UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only

(as permitted by Rule 14a-6(e)(2))

xDefinitive Proxy Statement

¨ Definitive Additional Materials

¨Soliciting Material Pursuant to (S)240.14a-12

Landry’s Restaurants, Inc.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

xNo fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

¨ Fee paid previously with preliminary materials.

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

May 4, 2005

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders that will be held on June 2, 2005, at 11:00 a.m., local time, at the Downtown Aquarium, 410 Bagby Street, Houston, Texas. Parking will be validated.

The enclosed notice and proxy statement contain details concerning the business to come before the meeting. You will note that our Board of Directors recommends a vote “FOR” the election of six directors to serve terms of office expiring at the 2006 Annual Meeting of Stockholders. Please sign and return your proxy card in the enclosed envelope at your earliest convenience to assure that your shares will be represented and voted at the meeting even if you cannot attend.

The Board of Directors and management look forward to seeing you at the Annual Meeting.

Very truly yours,

Tilman J. Fertitta

Chairman of the Board,

President and Chief Executive Officer

LANDRY’S RESTAURANTS, INC.

1510 West Loop South

Houston, Texas 77027

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 2, 2005

Notice is hereby given that the Annual Meeting of Stockholders of Landry’s Restaurants, Inc. will be held at the Downtown Aquarium, 410 Bagby Street, Houston, Texas, on June 2, 2005, at 11:00 a.m., local time, for the following purposes:

| | 1. | | To elect six directors to serve a term of office expiring at the 2006 Annual Meeting of Stockholders and until their successors shall have been duly elected and qualified; and |

| | 2. | | To transact such other business as may properly come before the Annual Meeting or any adjournment thereof. |

Our Board of Directors has fixed the close of business on April 20, 2005, as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting or any adjournment(s) thereof. Only stockholders of record at the close of business on the record date are entitled to notice of and to vote at the Annual Meeting. The stock transfer books will not be closed. A list of stockholders entitled to vote at the Annual Meeting will be available for examination at the Annual Meeting and during regular business hours at our corporate offices at 1510 West Loop South, Houston, Texas 77027, for 10 days prior to the Annual Meeting.

You are cordially invited to attend the Annual Meeting.Whether or not you expect to attend the Annual Meeting in person, however, you are urged to mark, sign, date, and mail the enclosed form of proxy promptly so that your shares of stock may be represented and voted in accordance with your wishes, even if you cannot attend, and in order that the presence of a quorum may be assured at the Annual Meeting. In the event you decide to attend the Annual Meeting, you may revoke the proxy and vote your shares in person.

BY ORDER OF THE BOARD OF DIRECTORS

Steven L. Scheinthal, Secretary

DATED: May 4, 2005

LANDRY’S RESTAURANTS, INC.

1510 West Loop South

Houston, Texas 77027

PROXY STATEMENT

Landry’s Restaurants Inc. (the “Company”) is mailing this proxy statement with the accompanying proxy card and its Annual Report to you on or about May 4, 2005. The enclosed proxy is solicited by the Board of Directors of the Company in connection with the Annual Meeting of Stockholders to be held on June 2, 2005, and any adjournment of that meeting. The Annual Meeting will be held at 11:00 a.m., local time, at the Downtown Aquarium, 410 Bagby Street, Houston, Texas.

GENERAL INFORMATION ABOUT VOTING

WHO CAN VOTE?

If you are a holder of the Company’s common stock according to its records at the close of business on April 20, 2005 (the record date for the Annual Meeting), you are entitled to vote at the Annual Meeting. On the record date, the Company had 23,157,447 shares of common stock issued and outstanding, exclusive of treasury shares. Each issued and outstanding share of common stock is entitled to one vote on each matter to be voted on at the Annual Meeting and can be voted only if the owner of record is present to vote or is represented by proxy.

HOW ARE VOTES COUNTED?

The holders of a majority in interest of all stock issued, outstanding and entitled to vote are required to be present in person or represented by proxy at the Annual Meeting in order to constitute a quorum for the transaction of business. Abstentions and broker non-votes are treated in the same manner as shares present or represented at the Annual Meeting for purposes of determining the existence of a quorum. (A “broker non-vote” occurs when a registered broker holding a customer’s shares in the name of the broker has not received voting instructions on a matter from the customer and is barred by stock exchange rules from exercising discretionary authority to vote on the matter. The broker will indicate this on the proxy card.)

The total number of votes that are cast “for” a proposal will determine whether the proposal is adopted. Abstentions are counted in determining the total number of votes cast. Broker non-votes are not counted in determining the number of votes cast.

The affirmative vote of a majority of the shares of common stock represented at the Annual Meeting and entitled to vote is required to elect directors. In voting for the election of directors, you may cast your vote in favor or against, but you may not specify an abstention.

WHAT HAPPENS IF I VOTE BY PROXY?

If you sign, date and return the enclosed proxy card in time for the Annual Meeting and do not subsequently revoke it, your shares will be voted in accordance with your instructions as marked on the proxy card. If you sign, date and return the proxy card, but do not specify how your shares are to be voted, then your shares will be voted FOR all nominees for director. The Company is not aware of any matter to be considered at the Annual Meeting other than those referred to in this proxy statement. If any other business should properly come before the Annual Meeting, the persons named on the proxy card will vote according to their best judgment.

CAN I REVOKE MY PROXY CARD INSTRUCTIONS?

You may revoke your proxy at any time before it is exercised by returning to the Company another properly signed proxy card representing your shares and bearing a later date, or by delivering a written revocation letter to Steven L. Scheinthal, Secretary of the Company, or by attending the Annual Meeting in person, notifying the Secretary, and voting by ballot at the Annual Meeting. Mr. Scheinthal’s mailing address is Landry’s Restaurants, Inc., 1510 West Loop South, Houston, Texas 77027.

Any stockholder of record attending the Annual Meeting may vote in person whether or not a proxy has been previously given, but the mere presence (without notifying the Secretary) of a stockholder at the Annual Meeting will not constitute revocation of a previously given proxy.

WHAT DO I NEED TO DO IF I PLAN TO ATTEND THE ANNUAL MEETING?

If you are a holder of record of shares of common stock and you plan to attend the Annual Meeting, you need only bring a form of personal identification with you in order to be admitted to the Annual Meeting. If you are not a record holder of shares but hold the Company’s common stock through a bank or broker, you will need proof of ownership to be admitted to the Annual Meeting. A recent brokerage statement or letter from a bank or broker are examples of proof of ownership. If you hold your shares through a broker or bank and want to vote in person at the Annual Meeting, you will need to contact the registered holder of your shares and obtain a proxy in your name from that registered holder.

WHO PAYS THE EXPENSES OF THIS SOLICITATION?

The Company bears the cost of preparing, assembling and mailing the notice, proxy statement and proxy card for the Annual Meeting. In addition to such solicitation by use of the mails, the Company’s employees may solicit proxies by personal interview, by telephone or by other means of communication, without any additional compensation. The Company will also provide persons, firms, banks and corporations holding shares in their names, or in the names of their nominees, which in either case are beneficially owned by others, with proxy materials for transmittal to the beneficial owners, and the Company will reimburse the record holders for their reasonable expenses in transmitting those materials.

2

PROPOSAL I—ELECTION OF DIRECTORS

The Board of Directors has reduced the number of directors to six from seven in accordance with the Company’s By-laws. As of the date of this proxy statement, the Board of Directors consists of six members. At the 2004 Annual Meeting, Stockholders elected Mr. Paul S. West to the Company’s Board. During 2004, Mr. West resigned and his Board seat was never filled. All directors who have been nominated have consented to stand for election. Each nominee will serve until the 2006 Annual Meeting of the Company’s stockholders or until his respective successor is duly elected and qualified. A majority of shares present at the Annual Meeting is required to be cast in favor of a nominee for the election of each of the nominees listed below. At the Annual Meeting, the common stock represented by proxies, unless otherwise specified, will be voted for the election of the six nominees named below.

Although the Board of Directors does not contemplate that any of the nominees will be unable to serve, if that situation arises prior to the Annual Meeting, the persons named on the enclosed form of proxy will vote for a substitute nominee in accordance with their best judgment.

As set forth below, the Nominating and Corporate Governance Committee has established criteria for the selection and recommendation of candidates to become nominees submitted by the Board of Directors for election to the Board by the Company’s stockholders. As used herein, “Non-Employee” Directors are all Directors who are not Company employees. The Non-Employee Director nominees are Messrs. Chadwick, Richmond, Taylor and Brimmer.

Director Independence

The Board of Directors has set forth standards for determining if a Director is “independent” in accordance with the criteria, including any additional requirements for the committees on which each Director serves, set forth by the New York Stock Exchange (“NYSE”) and the Securities and Exchange Commission (“SEC”). The Company’s Corporate Governance Guidelines provide that a Director will be considered independent if, in addition to meeting applicable NYSE and SEC criteria, the director meets the following standards:

| | • | | No director who is an employee, or whose immediate family member is an executive officer of the Company is independent until three years after the end of such employment relationship. |

| | • | | No director who received, or whose immediate family member receives, more than $100,000 per year in direct compensation from the Company, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service), is independent until three years after he or she ceases to receive more than $100,000 per year in such compensation. |

| | • | | No director who is affiliated with or employed by, or whose immediate family member is affiliated with or employed in a professional capacity by, a present or former internal or external auditor of the Company is independent until three years after the end of the affiliation or the employment of such auditing relationship. |

| | • | | No director who is employed or whose immediate family member is employed, as an executive officer of another company where any of the Company’s present executives serve on that company’s compensation committee is independent until three years after the end of such service or the employment relationship. |

| | • | | No director who is an executive officer or an employee, or whose immediate family member is an executive officer, of a company that makes payments to, or receives payments from, the Company for property or services in an amount which, in any single fiscal year, exceeds the greater of $1 million, or 2% of such other company’s consolidated gross revenues, is independent until three years after falling below such threshold. |

3

The Board has determined that each Non-Employee Director is independent in accordance with the criteria.

The following information is set forth with respect to the persons nominated for election as a director.

Nominees for Election at the Annual Meeting

| | | | | | | | |

Name

| | Age

| | Positions

| | Director Since

| | Term Expires

|

Tilman J. Fertitta (3) | | 47 | | President, Chief Executive Officer and Director | | 1993 | | 2005 |

Steven L. Scheinthal (3) | | 43 | | Executive Vice President and General Counsel, Secretary and Director | | 1993 | | 2005 |

Michael S. Chadwick (1)(2) | | 51 | | Director | | 2001 | | 2005 |

Michael Richmond (1)(2) | | 57 | | Director | | 2003 | | 2005 |

Joe Max Taylor (2)(3)(4) | | 70 | | Director | | 1993 | | 2005 |

Kenneth Brimmer (1)(4) | | 49 | | Director | | 2004 | | 2005 |

| (1) | | Member of Audit Committee |

| (2) | | Member of Compensation/Stock Option Committee |

| (3) | | Member of Executive Committee |

| (4) | | Member of Nominating and Corporate Governance Committee |

Mr. Fertittahas served as President and Chief Executive Officer of the Company since 1987. In 1988, he became the controlling stockholder and assumed full responsibility for all of the Company’s operations. Prior to serving as President and Chief Executive Officer of the Company, Mr. Fertitta devoted his full time to the control and operation of a hospitality and development company. Mr. Fertitta serves on the boards of the Houston Livestock Show and Rodeo, Space Center Houston, the Museum of Fine Arts, The Greater Houston Convention and Visitor’s Bureau, the Better Business Bureau of Houston, the Childress Foundation and the National Forest Foundation. He is also a minority partner in the Houston Texans National Football League team.

Mr. Scheinthal has served as Executive Vice President or Vice President of Administration, General Counsel and Secretary to the Company since September 1992. He devotes a substantial amount of time to lease and contract negotiations and is primarily responsible for the Company’s compliance with all federal, state and local ordinances. Prior to joining the Company, he was a partner in the law firm of Stumpf & Falgout in Houston, Texas. Mr. Scheinthal represented the Company for approximately five years before joining the Company. He has been licensed to practice law in the state of Texas since 1984.

Mr. Chadwick has been engaged in the commercial and investment banking businesses since 1975. From 1988 to 1994, Mr. Chadwick was President of Chadwick, Chambers & Associates, Inc., a private merchant investment banking firm in Houston, Texas, which he founded in 1988. In 1994, Mr. Chadwick joined Sanders Morris Harris, an investment banking and financial advisory firm, as Senior Vice President and a Managing Director in the Corporate Finance Group. Mr. Chadwick was elected to the Board of Directors of the Company in 2001.

Mr. Richmond currently serves as a Director and Vice Chairman of Woodforest National Bank, a Houston area-based bank. Prior to joining Woodforest National Bank in January 2003, Mr. Richmond worked for The Woodlands Operating Company, L.P., a developer specializing in master-planned communities, commercial and investment properties, from 1972 to 2002. Mr. Richmond served as President and CEO from 1998-2002 and held such other titles as COO, Senior Vice President of Financial Operations, Treasurer, and Controller. Mr. Richmond has been a certified public accountant since the 1970’s.

Mr. Taylorwas formerly the chief law enforcement administrator for Galveston County, Texas. He has served as a Director and Executive Committee member of American National Insurance Company, a publicly-traded insurance company, for ten years and served on the Board of Directors of Moody Gardens, a hospitality and entertainment complex located in Galveston, Texas.

4

Mr. Brimmer is the Chief Executive Officer and Director of Sterion Incorporated, a publicly-traded manufacturer and supplier of medical supplies. From April 2002 until June 2003, he served as Chairman and Director of Active IQ Technologies, Inc. and was Chief Executive Officer from April 2000 until December 2001. Previously, Mr. Brimmer was President of Rainforest Café, Inc. from April 1997 until April 2000 and was Treasurer from its inception in 1995 until April 2000. Prior to that, Mr. Brimmer was employed by Grand Casinos, Inc. and its predecessor from October 1990 until April 1997. Mr. Brimmer currently serves as Chairman of the Audit Committee on the Board of Chiral Quest, Inc. and is on both the Audit and Compensation Committees of Entrx Corporation. He has a degree in accounting and worked as a CPA in the audit division of Arthur Andersen from 1977 through 1981.

There were fifteen meetings of the Executive Committee, six meetings of the Audit Committee, three meetings of the Compensation/Stock Option Committee, and six meetings of the Company’s Board of Directors held during 2004. All of the current Board members attended 75% or more of the meetings of the Board and of the committees of the Board on which they were members. It is the policy of the Board that, to the extent possible, all Directors attend the Annual Meeting of Stockholders. All Directors attended the 2004 Annual Meeting of Stockholders.

The Board of Directors recommends that stockholders vote “FOR” each nominee for the Board of Directors.

Executive Sessions of the Board of Directors

Non-Employee Directors meet regularly in executive sessions prior to or after scheduled meetings of the Board of Directors. Unless otherwise designated, Joe Max Taylor, the Chairman of the Compensation/Stock Option Committee, serves as the presiding director at each such executive session.

Communications with Directors

The Board of Directors has adopted corporate governance guidelines that provide that security holders of the Company and other interested parties may communicate with one or more of the Company’s Directors, including the Non-Employee Directors, by mail in care of: Steven L. Scheinthal, Secretary, Landry’s Restaurants, Inc., 1510 West Loop South, Houston, Texas 77027. Such communications should specify the intended recipient or recipients. All such communications, other than unsolicited commercial solicitations, will be forwarded to the appropriate director or directors for review.

Codes of Business Conduct and Ethics

The Company has adopted a Code of Business Conduct and Ethics that is applicable to all Company Directors, Officers and other employees. The Code is posted under the Corporate Governance portion of the Investor Relations section on the Company’s website atwww.LandrysRestaurants.com and is available to any stockholder upon request. The Company has also adopted a Code of Ethics Statement by the Chief Executive Officer and Senior Financial Officers, which is filed with the SEC as an exhibit to the Company’s 2003 Annual Report on Form 10-K. If there are any changes or waivers of the Code of Business Conduct and Ethics which applies to the Chief Executive Officer and Senior Financial Officers, the Company will disclose it on its website in the same location.

5

EXECUTIVE OFFICERS

In addition to Messrs. Fertitta and Scheinthal, for which information is provided above, the following persons are executive officers:

| | | | | | |

Name

| | Age

| | Position

| | Officer

Since

|

Richard E. Ervin | | 48 | | Executive Vice President of Restaurant Operations | | 1991 |

Richard (“Rick”) H. Liem | | 51 | | Senior Vice President of Finance and Chief Financial Officer | | 2004 |

Mr. Ervin has served as Executive Vice President of Restaurant Operations or Vice President of Restaurant Operations since 1991. Prior to that time, he was the Vice President of Internal Controls and Director of Beverage Operations. He has over 20 years of experience in high volume, multi-unit food and beverage operations. His experience includes new restaurant development and employee training programs.

Mr. Liem has served as Senior Vice President and Chief Financial Officer since June 2004. He has been employed by the Company since 1999 as the Vice President of Accounting or Corporate Controller. Mr. Liem joined the Company from Carrols Corporation, a restaurant company located in Syracuse, NY, where he was the Vice President of Financial Operations from 1994 to 1999. He was with the audit division of Price Waterhouse, L.L.P. from 1983 to 1994. Mr. Liem is a certified public accountant and was first licensed in Texas in 1989. On June 4, 2004, Paul West, the Company’s former Chief Financial Officer, resigned to pursue other interests and was replaced by Mr. Liem.

COMMITTEES OF THE BOARD OF DIRECTORS

The Company has an Executive Committee, an Audit Committee, a Compensation/Stock Option Committee, and a Nominating and Corporate Governance Committee. The Company has reviewed its committee structure in order to fully satisfy the existing rules of the SEC and NYSE and believes that it satisfies all of such rules. Copies of the Audit Committee, Compensation/Stock Option Committee, and Nominating and Corporate Governance Committee Charters are available under the Corporate Governance portion of the Investor Relations section of the Company’s website atwww.LandrysRestaurants.com.

Executive Committee

The Executive Committee has and may exercise all of the authority of the Board of Directors with respect to the management of its business, except with respect to certain specified matters that by law, its Certificate of Incorporation or its By-laws must be approved by the entire Board of Directors. The Executive Committee met fifteen times during 2004. All actions taken by the Executive Committee were subsequently ratified unanimously by the Board of Directors.

Audit Committee

The Audit Committee consists of three Non-Employee Directors. The members of the Audit Committee during 2004 were Michael Chadwick (Chairman), Michael Richmond and Kenneth Brimmer. Prior to Mr. Brimmer’s appointment to the Board in 2004, Joe Max Taylor served as an Audit Committee member. Mr. Brimmer replaced Mr. Taylor during 2004 as an Audit Committee member. The Audit Committee held six meetings in 2004. The Audit Committee’s primary purpose is to assist the Board of Directors oversight of (a) the integrity of the Company’s financial statements and disclosures; (b) the Company’s compliance with legal and regulatory requirements; (c) the independent auditor’s qualifications and independence; and (d) the performance of the Company’s internal audit function and independent auditors. The Audit Committee has the sole authority to appoint and terminate the Company’s independent auditors. The Company’s Board of Directors has

6

determined that Mr. Chadwick, Chairman of the Audit Committee, is an “audit committee financial expert” as described in Item 401(h) of the SEC’s Regulation S-K. In addition, the Board of Directors has determined that each member of the Audit Committee is independent, as independence for audit committee members is defined in the listing standards of the NYSE. The Audit Committee is established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934 (the “Exchange Act”). See “Report of the Audit Committee” below.

Compensation/Stock Option Committee

The Board of Directors has a Compensation/Stock Option Committee which consists of three Non-Employee Directors. The members of the Compensation/Stock Option Committee are Mr. Taylor (Chairman), Michael Chadwick and Michael Richmond. The Compensation/Stock Option Committee held three meetings during 2004. The Compensation/Stock Option Committee has the responsibility for assuring that the senior executives of the Company are compensated in a manner consistent with the compensation philosophy and strategy of the Board and in compliance with the requirements of the regulatory bodies that oversee the Company’s operations. Generally, the Committee is charged with reviewing and approving the Company’s compensation philosophy and its executive compensation programs, plans and awards. The Committee also administers the Company’s stock-option plans and reviews and approves general employee benefit plans on an as-needed basis. The Company’s Board of Directors has determined that each member of the Compensation/Stock Option Committee is independent, as independence for compensation committee members is defined in the listings standards for the NYSE. See “Report of the Compensation/Stock Option Committee” below.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee consists of two Non-Employee Directors. The current members of the Nominating and Corporate Governance Committee are Mr. Taylor (Chairman) and Mr. Brimmer. Mr. Brimmer replaced Mr. Richmond during 2004 as a Nominating and Corporate Governance committee member. The Nominating and Corporate Governance Committee is charged with identifying and making recommendations to the Board of Directors of individuals suitable to become members of the Board of Directors and in overseeing the administration of the Company’s various policies related to corporate governance matters. The Nominating and Corporate Governance Committee met once in 2004.

Nominating and Corporate Governance Committee Director Nominations

The Nominating and Corporate Governance Committee has established criteria for the selection and recommendation of candidates to become nominees submitted by the Board of Directors for election to the Board of Directors by the Company’s stockholders. The Committee selects each recommended nominee based on the nominee’s experience, independence and availability. As set forth in the Company’s Corporate Governance Guidelines, the following criteria are considered in selecting candidates for the Board of Directors: a high degree of personal and professional ethics, integrity and values, an independent mind and mature judgment. In addition, candidates are to be involved only in activities or interests that would not create a conflict with potential directorial responsibilities to the Company and its stockholders.

When soliciting candidates for Director, the Corporate Governance and Nominating Committee may solicit suggestions from incumbent Directors, management and stockholders. While the Committee has authority under its charter to retain a search firm for this purpose, no such firm was utilized in 2004. If the Committee believes a candidate would be a valuable addition to the Board of Directors, it will recommend that candidate’s election to the full Board of Directors.

Stockholder Nominations

The Charter of the Nominating and Corporate Governance Committee provides that the Nominating and Corporate Governance Committee will consider proposals for nominees for Director from stockholders. Stockholder nominations for Director should be made in writing to Mr. Steven L. Scheinthal, Secretary, Landry’s

7

Restaurants, Inc., 1510 West Loop South, Houston, Texas 77027. In order to nominate a Director at the Annual Meeting, the Company requires that a stockholder follow the procedures set forth herein. In order to recommend a nominee for a Director position, a stockholder must be a stockholder of record at the time he/she/or it gives notice of recommendation and must be entitled to vote for the election of Directors at the meeting at which such nominee will be considered. Stockholder recommendations must be made pursuant to written notice delivered to the Secretary at the principal executive offices of the Company (i) in the case of a nomination for election at an annual meeting, not less than 60 days prior to the first anniversary of the date of the Company’s notice of annual meeting for the preceding year’s annual meeting; and (ii) in the case of a special meeting at which Directors are to be elected, not later than the close of business on the later of the 90th day prior to such special meeting or the tenth day following the day on which public announcement is first made of the date of the meeting and of the nominees proposed by the Board of Directors to be elected at the special meeting. In the event that the date of the annual meeting is changed by more than 30 days from the anniversary date of the preceding year’s annual meeting, the stockholder notice described above will be deemed timely if it is received not later than the close of business on the later of the 90th day prior to such annual meeting or the tenth day following the day on which public announcement of the date of such meeting is first made.

The stockholder notice must set forth the following:

| | • | | As to each person the stockholder proposes to nominate for election as a Director, all information relating to such person that would be required to be disclosed in solicitations of proxies for the election of such nominees as Directors pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and such person’s written consent to serve as a Director if elected; and |

| | • | | As to the nominating stockholder and the beneficial owner, if any, on whose behalf the nomination is made, such stockholder’s and beneficial owner’s, name and address as they appear on the Company’s books, the class and number of shares of the Company’s common stock which are owned beneficially and of record by such stockholder and such beneficial owner, and an affirmative statement of whether either such stockholder or such beneficial owner intends to deliver a proxy statement and form of proxy to a sufficient number of stockholders to elect such nominee or nominees. |

In addition to complying with the foregoing procedures, any stockholder nominating a director must also comply with all applicable requirements of the Exchange Act and the rules and regulations thereunder.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires the Company’s directors, executive officers and holders of more than 10% of its common stock to file with the SEC initial reports of ownership and reports of changes in ownership of common stock. The Company believes, based solely on a review of the copies of such reports furnished to it and on written representations from its directors and executive officers, all persons subject to the reporting requirements of Section 16(a) filed all reports required during, or with respect to, the year ended December 31, 2004 on a timely basis.

8

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL HOLDERS AND MANAGEMENT

The following table sets forth, as of the record date, certain information regarding the beneficial ownership of the Company’s common stock by (a) each person known to it to own beneficially more than five percent of the outstanding shares of the Company’s common stock, (b) each of its directors and nominees for director, (c) each executive officer named in the Summary Compensation Table below, and (d) all of its executive officers and directors as a group. Unless otherwise indicated, each of the stockholders has sole voting and investment power with respect to the shares beneficially owned. The address of each of Messrs. Fertitta, Scheinthal, Liem, Chadwick, Ervin, Taylor, Richmond and Brimmer is 1510 West Loop South, Houston, Texas 77027.

| | | | | |

Name of Beneficial Owner

| | Shares Beneficially

Owned

| |

| | | Number

| | Percent

| |

Tilman J. Fertitta (1) | | 6,105,148 | | 25.4 | % |

Steven L. Scheinthal (2) | | 203,500 | | * | |

Richard H. Liem (2) | | 28,143 | | * | |

Michael S. Chadwick (2) | | 8,000 | | * | |

Joe Max Taylor (2) | | 3,600 | | * | |

Richard E. Ervin (2) | | 154,500 | | * | |

Michael Richmond | | 2,400 | | * | |

Kenneth Brimmer | | 2,000 | | * | |

Dimensional Fund Advisors Inc. (3) | | 2,014,469 | | 8.7 | % |

Wellington Management Company, LLP (4) | | 1,660,017 | | 7.2 | % |

HYMF Limited (5) | | 1,433,451 | | 6.2 | % |

All executive officers and directors as a group (8 persons) (6) | | 6,507,291 | | 26.7 | % |

| (1) | | Includes 883,334 shares subject to options owned by Mr. Fertitta that are immediately exercisable, and 300,000 shares of restricted stock which vest ten years from the effective date of grant. |

| (2) | | Includes 159,500, 5,000, 8,000, 3,600, 147,500, 2,400 and 2,000 shares subject to options, respectively, for the persons named in the above table, which are exercisable within 60 days of the record date. |

| (3) | | The address of Dimensional Fund Advisors Inc. is 1299 Ocean Avenue, 11th Floor, Santa Monica, CA 90401. The information set forth herein has been compiled from filings made with the SEC on Schedule 13G filed on February 9, 2005. |

| (4) | | The address of Wellington Management Company, LLP is 75 State Street, Boston, MA, 02109. The information set forth herein has been compiled from filings made with the SEC on Schedule 13G filed on February 14, 2005. |

| (5) | | The address of HYMF Limited is Walker House Mary Street, P.O. Box 908 GT, George Town, Grand Cayman, Cayman Islands. The shares are held in trust accounts for the economic benefit of Barclays Global Investor, NA, Barclay’s Global Fund Advisors, and Palomino Limited. The information set forth herein has been compiled from filings made with the SEC on Schedule 13G filed on February 15, 2005. |

| (6) | | Includes 1,211,334 shares subject to options for all officers and directors as a group which are, or will become exercisable within 60 days of the record date and 300,000 shares of restricted stock which vest ten years from the effective date of grant. |

9

EXECUTIVE COMPENSATION

The following table sets forth in summary, compensation paid by the Company and its subsidiaries for the year ended December 31, 2004 to its CEO and its other most highly compensated executive officers whose cash compensation exceeded $100,000:

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | |

| | | Annual Compensation

| | Long Term

Compensation Awards

| | |

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus ($)(1)

| | Other Annual

Compen- sation ($)

| | Securities

Underlying

Options (#)

| | Restricted

Stock

Awards

SARS ($)

| | All Other

Compen- sation ($)

|

Tilman J. Fertitta, (2) President and Chief Executive Officer | | 2004

2003

2002 | | 1,300,000

1,250,000

950,000 | | 1,825,000

1,750,000

1,350,000 | | 161,891

195,967

76,110 | | 250,000

0

300,000 | | 2,954,000

1,993,000

— | | 286,680

283,680

— |

| | | | | | | |

Steven L. Scheinthal, (3) Executive Vice President, Secretary & General Counsel | | 2004

2003

2002 | | 315,000

305,000

295,000 | | 425,000

410,000

340,000 | | —

—

— | | 40,000

0

50,000 | | —

—

— | | 34,350

7,450

— |

| | | | | | | |

Richard E. Ervin, (3) Executive Vice President of Restaurant Operations | | 2004

2003

2002 | | 250,000

240,000

225,000 | | 300,000

290,000

240,000 | | —

—

— | | 25,000

0

37,500 | | —

—

— | | 9,735

3,245

— |

| | | | | | | |

Richard H. Liem, (3) Senior Vice President of Finance and Chief Financial Officer | | 2004

2003

2002 | | 185,000

160,000

154,500 | | 190,000

45,000

35,000 | | —

—

— | | 25,000

0

0 | | —

—

— | | 16,663

1,455

— |

| | | | | | | |

Paul S. West, (4) Former Chief Financial Officer | | 2004

2003

2002 | | 139,000

300,000

290,000 | | 0

400,000

330,000 | | —

—

— | | 0

0

50,000 | | —

—

— | | 5,530

2,765

— |

| (1) | | Bonuses were paid in the year following the date indicated in the table to reflect accomplishments in the year indicated. |

| (2) | | “Other Annual Compensation” for 2004 and 2003 includes $95,376 and $100,740, respectively for administrative services and for 2002 includes $28,724 for medical reimbursement and $21,844 for administrative services. “All Other Compensation” for 2004 and 2003 includes $283,680 each year for annual life insurance payments. In addition, “All Other Compensation” for 2004 includes the Company’s contribution under its deferred compensation plan for 2004 in the amount of $3,000, which amount was paid in 2005. The aggregate value of the 200,000 restricted stock holdings at the end of the last completed fiscal year was $5,812,000. Dividends will be paid on the restricted stock. |

| (3) | | These executive officers received personal benefits in addition to salary. However, the Company has concluded that the aggregate amount of such personal benefits do not exceed the lesser of $50,000 or 10% of annual salary and bonus reported for each such executive. “All Other Compensation” for 2004 and 2003 is for annual life insurance payments. In addition, “All Other Compensation” for 2004 includes the Company’s contribution in the amount of $12,000 and $12,298, respectively for Mr. Scheinthal and Mr. Liem under the Company’s deferred compensation plan for 2004, which amounts were paid in 2005. |

| (4) | | Mr. West resigned his position on June 4, 2004. “All Other Compensation” for 2004 and 2003 is for annual life insurance payments. |

10

The following table provides details regarding stock options granted in 2004 to executive officers named in the Summary Compensation Table. In addition, in accordance with SEC rules, the hypothetical gains are shown that would exist for the respective options based on assumed rates of annual compounded growth in the stock price of 5% and 10% from the date the options were granted over the full option term. The actual value, if any, an executive may realize will depend on the spread between the market price and the exercise price on the date the options are exercised. No stock options were granted to executive officers last year.

OPTION GRANTS IN THE LAST FISCAL YEAR

| | | | | | | | | | | | | |

| | | Individual Grants

| | | | |

Name

| | No. of

Securities

Underlying

Options

Granted in

2004

| | % of Total

Options

Granted

to all

Employees

in 2004

| | | Exercise

Price ($/Share)

| | Expiration Date

| | Potential Realizable Value

at Assumed Annual Rates

of Stock Price Appreciation

for Option Term ($)

|

| | | | | | 5%

| | 10%

|

Tilman J. Fertitta | | 250,000 | | 50 | % | | 27.50 | | 6/8/14 | | 4,325,000 | | 10,957,500 |

Steven L. Scheinthal | | 40,000 | | 8 | % | | 27.50 | | 6/8/14 | | 692,000 | | 1,753,200 |

Richard H Liem | | 25,000 | | 5 | % | | 27.50 | | 6/8/14 | | 432,500 | | 1,095,750 |

Richard E. Ervin | | 25,000 | | 5 | % | | 27.50 | | 6/8/14 | | 432,500 | | 1,095,750 |

AGGREGATED OPTION EXERCISES IN LAST FISCAL

YEAR AND FY-END OPTION VALUES

| | | | | | | | |

Name

| | Shares

Acquired

on Exercise (#)

| | Value Realized ($)

| | Number of Securities

Underlying Unexercised

Options at Fiscal Year End (#)

Exercisable/Unexercisable

| | Value of Unexercised In-The-Money Options at

Fiscal Year-End ($) (1) Exercisable/Unexercisable

|

Tilman J. Fertitta. | | 0 | | 0 | | 1,400,000/250,000 | | 22,799,000/390,000 |

Steven L. Scheinthal | | 10,000 | | 208,000 | | 131,500/100,000 | | 2,687,390/1,026,000 |

Richard E. Ervin | | 0 | | 0 | | 127,500/70,000 | | 2,673,900/761,700 |

Richard H. Liem | | 8,000 | | 152,000 | | 8,000/25,000 | | 176,480/39,000 |

| (1) | | The values were determined on the basis of the closing Common Stock price of $29.06 on December 31, 2004 (the last trading day of the year), and equals the aggregate amount by which the market value of the option shares exceeded the exercise price of outstanding options. |

COMPENSATION OF DIRECTORS

Directors of the Company who are not executive officers received Director’s fees of $36,000 for 2004, plus the expenses incurred by them on behalf of the Company. Non-Employee Directors also receive $1,000 for each Audit, Compensation/Stock Option and Nominating and Corporate Governance Committee meeting, as well as other executive committees they attend, plus $5,000 a month for service on the Executive Committee. During 2004, Mr. Taylor, was the only Non-Employee Director on the Executive Committee and received $60,000 for his services, which also included compensation for service on the Development and Building Committees which were terminated in 2004. Each current Non-Employee Director has received stock options to acquire shares of Common Stock under the Company’s Non-Qualified Formula Stock Option Plan for Non-Employee Directors (the “Non-Employee Director’s Plan”). The Non-Employee Director’s Plan provides for the granting of non-qualified stock options to Non-Employee Directors of the Company. Pursuant to the Non-Employee Director’s Plan, 80,000 shares of Common Stock are reserved for issuance to eligible Non-Employee Directors of the Company or its subsidiaries. The Non-Employee Director’s Plan is administered by the President of the Company and requires that the purchase price under each option must not be less than 100% of the fair market

11

value (as defined in the Non-Employee Director’s Plan) of the Common Stock at the time of the grant of the option. Full payment for shares purchased upon exercise of an option must be made at the time of exercise and no shares may be issued until full payment is made. Options granted pursuant to the Non-Employee Director’s Plan generally vest in five installments beginning no earlier than the first anniversary of the date of grant, and the options expire ten years from the grant date. The Non-Employee Director’s Plan provides that an option agreement may include a provision for permitting an optionee the right to deliver previously owned shares of Common Stock in partial or full payment for shares to be purchased upon exercise of an option. In 1995, the Non-Employee Director’s Plan was amended to provide that each Non-Employee Director would receive an additional option in the amount of 2,000 shares each time such person was re-elected for an additional term as a director. Pursuant to the Non-Employee Director’s Plan, each Non-Employee Director receives an option to purchase 10,000 shares of Common Stock upon their initial appointment to the Board. Mr. Brimmer was awarded 10,000 shares upon his election to the Board of Directors on June 8, 2004 at a strike price of $27.50 per share. On June 8, 2004, all persons who were Non-Employee Directors at that time received options to acquire 2,000 shares each at a price of $27.50 per share as a result of their re-election to the Board. In 2004, in connection with their positions as Director as well as their functions as members of Committees of Non-Employee Directors, Messrs. Taylor, Richmond, Chadwick and Brimmer were paid $103,000, $41,000, $41,000, and $23,000, respectively.

COMPENSATION/STOCK OPTION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

In August 1993, the Board of Directors established a Compensation/Stock Option Committee to review and approve the compensation levels of members of management, evaluate the performance of management, consider management succession and consider any related matters for the Company. The Committee is charged with reviewing with the Board of Directors in detail all aspects of compensation for the Company’s executive officers.

The philosophy of the Company’s compensation program is to employ, retain and reward executives capable of leading the Company in achieving the Company’s business objectives. These objectives include creating and preserving strong financial performance, increasing the Company’s assets, positioning the Company’s assets and business operations in geographic markets and industry segments offering long-term growth opportunities, enhancing stockholder value, and ensuring the Company’s survival. The Committee measures the accomplishment of these objectives against conditions prevalent in the industry within which the Company operates. In recent years, these conditions reflect a highly competitive market environment.

The available forms of executive compensation include base salary, cash bonus awards, stock grants and stock options. Each component is intended to serve the Compensation/Stock Option Committee’s philosophy; however, performance of the Company is a key consideration. The Company’s compensation policy recognizes, however, that stock price performance is only one measure of performance and, given industry business conditions and the Company’s long term strategic direction and goals, it may not necessarily be the best current measure of executive performance. Therefore, the Company’s compensation policy also gives consideration to the achievement of specified business objectives when determining executive officer compensation. An additional objective of the Compensation/Stock Option Committee has been to reward executive officers with equity compensation in addition to salary in keeping with its overall compensation philosophy, which attempts to place equity in the hands of its key employees in an effort to further instill stockholder considerations and values in the actions of all the key employees and executive officers. In 2004, the Committee also reviewed the base salary and bonus recommendation made by the CEO based upon his assessment of the performance of individual executive officers and his assessment of each of the Company’s executive officer’s past performance and expectations as to future contributions.

In furtherance of the Company’s compensation philosophy and goal of employing, retaining and rewarding its executives who have demonstrated a desire and ability to lead the Company in the pursuit of its business objectives, in 2003 the Company entered into a Personal Service and Employment Agreement with the CEO. Prior to entering into the employment agreement, the Committee hired a compensation consultant to advise it

12

concerning the appropriate compensation and perquisites, including long term compensation that should be paid to the CEO. The employment agreement, which is discussed in more detail below, became effective as of January 1, 2003 and terminates on December 31, 2008. The employment agreement establishes the framework for the initial base salary payable to the CEO and further provides for additional bonus awards under any bonus programs established by the Company and/or, based upon merit and the Company’s performance and provides a range of bonus awards from the Compensation/Stock Option Committee. The employment agreement also provides for certain additional executive benefits and perquisites to be provided to the CEO.

The employment agreement established the initial salary payable in 2003 for the CEO and a minimum base salary for 2004. In establishing the salary payable to the CEO for 2004, the Compensation/Stock Option Committee considered a number of factors. The general considerations included a review and evaluation of the compensation and salary levels for similar level executives for other comparable companies, the achievement of specified business objectives during the prior fiscal year including progress made by the Company in improving revenues, income and operating cash flows, and progress made by the Company in development and improvements in customer satisfaction. The stock grant and stock options were awarded to the CEO in accordance with the terms of his employment agreement. In determining the cash bonus awarded to the CEO, the Compensation/Stock Option Committee took into account the performance of the Company’s common stock, its increased revenues and earnings, the restructuring of the Company outstanding debt and the exceptional performance required to develop significant projects in Texas and around the country.

Section 162(m) of the Internal Revenue Code generally denies a deduction to any publicly held corporation for compensation paid in a taxable year to the Company’s CEO and four other highest compensated officers to the extent that the officer’s compensation (other than qualified performance-based compensation) exceeds $1 million. The Compensation/Stock Option Committee does not intend to be limited in awarding executive compensation that meets the Section 162(m) deductibility requirements and has not structured the CEO’s bonus to satisfy Section 162(m). The Compensation/Stock Option Committee will exercise its discretion to award non-deductible compensation when it considers it in the best interests of the Company and stockholders to do so.

COMPENSATION/STOCK OPTION COMMITTEE

Joe Max Taylor, Chairman

Michael Richmond

Michael S. Chadwick

COMPENSATION/STOCK OPTION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

No member of the Compensation/Stock Option Committee is or has been an officer or employee of the Company or any of the Company’s subsidiaries. The members of the Compensation/Stock Option Committee had no other relationships with the Company requiring disclosure pursuant to Item 404 of SEC Regulation S-K. No executive officer of the Company served as a member of the Compensation/Stock Option Committee (or other Board committee performing similar functions or, in the absence of any such committee, the entire Board of Directors) of another corporation whose executive officer served on the Compensation/Stock Option Committee. No executive officer of the Company served as a director of another corporation whose executive officers served on the Compensation/Stock Option Committee. No executive officer of the Company served as a member of the Compensation/Stock Option Committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire Board of Directors) of another corporation an executive officers of which served as a director of the Company.

EMPLOYMENT CONTRACTS AND CHANGE-IN-CONTROL ARRANGEMENTS

Effective January 1, 2003, the Company entered into a Personal Service and Employment Agreement with the CEO that set forth the general terms and conditions of his employment for the term commencing January 1, 2003. The contract expires in 2008.

13

Pursuant to the terms and provisions of the Personal Service and Employment Agreement between the Company and Mr. Fertitta (the “CEO’s Agreement”), Mr. Fertitta agreed to serve as President and Chief Executive Officer of the Company through December 31, 2008. The CEO’s Agreement provides that Mr. Fertitta would devote substantially all of his time and attention to the business and affairs of the Company and will receive, among other things, an annual base salary in an amount not less than $1,250,000 and annual cash bonuses in amounts determined by the Compensation/Stock Option Committee. In addition, Mr. Fertitta was granted the right to receive stock options covering at least 800,000 shares, although only 250,000 options were granted in 2004, and 500,000 shares of restricted stock, to be issued in the amount of 100,000 shares a year over the term of the CEO Agreement. 100,000 shares of restricted stock were issued in 2004 to Mr. Fertitta. None of the restricted stock will vest until approximately 10 years from the effective date of the grant. Mr. Fertitta is also entitled to a life insurance policy and certain other benefits and perquisites, including use of a Company automobile and airplane, certain memberships, and matching charitable contributions.

In the event Mr. Fertitta’s employment is terminated as a result of his death or disability (as defined in the CEO’s Agreement), he, or his legal representative, is entitled to receive all compensation he would otherwise have been entitled to receive throughout the remaining term of the employment period as well as other death or disability benefits provided by the Company. In addition, any stock options or restricted stock immediately vest. In the event Mr. Fertitta’s employment is terminated (i) by him other than for good reason, or (ii) by the Company for cause, Mr. Fertitta will receive all accrued compensation and other amounts owed to him as of the date of termination. In the event Mr. Fertitta’s employment is terminated (i) by the Company other than for cause, (ii) by Mr. Fertitta for good reason or (iii) after a change in control, Mr. Fertitta is entitled to receive, among other things, (a) a lump sum payment of $5,000,000 in consideration of his agreement not to compete with the Company, (b) an amount equal to three times 180% of his base salary, (c) an additional lump sum payment necessary to pay the life insurance policy, and (d) a continuation of certain other employee benefits.

14

PERFORMANCE GRAPH

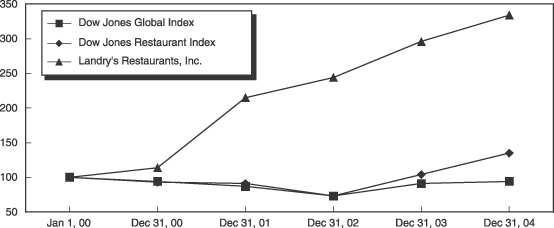

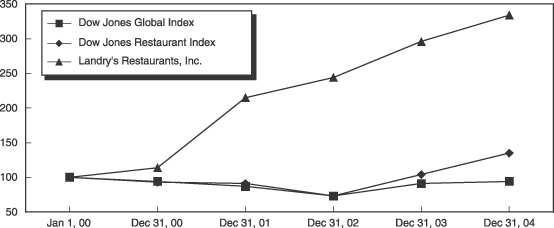

Comparison of Five-Year Cumulative Total Return Among

Landry’s Restaurants, Inc., Dow Jones Global Index

And Dow Jones Restaurant Index

| | | | | | | | | | | | |

| | | 1/1/00

| | 12/31/00

| | 12/31/01

| | 12/31/02

| | 12/31/03

| | 12/31/04

|

Dow Jones Global Index | | 100 | | 94 | | 87 | | 73 | | 91 | | 94 |

Dow Jones Restaurant Index | | 100 | | 93 | | 91 | | 73 | | 104 | | 135 |

Landry’s Restaurants, Inc. | | 100 | | 114 | | 215 | | 244 | | 296 | | 334 |

CERTAIN TRANSACTIONS

The Company’s policy is, to the extent practicable, to avoid transactions (except those which are employment related) with officers, directors, and affiliates. In any event, any such transactions will be entered into on terms no less favorable to the Company than could be obtained from third parties, and such transactions will be approved by a majority of the Company’s disinterested directors.

In 2003, the Company entered into a Management Agreement (the “Agreement”) with Fertitta Hospitality, L.L.C. (“Fertitta Hospitality”), which is jointly owned by the Chairman and Chief Executive Officer of the Company and his wife. Pursuant to the Agreement, the Company provides services to Fertitta Hospitality with respect to management and operational matters, administrative, personnel and transportation matters and receives a fee of $7,500 a month, plus reimbursement of expenses. The Management Agreement provides for a renewable three year term. The terms of the Management Agreement were approved by the Non-Employee Directors, who received an opinion of an independent consultant that the economic and non-economic terms of the Management Agreement was a fair-market transaction.

In 1999, the Company entered into a ground lease agreement with 610 Loop Venture, LLC, a company wholly-owned by the Chairman and Chief Executive Officer of the Company, on land adjacent to the Company’s corporate headquarters. The ground lease was for a term of five years with one option renewal period. Under the terms of the ground lease, 610 Loop Venture pays the Company base rent of $12,000 per month plus pro-rata real property taxes and insurance. 610 Loop Venture also has the option to purchase certain property based upon an appraised or predetermined value. In 2004, the ground lease agreement was extended for another five (5) years.

In 2002, in connection with the construction of a Rainforest Cafe restaurant on a prime tract of waterfront property in Galveston, Texas, the Company entered into a 20-year, with option renewals, ground lease agreement with Fertitta Hospitality having a base rent of $96,000 per year. Pursuant to the terms of the lease, the annual rent

15

is equal to the greater of the base rent or sliding scale percentage rent from four to six percent of restaurant revenues, plus real property taxes and insurance. The terms of the lease were approved by the Non-Employee Directors, who received the opinion of an independent real estate firm that the economic and non-economic terms of the lease was a fair-market transaction. In 2004, the Company paid total base and percentage rent in the amount of $514,000.

As permitted by the employment contract between the Company and the CEO, the Company made a charitable contribution in the amount of $146,000 to a charitable foundation that the CEO served as trustee in 2004.

On a routine basis the Company holds or hosts promotional events, training seminars and conferences for the Company’s personnel. In connection therewith, in 2004, the Company incurred expenses in the amount of $68,000 at resort hotel properties owned by the Company’s CEO and to which the Company provides management services. The amount that the Company paid is below the amount that would have been paid by an unaffiliated third party.

The Company jointly sponsor events and promotional activities which result in shared costs and use of the Company’s personnel or Fertitta Hospitality employees and assets.

The above agreements were entered into between related parties and was not the result of arm’s-length negotiations. Accordingly, the terms of each transaction may have been more or less favorable to the Company than might have been obtained from unaffiliated third parties. The Company believes that the terms of each transaction were at least as favorable to the Company as that which could have been obtained in arm’s-length transactions with an unaffiliated party.

REPORT OF THE AUDIT COMMITTEE

FOR THE YEAR ENDED DECEMBER 31, 2004

The Audit Committee is composed of three Non-Employee Directors and acts under a written charter adopted by the Board of Directors. The Audit Committee has the sole responsibility for the appointment and retention of the Company’s independent auditors and the approval of all audit and engagement fees. The Audit Committee meets periodically with management, the internal auditors and the independent auditors regarding accounting policies and procedures, audit results and internal accounting controls. The internal auditors and the independent auditors have free access to the Audit Committee, without management’s presence to discuss the scope and results of their audit work. The Company’s management is primarily responsible for Company’s financial statements and the quality and integrity of the reporting process, including establishing and maintaining the systems of internal controls over financial reporting and assessing the effectiveness of those controls. The independent auditors, Grant Thornton LLP (“GT”), are responsible for auditing those financial statements and internal controls over financial reporting in accordance with the standards of the Public Company Accounting Oversight Board (United States) and for expressing an opinion on the conformity of the financial statements with accounting principles generally accepted in the United States as well as reporting on the effectiveness of the Company’s internal controls over financial reporting. On behalf of the Board of Directors, the Audit Committee monitors the Company’s financial reporting processes and systems of internal control, the independence and the performance of the independent accountants, and the performance of the internal auditors.

Management has represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the Audit Committee has reviewed and discussed the consolidated financial statements with management and the independent accountants. The Audit Committee has discussed with the independent accountants their evaluation of the accounting principles, practices and judgments applied by management, and the Audit Committee has discussed any items required to be communicated to it by the independent accountants in accordance with standards established by the American Institute of Certified Public Accountants.

16

In fulfilling its oversight responsibilities, the Audit Committee has reviewed and discussed the audited financial statements for the year ended December 31, 2004, and matters related to Section 404 of the Sarbanes-Oxley Act of 2002 with the Company’s management and representatives of GT. The Audit Committee discussed with GT the matters required to be discussed by Statement on Auditing Standards No. 61,Communication with Audit Committees, as amended. In addition, the Audit Committee discussed with GT their independence from the Company and its management, including the matters in the written disclosures required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees,and has received from GT the written disclosure required by Standard No. 1.

During 2004, management completed the documentation, testing and evaluation of the Company’s internal controls over financial reporting. The Audit Committee was kept apprised of the progress of the evaluation and provided oversight and advice to management during this process. In connection with this oversight, the Audit Committee received periodic updates provided by management and GT. In addition, management provided the Audit Committee with, and the Audit Committee reviewed, a report on the effectiveness of the Company’s internal control over financial reporting.

Based on the reviews and discussions described above, the Audit Committee has recommended to the Company’s Board of Directors that the Company’s audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2004.

The Audit Committee has again retained GT as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2005. A representative of GT will be present at the annual meeting. The representative will be given an opportunity to make a statement, if he or she desires to do so, and to respond to appropriate questions.

Audit Fees

During the year ended December 31, 2004, the aggregate fees billed by GT for the audit of the Company’s financial statements for such year and for the reviews of the Company’s interim financial statements were $784,374.

During the year ended December 31, 2003, Ernst & Young, LLP (“E&Y”) served as the Company’s independent auditors. The aggregate fees billed by E&Y for the audit of the Company’s financial statements for such year and for the reviews of the Company’s interim financial statements were $596,300.

Audit-Related Fees

The Company paid Audit-Related Fees for fiscal year ended December 31, 2004 for assurance and related services rendered by GT that are reasonably related to the performance of the audit or review of the Company’s financial statements but not reportable as Audit Fees in the amount of $64,535.

The Company did not pay any Audit-Related Fees for fiscal year ended December 31, 2003 for assurance and related services rendered by E&Y that are reasonably related to the performance of the audit or review of the Company’s financial statements but not reportable as Audit Fees.

Tax Fees

Prior to their retention as the Company’s independent registered public accounting firm, the Company incurred $62,965 in fees for professional services rendered by GT for tax compliance, tax advice and tax planning relating to certain state and sales tax liabilities during the fiscal year ended December 31, 2004. A portion of said amount, $50,965, was related to a contingent fee arrangement.

17

The Company did not pay any fees for professional services rendered by E&Y for tax compliance, tax advice and tax planning for the fiscal year ended December 31, 2003.

All Other Fees

The aggregate fees billed for services rendered by GT not reportable as Audit Fees, Audit-Related Fees or Tax Fees for the fiscal year ended December 31, 2004 were $0.

The aggregate fees billed for services rendered by E&Y not reportable as Audit Fees, Audit-Related Fees or Tax Fees for the fiscal year ended December 31, 2003 were $215,501. All other fees in 2003 primarily relate to non-recurring expert testimony services.

Audit Committee Pre-Approval Policies and Procedures

The Audit Committee annually reviews and pre-approves the audit, review, attest and permitted non-audit services to be provided during the next audit cycle by the independent registered public accounting firm. To the extent practicable, at the same meeting the Audit Committee also reviews and approves a budget for each of such services. Services proposed to be provided by the independent registered public accounting firm that have not been pre-approved during the annual review and the fees for such proposed services must be pre-approved by the Audit Committee. Additionally, fees for previously approved services that are expected to exceed the previously approved budget must also be approved by the Audit Committee.

All requests or applications for the independent registered public accounting firm to provide services to the Company must be submitted to the Audit Committee by the independent registered public accounting firm and management and state as to whether, in their view, the request or application is consistent with applicable laws, rules and regulations relating to independent registered public accounting firm independence. In the event that any member of management or the independent registered public accounting firm becomes aware that any services are being, or have been, provided by the independent registered public accounting firm to the Company without the requisite pre-approval, such individual must immediately notify the Chief Financial Officer, who must promptly notify the Chairman of the Audit Committee and appropriate management so that prompt action may be taken to the extent deemed necessary or advisable.

All of the services provided by the Company’s independent registered public accounting firm during 2003 and 2004 were pre-approved by the Audit Committee.

Submitted by the Audit Committee:

Michael S. Chadwick, Chairman

Michael Richmond

Kenneth Brimmer

PRIOR AUDITORS

On April 30, 2004, E&Y was dismissed as independent registered public accountants for the Company, effective upon that date, and on May 3, 2004, GT was appointed as the new independent registered public accountants for the Company to replace E&Y for the fiscal year ending December 31, 2004. The decision to dismiss E&Y and to appoint GT was recommended by the Audit Committee of the Company’s Board of Directors and was approved by the Company’s Board of Directors. The decision to dismiss E&Y was the result of the Company’s and E&Y’s conclusion to discontinue the client-auditor relationship.

E&Y’s reports on the Company’s financial statements for the past two fiscal years did not contain an adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles.

18

The Company has had no disagreements with its accountants on any accounting or financial disclosures, or auditing scope or procedure.

STOCKHOLDER PROPOSALS

Any stockholder who intends to present a proposal at the 2006 Annual Meeting of Stockholders for inclusion in the proxy statement and form of proxy relating to that meeting is advised that the proposal must be received by the Company at the Company’s principal executive offices not later than January 5, 2006. The Company will not be required to include in its proxy statement or form of proxy a stockholder proposal which is received after that date or which otherwise fails to meet requirements for stockholder proposals established by regulations of the Securities and Exchange Commission. The persons named in the Company’s form of proxy for the 2006 Annual Meeting of Stockholders will have discretionary authority to vote any proxies they hold at such meeting on any matter for which the Company does not receive notice by 45 days prior to the date this proxy is mailed even though there is no description of the proposal in the proxy statement.

If the date of the 2006 Annual Meeting of Stockholders is changed by more than 30 days from the date of the 2005 Annual Meeting of Stockholders:

| | • | | The deadline for submitting proposals is a reasonable time before the Company begins to print and mail its proxy materials for its 2006 Annual Meeting of Stockholders, and |

| | • | | The persons named in the Company’s form of proxy for the 2006 Annual Meeting of Stockholders will be able to exercise discretionary authority if notice of the matter has not been received in an reasonable time before the Company mails its proxy materials for the 2006 Annual Meeting of Stockholders. |

CORPORATE GOVERNANCE

The Company is committed to good corporate governance. The Company’s corporate governance is founded on a commitment to its stockholders’ interests and compliance with the corporate governance rules promulgated by the New York Stock Exchange and the Securities and Exchange Commission. In compliance with SEC and NYSE rules, the Board has adopted Corporate Governance Guidelines that govern the function and operation of the Company’s Board of Directors, including the qualification and independence standards for Board members. In addition, the Board of Directors has drafted Board Committee Charters and Code of Ethics to comply with the new strictures of the SEC and NYSE. The Company’s Corporate Governance Guidelines, Committee Charters and Code of Ethics may be found on its website atwww.LandrysRestaurants.com and can also be obtained by directing a written request to Steven L. Scheinthal, Secretary, Landry’s Restaurants, Inc., 1510 West Loop South, Houston, Texas 77027.

FORM 10-K

The Company will furnish without charge to each person whose proxy is being solicited, upon request of any such person, a copy of its Annual Report on Form 10-K for the fiscal year ended December 31, 2004 as filed with the Securities and Exchange Commission, including the financial statements and schedules thereto, but not the exhibits. Requests for copies of such report should be directed to Steven L. Scheinthal, Secretary, Landry’s Restaurants, Inc., 1510 West Loop South, Houston, Texas 77027. Copies of any exhibit to the Form 10-K will be forwarded upon receipt of a written request therefor addressed to Mr. Scheinthal.

19

EACH STOCKHOLDER WHO DOES NOT EXPECT TO ATTEND THE ANNUAL MEETING IN PERSON IS URGED TO EXECUTE THE PROXY CARD AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE.

By Order of the Board of Directors,

Steven L. Scheinthal,

Secretary

May 4, 2005

20

LANDRY’S RESTAURANTS, INC.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

Tilman J. Fertitta and Steven L. Scheinthal or either of them, with power of substitution of each, are hereby authorized to represent the undersigned at the Annual Meeting of Stockholders of Landry’s Restaurants, Inc., to be held at the Downtown Aquarium, 410 Bagby Street., Houston, Texas, on June 2, 2005, at 11:00 a.m., and any adjournment or adjournments thereof, and to vote the number of shares which the undersigned would be entitled to vote if personally present.

To vote in accordance with the Board of Directors’ recommendations, just sign the reverse side; no boxes need be checked.

(Continued and to be signed on reverse side)

Please date, sign and mail your proxy card back as soon as possible!

Annual Meeting of Stockholders

LANDRY’S RESTAURANTS, INC.

June 2, 2005

Please Detach and Mail in the Envelope Provided

x Please mark your votes as in this example.

| | |

1. Election of Directors: | | |

| |

| FOR ALL NOMINEES | | WITHHOLD AUTHORITY TO VOTE FOR |

| | | ALL NOMINEES LISTED BELOW |

| ¨ | | ¨ |

| |

Nominees: Tilman J. Fertitta | | |

Steven L. Scheinthal | | |

Michael S. Chadwick | | |

Michael Richmond | | |

Joe Max Taylor | | |

Kenneth Brimmer | | |

(INSTRUCTION: To withhold authority to vote for any individual nominee, strike a line through the nominee’s name in the list above)

| 2. | | In their discretion, upon such other matters as properly come before the meeting. |

When properly executed, this proxy will be voted as designated hereon by the undersigned. If no choice is specified, the proxy will be voted “FOR” the election of all nominees for Director listed hereon and, according to the discretion of the proxy holders, on any other matters that may properly come before the Annual Meeting or any and all postponements or adjournments thereof.

PLEASE DO NOT FOLD OR MUTILATE THIS CARD

NOTE: Please sign exactly as your name appears on this card. On joint accounts, each joint holder should sign. When signing as attorney, executor, administrator, trustee or guardian, please give your full title as such. If a corporation, please sign in full corporate name by President or other authorized person. If a partnership, please sign in partnership name by authorized person.

Please mark, sign, date and return this proxy card promptly using the enclosed envelope.

| | |

| SIGNATURE | | DATE , 2005 |

| |

| SIGNATURE | | DATE , 2005 |