UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07838

American Select Portfolio Inc.

(Exact name of registrant as specified in charter)

800 Nicollet Mall, Minneapolis, MN | | 55402 |

(Address of principal executive offices) | | (Zip code) |

Charles D. Gariboldi, Jr., 800 Nicollet Mall, Minneapolis, MN 55402

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-677-3863

Date of fiscal year end: August 31

Date of reporting period: August 31, 2008

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

Item 1. Report to Shareholders

Annual Report

August 31, 2008

ASP

American Strategic

Income Portfolio Inc.

BSP

American Strategic

Income Portfolio Inc. II

CSP

American Strategic

Income Portfolio Inc. III

SLA

American Select

Portfolio Inc.

First American Mortgage Funds

Primary Investments

American Strategic Income Portfolio Inc. ("ASP"), American Strategic Income Portfolio Inc. II ("BSP"), American Strategic Income Portfolio Inc. III ("CSP"), and American Select Portfolio Inc. ("SLA") ("First American Mortgage Funds" or the "funds") invest in mortgage-related assets that directly or indirectly represent a participation in or are secured by and payable from mortgage loans. The funds may also invest in U.S. government securities, corporate debt securities, preferred stock issued by real estate investment trusts, and mortgage servicing rights. The funds borrow through the use of reverse repurchase agreements and revolving credit facilities. Use of borrowing and certain other investments and investment techniques may cause the funds' net asset value ("NAV") to fluctuate to a greater extent than would be expected from interest-rate movements alone.

Fund Objectives

Each fund's primary objective is to achieve high levels of current income. Each fund's secondary objective is to seek capital appreciation. As with other mutual funds, there can be no assurance these funds will achieve their objectives.

Table of Contents

| | 1 | | | Explanation of Financial Statements | |

|

| | 3 | | | Fund Overviews | |

|

| | 18 | | | Financial Statements | |

|

| | 23 | | | Notes to Financial Statements | |

|

| | 36 | | | Schedule of Investments | |

|

| | 53 | | | Report of Independent Registered Public Accounting Firm | |

|

| | 54 | | | Notice to Shareholders | |

|

NOT FDIC INSURED NO BANK GUARANTEE MAY LOSE VALUE

Explanation of FINANCIAL STATEMENTS

As a shareholder in one or more of the funds, you receive shareholder reports semiannually. We strive to present this financial information in an easy-to-understand format; however, for many investors, the information contained in this shareholder report may seem very technical. So, we would like to take this opportunity to explain several sections of the shareholder report.

The Statement of Assets and Liabilities lists the assets and liabilities of the fund on the last day of the reporting period and presents the fund's net asset value ("NAV") and market price per share. The NAV is calculated by dividing the fund's net assets (assets minus liabilities) by the number of shares outstanding. The market price is the closing price on the exchange on which the fund's shares trade. This price, which may be higher or lower than the fund's NAV, is the price an investor pays or receives when shares of the fund are purchased or sold. The investments, as presented in the Schedule of Investments, comprise substantially all of the fund's assets. Other assets include cash and receivables for items such as income earned by the fund but not yet received. Liabilities include payables for items such as fund expenses incurred but not yet pa id.

The Statement of Operations details the dividends and interest income earned from investments as well as the expenses incurred by the fund during the reporting period. Fund expenses may be reduced through fee waivers or reimbursements. This statement reflects total expenses before any waivers or reimbursements, the amount of waivers and reimbursements (if any), and the net expenses. This statement also shows the net realized and unrealized gains and losses from investments owned during the period. The Notes to Financial Statements provide additional details on investment income and expenses of the fund.

The Statement of Changes in Net Assets describes how the fund's net assets were affected by its operating results and distributions to shareholders during the reporting period. This statement is important to investors because it shows exactly what caused the fund's net asset size to change during the period.

The Statement of Cash Flows is required when a fund has a substantial amount of illiquid investments, a substantial amount of the fund's securities are internally valued, or the fund carries some amount of debt. When presented, this statement explains the change in cash during the reporting period. It reconciles net cash provided by and used for operating activities to the net increase or decrease in net assets from operations and classifies cash receipts and payments as resulting from operating, investing, and financing activities.

The Notes to Financial Statements disclose the organizational background of the fund, its significant accounting policies, federal tax information, fees and compensation paid to affiliates, and significant risks and contingencies. Included within the notes to financial statements is the Financial Highlights. This table provides a per-share breakdown of the components that affected the fund's NAV for the current and past reporting periods. It also shows total return, expense ratios, net investment income ratios, and portfolio turnover rates. The net investment income ratios summarize the income earned less expenses, divided by the average net assets. The expense ratios represent the percentage of average net assets that were used to cover operating expenses during the period. The portfolio turnover rate represents the percentage of the fund's holdings that have changed over the course of the period, and gives an idea of how long the fund holds onto a particular security. A 100% turnover rate implies that an amount equal to the value of the entire portfolio is turned over in a year through the purchase or sale of securities.

The Schedule of Investments details all of the securities held in the fund and their related dollar values on the last day of the reporting period. Securities are usually presented by type (bonds, common stock, etc.) and by industry classification (healthcare, education, etc.). This information is useful for analyzing how your fund's assets are invested and seeing where your portfolio manager believes the best opportunities exist to meet your objectives. Holdings are subject to change without notice and do not constitute a recommendation of any individual security. The Notes to Financial Statements provide additional details on how the securities are valued.

We hope this guide to your shareholder report will help you get the most out of this important resource.

First American Mortgage Funds 2008 Annual Report

1

(This page intentionally left blank.)

First American Mortgage Funds 2008 Annual Report

2

Fund OVERVIEWS

The fiscal year witnessed unprecedented volatility in world financial systems. Aggressive subprime residential mortgage lending and security creation, increasing risk aversion, unwinding of leverage, and growing capital constraints have resulted in heavy losses among many participants in the world financial markets. One result of this is a larger risk premium required by investors. This hurts the funds' NAV as assets are marked to market, but is beneficial as the funds invest in new assets at higher yields. Looking past the financial markets to the underlying fundamentals of the U.S. commercial real estate markets, we see slowing occupancies and slowing net income growth, in keeping with the slowing economy and lack of employment growth. U.S. commercial real estate markets are in a capital-constrained environment. This could help us achieve higher rates on fund investments and should limit the supply of new construction.

The funds continued to use leverage, or borrowing, during the period, primarily through the use of secured credit facilities. It is important to keep in mind that the use of leverage increases interest-rate risk in the funds and will increase the volatility of the funds' NAV and market price. A significant event during the period was the change in credit facilities provider from Morgan Stanley Mortgage Capital Holdings LLC to Massachusetts Mutual Life Insurance Company. The credit facilities use the one-month London Interbank Offering Rate ("LIBOR") as their base rate. During the fiscal year, the one-month LIBOR fell from 5.32% to 2.48%. It should be noted that the funds pay the new credit facilities a spread of 2.625% over the one-month LIBOR, which is higher than the former facilities spread of 0.875% over the one-month LIBOR. The funds do not have any direct subprime mortgage exposure and very little residential mortgage expo sure, most of which consists of investments in Federal National Mortgage Association (FNMA) and Federal Home Loan Mortgage Corporation (FHLMC) pass-through securities.

First American Mortgage Funds 2008 Annual Report

3

Fund OVERVIEWS

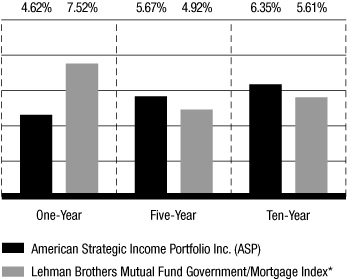

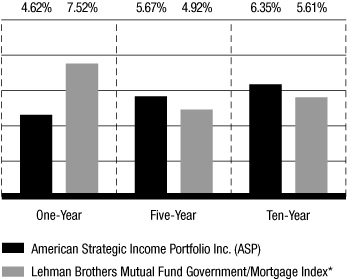

Average Annual Total Returns – ASP

Based on NAV for the period ended August 31, 2008

*The Lehman Brothers Mutual Fund Government/Mortgage Index is comprised of all U.S. government agency and Treasury securities and agency mortgage-backed securities. Index performance is for illustrative purposes only and does not reflect any fees or expenses. The index is unmanaged and is not available for direct investment. Although we believe this is the most appropriate benchmark available, it is not a perfect match. The benchmark index is comprised of U.S. government securities while the fund is comprised primarily of nonsecuritized, illiquid whole loans, which limits the ability of the fund to respond quickly to market changes.

The average annual total returns for the fund are based on the change in its NAV and assume reinvestment of distributions at NAV. NAV-based performance is used to measure investment management results.

• Average annual total returns based on the change in market price for the one-year, five-year, and ten-year periods ended August 31, 2008, were -8.00%, 3.10%, and 5.90%, respectively.

• Market price returns assume that all distributions have been reinvested at actual prices pursuant to the fund's dividend reinvestment plan. Market price returns reflect any broker commissions or sales charges on dividends reinvested at market price.

• Please remember, you could lose money with this investment. Neither safety of principal nor stability of income is guaranteed. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that fund shares, when sold, may be worth more or less than their original cost. Closed-end funds, such as this fund, often trade at discounts to NAV. Therefore, you may be unable to realize the full NAV of your shares when you sell.

First American Mortgage Funds 2008 Annual Report

4

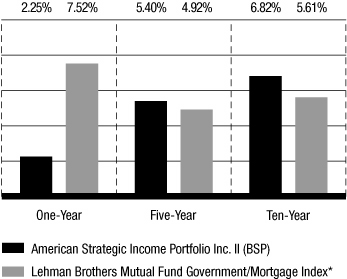

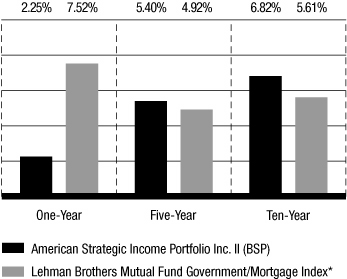

Average Annual Total Returns – BSP

Based on NAV for the period ended August 31, 2008

*The Lehman Brothers Mutual Fund Government/Mortgage Index is comprised of all U.S. government agency and Treasury securities and agency mortgage-backed securities. Index performance is for illustrative purposes only and does not reflect any fees or expenses. The index is unmanaged and is not available for direct investment. Although we believe this is the most appropriate benchmark available, it is not a perfect match. The benchmark index is comprised of U.S. government securities while the fund is comprised primarily of nonsecuritized, illiquid whole loans, which limits the ability of the fund to respond quickly to market changes.

The average annual total returns for the fund are based on the change in its NAV and assume reinvestment of distributions at NAV. NAV-based performance is used to measure investment management results.

• Average annual total returns based on the change in market price for the one-year, five-year, and ten-year periods ended August 31, 2008, were -6.80%, 2.70%, and 6.66%, respectively.

• Market price returns assume that all distributions have been reinvested at actual prices pursuant to the fund's dividend reinvestment plan. Market price returns reflect any broker commissions or sales charges on dividends reinvested at market price.

• Please remember, you could lose money with this investment. Neither safety of principal nor stability of income is guaranteed. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that fund shares, when sold, may be worth more or less than their original cost. Closed-end funds, such as this fund, often trade at discounts to NAV. Therefore, you may be unable to realize the full NAV of your shares when you sell.

First American Mortgage Funds 2008 Annual Report

5

Fund OVERVIEWS

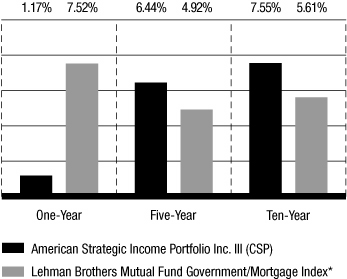

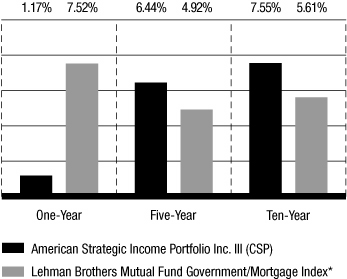

Average Annual Total Returns – CSP

Based on NAV for the period ended August 31, 2008

*The Lehman Brothers Mutual Fund Government/Mortgage Index is comprised of all U.S. government agency and Treasury securities and agency mortgage-backed securities. Index performance is for illustrative purposes only and does not reflect any fees or expenses. The index is unmanaged and is not available for direct investment. Although we believe this is the most appropriate benchmark available, it is not a perfect match. The benchmark index is comprised of U.S. government securities while the fund is comprised primarily of nonsecuritized, illiquid whole loans, which limits the ability of the fund to respond quickly to market changes.

The average annual total returns for the fund are based on the change in its NAV and assume reinvestment of distributions at NAV. NAV-based performance is used to measure investment management results.

• Average annual total returns based on the change in market price for the one-year, five-year, and ten-year periods ended August 31, 2008, were -5.78%, 4.60%, and 7.29%, respectively.

• Market price returns assume that all distributions have been reinvested at actual prices pursuant to the fund's dividend reinvestment plan. Market price returns reflect any broker commissions or sales charges on dividends reinvested at market price.

• Please remember, you could lose money with this investment. Neither safety of principal nor stability of income is guaranteed. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that fund shares, when sold, may be worth more or less than their original cost. Closed-end funds, such as this fund, often trade at discounts to NAV. Therefore, you may be unable to realize the full NAV of your shares when you sell.

First American Mortgage Funds 2008 Annual Report

6

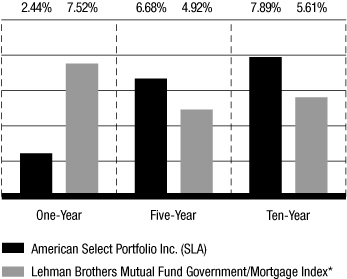

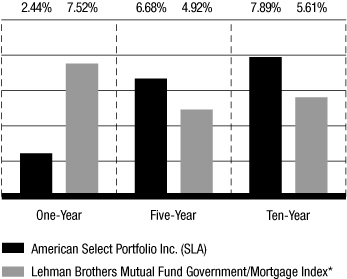

Average Annual Total Returns – SLA

Based on NAV for the period ended August 31, 2008

*The Lehman Brothers Mutual Fund Government/Mortgage Index is comprised of all U.S. government agency and Treasury securities and agency mortgage-backed securities. Index performance is for illustrative purposes only and does not reflect any fees or expenses. The index is unmanaged and is not available for direct investment. Although we believe this is the most appropriate benchmark available, it is not a perfect match. The benchmark index is comprised of U.S. government securities while the fund is comprised primarily of nonsecuritized, illiquid whole loans, which limits the ability of the fund to respond quickly to market changes.

The average annual total returns for the fund are based on the change in its NAV and assume reinvestment of distributions at NAV. NAV-based performance is used to measure investment management results.

• Average annual total returns based on the change in market price for the one-year, five-year, and ten-year periods ended August 31, 2008, were -7.06%, 4.87%, and 7.61%, respectively.

• Market price returns assume that all distributions have been reinvested at actual prices pursuant to the fund's dividend reinvestment plan. Market price returns reflect any broker commissions or sales charges on dividends reinvested at market price.

• Please remember, you could lose money with this investment. Neither safety of principal nor stability of income is guaranteed. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that fund shares, when sold, may be worth more or less than their original cost. Closed-end funds, such as this fund, often trade at discounts to NAV. Therefore, you may be unable to realize the full NAV of your shares when you sell.

First American Mortgage Funds 2008 Annual Report

7

Fund OVERVIEWS–ASP

Fund Management

John Wenker

is primarily responsible for the management of the fund. He has 25 years of financial experience.

Chris Neuharth, CFA,

is responsible for the management of the mortgage-backed securities portion of the fund. He has 27 years of financial experience.

David Yale

is responsible for the acquisition of mortgage loans for the fund. He has 27 years of financial experience.

For the fiscal year ended August 31, 2008, the fund had a total return of 4.62% based on its NAV. The fund's benchmark, the Lehman Brothers Mutual Fund Government/Mortgage Index, had a return of 7.52% during the period. The fund underperformed its benchmark mainly because the securitized product which comprises the benchmark index experienced strong performance relative to performance of the whole loans, which comprise the majority of the assets of the fund.

During the fiscal year, six loans were paid off with an unpaid principal balance of $8.32 million and a net weighted average coupon of 7.33%, and one loan was purchased with an original principal balance of $3.20 million and a coupon of 6.75%. As of August 31, 2008, there were no multifamily or commercial loans in default; one single family loan was in default. Prepayment penalties from loans that were paid off during the reporting period amounted to $148,000.

During the fiscal year, the fund paid $0.7800 per share in dividends, which included a $0.0300 per share return of capital dividend, resulting in an annualized distribution yield of 7.69% based on the August 31, 2008, market price of $9.75. As of August 31, 2008, undistributed net investment income was $0.0170 per share.

Portfolio Allocation

As a percentage of total investments on August 31, 2008

| Commercial Loans | | | 46 | % | |

| Multifamily Loans | | | 20 | % | |

| Preferred Stocks | | | 16 | % | |

| U.S. Government Agency Mortgage-Backed Securities | | | 7 | % | |

| Corporate Notes | | | 5 | % | |

| Short-Term Investments | | | 5 | % | |

| Single Family Loans | | | 1 | % | |

| | | | 100 | % | |

First American Mortgage Funds 2008 Annual Report

8

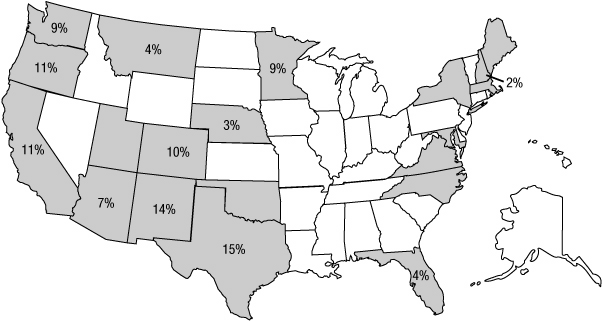

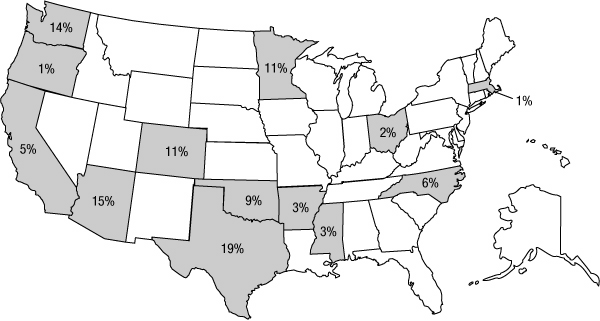

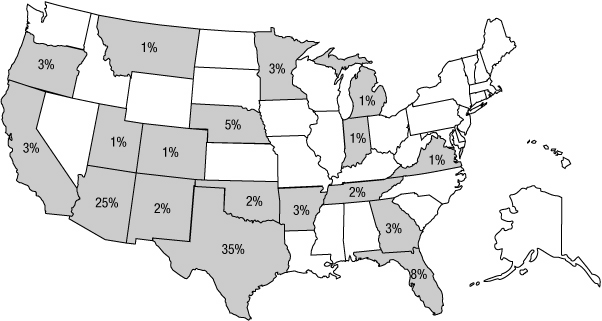

Geographical Distribution

We attempt to buy mortgage loans in many parts of the country to help avoid the risks of concentrating in one area. These percentages reflect the value of whole loans and participation mortgages as of August 31, 2008. Shaded areas without values indicate states in which the fund has invested less than 0.50% of its assets.

Delinquent Loan Profile

The tables below show the percentages of single family loans and multifamily and commercial loans in the portfolio that are 30, 60, 90, or 120 or more days delinquent as of August 31, 2008, based on the value outstanding.

| Single family loans | | | | Multifamily and commercial loans | | | |

| Current | | | 96.2 | % | | Current | | | 100.0 | % | |

| 30 Days | | | 0.0 | % | | 30 Days | | | 0.0 | % | |

| 60 Days | | | 0.3 | % | | 60 Days | | | 0.0 | % | |

| 90 Days | | | 0.0 | % | | 90 Days | | | 0.0 | % | |

| 120+ Days | | | 3.5 | % | | 120+ Days | | | 0.0 | % | |

| | | | 100.0 | % | | | | | 100.0 | % | |

First American Mortgage Funds 2008 Annual Report

9

Fund OVERVIEWS–BSP

Fund Management

John Wenker

is primarily responsible for the management of the fund. He has 25 years of financial experience.

Chris Neuharth, CFA,

is responsible for the management of the mortgage-backed securities portion of the fund. He has 27 years of financial experience.

David Yale

is responsible for the acquisition of mortgage loans for the fund. He has 27 years of financial experience.

For the fiscal year ended August 31, 2008, the fund had a total return of 2.25%, based on its NAV. The fund's benchmark, the Lehman Brothers Mutual Fund Government/Mortgage Index, had a return of 7.52% during the period. The fund underperformed its benchmark mainly because the securitized product which comprises the benchmark index experienced strong performance relative to performance of the whole loans, which comprise the majority of the assets of the fund.

During the fiscal year, seven loans were paid off with an unpaid principal balance of $22.86 million and a net weighted average coupon of 10.11%, and four loans were purchased with an original principal balance of $22.47 million and a net weighted average coupon of 7.15%. As of August 31, 2008, there were no multifamily, commercial, or single family loans in default. Prepayment penalties from loans that were paid off during the reporting period amounted to $46,753.

During the fiscal year, the fund paid $0.7850 per share in dividends, which included a $0.1000 per share return of capital dividend, resulting in an annualized distribution yield of 6.99% based on the August 31, 2008 market price of $9.80. The fund decreased its dividend from $0.0600 per share to $0.0550 per share in July 2008.

Portfolio Allocation

As a percentage of total investments on August 31, 2008

| Commercial Loans | | | 45 | % | |

| Multifamily Loans | | | 30 | % | |

| Preferred Stocks | | | 12 | % | |

| Corporate Notes | | | 9 | % | |

| U.S. Government Agency Mortgage-Backed Securities | | | 3 | % | |

| Short-Term Investments | | | 1 | % | |

| | | | 100 | % | |

First American Mortgage Funds 2008 Annual Report

10

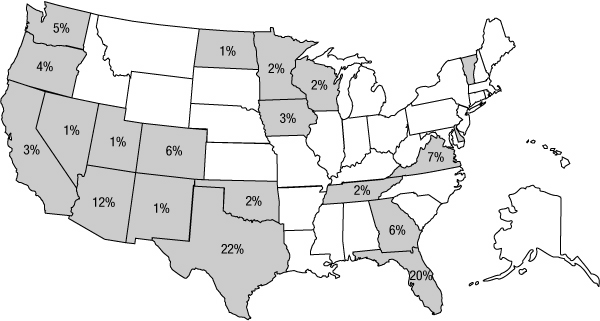

Geographical Distribution

We attempt to buy mortgage loans in many parts of the country to help avoid the risks of concentrating in one area. These percentages reflect the value of whole loans and participation mortgages as of August 31, 2008. Shaded areas without values indicate states in which the fund has invested less than 0.50% of its assets.

Delinquent Loan Profile

The tables below show the percentages of single family loans and multifamily and commercial loans in the portfolio that are 30, 60, 90, or 120 or more days delinquent as of August 31, 2008, based on the value outstanding.

| Single family loans | | | | Multifamily and commercial loans | | | |

| Current | | | 100.0 | % | | Current | | | 100.0 | % | |

| 30 Days | | | 0.0 | % | | 30 Days | | | 0.0 | % | |

| 60 Days | | | 0.0 | % | | 60 Days | | | 0.0 | % | |

| 90 Days | | | 0.0 | % | | 90 Days | | | 0.0 | % | |

| 120+ Days | | | 0.0 | % | | 120+ Days | | | 0.0 | % | |

| | | | 100.0 | % | | | | | 100.0 | % | |

First American Mortgage Funds 2008 Annual Report

11

Fund OVERVIEWS–CSP

Fund Management

John Wenker

is primarily responsible for the management of the fund. He has 25 years of financial experience.

Chris Neuharth, CFA,

is responsible for the management of the mortgage-backed securities portion of the fund. He has 27 years of financial experience.

David Yale

is responsible for the acquisition of mortgage loans for the fund. He has 27 years of financial experience.

For the fiscal year ended August 31, 2008, the fund had a total return of 1.17%, based on its NAV. The fund's benchmark, the Lehman Brothers Mutual Fund Government/Mortgage Index, had a return of 7.52% during the period. The fund underperformed its benchmark mainly because the securitized product which comprises the benchmark index experienced strong performance relative to performance of the whole loans, which comprise the majority of the assets of the fund.

During the fiscal year, one loan was paid off with an unpaid principal balance of $3.65 million and a coupon of 7.50%, and eight loans were purchased with an original principal balance of $41.09 million and a net weighted average coupon of 8.88%. As of August 31, 2008, no commercial loans or the private mortgage-backed security were in default; three multifamily loans were in default. The total estimated value of the loans represents 2.41% of the fund's net assets as of August 31, 2008. There were no prepayment penalties collected during the period.

During the fiscal year, the fund paid $0.9690 per share in dividends, which included a $0.0690 per share special cash dividend, and a $0.0100 per share return of capital dividend, resulting in an annualized distributed yield of 9.82% based on the August 31, 2008, market price of $9.77. As of August 31, 2008, undistributed net investment income was $0.0403 per share.

Portfolio Allocation

As a percentage of total investments on August 31, 2008

| Commercial Loans | | | 49 | % | |

| Multifamily Loans | | | 30 | % | |

| Preferred Stocks | | | 10 | % | |

| Corporate Notes | | | 8 | % | |

| U.S. Government Agency Mortgage-Backed Securities | | | 2 | % | |

| Short-Term Investments | | | 1 | % | |

| | | | 100 | % | |

First American Mortgage Funds 2008 Annual Report

12

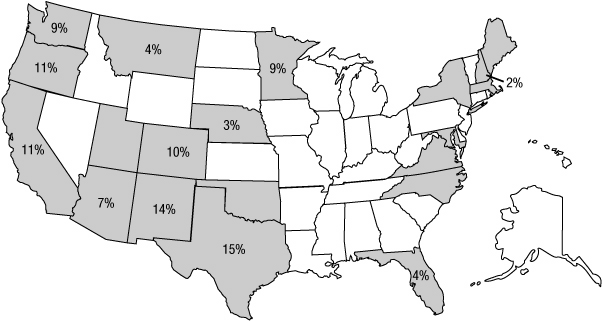

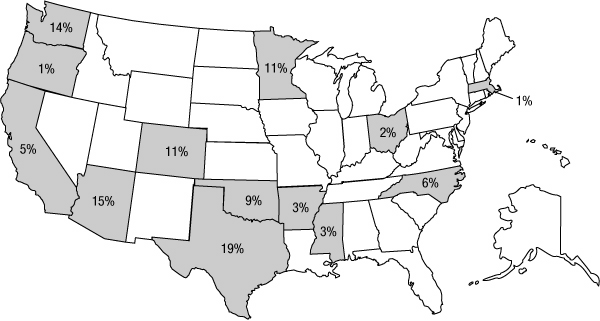

Geographical Distribution

We attempt to buy mortgage loans in many parts of the country to help avoid the risks of concentrating in one area. These percentages reflect the value of whole loans and participation mortgages as of August 31, 2008. Shaded areas without values indicate states in which the fund has invested less than 0.50% of its assets.

Delinquent Loan Profile

The tables below show the percentages of single family loans and a private mortgage-backed security and multifamily and commercial loans in the portfolio that are 30, 60, 90, or 120 or more days delinquent as of August 31, 2008, based on the value outstanding.

| Private mortgage-backed security | | | | Multifamily and commercial loans | | | |

| Current | | | 100.0 | % | | Current | | | 97.7 | % | |

| 30 Days | | | 0.0 | % | | 30 Days | | | 0.0 | % | |

| 60 Days | | | 0.0 | % | | 60 Days | | | 0.2 | % | |

| 90 Days | | | 0.0 | % | | 90 Days | | | 0.0 | % | |

| 120+ Days | | | 0.0 | % | | 120+ Days | | | 2.1 | % | |

| | | | 100.0 | % | | | | | 100.0 | % | |

First American Mortgage Funds 2008 Annual Report

13

Fund OVERVIEWS–SLA

Fund Management

John Wenker

is primarily responsible for the management of the fund. He has 25 years of financial experience.

Chris Neuharth, CFA,

is responsible for the management of the mortgage-backed securities portion of the fund. He has 27 years of financial experience.

David Yale

is responsible for the acquisition of mortgage loans for the fund. He has 27 years of financial experience.

For the fiscal year ended August 31, 2008, the fund had a total return of 2.44%, based on its NAV. The fund's benchmark, the Lehman Brothers Mutual Fund Government/Mortgage Index, had a return of 7.52% during the period. The fund underperformed its benchmark mainly because the securitized product which comprises the benchmark index experienced strong performance relative to performance of the whole loans, which comprise the majority of the assets of the fund.

During the fiscal year, three loans were paid off with an unpaid principal balance of $7.68 million and a net weighted average coupon of 8.42%, and five loans were purchased with an original principal balance of $25.66 million and a net weighted average coupon of 7.92%. As of August 31, 2008, no multifamily or commercial loans were in default. Prepayment penalties from loans that were paid off during the reporting period amounted to $37,500.

During the fiscal year, the fund paid $0.8879 per share in dividends, which included a $0.04787 per share long-term capital gain dividend, resulting in an annualized distribution yield of 8.34% based on the August 31, 2008, market price of $10.64. The monthly dividend of the fund was reduced from $0.0800 per share to $0.0650 per share in January 2008. As of August 31, 2008, undistributed net investment income was $0.0779 per share.

Portfolio Allocation

As a percentage of total investments on August 31, 2008

| Commercial Loans | | | 54 | % | |

| Multifamily Loans | | | 23 | % | |

| Preferred Stocks | | | 10 | % | |

| Corporate Notes | | | 10 | % | |

| U.S. Government Agency Mortgage-Backed Securities | | | 2 | % | |

| Short-Term Investments | | | 1 | % | |

| | | | 100 | % | |

First American Mortgage Funds 2008 Annual Report

14

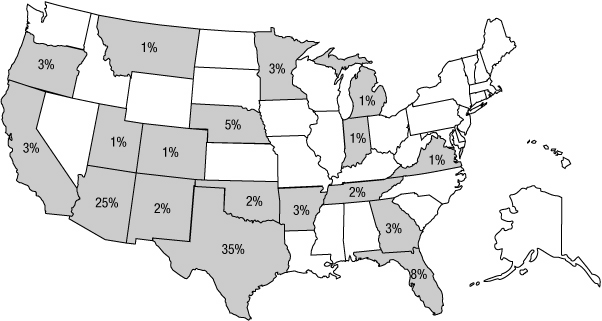

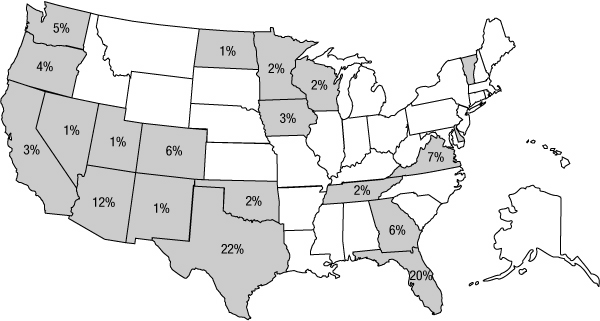

Geographical Distribution

We attempt to buy mortgage loans in many parts of the country to help avoid the risks of concentrating in one area. These percentages reflect the value of whole loans and participation mortgages as of August 31, 2008. Shaded areas without values indicate states in which the fund has invested less than 0.50% of its investments.

Delinquent Loan Profile

The tables below show the percentages of multifamily and commercial loans in the portfolio that are 30, 60, 90, or 120 or more days delinquent as of August 31, 2008, based on the value outstanding.

| Multifamily and commercial loans | | | |

| Current | | | 100.0 | % | |

| 30 Days | | | 0.0 | % | |

| 60 Days | | | 0.0 | % | |

| 90 Days | | | 0.0 | % | |

| 120+ Days | | | 0.0 | % | |

| | | | 100 | % | |

First American Mortgage Funds 2008 Annual Report

15

Fund OVERVIEWS

As of this writing, commercial real estate markets are sound but face some headwinds. The subprime mortgage crisis that began in 2007 has spread to a much broader contagion of world financial markets. A weak economic environment, including a growing unemployment rate and significantly more restricted credit environment, poses challenges for the commercial real estate sector. We will continue to diligently manage the credit risk in the funds, and we feel that their current credit profiles are acceptable.

Thank you for your investment in the funds and your continued trust as we navigate the investment landscape. If you have any questions about the funds, please call us at 800.677.FUND.

Sincerely,

John Wenker

Managing Director, Head of Real Estate

FAF Advisors, Inc.

First American Mortgage Funds 2008 Annual Report

16

Valuation of Investments

The funds' investments in whole loans (single family, multifamily, and commercial), participation mortgages, and mortgage servicing rights are generally not traded in any organized market; therefore, market quotations are not readily available. These investments are valued at "fair value" according to procedures adopted by the funds' board of directors. Pursuant to these procedures, whole loan, participation mortgage, and mortgage servicing rights investments are initially valued at cost and their values are subsequently monitored and adjusted pursuant to a pricing model designed by FAF Advisors, Inc., to incorporate, among other things, the present value of the projected stream of cash flows on such investments. The pricing model takes into account a number of relevant factors including the projected rate of prepayments, the delinquency profile, the historical payment record, the expected yield at purchase, changes in prevailin g interest rates, and changes in the real or perceived liquidity of whole loans, participation mortgages, and mortgage servicing rights, as the case may be. The results of the pricing model may be further subject to price ceilings due to the illiquid nature of the investments. Changes in prevailing interest rates, real or perceived liquidity, yield spreads, and creditworthiness are factored into the pricing model each week. Certain mortgage loan information is received on a monthly basis and includes, but is not limited to, the projected rate of prepayments, projected rate and severity of defaults, the delinquency profile, and the historical payment record. Valuations of whole loans, participation mortgages, and mortgage servicing rights are determined no less frequently than weekly.

First American Mortgage Funds 2008 Annual Report

17

FINANCIAL STATEMENTS

Statements of Assets and Liabilities August 31, 2008

| | | ASP | | BSP | | CSP | | SLA | |

| Assets: | |

Unaffiliated investments, at value (cost: $63,973,051, $255,125,132,

$331,742,618, $177,628,084) (note 2) | | $ | 61,975,024 | | | $ | 241,719,778 | | | $ | 312,412,949 | | | $ | 174,225,292 | | |

Affiliated money market fund, at value (cost: $3,377,551, $3,463,142,

$3,166,199, $2,411,004) (note 3) | | | 3,377,551 | | | | 3,463,142 | | | | 3,166,199 | | | | 2,411,004 | | |

| Receivable for accrued dividends and interest | | | 370,070 | | | | 1,319,238 | | | | 1,874,168 | | | | 1,020,219 | | |

| Prepaid expenses and other assets | | | 130,203 | | | | 658,583 | | | | 778,226 | | | | 458,977 | | |

| Total assets | | | 65,852,848 | | | | 247,160,741 | | | | 318,231,542 | | | | 178,115,492 | | |

| Liabilities: | |

| Payable under loan agreement (note 2) | | | 10,000,000 | | | | 50,000,000 | | | | 62,000,000 | | | | 38,000,000 | | |

| Payable for reverse repurchase agreements (note 2) | | | 6,130,000 | | | | 12,644,000 | | | | 15,366,000 | | | | 7,189,000 | | |

| Bank overdraft | | | 63,111 | | | | 246,011 | | | | 288,120 | | | | 173,472 | | |

| Payable for investment advisory fees (note 3) | | | 22,368 | | | | 77,686 | | | | 111,622 | | | | 55,805 | | |

| Payable for administrative fees (note 3) | | | 10,442 | | | | 38,767 | | | | 50,584 | | | | 27,902 | | |

| Payable for interest expense | | | 9,208 | | | | 38,707 | | | | 49,476 | | | | 24,979 | | |

| Payable for professional fees | | | 18,525 | | | | 18,538 | | | | 18,543 | | | | 18,533 | | |

| Payable for transfer agent fees | | | 3,193 | | | | 3,862 | | | | 3,965 | | | | 3,659 | | |

| Payable for other expenses | | | 10,166 | | | | 79,031 | | | | 401,828 | | | | 156,251 | | |

| Total liabilities | | | 16,267,013 | | | | 63,146,602 | | | | 78,290,138 | | | | 45,649,601 | | |

| Net assets applicable to outstanding capital stock | | $ | 49,585,835 | | | $ | 184,014,139 | | | $ | 239,941,404 | | | $ | 132,465,891 | | |

| Composition of net assets: | |

| Capital stock and additional paid-in capital | | $ | 53,329,171 | | | $ | 204,967,357 | | | $ | 265,788,985 | | | $ | 139,930,119 | | |

| Undistributed (distributions in excess of) net investment income | | | 649 | | | | (1,754 | ) | | | (112,147 | ) | | | 313,286 | | |

| Accumulated net realized loss on investments (note 5) | | | (1,745,958 | ) | | | (7,546,110 | ) | | | (6,405,765 | ) | | | (4,374,722 | ) | |

| Net unrealized depreciation of investments | | | (1,998,027 | ) | | | (13,405,354 | ) | | | (19,329,669 | ) | | | (3,402,792 | ) | |

| Total–representing net assets applicable to capital stock | | $ | 49,585,835 | | | $ | 184,014,139 | | | $ | 239,941,404 | | | $ | 132,465,891 | | |

| Net asset value and market price of capital stock: | |

| Net assets applicable to capital stock | | $ | 49,585,835 | | | $ | 184,014,139 | | | $ | 239,941,404 | | | $ | 132,465,891 | | |

| Shares outstanding (authorized 1 billion shares of each fund of $0.01 par value) | | | 4,231,331 | | | | 15,985,741 | | | | 21,356,023 | | | | 10,662,195 | | |

| Net asset value per share | | $ | 11.72 | | | $ | 11.51 | | | $ | 11.24 | | | $ | 12.42 | | |

| Market price per share | | $ | 9.75 | | | $ | 9.80 | | | $ | 9.77 | | | $ | 10.64 | | |

The accompanying notes are an integral part of the financial statements.

First American Mortgage Funds 2008 Annual Report

18

Statements of Operations For the Year Ended August 31, 2008

| | | ASP | | BSP | | CSP | | SLA | |

| Investment Income: | |

| Interest from unaffiliated investments | | $ | 4,175,939 | | | $ | 14,492,437 | | | $ | 21,684,355 | | | $ | 12,009,635 | | |

| Dividends from unaffiliated investments | | | 675,713 | | | | 2,785,104 | | | | 3,672,430 | | | | 1,930,276 | | |

| Dividends from affiliated money market fund | | | 55,903 | | | | 112,062 | | | | 134,017 | | | | 79,841 | | |

| Net operating income from real estate owned (note 2) | | | — | | | | — | | | | 5,422 | | | | — | | |

| Total investment income | | | 4,907,555 | | | | 17,389,603 | | | | 25,496,224 | | | | 14,019,752 | | |

| Expenses (note 3): | |

| Investment advisory fees | | | 281,903 | | | | 975,840 | | | | 1,394,200 | | | | 677,339 | | |

| Interest expense | | | 874,783 | | | | 3,747,940 | | | | 4,532,720 | | | | 2,869,998 | | |

| Administrative fees | | | 125,895 | | | | 476,502 | | | | 629,568 | | | | 338,669 | | |

| Custodian fees | | | 10,569 | | | | 38,975 | | | | 51,084 | | | | 28,764 | | |

| Mortgage servicing fees | | | 58,529 | | | | 153,805 | | | | 205,114 | | | | 123,735 | | |

| Professional fees | | | 55,204 | | | | 64,349 | | | | 59,192 | | | | 55,174 | | |

| Postage and printing fees | | | 14,319 | | | | 30,311 | | | | 39,341 | | | | 24,317 | | |

| Transfer agent fees | | | 14,629 | | | | 16,856 | | | | 18,049 | | | | 15,982 | | |

| Listing fees | | | 23,815 | | | | 25,229 | | | | 25,229 | | | | 23,811 | | |

| Directors' fees | | | 26,512 | | | | 26,512 | | | | 26,512 | | | | 26,512 | | |

| Insurance fees | | | 11,976 | | | | 12,023 | | | | 12,049 | | | | 12,005 | | |

| Pricing fees | | | 15,658 | | | | 15,658 | | | | 15,709 | | | | 15,675 | | |

| Other expenses | | | 28,016 | | | | 35,867 | | | | 42,771 | | | | 31,235 | | |

| Total expenses | | | 1,541,808 | | | | 5,619,867 | | | | 7,051,538 | | | | 4,243,216 | | |

| Less: Fee reimbursements (note 3) | | | (2,025 | ) | | | (3,909 | ) | | | (5,741 | ) | | | (3,381 | ) | |

| Less: Indirect payments from custodian (note 3) | | | (2,157 | ) | | | (3,069 | ) | | | (2,253 | ) | | | (2,060 | ) | |

| Total net expenses | | | 1,537,626 | | | | 5,612,889 | | | | 7,043,544 | | | | 4,237,775 | | |

| Net investment income | | | 3,369,929 | | | | 11,776,714 | | | | 18,452,680 | | | | 9,781,977 | | |

| Net realized and unrealized losses on investments (notes 2 and 4): | |

| Net realized loss on investments | | | (753,484 | ) | | | (4,382,077 | ) | | | (4,909,943 | ) | | | (4,263,798 | ) | |

| Net realized loss on real estate owned (note 2) | | | — | | | | — | | | | (1,416,458 | ) | | | — | | |

| Net change in unrealized appreciation or depreciation of investments | | | (351,230 | ) | | | (2,998,336 | ) | | | (8,958,545 | ) | | | (2,146,712 | ) | |

| Net loss on investments | | | (1,104,714 | ) | | | (7,380,413 | ) | | | (15,284,946 | ) | | | (6,410,510 | ) | |

| Net increase in net assets resulting from operations | | $ | 2,265,215 | | | $ | 4,396,301 | | | $ | 3,167,734 | | | $ | 3,371,467 | | |

First American Mortgage Funds 2008 Annual Report

19

FINANCIAL STATEMENTS

Statements of Changes in Net Assets

| | | ASP | | BSP | |

| | | Year Ended

8/31/08 | | Year Ended

8/31/07 | | Year Ended

8/31/08 | | Year Ended

8/31/07 | |

| Operations: | |

| Net investment income | | $ | 3,369,929 | | | $ | 3,397,438 | | | $ | 11,776,714 | | | $ | 12,759,869 | | |

| Net realized gain (loss) on investments | | | (753,484 | ) | | | 35,669 | | | | (4,382,077 | ) | | | 1,163,381 | | |

| Net realized loss on real estate owned (note 2) | | | — | | | | — | | | | — | | | | (5,777,852 | ) | |

| Net change in unrealized appreciation or depreciation of investments | | | (351,230 | ) | | | (348,738 | ) | | | (2,998,336 | ) | | | 6,921,781 | | |

| Net increase in net assets resulting from operations | | | 2,265,215 | | | | 3,084,369 | | | | 4,396,301 | | | | 15,067,179 | | |

| Distributions to shareholders (note 2): | |

| From net investment income | | | (3,165,549 | ) | | | (3,555,377 | ) | | | (10,970,395 | ) | | | (13,439,536 | ) | |

| From net realized gain on investments | | | — | | | | — | | | | — | | | | — | | |

| From return of capital | | | (134,890 | ) | | | — | | | | (1,578,414 | ) | | | — | | |

| Total distributions | | | (3,300,439 | ) | | | (3,555,377 | ) | | | (12,548,809 | ) | | | (13,439,536 | ) | |

| Total increase (decrease) in net assets | | | (1,035,224 | ) | | | (471,008 | ) | | | (8,152,508 | ) | | | 1,627,643 | | |

| Net assets at beginning of year | | | 50,621,059 | | | | 51,092,067 | | | | 192,166,647 | | | | 190,539,004 | | |

| Net assets at end of year | | $ | 49,585,835 | | | $ | 50,621,059 | | | $ | 184,014,139 | | | $ | 192,166,647 | | |

| Undistributed (distributions in excess of) net investment income | | $ | 649 | | | $ | 2,403 | | | $ | (1,754 | ) | | $ | — | | |

The accompanying notes are an integral part of the financial statements.

First American Mortgage Funds 2008 Annual Report

20

| | | CSP | | SLA | |

| | | Year Ended

8/31/08 | | Year Ended

8/31/07 | | Year Ended

8/31/08 | | Year Ended

8/31/07 | |

| Operations: | |

| Net investment income | | $ | 18,452,680 | | | $ | 25,143,146 | | | $ | 9,781,977 | | | $ | 10,047,779 | | |

| Net realized gain (loss) on investments | | | (4,909,943 | ) | | | (305,760 | ) | | | (4,263,798 | ) | | | 76,600 | | |

| Net realized loss on real estate owned (note 2) | | | (1,416,458 | ) | | | — | | | | — | | | | — | | |

| Net change in unrealized appreciation or depreciation of investments | | | (8,958,545 | ) | | | 2,039,731 | | | | (2,146,712 | ) | | | 683,804 | | |

| Net increase in net assets resulting from operations | | | 3,167,734 | | | | 26,877,117 | | | | 3,371,467 | | | | 10,808,183 | | |

| Distributions to shareholders (note 2): | |

| From net investment income | | | (20,564,180 | ) | | | (25,202,031 | ) | | | (8,956,245 | ) | | | (11,126,853 | ) | |

| From net realized gain on investments | | | — | | | | (1,450,715 | ) | | | (510,399 | ) | | | (1,033,380 | ) | |

| From return of capital | | | (129,811 | ) | | | — | | | | — | | | | — | | |

| Total distributions | | | (20,693,991 | ) | | | (26,652,746 | ) | | | (9,466,644 | ) | | | (12,160,233 | ) | |

| Total increase (decrease) in net assets | | | (17,526,257 | ) | | | 224,371 | | | | (6,095,177 | ) | | | (1,352,050 | ) | |

| Net assets at beginning of year | | | 257,467,661 | | | | 257,243,290 | | | | 138,561,068 | | | | 139,913,118 | | |

| Net assets at end of year | | $ | 239,941,404 | | | $ | 257,467,661 | | | $ | 132,465,891 | | | $ | 138,561,068 | | |

| Undistributed (distributions in excess of) net investment income | | $ | (112,147 | ) | | $ | 3,101,431 | | | $ | 313,286 | | | $ | 4,512 | | |

First American Mortgage Funds 2008 Annual Report

21

FINANCIAL STATEMENTS

Statements of Cash Flows For the Year Ended August 31, 2008

| | | ASP | | BSP | | CSP | | SLA | |

| Cash flows from operating activities: | |

| Net increase in net assets resulting from operations | | $ | 2,265,215 | | | $ | 4,396,301 | | | $ | 3,167,734 | | | $ | 3,371,467 | | |

Adjustments to reconcile net increase in net assets resulting from operations to

net cash provided by operating activities: | |

| Purchases of investments | | | (11,523,061 | ) | | | (110,331,099 | ) | | | (23,246,214 | ) | | | (37,270,402 | ) | |

| Proceeds from paydowns and sales of investments | | | 16,980,381 | | | | 124,324,214 | | | | 15,671,165 | | | | 34,790,113 | | |

| Net purchases of short-term investments | | | (2,035,190 | ) | | | (2,186,294 | ) | | | (1,737,570 | ) | | | (1,077,211 | ) | |

| Net amortization/accretion of bond discount and premium | | | 1,191 | | | | 8,308 | | | | 4,846 | | | | 4,325 | | |

| Net change in unrealized appreciation or depreciation of investments | | | 351,230 | | | | 2,998,336 | | | | 8,958,545 | | | | 2,146,712 | | |

| Net realized gain on investments | | | 753,484 | | | | 4,382,077 | | | | 6,326,401 | | | | 4,263,798 | | |

| Increase/decrease in receivable for accrued interest and dividends | | | 25,434 | | | | 49,678 | | | | (8,407 | ) | | | (55,623 | ) | |

| Increase in prepaid expenses and other assets | | | (119,173 | ) | | | (524,235 | ) | | | (684,084 | ) | | | (446,928 | ) | |

| Decrease in accrued fees and expenses | | | (111,795 | ) | | | (237,937 | ) | | | (296,799 | ) | | | (117,139 | ) | |

| Net cash provided by operating activities | | | 6,587,716 | | | | 22,879,349 | | | | 8,155,617 | | | | 5,609,112 | | |

| Cash flows from financing activities: | |

| Net proceeds for borrowings under loan agreement | | | 10,000,000 | | | | 50,000,000 | | | | 62,000,000 | | | | 38,000,000 | | |

| Net payments from reverse repurchase agreements | | | (13,302,934 | ) | | | (60,580,065 | ) | | | (49,596,714 | ) | | | (34,267,112 | ) | |

| Distributions paid to shareholders | | | (3,300,439 | ) | | | (12,548,809 | ) | | | (20,693,991 | ) | | | (9,466,644 | ) | |

| Net cash used in financing activities | | | (6,603,373 | ) | | | (23,128,874 | ) | | | (8,290,705 | ) | | | (5,733,756 | ) | |

| Net decrease in cash | | | (15,657 | ) | | | (249,525 | ) | | | (135,088 | ) | | | (124,644 | ) | |

| Cash (bank overdraft) at beginning of year | | | (47,454 | ) | | | 3,514 | | | | (153,032 | ) | | | (48,828 | ) | |

| Bank overdraft at end of year | | $ | (63,111 | ) | | $ | (246,011 | ) | | $ | (288,120 | ) | | $ | (173,472 | ) | |

Supplemental disclosure of cash flow information:

Cash paid for interest | | $ | 948,146 | | | $ | 4,037,431 | | | $ | 4,672,901 | | | $ | 3,027,711 | | |

The accompanying notes are an integral part of the financial statements.

First American Mortgage Funds 2008 Annual Report

22

Notes to FINANCIAL STATEMENTS

(1) Organization

American Strategic Income Portfolio Inc. ("ASP"), American Strategic Income Portfolio Inc. II ("BSP"), American Strategic Income Portfolio Inc. III ("CSP"), and American Select Portfolio Inc. ("SLA") (the "funds") are registered under the Investment Company Act of 1940 (as amended) as diversified, closed-end management investment companies. The funds emphasize investments in mortgage-related assets that directly or indirectly represent a participation in or are secured by and payable from mortgage loans. They may also invest in U.S. government securities, corporate debt securities, preferred stock issued by real estate investment trusts, and mortgage servicing rights. In addition, the funds may borrow using reverse repurchase agreements and revolvi ng credit facilities. Fund shares are listed on the New York Stock Exchange under the symbols ASP, BSP, CSP, and SLA, respectively.

(2) Summary of Significant Accounting Policies

Security Valuations

Security valuations for the funds' investments (other than whole loans, participation mortgages, and mortgage servicing rights) are furnished by an independent pricing service that has been approved by the funds' board of directors. Investments in equity securities that are traded on a national securities exchange (or reported on the Nasdaq national market system) are stated at the last quoted sales price if readily available for such securities on each business day. For securities traded on the Nasdaq national market system, the funds utilize the Nasdaq Official Closing Price which compares the last trade to the bid/ask price of a security. If the last trade falls within the bid/ask range, then that price will be the closing price. If the last trade is outside the bid/ask range, and falls above the ask, the ask price will be the closing price. If the last trade is below the bid, the bid will be the closing price. Other equity s ecurities traded in the over-the-counter market and listed equity securities for which no sale was reported on that date are stated at the last quoted bid price. Investments in open-end mutual funds are valued at their respective net asset values on the valuation date.

Debt obligations exceeding 60 days to maturity are valued by an independent pricing service. The pricing service may employ methodologies that utilize actual market transactions, broker-dealer supplied valuations, or other formula-driven valuation techniques. These techniques generally consider such factors as yields or prices of bonds of comparable quality, type of issue, coupon, maturity, ratings, and general market conditions. Securities for which prices are not available from an independent pricing service but where an active market exists are valued using market quotations obtained from one or more dealers that make markets in the securities or from a widely-used quotation system. Debt obligations with 60 days or less remaining until maturity may be valued at their amortized cost which approximates market value.

The following investment vehicles, when held by a fund, are priced as follows: Exchange listed futures and options on futures are priced at their last sale price on the exchange on which they are principally traded, as determined by FAF Advisors, Inc. ("FAF Advisors"), on the day the valuation is made. If there were no sales on that day, futures and options on futures will be valued at the last reported bid price. Options on securities, indices, and currencies traded on Nasdaq or listed on a stock exchange, whether domestic or foreign, are valued at the last sale price on Nasdaq or on any exchange on the day the valuation is made. If there were no sales on that day, the options will be valued at the last sale price on the previous valuation date. Last sale prices are obtained from an independent pricing service. Forward contracts (other than currency forward contracts), swaps, and over-the-counter options on securities, indices, and currencies are valued at the quotations received from an independent pricing service, if available.

First American Mortgage Funds 2008 Annual Report

23

Notes to FINANCIAL STATEMENTS

When market quotations are not readily available, securities are valued at fair value as determined in good faith by procedures established and approved by the funds' board of directors. Some of the factors which may be considered in determining fair value are fundamental analytical data relating to the investment; the nature and duration of any restrictions on disposition; trading in similar securities of the same issuer or comparable companies; information from broker-dealers; and an evaluation of the forces that influence the market in which the securities are purchased or sold. If events occur that materially affect the value of securities (including non-U.S. securities) between the close of trading in those securities and the close of regular trading on the New York Stock Exchange, the securities will be valued at fair value.

The funds' investments in whole loans (single family, multifamily, and commercial), participation mortgages, and mortgage servicing rights are generally not traded in any organized market and therefore, market quotations are not readily available. These investments are valued at fair value according to procedures adopted by the funds' board of directors. Pursuant to these procedures, whole loan investments are initially fair valued at cost and adjusted using a FAF Advisors pricing model designed to incorporate, among other things, the present value of the projected stream of cash flows on such investments. The pricing model takes into account a number of relevant factors including the projected rate of prepayments, the delinquency profile, the historical payment record, the expected yield at purchase, changes in prevailing interest rates, and changes in the real or perceived liquidity of whole loans, participation mortgages, and mortgage servicing rights as the case may be. The results of the pricing model may be further subject to price ceilings due to the illiquid nature of the loans. Changes in prevailing interest rates, real or perceived liquidity, yield spreads, and creditworthiness are factored into the pricing model each week.

Certain mortgage loan information is received once a month. This information includes, but is not limited to, the projected rate of prepayments, projected rate and severity of defaults, the delinquency profile, and the historical payment record. Valuations of whole loans, participation mortgages, and mortgage servicing rights are determined no less frequently than weekly. Although FAF Advisors believes the pricing model to be reasonable and appropriate, the actual values that may be realized upon the sale of whole loans, participation mortgages, and mortgage servicing rights can only be determined in negotiations between the funds and third parties.

As of August 31, 2008, the funds held fair valued securities as follows:

| Fund | | Fair Value | | Percentage

of Total Net Assets | |

| ASP | | $ | 46,643,980 | | | | 94.1 | % | |

| BSP | | | 205,914,723 | | | | 111.9 | | |

| CSP | | | 274,791,933 | | | | 114.5 | | |

| SLA | | | 152,978,200 | | | | 115.5 | | |

Security Transactions and Investment Income

For financial statement purposes, the funds record security transactions on the trade date of the security purchase or sale. Dividend income is recorded on the ex-dividend date. Interest income, including accretion of bond discounts and amortization of bond premiums, is recorded on the accrual basis. Security gains and losses are determined on the basis of identified cost, which is the same basis used for federal income tax purposes.

First American Mortgage Funds 2008 Annual Report

24

Whole Loans and Participation Mortgages

Whole loans and participation mortgages may bear a greater risk of loss arising from a default on the part of the borrower of the underlying loans than do traditional mortgage-backed securities. This is because whole loans and participation mortgages, unlike most mortgage-backed securities, generally are not backed by any government guarantee or private credit enhancement. Such risk may be greater during a period of declining or stagnant real estate values. The funds may invest in single family, multifamily, and commercial loans. Each fund currently limits its investment in commercial loans to 50% of its total assets. A participating loan is one which contains provisions for the lender to participate in the income stream provided by the property, including net cash flow and capital proceeds.

At August 31, 2008, ASP had one single family loan representing 0.03% of net assets and 2.55% of total single family loans outstanding that was 120 or more days delinquent as to the timely monthly payment of principal and interest. At August 31, 2008, no multifamily or commercial loans in ASP were delinquent.

At August 31, 2008, CSP had two multifamily loans representing 2.21% of net assets and 5.53% of total multifamily loans outstanding that were 120 or more days delinquent as to the timely monthly payment of principal and interest. At August 31, 2008, no commercial loans or the private mortgage-backed security in CSP were delinquent.

At August 31, 2008, no loans were delinquent in BSP and SLA.

The funds may incur certain costs and delays in the event of a foreclosure. Also, there is no assurance that the subsequent sale of the property will produce an amount equal to the sum of the unpaid principal balance of the loan as of the date the borrower went into default, the accrued unpaid interest, and all of the foreclosure expenses. In this case, the funds may suffer a loss. In accordance with the valuation procedures adopted by the funds' board of directors, real estate acquired through foreclosure, if any, is valued at estimated market value, as determined by independent third party appraisals, less estimated selling costs. As material capital improvements are made to the property, new market value appraisals are obtained.

Real estate may be acquired through foreclosure on whole loans or similar obligations. The funds may receive rental or other income as a result of holding real estate. In addition, the funds may incur expenses associated with maintaining or improving any real estate owned. As of August 31, 2008, the funds held no real estate owned through foreclosure.

CSP recognized a loss of $1,416,458 on a real estate property sold during the year ended August 31, 2008. The income and capital improvements for the year ended August 31, 2008 on real estate properties sold were:

| CSP | | Gross Rental

Income | | Operating

Expenses | | Net Operating

Income | | Capital

Improvements | |

| Chateau Club Apartment Building | | $ | 343,372 | | | $ | 337,950 | | | $ | 5,422 | | | $ | 31,839 | | |

Real estate income is recorded on a net basis in the income section of the funds' Statement of Operations. Capital improvements were recorded as an addition to the cost basis of the property, which increased the loss upon sale as noted above.

First American Mortgage Funds 2008 Annual Report

25

Notes to FINANCIAL STATEMENTS

Mortgage Servicing Rights

The funds may acquire interests in the cash flow from servicing fees through contractual arrangements with mortgage services. Mortgage servicing rights, similar to interest-only securities, generate no further cash flow when a mortgage is prepaid or goes into default. Mortgage servicing rights are accounted for on a level-yield basis with recognized income based on the estimated amounts and timing of cash flows. Such estimates are adjusted periodically as the underlying market conditions change. As of and for the year ended August 31, 2008, the funds held no mortgage servicing rights.

Borrowings & Reverse Repurchase Agreements

Effective July 11, 2008, the funds entered into loan agreements with Massachusetts Mutual Life Insurance Company ("MMLIC") under which MIMLIC made term loans to ASP, BSP, CSP, and SLA of $8,600,000, $45,100,000, $54,400,000, and $31,900,000, respectively, and agreed to make revolving loans to the funds of up to $2,400,000, $12,900,000, $15,600,000, and $9,100,000, respectively. Loans made under the loan agreements are secured by whole loans in the funds' portfolios, bear interest at the one-month London Interbank Offered Rate plus 2.625%, and mature on July 21, 2011. In addition to principal and interest payments paid by each fund to MMLIC for borrowings outstanding, each fund pays an annual fee of 1.28% on any unused portion of the fund's revolving loan commitment. Prior to this agreement, the funds had lending agreements with Morgan Stanley Mortgage Capital Holdings LLC ("Morgan Stanley"), under which ASP, BSP, CSP, and SLA co uld borrow up to $10,000,000, $70,000,000, $90,000,000, and $50,000,000, respectively, using whole loans as collateral. In addition to principal and interest payments paid by each fund to Morgan Stanley for borrowings outstanding, each fund paid an annual fee of 0.15% to Morgan Stanley on any unused portion of the fund's loan commitment. Such agreements were terminated by Morgan Stanley at which time the funds refinanced the borrowings with the MMLIC agreements.

The funds may also borrow money by entering into reverse repurchase agreements, which involve the sale of portfolio-eligible securities by the funds, coupled with an agreement to repurchase the securities at a specified date and price. Borrowings may increase volatility of the funds' net asset values and involve the risk that interest costs on money borrowed may exceed the return on securities purchased with that borrowed money. Each fund is subject to a restriction on borrowing under which each fund must maintain asset coverage of at least 300%. The interest expense incurred on borrowings is recognized as "Interest Expense" in the Statements of Operations. For the year ended August 31, 2008, the weighted average borrowings outstanding for ASP, BSP, CSP, and SLA were $17,076,766, $68,638,443, $85,057,001, and $52,555,923, respectively, and the weighted average interest rates paid by the funds on such borrowings were 4.91%, 5.28% , 5.15%, and 5.24%, respectively.

Securities Purchased on a When-Issued Basis

Delivery and payment for securities that have been purchased by the funds on a when-issued or forward-commitment basis can take place a month or more after the transaction date. Such securities do not earn interest, are subject to market fluctuation, and may increase or decrease in value prior to their delivery. Each fund segregates, with its custodian, assets with a market value equal to or greater than the amount of its purchase commitments. The purchase of securities on a when-issued or forward-commitment basis may increase the volatility of a fund's net asset value if the fund makes such purchases while remaining substantially fully invested. As of August 31, 2008, the funds had no outstanding when-issued or forward-commitment securities.

First American Mortgage Funds 2008 Annual Report

26

Repurchase Agreements

For repurchase agreements entered into with certain broker-dealers, the funds, along with other affiliated registered investment companies, may transfer uninvested cash balances into a joint trading account, the daily aggregate of which is invested in repurchase agreements secured by U.S. government or agency obligations. Securities pledged as collateral for all individual and joint repurchase agreements are held by the funds' custodian bank until maturity of the repurchase agreement. All agreements require that the daily market value of the collateral be in excess of the repurchase amount, including accrued interest, to protect the funds in the event of a default. As of August 31, 2008, the funds had no outstanding repurchase agreements.

Federal Taxes

Each fund is treated as a separate taxable entity. Each fund intends to continue to qualify as a regulated investment company as provided in Subchapter M of the Internal Revenue Code, as amended, and to distribute all taxable income, if any, to its shareholders. Accordingly, no provision for federal income taxes is required. Each fund also intends to distribute its taxable net investment income and realized gains, if any, to avoid the payment of any federal excise taxes.

Financial Accounting Standards Board ("FASB") Interpretation No. 48, "Accounting for Uncertainty in Income Taxes" ("FIN 48") provides guidance for how uncertain tax positions should be recognized, measured, presented, and disclosed in the financial statements. FIN 48 requires the evaluation of tax positions taken or expected to be taken in the course of preparing each funds tax returns to determine whether the tax positions are "more-likely-than-not" of being sustained by the applicable tax authority. Tax positions not deemed to meet a "more-likely-than-not" threshold would be recorded as a tax benefit or expense in the current year. As of August 31, 2008, the funds did not have any tax positions that did not meet the "more-likely-than-not" threshold of being sustained by the applicable taxing authority. Generally, tax authorities can examine all the tax returns filed for the last three years.

Net investment income and net realized gains and losses may differ for financial statement and tax purposes because of temporary or permanent book/tax differences. These differences are primarily due to deferred wash sale losses, paydown gains and losses, tax mark-to-market adjustments under Section 311(e) of the Taxpayer relief Act of 1997, tax deductions for real estate owned and investments in REITS. To the extent these differences are permanent, reclassifications are made to the appropriate capital accounts in the fiscal period that the differences arise.

On the Statements of Assets and Liabilities, the following reclassifications were made:

| | | ASP | | BSP | | CSP | | SLA | |

| Undistributed net investment income | | $ | (71,244 | ) | | $ | 770,341 | | | $ | (972,267 | ) | | $ | (516,958 | ) | |

| Accumulated net realized gain (loss) | | | 206,134 | | | | (144,003 | ) | | | 1,102,078 | | | | 516,958 | | |

| Additional paid-in capital (reduction) | | | (134,890 | ) | | | (626,338 | ) | | | (129,811 | ) | | | — | | |

The character of distributions made during the fiscal period from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes. In addition, due to the timing of dividend distributions, the fiscal period in which amounts are distributed may differ from the fiscal period that the income or realized gains or losses were recorded by the funds.

First American Mortgage Funds 2008 Annual Report

27

Notes to FINANCIAL STATEMENTS

The character of distributions paid during the fiscal years ended August 31, 2008 and August 31, 2007, were as follows:

| | | ASP | | BSP | |

| | | 8/31/08 | | 8/31/07 | | 8/31/08 | | 8/31/07 | |

| Distributions paid from: | |

| Ordinary income | | $ | 3,165,549 | | | $ | 3,555,377 | | | $ | 10,970,395 | | | $ | 13,439,536 | | |

| Long-term capital gains | | | — | | | | — | | | | — | | | | — | | |

| Return of capital | | | 134,890 | | | | — | | | | 1,578,414 | | | | — | | |

| Total | | $ | 3,300,439 | | | $ | 3,555,377 | | | $ | 12,548,809 | | | $ | 13,439,536 | | |

| | | CSP | | SLA | |

| | | 8/31/08 | | 8/31/07 | | 8/31/08 | | 8/31/07 | |

| Distributions paid from: | |

| Ordinary income | | $ | 20,564,180 | | | $ | 25,604,202 | | | $ | 8,956,245 | | | $ | 11,160,865 | | |

| Long-term capital gains | | | — | | | | 1,048,544 | | | | 510,399 | | | | 999,368 | | |

| Return of capital | | | 129,811 | | | | — | | | | — | | | | — | | |

| Total | | $ | 20,693,991 | | | $ | 26,652,746 | | | $ | 9,466,644 | | | $ | 12,160,233 | | |

At August 31, 2008, the components of accumulated deficit on a tax basis were as follows:

| | | ASP | | BSP | | CSP | | SLA | |

| Undistributed ordinary income | | $ | — | | | $ | — | | | $ | — | | | $ | 315,040 | | |

| Accumulated long-term capital gains | | | — | | | | — | | | | — | | | | 32,960 | | |

| Accumulated capital and post-October losses | | | (1,561,502 | ) | | | (7,401,897 | ) | | | (6,321,076 | ) | | | (3,915,927 | ) | |

| Unrealized depreciation | | | (2,180,080 | ) | | | (13,549,567 | ) | | | (19,524,751 | ) | | | (3,894,547 | ) | |

| Accumulated deficit | | $ | (3,741,582 | ) | | $ | (20,951,464 | ) | | $ | (25,845,827 | ) | | $ | (7,462,474 | ) | |

The difference between book basis and tax basis unrealized appreciation (depreciation) at August 31, 2008, is attributable to adjustments for REITs, tax deferral of losses on wash sales, and a one-time tax election whereby the funds marked appreciated securities to market creating capital gains that were used to reduce capital loss carryovers and increase tax cost basis.

Distributions to Shareholders

Distributions from net investment income are declared and paid on a monthly basis. Any net realized capital gains on sales of securities for the funds are distributed to shareholders at least annually. These distributions are recorded as of the close of business on the ex-dividend date. Such distributions are payable in cash or, pursuant to the funds' dividend reinvestment plans, reinvested in additional shares of the funds' capital stock. Under each fund's plan, fund shares will be purchased in the open market unless the market price plus commissions exceeds the net asset value by 5% or more. If, at the close of business on the dividend payment date, the shares purchased in the open market are insufficient to satisfy the dividend reinvestment requirement, the funds will issue new shares at a discount of up to 5% from the current market price.

The funds receive substantial distributions from holdings in real estate investment trusts ("REITs"). Distributions from REITs may be characterized as ordinary income, net capital gain, or a return of capital to the REIT shareholder. The proper characterization of REIT distributions is generally not known until after the end of each calendar year. As such, the funds must use estimates in reporting the character of its income and distributions for financial statement purposes. The actual character

First American Mortgage Funds 2008 Annual Report

28

of distributions to a funds shareholders will be reflected on the Form 1099 received by shareholders after the end of the calendar year. Due to the nature of REIT investments, a portion of the distributions received by a fund shareholder may represent a return of capital.

Deferred Compensation Plan

Under a Deferred Compensation Plan (the "Plan"), non-interested directors of the First American Family of Funds may participate and elect to defer receipt of part or all of their annual compensation. Deferred amounts are treated as though equivalent dollar amounts had been invested in shares of open-end First American Funds, preselected by each director. All amounts in the Plan are 100% vested and accounts under the Plan are obligations of the funds. Deferred amounts remain in the funds until distributed in accordance with the Plan.

Use of Estimates in the Preparation of Financial Statements

The preparation of financial statements, in conformity with U.S. generally accepted accounting principles, requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the results of operations during the reporting period. Actual results could differ from these estimates.

(3) Expenses

Investment Advisory Fees

Pursuant to investment advisory agreements with each fund (each an "Agreement"), FAF Advisors, a subsidiary of U.S. Bank National Association ("U.S. Bank"), manages the funds' assets and furnishes related office facilities, equipment, research, and personnel. For ASP, BSP, and CSP, the Agreement provides FAF Advisors with a monthly investment advisory fee in an amount equal to an annualized rate of 0.20% of the respective fund's average weekly net assets and 4.50% of the daily gross income accrued by such fund during the month (i.e., investment income, including accretion of bond discounts and amortization of premiums, other than gains from the sale of securities or gains from options and futures contracts less interest on money borrowed by the funds). The monthly investment advisory fee shall not exceed, in the aggregate, 1/12 of 0.725% of the respective fund's average weekly net assets during the month (approximately 0.725% on an annual basis). For SLA, the Agreement provides FAF Advisors with a monthly investment advisory fee in an amount equal to an annualized rate of 0.50% of the fund's average weekly net assets. For its fees, FAF Advisors provides investment advice and, in general, conducts the management and investment activities of the funds.

The funds may invest in money market funds that are a series of First American Funds, Inc., subject to certain limitations. In order to avoid the payment of duplicative investment advisory fees to FAF Advisors, which acts as the investment advisor to these funds and the related money market funds, FAF Advisors will reimburse to each fund an amount equal to the investment advisory fees received from the related money market funds that are attributable to the assets of that fund. These reimbursements, if any, are disclosed as "Fee reimbursements" in the Statement of Operations.

Administrative Fees

FAF Advisors serves as the funds' administrator pursuant to administration agreements between FAF Advisors and each fund. Under these agreements, FAF Advisors receives a monthly administrative fee from each fund in an amount equal to 0.25% of the fund's average weekly net assets. For its fee, FAF Advisors provides numerous services to the funds including, but not limited to, handling the general business affairs, financial and regulatory reporting, and various other services.

First American Mortgage Funds 2008 Annual Report

29

Notes to FINANCIAL STATEMENTS

Custodian Fees

U.S. Bank serves as each funds' custodian pursuant to a custodian agreement with the funds. The custodian fee charged to each fund is equal to an annual rate of 0.02% of such fund's average weekly net assets. These fees are computed weekly and paid monthly.

Under the custodian agreement, interest earned on uninvested cash balances is used to reduce a portion of each fund's custodian expenses. These credits, if any, are disclosed as "Indirect payments from custodian" in the Statement of Operations. Conversely, the custodian charges a fee for any cash overdrafts incurred, which will increase the fund's custodian expenses. For the year ended August 31, 2008, custodian fees for ASP, BSP, CSP, and SLA were increased by $390, $442, $185, and $1,391 as a result of overdrafts and reduced by $2,157, $3,069, $2,253, and $2,060 as a result of interest earned, respectively.

Mortgage Servicing Fees

The funds may enter into mortgage servicing agreements with mortgage servicers for whole loans and participation mortgages. For a fee, mortgage servicers maintain loan records, such as insurance and taxes and the proper allocation of payments between principal and interest.

Other Fees and Expenses

In addition to the investment advisory, administrative, custodian, and mortgage servicing fees, the funds are responsible for paying most other operating expenses, including: legal, auditing, and accounting services, postage and printing of shareholder reports, transfer agent fees and expenses, listing fees, outside directors' fees and expenses, insurance, pricing, interest, expenses related to real estate owned, fees to outside parties retained to assist in conducting due diligence, taxes, and other miscellaneous expenses. For the year ended August 31, 2008, legal fees and expenses of $5,533, $5,533, $5,533, and $5,533 for ASP, BSP, CSP, and SLA, respectively, were paid to a law firm of which an Assistant Secretary of the funds is a partner.

Expenses that are directly related to a fund are charged directly to that fund. Other operating expenses of the First American Family of Funds are allocated to the funds on several bases, including evenly across all funds, allocated based on relative net assets of all funds within the First American Family of Funds or a combination of both methods.

(4) Investment Security Transactions

Cost of purchases and proceeds from sales of securities and real estate, other than temporary investments in short-term securities, for the year ended August 31, 2008, were as follows:

| Fund | | Cost of Purchases | | Proceeds from Sales | |

| ASP | | $ | 11,523,061 | | | $ | 16,980,381 | | |

| BSP | | | 110,331,099 | | | | 124,324,214 | | |

| CSP | | | 23,246,214 | | | | 15,671,165 | | |

| SLA | | | 37,270,402 | | | | 34,790,113 | | |

Included in proceeds from sales for ASP, BSP, and SLA were $148,000, $46,753, and $37,500, respectively, from prepayment penalties.

First American Mortgage Funds 2008 Annual Report

30

(5) Capital Loss Carryover

For federal income tax purposes, the following funds had capital loss carryovers at August 31, 2008, which, if not offset by subsequent capital gains, will expire on the funds' fiscal year-ends as follows:

| | | Expiration | |

| Fund | | 2009 | | 2010 | | 2011 | | 2012 | | 2013 | | 2014 | | 2015 | | 2016 | | Total | |

| ASP | | $ | 737,067 | | | $ | 215,371 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 952,438 | | |

| BSP | | | — | | | | — | | | | — | | | | — | | | | — | | | | 2,858,586 | | | | — | | | | 133,712 | | | | 2,992,298 | | |

| CSP | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 551,492 | | | | 381,985 | | | | 933,477 | | |

The funds incurred a loss for tax purposes for the period from November 1, 2007 to August 31, 2008. As permitted by tax regulations, the funds intend to elect to defer and treat the losses as arising in the fiscal year ending August 31, 2009. The deferred losses were as follows:

| Fund | | Amount | |

| ASP | | $ | 609,064 | | |

| BSP | | | 4,409,599 | | |

| CSP | | | 5,387,599 | | |

| SLA | | | 3,915,927 | | |

(6) Indemnifications