UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07852

USAA Mutual Funds Trust

(Exact name of registrant as specified in charter)

| 15935 La Cantera Pkwy, San Antonio, Texas | 78256 | ||

| (Address of principal executive offices) | (Zip code) |

Citi Fund Services Ohio, Inc., 4400 Easton Commons, Suite 200, Columbus, Ohio 43219

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-235-8396

Date of fiscal year end: July 31

Date of reporting period: July 31, 2022

Item 1. Reports to Stockholders.

JULY 31, 2022

Annual Report

USAA Capital Growth Fund

Victory Capital means Victory Capital Management Inc., the investment adviser of the USAA Mutual Funds. USAA Mutual Funds are distributed by Victory Capital Services, Inc., member FINRA, an affiliate of Victory Capital. Victory Capital and its affiliates are not affiliated with United Services Automobile Association or its affiliates. USAA and the USAA logos are registered trademarks and the USAA Mutual Funds and USAA Investments logos are trademarks of United Services Automobile Association and are being used by Victory Capital and its affiliates under license.

www.vcm.com

News, Information And Education 24 Hours A Day, 7 Days A Week

The Victory Capital website gives fund shareholders, prospective shareholders, and investment professionals a convenient way to access fund information, get guidance, and track fund performance anywhere they can access the Internet. The site includes:

• Detailed performance records

• Daily share prices

• The latest fund news

• Investment resources to help you become a better investor

• A section dedicated to investment professionals

Whether you're a potential investor searching for the fund that matches your investment philosophy, a seasoned investor interested in planning tools, or an investment professional, www.vcm.com has what you seek. Visit us anytime. We're always open.

USAA Mutual Funds Trust

TABLE OF CONTENTS

Shareholder Letter (Unaudited) | 2 | ||||||

Managers' Commentary (Unaudited) | 4 | ||||||

Investment Overview (Unaudited) | 6 | ||||||

| Investment Objective & Portfolio Holdings (Unaudited) | 7 | ||||||

Schedule of Portfolio Investments | 8 | ||||||

Financial Statements | |||||||

Statement of Assets and Liabilities | 28 | ||||||

Statement of Operations | 29 | ||||||

Statements of Changes in Net Assets | 30 | ||||||

Financial Highlights | 32 | ||||||

Notes to Financial Statements | 34 | ||||||

| Report of Independent Registered Public Accounting Firm | 43 | ||||||

Supplemental Information (Unaudited) | 44 | ||||||

Trustees' and Officers' Information | 44 | ||||||

Proxy Voting and Portfolio Holdings Information | 50 | ||||||

Expense Examples | 50 | ||||||

Additional Federal Income Tax Information | 51 | ||||||

Liquidity Risk Management Program | 52 | ||||||

Privacy Policy (inside back cover) | |||||||

This report is for the information of the shareholders and others who have received a copy of the currently effective prospectus of the Fund, managed by Victory Capital Management Inc. It may be used as sales literature only when preceded or accompanied by a current prospectus, which provides further details about the Fund.

IRA DISTRIBUTION WITHHOLDING DISCLOSURE

We generally must withhold federal income tax at a rate of 10% of the taxable portion of your distribution and, if you live in a state that requires state income tax withholding, at your state's tax rate. However, you may elect not to have withholding apply or to have income tax withheld at a higher rate. Any withholding election that you make will apply to any subsequent distribution unless and until you change or revoke the election. If you wish to make a withholding election, or change or revoke a prior withholding election, call (800) 235-8396, and form W-4P (OMB No. 1545-0074 withholding certificate for pension or annuity payments) will be electronically sent.

If you do not have a withholding election in place by the date of a distribution, federal income tax will be withheld from the taxable portion of your distribution at a rate of 10%. If you must pay estimated taxes, you may be subject to estimated tax penalties if your estimated tax payments are not sufficient and sufficient tax is not withheld from your distribution.

For more specific information, please consult your tax adviser.

• NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE • INVESTMENTS INVOLVE RISK • PRINCIPAL LOSS IS POSSIBLE

1

(Unaudited)

Dear Shareholder,

It certainly has been an interesting — make that challenging — year for investors. If anything, our most recent annual reporting period ended July 31, 2022 reminded us of two enduring realities: 1) financial markets are dynamic and apt to change abruptly; 2) it's vitally important that we remain calm and rational whenever faced with those inevitable bouts of turmoil.

Consider what the past year has dealt us. The latter half of 2021 was largely constructive for financial markets, with record corporate earnings, ample liquidity in markets, and investors largely embracing risk assets. But as the calendar year turned, the script flipped. Almost overnight investor sentiment turned negative. There were many culprits. Inflation data was running persistently hotter than expected, with some of the highest readings in decades. Even the U.S. Federal Reserve (the "Fed") stopped calling inflation "transitory" and pivoted to a restrictive monetary policy. The Fed is now singularly focused on inflation and has embarked on a new aggressive rate-hike cycle. On top of all that, a terrible war began (and continues) in Eastern Europe, which fueled rising energy prices and slowed global growth.

These issues, among other factors, have ratcheted up market volatility in both stock and bond markets. Many broad market stock indices pulled back substantially during the first half of 2022 and even entered "bear market" territory in June, which is typically considered a 20% pullback from the most recent highs. Meanwhile, fixed income investors were also dealing with elevated volatility, and wide swaths of the bond market struggled in the face of rising interest rates. For a short while, bonds were not acting as their traditional counterbalance to equities, and that further troubled investors.

Just as quickly the script flipped again as our annual reporting period was drawing to a close. Risk was back on and investors seemingly went bargain hunting in July. Most equity indexes bounced back smartly — not fully recovering losses since the beginning of the calendar year but still making sharp moves higher.

Throughout the ups and downs of the past annual reporting period, there have been interesting subplots playing out within the broader market as different investment styles and sectors took turns in leadership positions. For example, it was interesting to watch crypto assets captivate investors through the earlier part of our annual reporting period, only to see them fall out of favor as sentiment soured. Ironically, those "less-exciting" assets, such as utilities and even money market funds, have been among the better performing throughout 2022. Indeed, things really can change markedly, and if anything, this underscores the importance of diversification.

Looking at the numbers we see that the S&P 500® Index, the bell-weather proxy for our domestic stock market, had an annual total return of -4.64% for the 12-month period ended July 31, 2022. Over this same annual period, the yield on the 10-Year U.S. Treasury jumped 143 basis points (a basis point is 1/100th of a percentage point), thanks largely to the Fed's policy shift and several aggressive rate hikes. At the end of our reporting period, the yield on the 10-Year U.S. Treasury finished at 2.67%.

Given the volatile market environment of the past year, it's comforting that we can draw on our experience managing portfolios through all market environments. This

2

has taught us to remain calm in the face of turmoil. It's imperative that investors do the same, as opposed to chasing short-term trends and acting emotionally. It is our view that a long-term plan, a well-diversified portfolio across asset classes and investment types, and a clear understanding of individual risk tolerances are some of the key ingredients for staying the course and progressing on investment goals.

As ever, there will be challenges ahead. The Fed has declared its intent to continue raising rates even as some elevated inflation readings begin to decline. Labor shortages, ongoing supply chain issues, elevated energy prices, and the Russia-Ukraine war are among the headwinds investors continue to navigate. There's even been some chatter about a possible recession in 2023.

Although no one can definitively predict what markets will do in the future, we can assure you that the investment professionals at all our independent franchises continually monitor the environment and work hard to position portfolios opportunistically no matter what the markets bring.

On the following pages, you will find information relating to your USAA® Mutual Fund, brought to you by Victory Capital. If you have any questions regarding the current market dynamics or your specific portfolio or investment plan, we encourage you to contact our representatives. Call (800) 235-8396 or visit our website at www.vcm.com.

From all of us here at Victory Capital, thank you for letting us help you work toward your investment goals.

Christopher K. Dyer, CFA

President,

USAA Mutual Funds Trust

3

USAA Capital Growth Fund

Managers' Commentary

(Unaudited)

• What were the market conditions during the reporting period?

Financial markets produced broadly flat returns during the early part of the annual reporting period ended July 31, 2022. Conditions were initially supportive in August thanks to positive economic data and continued strength in corporate earnings. The picture changed in September, however, as investors began to focus on risk factors such as supply-chain disruptions and rising inflation. In addition, the U.S. Federal Reserve (the "Fed") indicated it may begin tapering its stimulative quantitative easing policy — a development investors took as an indication that the first interest-rate increases may be on the way in 2022. News flow from overseas also took a negative turn in September, with the emergence of energy shortages in Europe and worries that the debt problems of Chinese property developer Evergrande could have a broader, systemic effect on China's economy.

Despite a number of headwinds to sentiment, U.S. equities posted solid gains in the fourth quarter of 2021 as reflected in the 11.03% return for the bellwether S&P 500® Index. The markets faced a shift in Fed policy as persistent inflation, driven by supply chain issues and rising commodity prices, led the central bank to announce, and subsequently accelerate, the tapering of its bond purchases that have helped keep longer-term borrowing costs low. In addition, the Fed began to signal the likelihood of two or more hikes in its benchmark overnight lending rate in 2022, representing a moving forward of the prior timetable. Prolonged negotiations over President Biden's Build Back Better spending bill put into question a source of anticipated fiscal stimulus. Finally, investors had to contend with the rapid emergence and spread of the Omicron variant of COVID-19, which threatened a new wave of lockdowns. Nonetheless, most major U.S. equity indices closed 2021 at or near all-time highs, supported by robust corporate profits and investor inflows given fixed income yields that remained unattractive.

The Russian invasion of Ukraine in February of 2022 added significant volatility to both equity and bond markets that were already concerned with elevated levels of inflation, a hawkish Fed, and rising interest rates. In the first quarter of 2022, the combination of widening credit spreads and rising interest rates led to the worst quarter for the Bloomberg U.S. Aggregate Bond Index in 40 years. Equity markets did not fare any better as the bellwether S&P 500® also posted a negative return during the quarter. With the Fed now embarking on a tightening cycle, the markets remained focused on the Fed and whether it can engineer a soft landing amidst the highest inflation readings in 40 years.

The second quarter of 2022 saw continued pressure on stocks and bonds. The Fed's hawkish pivot, which started in the fourth quarter of 2021, continued to put pressure on equity valuation multiples, especially for long-duration growth stocks. With inflation readings hitting four-decade highs, the Fed now faced an increasingly difficult task of implementing policy strong enough to tame inflation and provide a "soft landing" for the economy, while not being too aggressive and tilting the economy into recession. This risk contributed to the heightened stock market volatility, in addition to mounting COVID-related lockdowns in China, rising oil prices, and the ongoing conflict between Russia and the Ukraine.

4

USAA Capital Growth Fund

Managers' Commentary (continued)

In May the Fed raised rates by 50 basis points (a basis point is 1/100th of a percentage point) and by an additional 75 basis points in both June and July to combat inflation. Stocks and bonds began to rally in mid-June and continued to move higher through the end of the reporting period in July. Factors contributing to the rally included declining oil prices, economic data that was generally supportive of the underlying strength of the economy, and second quarter earnings season that was better than feared. The yield on the 10-Year U.S. Treasury Note declined almost 100 basis points over this period, inverting the yield curve, and reflecting a near-term shift in sentiment that the Fed might not need to be quite as aggressive as initially feared.

• How did the USAA Capital Growth Fund (the "Fund") perform during the reporting period?

The Fund has two share classes: Fund Shares and Institutional Shares. For the reporting period ended July 31, 2022, the Fund Shares and Institutional Shares had total returns of -6.74% and -6.68%, respectively. This compares to returns of -10.48% for the MSCI All-Country World Index (the "Index") and -15.07% for the Lipper Global Funds Index.

• What strategies did you employ during the reporting period?

For the reporting period, the Fund outperformed the Index as stock selection and sector allocation both were positive contributors to performance versus the Index. Stock selection within the information technology and industrials contributed to performance, while the Fund's selection within financials hurt performance. In terms of allocation, an overweight position to the industrials hurt performance, while an underweight to the communication services helped.

Thank you for allowing us to assist you with your investment needs.

5

USAA Capital Growth Fund

Investment Overview

(Unaudited)

Average Annual Total Return

Year Ended July 31, 2022

Fund Shares | Institutional Shares | ||||||||||||||||||

INCEPTION DATE | 10/27/00 | 8/7/15 | |||||||||||||||||

Net Asset Value | Net Asset Value | MSCI All-Country World Index1 | Lipper Global Funds Index2 | ||||||||||||||||

One Year | –6.74 | % | –6.68 | % | –10.48 | % | –15.07 | % | |||||||||||

Five Year | 6.77 | % | 6.94 | % | 7.86 | % | 6.23 | % | |||||||||||

Ten Year | 10.37 | % | NA | 9.35 | % | 8.89 | % | ||||||||||||

Since Inception | N/A | 7.39 | % | N/A | N/A | ||||||||||||||

The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month's end, please visit www.vcm.com.

Total return measures the price change in a share assuming the reinvestment of all net investment income and realized capital gain distributions, if any. The total returns quoted do not reflect adjustments made to the enclosed financial statements in accordance with U.S. Generally Accepted Accounting Principles or the deduction of taxes that a shareholder would pay on net investment income and realized capital gain distributions, including reinvested distributions, or redemptions of shares. The total return figures set forth above include all waivers of fees. Without such fee waivers, the total returns would have been lower.

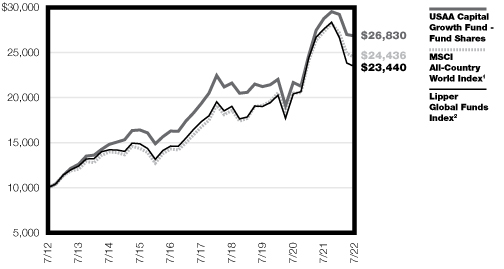

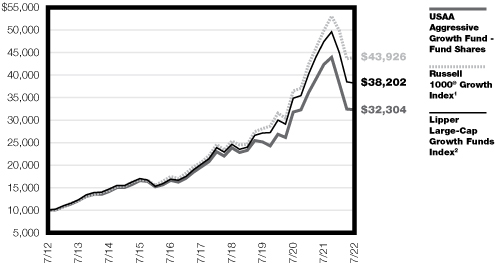

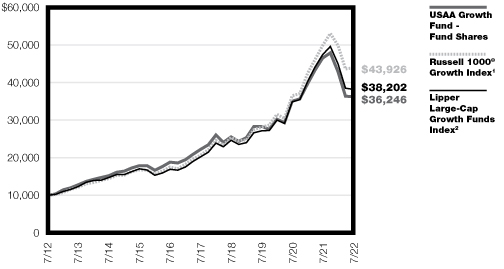

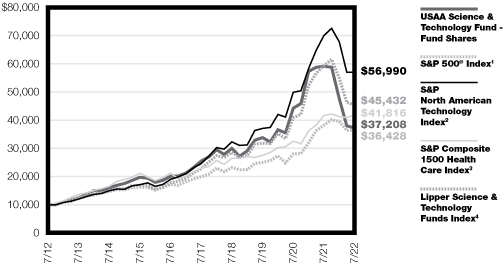

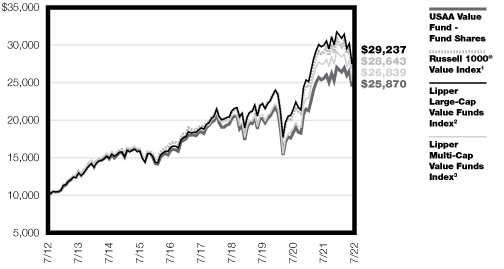

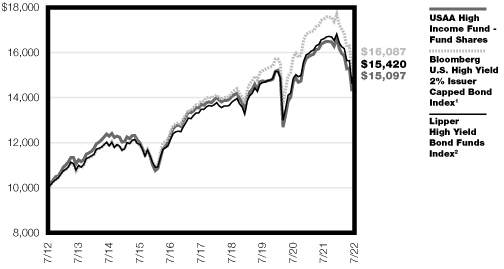

USAA Capital Growth Fund — Growth of $10,000

1The MSCI All-Country World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. This index does not include the effect of sales charges, commissions, expenses or taxes, is not representative of the Fund, and it is not possible to invest directly in an index.

2The Lipper Global Funds Index tracks the total return performance of funds within the Lipper Global Funds category. This category includes funds that invest at least 25% of their portfolio in securities traded outside of the United States and that may own U.S. securities as well. This index does not include the effect of sales charges, commissions, expenses, or taxes, is not representative of the Fund, and it is not possible to invest directly in an index.

The graph reflects investment of growth of a hypothetical $10,000 investment in the Fund.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

Past performance is not indicative of future results.

6

| USAA Mutual Funds Trust USAA Capital Growth Fund | July 31, 2022 | ||||||

(Unaudited)

Investment Objective and Portfolio Holdings:

The Fund seeks capital appreciation.

Top 10 Equity Holdings*:

July 31, 2022

(% of Net Assets)

Microsoft Corp. | 2.9 | % | |||||

Apple, Inc. | 2.4 | % | |||||

Alphabet, Inc. Class C | 2.1 | % | |||||

UnitedHealth Group, Inc. | 1.2 | % | |||||

Johnson & Johnson | 1.1 | % | |||||

Nestle SA Registered Shares | 1.0 | % | |||||

Berkshire Hathaway, Inc. Class B | 1.0 | % | |||||

Lockheed Martin Corp. | 1.0 | % | |||||

Eli Lilly & Co. | 0.9 | % | |||||

LVMH Moet Hennessy Louis Vuitton SE | 0.9 | % | |||||

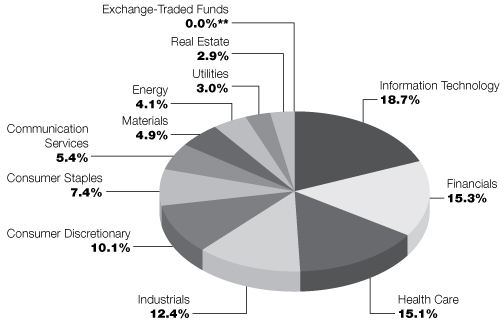

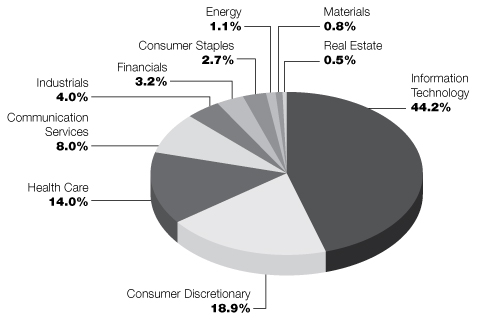

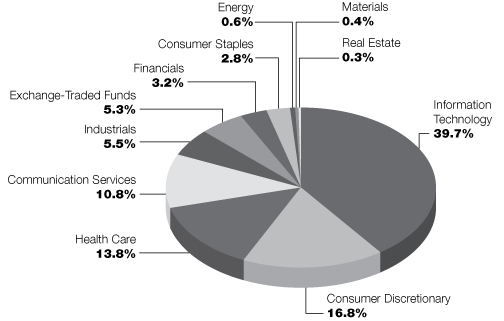

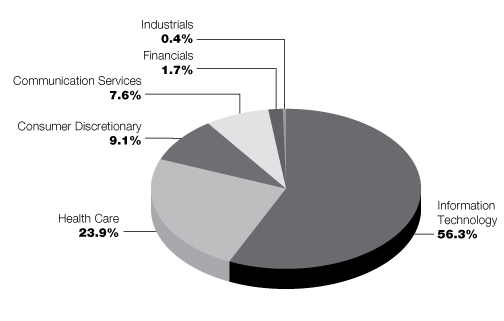

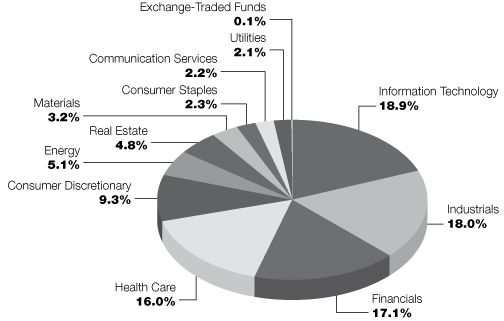

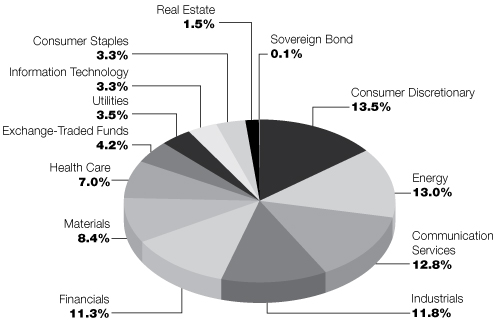

Sector Allocation*:

July 31, 2022

(% of Net Assets)

* Does not include futures contracts, money market instruments, and short-term investments purchased with cash collateral from securities loaned.

** Rounds to less than 0.05%.

Percentages are of the net assets of the Fund and may not equal 100%.

Refer to the Schedule of Portfolio Investments for a complete list of securities.

7

| USAA Mutual Funds Trust USAA Capital Growth Fund | Schedule of Portfolio Investments July 31, 2022 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

Common Stocks (99.3%) | |||||||||||

Australia (2.1%): | |||||||||||

Consumer Discretionary (0.3%): | |||||||||||

Aristocrat Leisure Ltd. | 91,087 | $ | 2,272 | ||||||||

Energy (0.1%): | |||||||||||

Santos Ltd. | 102,492 | 533 | |||||||||

Woodside Energy Group Ltd. | 24,900 | 562 | |||||||||

1,095 | |||||||||||

Financials (0.5%): | |||||||||||

Macquarie Group Ltd. | 20,463 | 2,618 | |||||||||

National Australia Bank Ltd. | 66,215 | 1,430 | |||||||||

4,048 | |||||||||||

Health Care (0.5%): | |||||||||||

CSL Ltd. | 14,969 | 3,047 | |||||||||

Sonic Healthcare Ltd. | 27,313 | 657 | |||||||||

3,704 | |||||||||||

Materials (0.4%): | |||||||||||

BHP Group Ltd. | 103,992 | 2,845 | |||||||||

Rio Tinto Ltd. | 8,302 | 575 | |||||||||

3,420 | |||||||||||

Real Estate (0.3%): | |||||||||||

Goodman Group | 35,450 | 519 | |||||||||

Scentre Group | 807,053 | 1,653 | |||||||||

Stockland | 176,854 | 479 | |||||||||

2,651 | |||||||||||

17,190 | |||||||||||

Austria (0.1%): | |||||||||||

Industrials (0.1%): | |||||||||||

ANDRITZ AG | 12,097 | 566 | |||||||||

Belgium (0.2%): | |||||||||||

Information Technology (0.2%): | |||||||||||

Melexis NV | 16,114 | 1,382 | |||||||||

Brazil (0.3%): | |||||||||||

Consumer Discretionary (0.0%): (a) | |||||||||||

Vibra Energia SA | 61,400 | 198 | |||||||||

Consumer Staples (0.1%): | |||||||||||

Sao Martinho SA | 25,200 | 171 | |||||||||

Sendas Distribuidora SA | 119,963 | 368 | |||||||||

SLC Agricola SA | 29,740 | 253 | |||||||||

792 | |||||||||||

Financials (0.0%): (a) | |||||||||||

Banco ABC Brasil SA Preference Shares | 86,500 | 288 | |||||||||

See notes to financial statements.

8

| USAA Mutual Funds Trust USAA Capital Growth Fund | Schedule of Portfolio Investments — continued July 31, 2022 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

Industrials (0.1%): | |||||||||||

Randon SA Implementos e Participacoes Preference Shares | 142,600 | $ | 277 | ||||||||

SIMPAR SA | 137,616 | 275 | |||||||||

552 | |||||||||||

Materials (0.1%): | |||||||||||

Dexco SA | 109,230 | 206 | |||||||||

Metalurgica Gerdau SA | 161,600 | 319 | |||||||||

525 | |||||||||||

Utilities (0.0%): (a) | |||||||||||

Neoenergia SA | 83,200 | 238 | |||||||||

2,593 | |||||||||||

Canada (2.4%): | |||||||||||

Consumer Staples (0.3%): | |||||||||||

Alimentation Couche-Tard, Inc. | 59,430 | 2,655 | |||||||||

Energy (0.2%): | |||||||||||

Parex Resources, Inc. | 74,167 | 1,381 | |||||||||

Financials (0.9%): | |||||||||||

Manulife Financial Corp. | 134,010 | 2,453 | |||||||||

National Bank of Canada | 20,884 | 1,466 | |||||||||

The Toronto-Dominion Bank | 54,758 | 3,557 | |||||||||

7,476 | |||||||||||

Industrials (0.4%): | |||||||||||

Canadian Pacific Railway Ltd. | 35,768 | 2,821 | |||||||||

Information Technology (0.4%): | |||||||||||

Constellation Software, Inc. | 1,786 | 3,039 | |||||||||

Materials (0.2%): | |||||||||||

Aginco Eagle Mines Ltd. | 37,310 | 1,604 | |||||||||

18,976 | |||||||||||

Chile (0.1%): | |||||||||||

Consumer Staples (0.0%): (a) | |||||||||||

SMU SA | 2,584,819 | 264 | |||||||||

Industrials (0.0%): (a) | |||||||||||

Quinenco SA | 106,382 | 289 | |||||||||

Materials (0.1%): | |||||||||||

CAP SA | 36,418 | 334 | |||||||||

887 | |||||||||||

China (0.5%): | |||||||||||

Communication Services (0.1%): | |||||||||||

Tencent Holdings Ltd. | 28,700 | 1,109 | |||||||||

Consumer Discretionary (0.1%): | |||||||||||

Jiumaojiu International Holdings Ltd. (b) | 170,000 | 370 | |||||||||

See notes to financial statements.

9

| USAA Mutual Funds Trust USAA Capital Growth Fund | Schedule of Portfolio Investments — continued July 31, 2022 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

Consumer Staples (0.1%): | |||||||||||

Chacha Food Co. Ltd. Class A | 41,900 | $ | 297 | ||||||||

Chenguang Biotech Group Co. Ltd. Class A | 118,200 | 258 | |||||||||

Chlitina Holding Ltd. | 50,000 | 309 | |||||||||

864 | |||||||||||

Health Care (0.0%): (a) | |||||||||||

Amoy Diagnostics Co. Ltd. Class A | 38,160 | 170 | |||||||||

China Resources Medical Holdings Co. Ltd. | 264,500 | 161 | |||||||||

331 | |||||||||||

Industrials (0.1%): | |||||||||||

Binjiang Service Group Co. Ltd. | 130,000 | 366 | |||||||||

Xinte Energy Co. Ltd. Class H | 160,800 | 428 | |||||||||

794 | |||||||||||

Information Technology (0.1%): | |||||||||||

AsiaInfo Technologies Ltd. (b) | 236,000 | 376 | |||||||||

WUS Printed Circuit Kunshan Co. Ltd. Class A | 168,740 | 304 | |||||||||

680 | |||||||||||

4,148 | |||||||||||

Cyprus (0.0%): (a) | |||||||||||

Materials (0.0%): | |||||||||||

Tharisa PLC | 190,445 | 239 | |||||||||

Denmark (1.2%): | |||||||||||

Consumer Discretionary (0.2%): | |||||||||||

Pandora A/S | 22,001 | 1,635 | |||||||||

Consumer Staples (0.2%): | |||||||||||

Royal Unibrew A/S | 19,095 | 1,629 | |||||||||

Health Care (0.7%): | |||||||||||

Novo Nordisk A/S Class B | 46,890 | 5,462 | |||||||||

Industrials (0.1%): | |||||||||||

AP Moller — Maersk A/S Class B | 317 | 866 | |||||||||

9,592 | |||||||||||

Finland (0.1%): | |||||||||||

Information Technology (0.1%): | |||||||||||

Nokia Oyj | 88,914 | 463 | |||||||||

France (3.0%): | |||||||||||

Communication Services (0.1%): | |||||||||||

Publicis Groupe SA | 11,382 | 605 | |||||||||

Consumer Discretionary (1.1%): | |||||||||||

La Francaise des Jeux SAEM (b) | 51,408 | 1,836 | |||||||||

LVMH Moet Hennessy Louis Vuitton SE | 10,571 | 7,339 | |||||||||

9,175 | |||||||||||

See notes to financial statements.

10

| USAA Mutual Funds Trust USAA Capital Growth Fund | Schedule of Portfolio Investments — continued July 31, 2022 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

Consumer Staples (0.1%): | |||||||||||

Pernod Ricard SA | 4,718 | $ | 927 | ||||||||

Energy (0.2%): | |||||||||||

Gaztransport Et Technigaz SA | 9,957 | 1,373 | |||||||||

Financials (0.2%): | |||||||||||

AXA SA | 30,897 | 712 | |||||||||

BNP Paribas SA | 13,611 | 643 | |||||||||

1,355 | |||||||||||

Industrials (0.5%): | |||||||||||

Cie de Saint-Gobain | 14,008 | 653 | |||||||||

Eiffage SA | 4,646 | 436 | |||||||||

Rexel SA | 23,671 | 421 | |||||||||

Safran SA | 17,809 | 1,957 | |||||||||

Teleperformance | 1,499 | 501 | |||||||||

3,968 | |||||||||||

Information Technology (0.4%): | |||||||||||

Capgemini SE | 16,224 | 3,094 | |||||||||

Edenred | 9,136 | 469 | |||||||||

3,563 | |||||||||||

Materials (0.3%): | |||||||||||

Arkema SA | 26,406 | 2,501 | |||||||||

Real Estate (0.1%): | |||||||||||

Klepierre SA | 16,606 | 369 | |||||||||

23,836 | |||||||||||

Germany (1.7%): | |||||||||||

Communication Services (0.2%): | |||||||||||

Deutsche Telekom AG | 66,681 | 1,267 | |||||||||

Consumer Discretionary (0.3%): | |||||||||||

Mercedes-Benz Group AG | 11,042 | 651 | |||||||||

Volkswagen AG Preference Shares | 10,737 | 1,518 | |||||||||

2,169 | |||||||||||

Energy (0.1%): | |||||||||||

VERBIO Vereinigte BioEnergie AG | 8,981 | 557 | |||||||||

Financials (0.4%): | |||||||||||

Allianz SE Registered Shares | 13,681 | 2,484 | |||||||||

Hannover Rueck SE | 3,462 | 491 | |||||||||

2,975 | |||||||||||

Health Care (0.2%): | |||||||||||

Bayer AG Registered Shares | 14,139 | 824 | |||||||||

Merck KGaA | 5,529 | 1,053 | |||||||||

1,877 | |||||||||||

Industrials (0.1%): | |||||||||||

Deutsche Post AG Registered Shares | 18,801 | 751 | |||||||||

See notes to financial statements.

11

| USAA Mutual Funds Trust USAA Capital Growth Fund | Schedule of Portfolio Investments — continued July 31, 2022 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

Information Technology (0.4%): | |||||||||||

Infineon Technologies AG | 15,677 | $ | 430 | ||||||||

SAP SE | 32,388 | 3,020 | |||||||||

3,450 | |||||||||||

Real Estate (0.0%): (a) | |||||||||||

LEG Immobilien SE | 3,651 | 332 | |||||||||

13,378 | |||||||||||

Greece (0.1%): | |||||||||||

Financials (0.0%): (a) | |||||||||||

National Bank of Greece SA (c) | 123,261 | 386 | |||||||||

Industrials (0.1%): | |||||||||||

Mytilineos SA | 25,706 | 398 | |||||||||

784 | |||||||||||

Hong Kong (1.0%): | |||||||||||

Consumer Discretionary (0.1%): | |||||||||||

Chow Tai Fook Jewellery Group Ltd. | 269,200 | 532 | |||||||||

| EC Healthcare | 252,000 | 217 | |||||||||

749 | |||||||||||

Consumer Staples (0.1%): | |||||||||||

WH Group Ltd. (b) | 573,500 | 434 | |||||||||

Financials (0.2%): | |||||||||||

AIA Group Ltd. | 145,400 | 1,461 | |||||||||

CSSC Hong Kong Shipping Co. Ltd. | 2,390,000 | 441 | |||||||||

1,902 | |||||||||||

Industrials (0.1%): | |||||||||||

CK Hutchison Holdings Ltd. | 63,000 | 418 | |||||||||

LK Technology Holdings Ltd. | 182,500 | 319 | |||||||||

Pacific Basin Shipping Ltd. | 702,000 | 336 | |||||||||

1,073 | |||||||||||

Real Estate (0.5%): | |||||||||||

CK Asset Holdings Ltd. | 516,000 | 3,653 | |||||||||

7,811 | |||||||||||

India (0.9%): | |||||||||||

Communication Services (0.0%): (a) | |||||||||||

Sun TV Network Ltd. | 60,368 | 361 | |||||||||

Consumer Discretionary (0.1%): | |||||||||||

Asahi India Glass Ltd. | 56,148 | 422 | |||||||||

Balkrishna Industries Ltd. | 13,987 | 410 | |||||||||

Raymond Ltd. | 25,270 | 307 | |||||||||

1,139 | |||||||||||

Consumer Staples (0.1%): | |||||||||||

Dabur India Ltd. | 49,313 | 364 | |||||||||

See notes to financial statements.

12

| USAA Mutual Funds Trust USAA Capital Growth Fund | Schedule of Portfolio Investments — continued July 31, 2022 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

Energy (0.0%): (a) | |||||||||||

Hindustan Petroleum Corp. Ltd. | 109,449 | $ | 334 | ||||||||

Financials (0.2%): | |||||||||||

Cholamandalam Investment & Finance Co. Ltd. | 54,539 | 485 | |||||||||

City Union Bank Ltd. | 164,795 | 336 | |||||||||

Home First Finance Co. India Ltd. (b) (c) | 37,527 | 393 | |||||||||

1,214 | |||||||||||

Health Care (0.0%): (a) | |||||||||||

Alkem Laboratories Ltd. | 8,569 | 350 | |||||||||

Industrials (0.2%): | |||||||||||

Ashoka Buildcon Ltd. (c) | 294,501 | 280 | |||||||||

Craftsman Automation Ltd. | 12,216 | 433 | |||||||||

Somany Ceramics Ltd. (c) | 58,135 | 464 | |||||||||

1,177 | |||||||||||

Information Technology (0.1%): | |||||||||||

Mphasis Ltd. | 11,190 | 326 | |||||||||

WNS Holdings Ltd., ADR (c) | 3,666 | 318 | |||||||||

644 | |||||||||||

Materials (0.1%): | |||||||||||

APL Apollo Tubes Ltd. (c) | 32,646 | 394 | |||||||||

Finolex Industries Ltd. | 170,341 | 287 | |||||||||

Solar Industries India Ltd. | 8,605 | 298 | |||||||||

Supreme Industries Ltd. | 12,200 | 293 | |||||||||

1,272 | |||||||||||

Utilities (0.1%): | |||||||||||

CESC Ltd. | 319,334 | 310 | |||||||||

PTC India Ltd. | 275,182 | 289 | |||||||||

599 | |||||||||||

7,454 | |||||||||||

Indonesia (0.2%): | |||||||||||

Consumer Discretionary (0.0%): (a) | |||||||||||

PT Mitra Adiperkasa Tbk (c) | 4,369,900 | 263 | |||||||||

Consumer Staples (0.0%): (a) | |||||||||||

PT Industri Jamu Dan Farmasi Sido Muncul Tbk | 4,680,500 | 286 | |||||||||

Financials (0.1%): | |||||||||||

PT Bank CIMB Niaga Tbk | 4,500,500 | 317 | |||||||||

Health Care (0.1%): | |||||||||||

PT Medikaloka Hermina Tbk | 4,059,800 | 393 | |||||||||

Real Estate (0.0%): (a) | |||||||||||

PT Puradelta Lestari Tbk | 24,920,300 | 274 | |||||||||

1,533 | |||||||||||

See notes to financial statements.

13

| USAA Mutual Funds Trust USAA Capital Growth Fund | Schedule of Portfolio Investments — continued July 31, 2022 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

Ireland (0.9%): | |||||||||||

Health Care (0.0%): (a) | |||||||||||

ICON PLC (c) | 2,328 | $ | 561 | ||||||||

Industrials (0.1%): | |||||||||||

DCC PLC | 9,911 | 647 | |||||||||

Information Technology (0.8%): | |||||||||||

Accenture PLC Class A | 20,932 | 6,411 | |||||||||

7,619 | |||||||||||

Israel (0.1%): | |||||||||||

Financials (0.0%): (a) | |||||||||||

Bank Leumi Le | 47,559 | 463 | |||||||||

Information Technology (0.1%): | |||||||||||

Nice Ltd. (c) | 2,535 | 542 | |||||||||

1,005 | |||||||||||

Italy (0.6%): | |||||||||||

Industrials (0.1%): | |||||||||||

Leonardo SpA | 50,460 | 472 | |||||||||

Information Technology (0.0%): (a) | |||||||||||

Nexi SpA (b) (c) | 39,292 | 357 | |||||||||

Utilities (0.5%): | |||||||||||

Enel SpA | 495,510 | 2,498 | |||||||||

Iren SpA | 163,524 | 308 | |||||||||

Snam SpA | 304,203 | 1,526 | |||||||||

4,332 | |||||||||||

5,161 | |||||||||||

Japan (6.4%): | |||||||||||

Communication Services (0.6%): | |||||||||||

Capcom Co. Ltd. | 62,300 | 1,732 | |||||||||

Kakaku.com, Inc. | 72,500 | 1,420 | |||||||||

Konami Holdings Corp. | 6,300 | 373 | |||||||||

Nippon Telegraph & Telephone Corp. | 36,200 | 1,034 | |||||||||

4,559 | |||||||||||

Consumer Discretionary (1.2%): | |||||||||||

Open House Group Co. Ltd. | 10,200 | 445 | |||||||||

Sony Group Corp. | 19,100 | 1,621 | |||||||||

Toyota Motor Corp. | 371,500 | 6,031 | |||||||||

ZOZO, Inc. | 64,400 | 1,391 | |||||||||

9,488 | |||||||||||

Consumer Staples (0.3%): | |||||||||||

Ajinomoto Co., Inc. | 24,800 | 653 | |||||||||

Seven & i Holdings Co. Ltd. | 15,200 | 620 | |||||||||

Toyo Suisan Kaisha Ltd. | 30,600 | 1,300 | |||||||||

2,573 | |||||||||||

See notes to financial statements.

14

| USAA Mutual Funds Trust USAA Capital Growth Fund | Schedule of Portfolio Investments — continued July 31, 2022 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

Financials (0.9%): | |||||||||||

Mitsubishi UFJ Financial Group, Inc. | 394,200 | $ | 2,221 | ||||||||

Mizuho Financial Group, Inc. | 52,920 | 631 | |||||||||

ORIX Corp. | 61,200 | 1,091 | |||||||||

Sumitomo Mitsui Financial Group, Inc. | 19,500 | 612 | |||||||||

Tokio Marine Holdings, Inc. | 42,600 | 2,494 | |||||||||

7,049 | |||||||||||

Health Care (0.6%): | |||||||||||

Hoya Corp. | 27,300 | 2,736 | |||||||||

Ono Pharmaceutical Co. Ltd. | 20,100 | 565 | |||||||||

Shionogi & Co. Ltd. | 33,400 | 1,713 | |||||||||

5,014 | |||||||||||

Industrials (1.7%): | |||||||||||

AGC, Inc. | 12,300 | 448 | |||||||||

Fuji Electric Co. Ltd. | 71,000 | 3,207 | |||||||||

Hitachi Ltd. | 16,500 | 835 | |||||||||

ITOCHU Corp. | 37,600 | 1,095 | |||||||||

Komatsu Ltd. | 23,100 | 534 | |||||||||

Mitsubishi Heavy Industries Ltd. | 39,100 | 1,452 | |||||||||

Mitsui & Co. Ltd. | 33,500 | 739 | |||||||||

NIPPON EXPRESS HOLDINGS, Inc. | 9,900 | 592 | |||||||||

Nippon Yusen KK | 26,600 | 2,090 | |||||||||

OKUMA Corp. | 20,400 | 802 | |||||||||

Sanwa Holdings Corp. | 191,000 | 2,064 | |||||||||

13,858 | |||||||||||

Information Technology (0.7%): | |||||||||||

Canon, Inc. | 18,600 | 440 | |||||||||

Fujitsu Ltd. | 20,900 | 2,803 | |||||||||

Murata Manufacturing Co. Ltd. | 8,700 | 508 | |||||||||

Tokyo Electron Ltd. | 2,400 | 826 | |||||||||

Ulvac, Inc. | 30,500 | 1,152 | |||||||||

5,729 | |||||||||||

Materials (0.1%): | |||||||||||

Shin-Etsu Chemical Co. Ltd. | 4,100 | 525 | |||||||||

Tosoh Corp. | 39,100 | 510 | |||||||||

1,035 | |||||||||||

Real Estate (0.1%): | |||||||||||

Mitsui Fudosan Co. Ltd. | 20,600 | 460 | |||||||||

Utilities (0.2%): | |||||||||||

Chubu Electric Power Co., Inc. | 80,100 | 855 | |||||||||

Osaka Gas Co. Ltd. | 30,000 | 539 | |||||||||

1,394 | |||||||||||

51,159 | |||||||||||

See notes to financial statements.

15

| USAA Mutual Funds Trust USAA Capital Growth Fund | Schedule of Portfolio Investments — continued July 31, 2022 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

Korea, Republic Of (0.7%): | |||||||||||

Communication Services (0.0%): (a) | |||||||||||

JYP Entertainment Corp. | 10,074 | $ | 432 | ||||||||

Consumer Discretionary (0.1%): | |||||||||||

Danawa Co. Ltd. | 9,672 | 137 | |||||||||

Handsome Co. Ltd. | 12,343 | 296 | |||||||||

Shinsegae, Inc. | 2,046 | 345 | |||||||||

778 | |||||||||||

Financials (0.1%): | |||||||||||

DGB Financial Group, Inc. | 45,140 | 269 | |||||||||

JB Financial Group Co. Ltd. | 58,374 | 336 | |||||||||

KIWOOM Securities Co. Ltd. | 4,266 | 278 | |||||||||

883 | |||||||||||

Health Care (0.2%): | |||||||||||

Daewoong Pharmaceutical Co. Ltd. | 2,211 | 313 | |||||||||

InBody Co. Ltd. | 12,563 | 241 | |||||||||

I-Sens, Inc. | 9,544 | 255 | |||||||||

809 | |||||||||||

Industrials (0.1%): | |||||||||||

CJ Corp. | 4,407 | 271 | |||||||||

Hanwha Aerospace Co. Ltd. | 9,903 | 493 | |||||||||

764 | |||||||||||

Information Technology (0.1%): | |||||||||||

Hana Materials, Inc. | 7,586 | 237 | |||||||||

Innox Advanced Materials Co. Ltd. | 12,720 | 365 | |||||||||

Samwha Capacitor Co. Ltd. | 5,768 | 191 | |||||||||

TES Co. Ltd. | 14,764 | 239 | |||||||||

1,032 | |||||||||||

Materials (0.1%): | |||||||||||

Hyosung TNC Corp. | 730 | 194 | |||||||||

PI Advanced Materials Co. Ltd. | 9,579 | 276 | |||||||||

470 | |||||||||||

5,168 | |||||||||||

Luxembourg (0.2%): | |||||||||||

Communication Services (0.0%): (a) | |||||||||||

SES SA | 52,597 | 397 | |||||||||

Energy (0.1%): | |||||||||||

Tenaris SA | 43,196 | 604 | |||||||||

Materials (0.1%): | |||||||||||

ArcelorMittal SA | 21,111 | 521 | |||||||||

1,522 | |||||||||||

See notes to financial statements.

16

| USAA Mutual Funds Trust USAA Capital Growth Fund | Schedule of Portfolio Investments — continued July 31, 2022 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

Malaysia (0.1%): | |||||||||||

Financials (0.1%): | |||||||||||

Hong Leong Financial Group Bhd | 85,000 | $ | 373 | ||||||||

Information Technology (0.0%): (a) | |||||||||||

Inari Amertron Bhd | 557,000 | 360 | |||||||||

Materials (0.0%): (a) | |||||||||||

Evergreen Fibreboard Bhd | 1,541,200 | 163 | |||||||||

896 | |||||||||||

Mexico (0.1%): | |||||||||||

Consumer Discretionary (0.0%): (a) | |||||||||||

Alsea SAB de CV (c) | 153,537 | 299 | |||||||||

Financials (0.1%): | |||||||||||

Regional SAB de CV | 66,157 | 361 | |||||||||

660 | |||||||||||

Netherlands (1.7%): | |||||||||||

Communication Services (0.3%): | |||||||||||

Koninklijke KPN NV | 795,090 | 2,623 | |||||||||

Consumer Staples (0.2%): | |||||||||||

Heineken NV | 6,005 | 592 | |||||||||

Koninklijke Ahold Delhaize NV | 34,910 | 961 | |||||||||

1,553 | |||||||||||

Financials (0.4%): | |||||||||||

ING Groep NV | 232,311 | 2,256 | |||||||||

NN Group NV | 12,446 | 584 | |||||||||

2,840 | |||||||||||

Health Care (0.1%): | |||||||||||

QIAGEN NV (c) | 10,765 | 540 | |||||||||

Industrials (0.0%): (a) | |||||||||||

Signify NV (b) | 9,966 | 324 | |||||||||

Information Technology (0.4%): | |||||||||||

ASM International NV | 8,644 | 2,655 | |||||||||

STMicroelectronics NV | 23,773 | 899 | |||||||||

3,554 | |||||||||||

Materials (0.3%): | |||||||||||

LyondellBasell Industries NV Class A | 23,948 | 2,134 | |||||||||

13,568 | |||||||||||

New Zealand (0.1%): | |||||||||||

Health Care (0.1%): | |||||||||||

Fisher & Paykel Healthcare Corp. Ltd. | 64,970 | 869 | |||||||||

Norway (0.5%): | |||||||||||

Consumer Staples (0.1%): | |||||||||||

Mowi ASA | 26,869 | 620 | |||||||||

See notes to financial statements.

17

| USAA Mutual Funds Trust USAA Capital Growth Fund | Schedule of Portfolio Investments — continued July 31, 2022 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

Energy (0.2%): | |||||||||||

Aker BP ASA | 21,562 | $ | 750 | ||||||||

Equinor ASA | 13,909 | 536 | |||||||||

Var Energi ASA (c) | 121,997 | 489 | |||||||||

1,775 | |||||||||||

Financials (0.1%): | |||||||||||

SpareBank 1 SMN | 99,952 | 1,282 | |||||||||

Materials (0.1%): | |||||||||||

Yara International ASA | 12,714 | 542 | |||||||||

4,219 | |||||||||||

Romania (0.0%): (a) | |||||||||||

Real Estate (0.0%): | |||||||||||

NEPI Rockcastle S.A. | 1 | — | (d) | ||||||||

Russian Federation (0.0%): (a) | |||||||||||

Consumer Discretionary (0.0%): | |||||||||||

Detsky Mir PJSC (b) (e) (f) | 214,920 | 3 | |||||||||

Financials (0.0%): | |||||||||||

Bank St Petersburg PJSC (c) (e) (f) | 372,110 | 4 | |||||||||

Industrials (0.0%): | |||||||||||

Globaltrans Investment PLC Registered Shares, GDR (e) (f) | 54,896 | 2 | |||||||||

9 | |||||||||||

Saudi Arabia (0.1%): | |||||||||||

Consumer Discretionary (0.1%): | |||||||||||

Leejam Sports Co. JSC | 10,110 | 304 | |||||||||

United Electronics Co. | 10,667 | 338 | |||||||||

642 | |||||||||||

Energy (0.0%): (a) | |||||||||||

Aldrees Petroleum and Transport Services Co. | 17,566 | 339 | |||||||||

981 | |||||||||||

Singapore (0.3%): | |||||||||||

Consumer Staples (0.1%): | |||||||||||

Wilmar International Ltd. | 283,400 | 826 | |||||||||

Financials (0.1%): | |||||||||||

DBS Group Holdings Ltd. | 39,400 | 899 | |||||||||

Utilities (0.1%): | |||||||||||

Sembcorp Industries Ltd. | 223,800 | 473 | |||||||||

2,198 | |||||||||||

South Africa (0.1%): | |||||||||||

Consumer Discretionary (0.0%): (a) | |||||||||||

Woolworths Holdings Ltd. | 93,680 | 299 | |||||||||

See notes to financial statements.

18

| USAA Mutual Funds Trust USAA Capital Growth Fund | Schedule of Portfolio Investments — continued July 31, 2022 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

Industrials (0.1%): | |||||||||||

Raubex Group Ltd. | 145,480 | $ | 322 | ||||||||

The Bidvest Group Ltd. | 19,623 | 253 | |||||||||

575 | |||||||||||

874 | |||||||||||

Spain (0.6%): | |||||||||||

Financials (0.4%): | |||||||||||

Banco Bilbao Vizcaya Argentaria SA | 440,500 | 1,996 | |||||||||

Banco Santander SA | 216,524 | 542 | |||||||||

Bankinter SA | 71,252 | 351 | |||||||||

2,889 | |||||||||||

Health Care (0.0%): (a) | |||||||||||

Laboratorios Farmaceuticos Rovi SA | 6,844 | 358 | |||||||||

Utilities (0.2%): | |||||||||||

Corp. ACCIONA Energias Renovables SA | 16,675 | 731 | |||||||||

Iberdrola SA | 58,312 | 622 | |||||||||

1,353 | |||||||||||

4,600 | |||||||||||

Sweden (0.8%): | |||||||||||

Consumer Discretionary (0.0%): (a) | |||||||||||

Evolution AB (b) | 4,865 | 473 | |||||||||

Industrials (0.7%): | |||||||||||

Atlas Copco AB Class B (c) | 316,801 | 3,293 | |||||||||

Nibe Industrier AB Class B | 175,340 | 1,767 | |||||||||

Volvo AB Class B | 24,134 | 434 | |||||||||

5,494 | |||||||||||

Materials (0.1%): | |||||||||||

Boliden AB | 17,646 | 590 | |||||||||

6,557 | |||||||||||

Switzerland (4.0%): | |||||||||||

Consumer Discretionary (0.1%): | |||||||||||

Cie Financiere Richemont SA Registered Shares | 5,591 | 674 | |||||||||

Consumer Staples (1.3%): | |||||||||||

Coca-Cola HBC AG | 86,665 | 2,132 | |||||||||

Nestle SA Registered Shares | 67,695 | 8,296 | |||||||||

10,428 | |||||||||||

Financials (0.7%): | |||||||||||

Julius Baer Group Ltd. | 11,448 | 592 | |||||||||

Partners Group Holding AG | 523 | 571 | |||||||||

Swiss Life Holding AG | 1,950 | 1,033 | |||||||||

UBS Group AG | 211,851 | 3,463 | |||||||||

5,659 | |||||||||||

See notes to financial statements.

19

| USAA Mutual Funds Trust USAA Capital Growth Fund | Schedule of Portfolio Investments — continued July 31, 2022 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

Health Care (1.6%): | |||||||||||

Alcon, Inc. | 6,468 | $ | 509 | ||||||||

Novartis AG Registered Shares | 59,139 | 5,083 | |||||||||

Roche Holding AG | 21,558 | 7,158 | |||||||||

12,750 | |||||||||||

Industrials (0.1%): | |||||||||||

Adecco Group AG | 24,995 | 881 | |||||||||

Materials (0.2%): | |||||||||||

Glencore PLC | 136,150 | 772 | |||||||||

Holcim AG | 11,557 | 542 | |||||||||

1,314 | |||||||||||

31,706 | |||||||||||

Taiwan (0.6%): | |||||||||||

Consumer Discretionary (0.1%): | |||||||||||

Fusheng Precision Co. Ltd. | 48,000 | 296 | |||||||||

Health Care (0.0%): (a) | |||||||||||

Pegavision Corp. | 19,000 | 292 | |||||||||

Industrials (0.1%): | |||||||||||

Chicony Power Technology Co. Ltd. | 179,000 | 437 | |||||||||

Symtek Automation Asia Co. Ltd. | 87,000 | 274 | |||||||||

Turvo International Co. Ltd. | 62,000 | 237 | |||||||||

948 | |||||||||||

Information Technology (0.3%): | |||||||||||

Gold Circuit Electronics Ltd. | 153,000 | 418 | |||||||||

King Yuan Electronics Co. Ltd. | 338,000 | 446 | |||||||||

Macronix International Co. Ltd. | 378,000 | 414 | |||||||||

Phison Electronics Corp. | 22,000 | 216 | |||||||||

Powertech Technology, Inc. | 124,000 | 355 | |||||||||

Sigurd Microelectronics Corp. | 206,000 | 345 | |||||||||

Tripod Technology Corp. | 101,000 | 347 | |||||||||

2,541 | |||||||||||

Materials (0.1%): | |||||||||||

China General Plastics Corp. | 303,450 | 256 | |||||||||

Taiwan Hon Chuan Enterprise Co. Ltd. | 155,000 | 384 | |||||||||

Tung Ho Steel Enterprise Corp. | 216,410 | 375 | |||||||||

1,015 | |||||||||||

5,092 | |||||||||||

Thailand (0.2%): | |||||||||||

Financials (0.0%): (a) | |||||||||||

AEON Thana Sinsap Thailand PCL-NVDR | 65,500 | 297 | |||||||||

Health Care (0.1%): | |||||||||||

Mega Lifesciences PCL | 286,300 | 384 | |||||||||

Industrials (0.0%): (a) | |||||||||||

STARK Corp. PCL-NVDR (c) | 2,235,300 | 265 | |||||||||

See notes to financial statements.

20

| USAA Mutual Funds Trust USAA Capital Growth Fund | Schedule of Portfolio Investments — continued July 31, 2022 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

Materials (0.0%): (a) | |||||||||||

Sahamitr Pressure Container PCL | 730,200 | $ | 313 | ||||||||

Real Estate (0.1%): | |||||||||||

AP Thailand PCL | 1,756,800 | 469 | |||||||||

1,728 | |||||||||||

United Arab Emirates (0.0%): (a) | |||||||||||

Industrials (0.0%): | |||||||||||

RAS Al Khaimah Ceramics | 526,426 | 410 | |||||||||

United Kingdom (5.6%): | |||||||||||

Communication Services (0.0%): (a) | |||||||||||

WPP PLC | 34,021 | 367 | |||||||||

Consumer Discretionary (0.4%): | |||||||||||

Barratt Developments PLC | 61,287 | 376 | |||||||||

JD Sports Fashion PLC | 425,938 | 677 | |||||||||

Next PLC | 13,496 | 1,123 | |||||||||

Stellantis NV | 89,727 | 1,288 | |||||||||

3,464 | |||||||||||

Consumer Staples (0.8%): | |||||||||||

Diageo PLC | 67,428 | 3,194 | |||||||||

Imperial Brands PLC | 109,214 | 2,397 | |||||||||

Tesco PLC | 243,363 | 780 | |||||||||

6,371 | |||||||||||

Energy (1.0%): | |||||||||||

| BP PLC | 707,826 | 3,464 | |||||||||

Harbour Energy PLC | 92,458 | 413 | |||||||||

Shell PLC | 162,224 | 4,327 | |||||||||

8,204 | |||||||||||

Financials (1.3%): | |||||||||||

| 3i Group PLC | 59,491 | 924 | |||||||||

Aon PLC Class A | 8,957 | 2,607 | |||||||||

Barclays PLC | 850,986 | 1,630 | |||||||||

HSBC Holdings PLC | 431,624 | 2,703 | |||||||||

Legal & General Group PLC | 513,180 | 1,639 | |||||||||

Standard Chartered PLC | 125,009 | 861 | |||||||||

10,364 | |||||||||||

Health Care (0.3%): | |||||||||||

AstraZeneca PLC | 10,688 | 1,406 | |||||||||

CVS Group PLC | 31,497 | 661 | |||||||||

2,067 | |||||||||||

Industrials (0.5%): | |||||||||||

Ashtead Group PLC | 47,975 | 2,700 | |||||||||

Ferguson PLC | 4,840 | 609 | |||||||||

RS GROUP PLC | 39,953 | 504 | |||||||||

3,813 | |||||||||||

See notes to financial statements.

21

| USAA Mutual Funds Trust USAA Capital Growth Fund | Schedule of Portfolio Investments — continued July 31, 2022 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

Materials (1.1%): | |||||||||||

Anglo American PLC | 24,630 | $ | 890 | ||||||||

Croda International PLC | 13,991 | 1,279 | |||||||||

Linde PLC | 9,578 | 2,893 | |||||||||

Pan African Resources PLC | 1,294,229 | 315 | |||||||||

Rio Tinto PLC | 59,061 | 3,565 | |||||||||

8,942 | |||||||||||

Real Estate (0.1%): | |||||||||||

Safestore Holdings PLC | 29,232 | 407 | |||||||||

Utilities (0.1%): | |||||||||||

Drax Group PLC | 55,036 | 528 | |||||||||

44,527 | |||||||||||

United States (61.7%): | |||||||||||

Communication Services (4.1%): | |||||||||||

Alphabet, Inc. Class C (c) | 145,060 | 16,920 | |||||||||

AT&T, Inc. | 156,457 | 2,938 | |||||||||

Comcast Corp. Class A | 81,696 | 3,065 | |||||||||

Match Group, Inc. (c) | 32,199 | 2,360 | |||||||||

Sirius XM Holdings, Inc. (g) | 370,507 | 2,475 | |||||||||

The Interpublic Group of Cos., Inc. | 67,529 | 2,017 | |||||||||

Verizon Communications, Inc. | 65,978 | 3,048 | |||||||||

32,823 | |||||||||||

Consumer Discretionary (5.9%): | |||||||||||

AutoZone, Inc. (c) | 2,428 | 5,190 | |||||||||

Best Buy Co., Inc. | 23,171 | 1,784 | |||||||||

eBay, Inc. | 52,052 | 2,531 | |||||||||

Ford Motor Co. | 199,144 | 2,925 | |||||||||

General Motors Co. (c) | 69,295 | 2,513 | |||||||||

Lennar Corp. Class A | 32,601 | 2,771 | |||||||||

Lowe's Cos., Inc. | 28,397 | 5,439 | |||||||||

McDonald's Corp. | 12,190 | 3,210 | |||||||||

O'Reilly Automotive, Inc. (c) | 7,770 | 5,467 | |||||||||

Target Corp. | 11,948 | 1,952 | |||||||||

Tesla, Inc. (c) | 6,646 | 5,925 | |||||||||

The Home Depot, Inc. | 24,197 | 7,282 | |||||||||

46,989 | |||||||||||

Consumer Staples (3.6%): | |||||||||||

Altria Group, Inc. | 48,950 | 2,147 | |||||||||

Colgate-Palmolive Co. | 32,453 | 2,555 | |||||||||

Costco Wholesale Corp. | 6,371 | 3,449 | |||||||||

PepsiCo, Inc. | 18,961 | 3,317 | |||||||||

Philip Morris International, Inc. | 27,468 | 2,668 | |||||||||

The Clorox Co. | 14,471 | 2,053 | |||||||||

The Coca-Cola Co. | 52,341 | 3,359 | |||||||||

The Hershey Co. | 10,411 | 2,373 | |||||||||

The Kroger Co. | 47,412 | 2,202 | |||||||||

See notes to financial statements.

22

| USAA Mutual Funds Trust USAA Capital Growth Fund | Schedule of Portfolio Investments — continued July 31, 2022 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

Tyson Foods, Inc. Class A | 27,448 | $ | 2,416 | ||||||||

Walgreens Boots Alliance, Inc. | 56,105 | 2,223 | |||||||||

28,762 | |||||||||||

Energy (2.2%): | |||||||||||

ConocoPhillips | 59,467 | 5,794 | |||||||||

Devon Energy Corp. | 38,012 | 2,389 | |||||||||

EOG Resources, Inc. | 21,232 | 2,361 | |||||||||

Exxon Mobil Corp. | 47,950 | 4,648 | |||||||||

Marathon Petroleum Corp. | 26,750 | 2,452 | |||||||||

17,644 | |||||||||||

Financials (8.6%): | |||||||||||

AGNC Investment Corp. | 7,024 | 89 | |||||||||

American Express Co. | 16,508 | 2,543 | |||||||||

American Financial Group, Inc. | 15,419 | 2,061 | |||||||||

Annaly Capital Management, Inc. | 19,302 | 133 | |||||||||

Berkshire Hathaway, Inc. Class B (c) | 26,553 | 7,982 | |||||||||

Blackstone, Inc. | 25,637 | 2,617 | |||||||||

Capital One Financial Corp. | 21,606 | 2,373 | |||||||||

Citigroup, Inc. | 57,608 | 2,990 | |||||||||

Erie Indemnity Co. Class A | 2,611 | 531 | |||||||||

JPMorgan Chase & Co. | 33,329 | 3,845 | |||||||||

M&T Bank Corp. | 13,765 | 2,443 | |||||||||

Marsh & McLennan Cos., Inc. | 16,152 | 2,648 | |||||||||

MetLife, Inc. | 38,905 | 2,461 | |||||||||

Morgan Stanley | 35,989 | 3,034 | |||||||||

MSCI, Inc. | 6,152 | 2,961 | |||||||||

Prudential Financial, Inc. | 23,317 | 2,331 | |||||||||

Raymond James Financial, Inc. | 24,084 | 2,372 | |||||||||

Regions Financial Corp. | 110,817 | 2,347 | |||||||||

S&P Global, Inc. | 8,272 | 3,118 | |||||||||

SEI Investments Co. | 38,395 | 2,125 | |||||||||

Signature Bank | 10,166 | 1,886 | |||||||||

SVB Financial Group (c) | 4,929 | 1,989 | |||||||||

T. Rowe Price Group, Inc. | 18,911 | 2,335 | |||||||||

The Goldman Sachs Group, Inc. | 9,380 | 3,127 | |||||||||

The Progressive Corp. | 22,801 | 2,623 | |||||||||

Wells Fargo & Co. | 138,249 | 6,065 | |||||||||

69,029 | |||||||||||

Health Care (10.6%): | |||||||||||

AbbVie, Inc. | 46,550 | 6,680 | |||||||||

AmerisourceBergen Corp. | 14,542 | 2,122 | |||||||||

Amgen, Inc. | 24,409 | 6,041 | |||||||||

Biogen, Inc. (c) | 13,592 | 2,923 | |||||||||

Bristol-Myers Squibb Co. | 41,873 | 3,089 | |||||||||

Cigna Corp. | 10,779 | 2,968 | |||||||||

CVS Health Corp. | 30,436 | 2,912 | |||||||||

Elevance Health, Inc. | 11,578 | 5,524 | |||||||||

Eli Lilly & Co. | 22,491 | 7,415 | |||||||||

See notes to financial statements.

23

| USAA Mutual Funds Trust USAA Capital Growth Fund | Schedule of Portfolio Investments — continued July 31, 2022 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

Gilead Sciences, Inc. | 45,002 | $ | 2,689 | ||||||||

IDEXX Laboratories, Inc. (c) | 6,734 | 2,688 | |||||||||

Johnson & Johnson | 49,963 | 8,720 | |||||||||

McKesson Corp. | 7,360 | 2,514 | |||||||||

Merck & Co., Inc. | 39,143 | 3,497 | |||||||||

Mettler-Toledo International, Inc. (c) | 1,935 | 2,612 | |||||||||

Pfizer, Inc. | 75,737 | 3,826 | |||||||||

Thermo Fisher Scientific, Inc. | 5,998 | 3,589 | |||||||||

UnitedHealth Group, Inc. | 17,542 | 9,514 | |||||||||

Waters Corp. (c) | 7,377 | 2,685 | |||||||||

West Pharmaceutical Services, Inc. | 7,668 | 2,634 | |||||||||

84,642 | |||||||||||

Industrials (7.1%): | |||||||||||

3M Co. | 35,737 | 5,119 | |||||||||

Cintas Corp. | 6,238 | 2,654 | |||||||||

Cummins, Inc. | 12,119 | 2,682 | |||||||||

Fastenal Co. | 43,865 | 2,253 | |||||||||

FedEx Corp. | 12,785 | 2,980 | |||||||||

General Dynamics Corp. | 22,213 | 5,035 | |||||||||

Illinois Tool Works, Inc. | 11,717 | 2,434 | |||||||||

Lockheed Martin Corp. | 18,596 | 7,695 | |||||||||

Masco Corp. | 40,280 | 2,231 | |||||||||

Northrop Grumman Corp. | 5,478 | 2,624 | |||||||||

Old Dominion Freight Line, Inc. | 8,431 | 2,559 | |||||||||

Otis Worldwide Corp. | 30,668 | 2,397 | |||||||||

PACCAR, Inc. | 28,607 | 2,618 | |||||||||

Republic Services, Inc. | 17,627 | 2,444 | |||||||||

Union Pacific Corp. | 12,584 | 2,860 | |||||||||

United Parcel Service, Inc. Class B | 16,675 | 3,250 | |||||||||

W.W. Grainger, Inc. | 4,792 | 2,605 | |||||||||

Waste Management, Inc. | 15,568 | 2,562 | |||||||||

57,002 | |||||||||||

Information Technology (14.6%): | |||||||||||

Adobe, Inc. (c) | 7,974 | 3,270 | |||||||||

Apple, Inc. | 119,760 | 19,462 | |||||||||

Applied Materials, Inc. | 27,026 | 2,864 | |||||||||

Broadcom, Inc. | 11,751 | 6,293 | |||||||||

Cisco Systems, Inc. | 132,602 | 6,016 | |||||||||

Cognizant Technology Solutions Corp. Class A | 34,169 | 2,322 | |||||||||

Fair Isaac Corp. (c) | 6,539 | 3,021 | |||||||||

Fortinet, Inc. (c) | 47,530 | 2,835 | |||||||||

Gartner, Inc. (c) | 9,467 | 2,513 | |||||||||

HP, Inc. | 135,157 | 4,513 | |||||||||

Intel Corp. | 71,386 | 2,592 | |||||||||

International Business Machines Corp. | 22,107 | 2,891 | |||||||||

Intuit, Inc. | 7,152 | 3,263 | |||||||||

Micron Technology, Inc. | 40,769 | 2,522 | |||||||||

Microsoft Corp. | 81,371 | 22,844 | |||||||||

Motorola Solutions, Inc. | 11,422 | 2,725 | |||||||||

See notes to financial statements.

24

| USAA Mutual Funds Trust USAA Capital Growth Fund | Schedule of Portfolio Investments — continued July 31, 2022 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

NVIDIA Corp. | 17,870 | $ | 3,246 | ||||||||

Oracle Corp. | 41,340 | 3,218 | |||||||||

Palo Alto Networks, Inc. (c) | 5,184 | 2,587 | |||||||||

Parade Technologies Ltd. | 10,000 | 377 | |||||||||

Paychex, Inc. | 19,441 | 2,494 | |||||||||

QUALCOMM, Inc. | 44,385 | 6,439 | |||||||||

Texas Instruments, Inc. | 36,374 | 6,507 | |||||||||

VeriSign, Inc. (c) | 13,740 | 2,599 | |||||||||

117,413 | |||||||||||

Materials (1.5%): | |||||||||||

Avery Dennison Corp. | 12,699 | 2,419 | |||||||||

CF Industries Holdings, Inc. | 25,076 | 2,395 | |||||||||

Nucor Corp. | 37,976 | 5,157 | |||||||||

The Sherwin-Williams Co. | 9,040 | 2,187 | |||||||||

12,158 | |||||||||||

Real Estate (1.7%): | |||||||||||

Alexandria Real Estate Equities, Inc. | 1,930 | 320 | |||||||||

American Tower Corp. | 6,092 | 1,650 | |||||||||

AvalonBay Communities, Inc. | 1,861 | 398 | |||||||||

Boston Properties, Inc. | 1,975 | 180 | |||||||||

Camden Property Trust | 1,344 | 190 | |||||||||

CBRE Group, Inc. Class A (c) | 4,471 | 383 | |||||||||

Crown Castle International Corp. | 5,797 | 1,047 | |||||||||

Digital Realty Trust, Inc. | 3,771 | 499 | |||||||||

Equinix, Inc. | 1,196 | 842 | |||||||||

Equity LifeStyle Properties, Inc. | 2,333 | 171 | |||||||||

Equity Residential | 4,745 | 372 | |||||||||

Essex Property Trust, Inc. | 867 | 248 | |||||||||

Extra Space Storage, Inc. | 1,782 | 338 | |||||||||

Healthpeak Properties, Inc. | 7,186 | 199 | |||||||||

Host Hotels & Resorts, Inc. | 9,459 | 168 | |||||||||

Invitation Homes, Inc. | 7,714 | 301 | |||||||||

Iron Mountain, Inc. | 3,875 | 188 | |||||||||

Medical Properties Trust, Inc. | 7,895 | 136 | |||||||||

Mid-America Apartment Communities, Inc. | 1,549 | 288 | |||||||||

Prologis, Inc. | 9,867 | 1,308 | |||||||||

Public Storage | 2,105 | 687 | |||||||||

Realty Income Corp. | 7,353 | 544 | |||||||||

Regency Centers Corp. | 2,034 | 131 | |||||||||

SBA Communications Corp. | 1,470 | 494 | |||||||||

Simon Property Group, Inc. | 4,380 | 476 | |||||||||

Sun Communities, Inc. | 1,548 | 254 | |||||||||

UDR, Inc. | 3,947 | 191 | |||||||||

Ventas, Inc. | 5,242 | 282 | |||||||||

VICI Properties, Inc. | 8,198 | 280 | |||||||||

Vornado Realty Trust | 2,165 | 66 | |||||||||

Welltower, Inc. | 5,647 | 488 | |||||||||

Weyerhaeuser Co. | 10,027 | 364 | |||||||||

See notes to financial statements.

25

| USAA Mutual Funds Trust USAA Capital Growth Fund | Schedule of Portfolio Investments — continued July 31, 2022 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

WP Carey, Inc. | 2,465 | $ | 220 | ||||||||

Zillow Group, Inc. Class C (c) | 3,049 | 106 | |||||||||

13,809 | |||||||||||

Utilities (1.8%): | |||||||||||

CenterPoint Energy, Inc. | 74,491 | 2,361 | |||||||||

Exelon Corp. | 51,017 | 2,372 | |||||||||

FirstEnergy Corp. | 54,080 | 2,223 | |||||||||

NRG Energy, Inc. | 53,982 | 2,038 | |||||||||

The AES Corp. | 109,070 | 2,423 | |||||||||

UGI Corp. | 60,765 | 2,622 | |||||||||

14,039 | |||||||||||

494,310 | |||||||||||

Total Common Stocks (Cost $694,837) | 795,670 | ||||||||||

Exchange-Traded Funds (0.0%) (a) | |||||||||||

United States (0.0%): | |||||||||||

iShares Core MSCI EAFE ETF | 5,884 | 365 | |||||||||

Total Exchange-Traded Funds (Cost $385) | 365 | ||||||||||

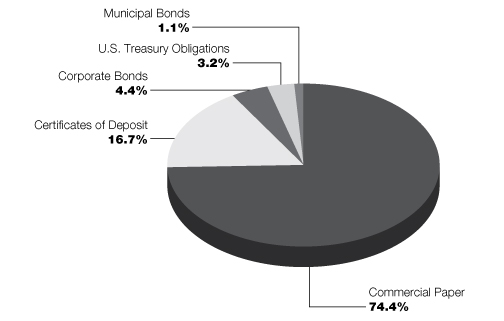

Collateral for Securities Loaned (0.3%)^ | |||||||||||

United States (0.3%): | |||||||||||

HSBC U.S. Government Money Market Fund, I Shares, 2.15% (h) | 2,480,743 | 2,481 | |||||||||

Total Collateral for Securities Loaned (Cost $2,481) | 2,481 | ||||||||||

Total Investments (Cost $697,703) — 99.6% | 798,516 | ||||||||||

Other assets in excess of liabilities — 0.4% | 2,945 | ||||||||||

NET ASSETS — 100.00% | $ | 801,461 | |||||||||

^ Purchased with cash collateral from securities on loan.

(a) Amount represents less than 0.05% of net assets.

(b) Rule 144A security or other security that is restricted as to resale to institutional investors. The Fund's Adviser has deemed this security to be liquid (unless otherwise noted as illiquid) based upon procedures approved by the Board of Trustees. As of July 31, 2022, the fair value of these securities was $4,566 thousands and amounted to 0.6% of net assets.

(c) Non-income producing security.

(d) Rounds to less than $1 thousand.

(e) Security was fair valued based upon procedures approved by the Board of Trustees and represents less than 0.05% of net assets as of July 31, 2022. This security is classified as Level 3 within the fair value hierarchy. (See Note 2 in the Notes to Financial Statements)

(f) The Fund's Adviser has deemed this security to be illiquid based upon procedures approved by the Board of Trustees. At July 31, 2022, illiquid securities were less than 0.05% of the Fund's net assets.

(g) All or a portion of this security is on loan.

See notes to financial statements.

26

| USAA Mutual Funds Trust USAA Capital Growth Fund | Schedule of Portfolio Investments — continued July 31, 2022 | ||||||

(h) Rate disclosed is the daily yield on July 31, 2022.

ADR — American Depositary Receipt

ETF — Exchange-Traded Fund

GDR — Global Depositary Receipt

NVDR — Non-Voting Depository Receipt

PCL — Public Company Limited

PLC — Public Limited Company

See notes to financial statements.

27

USAA Mutual Funds Trust | Statement of Assets and Liabilities July 31, 2022 | ||||||

(Amounts in Thousands, Except Per Share Amounts)

| USAA Capital Growth Fund | |||||||

Assets: | |||||||

Investments, at value (Cost $697,703) | $ | 798,516 | (a) | ||||

Foreign currency, at value (Cost $504) | 507 | ||||||

Cash | 3,496 | ||||||

Receivables: | |||||||

Interest and dividends | 1,049 | ||||||

Capital shares issued | 140 | ||||||

Investments sold | 544 | ||||||

Reclaims | 975 | ||||||

From Adviser | 2 | ||||||

Prepaid expenses | 14 | ||||||

Total Assets | 805,243 | ||||||

Liabilities: | |||||||

Payables: | |||||||

Collateral received on loaned securities | 2,481 | ||||||

Investments purchased | 158 | ||||||

Capital shares redeemed | 267 | ||||||

Accrued foreign capital gains taxes | 99 | ||||||

Accrued expenses and other payables: | |||||||

Investment advisory fees | 488 | ||||||

Administration fees | 97 | ||||||

Custodian fees | 29 | ||||||

Transfer agent fees | 91 | ||||||

Compliance fees | 1 | ||||||

Trustees' fees | 2 | ||||||

Other accrued expenses | 69 | ||||||

Total Liabilities | 3,782 | ||||||

Net Assets: | |||||||

Capital | 655,976 | ||||||

Total accumulated earnings/(loss) | 145,485 | ||||||

Net Assets | $ | 801,461 | |||||

Net Assets | |||||||

Fund Shares | $ | 799,210 | |||||

Institutional Shares | 2,251 | ||||||

Total | $ | 801,461 | |||||

Shares (unlimited number of shares authorized with no par value): | |||||||

Fund Shares | 70,730 | ||||||

Institutional Shares | 198 | ||||||

Total | 70,928 | ||||||

Net asset value, offering and redemption price per share: (b) | |||||||

Fund Shares | $ | 11.30 | |||||

Institutional Shares | 11.39 | ||||||

(a) Includes $2,450 thousand of securities on loan.

(b) Per share amount may not recalculate due to rounding of net assets and/or shares outstanding.

See notes to financial statements.

28

USAA Mutual Funds Trust | Statement of Operations For the Year Ended July 31, 2022 | ||||||

(Amounts in Thousands)

| USAA Capital Growth Fund | |||||||

Investment Income: | |||||||

Dividends | $ | 24,081 | |||||

Interest | 2 | ||||||

Securities lending (net of fees) | 113 | ||||||

Foreign tax withholding | (1,520 | ) | |||||

Total Income | 22,676 | ||||||

Expenses: | |||||||

Investment advisory fees | 6,427 | ||||||

Administration fees — Fund Shares | 1,298 | ||||||

Administration fees — Institutional Shares | 2 | ||||||

Sub-Administration fees | 76 | ||||||

Custodian fees | 177 | ||||||

Transfer agent fees — Fund Shares | 1,085 | ||||||

Transfer agent fees — Institutional Shares | 2 | ||||||

Trustees' fees | 49 | ||||||

Compliance fees | 6 | ||||||

Legal and audit fees | 114 | ||||||

State registration and filing fees | 47 | ||||||

Other expenses | 140 | ||||||

Recoupment of prior expenses waived/reimbursed by Adviser | 57 | ||||||

Total Expenses | 9,480 | ||||||

Expenses waived/reimbursed by Adviser | (13 | ) | |||||

Net Expenses | 9,467 | ||||||

Net Investment Income (Loss) | 13,209 | ||||||

Realized/Unrealized Gains (Losses) from Investments: | |||||||

| Net realized gains (losses) from investment securities and foreign currency transactions | 65,653 | ||||||

Foreign taxes on realized gains | (134 | ) | |||||

| Net change in unrealized appreciation/depreciation on investment securities and foreign currency translations | (137,905 | ) | |||||

Net change in accrued foreign taxes on unrealized gains | 340 | ||||||

Net realized/unrealized gains (losses) on investments | (72,046 | ) | |||||

Change in net assets resulting from operations | $ | (58,837 | ) | ||||

See notes to financial statements.

29

USAA Mutual Funds Trust | Statements of Changes in Net Assets | ||||||

(Amounts in Thousands)

USAA Capital Growth Fund | |||||||||||

| Year Ended July 31, 2022 | Year Ended July 31, 2021 | ||||||||||

From Investments: | |||||||||||

Operations: | |||||||||||

Net Investment Income (Loss) | $ | 13,209 | $ | 8,666 | |||||||

Net realized gains (losses) | 65,519 | 90,229 | |||||||||

Net change in unrealized appreciation/depreciation | (137,565 | ) | 136,449 | ||||||||

Change in net assets resulting from operations | (58,837 | ) | 235,344 | ||||||||

Distributions to Shareholders: | |||||||||||

Fund Shares | (105,732 | ) | (24,838 | ) | |||||||

Institutional Shares | (271 | ) | (206 | ) | |||||||

Change in net assets resulting from distributions to shareholders | (106,003 | ) | (25,044 | ) | |||||||

Change in net assets resulting from capital transactions | 64,768 | (75,428 | ) | ||||||||

Change in net assets | (100,072 | ) | 134,872 | ||||||||

Net Assets: | |||||||||||

Beginning of period | 901,533 | 766,661 | |||||||||

End of period | $ | 801,461 | $ | 901,533 | |||||||

Capital Transactions: | |||||||||||

Fund Shares | |||||||||||

Proceeds from shares issued | $ | 53,698 | $ | 53,898 | |||||||

Distributions reinvested | 105,030 | 24,634 | |||||||||

Cost of shares redeemed | (94,848 | ) | (142,355 | ) | |||||||

Total Fund Shares | $ | 63,880 | $ | (63,823 | ) | ||||||

Institutional Shares | |||||||||||

Proceeds from shares issued | $ | 1,776 | $ | 1,635 | |||||||

Distributions reinvested | 264 | 32 | |||||||||

Cost of shares redeemed | (1,152 | ) | (13,272 | ) | |||||||

Total Institutional Shares | $ | 888 | $ | (11,605 | ) | ||||||

Change in net assets resulting from capital transactions | $ | 64,768 | $ | (75,428 | ) | ||||||

Share Transactions: | |||||||||||

Fund Shares | |||||||||||

Issued | 4,272 | 4,393 | |||||||||

Reinvested | 8,241 | 2,105 | |||||||||

Redeemed | (7,586 | ) | (11,813 | ) | |||||||

Total Fund Shares | 4,927 | (5,315 | ) | ||||||||

Institutional Shares | |||||||||||

Issued | 144 | 128 | |||||||||

Reinvested | 20 | 3 | |||||||||

Redeemed | (94 | ) | (1,087 | ) | |||||||

Total Institutional Shares | 70 | (956 | ) | ||||||||

Change in Shares | 4,997 | (6,271 | ) | ||||||||

See notes to financial statements.

30

This page is intentionally left blank.

31

USAA Mutual Funds Trust | Financial Highlights | ||||||

For a Share Outstanding Throughout Each Period

Investment Activities | Distributions to Shareholders From | ||||||||||||||||||||||||||

| Net Asset Value, Beginning of Period | Net Investment Income (Loss) | Net Realized and Unrealized Gains (Losses) | Total from Investment Activities | Net Investment Income | Net Realized Gains from Investments | ||||||||||||||||||||||

USAA Capital Growth Fund | |||||||||||||||||||||||||||

Fund Shares | |||||||||||||||||||||||||||

| Year Ended July 31: 2022 | $ | 13.67 | 0.19 | (f) | (0.95 | ) | (0.76 | ) | (0.16 | ) | (1.45 | ) | |||||||||||||||

2021 | $ | 10.62 | 0.13 | (f) | 3.28 | 3.41 | (0.12 | ) | (0.24 | ) | |||||||||||||||||

2020 | $ | 11.36 | 0.14 | (f) | 0.13 | 0.27 | (0.17 | ) | (0.84 | ) | |||||||||||||||||

2019 | $ | 12.63 | 0.16 | (0.48 | ) | (0.32 | ) | (0.17 | ) | (0.78 | ) | ||||||||||||||||

2018 | $ | 11.67 | 0.15 | 1.21 | 1.36 | (0.12 | ) | (0.28 | ) | ||||||||||||||||||

Institutional Shares | |||||||||||||||||||||||||||

| Year Ended July 31: 2022 | $ | 13.81 | 0.20 | (f) | (0.95 | ) | (0.75 | ) | (0.22 | ) | (1.45 | ) | |||||||||||||||

2021 | $ | 10.66 | 0.15 | (f) | 3.35 | 3.50 | (0.11 | ) | (0.24 | ) | |||||||||||||||||

2020 | $ | 11.39 | 0.14 | (f) | 0.14 | 0.28 | (0.17 | ) | (0.84 | ) | |||||||||||||||||

2019 | $ | 12.66 | 0.23 | (f) | (0.55 | ) | (0.32 | ) | (0.17 | ) | (0.78 | ) | |||||||||||||||

2018 | $ | 11.70 | 0.17 | 1.20 | 1.37 | (0.13 | ) | (0.28 | ) | ||||||||||||||||||

(a) Assumes reinvestment of all net investment income and realized capital gain distributions, if any, during the period. Includes adjustments in accordance with U.S. Generally Accepted Accounting Principles and could differ from the Lipper reported return.

(b) The net expense ratio may not correlate to the applicable expense limits in place during the period since the current contractual expense limitation is applied for a period beginning July 1, 2019 and in effect through November 30, 2023, instead of coinciding with the Fund's fiscal year end. Details of the current contractual expense limitation in effect can be found in Note 4 of the accompanying Notes to Financial Statements.

(c) Does not include acquired fund fees and expenses, if any.

(d) From the period beginning July 1, 2019, the amount of any waivers or reimbursements and the amount of any recoupment are calculated without regard to the impact of any performance adjustment to the Fund's management fee.

(e) Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued.

(f) Per share net investment income (loss) has been calculated using the average daily shares method.

(g) Reflects a return to normal trading levels after a prior year transition.

(h) Reflects increased trading activity due to current year transition or asset allocation shift.

(i) Reflects overall increase in purchases and sales of securities.

(j) Reflects overall decrease in purchases and sales of securities.

See notes to financial statements.

32

USAA Mutual Funds Trust | Financial Highlights — continued | ||||||

For a Share Outstanding Throughout Each Period

Ratios to Average Net Assets | Supplemental Data | ||||||||||||||||||||||||||||||||||

| Total Distributions | Net Asset Value, End of Period | Total Return(a) | Net Expenses(b)(c)(d) | Net Investment Income (Loss) | Gross Expenses(c) | Net Assets, End of Period (000's) | Portfolio Turnover(e) | ||||||||||||||||||||||||||||

USAA Capital Growth Fund | |||||||||||||||||||||||||||||||||||

Fund Shares | |||||||||||||||||||||||||||||||||||

| Year Ended July 31: 2022 | (1.61 | ) | $ | 11.30 | (6.74 | )% | 1.09 | % | 1.52 | % | 1.09 | % | $ | 799,210 | 58 | % | |||||||||||||||||||

2021 | (0.36 | ) | $ | 13.67 | 32.74 | % | 1.07 | % | 1.04 | % | 1.07 | % | $ | 899,767 | 67 | %(g) | |||||||||||||||||||

2020 | (1.01 | ) | $ | 10.62 | 2.14 | % | 1.12 | % | 1.35 | % | 1.13 | % | $ | 755,102 | 152 | %(h) | |||||||||||||||||||

2019 | (0.95 | ) | $ | 11.36 | (1.82 | )% | 1.13 | % | 1.43 | % | 1.13 | % | $ | 826,325 | 54 | %(i) | |||||||||||||||||||

2018 | (0.40 | ) | $ | 12.63 | 11.76 | % | 1.15 | % | 1.25 | % | 1.15 | % | $ | 902,670 | 22 | %(j) | |||||||||||||||||||

Institutional Shares | |||||||||||||||||||||||||||||||||||

| Year Ended July 31: 2022 | (1.67 | ) | $ | 11.39 | (6.68 | )% | 1.06 | % | 1.58 | % | 1.66 | % | $ | 2,251 | 58 | % | |||||||||||||||||||

2021 | (0.35 | ) | $ | 13.81 | 33.45 | % | 0.77 | % | 1.30 | % | 0.92 | % | $ | 1,766 | 67 | %(g) | |||||||||||||||||||

2020 | (1.01 | ) | $ | 10.66 | 2.20 | % | 1.01 | % | 1.31 | % | 1.01 | % | $ | 11,559 | 152 | %(h) | |||||||||||||||||||

2019 | (0.95 | ) | $ | 11.39 | (1.77 | )% | 1.03 | % | 2.04 | % | 1.03 | % | $ | 110,430 | 54 | %(i) | |||||||||||||||||||

2018 | (0.41 | ) | $ | 12.66 | 11.84 | % | 1.10 | % | 1.38 | % | 1.21 | % | $ | 7,961 | 22 | %(j) | |||||||||||||||||||

See notes to financial statements.

33

USAA Mutual Funds Trust | Notes to Financial Statements July 31, 2022 | ||||||

1. Organization:

USAA Mutual Funds Trust (the "Trust") is organized as a Delaware statutory trust and is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as an open-end investment company. The Trust is comprised of 45 funds and is authorized to issue an unlimited number of shares, which are units of beneficial interest with no par value.

The accompanying financial statements are those of the USAA Capital Growth Fund (the "Fund"). The Fund offers two classes of shares: Fund Shares and Institutional Shares. The Fund is classified as diversified under the 1940 Act.

Each class of shares of the Fund has substantially identical rights and privileges, except with respect to fees paid under distribution plans, expenses allocable exclusively to each class of shares, voting rights on matters solely affecting a single class of shares, and the exchange privilege of each class of shares.

Under the Trust's organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund enters into contracts with its vendors and others that provide for general indemnifications. The Fund's maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund. However, based on experience, the Fund expects that risk of loss to be remote.

2. Significant Accounting Policies:

The following is a summary of significant accounting policies followed by the Trust in the preparation of its financial statements. The policies are in conformity with U.S. Generally Accepted Accounting Principles ("GAAP"). The preparation of financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates. The Fund follows the specialized accounting and reporting requirements under GAAP that are applicable to investment companies under Accounting Standards Codification Topic 946.

Investment Valuation:

The Fund records investments at fair value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.