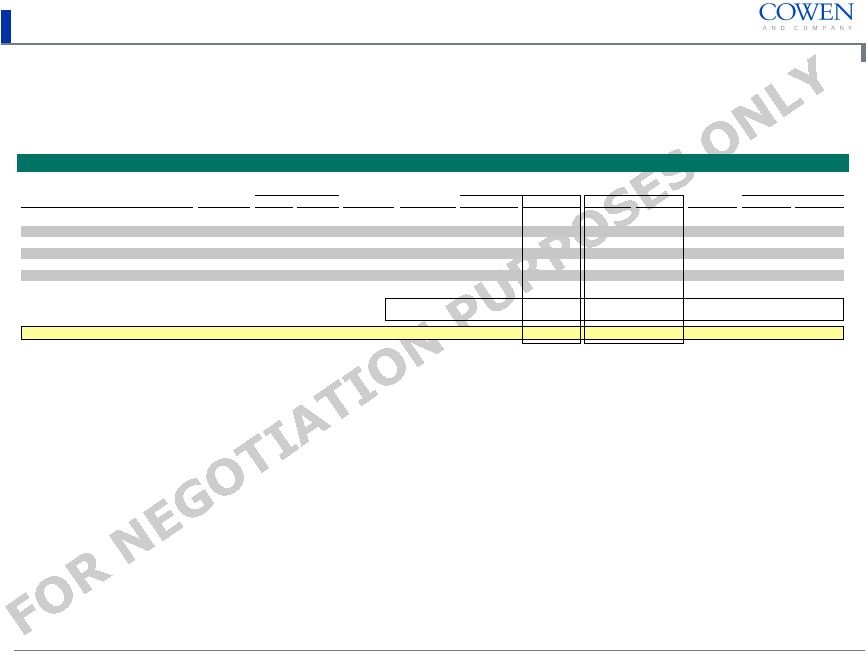

PROJECT LASSO Pre-opening is typically an ongoing expense for a growth company. However, it is not a $4.0 million ongoing expense for Lasso, given the limited expected future new unit openings. The projection model has $750,000 of pre-opening expense annually in future years, and it is agreed that this is an ongoing expense. Two recent transactions, OSI Restaurant Partners and RARE Hospitality International, are not comparable and did not have declining unit openings and pre-opening expense in the relevant projection periods. Both situations had projected continued new unit growth and pre-opening expense consistent with historical levels. For both of these companies, it is agreed that pre-opening is a recurring operating expense. With Lasso’s pre-opening falling from $4.0 million in 2007 to a run-rate of $750,000 going forward, the correct ongoing pre-opening expense to reflect the Company’s growth rate is $750,000. It does not seem appropriate to penalize EBITDA with a level of pre-opening expense that clearly does not reflect the current growth expectations. As a result, $2.9 million of pre-opening for the March 31, 2008 LTM period should be added back to EBITDA. Determination of EBITDA Pre-opening Expense OSI Restaurant Partners New Unit Growth RARE Hospitality Projected Pre-opening (a) Per OSI Restaurant Partners DEFM14A SEC filing dated April 3, 2007. (b) Per Wall Street research as of February 29, 2008. (c) Per RARE Hospitality International SC-TO-C SEC filing dated August 17, 2007. Projected Fiscal Year Ending December 31, 2006 2007 2008 2009 2010 OSI Restaurant Partners New Unit Growth (a) 122 94 90 95 100 2005A 2006A 2007E 2008E RARE Hospitality Projected Pre-opening (b) $7.5 $8.9 $10.2 $12.5 Darden Post-integration Outlook (c) : Plan on "accelerating new restaurant growth at both concepts" |