UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07838

American Select Portfolio Inc.

(Exact name of registrant as specified in charter)

800 Nicollet Mall, Minneapolis, MN | | 55402 |

(Address of principal executive offices) | | (Zip code) |

Charles D. Gariboldi, Jr., 800 Nicollet Mall, Minneapolis, MN 55402

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-677-3863

Date of fiscal year end: August 31

Date of reporting period: February 28, 2009

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

Item 1. Report to Shareholders

Semiannual Report

February 28, 2009

ASP

American Strategic

Income Portfolio Inc.

BSP

American Strategic

Income Portfolio Inc. II

CSP

American Strategic

Income Portfolio Inc. III

SLA

American Select

Portfolio Inc.

First American Mortgage Funds

Our Image – George Washington

His rich legacy as patriot and leader is widely recognized as embodying the sound judgment, reliability, and strategic vision that are central to our brand. Fashioned in a style reminiscent of an 18th century engraving, the illustration conveys the symbolic strength and vitality of Washington, which are attributes that we value at First American.

Table of Contents

| | 1 | | | Explanation of Financial Statements | |

|

| | 2 | | | Fund Overviews | |

|

| | 6 | | | Schedule of Investments | |

|

| | 24 | | | Statements of Assets and Liabilities | |

|

| | 25 | | | Statements of Operations | |

|

| | 26 | | | Statements of Changes in Net Assets | |

|

| | 28 | | | Statements of Cash Flows | |

|

| | 29 | | | Financial Highlights | |

|

| | 33 | | | Notes to Financial Statements | |

|

| | 42 | | | Notice to Shareholders | |

|

NOT FDIC INSURED NO BANK GUARANTEE MAY LOSE VALUE

Explanation of FINANCIAL STATEMENTS

As a shareholder in one or more of the funds, you receive shareholder reports semiannually. We strive to present this financial information in an easy-to-understand format; however, for many investors, the information contained in this shareholder report may seem very technical. So, we would like to take this opportunity to explain several sections of the shareholder report.

The Schedule of Investments details all of the securities held in the fund and their related dollar values on the last day of the reporting period. Securities are usually presented by type (bonds, common stock, etc.) and by industry classification (healthcare, education, etc.). This information is useful for analyzing how your fund's assets are invested and seeing where your portfolio manager believes the best opportunities exist to meet your objectives. Holdings are subject to change without notice and do not constitute a recommendation of any individual security. The Notes to Financial Statements provide additional details on how the securities are valued.

The Statement of Assets and Liabilities lists the assets and liabilities of the fund on the last day of the reporting period and presents the fund's net asset value ("NAV") and market price per share. The NAV is calculated by dividing the fund's net assets (assets minus liabilities) by the number of shares outstanding. The market price is the closing price on the exchange on which the fund's shares trade. This price, which may be higher or lower than the fund's NAV, is the price an investor pays or receives when shares of the fund are purchased or sold. The investments, as presented in the Schedule of Investments, comprise substantially all of the fund's assets. Other assets include cash and receivables for items such as income earned by the fund but not yet received. Liabilities include payables for items such as fund expenses incurred but not yet pa id.

The Statement of Operations details the dividends and interest income earned from investments as well as the expenses incurred by the fund during the reporting period. Fund expenses may be reduced through fee waivers or reimbursements. This statement reflects total expenses before any waivers or reimbursements, the amount of waivers and reimbursements (if any), and the net expenses. This statement also shows the net realized and unrealized gains and losses from investments owned during the period. The Notes to Financial Statements provide additional details on investment income and expenses of the fund.

The Statement of Changes in Net Assets describes how the fund's net assets were affected by its operating results and distributions to shareholders during the reporting period. This statement is important to investors because it shows exactly what caused the fund's net asset size to change during the period.

The Statement of Cash Flows is required when a fund has a substantial amount of illiquid investments, a substantial amount of the fund's securities are internally valued, or the fund carries some amount of debt. When presented, this statement explains the change in cash during the reporting period. It reconciles net cash provided by and used for operating activities to the net increase or decrease in net assets from operations and classifies cash receipts and payments as resulting from operating, investing, and financing activities.

The Financial Highlights provide a per-share breakdown of the components that affected the fund's NAV for the current and past reporting periods. It also shows total return, expense ratios, net investment income ratios, and portfolio turnover rates. The net investment income ratios summarize the income earned less expenses, divided by the average net assets. The expense ratios represent the percentage of average net assets that were used to cover operating expenses during the period. The portfolio turnover rate represents the percentage of the fund's holdings that have changed over the course of the period, and gives an idea of how long the fund holds onto a particular security. A 100% turnover rate imp lies that an amount equal to the value of the entire portfolio is turned over in a year through the purchase or sale of securities.

The Notes to Financial Statements disclose the organizational background of the fund, its significant accounting policies, federal tax information, fees and compensation paid to affiliates, and significant risks and contingencies.

We hope this guide to your shareholder report will help you get the most out of this important resource.

First American Mortgage Funds 2009 Semiannual Report

1

Fund OVERVIEWS

American Strategic Income Portfolio (ASP)

Portfolio Allocation

As a percentage of total investments on February 28, 2009

| Commercial Loans | | | 44 | % | |

| Multifamily Loans | | | 14 | | |

| Preferred Stocks | | | 14 | | |

| Commercial Mortgage-Backed Securities | | | 10 | | |

| U.S. Government Agency Mortgage-Backed Securities | | | 8 | | |

| Corporate Note | | | 6 | | |

| Short-Term Investment | | | 3 | | |

| Single Family Loans | | | 1 | | |

| | | | 100 | % | |

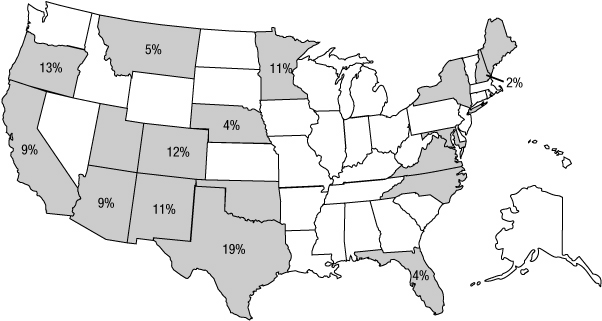

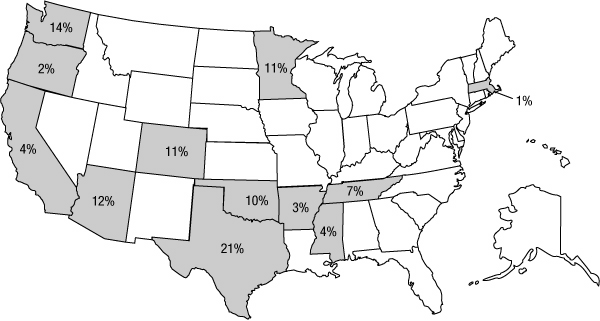

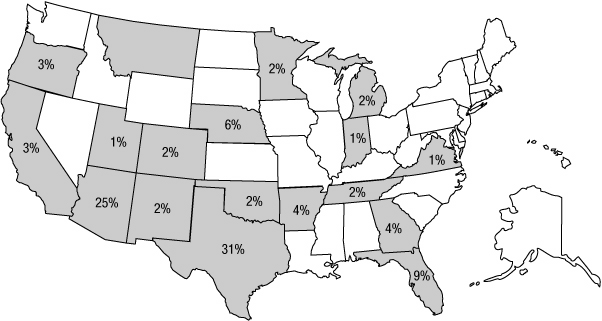

Geographical Distribution

We attempt to buy mortgage loans in many parts of the country to help avoid the risks of concentrating in one area. These percentages reflect the value of whole loans as of February 28, 2009. Shaded areas without values indicate states in which the fund has invested less than 0.50% of its investments.

Delinquent Loan Profile

The table below shows the percentages of whole loans in the portfolio that are 30, 60, 90, or 120 or more days delinquent as of February 28, 2009, based on the value outstanding.

Whole loans

| Current | | | 95.8 | % | |

| 30 Days | | | 4.2 | | |

| 60 Days | | | 0.0 | | |

| 90 Days | | | 0.0 | | |

| 120+ Days | | | 0.0 | | |

| | | | 100.0 | % | |

First American Mortgage Funds 2009 Semiannual Report

2

American Strategic Income Portfolio II (BSP)

Portfolio Allocation

As a percentage of total investments on February 28, 2009

| Commercial Loans | | | 44 | % | |

| Multifamily Loans | | | 32 | | |

| Corporate Notes | | | 10 | | |

| Preferred Stocks | | | 9 | | |

| Short-Term Investment | | | 3 | | |

| U.S. Government Agency Mortgage-Backed Securities | | | 2 | | |

| | | | 100 | % | |

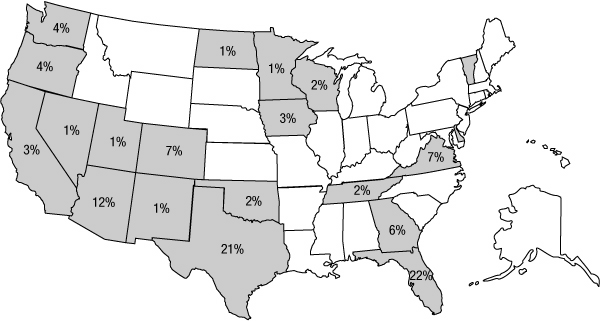

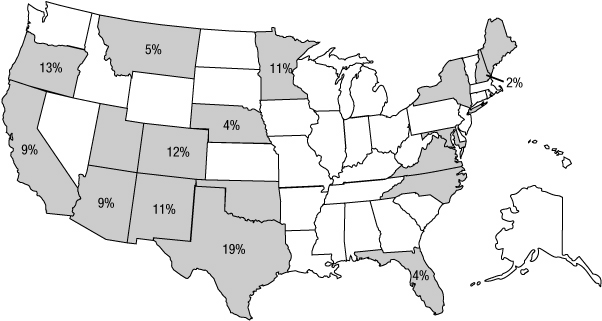

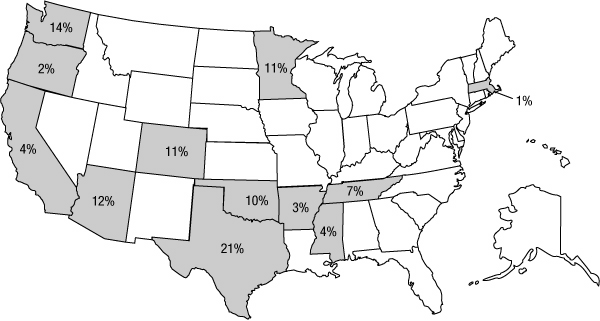

Geographical Distribution

We attempt to buy mortgage loans in many parts of the country to help avoid the risks of concentrating in one area. These percentages reflect the value of whole loans as of February 28, 2009. Shaded areas without values indicate states in which the fund has invested less than 0.50% of its investments.

Delinquent Loan Profile

The table below shows the percentages of whole loans in the portfolio that are 30, 60, 90, or 120 or more days delinquent as of February 28, 2009, based on the value outstanding.

Whole loans

| Current | | | 88.2 | % | |

| 30 Days | | | 5.2 | | |

| 60 Days | | | 0.0 | | |

| 90 Days | | | 0.0 | | |

| 120+ Days | | | 6.6 | | |

| | | | 100.0 | % | |

First American Mortgage Funds 2009 Semiannual Report

3

Fund OVERVIEWS

American Strategic Income Portfolio III (CSP)

Portfolio Allocation

As a percentage of total investments on February 28, 2009

| Commercial Loans | | | 46 | % | |

| Multifamily Loans | | | 32 | | |

| Preferred Stocks | | | 10 | | |

| Corporate Notes | | | 9 | | |

| U.S. Government Agency Mortgage-Backed Securities | | | 2 | | |

| Short-Term Investment | | | 1 | | |

| | | | 100 | % | |

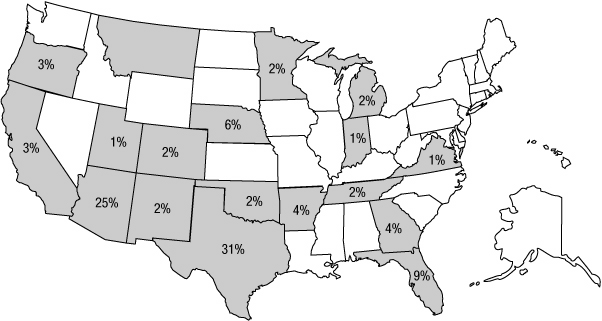

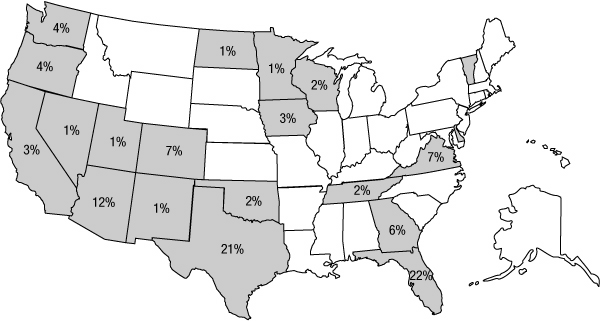

Geographical Distribution

We attempt to buy mortgage loans in many parts of the country to help avoid the risks of concentrating in one area. These percentages reflect the value of whole loans as of February 28, 2009. Shaded areas without values indicate states in which the fund has invested less than 0.50% of its investments.

Delinquent Loan Profile

The table below shows the percentages of whole loans in the portfolio that are 30, 60, 90, or 120 or more days delinquent as of February 28, 2009, based on the value outstanding.

Whole loans

| Current | | | 89.8 | % | |

| 30 Days | | | 7.6 | | |

| 60 Days | | | 0.0 | | |

| 90 Days | | | 0.0 | | |

| 120+ Days | | | 2.6 | | |

| | | | 100.0 | % | |

First American Mortgage Funds 2009 Semiannual Report

4

American Select Portfolio (SLA)

Portfolio Allocation

As a percentage of total investments on February 28, 2009

| Commercial Loans | | | 55 | % | |

| Multifamily Loans | | | 22 | | |

| Corporate Notes | | | 11 | | |

| Preferred Stocks | | | 8 | | |

| U.S. Government Agency Mortgage-Backed Securities | | | 2 | | |

| Commercial Mortgage-Backed Securities | | | 1 | | |

| Short-Term Investment | | | 1 | | |

| | | | 100 | % | |

Geographical Distribution

We attempt to buy mortgage loans in many parts of the country to help avoid the risks of concentrating in one area. These percentages reflect the value of whole loans as of February 28, 2009. Shaded areas without values indicate states in which the fund has invested less than 0.50% of its investments.

Delinquent Loan Profile

The table below shows the percentages of whole loans in the portfolio that are 30, 60, 90, or 120 or more days delinquent as of February 28, 2009, based on the value outstanding.

| Whole loans | |

| Current | | | 100.0 | % | |

| 30 Days | | | 0.0 | | |

| 60 Days | | | 0.0 | | |

| 90 Days | | | 0.0 | | |

| 120+ Days | | | 0.0 | | |

| | | | 100.0 | % | |

First American Mortgage Funds 2009 Semiannual Report

5

Schedule of INVESTMENTS February 28, 2009 (unaudited)

American Strategic Income Portfolio (ASP)

| DESCRIPTION | | DATE

ACQUIRED | | PAR | | COST | | VALUE (I) | |

| (Percentages of each investment category relate to total net assets) | |

| U.S. Government Agency Mortgage-Backed Securities — 10.1% | |

| Fixed Rate — 10.1% | |

| Federal Home Loan Mortgage Corporation, | |

| 5.50%, 1/1/18, #E93231 (A) | | | | $ | 477,301 | | | $ | 487,905 | | | $ | 497,934 | | |

| 9.00%, 7/1/30, #C40149 | | | | | 74,697 | | | | 76,392 | | | | 79,216 | | |

| Federal National Mortgage Association, | |

| 6.00%, 10/1/16, #610761 (A) | | | | | 234,621 | | | | 237,717 | | | | 246,010 | | |

| 5.00%, 7/1/18, #724954 (A) | | | | | 1,085,907 | | | | 1,084,816 | | | | 1,123,009 | | |

| 6.50%, 6/1/29, #252497 (A) | | | | | 143,250 | | | | 142,428 | | | | 151,250 | | |

| 7.50%, 3/1/30, #495694 | | | | | 80,919 | | | | 79,797 | | | | 85,436 | | |

| 7.50%, 5/1/30, #535289 (A) | | | | | 29,121 | | | | 28,286 | | | | 31,133 | | |

| 8.00%, 5/1/30, #538266 (A) | | | | | 11,403 | | | | 11,280 | | | | 12,175 | | |

| 6.00%, 5/1/31, #535909 (A) | | | | | 270,848 | | | | 272,163 | | | | 281,694 | | |

| 6.50%, 11/1/31, #613339 (A) | | | | | 133,650 | | | | 136,189 | | | | 140,947 | | |

| 5.50%, 7/1/33, #720735 (A) | | | | | 1,812,280 | | | | 1,793,522 | | | | 1,863,898 | | |

| Total U.S. Government Agency Mortgage-Backed Securities | | | 4,350,495 | | | | 4,512,702 | | |

| Commercial Mortgage-Backed Securities r — 12.2% | |

| Other — 12.2% | |

Bear Stearns Commercial Mortgage Securities,

Series 2006-PW12, Class A4, 5.72%, 9/11/38 | | | | | 1,200,000 | | | | 972,146 | | | | 861,051 | | |

| Series 2007-T28, Class A4, 5.74%, 9/11/42 | | | | | 1,200,000 | | | | 931,223 | | | | 794,047 | | |

Citigroup/Deutsche Bank Commercial Mortgage Trust

Series 2005-CD1, Class A4, 5.23%, 7/15/44 | | | | | 2,357,000 | | | | 1,495,729 | | | | 1,799,228 | | |

| LB-UBS Commercial Mortgage Trust, Series 2008-C1, Class A2, 6.15%, 4/15/41 | | | | | 1,875,000 | | | | 1,371,598 | | | | 1,191,015 | | |

| Morgan Stanley Capital I, Series 2007-T27, Class A4, 5.65%, 6/13/42 | | | | | 1,160,000 | | | | 928,764 | | | | 783,531 | | |

| Total Commercial Mortgage-Backed Securities | | | 5,699,460 | | | | 5,428,872 | | |

| Corporate Note °° ¶ — 7.9% | |

| Fixed Rate — 7.9% | |

| Stratus Properties V, 6.92%, 12/31/116/1/073,500,000 | | | 3,500,000 | | | | 3,534,650 | | |

| Whole Loans °° (P) — 75.8% | |

| Commercial Loans — 56.6% | |

| Advance Self Storage, Lincoln, NE, 6.13%, 1/1/11 (B) | | 12/30/05 | | | 1,422,239 | | | | 1,422,239 | | | | 1,384,818 | | |

| Buca Restaurant, Maple Grove, MN, 8.63%, 1/1/11 | | 12/27/00 | | | 831,294 | | | | 831,294 | | | | 839,607 | | |

| Copper Junction, Copper Mountain, CO, 6.38%, 7/1/17 (B) | | 6/14/07 | | | 1,918,856 | | | | 1,918,856 | | | | 1,628,391 | | |

| Hampden Medical Office, Englewood, CO, 7.38%, 10/1/12 | | 9/9/02 | | | 1,546,048 | | | | 1,546,048 | | | | 1,303,354 | | |

| Integrity Plaza Shopping Center, Albuquerque, NM, 7.88%, 7/1/12 (B) | | 6/11/02 | | | 1,938,024 | | | | 1,938,024 | | | | 1,949,329 | | |

| La Costa Meadows Industrial Park I, San Marcos, CA, 6.78%, 7/1/17 ¶ (B) | | 6/28/07 | | | 1,250,000 | | | | 1,250,000 | | | | 1,116,301 | | |

| La Costa Meadows Industrial Park II, San Marcos, CA, 7.53%, 7/1/17 ¶ (B) | | 6/28/07 | | | 2,000,000 | | | | 2,000,000 | | | | 1,975,576 | | |

| Minikahda Mini Storage IV, Minneapolis, MN, 7.15%, 3/1/11 (B) | | 2/28/06 | | | 1,582,390 | | | | 1,582,390 | | | | 1,570,078 | | |

| Naples Boat Club, Naples, FL, 6.43%, 1/1/17 (B) | | 12/28/06 | | | 1,706,587 | | | | 1,706,587 | | | | 1,538,112 | | |

| Orchard Commons, Englewood, CO, 8.63%, 4/1/11 | | 3/28/01 | | | 955,867 | | | | 955,867 | | | | 984,442 | | |

| Palace Court, Santa Fe, NM, 6.68%, 11/1/11 ¶ (B) | | 10/2/06 | | | 1,895,831 | | | | 1,895,831 | | | | 1,554,940 | | |

| Par 3 Office Building, Bend, OR, 6.63%, 8/1/13 ¶ (B) | | 8/3/06 | | | 1,900,000 | | | | 1,900,000 | | | | 1,811,677 | | |

| Perkins Restaurant, Maple Grove, MN, 6.38%, 1/1/11 (B) | | 12/23/05 | | | 1,369,375 | | | | 1,369,375 | | | | 1,302,631 | | |

| Rockwood Galleria, Gresham, OR, 7.25%, 2/1/11 (B) | | 1/6/03 | | | 1,502,682 | | | | 1,502,682 | | | | 1,507,117 | | |

| Stephens Center, Missoula, MT, 6.38%, 9/1/10 (B) | | 4/20/06 | | | 1,816,709 | | | | 1,816,709 | | | | 1,802,319 | | |

| The Storage Place, Marana, AZ, 6.65%, 1/1/13 ¶ | | 12/20/07 | | | 3,200,000 | | | | 3,200,000 | | | | 3,001,067 | | |

| | | | 26,835,902 | | | | 25,269,759 | | |

The accompanying notes are an integral part of the financial statements.

First American Mortgage Funds 2009 Semiannual Report

6

American Strategic Income Portfolio (ASP)

| DESCRIPTION | | DATE

ACQUIRED | | PAR/

SHARES | | COST | | VALUE (I) | |

| Multifamily Loans — 18.0% | |

| Forest Club Apartments, Dallas, TX, 11.88%, 8/1/09 ¶ | | 4/19/06 | | $ | 1,720,000 | | | $ | 1,720,000 | | | $ | 1,595,830 | | |

| Franklin Woods Apartments, Franklin, NH, 5.88%, 3/1/10 | | 2/24/95 | | | 743,683 | | | | 743,683 | | | | 737,521 | | |

| Hunt Club Apartments, Waco, TX, 5.64%, 7/1/11 (B) | | 6/3/04 | | | 1,164,575 | | | | 1,164,575 | | | | 1,131,849 | | |

| Park Hollywood, Portland, OR, 7.38%, 6/1/12 (B) | | 5/31/02 | | | 1,097,061 | | | | 1,097,061 | | | | 1,103,373 | | |

| Spring Creek Gardens, Plano, TX, 3.56%, 1/1/09 r ¶ (D) (U) | | 12/22/05 | | | 2,050,000 | | | | 2,050,000 | | | | 1,435,000 | | |

| Vanderbilt Condominiums, Austin, TX, 8.04%, 10/1/09 | | 9/29/99 | | | 1,069,775 | | | | 1,069,775 | | | | 1,079,168 | | |

| Villa Bonita, Chez Royalle, Fitzhugh Apartments I, Dallas, TX, 7.25%, 3/1/09 r | | 2/21/03 | | | 821,018 | | | | 821,018 | | | | 821,018 | | |

| Villa Bonita, Chez Royalle, Fitzhugh Apartments II, Dallas, TX, 9.88%, 3/1/09 | | 2/21/03 | | | 152,632 | | | | 152,632 | | | | 137,679 | | |

| | | | 8,818,744 | | | | 8,041,438 | | |

| Single Family Loans — 1.2% | |

| American Portfolio, 1 loan, California, 4.88%, 10/18/15 | | 7/18/95 | | | 19,594 | | | | 18,657 | | | | 20,182 | | |

| Anivan, 1 loan, Maryland, 5.19%, 4/14/12 | | 6/14/96 | | | 71,841 | | | | 72,310 | | | | 73,817 | | |

| Bank of New Mexico, 1 loan, New Mexico, 6.23%, 3/31/10 | | 5/31/96 | | | 33,144 | | | | 32,526 | | | | 33,439 | | |

| Bluebonnet Savings & Loan, 6 loans, Texas, 6.66%, 8/31/10 | | 5/22/92 | | | 114,810 | | | | 105,084 | | | | 115,558 | | |

| Cross Roads Savings & Loan II, 1 loan, Oklahoma, 8.34%, 1/1/21 (U) | | 1/7/92 | | | 21,519 | | | | 20,237 | | | | 16,649 | | |

| Fairbanks, 1 loan, Utah, 5.50%, 9/23/15 | | 5/21/92 | | | 18,330 | | | | 15,539 | | | | 18,879 | | |

| Knutson Mortgage Portfolio I, 2 loans, Maine & Montana, 9.37%, 8/1/17 | | 2/26/92 | | | 129,685 | | | | 123,703 | | | | 133,576 | | |

| McClemore, Matrix Funding Corporation, 1 loan, North Carolina, 10.50%, 9/30/12 | | 9/9/92 | | | 41,846 | | | | 39,744 | | | | 43,100 | | |

| Nomura III, 2 loans, California & New York, 8.20%, 4/29/17 | | 9/29/95 | | | 66,841 | | | | 60,391 | | | | 68,846 | | |

| Rand Mortgage Corporation, 1 loan, Texas, 9.50%, 8/1/17 | | 2/21/92 | | | 31,482 | | | | 25,809 | | | | 32,427 | | |

| | | | 514,000 | | | | 556,473 | | |

| Total Whole Loans | | | 36,168,646 | | | | 33,867,670 | | |

| Preferred Stocks — 17.5% | |

| Real Estate Investment Trusts — 17.5% | |

| AMB Property, Series L | | | | | 26,560 | | | | 597,940 | | | | 318,720 | | |

| AMB Property, Series M | | | | | 5,600 | | | | 139,850 | | | | 72,800 | | |

| BRE Properties, Series C | | | | | 30,150 | | | | 599,080 | | | | 496,872 | | |

| BRE Properties, Series D | | | | | 2,400 | | | | 47,688 | | | | 36,720 | | |

| Developers Diversified Realty, Series G | | | | | 20,000 | | | | 447,000 | | | | 108,000 | | |

| Developers Diversified Realty, Series H | | | | | 12,060 | | | | 247,230 | | | | 60,421 | | |

| Developers Diversified Realty, Series I | | | | | 1,950 | | | | 40,657 | | | | 9,769 | | |

| Duke Realty, Series J | | | | | 2,100 | | | | 52,246 | | | | 16,800 | | |

| Duke Realty, Series L | | | | | 8,750 | | | | 167,300 | | | | 70,175 | | |

| Duke Realty, Series M | | | | | 26,120 | | | | 532,400 | | | | 229,856 | | |

| Duke Realty, Series O | | | | | 20,300 | | | | 479,080 | | | | 232,232 | | |

| Equity Residential Properties, Series N | | | | | 4,800 | | | | 101,520 | | | | 83,040 | | |

| Health Care Properties, Series E | | | | | 5,400 | | | | 141,419 | | | | 86,400 | | |

| Health Care Properties, Series F | | | | | 13,270 | | | | 341,394 | | | | 199,050 | | |

| HRPT Properties Trust, Series B | | | | | 8,171 | | | | 212,725 | | | | 99,931 | | |

| Kimco Realty, Series F | | | | | 19,400 | | | | 500,619 | | | | 220,190 | | |

| Kimco Realty, Series G | | | | | 41,700 | | | | 965,549 | | | | 531,675 | | |

| National Retail Properties, Series C | | | | | 25,000 | | | | 527,500 | | | | 381,250 | | |

| Post Properties, Series B | | | | | 17,800 | | | | 468,112 | | | | 222,500 | | |

| ProLogis Trust, Series F | | | | | 5,975 | | | | 139,549 | | | | 49,294 | | |

| ProLogis Trust, Series G | | | | | 3,800 | | | | 79,800 | | | | 33,896 | | |

| PS Business Parks, Series H | | | | | 22,060 | | | | 389,700 | | | | 352,960 | | |

| PS Business Parks, Series I | | | | | 4,240 | | | | 83,401 | | | | 64,914 | | |

| PS Business Parks, Series K | | | | | 25,000 | | | | 578,750 | | | | 437,500 | | |

| PS Business Parks, Series M | | | | | 12,060 | | | | 248,436 | | | | 188,136 | | |

| PS Business Parks, Series P | | | | | 3,750 | | | | 71,887 | | | | 54,375 | | |

| Public Storage, Series A | | | | | 6,000 | | | | 144,291 | | | | 110,940 | | |

| Public Storage, Series C | | | | | 5,000 | | | | 100,000 | | | | 82,950 | | |

First American Mortgage Funds 2009 Semiannual Report

7

Schedule of INVESTMENTS February 28, 2009 (unaudited)

American Strategic Income Portfolio (ASP)

| DESCRIPTION | | SHARES | | COST | | VALUE (I) | |

| Public Storage, Series E | | | 14,200 | | | $ | 263,000 | | | $ | 238,702 | | |

| Public Storage, Series F | | | 9,300 | | | | 231,105 | | | | 150,288 | | |

| Public Storage, Series I | | | 12,060 | | | | 262,305 | | | | 220,819 | | |

| Public Storage, Series K | | | 8,000 | | | | 174,000 | | | | 147,360 | | |

| Public Storage, Series X | | | 3,000 | | | | 74,330 | | | | 48,570 | | |

| Public Storage, Series Z | | | 11,500 | | | | 282,309 | | | | 180,320 | | |

| Realty Income, Series D | | | 20,500 | | | | 546,185 | | | | 369,000 | | |

| Realty Income, Series E | | | 37,060 | | | | 714,246 | | | | 617,049 | | |

| Regency Centers, Series C | | | 22,060 | | | | 482,737 | | | | 376,123 | | |

| Regency Centers, Series E | | | 24,060 | | | | 483,600 | | | | 353,682 | | |

| UDR, Series G | | | 12,060 | | | | 258,084 | | | | 190,910 | | |

| Vornado Realty Trust, Series E | | | 4,800 | | | | 121,338 | | | | 67,056 | | |

| Total Preferred Stocks | | | | | | | 12,338,362 | | | | 7,811,245 | | |

| Total Unaffiliated Investments | | | | | | | 62,056,963 | | | | 55,155,139 | | |

| Short-Term Investment — 4.2% | |

| First American Prime Obligations Fund, Class Z x | | | 1,892,383 | | | | 1,892,383 | | | | 1,892,383 | | |

| Total Investments p — 127.7% | | | | | | $ | 63,949,346 | | | $ | 57,047,522 | | |

| Other Assets and Liabilities, Net — (27.7)% | | | | | | | | | | | (12,369,050 | ) | |

| Total Net Assets — 100.0% | | $ | 44,678,472 | | |

(I) Securities are valued in accordance with procedures described in note 2 in Notes to Financial Statements.

(A) Securities pledged as collateral for outstanding reverse repurchase agreements. On February 28, 2009, securities valued at $4,348,050 were pledged as collateral for the following outstanding reverse repurchase agreements:

| Amount | | Acquisition

Date | | Rate* | | Due | | Accrued

Interest | | Name of Broker

and Description

of Collateral | |

| $ | 4,121,000 | | | | 2/19/09 | | | | 0.75 | % | | | 3/19/09 | | | $ | 859 | | | | (1 | ) | |

* Interest rate as of February 28, 2009. Rate is based on the London Interbank Offered Rate ("LIBOR") plus a spread and reset monthly.

Name of broker and description of collateral:

(1) Goldman Sachs:

Federal Home Loan Mortgage Corporation, 5.50%, 1/1/18, $477,301 par

Federal National Mortgage Association, 6.00%, 10/1/16, $234,621 par

Federal National Mortgage Association, 5.00%, 7/1/18, $1,085,907 par

Federal National Mortgage Association, 6.50%, 6/1/29, $143,250 par

Federal National Mortgage Association, 7.50%, 5/1/30, $29,121 par

Federal National Mortgage Association, 8.00%, 5/1/30, $11,403 par

Federal National Mortgage Association, 6.00%, 5/1/31, $270,848 par

Federal National Mortgage Association, 6.50%, 11/1/31, $133,650 par

Federal National Mortgage Association, 5.50%, 7/1/33, $1,812,280 par

The fund has entered into a lending commitment with Goldman Sachs. The monthly agreement permits the fund to enter into reverse repurchase agreements using U.S. government agency mortgage-backed securities as collateral.

r Variable Rate Security – The rate shown is the net coupon rate in effect as of February 28, 2009.

°° Securities purchased as part of a private placement which have not been registered with the Securities and Exchange Commission under the Securities Act of 1933 and which are considered to be illiquid. These securities are fair valued in accordance with the board approved valuation procedures. On February 28, 2009, the total value of fair valued securities was $37,402,320 or 83.7% of total net assets. See note 2 in Notes to Financial Statements.

¶ Interest Only – Represents securities that entitle holders to receive only interest payments on the mortgage. Principal balance on the loan is due at maturity. The interest rate disclosed represents the net coupon rate in effect as of February 28, 2009.

The accompanying notes are an integral part of the financial statements.

First American Mortgage Funds 2009 Semiannual Report

8

American Strategic Income Portfolio (ASP)

(P) Interest rates on commercial and multifamily loans are the net coupon rates in effect (after reducing the coupon rate by any mortgage servicing fees paid to mortgage servicers) on February 28, 2009. Interest rates and maturity dates disclosed on single family loans represent the weighted average coupon and weighted average maturity for the underlying mortgage loans as of February 28, 2009.

(B) Securities pledged as collateral for outstanding borrowings under a loan agreement with Massachusetts Mutual Life Insurance Company ("MMLIC"). On February 28, 2009, securities valued at $21,376,511 were pledged as collateral for the following outstanding borrowings:

| Amount | | Rate* | | Accrued

Interest | |

| $ | 8,600,000 | | | | 5.00 | % | | $ | 1,194 | | |

* Interest rate as of February 28, 2009. Rate is based on the LIBOR plus 2.625% subject to a "floor" interest rate of 5.00% and reset monthly.

Description of collateral:

Advance Self Storage, Lincoln, NE, 6.13%, 1/1/11, $1,422,239 par

Copper Junction, Copper Mountain, CO, 6.38%, 7/1/17, $1,918,856 par

Hunt Club Apartments, Waco, TX, 5.64%, 7/1/11, $1,164,575 par

Integrity Plaza Shopping Center, Albuquerque, NM, 7.88%, 7/1/12, $1,938,024 par

La Costa Meadows Industrial Park I, San Marcos, CA, 6.78%, 7/1/17, $1,250,000 par

La Costa Meadows Industrial Park II, San Marcos, CA, 7.53%, 7/1/17, $2,000,000 par

Minikahda Mini Storage IV, Minneapolis, MN, 7.15%, 3/1/11, $1,582,390 par

Naples Boat Club, Naples, FL, 6.43%, 1/1/17, $1,706,587 par

Palace Court, Santa Fe, NM, 6.68%, 11/1/11, $1,895,831 par

Par 3 Office Building, Bend, OR, 6.63%, 8/1/13, $1,900,000 par

Park Hollywood, Portland, OR, 7.38%, 6/1/12, $1,097,061 par

Perkins Restaurant, Maple Grove, MN, 6.38%, 1/1/11, $1,369,375 par

Rockwood Galleria, Gresham, OR, 7.25%, 2/1/11, $1,502,682 par

Stephe ns Center, Missoula, MT, 6.38%, 9/1/10, $1,816,709 par

The fund has entered into a loan agreement with MMLIC under which MMLIC made a term loan to the fund of $8,600,000, which matures on July 31, 2011, and agreed to make revolving loans to the fund of up to $2,400,000. Loans made under the loan agreement are secured by whole loans in the fund's portfolio and bear interest at the one-month LIBOR plus 2.625% with a "floor" interest rate of 5.00%. In addition, the fund pays an annual fee of 1.28% on any unused portion of the fund's revolving loan commitment.

(D) Loan has matured and the fund is anticipating payoff or refinancing. Unless disclosed otherwise, the loan continues to make monthly payments.

(U) Loan is currently in default with regards to scheduled interest and/or principal payments.

x Investment in affiliated security. This money market fund is advised by FAF Advisors, Inc., which also serves as advisor for the fund. See note 3 in Notes to Financial Statements.

p On February 28, 2009, the cost of investments for federal income tax purposes was approximately $63,949,346. The aggregate gross unrealized appreciation and depreciation of investments, based on this cost, were as follows:

| Gross unrealized appreciation | | $ | 614,753 | | |

| Gross unrealized depreciation | | | (7,516,577 | ) | |

| Net unrealized depreciation | | $ | (6,901,824 | ) | |

First American Mortgage Funds 2009 Semiannual Report

9

Schedule of INVESTMENTS February 28, 2009 (unaudited)

American Strategic Income Portfolio II (BSP)

| DESCRIPTION | | DATE

ACQUIRED | | PAR | | COST | | VALUE (I) | |

| (Percentages of each investment category relate to total net assets) | |

| U.S. Government Agency Mortgage-Backed Securities (A) — 3.4% | |

| Fixed Rate — 3.4% | |

| Federal Home Loan Mortgage Corporation, | |

| 5.50%, 1/1/18, #E93231 | | | | $ | 2,545,604 | | | $ | 2,602,151 | | | $ | 2,655,649 | | |

| 9.00%, 7/1/30, #C40149 | | | | | 124,495 | | | | 127,320 | | | | 132,027 | | |

| Federal National Mortgage Association, | |

| 6.00%, 10/1/16, #607030 | | | | | 198,341 | | | | 199,083 | | | | 207,969 | | |

| 5.50%, 6/1/17, #648508 | | | | | 216,780 | | | | 217,547 | | | | 225,880 | | |

| 5.00%, 9/1/17, #254486 | | | | | 387,105 | | | | 387,837 | | | | 400,815 | | |

| 5.00%, 11/1/17, #657356 | | | | | 792,424 | | | | 795,427 | | | | 820,489 | | |

| 6.50%, 6/1/29, #252497 | | | | | 954,998 | | | | 949,517 | | | | 1,008,333 | | |

| 7.50%, 5/1/30, #535289 | | | | | 104,838 | | | | 101,830 | | | | 112,078 | | |

| 8.00%, 5/1/30, #538266 | | | | | 41,050 | | | | 40,607 | | | | 43,832 | | |

| 8.00%, 6/1/30, #253347 | | | | | 127,805 | | | | 126,423 | | | | 136,468 | | |

| Total U.S. Government Agency Mortgage-Backed Securities | | | 5,547,742 | | | | 5,743,540 | | |

| Corporate Notes °° ¶ — 12.8% | |

| Fixed Rate — 12.8% | |

| Sarofim South and Bland, 6.90%, 1/1/11 | | 12/21/07 | | | 8,511,612 | | | | 8,511,612 | | | | 8,630,775 | | |

| Stratus Properties II, 6.56%, 12/31/11 | | 6/14/01 | | | 5,000,000 | | | | 5,000,000 | | | | 5,002,000 | | |

| Stratus Properties III, 6.56%, 12/31/11 | | 12/12/06 | | | 8,000,000 | | | | 8,000,000 | | | | 8,003,200 | | |

| Total Corporate Notes | | | 21,511,612 | | | | 21,635,975 | | |

| Whole Loans °° (P) — 101.1% | |

| Commercial Loans — 58.5% | |

| 5555 East Van Buren I, Phoenix, AZ, 5.68%, 7/1/11 (B) | | 6/23/04 | | | 6,291,299 | | | | 6,291,299 | | | | 6,154,019 | | |

| 5555 East Van Buren II, Phoenix, AZ, 7.13%, 7/1/11 (B) | | 8/18/06 | | | 1,467,535 | | | | 1,467,535 | | | | 1,469,598 | | |

| American Mini-Storage, Memphis, TN, 6.80%, 12/1/10 ¶ | | 11/5/07 | | | 3,060,000 | | | | 3,060,000 | | | | 3,024,087 | | |

| Bigelow Office Building, Las Vegas, NV, 6.38%, 4/1/17 (B) | | 3/31/97 | | | 1,123,508 | | | | 1,123,508 | | | | 999,394 | | |

| Cypress Point Office Park I, Tampa, FL, 5.30%, 6/1/09 (B) | | 5/19/04 | | | 4,405,377 | | | | 4,405,377 | | | | 4,363,630 | | |

| Cypress Point Office Park II, Tampa, FL, 5.30%, 6/1/09 (B) | | 5/19/04 | | | 4,280,079 | | | | 4,280,079 | | | | 4,239,519 | | |

| Hickman Road, Clive, IA, 6.78%, 1/1/13 ¶ (B) | | 12/3/07 | | | 5,500,000 | | | | 5,500,000 | | | | 5,381,915 | | |

| Oak Knoll Village Shopping Center, Austin, TX, 6.73%, 10/1/13 (B) | | 9/17/03 | | | 1,500,219 | | | | 1,500,219 | | | | 1,419,154 | | |

| Office City Plaza, Houston, TX, 6.43%, 6/1/12 (B) | | 5/25/07 | | | 5,504,940 | | | | 5,504,940 | | | | 5,400,407 | | |

| Oyster Point Office Park, Newport News, VA, 6.68%, 2/1/11 (B) | | 1/4/06 | | | 12,083,906 | | | | 12,083,906 | | | | 12,077,295 | | |

| PennMont Office Plaza, Albuquerque, NM, 6.63%, 4/1/11 (B) | | 3/30/06 | | | 1,438,855 | | | | 1,438,855 | | | | 1,433,549 | | |

| Perkins - Blaine, Blaine, MN, 6.63%, 1/1/17 (B) | | 12/13/06 | | | 1,822,999 | | | | 1,822,999 | | | | 1,545,257 | | |

| Raveneaux Country Club, Spring, TX, 7.93%, 1/1/10 ¶ (U) | | 12/19/05 | | | 8,800,000 | | | | 8,800,000 | | | | 8,800,000 | | |

| Redwood Dental Building, Taylorsville, UT, 7.40%, 7/1/12 (B) | | 6/28/02 | | | 2,443,604 | | | | 2,443,604 | | | | 2,462,876 | | |

| Robberson Auto Dealerships, Bend & Prineville, OR, 6.40%, 4/1/17 (B) | | 3/30/07 | | | 7,184,606 | | | | 7,184,606 | | | | 6,206,495 | | |

| Signal Butte, Mesa, AZ, 6.90%, 7/1/17 ¶ (B) | | 6/20/07 | | | 15,000,000 | | | | 15,000,000 | | | | 13,122,045 | | |

| Station Square, Pompano Beach, FL, 6.33%, 2/1/14 ¶ (B) | | 1/19/07 | | | 12,000,000 | | | | 12,000,000 | | | | 9,492,926 | | |

| Waste Connections Warehouse, Englewood, CO, 6.58%, 3/1/14 (B) | | 2/15/07 | | | 1,275,654 | | | | 1,275,654 | | | | 1,248,068 | | |

| Woodmen Corporate Center, Colorado Springs, CO, 8.43%, 11/1/08 ¶ (B) (D) | | 8/8/05 | | | 9,950,000 | | | | 9,950,000 | | | | 9,950,000 | | |

| | | | 105,132,581 | | | | 98,790,234 | | |

| Multifamily Loans — 42.5% | |

| Carolina Square Apartments, Tallahassee, FL, 6.63%, 8/1/12 ¶ (B) | | 7/20/07 | | | 7,875,000 | | | | 7,875,000 | | | | 7,656,132 | | |

| Chardonnay Apartments, Tulsa, OK, 6.40%, 7/1/13 (B) | | 6/5/03 | | | 3,875,873 | | | | 3,875,873 | | | | 3,686,317 | | |

| Lake Point Terrace Apartments, Madison, WI, 6.33%, 5/1/17 (B) (U) | | 4/13/07 | | | 4,970,969 | | | | 4,970,969 | | | | 3,479,678 | | |

| Meadows Point, College Station, TX, 7.93%, 2/1/13 ¶ (C) | | 1/24/08 | | | 5,400,000 | | | | 5,400,000 | | | | 4,618,636 | | |

| RP-Plaza Development, Oxnard, CA, 4.31%, 3/1/10 ¶ r | | 2/23/05 | | | 5,000,000 | | | | 5,000,000 | | | | 4,867,812 | | |

| Sapphire Skies, Cle Elum, WA, 4.59%, 1/1/09 ¶ (U) (D) r | | 12/23/05 | | | 8,805,908 | | | | 8,805,908 | | | | 7,773,240 | | |

| Summit Chase Apartments I, Coral Springs, FL, 6.68%, 1/1/09 ¶ (D) | | 7/7/05 | | | 12,670,000 | | | | 12,670,000 | | | | 8,869,000 | | |

| Summit Chase Apartments II, Coral Springs, FL, 9.90%, 1/1/09 ¶ (D) (C) (S) | | 7/7/05 | | | 3,234,000 | | | | 3,234,000 | | | | 2,263,800 | | |

The accompanying notes are an integral part of the financial statements.

First American Mortgage Funds 2009 Semiannual Report

10

American Strategic Income Portfolio II (BSP)

| DESCRIPTION | | DATE

ACQUIRED | | PAR | | COST | | VALUE (I) | |

| Sussex Club Apartments I, Athens, GA, 6.33%, 5/1/10 ¶ | | 4/17/07 | | $ | 9,126,000 | | | $ | 9,126,000 | | | $ | 9,148,633 | | |

| Sussex Club Apartments II, Athens, GA, 6.88%, 5/1/10 ¶ (C) (S) | | 4/17/07 | | | 2,165,000 | | | | 2,165,000 | | | | 1,956,100 | | |

| Trinity Oaks Apartments I, Dallas, TX, 6.53%, 4/1/09 ¶ | | 3/30/06 | | | 7,000,000 | | | | 7,000,000 | | | | 5,833,429 | | |

| Trinity Oaks Apartments II, Dallas, TX, 7.88%, 4/1/09 ¶ (C) (S) | | 3/30/06 | | | 1,690,000 | | | | 1,690,000 | | | | 1,183,000 | | |

| Vista Bonita Apartments, Denton, TX, 7.90%, 6/1/10 | | 3/4/05 | | | 2,706,358 | | | | 2,706,358 | | | | 2,706,358 | | |

| Windy Meadows, Arlington, TX, 6.93%, 5/1/10 ¶ (B) | | 4/27/07 | | | 6,380,000 | | | | 6,380,000 | | | | 6,439,690 | | |

| Winterland Apartments I, Grand Forks, ND, 9.23%, 7/1/12 | | 6/6/97 | | | 524,112 | | | | 524,112 | | | | 513,406 | | |

| Winterland Apartments II, Grand Forks, ND, 9.23%, 7/1/12 (C) | | 6/6/97 | | | 1,004,546 | | | | 1,004,546 | | | | 818,485 | | |

| | | | 82,427,766 | | | | 71,813,716 | | |

| Single Family Loans — 0.1% | |

| Merchants Bank, 2 loans, Vermont, 10.48%, 12/1/20 | | 12/18/92 | | | 54,153 | | | | 54,604 | | | | 55,778 | | |

| PHH U.S. Mortgage, 2 loans, California & Delaware, 8.65%, 1/1/12 | | 12/30/92 | | | 162,894 | | | | 157,965 | | | | 162,898 | | |

| | | | 212,569 | | | | 218,676 | | |

| Total Whole Loans | | | 187,772,916 | | | | 170,822,626 | | |

| Preferred Stocks — 12.1% | |

| Real Estate Investment Trusts — 12.1% | |

| AMB Property, Series L (A) | | | | | 99,600 | | | | 2,326,357 | | | | 1,195,200 | | |

| AMB Property, Series M | | | | | 14,360 | | | | 367,561 | | | | 186,680 | | |

| AMB Property, Series O (A) | | | | | 13,459 | | | | 336,475 | | | | 226,784 | | |

| BRE Properties, Series C | | | | | 94,000 | | | | 1,867,780 | | | | 1,549,120 | | |

| BRE Properties, Series D | | | | | 7,450 | | | | 148,032 | | | | 113,985 | | |

| Developers Diversified Realty, Series H | | | | | 37,600 | | | | 770,800 | | | | 188,376 | | |

| Developers Diversified Realty, Series I | | | | | 6,050 | | | | 126,143 | | | | 30,311 | | |

| Duke Realty, Series J (A) | | | | | 38,244 | | | | 974,588 | | | | 305,952 | | |

| Duke Realty, Series L | | | | | 27,260 | | | | 521,211 | | | | 218,625 | | |

| Duke Realty, Series M (A) | | | | | 83,200 | | | | 1,704,000 | | | | 732,160 | | |

| Duke Realty, Series O | | | | | 63,150 | | | | 1,490,340 | | | | 722,436 | | |

| Equity Residential Properties, Series N | | | | | 55,000 | | | | 1,067,250 | | | | 951,500 | | |

| Health Care Properties, Series E | | | | | 5,100 | | | | 131,070 | | | | 81,600 | | |

| Health Care Properties, Series F (A) | | | | | 40,485 | | | | 1,020,755 | | | | 607,275 | | |

| Kimco Realty, Series F (A) | | | | | 78,000 | | | | 1,823,500 | | | | 885,300 | | |

| Kimco Realty, Series G | | | | | 20,800 | | | | 467,376 | | | | 265,200 | | |

| ProLogis Trust, Series F (A) | | | | | 26,120 | | | | 630,278 | | | | 215,490 | | |

| ProLogis Trust, Series G | | | | | 11,700 | | | | 245,700 | | | | 104,364 | | |

| PS Business Parks, Series H | | | | | 37,600 | | | | 752,000 | | | | 601,600 | | |

| PS Business Parks, Series I | | | | | 13,200 | | | | 259,644 | | | | 202,092 | | |

| PS Business Parks, Series M | | | | | 37,600 | | | | 774,560 | | | | 586,560 | | |

| PS Business Parks, Series P | | | | | 11,650 | | | | 223,330 | | | | 168,925 | | |

| Public Storage, Series A (A) | | | | | 40,000 | | | | 977,346 | | | | 739,600 | | |

| Public Storage, Series B | | | | | 22,200 | | | | 543,900 | | | | 409,146 | | |

| Public Storage, Series E (A) | | | | | 28,200 | | | | 641,550 | | | | 474,042 | | |

| Public Storage, Series I | | | | | 37,600 | | | | 817,800 | | | | 688,456 | | |

| Public Storage, Series K | | | | | 24,850 | | | | 540,487 | | | | 457,737 | | |

| Public Storage, Series X (A) | | | | | 20,000 | | | | 502,366 | | | | 323,800 | | |

| Public Storage, Series Z | | | | | 20,000 | | | | 497,779 | | | | 313,600 | | |

| Realty Income, Series D | | | | | 90,000 | | | | 2,281,500 | | | | 1,620,000 | | |

| Realty Income, Series E | | | | | 37,600 | | | | 812,160 | | | | 626,040 | | |

| Regency Centers, Series C | | | | | 37,600 | | | | 812,912 | | | | 641,080 | | |

| Regency Centers, Series E | | | | | 84,200 | | | | 1,912,340 | | | | 1,237,740 | | |

| UDR, Series G | | | | | 37,600 | | | | 804,640 | | | | 595,208 | | |

| Weingarten Realty Investors, Series F (A) | | | | | 182,500 | | | | 4,489,375 | | | | 2,135,250 | | |

| Total Preferred Stocks | | | 33,662,905 | | | | 20,401,234 | | |

| Total Unaffiliated Investments | | | 248,495,175 | | | | 218,603,375 | | |

First American Mortgage Funds 2009 Semiannual Report

11

Schedule of INVESTMENTS February 28, 2009 (unaudited)

American Strategic Income Portfolio II (BSP)

| DESCRIPTION | | SHARES | | COST | | VALUE (I) | |

| Short-Term Investment — 3.5% | |

| First American Prime Obligations Fund, Class Z x | | | 5,937,123 | | | $ | 5,937,123 | | | $ | 5,937,123 | | |

| Total Investments p — 132.9% | | | | $ | 254,432,298 | | | $ | 224,540,498 | | |

| Other Assets and Liabilities, Net — (32.9)% | | | | | | | (55,562,712 | ) | |

| Total Net Assets — 100.0% | | $ | 168,977,786 | | |

(I) Securities are valued in accordance with procedures described in note 2 in Notes to Financial Statements.

(A) Securities pledged as collateral for outstanding reverse repurchase agreements. On February 28, 2009, securities valued at $10,801,673 were pledged as collateral for the following outstanding reverse repurchase agreements:

| Amount | | Acquisition

Date | | Rate* | | Due | | Accrued

Interest | | Name of Broker

and Description

of Collateral | |

| $ | 5,032,000 | | | 2/19/09 | | | 0.75 | % | | 3/19/09 | | $ | 1,048 | | | | (1 | ) | |

| | 2,097,000 | | | 2/9/09 | | | 2.20 | % | | 3/11/09 | | | 2,560 | | | | (2 | ) | |

| $ | 7,129,000 | | | | | | | | | $ | 3,608 | | | | |

* Interest rate as of February 28, 2009. Rate is based on the London Interbank Offered Rate ("LIBOR") plus a spread and reset monthly.

Name of broker and description of collateral:

(1) Goldman Sachs:

Federal Home Loan Mortgage Corporation, 5.50%, 1/1/18, $2,545,604 par

Federal Home Loan Mortgage Corporation, 9.00%, 7/1/30, $124,495 par

Federal National Mortgage Association, 6.00%, 10/1/16, $198,341 par

Federal National Mortgage Association, 5.50%, 6/1/17, $216,780 par

Federal National Mortgage Association, 5.00%, 9/1/17, $387,105 par

Federal National Mortgage Association, 5.00%, 11/1/17, $792,424 par

Federal National Mortgage Association, 6.50%, 6/1/29, $954,998 par

Federal National Mortgage Association, 7.50%, 5/1/30, $104,838 par

Federal National Mortgage Association, 8.00%, 5/1/30, $41,050 par

Federal National Mortgage Association, 8.00%, 6/1/30, $127,805 par

(2) Dresdner Bank:

AMB Property, Series L, 37,600 shares

AMB Property, Series O, 13,459 shares

Duke Realty, Series J, 38,244 shares

Duke Realty, Series M, 8,000 shares

Health Care Properties, Series F, 40,485 shares

Kimco Realty, Series F, 20,000 shares

ProLogis Trust, Series F, 18,220 shares

Public Storage, Series A, 40,000 shares

Public Storage, Series E, 15,000 shares

Public Storage, Series X, 20,000 shares

Weingarten Realty Investors, Series F, 22,500 shares

The fund has entered into lending commitments with Goldman Sachs and Dresdner Bank. The monthly agreements permit the fund to enter into reverse repurchase agreements using U. S. government agency mortgage-backed securities and/or preferred stocks as collateral.

°° Securities purchased as part of a private placement which have not been registered with the Securities and Exchange Commission under the Securities Act of 1933 and which are considered to be illiquid. These securities are fair valued in accordance with the board approved valuation procedures. On February 28, 2009, the total value of fair valued securities was $192,458,601 or 113.9% of total net assets. See note 2 in Notes to Financial Statements.

¶ Interest Only – Represents securities that entitle holders to receive only interest payments on the mortgage. Principal balance on the loan is due at maturity. The interest rate disclosed represents the net coupon rate in effect as of February 28, 2009.

(P) Interest rates on commercial and multifamily loans are the net coupon rates in effect (after reducing the coupon rate by any mortgage servicing fees paid to mortgage servicers) on February 28, 2009. Interest rates and maturity dates disclosed on single family loans represent the weighted average coupon and weighted average maturity for the underlying mortgage loans as of February 28, 2009. For participating loans the rates are based on the annual cash flow payments at the time of purchase.

The accompanying notes are an integral part of the financial statements.

First American Mortgage Funds 2009 Semiannual Report

12

American Strategic Income Portfolio II (BSP)

(B) Securities pledged as collateral for outstanding borrowings under a loan agreement with Massachusetts Mutual Life Insurance Company ("MMLIC"). On February 28, 2009, securities valued at $108,227,964 were pledged as collateral for the following outstanding borrowings:

| Amount | | Rate* | | Accrued

Interest | |

| $ | 50,000,000 | | | | 5.00 | % | | $ | 6,944 | | |

* Interest rate as of February 28, 2009. Rate is based on the LIBOR plus 2.625% subject to a "floor" interest rate of 5.00% and reset monthly.

Description of collateral:

5555 East Van Buren I, Phoenix, AZ, 5.68%, 7/1/11, $6,291,299 par

5555 East Van Buren II, Phoenix, AZ, 7.13%, 7/1/11, $1,467,535 par

Bigelow Office Building, Las Vegas, NV, 6.38%, 4/1/17, $1,123,508 par

Carolina Square Apartments, Tallahassee, FL, 6.63%, 8/1/12, $7,875,000 par

Chardonnay Apartments, Tulsa, OK, 6.40%, 7/1/13, $3,875,873 par

Cypress Point Office Park I, Tampa, FL, 5.30%, 6/1/09, $4,405,377 par

Cypress Point Office Park II, Tampa, FL, 5.30%, 6/1/09, $4,280,079 par

Hickman Road, Clive, IA, 6.78%, 1/1/13, $5,500,000 par

Lake Point Terrace Apartments, Madison, WI, 6.33%, 5/1/17, $4,970,969 par

Oak Knoll Village Shopping Center, Austin, TX, 6.73%, 10/1/13, $1,500,219 par

Office City Plaza, Houston, TX, 6.43%, 6/1/12, $5,504,940 par

Oyster Point Office Park, Newport News, VA, 6.68%, 2/1/11, $12,083,906 par

PennMont Office Plaza, Albuquerque, NM, 6.63%, 4/1/11, $1,438,855 p ar

Perkins – Blaine, Blaine, MN, 6.63%, 1/1/17, $1,822,999 par

Redwood Dental Building, Taylorsville, UT, 7.40%, 7/1/12, $2,443,604 par

Robberson Auto Dealerships, Bend & Prineville, OR, 6.40%, 4/1/17, $7,184,606 par

Signal Butte, Mesa, AZ, 6.90%, 7/1/17, $15,000,000 par

Station Square, Pompano Beach, FL, 6.33%, 2/1/14, $12,000,000 par

Waste Connections Warehouse, Englewood, CO, 6.58%, 3/1/14, $1,275,654 par

Windy Meadows, Arlington, TX, 6.93%, 5/1/10, $6,380,000 par

Woodmen Corporate Center, Colorado Springs, CO, 8.43%, 1/1/09, $9,950,000 par

The fund has entered into a loan agreement with MMLIC under which MMLIC made a term loan to the fund of $45,100,000 which matures on July 31, 2011, and agreed to make revolving loans to the fund of up to $12,900,000. Loans made under the loan agreement are secured by whole loans in the fund's portfolio and bear interest at the one-month LIBOR plus 2.625% with a "floor" interest rate of 5.00%. In addition, the fund pays an annual fee of 1.28% on any unused portion of the fund's revolving loan commitment.

(U) Loan is currently in default with regards to scheduled interest and/or principal payments.

(D) Loan has matured and the fund is anticipating payoff or refinancing. Unless disclosed otherwise, the loan continues to make monthly payments.

(C) Participating Loan – A participating loan is one which contains provisions for the fund to participate in the income stream provided by the property, including net cash flows and capital proceeds. Monthly cash flow proceeds are only required to the extent excess cash flow is generated by the property as determined by the loan documents.

(S) The participating loan is not currently making monthly cash flow payments.

r Variable Rate Security – The rate shown is the net coupon rate in effect as of February 28, 2009.

x Investment in affiliated security. This money market fund is advised by FAF Advisors, Inc., which also serves as advisor for the fund. See note 3 in Notes to Financial Statements.

p On February 28, 2009, the cost of investments for federal income tax purposes was approximately $254,432,298. The aggregate gross unrealized appreciation and depreciation of investments, based on this cost, were as follows:

| Gross unrealized appreciation | | $ | 429,947 | | |

| Gross unrealized depreciation | | | (30,321,747 | ) | |

| Net unrealized depreciation | | $ | (29,891,800 | ) | |

First American Mortgage Funds 2009 Semiannual Report

13

Schedule of INVESTMENTS February 28, 2009 (unaudited)

American Strategic Income Portfolio III (CSP)

| DESCRIPTION | | DATE

ACQUIRED | | PAR | | COST | | VALUE (I) | |

| (Percentages of each investment category relate to total net assets) | |

| U.S. Government Agency Mortgage-Backed Securities (A) — 2.7% | |

| Fixed Rate — 2.7% | |

| Federal Home Loan Mortgage Corporation, | |

| 5.50%, 1/1/18, #E93231 | | | | $ | 2,545,604 | | | $ | 2,602,150 | | | $ | 2,655,649 | | |

| 9.00%, 7/1/30, #C40149 | | | | | 174,293 | | | | 178,247 | | | | 184,838 | | |

| Federal National Mortgage Association, | |

| 6.00%, 10/1/16, #607030 | | | | | 198,341 | | | | 199,085 | | | | 207,969 | | |

| 5.50%, 2/1/17, #623874 | | | | | 345,418 | | | | 344,841 | | | | 360,134 | | |

| 5.50%, 6/1/17, #648508 | | | | | 216,780 | | | | 217,547 | | | | 225,880 | | |

| 5.00%, 9/1/17, #254486 | | | | | 387,104 | | | | 387,838 | | | | 400,814 | | |

| 5.00%, 11/1/17, #657356 | | | | | 792,424 | | | | 795,427 | | | | 820,489 | | |

| 6.50%, 6/1/29, #252497 | | | | | 668,499 | | | | 664,662 | | | | 705,833 | | |

| 7.50%, 5/1/30, #535289 | | | | | 104,838 | | | | 101,830 | | | | 112,078 | | |

| 8.00%, 5/1/30, #538266 | | | | | 41,050 | | | | 40,607 | | | | 43,833 | | |

| 8.00%, 6/1/30, #253347 | | | | | 115,025 | | | | 113,781 | | | | 122,822 | | |

| Total U.S. Government Agency Mortgage-Backed Securities | | | 5,646,015 | | | | 5,840,339 | | |

| Corporate Notes °° ¶ — 11.5% | |

| Fixed Rate — 11.5% | |

| Sarofim Brookhaven, 6.90%, 1/1/11 | | 12/21/07 | | | 10,040,375 | | | | 10,040,375 | | | | 10,180,940 | | |

| Stratus Properties IV, 6.56%, 12/31/11 | | 12/1/06 | | | 7,000,000 | | | | 7,000,000 | | | | 7,002,800 | | |

| Stratus Properties VI, 6.92%, 12/31/11 | | 6/1/07 | | | 8,000,000 | | | | 8,000,000 | | | | 8,079,200 | | |

| Total Corporate Notes | | | 25,040,375 | | | | 25,262,940 | | |

| Private Mortgage-Backed Security °° — 0.0% | |

| Fixed Rate — 0.0% | |

| First Gibraltar, Series 1992-MM, Class B, 6.06%, 10/25/217/30/9393,939 | | | 57,554 | | | | — | | |

| Whole Loans °° (P) — 100.9% | |

| Commercial Loans — 59.7% | |

| 150 North Pantano I, Tucson, AZ, 5.40%, 2/1/10 ¶ (B) r | | 1/4/05 | | | 3,525,000 | | | | 3,525,000 | | | | 3,301,500 | | |

| 150 North Pantano II, Tucson, AZ, 14.88%, 2/1/10 ¶ | | 1/4/05 | | | 440,000 | | | | 440,000 | | | | 308,000 | | |

| 8324 East Hartford Drive I, Scottsdale, AZ, 5.15%, 5/1/09 (B) | | 4/8/04 | | | 3,711,214 | | | | 3,711,214 | | | | 3,711,214 | | |

| Academy Spectrum, Colorado Springs, CO, 7.73%, 5/1/09 (B) (U) | | 12/18/02 | | | 4,959,112 | | | | 4,959,112 | | | | 3,471,378 | | |

| Alliant University, Fresno, CA, 7.15%, 8/1/11 (B) | | 7/12/06 | | | 2,788,977 | | | | 2,788,977 | | | | 2,800,173 | | |

| Apple Blossom Convenience Center, Winchester, VA, 6.58%, 8/1/12 ¶ | | 7/9/07 | | | 2,150,000 | | | | 2,150,000 | | | | 2,070,710 | | |

| Biltmore Lakes Corporate Center, Phoenix, AZ, 6.00%, 9/1/09 (B) | | 8/2/04 | | | 3,222,438 | | | | 3,222,438 | | | | 3,209,533 | | |

| Carrier 360 I, Grand Prairie, TX, 5.40%, 7/1/09 (B) | | 6/28/04 | | | 3,174,880 | | | | 3,174,880 | | | | 3,174,880 | | |

| Carrier 360 II, Grand Prairie, TX, 5.88%, 7/1/09 | | 12/16/05 | | | 330,569 | | | | 330,569 | | | | 329,750 | | |

| Fairview Business Park, Salem, OR, 7.33%, 8/1/11 (B) | | 7/14/06 | | | 7,590,028 | | | | 7,590,028 | | | | 7,448,747 | | |

| First Colony Marketplace, Sugar Land, TX, 6.43%, 9/1/10 ¶ (B) | | 8/15/07 | | | 12,900,000 | | | | 12,900,000 | | | | 11,354,561 | | |

| France Avenue Business Park II, Brooklyn Center, MN, 7.40%, 10/1/12 (B) | | 9/12/02 | | | 4,310,390 | | | | 4,310,390 | | | | 4,287,465 | | |

| France Avenue Business Park II (second), Brooklyn Center, MN, 7.38%, 10/1/12 ¶ | | 1/17/08 | | | 600,000 | | | | 600,000 | | | | 595,701 | | |

| Jilly's American Grill, Scottsdale, AZ, 4.31%, 9/1/09 ¶ (B) r | | 8/19/05 | | | 1,810,000 | | | | 1,810,000 | | | | 1,765,337 | | |

| La Cholla Plaza I, Tucson, AZ, 3.61%, 8/1/09 ¶ (B) r | | 7/26/06 | | | 11,135,604 | | | | 11,135,604 | | | | 10,806,951 | | |

| La Cholla Plaza II, Tucson, AZ, 14.88%, 8/1/09 ¶ ¹ | | 7/26/06 | | | 1,389,396 | | | | 1,389,396 | | | | 1,198,386 | | |

| Memphis Medical Building, Memphis, TN, 6.40%, 9/1/12 ¶ | | 8/22/07 | | | 4,250,000 | | | | 4,250,000 | | | | 4,096,733 | | |

| NCH Commercial Pool I, Tucson, AZ, 11.93%, 4/1/10 ¶ | | 3/27/07 | | | 5,500,000 | | | | 5,500,000 | | | | 5,176,923 | | |

| NCH Commercial Pool II, Phoenix, AZ, 11.93%, 1/1/11 ¶ ¹ | | 12/4/07 | | | 14,000,000 | | | | 14,000,000 | | | | 13,567,693 | | |

| Noah's Ark Self Storage, San Antonio, TX, 6.48%, 9/1/10 ¶ (B) | | 8/24/07 | | | 2,400,000 | | | | 2,400,000 | | | | 2,359,598 | | |

| North Austin Business Center, Austin, TX, 5.65%, 11/1/11 (B) | | 10/29/04 | | | 3,853,649 | | | | 3,853,649 | | | | 3,726,774 | | |

| Outlets at Casa Grande I, Casa Grande, AZ, 6.93%, 3/1/11 ¶ (B) | | 2/27/06 | | | 7,300,000 | | | | 7,300,000 | | | | 7,247,442 | | |

| Outlets at Casa Grande II, Casa Grande, AZ, 6.90%, 3/1/11 ¶ (B) | | 4/11/07 | | | 3,500,000 | | | | 3,500,000 | | | | 3,478,163 | | |

| Paradise Boulevard, Albuquerque, NM, 6.50%, 4/1/17 ¶ (B) | | 3/26/07 | | | 4,600,000 | | | | 4,600,000 | | | | 4,100,568 | | |

The accompanying notes are an integral part of the financial statements.

First American Mortgage Funds 2009 Semiannual Report

14

American Strategic Income Portfolio III (CSP)

| DESCRIPTION | | DATE

ACQUIRED | | PAR/

SHARES | | COST | | VALUE (I) | |

| RealtiCorp Fund III, Orlando/Crystal River, FL, 6.84%, 7/1/09 ¶ r | | 2/28/06 | | $ | 4,222,755 | | | $ | 4,222,755 | | | $ | 4,222,755 | | |

| Shoppes at Jonathan's Landing, Jupiter, FL, 7.95%, 5/1/10 (B) | | 4/12/00 | | | 2,697,672 | | | | 2,697,672 | | | | 2,732,493 | | |

| Silver Star Storage, Austin, TX, 6.40%, 4/1/11 ¶ | | 3/25/08 | | | 4,160,000 | | | | 4,160,000 | | | | 4,031,437 | | |

| Spa Atlantis, Pompano Beach, FL, 6.93%, 4/1/09 ¶ (U) | | 9/30/05 | | | 19,281,600 | | | | 19,281,600 | | | | 13,497,120 | | |

| Tatum Ranch Center, Phoenix, AZ, 6.53%, 9/1/11 (B) | | 8/25/04 | | | 3,485,319 | | | | 3,485,319 | | | | 3,388,171 | | |

| | | | 143,288,603 | | | | 131,460,156 | | |

| Multifamily Loans — 41.2% | |

| Avalon Hills I, Omaha, NE, 6.93%, 3/1/10 ¶ (B) | | 3/1/07 | | | 10,720,000 | | | | 10,720,000 | | | | 10,804,774 | | |

| Avalon Hills II, Omaha, NE, 9.88%, 3/1/10 ¶ (C) (S) | | 3/1/07 | | | 2,448,800 | | | | 2,448,800 | | | | 1,851,668 | | |

| Chateau Club Apartments I, Athens, GA, 6.68%, 12/1/10 ¶ | | 12/20/07 | | | 6,623,000 | | | | 6,623,000 | | | | 6,578,153 | | |

| Chateau Club Apartments II, Athens, GA, 6.88%, 12/1/10 ¶ (C) (S) | | 12/20/07 | | | 1,439,024 | | | | 1,439,024 | | | | 1,080,408 | | |

| Citadel Apartments I, El Paso, TX, 6.53%, 4/1/10 ¶ (B) | | 3/30/07 | | | 10,300,000 | | | | 10,300,000 | | | | 10,300,000 | | |

| Citadel Apartments II, El Paso, TX, 9.88%, 4/1/10 ¶ | | 3/30/07 | | | 500,000 | | | | 500,000 | | | | 465,986 | | |

| Country Villa Apartments, West Lafayette, IN, 6.90%, 9/1/13 (B) | | 8/29/03 | | | 2,449,864 | | | | 2,449,864 | | | | 2,229,083 | | |

| Courtyards at Mesquite I, Mesquite, TX, 6.53%, 11/1/09 (B) | | 10/14/05 | | | 7,444,215 | | | | 7,444,215 | | | | 7,476,654 | | |

| Courtyards at Mesquite II, Mesquite, TX, 7.90%, 11/1/09 ¶ (C) (S) | | 10/14/05 | | | 2,850,000 | | | | 2,850,000 | | | | 2,100,563 | | |

| El Dorado Apartments I, Tucson, AZ, 7.15%, 9/1/12 (B) | | 8/26/04 | | | 2,517,507 | | | | 2,517,507 | | | | 2,504,370 | | |

| El Dorado Apartments II, Tucson, AZ, 7.13%, 9/1/12 | | 8/26/04 | | | 493,978 | | | | 493,978 | | | | 488,477 | | |

| Geneva Village Apartments I, West Jordan, UT, 7.00%, 1/1/14 (B) | | 12/24/03 | | | 1,204,812 | | | | 1,204,812 | | | | 1,182,630 | | |

| Geneva Village Apartments II, West Jordan, UT, 9.88%, 1/1/13 | | 12/24/03 | | | 41,523 | | | | 41,523 | | | | 39,640 | | |

| Good Haven Apartments I, Dallas, TX, 5.43%, 9/1/07 ¶ r (U) (D) | | 8/24/04 | | | 6,737,000 | | | | 6,737,000 | | | | 4,715,900 | | |

| Good Haven Apartments II, Dallas, TX, 14.88%, 9/1/07 ¶ (U) (D) | | 8/24/04 | | | 842,000 | | | | 842,000 | | | | 589,400 | | |

| Good Haven Apartments III, Dallas, TX, 14.88%, 5/1/09 ¶ (U) | | 7/3/08 | | | 694,096 | | | | 694,096 | | | | 485,867 | | |

| Meadowview Village Apartments I, West Jordan, UT, 7.00%, 1/1/14 | | 12/24/03 | | | 874,460 | | | | 874,460 | | | | 858,361 | | |

| Meadowview Village Apartments II, West Jordan, UT, 9.88%, 1/1/13 | | 12/24/03 | | | 41,523 | | | | 41,523 | | | | 39,640 | | |

| Meridian Pointe Apartments, Kalispell, MT, 8.73%, 4/1/12 (B) | | 3/7/97 | | | 1,031,387 | | | | 1,031,387 | | | | 1,066,926 | | |

| Montevista Apartments, Fort Worth, TX, 7.43%, 9/1/12 ¶ (C) | | 8/30/07 | | | 7,308,000 | | | | 7,308,000 | | | | 5,408,469 | | |

| NCH Multifamily Pool, Oklahoma City, OK, 11.93%, 11/1/09 ¶ | | 10/17/06 | | | 4,993,450 | | | | 4,993,450 | | | | 4,672,927 | | |

| Parkway Village Apartments I, West Jordan, UT, 7.00%, 1/1/14 | | 12/24/03 | | | 828,792 | | | | 828,792 | | | | 813,940 | | |

| Parkway Village Apartments II, West Jordan, UT, 9.88%, 1/1/13 | | 12/24/03 | | | 41,522 | | | | 41,522 | | | | 39,640 | | |

| Plantation Pines I, Tyler, TX, 6.59%, 2/1/10 ¶ (B) | | 1/17/07 | | | 3,328,000 | | | | 3,328,000 | | | | 3,333,549 | | |

| Plantation Pines II, Tyler, TX, 10.57%, 2/1/10 ¶ | | 1/17/07 | | | 416,000 | | | | 416,000 | | | | 346,576 | | |

| RiverPark Land Lot III, Oxnard, CA, 4.31%, 11/1/09 ¶ r | | 10/9/07 | | | 3,650,000 | | | | 3,650,000 | | | | 3,571,062 | | |

| Villas of Woodgate, Lansing, MI, 6.40%, 2/1/12 (B) | | 2/1/07 | | | 3,573,168 | | | | 3,573,168 | | | | 3,397,580 | | |

| Vista Village Apartments I, El Paso, TX, 6.53%, 4/1/10 ¶ (B) | | 3/30/07 | | | 6,100,000 | | | | 6,100,000 | | | | 6,100,000 | | |

| Vista Village Apartments II, El Paso, TX, 9.88%, 4/1/10 ¶ | | 3/30/07 | | | 350,000 | | | | 350,000 | | | | 327,765 | | |

| Whispering Oaks I, Little Rock, AR, 6.53%, 2/1/10 ¶ (B) | | 1/10/07 | | | 6,800,000 | | | | 6,800,000 | | | | 6,793,993 | | |

| Whispering Oaks II, Little Rock, AR, 9.88%, 2/1/10 ¶ (C) (S) | | 1/10/07 | | | 1,636,000 | | | | 1,636,000 | | | | 1,145,200 | | |

| | | | 98,278,121 | | | | 90,809,201 | | |

| Total Whole Loans | | | 241,566,724 | | | | 222,269,357 | | |

| Preferred Stocks — 13.8% | |

| Real Estate Investment Trusts — 13.8% | |

| AMB Property, Series L | | | | | 164,120 | | | | 3,789,361 | | | | 1,969,440 | | |

| AMB Property, Series M (A) | | | | | 41,240 | | | | 950,889 | | | | 536,120 | | |

| AMB Property, Series O (A) | | | | | 9,613 | | | | 240,325 | | | | 161,979 | | |

| AMB Property, Series P | | | | | 21,200 | | | | 429,300 | | | | 255,460 | | |

| BRE Properties, Series C | | | | | 66,300 | | | | 1,317,381 | | | | 1,092,624 | | |

| BRE Properties, Series D | | | | | 5,250 | | | | 104,318 | | | | 80,325 | | |

| Developers Diversified Realty, Series G | | | | | 57,600 | | | | 997,080 | | | | 311,040 | | |

| Developers Diversified Realty, Series H | | | | | 69,320 | | | | 1,234,880 | | | | 347,293 | | |

| Developers Diversified Realty, Series I | | | | | 4,270 | | | | 89,030 | | | | 21,393 | | |

| Duke Realty, Series J (A) | | | | | 20,956 | | | | 535,385 | | | | 167,648 | | |

| Duke Realty, Series L | | | | | 19,220 | | | | 367,486 | | | | 154,145 | | |

| Duke Realty, Series M | | | | | 55,040 | | | | 1,110,800 | | | | 484,352 | | |

| Duke Realty, Series O | | | | | 44,550 | | | | 1,051,380 | | | | 509,652 | | |

First American Mortgage Funds 2009 Semiannual Report

15

Schedule of INVESTMENTS February 28, 2009 (unaudited)

American Strategic Income Portfolio III (CSP)

| DESCRIPTION | | SHARES | | COST | | VALUE (I) | |

| Equity Residential Properties, Series N | | | 10,700 | | | $ | 226,305 | | | $ | 185,110 | | |

| Health Care Properties, Series E (A) | | | 7,690 | | | | 197,633 | | | | 123,040 | | |

| Health Care Properties, Series F (A) | | | 84,750 | | | | 2,140,449 | | | | 1,271,250 | | |

| Kimco Realty, Series F | | | 163,000 | | | | 3,797,000 | | | | 1,850,050 | | |

| Kimco Realty, Series G | | | 114,700 | | | | 2,796,559 | | | | 1,462,425 | | |

| Post Properties, Series B | | | 1,600 | | | | 39,940 | | | | 20,000 | | |

| ProLogis Trust, Series F | | | 33,905 | | | | 835,567 | | | | 279,716 | | |

| ProLogis Trust, Series G | | | 8,300 | | | | 174,300 | | | | 74,036 | | |

| PS Business Parks, Series H | | | 26,520 | | | | 530,400 | | | | 424,320 | | |

| PS Business Parks, Series I | | | 94,300 | | | | 1,634,731 | | | | 1,443,733 | | |

| PS Business Parks, Series K | | | 25,000 | | | | 575,000 | | | | 437,500 | | |

| PS Business Parks, Series L (A) | | | 7,000 | | | | 179,550 | | | | 115,150 | | |

| PS Business Parks, Series M | | | 26,520 | | | | 546,312 | | | | 413,712 | | |

| PS Business Parks, Series O | | | 100,000 | | | | 2,050,000 | | | | 1,674,000 | | |

| PS Business Parks, Series P | | | 8,200 | | | | 157,194 | | | | 118,900 | | |

| Public Storage, Series A (A) | | | 38,000 | | | | 921,909 | | | | 702,620 | | |

| Public Storage, Series C | | | 30,000 | | | | 626,100 | | | | 497,700 | | |

| Public Storage, Series E | | | 9,300 | | | | 186,000 | | | | 156,333 | | |

| Public Storage, Series H | | | 40,000 | | | | 876,000 | | | | 708,800 | | |

| Public Storage, Series I | | | 26,520 | | | | 576,810 | | | | 485,581 | | |

| Public Storage, Series K | | | 17,550 | | | | 381,712 | | | | 323,271 | | |

| Public Storage, Series L | | | 20,000 | | | | 430,000 | | | | 332,000 | | |

| Public Storage, Series X | | | 74,000 | | | | 1,786,319 | | | | 1,198,060 | | |

| Public Storage, Series Z | | | 30,000 | | | | 746,643 | | | | 470,400 | | |

| Realty Income, Series D (A) | | | 97,500 | | | | 2,474,125 | | | | 1,755,000 | | |

| Realty Income, Series E | | | 26,520 | | | | 572,832 | | | | 441,558 | | |

| Regency Centers, Series C | | | 26,520 | | | | 573,362 | | | | 452,166 | | |

| Regency Centers, Series E | | | 94,270 | | | | 2,221,248 | | | | 1,385,769 | | |

| UDR, Series G | | | 26,520 | | | | 567,528 | | | | 419,812 | | |

| Vornado Realty Trust, Series E (A) | | | 7,400 | | | | 186,598 | | | | 103,378 | | |

| Vornado Realty Trust, Series F | | | 7,800 | | | | 164,970 | | | | 101,400 | | |

| Vornado Realty Trust, Series H | | | 163,000 | | | | 2,771,000 | | | | 2,105,960 | | |

| Weingarten Realty Investors, Series F (A) | | | 242,500 | | | | 5,989,375 | | | | 2,837,250 | | |

| Total Preferred Stocks | | | | | | | 50,151,086 | | | | 30,461,471 | | |

| Total Unaffiliated Investments | | | | | | | 322,461,754 | | | | 283,834,107 | | |

| Short-Term Investment — 1.2% | |

| First American Prime Obligations Fund, Class Z x | | | 2,640,488 | | | | 2,640,488 | | | | 2,640,488 | | |

| Total Investments p — 130.1% | | | | | | $ | 325,102,242 | | | $ | 286,474,595 | | |

| Other Assets and Liabilities, Net — (30.1)% | | | | | | | | | | | (66,201,927 | ) | |

| Total Net Assets — 100.0% | | $ | 220,272,668 | | |

(I) Securities are valued in accordance with procedures described in note 2 in Notes to Financial Statements.

(A) Securities pledged as collateral for outstanding reverse repurchase agreements. On February 28, 2009, securities valued at $8,387,416 were pledged as collateral for the following outstanding reverse repurchase agreements:

| Amount | | Acquisition

Date | | Rate* | | Due | | Accrued

Interest | | Name of Broker

and Description

of Collateral | |

| $ | 5,235,000 | | | 2/19/09 | | | 0.75 | % | | 3/19/09 | | $ | 1,091 | | | | (1 | ) | |

| | 1,249,000 | | | 2/9/09 | | | 2.20 | % | | 3/11/09 | | | 1,525 | | | | (2 | ) | |

| $ | 6,484,000 | | | | | | | | | $ | 2,616 | | | | |

The accompanying notes are an integral part of the financial statements.

First American Mortgage Funds 2009 Semiannual Report

16

American Strategic Income Portfolio III (CSP)

* Interest rate as of February 28, 2009. Rate is based on the London Interbank Offered Rate ("LIBOR") plus a spread and reset monthly.

Name of broker and description of collateral:

(1) Goldman Sachs:

Federal Home Loan Mortgage Corporation, 5.50%, 1/1/18, $2,545,604 par

Federal Home Loan Mortgage Corporation, 9.00%, 7/1/30, $174,293 par

Federal National Mortgage Association, 6.00%, 10/1/16, $198,341 par

Federal National Mortgage Association, 5.50%, 2/1/17, $345,418 par

Federal National Mortgage Association, 5.50%, 6/1/17, $216,780 par

Federal National Mortgage Association, 5.00%, 9/1/17, $387,104 par

Federal National Mortgage Association, 5.00%, 11/1/17, $792,424 par

Federal National Mortgage Association, 6.50%, 6/1/29, $668,499 par

Federal National Mortgage Association, 7.50%, 5/1/30, $104,838 par

Federal National Mortgage Association, 8.00%, 5/1/30, $41,050 par

Federal National Mortgage Association, 8.00%, 6/1/30, $115,025 par

(2) Dresdner Bank:

AMB Property, Series M, 21,240 shares

AMB Property, Series O, 9,613 shares

Duke Realty, Series J, 20,956 shares

Health Care Properties, Series E, 7,690 shares

Health Care Properties, Series F, 1,950 shares

PS Business Parks, Series L, 7,000 shares

Public Storage, Series A, 38,000 shares

Realty Income, Series D, 17,000 shares

Vornado Realty Trust, Series E, 7,400 shares

Weingarten Realty Investors, Series F, 22,500 shares

The fund has entered into lending commitments with Goldman Sachs and Dresdner Bank. The monthly agreements permit the fund to enter into reverse repurchase agreements using U.S. government agency mortgage-backed securities and/or preferred stocks as collateral.

°° Securities purchased as part of a private placement which have not been registered with the Securities and Exchange Commission under the Securities Act of 1933 and which are considered to be illiquid. These securities are fair valued in accordance with the board approved valuation procedures. On February 28, 2009, the total value of fair valued securities was $247,532,297 or 112.4% of total net assets. See note 2 in Notes to Financial Statements.

¶ Interest Only – Represents securities that entitle holders to receive only interest payments on the mortgage. Principal balance on the loan is due at maturity. The interest rate disclosed represents the net coupon rate in effect as of February 28, 2009.

(P) Interest rates on commercial and multifamily loans are the net coupon rates in effect (after reducing the coupon rate by any mortgage servicing fees paid to mortgage servicers) on February 28, 2009. For participating loans the rates are based on the annual cash flow payments expected at the time of purchase.

(B) Securities pledged as collateral for outstanding borrowings under a loan agreement with Massachusetts Mutual Life Insurance Company ("MMLIC"). On February 28, 2009, securities valued at $137,554,507 were pledged as collateral for the following outstanding borrowings:

| Amount | | Rate* | | Accrued

Interest | |

| $ | 62,000,000 | | | | 5.00 | % | | $ | 8,611 | | |

* Interest rate as of February 28, 2009. Rate is based on the LIBOR plus 2.625% subject to a "floor" interest rate of 5.00% and reset monthly.

Description of collateral:

150 North Pantano I, Tucson, AZ, 5.40%, 2/1/09, $3,525,000 par

8324 East Hartford Drive I, Scottsdale, AZ, 5.15%, 5/1/09, $3,711,214 par

Academy Spectrum, Colorado Springs, CO, 7.73%, 5/1/09, $4,959,112 par

Alliant University, Fresno, CA, 7.15%, 8/1/11, $2,788,977 par

Avalon Hills I, Omaha, NE, 6.93%, 3/1/10, $10,720,000 par

Biltmore Lakes Corporate Center, Phoenix, AZ, 6.00%, 9/1/09, $3,222,438 par

Carrier 360 I, Grand Prairie, TX, 5.40%, 7/1/09, $3,174,880 par

Citadel Apartments I, El Paso, TX, 6.53%, 4/1/10, $10,300,000 par

Country Villa Apartments, West Lafayette, IN, 6.90%, 9/1/13, $2,449,864 par

Courtyards at Mesquite I, Mesquite, TX, 6.53%, 11/1/09, $7,444,215 par

El Dorado Apartments I, Tucson, AZ, 7.15%, 9/1/12, $2,517,507 par

Fairview Business Park, Salem, OR, 7.33%, 8/1/11, $7,590,028 par

First Colony Marketplace, Sugar Land, TX, 6.43%, 9/1/10, $12,900,000 par

First American Mortgage Funds 2009 Semiannual Report

17

Schedule of INVESTMENTS February 28, 2009 (unaudited)

American Strategic Income Portfolio III (CSP)

France Avenue Business Park II, Brooklyn Center, MN, 7.40%, 10/1/12, $4,310,390 par

Geneva Village Apartments I, West Jordan, UT, 7.00%, 1/1/14, $1,204,812 par

Jilly's American Grill, Scottsdale, AZ, 4.31%, 9/1/09, $1,810,000 par

La Cholla Plaza I, Tucson, AZ, 3.61%, 8/1/09, $11,135,604 par

Meridian Pointe Apartments, Kalispell, MT, 8.73%, 4/1/12, $1,031,387 par

Noah's Ark Self Storage, San Antonio, TX, 6.48%, 9/1/10, $2,400,000 par

North Austin Business Center, Austin, TX, 5.65%, 11/1/11, $3,853,649 par

Outlets at Casa Grande I, Casa Grande, AZ, 6.93%, 3/1/11, $7,300,000 par

Outlets at Casa Grande II, Casa Grande, AZ, 6.90%, 3/1/11, $3,500,000 par

Paradise Boulevard, Albuquerque, NM, 6.50%, 4/1/17, $4,600,000 par

Plantation Pines I, Tyler, TX, 6.59%, 2/1/10, $3,328,000 par

Shoppes at Jonathan's Landing, Jupiter, FL, 7.95%, 5/1/10, $2,697,672 par

Tatum Ranch Center, Phoenix, AZ, 6.53%, 9/1/11, $3,485,319 par

Villas of Woodgate, Lansing, MI, 6.40%, 2/1/12, $3,573,168 par

Vista Village Apartments I, El Paso, TX, 6.53%, 4/1/10, $6,100,000 par

Whispering Oaks I, Little Rock, AR, 6.53%, 2/1/10, $6,800,000 par

The fund has entered into a loan agreement with MMLIC under which MMLIC made a term loan to the fund of $54,400,000, which matures on July 31, 2011, and agreed to make revolving loans to the fund of up to $15,600,000. Loans made under the loan agreement are secured by whole loans in the fund's portfolio and bear interest at the one-month LIBOR plus 2.625% with a "floor" interest rate of 5.00%. In addition, the fund pays an annual fee of 1.28% on any unused portion of the fund's revolving loan commitment.

r Variable Rate Security – The rate shown is the net coupon rate in effect as of February 28, 2009.

(U) Loan is currently in default with regards to scheduled interest and/or principal payments.

¹ Loan agreement was modified to allow borrower to pay no interest currently; however, interest will continue to accrue and will be payable at maturity.

(C) Participating Loan – A participating loan is one which contains provisions for the fund to participate in the income stream provided by the property, including net cash flows and capital proceeds. Monthly cash flow proceeds are only required to the extent excess cash flow is generated by the property as determined by the loan documents.

(S) The participating loan is not currently making monthly cash flow payments.

(D) Loan has matured and the fund is anticipating payoff or refinancing. Unless disclosed otherwise, the loan continues to make monthly payments.

x Investment in affiliated security. This money market fund is advised by FAF Advisors, Inc., which also serves as advisor for the fund. See note 3 in Notes to Financial Statements.

p On February 28, 2009, the cost of investments for federal income tax purposes was approximately $325,102,242. The aggregate gross unrealized appreciation and depreciation of investments, based on this cost, were as follows:

| Gross unrealized appreciation | | $ | 621,207 | | |

| Gross unrealized depreciation | | | (39,248,854 | ) | |

| Net unrealized depreciation | | $ | (38,627,647 | ) | |

The accompanying notes are an integral part of the financial statements.

First American Mortgage Funds 2009 Semiannual Report

18

American Select Portfolio (SLA)

| DESCRIPTION | | DATE

ACQUIRED | | PAR | | COST | | VALUE (I) | |

| (Percentages of each investment category relate to total net assets) | |

| U.S. Government Agency Mortgage-Backed Securities (A) — 3.0% | |

| Fixed Rate — 3.0% | |

| Federal Home Loan Mortgage Corporation, | |

| 5.50%, 1/1/18, #E93231 | | | | $ | 1,431,903 | | | $ | 1,463,708 | | | $ | 1,493,803 | | |

| 7.50%, 12/1/29, #C00896 | | | | | 233,615 | | | | 229,891 | | | | 249,479 | | |

| Federal National Mortgage Association, | |

| 5.00%, 11/1/17, #657356 | | | | | 792,424 | | | | 795,426 | | | | 820,489 | | |

| 6.50%, 6/1/29, #252497 | | | | | 859,498 | | | | 854,564 | | | | 907,500 | | |

| 7.50%, 5/1/30, #535289 | | | | | 58,243 | | | | 56,572 | | | | 62,265 | | |

| 8.00%, 5/1/30, #538266 | | | | | 22,805 | | | | 22,559 | | | | 24,351 | | |

| Total U.S. Government Agency Mortgage-Backed Securities | | | 3,422,720 | | | | 3,557,887 | | |

| Corporate Notes °° ¶ — 14.0% | |

| Fixed Rate — 14.0% | |

| Sarofim Northwest, 6.90%, 1/1/11 | | 12/21/07 | | | 8,181,250 | | | | 8,181,250 | | | | 8,295,787 | | |

| Stratus Properties I, 6.56%, 12/31/11 | | 12/28/00 | | | 5,000,000 | | | | 5,000,000 | | | | 5,002,000 | | |

| Stratus Properties VII, 6.92%, 12/31/11 | | 6/1/07 | | | 3,500,000 | | | | 3,500,000 | | | | 3,534,650 | | |

| Total Corporate Notes | | | 16,681,250 | | | | 16,832,437 | | |

| Commercial Mortgage-Backed Securities r — 1.9% | |

| Other — 1.9% | |

| Bear Stearns Commercial Mortgage Securities, Series 2007-T28, Class A4, 5.74%, 9/11/42 | | | | | 1,456,221 | | | | 1,011,573 | | | | 963,589 | | |

| LB-UBS Commercial Mortgage Trust, Series 2008-C1, Class A2, 6.15%, 4/15/41 | | | | | 2,000,000 | | | | 1,372,187 | | | | 1,270,417 | | |

| Total Commercial Mortgage-Backed Securities | | | 2,383,760 | | | | 2,234,006 | | |

| Whole Loans °° (P) — 103.7% | |

| Commercial Loans — 73.9% | |

| 12000 Aerospace, Clear Lake, TX, 5.43%, 1/1/10 (B) | | 12/22/04 | | | 4,985,244 | | | | 4,985,244 | | | | 4,966,760 | | |

| ABC Conoco, Aspen, CO, 6.65%, 11/1/11 (B) | | 10/31/06 | | | 3,957,384 | | | | 3,957,384 | | | | 3,872,441 | | |

| Cingular Wireless Building, Richardson, TX, 7.03%, 7/1/11 (B) | | 6/21/06 | | | 6,469,290 | | | | 6,469,290 | | | | 6,501,498 | | |

| Clear Lake Central I, Webster, TX, 6.63%, 8/1/11 (B) | | 7/27/06 | | | 7,067,782 | | | | 7,067,782 | | | | 7,012,115 | | |

| Gallery Row, Tucson, AZ, 11.88%, 10/1/11 ¶ | | 9/7/06 | | | 500,000 | | | | 500,000 | | | | 425,465 | | |

| George Gee Hummer, Liberty Lake, WA, 3.88%, 7/1/10 ¶ (B) | | 6/30/05 | | | 2,125,000 | | | | 2,125,000 | | | | 1,643,074 | | |

| George Gee Pontiac I, Liberty Lake, WA, 3.90%, 7/1/10 ¶ (B) | | 6/30/05 | | | 4,675,000 | | | | 4,675,000 | | | | 3,616,597 | | |

| George Gee Pontiac II, Liberty Lake, WA, 3.88%, 7/1/10 ¶ | | 9/14/06 | | | 750,000 | | | | 750,000 | | | | 579,909 | | |

| George Gee Porsche, Liberty Lake, WA, 3.88%, 7/1/10 ¶ (B) | | 9/14/06 | | | 2,500,000 | | | | 2,500,000 | | | | 1,933,029 | | |

| Highland Park I, Scottsdale, AZ, 6.77%, 3/1/11 (B) | | 2/23/06 | | | 9,327,844 | | | | 9,327,844 | | | | 9,355,894 | | |

| Highland Park II, Scottsdale, AZ, 9.88%, 3/1/11 | | 2/23/06 | | | 1,191,330 | | | | 1,191,330 | | | | 1,126,058 | | |

| Kolb Plaza I, Tucson, AZ, 6.50%, 8/1/10 ¶ (B) | | 7/18/07 | | | 3,520,000 | | | | 3,520,000 | | | | 3,513,200 | | |

| Kolb Plaza II, Tucson, AZ, 9.88%, 8/1/10 ¶ | | 7/18/07 | | | 440,000 | | | | 440,000 | | | | 371,785 | | |