UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07838

American Select Portfolio Inc.

(Exact name of registrant as specified in charter)

| | |

| 800 Nicollet Mall, Minneapolis, MN | | 55402 |

| (Address of principal executive offices) | | (Zip code) |

Jill M. Stevenson, 800 Nicollet Mall, Minneapolis, MN 55402

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-677-3863

Date of fiscal year end: August 31

Date of reporting period: August 31, 2013

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

ANNUAL REPORT

August 31, 2013

| | | | |

| ASP | | | | American Strategic

Income Portfolio Inc. |

| | |

| BSP | | | | American Strategic

Income Portfolio Inc. II |

| | |

| CSP | | | | American Strategic

Income Portfolio Inc. III |

| | |

| SLA | | | | American Select

Portfolio Inc. |

First American Mortgage Funds

PRIMARY INVESTMENTS

American Strategic Income Portfolio Inc. (“ASP”), American Strategic Income Portfolio Inc. II (“BSP”), American Strategic Income Portfolio Inc. III (“CSP”), and American Select Portfolio Inc. (“SLA”) (“First American Mortgage Funds” or the “funds”) invest in mortgage-related assets that directly or indirectly represent a participation in or are secured by and payable from mortgage loans. The funds may also invest in U.S. Government securities, corporate debt securities, preferred stock issued by real estate investment trusts, and mortgage servicing rights. The funds borrow through the use of reverse repurchase agreements and credit facilities. Use of borrowing and certain other investments and investment techniques may cause the funds’ net asset value (“NAV”) to fluctuate to a greater extent than would be expected from interest-rate movements alone.

FUND OBJECTIVES

Each fund’s primary objective is to achieve high levels of current income. Each fund’s secondary objective is to seek capital appreciation. As with other mutual funds, there can be no assurance these funds will achieve their objectives.

|

| NOT FDIC INSURED NO BANK GUARANTEE MAY LOSE VALUE |

EXPLANATION OF FINANCIAL STATEMENTS

As a shareholder in one or more of the funds, you receive shareholder reports semiannually. We strive to present this financial information in an easy-to-understand format; however, for many investors, the information contained in this shareholder report may seem very technical. So, we would like to take this opportunity to explain several sections of the shareholder report.

The Schedule of Investments details all of the securities held in the fund and their related dollar values on the last day of the reporting period. Securities are usually presented by type (bonds, common stock, etc.) and by industry classification (healthcare, education, etc.). This information is useful for analyzing how your fund’s assets are invested and seeing where your portfolio manager believes the best opportunities exist to meet your objectives. Holdings are subject to change without notice and do not constitute a recommendation of any individual security. The Notes to Financial Statements provide additional details on how the securities are valued.

The Statement of Assets and Liabilities lists the assets and liabilities of the fund on the last day of the reporting period and presents the fund’s NAV and market price per share. The NAV is calculated by dividing the fund’s net assets (assets minus liabilities) by the number of shares outstanding. The market price is the closing price on the exchange on which the fund’s shares trade. This price, which may be higher or lower than the fund’s NAV, is the price an investor pays or receives when shares of the fund are purchased or sold. The investments, as presented in the Schedule of Investments, comprise substantially all of the fund’s assets. Other assets include cash and receivables for items such as income earned by the fund but not yet received. Liabilities include payables for items such as fund expenses incurred but not yet paid.

The Statement of Operations details the dividends and interest income earned from investments as well as the expenses incurred by the fund during the reporting period. Fund expenses may be reduced through fee waivers or reimbursements. This statement reflects total expenses before any waivers or reimbursements, the amount of waivers and reimbursements (if any), and the net expenses. This statement also shows the net realized and unrealized gains and losses from investments owned during the period. The Notes to Financial Statements provide additional details on investment income and expenses of the fund.

The Statement of Changes in Net Assets describes how the fund’s net assets were affected by its operating results and distributions to shareholders during the reporting period. This statement is important to investors because it shows exactly what caused the fund’s net asset size to change during the period.

The Statement of Cash Flows is required when a fund has a substantial amount of illiquid investments, a substantial amount of the fund’s securities are internally fair valued, or the fund carries some amount of debt. When presented, this statement explains the change in cash during the reporting period. It reconciles net cash provided by and used for operating activities to the net increase or decrease in net assets from operations and classifies cash receipts and payments as resulting from operating, investing, and financing activities.

The Financial Highlights provide a per-share breakdown of the components that affected the fund’s NAV for the current and past reporting periods. It also shows total return, net investment income ratios, expense ratios, and portfolio turnover rates. The net investment income ratios summarize the income earned less expenses, divided by the average net assets. The expense ratios represent the percentage of average net assets that were used to cover operating expenses during the period. The portfolio turnover rate represents the percentage of the fund’s holdings that have changed over the course of the period, and gives an idea of how long the fund holds on to a particular security. A 100% turnover rate implies that an amount equal to the value of the entire portfolio is turned over in a year through the purchase or sale of securities.

The Notes to Financial Statements disclose the organizational background of the fund, its significant accounting policies, federal tax information, fees and compensation paid to affiliates, and significant risks and contingencies.

We hope this guide to your shareholder report will help you get the most out of this important resource.

| | | | | | |

| FIRST AMERICAN MORTGAGE FUNDS | | 2013 ANNUAL REPORT | | | 1 | |

Fund Overviews

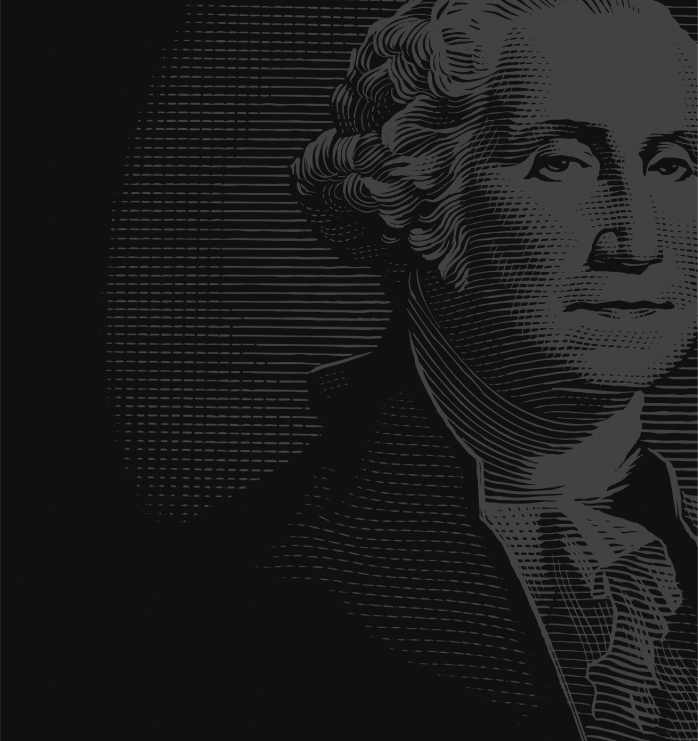

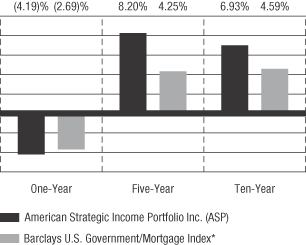

Average Annual Total Returns – ASP

Based on NAV for the period ended August 31, 2013

*The Barclays U.S. Government/Mortgage Index is comprised of all U.S. Government agency and Treasury securities and agency mortgage-backed securities. Index performance is for illustrative purposes only and does not reflect any fees or expenses. The index is unmanaged and is not available for direct investment. Although we believe this is the most appropriate benchmark available, it is not a perfect match. The benchmark index is comprised of U.S. Government securities while the fund is comprised primarily of nonsecuritized, illiquid whole loans, which limits the ability of the fund to respond quickly to market changes.

The average annual total returns for the fund are based on the change in its NAV and assume reinvestment of distributions at NAV. NAV-based performance is used to measure investment management results.

• Average annual total returns based on the change in market price for the one-year, five-year, and ten-year periods ended August 31, 2013, were -12.99%, 9.44%, and 6.22%, respectively.

• Market price returns assume that all distributions have been reinvested at actual prices pursuant to the fund’s dividend reinvestment plan. Market price returns reflect any broker commissions or sales charges on dividends reinvested at market price.

• Please remember, you could lose money with this investment. Neither safety of principal nor stability of income is guaranteed. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that fund shares, when sold, may be worth more or less than their original cost. Closed-end funds, such as this fund, often trade at discounts to NAV. Therefore, you may be unable to realize the full NAV of your shares when you sell.

| | | | |

| 2 | | FIRST AMERICAN MORTGAGE FUNDS | | 2013 ANNUAL REPORT |

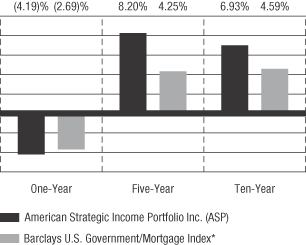

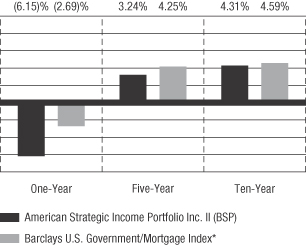

Average Annual Total Returns – BSP

Based on NAV for the period ended August 31, 2013

*The Barclays U.S. Government/Mortgage Index is comprised of all U.S. Government agency and Treasury securities and agency mortgage-backed securities. Index performance is for illustrative purposes only and does not reflect any fees or expenses. The index is unmanaged and is not available for direct investment. Although we believe this is the most appropriate benchmark available, it is not a perfect match. The benchmark index is comprised of U.S. Government securities while the fund is comprised primarily of nonsecuritized, illiquid whole loans, which limits the ability of the fund to respond quickly to market changes.

The average annual total returns for the fund are based on the change in its NAV and assume reinvestment of distributions at NAV. NAV-based performance is used to measure investment management results.

• Average annual total returns based on the change in market price for the one-year, five-year, and ten-year periods ended August 31, 2013, were -0.86%, 5.80%, and 4.24%, respectively.

• Market price returns assume that all distributions have been reinvested at actual prices pursuant to the fund’s dividend reinvestment plan. Market price returns reflect any broker commissions or sales charges on dividends reinvested at market price.

• Please remember, you could lose money with this investment. Neither safety of principal nor stability of income is guaranteed. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that fund shares, when sold, may be worth more or less than their original cost. Closed-end funds, such as this fund, often trade at discounts to NAV. Therefore, you may be unable to realize the full NAV of your shares when you sell.

| | | | | | |

| FIRST AMERICAN MORTGAGE FUNDS | | 2013 ANNUAL REPORT | | | 3 | |

Fund Overviews

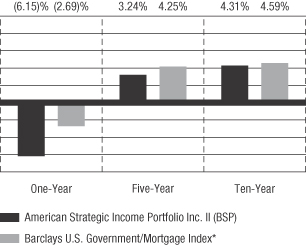

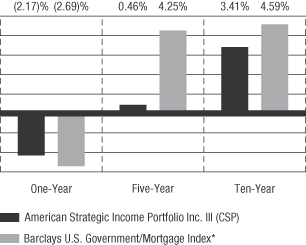

Average Annual Total Returns – CSP

Based on NAV for the period ended August 31, 2013

*The Barclays U.S. Government/Mortgage Index is comprised of all U.S. Government agency and Treasury securities and agency mortgage-backed securities. Index performance is for illustrative purposes only and does not reflect any fees or expenses. The index is unmanaged and is not available for direct investment. Although we believe this is the most appropriate benchmark available, it is not a perfect match. The benchmark index is comprised of U.S. Government securities while the fund is comprised primarily of nonsecuritized, illiquid whole loans, which limits the ability of the fund to respond quickly to market changes.

The average annual total returns for the fund are based on the change in its NAV and assume reinvestment of distributions at NAV. NAV-based performance is used to measure investment management results.

• Average annual total returns based on the change in market price for the one-year, five-year, and ten-year periods ended August 31, 2013, were -0.87%, 2.52%, and 3.56%, respectively.

• Market price returns assume that all distributions have been reinvested at actual prices pursuant to the fund’s dividend reinvestment plan. Market price returns reflect any broker commissions or sales charges on dividends reinvested at market price.

• Please remember, you could lose money with this investment. Neither safety of principal nor stability of income is guaranteed. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that fund shares, when sold, may be worth more or less than their original cost. Closed-end funds, such as this fund, often trade at discounts to NAV. Therefore, you may be unable to realize the full NAV of your shares when you sell.

| | | | |

| 4 | | FIRST AMERICAN MORTGAGE FUNDS | | 2013 ANNUAL REPORT |

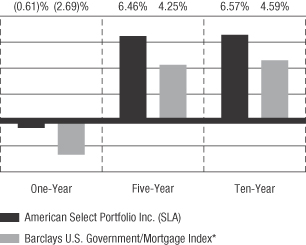

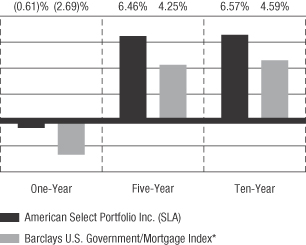

Average Annual Total Returns – SLA

Based on NAV for the period ended August 31, 2013

*The Barclays U.S. Government/Mortgage Index is comprised of all U.S. Government agency and Treasury securities and agency mortgage-backed securities. Index performance is for illustrative purposes only and does not reflect any fees or expenses. The index is unmanaged and is not available for direct investment. Although we believe this is the most appropriate benchmark available, it is not a perfect match. The benchmark index is comprised of U.S. Government securities while the fund is comprised primarily of nonsecuritized, illiquid whole loans, which limits the ability of the fund to respond quickly to market changes.

The average annual total returns for the fund are based on the change in its NAV and assume reinvestment of distributions at NAV. NAV-based performance is used to measure investment management results.

• Average annual total returns based on the change in market price for the one-year, five-year, and ten-year periods ended August 31, 2013, were -6.81%, 7.35%, and 6.10%, respectively.

• Market price returns assume that all distributions have been reinvested at actual prices pursuant to the fund’s dividend reinvestment plan. Market price returns reflect any broker commissions or sales charges on dividends reinvested at market price.

• Please remember, you could lose money with this investment. Neither safety of principal nor stability of income is guaranteed. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that fund shares, when sold, may be worth more or less than their original cost. Closed-end funds, such as this fund, often trade at discounts to NAV. Therefore, you may be unable to realize the full NAV of your shares when you sell.

| | | | | | |

| FIRST AMERICAN MORTGAGE FUNDS | | 2013 ANNUAL REPORT | | | 5 | |

(This page intentionally left blank.)

| | | | |

| 6 | | FIRST AMERICAN MORTGAGE FUNDS | | 2013 ANNUAL REPORT |

Fund Overviews

Investment Advisor

U.S. Bancorp Asset Management, Inc.

Sub-Advisors

Nuveen Asset Management, LLC

Nuveen Fund Advisors, LLC

Fund Management

John Wenker

of Nuveen Asset Management, LLC is responsible for overall management of the funds. He has 30 years of financial experience.

David Yale

of Nuveen Asset Management, LLC is responsible for management of the mortgage loan component and credit facilities of the funds. He has 32 years of financial experience.

Jason O’Brien, CFA

of Nuveen Asset Management, LLC is responsible for the management of the mortgage-backed securities portion of the funds. He has 20 years of financial experience.

Introduction

During the fiscal year ended August 31, 2013, commercial real estate markets had generally stabilized and continued a subdued recovery. With economic and employment growth still weak by historic standards, many commercial real estate markets have not fully recovered from the 2008 downturn. While many primary markets are doing well, the improved health of secondary and tertiary commercial real estate markets remains dependent upon a stronger economic environment and more employment growth. Debt capital markets have improved over the past year but lenders remain cautious in secondary and tertiary markets. A higher interest rate environment could slow transactions as buyers and sellers adjust.

Shared Fund Comments

The funds’ primary risk is credit risk. This comes mainly from the funds’ investments in commercial mortgage loans. The funds have modest residential mortgage exposure, which consists mostly of investments in Federal National Mortgage Association (FNMA) and Federal Home Loan Mortgage Corporation (FHLMC) pass-through securities.

Generally, the funds continued to recycle mortgage loan payoffs into higher credit quality, more liquid and — on a risk adjusted basis — better-yielding assets. The most active asset classes over the fiscal year were agency mortgage-backed securities, investment-grade real estate investment trust (REIT) preferred stock and investment-grade corporate bonds, primarily REIT bonds. This shift in composition adds duration to the portfolios and makes them more sensitive to interest rate changes. During the fiscal year the funds sold the remaining commercial mortgage-backed securities (CMBS) positions that had been opportunistically purchased during the 2008-09 downturn. The move to liquid securities has provided more efficient collateral for the funds’ credit facilities. The overall effect has been to reduce the average cost of borrowing and diversify among more credit facility providers. The funds pay interest on all their credit facilities at varying spreads over the one-month London Interbank Offering Rate (LIBOR). During the fiscal year, one-month LIBOR was fairly stable, ranging between 0.23% and 0.18%.

| | | | | | |

| FIRST AMERICAN MORTGAGE FUNDS | | 2013 ANNUAL REPORT | | | 7 | |

Fund Overviews

ASP

For the fiscal year ended August 31, 2013, the fund had a total return of -4.19% based on its net asset value (NAV). The fund’s benchmark, the Barclays U.S. Government/Mortgage Index, had a return of -2.69% during the period. Historically a significant portion of the return generated by the fund has been income. This was true for this fiscal year as well. Income generated by the commercial mortgage-backed securities, REIT preferred stock and corporate bonds and notes was very solid; no scheduled payments were missed. Performance of the whole loans and income generated by them was also very solid. At the end of the fiscal year, one loan was in default.

During the fiscal year, seven whole loans were paid off with an unpaid principal balance of $8.9 million and a net weighted average coupon of 6.53%. One whole loan was purchased for $1,500,000 and a net coupon of 4.13%. As of August 31, 2013 there was one commercial loan in Real Estate Owned (REO) status with unpaid principal balance of $3.18 million. Prepayment penalties in the amount of $90,082 were collected during the reporting period.

Portfolio Allocation1

As a percentage of total investments on August 31, 2013

| | | | |

Corporate Bonds | | | 34 | % |

Preferred Stocks | | | 26 | |

Commercial Loans | | | 20 | |

U.S. Government Agency Mortgage-Backed Securities | | | 10 | |

Corporate Note | | | 5 | |

Real Estate Owned | | | 3 | |

Short-Term Investment | | | 2 | |

| | | 100 | % |

1Portfolio allocations are subject to change and are not recommendations to buy or sell any security.

| | | | |

| 8 | | FIRST AMERICAN MORTGAGE FUNDS | | 2013 ANNUAL REPORT |

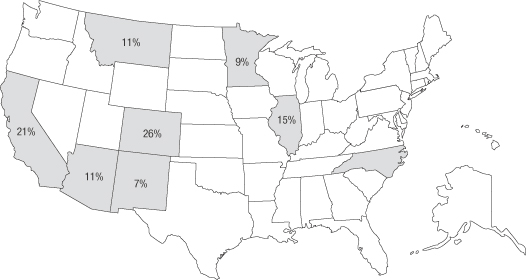

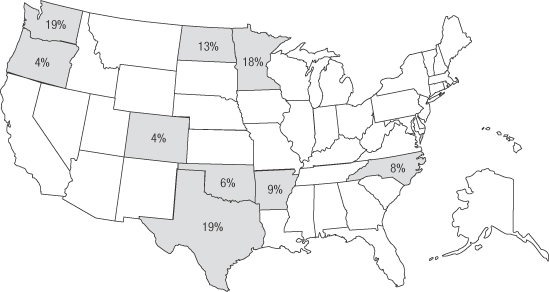

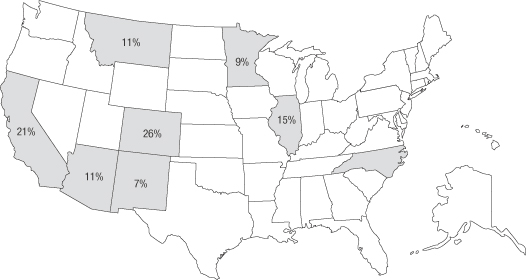

Geographical Distribution

The fund attempts to buy mortgage loans in many parts of the country to help avoid the risks of concentrating in one area. These percentages reflect the fair value of whole loans as of August 31, 2013. Shaded areas without fair values indicate states in which the fund has invested less than 0.50% of its investments.

Delinquent Loan Profile

The tables below show the percentages of single family loans and multifamily and commercial loans in the portfolio that are 30, 60, 90, or 120 or more days delinquent as of August 31, 2013, based on the value outstanding.

| | | | |

Single family loans | | | | |

Current | | | 98.6 | % |

30 Days | | | 1.4 | |

60 Days | | | 0.0 | |

90 Days | | | 0.0 | |

120+ Days | | | 0.0 | |

| | | 100.0 | % |

| | | | |

Multifamily and commercial loans | | | | |

Current | | | 100.0 | % |

30 Days | | | 0.0 | |

60 Days | | | 0.0 | |

90 Days | | | 0.0 | |

120+ Days | | | 0.0 | |

| | | 100.0 | % |

| | | | | | |

| FIRST AMERICAN MORTGAGE FUNDS | | 2013 ANNUAL REPORT | | | 9 | |

Fund Overviews

BSP

For the fiscal year ended August 31, 2013, the fund had a total return of -6.15% based on its NAV. The fund’s benchmark, the Barclays U.S. Government/Mortgage Index, had a return of -2.69% during the period. Historically a significant portion of the return generated by the fund has been income. This was true for this fiscal year as well. Income generated by the commercial mortgage-backed securities, REIT preferred stock and corporate bonds and notes was very solid; no scheduled payments were missed. Performance of the whole loans was held back by delinquent loans. This reduced the income generation of the loan portfolio. We were successful in working out solutions for some of the delinquent loans and continue to work on resolving the remaining issues. We are focused on doing this in a manner that attempts to maximize shareholder value. In some markets commercial real estate is still in the early stages of recovery.

During the fiscal year, six whole loans paid off with a principal balance of $15.0 million and a net weighted average coupon of 6.44%. One whole loan was purchased with a balance of $1,000,000 and a net coupon of 4.88%. As of August 31, 2013 there were three multifamily loans in default, comprising $24.7 million of unpaid principal balance. No prepayment penalties were collected during the period.

Portfolio Allocation1

As a percentage of total investments on August 31, 2013

| | | | |

Commercial Loans | | | 31 | % |

Preferred Stocks | | | 25 | |

Corporate Bonds | | | 19 | |

Multifamily Loans | | | 14 | |

Corporate Notes | | | 5 | |

U.S. Government Agency Mortgage-Backed Securities | | | 4 | |

Short-Term Investment | | | 1 | |

Asset-Backed Security | | | 1 | |

| | | 100 | % |

1Portfolio allocations are subject to change and are not recommendations to buy or sell any security.

| | | | |

| 10 | | FIRST AMERICAN MORTGAGE FUNDS | | 2013 ANNUAL REPORT |

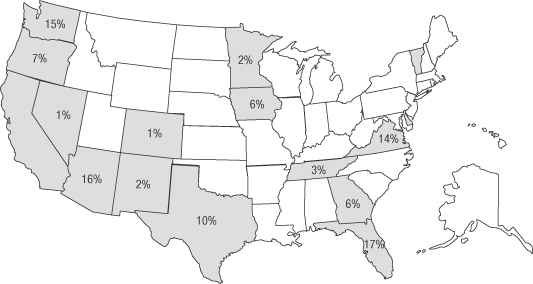

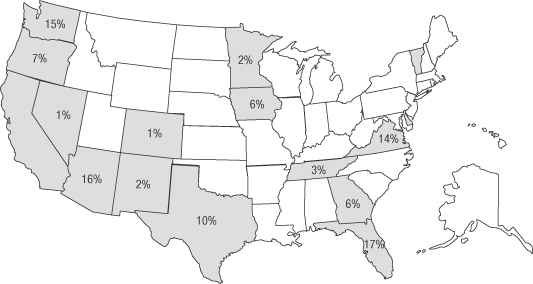

Geographical Distribution

The fund attempts to buy mortgage loans in many parts of the country to help avoid the risks of concentrating in one area. These percentages reflect the fair value of whole loans as of August 31, 2013. Shaded areas without fair values indicate states in which the fund has invested less than 0.50% of its investments.

Delinquent Loan Profile

The tables below show the percentages of single family loans and multifamily and commercial loans in the portfolio that are 30, 60, 90, or 120 or more days delinquent as of August 31, 2013, based on the fair value outstanding.

| | | | |

Single family loans | | | | |

Current | | | 100.0 | % |

30 Days | | | 0.0 | |

60 Days | | | 0.0 | |

90 Days | | | 0.0 | |

120+ Days | | | 0.0 | |

| | | 100.0 | % |

| | | | |

Multifamily and commercial loans | | | | |

Current | | | 89.9 | % |

30 Days | | | 0.1 | |

60 Days | | | 0.0 | |

90 Days | | | 0.0 | |

120+ Days | | | 10.0 | |

| | | 100.0 | % |

| | | | | | |

| FIRST AMERICAN MORTGAGE FUNDS | | 2013 ANNUAL REPORT | | | 11 | |

Fund Overviews

CSP

For the fiscal year ended August 31, 2013, the fund had a total return of -2.17% based on its NAV. The fund’s benchmark, the Barclays U.S. Government/Mortgage Index, had a return of -2.69% during the period. Historically a significant portion of the return generated by the fund has been income. This was true this fiscal year as well. Income generated by the commercial mortgage-backed securities, REIT preferred stock and corporate bonds and notes was very solid; no scheduled payments were missed. Performance of the whole loans was held back by delinquent loans. This significantly reduced income generation in the fund. We enjoyed some success working through delinquent loans this fiscal year. We remain very focused on resolving the residual issues, which we believe would raise the income levels of the fund. Commercial real estate markets have been through a tough period the last few years. We are hopeful a stronger economic environment will provide opportunities to resolve the remaining problem loans.

During the fiscal year, seventeen whole loans paid off, were written off, or resolved through REO sale, with an unpaid principal balance of $54.6 million and a net weighted average coupon of 7.20%. Three whole loans were purchased with a principal balance of $5,518,750 and coupon of 4.19%. As of August 31, 2013, there were four multifamily and six commercial loans in default, comprising $49.2 million of unpaid principal balance. No prepayment penalties were collected during the reporting period.

Portfolio Allocation1

As a percentage of total investments on August 31, 2013

| | | | |

Commercial Loans | | | 31 | % |

Corporate Bonds | | | 28 | |

Preferred Stocks | | | 25 | |

Multifamily Loans | | | 10 | |

U.S. Government Agency Mortgage-Backed Securities | | | 5 | |

Short-Term Investment | | | 1 | |

| | | 100 | % |

1Portfolio allocations are subject to change and are not recommendations to buy or sell any security.

| | | | |

| 12 | | FIRST AMERICAN MORTGAGE FUNDS | | 2013 ANNUAL REPORT |

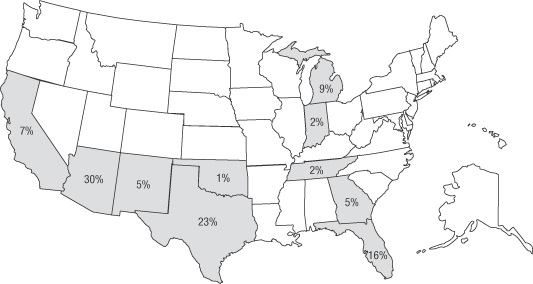

Geographical Distribution

The fund attempts to buy mortgage loans in many parts of the country to help avoid the risks of concentrating in one area. These percentages reflect the fair value of whole loans as of August 31, 2013. Shaded areas without fair values indicate states in which the fund has invested less than 0.50% of its investments.

Delinquent Loan Profile

The table below shows the percentages of multifamily and commercial loans in the portfolio that are 30, 60, 90, or 120 or more days delinquent as of August 31, 2013, based on the fair value outstanding.

| | | | |

Multifamily and commercial loans | | | | |

Current | | | 71.2 | % |

30 Days | | | 6.6 | |

60 Days | | | 0.0 | |

90 Days | | | 0.0 | |

120+ Days | | | 22.2 | |

| | | 100.0 | % |

| | | | | | |

| FIRST AMERICAN MORTGAGE FUNDS | | 2013 ANNUAL REPORT | | | 13 | |

Fund Overviews

SLA

For the fiscal year ended August 31, 2013, the fund had a total return of -0.61% based on its NAV. The fund’s benchmark, the Barclays U.S. Government/Mortgage Index, had a return of -2.69% during the period. Historically a significant portion of the return generated by the fund has been income. This was true this fiscal year as well. Income generated by the commercial mortgage-backed securities, REIT preferred stock and corporate bonds and notes was very solid; no scheduled payments were missed. Performance of the whole loans was fairly stable, although several delinquent loans existed at the end of the fiscal period. Delinquent loans have the effect of reducing income. Our goal is to resolve these issues, while recognizing the limits presented by the slow commercial real estate recovery and attempting to maximize long-term shareholder value.

During the fiscal year, six whole loans paid off, or were written off, with an unpaid principal balance of $24.7 million and a net weighted average coupon of 6.69%. Two whole loans were purchased with a balance of $8,325,000 and net coupon of 4.41%. As of August 31, 2013, there was one multifamily loan in default with an unpaid principal balance of $5.4 million. No prepayment penalties were collected during the reporting period.

Portfolio Allocation1

As a percentage of total investments on August 31, 2013

| | | | |

Corporate Bonds | | | 28 | % |

Preferred Stocks | | | 26 | |

Commercial Loans | | | 21 | |

U.S. Government Agency Mortgage-Backed Securities | | | 10 | |

Multifamily Loans | | | 8 | |

Corporate Notes | | | 5 | |

Short-Term Investment | | | 2 | |

| | | 100 | % |

1Portfolio allocations are subject to change and are not recommendations to buy or sell any security.

| | | | |

| 14 | | FIRST AMERICAN MORTGAGE FUNDS | | 2013 ANNUAL REPORT |

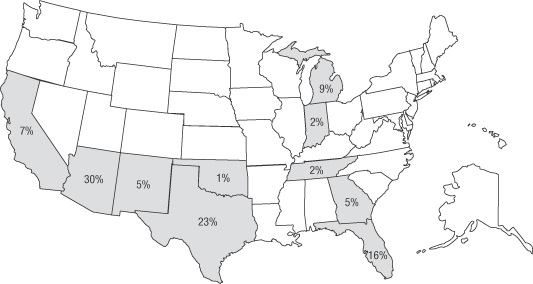

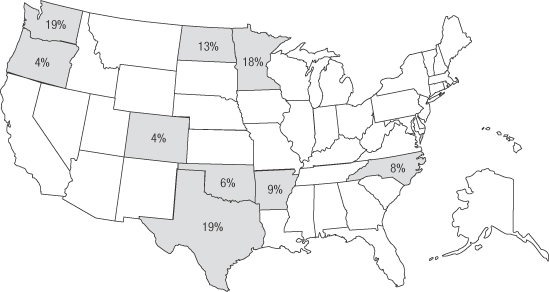

Geographical Distribution

The fund attempts to buy mortgage loans in many parts of the country to help avoid the risks of concentrating in one area. These percentages reflect the fair value of whole loans as of August 31, 2013. Shaded areas without fair values indicate states in which the fund has invested less than 0.50% of its investments.

Delinquent Loan Profile

The table below shows the percentages of multifamily and commercial loans in the portfolio that are 30, 60, 90, or 120 or more days delinquent as of August 31, 2013, based on the fair value outstanding.

| | | | |

Multifamily and commercial loans | | | | |

Current | | | 93.9 | % |

30 Days | | | 0.0 | |

60 Days | | | 0.0 | |

90 Days | | | 0.0 | |

120+ Days | | | 6.1 | |

| | | 100.0 | % |

| | | | | | |

| FIRST AMERICAN MORTGAGE FUNDS | | 2013 ANNUAL REPORT | | | 15 | |

Fund Overviews

Conclusion

As of this writing, commercial real estate markets generally continue a slow, grinding recovery, although some primary markets have fully recovered. Uneven economic conditions, spotty job growth and a subdued environment for debt capital present big challenges for the commercial real estate sector in many markets where the funds have mortgage loans. We continue to focus on the credit risk in the funds and are hopeful an improving economy will present opportunities to protect and enhance net asset value.

Thank you for your investment in the funds and your continued trust as we navigate the investment landscape. If you have any questions about the funds, please call us at 800.677.3863.

Sincerely,

John Wenker

Managing Director, Head of Real Assets

Nuveen Asset Management, LLC

| | | | |

| 16 | | FIRST AMERICAN MORTGAGE FUNDS | | 2013 ANNUAL REPORT |

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Directors of American Strategic Income Portfolio Inc., American Strategic Income Portfolio Inc. II, American Strategic Income Portfolio Inc. III, and American Select Portfolio Inc.

We have audited the accompanying statements of assets and liabilities of American Strategic Income Portfolio Inc., American Strategic Income Portfolio Inc. II, American Strategic Income Portfolio Inc. III, and American Select Portfolio Inc. (collectively the “funds”), including the schedules of investments, as of August 31, 2013, and the related statements of operations and cash flows for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the funds’ internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the funds’ internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of August 31, 2013, by correspondence with the custodian and brokers or by other appropriate auditing procedures where replies from brokers were not received. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of American Strategic Income Portfolio Inc., American Strategic Income Portfolio Inc. II, American Strategic Income Portfolio Inc. III, and American Select Portfolio Inc. at August 31, 2013, the results of their operations and their cash flows for the year then ended, the changes in their net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Chicago, Illinois

October 23, 2013

| | | | | | |

| FIRST AMERICAN MORTGAGE FUNDS | | 2013 ANNUAL REPORT | | | 17 | |

| | |

| Schedule of Investments | | August 31, 2013 |

American Strategic Income Portfolio (ASP)

| | | | | | | | | | | | | | | | |

DESCRIPTION | | DATE

ACQUIRED | | | PAR | | | COST | | | VALUE ¶ | |

| | | | |

(Percentages of each investment category relate to total net assets) | | | | | | | | | | | | | | | | |

| | | | |

Whole Loans ¥ p — 28.4% | | | | | | | | | | | | | | | | |

Commercial Loans — 28.2% | | | | | | | | | | | | | | | | |

Carl’s Jr., Idaho Springs, CO, 4.13%, 5/1/23 | | | 4/23/13 | | | $ | 1,488,384 | | | $ | 1,488,384 | | | $ | 1,431,191 | |

Chicago Social Security Building, Chicago, IL, 4.78%, 6/1/22 | | | 5/31/12 | | | | 2,178,526 | | | | 2,178,526 | | | | 2,256,692 | |

Copper Junction, Copper Mountain, CO, 6.38%, 7/1/17 | | | 6/14/07 | | | | 1,806,545 | | | | 1,806,545 | | | | 1,896,873 | |

Hampden Medical Office, Englewood, CO, 7.38%, 10/1/12 § | | | 9/9/02 | | | | 1,171,802 | | | | 1,171,802 | | | | 680,628 | |

La Costa Meadows Industrial Park I, San Marcos, CA, 6.78%, 7/1/17 | | | 6/28/07 | | | | 1,230,389 | | | | 1,230,389 | | | | 1,291,908 | |

La Costa Meadows Industrial Park II, San Marcos, CA, 7.53%, 7/1/17 | | | 6/28/07 | | | | 1,972,586 | | | | 1,972,586 | | | | 1,992,311 | |

Palace Court, Santa Fe, NM, 4.88%, 8/1/15 � | | | 10/2/06 | | | | 1,858,913 | | | | 1,858,913 | | | | 1,039,133 | |

Perkins Restaurant, Maple Grove, MN, 6.38%, 1/1/18 | | | 12/23/05 | | | | 1,285,899 | | | | 1,285,899 | | | | 1,350,194 | |

Stephens Center, Missoula, MT, 6.88%, 9/1/15 | | | 4/20/06 | | | | 1,642,344 | | | | 1,642,344 | | | | 1,675,191 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | 14,635,388 | | | | 13,614,121 | |

| | | | | | | | | | | | | | | | |

Single Family Loans — 0.2% | | | | | | | | | | | | | | | | |

American Portfolio, 1 loan, California, 3.00%, 1/1/17 | | | 7/18/95 | | | | 9,295 | | | | 8,854 | | | | 9,242 | |

Bank of New Mexico, 1 loan, New Mexico, 3.63%, 2/1/18 | | | 5/31/96 | | | | 16,150 | | | | 16,150 | | | | 16,634 | |

Bluebonnet Savings & Loan, 2 loans, Texas, 3.14%, 8/24/15 | | | 5/22/92 | | | | 15,834 | | | | 15,834 | | | | 15,902 | |

McClemore, Matrix Funding Corporation, 1 loan, North Carolina, 10.50%, 8/1/19 | | | 9/9/92 | | | | 29,536 | | | | 28,060 | | | | 30,423 | |

Nomura III, 1 loan, California, 4.00%, 5/1/19 | | | 9/29/95 | | | | 33,025 | | | | 29,853 | | | | 33,521 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | 98,751 | | | | 105,722 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Whole Loans | | | | | | | | | | | 14,734,139 | | | | 13,719,843 | |

| | | | | | | | | | | | | | | | |

| | | | |

Corporate Note ¥ � — 7.3% | | | | | | | | | | | | | | | | |

Fixed Rate — 7.3% | | | | | | | | | | | | | | | | |

Stratus Properties V, 7.25%, 3/31/15 | | | 6/1/07 | | | | 3,500,000 | | | | 3,500,000 | | | | 3,535,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

Corporate Bonds — 48.5% | | | | | | | | | | | | | | | | |

Banking x — 3.9% | | | | | | | | | | | | | | | | |

Bank of America, Series MTN, 5.00%, 5/13/21 | | | | | | | 795,000 | | | | 865,919 | | | | 841,779 | |

Goldman Sachs Group, 6.00%, 6/15/20 | | | | | | | 925,000 | | | | 1,046,565 | | | | 1,037,950 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | 1,912,484 | | | | 1,879,729 | |

| | | | | | | | | | | | | | | | |

Real Estate Investment Trusts — 44.6% | | | | | | | | | | | | | | | | |

BioMed Realty, 4.25%, 7/15/22 | | | | | | | 470,000 | | | | 491,813 | | | | 453,169 | |

Brandywine Operating Partnership, 3.95%, 2/15/23 x | | | | | | | 1,500,000 | | | | 1,484,716 | | | | 1,406,321 | |

CommonWealth REIT, 5.88%, 9/15/20 x | | | | | | | 1,325,000 | | | | 1,429,227 | | | | 1,334,503 | |

Developers Diversified Realty, 4.63%, 7/15/22 x | | | | | | | 1,500,000 | | | | 1,617,567 | | | | 1,504,840 | |

Digital Realty, 3.63%, 10/1/22 x | | | | | | | 1,500,000 | | | | 1,498,090 | | | | 1,363,379 | |

Essex Portfolio, 3.63%, 8/15/22 | | | | | | | 679,000 | | | | 646,350 | | | | 641,427 | |

Health Care REIT, 4.95%, 1/15/21 | | | | | | | 1,350,000 | | | | 1,473,099 | | | | 1,417,912 | |

Health Care REIT, 3.75%, 3/15/23 | | | | | | | 490,000 | | | | 494,577 | | | | 461,799 | |

Healthcare Realty, 5.75%, 1/15/21 x | | | | | | | 1,160,000 | | | | 1,290,953 | | | | 1,252,261 | |

Hospitality Properties, 5.00%, 8/15/22 x | | | | | | | 1,500,000 | | | | 1,596,620 | | | | 1,487,257 | |

Host Hotels & Resorts, 5.25%, 3/15/22 | | | | | | | 495,000 | | | | 512,598 | | | | 509,436 | |

Liberty Property, 3.38%, 6/15/23 x | | | | | | | 1,500,000 | | | | 1,496,632 | | | | 1,367,723 | |

National Retail Properties, 3.80%, 10/15/22 | | | | | | | 1,225,000 | | | | 1,265,304 | | | | 1,158,879 | |

Post Apartment Homes, 3.38%, 12/1/22 | | | | | | | 395,000 | | | | 394,761 | | | | 363,126 | |

Realty Income, 4.65%, 8/1/23 | | | | | | | 265,000 | | | | 268,973 | | | | 268,095 | |

Senior Housing Properties, 6.75%, 4/15/20 x | | | | | | | 1,250,000 | | | | 1,391,091 | | | | 1,366,006 | |

Senior Housing Properties, 5.63%, 8/1/42 x | | | | | | | 525,000 | | | | 512,400 | | | | 444,780 | |

SL Green Realty, 4.50%, 12/1/22 | | | | | | | 485,000 | | | | 496,098 | | | | 462,049 | |

Ventas Realty, 4.75%, 6/1/21 | | | | | | | 1,350,000 | | | | 1,469,134 | | | | 1,407,920 | |

The accompanying notes are an integral part of the financial statements.

| | | | |

| 18 | | FIRST AMERICAN MORTGAGE FUNDS | | 2013 ANNUAL REPORT |

American Strategic Income Portfolio (ASP)

| | | | | | | | | | | | | | |

DESCRIPTION | | | | PAR/

SHARES | | | COST | | | VALUE ¶ | |

Ventas Realty, 5.45%, 3/15/43 | | | | $ | 1,605,650 | | | $ | 1,613,463 | | | $ | 1,371,225 | |

Weingarten Realty Investors, 3.38%, 10/15/22 x | | | | | 1,700,000 | | | | 1,701,454 | | | | 1,552,482 | |

| | | | | | | | | | | | | | |

| | | | | | | | | 23,144,920 | | | | 21,594,589 | |

| | | | | | | | | | | | | | |

| | | | |

Total Corporate Bonds | | | | | | | | | 25,057,404 | | | | 23,474,318 | |

| | | | | | | | | | | | | | |

| | | | |

U.S. Government Agency Mortgage-Backed Securities — 13.8% | | | | | | | | | | | | | | |

Fixed Rate — 13.8% | | | | | | | | | | | | | | |

Federal Home Loan Mortgage Corporation, | | | | | | | | | | | | | | |

5.50%, 1/1/18, #E93231 a | | | | | 113,198 | | | | 114,432 | | | | 120,324 | |

9.00%, 7/1/30, #C40149 | | | | | 35,274 | | | | 35,905 | | | | 42,255 | |

5.00%, 5/1/39, #G05430 a | | | | | 447,523 | | | | 457,914 | | | | 478,541 | |

Federal National Mortgage Association, | | | | | | | | | | | | | | |

6.00%, 10/1/16, #610761 a | | | | | 33,978 | | | | 34,161 | | | | 35,435 | |

5.00%, 7/1/18, #724954 a | | | | | 482,493 | | | | 482,245 | | | | 513,058 | |

6.50%, 6/1/29, #252497 a | | | | | 41,187 | | | | 41,003 | | | | 45,736 | |

7.50%, 3/1/30, #495694 | | | | | 12,140 | | | | 12,008 | | | | 12,374 | |

7.50%, 5/1/30, #535289 a | | | | | 13,048 | | | | 12,753 | | | | 14,906 | |

8.00%, 5/1/30, #538266 a | | | | | 6,741 | | | | 6,684 | | | | 7,075 | |

6.00%, 5/1/31, #535909 a | | | | | 61,693 | | | | 61,932 | | | | 68,180 | |

6.50%, 11/1/31, #613339 a | | | | | 45,883 | | | | 46,581 | | | | 50,162 | |

5.50%, 7/1/33, #720735 a | | | | | 472,867 | | | | 468,879 | | | | 516,814 | |

5.00%, 7/1/39, #935588 a | | | | | 266,850 | | | | 272,463 | | | | 286,926 | |

4.00%, 12/1/40, #AB1959 a | | | | | 883,841 | | | | 881,510 | | | | 913,321 | |

4.00%, 12/1/40, #MA0583 a | | | | | 416,248 | | | | 420,651 | | | | 430,175 | |

4.00%, 1/1/41, #MA0614 a | | | | | 678,051 | | | | 671,577 | | | | 700,857 | |

3.50%, 3/1/41, #AE0981 a | | | | | 1,201,666 | | | | 1,239,372 | | | | 1,202,516 | |

3.50%, 3/1/42, #AB4749 a | | | | | 1,238,507 | | | | 1,280,276 | | | | 1,239,385 | |

| | | | | | | | | | | | | | |

| | | | |

Total U.S. Government Agency Mortgage-Backed Securities | | | | | | | | | 6,540,346 | | | | 6,678,040 | |

| | | | | | | | | | | | | | |

| | | | |

Preferred Stocks — 36.2% | | | | | | | | | | | | | | |

Real Estate Investment Trusts — 36.2% | | | | | | | | | | | | | | |

Alexandria Real Estate Equities, Series E x | | | | | 60,403 | | | | 1,530,438 | | | | 1,411,014 | |

Boston Properties, Series B | | | | | 51,950 | | | | 1,295,400 | | | | 1,081,209 | |

BRE Properties, Series D x | | | | | 2,400 | | | | 47,688 | | | | 60,975 | |

CommonWealth REIT, Series E x | | | | | 58,480 | | | | 1,508,824 | | | | 1,350,525 | |

Developers Diversified Realty, Series H x | | | | | 3,193 | | | | 65,457 | | | | 79,921 | |

Digital Realty, Series E x | | | | | 48,414 | | | | 1,231,102 | | | | 1,142,270 | |

Digital Realty, Series F x | | | | | 6,000 | | | | 152,580 | | | | 136,740 | |

Digital Realty, Series G | | | | | 4,905 | | | | 110,407 | | | | 100,553 | |

Duke Realty, Series J x | | | | | 2,100 | | | | 43,466 | | | | 50,597 | |

Duke Realty, Series L x | | | | | 8,750 | | | | 167,300 | | | | 207,266 | |

Equity Residential Properties, Series K x | | | | | 10,000 | | | | 557,500 | | | | 621,250 | |

Health Care REIT, Series J x | | | | | 57,700 | | | | 1,490,045 | | | | 1,367,490 | |

Hospitality Properties, Series D x | | | | | 29,652 | | | | 803,365 | | | | 733,294 | |

Kimco Realty, Series I | | | | | 7,728 | | | | 198,610 | | | | 174,877 | |

Kimco Realty, Series J x | | | | | 20,000 | | | | 503,000 | | | | 412,200 | |

Kimco Realty, Series K | | | | | 6,519 | | | | 167,212 | | | | 137,095 | |

National Retail Properties, Series D x | | | | | 59,996 | | | | 1,522,323 | | | | 1,406,906 | |

PS Business Parks, Series R x | | | | | 9,500 | | | | 234,175 | | | | 234,745 | |

PS Business Parks, Series S | | | | | 24,291 | | | | 606,546 | | | | 564,499 | |

PS Business Parks, Series T x | | | | | 23,000 | | | | 578,450 | | | | 495,880 | |

Public Storage, Series T | | | | | 3,859 | | | | 99,948 | | | | 85,515 | |

Public Storage, Series U | | | | | 41,000 | | | | 954,300 | | | | 888,470 | |

Public Storage, Series V | | | | | 2,960 | | | | 75,036 | | | | 62,219 | |

Public Storage, Series W | | | | | 11,000 | | | | 277,750 | | | | 225,170 | |

| | | | | | |

| FIRST AMERICAN MORTGAGE FUNDS | | 2013 ANNUAL REPORT | | | 19 | |

| | |

| Schedule of Investments | | August 31, 2013 |

American Strategic Income Portfolio (ASP)

| | | | | | | | | | | | | | |

DESCRIPTION | | | | SHARES | | | COST | | | VALUE ¶ | |

Realty Income, Series E x | | | | | 37,060 | | | $ | 714,246 | | | $ | 925,344 | |

Realty Income, Series F | | | | | 12,000 | | | | 320,160 | | | | 290,040 | |

Regency Centers, Series F x | | | | | 47,900 | | | | 1,292,250 | | | | 1,128,955 | |

Regency Centers, Series G | | | | | 5,000 | | | | 126,900 | | | | 107,600 | |

Simon Property Group, Series J x | | | | | 11,000 | | | | 511,500 | | | | 716,375 | |

Vornado Realty, Series G x | | | | | 30,000 | | | | 483,000 | | | | 727,800 | |

Vornado Realty, Series K x | | | | | 11,867 | | | | 300,829 | | | | 250,512 | |

Vornado Realty, Series L | | | | | 4,000 | | | | 98,600 | | | | 82,760 | |

Weingarten Realty Investors, Series F x | | | | | 10,929 | | | | 260,657 | | | | 270,835 | |

| | | | | | | | | | | | | | |

| | | | |

Total Preferred Stocks | | | | | | | | | 18,294,378 | | | | 17,530,901 | |

| | | | | | | | | | | | | | |

| | | | |

Total Unaffiliated Investments | | | | | | | | | 68,160,953 | | | | 64,938,102 | |

| | | | | | | | | | | | | | |

| | | | |

Real Estate Owned ¥ l — 3.5% | | | | | | | | | | | | | | |

The Storage Place, Marana, AZ | | | | | | | | | 3,189,940 | | | | 1,700,000 | |

| | | | | | | | | | | | | | |

| | | | |

Short-Term Investment — 3.2% | | | | | | | | | | | | | | |

First American Prime Obligations Fund, Class Z, 0.01% W | | | | | 1,565,061 | | | | 1,565,061 | | | | 1,565,061 | |

| | | | | | | | | | | | | | |

| | | | |

Total Investments p — 140.9% | | | | | | | | | 72,915,954 | | | $ | 68,203,163 | |

| | | | | | | | | | | | | | |

Other Assets and Liabilities, Net — (40.9)% | | | | | | | | | | | | | (19,796,255 | ) |

| | | | | | | | | | | | | | |

Total Net Assets — 100.0% | | | | | | | | | | | | $ | 48,406,908 | |

| | | | | | | | | | | | | | |

| ¶ | Securities are valued in accordance with procedures described in note 2 in Notes to Financial Statements. |

| ¥ | Securities purchased as part of a private placement which have not been registered with the U.S. Securities and Exchange Commission under the Securities Act of 1933 and which are considered to be illiquid. These securities are fair valued in accordance with the board approved valuation procedures. On August 31, 2013, the total fair value of these securities was $18,954,843 or 39.2% of total net assets. See note 2 in Notes to Financial Statements. |

| p | Interest rates on commercial and multifamily loans are the net coupon rates in effect (after reducing the coupon rate by any mortgage servicing fees paid to mortgage servicers) on August 31, 2013. Interest rates and maturity dates disclosed on single family loans represent the weighted average coupon and weighted average maturity for the underlying mortgage loans as of August 31, 2013. |

| § | Loan has matured or will mature in the next couple of months and the fund is anticipating payoff or refinancing. Unless disclosed otherwise, the loan continues to make monthly payments. |

| � | Interest Only – Represents securities that entitle holders to receive only interest payments on the mortgage. Principal balance on the loan is due at maturity. The interest rate disclosed represents the net coupon rate in effect as of August 31, 2013. |

| x | Securities pledged as collateral for outstanding borrowings under a loan agreement with Bank of America, N.A. On August 31, 2013, securities valued at $28,690,175 were pledged as collateral for the following outstanding borrowings: |

| | | | | | | | | | |

| Amount | | | Rate* | | | Accrued

Interest | |

| $ | 13,700,000 | | | | 1.03 | % | | $ | 787 | |

| | | | | | | | | | |

| | * | Interest rate as of August 31, 2013. Rate is based on one-month London Interbank Offered Rate (“LIBOR”) plus 0.85%. |

The accompanying notes are an integral part of the financial statements.

| | | | |

| 20 | | FIRST AMERICAN MORTGAGE FUNDS | | 2013 ANNUAL REPORT |

American Strategic Income Portfolio (ASP)

Description of collateral:

Corporate Bonds

Bank of America, Series MTN, 5.00%, 5/13/21, $795,000 par

Goldman Sachs Group, 6.00%, 6/15/20, $925,000 par

Brandywine Operating Partnership, 3.95%, 2/15/23, $1,500,000 par

CommonWealth REIT, 5.88%, 9/15/20, $1,325,000 par

Developers Diversified Realty, 4.63%, 7/15/22, $1,500,000 par

Digital Realty, 3.63%, 10/1/22, $1,500,000 par

Healthcare Realty, 5.75%, 1/15/21, $1,160,000 par

Hospitality Properties, 5.00%, 8/15/22, $1,500,000 par

Liberty Property, 3.38%, 6/15/23, $1,500,000 par

Senior Housing Properties, 6.75%, 4/15/20, $1,250,000 par

Senior Housing Properties, 5.63%, 8/1/42, $21,000 par

Weingarten Realty Investors, 3.38%, 10/15/22, $1,700,000 par

Preferred Stocks

Alexandria Real Estate Equities, Series E, 60,403 shares

BRE Properties, Series D, 2,400 shares

CommonWealth REIT, Series E, 58,480 shares

Developers Diversified Realty, Series H, 3,193 shares

Digital Realty, Series E, 48,414 shares

Digital Realty, Series F, 6,000 shares

Duke Realty, Series J, 2,100 shares

Duke Realty, Series L, 8,750 shares

Equity Residential Properties, Series K, 10,000 shares

Health Care REIT, Series J, 57,700 shares

Hospitality Properties, Series D, 29,652 shares

Kimco Realty, Series J, 20,000 shares

National Retail Properties, Series D, 59,996 shares

PS Business Parks, Series R, 9,500 shares

PS Business Parks, Series T, 23,000 shares

Realty Income, Series E, 37,060 shares

Regency Centers, Series F, 47,900 shares

Simon Property Group, Series J, 11,000 shares

Vornado Realty, Series G, 30,000 shares

Vornado Realty, Series K, 11,867 shares

Weingarten Realty Investors, Series F, 10,929 shares

| a | Securities pledged as collateral for outstanding reverse repurchase agreements. On August 31, 2013, securities valued at $6,623,411 were pledged as collateral for the following outstanding reverse repurchase agreements: |

| | | | | | | | | | | | | | | | | | | | | | |

| Amount | | | Acquisition

Date | | | Rate* | | | Due | | | Accrued

Interest | | | Name of Broker

and Description

of Collateral | |

| $ | 6,331,000 | | | | 8/9/13 | | | | 0.36 | % | | | 9/9/13 | | | $ | 1,456 | | | | (1 | ) |

| | | | | | | | | | | | | | | | | | | | | | |

| | * | Interest rate as of August 31, 2013. Rate is based on one-month LIBOR plus a spread and reset monthly. |

Name of broker and description of collateral:

Federal Home Loan Mortgage Corporation, 5.50%, 1/1/18, $113,198 par

Federal Home Loan Mortgage Corporation, 5.00%, 5/1/39, $447,523 par

Federal National Mortgage Association, 6.00%, 10/1/16, $33,978 par

Federal National Mortgage Association, 5.00%, 7/1/18, $482,493 par

Federal National Mortgage Association, 6.50%, 6/1/29, $41,187 par

Federal National Mortgage Association, 7.50%, 5/1/30, $13,048 par

Federal National Mortgage Association, 8.00%, 5/1/30, $6,741 par

Federal National Mortgage Association, 6.00%, 5/1/31, $61,693 par

Federal National Mortgage Association, 6.50%, 11/1/31, $45,883 par

Federal National Mortgage Association, 5.50%, 7/1/33, $472,867 par

Federal National Mortgage Association, 5.00%, 7/1/39, $266,850 par

Federal National Mortgage Association, 4.00%, 12/1/40, $883,841 par

Federal National Mortgage Association, 4.00%, 12/1/40, $416,248 par

Federal National Mortgage Association, 4.00%, 1/1/41, $678,051 par

Federal National Mortgage Association, 3.50%, 3/1/41, $1,201,666 par

Federal National Mortgage Association, 3.50%, 3/1/42, $1,238,507 par

| | | | | | |

| FIRST AMERICAN MORTGAGE FUNDS | | 2013 ANNUAL REPORT | | | 21 | |

| | |

| Schedule of Investments | | August 31, 2013 |

American Strategic Income Portfolio (ASP)

| | The fund has entered into a lending commitment with Goldman Sachs. The monthly agreement permits the fund to enter into reverse repurchase agreements using U.S. Government Agency Mortgage-Backed Securities as collateral. |

| l | Real Estate Owned. See note 2 in the Notes to Financial Statements. |

| W | Investment in affiliated security. This money market fund is advised by U.S. Bancorp Asset Management, Inc., which also serves as advisor for the fund. The rate shown is the annualized seven-day effective yield as of August 31, 2013. See note 2 in Notes to Financial Statements. |

| p | On August 31, 2013, the cost of investments for federal income tax purposes was $72,922,539. The aggregate gross unrealized appreciation and depreciation of investments, based on this cost, were as follows: |

| | | | |

Gross unrealized appreciation | | $ | 1,407,280 | |

Gross unrealized depreciation | | | (6,126,656 | ) |

| | | | |

Net unrealized depreciation | | $ | (4,719,376 | ) |

| | | | |

REIT–Real Estate Investment Trust

The accompanying notes are an integral part of the financial statements.

| | | | |

| 22 | | FIRST AMERICAN MORTGAGE FUNDS | | 2013 ANNUAL REPORT |

American Strategic Income Portfolio II (BSP)

| | | | | | | | | | | | | | | | |

DESCRIPTION | | DATE

ACQUIRED | | | PAR | | | COST | | |

VALUE ¶ | |

| | | | |

(Percentages of each investment category relate to total net assets) | | | | | | | | | | | | | | | | |

| | | | |

Whole Loans ¥ p — 64.2% | | | | | | | | | | | | | | | | |

Commercial Loans — 44.1% | | | | | | | | | | | | | | | | |

5555 East Van Buren I, Phoenix, AZ, 4.93%, 10/1/14 � | | | 6/23/04 | | | $ | 6,035,296 | | | $ | 6,035,296 | | | $ | 4,069,135 | |

5555 East Van Buren II, Phoenix, AZ, 4.88%, 10/1/14 � | | | 8/18/06 | | | | 1,255,552 | | | | 1,255,552 | | | | 712,630 | |

American Mini-Storage, Memphis, TN, 6.80%, 12/1/11 § | | | 11/5/07 | | | | 2,962,479 | | | | 2,962,479 | | | | 2,800,715 | |

Bigelow Office Building, Las Vegas, NV, 6.38%, 4/1/17 | | | 3/31/97 | | | | 1,013,697 | | | | 1,013,697 | | | | 1,064,382 | |

Hickman Road, Clive, IA, 4.93%, 4/1/16 | | | 12/3/07 | | | | 5,418,699 | | | | 5,418,699 | | | | 5,527,073 | |

Office City Plaza, Houston, TX, 3.90%, 3/1/17 � | | | 2/10/12 | | | | 3,900,000 | | | | 3,900,000 | | | | 3,900,000 | |

Oyster Point Office Park, Newport News, VA, 4.18%, 5/1/16 � | | | 1/4/06 | | | | 11,831,854 | | | | 11,831,854 | | | | 11,831,854 | |

Oyster Point Office Park II, Newport News, VA, 4.88%, 5/1/16 | | | 4/30/13 | | | | 1,000,000 | | | | 1,000,000 | | | | 899,709 | |

PennMont Office Plaza, Albuquerque, NM, 5.88%, 4/1/14 � | | | 3/30/06 | | | | 1,406,043 | | | | 1,406,043 | | | | 1,406,043 | |

Perkins - Blaine, Blaine, MN, 6.63%, 1/1/17 | | | 12/13/06 | | | | 1,683,226 | | | | 1,683,226 | | | | 1,767,388 | |

Robberson Auto Dealerships, Bend and Prineville, OR, 6.40%, 4/1/17 | | | 3/30/07 | | | | 6,521,144 | | | | 6,521,144 | | | | 6,651,567 | |

Signal Butte, Mesa, AZ, 4.93%, 7/1/17 � | | | 6/20/07 | | | | 15,000,000 | | | | 15,002,903 | | | | 10,058,130 | |

Station Square, Pompano Beach, FL, 6.33%, 2/1/14 � | | | 1/19/07 | | | | 11,807,036 | | | | 11,807,036 | | | | 11,807,036 | |

Waste Connections Warehouse, Englewood, CO, 6.58%, 3/1/14 | | | 2/15/07 | | | | 1,201,942 | | | | 1,201,942 | | | | 1,213,962 | |

| | | | | | | | | | | | | | | | |

| | | | 71,039,871 | | | | 63,709,624 | |

| | | | | | | | | | | | | | | | |

Multifamily Loans — 20.0% | | | | | | | | | | | | | | | | |

Carolina Square Apartments, Tallahassee, FL, 5.43%, 8/1/12 � § ¿ | | | 7/20/07 | | | | 7,875,000 | | | | 7,875,000 | | | | 4,402,125 | |

Meadows Point, College Station, TX, 7.93%, 5/1/16 � � | | | 1/24/08 | | | | 5,400,000 | | | | 5,400,000 | | | | 5,202,360 | |

Sapphire Skies I, Cle Elum, WA, 1.93%, 7/1/15 � | | | 12/23/05 | | �� | | 8,675,784 | | | | 8,717,492 | | | | 7,121,352 | |

Sapphire Skies II, Cle Elum, WA, 7.90%, 7/1/15 � � S | | | 3/20/09 | | | | 3,200,000 | | | | 3,200,000 | | | | 32,000 | |

Sapphire Skies III, Cle Elum, WA, 4.93%, 7/1/15 � ¿ | | | 7/13/10 | | | | 8,000,000 | | | | 8,000,000 | | | | 80,000 | |

Sapphire Skies IV, Cle Elum, WA, 3.88%, 7/1/15 � | | | 7/26/12 | | | | 8,000,000 | | | | 8,005,980 | | | | 6,566,648 | |

Sussex Club Apartments I, Athens, GA, 6.33%, 5/1/10 � § ¿ | | | 4/17/07 | | | | 8,800,000 | | | | 8,800,000 | | | | 4,919,200 | |

Sussex Club Apartments II, Athens, GA, 6.88%, 5/1/10 � § � S | | | 4/17/07 | | | | 2,298,600 | | | | 2,298,600 | | | | 633,519 | |

| | | | | | | | | | | | | | | | |

| | | | 52,297,072 | | | | 28,957,204 | |

| | | | | | | | | | | | | | | | |

Single Family Loans — 0.1% | | | | | | | | | | | | | | | | |

Merchants Bank, 2 loans, Vermont, 11.34%, 11/12/16 | | | 12/18/92 | | | | 30,233 | | | | 30,481 | | | | 31,140 | |

PHH U.S. Mortgage, 2 loans, California & Delaware, 6.59%, 4/18/20 | | | 12/30/92 | | | | 105,362 | | | | 105,362 | | | | 108,522 | |

| | | | | | | | | | | | | | | | |

| | | | 135,843 | | | | 139,662 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Whole Loans | | | | | | | | | | | 123,472,786 | | | | 92,806,490 | |

| | | | |

Corporate Notes ¥ � — 7.8% | | | | | | | | | | | | | | | | |

Fixed Rate — 7.8% | | | | | | | | | | | | | | | | |

Stratus Properties II, 7.25%, 12/31/15 | | | 6/14/01 | | | | 3,000,000 | | | | 3,000,000 | | | | 3,060,000 | |

Stratus Properties III, 7.25%, 12/31/16 | | | 12/12/06 | | | | 8,000,000 | | | | 8,000,000 | | | | 8,240,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Corporate Notes | | | | | | | | | | | 11,000,000 | | | | 11,300,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

Corporate Bonds — 27.9% | | | | | | | | | | | | | | | | |

Real Estate Investment Trusts — 27.9% | | | | | | | | | | | | | | | | |

Alexandria Real Estate Equities, 4.60%, 4/1/22 x | | | | | | | 1,750,000 | | | | 1,870,184 | | | | 1,750,051 | |

BioMed Realty, 4.25%, 7/15/22 x | | | | | | | 1,395,000 | | | | 1,465,942 | | | | 1,345,045 | |

Brandywine Operating Partnership, 3.95%, 2/15/23 x | | | | | | | 2,000,000 | | | | 1,987,672 | | | | 1,875,094 | |

Developers Diversified Realty, 4.63%, 7/15/22 x | | | | | | | 1,980,000 | | | | 2,146,548 | | | | 1,986,389 | |

Digital Realty, 5.25%, 3/15/21 x | | | | | | | 2,000,000 | | | | 2,222,554 | | | | 2,062,752 | |

Digital Realty, 3.63%, 10/1/22 x | | | | | | | 800,000 | | | | 793,646 | | | | 727,135 | |

Duke Realty, 4.38%, 6/15/22 x | | | | | | | 1,410,000 | | | | 1,500,711 | | | | 1,376,229 | |

Duke Realty, 3.88%, 10/15/22 x | | | | | | | 2,500,000 | | | | 2,561,011 | | | | 2,343,318 | |

Health Care REIT, 3.75%, 3/15/23 x | | | | | | | 2,000,000 | | | | 1,993,060 | | | | 1,884,892 | |

Highwoods Realty, 3.63%, 1/15/23 x | | | | | | | 2,000,000 | | | | 2,017,612 | | | | 1,843,010 | |

| | | | | | |

| FIRST AMERICAN MORTGAGE FUNDS | | 2013 ANNUAL REPORT | | | 23 | |

| | |

| Schedule of Investments | | August 31, 2013 |

American Strategic Income Portfolio II (BSP)

| | | | | | | | | | | | | | |

DESCRIPTION | | | | PAR/

SHARES | | | COST | | |

VALUE ¶ | |

Kilroy Realty, 3.80%, 1/15/23 x | | | | $ | 3,050,000 | | | $ | 3,072,757 | | | $ | 2,822,223 | |

Liberty Property, 4.13%, 6/15/22 x | | | | | 1,500,000 | | | | 1,579,121 | | | | 1,470,999 | |

National Retail Properties, 3.80%, 10/15/22 x | | | | | 1,450,000 | | | | 1,474,013 | | | | 1,371,735 | |

Post Apartment Homes, 3.38%, 12/1/22 x | | | | | 695,000 | | | | 694,579 | | | | 638,918 | |

ProLogis, 6.88%, 3/15/20 x | | | | | 2,000,000 | | | | 2,388,955 | | | | 2,342,600 | |

Senior Housing Properties, 6.75%, 12/15/21 x | | | | | 1,500,000 | | | | 1,698,147 | | | | 1,634,106 | |

Senior Housing Properties, 5.63%, 8/1/42 x | | | | | 2,275,000 | | | | 2,205,600 | | | | 1,927,380 | |

Ventas Realty, 5.45%, 3/15/43 | | | | | 4,248,100 | | | | 4,269,946 | | | | 3,627,877 | |

Vornado Realty, 5.00%, 1/15/22 x | | | | | 3,500,000 | | | | 3,862,185 | | | | 3,658,074 | |

Washington REIT, 3.95%, 10/15/22 x | | | | | 3,850,000 | | | | 3,961,128 | | | | 3,629,880 | |

| | | | | | | | | | | | | | |

| | | | |

Total Corporate Bonds | | | | | | | | | 43,765,371 | | | | 40,317,707 | |

| | | | | | | | | | | | | | |

| | | | |

U.S. Government Agency Mortgage-Backed Securities a — 5.9% | | | | | | | | | | | | | | |

Fixed Rate — 5.9% | | | | | | | | | | | | | | |

Federal Home Loan Mortgage Corporation, | |

5.50%, 1/1/18, #E93231 | | | | | 603,722 | | | | 610,299 | | | | 641,726 | |

9.00%, 7/1/30, #C40149 | | | | | 58,790 | | | | 59,709 | | | | 70,426 | |

5.00%, 5/1/39, #G05430 | | | | | 952,421 | | | | 974,534 | | | | 1,018,434 | |

3.50%, 6/1/42, #C09000 | | | | | 1,839,459 | | | | 1,930,525 | | | | 1,835,431 | |

Federal National Mortgage Association, | |

6.00%, 10/1/16, #607030 | | | | | 35,389 | | | | 35,442 | | | | 36,908 | |

5.50%, 6/1/17, #648508 | | | | | 47,765 | | | | 47,842 | | | | 50,414 | |

5.00%, 9/1/17, #254486 | | | | | 74,857 | | | | 74,924 | | | | 79,775 | |

5.00%, 11/1/17, #657356 | | | | | 99,103 | | | | 99,283 | | | | 105,610 | |

6.50%, 6/1/29, #252497 | | | | | 274,581 | | | | 273,355 | | | | 304,908 | |

7.50%, 5/1/30, #535289 | | | | | 46,972 | | | | 45,911 | | | | 53,663 | |

8.00%, 5/1/30, #538266 | | | | | 24,266 | | | | 24,060 | | | | 25,470 | |

8.00%, 6/1/30, #253347 | | | | | 67,320 | | | | 66,747 | | | | 80,464 | |

5.00%, 11/1/33, #725027 | | | | | 2,361,592 | | | | 2,406,567 | | | | 2,545,257 | |

5.00%, 7/1/39, #935588 | | | | | 1,601,098 | | | | 1,630,877 | | | | 1,721,556 | |

| | | | | | | | | | | | | | |

| | | | |

Total U.S. Government Agency Mortgage-Backed Securities | | | | | | | | | 8,280,075 | | | | 8,570,042 | |

| | | | | | | | | | | | | | |

| | | | |

Asset-Backed Security ¢ — 0.6% | | | | | | | | | | | | | | |

Other — 0.6% | | | | | | | | | | | | | | |

321 Henderson Receivables I LLC, Series 2007-3A, Class A, 6.15%, 10/15/48 | | | | | 837,399 | | | | 927,319 | | | | 866,050 | |

| | | | | | | | | | | | | | |

| | | | |

Preferred Stocks — 36.3% | | | | | | | | | | | | | | |

Real Estate Investment Trusts — 36.3% | | | | | | | | | | | | | | |

Alexandria Real Estate Equities, Series E x | | | | | 181,042 | | | | 4,712,859 | | | | 4,229,141 | |

Boston Properties, Series B x | | | | | 128,598 | | | | 3,180,505 | | | | 2,676,446 | |

BRE Properties, Series D x | | | | | 7,450 | | | | 148,032 | | | | 189,277 | |

CommonWealth REIT, Series E x | | | | | 161,500 | | | | 4,172,200 | | | | 3,729,649 | |

Developers Diversified Realty, Series H x | | | | | 1,747 | | | | 31,009 | | | | 43,727 | |

Digital Realty, Series F x | | | | | 155,754 | | | | 4,029,076 | | | | 3,549,634 | |

Digital Realty, Series G x | | | | | 30,624 | | | | 730,783 | | | | 627,792 | |

Duke Realty, Series J x | | | | | 38,000 | | | | 893,000 | | | | 915,564 | |

Duke Realty, Series L x | | | | | 74,260 | | | | 1,529,361 | | | | 1,759,034 | |

Equity Residential Properties, Series K x | | | | | 30,000 | | | | 1,680,000 | | | | 1,863,750 | |

Health Care REIT, Series J x | | | | | 176,000 | | | | 4,399,968 | | | | 4,171,200 | |

Hospitality Properties, Series D x | | | | | 61,211 | | | | 1,639,301 | | | | 1,513,748 | |

Kimco Realty, Series I x | | | | | 37,000 | | | | 916,250 | | | | 837,273 | |

Kimco Realty, Series J x | | | | | 105,000 | | | | 2,582,250 | | | | 2,164,050 | |

Kimco Realty, Series K x | | | | | 26,148 | | | | 670,696 | | | | 549,892 | |

National Retail Properties, Series D x | | | | | 177,437 | | | | 4,443,124 | | | | 4,160,898 | |

PS Business Parks, Series S x | | | | | 48,000 | | | | 1,286,400 | | | | 1,115,472 | |

The accompanying notes are an integral part of the financial statements.

| | | | |

| 24 | | FIRST AMERICAN MORTGAGE FUNDS | | 2013 ANNUAL REPORT |

American Strategic Income Portfolio II (BSP)

| | | | | | | | | | | | | | |

DESCRIPTION | | | | SHARES | | | COST | | |

VALUE ¶ | |

PS Business Parks, Series T x | | | | | 123,501 | | | $ | 3,074,190 | | | $ | 2,662,681 | |

PS Business Parks, Series U | | | | | 3,000 | | | | 62,700 | | | | 62,640 | |

PS Business Parks, Series V | | | | | 18,600 | | | | 406,590 | | | | 387,996 | |

Public Storage, Series R x | | | | | 10,000 | | | | 272,500 | | | | 244,375 | |

Public Storage, Series T x | | | | | 21,719 | | | | 568,822 | | | | 481,293 | |

Public Storage, Series U x | | | | | 113,255 | | | | 2,678,467 | | | | 2,454,236 | |

Public Storage, Series V x | | | | | 18,752 | | | | 475,363 | | | | 394,167 | |

Public Storage, Series W | | | | | 6,985 | | | | 176,371 | | | | 142,983 | |

Public Storage, Series X | | | | | 12,000 | | | | 279,600 | | | | 246,480 | |

Realty Income, Series E x | | | | | 37,600 | | | | 812,160 | | | | 938,827 | |

Realty Income, Series F x | | | | | 39,000 | | | | 1,052,550 | | | | 942,630 | |

Regency Centers, Series F x | | | | | 152,936 | | | | 3,977,775 | | | | 3,604,549 | |

Regency Centers, Series G x | | | | | 27,908 | | | | 690,049 | | | | 600,580 | |

Vornado Realty, Series K x | | | | | 183,204 | | | | 4,536,221 | | | | 3,867,436 | |

Weingarten Realty Investors, Series F x | | | | | 58,200 | | | | 1,438,323 | | | | 1,442,272 | |

| | | | | | | | | | | | | | |

| | | | |

Total Preferred Stocks | | | | | | | | | 57,546,495 | | | | 52,569,692 | |

| | | | | | | | | | | | | | |

| | | | |

Total Unaffiliated Investments | | | | | | | | | 244,992,046 | | | | 206,429,981 | |

| | | | | | | | | | | | | | |

| | | | |

Short-Term Investment — 1.8% | | | | | | | | | | | | | | |

First American Prime Obligation Fund, Class Z, 0.01% W | | | | | 2,556,649 | | | | 2,556,649 | | | | 2,556,649 | |

| | | | | | | | | | | | | | |

| | | | |

Total Investments p — 144.5% | | | | | | | | $ | 247,548,695 | | | $ | 208,986,630 | |

| | | | | | | | | | | | | | |

Other Assets and Liabilities, Net — (44.5)% | | | | | | | | | | | | | (64,317,723 | ) |

| | | | | | | | | | | | | | |

Total Net Assets — 100.0% | | | | | | | | | | | | $ | 144,668,907 | |

| | | | | | | | | | | | | | |

| ¶ | Securities are valued in accordance with procedures described in note 2 in Notes to Financial Statements. |

| ¥ | Securities purchased as part of a private placement which have not been registered with the U.S. Securities and Exchange Commission under the Securities Act of 1933 and which are considered to be illiquid. These securities are fair valued in accordance with the board approved valuation procedures. On August 31, 2013, the total fair value of these securities was $104,106,490 or 72.0% of total net assets. See note 2 in Notes to Financial Statements. |

| p | Interest rates on commercial and multifamily loans are the net coupon rates in effect (after reducing the coupon rate by any mortgage servicing fees paid to mortgage servicers) on August 31, 2013. Interest rates and maturity dates disclosed on single family loans represent the weighted average coupon and weighted average maturity for the underlying mortgage loans as of August 31, 2013. For participating loans, the rates are based on the annual cash flow payments expected at the time of purchase. |

| � | Interest Only – Represents securities that entitle holders to receive only interest payments on the mortgage. Principal balance on the loan is due at maturity. The interest rate disclosed represents the net coupon rate in effect as of August 31, 2013. |

| § | Loan has matured or will mature in the next couple of months and the fund is anticipating payoff or refinancing. Unless disclosed otherwise, the loan continues to make monthly payments. |

| ¿ | Loan is currently in default with regards to scheduled interest and/or principal payments. |

| � | Participating Loan – A participating loan is one which contains provisions for the fund to participate in the income stream provided by the property, including net cash flows and capital proceeds. Monthly cash flow proceeds are only required to the extent excess cash flow is generated by the property as determined by the loan documents. |

| S | The participating loan is not currently making monthly cash flow payments or is making cash flow payments of less than original coupon rate disclosed. |

| x | Securities pledged as collateral for outstanding borrowings under a loan agreement with Bank of America, N.A. On August 31, 2013, securities valued at $88,419,423 were pledged as collateral for the following outstanding borrowings: |

| | | | | | | | | | |

| Amount | | | Rate* | | | Accrued

Interest | |

| $ | 57,000,000 | | | | 1.03 | % | | $ | 3,275 | |

| | | | | | | | | | |

| | * | Interest rate as of August 31, 2013. Rate is based on one-month London Interbank Offered Rate (“LIBOR”) plus 0.85%. |

| | | | | | |

| FIRST AMERICAN MORTGAGE FUNDS | | 2013 ANNUAL REPORT | | | 25 | |

| | |

| Schedule of Investments | | August 31, 2013 |

American Strategic Income Portfolio II (BSP)

Description of collateral:

Corporate Bonds

Alexandria Real Estate Equities, 4.60%, 4/1/22, $1,750,000 par

BioMed Realty, 4.25%, 7/15/22, $1,395,000 par

Brandywine Operating Partnership, 3.95%, 2/15/23, $2,000,000 par

Developers Diversified Realty, 4.63%, 7/15/22, $1,980,000 par

Digital Realty, 5.25%, 3/15/21, $2,000,000 par

Digital Realty, 3.63%, 10/1/22, $800,000 par

Duke Realty, 4.38%, 6/15/22, $1,410,000 par

Duke Realty, 3.88%, 10/15/22, $2,500,000 par

Health Care REIT, 3.75%, 3/15/23, $2,000,000 par

Highwoods Realty, 3.63%, 1/15/23, $2,000,000 par

Kilroy Realty, 3.80%, 1/15/23, $3,050,000 par

Liberty Property, 4.13%, 6/15/22, $1,500,000 par

National Retail Properties, 3.80%, 10/15/22, $1,450,000 par

Post Apartment Homes, 3.38%, 12/1/22, $695,000 par

ProLogis, 6.88%, 3/15/20, $2,000,000 par

Senior Housing Properties, 6.75%, 12/15/21, $1,500,000 par

Senior Housing Properties, 5.63%, 8/1/42, $91,000 par

Vornado Realty, 5.00%, 1/15/22, $3,500,000 par

Washington REIT, 3.95%, 10/15/22, $3,850,000 par

Preferred Stocks

Alexandria Real Estate Equities, Series E, 181,042 shares

Boston Properties, Series B, 128,598 shares

BRE Properties, Series D, 7,450 shares

CommonWealth REIT, Series E, 161,500 shares

Developers Diversified Realty, Series H, 1,747 shares

Digital Realty, Series F, 155,754 shares

Digital Realty, Series G, 30,624 shares

Duke Realty, Series J, 38,000 shares

Duke Realty, Series L, 74,260 shares

Equity Residential Properties, Series K, 30,000 shares

Health Care REIT, Series J, 176,000 shares

Hospitality Properties, Series D, 61,211 shares

Kimco Realty, Series I, 37,000 shares

Kimco Realty, Series J, 105,000 shares

Kimco Realty, Series K, 26,148 shares

National Retail Properties, Series D, 177,437 shares

PS Business Parks, Series S, 48,000 shares

PS Business Parks, Series T, 123,501 shares

Public Storage, Series R, 10,000 shares

Public Storage, Series T, 21,719 shares

Public Storage, Series U, 113,255 shares

Public Storage, Series V, 18,752 shares

Realty Income, Series E, 37,600 shares

Realty Income, Series F, 39,000 shares

Regency Centers, Series F, 152,936 shares

Regency Centers, Series G, 27,908 shares

Vornado Realty, Series K, 183,204 shares

Weingarten Realty Investors, Series F, 58,200 shares

| a | Securities pledged as collateral for outstanding reverse repurchase agreements. On August 31, 2013, securities valued at $8,570,042 were pledged as collateral for the following outstanding reverse repurchase agreements: |

| | | | | | | | | | | | | | | | | | | | | | |

| Amount | | | Acquisition

Date | | | Rate* | | | Due | | | Accrued

Interest | | | Name of Broker

and Description

of Collateral | |

| $ | 8,174,000 | | | | 8/9/13 | | | | 0.36 | % | | | 9/9/13 | | | $ | 1,880 | | | | (1 | ) |

| | | | | | | | | | | | | | | | | | | | | | |

| | * | Interest rate as of August 31, 2013. Rate is based on one-month LIBOR plus a spread and reset monthly. |

The accompanying notes are an integral part of the financial statements.

| | | | |

| 26 | | FIRST AMERICAN MORTGAGE FUNDS | | 2013 ANNUAL REPORT |

American Strategic Income Portfolio II (BSP)

Name of broker and description of collateral:

Federal Home Loan Mortgage Corporation, 5.50%, 1/1/18, $603,722 par

Federal Home Loan Mortgage Corporation, 9.00%, 7/1/30, $58,790 par

Federal Home Loan Mortgage Corporation, 5.00%, 5/1/39, $952,421 par

Federal Home Loan Mortgage Corporation, 3.50%, 6/1/42, $1,839,459 par

Federal National Mortgage Association, 6.00%, 10/1/16, $35,389 par

Federal National Mortgage Association, 5.50%, 6/1/17, $47,765 par

Federal National Mortgage Association, 5.00%, 9/1/17, $74,857 par

Federal National Mortgage Association, 5.00%, 11/1/17, $99,103 par

Federal National Mortgage Association, 6.50%, 6/1/29, $274,581 par

Federal National Mortgage Association, 7.50%, 5/1/30, $46,972 par

Federal National Mortgage Association, 8.00%, 5/1/30, $24,266 par

Federal National Mortgage Association, 8.00%, 6/1/30, $67,320 par

Federal National Mortgage Association, 5.00%, 11/1/33, $2,361,592 par

Federal National Mortgage Association, 5.00%, 7/1/39, $1,601,098 par

The fund has entered into a lending commitment with Goldman Sachs. The monthly agreement permits the fund to enter into reverse repurchase agreements using U.S. Government Agency Mortgage-Backed Securities as collateral.

| ¢ | Securities purchased within terms of a private placement memorandum, exempt from registration under Rule 144A of the Securities Act of 1933, as amended, which may be sold only to dealers in that program or other “qualified institutional buyers”. On August 31, 2013, the total fair value of these investments was $866,050 or 0.6% of total net assets. |

| W | Investment in affiliated security. This money market fund is advised by U.S. Bancorp Asset Management, Inc., which also serves as advisor for the fund. The rate shown is the annualized seven-day effective yield as of August 31, 2013. See note 2 in Notes to Financial Statements. |

| p | On August 31, 2013, the cost of investments for federal income tax purposes was $247,623,067. The aggregate gross unrealized appreciation and depreciation of investments, based on this cost, were as follows: |

| | | | |

Gross unrealized appreciation | | $ | 1,620,737 | |

Gross unrealized depreciation | | | (40,257,175 | ) |

| | | | |

Net unrealized depreciation | | $ | (38,636,437 | ) |

| | | | |

REIT–Real Estate Investment Trust

| | | | | | |

| FIRST AMERICAN MORTGAGE FUNDS | | 2013 ANNUAL REPORT | | | 27 | |

| | |

| Schedule of Investments | | August 31, 2013 |

American Strategic Income Portfolio III (CSP)

| | | | | | | | | | | | | | | | |

DESCRIPTION | | DATE

ACQUIRED | | | PAR | | | COST | | |

VALUE ¶ | |

| | | | |

(Percentages of each investment category relate to total net assets) | | | | | | | | | | | | | | | | |

| | | | |

Whole Loans ¥ p — 58.3% | | | | | | | | | | | | | | | | |

Commercial Loans — 43.8% | | | | | | | | | | | | | | | | |

150 North Pantano I, Tucson, AZ, 5.90%, 8/1/14 � ¿ | | | 1/4/05 | | | $ | 3,525,000 | | | $ | 3,526,138 | | | $ | 1,970,475 | |

150 North Pantano II, Tucson, AZ, 14.88%, 8/1/14 � ¿ | | | 1/4/05 | | | | 440,000 | | | | 440,259 | | | | 153,357 | |

2165 Shermer Road, Northbrook, IL, 4.13%, 9/1/28 | | | 8/13/13 | | | | 2,425,000 | | | | 2,425,000 | | | | 2,308,564 | |

8324 East Hartford Drive I, Scottsdale, AZ, 5.90%, 5/1/20 � | | | 4/8/04 | | | | 3,220,015 | | | | 3,369,044 | | | | 3,220,015 | |

Allegiance Health, Jackson, MI, 5.88%, 1/1/21 | | | 12/28/10 | | | | 8,233,800 | | | | 8,233,800 | | | | 8,645,490 | |

Alliant University, Fresno, CA, 5.40%, 4/1/15 | | | 7/12/06 | | | | 2,648,878 | | | | 2,648,878 | | | | 2,648,878 | |