UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-07852 |

|

USAA Mutual Funds Trust |

(Exact name of registrant as specified in charter) |

|

15935 La Cantera Pkwy, Building Two, San Antonio, Texas | | 78256 |

(Address of principal executive offices) | | (Zip code) |

|

Citi Fund Services Ohio, Inc., 4400 Easton Commons, Suite 200, Columbus, OH 43219 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 800-235-8396 | |

|

Date of fiscal year end: | March 31 | |

|

Date of reporting period: | September 30, 2019 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

SEPTEMBER 30, 2019

Semi Annual Report

USAA California Bond Fund

Fund Shares (USCBX)

Adviser Shares (UXABX)

Beginning January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund's shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on usaa.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund or your financial intermediary electronically by notifying your financial intermediary directly, or if you are a direct investor, by calling (800) 235-8396 or logging on to usaa.com.

You may elect to receive all future reports in paper free of charge. You can inform the Fund or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by notifying your financial intermediary directly, or if you are a direct investor, by calling (800) 235-8396 or logging on to usaa.com. Your election to receive reports in paper will apply to all funds held with the USAA family of funds or your financial intermediary.

Victory Capital means Victory Capital Management Inc., the investment manager of the USAA Mutual Funds. USAA Mutual Funds are distributed by Victory Capital Advisers, Inc., a broker dealer registered with FINRA and an affiliate of Victory Capital. Victory Capital and its affiliates are not affiliated with United Services Automobile Association or its affiliates. USAA and the USAA logos are registered trademarks and the USAA Mutual Funds and USAA Investments logos are trademarks of United Services Automobile Association and are being used by Victory Capital and its affiliates under license.

TABLE OF CONTENTS

Financial Statements | |

Investment Objective & Portfolio Holdings | | | 2 | | |

Schedule of Portfolio Investments | | | 3 | | |

Statement of Assets and Liabilities | | | 10 | | |

Statement of Operations | | | 11 | | |

Statements of Changes in Net Assets | | | 12 | | |

Financial Highlights | | | 14 | | |

Notes to Financial Statements | | | 16 | | |

Supplemental Information | | | 25 | | |

Proxy Voting and Portfolio Holdings Information | | | 26 | | |

Expense Examples | | | 26 | | |

Advisory Contract Approval | | | 27 | | |

Privacy Policy (inside back cover) | | | |

This report is for the information of the shareholders and others who have received a copy of the currently effective prospectus of the Fund, managed by Victory Capital Management Inc. It may be used as sales literature only when preceded or accompanied by a current prospectus, which provides further details about the Fund.

IRA DISTRIBUTION WITHHOLDING DISCLOSURE

We generally must withhold federal income tax at a rate of 10% of the taxable portion of your distribution and, if you live in a state that requires state income tax withholding, at your state's tax rate. However, you may elect not to have withholding apply or to have income tax withheld at a higher rate. Any withholding election that you make will apply to any subsequent distribution unless and until you change or revoke the election. If you wish to make a withholding election, or change or revoke a prior withholding election, call (800) 235-8396.

If you do not have a withholding election in place by the date of a distribution, federal income tax will be withheld from the taxable portion of your distribution at a rate of 10%. If you must pay estimated taxes, you may be subject to estimated tax penalties if your estimated tax payments are not sufficient and sufficient tax is not withheld from your distribution.

For more specific information, please consult your tax adviser.

1

USAA Mutual Funds Trust

USAA California Bond Fund | | September 30, 2019 | |

(Unaudited)

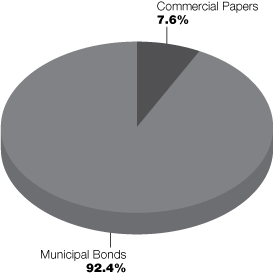

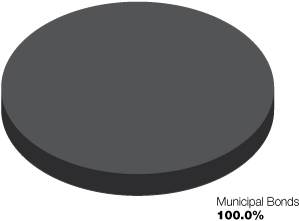

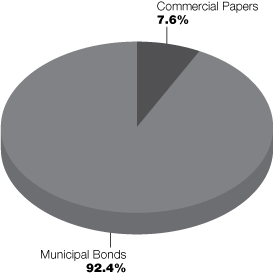

Investment Objective & Portfolio Holdings:

Investment Objective: Seeks to provide California investors with a high level of current interest income that is exempt from federal and California state income taxes.

Portfolio Holdings*:

* Percentages are of total investments of the Fund.

2

USAA Mutual Funds Trust

USAA California Bond Fund | | Schedule of Portfolio Investments

September 30, 2019 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Principal

Amount | | Value | |

Municipal Bonds (98.8%) | |

California (95.9%): | |

Abag Finance Authority for Nonprofit Corp. Revenue, 5.00%, 7/1/42,

Continuously Callable @100 | | $ | 1,500 | | | $ | 1,623 | | |

Abag Finance Authority for Nonprofit Corp. Revenue(NBGA — California Health

Insurance Construction Loan Insurance Program), 5.00%, 1/1/33,

Continuously Callable @101 | | | 4,235 | | | | 4,716 | | |

Adelanto Public Utility Authority Revenue(INS — Assured Guaranty

Municipal Corp.), 5.00%, 7/1/39, Continuously Callable @100 | | | 2,000 | | | | 2,417 | | |

Alameda Corridor Transportation Authority Revenue, Series B,

5.00%, 10/1/37, Continuously Callable @100 | | | 2,000 | | | | 2,326 | | |

Albany Unified School District, GO

Series B, 5.00%, 8/1/43, Continuously Callable @100 | | | 2,000 | | | | 2,399 | | |

Series B, 4.00%, 8/1/46, Continuously Callable @100 | | | 1,500 | | | | 1,643 | | |

Anaheim Public Financing Authority Revenue, Series A, 5.00%, 5/1/46,

Continuously Callable @100 | | | 1,500 | | | | 1,707 | | |

Association of Bay Area Governments Revenue(INS — XL Capital Assurance),

Series A, 4.75%, 3/1/36, Callable 3/1/20 @ 100 | | | 12,830 | | | | 12,984 | | |

Bay Area Toll Authority Revenue

2.83%, 4/1/36, Callable 10/1/26 @ 100 | | | 15,000 | | | | 15,877 | | |

Series H, 5.00%, 4/1/49, Continuously Callable @100 | | | 4,000 | | | | 4,894 | | |

Burbank Unified School District, GO

0.00%, 8/1/33, Continuously Callable @100 (c) | | | 3,085 | | | | 3,144 | | |

0.00%, 8/1/34, Continuously Callable @100 (c) | | | 3,000 | | | | 3,105 | | |

California Educational Facilities Authority Revenue

5.38%, 4/1/34, Pre-refunded 4/1/20 @ 100 | | | 6,000 | | | | 6,125 | | |

5.00%, 10/1/43, Continuously Callable @100 | | | 2,000 | | | | 2,484 | | |

5.00%, 10/1/48, Continuously Callable @100 | | | 2,000 | | | | 2,466 | | |

5.00%, 10/1/49, Continuously Callable @100 | | | 3,100 | | | | 3,682 | | |

Series A, 5.00%, 10/1/37, Continuously Callable @100 | | | 1,000 | | | | 1,183 | | |

California Enterprise Development Authority Revenue

4.00%, 3/1/39, Continuously Callable @100 | | | 8,105 | | | | 8,827 | | |

4.00%, 10/1/47, Continuously Callable @100 | | | 10,000 | | | | 11,079 | | |

4.00%, 11/1/49, Continuously Callable @100 | | | 1,900 | | | | 2,087 | | |

4.00%, 11/1/50, Continuously Callable @100 | | | 680 | | | | 740 | | |

Series A, 5.00%, 7/1/33, Continuously Callable @100 | | | 5,000 | | | | 5,649 | | |

Series A, 5.00%, 11/15/39, Continuously Callable @100 | | | 2,100 | | | | 2,337 | | |

Series A, 5.00%, 8/15/42, Continuously Callable @100 | | | 1,000 | | | | 1,183 | | |

Series B, 4.00%, 11/15/41, Continuously Callable @100 | | | 14,000 | | | | 15,311 | | |

California Enterprise Development Authority Revenue(NBGA — California Health

Insurance Construction Loan Insurance Program)

5.00%, 7/1/39, Continuously Callable @100 | | | 1,050 | | | | 1,231 | | |

5.00%, 6/1/42, Continuously Callable @100 | | | 7,805 | | | | 8,504 | | |

5.00%, 7/1/44, Continuously Callable @100 | | | 2,300 | | | | 2,677 | | |

California Municipal Finance Authority Revenue

5.00%, 6/1/43, Continuously Callable @100 | | | 2,500 | | | | 3,051 | | |

Series A, 5.00%, 2/1/37, Continuously Callable @100 | | | 750 | | | | 889 | | |

Series A, 5.00%, 2/1/42, Continuously Callable @100 | | | 1,000 | | | | 1,177 | | |

Series A, 4.00%, 10/1/44, Continuously Callable @100 | | | 2,000 | | | | 2,150 | | |

See notes to financial statements.

3

USAA Mutual Funds Trust

USAA California Bond Fund | | Schedule of Portfolio Investments — continued

September 30, 2019 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Principal

Amount | | Value | |

Series A, 5.00%, 2/1/47, Continuously Callable @100 | | $ | 1,000 | | | $ | 1,165 | | |

Series A, 5.00%, 7/1/47, Continuously Callable @100 | | | 1,000 | | | | 1,148 | | |

Series A, 5.00%, 6/1/50, Continuously Callable @100 | | | 1,000 | | | | 1,132 | | |

California Municipal Finance Authority Revenue(NBGA — California Health

Insurance Construction Loan Insurance Program)

4.13%, 5/15/39, Continuously Callable @100 | | | 1,900 | | | | 2,142 | | |

4.13%, 5/15/46, Continuously Callable @100 | | | 2,100 | | | | 2,334 | | |

Series B, 5.00%, 5/15/47, Continuously Callable @102 | | | 2,500 | | | | 2,954 | | |

California Pollution Control Financing Authority Revenue

5.00%, 7/1/39, Continuously Callable @100 (a) | | | 6,000 | | | | 7,414 | | |

5.25%, 8/1/40, Continuously Callable @100 (a) | | | 4,000 | | | | 4,115 | | |

5.00%, 11/21/45, Continuously Callable @100 (a) | | | 2,000 | | | | 2,435 | | |

California Public Finance Authority Revenue

5.00%, 10/15/37, Continuously Callable @100 | | | 1,000 | | | | 1,146 | | |

5.00%, 10/15/47, Continuously Callable @100 | | | 3,000 | | | | 3,388 | | |

California School Finance Authority Revenue

5.00%, 8/1/41, Continuously Callable @100 (a) | | | 1,750 | | | | 1,940 | | |

5.00%, 8/1/46, Continuously Callable @100 (a) | | | 2,250 | | | | 2,473 | | |

Series A, 5.00%, 7/1/47, Continuously Callable @100 (a) | | | 1,370 | | | | 1,575 | | |

Series A, 5.00%, 7/1/49, Continuously Callable @100 (a) | | | 1,000 | | | | 1,186 | | |

Series A, 5.00%, 7/1/54, Continuously Callable @100 (a) | | | 2,150 | | | | 2,550 | | |

California State Public Works Board Revenue

Series C, 5.00%, 4/1/31, Continuously Callable @100 | | | 6,875 | | | | 6,894 | | |

Series D, 5.00%, 4/1/31, Continuously Callable @100 | | | 5,705 | | | | 5,721 | | |

California Statewide Communities Development Authority Revenue

5.00%, 5/15/40, Continuously Callable @100 | | | 2,000 | | | | 2,328 | | |

5.00%, 5/15/42, Continuously Callable @100 | | | 1,500 | | | | 1,616 | | |

5.00%, 11/1/43, Continuously Callable @100 | | | 500 | | | | 576 | | |

5.00%, 10/1/46, Continuously Callable @100 | | | 2,750 | | | | 3,202 | | |

5.00%, 5/15/47, Continuously Callable @100 | | | 1,000 | | | | 1,167 | | |

5.00%, 5/15/47, Continuously Callable @100 | | | 1,500 | | | | 1,616 | | |

5.00%, 1/1/48, Continuously Callable @100 | | | 1,995 | | | | 2,341 | | |

5.00%, 7/1/48, Continuously Callable @100 | | | 4,000 | | | | 4,704 | | |

5.00%, 5/15/50, Continuously Callable @100 | | | 1,000 | | | | 1,167 | | |

Series A, 4.00%, 8/15/51, Continuously Callable @100 | | | 3,000 | | | | 3,239 | | |

Series A, 5.00%, 12/1/53, Continuously Callable @100 | | | 1,000 | | | | 1,212 | | |

Series A, 5.00%, 12/1/57, Continuously Callable @100 | | | 2,500 | | | | 2,960 | | |

Series C-1, 1.43%, 4/1/46, Continuously Callable @100 | | | 10,700 | | | | 10,700 | | |

Series C-3, 1.43%, 4/1/45, Continuously Callable @100 | | | 15,000 | | | | 15,000 | | |

California Statewide Communities Development Authority Revenue(NBGA —

California Health Insurance Construction Loan Insurance Program)

4.00%, 11/1/46, Continuously Callable @100 | | | 4,000 | | | | 4,327 | | |

Series S, 5.00%, 8/1/44, Continuously Callable @102 | | | 2,400 | | | | 2,680 | | |

Carlsbad Unified School District Certificate of Participation(INS — Assured

Guaranty Corp.), Series A, 5.00%, 10/1/34, Pre-refunded 10/1/19 @ 100 | | | 5,265 | | | | 5,265 | | |

Centinela Valley Union High School District, GO, Series B, 4.00%, 8/1/50,

Continuously Callable @100 | | | 9,500 | | | | 10,334 | | |

City of Atwater Wastewater Revenue(INS — Assured Guaranty Municipal Corp.),

Series A, 5.00%, 5/1/43, Continuously Callable @100 | | | 1,300 | | | | 1,550 | | |

City of Chula Vista Revenue, 5.88%, 1/1/34, Continuously Callable @100 | | | 5,000 | | | | 5,018 | | |

See notes to financial statements.

4

USAA Mutual Funds Trust

USAA California Bond Fund | | Schedule of Portfolio Investments — continued

September 30, 2019 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Principal

Amount | | Value | |

City of Fillmore Wastewater Revenue, 5.00%, 5/1/47, Continuously Callable @100 | | $ | 2,000 | | | $ | 2,396 | | |

City of Roseville Electric System Revenue, 5.00%, 2/1/37, Pre-refunded

2/1/20 @ 100 | | | 7,115 | | | | 7,204 | | |

City of Santa Clara Electric Revenue, Series A, 5.25%, 7/1/32, Continuously

Callable @100 | | | 2,000 | | | | 2,138 | | |

City of Tulare Sewer Revenue(INS — Assured Guaranty Municipal Corp.)

4.00%, 11/15/41, Continuously Callable @100 | | | 5,710 | | | | 6,261 | | |

4.00%, 11/15/44, Continuously Callable @100 | | | 5,000 | | | | 5,483 | | |

City of Upland Certificate of Participation

4.00%, 1/1/42, Continuously Callable @100 | | | 3,000 | | | | 3,174 | | |

5.00%, 1/1/47, Continuously Callable @100 | | | 2,000 | | | | 2,304 | | |

Corona-Norco Unified School District Special Tax,

5.00%, 9/1/32, Continuously Callable @100 | | | 1,350 | | | | 1,531 | | |

County of Sacramento Airport System Revenue, Series B,

5.00%, 7/1/41, Continuously Callable @100 | | | 1,100 | | | | 1,319 | | |

Educational Facility Authority(LIQ — Deutsche Bank AG),

Series 2017-7007, 1.88%, 3/1/42, Callable 3/1/20 @ 100 (a) (b) | | | 11,700 | | | | 11,700 | | |

San Francisco Multifamily Housing(LOC — Deutsche Bank AG),

Series DBE-8038, 1.93%, 12/1/52, Callable 12/1/20 @ 100 (a) | | | 15,000 | | | | 15,000 | | |

East Bay Municipal Utility District Wastewater System Revenue,

Series A-2, 5.00%, 6/1/38 | | | 9,000 | | | | 12,835 | | |

Elk Grove Finance Authority Special Tax(INS — Build America Mutual

Assurance Co.), 5.00%, 9/1/38, Continuously Callable @100 | | | 1,500 | | | | 1,759 | | |

Foothill-Eastern Transportation Corridor Agency Revenue, Series B-2,

3.50%, 1/15/53, Continuously Callable @100 | | | 1,500 | | | | 1,557 | | |

Foothill-Eastern Transportation Corridor Agency Revenue(INS — Assured

Guaranty Municipal Corp.)

0.00%, 1/15/34€ | | | 15,000 | | | | 10,343 | | |

0.00%, 1/15/35 (e) | | | 7,500 | | | | 5,000 | | |

Golden State Tobacco Securitization Corp. Revenue, Series A, 5.00%, 6/1/35,

Continuously Callable @100 | | | 5,500 | | | | 6,507 | | |

Grass Valley School District, GO(INS — Build America Mutual Assurance Co.),

5.00%, 8/1/45, Continuously Callable @100 | | | 2,400 | | | | 2,862 | | |

Hayward Unified School District, GO(INS — Build America Mutual Assurance Co.),

Series A, 5.00%, 8/1/44, Continuously Callable @100 | | | 3,000 | | | | 3,696 | | |

Indio Redevelopment Agency Successor Agency Tax Allocation, Series A,

5.25%, 8/15/31, Continuously Callable @100 | | | 2,940 | | | | 2,949 | | |

Inglewood Unified School District, GO(INS — Build America Mutual Assurance Co.),

Series B, 5.00%, 8/1/38, Continuously Callable @100 | | | 750 | | | | 877 | | |

Inland Empire Tobacco Securitization Corp. Revenue, Series B, 5.75%, 6/1/26,

Pre-refunded 6/1/20 @ 100 | | | 1,910 | | | | 1,968 | | |

Irvine Unified School District Special Tax

5.00%, 9/1/45, Continuously Callable @100 | | | 1,000 | | | | 1,170 | | |

5.00%, 9/1/49, Continuously Callable @100 | | | 2,000 | | | | 2,333 | | |

Series A, 4.00%, 9/1/39, Continuously Callable @100 | | | 1,020 | | | | 1,141 | | |

Series B, 5.00%, 9/1/42, Continuously Callable @100 | | | 1,000 | | | | 1,182 | | |

Series B, 5.00%, 9/1/47, Continuously Callable @100 | | | 1,000 | | | | 1,167 | | |

Series C, 5.00%, 9/1/42, Continuously Callable @100 | | | 1,000 | | | | 1,182 | | |

Series C, 5.00%, 9/1/47, Continuously Callable @100 | | | 525 | | | | 613 | | |

Series D, 5.00%, 9/1/49, Continuously Callable @100 | | | 1,000 | | | | 1,167 | | |

See notes to financial statements.

5

USAA Mutual Funds Trust

USAA California Bond Fund | | Schedule of Portfolio Investments — continued

September 30, 2019 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Principal

Amount | | Value | |

Irvine Unified School District Special Tax(INS — Build America Mutual

Assurance Co.), 5.00%, 9/1/56, Continuously Callable @100 | | $ | 6,000 | | | $ | 7,282 | | |

Jurupa Public Financing Authority Special Tax, Series A, 5.00%, 9/1/42,

Continuously Callable @100 | | | 1,000 | | | | 1,120 | | |

Local Public Schools Funding Authority School Improvement District No 2016-1,

GO(INS — Build America Mutual Assurance Co.), Series A, 4.00%, 8/1/52,

Continuously Callable @100 | | | 1,500 | | | | 1,653 | | |

Long Beach Bond Finance Authority Revenue, Series A, 5.00%, 11/15/35 | | | 3,875 | | | | 5,144 | | |

Los Angeles County Facilities Inc Revenue, 5.00%, 12/1/51, Continuously

Callable @100 | | | 4,000 | | | | 4,862 | | |

Los Angeles County Public Works Financing Authority Revenue

Series A, 5.00%, 12/1/44, Continuously Callable @100 | | | 2,000 | | | | 2,334 | | |

Series D, 5.00%, 12/1/45, Continuously Callable @100 | | | 6,000 | | | | 7,122 | | |

March Joint Powers Redevelopment Agency Successor Agency

Tax Allocation(INS — Build America Mutual Assurance Co.), 4.00%, 8/1/41,

Continuously Callable @100 | | | 5,790 | | | | 6,395 | | |

Monrovia Financing Authority Revenue, 5.00%, 12/1/45, Continuously

Callable @100 | | | 3,435 | | | | 4,084 | | |

Monrovia Financing Authority Revenue(INS — Assured Guaranty Municipal Corp.),

5.00%, 12/1/45, Continuously Callable @100 | | | 2,345 | | | | 2,767 | | |

Moreno Valley Unified School District, GO(INS — Assured Guaranty

Municipal Corp.), Series B, 5.00%, 8/1/47, Continuously Callable @100 | | | 6,500 | | | | 7,978 | | |

Mountain View School District/Los Angeles County, GO(INS — Build America

Mutual Assurance Co.), Series B, 5.00%, 8/1/48, Continuously Callable @100 | | | 3,315 | | | | 3,952 | | |

Mountain View Shoreline Regional Park Community Tax Allocation,

Series A, 5.63%, 8/1/35, Continuously Callable @100 | | | 2,000 | | | | 2,145 | | |

Norco Community Redevelopment Agency Successor Agency Tax Allocation

5.88%, 3/1/32, Pre-refunded 3/1/20 @ 100 | | | 1,500 | | | | 1,529 | | |

6.00%, 3/1/36, Pre-refunded 3/1/20 @ 100 | | | 1,250 | | | | 1,275 | | |

Norwalk Redevelopment Agency Tax Allocation(INS — National Public Finance

Guarantee Corp.)

Series A, 5.00%, 10/1/30, Continuously Callable @100 | | | 5,000 | | | | 5,014 | | |

Series A, 5.00%, 10/1/35, Continuously Callable @100 | | | 3,500 | | | | 3,510 | | |

Norwalk-La Mirada Unified School District, GO(INS — Assured Guaranty

Municipal Corp.), Series C, 0.00%, 8/1/30€ | | | 7,500 | | | | 5,941 | | |

Palomar Health, GO(INS — Assured Guaranty Municipal Corp.),

Series A, 0.00%, 8/1/31 (e) | | | 12,230 | | | | 9,161 | | |

Palomar Health, GO(INS — National Public Finance Guarantee Corp.),

0.00%, 8/1/26 (e) | | | 5,500 | | | | 4,748 | | |

Perris Union High School District, GO(INS — Assured Guaranty Corp.),

Series A, 4.00%, 9/1/48, Continuously Callable @100 | | | 5,000 | | | | 5,668 | | |

Pittsburg Successor Agency Redevelopment Agency Tax Allocation(INS — Assured

Guaranty Municipal Corp.), Series A, 5.00%, 9/1/29, Continuously Callable @100 | | | 2,000 | | | | 2,406 | | |

Pomona Unified School District, GO(INS — Build America Mutual Assurance Co.),

Series F, 5.00%, 8/1/39, Continuously Callable @100 | | | 1,500 | | | | 1,715 | | |

Regents of the University of California Medical Center Pooled Revenue,

Series L, 4.00%, 5/15/44, Continuously Callable @100 | | | 2,000 | | | | 2,181 | | |

Rio Elementary School District, GO(INS — Assured Guaranty Municipal Corp.),

Series B, 4.00%, 8/1/45, Continuously Callable @100 | | | 2,800 | | | | 3,054 | | |

See notes to financial statements.

6

USAA Mutual Funds Trust

USAA California Bond Fund | | Schedule of Portfolio Investments — continued

September 30, 2019 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Principal

Amount | | Value | |

Riverside County Public Financing Authority Tax Allocation(INS — Build America

Mutual Assurance Co.)

4.00%, 10/1/36, Continuously Callable @100 | | $ | 1,250 | | | $ | 1,373 | | |

4.00%, 10/1/37, Continuously Callable @100 | | | 1,625 | | | | 1,775 | | |

Riverside County Redevelopment Successor Agency Tax Allocation(INS — Build

America Mutual Assurance Co.), 4.00%, 10/1/37, Continuously Callable @100 | | | 2,000 | | | | 2,201 | | |

Riverside County Transportation Commission Revenue, Series A, 5.25%, 6/1/39,

Pre-refunded 6/1/23 @ 100 | | | 2,000 | | | | 2,294 | | |

RNR School Financing Authority Special Tax(INS — Build America Mutual

Assurance Co.), Series A, 5.00%, 9/1/41, Continuously Callable @100 | | | 2,000 | | | | 2,372 | | |

Sacramento Area Flood Control Agency Special Assessment, 5.00%, 10/1/44,

Continuously Callable @100 | | | 2,000 | | | | 2,275 | | |

Sacramento City Unified School District, GO(INS — Build America Mutual

Assurance Co.), Series S, 5.00%, 7/1/38, Continuously Callable @100 | | | 1,020 | | | | 1,135 | | |

San Bruno Park Elementary School District, GO, Series A, 5.00%, 8/1/48,

Continuously Callable @100 | | | 3,000 | | | | 3,580 | | |

San Diego County Regional Airport Authority Revenue

Series A, 5.00%, 7/1/40, Continuously Callable @100 | | | 2,000 | | | | 2,052 | | |

Series A, 5.00%, 7/1/47, Continuously Callable @100 | | | 1,500 | | | | 1,806 | | |

San Diego Public Facilities Financing Authority Revenue

Series A, 5.25%, 5/15/29, Pre-refunded 5/15/20 @ 100 | | | 1,000 | | | | 1,025 | | |

Series A, 5.00%, 10/15/44, Continuously Callable @100 | | | 2,500 | | | | 3,019 | | |

San Francisco City & County Airport Comm-San Francisco International Airport

Revenue, Series A, 4.90%, 5/1/29, Continuously Callable @100 | | | 5,465 | | | | 5,481 | | |

San Jose Financing Authority Revenue, Series A, 5.00%, 6/1/39,

Continuously Callable @100 | | | 10,000 | | | | 11,294 | | |

San Leandro Unified School District, GO(INS — Build America Mutual

Assurance Co.), Series B, 5.00%, 8/1/43, Continuously Callable @100 | | | 2,750 | | | | 3,374 | | |

San Luis & Delta Mendota Water Authority Revenue(INS — Build America

Mutual Assurance Co.), Series A, 5.00%, 3/1/38, Continuously Callable @100 | | | 1,500 | | | | 1,676 | | |

San Marcos Schools Financing Authority Revenue(INS — Assured Guaranty

Municipal Corp.), 5.00%, 8/15/35, Pre-refunded 8/15/20 @ 100 | | | 3,000 | | | | 3,099 | | |

San Ramon Redevelopment Agency Successor Agency Tax Allocation(INS — Build

America Mutual Assurance Co.), Series A, 5.00%, 2/1/38, Continuously

Callable @100 | | | 5,000 | | | | 5,797 | | |

Santa Clarita Community College District, GO, 4.00%, 8/1/46, Continuously

Callable @100 | | | 5,250 | | | | 5,759 | | |

Santa Cruz County Redevelopment Agency Tax Allocation(INS — Assured Guaranty

Municipal Corp.), Series A, 5.00%, 9/1/35, Continuously Callable @100 | | | 6,000 | | | | 7,104 | | |

Santa Rosa High School District, GO(INS — Assured Guaranty Municipal Corp.),

Series C, 5.00%, 8/1/43, Continuously Callable @100 | | | 1,000 | | | | 1,218 | | |

State of California, GO

5.25%, 2/1/30, Continuously Callable @100 | | | 4,000 | | | | 4,364 | | |

5.00%, 2/1/43, Continuously Callable @100 | | | 3,000 | | | | 3,334 | | |

4.00%, 10/1/44, Continuously Callable @100 | | | 1,000 | | | | 1,147 | | |

5.00%, 9/1/45, Continuously Callable @100 | | | 2,500 | | | | 3,004 | | |

5.00%, 8/1/46, Continuously Callable @100 | | | 9,500 | | | | 11,365 | | |

5.00%, 11/1/47, Continuously Callable @100 | | | 7,000 | | | | 8,563 | | |

Tahoe-Truckee Unified School District Certificate of Participation(INS — Build

America Mutual Assurance Co.), 4.00%, 6/1/43, Continuously Callable @100 | | | 1,000 | | | | 1,097 | | |

See notes to financial statements.

7

USAA Mutual Funds Trust

USAA California Bond Fund | | Schedule of Portfolio Investments — continued

September 30, 2019 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

Security Description | | Principal

Amount | | Value | |

Temecula Valley Unified School District Financing Authority Revenue Special

Tax(INS — Build America Mutual Assurance Co.), 5.00%, 9/1/40, Continuously

Callable @100 | | $ | 1,575 | | | $ | 1,835 | | |

Temecula Valley Unified School District, GO(INS — Assured Guaranty Municipal

Corp.), Series B, 4.00%, 8/1/45, Continuously Callable @100 | | | 7,500 | | | | 8,221 | | |

Sacramento City Financing Authority(LIQ — Deutsche Bank AG)

Series 2016-XG0067, 1.69%, 12/1/30 (a) | | | 4,955 | | | | 4,955 | | |

Series XG0100, 1.68%, 12/1/33 (a) | | | 17,765 | | | | 17,765 | | |

Golden State Tobacco Securitization Corp(LOC — Deutsche

Bank AG), Series 2015-XF1038, 1.68%, 6/1/45, Callable 6/1/25 @ 100 (a) | | | 4,940 | | | | 4,940 | | |

Twin Rivers Unified School District Certificate of Participation(INS — Assured

Guaranty Municipal Corp.), 3.20%, 6/1/41 (Put Date 6/1/20) (d) | | | 8,485 | | | | 8,498 | | |

Val Verde Unified School District Certificate of Participation(INS — Build

America Mutual Assurance Co.)

Series A, 5.00%, 8/1/34, Continuously Callable @100 | | | 1,105 | | | | 1,308 | | |

Series A, 5.00%, 8/1/35, Continuously Callable @100 | | | 1,530 | | | | 1,809 | | |

Val Verde Unified School District, GO(INS — Assured Guaranty Municipal Corp.),

Series C, 4.00%, 8/1/45, Continuously Callable @100 | | | 4,475 | | | | 4,882 | | |

Val Verde Unified School District, GO(INS — Build America Mutual Assurance Co.),

Series B, 5.00%, 8/1/44, Continuously Callable @100 | | | 4,000 | | | | 4,690 | | |

Victor Valley Union High School District, GO(INS — Assured Guaranty

Municipal Corp.), Series B, 4.00%, 8/1/37, Continuously Callable @100 | | | 5,000 | | | | 5,603 | | |

Victorville Joint Powers Finance Authority Revenue(LOC — BNP Paribas),

Series A, 1.58%, 5/1/40, Continuously Callable @100 (b) | | | 14,810 | | | | 14,810 | | |

Washington Township Health Care District Revenue, Series A, 5.00%, 7/1/42,

Continuously Callable @100 | | | 1,000 | | | | 1,159 | | |

West Kern Water District Certificate of Participation, 5.00%, 6/1/28, Continuously

Callable @100 | | | 4,585 | | | | 4,877 | | |

Western Placer Unified School District Certificate of Participation(INS — Assured

Guaranty Municipal Corp.), 4.00%, 8/1/41, Continuously Callable @100 | | | 6,000 | | | | 6,588 | | |

| | | | 688,762 | | |

Guam (2.2%): | |

Guam Government Waterworks Authority Revenue

5.50%, 7/1/43, Continuously Callable @100 | | | 4,000 | | | | 4,426 | | |

5.00%, 1/1/46, Continuously Callable @100 | | | 7,000 | | | | 7,848 | | |

Guam Power Authority Revenue

Series A, 5.00%, 10/1/34, Continuously Callable @100 | | | 1,000 | | | | 1,076 | | |

Series A, 5.00%, 10/1/40, Continuously Callable @100 | | | 2,800 | | | | 3,192 | | |

| | | | 16,542 | | |

Virgin Islands (0.7%): | |

Virgin Islands Public Finance Authority Revenue

5.00%, 9/1/33, Continuously Callable @100 (a) | | | 3,000 | | | | 3,316 | | |

Series A, 4.00%, 10/1/22 | | | 1,125 | | | | 1,114 | | |

| | | | 4,430 | | |

Total Municipal Bonds (Cost $668,153) | | | 709,734 | | |

Total Investments (Cost $668,153) — 98.8% | | | 709,734 | | |

Other assets in excess of liabilities — 1.2% | | | 8,514 | | |

NET ASSETS — 100.00% | | $ | 718,248 | | |

See notes to financial statements.

8

USAA Mutual Funds Trust

USAA California Bond Fund | | Schedule of Portfolio Investments — continued

September 30, 2019 | |

(Amounts in Thousands, Except for Shares) (Unaudited)

(a) Rule 144A security or other security that is restricted as to resale to institutional investors. The Fund's Adviser has deemed this security to be liquid, unless noted otherwise, based upon procedures approved by the Board of Trustees. As of September 30, 2019, the fair value of these securities was $81,364 (thousands) and amounted to 11.3% of net assets.

(b) Variable Rate Demand Notes that provide the rights to sell the security at face value on either that day or within the rate-reset period. The interest rate is reset on the put date at a stipulated daily, weekly, monthly, quarterly, or other specified time interval to reflect current market conditions. These securities do not indicate a reference rate and spread in their description.

(c) Stepped-coupon security converts to coupon form on 8/01/23 with a rate of 4.3%.

(d) Put Bond.

(e) Zero coupon bond.

GO — General Obligation

LOC — Line Letter of Credit

Credit Enhancements — Adds the financial strength of the provider of the enhancement to support the issuer's ability to repay the principal and interest payments when due. The enhancement may be provided by a high-quality bank, insurance company or other corporation, or a collateral trust. The enhancements do not guarantee the market values of the securities.

INS Principal and interest payments are insured by the name listed. Although bond insurance reduces the risk of loss due to default by an issuer, such bonds remain subject to the risk that value may fluctuate for other reasons, and there is no assurance that the insurance company will meet its obligations.

LIQ Liquidity enhancement that may, under certain circumstances, provide for repayment of principal and interest upon demand from the name listed.

LOC Principal and interest payments are guaranteed by a bank letter of credit or other bank credit agreement.

NBGA Principal and interest payments or, under certain circumstances, underlying mortgages, are guaranteed by a nonbank guarantee agreement from the name listed.

See notes to financial statements.

9

USAA Mutual Funds Trust | | Statement of Assets and Liabilities

September 30, 2019 | |

(Amounts in Thousands, Except Per Share Amounts) (Unaudited)

| | | USAA California

Bond Fund | |

Assets: | |

Investments, at value (Cost $668,153) | | $ | 709,734 | | |

Cash | | | 682 | | |

Interest receivable | | | 6,654 | | |

Receivable for capital shares issued | | | 91 | | |

Receivable for investments sold | | | 2,030 | | |

Prepaid expenses | | | 9 | | |

Total assets | | | 719,200 | | |

Liabilities: | |

Payables: | |

Distributions | | | 283 | | |

Capital shares redeemed | | | 338 | | |

Accrued expenses and other payables: | |

Investment advisory fees | | | 190 | | |

Administration fees | | | 89 | | |

Custodian fees | | | 24 | | |

Transfer agent fees | | | 16 | | |

Chief Compliance Officer fees | | | — | (a) | |

| 12b-1 fees | | | 1 | | |

Other accrued expenses | | | 11 | | |

Total liabilities | | | 952 | | |

Net Assets: | |

Capital | | | 680,762 | | |

Total distributable earnings/(loss) | | | 37,486 | | |

Net assets | | $ | 718,248 | | |

Net Assets | |

Adviser Shares | | $ | 7,367 | | |

Fund Shares | | | 710,881 | | |

Total | | $ | 718,248 | | |

Shares (unlimited number of shares authorized with no par value): | |

Adviser Shares | | | 648 | | |

Fund Shares | | | 62,448 | | |

| Total | | | 63,096 | | |

Net asset value, offering and redemption price per share: (b) | |

Adviser Shares | | $ | 11.37 | | |

Fund Shares | | $ | 11.38 | | |

(a) Rounds to less than $1.

(b) Per share amount may not recalculate due to rounding of net assets and/or shares outstanding.

See notes to financial statements.

10

USAA Mutual Funds Trust | | Statement of Operations

For the Six Months Ended September 30, 2019 | |

(Amounts in Thousands) (Unaudited)

| | | USAA California

Bond Fund | |

Investment Income: | |

Interest | | $ | 11,768 | | |

Total income | | | 11,768 | | |

Expenses: | |

Investment advisory fees | | | 1,168 | | |

Administration fees — Adviser Shares | | | 5 | | |

Administration fees — Fund Shares | | | 531 | | |

Professional fees | | | 3 | | |

12b-1 fees — Adviser Shares | | | 9 | | |

Custodian fees | | | 53 | | |

Trustees' fees | | | 18 | | |

Chief Compliance Officer fees | | | 1 | | |

Legal and audit fees | | | 36 | | |

Transfer agent fees — Adviser Shares | | | 1 | | |

Transfer agent fees — Fund Shares | | | 82 | | |

State registration and filing fees | | | — | (a) | |

Other expenses | | | — | (a) | |

Total expenses | | | 1,907 | | |

Net Investment Income (Loss) | | | 9,861 | | |

Realized/Unrealized Gains (Losses) from Investments: | |

Net realized gains (losses) from investment securities | | | 702 | | |

Net change in unrealized appreciation/depreciation on investment securities | | | 18,872 | | |

Net realized/unrealized gains (losses) on investments | | | 19,574 | | |

Change in net assets resulting from operations | | $ | 29,435 | | |

(a) Rounds to less than $1.

See notes to financial statements.

11

USAA Mutual Funds Trust | | Statements of Changes in Net Assets | |

(Amounts in Thousands)

| | | USAA California Bond Fund | |

| | | Six Months

Ended

September 30,

2019

(unaudited) | | Year

Ended

March 31,

2019 | |

From Investments: | |

Operations: | |

Net investment income (loss) | | $ | 9,861 | | | $ | 21,496 | | |

Net realized gains (losses) from investments | | | 702 | | | | 762 | | |

Net change in unrealized appreciation (depreciation) on

investments | | | 18,872 | | | | 8,728 | | |

Change in net assets resulting from operations | | | 29,435 | | | | 30,986 | | |

Distributions to Shareholders: | |

Adviser Shares | | | (91 | ) | | | (201 | ) | |

Fund Shares | | | (9,768 | ) | | | (21,287 | ) | |

Change in net assets resulting from distributions to shareholders | | | (9,859 | ) | | | (21,488 | ) | |

Change in net assets resulting from capital transactions | | | 276 | | | | 7,415 | | |

Change in net assets | | | 19,852 | | | | 16,913 | | |

Net Assets: | |

Beginning of period | | | 698,396 | | | | 681,483 | | |

End of period | | $ | 718,248 | | | $ | 698,396 | | |

Capital Transactions: | |

Adviser Shares | |

Proceeds from shares issued | | $ | 253 | | | $ | 895 | | |

Distributions reinvested | | | 16 | | | | 37 | | |

Cost of shares redeemed | | | (106 | ) | | | (1,008 | ) | |

Total Adviser Shares | | $ | 163 | | | $ | (76 | ) | |

Fund Shares | |

Proceeds from shares issued | | $ | 39,152 | | | $ | 67,106 | | |

Distributions reinvested | | | 7,879 | | | | 16,937 | | |

Cost of shares redeemed | | | (46,918 | ) | | | (76,552 | ) | |

Total Fund Shares | | $ | 113 | | | $ | 7,491 | | |

Change in net assets resulting from capital transactions | | $ | 276 | | | $ | 7,415 | | |

Share Transactions: | |

Adviser Shares | |

Issued | | | 23 | | | | 82 | | |

Reinvested | | | 1 | | | | 4 | | |

Redeemed | | | (9 | ) | | | (93 | ) | |

Total Adviser Shares | | | 15 | | | | (7 | ) | |

Fund Shares | |

Issued | | | 3,488 | | | | 6,162 | | |

Reinvested | | | 699 | | | | 1,554 | | |

Redeemed | | | (4,168 | ) | | | (7,042 | ) | |

Total Fund Shares | | | 19 | | | | 674 | | |

Change in Shares | | | 34 | | | | 667 | | |

See notes to financial statements.

12

This page is intentionally left blank.

13

USAA Mutual Funds Trust | | Financial Highlights | |

For a Share Outstanding Throughout Each Period

| | | | Investment Activities | | Distributions to

Shareholders From | |

| | | Net Asset

Value,

Beginning of

Period | | Net

Investment

Income

(Loss) | | Net Realized

and Unrealized

Gains (Losses)

on Investments | | Total from

Investment

Activities | | Net

Investment

Income | | Total

Distributions | |

USAA California Bond Fund | |

Adviser Shares | |

Six Months Ended

September 30, 2019

(unaudited) | | $ | 11.06 | | | | 0.14 | (e) | | | 0.31 | | | | 0.45 | | | | (0.14 | ) | | | (0.14 | ) | |

Year Ended

March 31, 2019 | | $ | 10.91 | | | | 0.32 | | | | 0.15 | | | | 0.47 | | | | (0.32 | ) | | | (0.32 | ) | |

Year Ended

March 31, 2018 | | $ | 10.91 | | | | 0.34 | | | | — | (f) | | | 0.34 | | | | (0.34 | ) | | | (0.34 | ) | |

Year Ended

March 31, 2017 | | $ | 11.28 | | | | 0.35 | | | | (0.37 | ) | | | (0.02 | ) | | | (0.35 | ) | | | (0.35 | ) | |

Year Ended

March 31, 2016 | | $ | 11.26 | | | | 0.39 | | | | 0.02 | | | | 0.41 | | | | (0.39 | ) | | | (0.39 | ) | |

Year Ended

March 31, 2015 | | $ | 10.82 | | | | 0.40 | | | | 0.44 | | | | 0.84 | | | | (0.40 | ) | | | (0.40 | ) | |

Fund Shares | |

Six Months Ended

September 30, 2019

(unaudited) | | $ | 11.07 | | | | 0.16 | (e) | | | 0.31 | | | | 0.47 | | | | (0.16 | ) | | | (0.16 | ) | |

Year Ended

March 31, 2019 | | $ | 10.92 | | | | 0.34 | | | | 0.15 | | | | 0.49 | | | | (0.34 | ) | | | (0.34 | ) | |

Year Ended

March 31, 2018 | | $ | 10.92 | | | | 0.37 | | | | — | (f) | | | 0.37 | | | | (0.37 | ) | | | (0.37 | ) | |

Year Ended

March 31, 2017 | | $ | 11.29 | | | | 0.37 | | | | (0.37 | ) | | | — | (f) | | | (0.37 | ) | | | (0.37 | ) | |

Year Ended

March 31, 2016 | | $ | 11.27 | | | | 0.42 | | | | 0.02 | | | | 0.44 | | | | (0.42 | ) | | | (0.42 | ) | |

Year Ended

March 31, 2015 | | $ | 10.83 | | | | 0.43 | | | | 0.44 | | | | 0.87 | | | | (0.43 | ) | | | (0.43 | ) | |

* Assumes reinvestment of all net investment income and realized capital gain distributions, if any, during the period. Includes adjustments in accordance with U.S. generally accepted accounting principles and could differ from the Lipper reported return.

^ The net expense ratio may not correlate to the applicable expense limits in place during the period since the current contractual expense limitation is applied for a two year period beginning July 1, 2019 and in effect through June 30, 2021, instead of coinciding with the Fund's fiscal year end. Details of the current contractual expense limitation in effect can be found in Note 4 of the accompanying Notes to Financial Statements.

(a) Not annualized for periods less than one year.

(b) Annualized for periods less than one year.

(c) Reflects total annual operating expenses for reductions of expenses paid indirectly for the March 31 fiscal years ended 2017, 2016, and 2015. Expenses paid indirectly decreased the expense ratio for each of these respective years by less than 0.01%.

(d) Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued.

(e) Per share net investment income (loss) has been calculated using the average daily shares method.

(f) Amount is less than $0.005 per share.

(g) Prior to August 1, 2014, AMCO had voluntarily agreed to limit the annual expenses of the Adviser Shares to 0.90% of the Adviser Shares' average daily net assets.

See notes to financial statements.

14

USAA Mutual Funds Trust | | Financial Highlights — continued | |

For a Share Outstanding Throughout Each Period

| | | | Ratios to Average Net Assets | | Supplemental Data | |

| | | Redemption

fees added to

beneficial

interests | | Net Asset

Value,

End of

Period | | Total

Return*(a) | | Net

Expenses^(b)(c) | | Net

Investment

Income

(Loss)(b) | | Gross

Expenses(b)(c) | | Net Assets,

End of

Period

(000's) | | Portfolio

Turnover(a)(d) | |

USAA California Bond Fund | |

Adviser Shares | |

Six Months Ended

September 30, 2019

(unaudited) | | | — | | | $ | 11.37 | | | | 4.10 | % | | | 0.78 | % | | | 2.52 | % | | | 0.78 | % | | $ | 7,367 | | | | 8 | % | |

Year Ended

March 31, 2019 | | | — | | | $ | 11.06 | | | | 4.37 | % | | | 0.76 | % | | | 2.92 | % | | | 0.76 | % | | $ | 7,005 | | | | 18 | % | |

Year Ended

March 31, 2018 | | | — | | | $ | 10.91 | | | | 3.12 | % | | | 0.75 | % | | | 3.08 | % | | | 0.75 | % | | $ | 6,985 | | | | 6 | % | |

Year Ended

March 31, 2017 | | | — | (f) | | $ | 10.91 | | | | (0.24 | )% | | | 0.75 | % | | | 3.09 | % | | | 0.75 | % | | $ | 7,083 | | | | 26 | % | |

Year Ended

March 31, 2016 | | | — | | | $ | 11.28 | | | | 3.73 | % | | | 0.80 | % | | | 3.49 | % | | | 0.80 | % | | $ | 8,303 | | | | 9 | % | |

Year Ended

March 31, 2015 | | | — | | | $ | 11.26 | | | | 7.86 | % | | | 0.83 | %(g) | | | 3.58 | % | | | 0.83 | % | | $ | 7,948 | | | | 4 | % | |

Fund Shares | |

Six Months Ended

September 30, 2019

(unaudited) | | | — | | | $ | 11.38 | | | | 4.23 | % | | | 0.53 | % | | | 2.77 | % | | | 0.53 | % | | $ | 710,881 | | | | 8 | % | |

Year Ended

March 31, 2019 | | | — | | | $ | 11.07 | | | | 4.61 | % | | | 0.52 | % | | | 3.15 | % | | | 0.52 | % | | $ | 691,391 | | | | 18 | % | |

Year Ended

March 31, 2018 | | | — | | | $ | 10.92 | | | | 3.37 | % | | | 0.51 | % | | | 3.32 | % | | | 0.51 | % | | $ | 674,498 | | | | 6 | % | |

Year Ended

March 31, 2017 | | | — | | | $ | 10.92 | | | | 0.01 | % | | | 0.51 | % | | | 3.34 | % | | | 0.51 | % | | $ | 669,435 | | | | 26 | % | |

Year Ended

March 31, 2016 | | | — | | | $ | 11.29 | | | | 3.98 | % | | | 0.56 | % | | | 3.74 | % | | | 0.56 | % | | $ | 698,731 | | | | 9 | % | |

Year Ended

March 31, 2015 | | | — | | | $ | 11.27 | | | | 8.14 | % | | | 0.57 | % | | | 3.85 | % | | | 0.57 | % | | $ | 675,694 | | | | 4 | % | |

See notes to financial statements.

15

USAA Mutual Funds Trust | | Notes to Financial Statements

September 30, 2019 | |

(Unaudited)

1. Organization:

USAA Mutual Funds Trust (the "Trust") is organized as a Delaware statutory trust and is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as an open-end investment company. The Trust is comprised of 47 funds and is authorized to issue an unlimited number of shares, which are units of beneficial interest with no par value.

The accompanying financial statements are those of the USAA California Bond Fund (the "Fund"). The Fund offers two classes of shares: Fund Shares and Adviser Shares. The Fund is classified as diversified under the 1940 Act.

Each class of shares of the Fund has substantially identical rights and privileges except with respect to fees paid under distribution plans, expenses allocable exclusively to each class of shares, voting rights on matters solely affecting a single class of shares, and the exchange privilege of each class of shares.

On November 6, 2018, United Services Automobile Association ("USAA"), the parent company of USAA Asset Management Company ("AMCO"), the investment adviser to the Fund, and USAA Transfer Agency Company, d/b/a USAA Shareholder Account Services ("SAS"), the transfer agent to the Fund, announced that AMCO and SAS would be acquired by Victory Capital Holdings Inc., a global investment management firm headquartered in Cleveland, Ohio (the "Transaction"). The Transaction closed on July 1, 2019. A special shareholder meeting was held on April 18, 2019, at which shareholders of the Fund approved a new investment advisory agreement between the Trust, on behalf of the Fund, and Victory Capital Management Inc. ("VCM" or "Adviser"). Effective July 1, 2019, VCM replaced AMCO as the investment adviser to the Fund and Victory Capital Transfer Agency Company replaced SAS as the Fund's transfer agent. In addition, effective on that same date, shareholders of the Fund also elected the following two new directors to the Board of the Trust to serve upon the closing of the Transaction: (1) David C. Brown, to serve as an Interested Trustee; and (2) John C. Walters, to serve as an Independent Trustee. Effective August 5, 2019, Citibank, N.A. is the new custodian for the USAA Mutual Funds.

Under the Trust's organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund enters into contracts with its vendors and others that provide for general indemnifications. The Fund's maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund. However, based on experience, the Fund expects that risk of loss to be remote.

2. Significant Accounting Policies:

The following is a summary of significant accounting policies followed by the Trust in the preparation of its financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America ("GAAP"). The preparation of financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates. The Fund follows the specialized accounting and reporting requirements under GAAP that are applicable to investment companies under Accounting Standards Codification Topic 946.

Investment Valuation:

The Fund records investments at fair value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

The valuation techniques described below maximize the use of observable inputs and minimize the use of unobservable inputs in determining fair value. The inputs used for valuing the Fund's investments are summarized in the three broad levels listed below:

• Level 1 — quoted prices in active markets for identical securities

• Level 2 — other significant observable inputs (including quoted prices for similar securities or interest rates applicable to those securities, etc.)

16

USAA Mutual Funds Trust | | Notes to Financial Statements — continued

September 30, 2019 | |

(Unaudited)

• Level 3 — significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments)

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The inputs or methodologies used for valuation techniques are not necessarily an indication of the risk associated with entering into those investments.

The Trust's Board of Trustees (the "Board") has established the Pricing and Liquidity Committee (the "Committee"), and subject to Board oversight, the Committee administers and oversees the Fund's valuation policies and procedures, which are approved by the Board.

Investments in open-end investment companies are valued at net asset value. These valuations are typically categorized as Level 1 in the fair value hierarchy.

Debt securities of United States ("U.S.") issuers, along with corporate and municipal securities, including short-term investments maturing in 60 days or less, may be valued using evaluated bid or the last sales price to price securities by dealers or an independent pricing service approved by the Board. These valuations are typically categorized as Level 2 in the fair value hierarchy.

In the event that price quotations or valuations are not readily available, are not reflective of market value, or a significant event has been recognized in relation to a security or class of securities, the securities are valued in good faith by the Committee in accordance with valuation procedures approved by the Board. These valuations are typically categorized as Level 2 or Level 3 in the fair value hierarchy, based on the observability of inputs used to determine the fair value. The effect of fair value pricing is that securities may not be priced on the basis of quotations from the primary market in which they are traded and the actual price realized from the sale of a security may differ materially from the fair value price. Valuing these securities at fair value is intended to cause the Fund's net asset value ("NAV") to be more reliable than it otherwise would be.

A summary of the valuations as of September 30, 2019, based upon the three levels defined above, is included in the table below while the breakdown, by category, of investments is disclosed in the Schedule of Portfolio Investments (amounts in thousands):

| | | Level 1 | | Level 2 | | Level 3 | | Total | |

Municipal Bonds | | $ | — | | | $ | 709,734 | | | $ | — | | | $ | 709,734 | | |

Total | | $ | — | | | $ | 709,734 | | | $ | — | | | $ | 709,734 | | |

Securities Purchased on a Delayed-Delivery or When-Issued Basis:

The Fund may purchase securities on a delayed-delivery or when-issued basis. Delivery and payment for securities that have been purchased by the Fund on a delayed-delivery or when-issued basis or for delayed draws on loans can take place a month or more after the trade date. At the time the Fund makes the commitment to purchase a security on a delayed-delivery or when-issued basis, the Fund records the transaction and reflects the value of the security in determining net asset value. No interest accrues to the Fund until the transaction settles and payment takes place. A segregated account is established and the Fund maintains cash and/or marketable securities at least equal in value to commitments for delayed-delivery or when-issued securities. If the Fund owns delayed-delivery or when-issued securities, these values are included in "Payable for investments purchased" on the accompanying Statement of Assets and Liabilities and the segregated assets are identified in the Schedule of Portfolio Investments.

Municipal Obligations:

The values of municipal obligations can fluctuate and may be affected by adverse tax, legislative, or political changes, and by financial developments affecting municipal issuers. Payment of municipal obligations may depend on a relatively limited source of revenue, resulting in greater credit risk. Future changes in federal tax laws or the activity of an issuer may adversely affect the tax-exempt status of municipal obligations.

17

USAA Mutual Funds Trust | | Notes to Financial Statements — continued

September 30, 2019 | |

(Unaudited)

Investment Companies:

The Fund may invest in portfolios of open-end investment companies. These investment companies value securities in their portfolios for which market quotations are readily available at their market values (generally the last reported sale price) and all other securities and assets at their fair value by the methods established by the board of directors of the underlying funds.

Investment Transactions and Related Income:

Changes in holdings of investments are accounted for no later than one business day following the trade date. For financial reporting purposes, however, investment transactions are accounted for on trade date on the last business day of the reporting period. Interest income is determined on the basis of coupon interest accrued using the effective interest method which adjusts, where applicable, the amortization of premiums or accretion of discount. Gains or losses realized on sales of securities are determined by comparing the identified cost of the security lot sold with the net sales proceeds.

Securities Lending:

The Fund, through a securities lending agreement with Citibank, N.A. ("Citibank"), may lend its securities to qualified financial institutions, such as certain broker-dealers, to earn additional income, net of income retained by Citibank. Borrowers are required to secure their loans for collateral in the amount of at least 102% of the value of U.S. securities loaned or at least 105% of the value of non-U.S. securities loaned, marked-to-market daily. Any collateral shortfalls associated with increases in the valuation of the securities loaned are cured the next business day once the shortfall exceeds $100,000. Collateral may be cash, U.S. government securities, or other securities as permitted by SEC guidelines. Cash collateral may be invested in high-quality short-term investments, primarily open-end investment companies. Collateral requirements are determined daily based on the value of the Fund's securities on loan as of the end of the prior business day. During the time portfolio securities are on loan, the borrower will pay the Fund any dividends or interest paid on such securities plus any fee negotiated between the parties to the lending agreement. The Fund also earns a return from the collateral. The Fund pays Citibank various fees in connection with the investment of cash collateral and fees based on the investment income received from securities lending activities. Securities lending income (net of these fees) is disclosed on the Statement of Operations. Loans are terminable upon demand and the borrower must return the loaned securities within the lesser of one standard settlement period or five business days. Risks relating to securities-lending transactions include that the borrower may not provide additional collateral when required or return the securities when due, and that the value of the short-term investments will be less than the amount of cash collateral required to be returned to the borrower. The Fund's agreement with Citibank does not include master netting provisions. Non-cash collateral received by the Fund may not be sold or re-pledged except to satisfy borrower default. Cash collateral is listed in the Fund's Portfolio of Investments and Financial Statements while non-cash collateral is not included.

During the six months ended September 30, 2019, the Fund had no securities on loan.

Federal Income Taxes:

It is the Fund's policy to continue to qualify as a regulated investment company by complying with the provisions available to certain investment companies, as defined in applicable sections of the Internal Revenue Code, and to make distributions of net investment income and net realized gains sufficient to relieve it from all, or substantially all, federal income taxes. Accordingly, no provision for federal income taxes is required in the financial statements. The Fund has a tax year end of March 31.

Management of the Fund has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (i.e., all open tax years and the interim tax period since then). Management believes that there is no tax liability resulting from unrecognized tax benefits related to uncertain tax positions taken.

18

USAA Mutual Funds Trust | | Notes to Financial Statements — continued

September 30, 2019 | |

(Unaudited)

Allocations:

Expenses directly attributable to the Fund are charged to the Fund, while expenses which are attributable to more than one fund in the Trust, or jointly with an affiliated trust, are allocated among the respective funds in the Trust and/or affiliated trust based upon net assets or another appropriate basis.

Income, expenses (other than class-specific expenses such as transfer agent fees, state registration fees, printing and 12b-1 fees), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets on the date income is earned or expenses and realized and unrealized gains and losses are incurred.

Cross-Trade Transactions:

Pursuant to Rule 17a-7 under the 1940 Act, the Fund may engage in cross-trades which are securities transactions with affiliated investment companies and advisory accounts managed by the Adviser and any applicable sub-adviser. Any such purchase or sale transaction must be effected without brokerage commission or other remuneration, except for customary transfer fees. The transaction must be effected at the current market price, which is either the security's last sale price on an exchange or, if there are no transactions in the security that day, at the average of the highest bid and lowest asked price. For the six months ended September 30, 2019, the Fund engaged in the following securities transactions with affiliated funds, which resulted in the following net realized gains (losses): (amounts in thousands)

| Purchases | | Sales | | Net Realized

Gains (Losses) | |

| $ | 6,400 | | | $ | — | | | $ | — | | |

Fees Paid Indirectly:

Expense offsets to custody fees that arise from credits on cash balances maintained on deposit are reflected on the Statement of Operations, as applicable, as "Fees paid indirectly".

3. Purchases and Sales:

Cost of purchases and proceeds from sales/maturities of securities (excluding securities maturing less than one year from acquisition) for the six months ended September 30, 2019 were as follows for the Fund (amounts in thousands):

Excluding

U.S. Government Securities | |

| Purchases | | Sales | |

| $ | 55,008 | | | $ | 82,827 | | |

There were no purchases and sales of U.S. Government Securities during the six months ended September 30, 2019.

4. Fees and Transactions with Affiliates and Related Parties:

Investment Advisory and Management fees:

Effective with the Transaction on July 1, 2019, investment advisory services are provided to the Fund by the Adviser, a New York corporation registered as an investment adviser with the Securities and Exchange Commission ("SEC"). The Adviser is a wholly-owned indirect subsidiary of Victory Capital Holdings, Inc., a publicly traded Delaware corporation, and a wholly-owned direct subsidiary of Victory Capital Operating, LLC. Under the terms of the Investment Advisory Agreement, the Adviser is entitled to receive a base fee and a performance adjustment. The Fund's base fee is accrued daily and paid monthly as a percentage of the average daily net assets of the Fund, on an annual basis equal to 0.50% of the first $50 million, 0.40% of that portion over $50 million but not over $100 million, and 0.30% of

19

USAA Mutual Funds Trust | | Notes to Financial Statements — continued

September 30, 2019 | |

(Unaudited)

that portion over $100 million. Amounts incurred and paid to VCM from July 1, 2019 through September 30, 2019 are $581 thousand and are reflected on the Statement of Operations as Investment Advisory fees.

Prior to the Transaction on July 1, 2019, AMCO provided investment management services to the Fund pursuant to an Advisory Agreement. Under this agreement, AMCO was responsible for managing the business and affairs of the Fund, and for directly managing day-to-day investment of the Fund's assets, subject to the authority of and supervision by the Board. The investment management fee for the Fund was comprised of a base fee and a performance adjustment. The Fund's base fee was accrued daily and paid monthly as a percentage of the average daily net assets of the Fund, which on an annual basis is equal to 0.50% of the first $50 million, 0.40% of that portion over $50 million but not over $100 million, and 0.30% of that portion over $100 million.

Effective with the Transaction on July 1, 2019, no performance adjustments will be made for periods beginning July 1, 2019, through June 30, 2020, and only performance beginning as of July 1, 2020, and thereafter will be utilized in calculating performance adjustments through June 30, 2020.

Prior to the Transaction on July 1, 2019, the performance adjustment for each share class was calculated monthly by comparing the Fund's performance to that of the Lipper California Municipal Debt Funds Index. The Lipper California Municipal Debt Funds Index tracks the total return performance of funds within the Lipper California Municipal Debt Funds category.

The performance period for each share class consists of the current month plus the previous 35 months. The following table is utilized to determine the extent of the performance adjustment:

Over/Under Performance

Relative to Index (in basis

points)(a) | | Annual Adjustment Rate

(in basis points)(a) | |

+/- 20 to 50 | | +/- 4 | |

+/- 51 to 100 | | +/- 5 | |

+/- 101 and greater | | +/- 6 | |

(a) Based on the difference between average annual performance of the relevant share class of the Fund and its relevant index, rounded to the nearest basis point. Average daily net assets of the share class are calculated over a rolling 36-month period.

Each class' annual performance adjustment rate is multiplied by the average daily net assets of each respective class over the entire performance period, which is then multiplied by a fraction, the numerator of which is the number of days in the month and the denominator of which is 365 (366 in leap years). The resulting amount is then added to (in the case of overperformance), or subtracted from (in the case of underperformance) the base fee.

Under the performance fee arrangement, each class pays a positive performance fee adjustment for a performance period whenever the class outperforms the Lipper California Municipal Debt Funds Index over that period, even if the class has overall negative returns during the performance period.

For the period April 1, 2019 through June 30, 2019, performance adjustments for Fund Shares and Adviser Sharers were $22 and $0 thousand, respectively, and 0.00% and 0.00% of net assets, respectively. Base fees incurred and paid to AMCO from April 1, 2019 through June 30, 2019 were $565 thousand and reflected on the Statement of Operations as Investment Advisory fees.

Administration and Servicing Fees:

Effective with the Transaction on July 1, 2019, VCM serves as the Fund's administrator and fund accountant. Under a Fund Administration, Servicing and Accounting Agreement, VCM is paid for its services an annual fee at a rate of 0.15% of average daily net assets for both the Fund Shares and Adviser Shares. Amounts incurred from July 1, 2019 through September 30, 2019 are $270 and $3 thousand for Fund Shares and Adviser Shares, respectively. These amounts are presented on the Statement of Operations as Administration fees.

20

USAA Mutual Funds Trust | | Notes to Financial Statements — continued

September 30, 2019 | |

(Unaudited)

Effective with the Transaction on July 1, 2019, the Fund (as part of the Trust) has entered into an agreement to provide compliance services with the Adviser, pursuant to which the Adviser furnishes its compliance personnel, including the services of the Chief Compliance Officer ("CCO") , and other resources reasonably necessary to provide the Trust with compliance oversight services related to the design, administration and oversight of a compliance program for the Trust in accordance with Rule 38a-1 under the 1940 Act. The CCO is an employee of the Adviser, which pays the compensation of the CCO and his support staff. Funds in the Trust, Victory Variable Insurance Funds, Victory Portfolios and Victory Portfolios II (collectively, the "Victory Funds Complex") in the aggregate, compensates the Adviser for these services. Amounts incurred during the period from April 1, 2019 to June 30, 2019 are reflected on the Statement of Operations as Chief Compliance Officer Fees.

Effective with the Transaction on July 1, 2019, Citi Fund Services Ohio, Inc. ("Citi"), an affiliate of Citibank, acts as sub-administrator and sub-fund accountant to the Fund pursuant to a Sub-Administration and Sub-Fund Accounting Services Agreement between VCM and Citi. VCM pays Citi a fee for providing these services. The Trust reimburses VCM and Citi for all of their reasonable out-of-pocket expenses incurred in providing these services.

Prior to the Transaction on July 1, 2019, AMCO provided certain administration and servicing functions for the Fund. For such services, AMCO received a fee accrued daily and paid monthly at an annualized rate of 0.15% of average daily net assets for both the Fund Shares and Adviser Shares. Amounts incurred from April 1, 2019 through June 30, 2019 were $261 and $2 thousand for Fund Shares and Adviser Shares, respectively. These amounts are presented on the Statement of Operations as Administration fees.

In addition to the services provided under its Administration and Servicing Agreement with the Fund, AMCO also provided certain compliance and legal services for the benefit of the Fund prior to the Transaction on July 1, 2019. The Board approved the reimbursement of a portion of these expenses incurred by AMCO. Amounts reimbursed by the Fund to AMCO for these compliance and legal services are presented on the Statement of Operations as Professional fees.

Transfer Agency Fees:

Effective with the Transaction on July 1, 2019, Victory Capital Transfer Agency, Inc. ("VCTA"), (formerly, USAA Shareholder Account Services ("SAS")), provides transfer agency services to the Fund. VCTA, an affiliate of the Adviser, provides transfer agent services to the Fund Shares and Adviser Shares based on an annual charge of $25.50 per shareholder account plus out-of-pocket expenses. VCTA pays a portion of these fees to certain intermediaries for the administration and servicing of accounts that are held with such intermediaries. Amounts incurred and paid to VCTA from July 1, 2019 through September 30, 2019 was $44 and less than $1 thousand for the Fund Shares and Adviser Shares, respectively. Amounts incurred and paid to SAS from April 1, 2019 through June 30, 2019 was $38 and less than $1 thousand for the Fund Shares and Adviser Shares, respectively. These amounts are reflected on the Statement of Operations as Transfer agent fees.

Effective with the Transaction on July 1, 2019, FIS Investor Services LLC serves as sub-transfer agent and dividend disbursing agent for the Fund pursuant to a Sub-Transfer Agent agreement between VCTA and FIS Investor Services LLC. VCTA provides FIS Investor Services LLC a fee for providing these services.

Distribution and Service 12b-1 Fees:

Effective with the Transaction on July 1, 2019, Victory Capital Advisers, Inc. (the "Distributor"), an affiliate of the Adviser, serves as distributor for the continuous offering of the Adviser Shares pursuant to a Distribution Agreement between the Distributor and the Trust. Pursuant to the Distribution and Service Plans adopted in accordance with Rule 12b-1 under the 1940 Act, the Distributor may receive a monthly distribution and service fee, at an annual rate of up to 0.25% of the average daily net assets of the Adviser Shares. Amounts incurred and paid to the Distributor from July 1, 2019 through September 30, 2019 are $5 thousand and reflected on the Statement of Operations as 12b-1 Fees.

Adviser Shares are offered and sold without imposition of an initial sales charge or a contingent deferred sales charge.

21

USAA Mutual Funds Trust | | Notes to Financial Statements — continued

September 30, 2019 | |

(Unaudited)

Prior to the Transaction on July 1, 2019, the Fund adopted a plan pursuant to Rule 12b-1 under the 1940 Act with respect to the Adviser Shares. Under the plan, the Adviser Shares paid fees to USAA Investment Management Company ("IMCO"), the distributor, for distribution and shareholder services. IMCO paid all or a portion of such fees to intermediaries that made the Adviser Shares available for investment by their customers. The fee was accrued daily and paid monthly at an annual rate of 0.25% of the Adviser Shares' average daily net assets. IMCO also provided exclusive underwriting and distribution of the Fund's shares on a continuing best-efforts basis and received no fee or other compensation for these services, but may have received 12b-1 fees as described above, with respect to Adviser Shares. Amounts incurred and paid to IMCO from April 1, 2019 through June 30, 2019 were $4 thousand and reflected on the Statement of Operations as 12b-1 Fees.

Other Fees:

Prior to the Transaction on July 1, 2019, State Street Bank and Trust Company served as the Fund's accounting agent and custodian.

Effective August 5, 2019, Citibank, N.A., serves as the Fund's custodian.

The Trust pays an annual retainer and quarterly meeting fees to each Independent Trustee and a retainer and quarterly meeting fees to each Chair of each Committee of the Board, of which there are four positions. The Chair of the Board also receives an annual retainer. The aggregate amount of the fees and expenses of the Independent Trustees and Chair are allocated amongst all the funds in the Trust and are presented in the Statements of Operations. Amounts incurred during the six month period ended June 30, 2019 are reflected on the Statement of Operations as Trustees' Fees.

K&L Gates LLP provides legal services to the Trust.

Effective with the Transaction on July 1, 2019, the Adviser has entered into an expense limitation agreement with the Fund until at least June 30, 2021. Under the terms of the agreement, the Adviser has agreed to waive fees or reimburse certain expenses to the extent that ordinary operating expenses incurred by certain classes of the Fund in any fiscal year exceed the expense limit for such classes of the Fund. Such excess amounts will be the liability of the Adviser. Interest, taxes, brokerage commissions, other expenditures which are capitalized in accordance with GAAP, and other extraordinary expenses not incurred in the ordinary course of the Fund's business are excluded from the expense limits. Effective July 1, 2019 through September 30, 2019, the expense limit (excluding voluntary waivers) is 0.80% and 0.54% for the Adviser Shares and Fund Shares, respectively.

Under this expense limitation agreement, the Fund has agreed to repay fees and expenses that were waived or reimbursed by the Adviser for a period up to three years after the fiscal year in which the waiver or reimbursement took place, subject to the lesser of any operating expense limits in effect at the time of: (a) the original waiver or expense reimbursement; or (b) the recoupment, after giving effect to the recoupment amount. As of September 30, 2019, there are no amounts available to be repaid to the Adviser.

The Adviser, may voluntarily waive or reimburse additional fees to assist the Fund in maintaining competitive expense ratios. Voluntary waivers and reimbursements applicable to the Fund are not available to be recouped at a future time. There were no voluntary waivers or reimbursements for the six months ended September 30, 2019.

Certain officers and/or interested trustees of the Fund are also officers and/or employees of the Adviser, Administrator, Sub-Administrator, Sub-Fund Accountant, and Legal.

5. Risks:

The Fund may be subject to other risks in addition to these identified risks.

An investment in the Fund's shares represent an indirect investment in the securities owned by the Fund, some of which will be traded on a national securities exchange or in the over-the-counter markets. The value of the securities in which the Fund invests, like other market investments, may move up or down, sometimes rapidly and unpredictably. The value of the securities in which the Fund invests may affect the value of the Fund's shares. An investment in the Fund's shares at any point in time may be

22

USAA Mutual Funds Trust | | Notes to Financial Statements — continued

September 30, 2019 | |

(Unaudited)

worth less than the original investment, even after taking into account the reinvestment of the Fund's distributions.

The Fund concentrates its investments in California tax-exempt securities and, therefore, may be exposed to more credit risk than portfolios with a broader geographical diversification.

The Fund will be subject to credit risk with respect to the amount it expects to receive from counterparties for financial instruments entered into by the Fund. The Fund may be negatively impacted if a counterparty becomes bankrupt or otherwise fails to perform its obligations due to financial difficulties. The Fund may experience significant delays in obtaining any recovery in bankruptcy or other reorganization proceeding and the Fund may obtain only limited recovery or may obtain no recovery in such circumstances. The Fund typically enters into transactions with counterparties whose credit ratings are investment grade, as determined by a nationally recognized statistical rating organization or, if unrated, judged by the Adviser to be of comparable quality.

The Fund is subject to credit and interest rate risk with respect to fixed income securities. Credit risk refers to the ability of an issuer to make timely payments of interest and principal. Interest rates may rise, or the rate of inflation may increase, impacting the value if investments in fixed income securities. A debt issuers' credit quality may be downgraded, or an issuer may default. Interest rates may fluctuate due to changes in governmental fiscal policy initiatives and resulting market reaction to those initiatives.

6. Borrowing and Interfund Lending:

Line of Credit:

Effective with the Transaction on July 1, 2019, the Victory Funds Complex participates in a short-term, demand note "Line of Credit" agreement with Citibank. Under the agreement with Citibank, the Victory Funds Complex could borrow up to $600 million, of which $300 million is committed and $300 million is uncommitted. $40 million of the Line of Credit is reserved for use by the Victory Floating Rate Fund, another series of the Victory Funds Complex, with that Fund paying the related commitment fees for that amount. The purpose of the agreement is to meet temporary or emergency cash needs, including redemption requests that might otherwise require the untimely disposition of securities. Citibank receives an annual commitment fee of 0.15% on $300 million for providing the Line of Credit. Each fund in the Victory Funds Complex pays a pro-rata portion of the commitment fees plus any interest (one month LIBOR plus one percent) on amounts borrowed. Interest charged to the Fund during the period is presented on the Statements of Operations under line of credit fees.

Prior to the Transaction on July 1, 2019, the line of credit among the Trust, with respect to its funds, and USAA Capital Corporation ("CAPCO") terminated. For the period from April 1, 2019 to June 30, 2019, the Fund paid CAPCO facility fees of $1 thousand.

The Fund had no borrowings under either agreement with Citibank or CAPCO during the six months ended September 30, 2019.

Interfund Lending:

Effective with the Transaction on July 1, 2019, the Trust and Adviser rely on an exemptive order granted by the SEC in March 2017 (the "Order"), permitting the establishment and operation of an Interfund Lending Facility (the "Facility"). The Facility allows the Fund to directly lend and borrow money to or from any other Fund in the Victory Fund Complex relying upon the Order at rates beneficial to both the borrowing and lending funds. Advances under the Facility are allowed for temporary or emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities, and are subject to the Fund's borrowing restrictions. The interfund loan rate is determined, as specified in the Order, by averaging the current repurchase agreement rate and the current bank loan rate. As a Borrower, interest charged to the Fund during the period is presented on the Statement of Operations under Interest expense on Interfund lending. As a Lender, interest earned by the Fund during the period is presented on the Statement of Operations under Income on Interfund lending.

23

USAA Mutual Funds Trust | | Notes to Financial Statements — continued

September 30, 2019 | |

(Unaudited)

The Fund did not utilize or participate in the Facility during the period July 1, 2019 through September 30, 2019.