| | OMB APPROVAL |

| | OMB Number: 3235-0570 |

| | Expires: November 30, 2005 |

| | Estimated average burden

hours per response. . . . 5.0 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-7838

American Select Portfolio Inc.

(Exact name of registrant as specified in charter)

800 Nicollet Mall, Minneapolis, MN | | 55402 |

(Address of principal executive offices) | | (Zip code) |

Charles D. Gariboldi 800 Nicollet Mall, Minneapolis, MN 55402

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-677-3863

Date of fiscal year end: November 30

Date of reporting period: May 31, 2005

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

Item 1. Report to Shareholders

AMERICAN SELECT PORTFOLIO INC. | |

| |

SLA | |

May 31, 2005

Semiannual Report

American Select Portfolio Inc.

| | Table of Contents |

| | |

3 | | Financial Statements |

| | |

7 | | Notes to Financial Statements |

| | |

20 | | Schedule of Investments |

| | |

27 | | Notice to Shareholders |

At a meeting held July 20, 2005, the board of directors for American Select Portfolio Inc. (the “fund”), in consultation with U.S. Bancorp Asset Management (“USBAM”), decided not to pursue the previously proposed reorganization of the fund, American Strategic Income Portfolio Inc., American Strategic Income Portfolio Inc. II, and American Strategic Income Portfolio Inc. III (collectively, the “existing funds”) into the First American Strategic Real Estate Portfolio Inc., a specialty finance company that would elect to be taxed as a REIT. The board of directors and USBAM are currently exploring other options, including the possibility of combining the existing funds into a single closed-end fund that would continue to be registered under the Investment Company Act.

NOT FDIC INSURED NO BANK GUARANTEE MAY LOSE VALUE

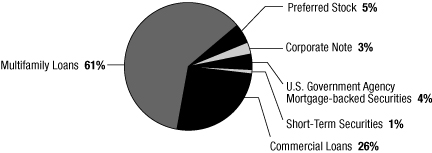

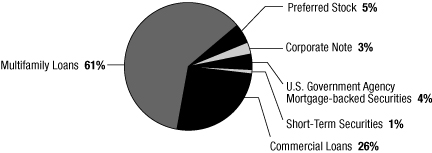

Portfolio Allocation

As a percentage of total assets on May 31, 2005

Delinquent Loan Profile

The table below shows the percentages of multifamily and commercial loans in the portfolio that are 30, 60, 90, or 120 or more days delinquent as of May 31, 2005, based on the value outstanding.

| Multifamily and commercial loans | |

| Current | | | 100.0 | % | |

| 30 Days | | | 0.0 | % | |

| 60 Days | | | 0.0 | % | |

| 90 Days | | | 0.0 | % | |

| 120+ Days | | | 0.0 | % | |

2005 Semiannual Report

American Select Portfolio

1

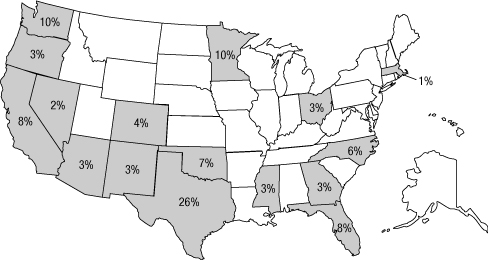

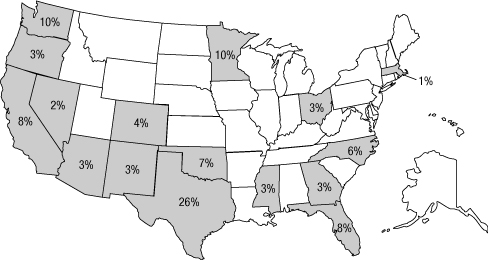

Geographical Distribution

We attempt to buy mortgage loans in many parts of the country to help avoid the risks of concentrating in one area. These percentages reflect the value of whole loans and participation mortgages as of May 31, 2005.

2005 Semiannual Report

American Select Portfolio

2

Financial STATEMENTS (Unaudited)

Statement of Assets and Liabilities May 31, 2005

| Assets: | | | |

| Investments in unaffiliated securities, at value* (note 2) | | $ | 190,989,916 | | |

| Investment in affiliated money market fund, at value** (note 3) | | | 1,230,281 | | |

| Receivable for accrued interest | | | 541,694 | | |

| Cash in bank on demand deposit | | | 200,979 | | |

| Other assets | | | 68,646 | | |

| Total assets | | | 193,031,516 | | |

| Liabilities: | | | |

| Payable for investment securities purchased | | | 872,542 | | |

| Payable for reverse repurchase agreements (note 2) | | | 51,279,089 | | |

| Payable for investment management fee | | | 60,326 | | |

| Payable for administrative fees | | | 29,588 | | |

| Payable for interest expense | | | 157,957 | | |

| Payable for other expenses | | | 119,825 | | |

| Total liabilities | | | 52,519,327 | | |

| Net assets applicable to outstanding capital stock | | $ | 140,512,189 | | |

| Composition of net assets: | | | |

| Capital stock and additional paid-in capital | | $ | 139,930,119 | | |

| Undistributed net investment income | | | 590,817 | | |

| Accumulated net realized loss on investments | | | (458,663 | ) | |

| Unrealized depreciation of investments | | | 449,916 | | |

| Total – representing net assets applicable to capital stock | | $ | 140,512,189 | | |

| *Investments unaffiliated in securities at cost | | $ | 190,540,000 | | |

| **Investment in affiliated money market fund, at cost | | $ | 1,230,281 | | |

| Net asset value and market price of capital stock: | | | |

| Net assets outstanding | | $ | 140,512,189 | | |

Shares outstanding (authorized 1 billion shares of

$0.01 par value) | | | 10,662,195 | | |

| Net asset value per share | | $ | 13.18 | | |

| Market price per share | | $ | 11.99 | | |

See accompanying Notes to Financial Statements.

2005 Semiannual Report

American Select Portfolio

3

Financial STATEMENTS (Unaudited) continued

Statement of Operations For the Six Months Ended May 31, 2005

| Income: | | | |

| Interest from unaffiliated securities | | $ | 6,613,162 | | |

| Dividends | | | 30,562 | | |

| Dividends from affiliated money market fund | | | 43,935 | | |

| Total investment income | | | 6,687,659 | | |

| Expenses (note 3): | | | |

| Investment management fee | | | 347,035 | | |

| Administrative fee | | | 173,517 | | |

| Custodian fees | | | 14,027 | | |

| Interest expense | | | 875,507 | | |

| Transfer agent fees | | | 14,014 | | |

| Exchange listing and registration fees | | | 17,221 | | |

| Reports to shareholders | | | 24,402 | | |

| Mortgage servicing fees | | | 68,616 | | |

| Directors' fees | | | 12,258 | | |

| Audit and legal fees | | | 35,119 | | |

| Other expenses | | | 9,179 | | |

| Total expenses | | | 1,590,895 | | |

| Net investment income | | | 5,096,764 | | |

Net realized and unrealized gains (losses) on

investments (note 4): | | | |

| Net realized gain on investments | | | 691,695 | | |

Net change in unrealized appreciation or depreciation of

investments | | | (646,632 | ) | |

| Net loss on investments | | | 45,063 | | |

| Net increase in net assets resulting from operations | | $ | 5,141,827 | | |

See accompanying Notes to Financial Statements.

2005 Semiannual Report

American Select Portfolio

4

Statement of Cash Flows For the Six Months Ended May 31, 2005

| Cash flows from operating activities: | | | |

| Net increase in net assets resulting from operations | | $ | 5,141,827 | | |

Adjustments to reconcile net increase in net assets resulting

from operations to net cash provided by operating activities: | |

| Purchases of investments | | | (50,938,522 | ) | |

| Proceeds from paydowns and sales of investments | | | 39,915,574 | | |

| Net sales of short-term securities | | | 413,973 | | |

| Net accretion of bond discount and premium | | | (21,031 | ) | |

| Net unrealized depreciation of investments | | | 646,632 | | |

| Net realized gain on investments | | | (691,695 | ) | |

| Decrease in accrued interest receivable | | | 304,806 | | |

| Increase in other assets | | | (19,065 | ) | |

| Increase in accrued fees and expenses | | | 65,814 | | |

| Net cash used in operating activities | | | (5,181,687 | ) | |

| Cash flows from financing activities: | | | |

| Net proceeds from reverse repurchase agreements | | | 9,996,988 | | |

| Distributions paid to shareholders | | | (4,691,366 | ) | |

| Net cash provided by financing activities | | | 5,305,622 | | |

| Net increase in cash | | | 123,935 | | |

| Cash at beginning of period | | | 77,044 | | |

| Cash at end of period | | $ | 200,979 | | |

Supplemental disclosure of cash flow information:

Cash paid for interest | | $ | 918,360 | | |

See accompanying Notes to Financial Statements.

2005 Semiannual Report

American Select Portfolio

5

Financial STATEMENTS (Unaudited) continued

Statements of Changes in Net Assets

| | | Six Months Ended

5/31/05

(Unaudited) | | Year Ended

11/30/04 | |

| Operations: | |

| Net investment income | | $ | 5,096,764 | | | $ | 11,009,521 | | |

| Net realized gain on investments | | | 691,695 | | | | 331,712 | | |

Net change in unrealized appreciation or

depreciation of investments | | | (646,632 | ) | | | (3,180,143 | ) | |

| Net increase in net assets resulting from operations | | | 5,141,827 | | | | 8,161,090 | | |

| Distributions to shareholders (note 2): | |

| From net investment income | | | (4,691,366 | ) | | | (11,115,340 | ) | |

| Total decrease in net assets | | | 450,461 | | | | (2,954,250 | ) | |

| Net assets at beginning of period | | | 140,061,728 | | | | 143,015,978 | | |

| Net assets at end of period | | $ | 140,512,189 | | | $ | 140,061,728 | | |

| Undistributed net investment income | | $ | 590,817 | | | $ | 185,419 | | |

See accompanying Notes to Financial Statements.

2005 Semiannual Report

American Select Portfolio

6

Notes to Financial STATEMENTS (Unaudited)

| (1) Organization | | American Select Portfolio Inc. (the "fund") is registered under the Investment Company Act of 1940 (as amended) as a diversified, closed-end management investment company. The fund emphasizes investments in mortgage-related assets that directly or indirectly represent a participation in or are secured by and payable from mortgage loans. It may also invest in U.S. government securities, corporate debt securities, and preferred stock issued by real estate investment trusts. In addition, the fund may borrow using reverse repurchase agreements and revolving credit facilities. Fund shares are listed on the New York Stock Exchange under the symbol SLA. | |

|

| (2) Summary of Significant Accounting Policies | | Security Valuations | |

|

| | | Security valuations for the fund's investments (other than whole loans and participation mortgages) are furnished by one or more independent pricing services that have been approved by the fund's board of directors. Investments in equity securities that are traded on a national securities exchange (or reported on the Nasdaq national market system) are stated at the last quoted sales price if readily available for such securities on each business day. For securities traded on the Nasdaq national market system, the fund utilizes the Nasdaq Official Closing Price which compares the last trade to the bid/ask price of a security. If the last trade falls within the bid/ask range, then that price will be the closing price. If the last trade is outside the bid/ask range, and falls above the ask, the ask price will be the closing price. If the last trade is below the bid, the bid will be the closing price. Other equity securitie s traded in the over-the-counter market and listed equity securities for which no sale was reported on that date are stated at the last quoted bid price. Debt obligations exceeding 60 days to maturity are valued by an independent pricing service. | |

|

2005 Semiannual Report

American Select Portfolio

7

Notes to Financial STATEMENTS (Unaudited) continued

| The pricing service may employ methodologies that utilize actual market transactions, broker-dealer supplied valuations, or other formula-driven valuation techniques. These techniques generally consider such factors as yields or prices of bonds of comparable quality, type of issue, coupon, maturity, ratings, and general market conditions. Securities for which prices are not available from an independent pricing service but where an active market exists are valued using market quotations obtained from one or more dealers that make markets in the securities or from a widely-used quotation system. When market quotations are not readily available, securities are valued at fair value as determined in good faith by procedures established and approved by the fund's board of directors. Some of the factors which may be considered in determining fair value are fundamental analytical data relating to the investment; the nature and duration of any restrictions on disposition; trading in similar securitites of the same issuer or comparable companies; information from broker-dealers; and an evaluation of the forces that influence the market in which the security is purchased or sold. If events occur that materially affect the value of securities (including non-U.S. securities) between the close of trading in those securities and the close of regular trading on the New York Stock Exchange, the securities will be valued at fair value. Debt obligations with 60 days or less remaining until maturity may be valued at their amortized cost which approximates market value. Security valuations are performed once a week and at the end of each month. | |

|

| The fund's investments in whole loans (multifamily and commercial), and participation mortgages are generally not traded in any organized market and therefore, market quotations are not readily available. These investments | |

|

2005 Semiannual Report

American Select Portfolio

8

| are valued at "fair value" according to procedures adopted by the fund's board of directors. Pursuant to these procedures, whole loan investments are initially valued at cost and their values are subsequently monitored and adjusted using a U.S. Bancorp Asset Management, Inc. ("USBAM") pricing model designed to incorporate, among other things, the present value of the projected stream of cash flows on such investments. The pricing model takes into account a number of relevant factors including the projected rate of prepayments, the delinquency profile, the historical payment record, the expected yield at purchase, changes in prevailing interest rates, and changes in the real or perceived liquidity of whole loans or participation mortgages, as the case may be. The results of the pricing model may be further subject to price ceilings due to the illiquid nature of the loans. Changes in prevailing interest rates, real or per ceived liquidity, yield spreads, and creditworthiness are factored into the pricing model each week. | |

|

| Certain mortgage loan information is received once a month. This information includes, but is not limited to, the projected rate of prepayments, projected rate and severity of defaults, the delinquency profile, and the historical payment record. Valuations of whole loans, participation mortgages and mortgage servicing rights are determined no less frequently than weekly. Although we believe the pricing model to be reasonable and appropriate, the actual values that may be realized upon the sale of whole loans, participation mortgages, and mortgage servicing rights can only be determined in a negotiation between the fund and third parties. As of May 31, 2005, the fund held fair valued securities with a value of $173,711,961 or 123.6% of net assets. | |

|

2005 Semiannual Report

American Select Portfolio

9

Notes to Financial STATEMENTS (Unaudited) continued

| Security Transactions and Investment Income | |

|

| The fund records security transactions on the trade date of the security purchase or sale. Dividend income is recorded on the ex-dividend date. Interest income, including accretion of bond discounts and amortization of premiums, is recorded on the accrual basis. Security gains and losses are determined on the basis of identified cost, which is the same basis used for federal income tax purposes. | |

|

| Whole Loans and Participation Mortgages | |

|

| Whole loans and participation mortgages may bear a greater risk of loss arising from a default on the part of the borrower of the underlying loans than do traditional mortgage-backed securities. This is because whole loans and participation mortgages, unlike most mortgage-backed securities, generally are not backed by any government guarantee or private credit enhancement. Such risk may be greater during a period of declining or stagnant real estate values. In addition, the individual loans underlying whole loans and participation mortgages may be larger than the loans underlying mortgage-backed securities. With respect to participation mortgages, the fund generally will not be able to unilaterally enforce its rights in the event of a default, but rather will be dependent on the cooperation of the other participation holders. | |

|

| The fund does not record past due interest as income until received. The fund may incur certain costs and delays in the event of a foreclosure. Also, there is no assurance that the subsequent sale of the property will produce an amount equal to the sum of the unpaid principal balance of the loan as of the date the borrower went into default, the accrued unpaid interest, and all of | |

|

2005 Semiannual Report

American Select Portfolio

10

| the foreclosure expenses. In this case, the fund may suffer a loss. At May 31, 2005, no multifamily or commercial loans were delinquent. | |

|

| Real estate acquired through foreclosure, if any, is recorded at estimated fair value. The fund may receive rental or other income as a result of holding real estate. In addition, the fund may incur expenses associated with maintaining any real estate owned. As of and for the six months ended May 31, 2005, the fund owned no real estate. | |

|

| Reverse Repurchase Agreements | |

|

| Reverse repurchase agreements involve the sale of a portfolio-eligible security by the fund, coupled with an agreement to repurchase the security at a specified date and price. Reverse repurchase agreements may increase volatility of the fund's net asset value and involve the risk that interest costs on money borrowed may exceed the return on securities purchased with that borrowed money. Reverse repurchase agreements are considered to be borrowings by the fund, and are subject to the fund's overall restriction on borrowing under which it must maintain asset coverage of at least 300%. For the six months ended May 31, 2005, the weighted average borrowings outstanding were $50,120,104 and the weighted average rate was 3.29%. | |

|

| Securities Purchased on a When-Issued Basis | |

|

| Delivery and payment for securities that have been purchased by the fund on a when-issued or forward-commitment basis can take place a month or more after the transaction date. During this period, such securities do not earn interest, are subject to market fluctuation and may increase or decrease in value prior to their delivery. The fund segregates, with its custodian, assets with a | |

|

2005 Semiannual Report

American Select Portfolio

11

Notes to Financial STATEMENTS (Unaudited) continued

| market value equal to the amount of its purchase commitments. The purchase of securities on a when-issued or forward-commitment basis may increase the volatility of the fund's net asset value if the fund makes such purchases while remaining substantially fully invested. As of May 31, 2005, the fund had no outstanding when-issued or forward-commitment securities. | |

|

| Federal Taxes | |

|

| The fund intends to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and not be subject to federal income tax. Therefore, no income tax provision is required. The fund also intends to distribute its taxable net investment income and realized gains, if any, to avoid the payment of any federal excise taxes. | |

|

| Net investment income and net realized gains and losses may differ for financial statement and tax purposes primarily because of temporary or permanent book/tax differences. These differences are primarily due to the timing of recognition of income on certain collateralized mortgage-backed securities, post-October losses and investments in REITS. To the extent these differences are permanent, reclassifications are made to the appropriate equity accounts in the period that the differences arise. | |

|

| The character of distributions made during the year from net investment income or net realized gains may differ from their ultimate characterization for federal income tax purposes. In addition, due to the timing of dividend distributions, the fiscal year in which amounts are distributed may differ from the year that the income or realized gains or losses were recorded by the fund. | |

|

2005 Semiannual Report

American Select Portfolio

12

| The tax character of distributions paid during the six months ended May 31, 2005 (estimated), and the fiscal year ended November 30, 2004 were as follows: | |

|

| | | 2005 | | 2004 | |

| Distributions paid from: | |

| Ordinary income | | $ | 4,691,366 | | | $ | 11,115,340 | | |

| | | $ | 4,691,366 | | | $ | 11,115,340 | | |

| | | | At November 30, 2004, the fund's most recently completed fiscal year-end, the components of accumulated earnings on a tax basis were as follows: | | |

|

| Undistributed ordinary income | | $ | 291,238 | | |

| Accumulated capital losses | | | (30,916 | ) | |

| Unrealized appreciation | | | 2,825,537 | | |

| Accumulated earnings | | $ | 3,085,859 | | |

| | | | The difference between book basis and tax basis unrealized appreciation and accumulated realized losses at November 30, 2004, is attributable to a one-time tax election whereby the fund marked appreciated securities to market creating capital gains that were used to reduce capital loss carryovers and increase tax cost basis. | | |

|

| | | | Distributions to Shareholders | | |

|

| | | | Distributions from net investment income are made monthly and realized capital gains, if any, will be distributed at least annually. These distributions are recorded as of the close of business on the ex-dividend date. Such distributions are payable in cash or, pursuant to the fund's dividend reinvestment plan, reinvested in additional shares of the fund's capital stock. Under the plan, fund shares will be purchased in the open market unless the market price plus commissions exceeds the net asset value by 5% or more. If, at the close of business on the dividend payment date, the shares purchased in the | | |

|

2005 Semiannual Report

American Select Portfolio

13

Notes to Financial STATEMENTS (Unaudited) continued

| open market are insufficient to satisfy the dividend reinvestment requirement, the fund will issue new shares at a discount of up to 5% from the current market price. | |

|

| | | Repurchase Agreements and Other Short-Term Securities | |

|

| | | For repurchase agreements entered into with certain broker-dealers, the fund, along with other affiliated registered investment companies, may transfer uninvested cash balances into a joint trading account, the daily aggregate of which is invested in repurchase agreements secured by U.S. government or agency obligations. Securities pledged as collateral for all individual and joint repurchase agreements are held by the fund's custodian bank until maturity of the repurchase agreement. Provisions for all agreements ensure that the daily market value of the collateral is in excess of the repurchase amount, including accrued interest, to protect the fund in the event of a default. | |

|

| | | Use of Estimates in Preparation of Financial Statements | |

|

| | | The preparation of financial statements, in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the results of operations during the reporting period. Actual results could differ from these estimates. | |

|

| | (3 | ) Expenses | | Investment Management and Administrative Fees | |

|

| | | Pursuant to an investment advisory agreement (the "Agreement"), USBAM, a subsidiary of U.S. Bank National Association ("U.S. Bank"), manages the fund's assets and furnishes related office facilities, equipment, research, and personnel. The Agreement provides | |

|

2005 Semiannual Report

American Select Portfolio

14

| USBAM with a monthly investment management fee in an amount equal to an annualized rate of 0.50% of the fund's average weekly net assets. For its fee, USBAM provides investment advice and, in general, conducts the management and investment activities of the fund. | |

|

| Pursuant to a co-administration agreement (the "Co-Administration Agreement"), USBAM serves as co-administrator for the fund (U.S. Bancorp Fund Services, LLC, a subsidiary of U.S. Bancorp is also co-administrator but currently has no functional responsibilities related to the fund) and provides administrative services, including legal and shareholder services, to the fund. Under this agreement, USBAM receives a monthly fee in an amount equal to an annualized rate of 0.25% of the fund's average weekly net assets (computed by subtracting liabilities from the value of the total assets of the fund). For its fee, USBAM provides numerous services to the Fund including, but not limited to, handling the general business affairs, financial and regulatory reporting, and record-keeping services. Separate from the Co-Administration Agreement, USBAM (from its own resources) has retained SEI Investments, Inc. to perform net asset val ue calculations. | |

|

| The fund may invest in related money market funds that are series of First American Funds, Inc., subject to certain limitations. In order to avoid the payment of duplicative investment advisory fees to USBAM, which acts as the investment advisor to both the fund and the related money market funds, USBAM will reimburse the fund an amount equal to the investment advisory fee received from the related money market funds that is attributable to the assets of the fund. For financial statement purposes, this reimbursement is recorded as investment income. | |

|

2005 Semiannual Report

American Select Portfolio

15

Notes to Financial STATEMENTS (Unaudited) continued

| Custodian Fees | |

|

| U.S. Bank serves as the fund's custodian pursuant to a custodian agreement with SLA. The fee for the fund is equal to an annual rate of 0.02% of average weekly net assets. These fees are computed weekly and paid monthly. | |

|

| Mortgage Servicing Fees | |

|

| The fund enters into mortgage servicing agreements with mortgage servicers for whole loans and participation mortgages. For a fee, mortgage servicers maintain loan records, such as insurance and taxes and the proper allocation of payments between principal and interest. | |

|

| Reorganization Expenses | |

|

| The fund previously filed a proxy statement/registration statement and took certain other steps in connection with a proposed reorganization of the fund, along with American Strategic Income Portfolio Inc. ("ASP"), American Strategic Income Portfolio Inc. II ("BSP") and American Strategic Income Portfolio Inc. III ("CSP"), into First American Strategic Real Estate Portfolio Inc., a specialty real estate finance company that would elect to be taxed as a real estate investment trust. As discussed in Note 7, the Board of Directors, in consultation with USBAM, has decided not to pursue this proposed reorganization. As set forth below, certain costs and expenses incurred in connection with the proposed reorganization of the fund (including, but not limited to, the preparation of all necessary registration statements, proxy materials and other documents, preparation for and attendance at board and committee, shareholder, plan ning, organizational, and other meetings, and costs and expenses of accountants, attorneys, financial advisors, and other experts engaged in connection with the reorganization) were borne by the fund, ASP, BSP, | |

|

2005 Semiannual Report

American Select Portfolio

16

| and CSP (collectively, the "existing funds''). The existing funds as a group bore the first $3,400,000 of such expenses and, subject to certain exceptions, have shared equally with USBAM all transaction expenses in excess of $3,400,000. Such costs and expenses were allocated among the existing funds based on their relative net asset values. Additionally, costs and expenses incurred in connection with the legal representation of USBAM's interests with respect to the reorganization and related matters were borne by USBAM. The existing funds' portion of the costs and expenses related to the reorganization have totaled approximately $4,000,000 through May 31, 2005. Of this amount, $862,330 has been allocated to the fund. | |

|

| | | Other Fees and Expenses | |

|

| | | In addition to the investment management, administrative, custodian, and mortgage servicing fees, the fund is responsible for paying other operating expenses, including: outside directors' fees and expenses, exchange listing and registration fees, printing and shareholder reports, transfer agent fees and expenses, legal, auditing and accounting services, insurance, interest, expenses related to real estate owned, fees to outside parties retained to assist in conducting due diligence, taxes, and other miscellaneous expenses. | |

|

| (4) Investment Security Transactions | | Cost of purchases and proceeds from paydowns and sales of securities and real estate, other than temporary investments in short-term securities, for the six months ended May 31, 2005 aggregated $51,832,095 and $39,915,574, respectively. Included in proceeds from sales are $692,898 from prepayment penalties. | |

|

2005 Semiannual Report

American Select Portfolio

17

Notes to Financial STATEMENTS (Unaudited) continued

| (5) Capital Loss Carryover | | For federal income tax purposes, the fund had capital loss carryovers at November 30, 2004, the fund's most recently completed fiscal year-end, which, if not offset by subsequent capital gains, will expire on the fund's fiscal year-ends as indicated below. | |

|

Capital Loss

Carryover | | Expiration | |

| $ | 30,916 | | | | 2010 | | |

| $ | 30,916 | | | | | | |

| (6) Indemnifications | | The fund enters into contracts that contain a variety of indemnifications. The fund's maximum exposure under these arrangements is unknown. However, the fund has not had prior claims or losses pursuant to these contracts and expects the risk of loss to be remote. | |

|

| (7) Subsequent Events | | At a meeting held June 20-22, 2005, the Board of Directors approved a new administration agreement under which, effective July 1, 2005, USBAM began serving as the sole administrator for the fund. The monthly administrative fee will be the same as under the prior agreement, and will equal an annualized rate of 0.25% of the fund's average weekly net assets. | |

|

| | | At the same meeting, the Board of Directors approved a change in the fund's year-end from November 30 to August 31. | |

|

| | | At a meeting held July 20, 2005, the Board of Directors, in consultation with USBAM, decided not to pursue the previously proposed reorganization of the fund, American Strategic Income Portfolio Inc., American Strategic Income Portfolio Inc. II, and American Strategic Income Portfolio Inc. III (collectively, the "existing funds") into First American Strategic Real Estate Portfolio Inc., a specialty finance company that would elect to be taxed as a real estate investment trust. The Board of Directors and USBAM are currently exploring other options, including the possibility of combining the existing funds into a single closed-end fund that would continue to be registered under the Investment Company Act. | |

|

2005 Semiannual Report

American Select Portfolio

18

| (8) Financial Highlights | | Per-share data for a share of capital shares outstanding throughout each period and selected information for each period are as follows: | |

|

| | | Six months

Ended

5/31/05 | | Year Ended November 30, | |

| | | (Unaudited) | | 2004 | | 2003 | | 2002 | | 2001 | | 2000 | |

| Per-Share Data | | | |

Net asset value, beginning

of period | | $ | 13.14 | | | $ | 13.41 | | | $ | 13.48 | | | $ | 13.38 | | | $ | 12.85 | | | $ | 12.67 | | |

| Operations: | |

| Net investment income | | | 0.48 | | | | 1.03 | | | | 1.05 | | | | 1.13 | | | | 1.13 | | | | 1.01 | | |

Net realized and unrealized

gains (losses) on

investments | | | 0.00 | | | | (0.26 | ) | | | (0.04 | ) | | | 0.17 | | | | 0.47 | | | | 0.18 | | |

| Total from operations | | | 0.48 | | | | 0.77 | | | | 1.01 | | | | 1.30 | | | | 1.60 | | | | 1.19 | | |

| Distributions to shareholders: | |

| From net investment income | | | (0.44 | ) | | | (1.04 | ) | | | (1.08 | ) | | | (1.20 | ) | | | (1.07 | ) | | | (1.01 | ) | |

| Net asset value, end of period | | $ | 13.18 | | | $ | 13.14 | | | $ | 13.41 | | | $ | 13.48 | | | $ | 13.38 | | | $ | 12.85 | | |

Per-share market value,

end of period | | $ | 11.99 | | | $ | 12.79 | | | $ | 13.64 | | | $ | 12.86 | | | $ | 13.54 | | | $ | 11.50 | | |

| Selected Information | | | |

| Total return, net asset value (a) | | | 3.73 | % | | | 5.97 | % | | | 7.72 | % | | | 10.13 | % | | | 12.83 | % | | | 9.87 | % | |

| Total return, market value (b) | | | 2.17 | % | | | 1.44 | % | | | 14.92 | % | | | 3.91 | % | | | 28.22 | % | | | 7.49 | % | |

Net assets at end of period

(in millions) | | $ | 141 | | | $ | 140 | | | $ | 143 | | | $ | 144 | | | $ | 143 | | | $ | 137 | | |

Ratio of expenses to average

weekly net assets | | | 2.29 | %(d) | | | 1.02 | % | | | 2.05 | % | | | 2.82 | % | | | 3.02 | % | | | 3.55 | % | |

Ratio of expenses to average

weekly net assets excluding

interest expense | | | 1.03 | %(d) | | | 0.81 | % | | | 1.18 | % | | | 1.47 | % | | | 1.02 | % | | | 1.14 | % | |

Ratio of net investment income

to average weekly net assets | | | 7.36 | %(d) | | | 7.77 | % | | | 7.79 | % | | | 8.41 | % | | | 8.56 | % | | | 7.98 | % | |

Portfolio turnover rate (excluding

short-term securities and

dollar roll transactions) | | | 22 | % | | | 13 | % | | | 38 | % | | | 31 | % | | | 28 | % | | | 44 | % | |

Amount of borrowings

outstanding at end of period

(in millions) | | $ | 50 | | | $ | 41 | | | $ | 49 | | | $ | 29 | | | $ | 47 | | | $ | 46 | | |

Per-share amount of borrowings

outstanding at end of period | | $ | 4.81 | | | $ | 3.87 | | | $ | 4.57 | | | $ | 2.67 | | | $ | 4.44 | | | $ | 4.28 | | |

Per-share amount of net assets,

excluding borrowings, at end

of period | | $ | 17.99 | | | $ | 17.01 | | | $ | 17.98 | | | $ | 16.15 | | | $ | 17.82 | | | $ | 17.13 | | |

| Asset coverage ratio (c) | | | 374 | % | | | 439 | % | | | 394 | % | | | 604 | % | | | 401 | % | | | 401 | % | |

(a) Assumes reinvestment of distributions at net asset value.

(b) Assumes reinvestment of distributions at actual prices pursuant to the fund's dividend reinvestment plan.

(c) Represents net assets, excluding borrowings, at end of period divided by borrowings outstanding at end of period.

(d) Annualized.

2005 Semiannual Report

American Select Portfolio

19

Schedule of INVESTMENTS (Unaudited)

American Select Portfolio May 31, 2005

| Description of Security | | Date

Acquired | | Par

Value | | Cost | | Value (a) | |

| (Percentages of each investment category relate to net assets) | |

| U.S. Government Agency Mortgage-Backed Securities (b) - 5.5% | |

| Fixed Rate - 5.5% | |

| FHLMC, 5.50%, 1/1/18 | | | | $ | 3,375,008 | | | $ | 3,481,208 | | | $ | 3,463,602 | | |

| FHLMC, 7.50%, 12/1/29 | | | | | 558,245 | | | | 547,805 | | | | 598,717 | | |

| FNMA, 5.00%, 11/1/17 | | | | | 1,616,296 | | | | 1,625,026 | | | | 1,639,538 | | |

| FNMA, 6.50%, 6/1/29 | | | | | 1,817,386 | | | | 1,805,100 | | | | 1,890,645 | | |

| FNMA, 7.50%, 5/1/30 | | | | | 149,005 | | | | 144,005 | | | | 159,389 | | |

| FNMA, 8.00%, 5/1/30 | | | | | 40,935 | | | | 40,418 | | | | 44,249 | | |

Total U.S. Government

Agency Mortgage-Backed

Securities | | | | | | | | | 7,643,562 | | | | 7,796,140 | | |

| Corporate Note (e) - 3.7% | | | |

| Adjustable Rate - 3.7% | |

Stratus Properties,

6.90%, 1/1/08 | | 12/28/00 | | | 5,000,000 | | | | 5,000,000 | | | | 5,150,000 | | |

| Whole Loans and Participation Mortgages (c,d,e) - 120.0% | | | |

| Commercial Loans - 35.3% | |

12000 Aerospace,

5.50%, 1/1/10 | | 12/22/04 | | | 5,200,000 | | | | 5,200,000 | | | | 5,340,800 | | |

7 Broadway,

5.80%, 1/1/08 | | 12/17/04 | | | 4,176,098 | | | | 4,176,098 | | | | 4,301,381 | | |

Advanced Circuits and

Hopkins II Business Center,

5.38%, 12/1/05 (b) | | 11/08/01 | | | 2,061,080 | | | | 2,061,080 | | | | 2,061,080 | | |

Best Buy,

8.63%, 1/1/11 | | 12/29/00 | | | 1,835,857 | | | | 1,835,857 | | | | 1,927,650 | | |

Career Education Corporation,

7.50%, 6/1/07 (b) | | 05/15/02 | | | 3,291,029 | | | | 3,291,029 | | | | 3,389,760 | | |

Career Education

Corporation II,

7.48%, 6/1/07 | | 09/01/04 | | | 357,561 | | | | 357,561 | | | | 368,288 | | |

Landmark Bank Center,

5.85%, 7/1/09 | | 10/01/04 | | | 4,784,861 | | | | 4,784,861 | | | | 4,947,628 | | |

Northlynn Plaza,

7.65%, 9/1/12 (b) | | 08/22/02 | | | 3,857,096 | | | | 3,857,096 | | | | 4,049,950 | | |

| See accompanying Notes to Schedule of Investments | |

2005 Semiannual Report

American Select Portfolio

20

American Select Portfolio

(Continued)

| Description of Security | | Date

Acquired | | Par

Value | | Cost | | Value (a) | |

Oxford Mall,

5.75%, 10/1/06 | | 09/24/04 | | $ | 5,175,000 | | | $ | 5,175,000 | | | $ | 5,031,932 | | |

Peony Promenade,

6.93%, 6/1/13 (b) | | 05/12/03 | | | 5,101,850 | | | | 5,101,850 | | | | 5,356,943 | | |

Point Plaza,

8.43%, 1/1/11 (b) | | 12/14/00 | | | 6,133,223 | | | | 6,133,223 | | | | 6,034,821 | | |

Town Square #

6, 7.40%, 9/1/12 (b) | | 08/02/02 | | | 3,947,088 | | | | 3,947,088 | | | | 4,144,443 | | |

Victory Packaging,

8.53%, 1/1/12 (b) | | 12/20/01 | | | 2,507,738 | | | | 2,507,738 | | | | 2,633,125 | | |

| | | | 48,428,481 | | | | 49,587,801 | | |

| Multifamily Loans - 84.7% | | | |

Briarhill Apartments I,

6.90%, 9/1/15 (b) | | 08/11/03 | | | 4,731,340 | | | | 4,731,340 | | | | 4,967,907 | | |

Briarhill Apartments II,

6.88%, 9/1/15 | | 08/11/03 | | | 741,936 | | | | 741,936 | | | | 779,033 | | |

Casa del Vista Apartments,

8.40%, 1/1/08 (b) | | 12/15/00 | | | 2,903,799 | | | | 2,903,799 | | | | 2,990,913 | | |

Castle Arms Apartments,

8.00%, 4/1/06 | | 03/19/99 | | | 903,133 | | | | 903,133 | | | | 912,164 | | |

Centre Court, White Oaks, and

Green Acres Apartments,

8.65%, 1/1/09 (b) | | 12/30/98 | | | 3,753,302 | | | | 3,753,302 | | | | 3,903,433 | | |

Churchill Park Apartments I,

6.53%, 2/1/06 (b) | | 12/23/02 | | | 8,650,000 | | | | 8,650,000 | | | | 8,736,500 | | |

Churchill Park Apartments II,

9.88%, 2/1/06 | | 12/23/02 | | | 375,000 | | | | 375,000 | | | | 349,990 | | |

Colonia Tepeyac Apartments I,

5.43%, 12/1/06 | | 12/03/03 | | | 5,744,000 | | | | 5,744,000 | | | | 5,858,880 | | |

Colonia Tepeyac Apartments II,

14.88%, 12/1/06 | | 12/03/03 | | | 718,000 | | | | 718,000 | | | | 686,561 | | |

El Conquistador Apartments,

7.65%, 4/1/09 (b) | | 03/24/99 | | | 2,709,877 | | | | 2,709,877 | | | | 2,818,272 | | |

Forest Hills Apartments,

5.98%, 2/1/08 | | 02/01/05 | | | 7,300,000 | | | | 7,300,000 | | | | 7,519,000 | | |

Four Seasons Apartments,,

6.00%, 3/1/08 | | 02/28/05 | | | 2,160,000 | | | | 2,160,000 | | | | 2,224,800 | | |

Greenwood Residences,

7.63%, 4/1/08 (b) | | 03/12/98 | | | 2,206,029 | | | | 2,206,029 | | | | 2,272,210 | | |

Hidden Colony Apartments,

7.90%, 6/1/08 (b) | | 03/22/94 | | | 2,854,960 | | | | 2,834,905 | | | | 2,969,158 | | |

| See accompanying Notes to Schedule of Investments | |

2005 Semiannual Report

American Select Portfolio

21

Schedule of INVESTMENTS (Unaudited) continued

American Select Portfolio

(Continued)

| Description of Security | | Date

Acquired | | Par

Value | | Cost | | Value (a) | |

Hunter's Meadow,

7.80%, 8/1/12 | | 07/02/02 | | $ | 6,265,912 | | | $ | 6,265,912 | | | $ | 6,579,207 | | |

Lakeside Village Apartments I,

5.40%, 6/1/07 | | 05/19/04 | | | 3,700,000 | | | | 3,700,000 | | | | 3,783,935 | | |

Lakeside Village Apartments II,

14.88%, 6/1/07 | | 05/19/04 | | | 460,000 | | | | 460,000 | | | | 433,821 | | |

Lakeville Apartments,

7.88%, 5/1/08 (b) | | 04/24/98 | | | 2,249,389 | | | | 2,249,389 | | | | 2,339,365 | | |

Lambert Gardens Apartments,

6.88%, 2/1/08 (b) | | 01/17/03 | | | 4,389,953 | | | | 4,389,953 | | | | 4,521,651 | | |

Parkside Apartments,

5.43%, 5/1/08 | | 04/14/03 | | | 6,575,000 | | | | 6,575,000 | | | | 6,711,017 | | |

Revere Apartments,

7.28%, 5/1/09 (b) | | 04/22/99 | | | 1,211,127 | | | | 1,211,127 | | | | 1,271,683 | | |

RP - Urban Partners,

5.99%, 3/1/10 (g) | | 02/23/05 | | | 5,000,000 | | | | 5,000,000 | | | | 5,000,000 | | |

Sheridan Ponds Apartments,

6.43%, 7/1/13 (b) | | 06/05/03 | | | 7,062,193 | | | | 7,062,193 | | | | 7,050,893 | | |

Signature Park Apartments,

9.90%, 12/1/07 | | 11/14/02 | | | 4,725,000 | | | | 4,725,000 | | | | 4,333,604 | | |

Summit Chase Apartments I,

5.43%, 5/1/06 (b) | | 04/15/03 | | | 8,200,000 | | | | 8,200,000 | | | | 8,282,000 | | |

Summit Chase Apartments II,

9.88%, 5/1/06 | | 04/15/03 | | | 1,647,000 | | | | 1,647,000 | | | | 1,298,715 | | |

Valle Sereno Apartments,

5.74%, 3/1/07 | | 02/09/05 | | | 3,700,000 | | | | 3,700,000 | | | | 3,718,500 | | |

Village Commons Apartments,,

5.33%, 5/1/08 | | 04/27/05 | | | 7,060,000 | | | | 7,060,000 | | | | 7,169,423 | | |

Wildwood Condominiums Land,

6.40%, 7/1/05 | | 12/22/04 | | | 2,700,000 | | | | 2,700,000 | | | | 2,371,322 | | |

Woodstock Apartments I,

6.11%, 1/1/06 | | 12/06/01 | | | 8,300,000 | | | | 8,300,000 | | | | 6,420,203 | | |

Woodstock Apartments II,

11.00%, 1/1/06 | | 12/06/01 | | | 1,000,000 | | | | 1,000,000 | | | | 700,000 | | |

| | | | 119,976,895 | | | | 118,974,160 | | |

Total Whole Loans and

Participation Mortgages | | | | | | | | | 168,405,375 | | | | 168,561,961 | | |

| See accompanying Notes to Schedule of Investments | |

2005 Semiannual Report

American Select Portfolio

22

American Select Portfolio

(Continued)

| Description of Security | | Shares | | Cost | | Value (a) | |

| Preferred Stocks - 6.7% | | | |

| Real Estate Investment Trusts - 6.7% | | | |

AMB Property,

Series M | | | 8,700 | | | $ | 222,285 | | | $ | 220,980 | | |

BRE Properties,

Series C | | | 60,000 | | | | 1,513,000 | | | | 1,518,600 | | |

BRE Properties,

Series D | | | 3,434 | | | | 86,548 | | | | 86,537 | | |

| Capital Automotive | | | 2,980 | | | | 74,500 | | | | 74,500 | | |

Developers Divers Realty,

Series H | | | 9,437 | | | | 239,256 | | | | 240,644 | | |

Developers Divers Realty,

Series I | | | 33,912 | | | | 868,357 | | | | 868,147 | | |

Duke Realty Corp.,

Series L | | | 71,000 | | | | 1,787,780 | | | | 1,762,220 | | |

Health Care Properties,

Series E | | | 3,510 | | | | 90,207 | | | | 90,347 | | |

PS Business Park,

Series H | | | 30,000 | | | | 744,036 | | | | 741,000 | | |

PS Business Park,

Series I | | | 16,000 | | | | 388,272 | | | | 391,200 | | |

PS Business Park,

Series M | | | 22,210 | | | | 554,629 | | | | 552,807 | | |

Public Storage,

Series E | | | 55,000 | | | | 1,382,250 | | | | 1,380,500 | | |

Regency Centers Corp.,

Series D | | | 1,888 | | | | 48,379 | | | | 48,333 | | |

Vornado Realty Trust,

Series F | | | 60,000 | | | | 1,491,563 | | | | 1,506,000 | | |

| Total Preferred Stocks | | | | | | | 9,491,062 | | | | 9,481,815 | | |

Total Investments in

Unaffiliated Securities | | | | | | | 190,540,000 | | | | 190,989,916 | | |

| Affiliated Money Market Fund (f) - 0.9% | | | |

First American Prime

Obligations Fund, Cl Z | | | 1,230,281 | | | | 1,230,281 | | | | 1,230,281 | | |

Total Investments in

Securities (g) - 136.8% | | | | | | | 191,770,281 | | | | 192,220,197 | | |

| See accompanying Notes to Schedule of Investments | |

2005 Semiannual Report

American Select Portfolio

23

Schedule of INVESTMENTS (Unaudited) continued

Notes to Schedule of Investments:

(a) Securities are valued in accordance with procedures described in note 2 in Notes to Financial Statements.

(b) On May 31, 2005, securities valued at $87,590,247 were pledged as collateral for the following outstanding reverse repurchase agreements:

| Amount | | Acquisition

Date | | Rate | | Due | | Accrued

Interest | | Name of

Broker

and Description

of Collateral | |

| $ | 7,554,199 | | | 5/11/2005 | | | 3.07 | %* | | 6/10/2005 | | $ | 13,528 | | | | (1 | ) | |

| | 43,724,890 | | | 5/2/2005 | | | 3.96 | %* | | 6/1/2005 | | | 144,429 | | | | (2 | ) | |

| $ | 51,279,089 | | | | | | | | | $ | 157,957 | | | | |

*Interest rate as of May 31, 2005. Rate is based on the London InterBank Offered Rate (LIBOR) and reset monthly.

Name of broker and description of collateral:

(1) Morgan Stanley:

FHLMC, 5.50%, 1/1/18, $3,375,008 par

FHLMC, 7.50%, 12/1/29, $558,245 par

FNMA, 5.00%, 11/1/17, $1,616,296 par

FNMA, 6.50%, 6/1/29, $1,817,386 par

FNMA, 7.50%, 5/1/30, $149,005 par

FNMA, 8.00%, 5/1/30, $40,935 par

(2) Morgan Stanley:

Advanced Circuits and Hopkins II Business Center, 5.38%, 12/1/05, $2,061,080 par

Briarhill Apartments I, 6.90%, 9/1/15, $4,731,340 par

Career Education Corporation I, 7.50%, 6/1/07, $3,291,029 par

Casa del Vista Apartments, 8.40%, 1/1/08, $2,903,799 par

Centre Court, White Oaks, and Green Acres Apartments, 8.65%, 1/1/09, $3,753,302 par

Churchill Park Apartments I, 6.53%, 2/1/06, $8,650,000 par

El Conquistador Apartments, 7.65%, 4/1/09, $2,709,877 par

Greenwood Residences, 7.63%, 4/1/08, $2,206,029 par

Hidden Colony Apartments, 7.90%, 6/1/08, $2,854,960 par

Lakeville Apartments, 7.88%, 5/1/08, $2,249,389 par

Lambert Gardens Apartments, 6.88%, 2/1/08, $4,389,953

Northlynn Plaza, 7.65%, 9/1/12, $3,857,096 par

Peony Promenade, 6.93%, 6/1/13, $5,101,850 par

Point Plaza, 8.43%, 1/1/11, $6,133,223 par

Revere Apartments, 7.28%, 5/1/09, $1,211,127 par

Sheridan Ponds Apartments, 6.43%, 7/1/13, $7,062,193 par

Summit Chase Apartments I, 5.43%, 5/1/06, $8,200,000 par

Town Square #6, 7.40%, 9/1/12, $3,947,088 par

Victory Packaging, 8.53%, 1/1/12, $2,507,738 par

The fund has entered into a lending commitment with Morgan Stanley. The agreement permits the fund to enter into reverse repurchase agreements up to $50,000,000 using whole loans as collateral. The fund pays a fee of 0.15% to Morgan Stanley on any unused portion of the $50,000,000 lending commitment.

(c) Interest rates on commercial and multifamily loans are the rates in effect on May 31, 2005.

(d) Commercial and multifamily loans are described by the name of the mortgaged property. The geographical location of the mortgaged properties is presented below.

2005 Semiannual Report

American Select Portfolio

24

Commercial Loans:

12000 Aerospace – Clear Lake, TX

7 Broadway Place – Albuquerque, NM

Advanced Circuts and Hopkins II Business Center – Hopkins, MN

Best Buy – Fullerton, CA

Career Education Corporation – Orlando, FL

Career Education Corporation II – Orlando, FL

Landmark Bank Center – Euless, TX

Northlynn Plaza – Lynnwood, WA

Oxford Mall – Oxford, MS

Peony Promenade – Plymouth, MN

Point Plaza – Tumwater, WA

Town Square #6 – Olympia, WA

Victory Packaging – Phoenix, AZ

Multifamily Loans:

Briarhill Apartments I – Eden Prairie, MN

Briarhill Apartments II – Eden Prairie, MN

Casa del Vista Apartments – Carson City, NV

Castle Arms Apartments – Austin, TX

Centre Court, White Oaks, and Green Acres Apartments – North Canton and Massillon, OH

Churchill Park Apartments I – San Antonio, TX

Churchill Park Apartments II – San Antonio, TX

Colonia Tepeyac Apartments I – Dallas, TX

Colonia Tepeyac Apartments II – Dallas, TX

Cypress Village Apartments – Buena Park, CA

El Conquistador Apartments – Tucson, AZ

Forest Hills Apartments – Hickory, NC

Greenwood Residences – Miton, WA

Hidden Colony Apartments – Doraville, GA

Hunter's Meadow – Colorado Springs, CO

Lakeside Village Apartments I – Oklahoma City, OK

Lakeside Village Apartments II – Oklahoma City, OK

Lakeville Apartments – Lakeville, MN

Lambert Gardens Apartments – Portland, OR

Parkside Apartments – Moreno Valley, CA

Revere Apartments – Revere, MA

RP – Urban Partners – Oxnard, CA

Sheridan Ponds Apartments – Tulsa, OK

Signature Park Apartments – Bryan, TX

Summit Chase Apartments I – Coral Springs, FL

Summit Chase Apartments II – Coral Springs, FL

Valle Sereno Apartments – El Paso, TX

Wildwood Condominiums Land – Atlanta, GA

Woodstock Apartments I – Dallas, TX

Woodstock Apartments II – Dallas, TX

(e) Securities purchased as part of a private placement which have not been registered with the Securities and Exchange Commission under the Securities Act of 1933 and are considered to be illiquid. On May 31, 2005, the total value of fair valued securities was $173,711,961 or 123.6% of net assets.

(f) Investment in affiliated security. This money market fund is advised by U.S. Bancorp Asset Management which also serves as advisor for the fund. See note 3 in Notes to Financial Statements.

2005 Semiannual Report

American Select Portfolio

25

Schedule of INVESTMENTS (Unaudited) continued

(g) Interest only–Represents securities that entitle holders to receive only interest payments on the underlying mortgages. The yield to maturity of an interest only is extremely sensitive to the rate of principal payments on the underlying mortgage assets. A rapid (slow) rate of principal repayments may have an adverse (positive) effect on yield to maturity. The principal amount shown is the notional amount of the underlying mortgages. The interest rate disclosed represents the coupon rate in effect as of May 31, 2005.

(h) On May 31, 2005, the cost of investments in securities for federal income tax purposes was $192,792,633. The aggregate gross unrealized appreciation and depreciation of investments in securities, based on this cost were as follows:

| Gross unrealized appreciation | | $ | 3,063,047 | | |

| Gross unrealized depreciation | | | (3,635,483 | ) | |

| Net unrealized depreciation | | $ | (572,436 | ) | |

Abbreviations:

APGM–Arnold Palmer Golf Management

FHLMC–Federal Home Loan Mortgage Corporation

FNMA–Federal National Mortgage Association

2005 Semiannual Report

American Select Portfolio

26

NOTICE TO SHAREHOLDERS (Unaudited)

| How to Obtain a Copy of the Fund's Proxy Voting Policies | |

|

| A description of the policies and procedures that the fund uses to determine how to vote proxies relating to portfolio securities, as well as information regarding how the fund voted proxies relating to portfolio securities during the most recent 12 month period ended June 30, is available (1) without charge upon request by calling 800.677.FUND; (2) at firstamericanfunds.com; and (3) on the U.S. Securities and Exchange Commission's website at sec.gov. | |

|

| Form N-Q Holdings Information | |

|

| The fund is required to file its complete schedule of portfolio holdings for the first and third quarters of each fiscal year with the Securities and Exchange Commission on Form N-Q. The fund's Form N-Q is available (1) without charge upon request by calling 800.677.FUND and (2) on the U.S. Securities and Exchange Commission's website at http://www.sec.gov. In addition, you may review and copy the funds' Forms N-Q at the Commission's Public Reference Room in Washington, D.C. You may obtain information on the operation of the Public Reference Room by calling 1-800-SEC-0330. | |

|

2005 Semiannual Report

American Select Portfolio

27

(This page has been left blank intentionally.)

Board of DIRECTORS

VIRGINIA STRINGER

Chairperson of American Select Portfolio Inc.

Owner and President of Strategic Management Resources, Inc.

BENJAMIN FIELD III

Director of American Select Portfolio Inc.

Retired; former Senior Vice President, Chief Financial Officer, and

Treasurer of Bemis Company, Inc.

ROGER GIBSON

Director of American Select Portfolio Inc.

Retired; former Vice President of Cargo-United Airlines

VICTORIA HERGET

Director of American Select Portfolio Inc.

Investment Consultant; former Managing Director of Zurich Scudder Investments

LEONARD KEDROWSKI

Director of American Select Portfolio Inc.

Owner and President of Executive and Management Consulting, Inc.

RICHARD RIEDERER

Director of American Select Portfolio Inc.

Retired; former President and Chief Executive Officer of Weirton Steel

JOSEPH STRAUSS

Director of American Select Portfolio Inc.

Owner and President of Strauss Management Company

JAMES WADE

Director of American Select Portfolio Inc.

Owner and President of Jim Wade Homes

American Select Portfolio Inc.’s Board of Directors is comprised entirely of independent directors.

AMERICAN SELECT PORTFOLIO INC.

2005 Semiannual Report

U.S. Bancorp Asset Management, Inc., is a wholly owned subsidiary of U.S. Bank National Association, which is a wholly owned subsidiary of U.S. Bancorp.

| This document is printed on paper

containing 10% postconsumer waste. |

7/2005 0171-05 SLA-SAR

Item 2—Code of Ethics

Not applicable to semi-annual report.

Item 3—Audit Committee Financial Expert

Not applicable to semi-annual report.

Item 4—Principal Accountant Fees and Services Response

Not applicable to semi-annual report.

Item 5—Audit Committee of Listed Registrants

Not applicable to semi-annual report.

Item 6 – Schedule of Investments

This schedule is included as part of the report to shareholders filed under Item 1 of this Form.

Item 7—Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies

Not applicable to semi-annual report.

Item 8 – Portfolio Managers of Closed-End Management Investment Companies

Not applicable until first annual report for a fiscal year ending on or after December 31, 2005.

Item 9 – Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers

Neither the registrant nor any “affiliated purchaser”, as defined in Rule 10b-18(a)(3) under the Exchange Act (17 CFR 240.10b-18(a)(3)), purchased any shares or other units of any class of the registrant’s equity securities that is registered pursuant to Section 12 of the Exchange Act (15 U.S.C. 781).

Item 10 – Submission of Matters to a Vote of Security Holders

There have been no material changes to the procedures by which shareholders may recommend nominees to the registrant’s board of directors, where those changes were implemented after the registrant last provided disclosure in response to the requirements of this Item.

Item 11 – Controls and Procedures

(a) The registrant’s Principal Executive Officer and Principal Financial Officer have evaluated the registrant’s disclosure controls and procedures within 90 days of the date of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized and reported timely.

(b) There were no changes in the registrant’s internal control over financial reporting that occurred during the second fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12 – Exhibits

(a)(1) Not applicable.

(a)(2) Certifications of the Principal Executive Officer and Principal Financial Officer of the registrant as required by Rule 30a-2(a) under the Investment Company Act are filed as exhibits hereto.

(a)(3) Not applicable.

(b) Certifications of the Principal Executive Officer and Principal Financial Officer of the registrant as required by Rule 30a-2(b) under the Investment Company Act are filed as exhibits hereto.

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

American Select Portfolio Inc.

By: | |

/s/ Thomas S. Schreier, Jr. | |

Thomas S. Schreier, Jr. |

President |

Date: August 8, 2005

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By: | |

/s/ Thomas S. Schreier, Jr. | |

Thomas S. Schreier, Jr. |

President |

Date: August 8, 2005

By: | |

/s/ Charles D. Gariboldi | |

Charles D. Gariboldi |

Treasurer |

Date: August 8, 2005