT TO ATTEND THE ANNUAL GENERAL MEETING IN PERSON ARE URGED TO SIGN, DATE, AND RETURN THE ENCLOSED PROXY CARD IN THE REPLY ENVELOPE PROVIDED. DUE TO THE SIGNIFICANT TIME DIFFERENCE BETWEEN NORTH AMERICA AND HONG KONG, PROXIES MUST BE RECEIVED ON OR PRIOR TO JANUARY 3, 2014 (HONG KONG TIME) FOR ACTION TO BE TAKEN.

|

By order of the Board of Directors Yap, Allan Chairman |

December 5, 2013

- 8 -

PART IV

REPORTS OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRMS

- 9 -

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

TO THE BOARD OF DIRECTORS AND SHAREHOLDERS OF

CHINA ENTERPRISES LIMITED

We have audited the accompanying consolidated balance sheets of China Enterprises Limited (“Company”) and subsidiaries as of December 31, 2010 and 2009, and the related consolidated statements of operations, shareholders’ equity and comprehensive income, and cash flows for each of the years in the two-year period ended December 31, 2010. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of the Company’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the consolidated financial position of the Company and subsidiaries as of December 31, 2010 and 2009 and the consolidated results of their operations and cash flows for each of the years in the two-year period ended December 31, 2010 in conformity with U.S. generally accepted accounting principles.

Our audits also included the translation of Renminbi (RMB) amounts into United States dollar (US$) amounts and, in our opinion, such translation, where provided, has been made in conformity with the basis stated in Note 2(h) to the consolidated financial statements. Such United States dollar amounts are presented for the convenience of the readers.

Crowe Horwath (HK) CPA Limited

Hong Kong, China

November 18, 2013

- 10 -

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and the Shareholders of China Enterprises Limited:

We have audited the accompanying consolidated statements of operations, shareholders’ equity and comprehensive loss, and cash flows of China Enterprises Limited and subsidiaries (the “Company”) for the year ended December 31, 2008. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing the audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, such consolidated financial statements present fairly, in all material respects, the results of operations and the cash flows of the Company for the year ended December 31, 2008, in conformity with accounting principles generally accepted in the United States of America.

DELOITTE TOUCHE TOHMATSU

Certified Public Accountants

Hong Kong

January 27, 2010

- 11 -

PART V

CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2008, 2009

AND 2010

- 12 -

CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in thousands, except number of shares and per share data)

| | | | | | | | | | | | | | | | |

| | | Year ended December 31, | |

| | | 2008 | | | 2009 | | | 2010 | | | 2010 | |

| | | Rmb | | | Rmb | | | Rmb | | | US$ | |

Operating activities | | | | | | | | | | | | | | | | |

General and administrative expenses | | | (5,770 | ) | | | (2,819 | ) | | | (3,316 | ) | | | (502 | ) |

Non-operating income (expenses): | | | | | | | | | | | | | | | | |

Interest income | | | 4,865 | | | | 3,291 | | | | 3,379 | | | | 512 | |

Interest expense | | | (3,834 | ) | | | (4,493 | ) | | | (3,299 | ) | | | (500 | ) |

Investment income | | | 1,228 | | | | 6,062 | | | | 5,989 | | | | 907 | |

Compensation income(note 8) | | | 17,000 | | | | — | | | | — | | | | — | |

Net realized loss recognized on investments | | | (2,568 | ) | | | (780 | ) | | | (1,287 | ) | | | (195 | ) |

Unrealized gain (loss) on trading securities still held at the balance sheet date | | | (56,673 | ) | | | 15,483 | | | | (3,555 | ) | | | (539 | ) |

Change in fair value of conversion option(note 7) | | | (4,244 | ) | | | 72 | | | | (185 | ) | | | (28 | ) |

Impairment loss recognized on available-for-sale securities | | | (69,524 | ) | | | — | | | | (6,015 | ) | | | (911 | ) |

Exchange gain | | | 3,105 | | | | 530 | | | | 1,345 | | | | 204 | |

| | | | | | | | | | | | | | | | |

(Loss) profit before income tax and equity in earnings of equity method affiliates | | | (116,415 | ) | | | 17,346 | | | | (6,944 | ) | | | (1,052 | ) |

Income tax benefit (expense) (note 10) | | | 9,529 | | | | (25,512 | ) | | | (15,194 | ) | | | (2,302 | ) |

Equity in earnings of equity method affiliates(note 6) | | | 35,445 | | | | 255,117 | | | | 190,167 | | | | 28,813 | |

| | | | | | | | | | | | | | | | |

Net income (loss) | | | (71,441 | ) | | | 246,951 | | | | 168,029 | | | | 25,459 | |

| | | | | | | | | | | | | | | | |

Earnings (loss) per common share | | | | | | | | | | | | | | | | |

Basic and diluted | | | (7.92 | ) | | | 27.39 | | | | 18.63 | | | | 2.82 | |

| | | | | | | | | | | | | | | | |

Weighted average number of shares used in the calculation of earnings (loss) per common share | | | | | | | | | | | | | | | | |

Basic and diluted | | | 9,017,310 | | | | 9,017,310 | | | | 9,017,310 | | | | 9,017,310 | |

| | | | | | | | | | | | | | | | |

See accompanying notes to consolidated financial statements.

- 13 -

CONSOLIDATED BALANCE SHEETS

(Amounts in thousands, except number of shares and their par values)

| | | | | | | | | | | | |

| | | As of December 31, | |

| | | 2009 | | | 2010 | | | 2010 | |

| | | Rmb | | | Rmb | | | US$ | |

ASSETS | | | | | | | | | | | | |

Current assets: | | | | | | | | | | | | |

Cash and cash equivalents | | | 229 | | | | 87 | | | | 14 | |

Notes receivable(note 4) | | | — | | | | — | | | | — | |

Prepaid expenses and other current assets | | | 965 | | | | 161 | | | | 24 | |

Due from related parties(note 15) | | | 30,153 | | | | 24,093 | | | | 3,650 | |

Trading securities(note 5) | | | 63,750 | | | | 54,821 | | | | 8,306 | |

| | | | | | | | | | | | |

Total current assets | | | 95,097 | | | | 79,162 | | | | 11,994 | |

Investments in and advances to equity method affiliates (less allowance of Rmb7,601 in 2009 and 2010)(note 6) | | | 648,467 | | | | 838,634 | | | | 127,065 | |

Convertible note receivable(note 7) | | | 51,789 | | | | 51,764 | | | | 7,843 | |

Deposit paid for acquisition of investment(note 9) | | | 75,000 | | | | 75,000 | | | | 11,364 | |

Available-for-sale securities(note 5) | | | 33,546 | | | | 31,511 | | | | 4,774 | |

Other assets | | | 6 | | | | 6 | | | | 1 | |

| | | | | | | | | | | | |

Total assets | | | 903,905 | | | | 1,076,077 | | | | 163,041 | |

| | | | | | | | | | | | |

LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | | | | | |

Current liabilities: | | | | | | | | | | | | |

Due to related parties(note 15) | | | 106,943 | | | | 93,756 | | | | 14,205 | |

Amounts due to securities brokers | | | 29,884 | | | | 23,961 | | | | 3,631 | |

Other payables | | | 1,095 | | | | 667 | | | | 101 | |

Accrued liabilities | | | 4,522 | | | | 5,815 | | | | 881 | |

Other taxes payable | | | 2,753 | | | | 2,753 | | | | 417 | |

Income taxes payable | | | 24,240 | | | | 23,484 | | | | 3,558 | |

| | | | | | | | | | | | |

Total current liabilities | | | 169,437 | | | | 150,436 | | | | 22,793 | |

Deferred tax liability(note 10) | | | 29,057 | | | | 48,074 | | | | 7,283 | |

| | | | | | | | | | | | |

Total liabilities | | | 198,494 | | | | 198,510 | | | | 30,076 | |

| | | | | | | | | | | | |

- 14 -

CONSOLIDATED BALANCE SHEETS — CONTINUED

(Amounts in thousands, except number of shares and their par values)

| | | | | | | | | | | | |

| | | As of December 31, | |

| | | 2009 | | | 2010 | | | 2010 | |

| | | Rmb | | | Rmb | | | US$ | |

Commitments and contingencies(note 13) | | | | | | | | | | | | |

Shareholders’ equity: | | | | | | | | | | | | |

Common stock — par value US$0.01 per share (50,000,000 shares authorized; 9,017,310 shares issued and outstanding at December 31, 2009 and December 31, 2010)(note 11) | | | 770 | | | | 770 | | | | 117 | |

Additional paid-in capital | | | 1,000,958 | | | | 1,000,958 | | | | 151,660 | |

Accumulated other comprehensive losses | | | (15,712 | ) | | | (11,585 | ) | | | (1,755 | ) |

Accumulated deficit | | | (280,605 | ) | | | (112,576 | ) | | | (17,057 | ) |

| | | | | | | | | | | | |

Total shareholders’ equity | | | 705,411 | | | | 877,567 | | | | 132,965 | |

| | | | | | | | | | | | |

Total liabilities and shareholders’ equity | | | 903,905 | | | | 1,076,077 | | | | 163,041 | |

| | | | | | | | | | | | |

See accompanying notes to consolidated financial statements.

- 15 -

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY AND COMPREHENSIVE INCOME

(Amounts in thousands, except number of shares)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | Accumulated | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | other | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | compre- | | | | | | | | | | |

| | | Supervoting | | | | | | Supervoting | | | | | | Additional | | | hensive | | | | | | | | | Compre- | |

| | | common | | | Common | | | common | | | Common | | | paid-in | | | (losses) | | | Accumulated | | | | | | hensive | |

| | | stock | | | stock | | | stock | | | stock | | | capital | | | income | | | deficit | | | Total | | | income | |

| | | | | | | | | Rmb | | | Rmb | | | Rmb | | | Rmb | | | Rmb | | | Rmb | | | Rmb | |

Balance at January 1, 2008 | | | — | | | | 9,017,310 | | | | — | | | | 770 | | | | 1,000,958 | | | | (7,288 | ) | | | (456,115 | ) | | | 538,325 | | | | | |

Net loss | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (71,441 | ) | | | (71,441 | ) | | | (71,441 | ) |

Foreign currency translation adjustment | | | — | | | | — | | | | — | | | | — | | | | — | | | | (8,079 | ) | | | — | | | | (8,079 | ) | | | (8,079 | ) |

Unrealized loss on available-for-sale securities | | | — | | | | — | | | | — | | | | — | | | | — | | | | (69,524 | ) | | | — | | | | (69,524 | ) | | | (69,524 | ) |

Impairment loss on available-for-sale securities | | | — | | | | — | | | | — | | | | — | | | | — | | | | 69,524 | | | | — | | | | 69,524 | | | | 69,524 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance at December 31, 2008 | | | — | | | | 9,017,310 | | | | — | | | | 770 | | | | 1,000,958 | | | | (15,367 | ) | | | (527,556 | ) | | | 458,805 | | | | (79,520 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 246,951 | | | | 246,951 | | | | 246,951 | |

Foreign currency translation adjustment | | | — | | | | — | | | | — | | | | — | | | | — | | | | (174 | ) | | | — | | | | (174 | ) | | | (174 | ) |

Unrealized loss on available-for-sale securities | | | — | | | | — | | | | — | | | | — | | | | — | | | | (171 | ) | | | — | | | | (171 | ) | | | (171 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance at December 31, 2009 | | | — | | | | 9,017,310 | | | | — | | | | 770 | | | | 1,000,958 | | | | (15,712 | ) | | | (280,605 | ) | | | 705,411 | | | | 246,606 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 168,029 | | | | 168,029 | | | | 168,029 | |

Foreign currency translation adjustment | | | — | | | | — | | | | — | | | | — | | | | — | | | | (1,023 | ) | | | — | | | | (1,023 | ) | | | (1,023 | ) |

Unrealized loss on available-for-sale securities | | | — | | | | — | | | | — | | | | — | | | | — | | | | (865 | ) | | | — | | | | (865 | ) | | | (865 | ) |

Impairment loss on available-for-sale securities | | | — | | | | — | | | | — | | | | — | | | | — | | | | 6,015 | | | | — | | | | 6,015 | | | | 6,015 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance at December 31, 2010 | | | — | | | | 9,017,310 | | | | — | | | | 770 | | | | 1,000,958 | | | | (11,585 | ) | | | (112,576 | ) | | | 877,567 | | | | 172,156 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance at December 31, 2010 (in US$) | | | | | | | | | | | — | | | | 117 | | | | 151,660 | | | | (1,755 | ) | | | (17,057 | ) | | | 132,965 | | | | 26,084 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

See accompanying notes to consolidated financial statements.

- 16 -

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts in thousands)

| | | | | | | | | | | | | | | | |

| | | Year ended December 31, | |

| | | 2008 | | | 2009 | | | 2010 | | | 2010 | |

| | | Rmb | | | Rmb | | | Rmb | | | US$ | |

Cash flows from operating activities: | | | | | | | | | | | | | | | | |

Net income (loss) | | | (71,441 | ) | | | 246,951 | | | | 168,029 | | | | 25,459 | |

Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | | | | | | | | | | | | | | | | |

Net realized loss recognized on investments | | | — | | | | 780 | | | | 1,287 | | | | 195 | |

Unrealized (gain) loss on trading securities still held at | | | | | | | | | | | | | | | | |

the balance sheet date | | | — | | | | (15,483 | ) | | | 3,555 | | | | 539 | |

Change in fair value of conversion option | | | 4,244 | | | | (72 | ) | | | 185 | | | | 28 | |

Impairment loss on available-for-sale securities | | | 69,524 | | | | — | | | | 6,015 | | | | 911 | |

Equity in earnings of equity method affiliates | | | (35,445 | ) | | | (255,117 | ) | | | (190,167 | ) | | | (28,813 | ) |

Compensation income from disclaiming rights in deposit paid for acquisition of properties | | | (17,000 | ) | | | — | | | | — | | | | — | |

Amortization of discount on subscription of convertible note receivable | | | (3,180 | ) | | | (3,275 | ) | | | (3,379 | ) | | | (512 | ) |

Interest income collected on convertible note | | | 1,124 | | | | 1,110 | | | | 1,097 | | | | 166 | |

Interest income from notes receivable and related party receivable | | | (1,684 | ) | | | (16 | ) | | | — | | | | — | |

Write- off of other current assets | | | 467 | | | | — | | | | — | | | | — | |

Deferred tax | | | (15,779 | ) | | | 25,512 | | | | 19,017 | | | | 2,881 | |

Changes in operating assets and liabilities: | | | | | | | | | | | | | | | | |

Prepaid expenses and other current assets | | | 47 | | | | (789 | ) | | | 804 | | | | 122 | |

Accounts and other payables | | | — | | | | (15,668 | ) | | | (429 | ) | | | (64 | ) |

Accrued liabilities | | | 2,086 | | | | (1,141 | ) | | | 1,292 | | | | 195 | |

| | | | | | | | | | | | | | | | |

Net cash provided by (used in) operating activities | | | (67,037 | ) | | | (17,208 | ) | | | 7,306 | | | | 1,107 | |

| | | | | | | | | | | | | | | | |

- 17 -

CONSOLIDATED STATEMENTS OF CASH FLOWS — CONTINUED

(Amounts in thousands)

| | | | | | | | | | | | | | | | |

| | | Year ended December 31, | |

| | | 2008 | | | 2009 | | | 2010 | | | 2010 | |

| | | Rmb | | | Rmb | | | Rmb | | | US$ | |

Cash flows from investing activities: | | | | | | | | | | | | | | | | |

Decrease in due from related parties | | | 20,456 | | | | 27,648 | | | | 6,155 | | | | 933 | |

Decrease in trading securities | | | 28,349 | | | | — | | | | — | | | | — | |

Purchases of trading securities | | | — | | | | (9,946 | ) | | | (165 | ) | | | (25 | ) |

Proceeds from trading securities | | | — | | | | 11,229 | | | | 3,215 | | | | 487 | |

(Increase) decrease in amounts due to securities brokers | | | — | | | | (11,278 | ) | | | (4,879 | ) | | | (739 | ) |

Purchase of available-for-sale securities | | | (53,232 | ) | | | — | | | | — | | | | — | |

Proceeds from available-for-sale securities | | | — | | | | 1,326 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Net cash provided by (used in) investing activities | | | (4,427 | ) | | | 18,979 | | | | 4,326 | | | | 656 | |

| | | | | | | | | | | | | | | | |

Cash flows provided by (used in) financing activities: | | | | | | | | | | | | | | | | |

Change in due to related parties | | | 71,061 | | | | (1,191 | ) | | | (13,282 | ) | | | (2,012 | ) |

| | | | | | | | | | | | | | | | |

Effect of exchange rate change | | | 2 | | | | (471 | ) | | | 1,508 | | | | 228 | |

| | | | | | | | | | | | | | | | |

Net increase (decrease) in cash and cash equivalents | | | (401 | ) | | | 109 | | | | (142 | ) | | | (21 | ) |

Cash and cash equivalents, beginning of year | | | 521 | | | | 120 | | | | 229 | | | | 35 | |

| | | | | | | | | | | | | | | | |

Cash and cash equivalents, end of year | | | 120 | | | | 229 | | | | 87 | | | | 14 | |

| | | | | | | | | | | | | | | | |

Supplemental schedule of cash flow information: | | | | | | | | | | | | | | | | |

Interest paid | | | (3,834 | ) | | | (4,493 | ) | | | (3,299 | ) | | | 500 | |

| | | | | | | | | | | | | | | | |

- 18 -

CONSOLIDATED STATEMENTS OF CASH FLOWS — CONTINUED

(Amounts in thousands)

| | | | | | | | | | | | | | | | |

| | | Year ended December 31, | |

| | | 2008 | | | 2009 | | | 2010 | | | 2010 | |

| | | Rmb | | | Rmb | | | Rmb | | | US$ | |

Non- cash investing and financing activities: | | | | | | | | | | | | | | | | |

Assignment of receivable and notes receivable through current accounts of related parties | | | 15,846 | | | | — | | | | — | | | | — | |

Settlement of notes receivable and other payables(note 4) | | | — | | | | 20,523 | | | | — | | | | — | |

Compensation income received and deposit paid on behalf by a former subsidiary | | | 75,000 | | | | — | | | | — | | | | — | |

Acquisition of a subsidiary(note 3) | | | | | | | | | | | | | | | | |

See accompanying notes to consolidated financial statements.

- 19 -

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Amounts in thousands, except number of shares, per share data and unless otherwise stated)

| 1. | ORGANIZATION AND PRINCIPAL ACTIVITIES |

China Enterprises Limited (the “Company”) was incorporated in Bermuda on January 28, 1993. Its common stock trades on the OTC (Over-the-Counter) Securities Market in the United States of America (the “US”).

China Strategic Holdings Limited (“CSH”), a public company listed on The Stock Exchange of Hong Kong Limited (the “HKSE”), was the Company’s ultimate parent company before its completion of a group reorganization in May 2006 following which the Company became a wholly-owned subsidiary of Group Dragon Investments Limited (“GDI”), a then equity method affiliate of Hanny Holdings Limited (“HHL”), a public company listed on the HKSE. In June 2006, HHL acquired a controlling interest in GDI and became the parent company. On December 8, 2006, HHL became a subsidiary of ITC Corporation Limited (“ITC”), a public company listed on HKSE and, as a result, ITC became the ultimate parent company. On May 18, 2007, HHL ceased to be a subsidiary of ITC and HHL became the ultimate parent company until 2008 when HHL reduced its equity interest in the Company. Following the completion of the distribution of its HHL shares to its shareholders in November 2010, ITC’s interests in HHL dropped from 42% to 0.1%. As of December 31, 2010, HHL held a 28.95% equity interest in the Company. There have been no further changes in the Company’s ownership status.

The accompanying financial statements include the financial statements of the Company and its wholly owned subsidiaries which primarily consist of Million Good Limited (“Million Good”, incorporated in the British Virgin Islands, “BVI”, principally engaged in investment holding), Wealth Faith Limited (“Wealth Faith”, incorporated in the BVI, principally engaged in investment holding), Cosmos Regent Limited (“Cosmos Regent”, incorporated in the BVI, principally engaged in investment holding), Cyber Generation Limited (“Cyber Generation”, incorporated in the BVI, principally engaged in investment holding) and Whole Good Limited (“Whole Good”, incorporated in the BVI, principally engaged in investment holding). The Company and all of its subsidiaries are collectively referred to as the “Group”.

As of December 31, 2009 and 2010, the Company also had a 26% equity interest in Hangzhou Zhongce Rubber Co., Limited (“HZ”, located in Hangzhou, Zhejiang Province, the PRC). HZ and its consolidated subsidiaries (the “PRC entities”) are engaged in the manufacture of rubber tires in the PRC.

On November 28, 2011, the Company sold all of its ownership interests in HZ to CZ Tire Holdings Limited, an independent third party company incorporated in the British Virgin Islands (Note 18(ii)).

- 20 -

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

(Amounts in thousands, except number of shares, per share data and unless otherwise stated)

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

The consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

Having re-considered the nature of the Company’s security trading activities, the Company has reclassified RMB13,575 of cash provided by operating activities to cash provided by investing activities and effect of exchange rate change related to trading securities and amounts due to securities brokers for fiscal 2009 in the Consolidated Statements of Cash Flows. This reclassification had no effect on the net increase (decrease) in cash and equivalents or on net income (loss), as previously reported. No such reclassification was made for the year ended December 31, 2008 as the turnover and amount of the Company’s security trading activities were relatively quicker and larger in the year then ended.

| | (b) | Basis of Consolidation |

The Company consolidates all entities in which it is the primary beneficiary of variable interests in variable interest entities and entities in which it has a controlling financial interest. The Company did not have a variable interest in any variable interest entity during the periods presented.

The consolidated financial statements include the assets, liabilities, revenue and expenses of the Company and its consolidated subsidiaries. All intercompany balances and transactions have been eliminated on consolidation.

| | (c) | Equity Method Investments in Affiliates |

Investments in 50% or less owned companies over which the Company exercises significant influence but not control, are accounted for using the equity method. Under the equity method, the Company’s proportionate share of the affiliate’s net income or loss is included in the consolidated statements of operations.

Investment in equity method affiliates is accounted for under the equity method, under which the amount of the investment is recorded at cost, with adjustments to recognize the Group’s share of the earnings or losses of the unconsolidated subsidiaries from the date of acquisition. The amount recorded in income is adjusted to eliminate intercompany gains and losses, and to amortize, if appropriate, any difference between the Group’s cost and the underlying equity in net assets of the affiliate at the date of investment. The investment amount is also adjusted to reflect the Group’s share of changes in the equity method affiliates’ capital. Dividends received from the unconsolidated subsidiaries reduce the carrying amount of the investment.

- 21 -

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

(Amounts in thousands, except number of shares, per share data and unless otherwise stated)

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES — continued |

| | (d) | Cash and Cash Equivalents |

The Company considers cash on hand, demand deposits with banks with original maturities of three months or less when purchased to be cash and cash equivalents.

Trading securities refer to equity securities that are bought and held principally for the purpose of selling them in the near term, and are reported at fair value, with unrealized gains and losses included in earnings. The fair value of the Company’s investments in trading securities is based on the quoted market price on the last business day of the fiscal year.

| | (f) | Available-for-sale Securities |

Available-for-sale securities consist of quoted equity securities that are not designated as trading securities. They are held at fair value with unrealized gains and losses, net of tax, reported in accumulated other comprehensive gain or losses. Any unrealized losses that are deemed other-than-temporary are included in current period earnings and removed from accumulated other comprehensive gain or losses.

Realized gains and losses on investment securities are included in current period earnings. For purposes of computing realized gains and losses, the cost basis of each investment sold is generally based on the average cost method.

The Company regularly evaluates whether the decline in fair value of available-for-sale securities is other-than-temporary and objective evidence of impairment could include:

| | • | | The severity and duration of the fair value decline; |

| | • | | Deterioration in the financial condition of the issuer; and |

| | • | | Evaluation of the factors that could cause individual securities to have an other-than-temporary impairment. |

During the year ended December 31, 2008 and 2010, RMB69,524 and RMB6,015 of losses previously classified in other comprehensive gain or losses were reclassified into earnings to recognize an other-than-temporary decline in fair value. No such other-than-temporary decline in fair value was recognized during the years ended December 31, 2009.

- 22 -

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

(Amounts in thousands, except number of shares, per share data and unless otherwise stated)

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES — continued |

Deferred income taxes are recognized for temporary differences between the tax basis of assets and liabilities and their reported amounts in the consolidated financial statements and unutilized tax loss carry forwards by applying enacted statutory tax rates applicable to future years. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. Current income taxes are provided in accordance with the laws of the relevant taxing authorities.

The Company adopted ASC Topic 740, Income Taxes, which clarifies the accounting for uncertainty in income taxes recognized in an enterprise’s financial statements. The interpretation prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. ASC Topic 740 also provides accounting guidance on de-recognition, classification, interest and penalties, accounting in interim periods, disclosure and transition.

The functional currency of the Company and its Hong Kong domiciled subsidiaries is Hong Kong dollars. The Company has elected Renminbi as its reporting currency.

Foreign currency transactions are translated into the functional currencies of the Company and its subsidiaries at the applicable exchange rates prevailing at the dates of the transactions. Monetary assets and liabilities denominated in foreign currencies are translated into functional currencies using the applicable exchange rates prevailing at the respective balance sheet dates. Exchange differences are included in the consolidated statements of operations.

Assets and liabilities of the Company and its subsidiaries domiciled in Hong Kong have been translated into Renminbi at the rates of exchange prevailing at the balance sheet dates and all income and expense items are translated into Renminbi at the average rates of exchange over the year. Exchange differences resulting from the translation have been recorded as a component of comprehensive losses.

The translation of Renminbi amounts into US$ amounts are included solely for the convenience of readers and have been made at US$1.00 = Rmb6.6, the noon buying rate from the Federal Reserve Bank of New York on December 31, 2010. No representation is made that the Renminbi amounts could have been, or could be, converted into United States dollar at that rate or at any other rate.

- 23 -

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

(Amounts in thousands, except number of shares, per share data and unless otherwise stated)

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES — continued |

| | (i) | Earnings (Loss) Per Share |

Basic earnings (loss) per share is computed by dividing net income (loss) by the weighted-average number of common shares outstanding during the year. The Company did not have dilutive potential common shares during fiscal 2008, 2009 and 2010.

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses for the years presented. Actual results may differ from those estimates. Significant estimates in these financial statements that are susceptible to change as more information becomes available are collectability of receivables, impairment of available-for-sale securities, valuation of derivative instruments and valuation allowances for deferred tax assets.

The Company recognizes all derivative instruments on the balance sheet at fair value with changes in fair values reported in the consolidated statements of operations.

The Company’s financial instruments that are exposed to concentration of credit risk consist primarily of its cash and cash equivalents, advances to affiliates, notes receivable, amounts due from related parties and convertible note receivables. The Company has reviewed the credit worthiness and financial position of its related parties for credit risks associated with amounts due from them. These entities have good credit standing and the Company does not expect to incur significant losses for uncollected advances from these entities.

Comprehensive income represents changes in equity resulting from transactions and other events and circumstances from non-owner sources. Comprehensive income consists of net income (loss) and the foreign exchange differences arising from translation to the reporting currency and unrealized gains and losses on available-for-sale securities.

- 24 -

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

(Amounts in thousands, except number of shares, per share data and unless otherwise stated)

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES — continued |

| | (m) | Recently Issued Accounting Pronouncements |

In January 2010, FASB issued ASU No. 2010-02 regarding accounting and reporting for decreases in ownership of a subsidiary. Under this guidance, an entity is required to deconsolidate a subsidiary when the entity ceases to have a controlling financial interest in the subsidiary. Upon deconsolidation of a subsidiary, an entity recognizes a gain or loss on the transaction and measures any retained investment in the subsidiary at fair value. In contrast, an entity is required to account for a decrease in its ownership interest of a subsidiary that does not result in a change of control of the subsidiary as an equity transaction. This ASU clarifies the scope of the decrease in ownership provisions, and expands the disclosures about the deconsolidation of a subsidiary or de-recognition of a group of assets. This ASU is effective beginning in the first interim or annual reporting period ending on or after December 15, 2009. The adoption of this ASU did not have a material impact on the Company’s consolidated financial statements.

In January 2010, the FASB issued ASU No. 2010-06 (“ASU 2010-06”), which requires a number of additional disclosures regarding (1) the different classes of assets and liabilities measured at fair value, (2) the valuation techniques and inputs used, (3) the activity in Level 3 fair value measurements, and (4) the transfers between Levels 1, 2, and 3. The new disclosures and clarifications of existing disclosures are effective for interim and annual reporting periods beginning after December 15, 2009, except for the disclosures about purchases, sales, issuances, and settlements in the roll forward of activity in Level 3 fair value measurements. Those disclosures are effective for fiscal years beginning after December 15, 2010, and for interim periods within those fiscal years. The Company has adopted the amendments for the period beginning January 1, 2010 except for the requirement to provide the Level 3 activity of purchases, sales, issuances, and settlements on a gross basis. The Company will adopt the requirement to provide the Level 3 activity of purchases, sales, issuances, and settlements on a gross basis for the period beginning January 1, 2011 and expects the adoption will not have significant impact on the Group’s consolidated financial statements.

In March 2010, the FASB issued ASU 2010-11, “Derivatives and Hedging (Topic 815): Scope Exception Related to Embedded Credit Derivatives”. The amendments in this ASU are effective for each reporting entity at the beginning of its first fiscal quarter beginning after June 15, 2010. Early adoption is permitted at the beginning of each entity’s first fiscal quarter beginning after issuance of this ASU. The Company does not expect the provisions of ASU 2010-11 to have a material effect on the financial position, results of operations or cash flows of the Company.

- 25 -

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

(Amounts in thousands, except number of shares, per share data and unless otherwise stated)

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES — continued |

| | (m) | Recently Issued Accounting Pronouncements — continued |

In March 2010, the FASB issued ASU 2010-11, “Derivatives and Hedging (Topic 815): Scope Exception Related to Embedded Credit Derivatives”. The amendments in this ASU are effective for each reporting entity at the beginning of its first fiscal quarter beginning after June 15, 2010. Early adoption is permitted at the beginning of each entity’s first fiscal quarter beginning after issuance of this ASU. The Company does not expect the provisions of ASU 2010-11 to have a material effect on the financial position, results of operations or cash flows of the Company.

In April 2010, the FASB issued ASU 2010-13, “Compensation-Stock Compensation (Topic 718): Effect of Denominating the Exercise Price of a Share-Based Payment Award in the Currency of the Market in Which the Underlying Equity Security Trades—a consensus of the FASB Emerging Issues Task Force”. The amendments in this ASU are effective for fiscal years, and interim periods within those fiscal years, beginning on or after December 15, 2010. Earlier application is permitted. The Company does not expect the provisions of ASU 2010-13 to have a material effect on the financial position, results of operations or cash flows of the Company.

In May 2010, the FASB issued ASU 2010-19, “Foreign Currency (Topic 830): Foreign Currency Issues: Multiple Foreign Currency Exchange Rates”. The amendments in this ASU are effective as of the announcement date of March 18, 2010. The adoption of this update did not have a material effect on the financial position, results of operations or cash flows of the Company.

In January 2011, the FASB issued ASU No. 2011-01 — Receivables (Topic 310): Deferral of the Effective Date of Disclosures about Troubled Debt Restructurings in Update No. 2010-20. The amendments in this update temporarily delay the effective date of the disclosures about troubled debt restructurings in ASU No. 2010-20, Receivables (Topic 310): Disclosures about the Credit Quality of Financing Receivables and the Allowance for Credit Losses, for public entities. The delay is intended to allow the FASB time to complete its deliberations on what constitutes a troubled debt restructuring. The effective date of the new disclosures about troubled debt restructurings for public entities and the guidance for determining what constitutes a troubled debt restructuring will then be coordinated. This deferral will have no material impact on the Company’s consolidated financial statements.

- 26 -

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

(Amounts in thousands, except number of shares, per share data and unless otherwise stated)

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES — continued |

| | (m) | Recently Issued Accounting Pronouncements — continued |

In January 2011, the FASB issued ASU No. 2011-02 — Receivables (Topic 310): A Creditor’s Determination of Whether a Restructuring Is a Troubled Debt Restructuring. The amendments in this update provide additional guidance to assist creditors in determining whether a restructuring of a receivable meets the criteria to be considered a troubled debt restructuring. For public companies, the new guidance is effective for interim and annual periods beginning on or after June 15, 2011, and applies retrospectively to restructurings occurring on or after the beginning of the fiscal year of adoption. Early application is permitted. The adoption of the provisions in ASU 2011-02 will have no material impact on the Company’s consolidated financial statements.

In May 2011, the FASB issued ASU No. 2011-04 — Fair Value Measurement (Topic 820): Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs. The amendments in this update intend to converge requirements for how to measure fair value and for disclosing information about fair value measurements in US GAAP with International Financial Reporting Standards. For public entities, this ASU is effective for interim and annual periods beginning after December 15, 2011. The adoption of the provisions in ASU 2011-04 will have no material impact on the Company’s consolidated financial statements.

In June 2011, the FASB issued ASU No. 2011-05 — Comprehensive Income (Topic 220): Presentation of Comprehensive Income. The amendments in this update require (i) that all non-owner changes in shareholders’ equity be presented either in a single continuous statement of comprehensive income or in two separate but consecutive statements (the current option to present components of other comprehensive income (“OCI”) as part of the statement of changes in shareholders’ equity is eliminated) and (ii) presentation of reclassification adjustments from OCI to net income on the face of the financial statements. For public entities, the amendments in this ASU are effective for years, and interim periods within those years, beginning after December 15, 2011. The amendments in this update should be applied retrospectively. Early adoption is permitted. The Company does not expect the adoption of this ASU will have a material impact on the Company’s consolidated financial statements.

- 27 -

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

(Amounts in thousands, except number of shares, per share data and unless otherwise stated)

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES — continued |

| | (m) | Recently Issued Accounting Pronouncements — continued |

In December 2011, the FASB issued ASU No. 2011-12 — Comprehensive Income (Topic 220). The amendments in this update supersede certain pending paragraphs in ASU No. 2011-05, to effectively defer only those changes in ASU No. 2011-05 that relate to the presentation of reclassification adjustments out of accumulated other comprehensive income. The amendments will be temporary to allow the Board time to redeliberate the presentation requirements for reclassifications out of accumulated other comprehensive income for annual and interim financial statements for public, private, and non-profit entities. The amendments in this update are effective for public entities for fiscal years, and interim periods within those years, beginning after December 15, 2011. The Company does not expect the adoption of the provisions in this update will have a significant impact on its consolidated financial statements.

In July 2012, the FASB issued ASU 2012-02 “Intangibles-Goodwill and Other (Topic 350): Testing Indefinite-Lived Intangible Assets for Impairment.” This ASU simplifies how entities test indefinite-lived intangible assets for impairment to improve consistency in impairment testing requirements among long-lived asset categories. These amended standards permit an assessment of qualitative factors to determine whether it is more likely than not that the fair value of an indefinite-lived intangible asset is less than its carrying value. For assets in which this assessment concludes it is more likely than not that the fair value is more than its carrying value, these amended standards eliminate the requirement to perform quantitative impairment testing as outlined in the previously issued standards. The guidance is effective for annual and interim impairment tests performed for fiscal years beginning after September 15, 2012; early adoption is permitted. The adoption of this standard is not expected to have a material impact on the Company’s consolidated financial position or results of operations.

In February 2013, the FASB issued Accounting Standards Update No. 2013-02 Comprehensive Income (Topic 220): The objective of this update is to improve the reporting of reclassifications out of accumulated other comprehensive income. The amendments in this update seek to attain that objective by requiring an entity to report the effect of significant reclassifications out of accumulated other comprehensive income on the respective line items in net income if the amount being reclassified is required under U.S. generally accepted accounting principles (GAAP) to be reclassified in its entirety to net income. For other amounts that are not required under U.S. GAAP to be reclassified in their entirety to net income in the same reporting period, an entity is required to cross-reference other disclosures required under U.S. GAAP that provide additional detail about those amounts. This would be the case when a portion of the amount reclassified out of accumulated other comprehensive income is reclassified to a balance sheet account (for example, inventory) instead of directly to income or expense in the same reporting period. For public entities, the amendments are effective prospectively for reporting periods beginning after December 15, 2012. The Company does not expect the adoption of the provisions in this update will have a significant impact on its consolidated financial statements.

- 28 -

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

(Amounts in thousands, except number of shares, per share data and unless otherwise stated)

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES — continued |

| | (m) | Recently Issued Accounting Pronouncements — continued |

In March 2013, the FASB issued ASU No. 2013-05, “Foreign Currency Matters, (Topic 830): Parent’s Accounting for the Cumulative Translation Adjustment upon Derecognition of Certain Subsidiaries or Groups of Assets within a Foreign Entity or of an Investment in a Foreign Entity”, to resolve a diversity in accounting for the cumulative translation adjustment of foreign currency upon derecognition of a foreign subsidiary or group of assets. This ASU requires the parent to apply the guidance in Subtopic 830-30 to release any related cumulative translation adjustment into net income when a reporting entity (parent) ceases to have a controlling financial interest in a subsidiary or group of assets within a foreign entity. Accordingly, the cumulative translation adjustment should be released into net income only if the sale or transfer results in the complete or substantially complete liquidation of the foreign entity in which the subsidiary or group of assets had resided. Further, this ASU clarified that the parent should apply the guidance in subtopic 810-10 if there is a sale of an investment in a foreign entity, including both (1) events that result in the loss of a controlling financial interest in a foreign entity and (2) events that result in an acquirer obtaining control of an acquiree in which it held an equity interest immediately before the acquisition date. Accordingly, the cumulative translation adjustment should be released into net income upon the occurrence of those events. The provisions in this update are effective for fiscal years, and interim periods within those years, beginning after December 15, 2013. Early adoption is permitted. The adoption of this standard is not expected to have a material impact on the Company’s consolidated financial position or results of operations.

In July 2013, the FASB issued Accounting Standards Update No. 2013-11, “Income Taxes (Topic 740)”. The amendments in this update provide guidance on the financial statement presentation of an unrecognized tax benefit when a net operating loss carryforward, similar tax loss, or tax credit carryforward exists. These amendments provide that an unrecognized tax benefit, or a portion thereof, should be presented in the financial statements as a reduction to a deferred tax asset for a net operating loss carryforward, a similar tax loss, or a tax credit carryforward, except to the extent that a net operating loss carryforward, a similar tax loss, or a tax credit carryforward is not available at the reporting date to settle any additional income taxes that would result from disallowance of a tax position, or the tax law does not require the entity to use, and the entity does not intend to use, the deferred tax asset for such purpose, then the unrecognized tax benefit should be presented as a liability. The amendments in this update are effective for fiscal years, and interim periods within those years, beginning after December 15, 2013. Early adoption is permitted. The Company does not expect ASU 2013-11 to have a significant impact on its consolidated financial statements.

Other accounting standards that have been issued or proposed by the FASB or other standards-setting bodies that do not require adoption until a future date are not expected to have a material impact on the Company’s consolidated financial statements upon adoption.

- 29 -

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

(Amounts in thousands, except number of shares, per share data and unless otherwise stated)

In April 2008, China Enterprises Limited acquired a 100% equity interest in Cosmos Regent Limited, Cyber Generation Limited and Whole Good Limited, companies engaged in securities investment, from HHL group. Pursuant to the terms of the acquisition agreements, total consideration was Rmb34,417 (US$5,045), and the amount was recorded as a payable of the Company owing to HHL.

The following summarizes the estimated fair value of assets acquired and liabilities assumed on the date of acquisition:

| | | | |

| | | Rmb | |

Assets acquired: | | | | |

Accounts and other receivable | | | 63 | |

Amount due from related parties | | | 23,518 | |

Available-for-sale securities | | | 51,102 | |

Trading securities | | | 68,645 | |

| | | | |

Total | | | 143,328 | |

| | | | |

Liabilities assumed: | | | | |

Amount due to related parties | | | 32,498 | |

Accounts and other payables | | | 57,042 | |

Tax payable | | | 19,371 | |

| | | | |

Total | | | 108,911 | |

| | | | |

Net assets acquired | | | 34,417 | |

| | | | |

The notes, carrying interest at commercial rates, were unsecured and receivable from an unrelated party. During 2009, the Company instructed the debtor to fully settle the notes receivable by directly paying off the Company’s other payables.

- 30 -

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

(Amounts in thousands, except number of shares, per share data and unless otherwise stated)

| | | | | | | | | | | | |

| | | 2009 | | | 2010 | | | 2010 | |

| | | Rmb | | | Rmb | | | US$ | |

Trading securities: | | | | | | | | | | | | |

Equity securities listed in Hong Kong | | | 50,116 | | | | 38,846 | | | | 5,886 | |

Equity securities listed in Singapore | | | 13,634 | | | | 15,975 | | | | 2,420 | |

| | | | | | | | | | | | |

Total | | | 63,750 | | | | 54,821 | | | | 8,306 | |

| | | | | | | | | | | | |

Available-for-sale securities: | | | | | | | | | | | | |

Equity securities listed in Hong Kong | | �� | 33,546 | | | | 31,511 | | | | 4,774 | |

| | | | | | | | | | | | |

| | | |

| | | 2009 | | | 2010 | | | 2010 | |

| | | Rmb | | | Rmb | | | US$ | |

Trading securities: | | | | | | | | | | | | |

Adjusted cost | | | 122,792 | | | | 117,600 | | | | 17,818 | |

Unrealized gains | | | 24,948 | | | | 16,016 | | | | 2,427 | |

Unrealized losses | | | (83,990 | ) | | | (78,795 | ) | | | (11,939 | ) |

| | | | | | | | | | | | |

Total at fair value | | | 63,750 | | | | 54,821 | | | | 8,306 | |

| | | | | | | | | | | | |

Available-for-sale securities: | | | | | | | | | | | | |

Cost | | | 101,926 | | | | 97,872 | | | | 14,829 | |

Impairment recognized in earnings | | | (68,209 | ) | | | (71,511 | ) | | | (10,835 | ) |

| | | | | | | | | | | | |

Adjusted amortized cost | | | 33,717 | | | | 26,361 | | | | 3,994 | |

Unrealized gains | | | 760 | | | | 5,150 | | | | 780 | |

Unrealized losses | | | (931 | ) | | | — | | | | — | |

| | | | | | | | | | | | |

Total at fair value | | | 33,546 | | | | 31,511 | | | | 4,774 | |

| | | | | | | | | | | | |

As of December 31, 2010, the Company considers the declines in market value of one of its marketable securities in its investment portfolio to be other than temporary in nature and considers this investment other-than-temporarily impaired. Fair values were determined using closing prices of each individual security in the investment portfolio. When evaluating an investment for other-than-temporary impairment, the Company reviews factors such as the length of time and extent to which fair value has been below its cost basis, the financial condition of the issuer and any changes thereto, and the Company’s intent to sell, or whether it is more likely than not it will be required to sell, the investment before recovery of the investment’s cost basis. During 2008, 2009 and 2010, the Company recognized impairment charges of Rmb69,524, nil and Rmb6,015, respectively.

- 31 -

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

(Amounts in thousands, except number of shares, per share data and unless otherwise stated)

| 6. | INVESTMENTS IN AND ADVANCES TO EQUITY METHOD AFFILIATES |

| | | | | | | | | | | | |

| | | 2009 | | | 2010 | | | 2010 | |

| | | Rmb | | | Rmb | | | US$ | |

Investments in equity method affiliates | | | 648,333 | | | | 838,500 | | | | 127,045 | |

Advances to equity method affiliates | | | 7,735 | | | | 7,735 | | | | 1,172 | |

| | | | | | | | | | | | |

Total | | | 656,068 | | | | 846,235 | | | | 128,217 | |

Less:Allowance for advances to equity method affiliate | | | (7,601 | ) | | | (7,601 | ) | | | (1,152 | ) |

| | | | | | | | | | | | |

| | | 648,467 | | | | 838,634 | | | | 127,065 | |

| | | | | | | | | | | | |

Equity ownership percentages for these affiliates are presented below:

| | | | | | | | | | |

| | | Place of | | | | | | |

| | | incorporation/ | | | | | | |

| Affiliate | | registration | | 2009 | | | 2010 | |

X One Holdings Limited (“X One”) | | Hong Kong | | | — | | | | — | |

HZ | | PRC | | | 26 | % | | | 26 | % |

X One:

In April 2009, X One was dissolved pursuant to Section 291 of the Hong Kong Companies Ordinance.

HZ:

As of December 31, 2009 and 2010, the Company had a 26% equity interest in Hangzhou Zhongce Rubber Co., Limited (“HZ”, located in Hangzhou, Zhejiang Province, the PRC). HZ and its consolidated subsidiaries (the “PRC entities”) are engaged in the manufacture of rubber tires in the PRC.

On November 28, 2011, the Company sold all of its ownership interests in HZ to CZ Tire Holdings Limited, an independent third party company incorporated in the British Virgin Islands (Note 18(ii)).

The advances to the affiliate are interest free and the Group will not demand repayment within one year from the respective balance sheet dates and the amount is therefore considered non-current.

- 32 -

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

(Amounts in thousands, except number of shares, per share data and unless otherwise stated)

| 6. | INVESTMENTS IN AND ADVANCES TO EQUITY METHOD AFFILIATES — continued |

HZ: — continued

Summarized financial information of HZ:

| | | | | | | | | | | | |

| | | 2009 | | | 2010 | | | 2010 | |

| | | Rmb | | | Rmb | | | US$ | |

Current assets | | | 4,335,233 | | | | 6,087,063 | | | | 922,282 | |

Non-current assets | | | 4,965,765 | | | | 5,709,195 | | | | 865,030 | |

Current liabilities | | | 5,398,066 | | | | 6,840,021 | | | | 1,036,367 | |

Non-current liabilities | | | 1,115,462 | | | | 1,395,616 | | | | 211,457 | |

Total equity | | | 2,494,629 | | | | 3,226,040 | | | | 488,794 | |

| | | | | | | | | | | | |

Company’s share of net assets of HZ | | | 648,467 | | | | 838,634 | | | | 127,065 | |

| | | | | | | | | | | | |

| |

| | | Year ended December 31, | |

| | | 2009 | | | 2010 | | | 2010 | |

| | | Rmb | | | Rmb | | | US$ | |

Revenues | | | 15,145,328 | | | | 20,258,466 | | | | 3,069,464 | |

| | | | | | | | | | | | |

Net income and comprehensive income attributable to shareholders of HZ | | | 981,221 | | | | 731,411 | | | | 110,820 | |

| | | | | | | | | | | | |

Company’s share of net income of HZ | | | 255,117 | | | | 190,167 | | | | 28,813 | |

| | | | | | | | | | | | |

HZ’s continuation as a going concern is dependent upon its ability to generate sufficient cash flows to meet its obligations on a timely basis and to obtain additional financing as may be required.

HZ has historically met cash needs from borrowings and operating cash flows. Subsequent to the balance sheet date, HZ has obtained new bank borrowings of Rmb381,350 repayable substantially from 2013 to 2014 and a new bond borrowing of Rmb880,976 repayable by 2014.

The directors of HZ are of the opinion that taking into account the presently available banking facilities and cash inflow from its operation, HZ has sufficient working capital to meet its debts when they fall due in the foreseeable future.

- 33 -

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

(Amounts in thousands, except number of shares, per share data and unless otherwise stated)

| 7. | CONVERTIBLE NOTE RECEIVABLE |

On March 23, 2006, Rosedale Hotel Holdings Limited (“Rosedale”) entered into a subscription agreement with the Company and other subscribers for 2% convertible exchangeable notes (the “Convertible Notes”) with an aggregate principal amount of HK$1,000,000. The Company and other subscribers agreed to subscribe for the Convertible Notes in exchange for cash in the principal amount of HK$300,000 and HK$700,000, respectively.

The initial conversion price of the Convertible Note was HK$0.79 per share, subject to anti-dilutive adjustments. In July 2008, the conversion price was reduced from HK$0.79 per share to HK$0.339 per share as a result of rights issued by Rosedale. Unless previously converted or lapsed or redeemed by Rosedale, Rosedale will redeem the Notes on the fifth anniversary from the date of issue of the Notes (i.e. June 7, 2011, the “Maturity Date”) at the redemption amount which is 110% of the principal amount of the Notes outstanding.

The Company shall have the right to convert, on any business day commencing from the 7th day after the date of issue of the Convertible Note up to and including the date which is 7 days prior to the Maturity Date, the whole or any part (in an amount or integral multiple of HK$1,000) of the principal amount of the Convertible Note into shares of Rosedale at the then prevailing conversion price. Had the Company’s Convertible Notes been converted into new shares of Rosedale in full as of December 31, 2009 and 2010, the equity ownership percentage held by the Company in Rosedale would change from 10.72% to 10.59% and 8.90% to 9.64% respectively.

Subject to certain restrictions which are intended to facilitate compliance with relevant rules and regulations, each noteholder shall have the right to exchange from time to time all or part (in the amount of HK$10,000 or integral multiples thereof) of 50% of the initial principal amount of its Convertible Notes for shares in the share capital of any company which is an affiliated company of Rosedale as defined in the Rules Governing the Listing of Securities on the HKSE or subsidiary of Rosedale that is to be listed on a stock exchange through an initial public offering at the price (the “Spin-off Shares”), subject to anti-dilutive adjustments, at which the Spin-off Shares are actually issued to the public at the time of the listing on that stock exchange. The decision on whether to list any of its affiliated companies or subsidiaries in the future is at the sole discretion of the directors of Rosedale.

The subscription of the Convertible Notes by the Company was completed on June 8, 2006 which resulted in a payment by its intermediate holding company, GDI, on behalf of the Company, of Rmb205,049, with the remainder of Rmb104,071 being offset by an advance previously made to Rosedale.

The Company exercised certain of its conversion rights in the principal amount of HK$158,000 (equivalent to approximately Rmb148,916) and HK$79,000 (equivalent to approximately Rmb74,458) in June 2007 and July 2007, respectively, under the terms of the Convertible Notes. No Convertible Notes were converted during the years ended December 31, 2008, 2009 and 2010.

- 34 -

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

(Amounts in thousands, except number of shares, per share data and unless otherwise stated)

| 7. | CONVERTIBLE NOTE RECEIVABLE — continued |

Pursuant to the instrument constituting the Convertible Notes, the conversion price should be adjusted from HK$0.339 to HK$0.337 (the “2009 Adjustment”) as a result of completion of the placing of 1,800 million shares as announced by Rosedale on August 4, 2009. Since the 2009 Adjustment was less than 3% of the then prevailing conversion price of HK$0.339, pursuant to the terms of the Convertible Notes, the 2009 Adjustment did not take effect but would be carried forward and be taken into account in the next subsequent adjustment.

On February 2, 2010, Rosedale had completed a capital reorganization which involved, among others, consolidation of every 20 of its then issued shares of HK$0.01 each into 1 issued consolidated share of HK$0.20 each. Consequently, the conversion price of the Convertible Notes was adjusted from HK$0.339 to HK$6.780 with effect from February 1, 2010.

In accordance with Derivative and Hedging Topic of the FASB Accounting Standards Codification Topic 815 (“ASC 815”), the conversion option element of the Convertible Notes represents an embedded derivative instrument which must be accounted for separately from the Convertible Notes and, as such, to be measured at fair value when initially recorded and at subsequent reporting dates. The debt element of the Convertible Notes was also measured at fair value initially and subsequently at amortized cost with an effective interest rate of 6.5%. The fair value of the conversion option was estimated using the Black-Scholes option pricing model at the date of its issuance and at each subsequent balance sheet date. The impact of changes in fair value of this conversion option, taking into account the portion of the conversion option exercised during fiscal 2008, 2009 and 2010, was a loss of Rmb4,244, a gain of Rmb72 and a loss of Rmb185 (US$28) which have been recognized in the consolidated statements of operations for 2008, 2009 and 2010, respectively.

The assumptions adopted for the valuation of the conversion option as of December 31, 2009 and 2010 under the Black-Scholes model are as follows:

| | | | | | | | |

| | | December | | | December | |

| | | 31, 2009 | | | 31, 2010 | |

Risk-free interest rate | | | | | | | | |

(by reference to the yield of Hong Kong Exchange Fund Bills & Notes) | | | 0.32 | % | | | 0.30 | % |

Expected volatility | | | | | | | | |

(estimated by the average annualized standard deviations of the continuously compounded rates of return on the Company’s share prices) | | | 106.93 | % | | | 37.98 | % |

Expected life (in years) | | | 1.43 | | | | 0.43 | |

Expected dividend yield (per annum) | | | 0 | % | | | 0 | % |

Fair Value: | | | | | | | | |

Conversion feature (Rmb) | | | 187 | | | | — | |

| | | | | | | | |

- 35 -

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

(Amounts in thousands, except number of shares, per share data and unless otherwise stated)

| 7. | CONVERTIBLE NOTE RECEIVABLE — continued |

Convertible note receivable consists of:

| | | | | | | | | | | | |

| | | 2009 | | | 2010 | | | 2010 | |