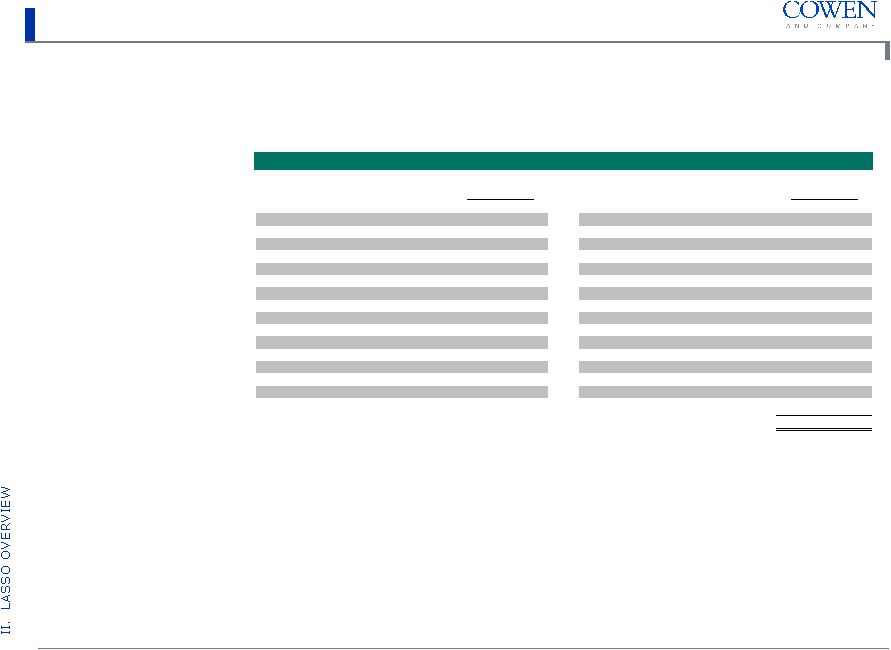

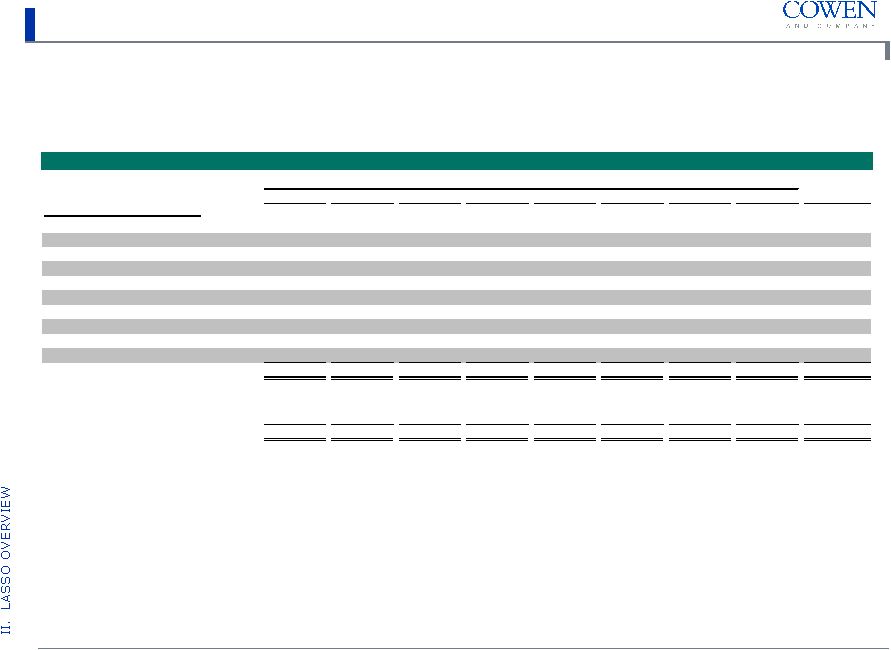

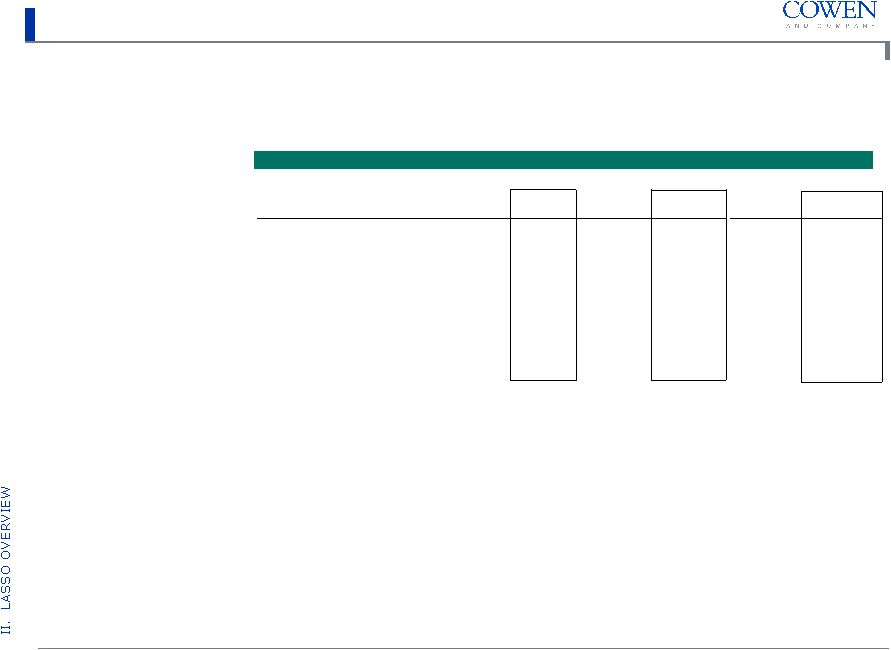

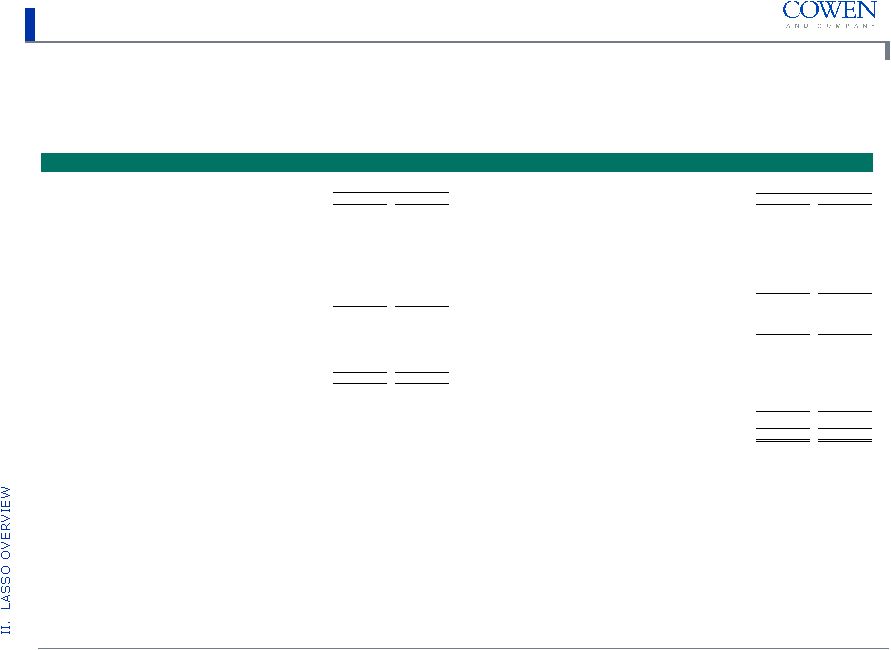

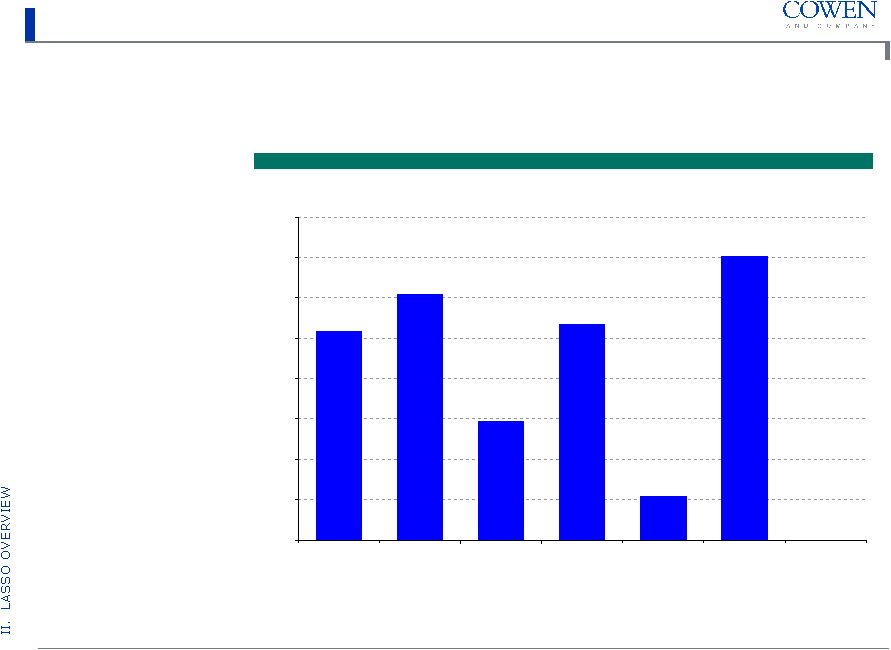

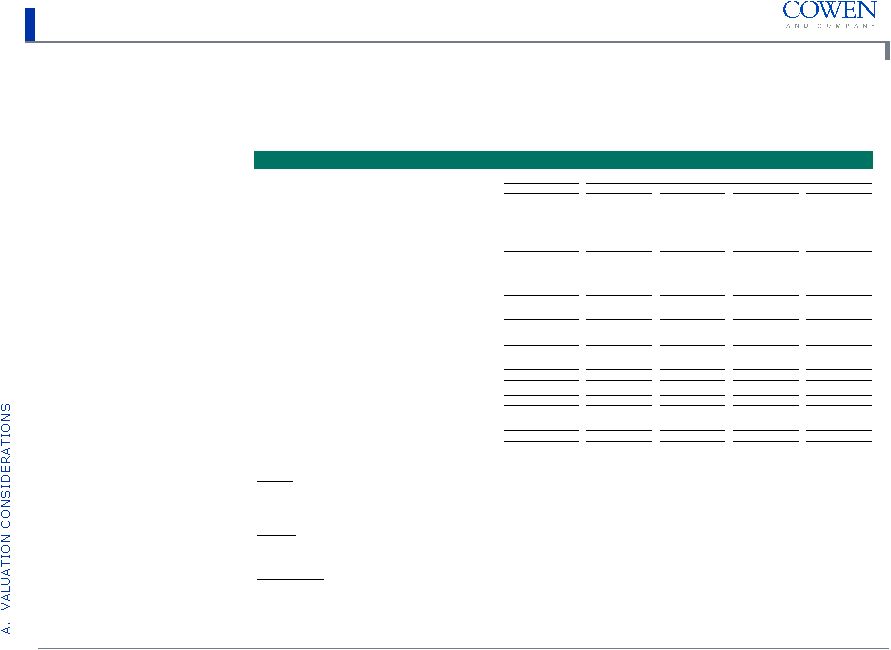

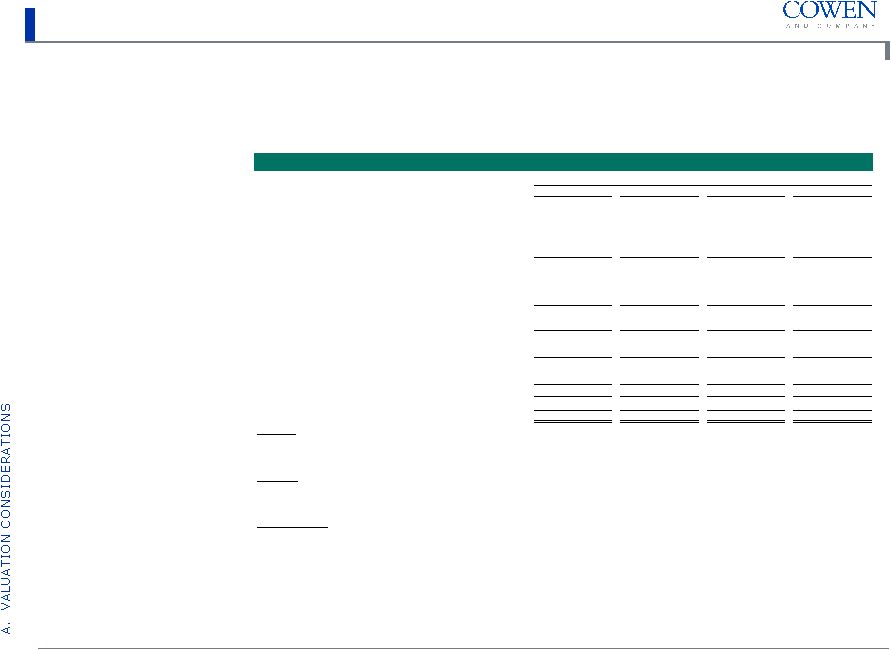

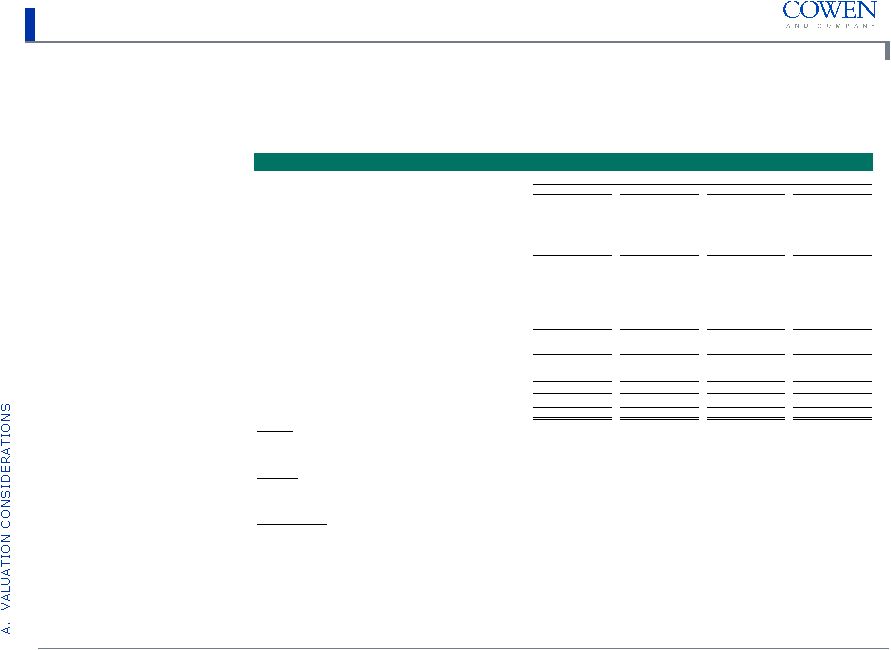

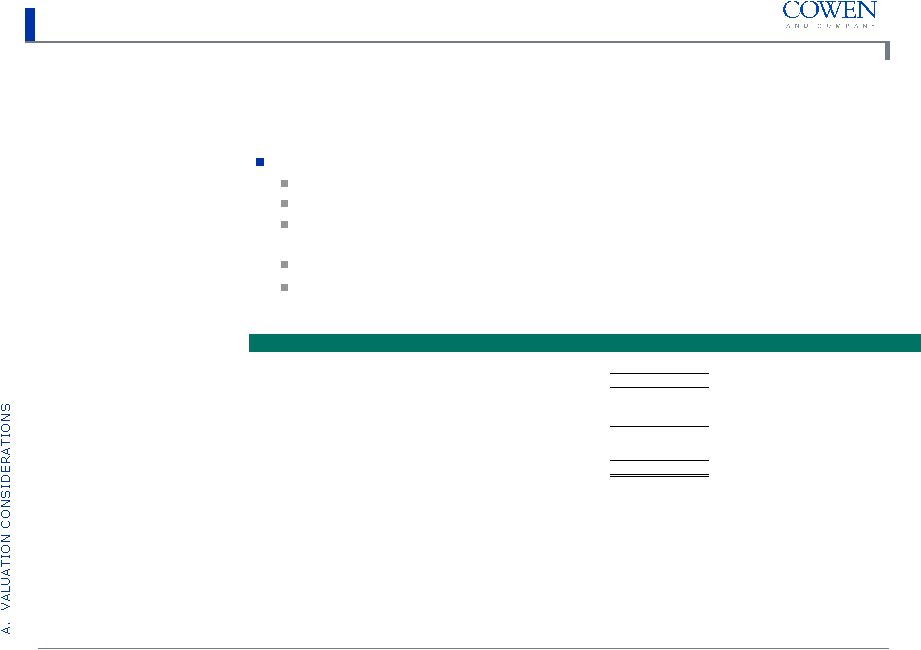

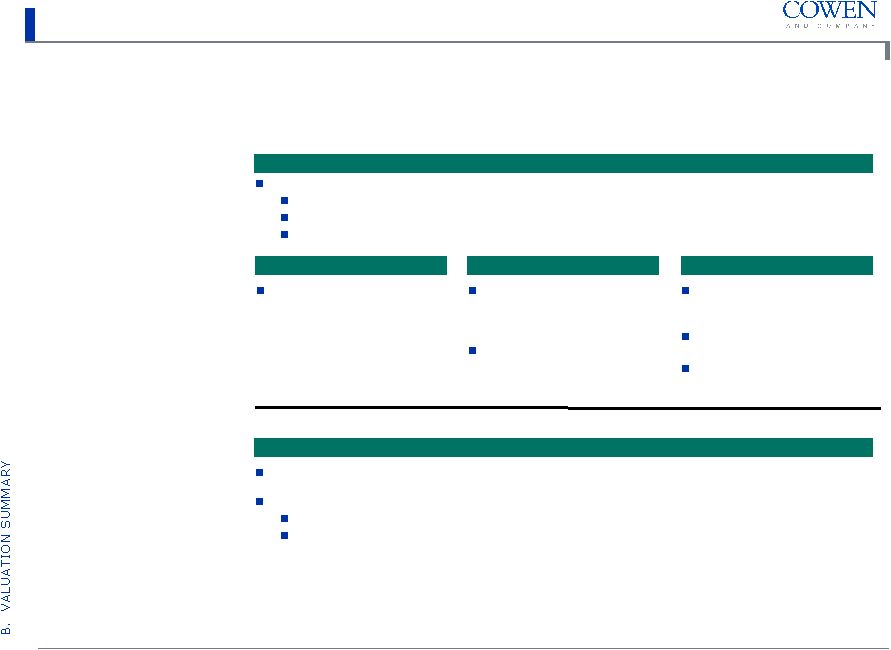

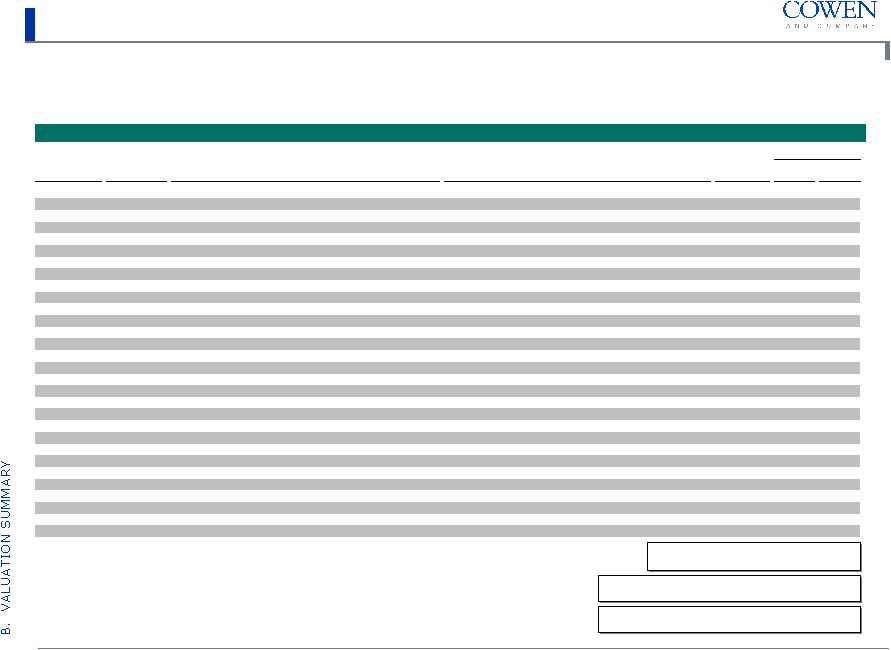

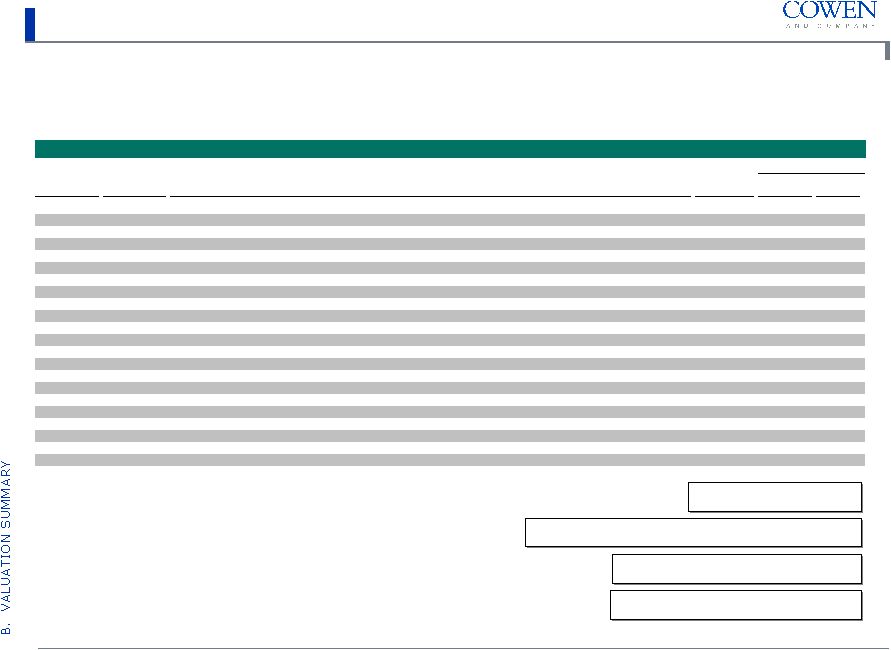

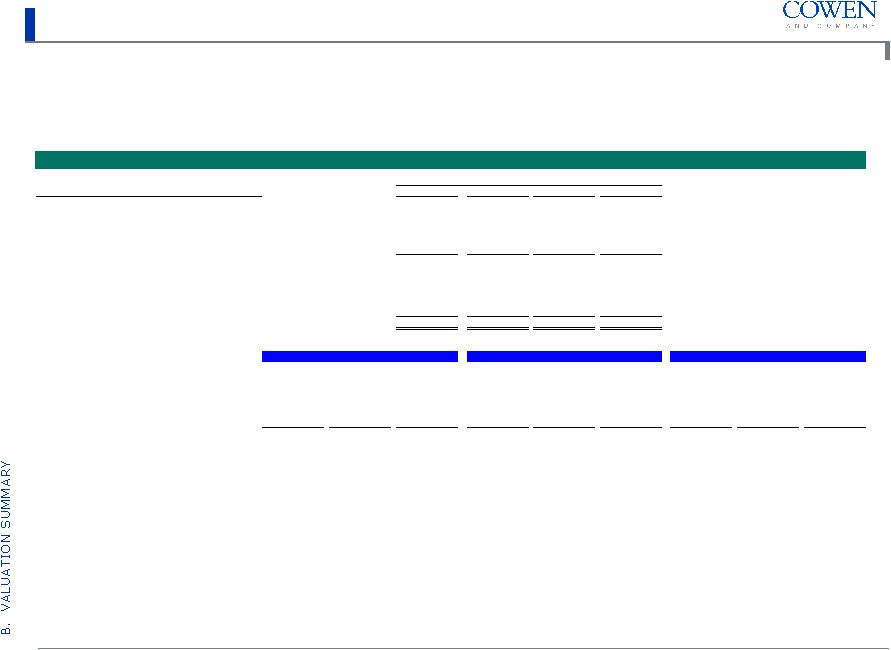

20 PROJECT LASSO Research Analyst Comments Rating EPS BB&T Barry Stouffer May 12, 2008 Investors should note that the range of possible results next year is "wide enough to drive a truck through." (March 12, 2008) In our view, Lasso has taken a lack of transparency to new heights, making earnings forecasting more challenging. The lack of unit growth means that EPS will be highly sensitive to changes in comps and margins. We believe this variability will be exacerbated going forward by the Q307 repurchase of roughly 20% of the outstanding stock and given that interest expense will consume about 70% of FY08 operating income in our revised EPS model. (November 14, 2007) We believe a credible argument could be made that Lasso should trade on the lower en of the industry range based on several factors, including a high degree of leverage, lack of transparency with respect to the performance of the company's various operations, well below-average historical return on assets, limited EPS momentum and poor earnings visibility. (November 14, 2007) Hold 2008E – $1.02 2008E (prior) – $1.15 2008E (prior) – $1.27 2008E (prior) - $1.39 2009E – $1.15 2009E (prior) - $1.30 CL King Michael Gallo May 9, 2008 The primary risk is that Lasso will need to refinance its debt by early 2009 and that the credit markets remain very challenging. Additionally, Lasso operates in the challenging consumer and restaurant environment. (April 7, 2008) Lasso noted that it will not provide any guidance for 2008, given the uncertainty of rates and timing of a potential refinancing of its Senior Notes. (March 12, 2008) Neutral Strong Buy (prior) 2008E – $1.30 2008E (prior) – $1.50 2008E (prior) – $1.70 2009E – $1.25 2009E (prior) – $1.50 Cowen Paul Westra March 11, 2008 Given Lasso's uniquely high capital leverage and business focus (restaurants/entertainment/gaming), we believe that such diverse interests may be best served in a private entity - at least in the near term or until financial/consumer markets become more stabilized. (January 28, 2008) As has been typical over the past two years with Lasso, there were many moving parts and charges that will be further clarified on today's 4PM EST conference call...Despite the lack of EPS visibility driven by Lasso's casino reconstructions and debt-refinancings, we nevertheless continue to believe Lasso shares represent compelling value. (November 8, 2007) Outperform 2008E – $1.40 2008E (prior) – $1.70 SMH Capital William Hamilton May 13, 2008 Because of the potential impact and lack of visibility on timing, management refrained from providing earnings guidance for 2008. (March 12, 2008) Management has shifted the company's focus away from the lower-end casual dining and toward a blend of high-end restaurants and gaming. We applaud that move but, in our opinion, the growth strategy going forward is not very clear and a lack of transparency clouds visibility. (November 20, 2007) The conflicting trends between the restaurant and gaming business, along with the lack of transparency, lead us to believe that there is no compelling reason now to buy or sell the stock. (August 21, 2007) Neutral 2008E – $1.24 2008E (prior) – $1.60 2008E (prior) – $1.50 2008E (prior) – $1.73 2009E – $1.35 2009E (prior) – $1.64 Current Research Sentiment Recent Commentary from Lasso Research Coverage Note: Per Wall Street Research. Rating and EPS are from the most recent available research report, unless noted as "(prior)". |